There is a great change in payment mode from 2007 till this year. The payment system in Switzerland has been changing very fast for a few years now i.e from bank transfer to E-billing. These changes are the result of European norm application, also called SEPA. The most visible part is the QR invoicing which has been replacing the old ESR invoicing since July 2020.

There is no mandatory chart of accounts in Switzerland. However, the sterchi chart of accounts for SMEs is the commonly used one. Also, all VAT rates are applicable and export-import rates can be automated based on a country by setting fiscal position.

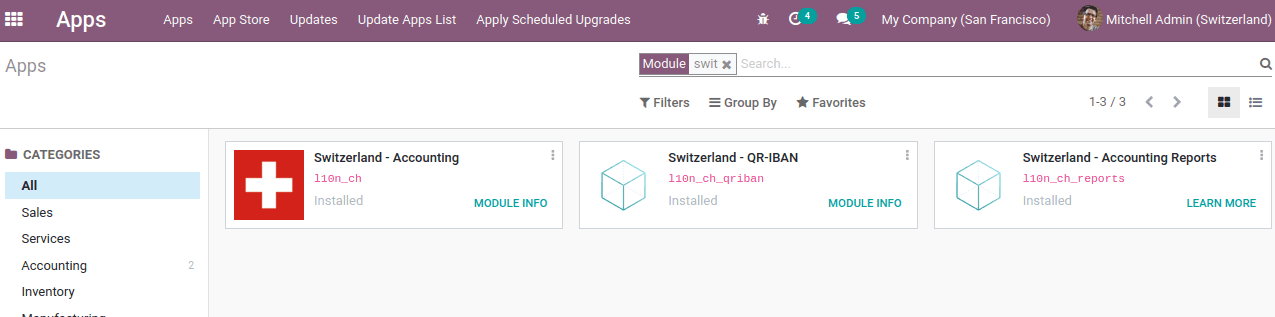

Install the Switzerland accounting package from Odoo apps.

The Switzerland accounting packages involve three modules.

l10n_ch: this module provides the basic accounting feature like a chart of accounts and taxes and allows ISR generation when printing an invoice or submitting it by mail.

l10n_ch_qriban: This will add a QR-IBAN field on the bank account. The bank account number itself is considered as QR-IBAN if the field is left empty. Once the QR-IBAN field is filled, it will be used as the QR-IBAN. This should aid in reconciling bank accounts where the old IBAN code is still in use.

l10n_ch_reports: Generates accounting reports for Switzerland specific localization

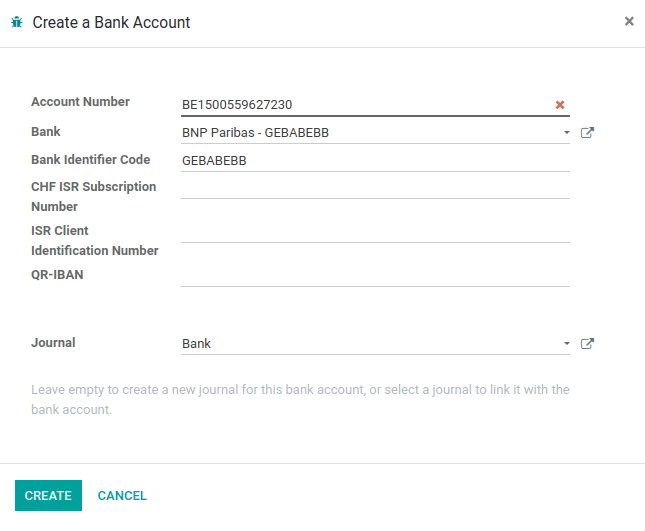

Creating Bank Account

Bank accounts can be added from the accounting overview, click on add a bank and fill in all the required details.

Add a bank account and bank. Bank identifier code will then be auto-filled.

