What is accounting localization in Odoo?

The practice of modifying accounting software to conform to the unique accounting laws and regulations of a specific country is known as accounting localization. In basic terms, you are customizing the product to meet the local financial requirements of your country. Several accounting tasks are automated through localization according to local practices. This includes attributes like:

* Automatic tax calculation.

* the creation of invoices and reports that match

* If suitable, integration with regional e-invoicing systems

Accounting localization automates processes and adheres to local standards, saving your accounting team time and money. They can concentrate on more strategic tasks rather than compliance assurance and tedious data entry. We will talk about an Estonian company's localization features in this blog.

Localization for Estonia in Odoo 17

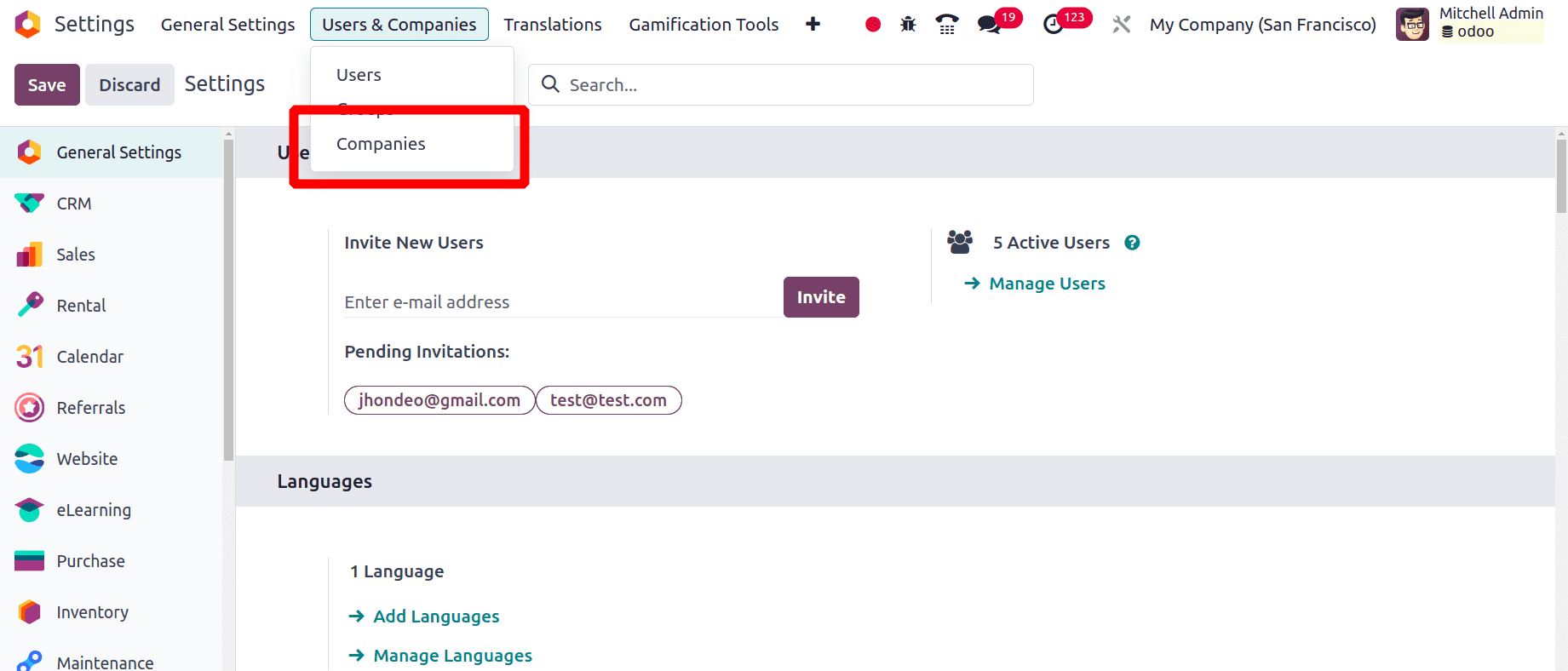

To set up the localization for Estonia in Odoo, we must first establish an organization or a company from Estonia. Go to Odoo's General settings and select the Users & Companies menu, followed by the Companies sub-menu, to perform this.

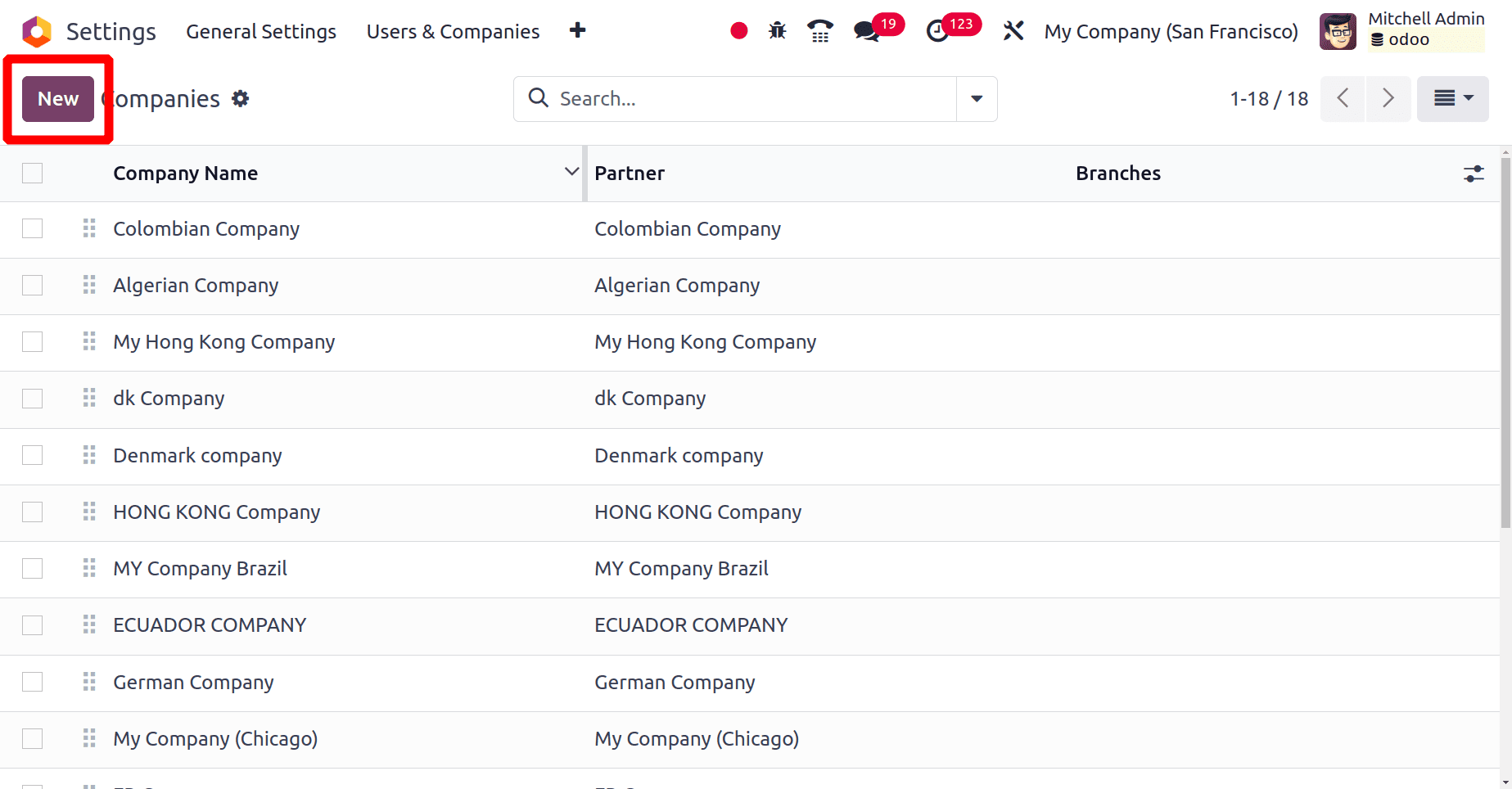

Clicking the "Companies" sub-menu displays all of the companies that have already been created and to add a new company, press the "New" button.

