For Netherland, localization brings the country-specific accounting features as all other localisations. This includes a flexible collection of laws and market practices unique to the Netherlands. This accounting package follows the best business rules and practices that the dutch follows.

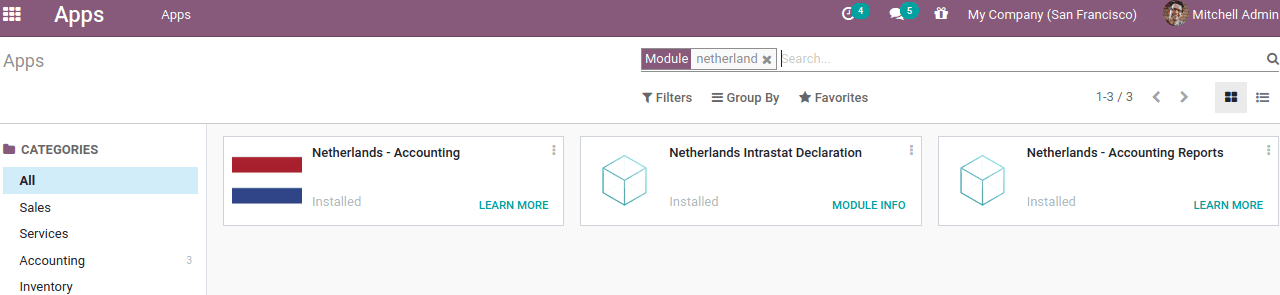

Install the Netherland accounting package from Odoo apps.

The Netherland accounting packages involves:

Netherlands-Accounting: this is the basic accounting module providing the features including the Dutch Chart of Accounts and the VAT Schema. To produce necessary reports, the VAT accounts are properly linked here.

Netherlands Intrastat Declaration: Generates Netherlands Intrastat report for declaration based on invoices.

Netherlands-Accounting reports: Generate Netherland specific reports

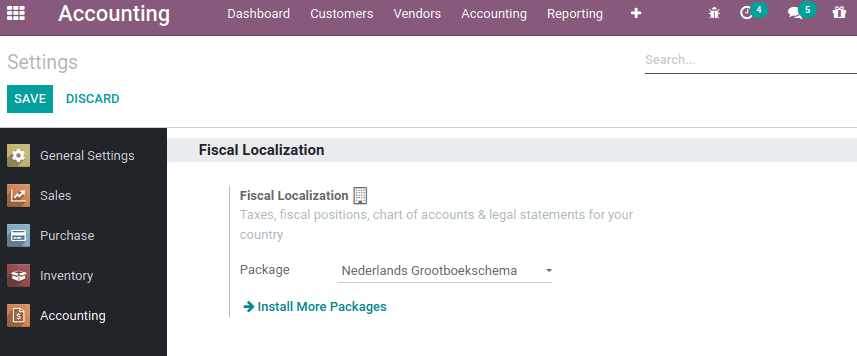

After installation, from the accounting configuration settings choose the fiscal localisations and save before making any accounting entry.

For any localization, the package cannot change from the setting after making the accounting entry. So ensure that the localization chosen is the exact one that the requirement of the company satisfies.

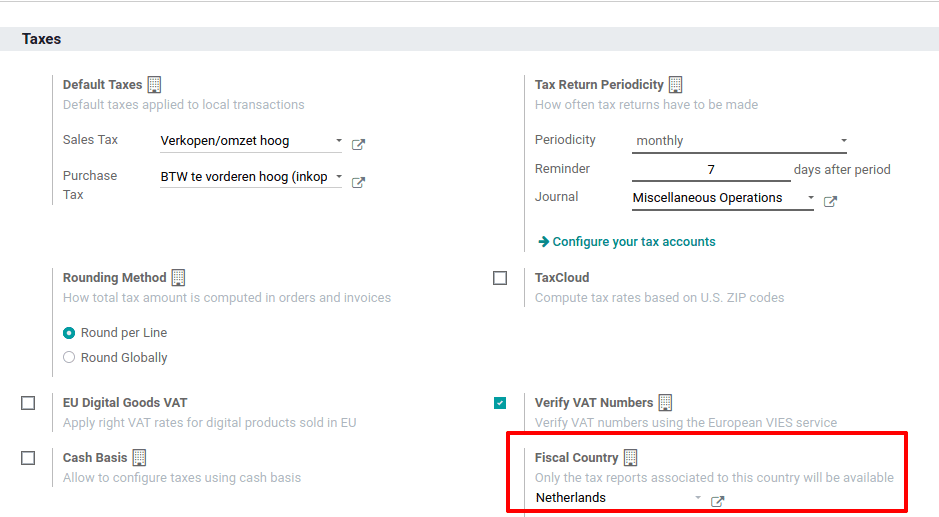

The fiscal country automatically chose the country-specific to localization. In the accounting configuration settings, under taxes, one can see the fiscal country.

