Accounting localization in Odoo 17 is the feature that modifies the accounting module by the specific rules, tax laws, and financial reporting specifications of a given nation. The Odoo 17 accounting module automatically tries to determine your company's country code when it is set up. It tries to install the appropriate localization module through this code. Localization guarantees that your accounting procedures comply with regional laws, lowering the possibility of mistakes and fines. Saves time by automating the tax calculations, tax report generation, Tax laws and accounts that are already set up to reduce the possibility of manual errors.

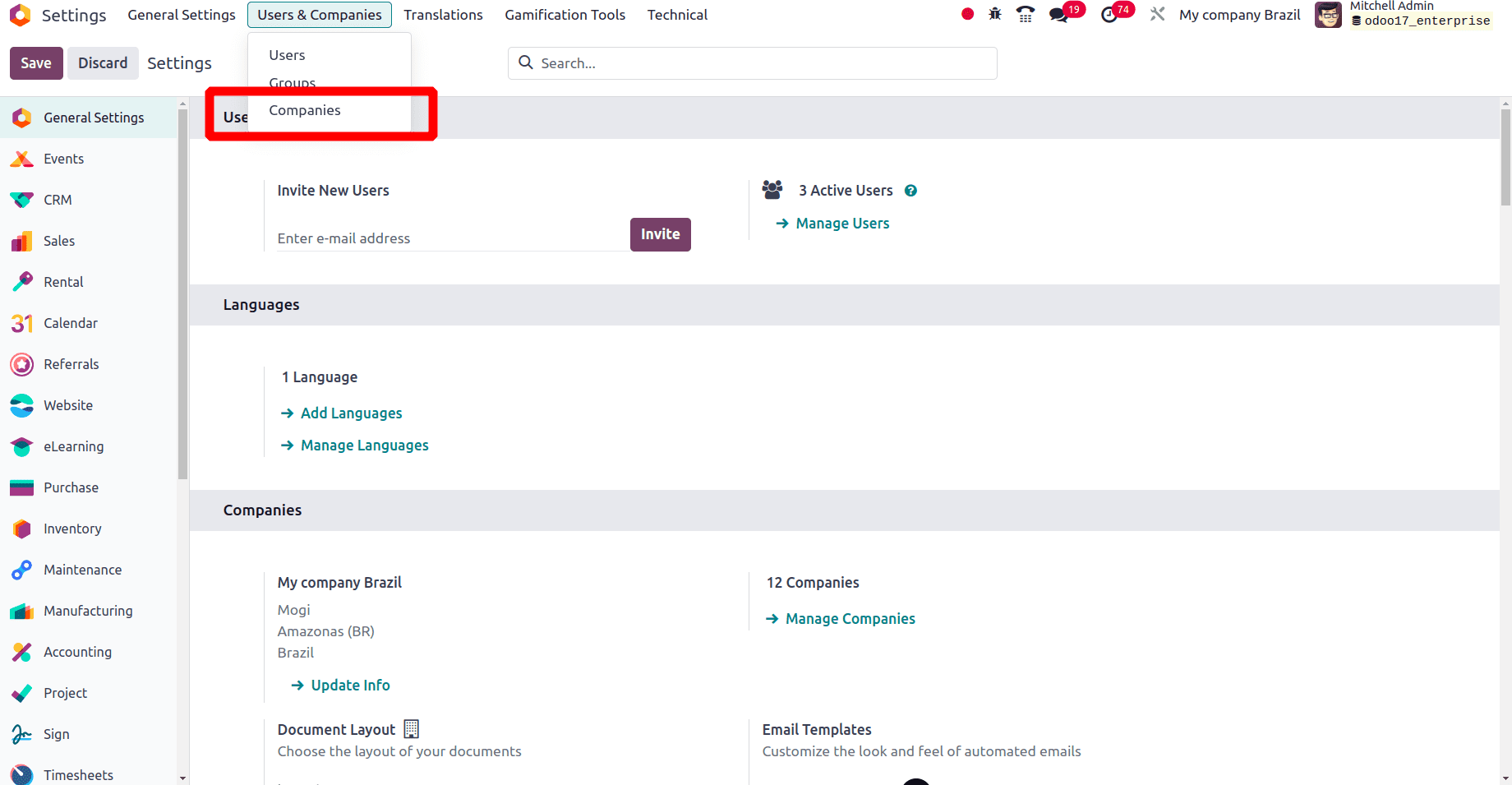

In this blog, we are going to discuss the accounting localization for Australia in Odoo 17. To set up the accounting localization for Australia, we want to create a new company which is working in Australia. So to create a new company, move to the General settings in Odoo 17. In the Settings, there is the users & companies menu and then the Companies sub-menu.

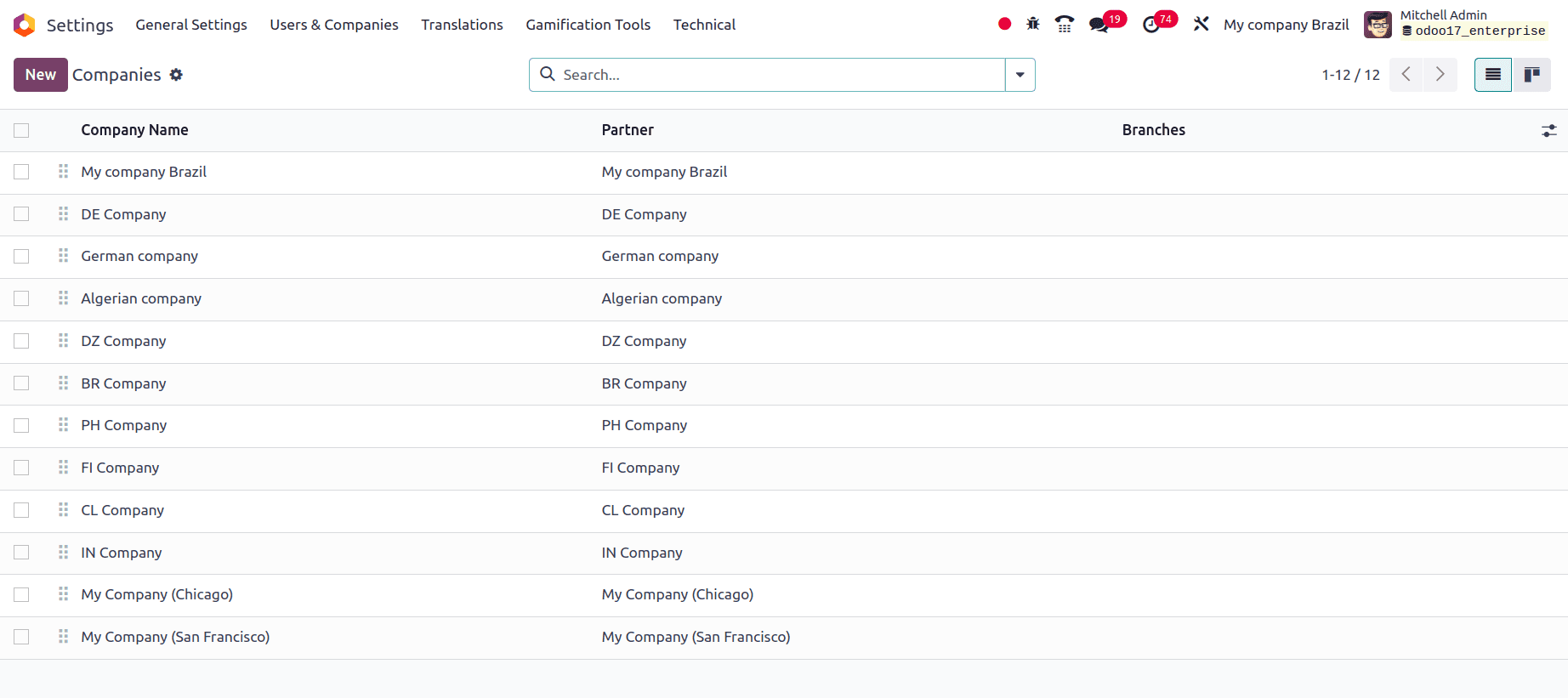

Then we can see a list of companies that are working in different countries under the companies sub-menu. We can click the New button to create a new company. When we click the New button, a form will appear, and we can provide the company details in this form.