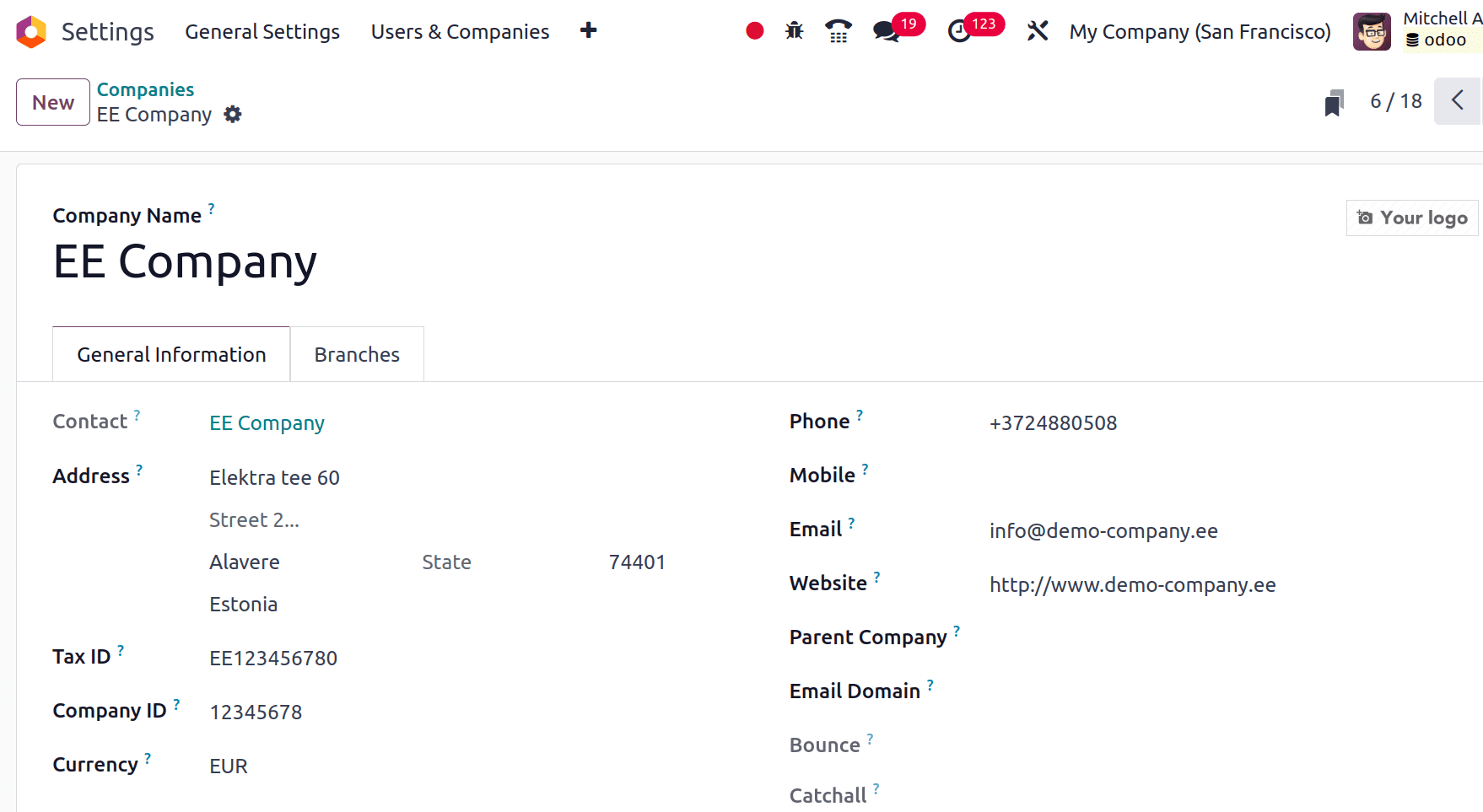

Upon selecting the "New" button, a form will appear for us to complete, detailing the information about the new company.

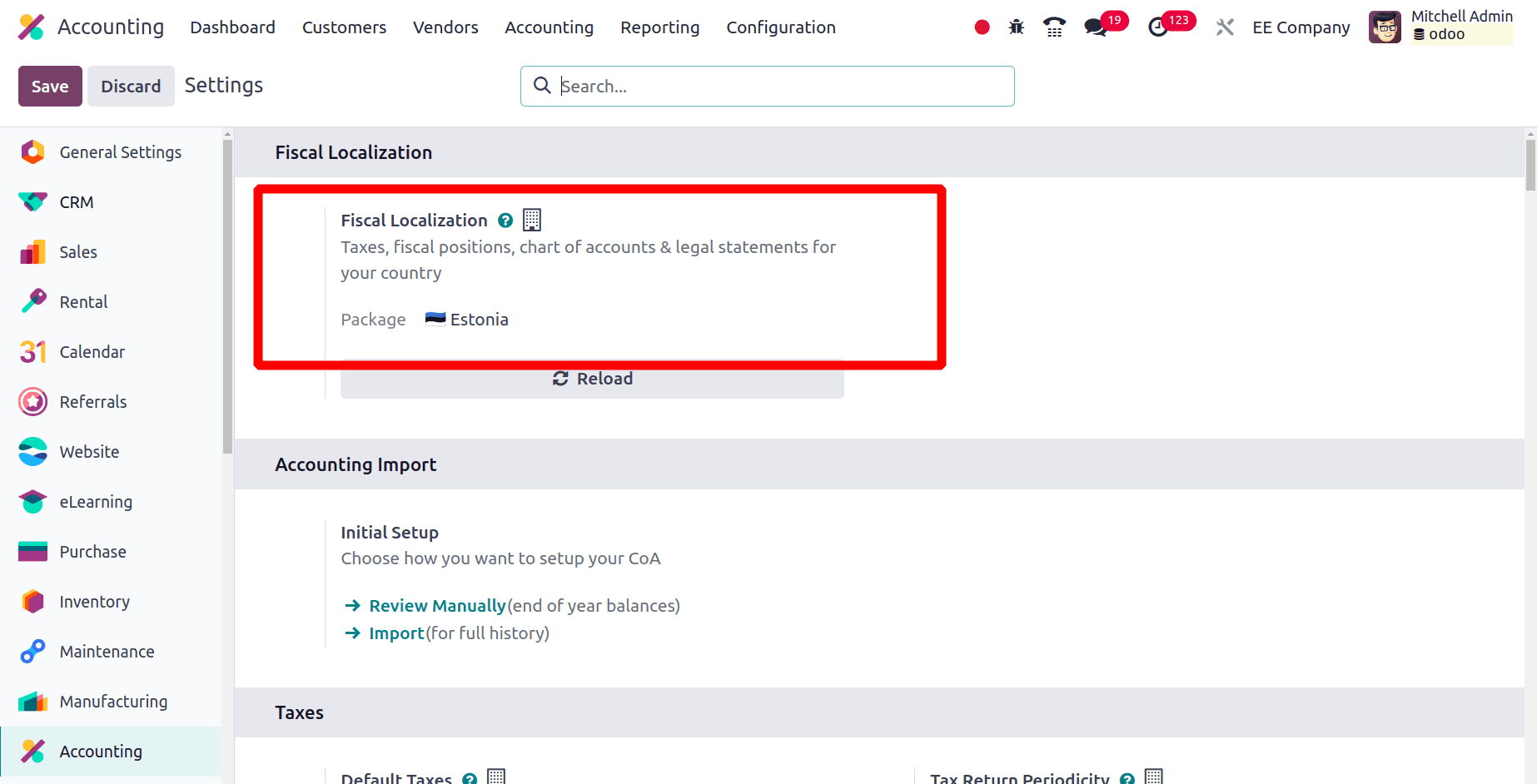

Click the save icon to save the company details once all of the configurations have been made correctly. Since the Euro (EUR) is the official currency of Estonia, Odoo automatically adjusts the company's currency to reflect this change when the country is set to Estonia. Setting up the localization package for this business is the next stage. Navigate to Odoo 17's accounting application, then select Configuration > Settings. We can set the localization package in the Fiscal Localization section. Select Estonia as the package and click the save button.

Changes found during the configuration of the Estonian localization

Many changes will occur once the company's localization is set to Estonian. Fiscal position, Chart of Accounts, Taxes, and Journals, are some of the major configurations in Odoo. Let's have a look at these.

