Deferred or prepaid expenses are payments made in advance that have not yet been used or spent. Also referred to as amortization or expense recognition, they are progressively recorded on the income statement over time. When a business pays for a service, asset, or benefit before it is actually used or consumed, it creates a deferred expense that appears on the balance sheet as an asset that will help generate future economic advantages. Businesses must postpone the full cost to later periods as the benefit is realized rather than acknowledging it all at once. Accurate financial reporting depends on effectively managing deferred expenses, which guarantees that costs are recorded as they are incurred and helps generate income.

Controlling delayed expenses is crucial to maintaining accurate financial records in the accounting industry. Strong accounting functions, such as instruments for managing deferred expenses, are provided by the flexible business management program Odoo 18. We will examine how to compute deferred expenses in Odoo 18 accounting in this blog article, giving companies a clear road map for efficient financial management.

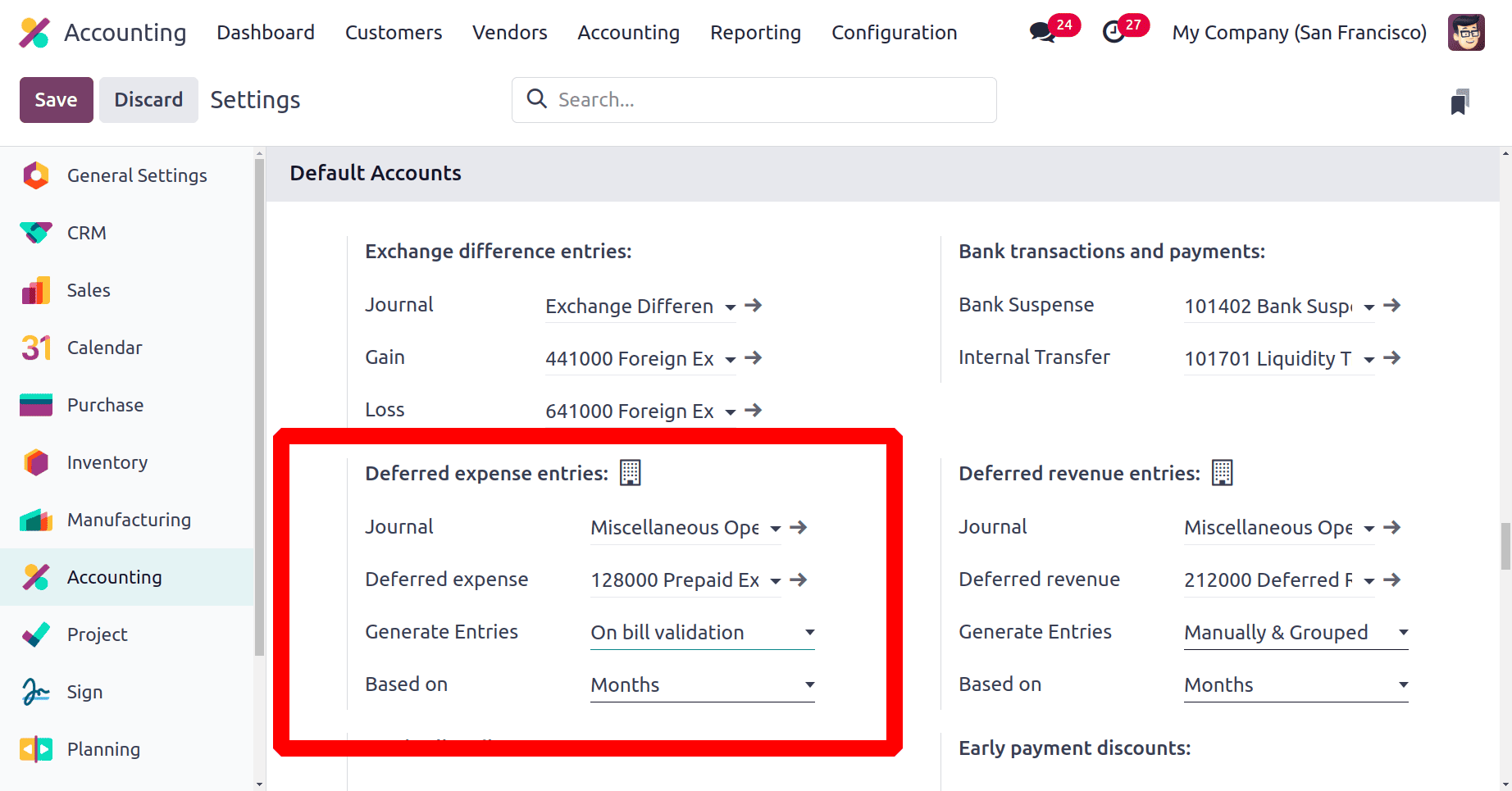

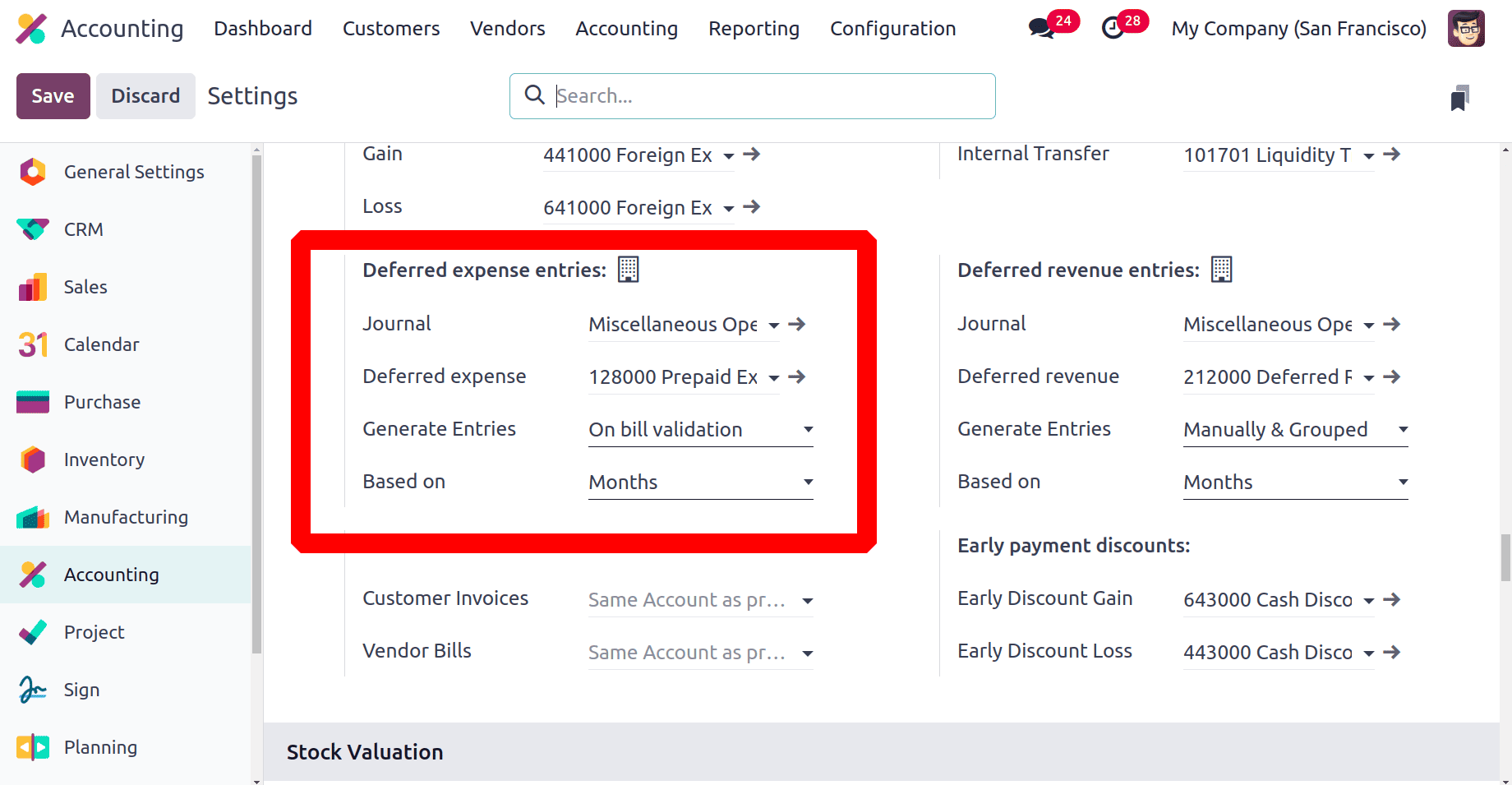

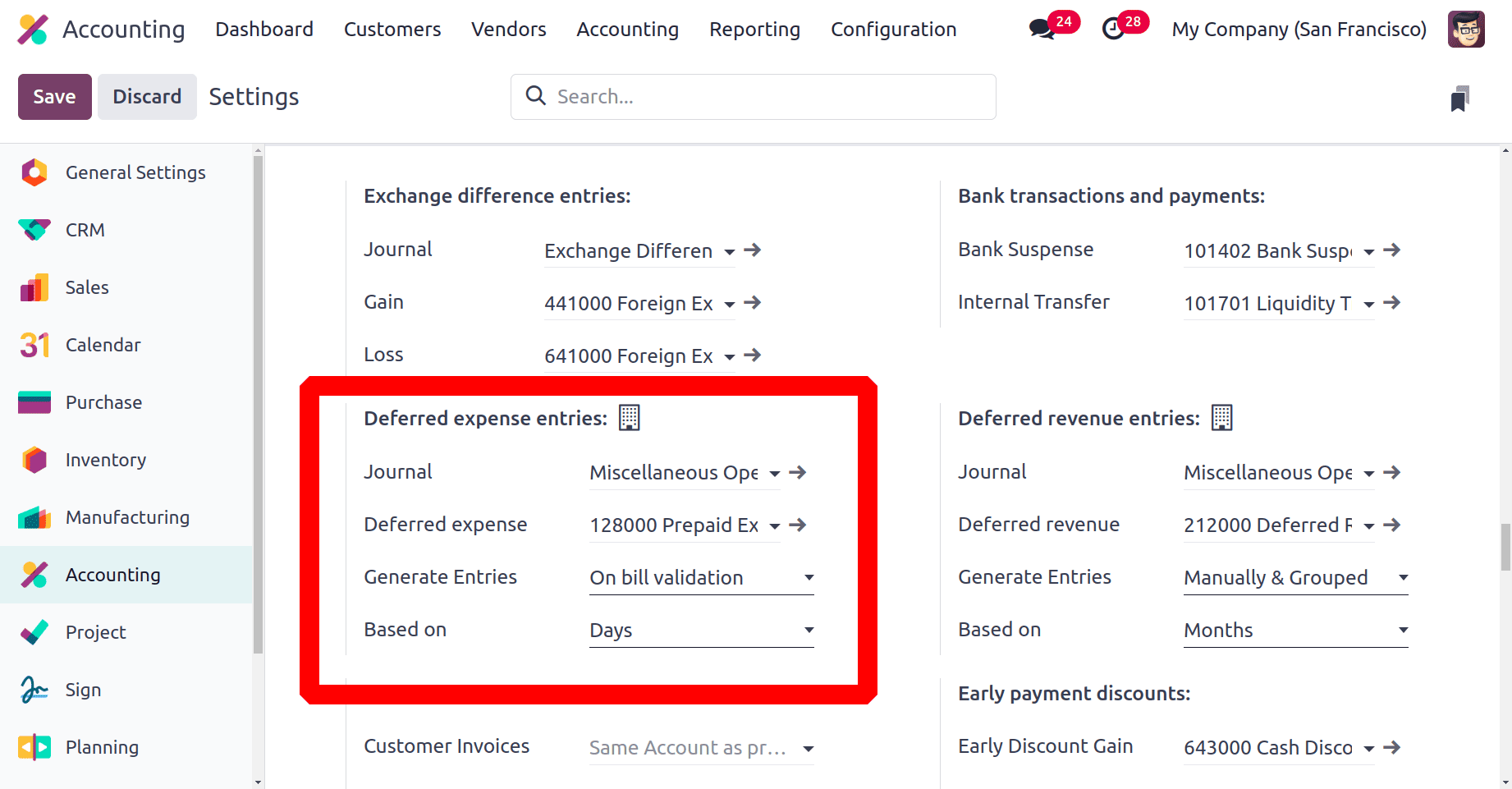

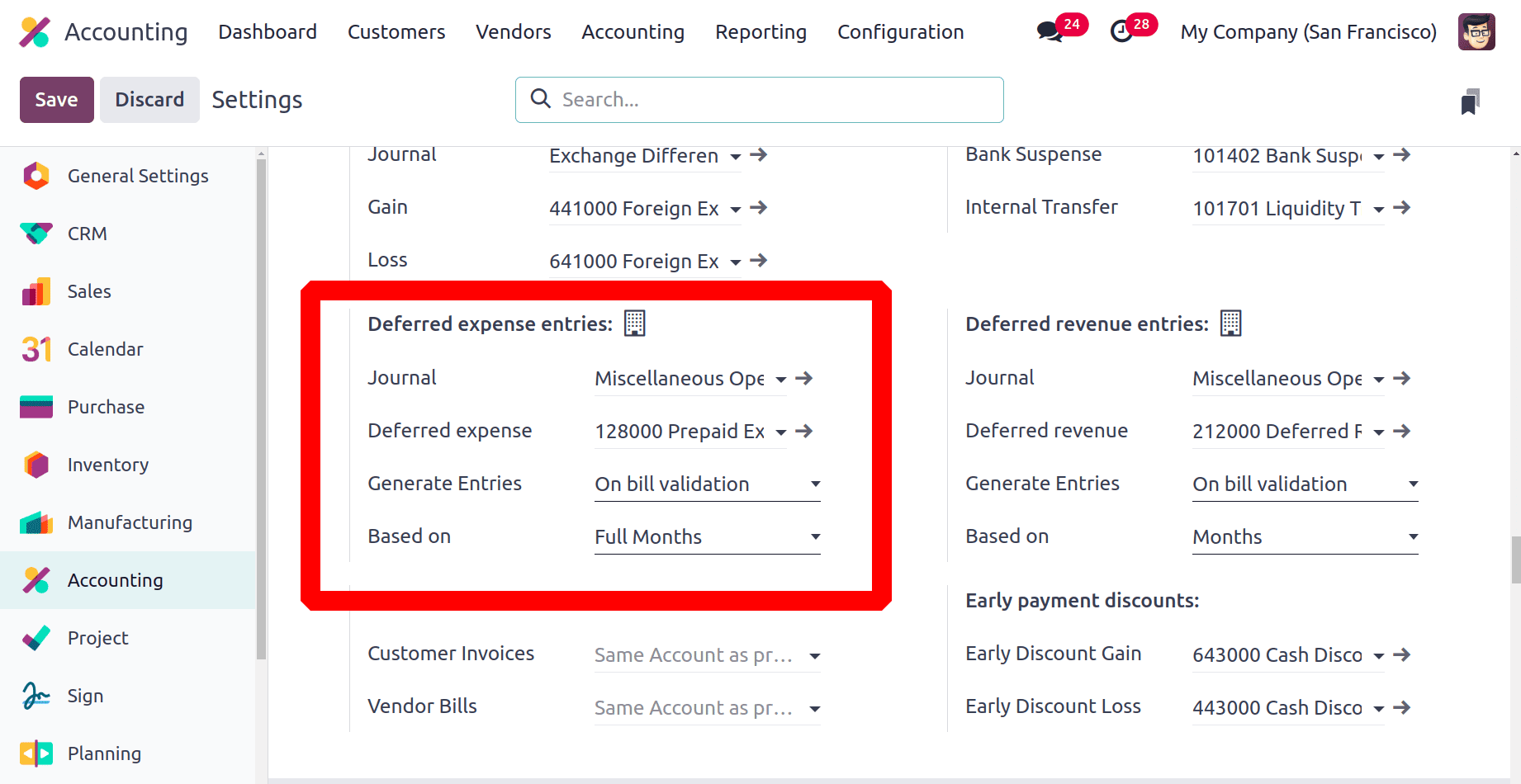

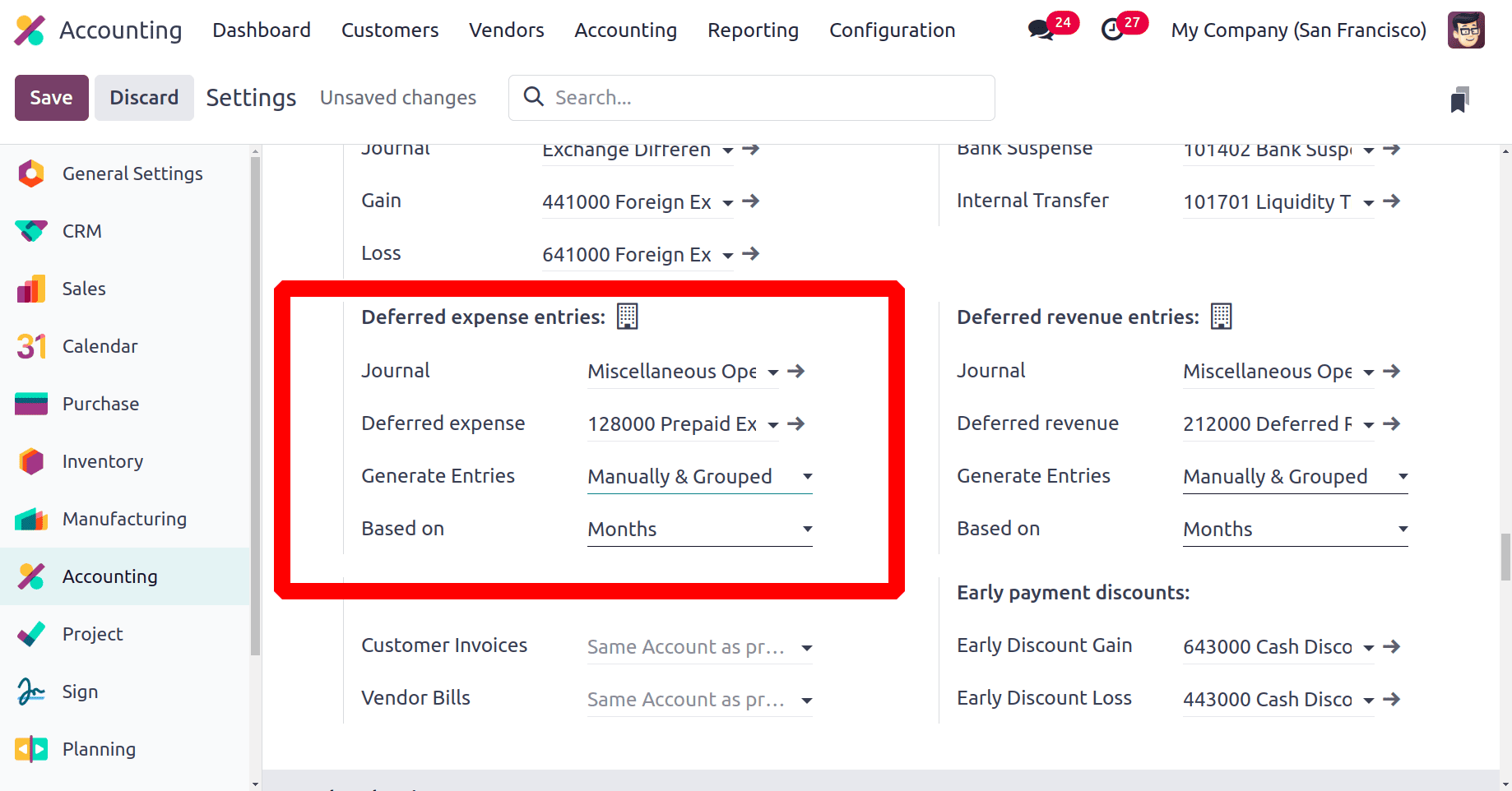

