In Odoo 18 accounting, a credit note is a document used to adjust or reverse part or all of a sales invoice. It is issued when a customer returns goods or when there is an overcharge or error on an invoice, and the business needs to reduce the customer's owed amount. It is a document that is used to record a decrease in the amount a customer asks from a business.

* If a customer returns a product that they previously purchased, they can just create a credit note to manage the returns and their further procedures.

* If a customer accidentally pays more than they purchased, they can also use the credit note feature, with the reason that the amount is in excess.

* If there is any mistake in the original invoice, such as incorrect price or quantity, one can create a credit note to correct the errors.

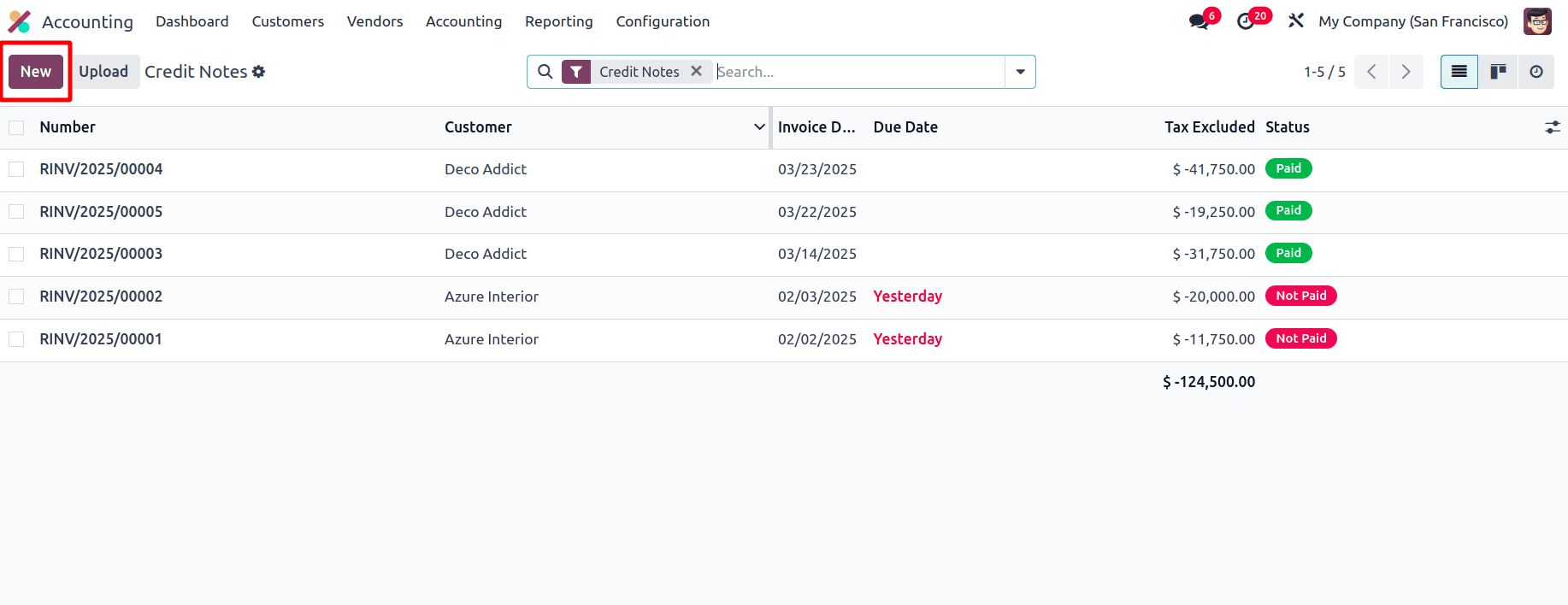

The above-mentioned are some conditions by which one can use the Credit note feature in Odoo 18. To find the use of credit notes in Odoo 18, just move to the Accounting module. In the Accounting module, under the Customer menu, there will be the Credit card sub-menu.

When this Credit note sub-menu is clicked, all the credit notes that are already created will be listed there, and if you needs to create a new credit note, by clicking the New button, you can create a new credit note.