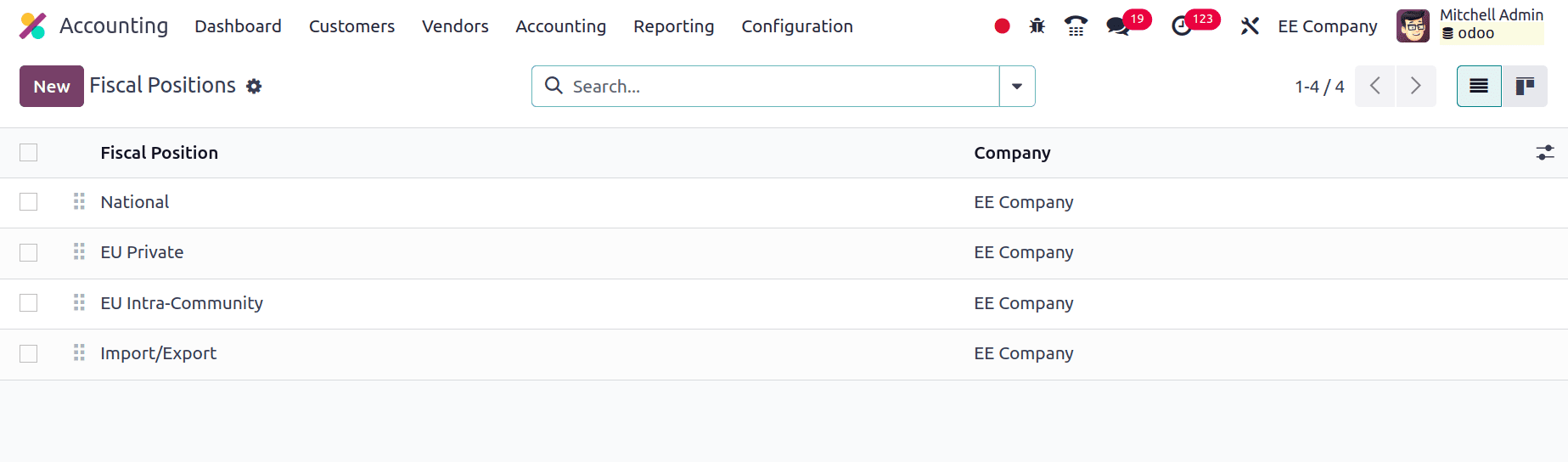

Fiscal Position: Based on factors like the location of the customer, the type of business, the product category, and so on, a fiscal position in Odoo serves as a set of guidelines that specify how accounting and taxes are applied to transactions. In basic terms, it aids in the management of accounting and tax difficulties brought on by several countries.

The Fiscal positions listed in the above screenshot are the default Fiscal positions that are already configured by Odoo for the companies from Estonia. As said, Account Mapping and Tax mapping for different purposes are done using these listed Fiscal positions.

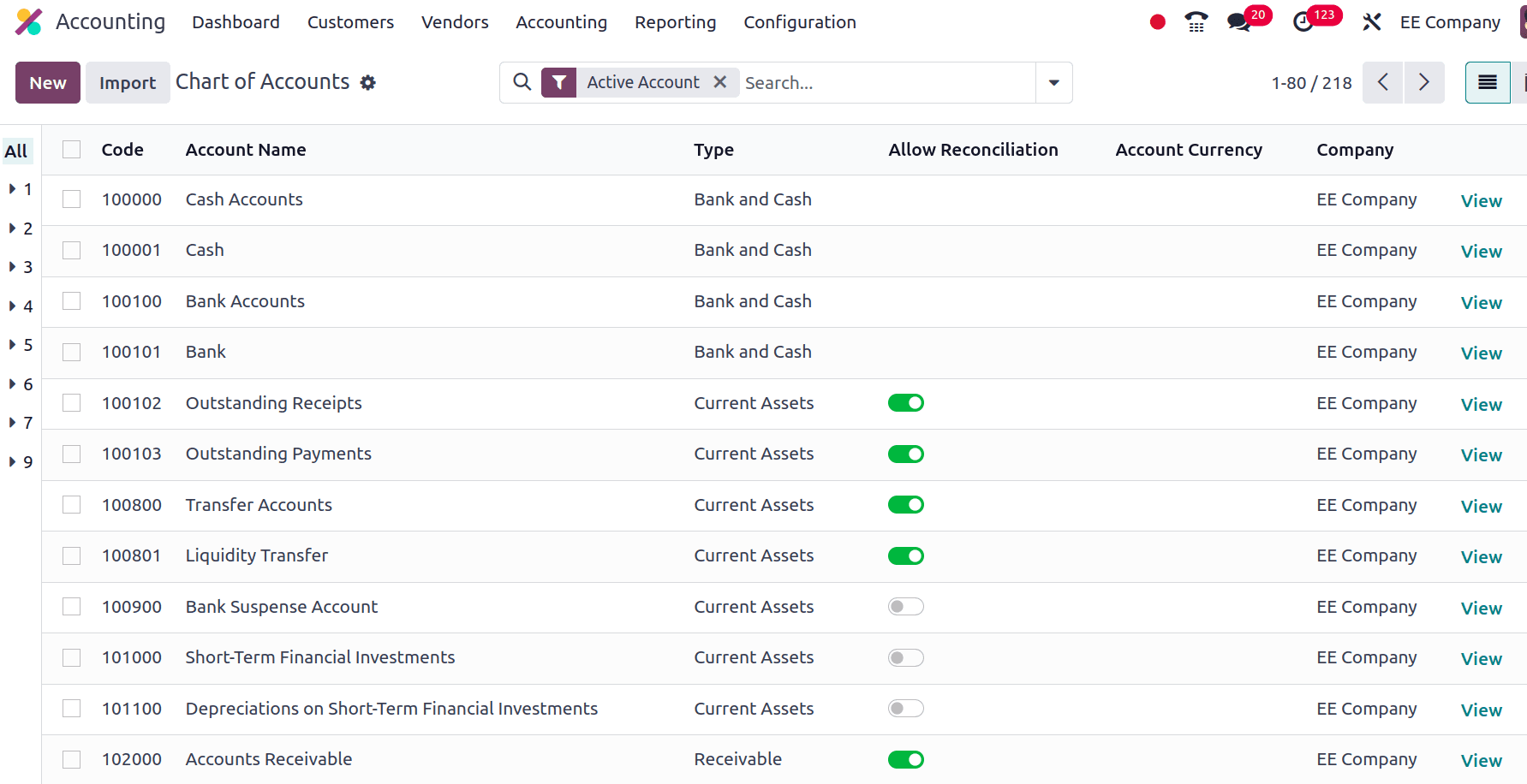

Chart of Accounts: One essential component of Odoo's accounting module is the chart of accounts. It serves as a catalog of all the accounts you use to keep track of the financial activities of your company. The chart of Accounts used by companies from different countries may vary. Under the Configuration Menu, we can choose the Chart of Accounts sub-menu.

The above screenshot shows the Chart of Accounts used by the companies from Estonia. You can also create a new Chart of Account by clicking the New button.

