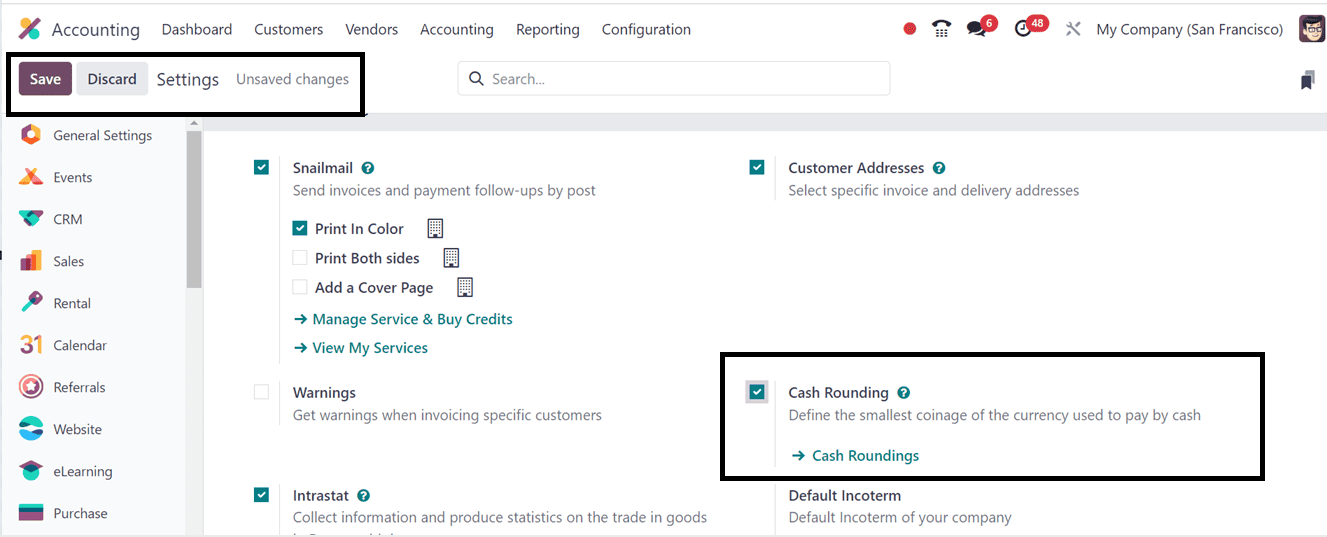

The Odoo ERP Accounting Module has a helpful function called cash rounding that enables users to round off a bill's total to the closest accessible currency denomination. To activate this function, go to the Accounting module's "Settings" menu, pick the "Cash Rounding" option, and then select the "Customer Invoices" tab, as seen in the picture below.

Setting Up Cash Rounding in Odoo 18

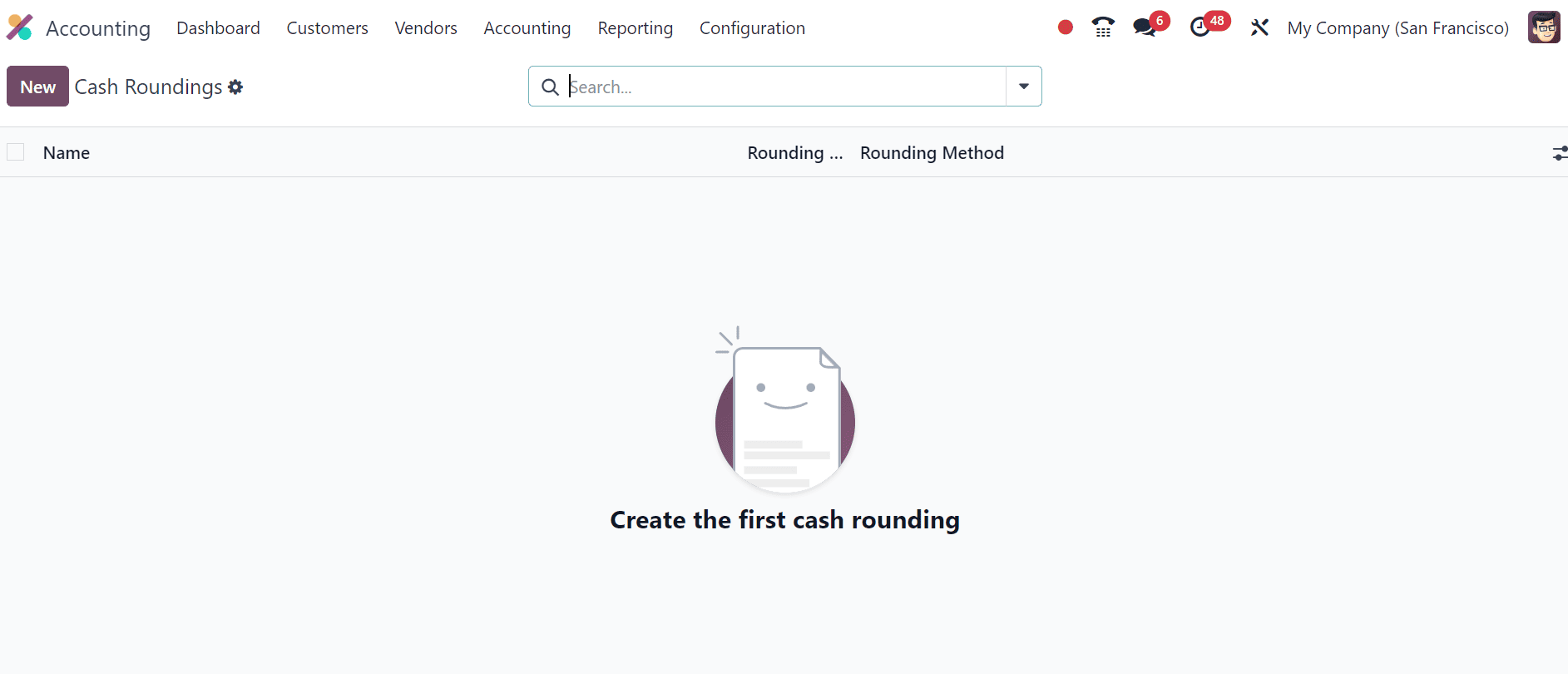

By selecting the 'Cash Roundings' option, you may manage existing cash rounding setups or add new ones after the capability has been enabled. Alternatively, we may select the 'Cash Rounding' option from the 'Configuration' menu's 'Management' section.