Open the accounting modules and click on the Configuration menu. From the list choose Settings. Under the Default Accounts section users can view Deferred expense entries as shown below.

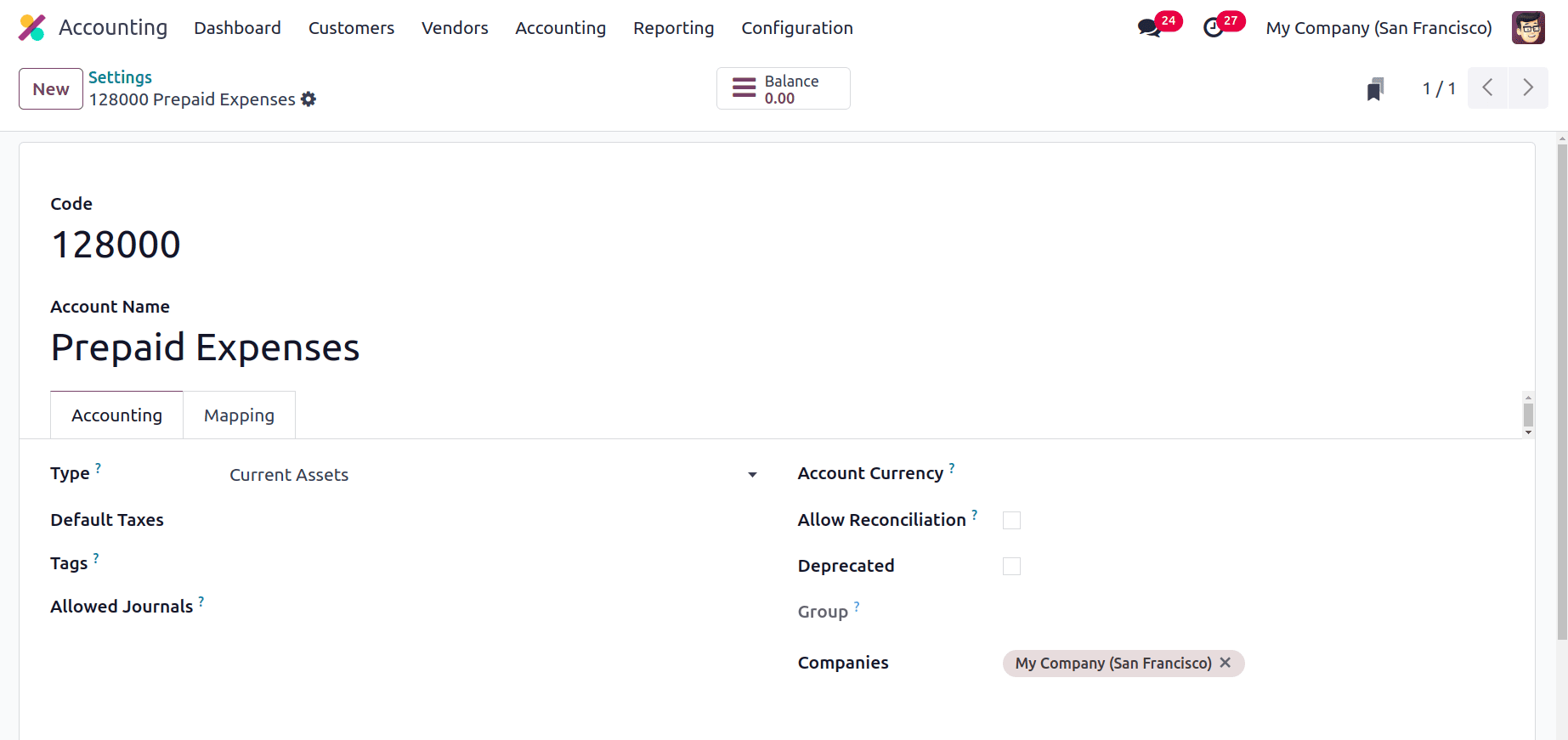

The Journal used while creating a deferred expense journal entry is first given there. Then the Deferred expense account is mentioned inside the settings. While checking the Account it's clear that the account type is Current Assets. The account can be opened from the settings through the internal link.

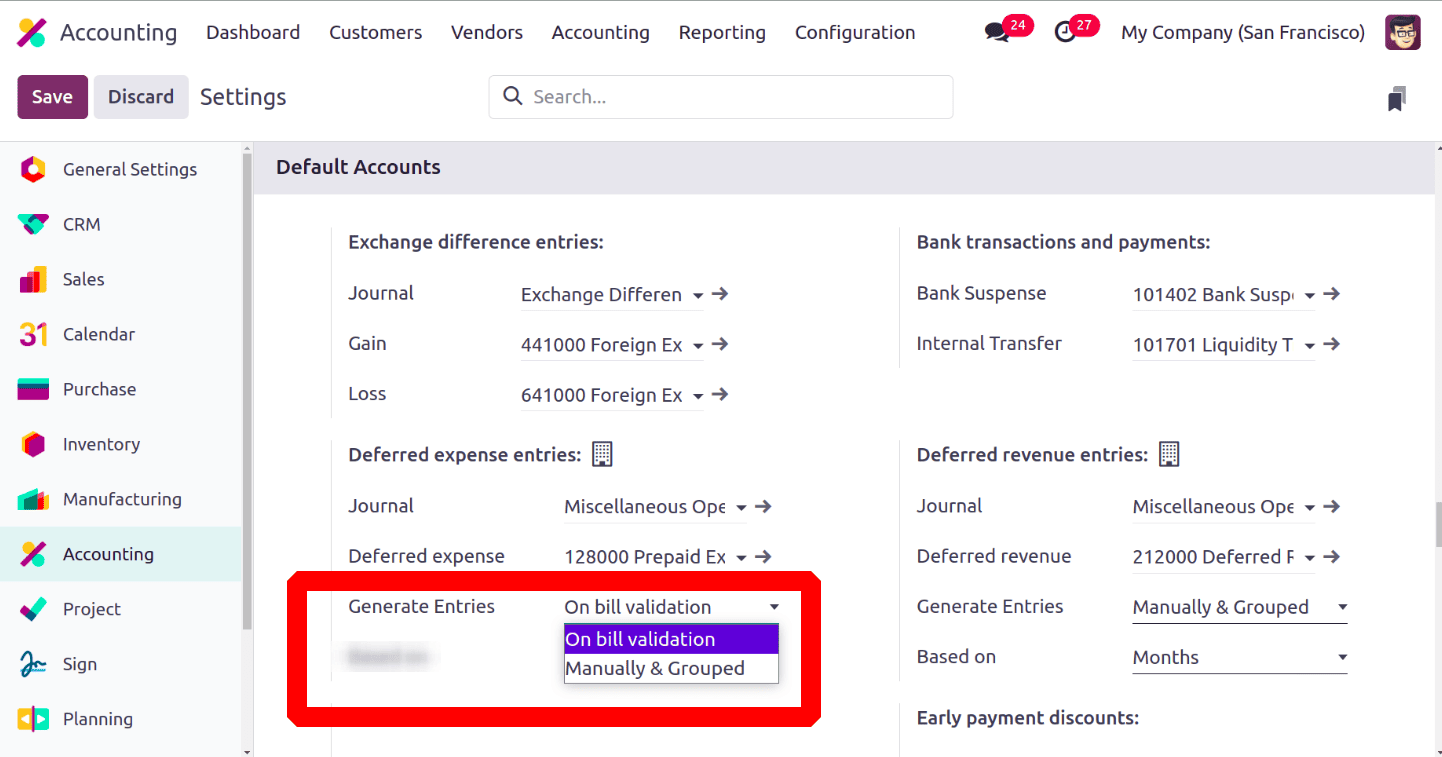

Users can generate the journal entries in two methods. One is to generate entries during the bill validation process. The second method is to generate the journal entries manually. Let's check each method separately in this blog.

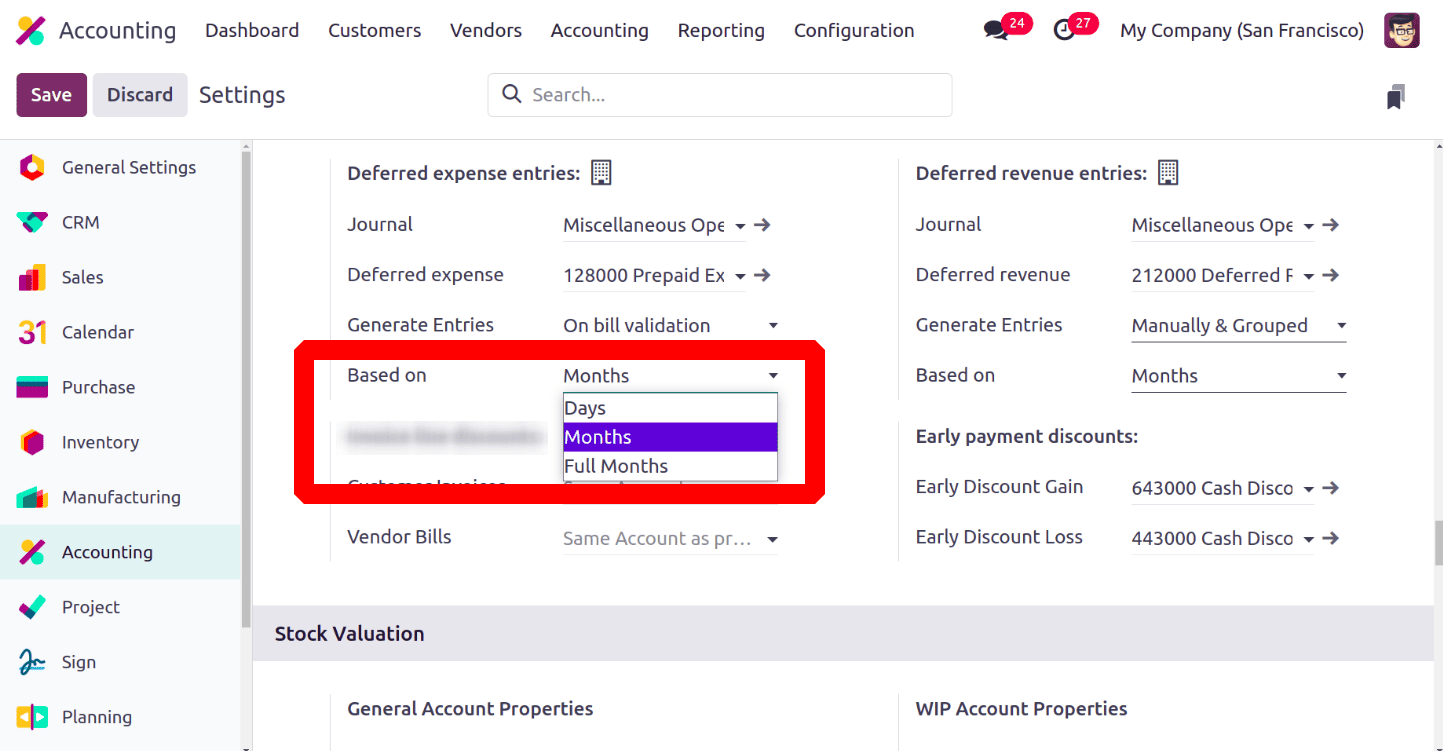

The calculation of the depreciation amount can be done based on Days, Months, and Full Months. According to this, the depreciation amount will be calculated.

Let's check how the Deferred Expense journal entries are generated in Odoo 18.

Generate Entries On Bill Validation

Deferred expense journal entries can be automatically generated on bill validation. For that set deferred expense journal entries are generated based on bill validation. The deferred entries can be calculated in 3 different ways. Based on Months, Days, and Full Months.

* Based on Months

Set the Deferred Expense settings, Generate entries on Bill validation, and Based on Months.