So only the tax reports associated with the country ‘Netherlands’ will be available.

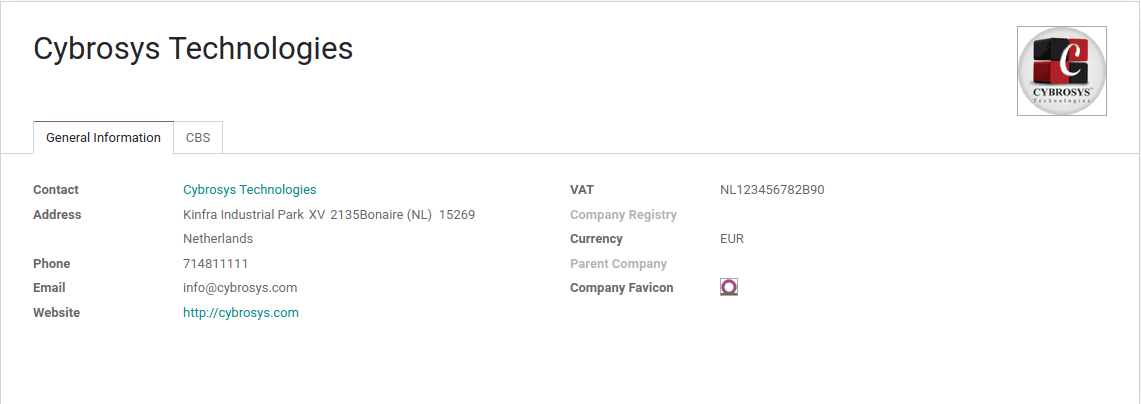

Configuring company

Company can be configured from Settings > Users & Companies > Company.

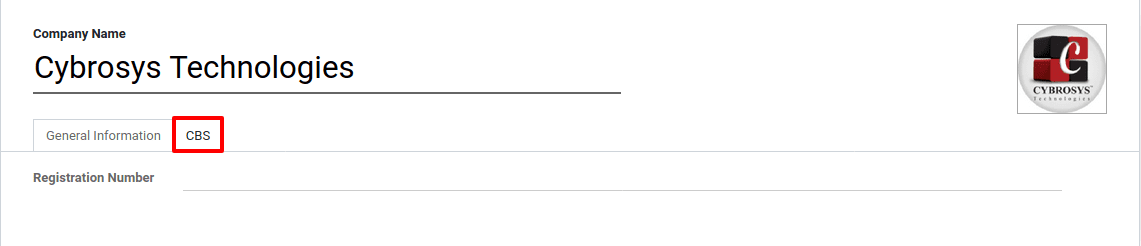

According to the new rule in the Netherlands, taxpayers must submit a CbC report to the Dutch tax authorities and also need to keep the local file as well as the master file in the administration. Those companies having annual revenue of EURO 750 million are required to submit this report. The CBC Report offers a summary of aggregate information on total revenue, profit and loss on income tax, tax paid, number of employees, etc.

Under the CBC tab, add the registration number.

The chart of accounts, taxes, and journals are auto-generated. All these are specific to the locality with localization support. One can also add additional accounts by consulting the company accountant. The configurations are the same as the default configuration of Odoo.

