Efficient tax computation is a cornerstone of effective financial management, and for businesses utilizing the cash-based accounting method, it becomes crucial to align tax calculations with actual cash transactions. Odoo 17, with its modular and adaptable structure, provides a robust Accounting Module that caters to various accounting methods, including cash basis. In this blog post, we will explore the step-by-step process of creating a cash-based tax computation inside the Odoo 17 Accounting Module. With cash-based accounting, income and costs are reported as soon as they are paid or received as opposed to when they are incurred. This approach provides a real-time view of a company's cash flow, making it a preferred choice for many small businesses. Odoo 17's Accounting Module accommodates this method, allowing businesses to compute taxes based on actual cash transactions. Understanding and implementing this feature can significantly enhance the accuracy and efficiency of financial reporting in accordance with the cash flow of the organization.

This blog will give you an overview of configuring and creating Cash basic tax computation inside the Odoo 17 Accounting Module.

Configuring Cash Basis Accounting in Odoo 17

Start by logging into your Odoo 17 instance and navigate to the dashboard. Ensure you have administrative privileges to configure accounting settings.

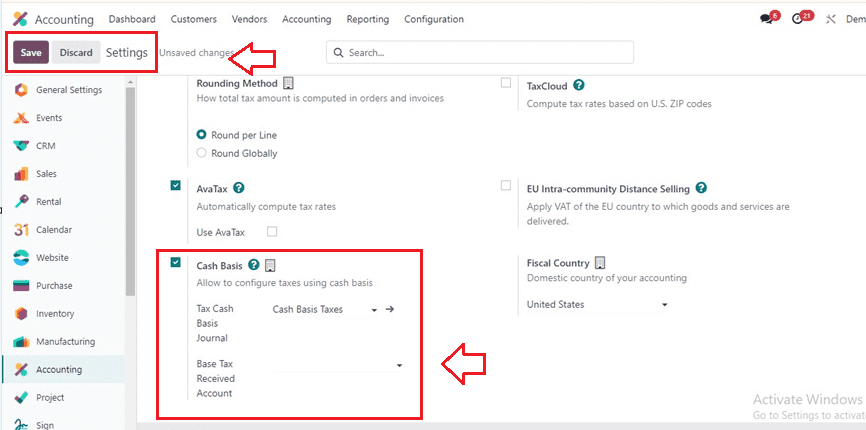

Setting up Cash Basis Accounting: Proceed to the 'Accounting' module's 'Configuration' menu and choose 'Settings.' Then, find the 'Taxes' area and select the accounting option labeled 'Cash Basis' to enable cash-based accounting and save the modifications.

Creating Tax Zones: Establish tax zones based on relevant geographical criteria. These zones can represent different tax jurisdictions or regions where your business operates.

Defining Tax Rates: For each tax zone, set the applicable tax rates. Ensure these rates align with the tax regulations governing the specified regions.

Creating Cash Basis Tax Rules

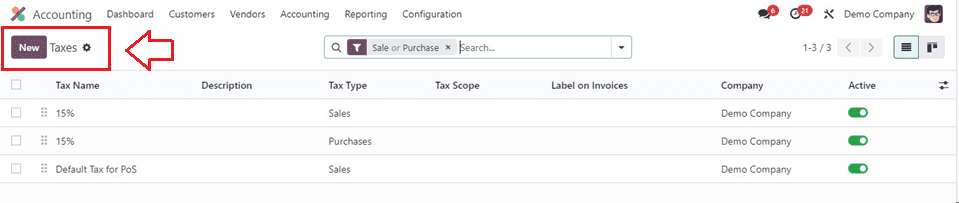

You can find the 'Taxes' option under the 'Accounting' part of the 'Configuration' menu. Open the window, and you will get the dashboard of all the preconfigured Taxes with their Tax Name, Description, Tax Type, Tax Scope, Label on Invoices, Company, and Active.

Here, you can create specific rules for cash-based tax computation by clicking on the “New” button.