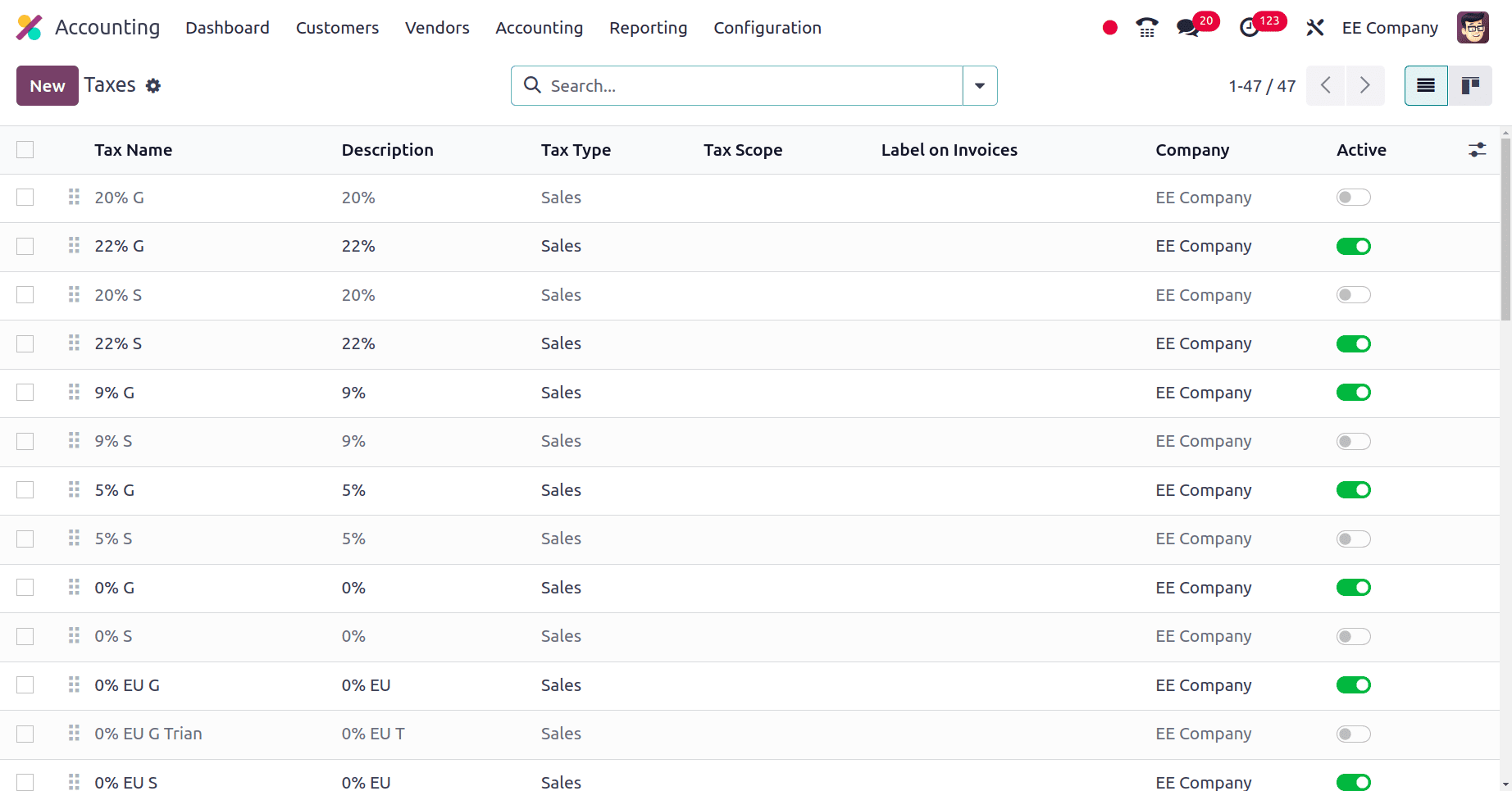

Taxes: Taxes are a type of charges applied to different elements of a commercial transaction. The tax features in Odoo assist you in managing tax compliance, automating tax computations, and ensuring correct financial reporting. You can establish various tax kinds such as sales tax, purchase tax, etc together with their corresponding rates and conditions in Odoo. Odoo automatically determines the necessary taxes when generating purchase orders or invoices based on the location of the vendor and the product or service being sold or purchased. Under the Configuration menu, we have a Taxes sub-menu.

When we choose the Taxes sub-menu we can see all the taxes that businesses from Estonia can use. We can also create new taxes for businesses. There are mainly two types of taxes, Sales taxes and Purchase taxes. Sales taxes are applied on sale orders and the Purchase taxes are applied on the purchase orders.

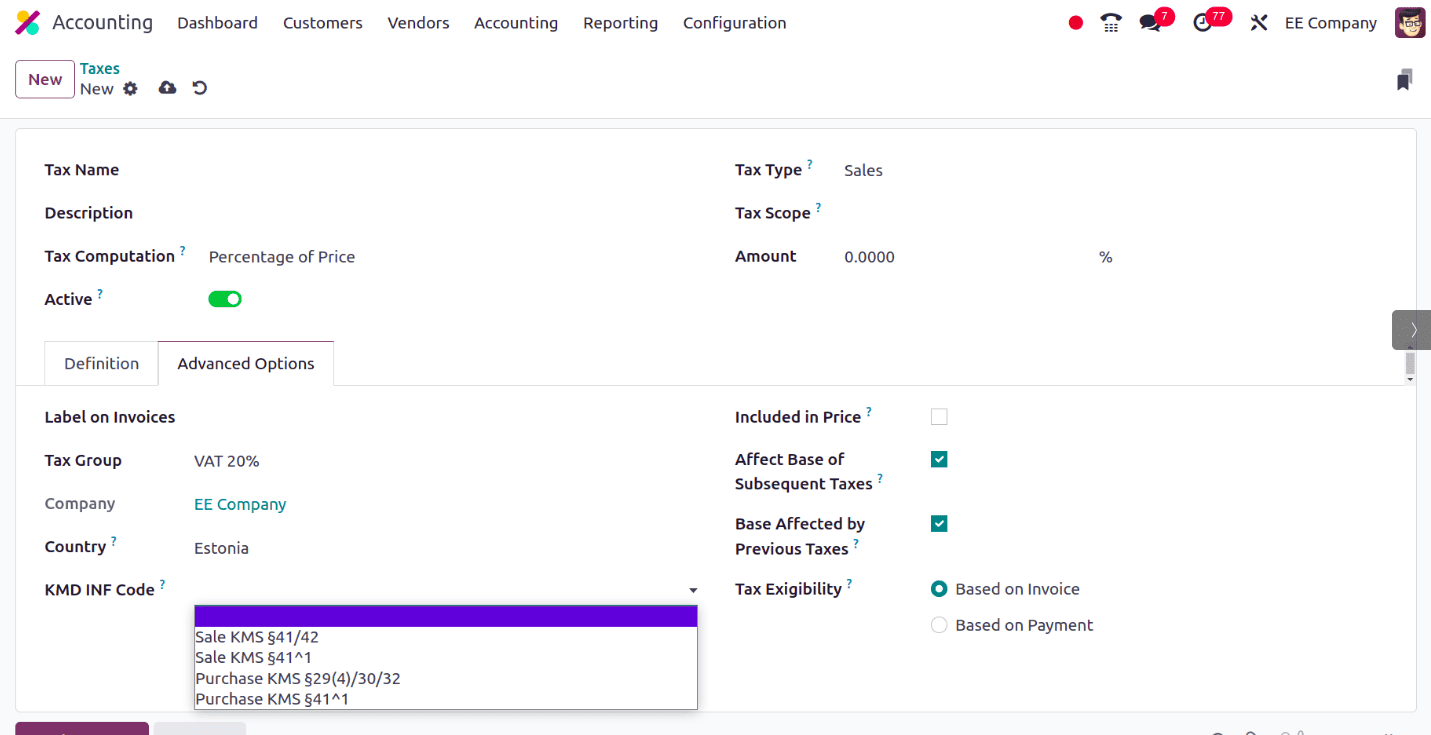

By clicking the New button, we can able to create new taxes for this company. There we can provide the name of the new tax, type, tax amount, etc. When we move to the Advanced Options tab there the options to provide Tax Group, Country, KMD INF Code, etc.

KMD INF Code: This field is used for comments/special code column in the KMD INF report. It acts as an identifier within Odoo for the Estonian VAT Report Annex. This code also simplifies the process of generating the Estonian VAT report Annex within Odoo. We can select the code from the drop-down list.

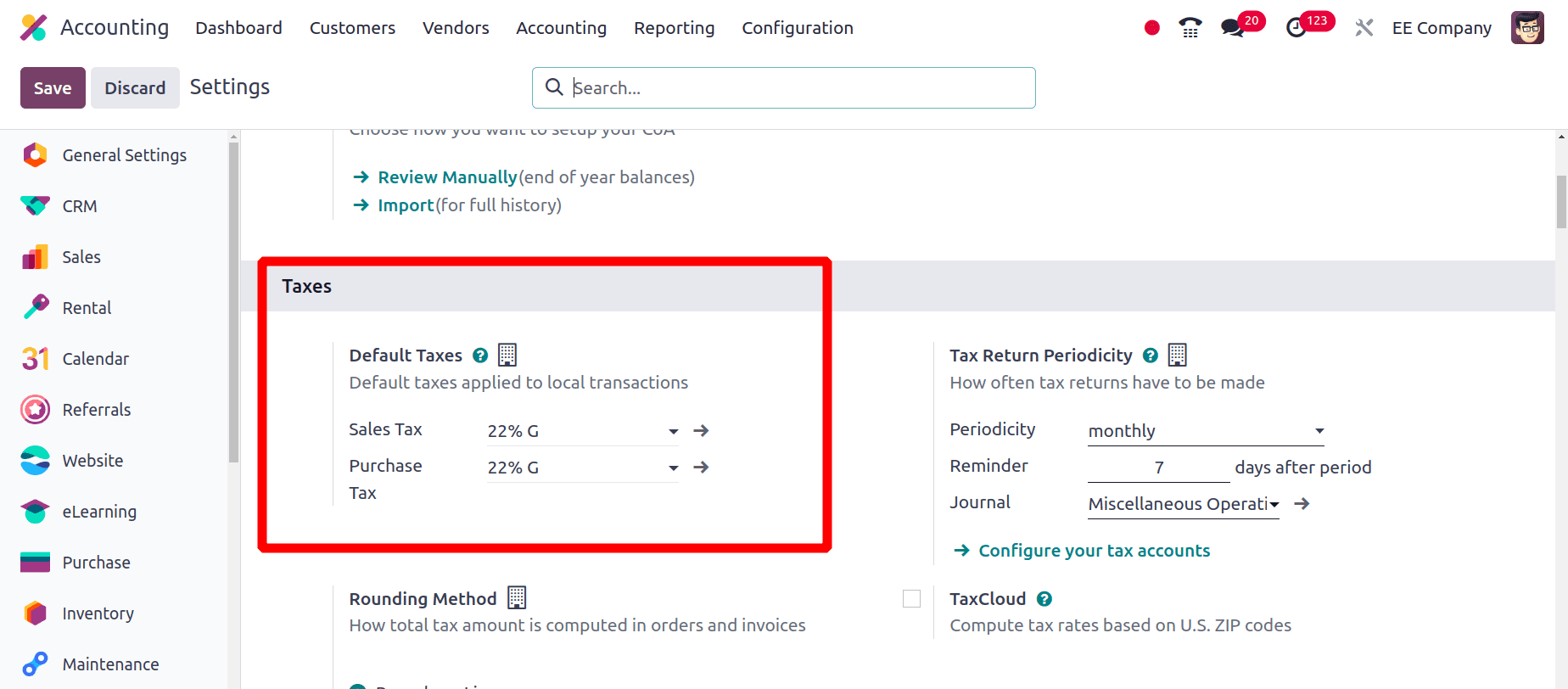

Then in the Configuration > Settings under the Taxes section, there is an option to add the Default Taxes. Either we can add the default taxes manually or Odoo will add it automatically. And here Odoo adds it automatically when we set the localization package for the company as Estonia.

