Different companies have their accounting localizations according to the country in which they function; Odoo 17 supports the localization of several countries. We should set the correct accounting localization for the company for accurate dealings with taxes and other legal activities. So in this blog, we will be discussing the Accounting localization for Mexico in Odoo 17. Accounting localization in Mexico provides all the accounting features that are required in a company that is operating in Mexico. When we install a country’s localization, the chart of accounts and taxes are automatically generated.

The following prerequisites must be satisfied before setting up the Odoo modules for the Mexican localization:

* Should have a valid RFC and be SAT registered.

* Should own a Digital Seal Certificate (CSD).

* Select an Authorised Certification Provider, or PAC (Proveedor Autorizado de Certificación). At the moment, Odoo integrates with Quadrum (formerly Finkok), Solución Factible, and SW Sapien - Smarter Web PACs.

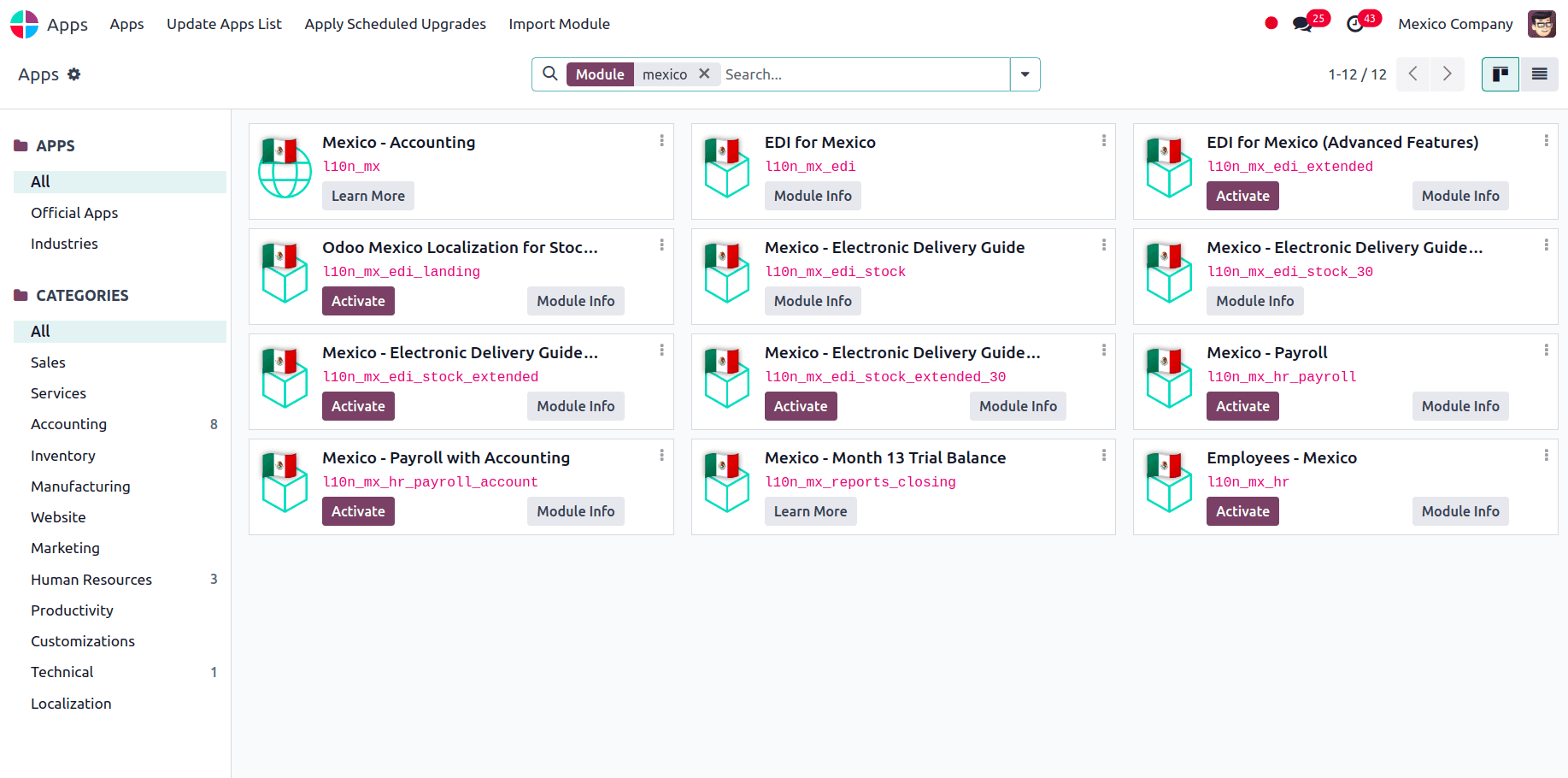

The first step is to install the Mexican localization. For that, we can go to Apps and install the modules that are required to set up the Mexican localization.