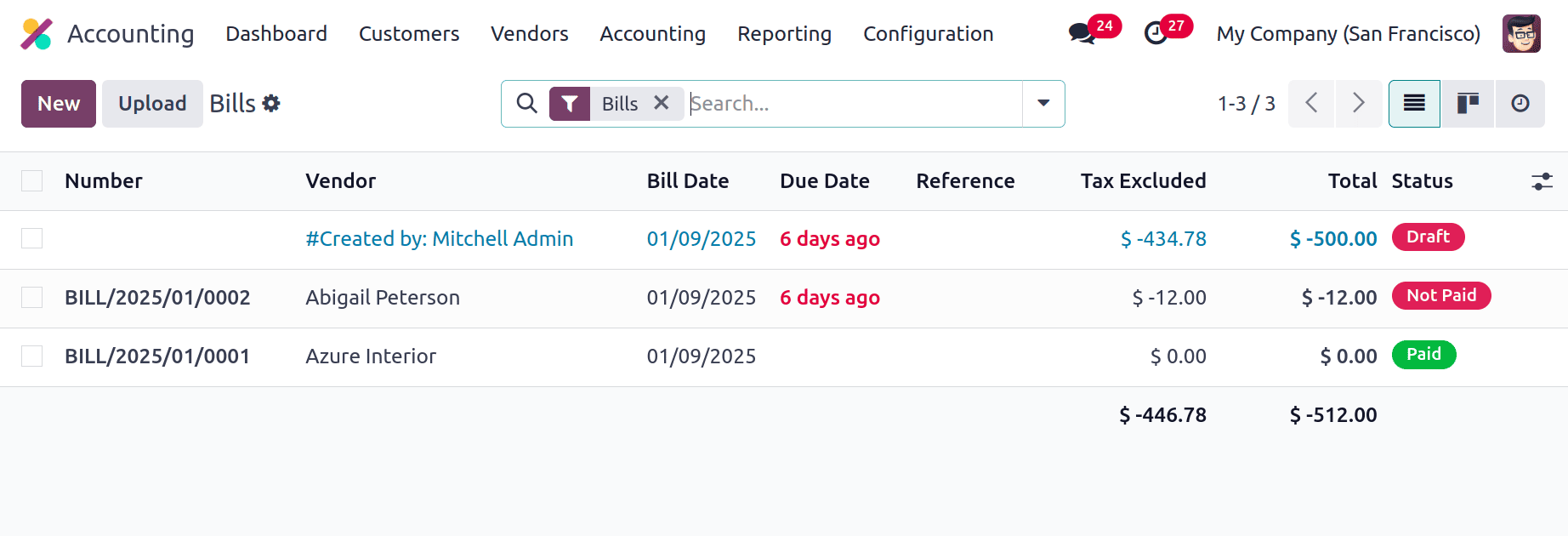

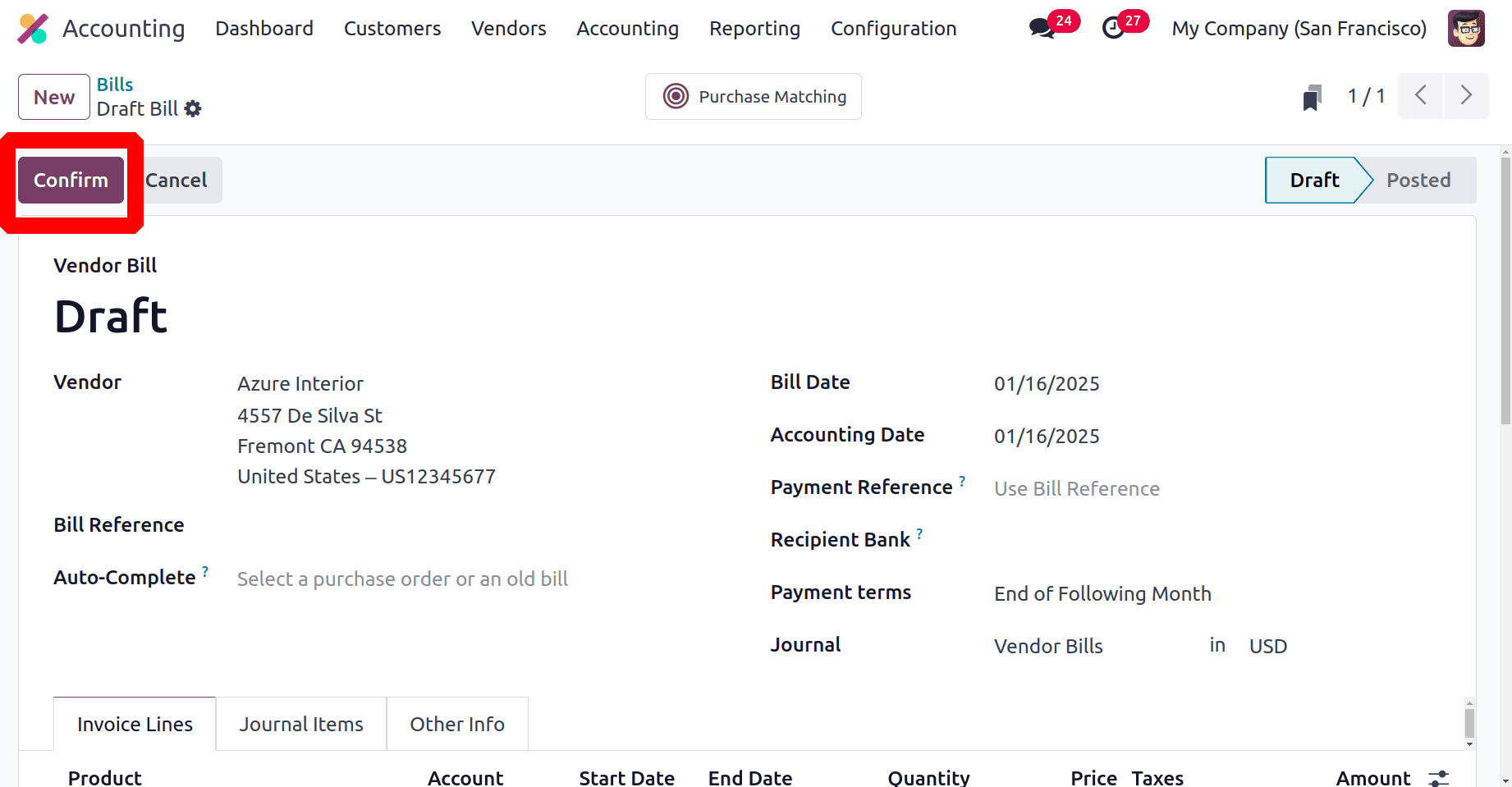

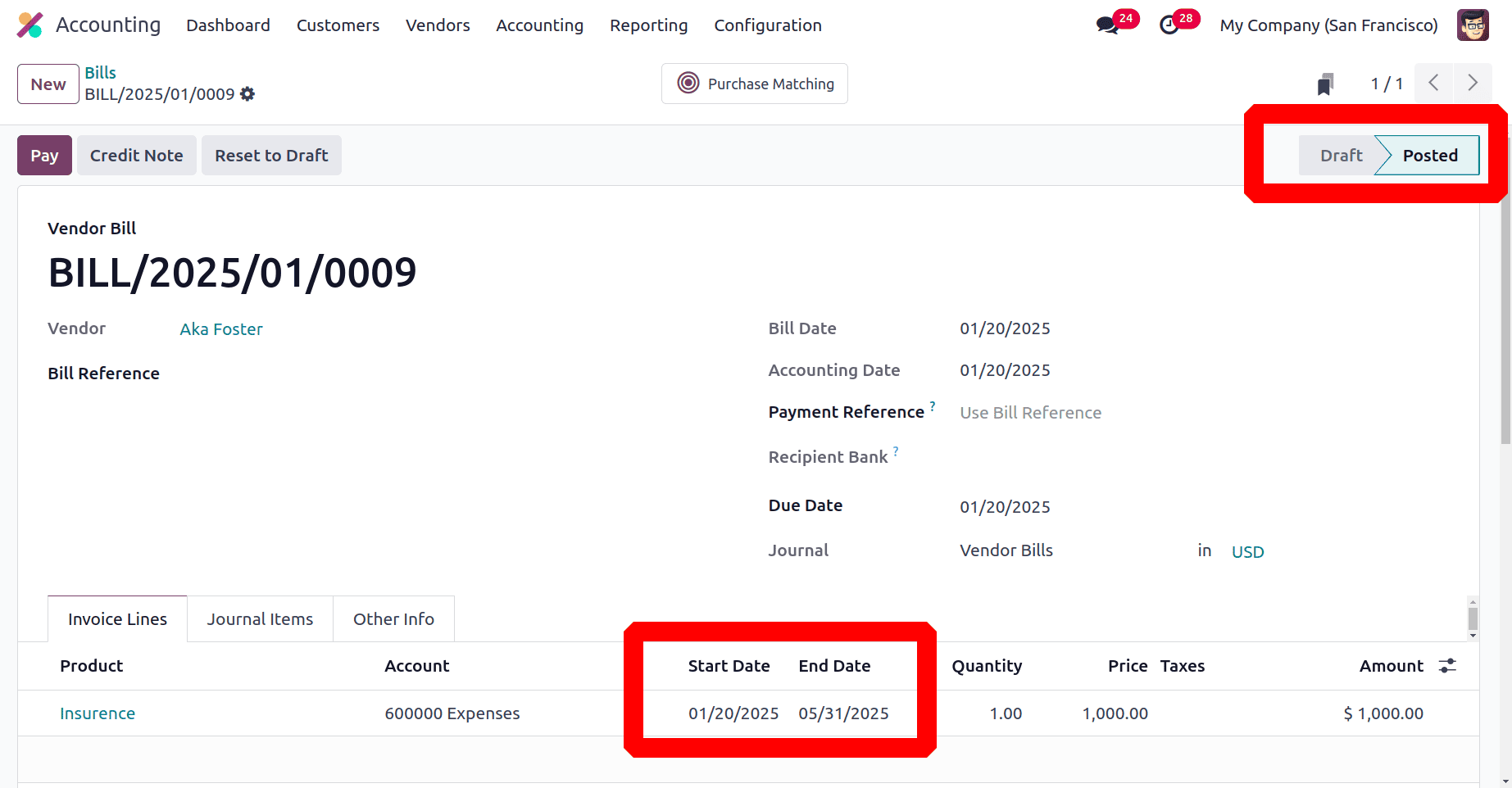

Then let's create a new vendor bill. For that, click on the Vendor menu. A list contains Bills, Refunds, Payments, Products, and vendors. Click on the Bills, and then a list of created bills is displayed there. The list view of bills contains the details about the created bills like Number, Vendor, Bill Date, Due Date, Reference, Tax Excluded, Total, and Status. Users can upload the bill by clicking on the Upload button. To add a new bill use the New button.

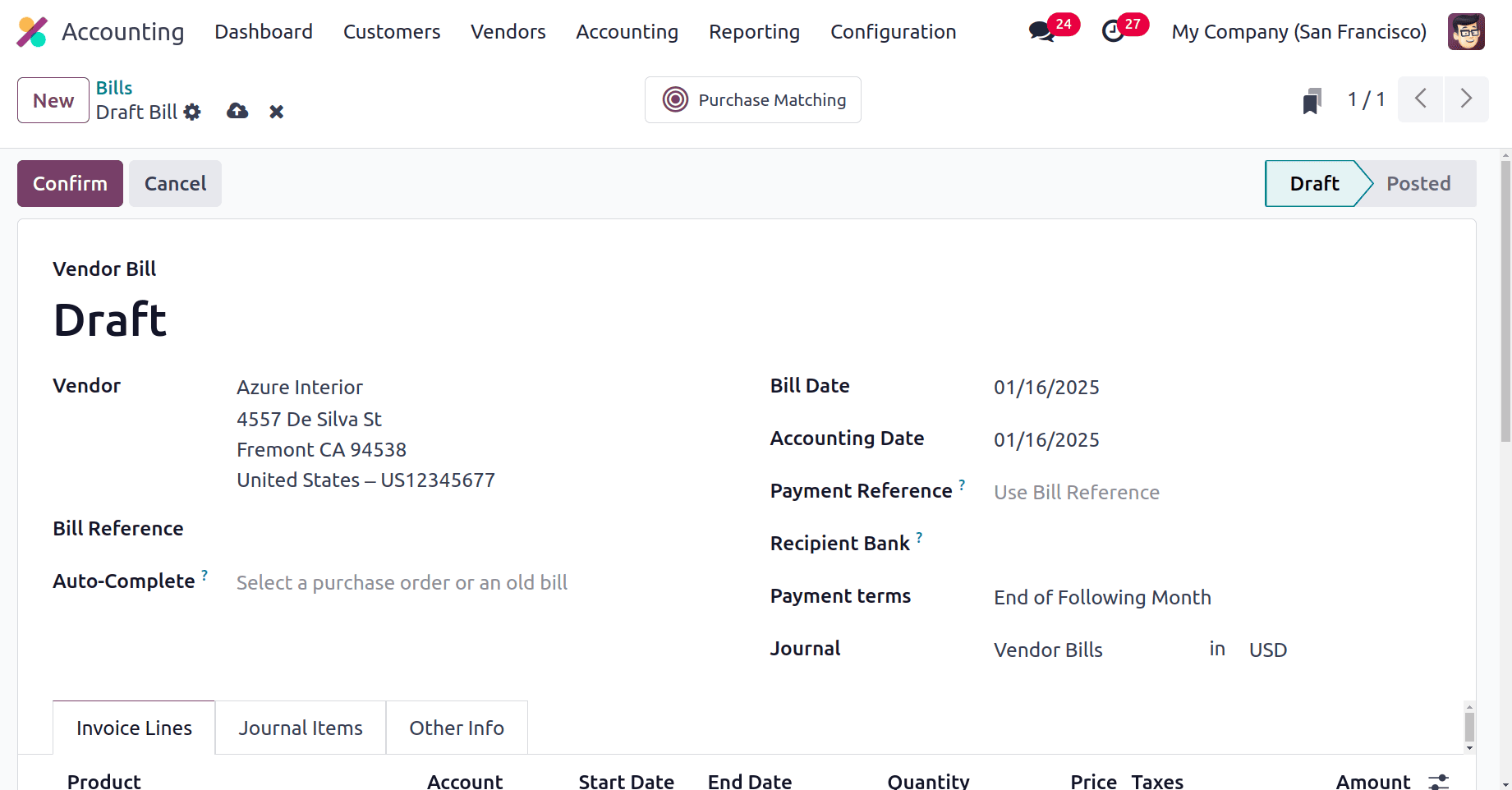

Inside the creation page, add the vendor name first. Then the other details like Bill Reference, Bill Date, Accounting date, payment Reference, Recipient Bank, Payment terms, Journal, etc. Here the Auto-Complete field will help the user to auto-complete the details from any past bill or purchase order.