Here, we can see that the Default Sales Tax is 22% G and the Default Purchase Tax for the company is also 22% G. That is all of the businesses from Estonia should use this as their default tax for their business transactions.

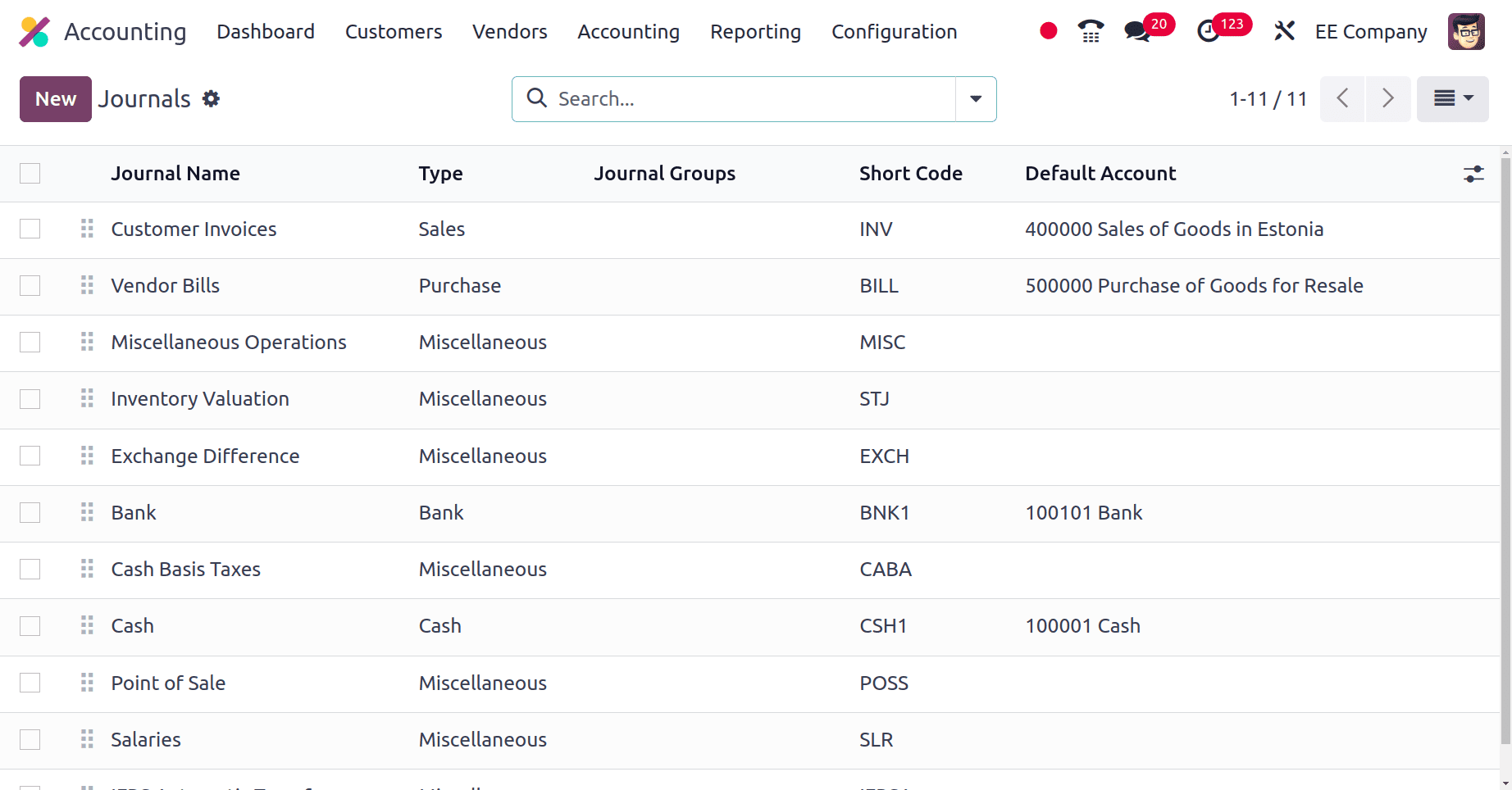

Journals: Journals function as a chronological record of your financial transactions in Odoo's accounting module. They arrange these transactions clearly and make accurate financial reporting easier by classifying these transactions according to their type. The main method for entering all financial transactions into your Odoo accounting system is through journals. Depending on its nature, each transaction is entered into separate journals. There are mainly five types of journals: Sales journals, purchase journals, Bank Journals, cash Journals, and Miscellaneous journals, etc. all of these journals are used for different purposes.

The different Journals used by the companies from Estonia are shown in the screenshot above. There will be an account for each journal to store the transactions.

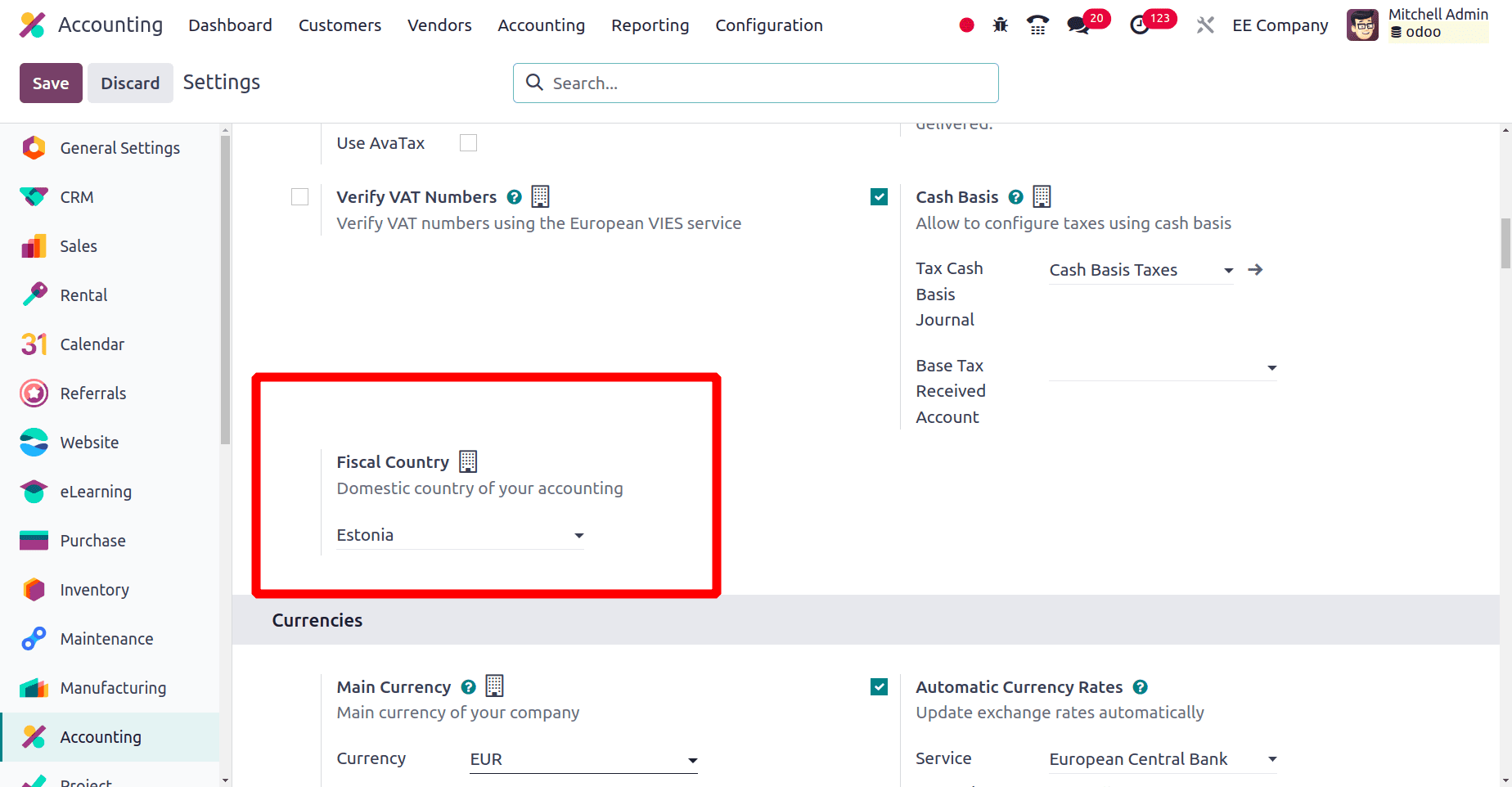

When we look at the configuration > Settings of the Accounting module, under the Taxes section there is an option to set the Fiscal country for the company which is the domestic country for our accounting.