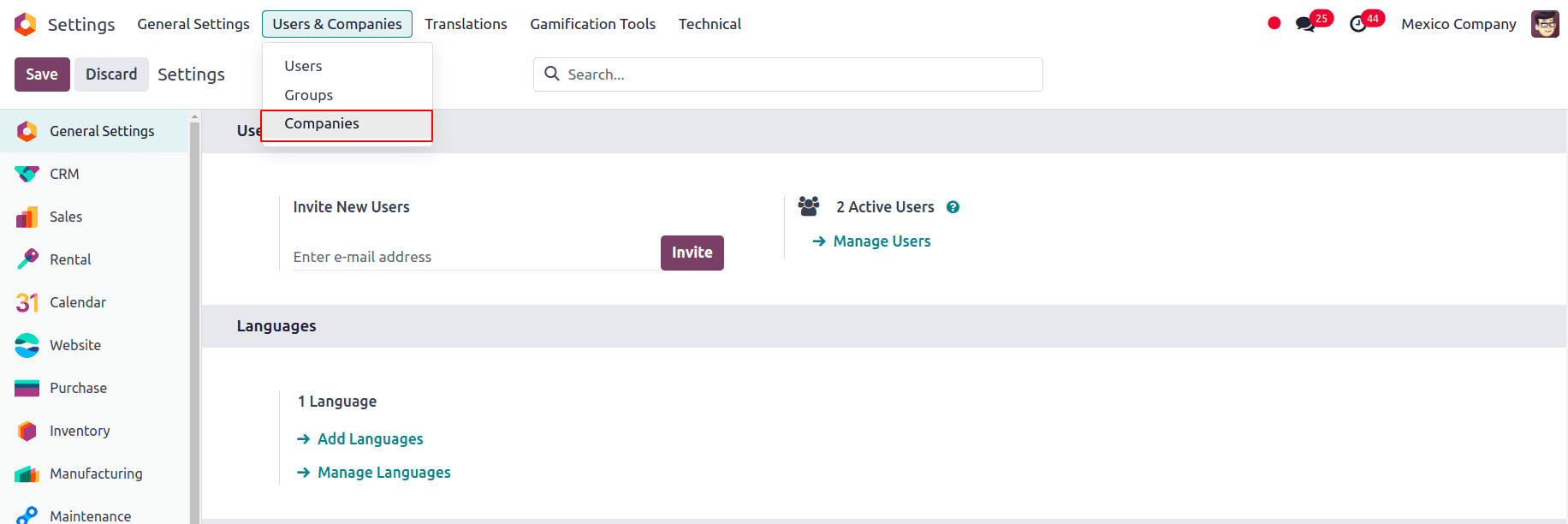

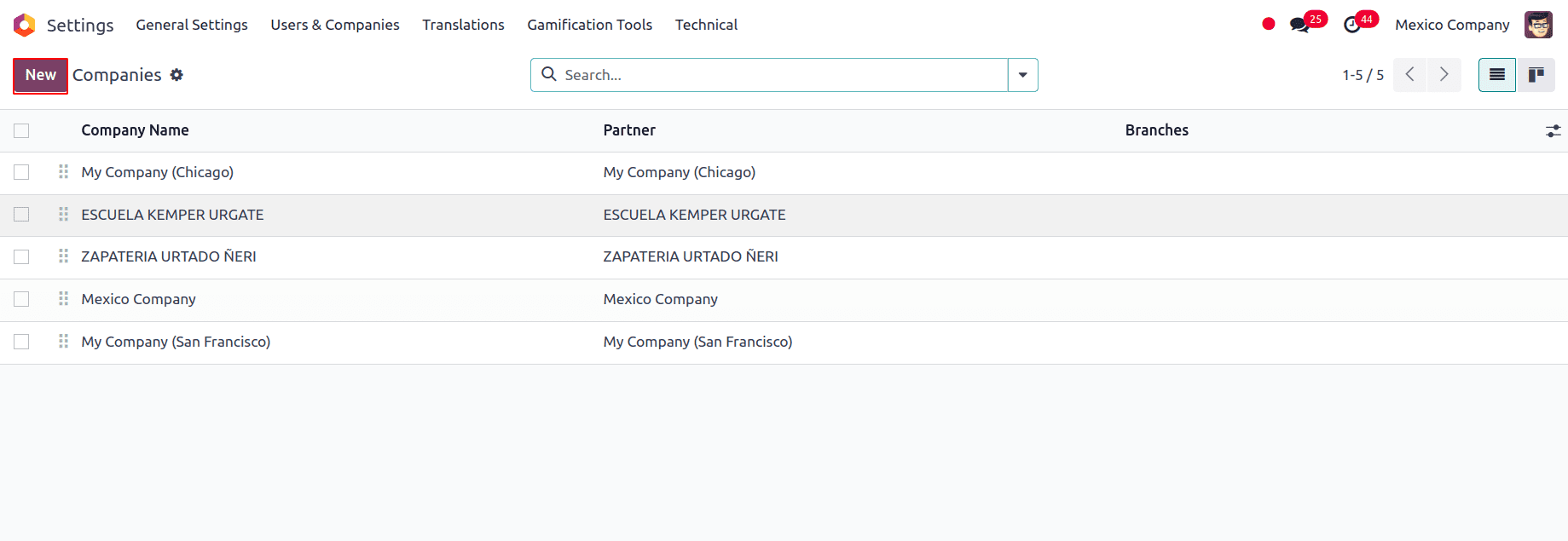

Next, we have to make sure that the company is configured properly with a valid company address and other valid details or we can create a new company. Odoo installs the Mexico - Accounting, EDI for Mexico, and EDI v4.0 for Mexico modules automatically when you setup a database from scratch and choose Mexico as the country. For checking the company configurations go to Settings => Users and Companies => Companies.

A new page appears with a list of all the companies and click on the New button at the top left to create a company.

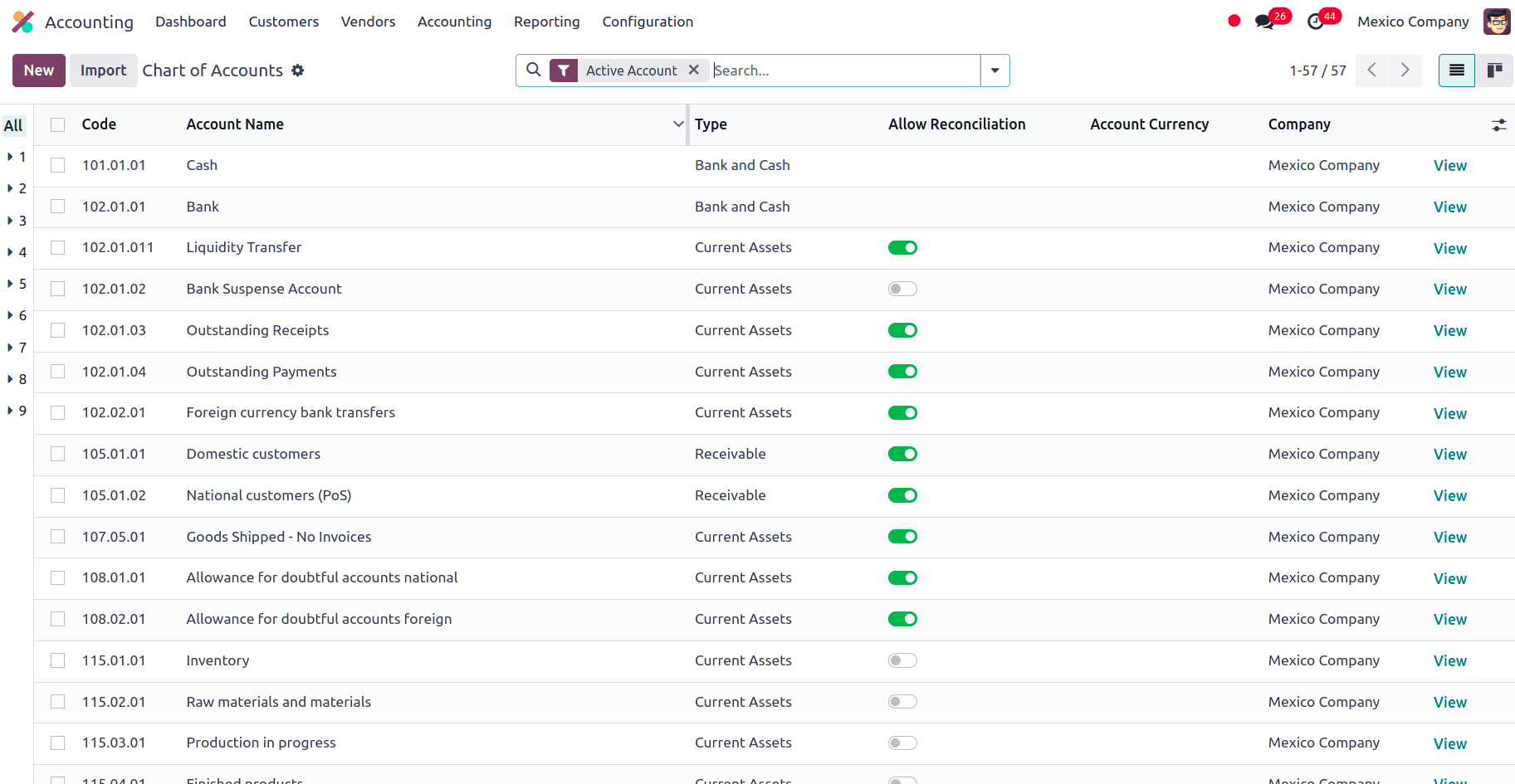

Charts of Account

The Código agrupador de cuentas (SAT) is the basis for the particular pattern that the chart of accounts in Mexico follows. Any account can be created as long as it follows the SAT encoding, which is NNN.YY.ZZ or NNN.YY.ZZZ. 401.01.001 and 102.01.99 are a couple of examples.

The right grouping code appears in Tags and your account appears in the COA report when you create a new account with the SAT encoding group pattern in Accounting => Configuration => Chart of Accounts.