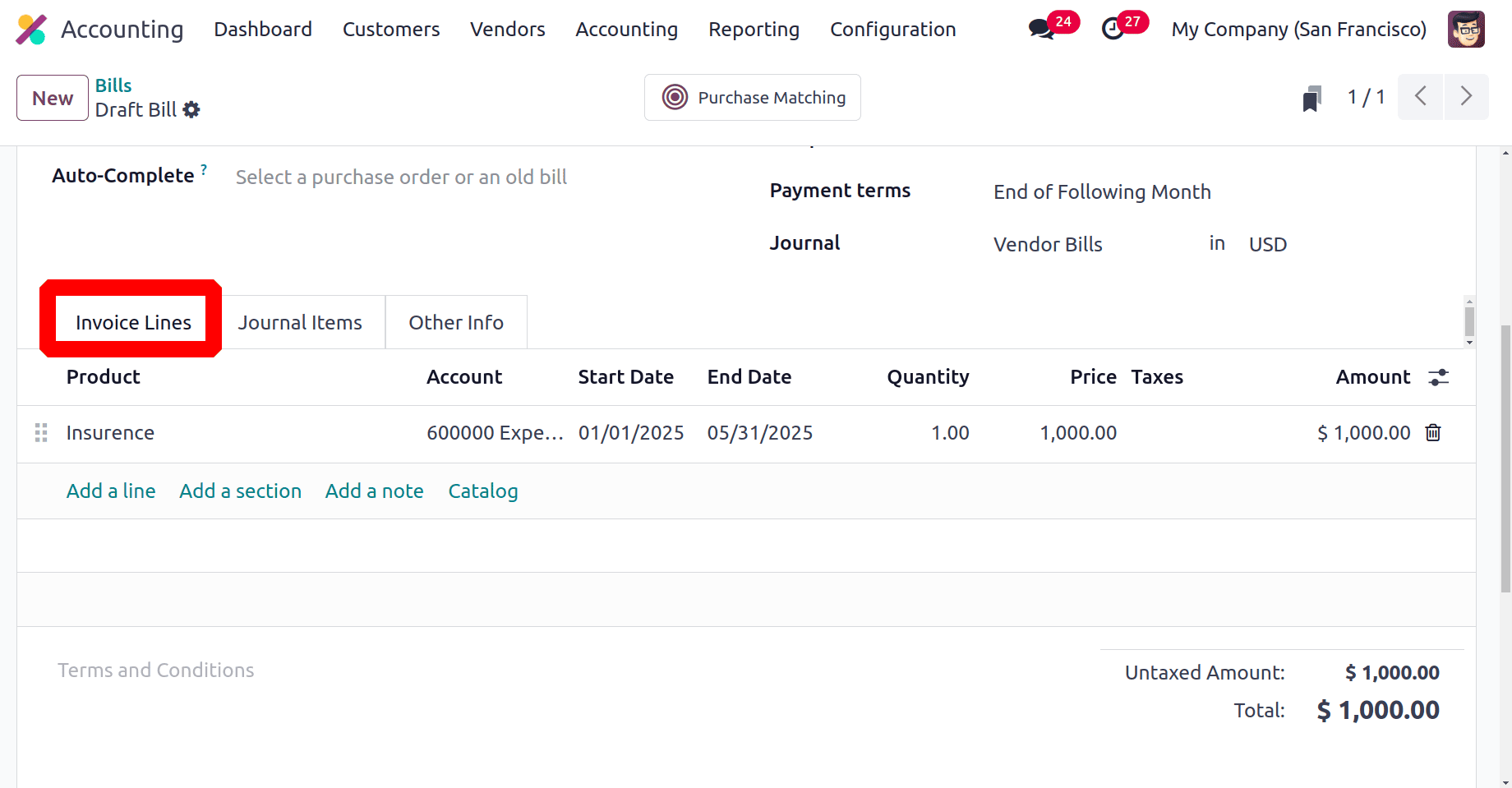

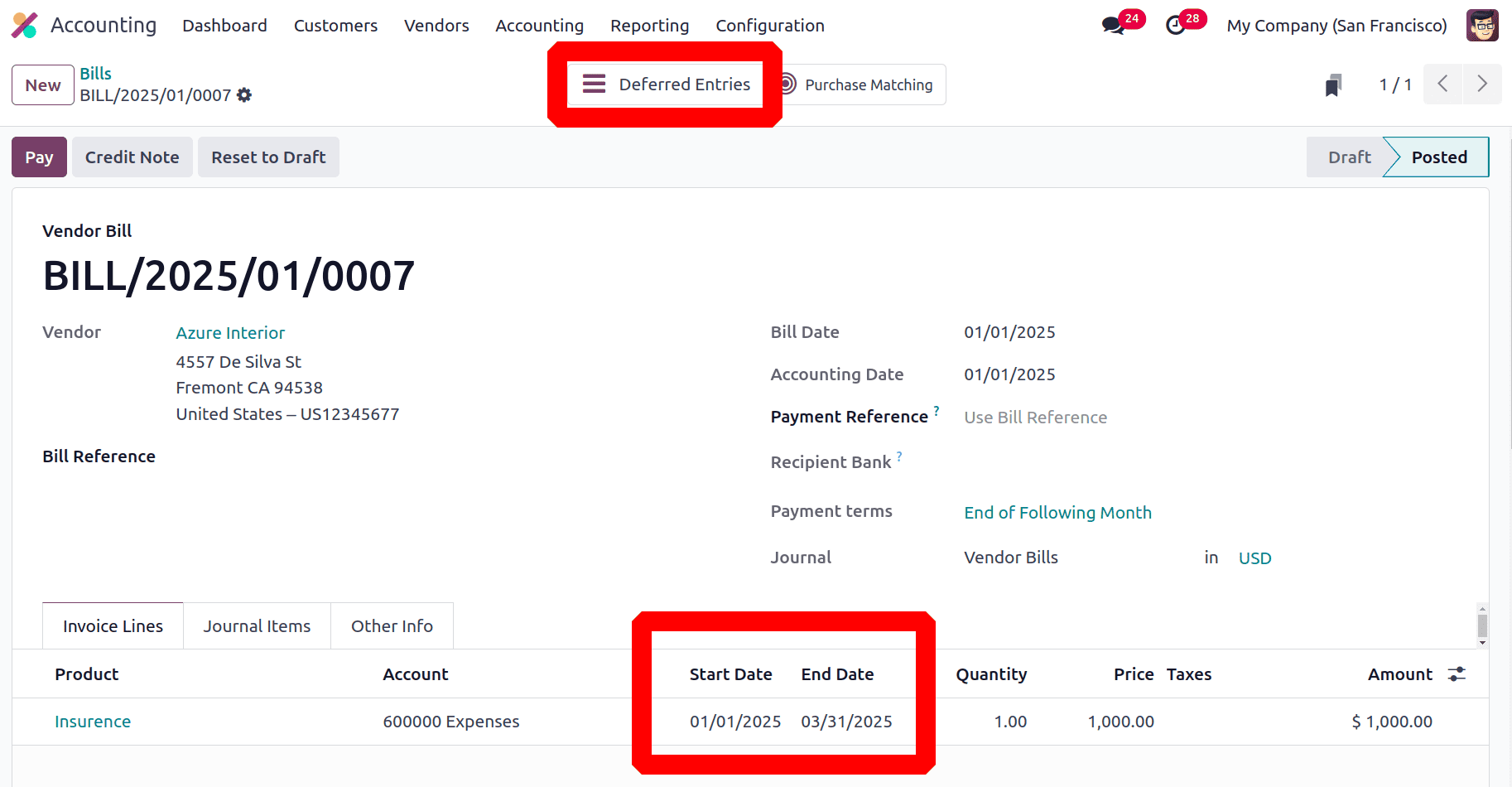

The Invoice Lines of the bill are used to add the product with quantity and unit price. So here the company creates a bill for a service product, which is Insurance. Here the Insurance is taken for 5 months. So the Start Date and End Date can be mentioned inside the Invoice Line.

Here the Service product Insurance is added at a cost of $1000.

The start date is set as 01/01/2025 and the end date is set as 01/31/2025. Confirm the bill first.

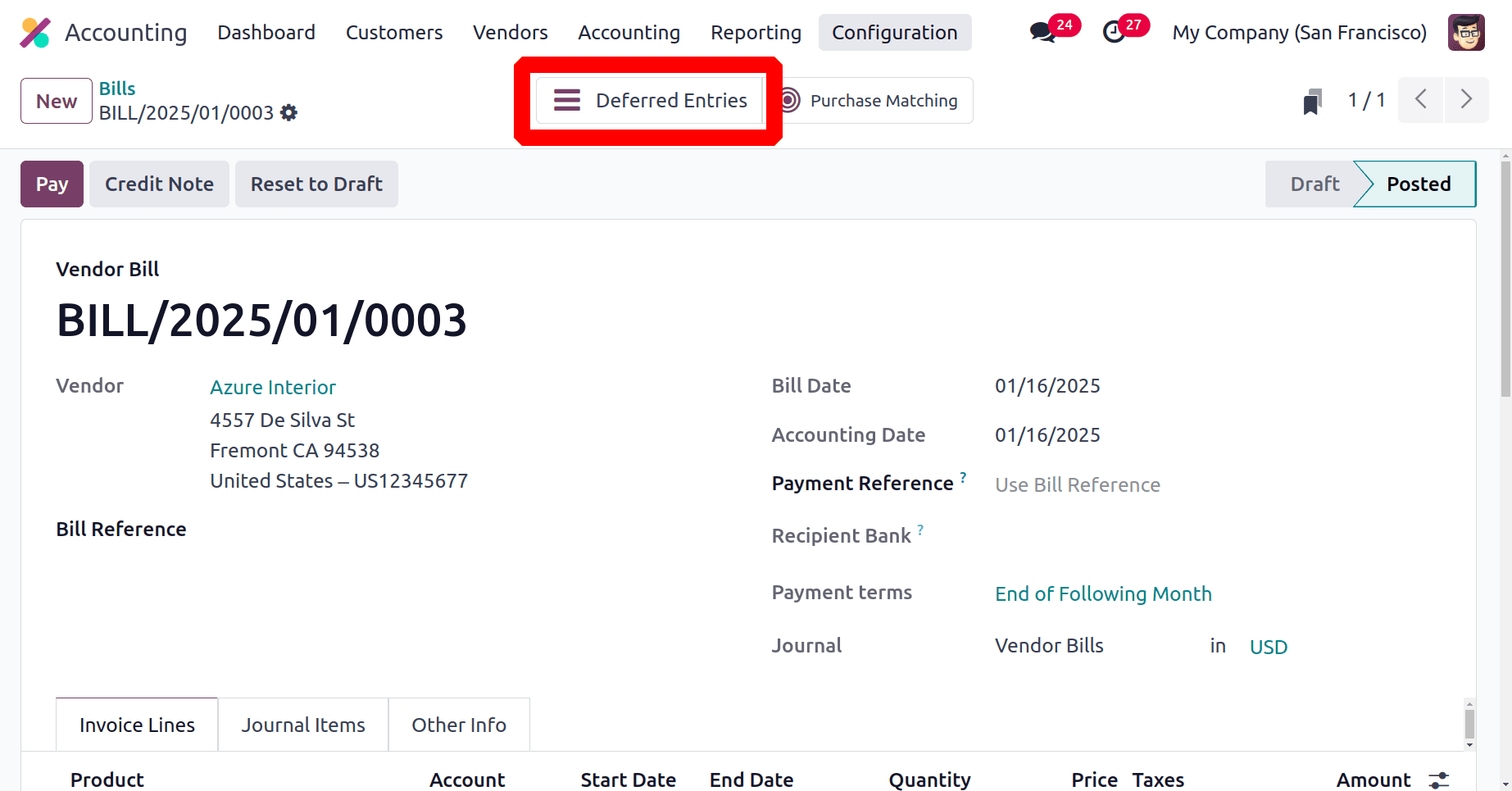

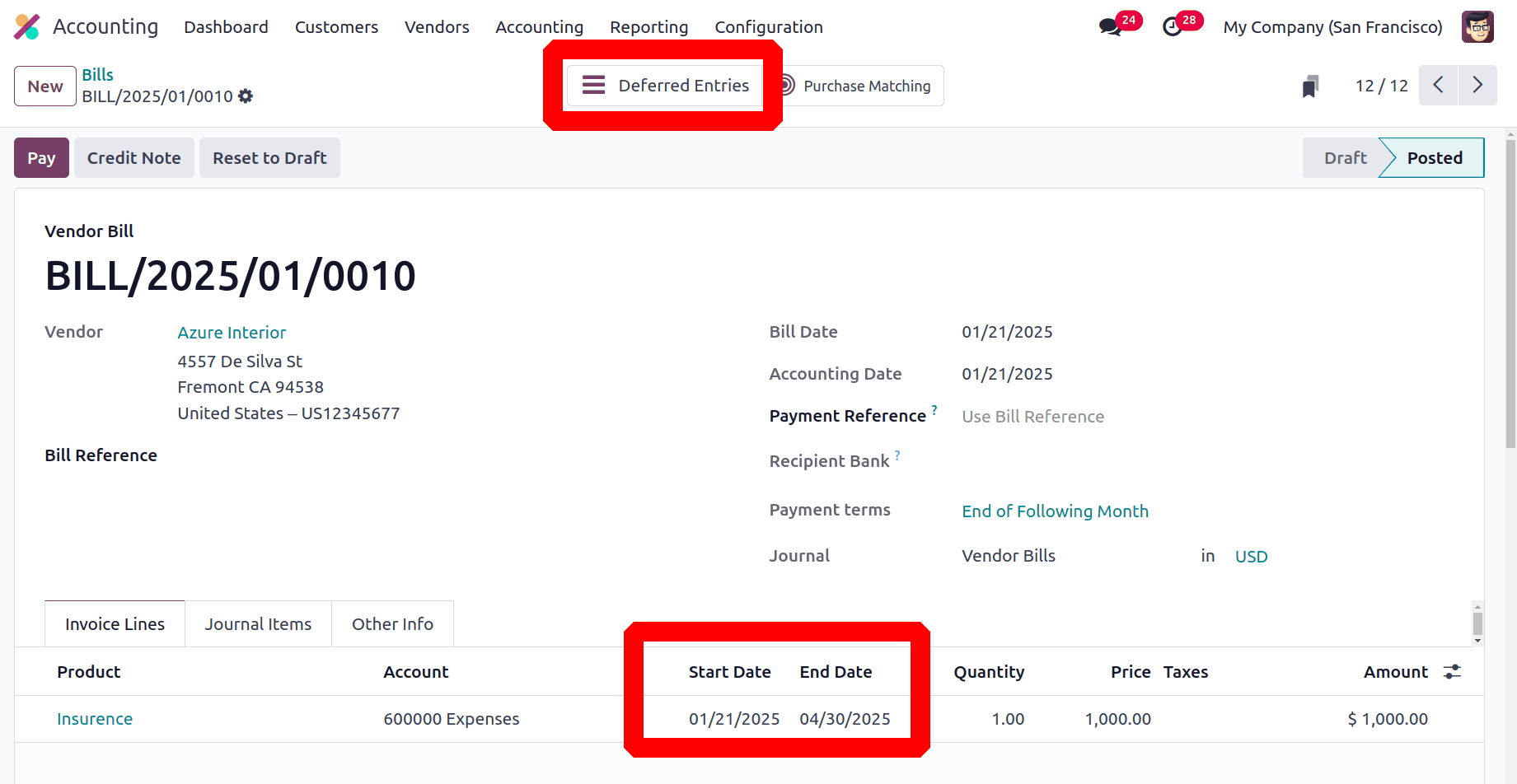

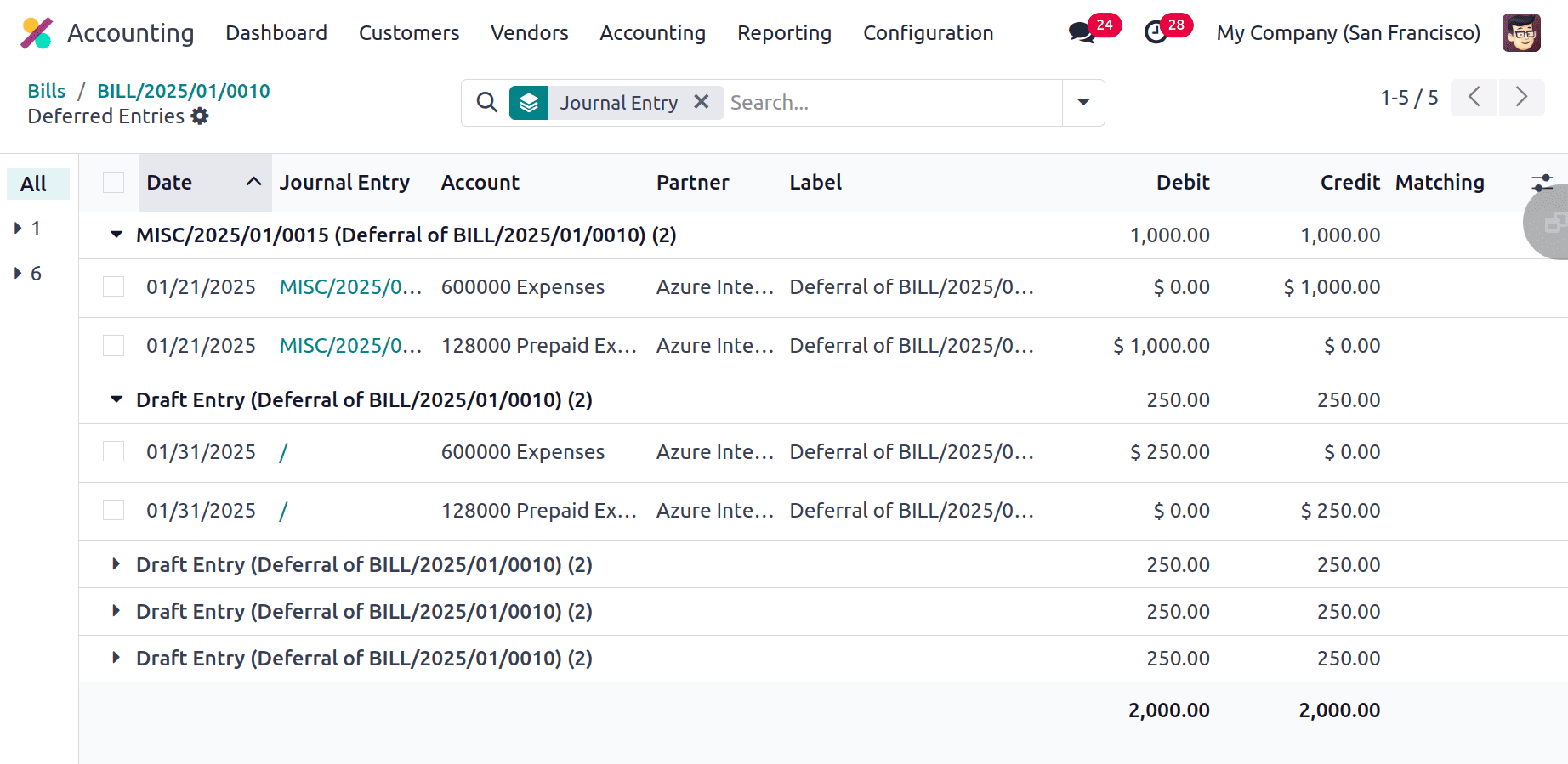

After confirmation, the bill will change to a posted stage. A new smart tab named Deferred Entries will appear there. Click on the smart tab to view the created deferred expense entries.