CHF ISR Subscription Number: subscription number provided by the Swiss bank or post finance to identify the bank, used to generate ISR in CHF in order to send payments directly to the bank.

ISR Client Identification Number: This field is used for the swiss postal account number on a vendor account and for the client number on your own account. The client number is mostly 6 digits without ‘-’ while postal account number includes ‘-’

QR-IBAN: Add the QR-IBAN number for your bank account. Thus one can still use the IBAN in the account number while one can see the QR-IBAN for the barcode.

Journal: Specify the journal for which this bank needs to link with or leave the field empty to create a new journal for this bank.

ISR (In-payment Slip with Reference number)

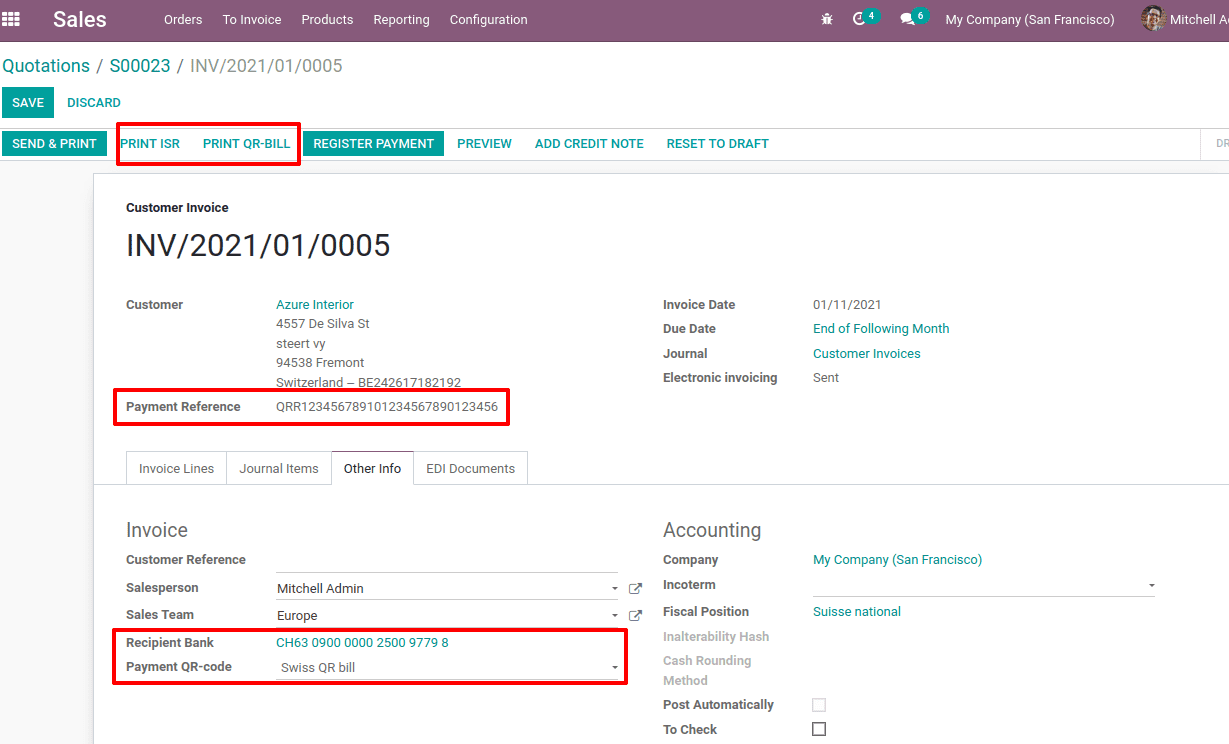

ISR payment is one of the payment systems used in Switzerland. Users can print it directly from Odoo. There are two new buttons on the consumer invoice called Print ISR and Print QR-BILL. This will generate invoices with ISR and QR codes along with normal customer invoices.

In the other info, tab add the bank and payment QR-Code. Also, a payment reference should be added, which starts with QRR.

