In Odoo 18 Accounting, reports are crucial for giving businesses a clear picture of their financial situation and assisting them in making wise decisions. By providing precise and thorough records of financial transactions, they make it easier to comply with regulatory requirements. Reports also make performance tracking easier, which helps companies see trends, control cash flow, and improve operations.

Partner reports, which offer information on unpaid invoices, payments, and credit balances, are essential for tracking financial connections with suppliers and customers in Odoo 18 accounting. They assist companies in preserving openness, enhancing cash flow control, and cultivating improved partner communication. These reports also make it possible to accurately track partner performance, which facilitates strategic decision-making and the development of more solid, trustworthy alliances.

Aged reports in Odoo 18 accounting are crucial for tracking overdue receivables and payables, helping businesses manage cash flow, and limiting the risk of bad debts. They provide a clear overview of outstanding sums categorized by aging periods, enabling prompt follow-ups and enhanced financial planning. There are two types of Aged Reports in Odoo 18. Aged Payable and Aged Receivable.

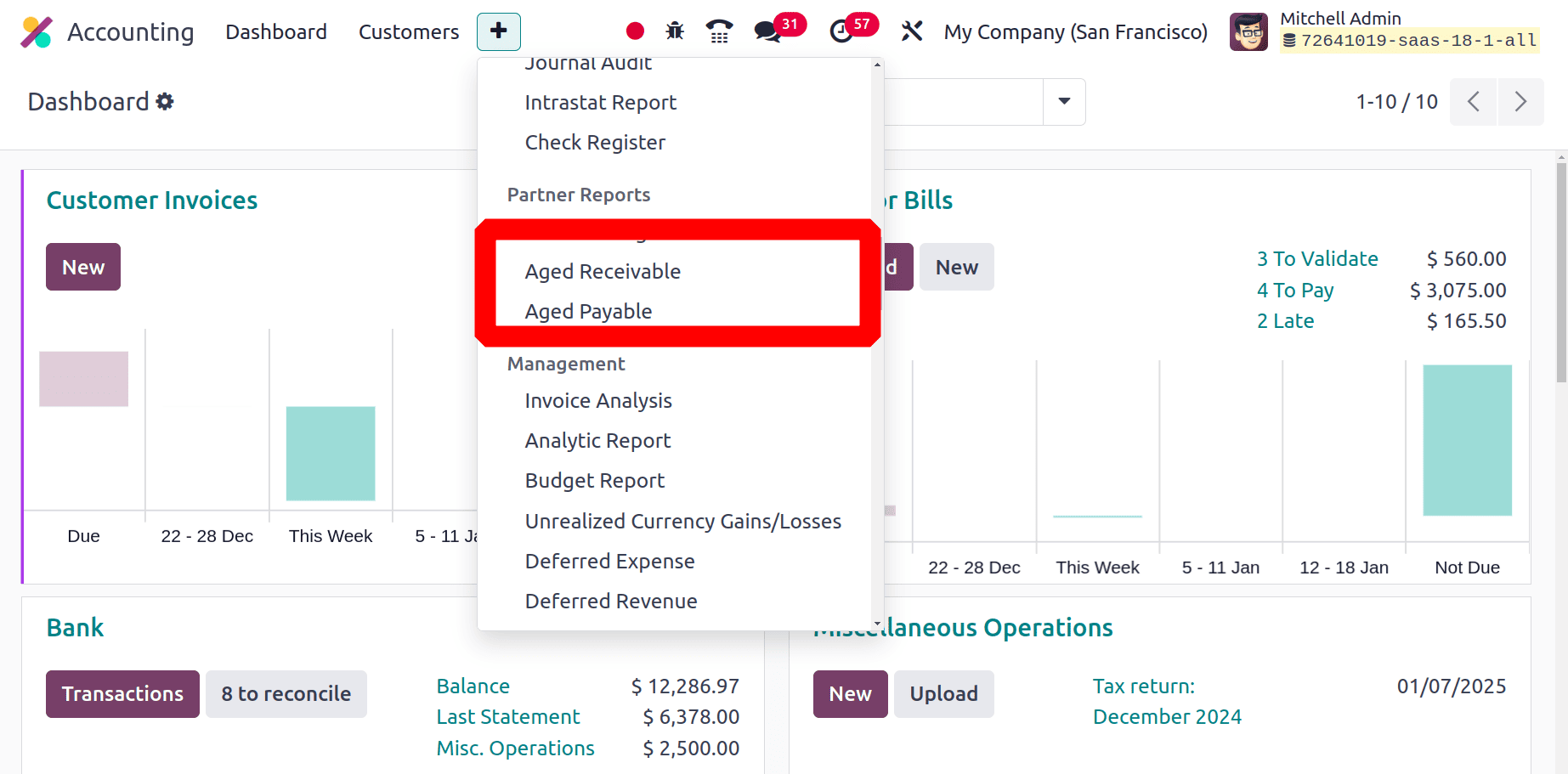

The Aged reports are placed under the Partner reports as shown below.

Aged Receivable

Payments that are not paid for by a client or partner are categorized by the company as old receivable payments. Even after the predetermined payment period has passed, the delayed amount will be considered an aged receivable.

