As we know the localization is the process of adapting our ERP software for use in specific locations. The business rules and regulations differ from country to country and hence the tax computation and use of charts of accounts also differ. Based on the localization package that Odoo provides, this issue can be resolved and Odoo can be used in any country.

Normally at the time of the creation of a database, it will ask the user to mention the country. On choosing the country, the localization package of Odoo for that country will automatically be added. So on installing the accounting, it will follow the accounting properties based on the localization. The taxes, chart of accounts, invoicing, etc. will follow the rules defined in the localization.

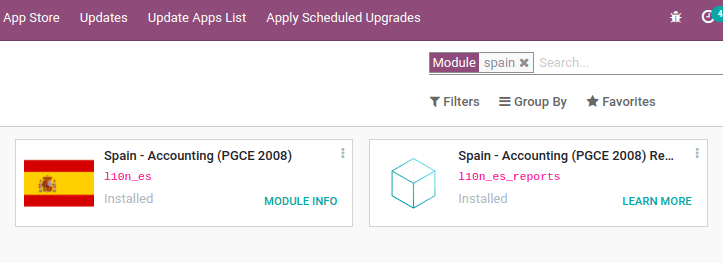

Here, let us move on to Spain localization and see the features provided in the Spain localization package. The localization package of Spain will be available in Odoo apps. Search for Spain in apps that will show the associated localization modules.

For Spain localization package includes two modules:

1. Spain-Accounting (PGCE 2008) [l10n_es] : This module defines the chart of accounts for this localization. It can be,

Spanish general chart of accounts 2008

Spanish general chart of accounts 2008 for small and medium companies

Spanish general chart of accounts 2008 for associations

Also, it defines templates for sale and purchase VAT, tax reports and fiscal positions for Spanish fiscal legislation.

2. Spain - Accounting (PGCE 2008) Reports [l10_es_reports]: This module defines the Spanish accounting reports.

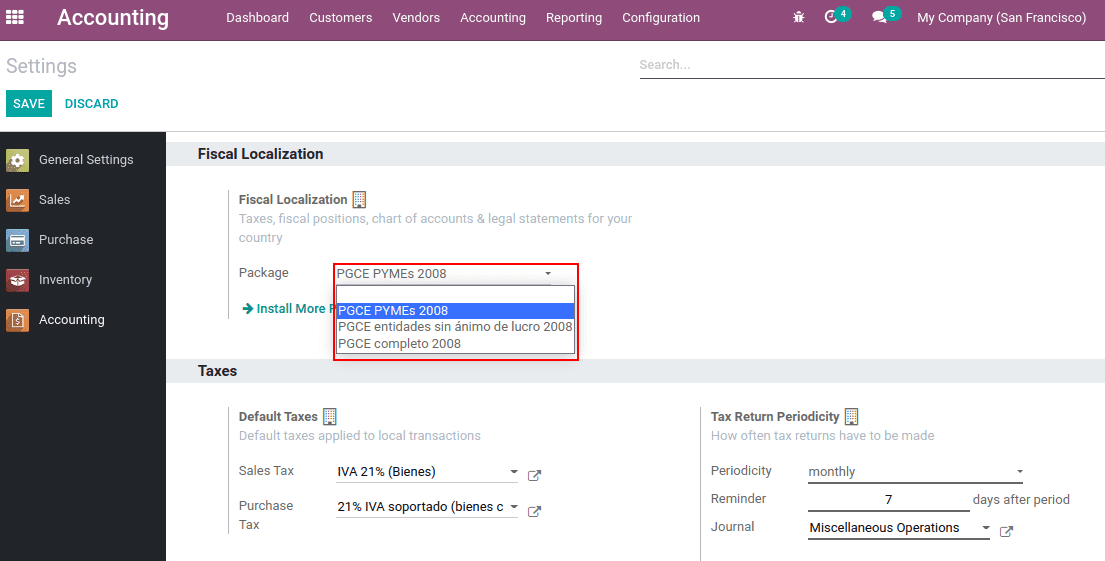

One can also install the new localization package for the new database and can choose which package needs to be used from the accounting configuration settings. This has to be done before making any entry.

The noteworthy feature provided by this localization is its Chart of accounts and reports.

Chart of accounts

On installation, charts of accounts for the corresponding localisation were automatically generated. Spain localization package provides the following chart of accounts.

PGCE PYMEs 2008

PGCE Completo 2008

PGCE Entitades

By default, the chart of account 'PGCE PYMEs 2008' will be chosen as a chart of accounts in the Odoo SaaS instant. One can choose any of the three packages before making any accounting entry. Because whenever any accounting entry is saved then the localization packages cannot be changed hereafter.

The localization package can be chosen from the accounting module configuration settings. Go to Accounting Module> Configuration> Settings ,

Choose the package from here and save it.

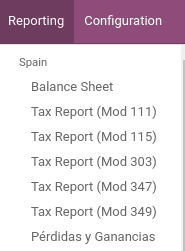

Spanish Accounting Reports

The Spanish accounting reports is another new feature. In the reporting menu, the additional multiple reports are available.

