Closing the accounts and the ledgers at the end of the year is an unavoidable task for all business organizations. As the closing of the ledgers is done for the financial years there may be due amounts liable to the company to pay or to be acceptable. These payments can be neglected or certain terms on certain conditions may be discussed with the customers and the vendors.

This blog will provide information on

How Odoo fiscal year settings works

How to set up a user as an advisor

How to close an Odoo fiscal year and it affects the platform

How Odoo fiscal year settings works

The Odoo platform allows the user with the option to perform their business based on the fiscal year terminology. The salient feature of the methodology in Odoo is that the user can set the fiscal year-end date, the fiscal year should not be a year but can be less than a year and be based on months and weeks. The various settings while managing the fiscal year are not accessible to the user but it can be modified and customized by the advisor in the Odoo platform. There is a concept to be made clear while working in Odoo that the adviser has more power than the user and all the operational settings which cannot be accessed by the user can be accessed by the advisor.

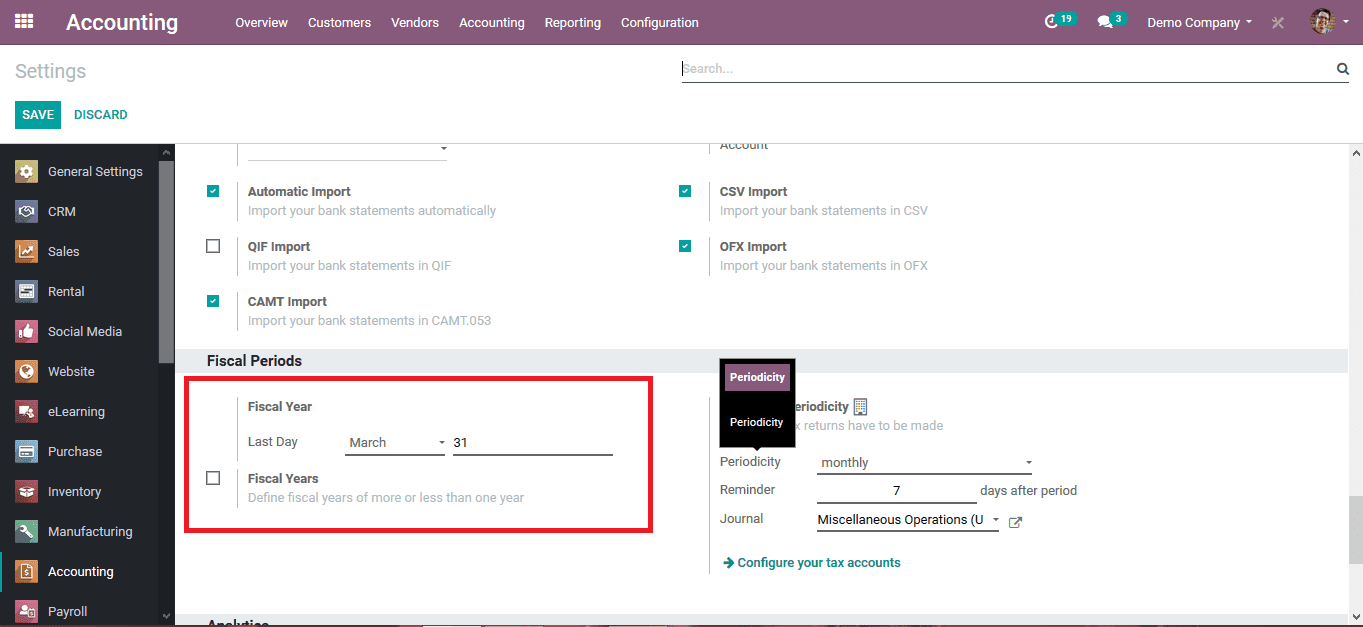

The fiscal year settings can be changed in the settings menu of the accounting module. The user is provided with the provision to apply the last day of the fiscal year and the month. The first day of the fiscal year is set automatically as the next day of the end date of a fiscal year. The Odoo platform provides the provision to set up the fiscal year dates since it's been used in various regions and countries of the world where the financial year varies from one another since Odoo is a multinationally used Software this option to set up the financial year seems to be mandatory.

