In odoo journal entries for each of the accounting transactions like invoices, vendor bills, expenses, pos orders, stock moves will be created automatically during each of the processes.

Odoo uses the double-entry bookkeeping system in accounting. So all of the journal entries will be automatically balanced, i.e. the sum of debits = sum of credits.

In Odoo, the end-user can manage accrual accounting and cash basis accounting. Cash basis accounting and accrual basis accounting are two different methods used to record accounting transactions. The main difference between these two methods is in the recording of the transaction time.

1. Accrual basis: In accrual basis accounting, revenue or expenses are recorded when earned or consumed.

2. Cash basis: In cash basis accounting, revenue or expenses are recorded when cash is received from customers or cash is paid to suppliers.

The name ‘accrual’ in accrual accounting refers to the recording of revenue or expense in the absence of the cash transaction.

The two types of accrual in accounting are,

1. Expense Accrual

2. Revenue Accrual

Under expense accrual, it records the expenses incurred and does not record the cash transaction.

For example, an employee created an expense say ‘Travel expense’ and submitted it to the company. In this case, the amount is paid by the employee, not by the company. So the employee can submit this expense report to the manager to claim the money he spends from the company. It can be considered as an expense accrual because this amount is not claimed back yet from the company. Also, the purchase orders, which will not make a payment for the bill is an accrual expense.

Under revenue accrual, it records the revenue incurred and not record the cash transactions yet.

For example, if we create a sales order and made the stock transfer and not have invoiced yet. This is considered as a revenue accrual.

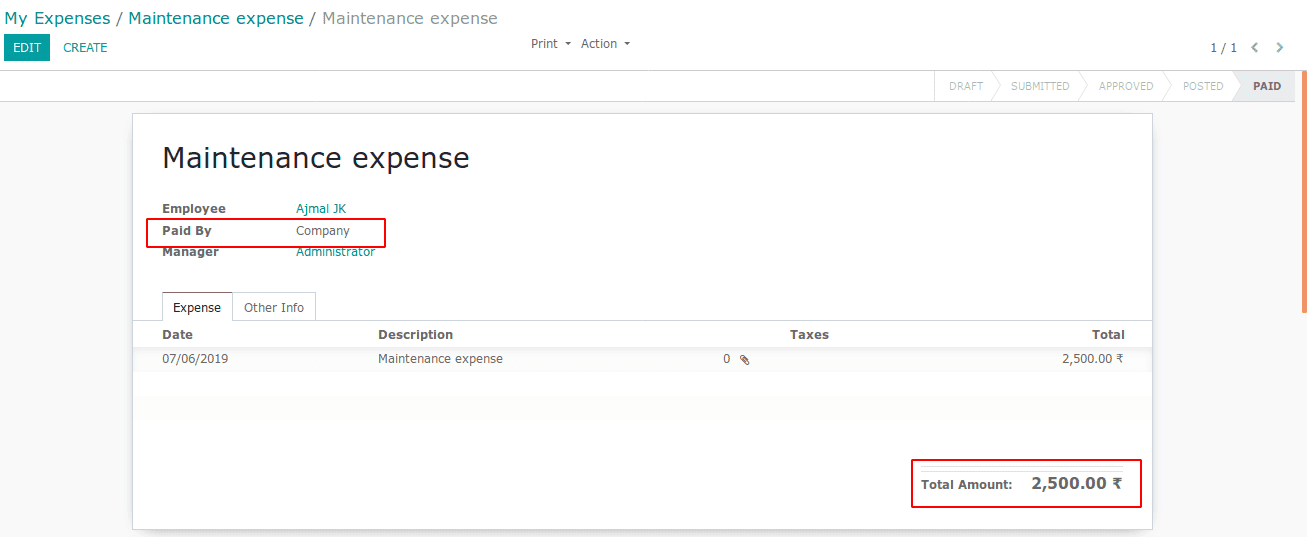

On the other hand, in cash basis accounting, the transactions are recorded when cash is received or paid. For example, an expense is created say ‘Maintenance expense’ and it is paid by the company. This can be categorized as cash basis accounting.