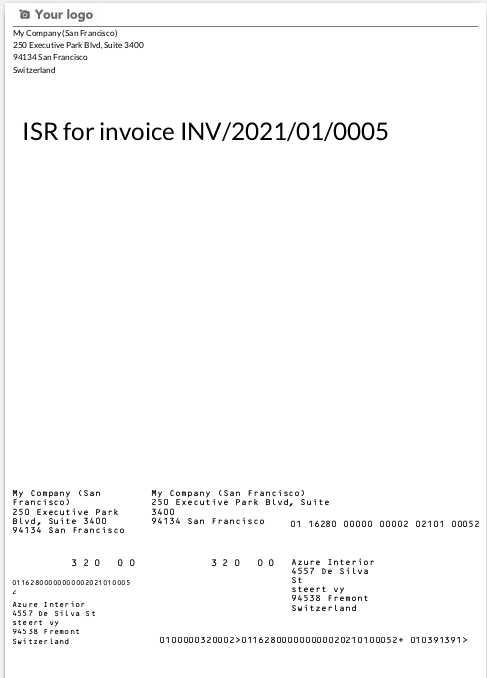

The ‘Print ISR’ button will appear in the bank account is mentioned in the customer invoice. Click on the print ISR button, which will open the pdf file with ISR.

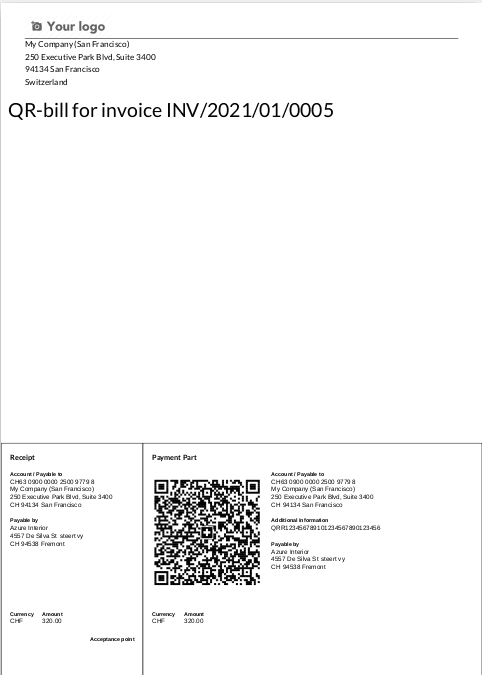

Similarly, on clicking the ‘print QR-BILL’ button the invoice with QR code can be generated. This will help the client to make payments in an easier way.