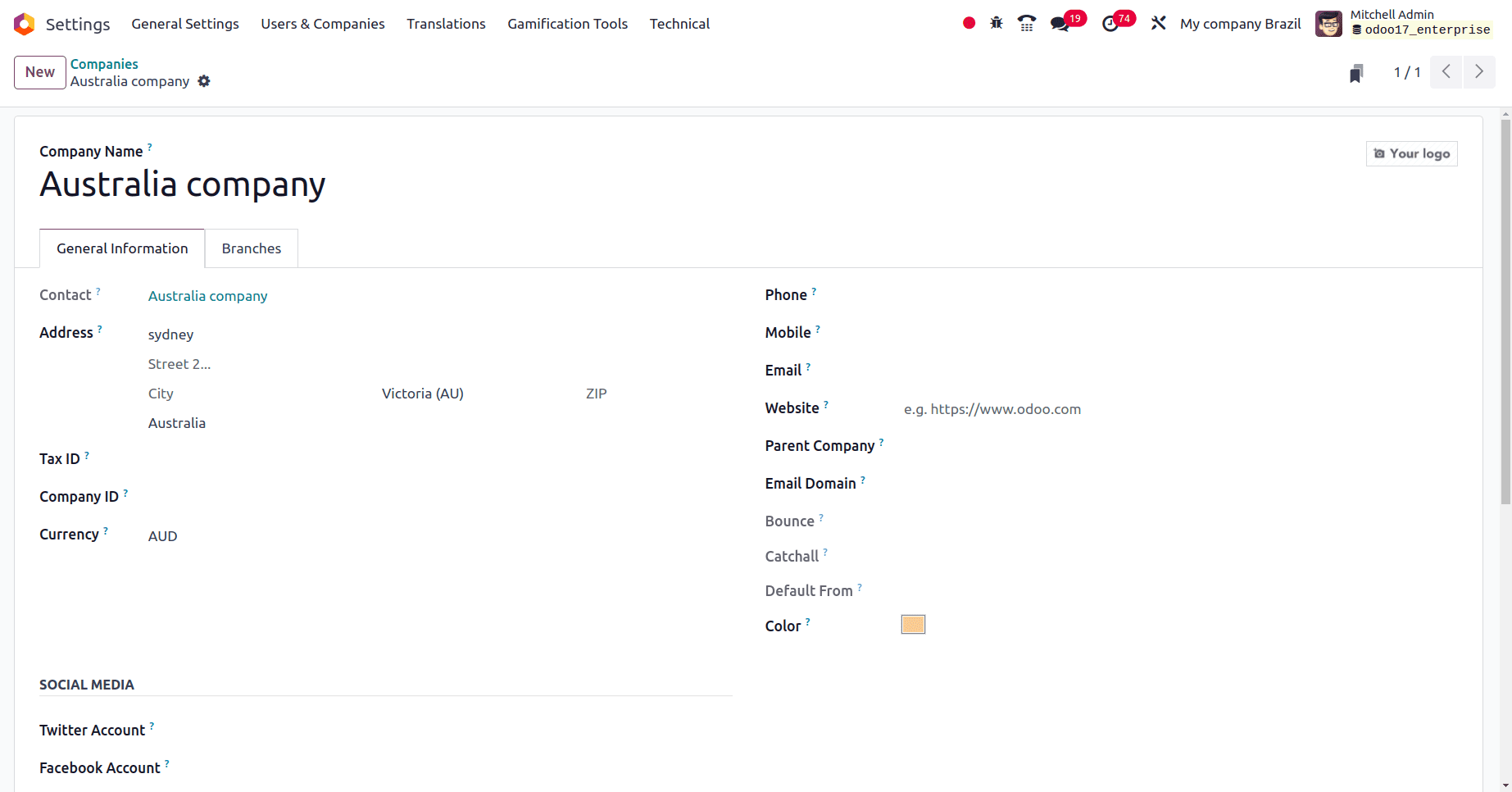

Give the company name, address, company ID, and all other details of the company. Click the save icon to save the details of the newly created company.

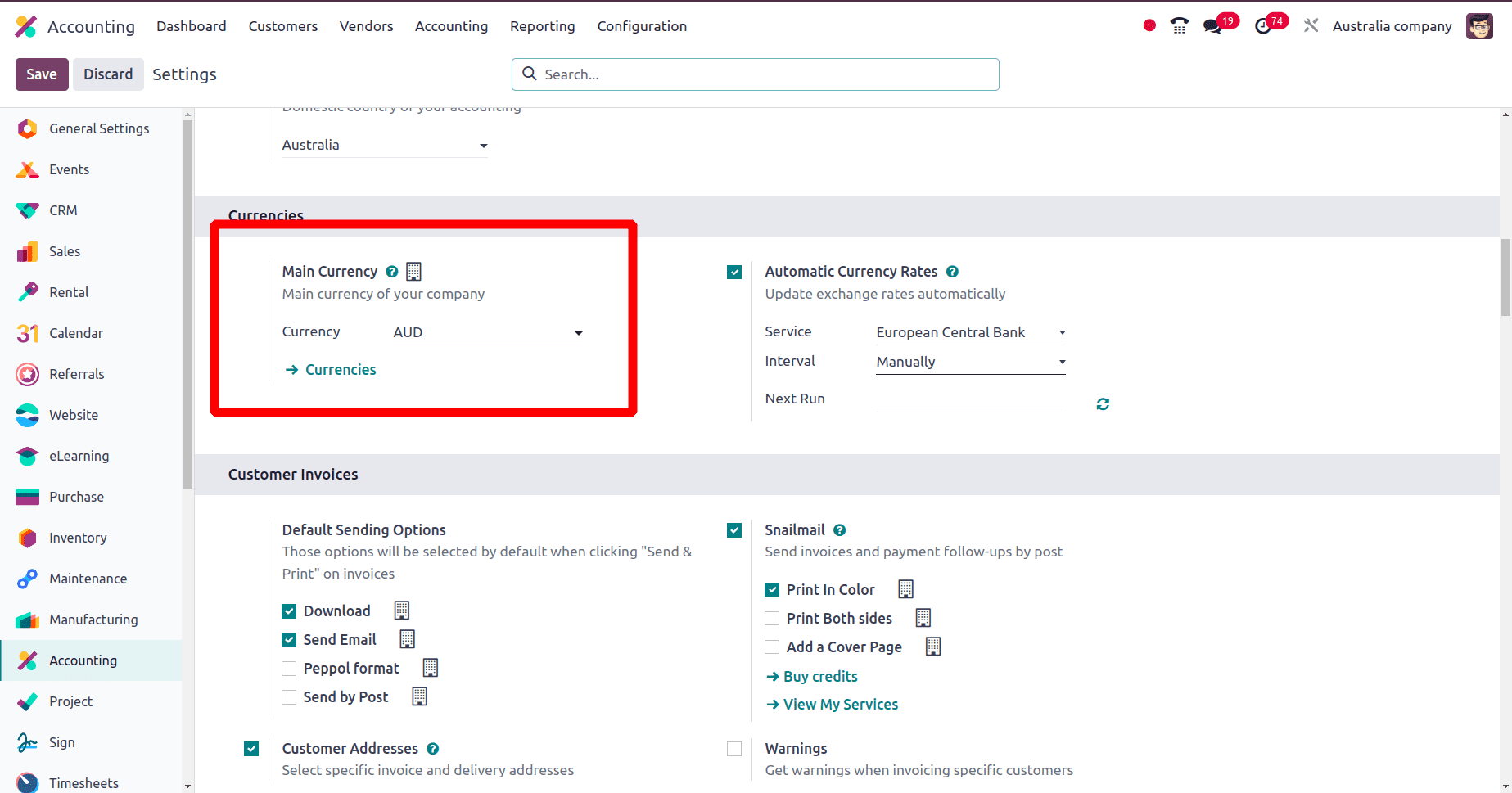

When we set a country for the company, Odoo will automatically configure the currency, the Australian dollar (AUD), for the company.

