The tax is unique for each state or country since their laws are distinct. There would also be a difference in currency prices and tax rates when making a transaction. To make it simpler, Odoo features a multi-company and multi-currency feature.

Many of the organizations have clients from different countries. Each of the countries has its own tax rules and configurations. Thereby, tax mapping to their own country tax is an inevitable factor in business across the world.

Thus the Fiscal positions enable us to create a bunch of rules to change taxes and accounts used by a transaction automatically. They can be enforced in several ways: applied automatically, depending on certain rules. or to be added manually to a transaction.

Tax mapping

To configure and use the tax mapping technique, firstly install the accounting module. The fiscal position is configured in the accounting module. Then later, fiscal positions can be applied to customers and vendors.

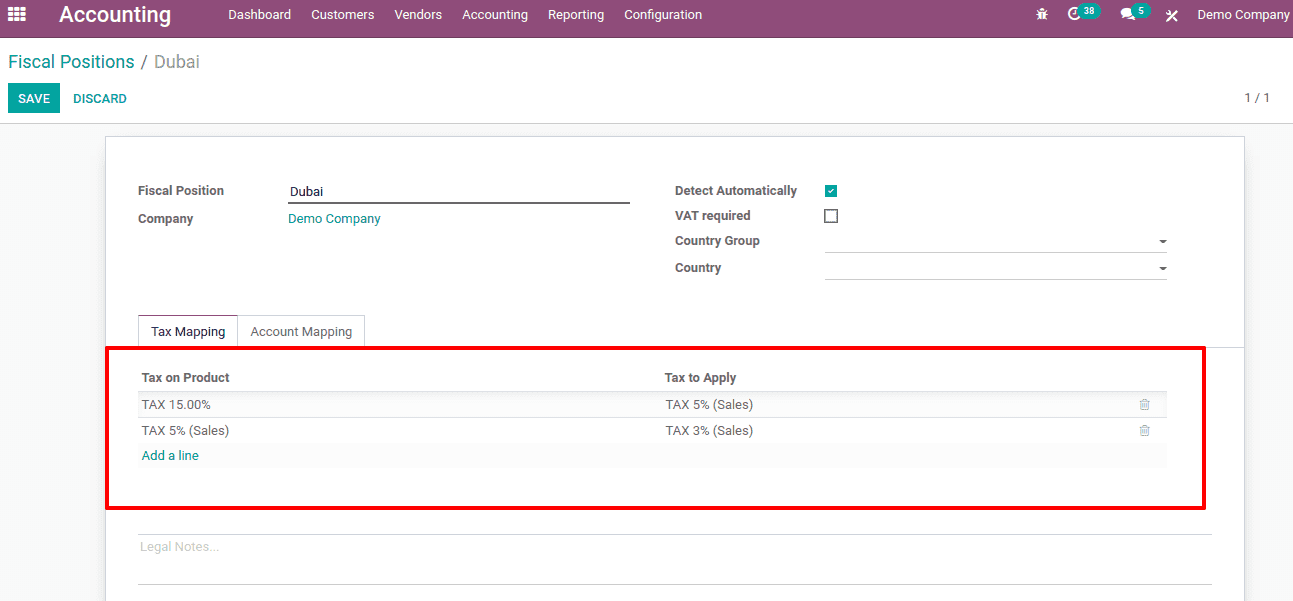

Let us create a Fiscal position. For that Go to Accounting module> Configuration> Accounting> Fiscal positions and then CREATE.

Fill the form. Add the name of the fiscal position. Choose the company to which this fiscal position belongs to. To apply for the fiscal position automatically for certain countries, enable the option 'Detect Automatically' and add the country group and country.

Under the Tax Mapping Tab, we can set rules like which tax on the product should be mapped to another tax. So 'Tax on product' is the tax that is applied on the product. While 'Tax to apply' is the tax that should apply to the product instead of the default product tax.

Here 'tax on product' is 15% and 'Tax to apply is 5%. This means when the product with 15% tax is selling to a customer and if the customer belongs to the fiscal position 'Dubai', then the tax is automatically taken as 5%.

Thus the fiscal position is created and let us apply this fiscal position to some customers.