Here, Odoo automatically sets the Fiscal country for the company as Estonia when we configure the localization package for the country as Estonia.

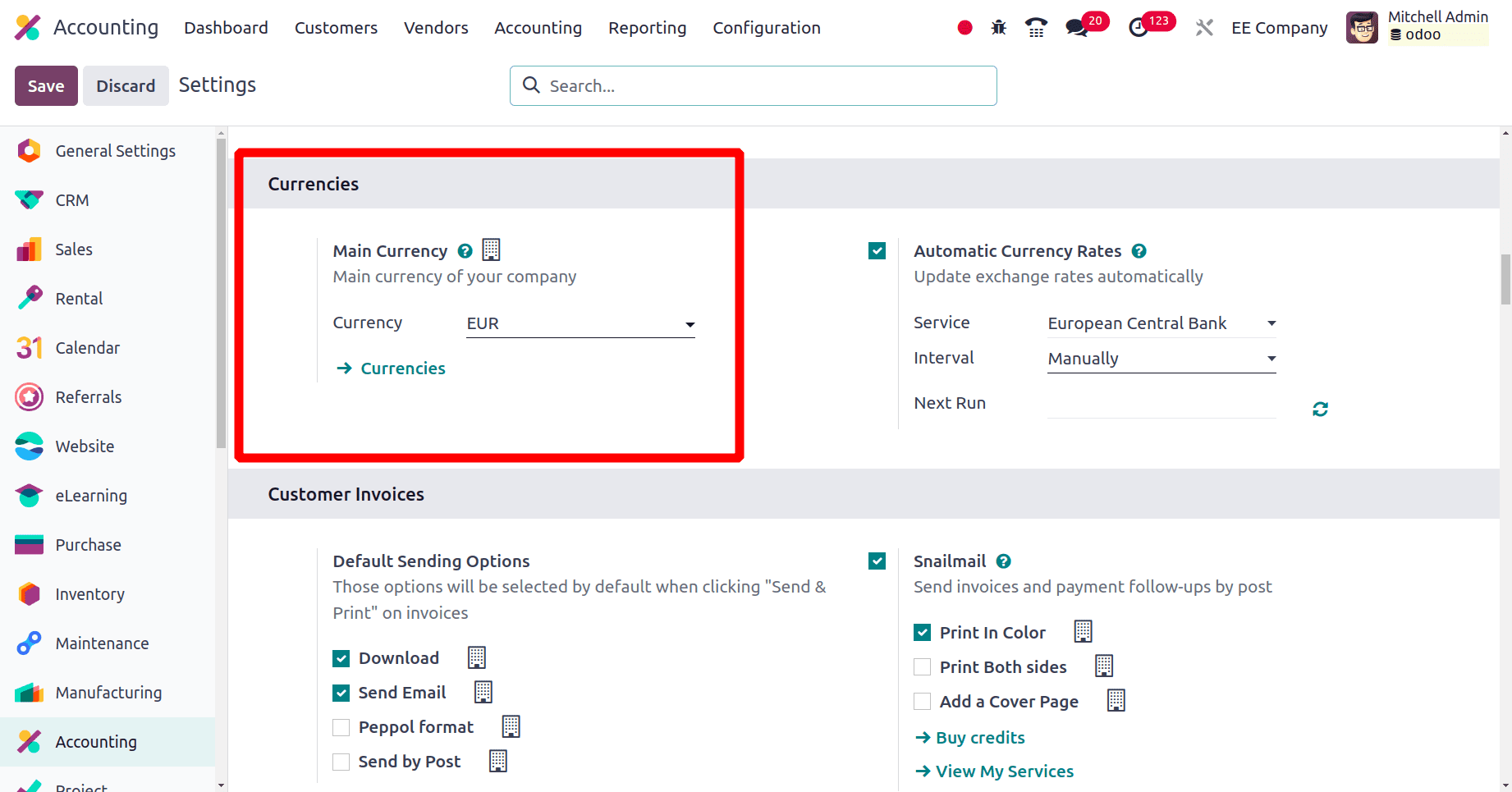

We know that the official currency used in Estonia is Euro (EUR) and in Odoo we have the option to set the main currency for the company . Here, Odoo automatically updates the main currency for the company as the Euro (EUR).

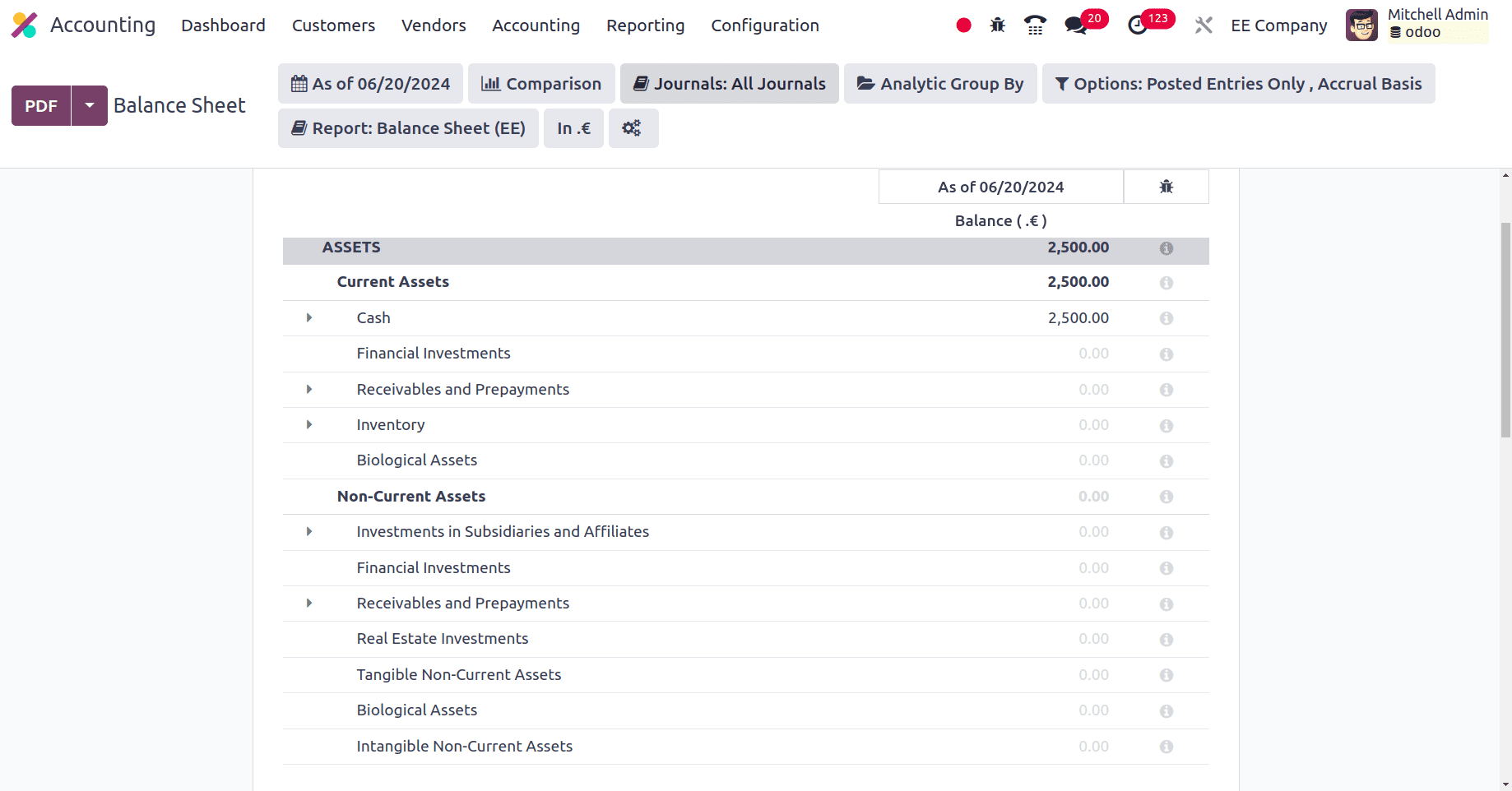

Under the Reporting menu of the accounting application, we have the Balance Sheet of the newly configured company. It summarizes the company's financial position by showing Assets, Liabilities, and Equity.