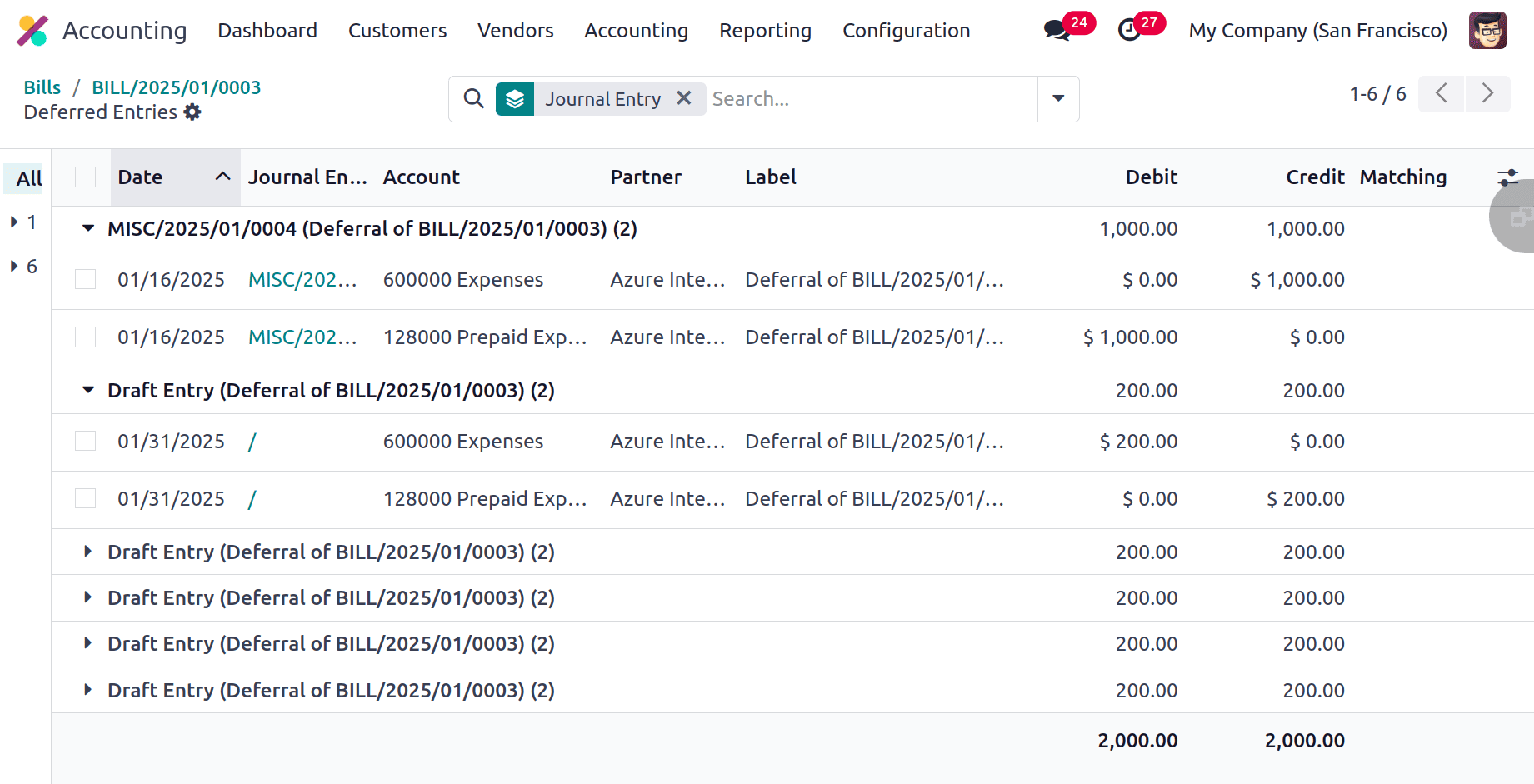

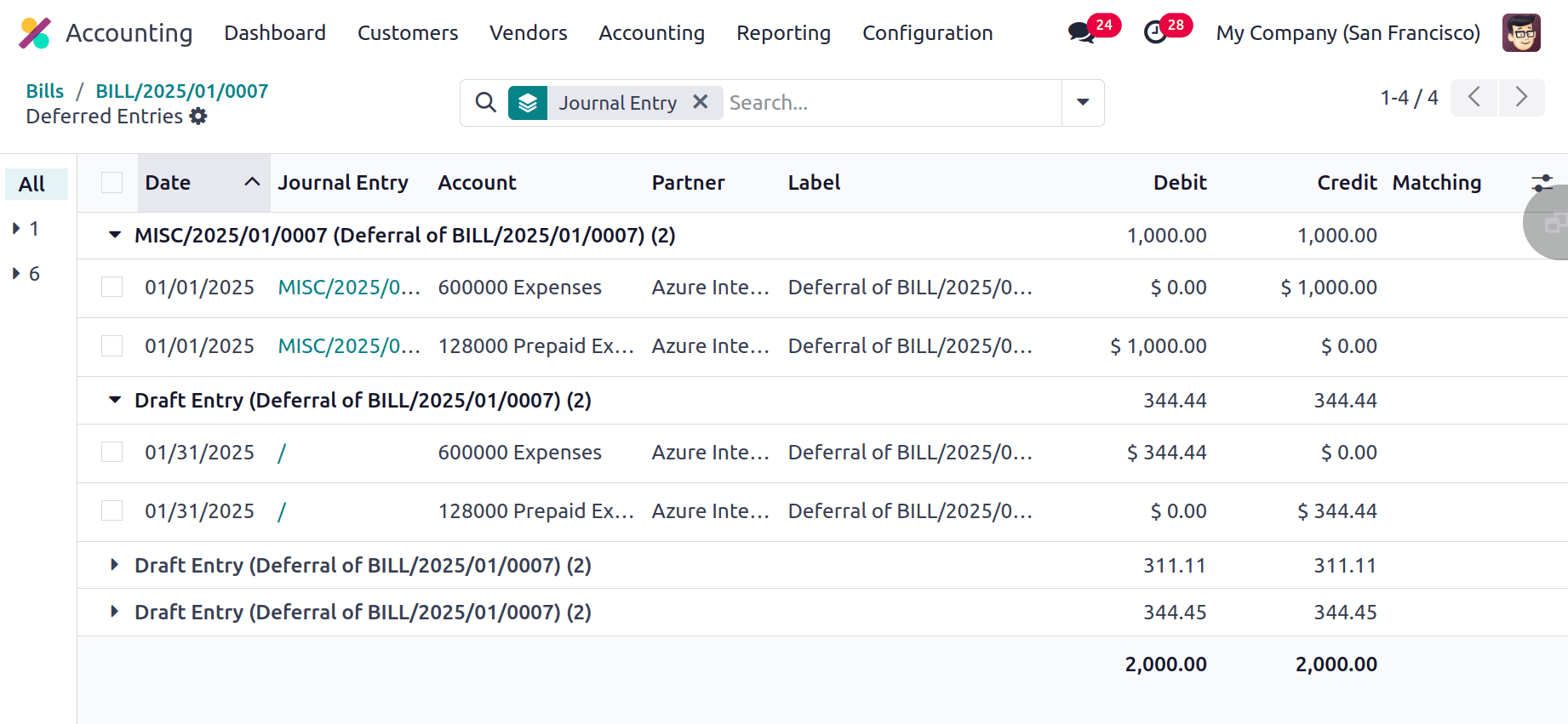

A list of deferred journal entries created for 5 months is shown there. The first entry is posted, and others are in the draft stage.

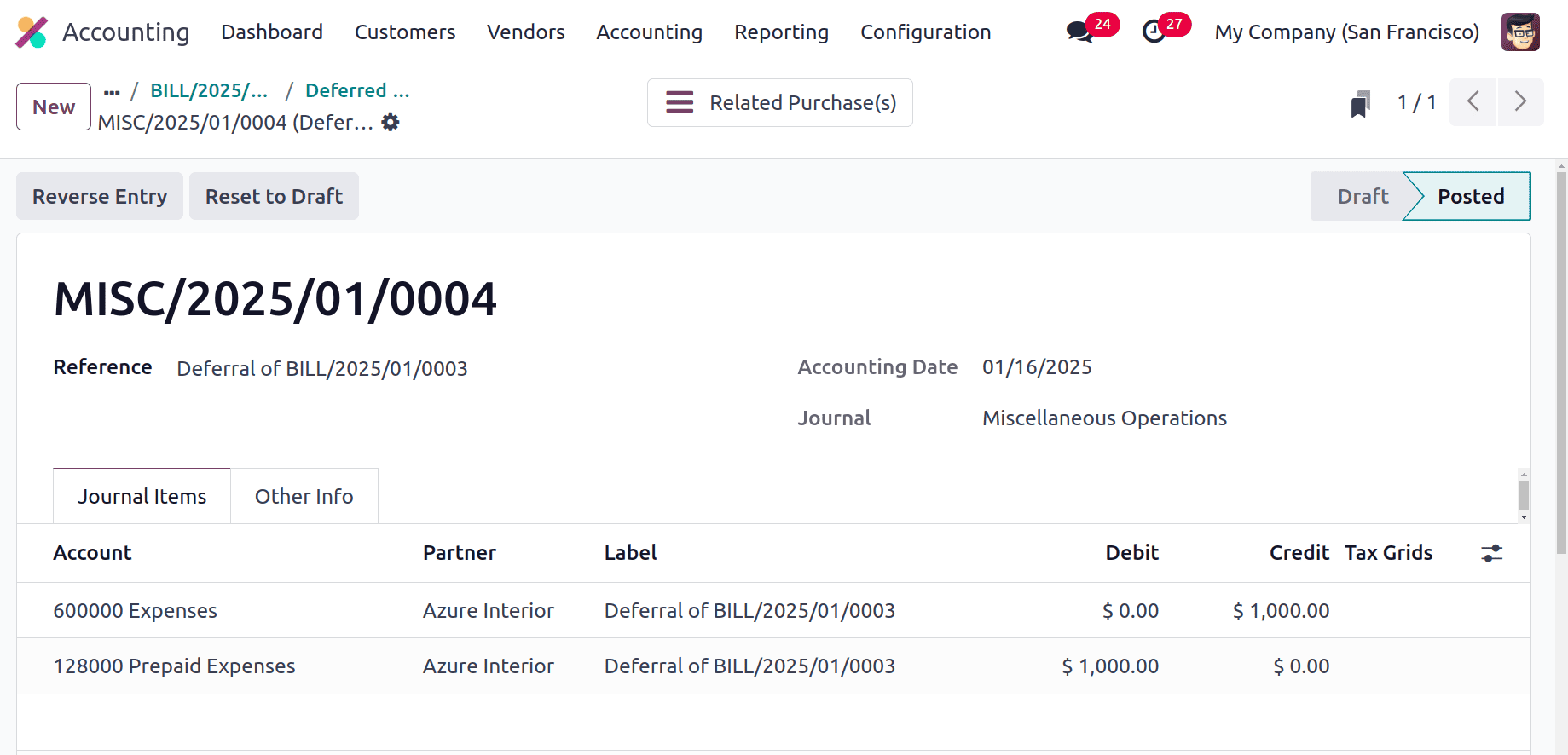

Click on the first entry to view. As said before, the first entry is posted. There are two accounts shown there, the first one is an Expense Account and the second one is a Prepaid Expense Account. Here in the case of Deferred Expense, the expense is created for 5 months, so the expense is decreased. When the expense decreases then the account will be credited with the whole amount. Prepaid Expense is a Current asset by type. When the asset increases then the account is debited.

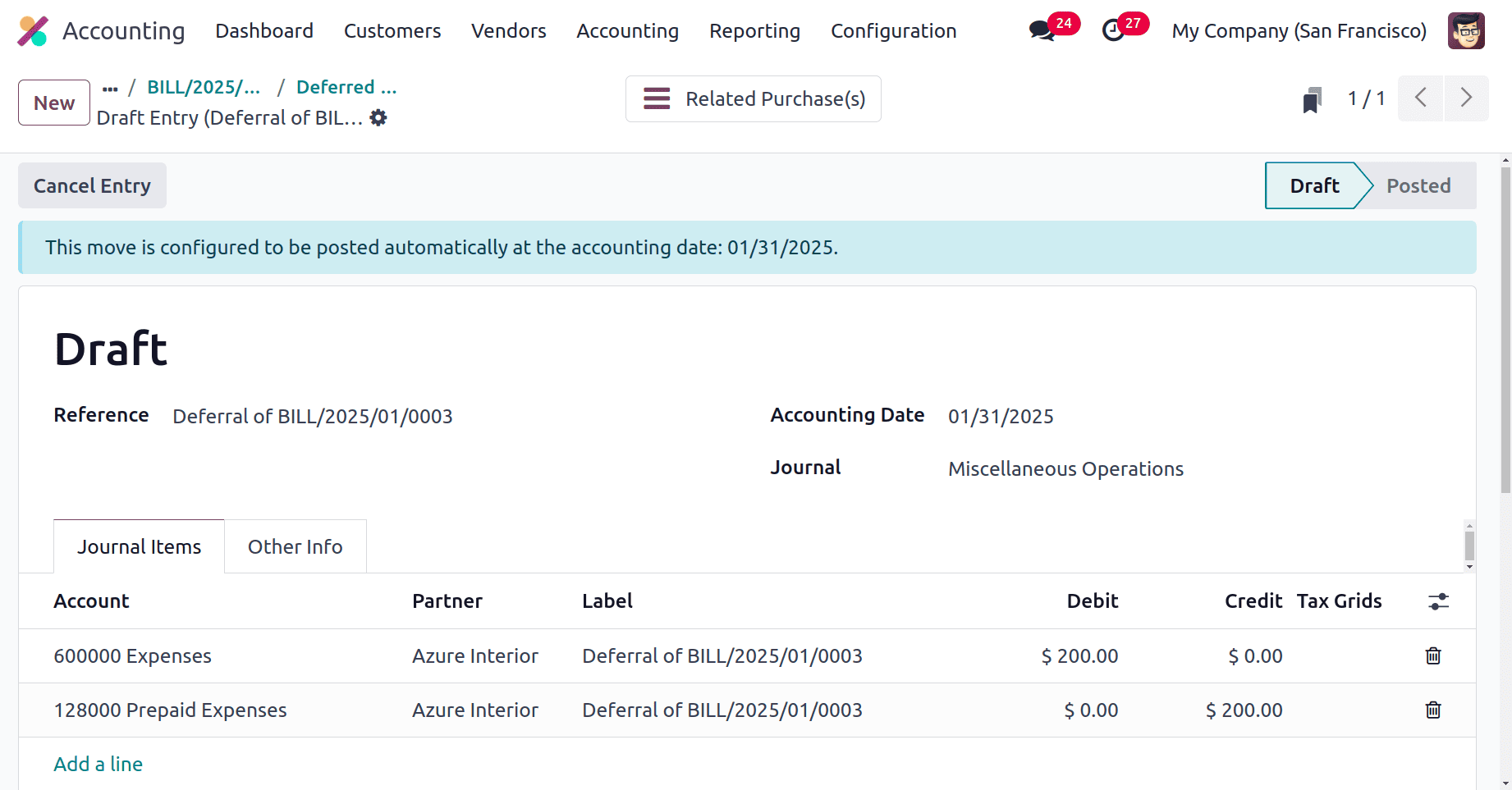

The second journal entry, which has not been posted, will automatically be posted on the accounting date, is shown below.

Here in the journal entry, two accounts are shown, Expense and Prepaid Expense.

The bill total was $1000, which belongs to 5 months.

Deferred Expense per month = 1000/5=200.

So the depreciated amount for each month is $200, which means the (Total amount in bills/Total number of months).

Here the start date is set as January first, so the full month is considered. The amount of $200 will be depreciated.

Each month the Expense will increase and the asset value will decrease. So the Expense account is Debited with the depreciation amount and the Prepaid Expense account is credited.

* Based on Days

Change the settings first. As shown below the set deferred entries are based on Days. The deferred entries are calculated on the basis of the total number of days.

Then create a new bill. The same customer and vendor are chosen. The start date is set as 01/01/2025 and the end date is set as 03/31/2025. Confirm the bill, and then the smart tab Deferred Entries will show the entries.

The accounts are the same there. But the values may change. Just because the chosen calculation method is based on days. So the depreciation value is based on days calculated by dividing the total bill amount by the total number of days.

So here the start date is January 1st and the end date is March 31st. So there are 90 days.

The total bill amount is $1000.