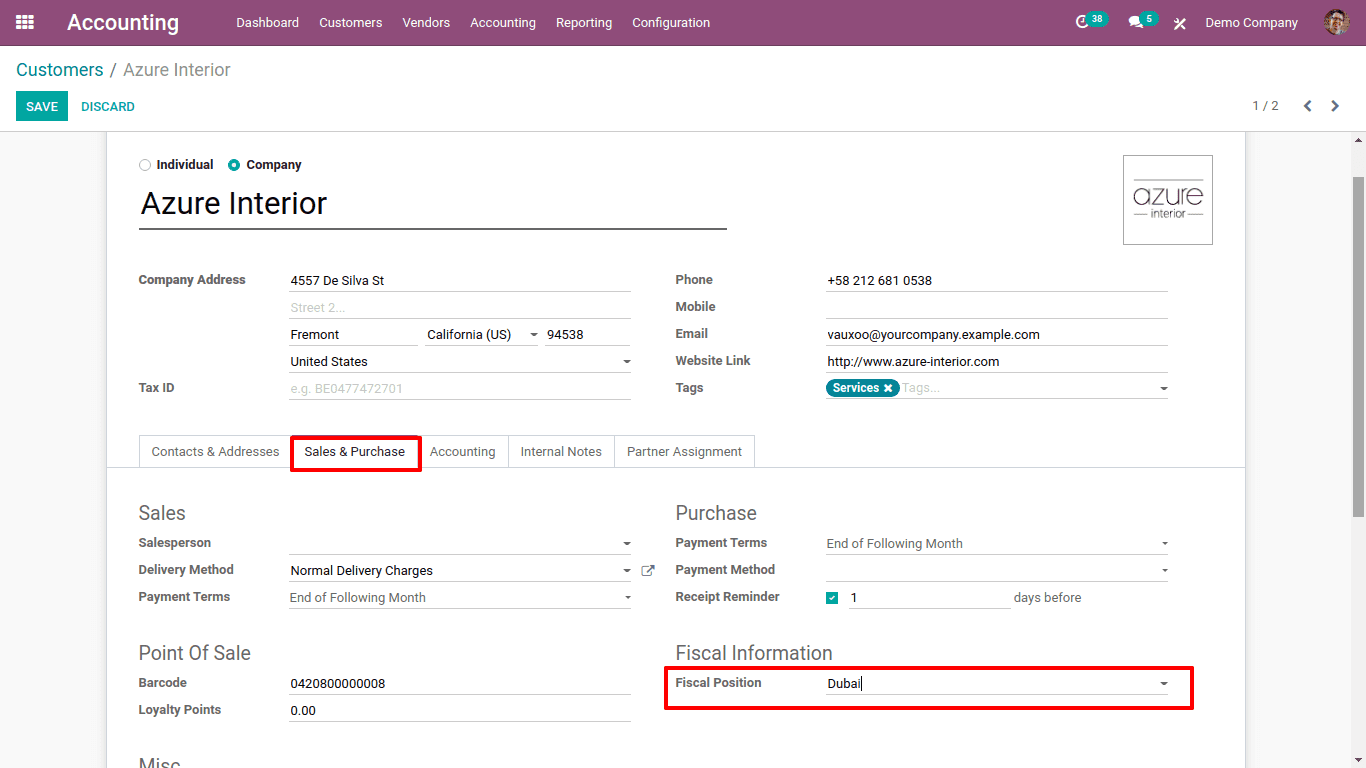

In the customer form, under the 'Sales & Purchase' tab, the fiscal position is set. Now Save changes.