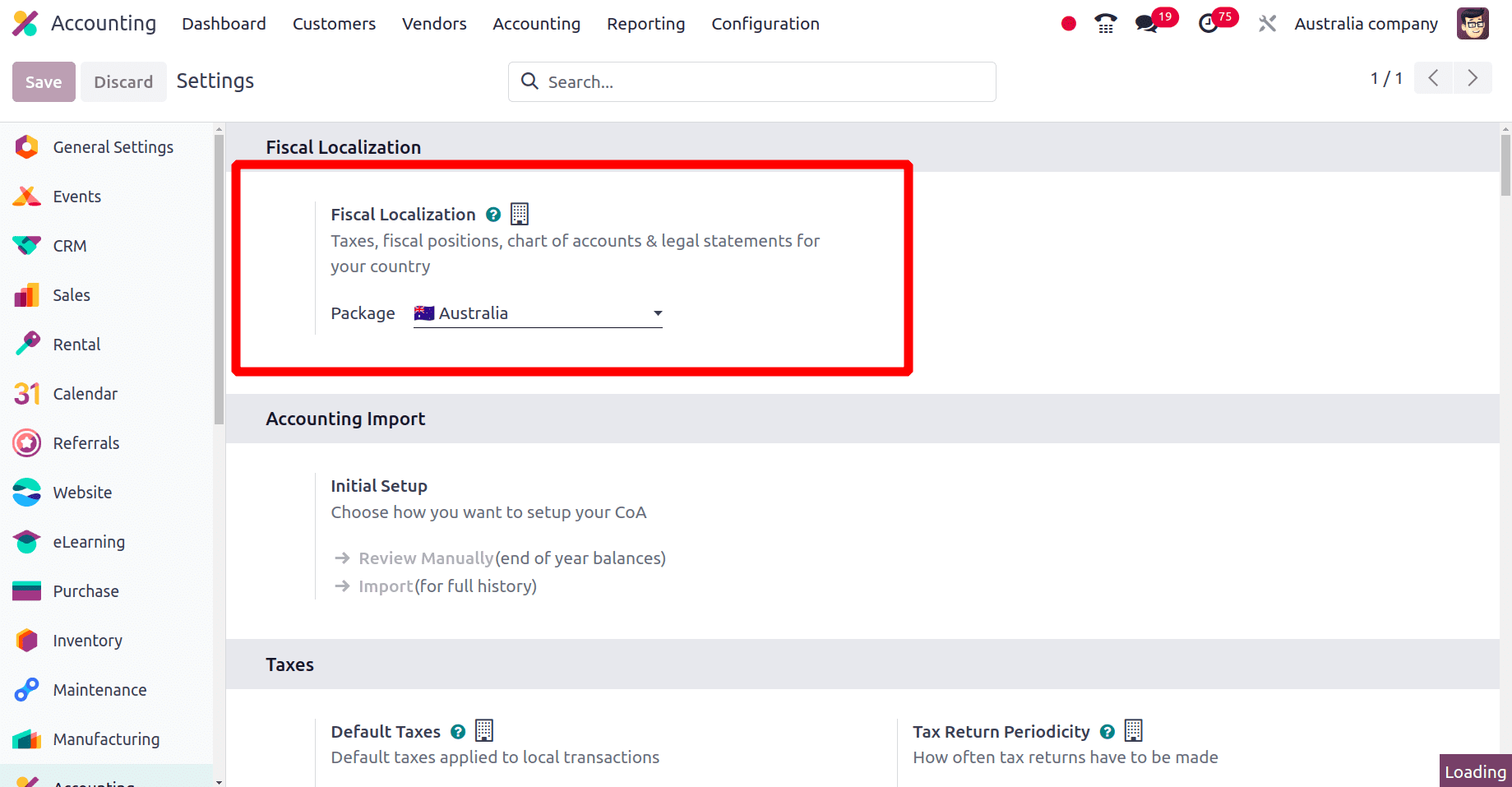

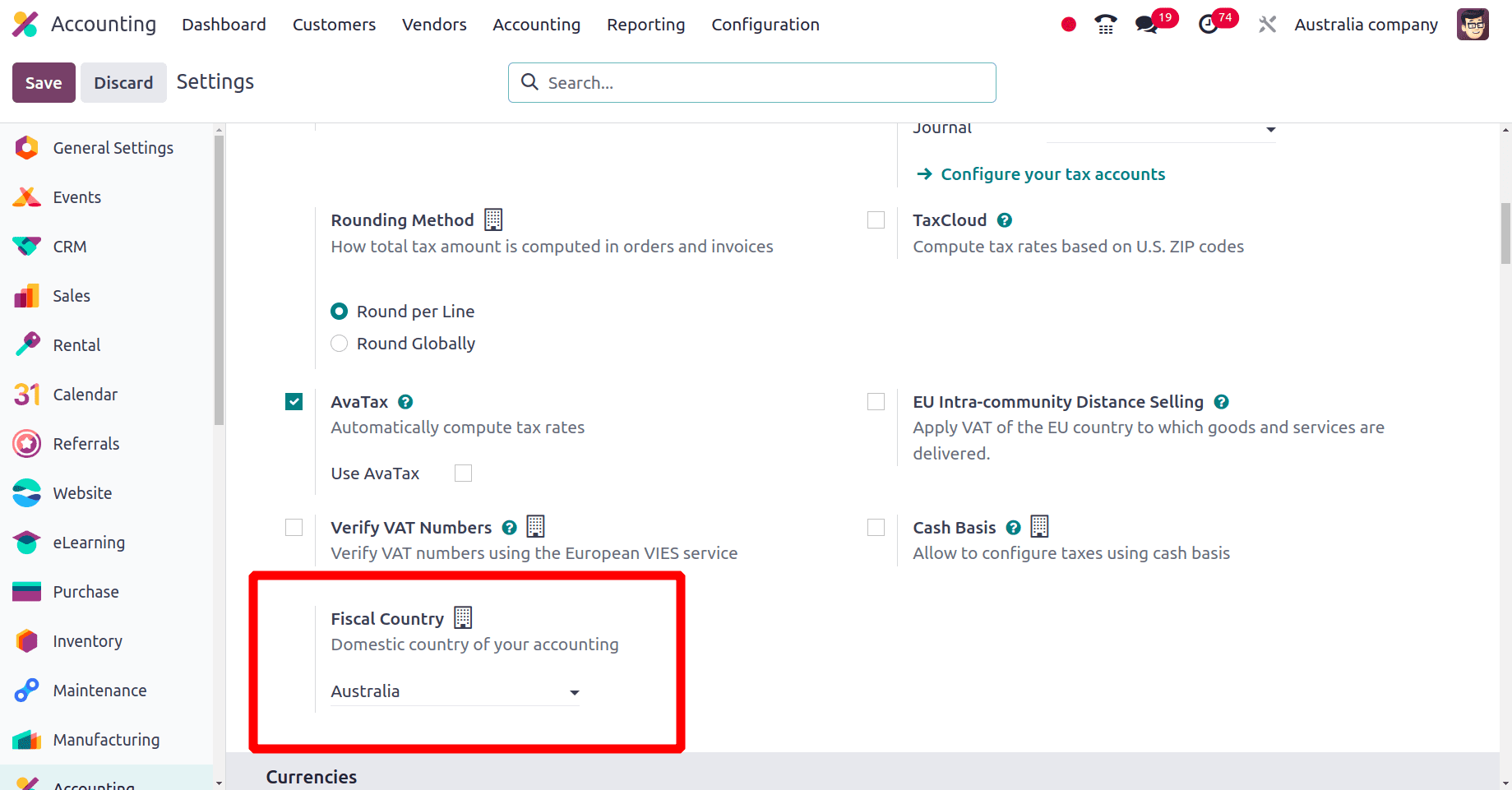

Then, go to the accounting application and choose the Configuration settings. Under the fiscal localization section, set the package as Australia and click the save button to save the settings.