The user can select the fiscal year check box if the user wants to define the fiscal year to be less than a year and be based on months, weeks, or days.

How to set up a user as an advisor?

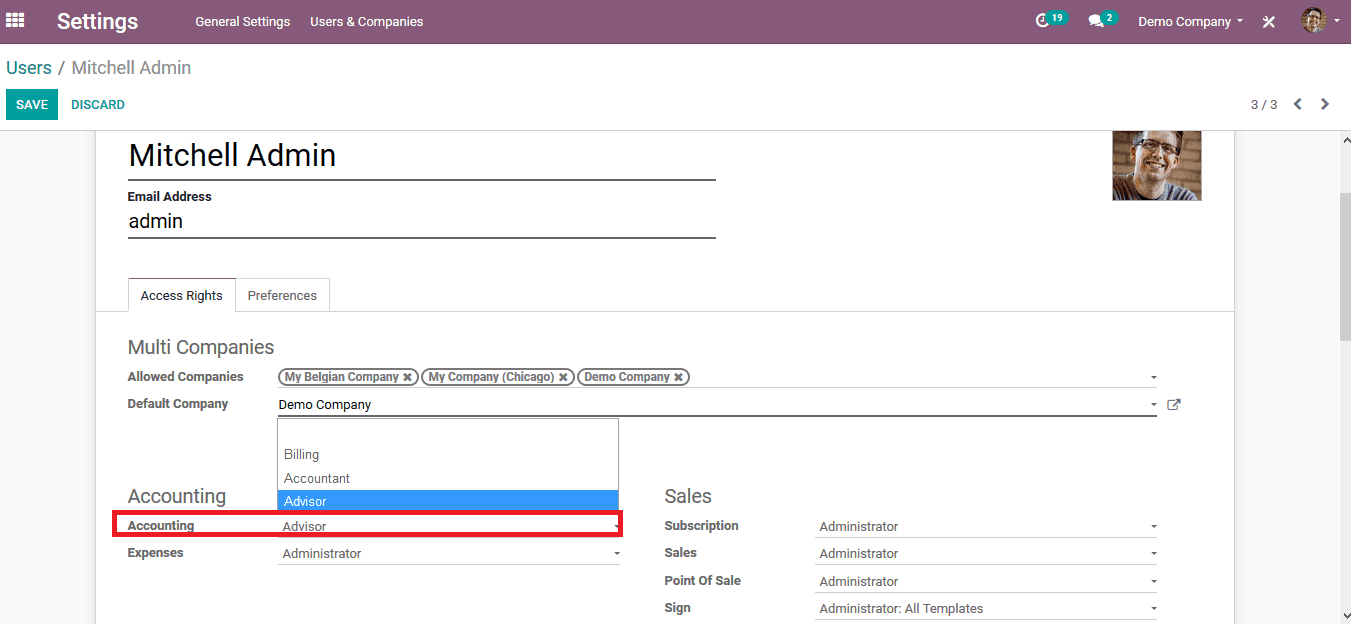

Since certain Options for the fiscal year settings are only available in the advisor mode of Odoo the user should allocate the accounting privileges to the advisor. The operator privileges in Odoo can be managed to the settings module of the platform. From the user's and companies' settings menu select the respective person to be assigned as the advisor to the module. From the access rights menu of the respective persons, the dashboard selects the accounting option.

The user can view the default options available as the billing, accountant, and advisor. The user can select the respective option to which the person should be allocated to. For operations such as changing and meaning fiscal year settings, the user should select the advisor mode for the responsible person since certain options are only available in the advisor mode.

How to close a fiscal year and it affects the platform?