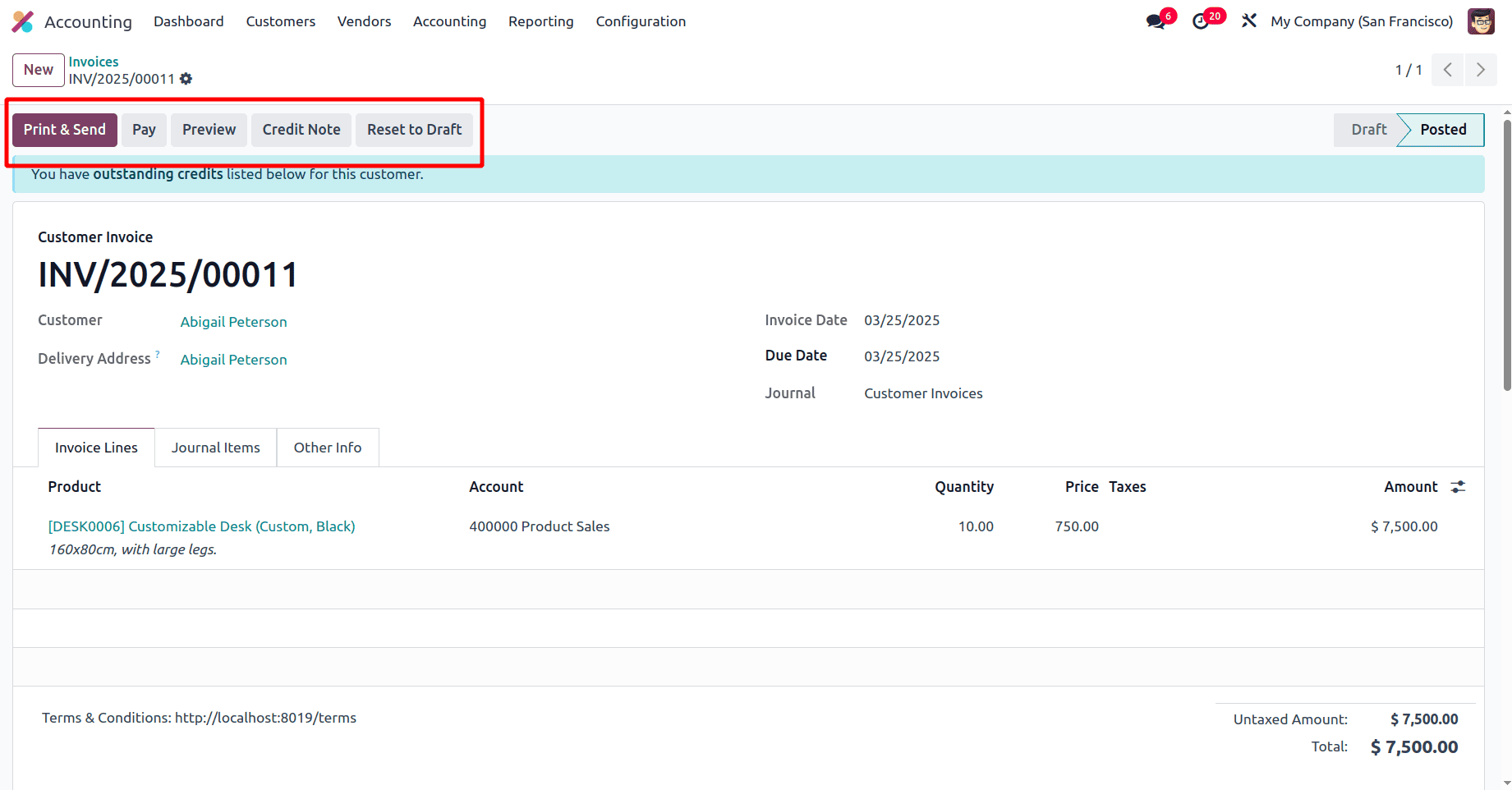

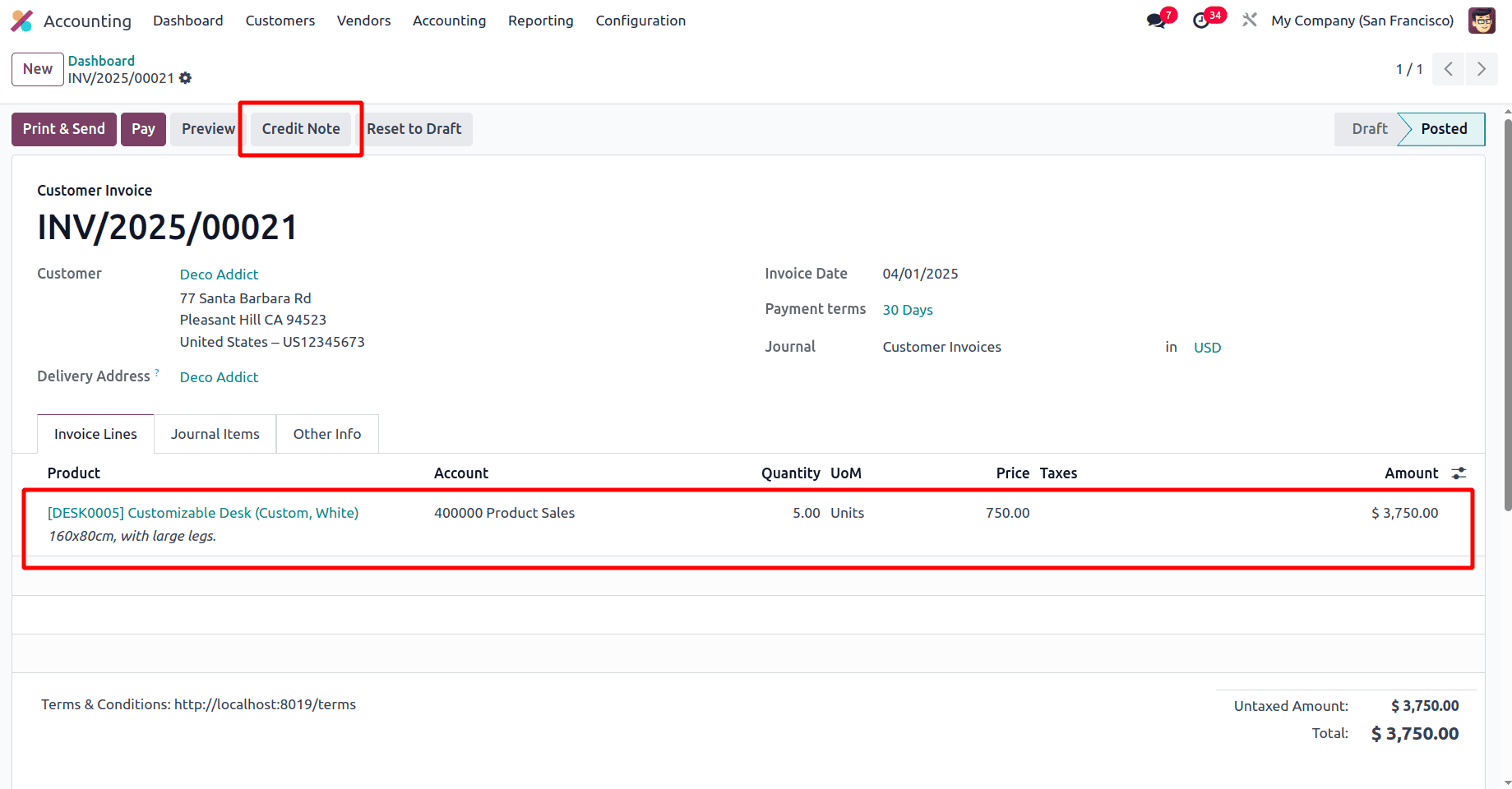

It is possible to create a credit note for an invoice. For example, when a customer buys 2 quantities of a product, and after the delivery has been completed, the customer finds that one of the products is damaged, and the customer needs to return the product. So, to create a new invoice, move to the Customer menu and then choose the Invoice sub-menu. So create an invoice from the accounting module, and once the invoice is confirmed, either the customer can pay for the invoice completely and then make the return, or after the return of the damaged product, the customer can make the remaining payment. So first, create an invoice from the accounting application.