Changes appeared when Australian localization was configured in Odoo 17

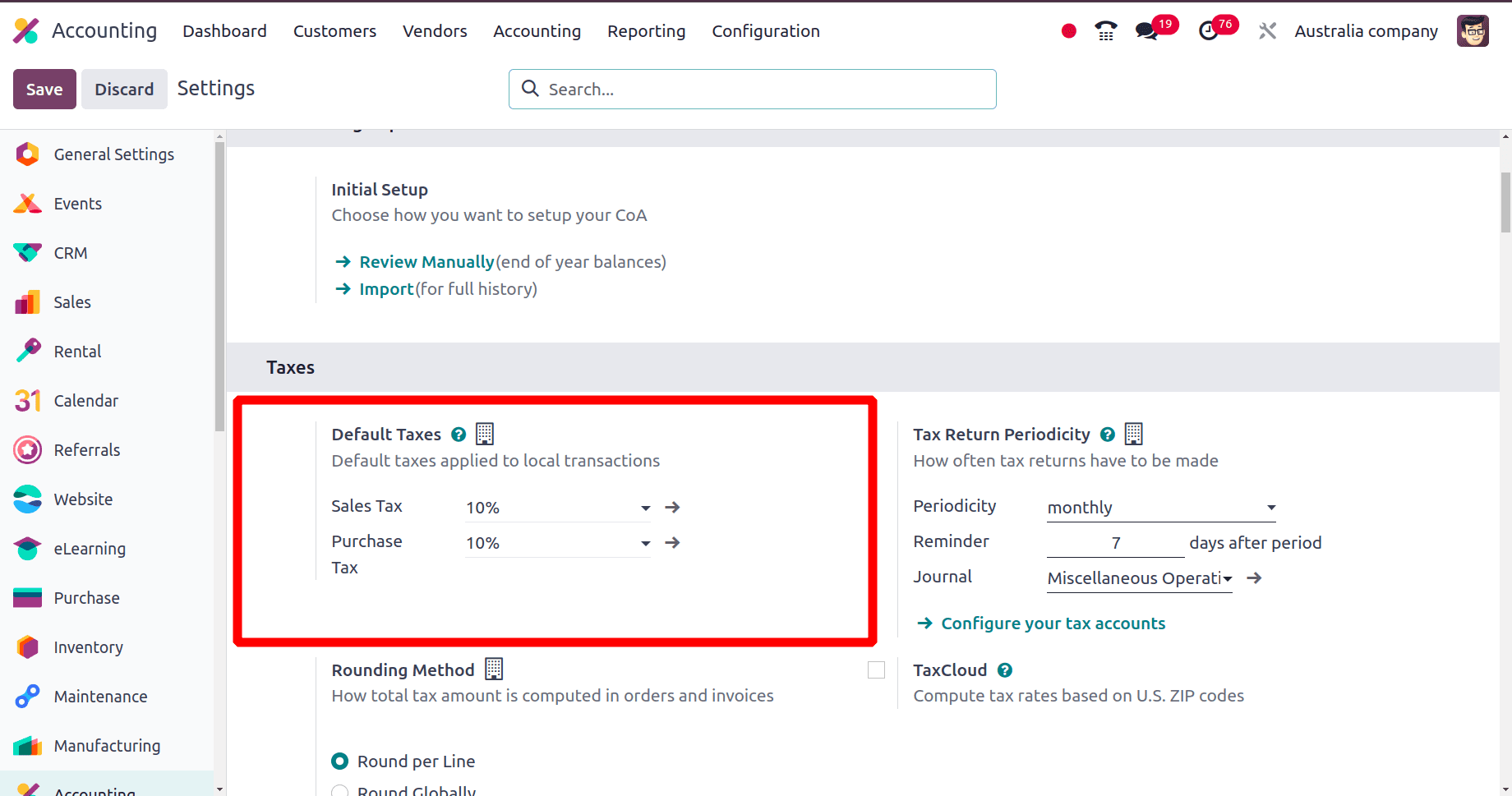

In the configuration settings itself, we can configure the default taxes under the taxes section. So there is no need to set the localization manually, that is when we set up the package as Australia Odoo 17 automatically updates the default tax which all the Australian companies are assigned to use.

From the above screenshot, we can see the default tax for the Australian companies is configured by Odoo 17 itself.

The next is the currency. We can configure the main currency for a company from the configuration settings. We know that the Australian currency is the Australian dollar (AUD), and the Odoo 17 configures the currency when we set the country for the company.

In the configuration settings, we can configure the fiscal country for the company, but if we set up the specific package for the company, under the taxes section, the fiscal country will automatically be configured by Odoo 17.

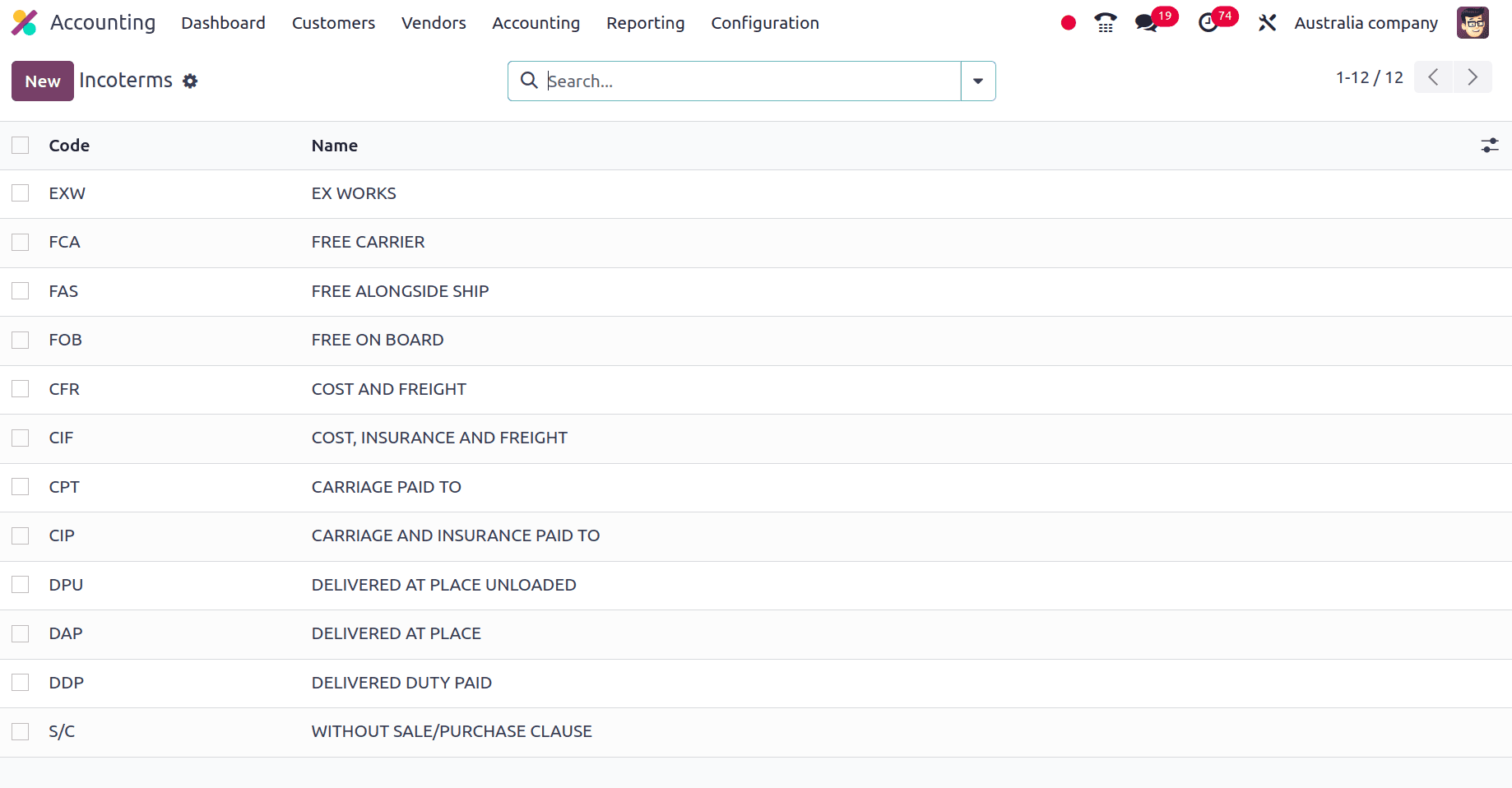

The obligations and responsibilities of buyers and sellers in cross-border trade transactions are specified by Incoterms (International Commercial Terms) in Odoo 17. These terms and conditions specify who is responsible for what costs and responsibilities related to product delivery and transportation.

These are the incoterms that an Australian company can use for their needs.