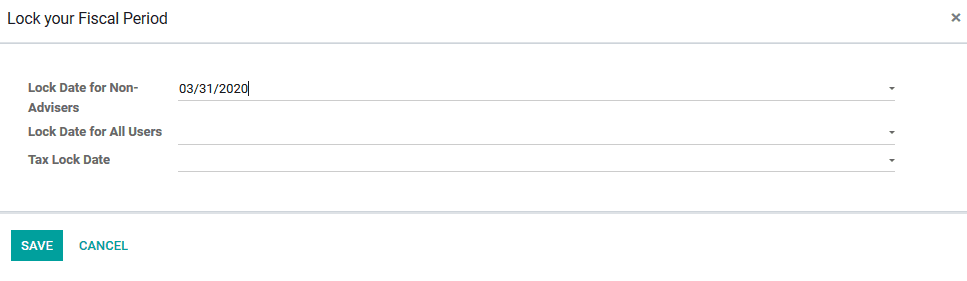

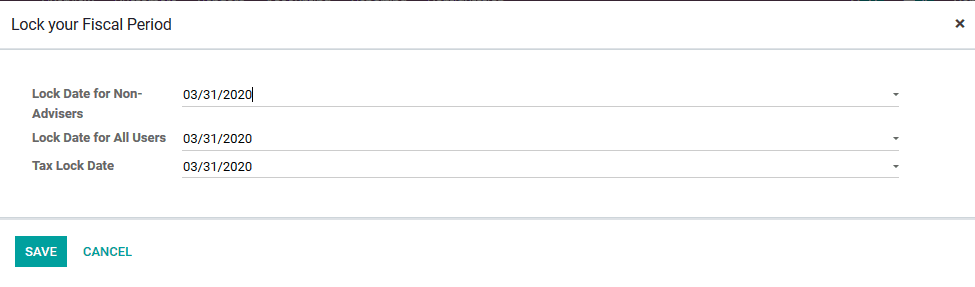

If the advisor settings are changed when the respective person logs into the platform he would be able to change various fiscal year settings. As the advisor to close the fiscal year initially the closing date of the fiscal year should be set up. Select the lock fiscal year options available in the accounting dashboard. On selecting to fiscal year locks the pop-up window as shown below is depicted. Select the fiscal year dates for the non-advisors and save it. The fiscal years for the other users can be set up upon performing the closing action.