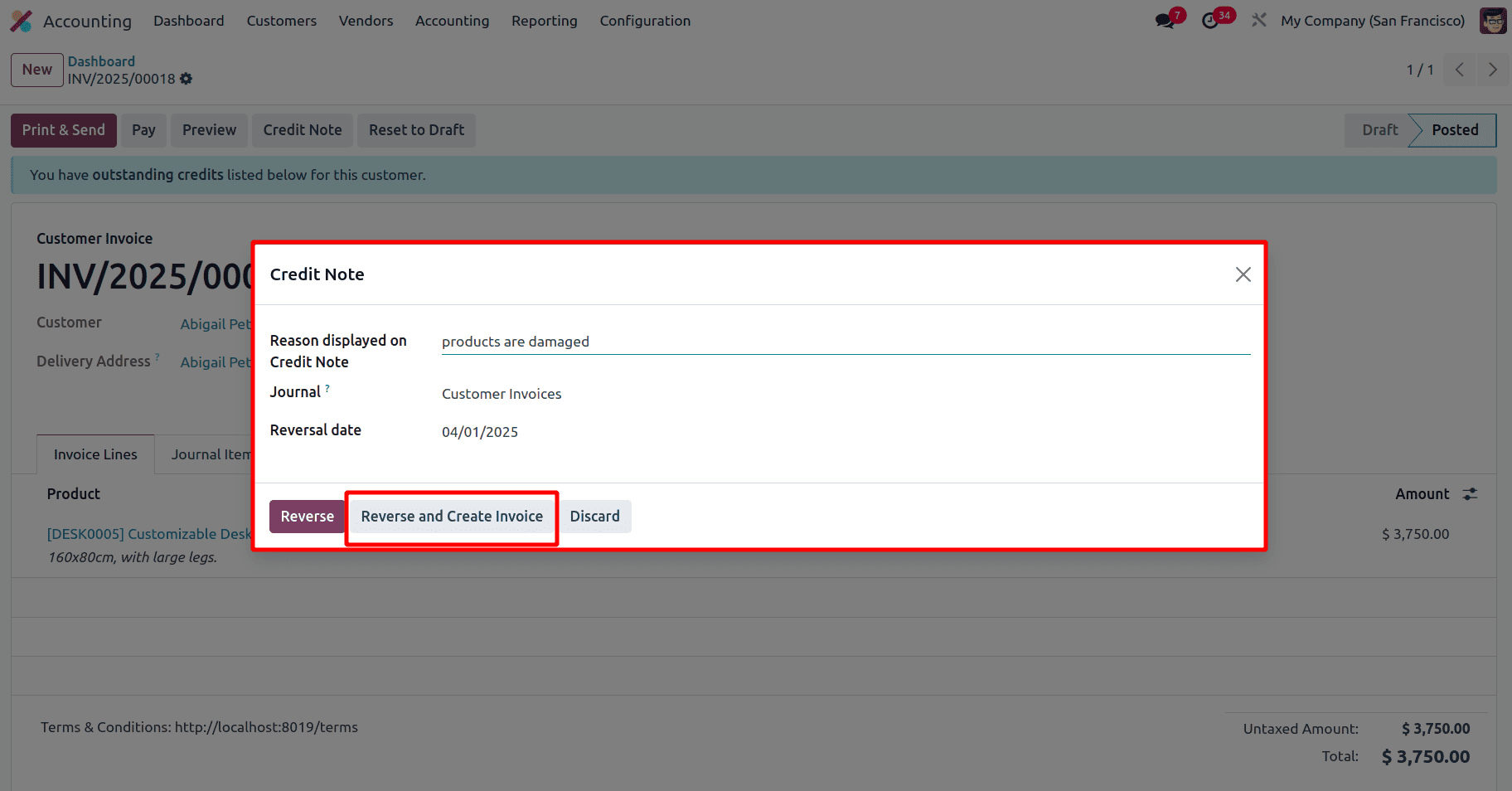

Once the invoice is confirmed, the Print & Send, Pay, Preview, Reset to Draft, and Credit Note buttons appear on the invoice page. On clicking the credit note button, Odoo 18 provides a pop-up window.