The deferred expense amount for one day is =1000/90= 11.11

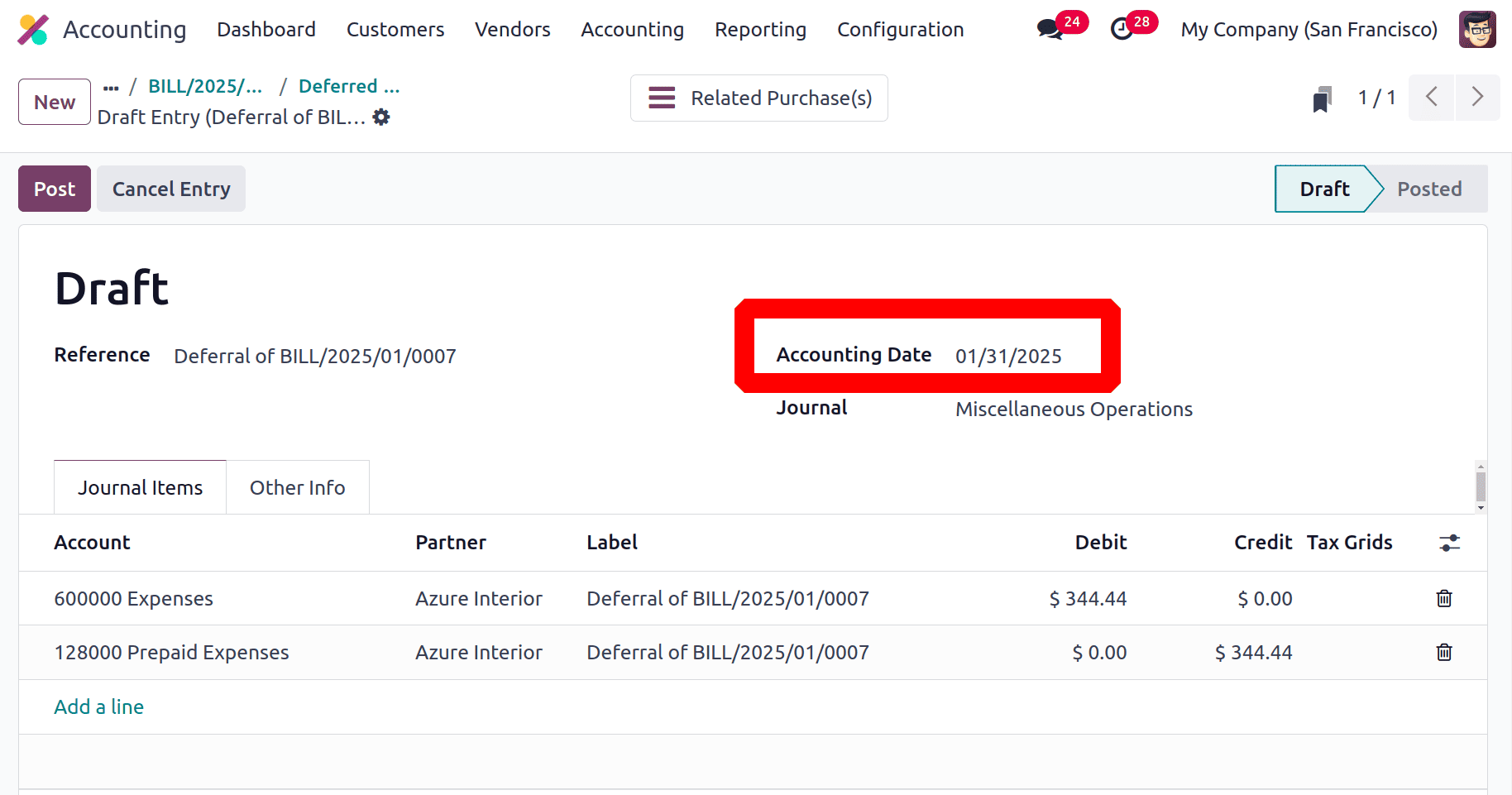

So deferred expense value of the month of January is 11.11*31 =344.41 (31 days in January).

Which will be debited from the Expense Account and credited to the Prepaid Expense Account.

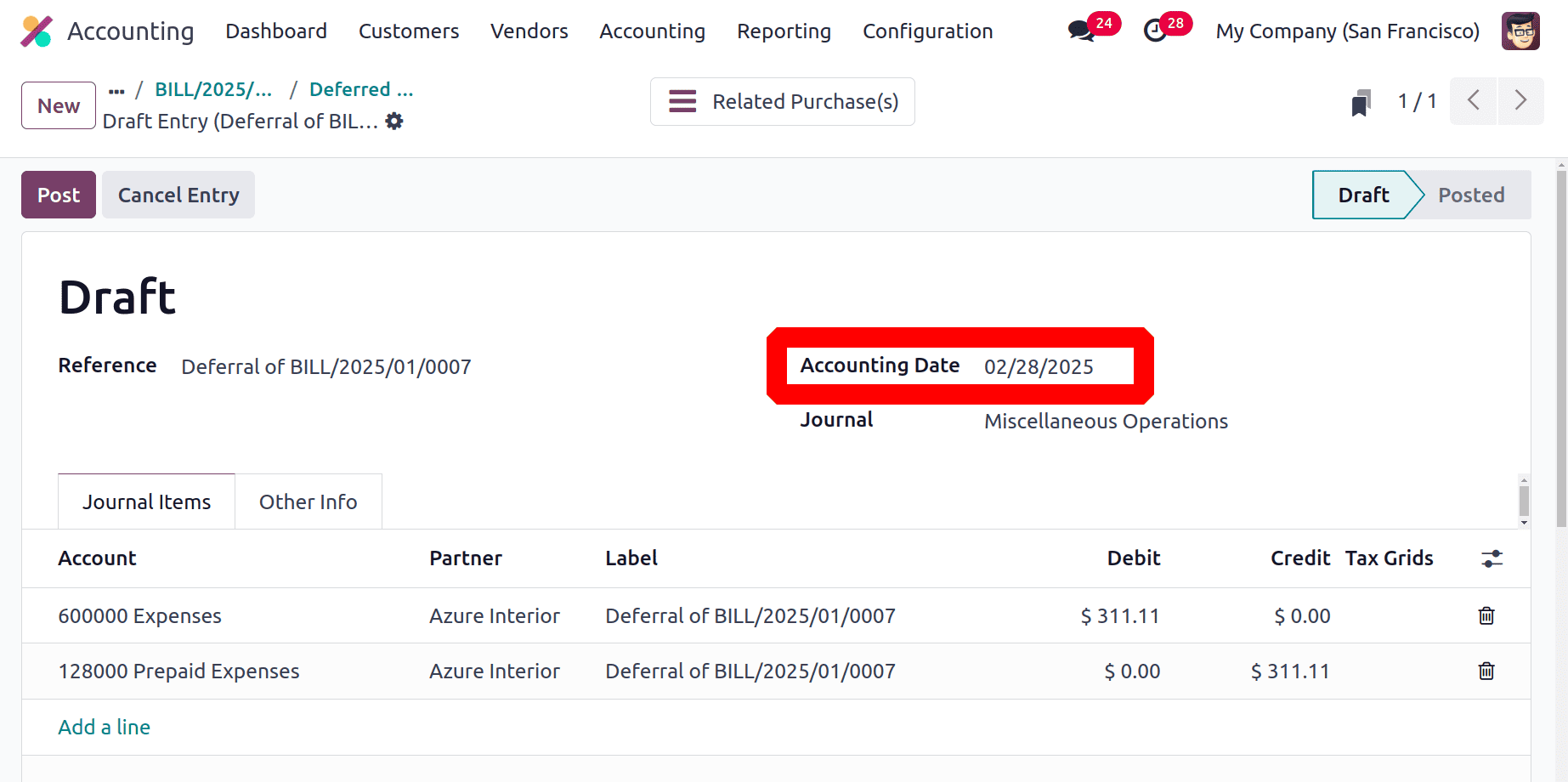

Then while checking the deferred expenses for February,

The total number of days in February is 28.

So the amount credit on the Prepaid Expense Account = 11.11*28=311.08.

This is how the deferred entry is calculated based on days.

* Based on Full Months

Change the configuration. Set the entry calculation based on Full Months.

Then create a new bill. Add the same product Insurance with a price of $1000. Here the start date is set as 01/21/2025 and the end date is 04/30/2025. Then confirm the bill.

Open the smart tab named Deferred Entries. Here the same amount is credited to the Prepaid Expense Account each month.

Here the total bill amount is $1000 and the period is 4 months. So the deferred expense for each month is calculated by dividing the total amount by the period.

Deferred Expense for month = 1000/4= 250.

Generate Entries Manually & Grouped

Manually & Grouped is the second technique for creating deferred entries. The journal entries are not generated automatically while using this method. Therefore, each month's entry must be created by the user independently. To begin, the user must select the Deferred Entries option under Accounting Settings. Next, select Manually & Grouped in the Generate Entries area.

As said before, save the settings and create a new bill. Add the vendor and other details inside the bill. Then add the product. Here the same service product Insurance is added. The start date is set as 01/20/2025 and the end date is 05/31/2025. Confirm the bill. After confirmation, no journal entries are created there.

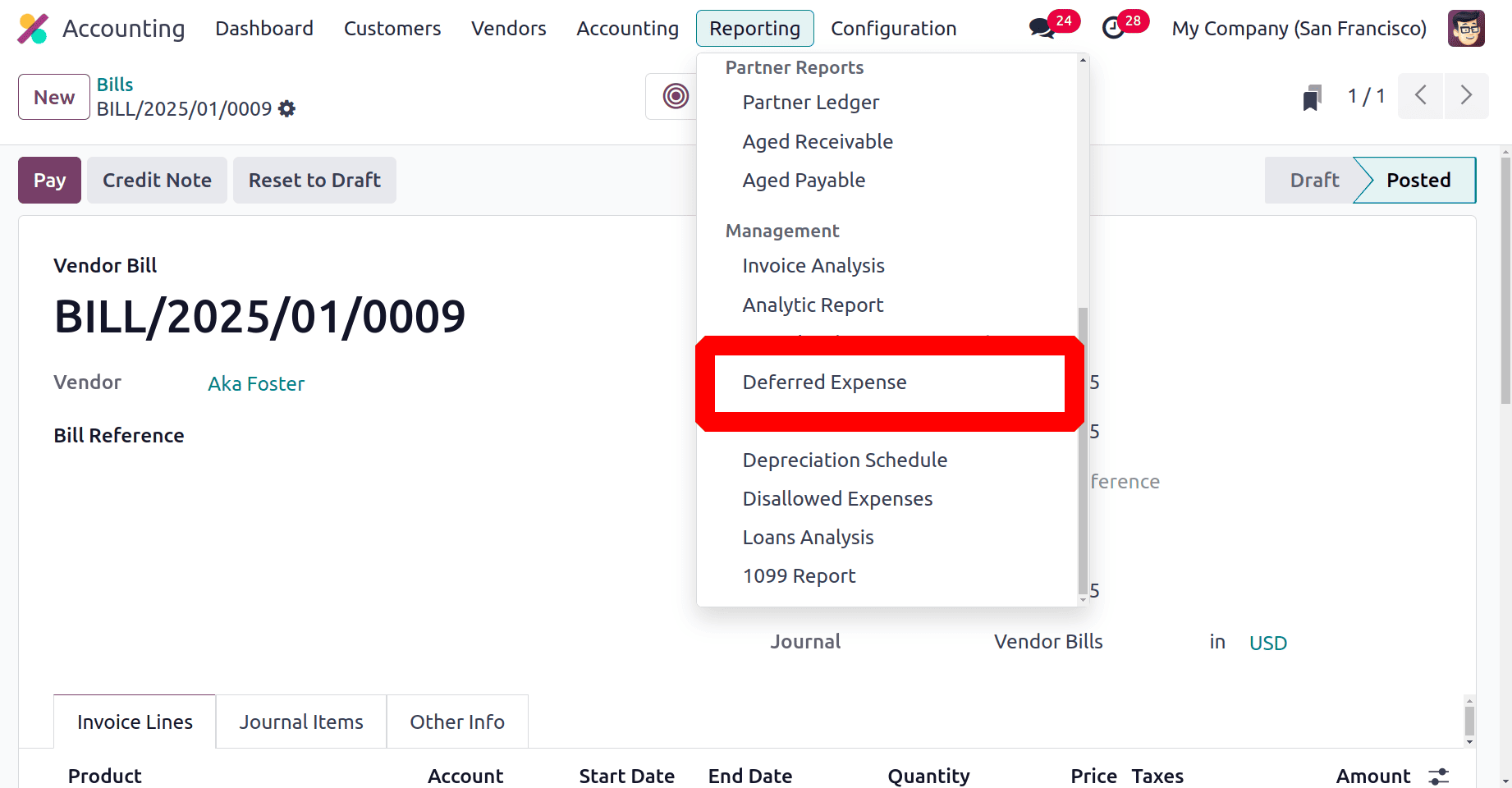

So the journal entries can be manually generated from the Deferred Expense Report. For that click on the Reporting menu. Under the Management report the users can view the Deferred Expense Report.

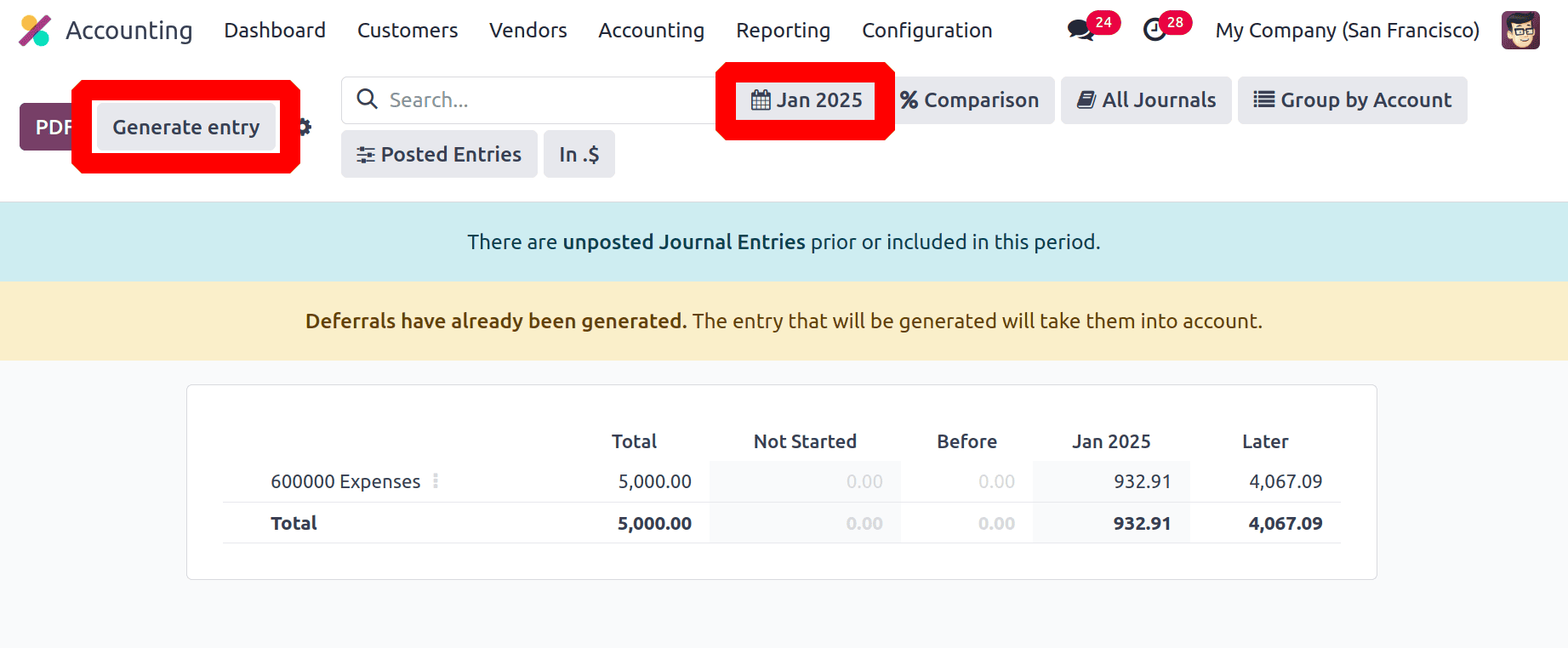

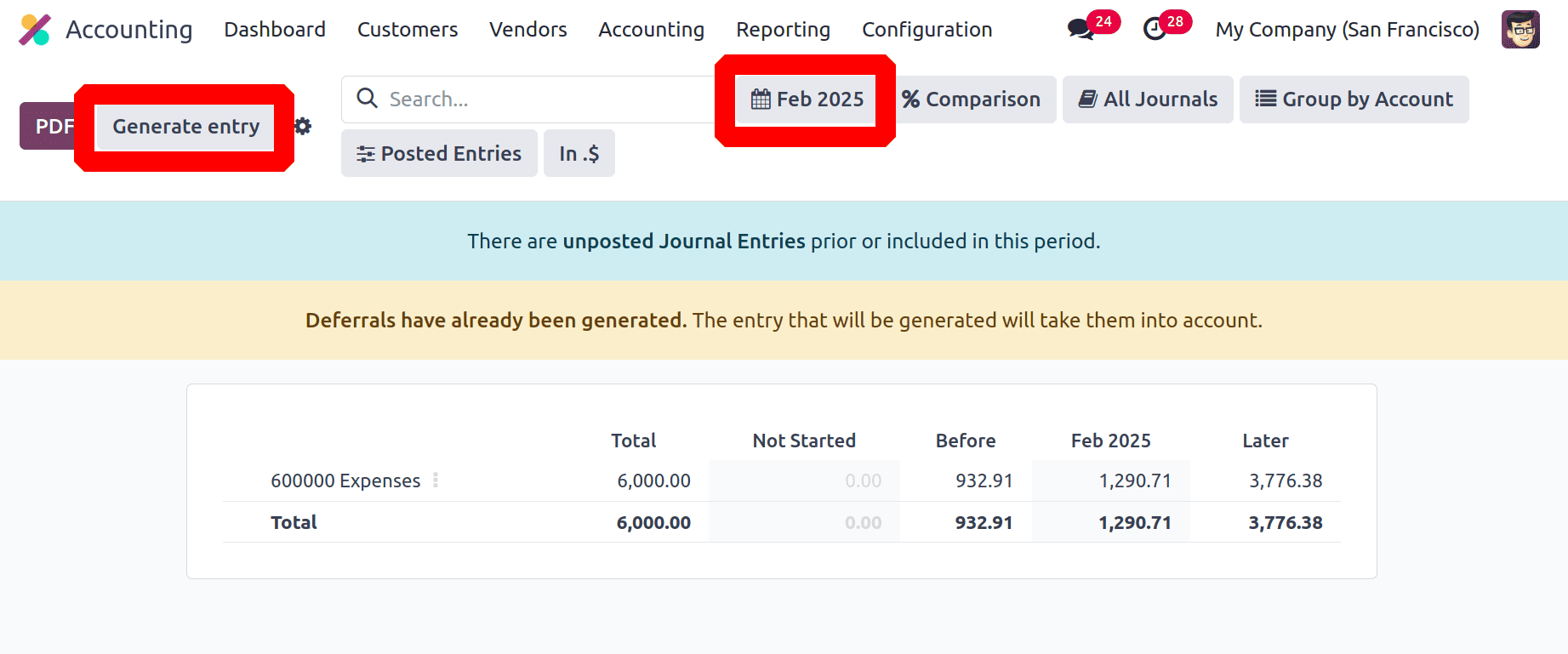

From the report first choose the month on which the entry wants to be generated. Then click on the Generate entry button placed in the upper left corner.