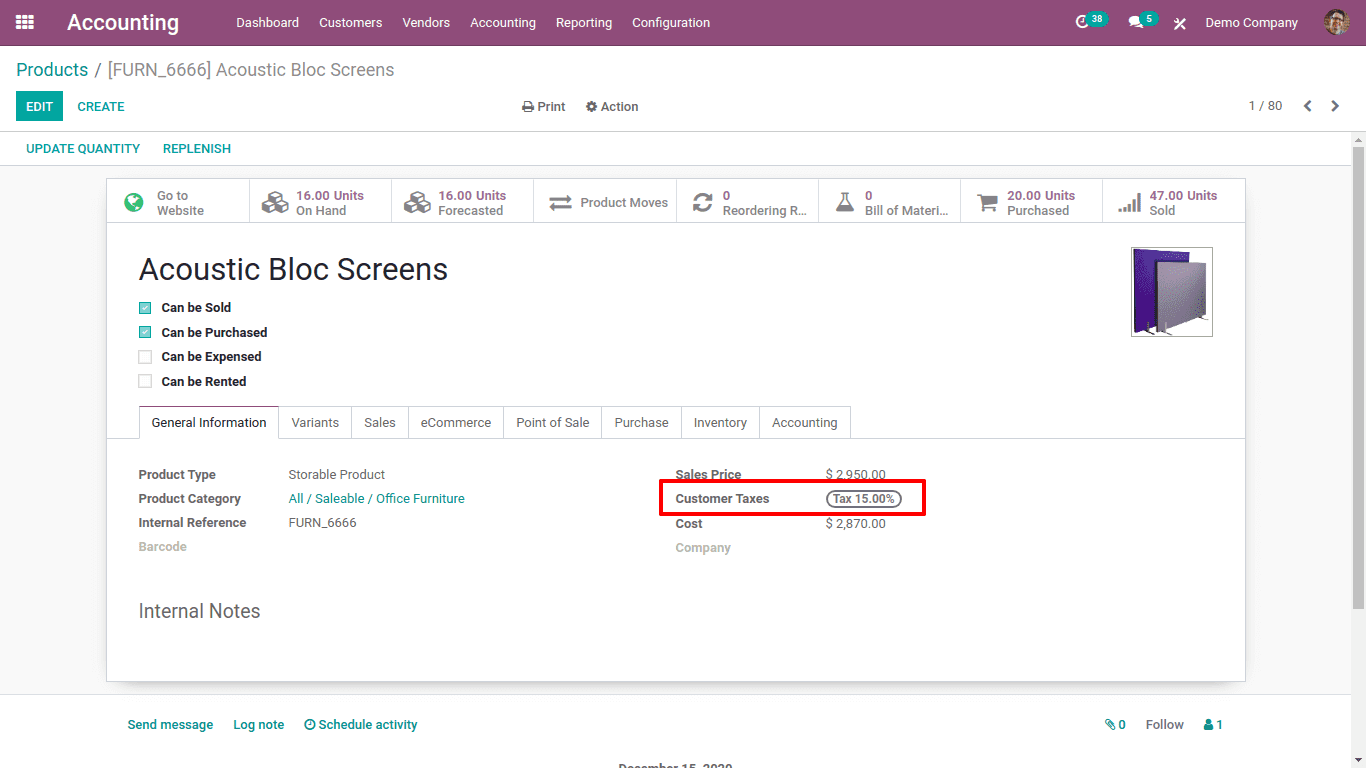

From now, when sales happen to this customer, it will take the tax depending on the fiscal position. Consider the product 'acoustic block screen' whose customer tax is 15%.