* Assets: Assets are valuable belongings that one owns and expects will increase in value gradually. It can be classified as either current or non-current assets.

Assets = Liabilities + Equity

* Liabilities: The company's financial obligations that need to be paid in the future are known as liabilities. They are categorized as current or non-current liabilities.

* Equity: The owners' investment in the company and retained earnings.

Here we can see that Cash, Financial Investments, Receivables and Prepayments, Inventory, and Biological Assets are included in Current Assets. Investments in Subsidiaries and Affiliates, Financial Investments, Real estate Investments, etc are included under the Non-Current Assets. Provisions, Government grants, Loan Liabilities, etc are included as Liabilities. Share Capital, Own Shares, Unlocated Profit/Loss, etc are included in the Equity.

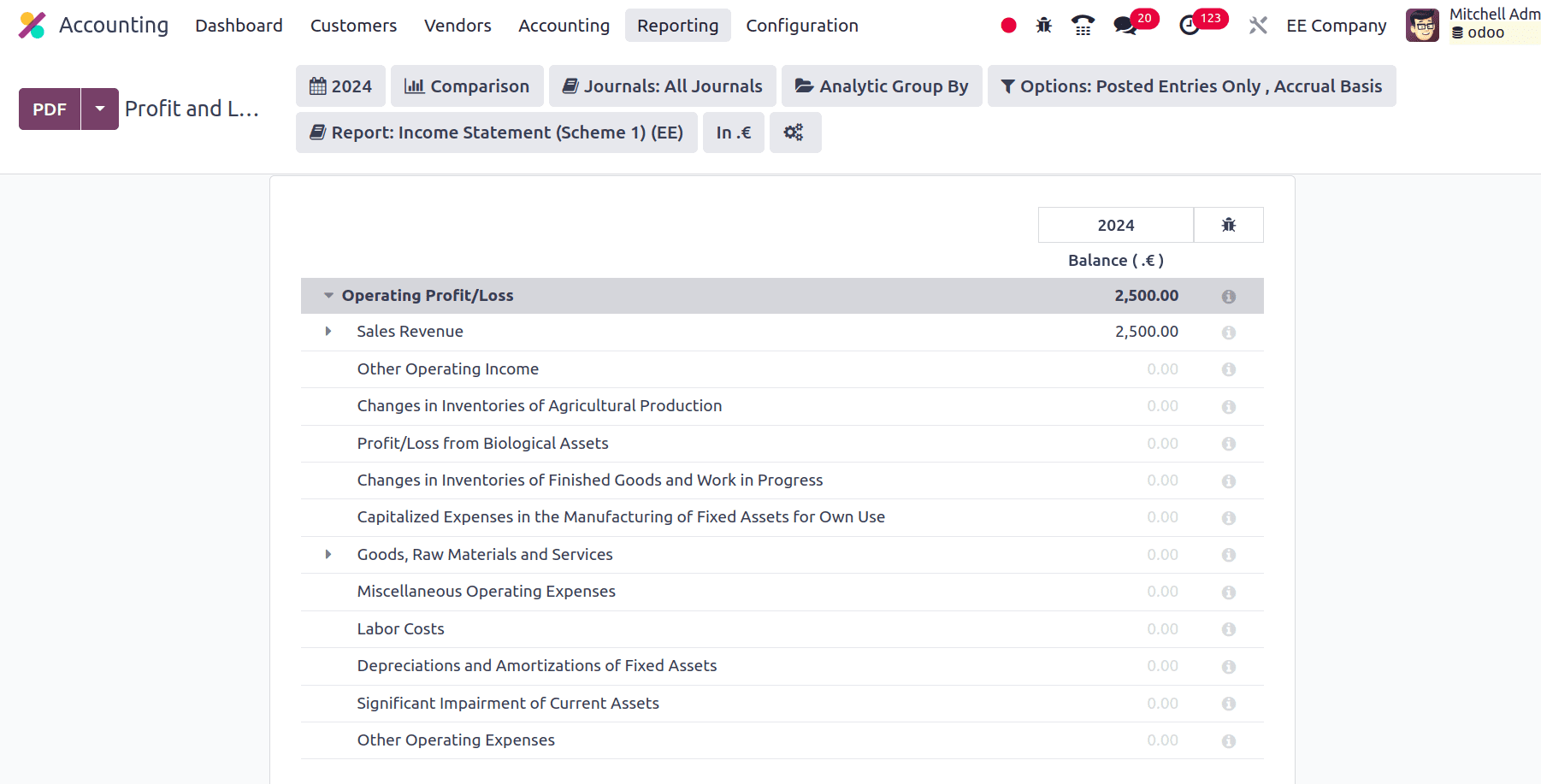

Next, under the Reporting menu, there is a profit and loss report. One financial statement that might assist you in understanding the profitability of your business over a certain period of time is the Odoo Profit and Loss report.

The profit and loss report of this company includes sales Revenue, Operating Income, labor Costs, Interest Incomes, Interest Expenses, etc.

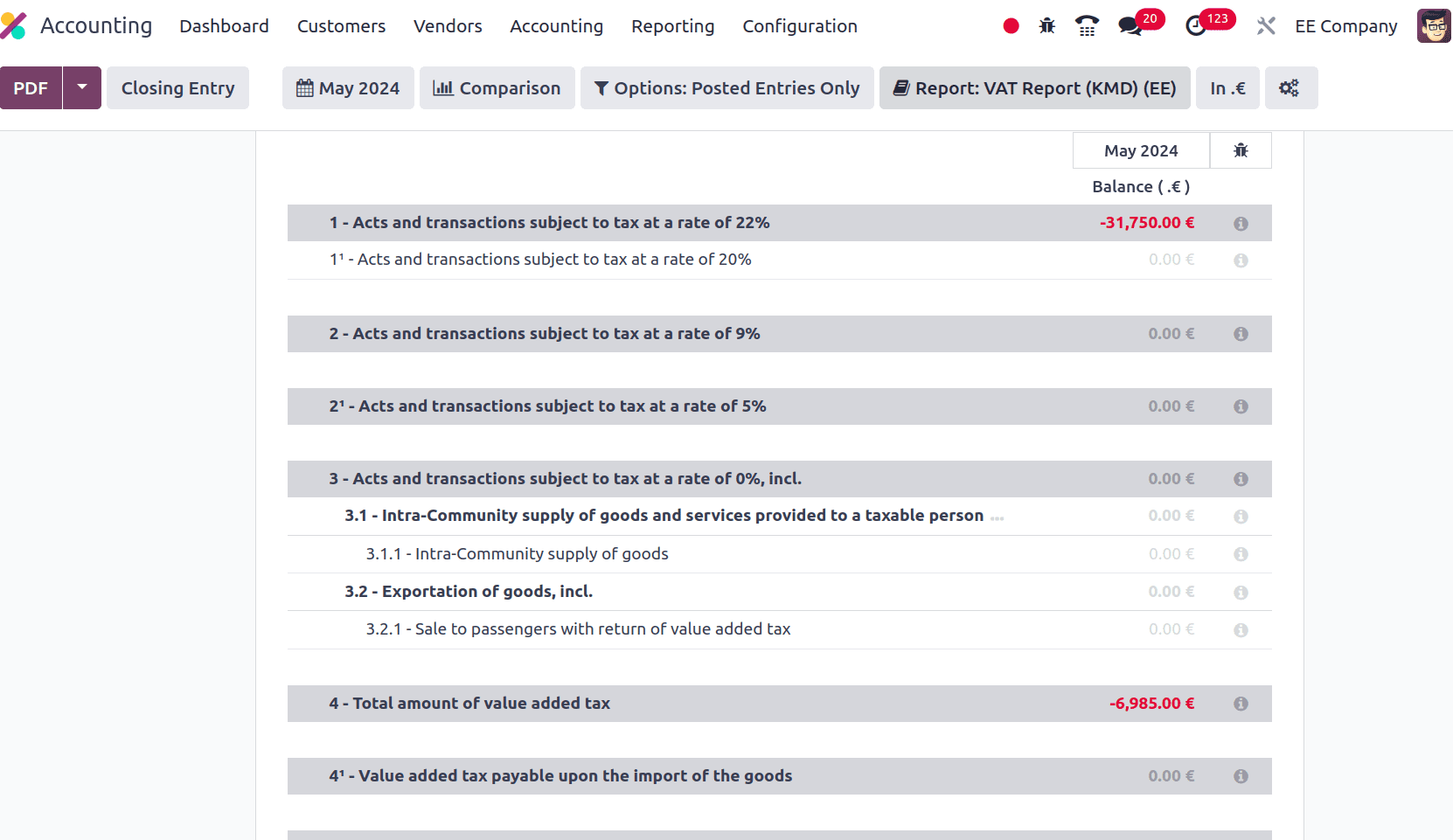

When we move to the tax report of the company, we get a detailed tax report of the company by clicking the Tax Reports sub-menu under the Reporting menu. A Tax report in Odoo is an extended recorded summary of your tax activities for a given time frame. It assists you in scheduling tax payments, calculating your tax liabilities, and even filing for refunds. Based on the taxes that are configured in your system, Odoo creates tax reports.