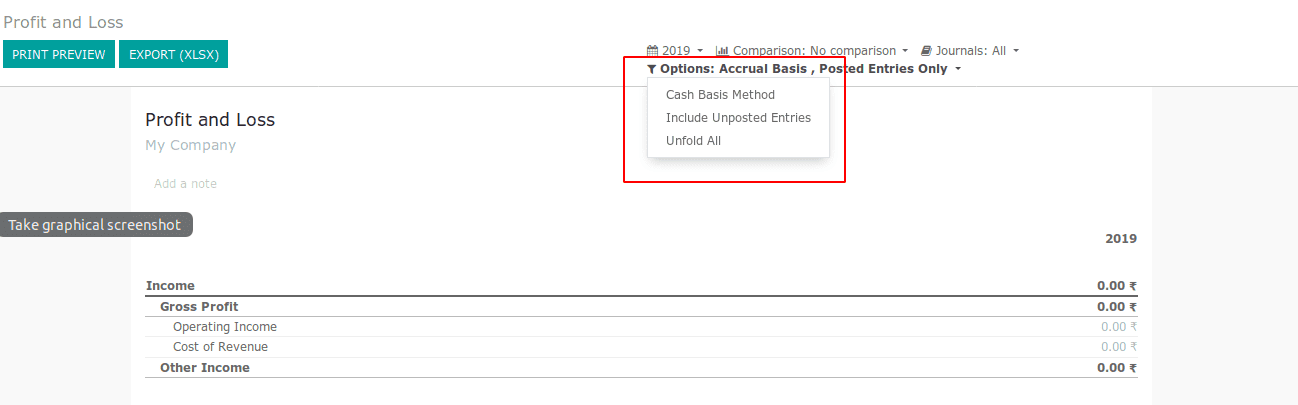

In Odoo Enterprise, one can track the accrual basis and cash basis accounting separately from the accounting reports. One can select the cash basis method transactions alone from the reports.

Go to Accounting -> Reports

We can create a cash basis transaction and check the reports to understand how it works.

Let us create an expense record says ‘Maintenance expense’ as we mentioned above which is paid by the company.