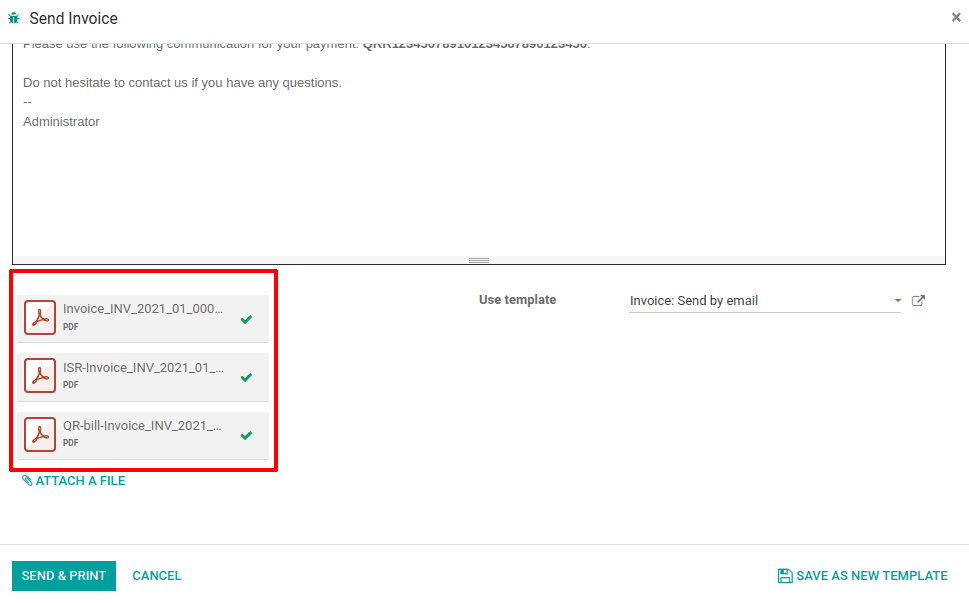

One can send these two invoices along with the default invoice, with a single click. Click on ‘send and print’, so the mail will attach with these three invoices.

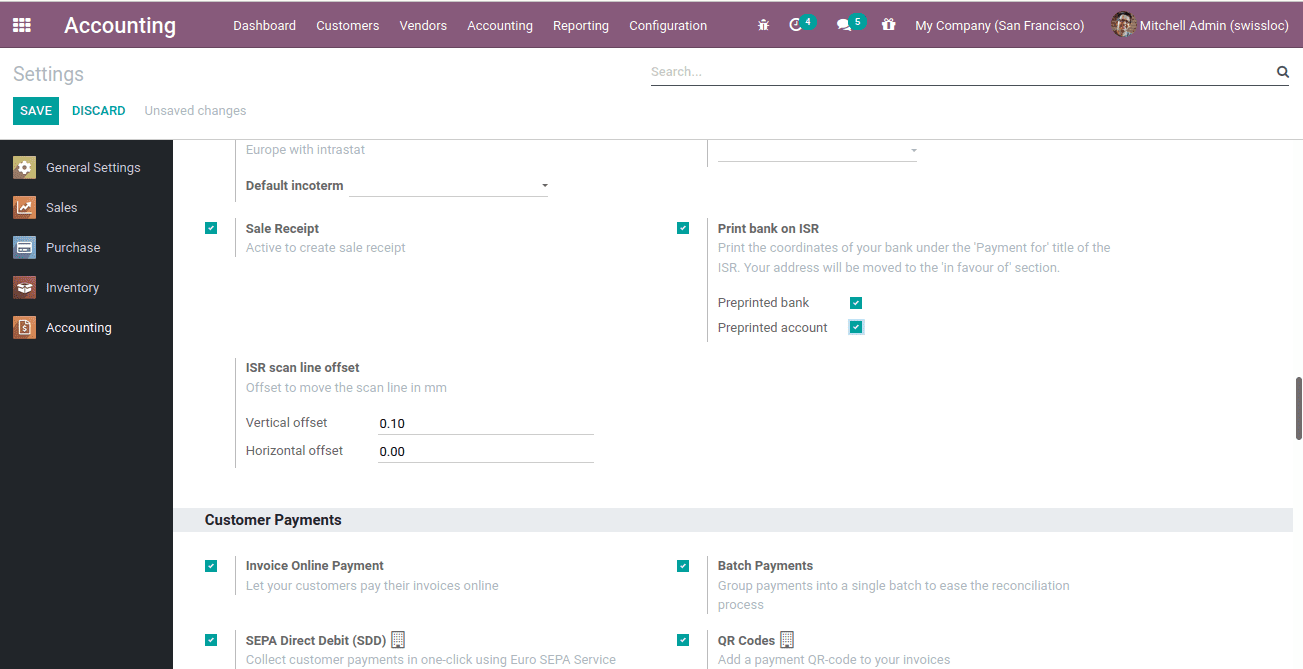

From accounting settings, one can activate the ISR layout in two ways. It can be with bank coordinates and without bank coordinates. This can be activated from Accounting > Configuration > Settings, under customer invoices enable print bank on ISR.