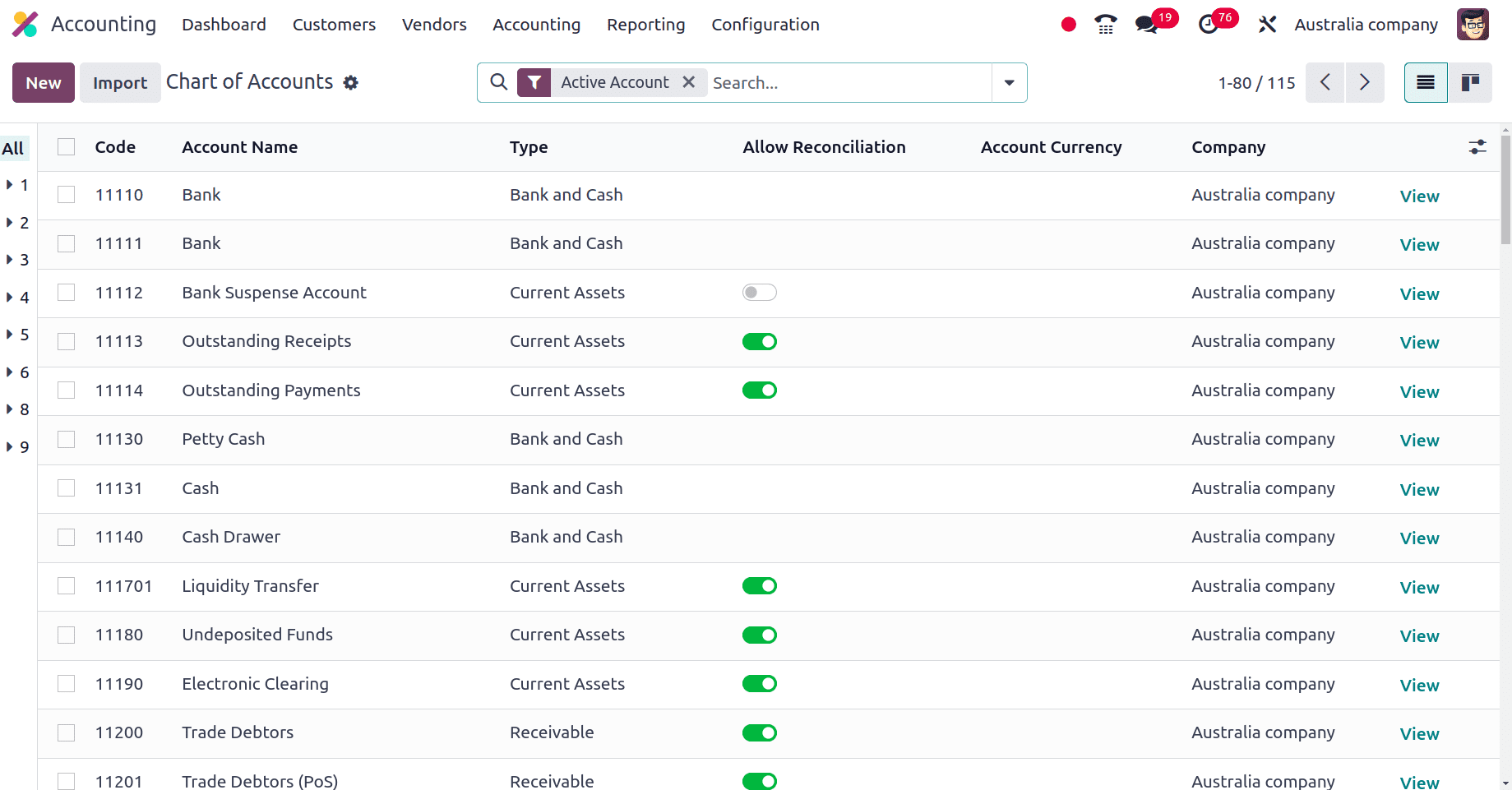

The general ledger (GL) accounts that a business or organization uses to record financial transactions are all listed in an organized manner in the chart of accounts in Odoo 17. It offers a methodical approach to classifying and organizing financial data in preparation for reporting and analysis.

Charts of accounts for different countries may differ. The chart of accounts that an Australian company can use is shown in the above screenshot.

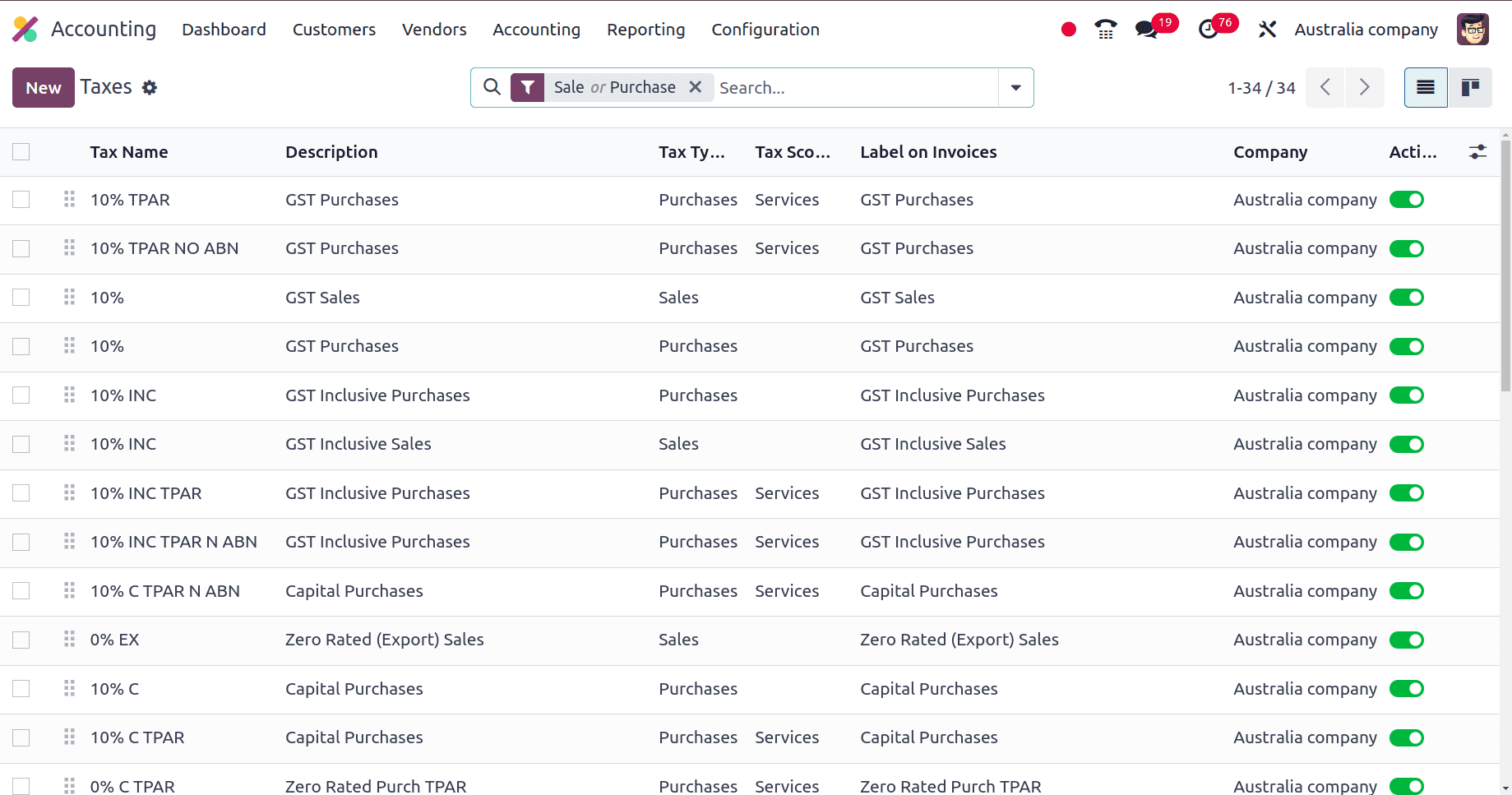

Taxes are handled by the accounting and invoicing modules in Odoo 17, and they are essential for precisely computing the tax obligations related to sales and purchase transactions.

Common taxes used in Australia are, TPRA, ABN, etc. that is for different products and different services also, the taxes used may vary

* TPRA: This is a tax rate applied to the income of temporary residents in Australia for the portion of the income year they reside in the country.