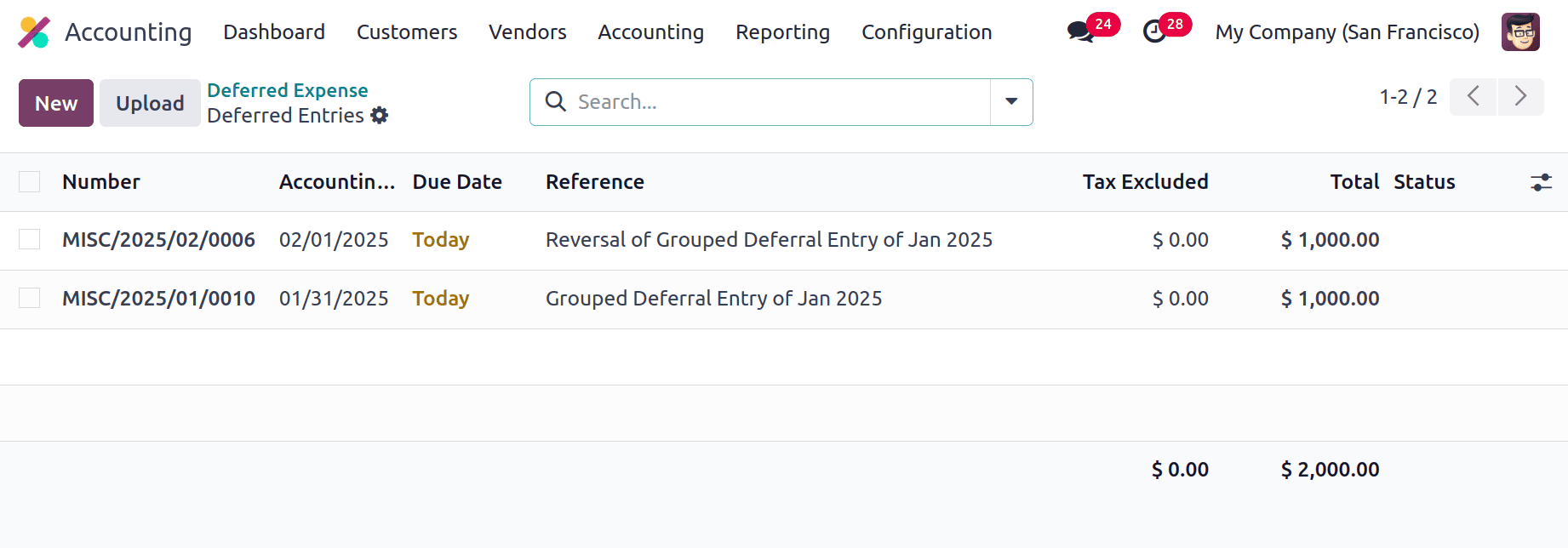

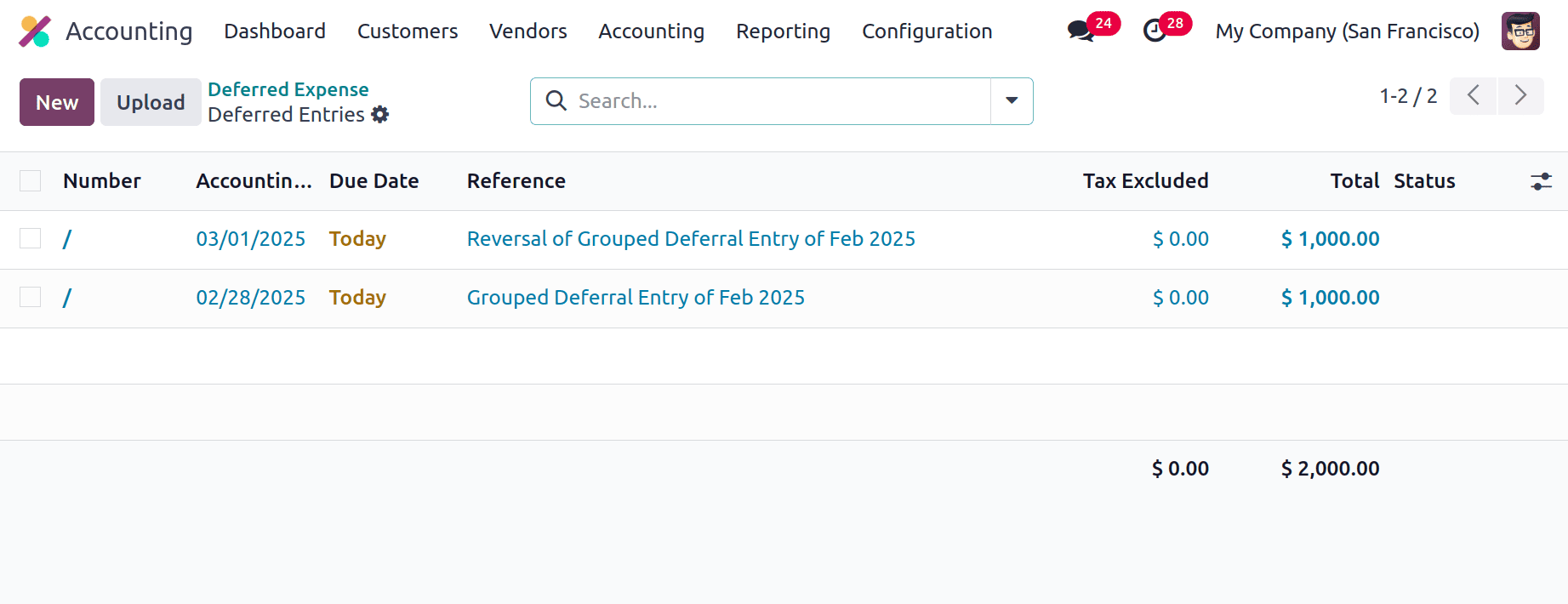

Their users can see two journal entries are generated. One is Grouped Deferral Entry of Jan 2025 and the second one is Reversal of Grouped Deferral Entry of Jan 2025. So choose the first one.

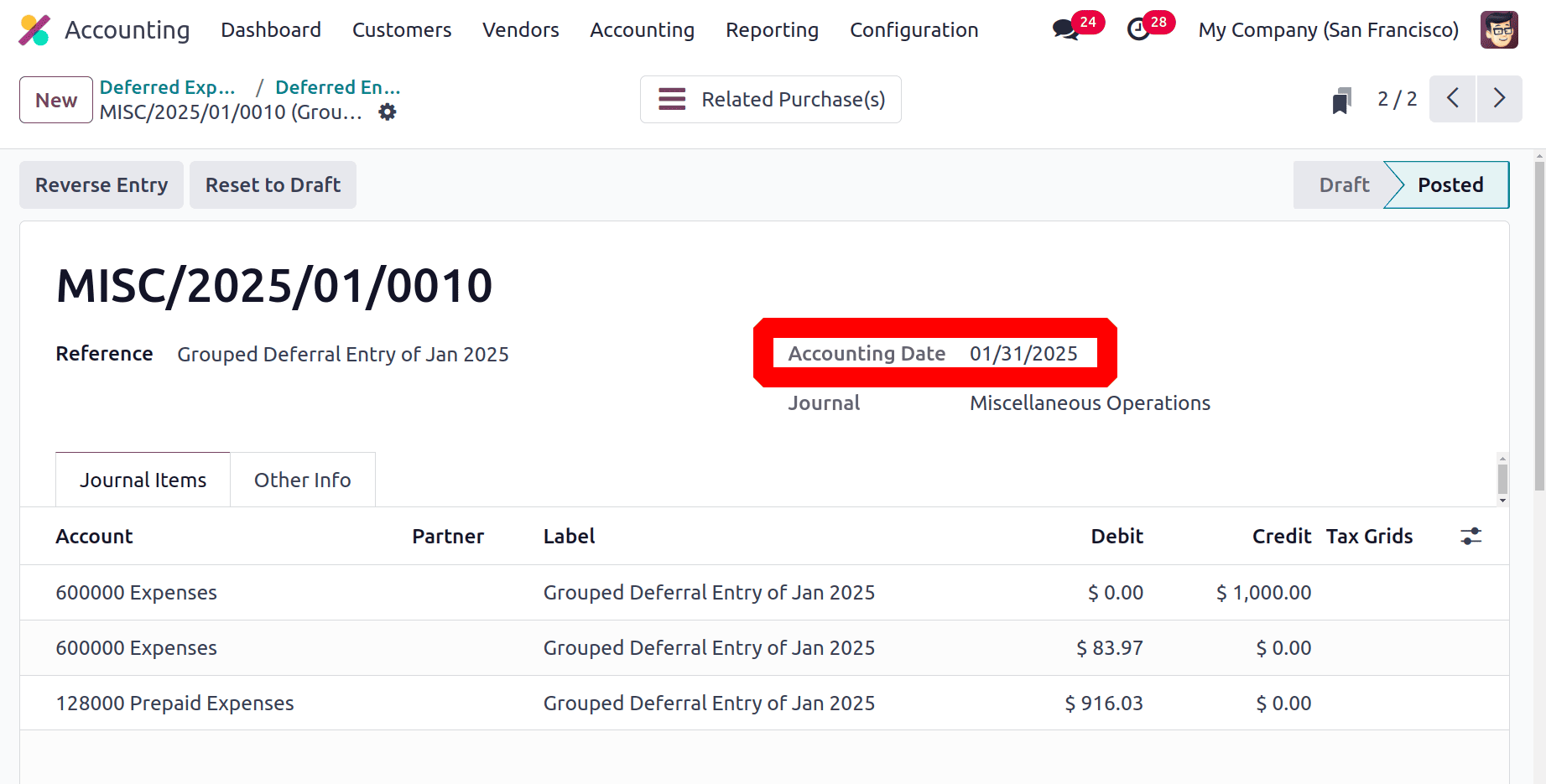

The first opened entry is the Grouped Deferral Entry of Jan 2025.

Here the total number of months is 5 (January to May). Here 1 month is considered of having 30 days for every month.

In the bill, the start date is January 20th. So the remaining total number of days in January is 11 days (11/30= 0.367).

Total Months = 4 months + 0.366666667= 4.366666667

Deferred Expense per month = 1000/4.366 = 229.007633588

The first Journal Item is an Expense account, the bill amount is credited there.

The expense for January is (11/30) * 229.007 = $83.97.

So the expense is increased so the depreciation amount is debited there. Then the balance amount of $916.03 is debited from the Prepaid Expense account.