The above screenshot shows the Tax Report of this company and the report is provided as VAT Report(KMD).

VAT Report (KMD): In the Estonian localization of Odoo 17, a report created especially to meet the requirements for filing Estonian VAT returns is referred to as the VAT Report (KMD). Here KMD means "Käibemaksudeklaratsioon" or "VAT Declaration" in English. This report allows the electronic generation of the KMD form within Odoo for companies in Estonia, hence simplifying the process of filing VAT returns.

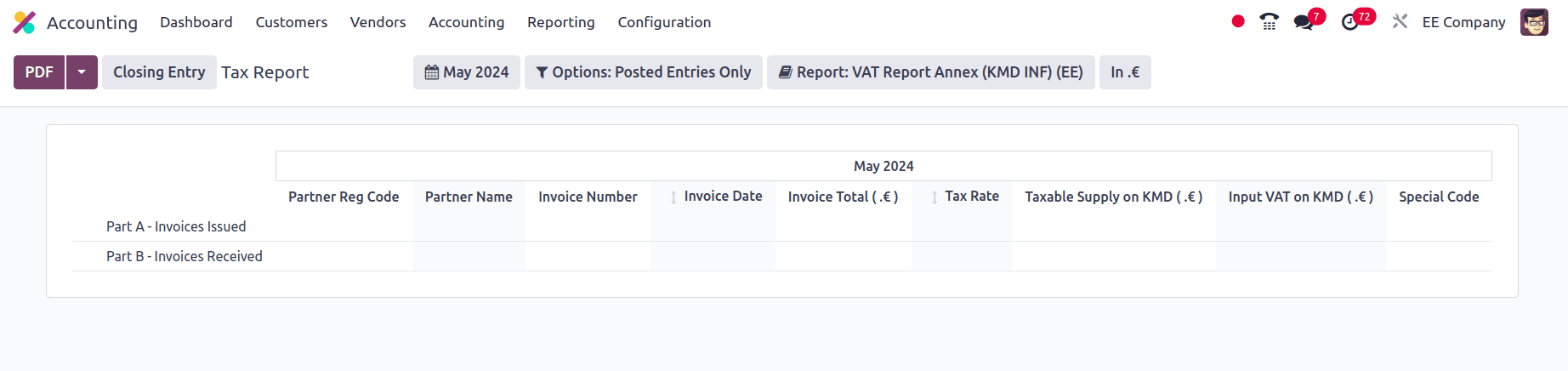

We have one more tax report which is the VAT Report (KMD INF)

VAT Report Annex (KMD INF): The VAT Report Annex (KMD INF) in Estonia is a supplementary document required alongside the main VAT return form (KMD). It essentially details your sales and purchase transactions exceeding a specific threshold.

The tax report of the companies from Estonia is entirely different from the Tax report of other countries. The report compiles tax data from your credit notes, sales invoices, and vendor bills.

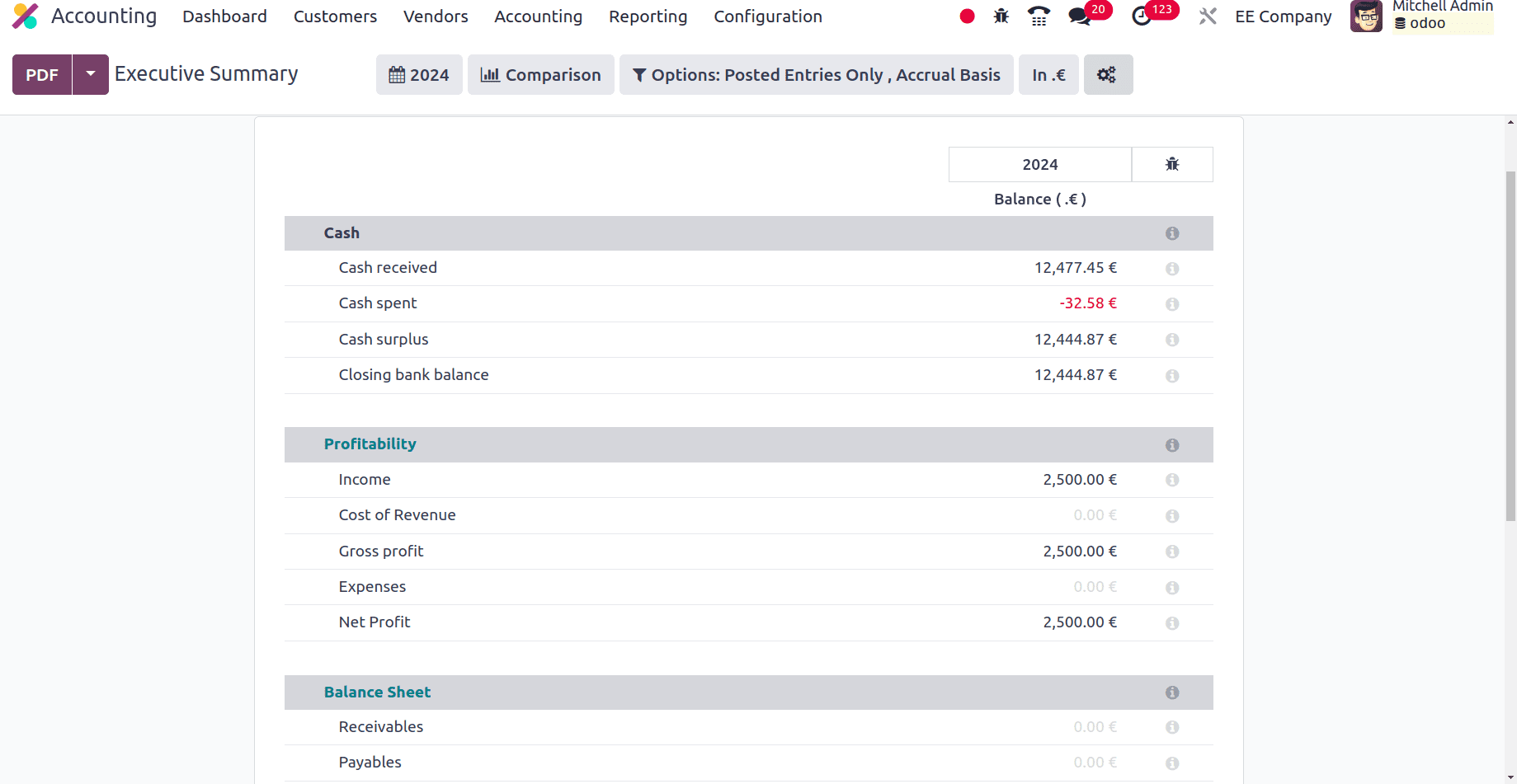

With just a quick glance, the Executive Summary feature in Odoo accounting reports offers a clear overview of your business's financial status. Basically, it's an advanced financial dashboard integrated with your Odoo reports.

It summarises important financial information from numerous in-depth accounting reports, saving executives and stakeholders time. It also removes the need to read through lengthy papers in order to understand the financial health of the organization.

Here, we have discussed the localization package for a company from Estonia. Now we can infer that Odoo 17's Estonian localization ensures compliance with complicated Estonian tax rules. permits us to produce financial reports that respect to country standards and are simple enough for Estonian financial institutions and stakeholders to understand. All things considered, Odoo 17's accounting localization for Estonia offers businesses operating in the region a comprehensive solution. It ensures compliance, simplifies processes, improves accuracy, and enables more informed financial decision-making.

To read more about An Overview of Accounting Localization for Greece in Odoo 17, refer to our blog An Overview of Accounting Localization for Greece in Odoo 17.