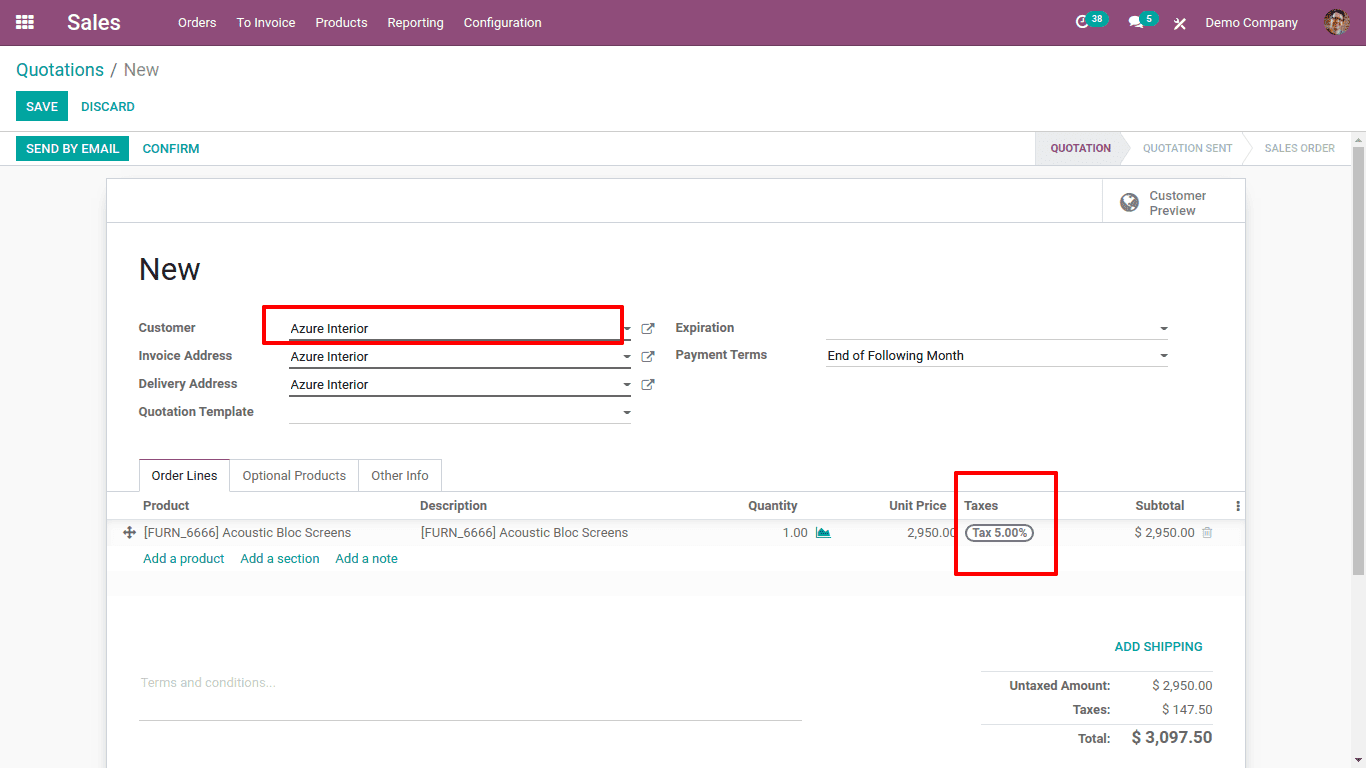

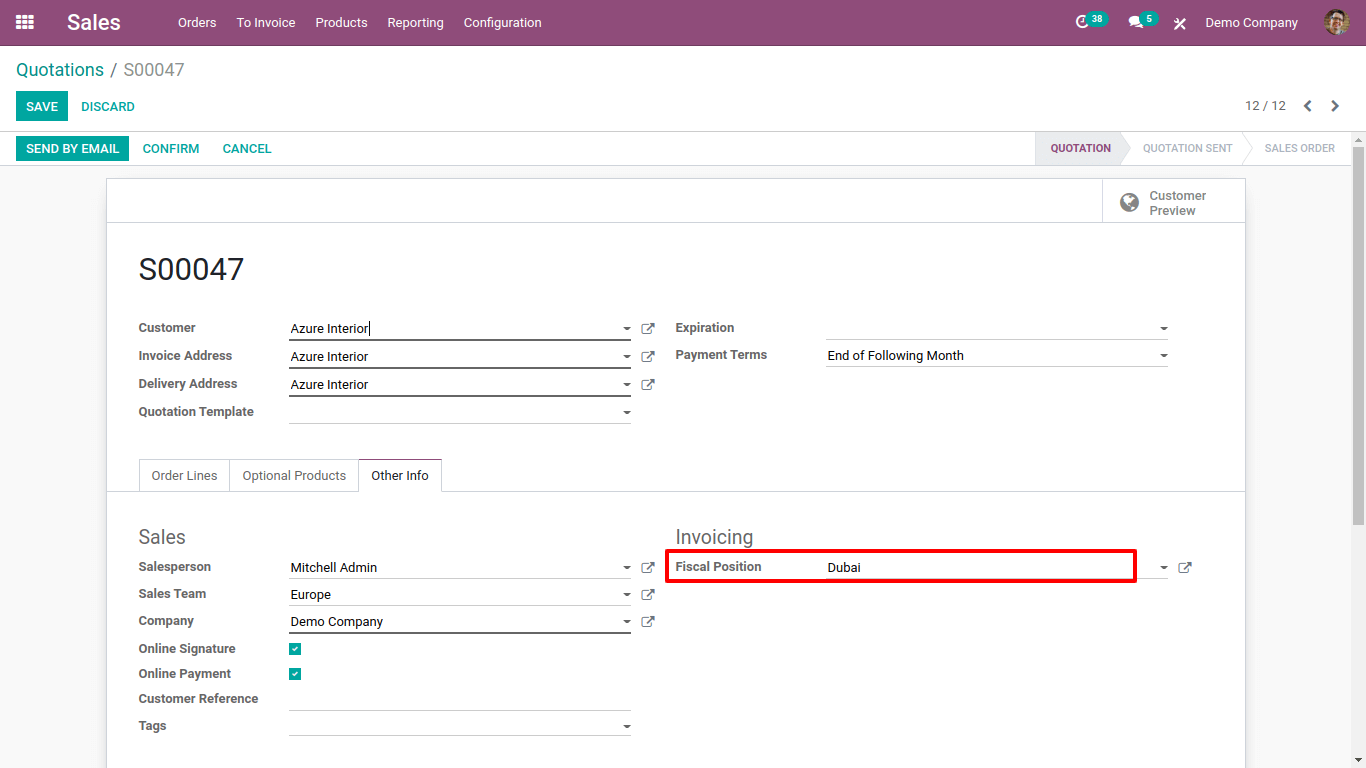

Now go to the sales module and create a sales order for customer 'Azure Interior'. The product 'Acoustic Block screen' is added to the sales order.

So the tax is automatically taken as 5%. This is because the fiscal position is already set to the customer. Under the 'other info' tab, one can see the fiscal position used.

Thus the tax is mapped from Tax 15% to Tax 5% with the fiscal position.