Taxes

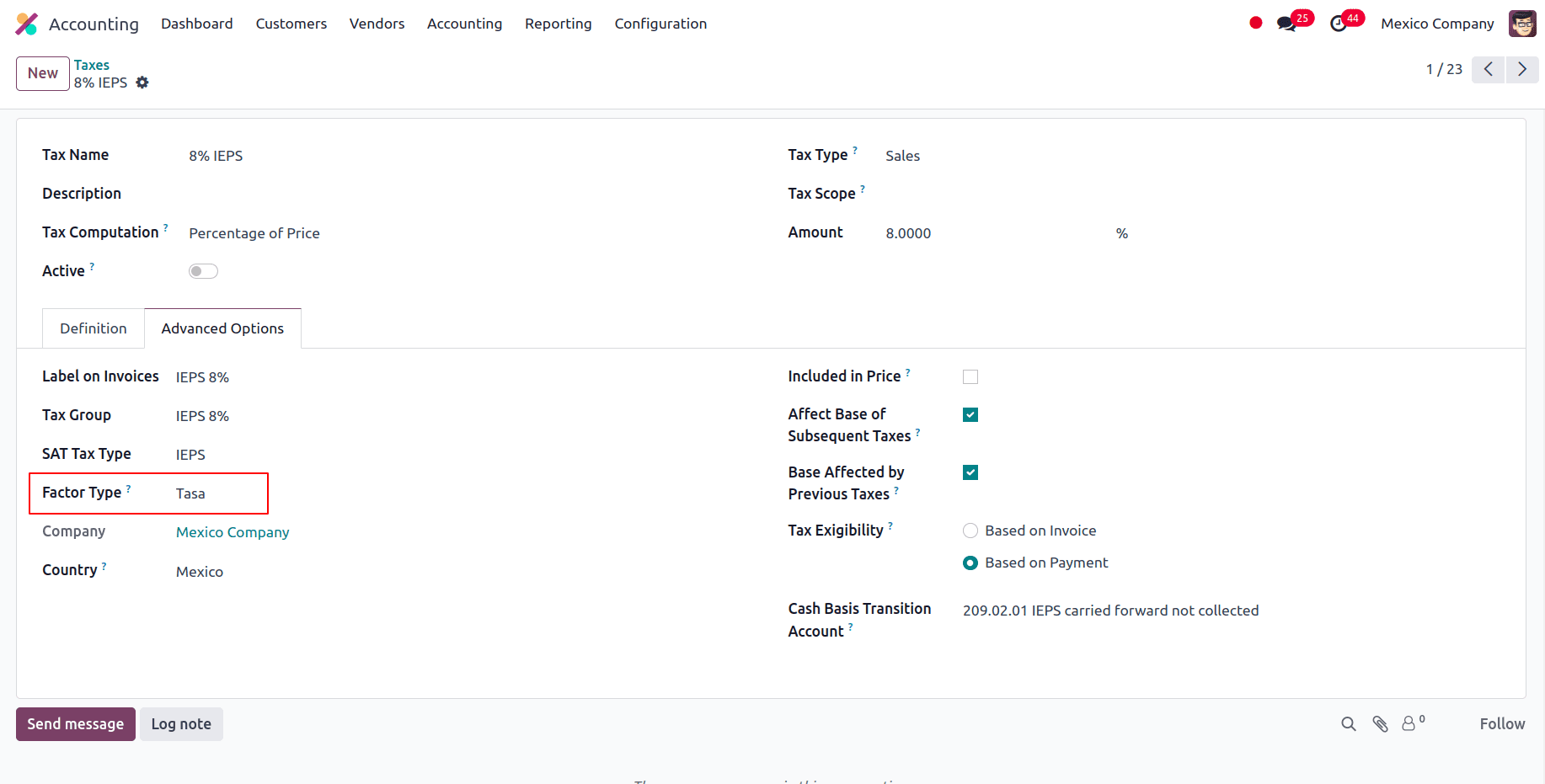

In the case of Taxes, to sign invoices correctly, a few more configurations for factor type and tax objects must be added to the sales taxes. Go to Accounting => Configuration => Taxes, and in the Advanced Options, there is an option called Factor Type. It will be automatically loaded for the default taxes, and when we are creating new taxes we have to enable this field.

Odoo will transfer taxes from the Cash Basis Transition Account to the account specified in the Definition tab when registering a payment. When reclassifying taxes, the Basee Imponible de Impuestos en Base a Flujo de Efectivo tax base account will be used in the journal entry. Don't remove this account.

You must include the appropriate Tax Grids (IVA, ISR, or IEPS) for any new taxes you create under Accounting ? Configuration ? Taxes. Odoo only facilitates these three tax categories.