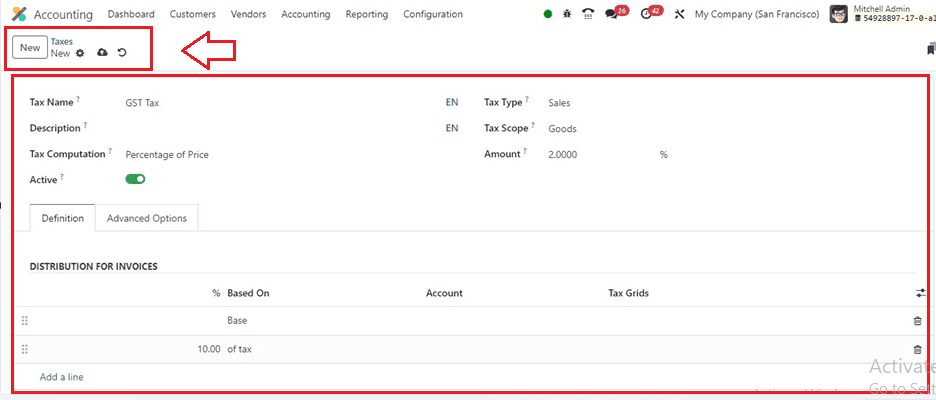

The term "tax" is used to describe the tax. In the corresponding areas, you may provide the "Tax Name" and the "Description." Then select between Fixed, Percentage of Price, or Percentage of Price (Discount Included) as the calculating technique from the “Tax Computation” field. Toggle the “Active” button to enable or disable this tax rate in your Accounting Database. Finally, choose a “Tax Type” and set the scope of the tax. This can be established by taking into account if the tax is included in the cost of the goods or services by choosing these options from the “Tax Scope” field. The “Amount” field can be used to set the percentage of this particular tax.

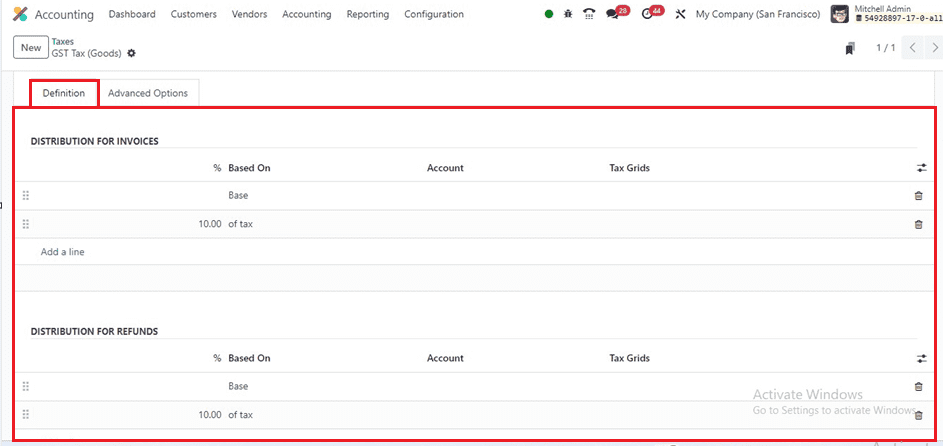

Definition Tab

You can set the DISTRIBUTION FOR INVOICES and DISTRIBUTION FOR REFUNDS Based on the invoice line pricing and a percentage of tax, the system enables the accurate distribution of taxable basis or percentages of computed tax to various Accounts and Tax Grids. Using tax grids, you may automatically create tax reports that comply with the laws of your nation.

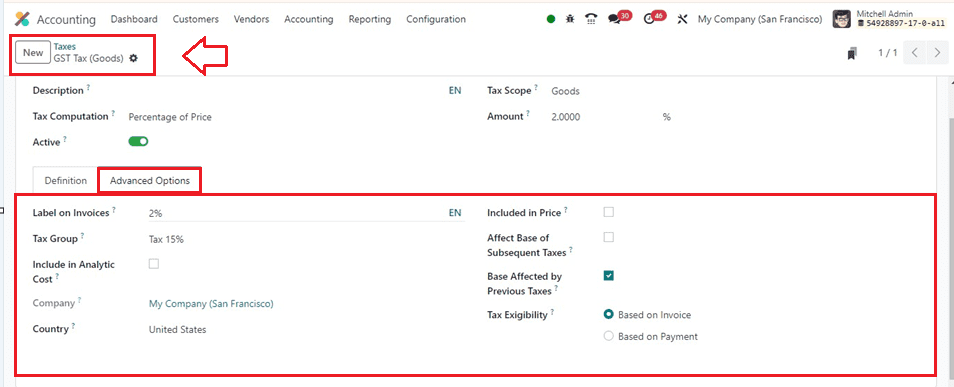

Advanced Options Tab

You can set some essential advanced tax options inside this tab section. Select the “Tax Eligibility” option under the ‘Advanced Options’ tab. If you choose ‘Based on Payment,’ the tax is payable upon receipt of the invoice's payment. As long as the original invoice hasn't been reconciled, you can also specify the Cash Basis Transition Account, where the tax amount is recorded.