For the month January =0.366666667×229.007633588 = 83.97

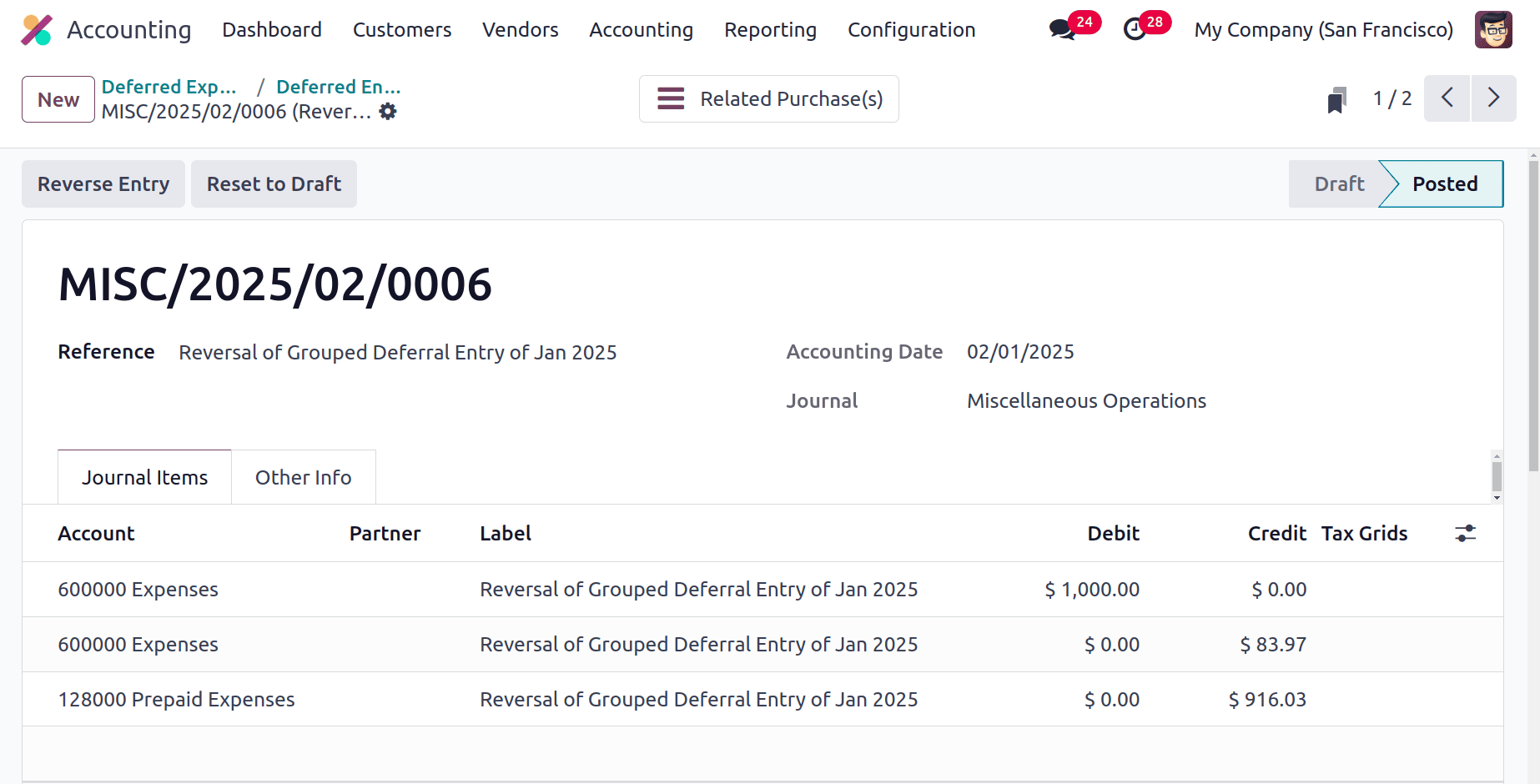

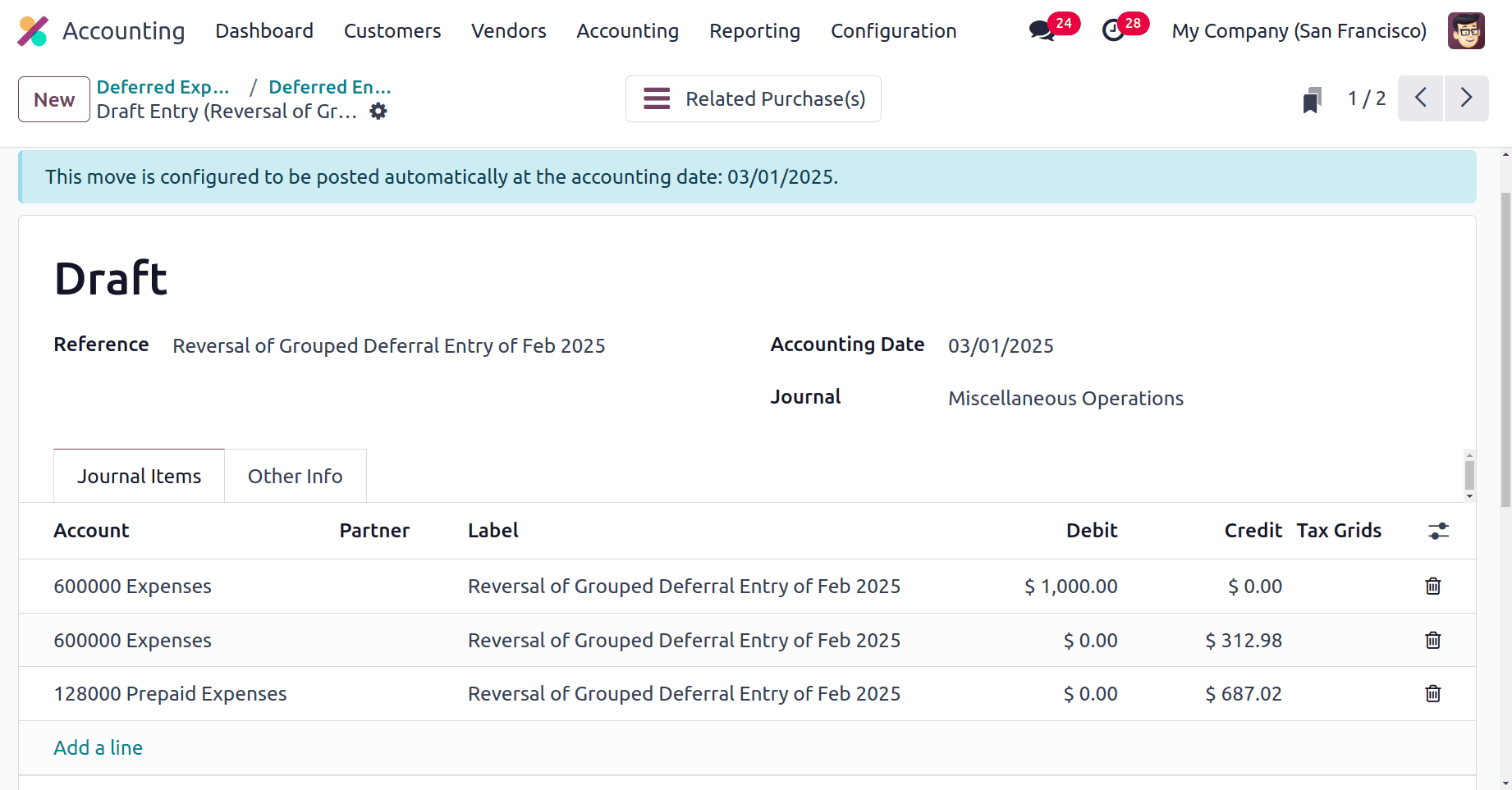

The next one is the Reversal of the Grouped Deferral Entry of Jan 2025. While opening the journal entry here it's clear that it is created as a reversal entry of the previous one. Here the

The expense account is Debited with the Bill total. Both the Expense account and Prepaid Expense accounts are Credited with the depreciation amount and balance amount respectively.

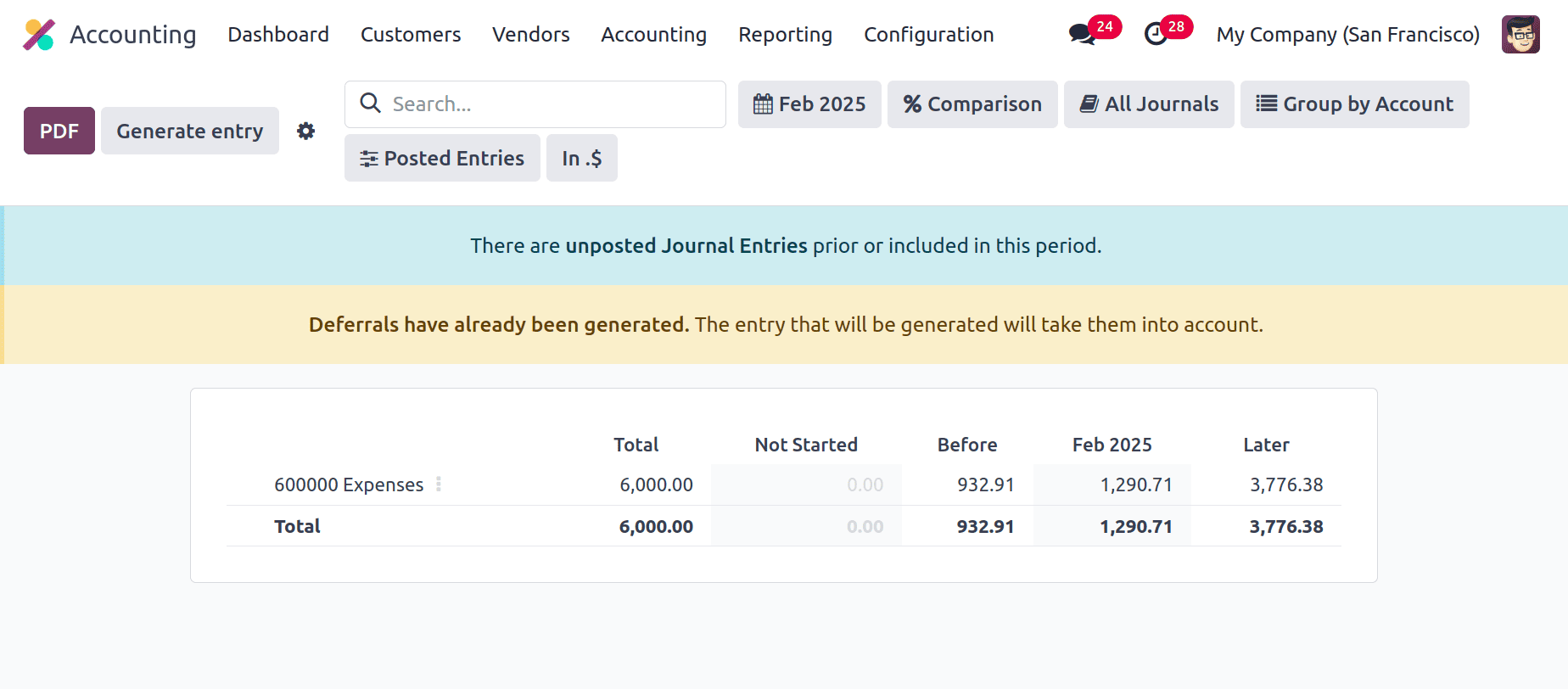

After that, return to the report and switch the filter to the following month once more. The Generate entry button should be clicked. Two journal entries will be created there, as previously stated.

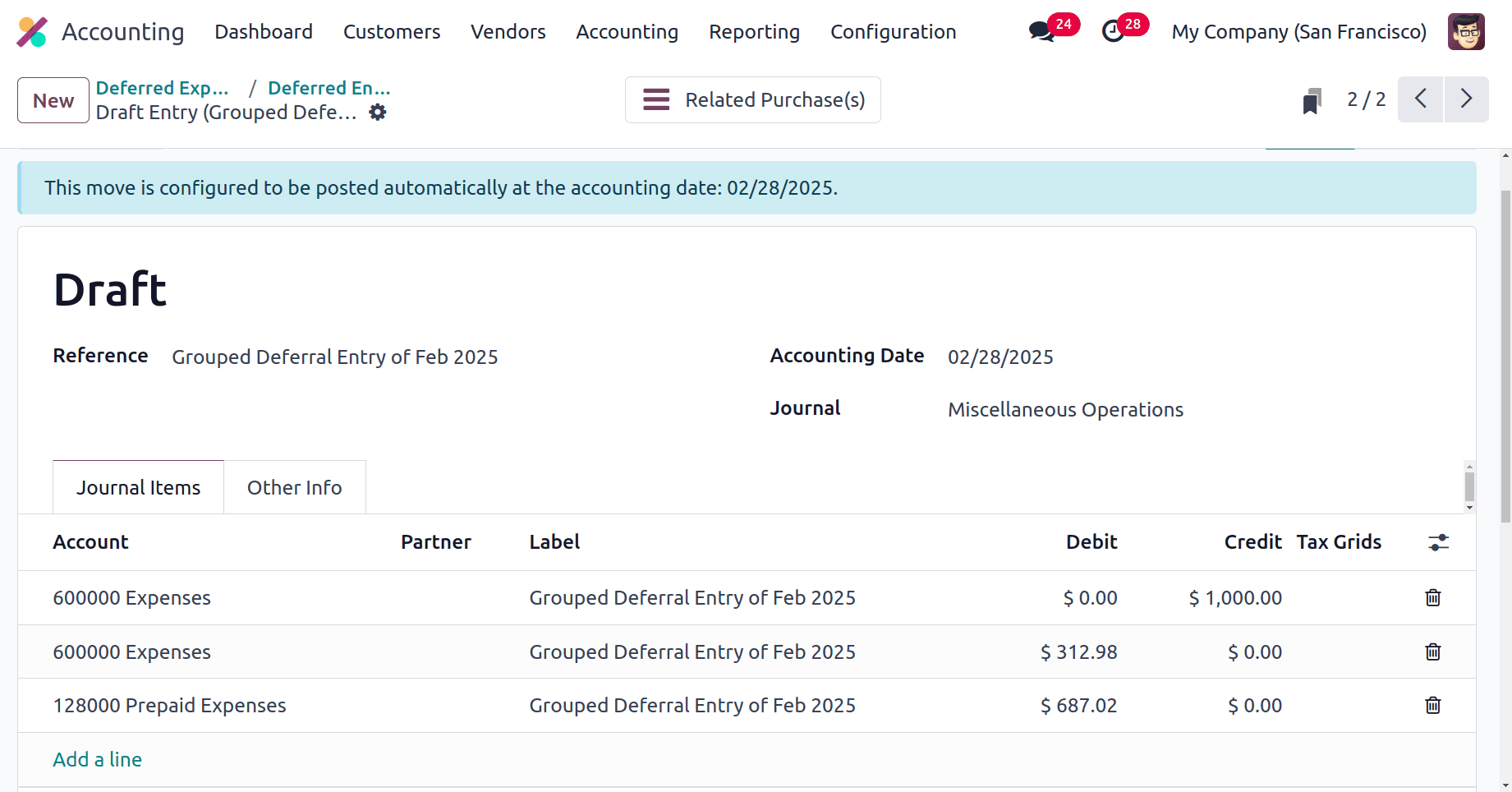

The first is the February 2025 Grouped Deferral Entry, while the second is the February 2025 Reversal of Grouped Deferral Entry. Both entries are in the Draft stage.

The entire sum of $1000 is once more credited to the expense account in the "Grouped Deferral Entry of Feb 2025."

The second month's expenses = 1000÷ 4.366666667 = 229.00763357

The second month's expenses total (Deferred Expense of February + Deferred Expense of January) = 229.00763357+83.97 = 312.978

Which is credited to the expenditure account. Additionally, the remaining sum is owed in the Prepaid Expense account.

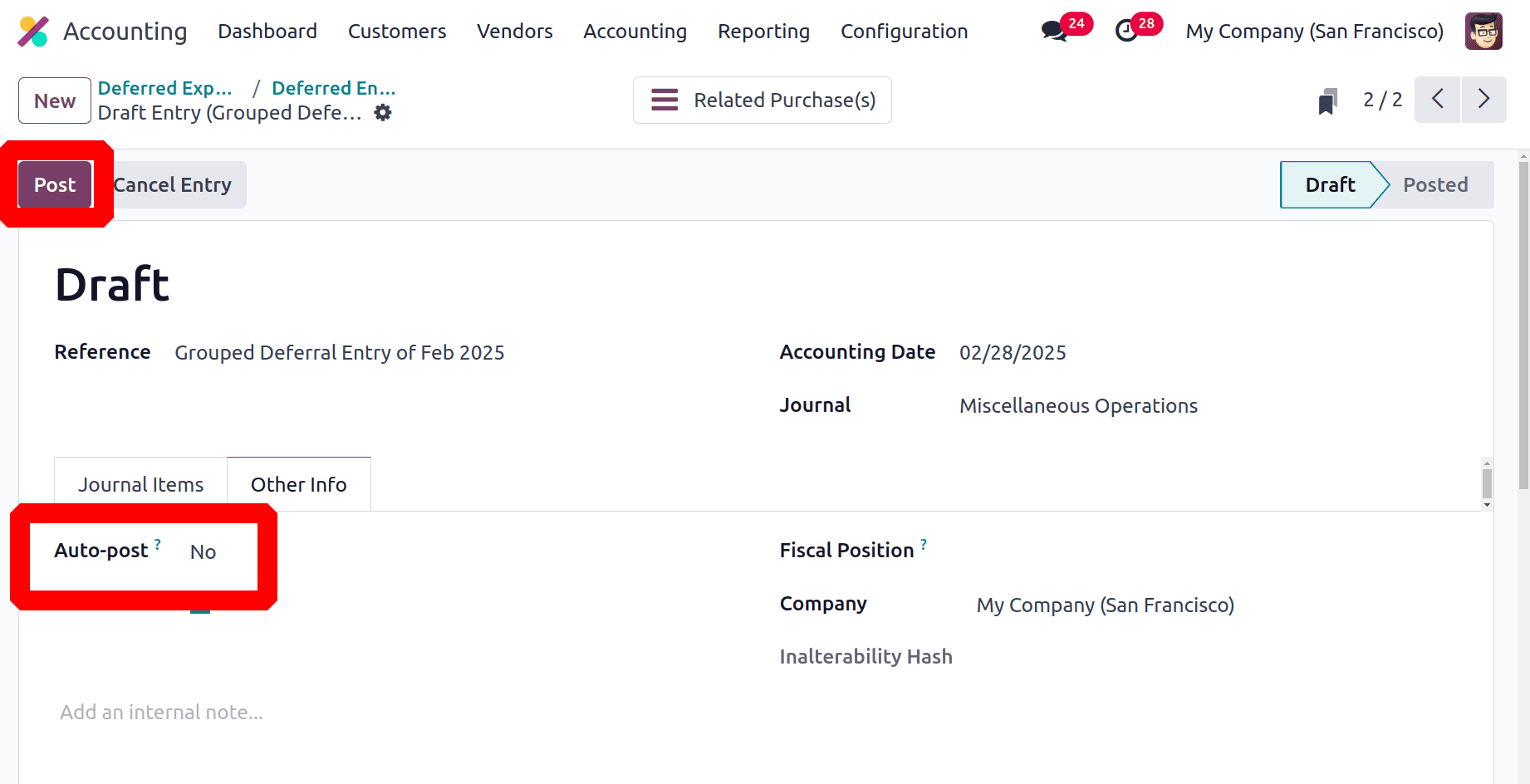

The entry will automatically post on the accounting date, although it is currently in the draft stage. From the Other Info tab, select the Auto Post Option and set it to No if the user wishes to post the entry. Next, press the "Post" button.

The following entry is the opposite of the preceding one, as seen in the illustration below. This will only be published on March 1, 2025.

The deferred expense value of the remaining months will be the same as the previous value.

All the posted Deferred Expense entries will be updated on the report. So the expense account is shown in the report. Total value of Deferred Expense and depreciation amount of each month are shown in the report.

Businesses may divide costs across pertinent periods by managing deferred expenses in Odoo 18 Accounting effectively, which guarantees correct financial reporting and compliance. Businesses can improve control over their financial processes and expedite spending management by utilizing Odoo's automation and tracking features.

To read more about How to Calculate Deferred Expense in Odoo 17 Accounting, refer to our blog How to Calculate Deferred Expense in Odoo 17 Accounting.