Products

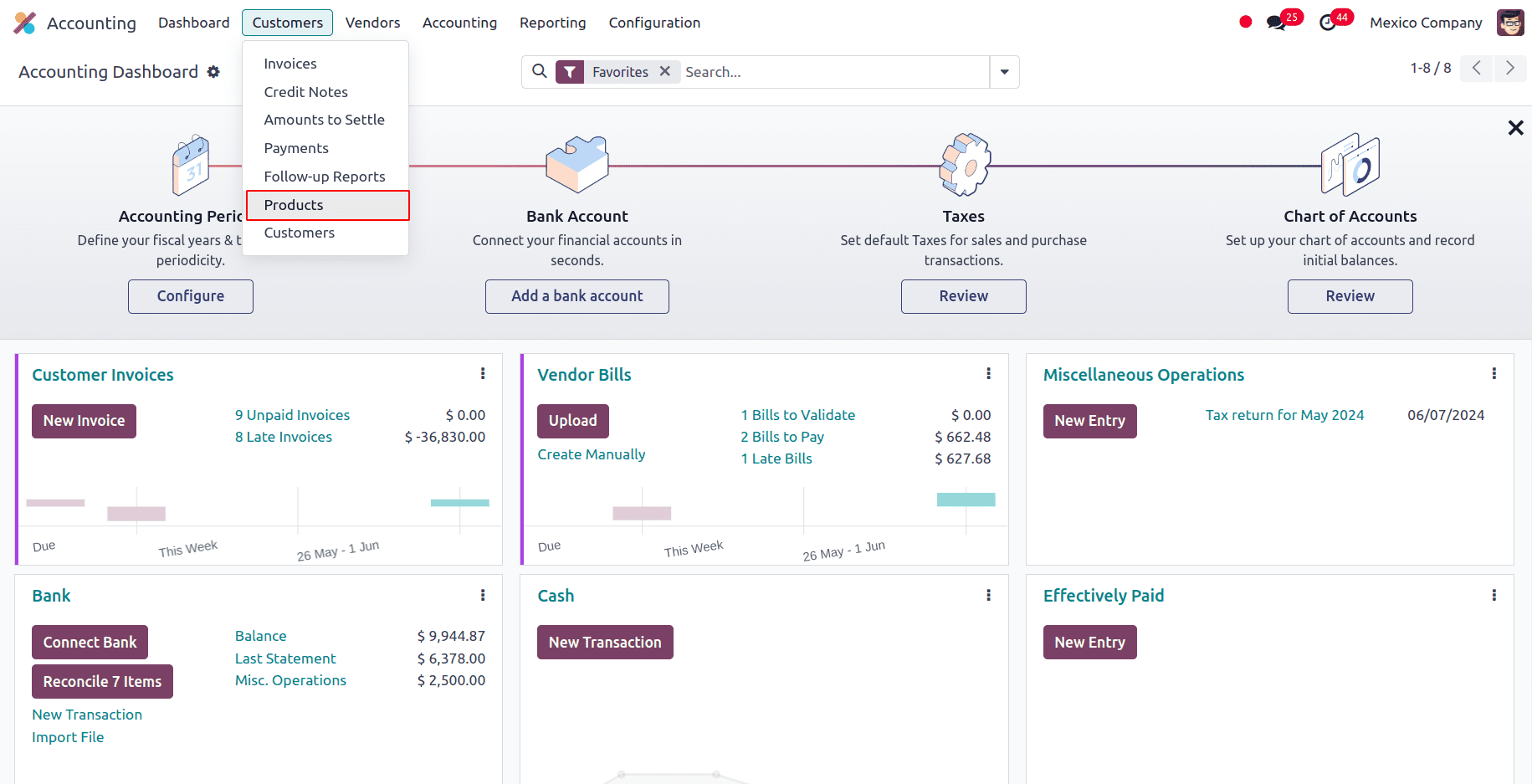

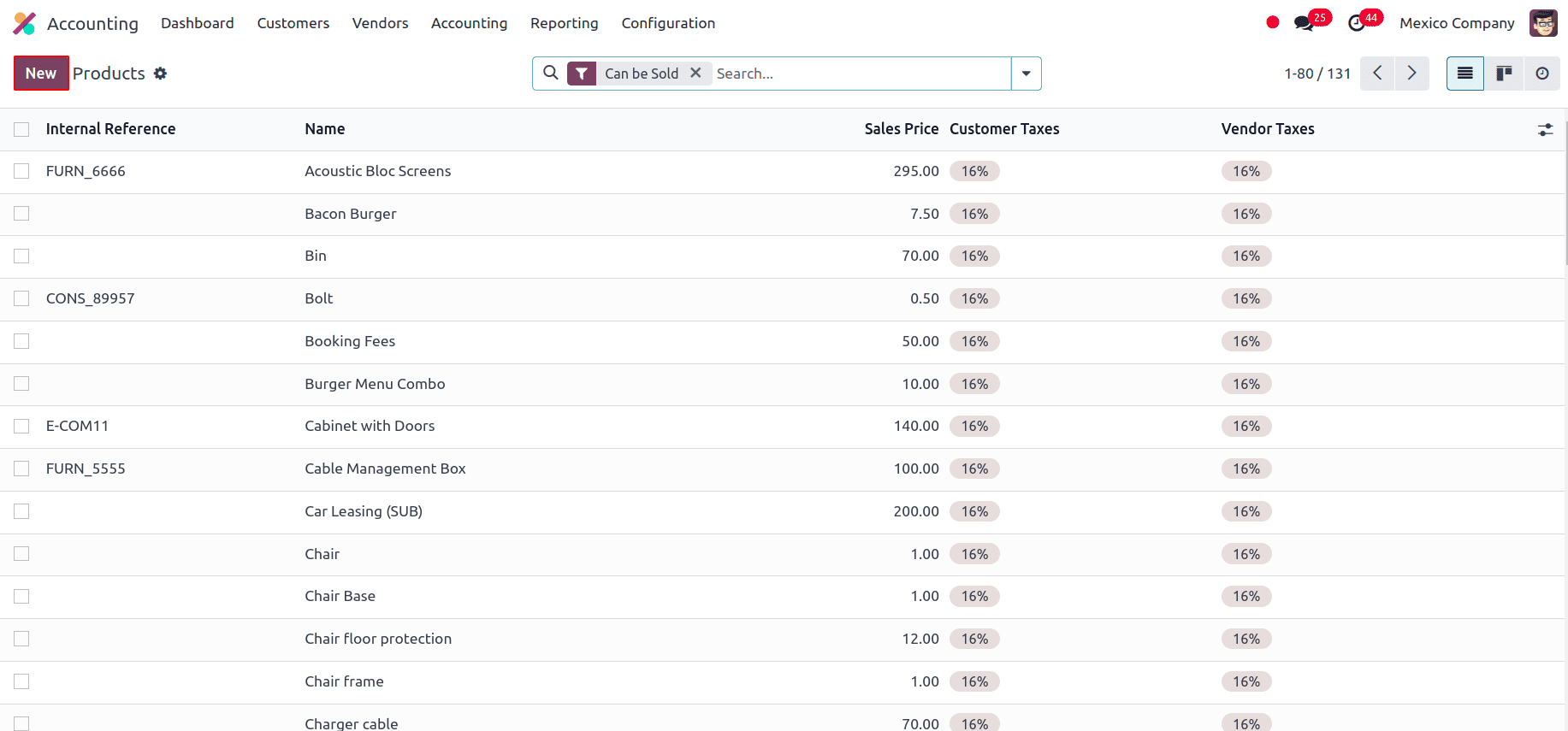

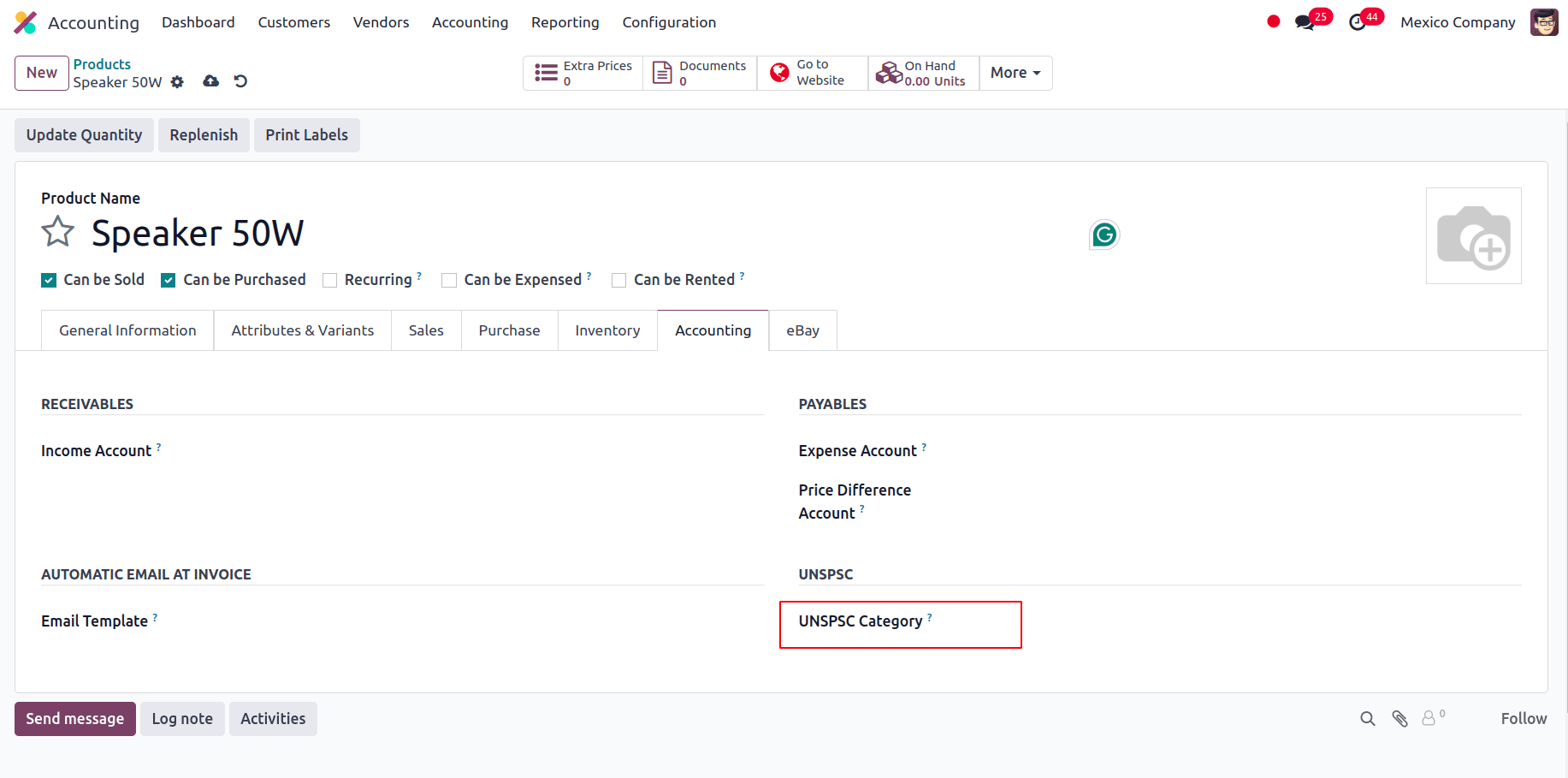

When we are configuring Products, in the Accounting tab, we have a field called UNSPSC Product Category, we can select the category that represents the product. It is used in Electronic Data Interchange in certain countries including Mexico. To access that feature, navigate to Accounting => Customers => Products.