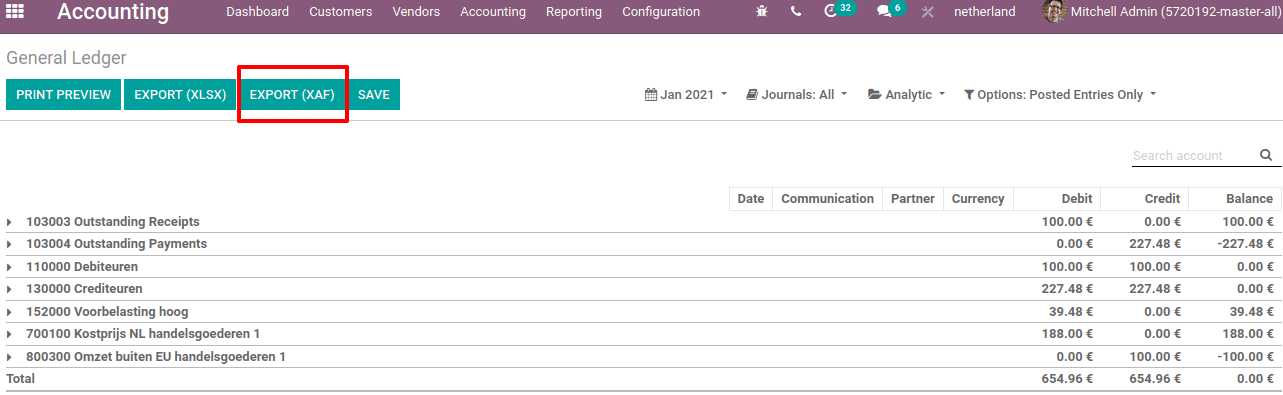

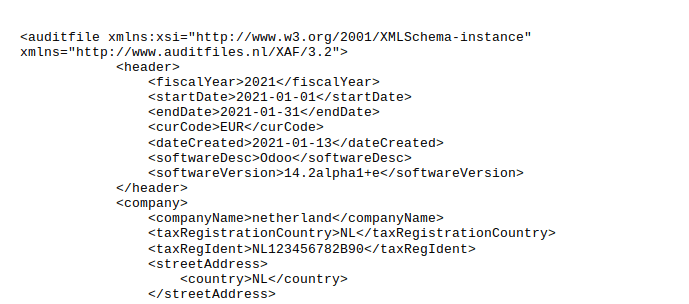

XAF Export

The Dutch localization allows exporting all the accounting entries to XAF format. The reporting side provides a button to export the report to XAF format. Go to Accounting > Reporting > General ledger, filter the required details, and click on EXPORT(XAF).

The XAF files save data in XML format.

Reporting

Netherland localization provides some specific reports other than the default reports Including,

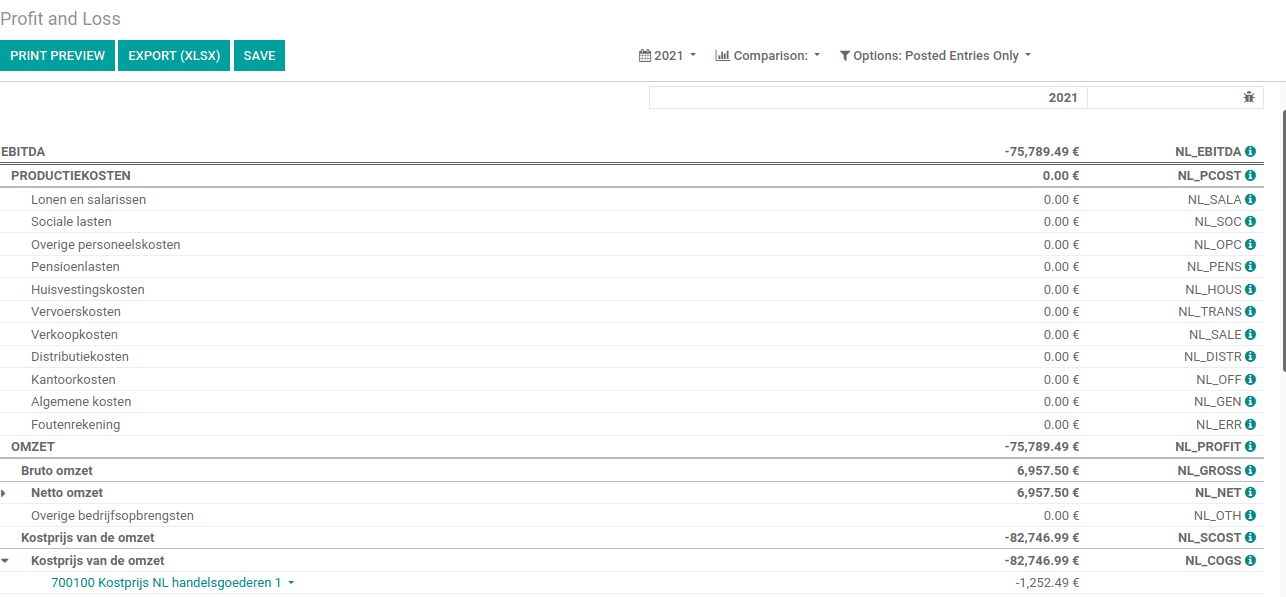

1. Profit and Loss report

2. Intrastat Report (ICP)

Profit and loss report is one of the significant reports for the company owners and accountants which displays the net profit of the company. It details the production cost, revenue, gross turnover, and other costs.