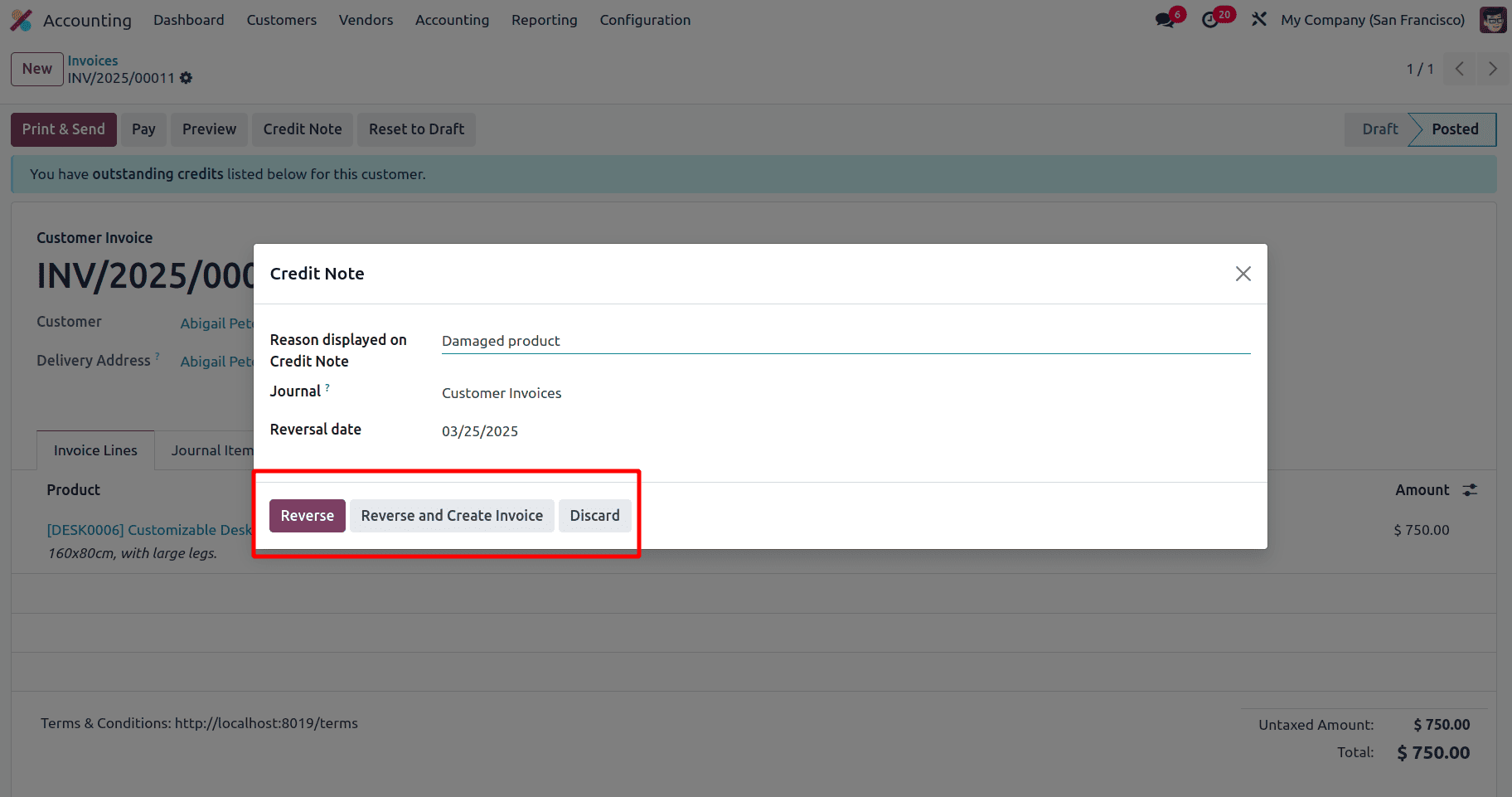

* Reason displayed on Credit Note: Used to specify the justification for a credit note or why the customer is making this credit note.

* Journal: If empty, use the journal of the journal entry to be reversed

* Reversal: It refers to the date on which this credit note is issued

In this pop-up, there are two options, ‘Reverse’ and ‘Reverse and Create Invoice’. Once the Reverse and Create invoice button is clicked, the reversal order will get confirmed, and then the user will need to confirm the invoice. If the reverse button is clicked, first confirm the reversal order and then confirm the invoice for the reversal order. Here, just click the Reverse button.

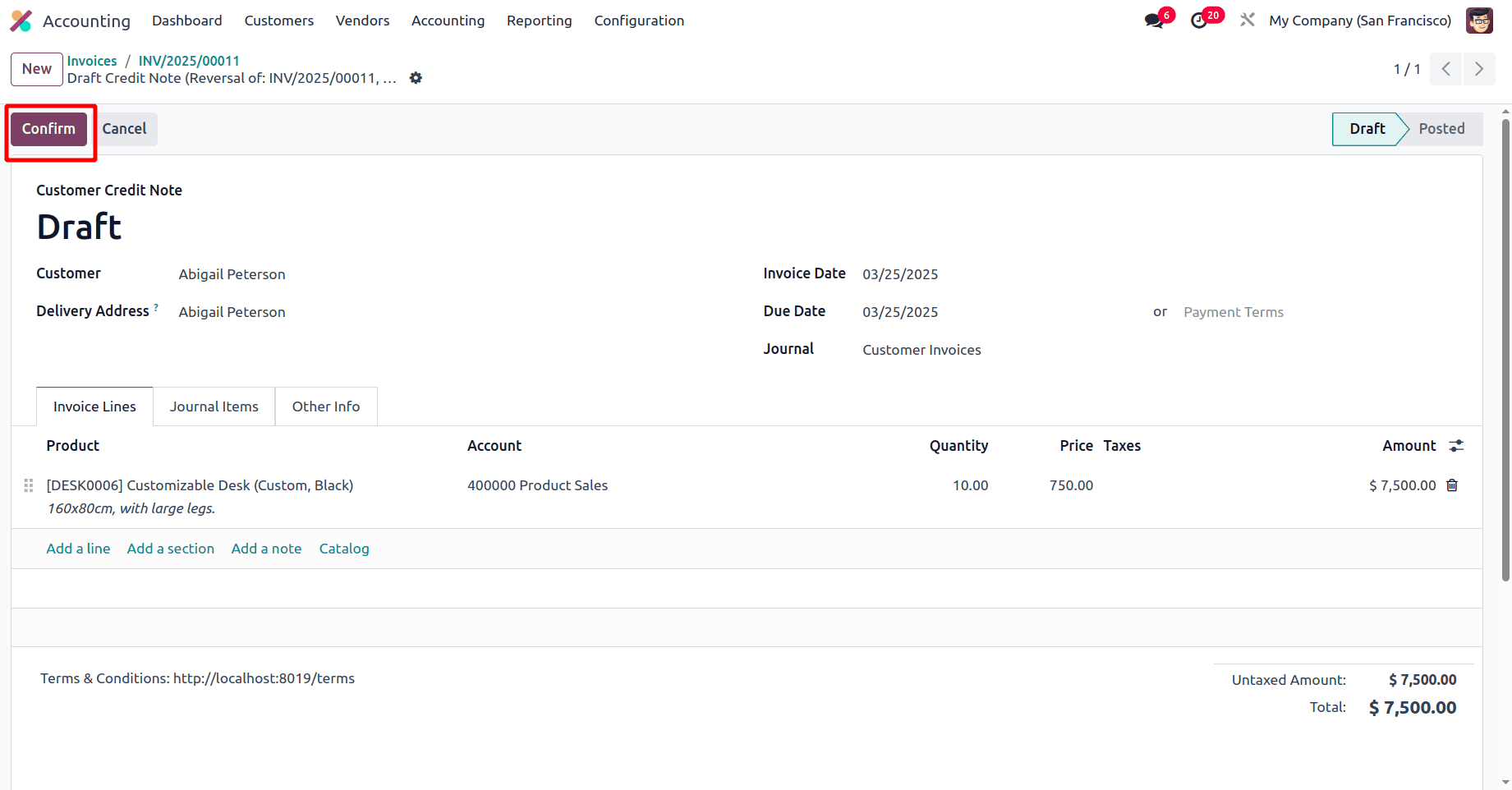

Then the credit note in the draft state will be there. One can click the Confirm button to post the Credit note.