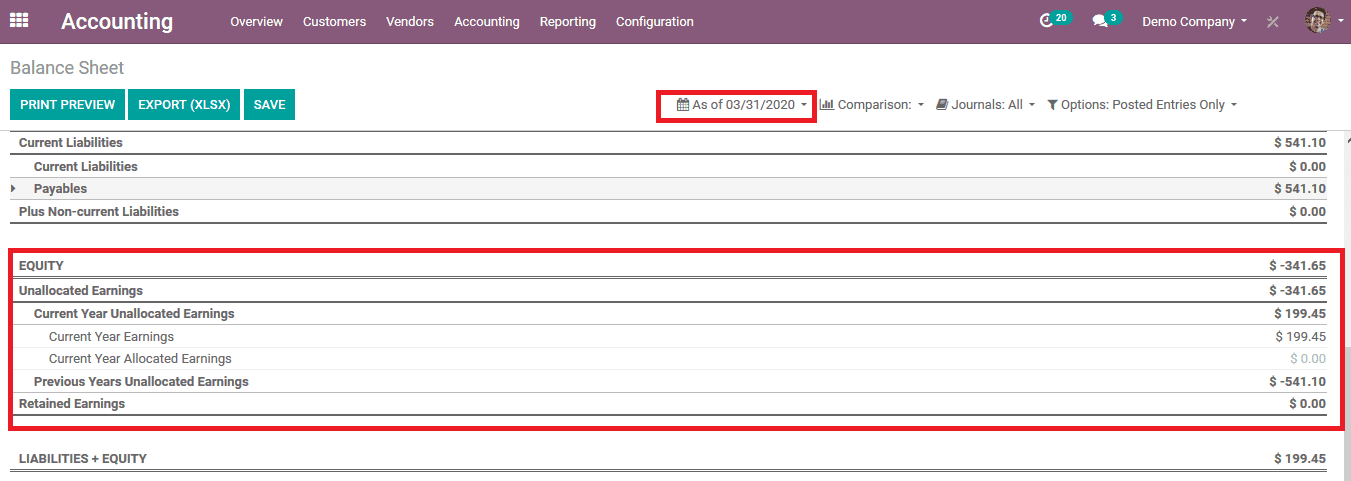

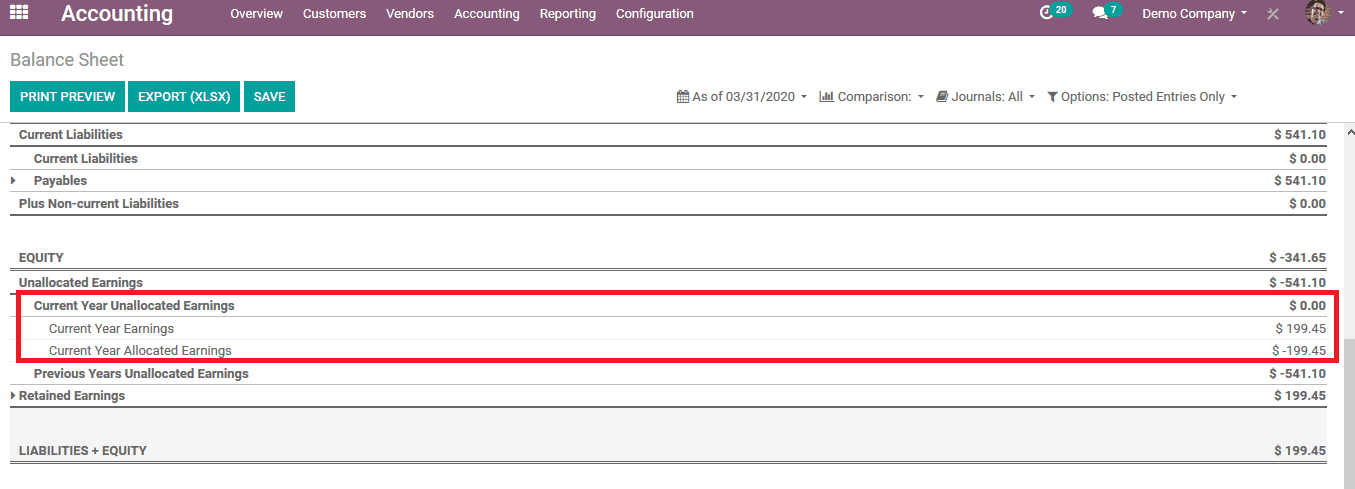

In order to close the fiscal year, the user should determine that there are no existing unallocated earnings to the company. To ensure that in the balance sheet menu of the reporting dashboard set the filtering date as the determined date as the fiscal year closing. Scroll down to the equity section of the balance sheet and check for the unallocated earnings. As you can view in the below image there is an amount which is unallocated earning in the current fiscal year. The user should clear or allocate the unallocated earnings available to a ledger or an account before closing the fiscal year.