We can select a product or configure a new one, to create a new product click on the New button at the top left.

In the Accounting tab, we have the feature UNSPSC Product Category.

Every product has to have a UNSPSC category, similar to the regular invoicing. And there are two extra configurations for the products included in the delivery guides:

* For stock movements to be produced, the Product Type needs to be set to Storable Product.

* The Weight field in the Inventory tab needs to have a value greater than 0.

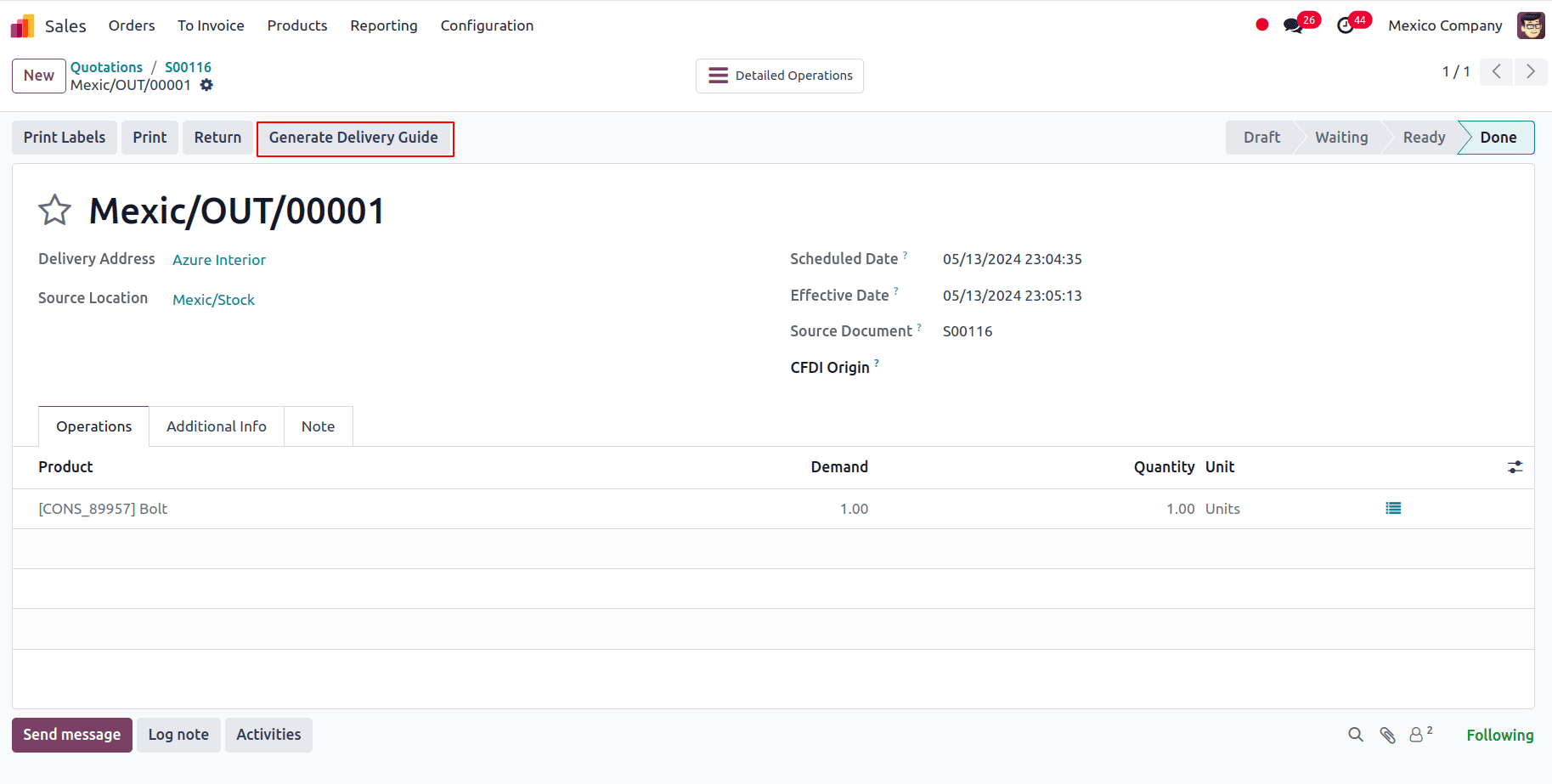

Before creating a delivery guide you must first create and confirm a sales order from Sales => Sales Order. As a result, a Delivery smart button appears. After you click it, confirm the transfer. You can change the transfer and choose the Transport Type (federal transport or no federal highways) once the status is set to Done. You can select Generate Delivery Guide after saving the transfer if your delivery guide has the category No Federal Highways. You may find the generated XML in the conversation.

Electronic Invoicing

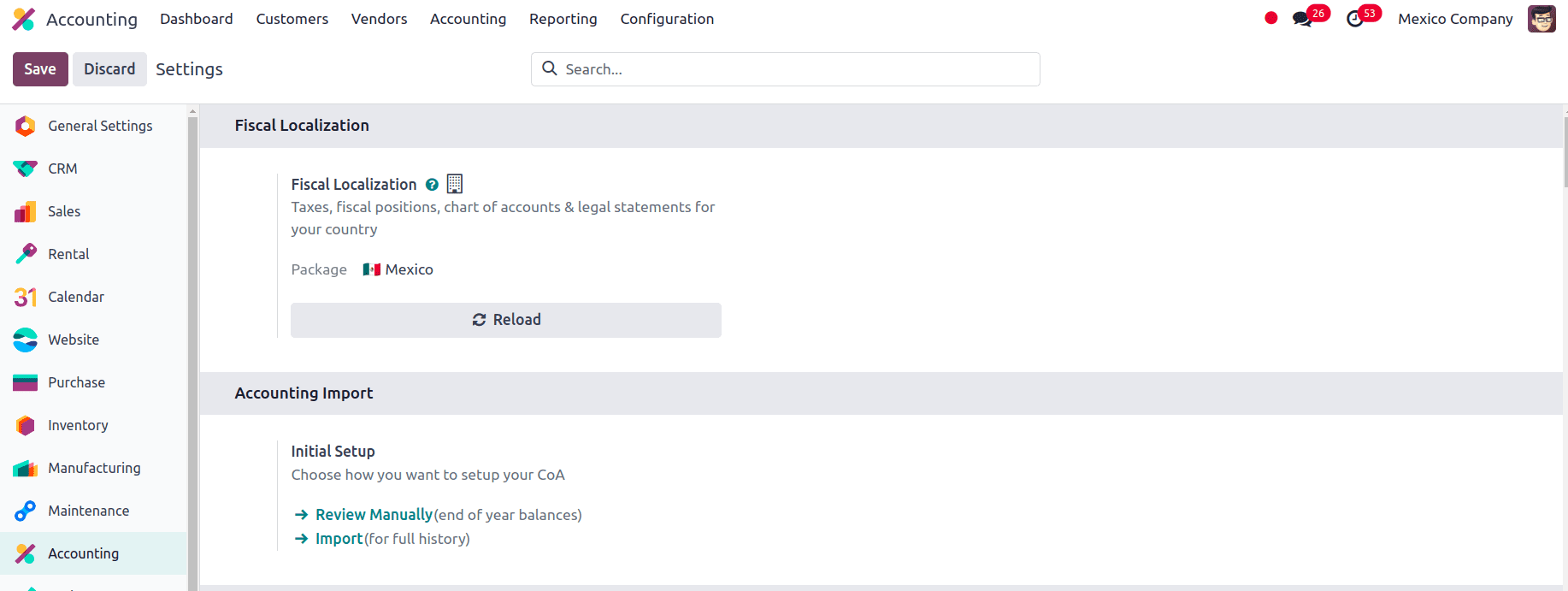

As of January 1, 2022, the Odoo Mexican localization modules agree with the SAT criteria for version 4.0 of the CFDI, which requires the signing of electronic invoices. These modules additionally include important accounting reports (delivery guidelines, foreign trade enabled, and DIOT). We can go to Accounting => Configuration=>? Settings and select the Mexican Package for the Fiscal Localization.