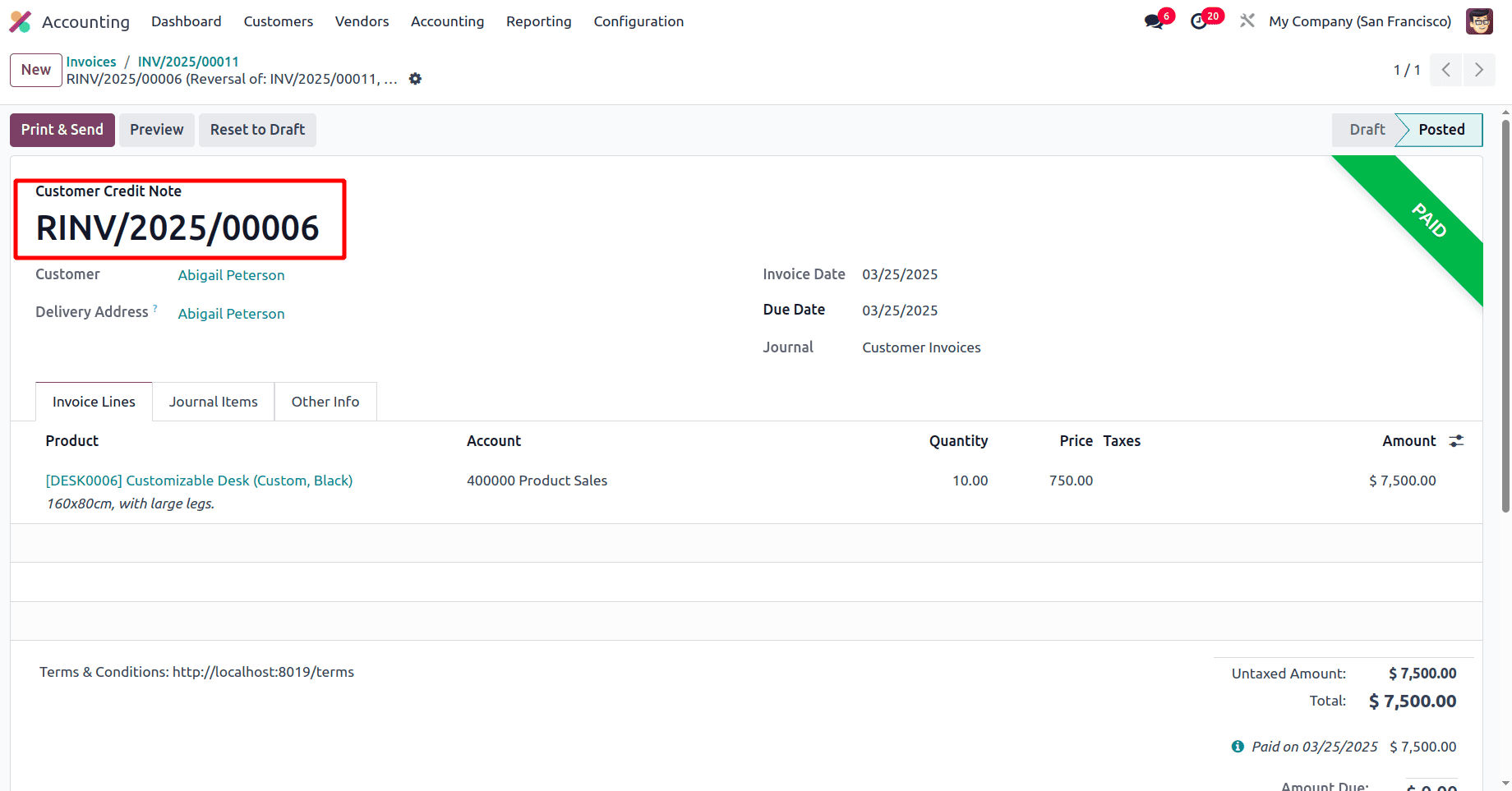

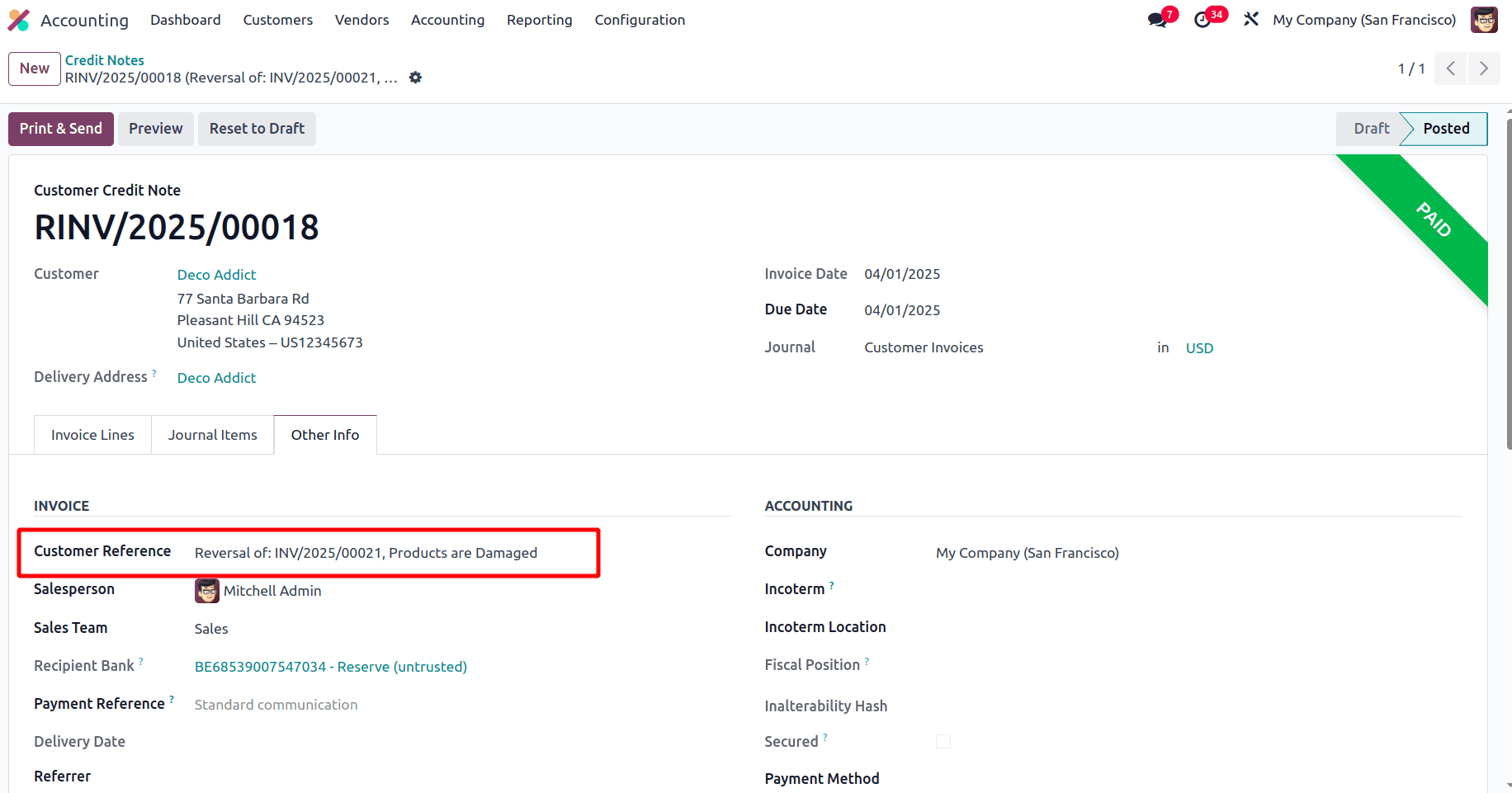

In the sequence of a Credit Note, an 'R' is appended to the numbering sequence when the same journal is used for both the Credit Note and the Customer Invoice.

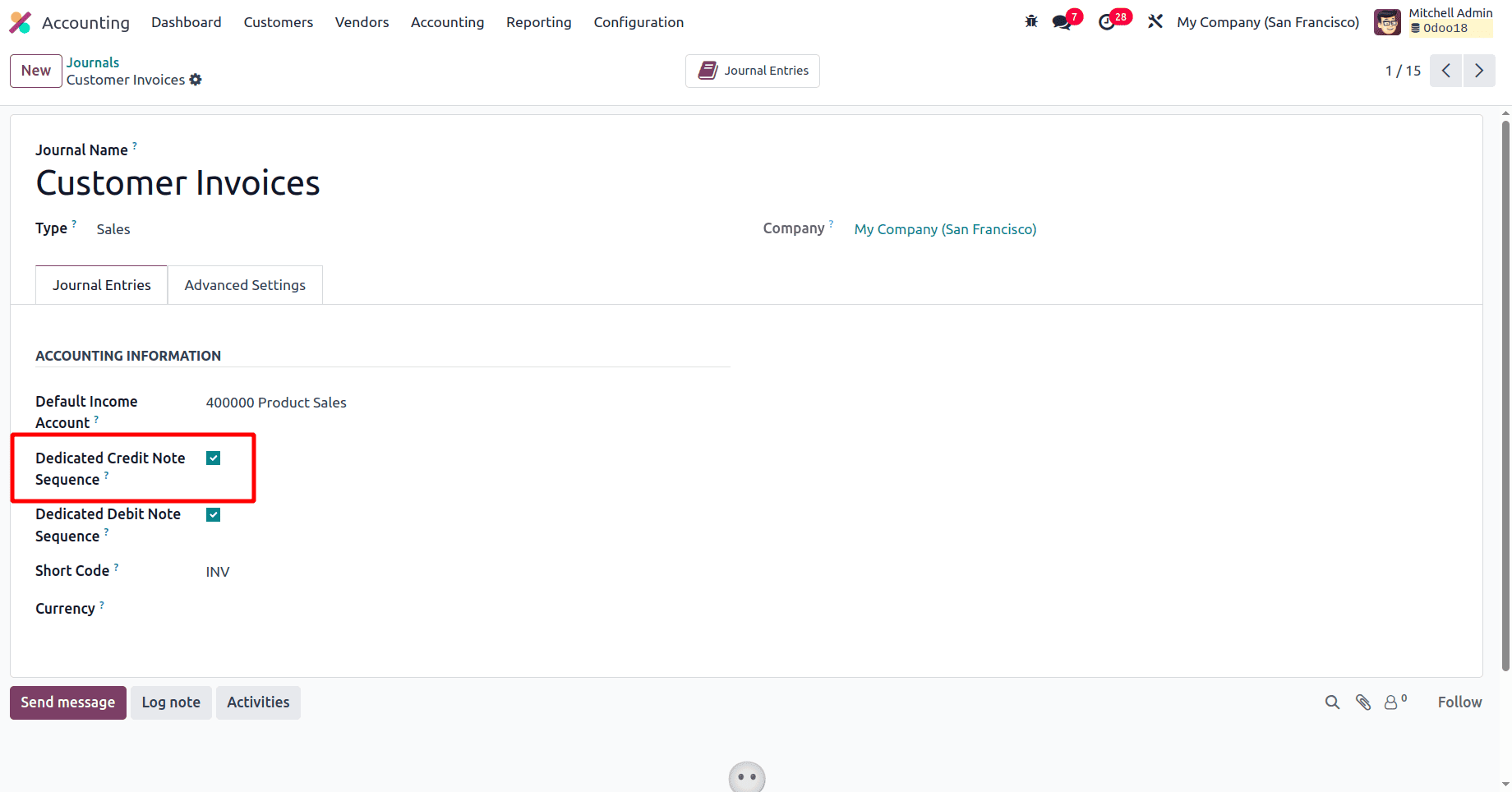

So when we open the journal customer invoice from the Odoo 18 Accounting module, there will be an option ‘Dedicated Credit Note Sequence’.

Once the ‘Dedicated Credit Note Sequence’ option is enabled in a journal, any credit note created for an invoice issued through that journal will include the letter "R" in its sequence number. If this is the first credit note from that specific journal, the number of the credit note will be ‘0001’. This ensures that credit notes have a distinct sequence, separate from invoices, even when both use the same journal.

If the Dedicated Credit Note Sequence option is disabled, credit notes will share the same sequence format as invoices.