* ABN: An ABN is a unique 11-digit identifier for businesses and individuals registered for GST (Goods and Services Tax) in Australia

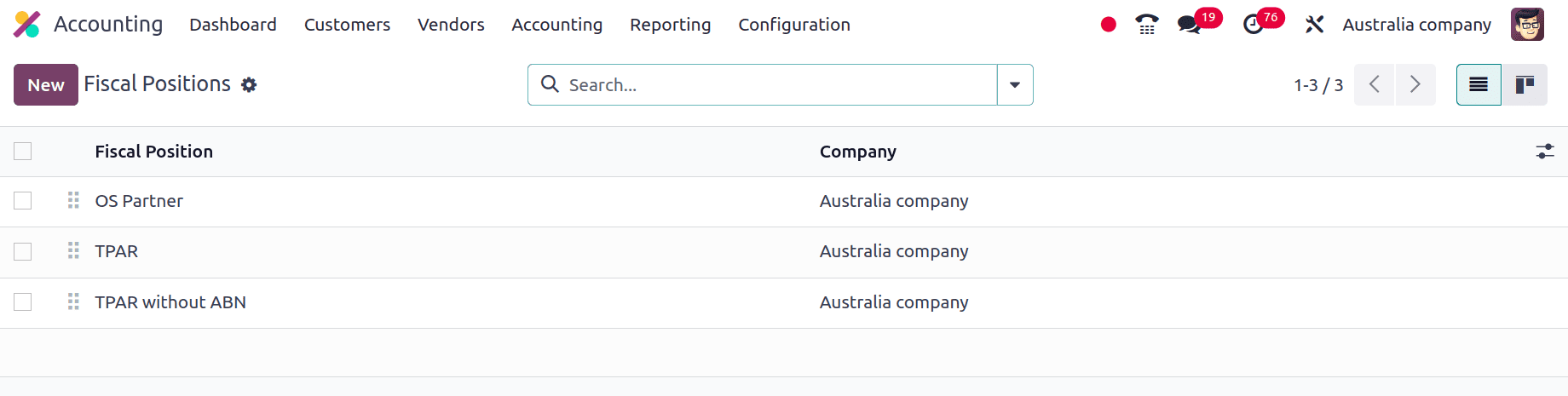

A fiscal position in Odoo 17 is a configuration setting that lets companies specify the taxes that are applied to sales and purchases based on particular parameters like the location of customers or suppliers, the kind of goods, or company regulations. Companies with complex tax legislation or those operating in various tax countries may find fiscal positions very helpful. In the screenshot, we can see that the fiscal position set for the Australian businesses is listed.

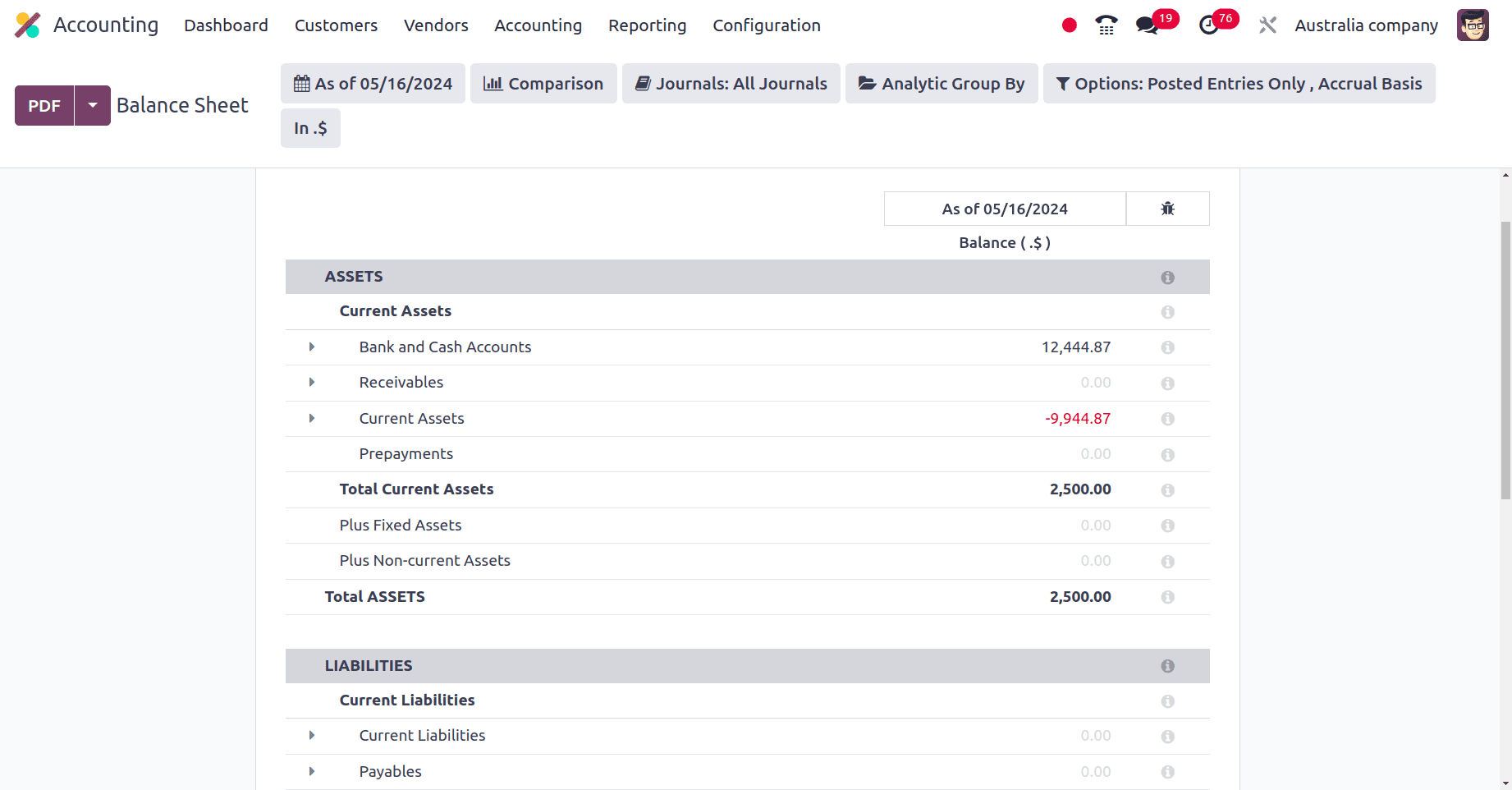

The balance sheet in Odoo 17 is a type of financial report that shows you the financial status of your business as of a particular date. It effectively works like a scaled photograph, providing a clear picture of the financial health of your company at that certain moment. The balance sheet configured for Australian businesses is shown in the screenshot. In this case, the company's assets, equity, and liabilities are mainly focused on. Assets include current assets, bank and cash payments, receivables, etc. liabilities include payables, current liabilities, etc. and equity includes, unallocated earnings, retained earnings, etc.