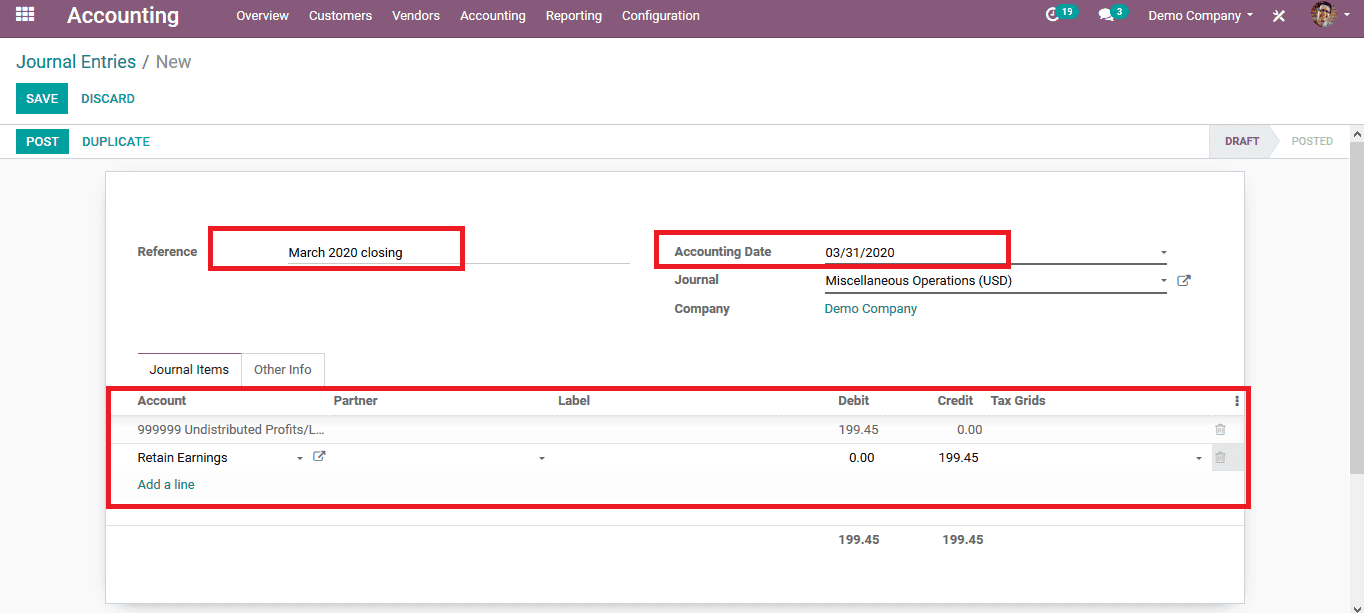

In order to allocate the earnings to an account, the user should create a new journal entry from the account journals menu of the accounting dashboard. Provide the account reference and the date in which the account should be set up. The user should consider that the accounting date should be set on or before the fiscal year closing date to allocate the earnings. If not the unallocated earnings will be carried on and won't be able to close the fiscal year.

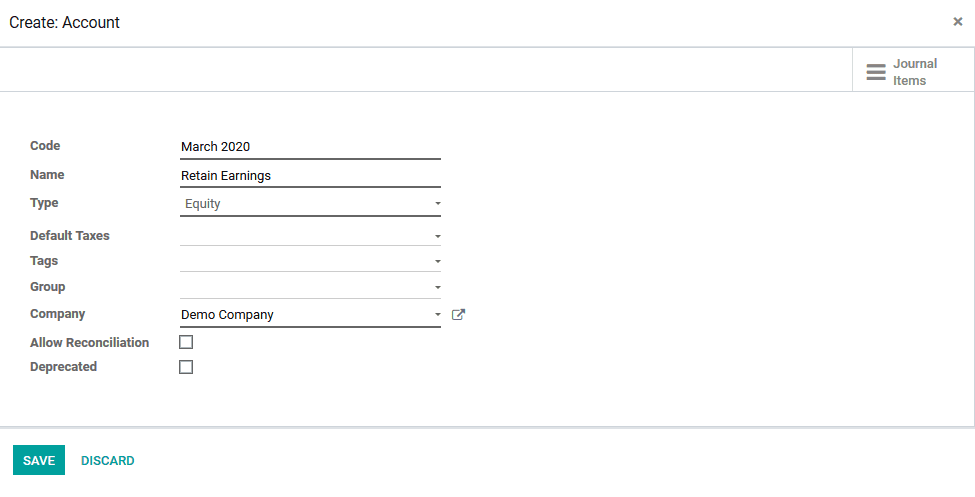

In order to set a journal entry, the user should create or allocate an account to it. A new account is to be created to retain the unallocated earnings. The only condition in the account should be that the type should be equity.