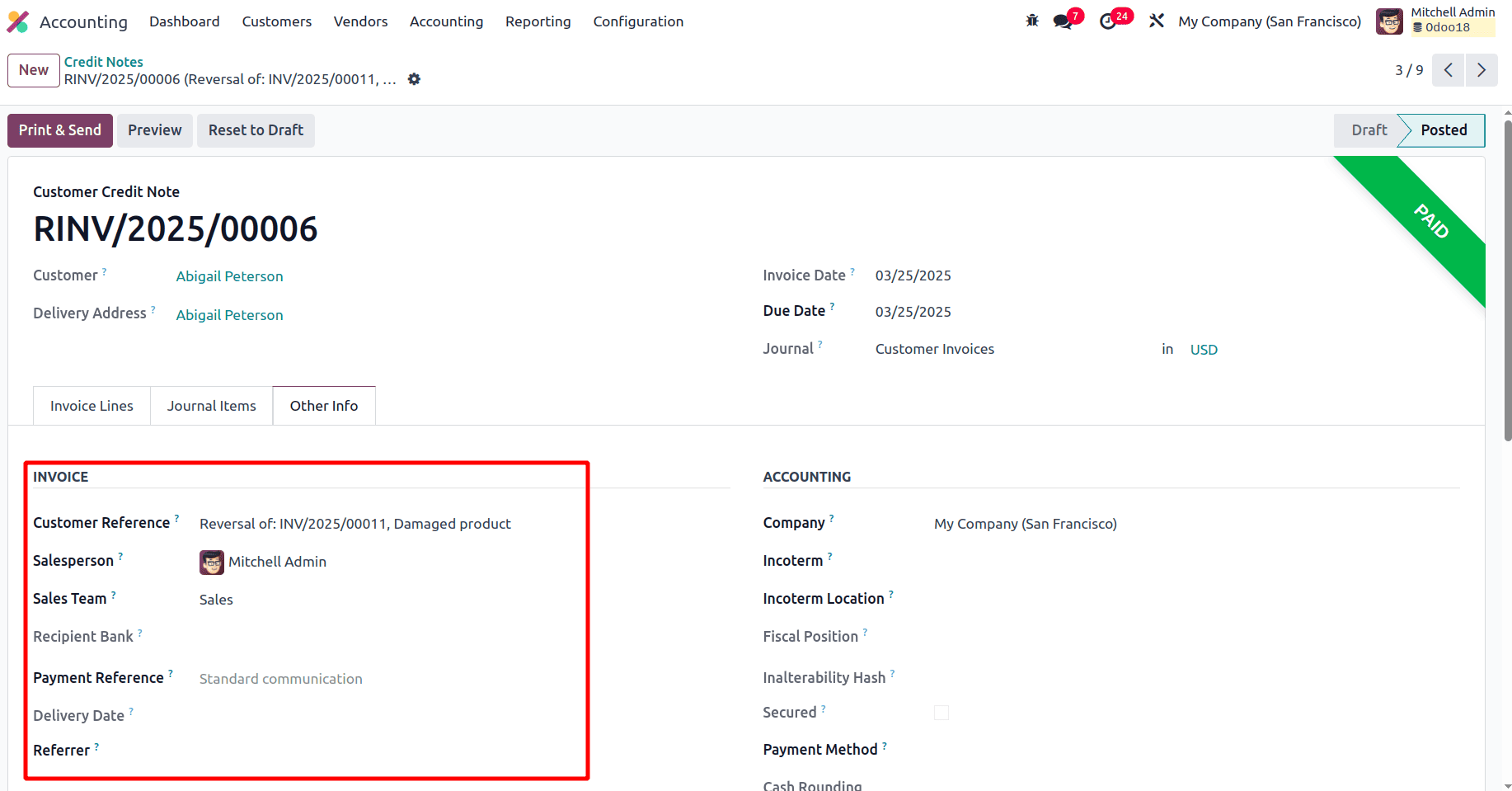

When checking the other info tab of the credit note, all the details of the invoice corresponding to the credit note, the reason for the creation of the credit note, etc, will be displayed in the other info tab.