ISR reference on invoices

By adding the ISR reference as the payment reference, one can easily do the reconciliation.

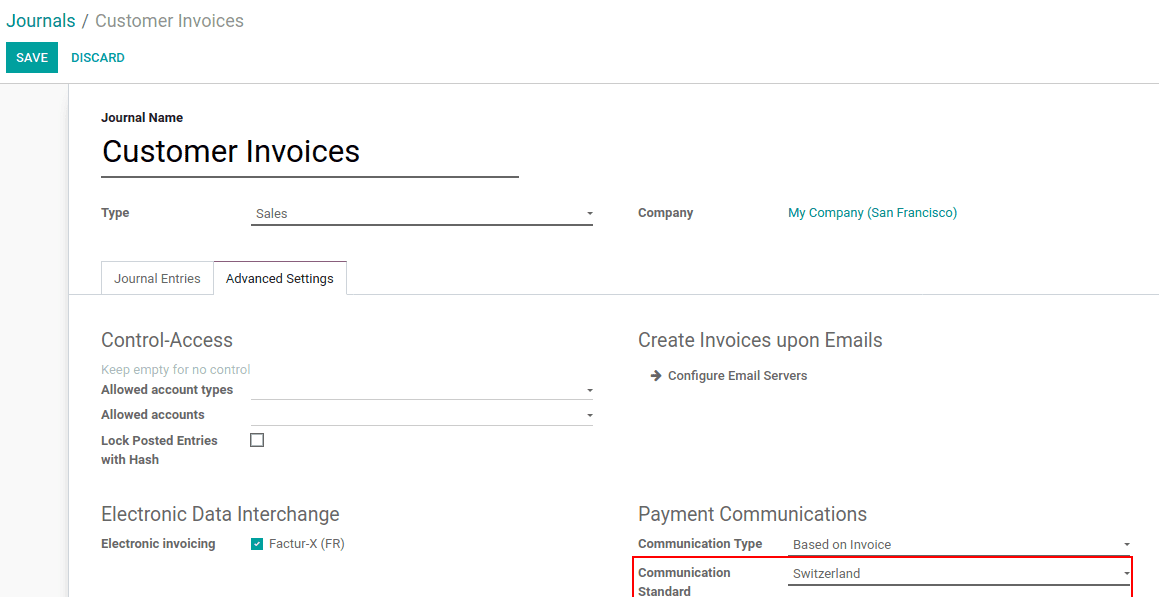

So, for that one can add the communication standard for the journal. Go to journals, Accounting > Configuration > Journals. Open the journal, customer invoice and under the advanced settings tab choose communication standard as ‘Switzerland’. Then save the changes.

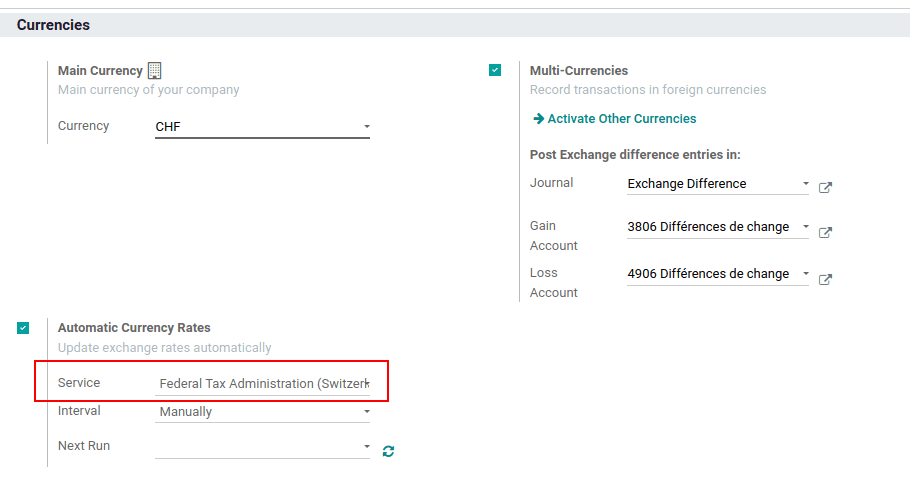

Currency Rate Updation

For swiss localization, the currency rate is updated by the Federal Tax Administration from Switzerland. Activate multi-currency from accounting configuration settings. Then the currency automated rate service provider can be selected from the dropdown list.

