Fiscal Position is an advanced Accounting feature used by the Odoo system. Odoo allows you to configure taxes according to your country's tax policies. It allows you to set Taxes for one time that can be used at any time and you can set in product or product categories and the respective taxes will be applied in the sales orders and invoices. Fiscal Positions play an important role in Business as it is used for applying dynamic taxes on quotation lines or invoicing lines with the customer's tax or fiscal policy. With this feature, you can configure the Product taxes easily and configure the existing taxes on the product and what tax to be applied instead of the existing one in the fiscal position. In the same way, you can change the tax rate on certain customers and if the fiscal position is set to a customer tax it will be applied to products automatically during invoice or quotation creation, and because of the automated nature of the feature, you can save a huge amount of time and energy in the process.

This blog will give you a short description of using Fiscal positions in the POS module of Odoo 14

Managing fiscal position in the POS module is easy. You can set Fiscal points to orders in the Point of sale that is in your Retail shop and you can also set a default fiscal point in the Point of sale module. This is an extremely useful tool for business management with which you can efficiently map taxes and accounts. You can use the feature in shops to effectively map your taxes and accounts and the feature can be effectively used in the Restaurant feature on the POS module because it can help you in managing your restaurant and your customers efficiently. You can use it to apply different taxes to your customers based on whether if the customer eats in or takes away. Taxes can be used dynamically with the support of Fiscal Positions, as you can set any Tax with respect to your product and customer positions in the Tax chain and this can be an added advantage when you are running a business institution with a dynamic nature.

To set this feature go to the Point of Sale option from the Configuration tab of your POS module or click on the shop configuration button and click on Settings and under Taxes click on the Fiscal positions per order and click on the box to activate the feature as shown in the screenshot below.

Click on FIscal positions as shown in the screenshot to have more features on the Fiscal positions and configurations, and you can create new Fiscal positions by entering the necessary details, to do this click on the Create button in the tab and enter the details and the tax details on the Tax mapping and Account mapping; to know more on Tax and Account Mapping click on this link https://www.cybrosys.com/blog/fiscal-position-in-odoo-14

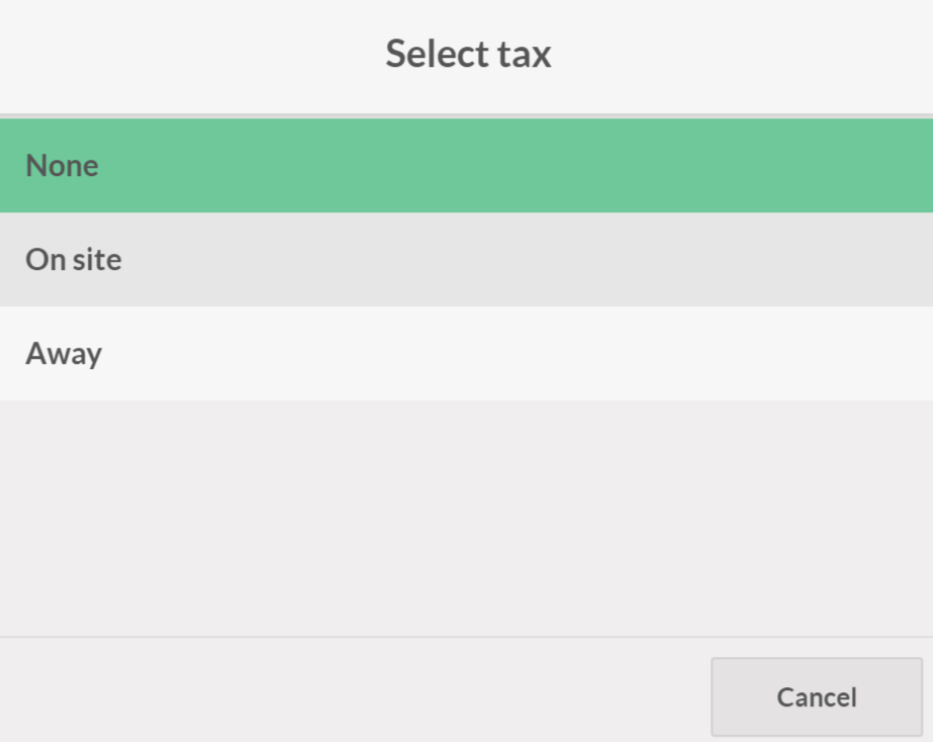

In addition, if you want to set up a default Fiscal Point all you have to do is go to the Point scale option on the configuration tab in your POS module and enable Fiscal Position and now choose from the dropdowns to set the default one. After the activation it is easy to use the Fiscal feature, all you have to do is click on the Tax button or the default button from your POS interface and choose the Fiscal Position you need for the current order as in the screenshot given below.