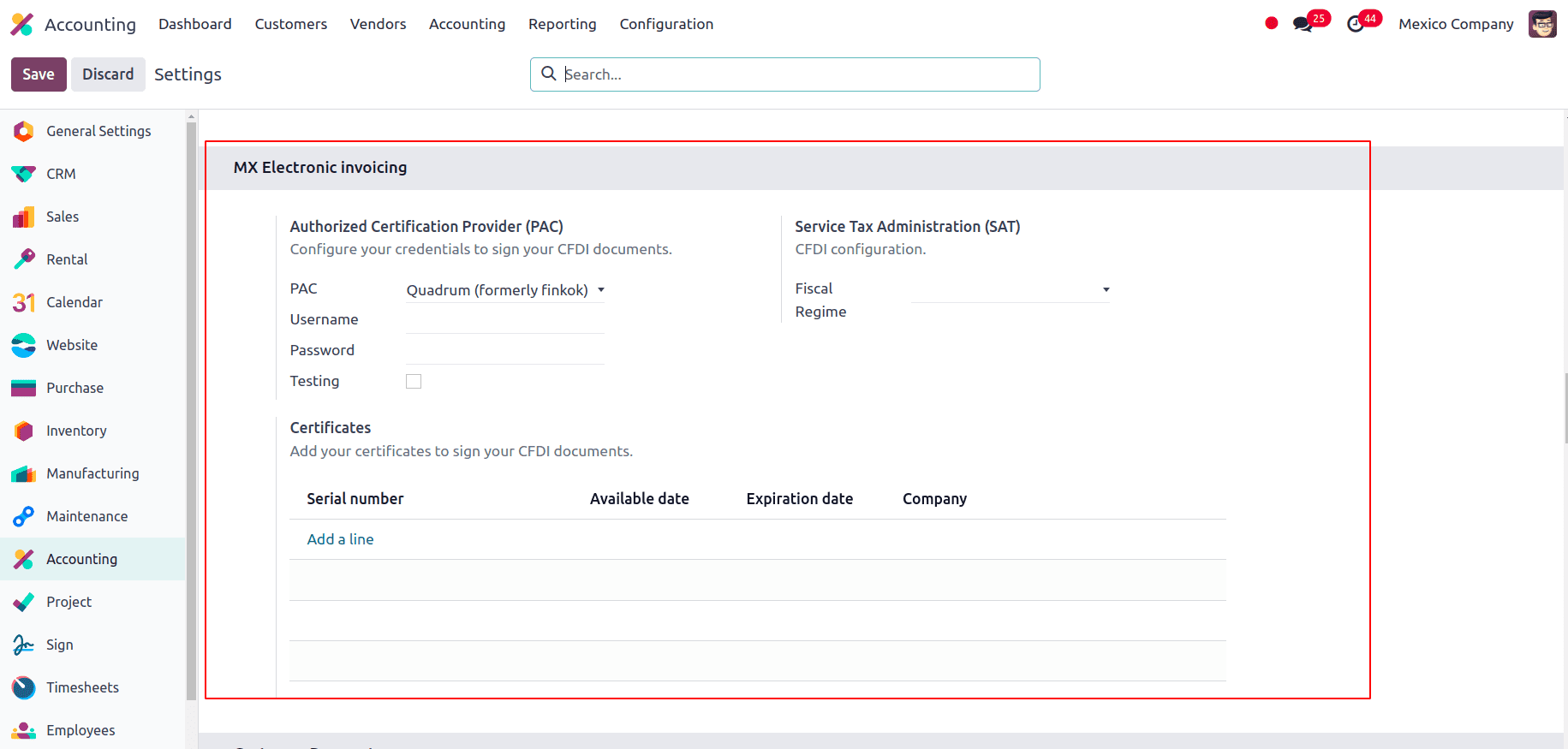

From the configuration settings, we can see that a section for MX Electronic Invoicing is included in the configuration settings.

Here we can select a Fiscal Regime that applies to the company from the drop down menu. Also, add certificates to sign your CFDI documents. We can also provide the PAC and username, and if we do not have the PAC credentials and still want to test the electronic invoicing, there is an option to enable the Testing.

Before you can begin creating invoices using Odoo, you must first process your Private Key (CSD) with the SAT and then register directly with the PAC of your choosing. Navigate to Settings ? Accounting ? Electronic Invoicing (MX) after creating an account with any of these providers. Enter the name of your PAC along with your login information (PAC username and PAC password) under the MX PAC section. The company's digital certificates need to be uploaded in the MX Certificates area. Go to Settings ? Accounting ? Electronic Invoicing (MX) to accomplish this. Choose Add a line from the MX Certificates section to open a new window.