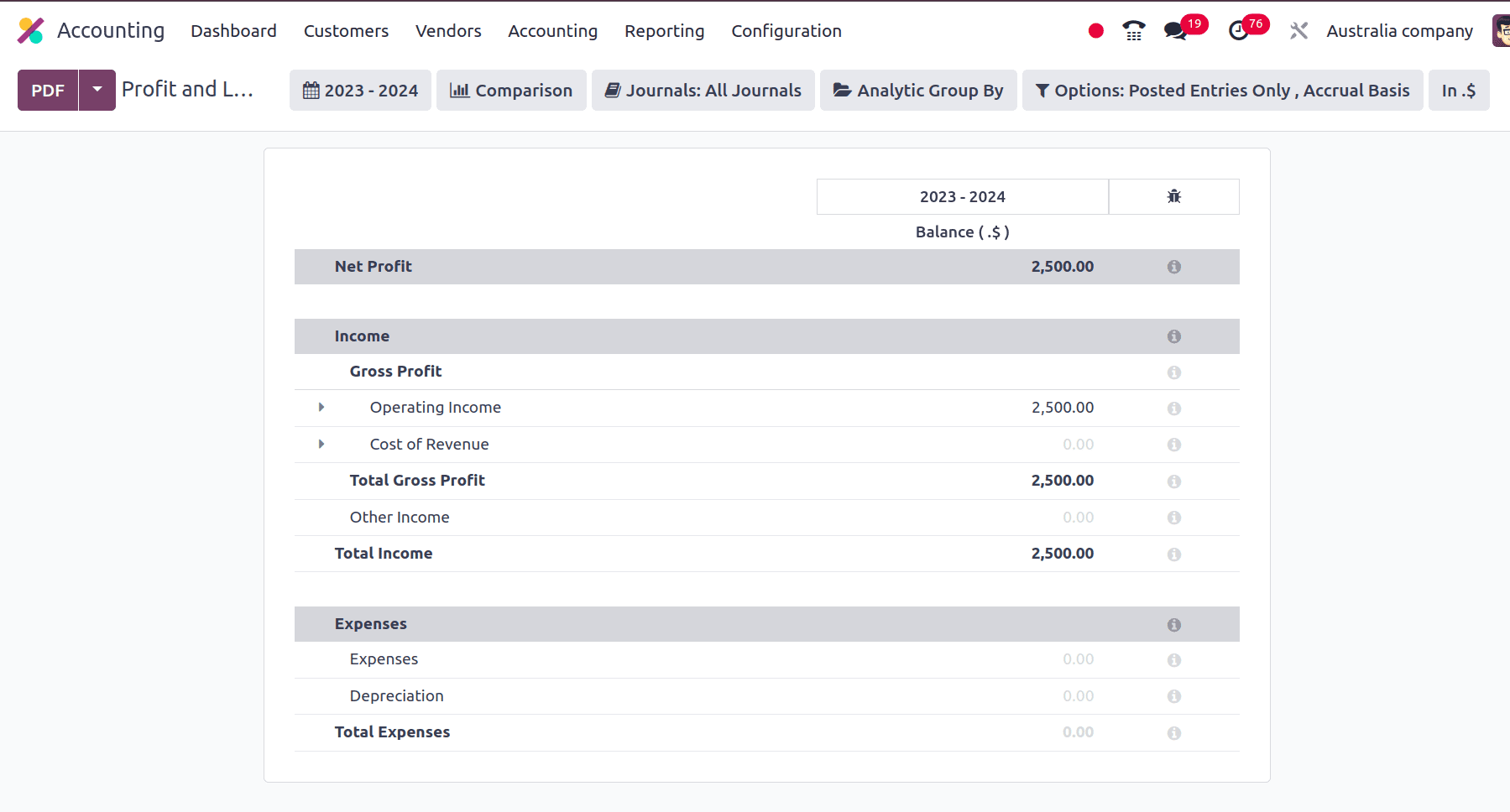

An essential financial document that provides an overview of your business's earnings and outlays for a given time frame is the profit and loss report. It reveals your total profitability by essentially telling you how much money your organization has made and spent over that period of time. The main terms included in the profit and loss of an Australian company are income and expenses. In income, there will be operating cost, cost of revenue, etc, and in expenses, expenses and depreciation are included.

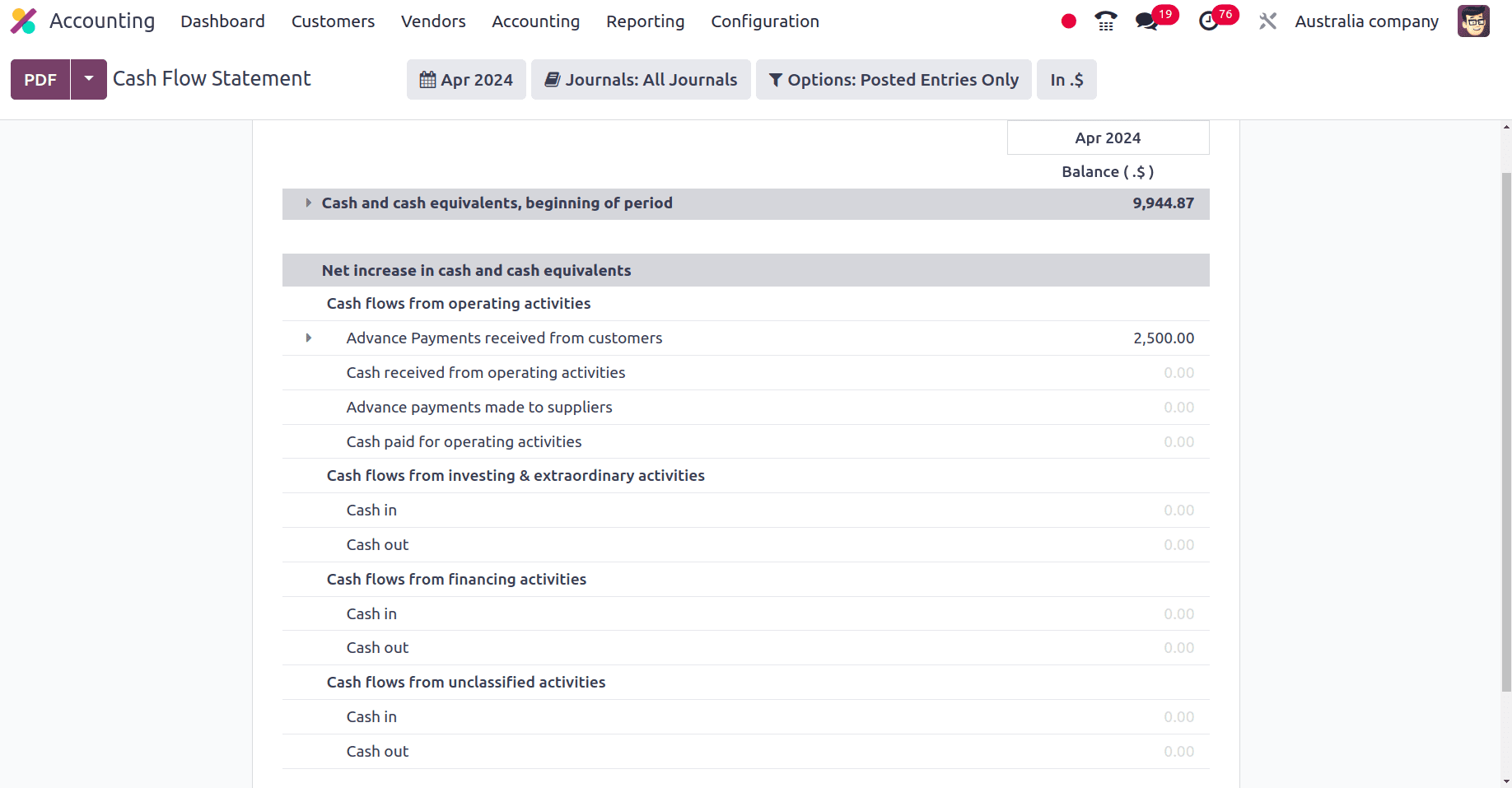

The cash flow statement, a financial report found in the Odoo17 accounting module, offers information on how cash moved through your business during a certain time period. It focuses on how your cash inflows and outflows affect your total liquidity rather than directly reflecting your profitability.

The cash flow statements that are used for the businesses in Australia and the Australian companies are shown in the above screenshot.