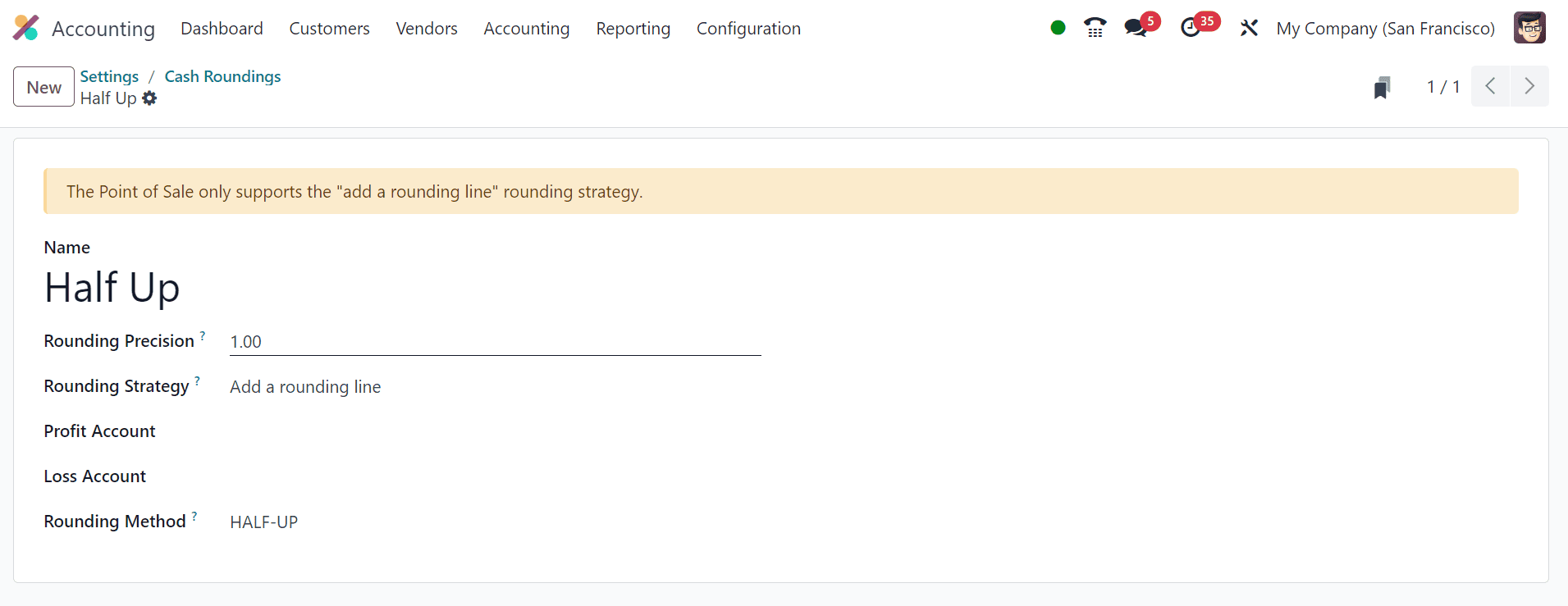

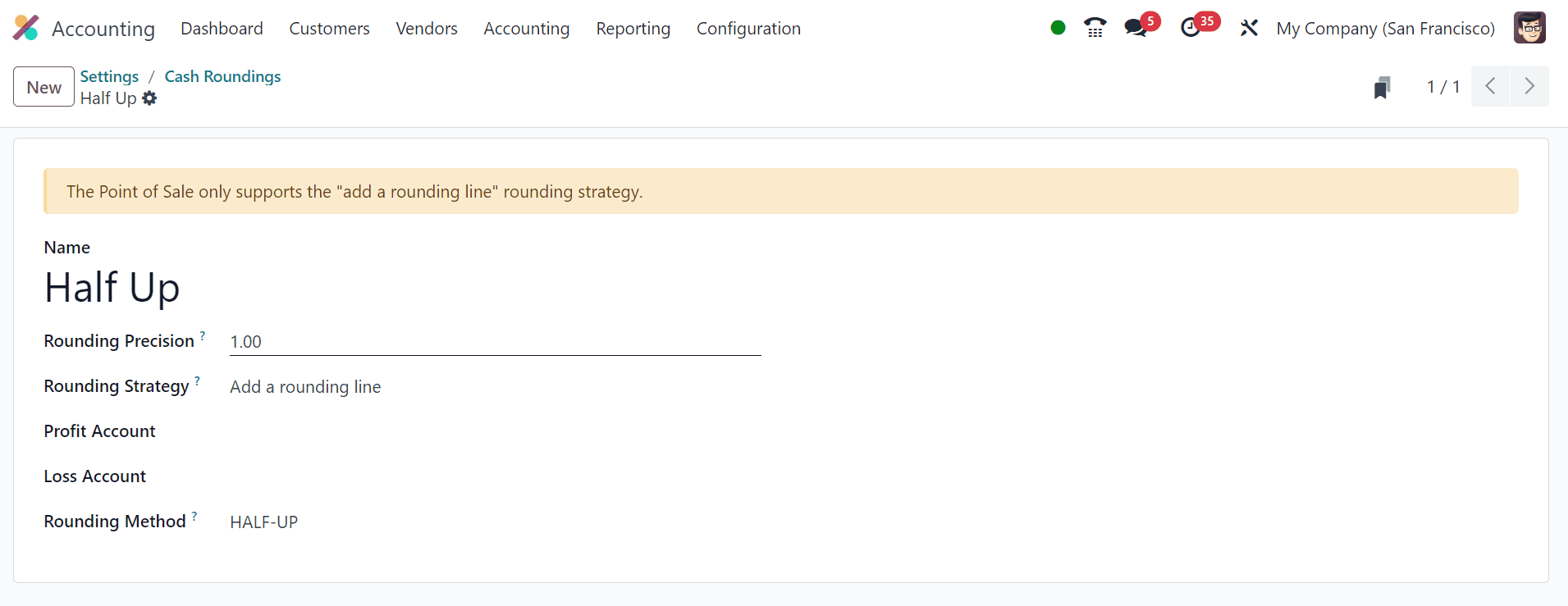

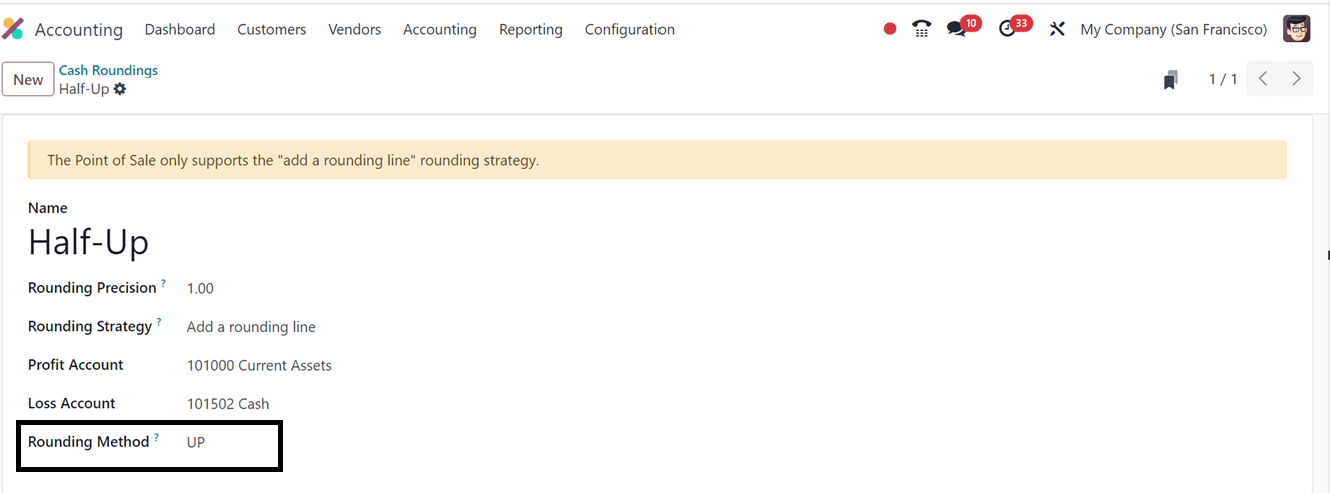

To create a new cash rounding method, click the ‘New’ button, which opens a configuration form. Start by entering a name for the cash rounding method in the ‘Name’ field. The ‘Rounding Precision’ field allows you to select the smallest non-zero currency unit. Under the "Rounding Strategy" section, define how the invoice amount will be rounded—whether by adjusting the tax amount or by adding a rounding line by choosing the relevant option from the dropdown list.

When adding a rounding line, you must specify the ‘Profit Account’ and ‘Loss Account.’ You can choose from three

1. UP: Rounds the amount up to the nearest value according to the rounding precision.

2. Down: Round the amount down according to the rounding precision.

3. HALF-UP: This method rounds values with fractional components below 0.5 down and values of 0.5 or above up.

After configuring the required fields, save the cash rounding method. This configuration allows businesses to define the smallest coinage denomination in the Odoo 18 Accounting Module.