Account Mapping

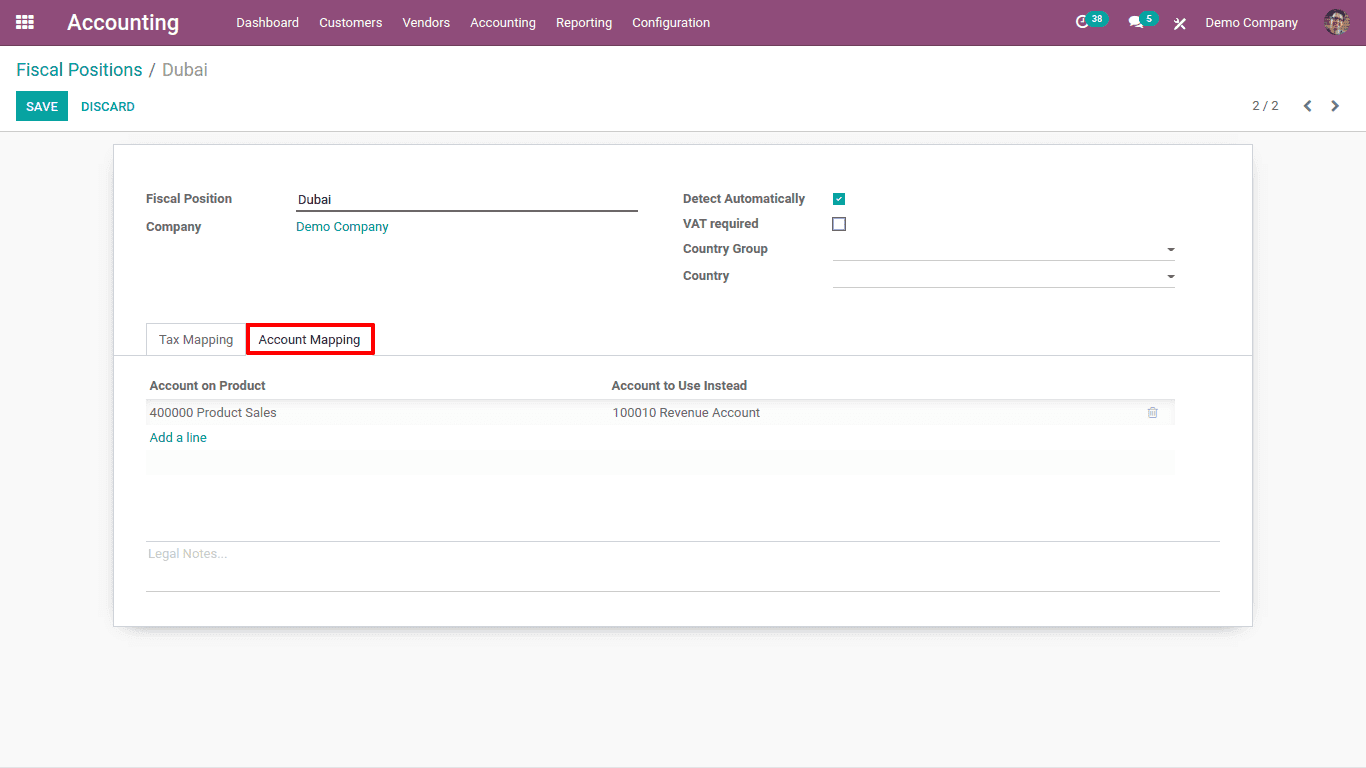

Another feature of the fiscal position is account mapping. As tax is mapping, accounts can also be mapping based on country or customers.

Under the 'Account Mapping' tab, one can mention which account is mapped to another account. 'Account on Product' is the account mentioned for the income account for the product.

Sometimes the income created from certain customers from different countries needs to be accounted for in another account. For such circumstances, we can use this account mapping. So, that account can be mentioned in 'Accounts to use instead'.