The accounting reports specific to Spain localization include:

1. Balance Sheet

Balance Sheet specific to Spain localization

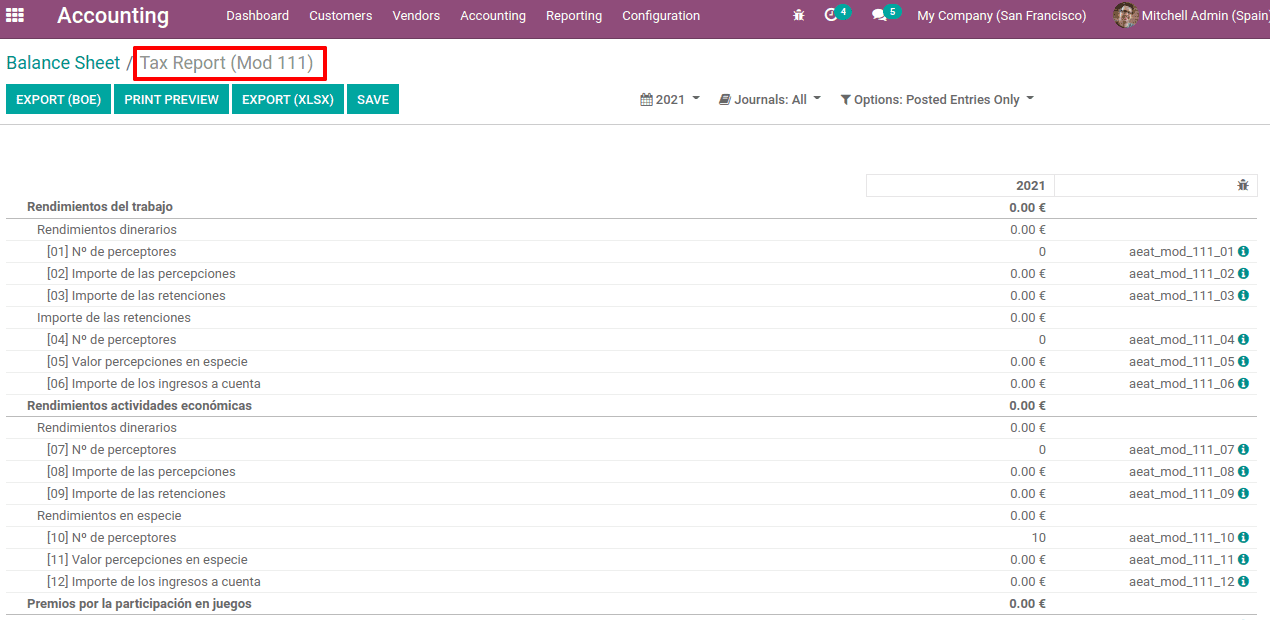

2. Tax Report (Mod 111)

Every quarter, some specific amount of tax is collected from the employees and other professionals is defined by the mod 111 report. This report details the earning from work, economic activity returns, capital gains derived, total settlements, etc.

3. Tax Report (Mod 115)

Every quarter the tenants have to pay 19% tax on the business rentals, issued by the mod 115 report.

4. Tax Report (Mod 303)

Defines the VAT return form that all self-employed people in Spain must make every quarter to report their earnings and to pay tax.

5 . Tax Report (Mod 347)

For all business transactions above 3,005,06 euros, mod 347 tax declaration has to be submitted to the Spanish tax authority. In this report, all receivables and payables are recorded and also contains reports on insurance and lease activities, as well as leasing information of buildings leased and owned by the company.

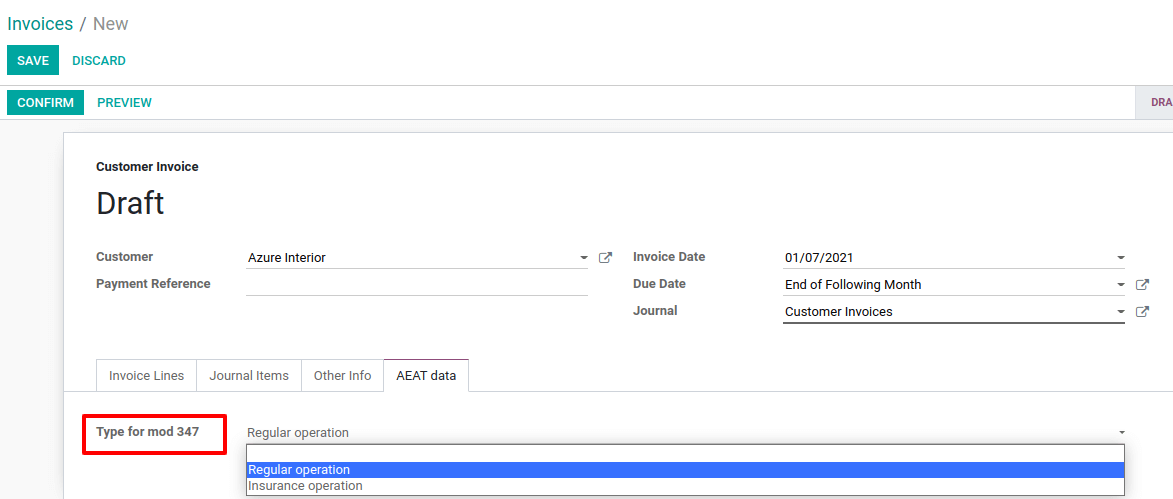

While drafting an invoice, under the AETA tab, there is a field to choose the type for mod 347.

It defines the category into which this invoice falls for mod 347 reports. The same is applicable to vendor bills also.

6. Tax Report (Mod 349)

If the company engages in business with firms that are members of the European Union (EU), the company must apply a tax declaration of 349 to the Spanish tax authority. The 349 tax report contains details about both accounts payable and accounts receivable activities with companies within the EU.

7. Pérdidas y Ganancias (Profit and Loss)

The profit and loss report details, the net turnover, worked out by the company for its assets, procurement, impairment, results from disposals of fixed assets, etc., and financial results like income, expenses, exchange differences, and tax on profits.