Applying Cash Rounding to Invoices

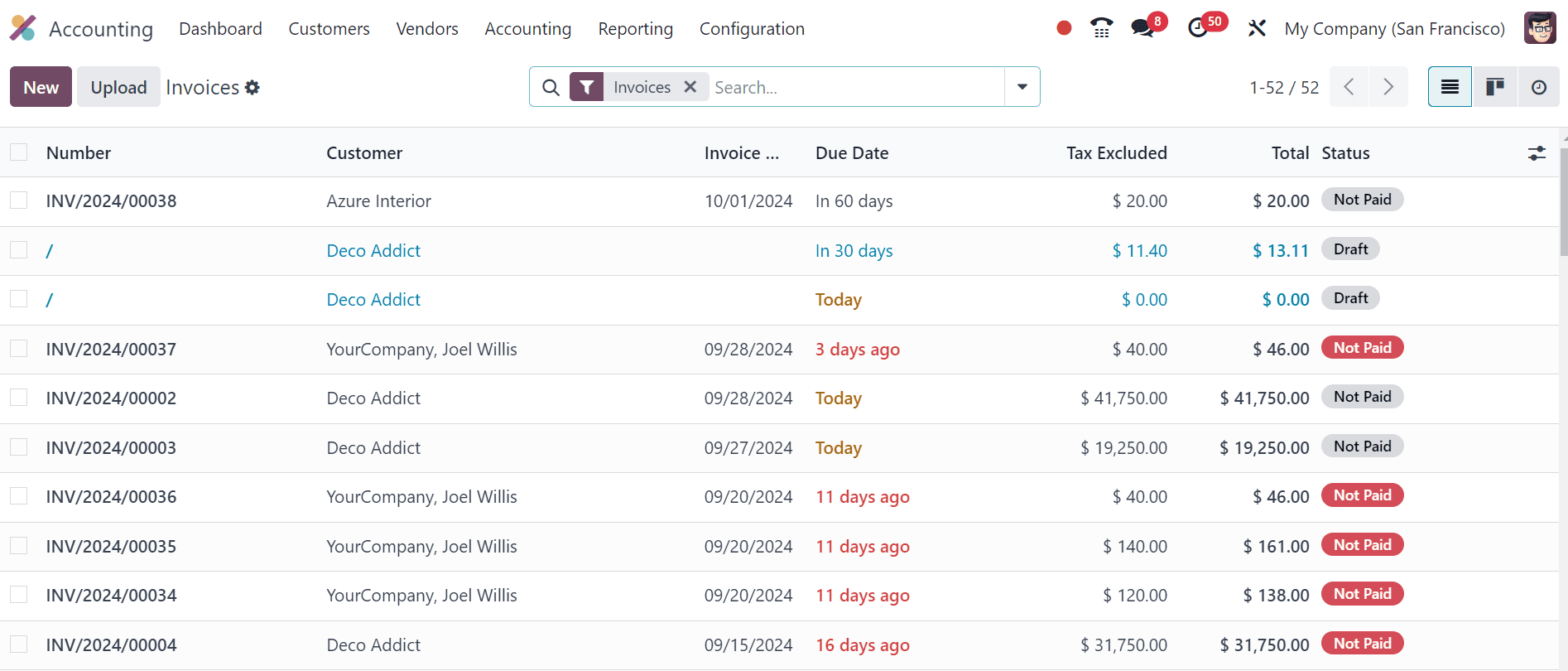

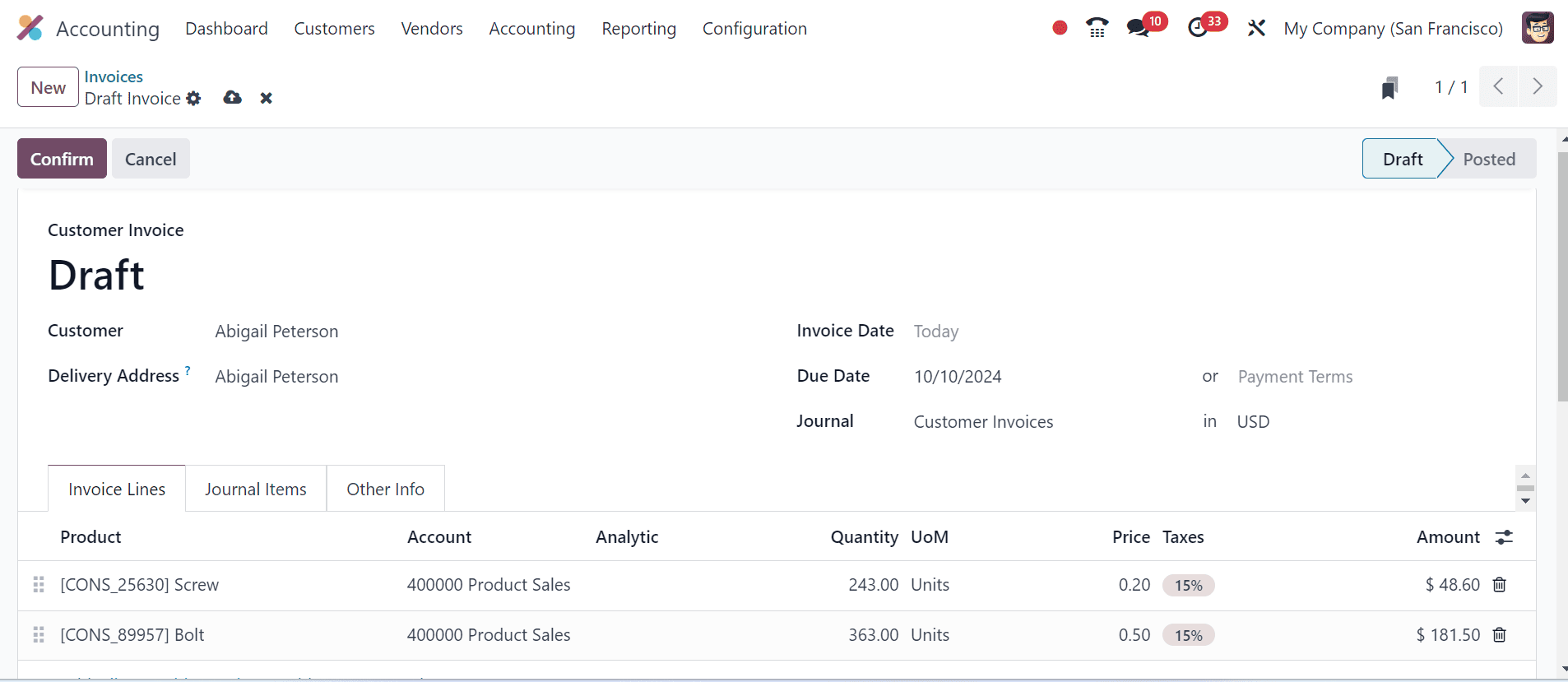

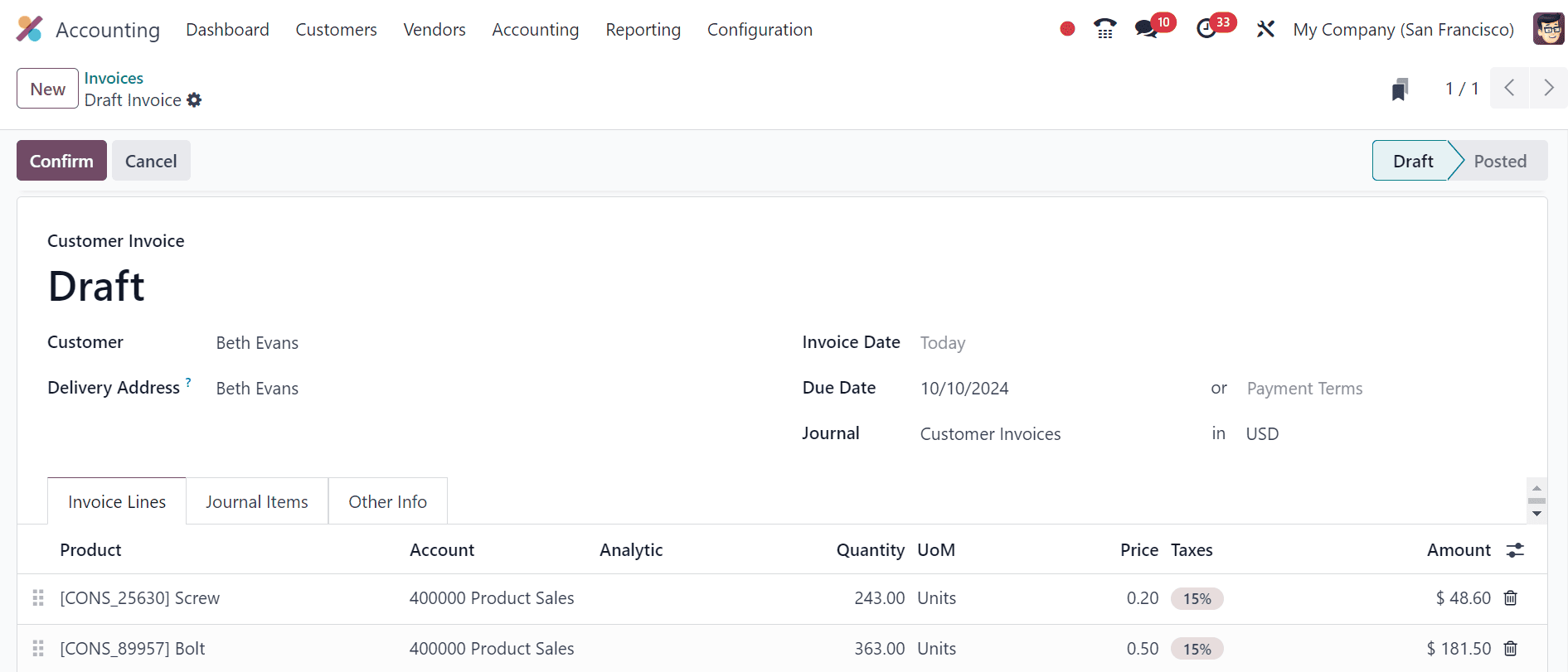

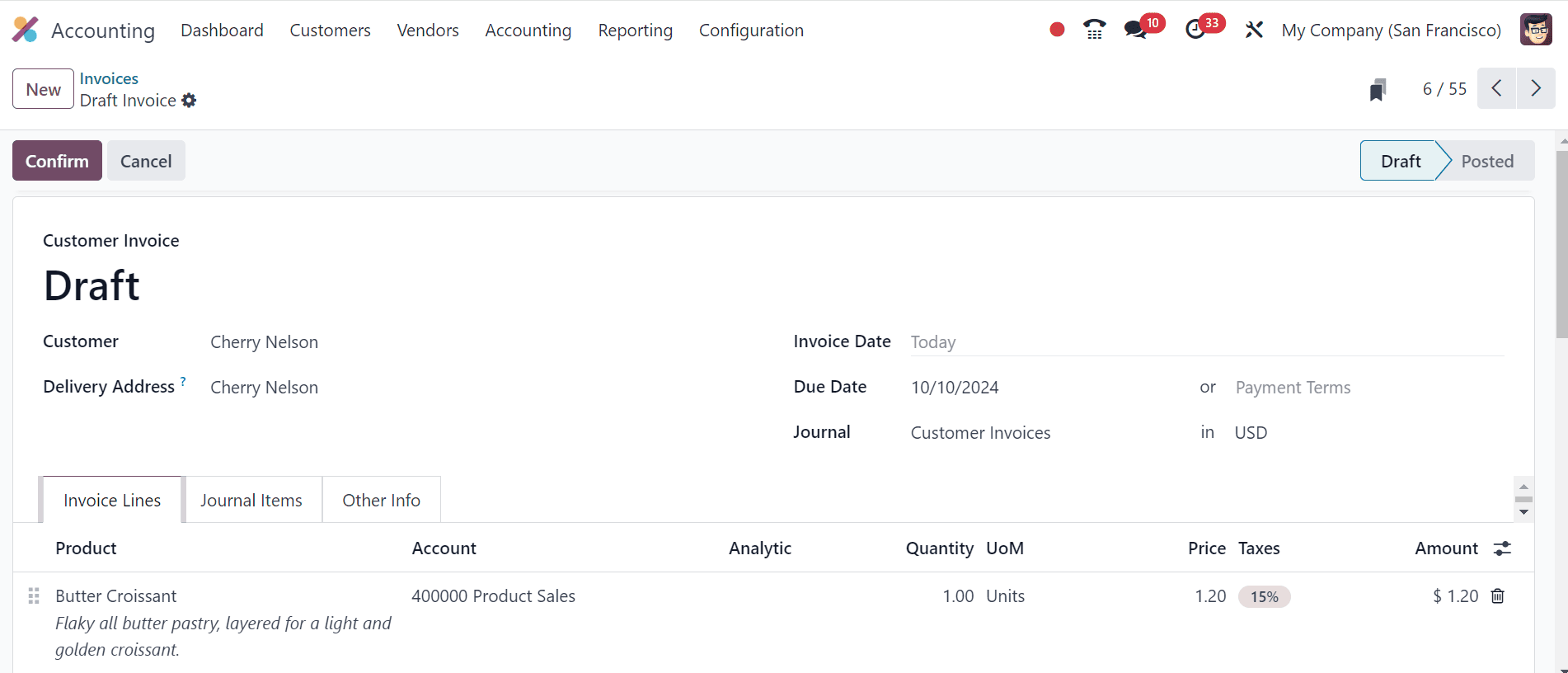

To test the cash rounding functionality, create a new invoice