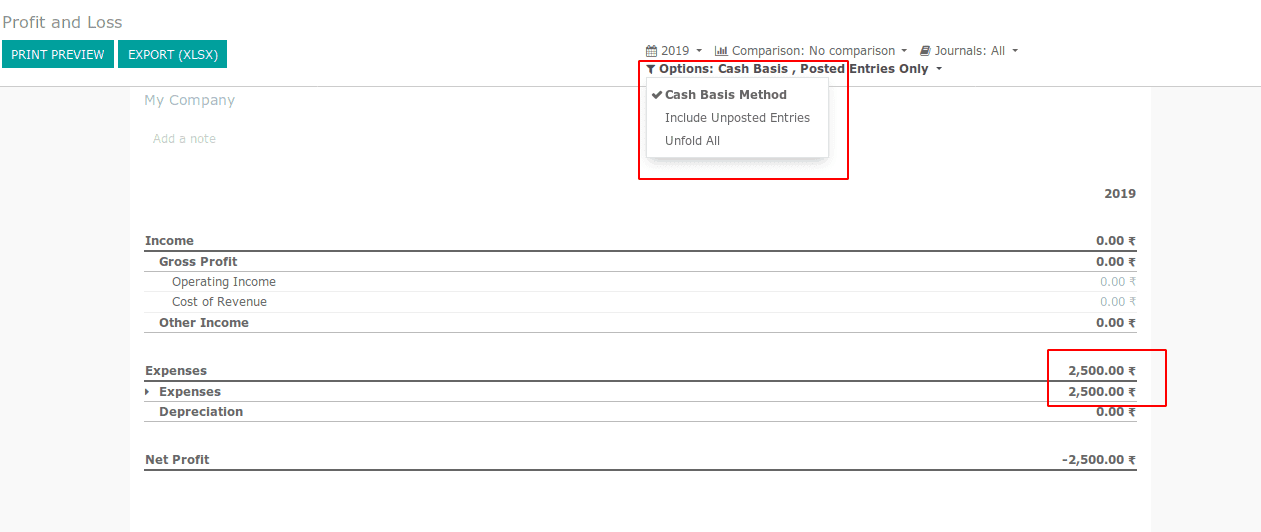

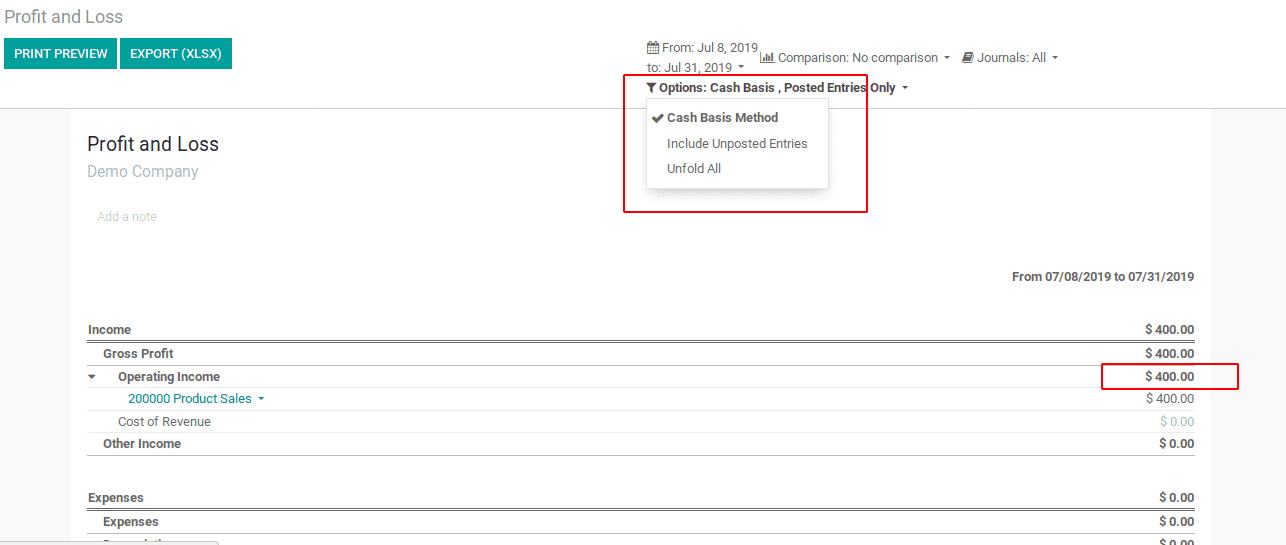

Go to Accounting -> Reports -> Profit and Loss and select the ‘Cash basis method’, then we can see the expense that is paid by the company.

If we select the ‘Cash basis Method’, in reports, it will only display the cash basis accounting transactions.

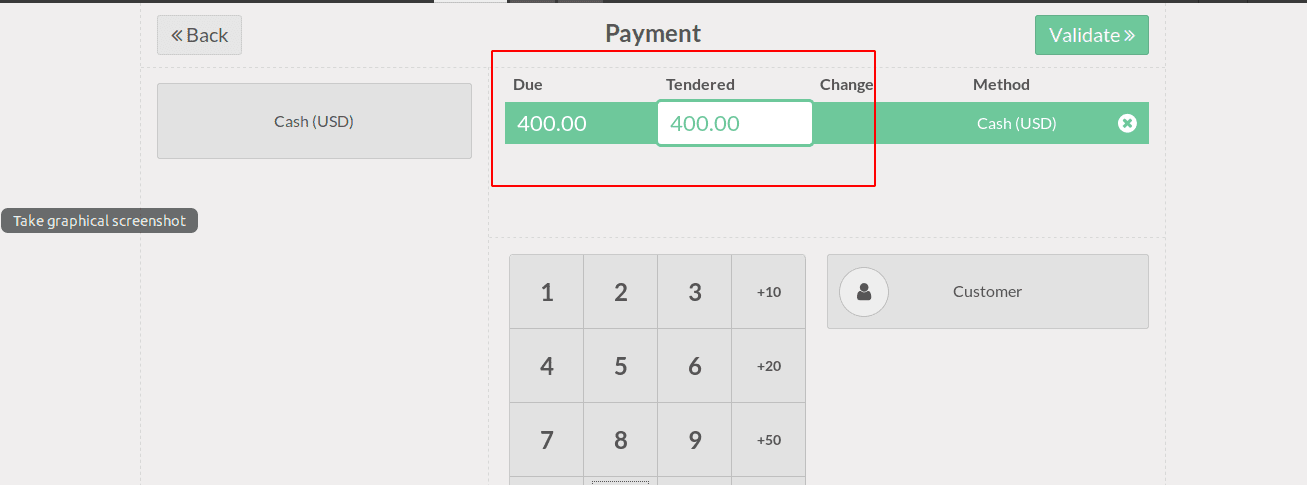

For another example, we can create a point of sale order and can check it in the report.

From the report, if we filter by the ‘Cash basis method’ the end user can get the point of sale order transaction details.

This is how cash basis and accrual basis accounting works in Odoo.

To know more about Odoo Accounting, the Best Accounting Software. Watch the video below to know more about the features of Odoo Accounting