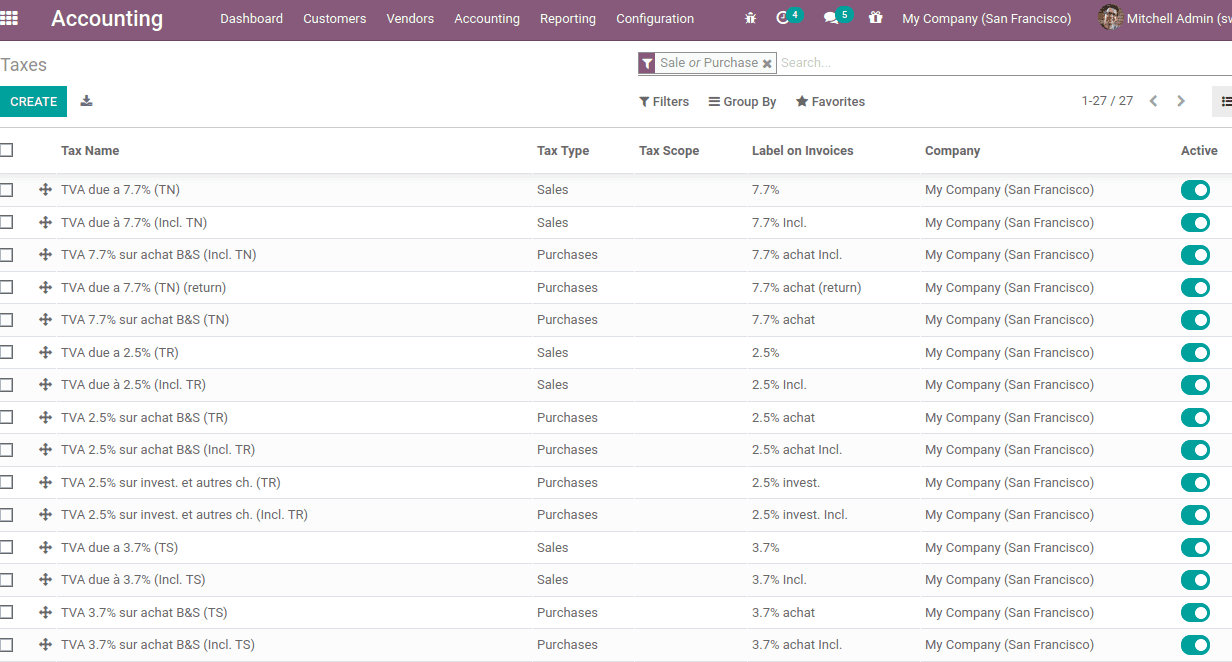

New VAT updated for January 2018

From January 2018, the new tax rate came into force in Switzerland. The VAT 8% was reduced to 7.7% and in the hotel, sector VAT reduced from 3.8% to 3.7%.

Users with earlier versions of odoo V11, have to update the localization module ‘Switzerland - Accounting Reports’ form odoo apps to update the VAT. Then one can create and use new taxes.

For the latest version users, the VAT is automatically created at the time of installing the localization itself.

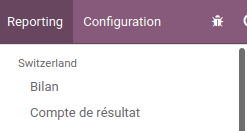

Swiss Localisation Reports

When it comes to the reporting side, apart from the default reports provided by odoo, there are two localization specific reports Bilan (Balance Sheet) and Compte de resultat (Income statement).