by navigating to the ‘Invoices’ option under the ‘Customers’ menu. This will display a list of all company invoices with relevant details like Number, Customer, Invoice Date, and Total.

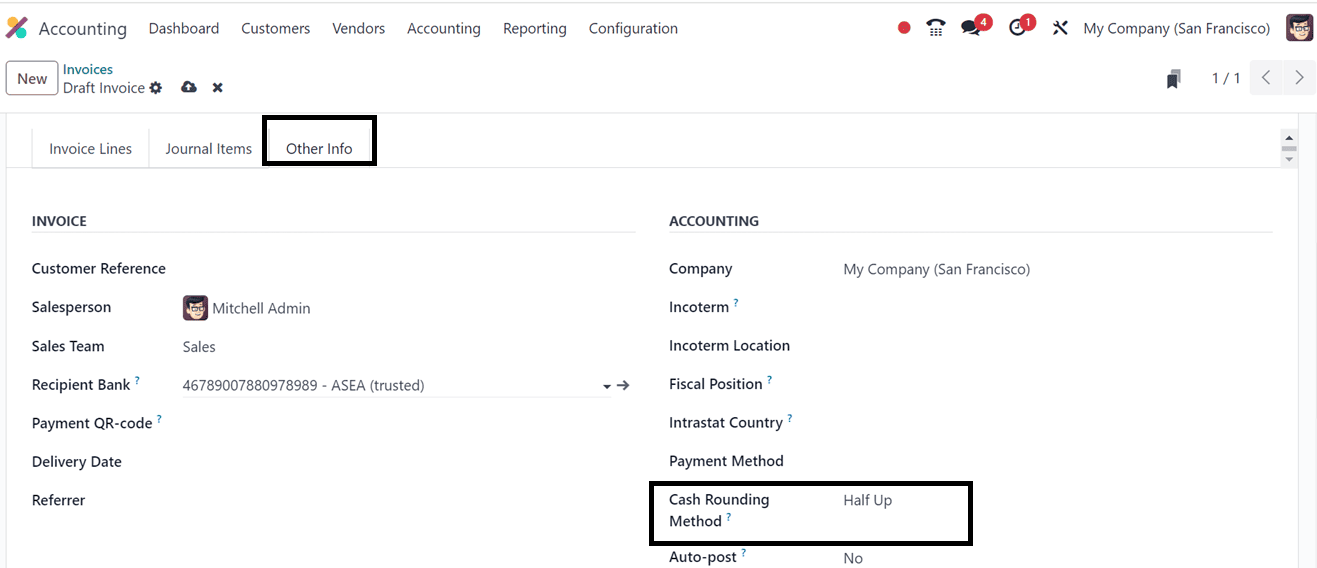

Click the "New" button to open a new invoice form. After entering the customer’s name and other necessary details, add the invoiced items under the “Invoice Lines” tab. In the "Other Info" tab, select the appropriate cash rounding method from the "Cash Rounding Method" box under the "ACCOUNTING" section.