The undistributed profits and losses account is allocated to the journal to debit the unallocated payment from. The account undistributed profits and losses is an auto-create account in the Odoo platform to debit and credit the unallocated earnings and losses. The user modifies the unallocated earnings is debited from the undistributed profits and losses account thus the retained earnings account which is the newly created equity account is credited with the same amount. Now there are no unallocated earnings in the mode for the closing of the fiscal year.

Now as the user views the balance sheet information up to the fiscal year closing date he/ she can view that the current year earnings are deduced from the total with the same amount by the current year allocated earnings.

The fiscal year is successfully closed upon following the above steps and the advisor can now allocate the fiscal year closing dates for the users. Select the lock fiscal year option available in the accounting menu and change the lock dates of all users to be the same as that of the non-advisors and save it. Now no user of the platform will be able to modify the closing dates of the fiscal year since it's been set as a respective date by the advisor. As the advisor has more power in the Odoo platform no user will be able to change the settings.

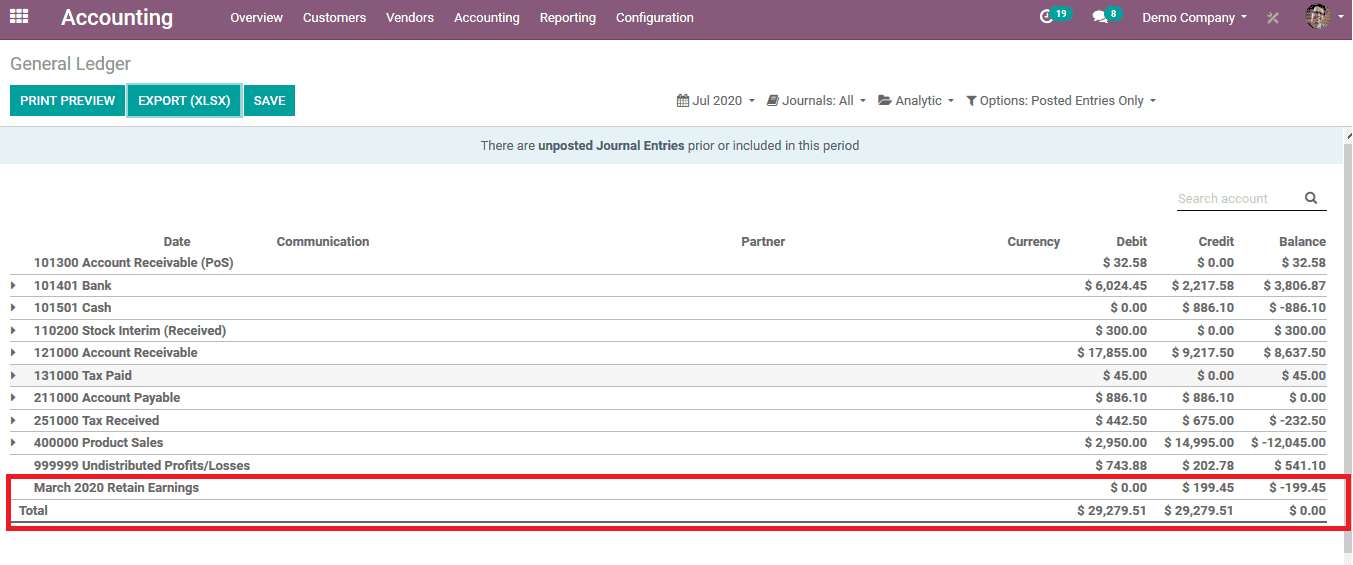

If the user wants to view the report of the transactions of the fiscal year after closing it the user can select the general ledger menu from the accounting menu of the module. As in the below image depicts the general ledger for the and the credit and the debit for the time period will be tallied and the balance will be null for the fiscal year in the end.

The functional set up in the Odoo platform to set the fiscal year dates comes in handy as the platform is being used in various regions and countries. And the financial year or team may vary between each other so having a fixed financial year or period will not do the job. The platform is also keen on the modification of these fiscal year settings only allowing the advisor to make changes.

Take a look at how to configure and use a fiscal position in the sales module and accounting module by referring the blog: Fiscal position in Odoo 13