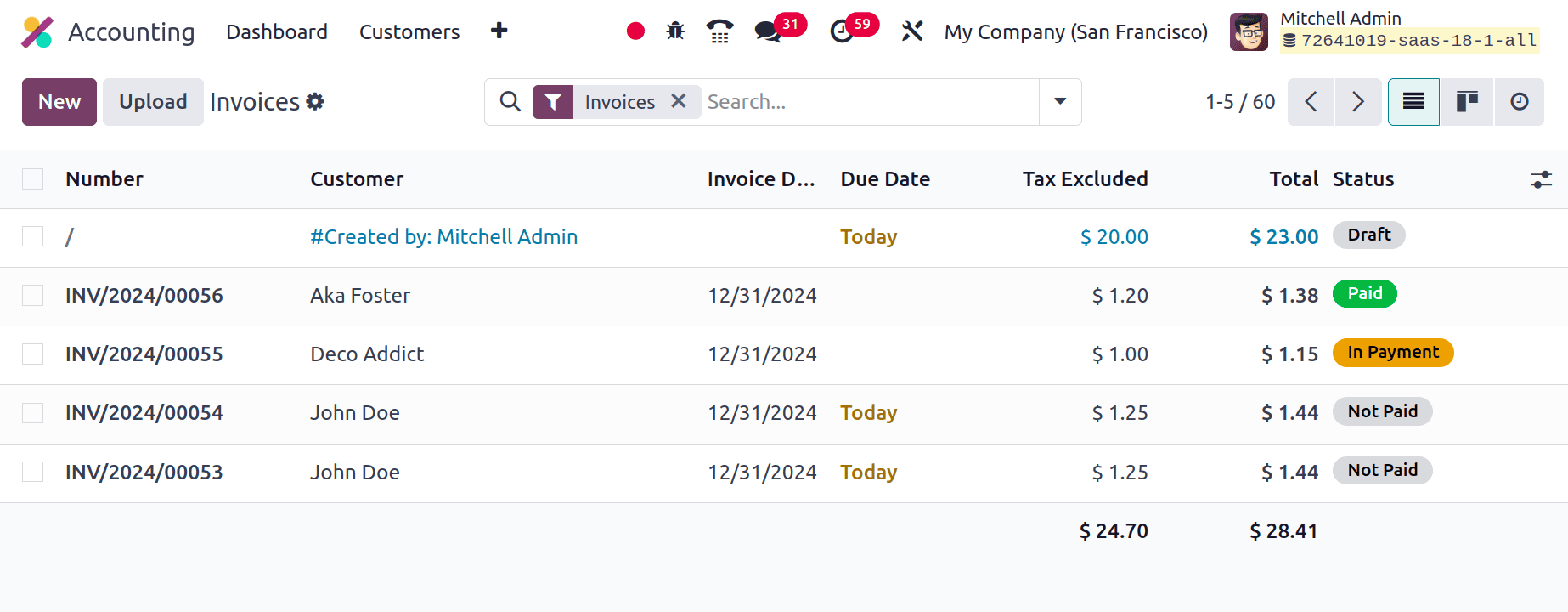

Create a new Invoice to demonstrate the use of the Aged Receivable report in Odoo 18. To add a new Invoice, click on the Customer menu. Details like Reference, Customer name, Invoice Date, Due Date, Tax Excluded price, Total, and Status are shown as a list.