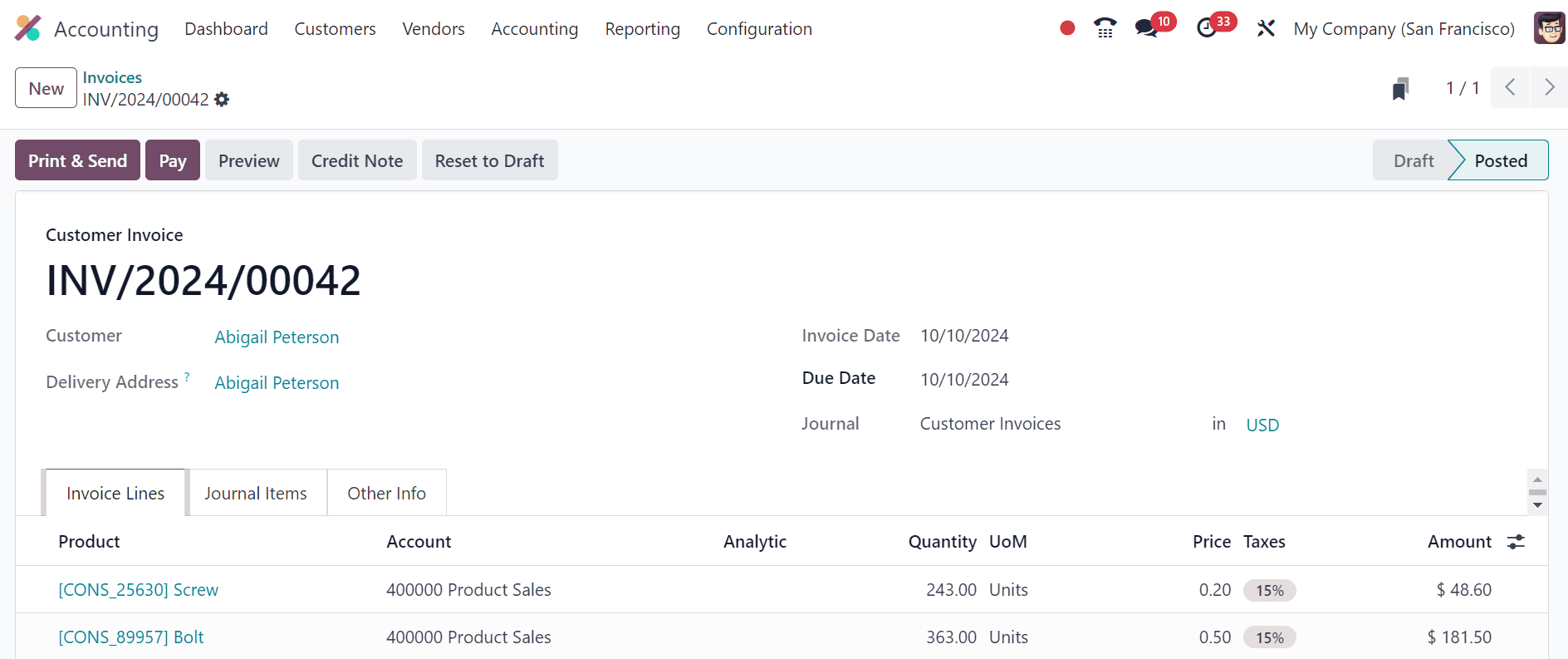

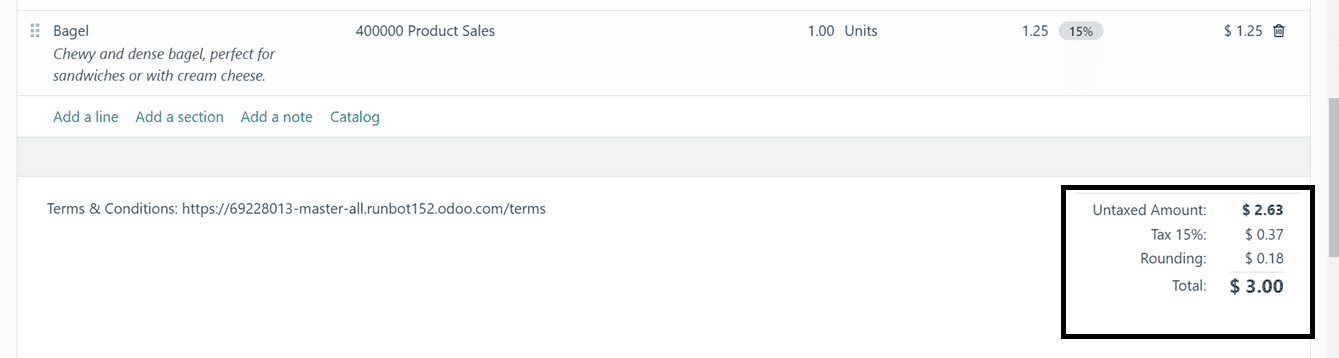

After editing all the required data, save the invoice details and proceed with the invoice using the ‘Confirm’ button. Here, I have chosen some random products just for demonstration purposes. After selecting the products and using the cash rounding method, the total invoice amount will reflect the rounding.

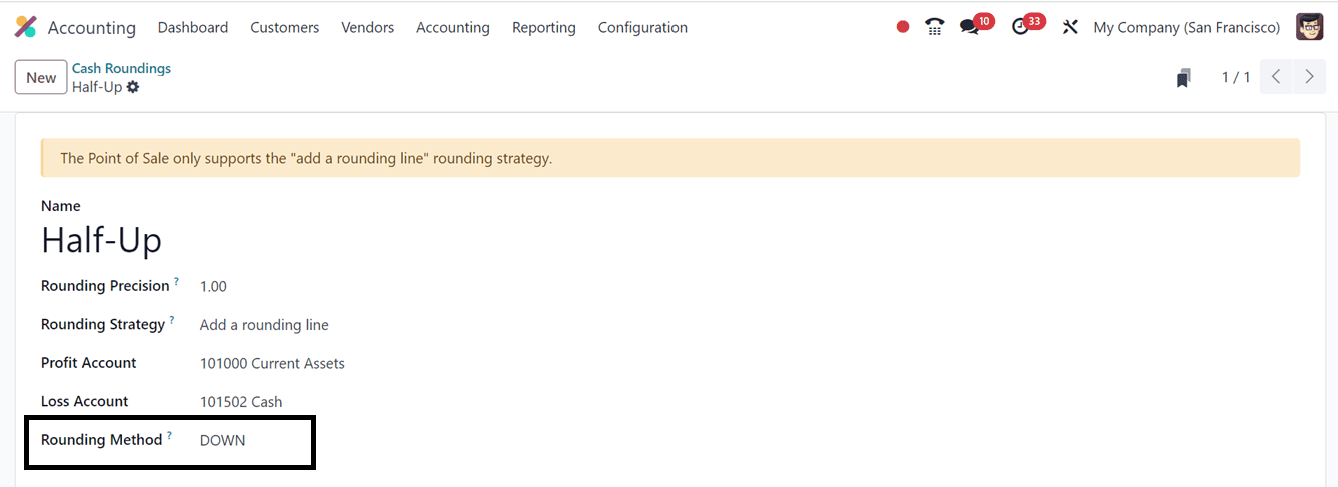

Choosing a Rounding Method

Half-Up

Here, we are choosing the HALF-UP Rounding Method from the configurations window. For example, if the product total is $2.98 and the ‘HALF-UP’ method is used, the amount may be rounded up to $3.30, with the rounded difference displayed in the ‘Rounding Method’ field.