Now, we can Link this Tax Rule to Tax Rates: Associate the cash basis tax rule with the relevant tax rates you previously defined. This establishes a connection between the rule and the rates applicable for cash transactions.

Testing Cash Basis Tax Computation:

Initiate a cash transaction, such as receiving payment for an invoice or making an expense payment. This will serve as a test to validate the effectiveness of the cash-based tax computation. The Odoo 17 Accounting Module, configured for cash-based accounting, will calculate taxes based on the actual cash movement, providing real-time accuracy.

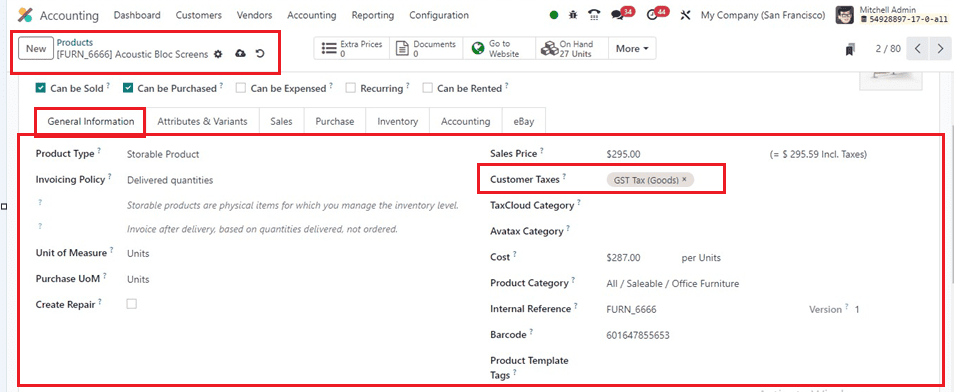

Here, we can create or choose a product. Let's use the sale of a $295 product as an example to show how cash-based taxes affect accounting activities. From the product configuration form of a product, we can do this procedure. You can choose the recently configured tax within the “Customer Taxes” field inside the ‘General Information’ tab of the product, as shown below.

You can also fill up the other form fields according to the product and its specifications and save the data using the save icon. Now, Let's create a customer invoice for the above product using the “Invoices” section of the “Customers” menu.

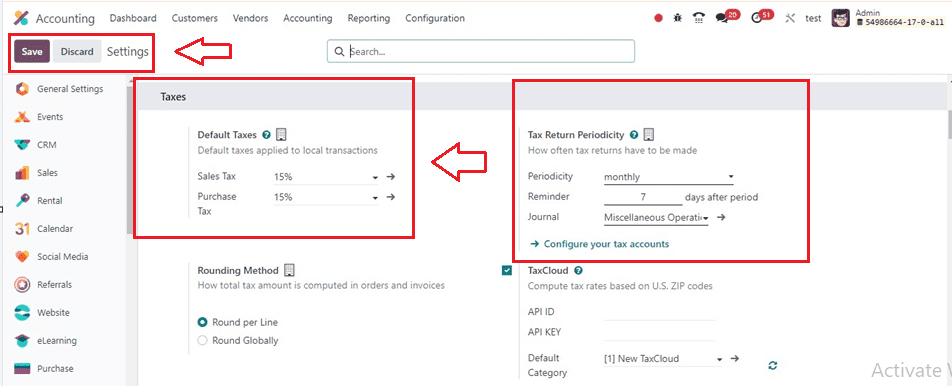

Choosing Default Taxes for Your Accounting Processes

When no other taxes are provided, financial operations automatically choose Odoo's default taxes. New things are subject to these tariffs, which are later modifiable through the product form. In the event that no more taxes are available, they will be translated locally. As seen in the above figure, the Accounting module's ‘Settings’ menu allows you to change the ‘Default Taxes’ for sales and purchases. The internal link included in the ‘Default Taxes’ section allows you to modify the sales and purchase taxes. The ‘Tax Return Periodicity’ parameter specifies how often tax returns have to be filed. Tax returns may be entered into the relevant areas using Periodicity, Reminders, and Journal fields, as shown below.

The ‘Rounding Method’ feature of the Odoo 16 Accounting module allows you to figure out how much tax is totaled on orders and invoices. Users may opt to Round per line or Round Globally, and if tax is included in the pricing, they can round each line individually. Line subtotals are added to get the total, including taxes. Users can specify the conditions under which tax is waived when a cash discount is given in the Cash Discount Tax Reduction section.