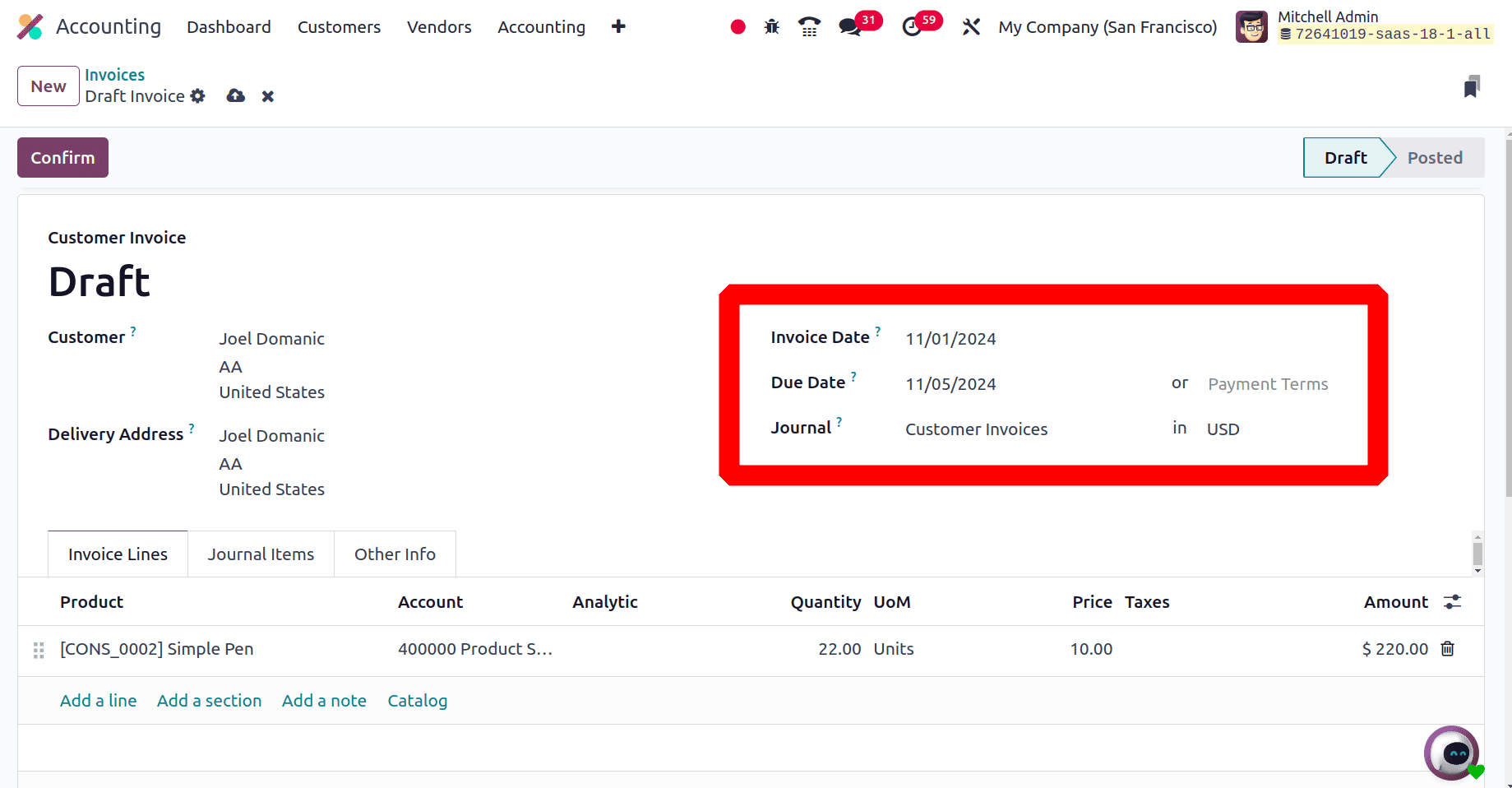

To add a new one, click on the New button. Add the Customer's name first. Then the other details like Invoice Date, Due Date, and Journal. Inside the Invoice line, the user can specify the details of the product like the product name, quantities, and unit price. Then the total price is also visible there.

The invoice date is the date at which the invoice is created and the Due Date is the date at which the invoice amount is paid. The chosen customer is Joel Domanic and chose 22 quantities of Simple Pen. The invoice date is November 1st and the Due date is set as November 5th. Let's confirm the invoice first.