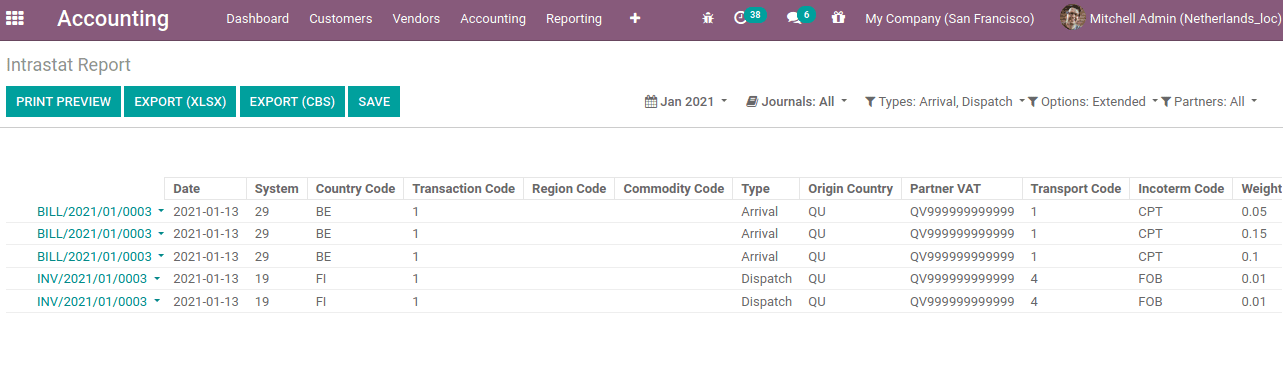

Intrastat Report gathers information and the production statistics on trade in goods between European Union countries (EU). By default odoo provides the Intrastat report, i.e from Accounting > Reporting > Audit reports > Intrastat Report.

Apart from this, the localization specific Intrastat report (ICR) will be available in Accounting > Reporting > Netherlands > Intrastat Report (ICR).

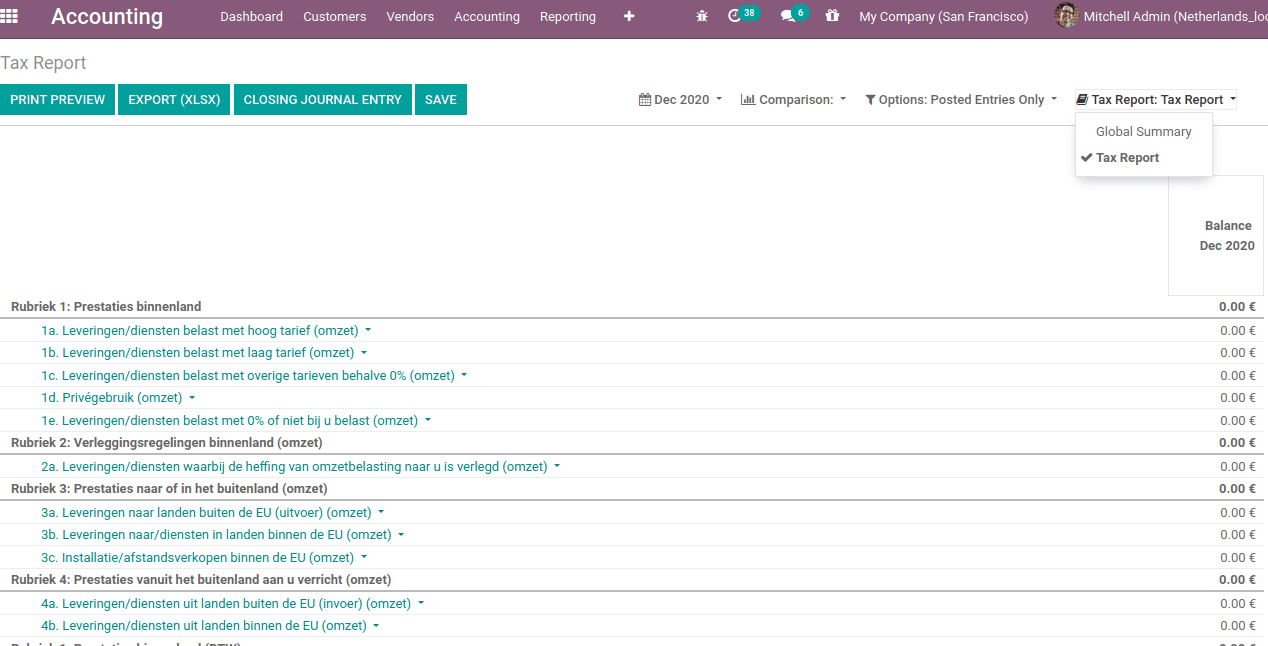

TAX Report

Tax reports for this localization can be available from Accounting > Reporting > Audit Report > Tax report and can export to XLSX and print the preview also.