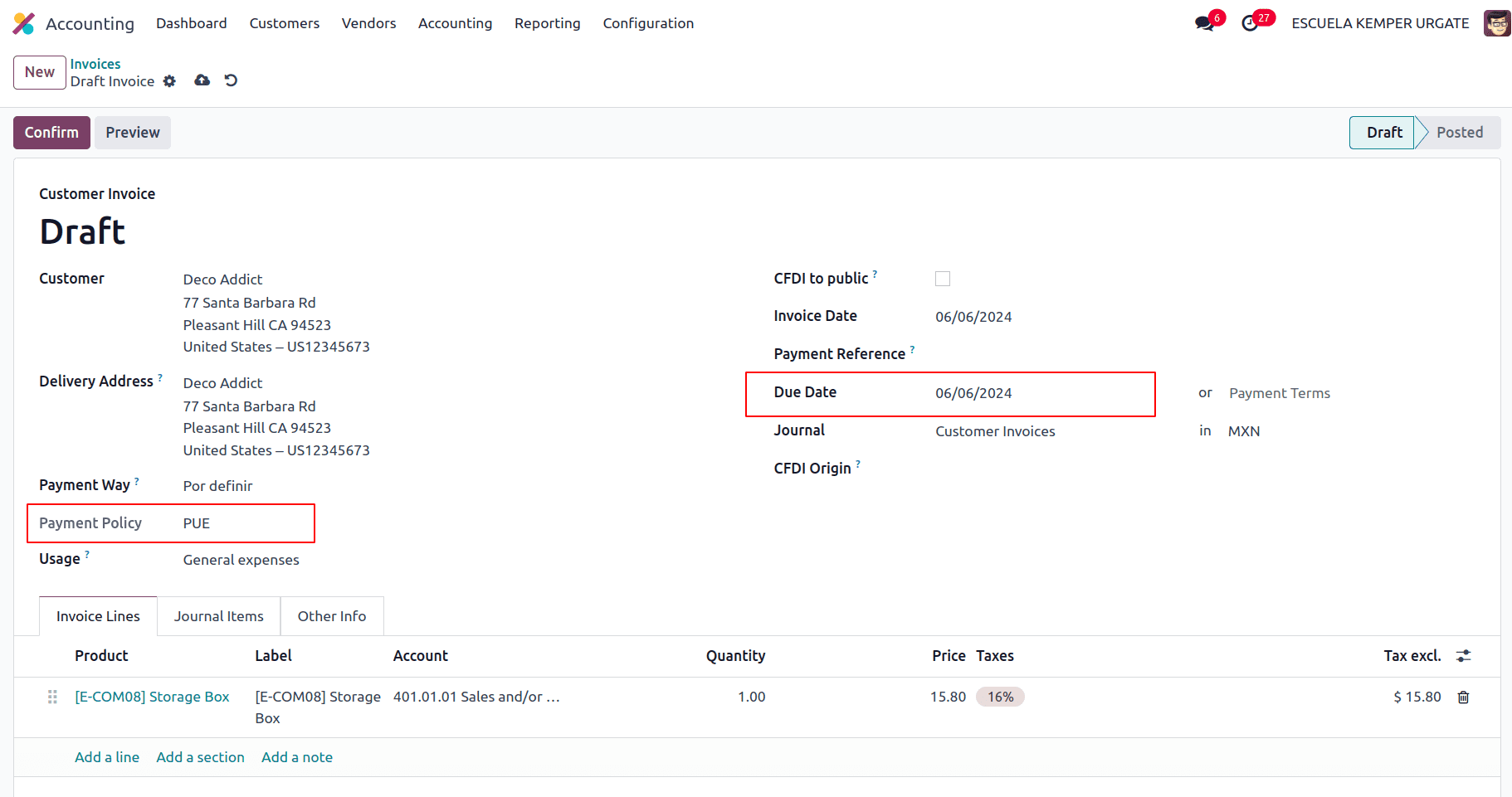

The invoicing process in Odoo is based on Annex 20 version 4.0 of electronic invoicing of the SAT. We have to create an invoice using the general invoice flow. The correct Payment Way or Use that the customer may require can be added, for example, while the document is still in draft form. A blue notification explaining that the following e-invoicing provider will process the invoice asynchronously will show once you confirm the customer invoice: CFDI (4.0). The document is sent to the government for signatures when the "Process Now" button is clicked. AdvancedFollowing receipt of the signed document back from the government, the XML file is attached to the conversation and the Fiscal Folio field appears on the document. While configuring contacts, all of your contacts must have their correct business name registered in the SAT, just like your own firm does. The Fiscal Regime, which must be added to the MX EDI tab, is likewise affected by this.

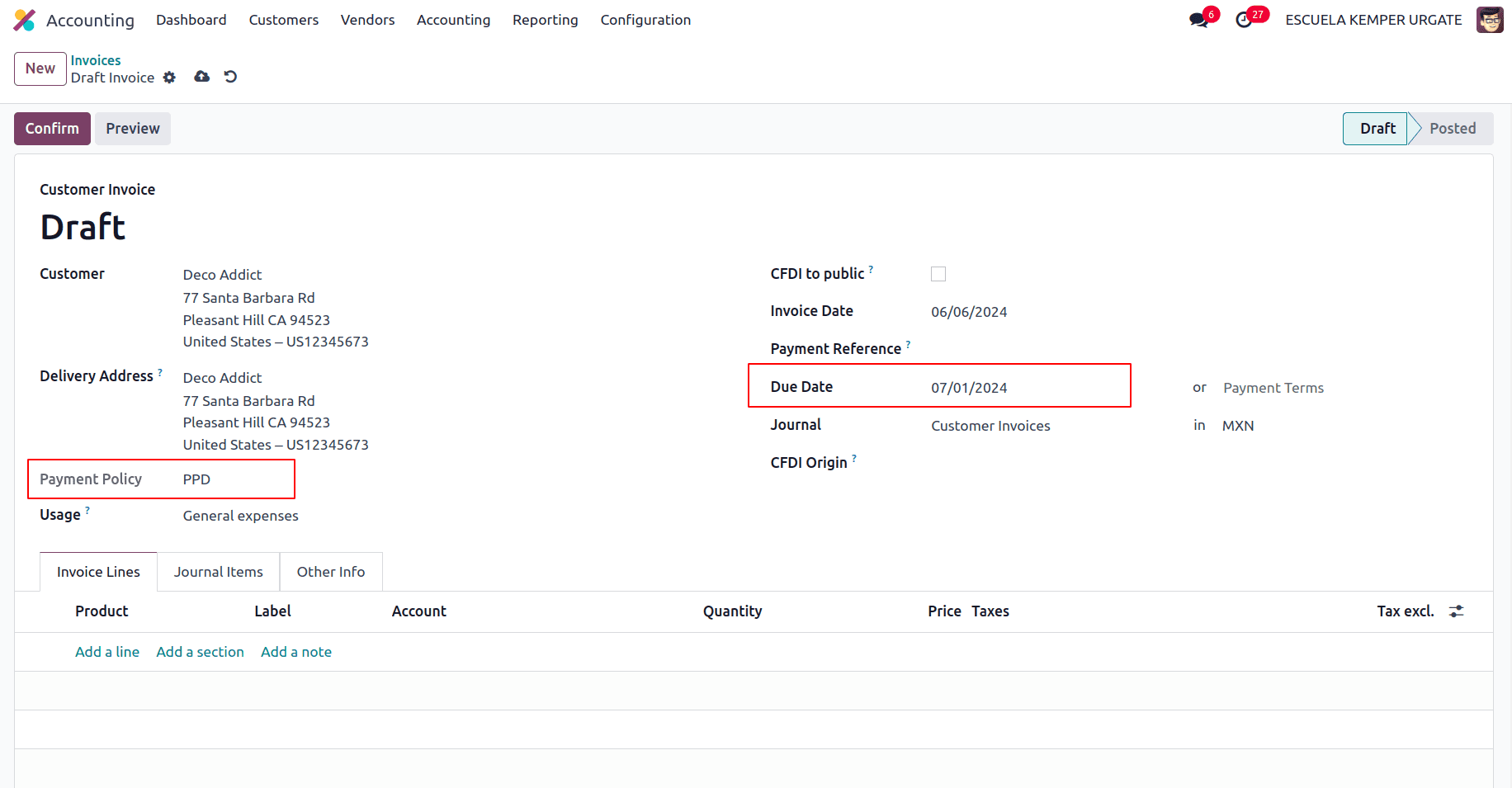

Another added feature is the Payment Policy, there are two types of payment policies according to SAT, PUE Payment in single exhibition and PPD Payment in installments or deferred. Navigate to Accounting ? Customers ? Invoices to configure PUE invoices. You can then choose an invoice due date that falls within the current month or a payment term that doesn't need modifying the due date.

Go to Accounting => Customers => Invoices and choose an invoice with a Due Date after the beginning of the next month to set PPD invoices. This also holds true if the next month is when your Payment Term is due.

The payment procedure in Odoo is the same for both scenarios; the primary distinction is that payments made in relation to PPD invoices cause a document type “P” (Pago) to be created.

A payment can be registered with the wizard and linked to the relevant invoice if it is connected to a PUE invoice. Go to Accounting ? Customers ? Invoices and choose an invoice to accomplish this. After that, we can click on the Register Payment button. Due to the fact that the payment is essentially recognized upon bank reconciliation, the invoice status is updated to In Payment.

The EDI documents submitted to the SAT can be canceled. Since January 1st, 2022, there are two conditions for this, per the Reforma Fiscal 2022:

* You must include a reason for the cancellation with every request for cancellation.

* The client must be asked to approve the cancellation once the invoice has been created for 24 hours.

Invoices can also be canceled due to many reasons in odoo that is if the originally sent invoice needs to be replaced due to any field being incorrectly added or the invoice needs to be cancelled and does not need to be replaced by another one.