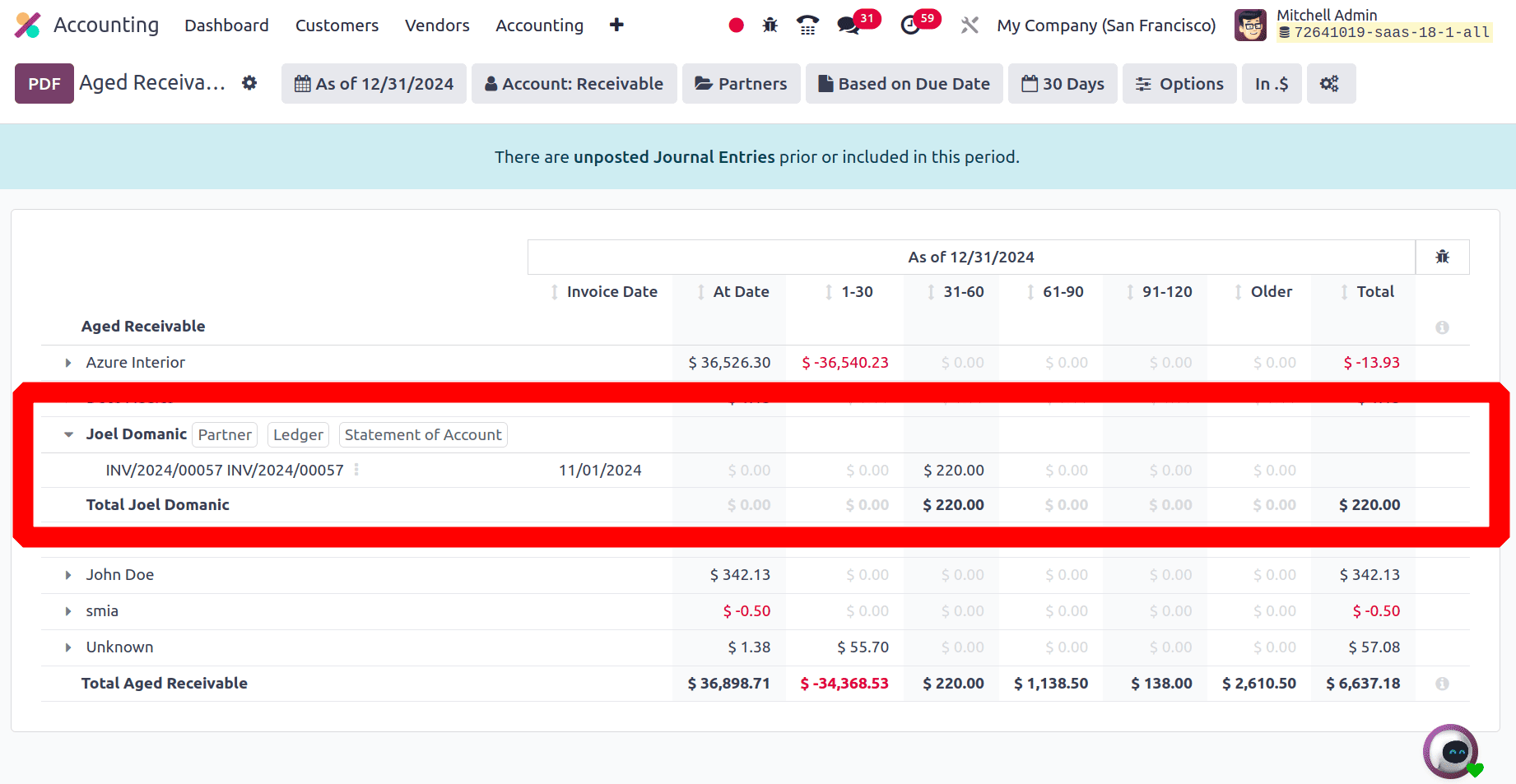

Here the payment date of the invoice is already passed. Check the Aged Receivable Report. For that, choose it from the Partner report.

All of the partner-related entries will be shown and available through the different drop-down arrow options. When the arrow is lowered, the invoice details for each of their older receivables will be shown independently from the partner or client information. To further indicate the amount to be paid if the payment is prolonged based on the duration, the Report Date, Journal Details, Amount Involved, and Expiration Date are all shown as 1- 30, 31-60, 61-90, 91-120, and older, respectively. At the end, the total amount owed will also be displayed. The Aged Receivable reporting option defines all Aged Receivable items of the partner.

Aged Payable Report

The Aged Payable reporting feature in Odoo 18 and the Aged Receivable reports in the Odoo 18 Accounting module are identical. However, the late payment that your business needs to make to the partner will be the basis for the report.

This reporting feature will help you understand the aspect of the overdue payments that the company ought to have made. The Aged Payable entries for each of the Business Operations Partners or Vendors will be defined in the Aged Payable reports, precisely as they are in the Aged Receivable reports.

So let us check how it works, and for that, create a new Vendor bill. To add a new vendor bill click on the Vendor menu and choose the Bills.