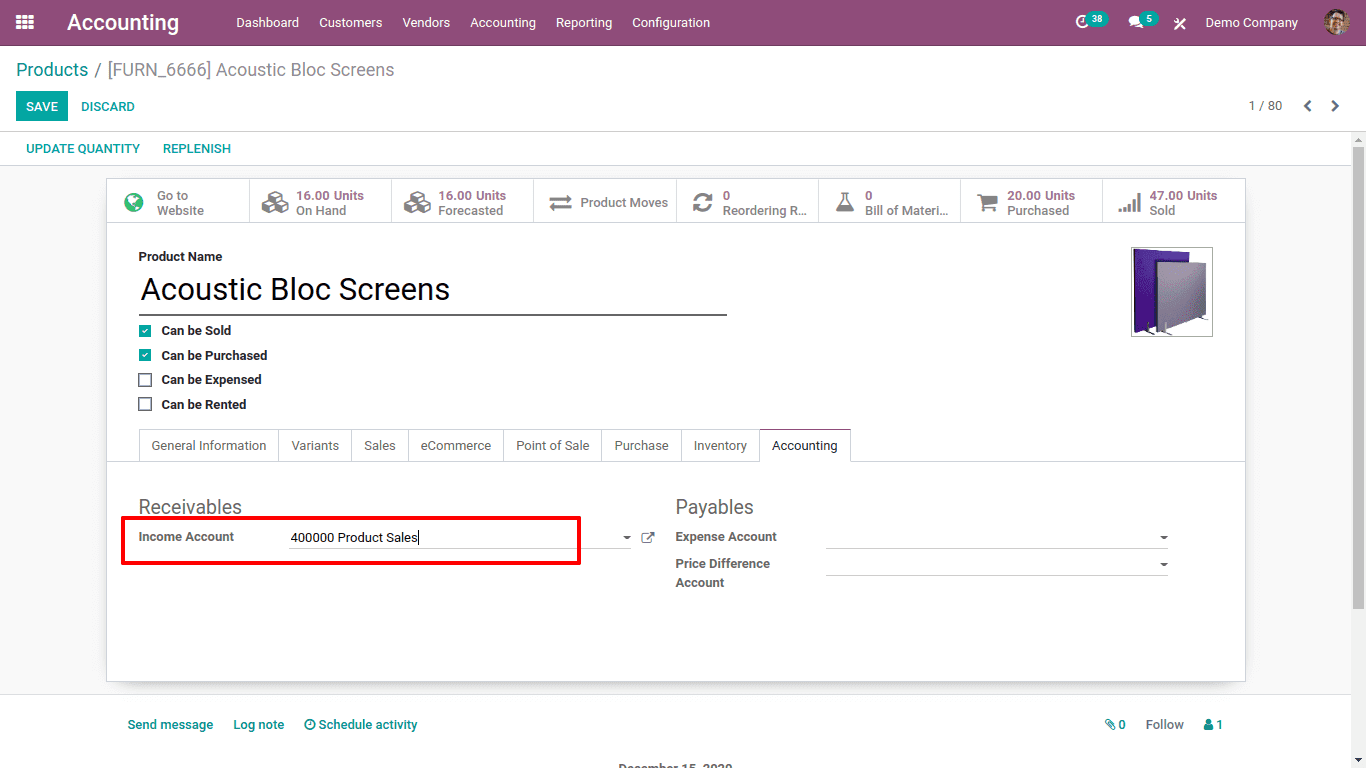

Suppose for the product 'Acoustic block screen' the income account is set as 'Product Sales'. So the income created by this product will be recorded in the account 'Product sales'.

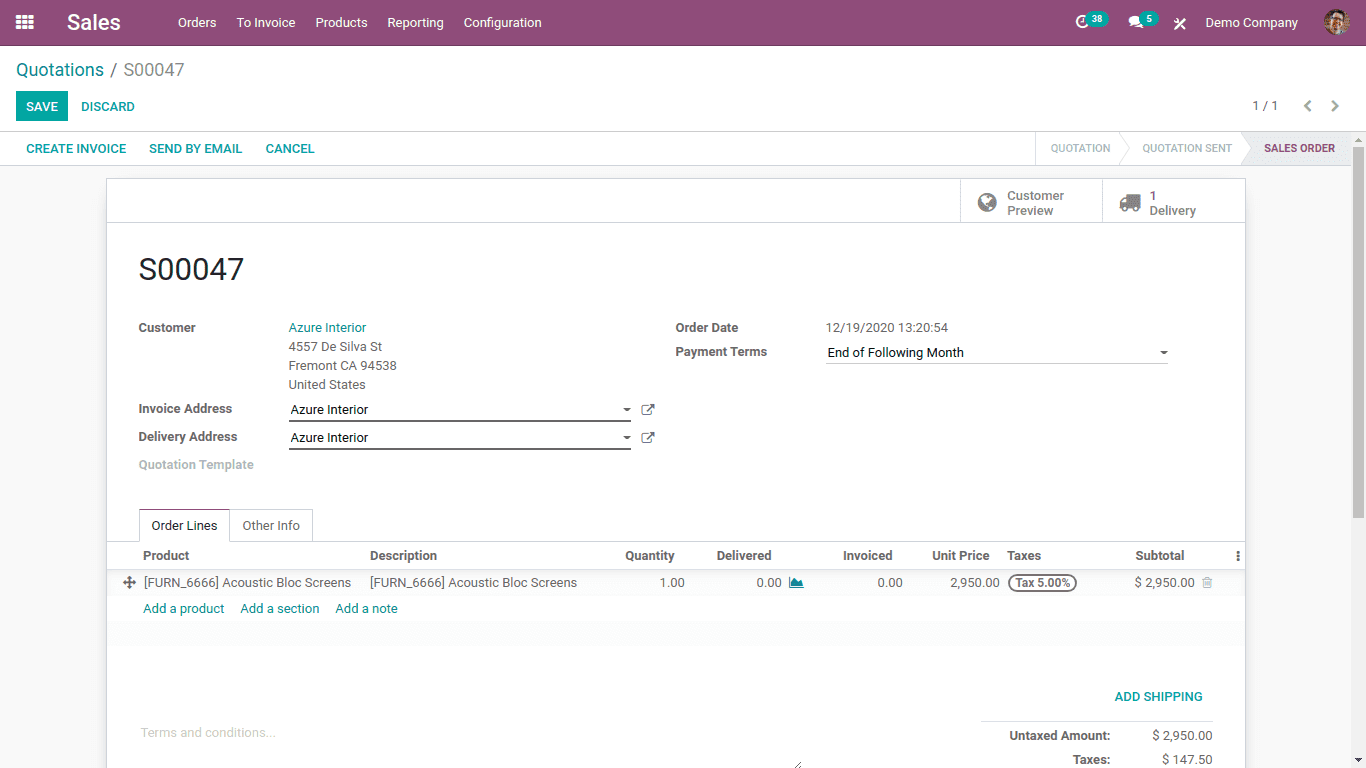

Now assign the fiscal position to some customer and create a sale order for him for the product 'Acoustic block screen' and confirm.