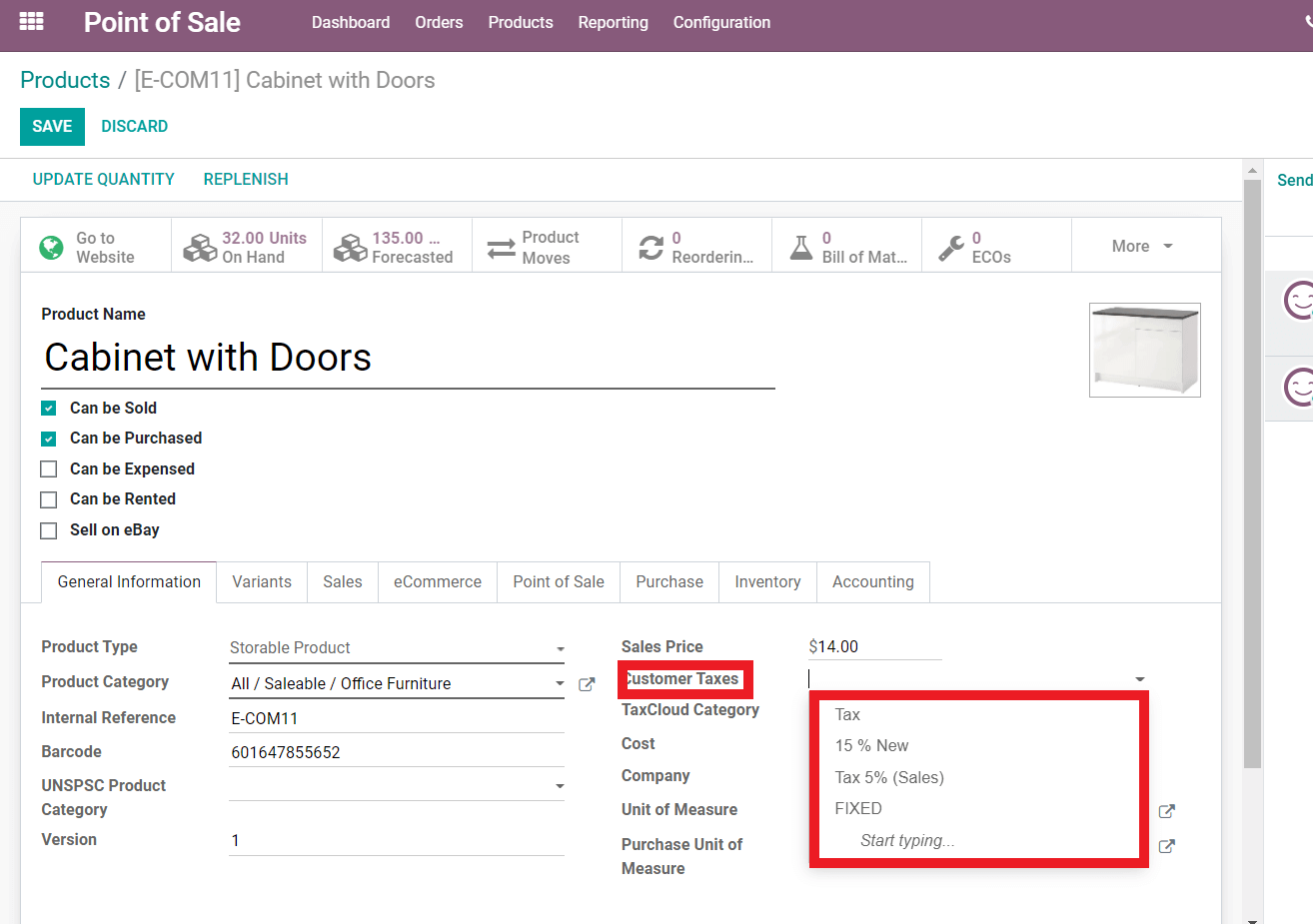

It is important to note that you have to set taxes on the product before billing out or the POS interface won't show the tax details. To set a tax on a product go to the Dashboard of your POS module and click on Products from the Product tab and choose the product that you want the tax to be added to as shown in the screenshot given below.

You have to be careful about the product categories that you have set earlier as the POS module will only detect products based on the categories that you have restricted the module to. You can choose whether to opt for a Product category or not either way the POS module works strictly based on your configurations. After the payment, you can see that the tax percentage will be printed on the product bill for your customer to review.

Fiscal positions is an advanced tool for effective Tax management in Dynamic business surroundings. You can configure the entire tool from the Invoicing module of Odoo 14. The feature has its roots all over your Odoo system and as the Odoo is highly integrated with nature you can work seamlessly in the Modules. The POS module uses Fiscal Positions in its own way and every other module uses the feature in the respect to their functionality. The Feature depends totally on the customers and the country in which the system is located and you can use the dynamic working nature of the feature to assign appropriate taxes with respect to your company's policies and also ultimately to the policies of the country in which the Business is running.

You can personalize the tax system of the products with the help of the Fiscal Positions on Odoo. You can configure the taxes on a particular product or a set of products for certain customers and manage the system effectively. You can set the taxes on many criteria's and Odoo gives you enough space for setting and configuring the criteria for customer Tax management and you can set the bar to any criteria that you prefer and usually these criteria satisfies the policies of your business or the tax policies of your country and again it totally depends upon the customer and the product and the quantity of the product that the customer has opted for and in each case the tax rates changes with respect to the product and the volume or the quantity where the feature Fiscal positions come in to play.