: Vendor > Bills > New

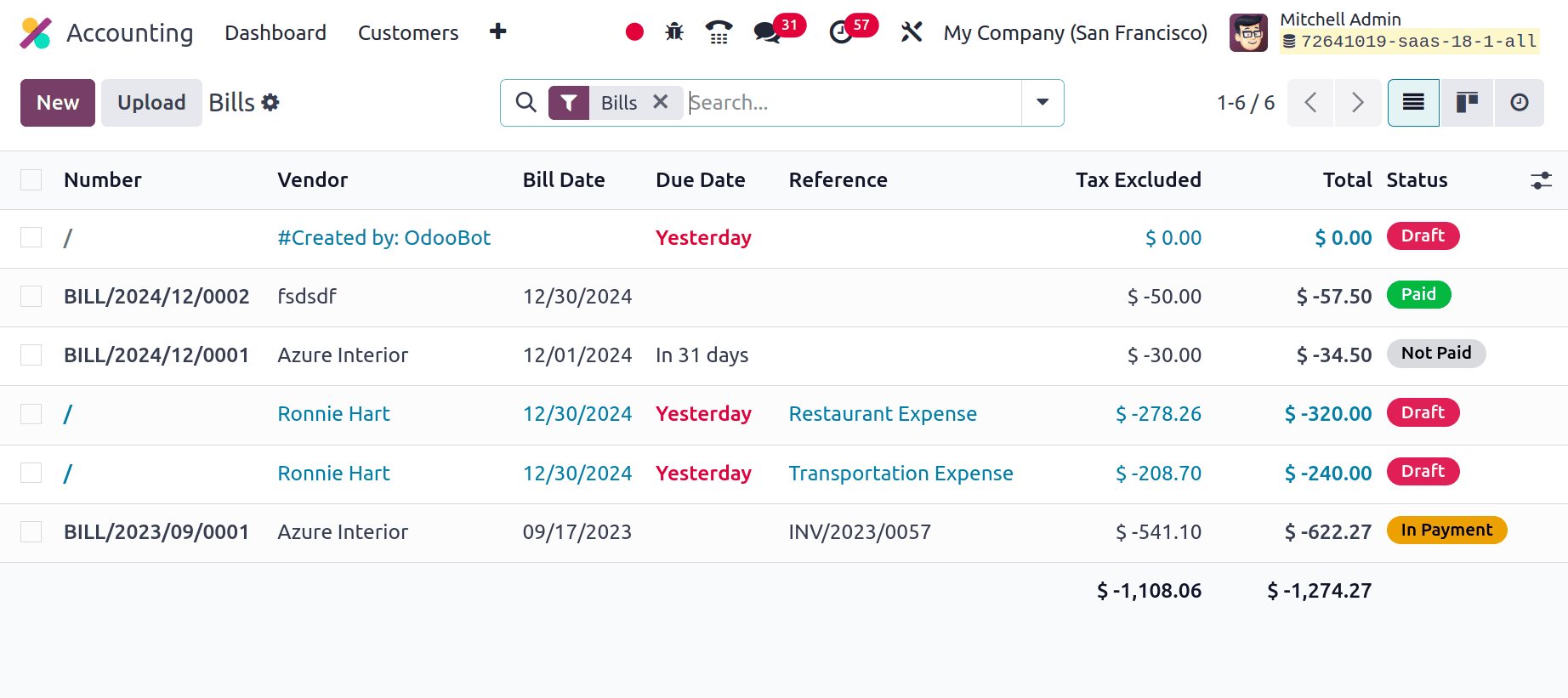

A list of previously configured bills is shown here with details like Number, Vendor name, Bill Date, Reference, Tax Excluded price, and Status. Click the New button to add a new one.