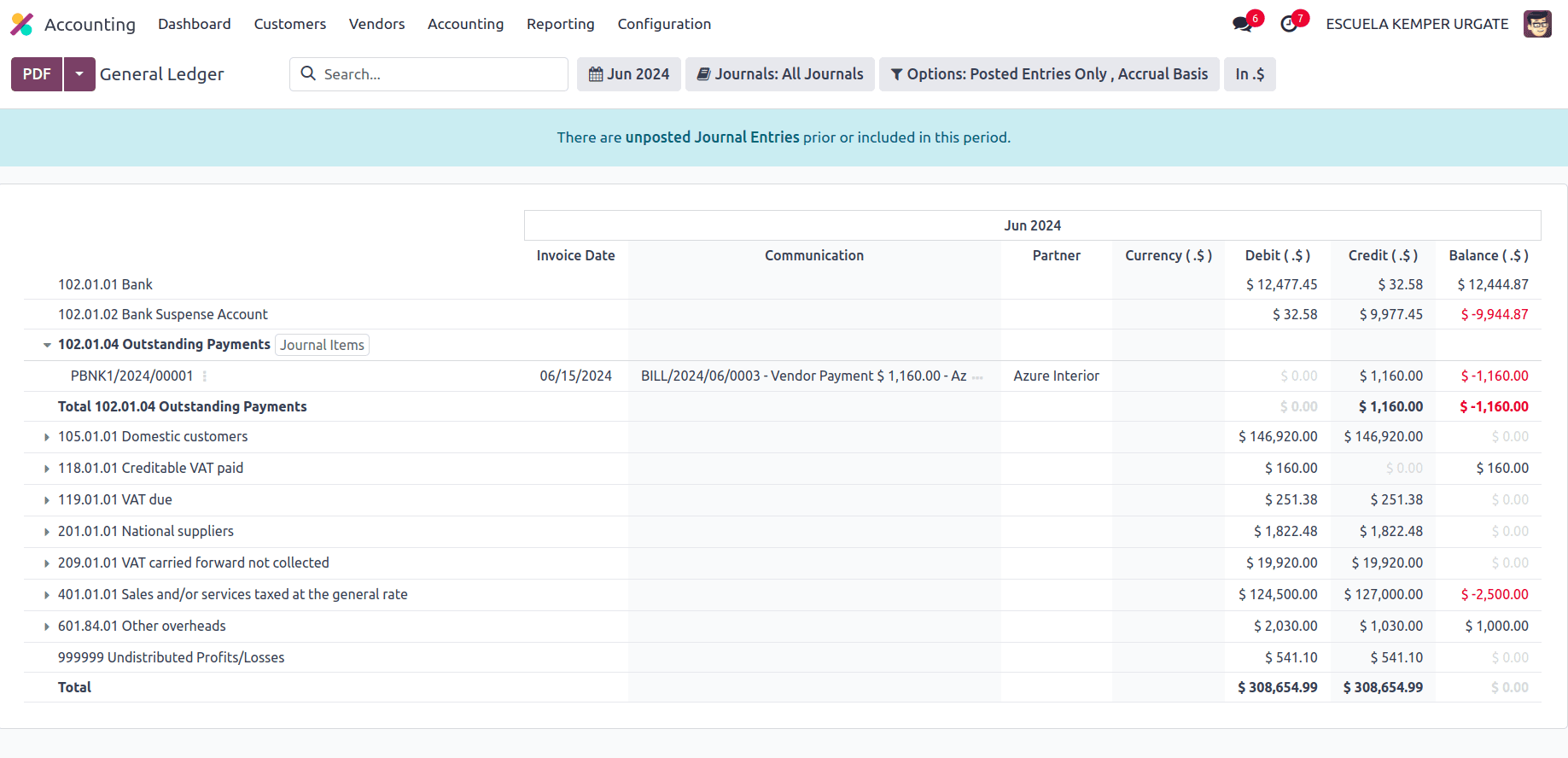

General ledger

In Mexico, all transactions are required by law to be digitally documented. You can export your journal entries to comply with SAT audits and/or tax refunds because Odoo automatically creates all the underlying journal entries of your payments and invoices. Click XML (Polizas) under Accounting ? Reporting ? Audit Reports ? General Ledger to create the XML. Here, you have a choice of four different export types:

* Tax audit

* Audit certification

* Return of goods

* Compensation

You must write the Order Number that the SAT supplied for the Tax audit or Audit certification. You must write down your Process Number—which the SAT also provides—in order to request a return of goods or compensation.

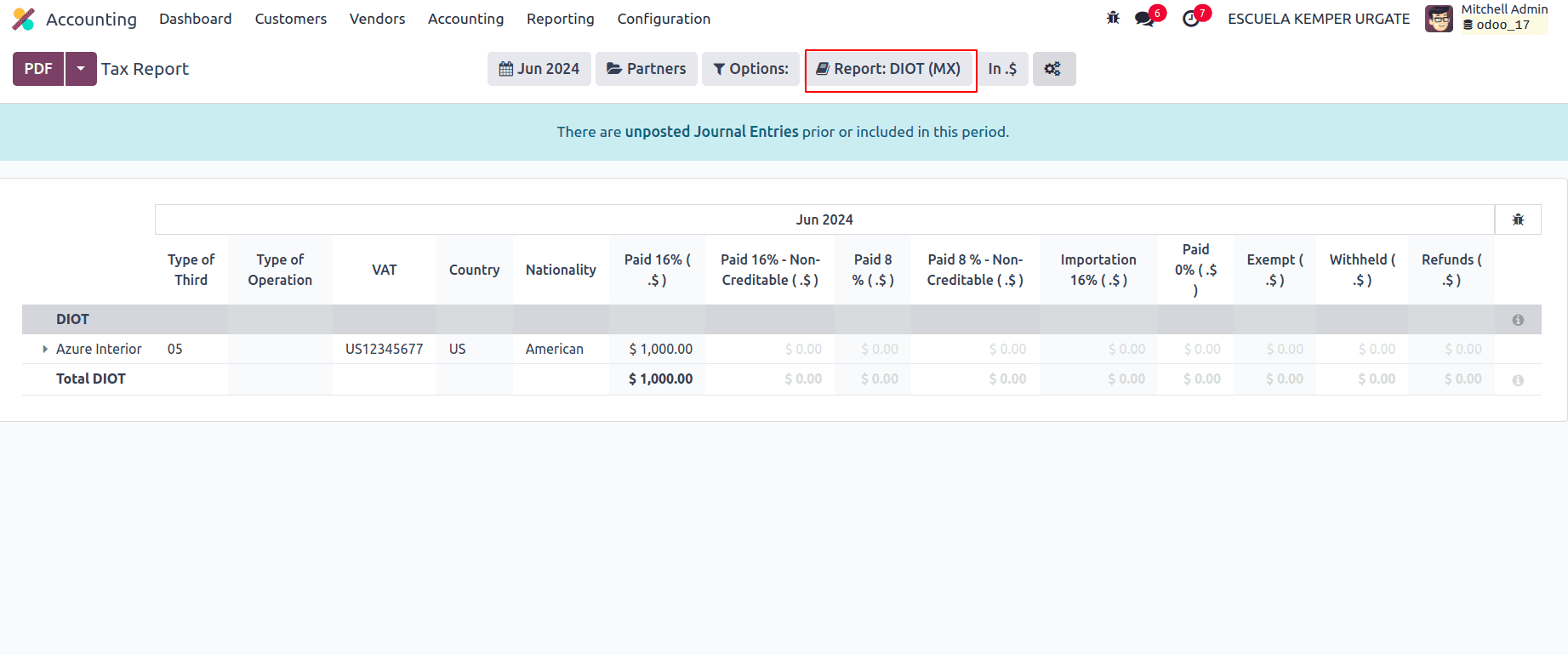

DIOT report

The Mexican localization module offers functionalities beyond core document generation. It facilitates the creation of reports like the DIOT (Declaración Informativa de Operaciones con Terceros) for foreign trade, simplifying your reporting obligations. In contrast to other reports, the DIOT is uploaded to SAT-provided software that includes the A-29 form. To circumvent direct data capture, you can obtain your transaction records from Odoo as a.txt file, which you can then upload to the form.

The Mexican localization module for Odoo enables companies in Mexico to handle their finances effectively. This module expedites accounting procedures and saves you significant time by producing necessary financial documentation and guaranteeing compliance with electronic invoicing mandates. You can make the most of this module and provide your Mexican firm with more financial management by being aware of its capabilities and existing limits.