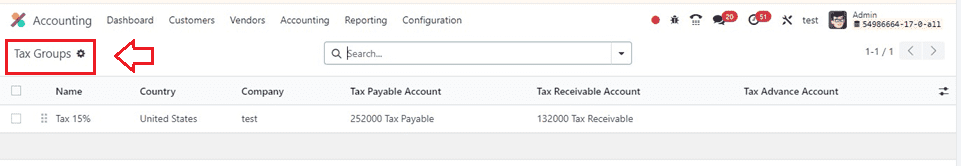

Tax Groups in Odoo

Odoo supports various tax groups for goods, services, suppliers, businesses, and accounts, which can be accessed through the Configuration menu of the Accounting module. The list view provides information on the Name, Country, Tax Payable Account, Tax Received Account, and Tax Advance Account.

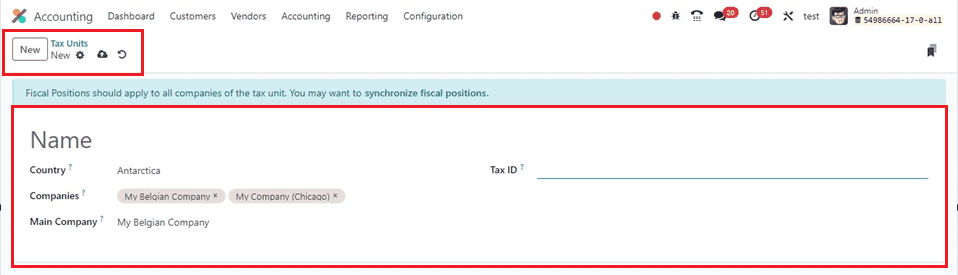

Tax Units in Odoo

The Accounting module's ‘Configuration’ menu's ‘Tax Unit’ option is utilized to group the Tax Report Declaration, resulting in the emergence of a new Tax Units configuration window.

To aggregate your company's tax report declaration, add a title to the taxing unit and choose the countries. Then, enter the Companies and Main Company in the corresponding fields. The Tax ID field can be amended to include the identifier for submitting a report for this unit.

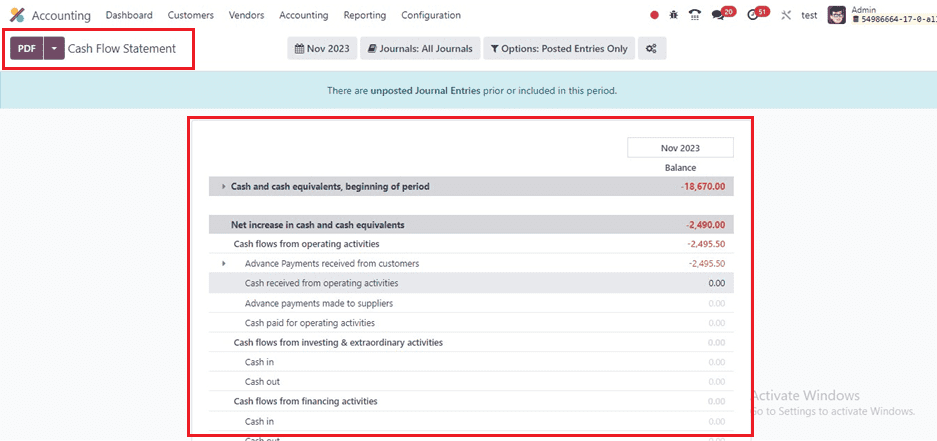

Generating Cash Basis Reports

Utilize the reporting features within the Odoo 17 Accounting Module to generate specific reports aligned with cash-based accounting. These reports may include cash-based profit and loss statements, ensuring a clear view of the financial landscape.

To regularly monitor cash-based transactions, you can go to the ‘Cash flow Statement’ reporting window available inside the “Reporting” menu of the Odoo 17 Accounting Module. This includes verifying that tax computations accurately reflect the cash movement in real-time.

The cash flow statement reporting window provides a comprehensive financial statement detailing all cash inflows and outflows based on the accounts configured for the invoice and includes reports on operating, investment, and financial activities based on current and previous Months, Financial Years, and Quarterly years.

Configuring cash basis tax computation inside the Odoo 17 Accounting Module empowers businesses to align their tax calculations with actual cash transactions. By following the comprehensive guide provided in this blog post, businesses can seamlessly integrate cash-based accounting into their financial management processes, ensuring accuracy and compliance. Stay informed about updates to Odoo 17 to maximize the benefits of its advanced features and elevate your business's financial management capabilities with a tailored approach to cash-based tax computation.