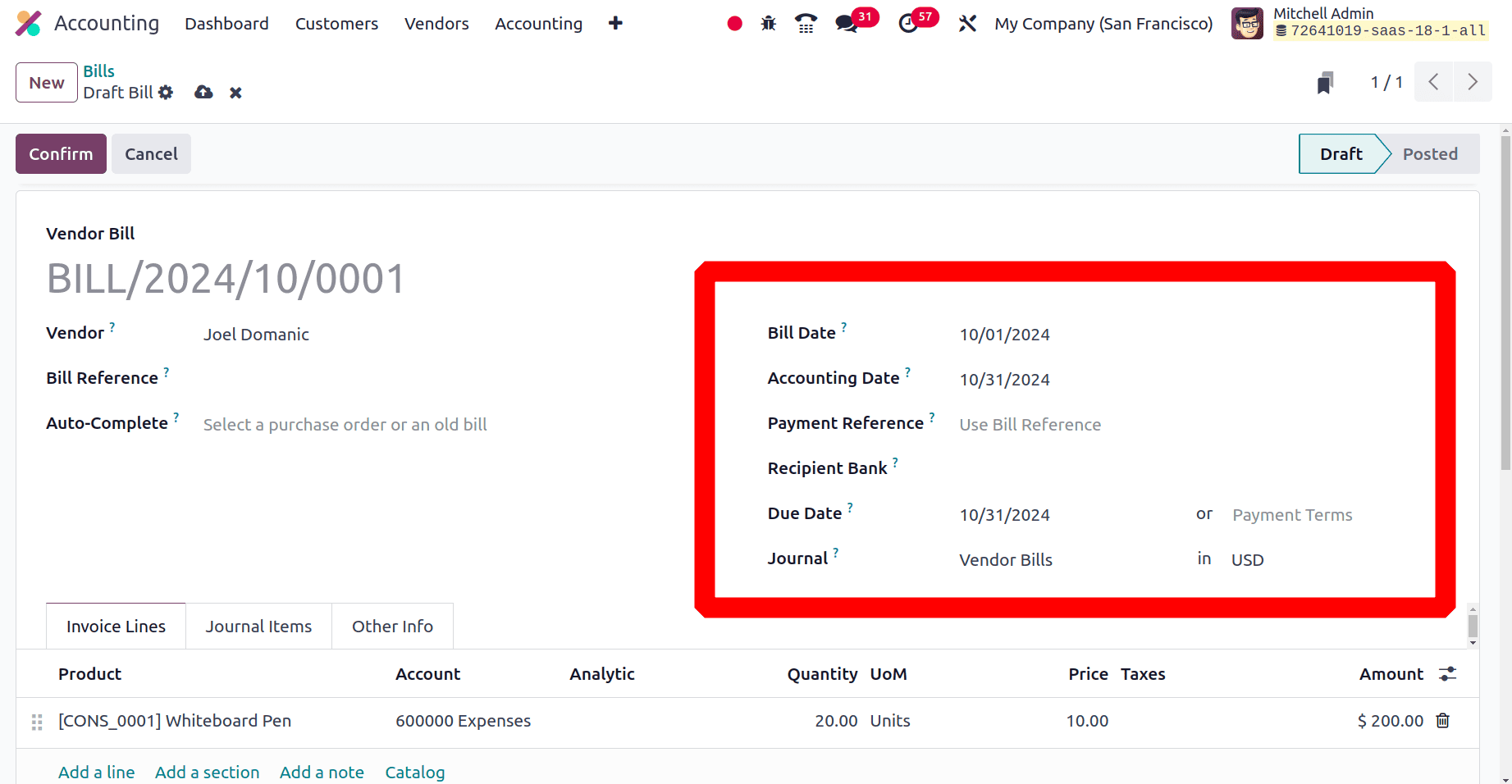

So the bill below is created for the Vendor named Joel Domanic. Add details like Bill Date, Accounting Date, payment Reference, Recipient Bank, Due Date, Journal, etc. Inside the Invoice Lines users can add the products with quantity and unit price.

The day the bill is created is known as the Bill Day, and the date it is added to the accounts is known as the Accounting Date. The bill must be paid by the due date. In this case, October 1st is the bill date, and October 31st is the accounting and due date. The Whiteboard Pen product has been added to the invoice line in 20 units. Thus, $200 is the entire cost. Click the Confirm button once all the information has been entered.