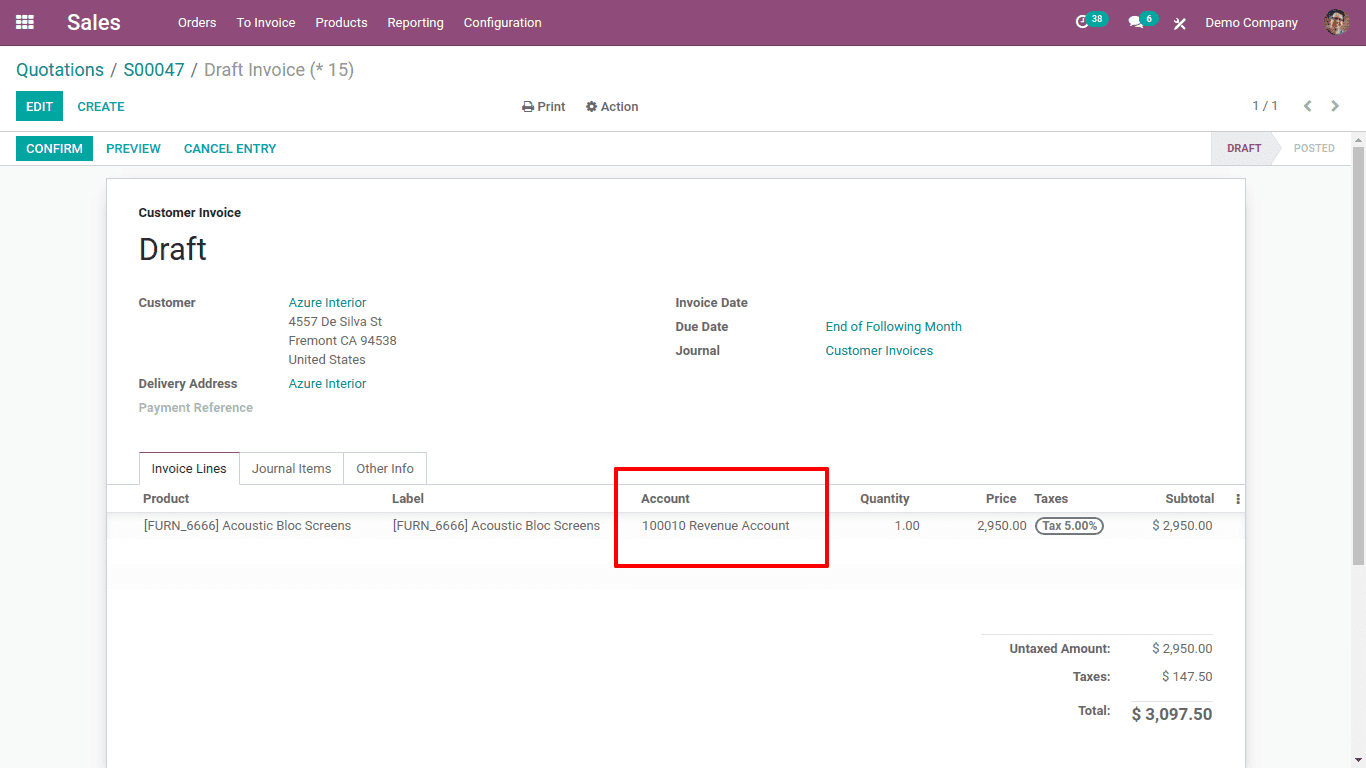

Now create the invoice for the order.

Here one can see the account as 'Revenue Account'. The income account we have given for the product was 'Product sales'.

Since the customer 'Azure Interior' uses the fiscal position dubai, where we have set the account mapping rules. For this customer 'Azure interior' whenever a sales happen for a product with income account 'Product sales', the income account will map to 'Revenue account'.

Thus the account is mapped from 'Product Sales' to 'Revenue Account'.

This is how tax mapping and account mapping can be done by setting the fiscal position.

Refer to our previously Published blog to learn on How to Configure Taxes in Odoo 14