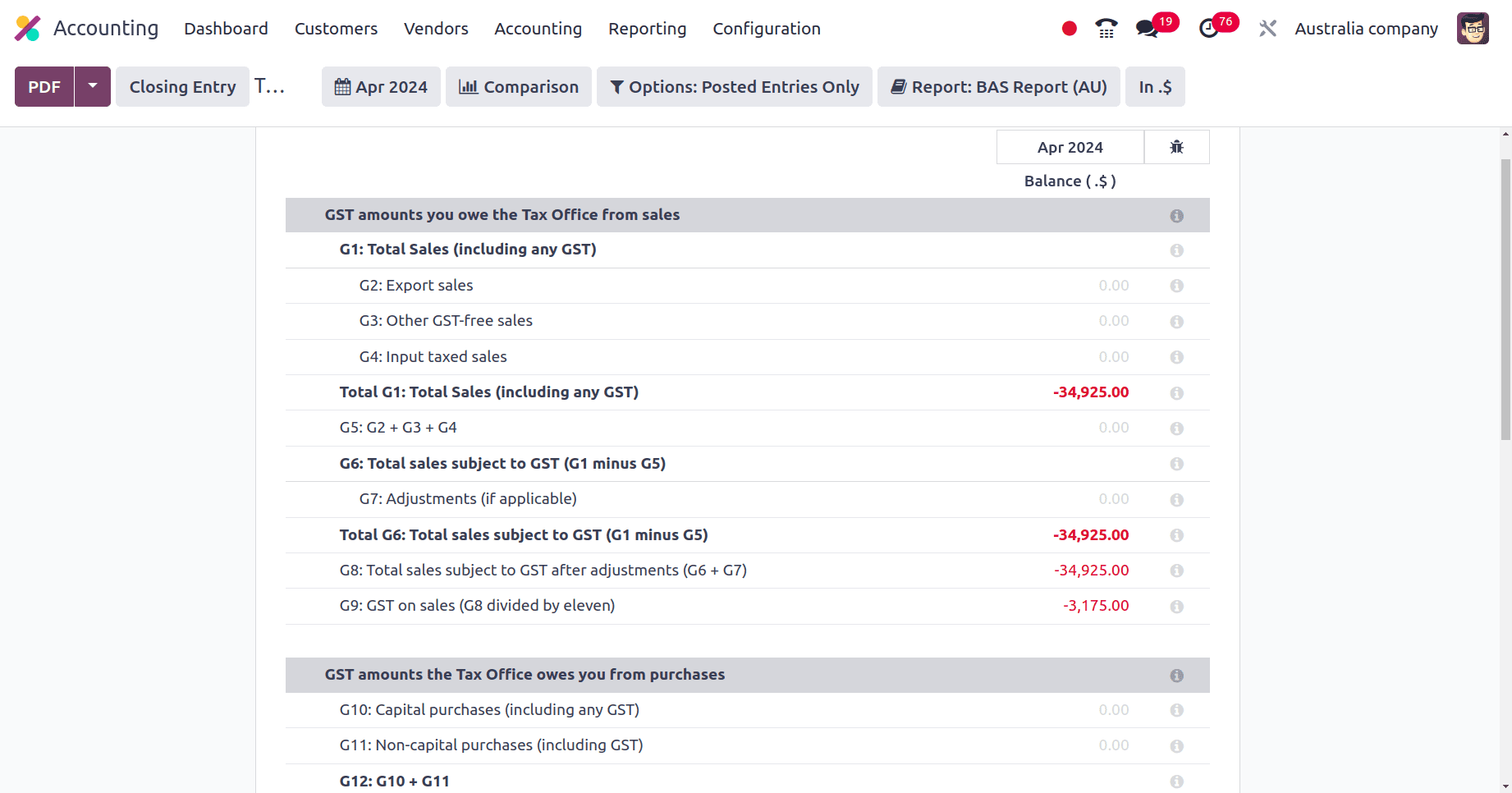

Tax reports in Odoo17 are essential for businesses to track their tax liabilities, file taxes accurately, and comply with tax laws. The tax report of an Australian company includes export sales, other GST-free sales, input-taxed sales, non-capital purchases, capital purchases, etc

* Export sales: Generally, GST is not applied to Australian export sales of products and services. This indicates that your export invoices are GST-free and are not included in the taxable sales section of your Odoo GST report (also called the BAS, or Business Activity Statement).

* Input-taxed sales: Input-taxed sales are sales of goods or services that are not subjected to GST.

* Non-capital purchase: Business expenses for ongoing operations that aren't anticipated to pay off after a single revenue year are referred to as non-capital purchases. In the income year in which they are incurred, these costs are entirely deductible.

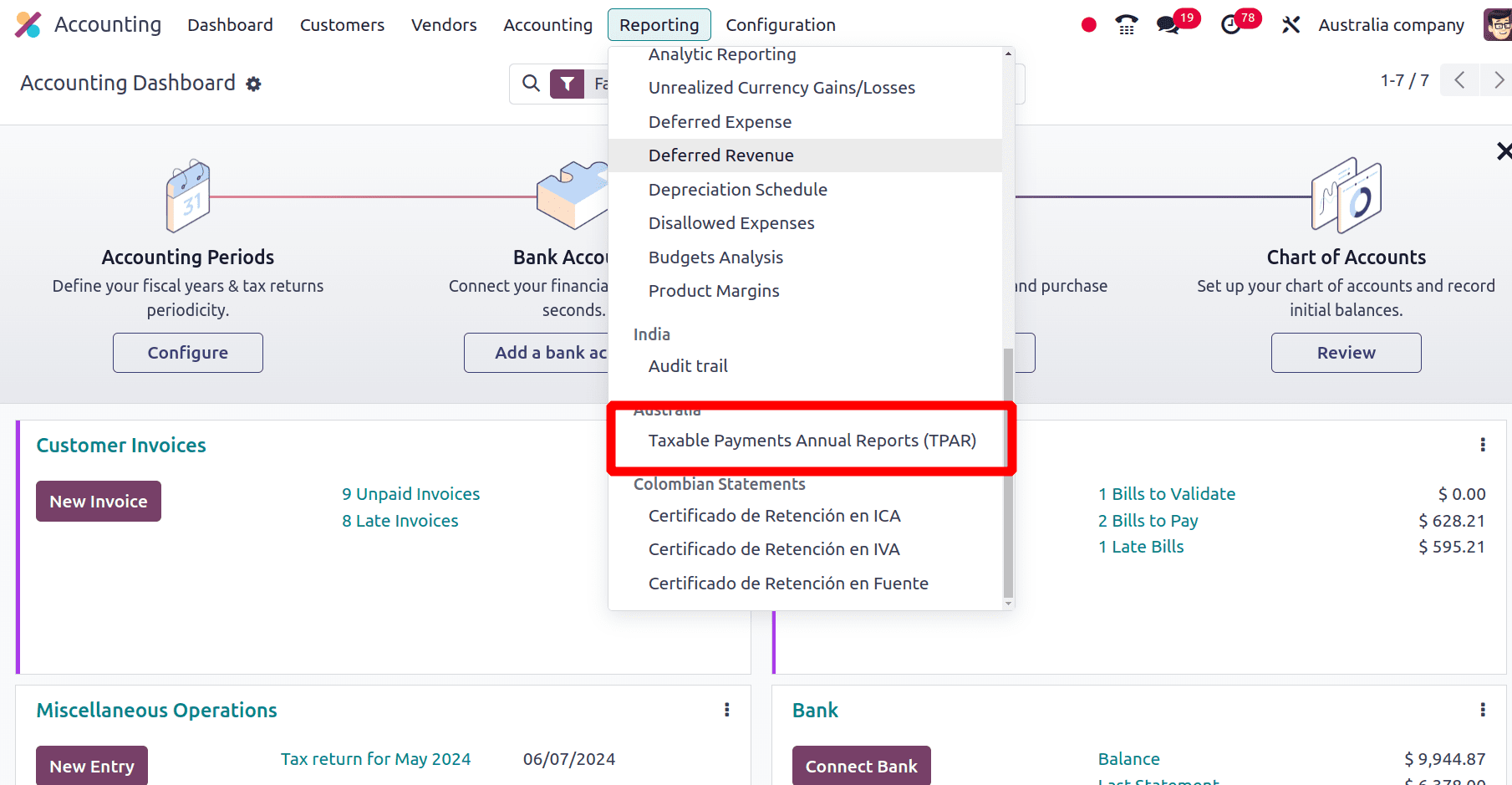

Under the Reporting menu of the accounting application, an extra sub-menu Taxable Payment Annual Reports (TPAR), is found.

Taxable Payment Annual Reports (TPAR) are the reports detailing the payments made to subcontractors or contractors throughout the course of a fiscal year. Companies that use subcontractors must provide the ATO with this report. when we click this sub-menu, we can see all Taxable Payment Annual Reports.

The localization feature for accounting procedures in Odoo 17 offers a comprehensive solution tailored to the particular needs and regulations of numerous places. By implementing country-specific regulations into Odoo 17, businesses may strengthen compliance, streamline financial operations, and improve reporting accuracy. Localization helps businesses manage complex tax systems, adhere to legal standards, and gain greater financial performance information. Ultimately, Odoo 17's accounting localization ensures compliance with local financial regulations, promoting growth and longevity, and empowering enterprises to operate successfully in global markets.