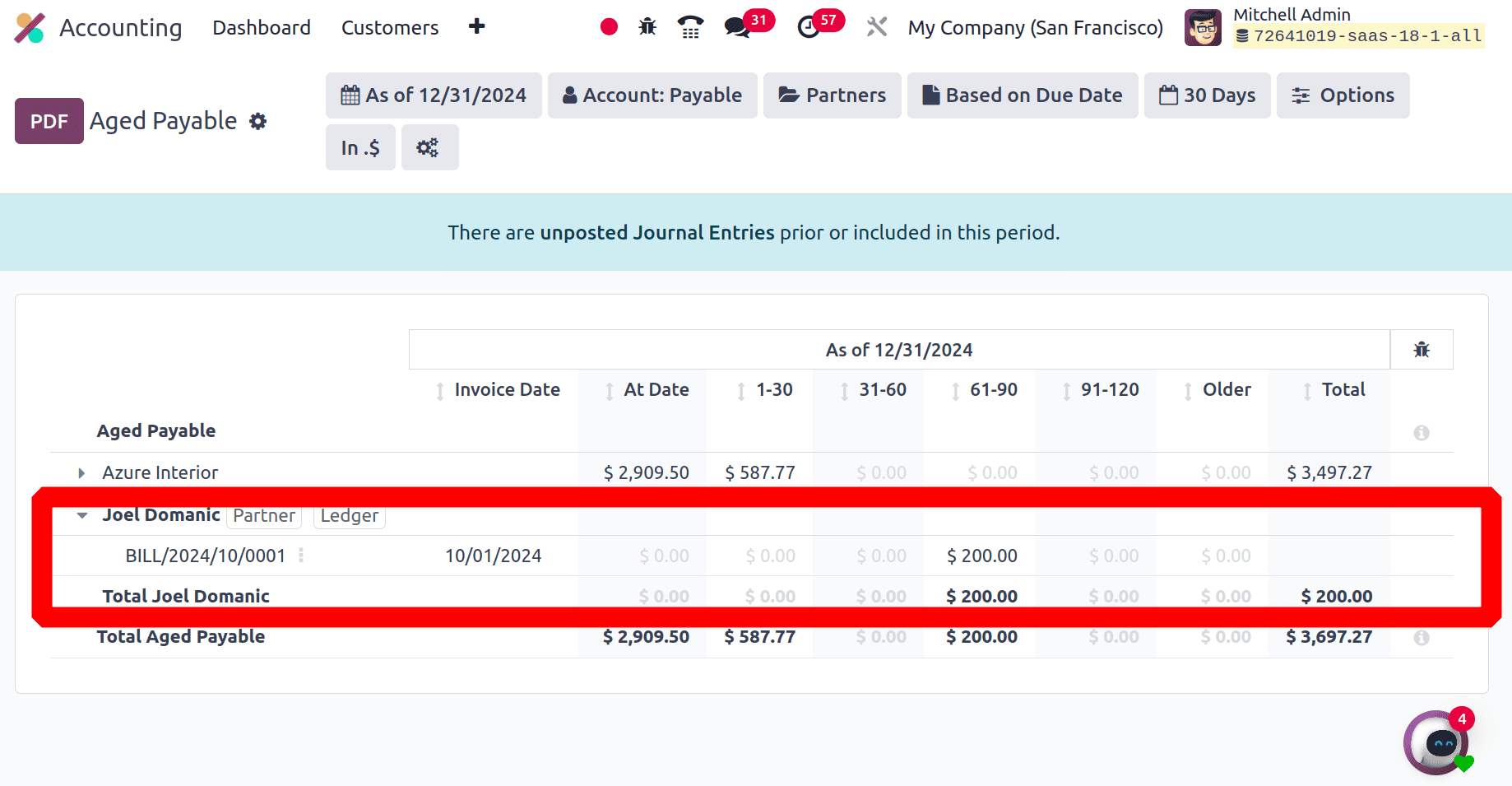

The user has confirmed the bill, but it hasn't been paid yet. Additionally, the payment deadline has passed. In these situations, the bill is shown within the Aged Payable report. From the Reporting Menu, select the Aged Payable report.

The Aged Payable reports' entries will display the following: Report Date, Journal Details, Amount Involved, and Expiration Date. If there is any depreciation, the amount will be shown as 1- 30, 31-60, 61-90, 91-120, and older ones that indicate the amount to be paid if the payment is extended on the basis of duration.

Here the journal entry created for the partner Joel Domanic is visible there. The amount shows under the section 61-90 days due entry.

To sum up, aged reports in Odoo 18 accounting are essential for upholding fiscal restraint, guaranteeing on-time payments, and assisting with proactive cash flow management.

To read more about An Overview of Odoo 17 Accounting Reports, refer to our blog An Overview of Odoo 17 Accounting Reports.