Our accounting database may contain numerous types of cash rounding alternatives. When updating the Invoice configuration window, we have the option to select the appropriate or designated cash rounding technique. Alternatively, we may select the Cash Rounding Method from the Other Info tab, as seen below.

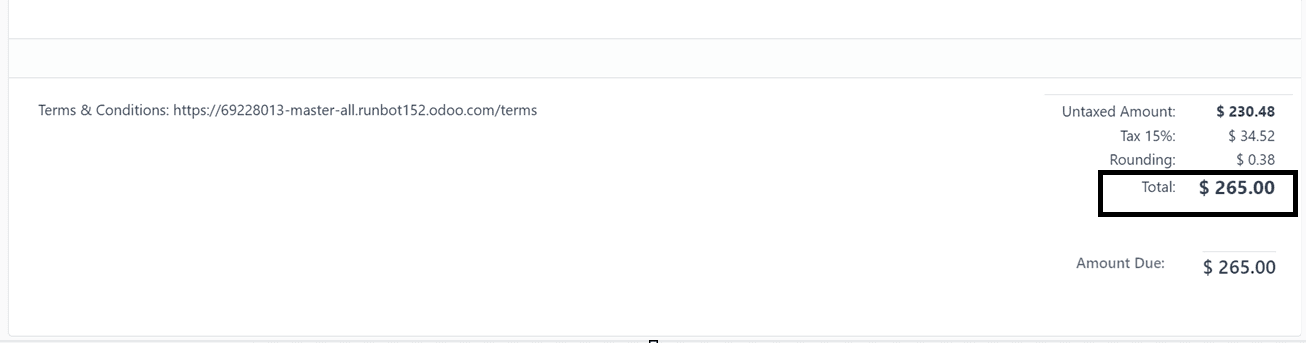

After choosing the cash rounding method, the Rounding will be applied to the Total amount of the invoice products. Here, the total amount, including all the costs, will become $265.38, but it will be rounded to a value with fractional components of 0.5 below. This can be shown at the bottom of the invoice with the exact rounding percentage, as illustrated in the screenshot below.

Then, we can confirm the invoice and move forward to the next steps. You can experiment with different rounding methods, such as ‘DOWN,’ which might round the amount down, or ‘UP,’ which rounds it up. Each method demonstrates how the Odoo 17 Accounting module simplifies cash rounding, allowing businesses to manage their transactions accurately and efficiently with customizable rounding methods.

DOWN Method

Setting the DOWN Cash rounding method inside the cash rounding configuration form will reduce the actual total invoice amount using the mentioned Rounding Precision.

Here, we are going to create another invoice with the same products that we have chosen for the previous invoice but for a different customer and set its cash rounding method.

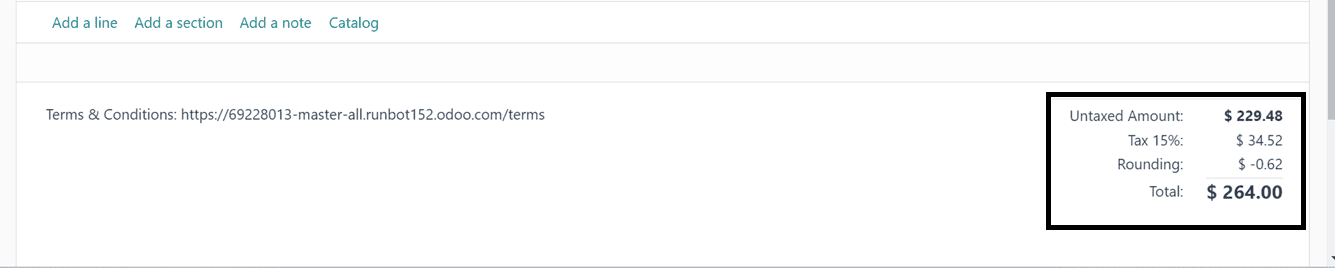

In this scenario, we can see the total amount is rounded down to the specified Rounding Precision of 1.0 using the DOWN Cash Rounding method, as illustrated in the screenshot below.

Next, we can check the UP Cash Rounding Method with some random products for another customer just to know how the cash rounding for different methods works and its effect on the invoice amount. So, we will begin with the alteration of the rounding method to UP in the cash rounding configuration form.

UP Method

This method will round the amount up to the nearest value according to the provided rounding precision. So, I have selected the rounding method, which is shown below.

After that, I created a fresh invoice with the products. It is evident that the whole amount of the products has been rounded here. The screenshot below shows us where the rounding computation is located. The rounding field is located in the invoice amount section at the bottom of the page.

This is how the Odoo 18 accounting system's Cash Rounding feature operates. By keeping precise financial records and tracking the rounding discrepancy separately in the accounting entries, this technique provides transparency.

By automatically rounding up or down invoices or payments to the closest rounding unit, Odoo 18 Accounting's Cash Roundings functionality streamlines financial operations. In nations where there are no tiny denominations, this is advantageous. Companies might set up rounding guidelines to ensure accuracy and transparency. Automation lowers the possibility of potential errors, enhances cash management, and guarantees adherence to regional laws.

To read more about How to Manage Cash Roundings in Odoo 17 Accounting, refer to our blog How to Manage Cash Roundings in Odoo 17 Accounting.