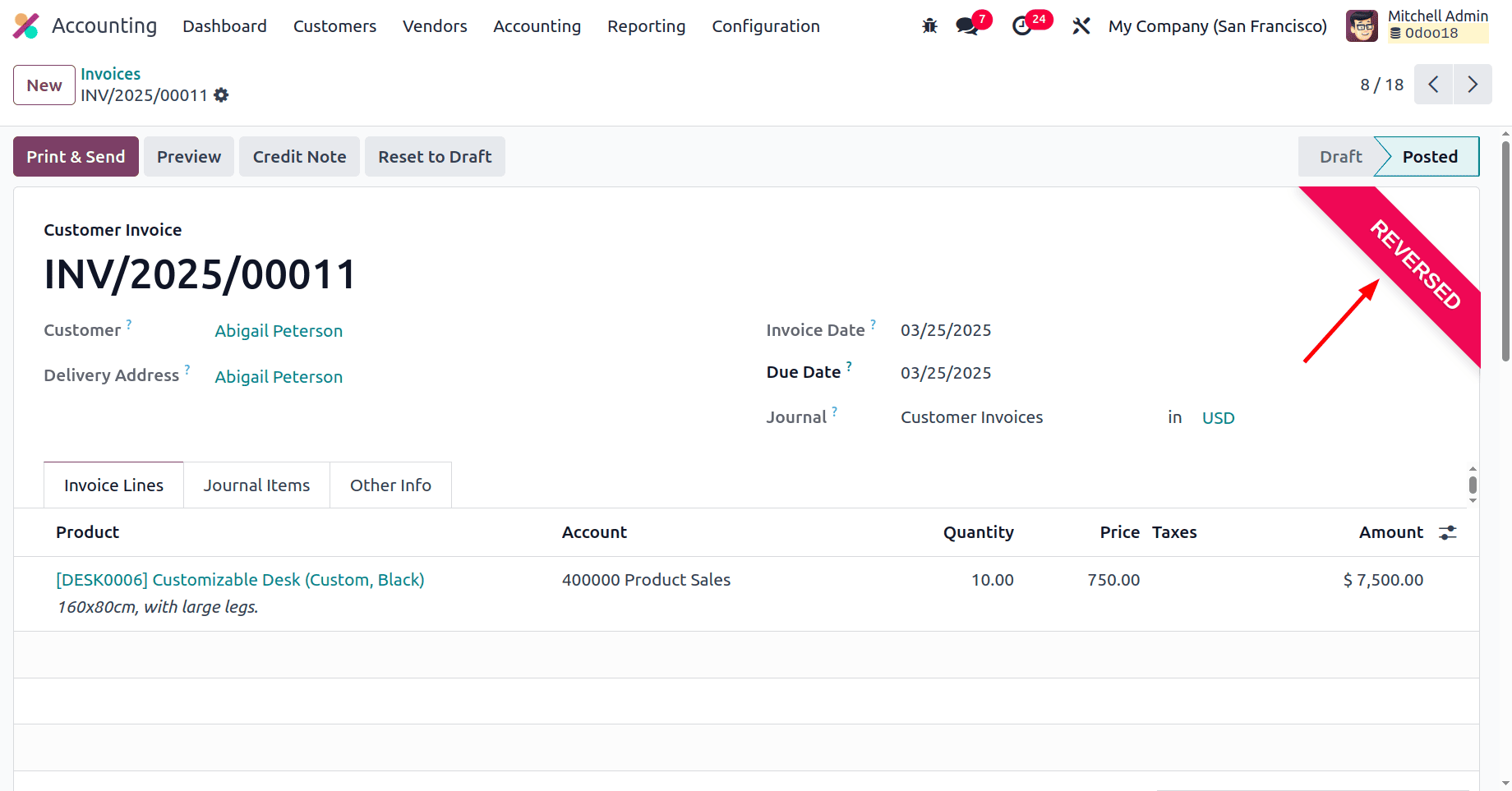

The status of the credit note will be in paid state, and when we check the status of the invoice corresponding to the credit note, it will be in ‘Reversed’ state.

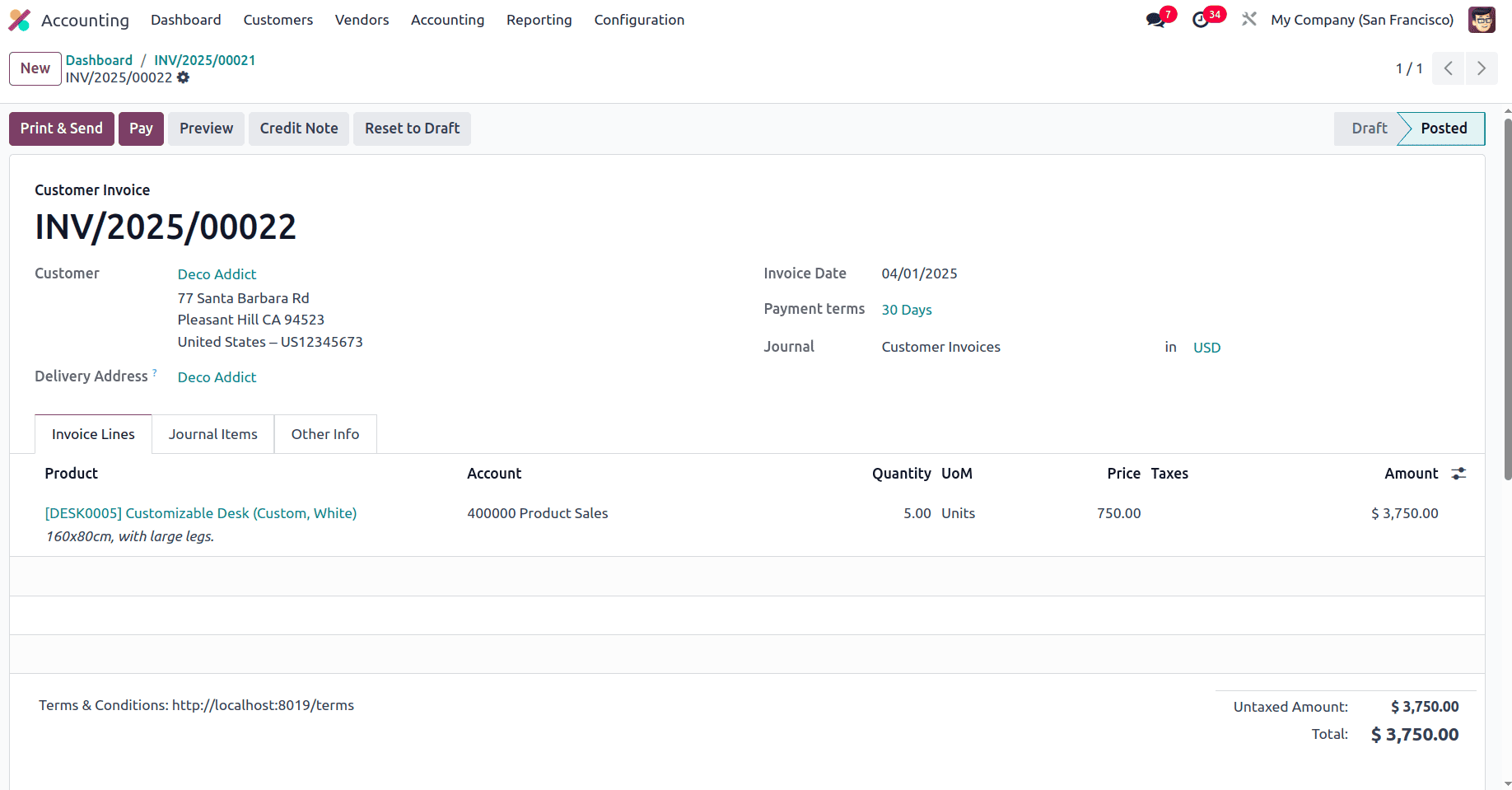

While creating the reverse invoice, there is one more option, ‘Reverse and Create Invoice. ’ So, to use that option, let us create one more invoice and create a credit note for that invoice.

Here, we have created an invoice for 5 quantities of one product, and after the product has been delivered, the customer wants to return them. So, click the Credit Note button to return that product.

Then, Odoo will provide a pop-up window in which we can add the reason for returning the products. When clicking the Reverse and Create invoice button, Odoo automatically creates one more invoice for the products that are returning, and we can click the Confirm button to confirm the second invoice.

On moving to the list of credit notes, the credit note corresponding to the first invoice will be there.

Odoo 18 allows for streamlined credit note processing, enabling users to create and manage credit notes directly from invoices with minimal manual effort. It ensures accurate financial records by properly reconciling invoices and refunds while maintaining a clear audit trail for compliance. The system supports dedicated credit note sequences, ensuring that credit notes have distinct numbering from invoices for better traceability. Seamless integration with accounting automates journal entries, reducing manual adjustments and maintaining accurate financial reports. Managing credit notes efficiently improves customer relationships by enabling quick refunds and transparent transaction records.

To read more about What are the Key Features of Odoo 18 Full Accounting Kit for Community, refer to our blog What are the Key Features of Odoo 18 Full Accounting Kit for Community.