In the world of business software, following local tax rules is crucial for companies to run smoothly. Odoo 17 has specific features designed to help businesses in Spain comply with local tax laws. Managing finances and navigating tax regulations in Spain can be difficult, but with the right tools like Odoo, it becomes much simpler. Odoo is designed to handle Spanish tax rules effortlessly, automating calculations for VAT and income tax. This automation saves businesses from the complexities of manual calculations and ensures accuracy.

One of Odoo's strengths lies in its alignment with Spanish accounting practices. It uses the same chart of accounts as Spanish accountants, making it easier for businesses to understand and organize their financial data. This alignment streamlines the entire accounting process, from categorizing expenses to preparing financial statements.

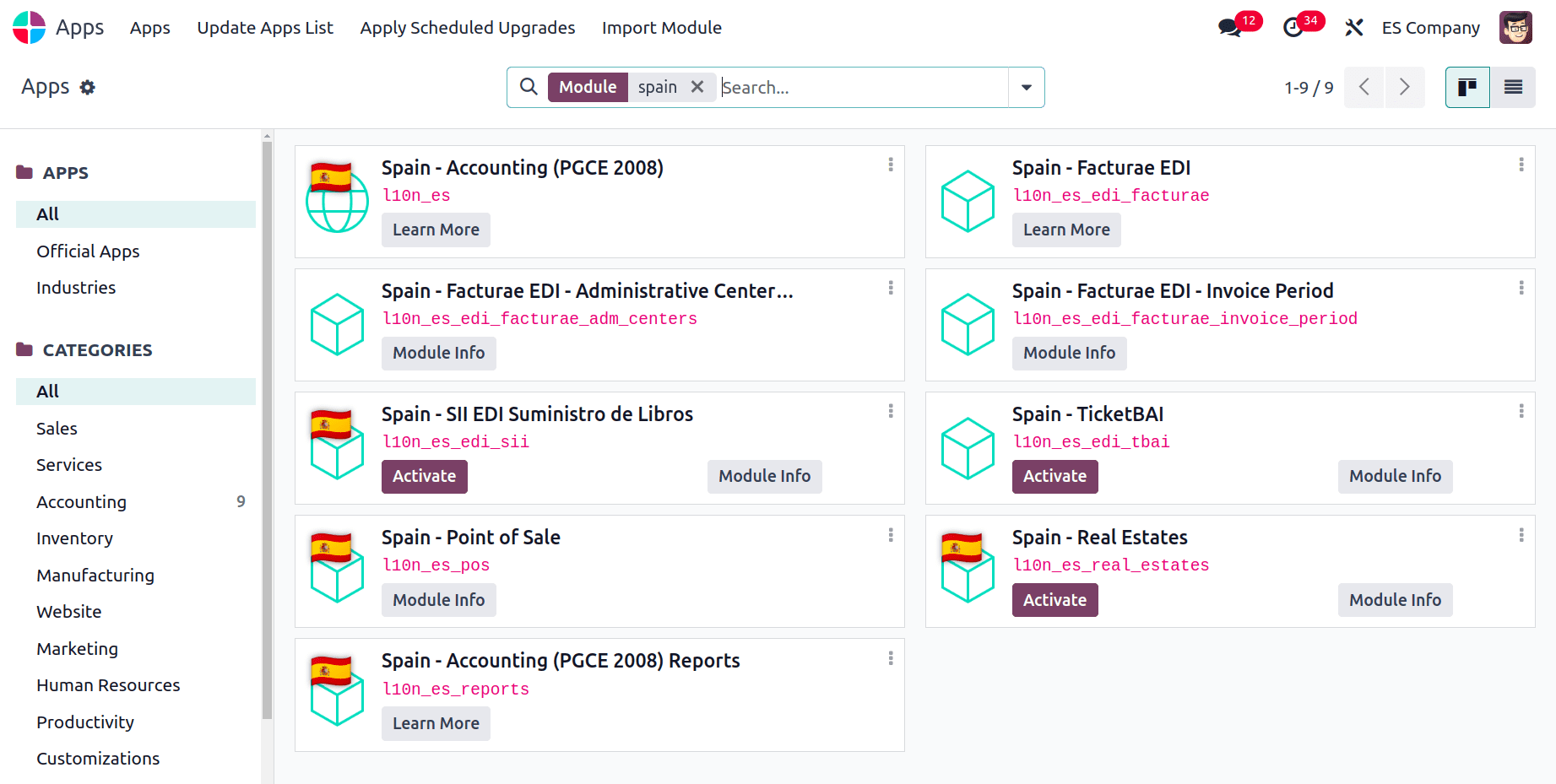

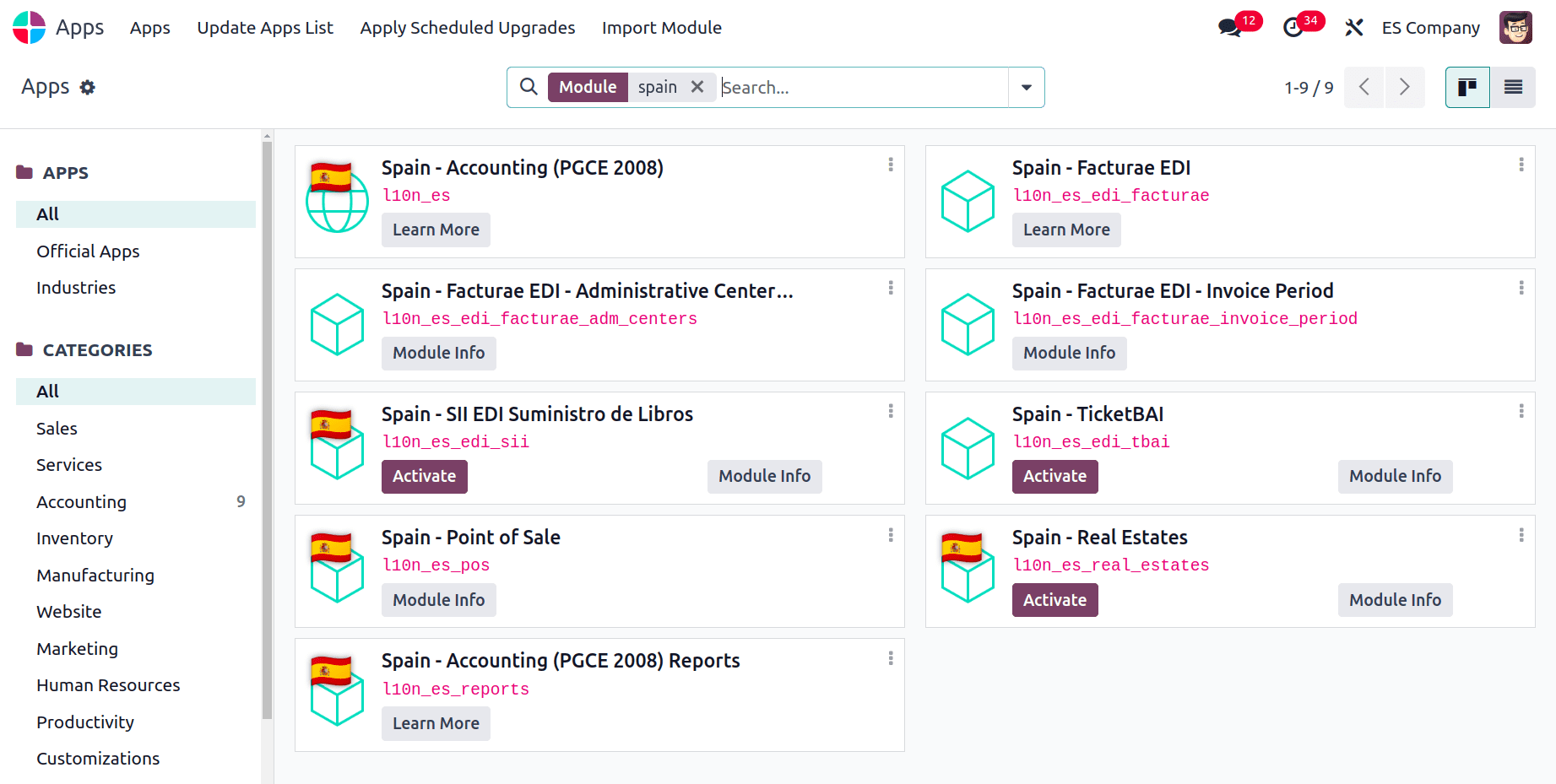

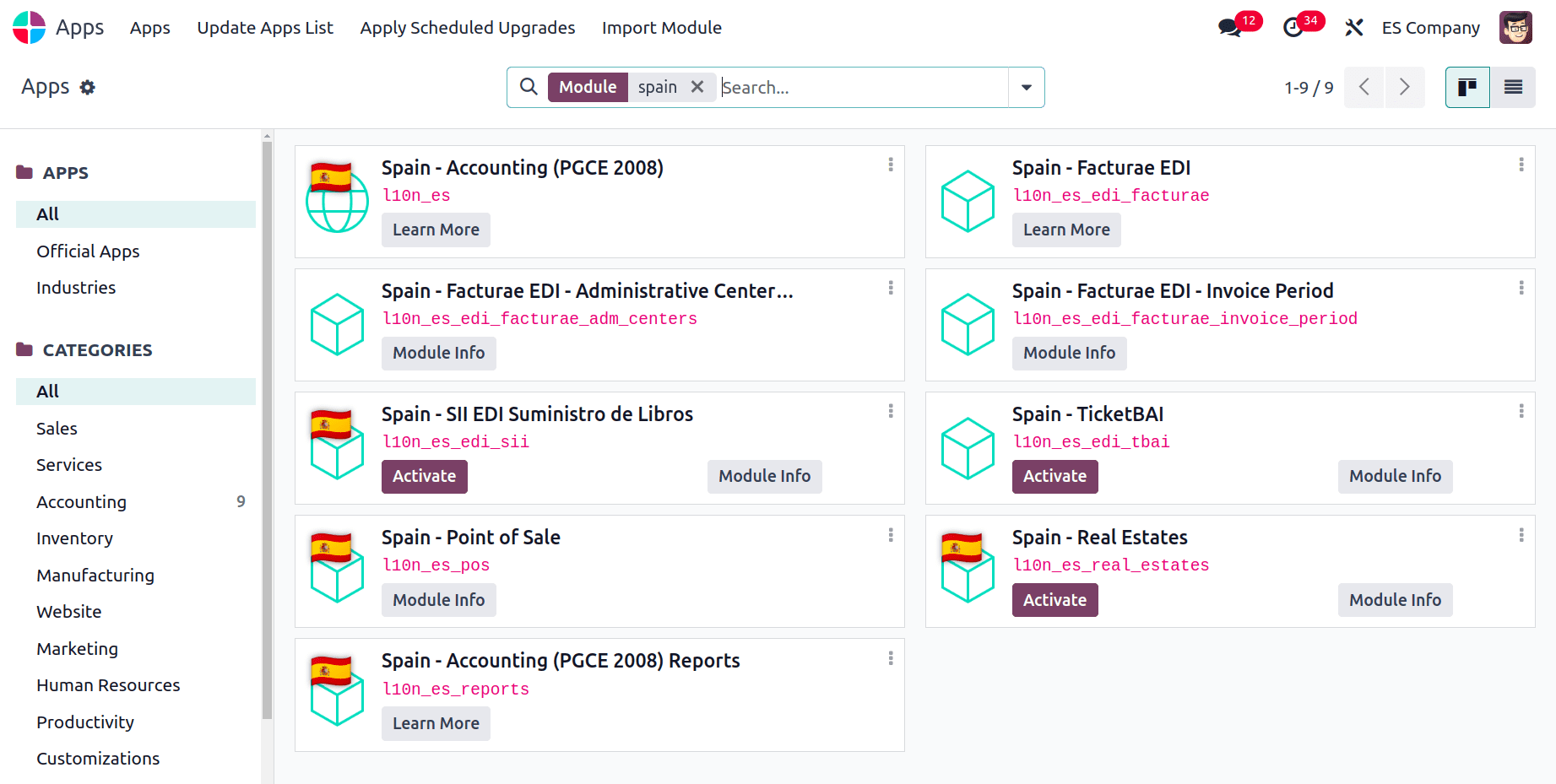

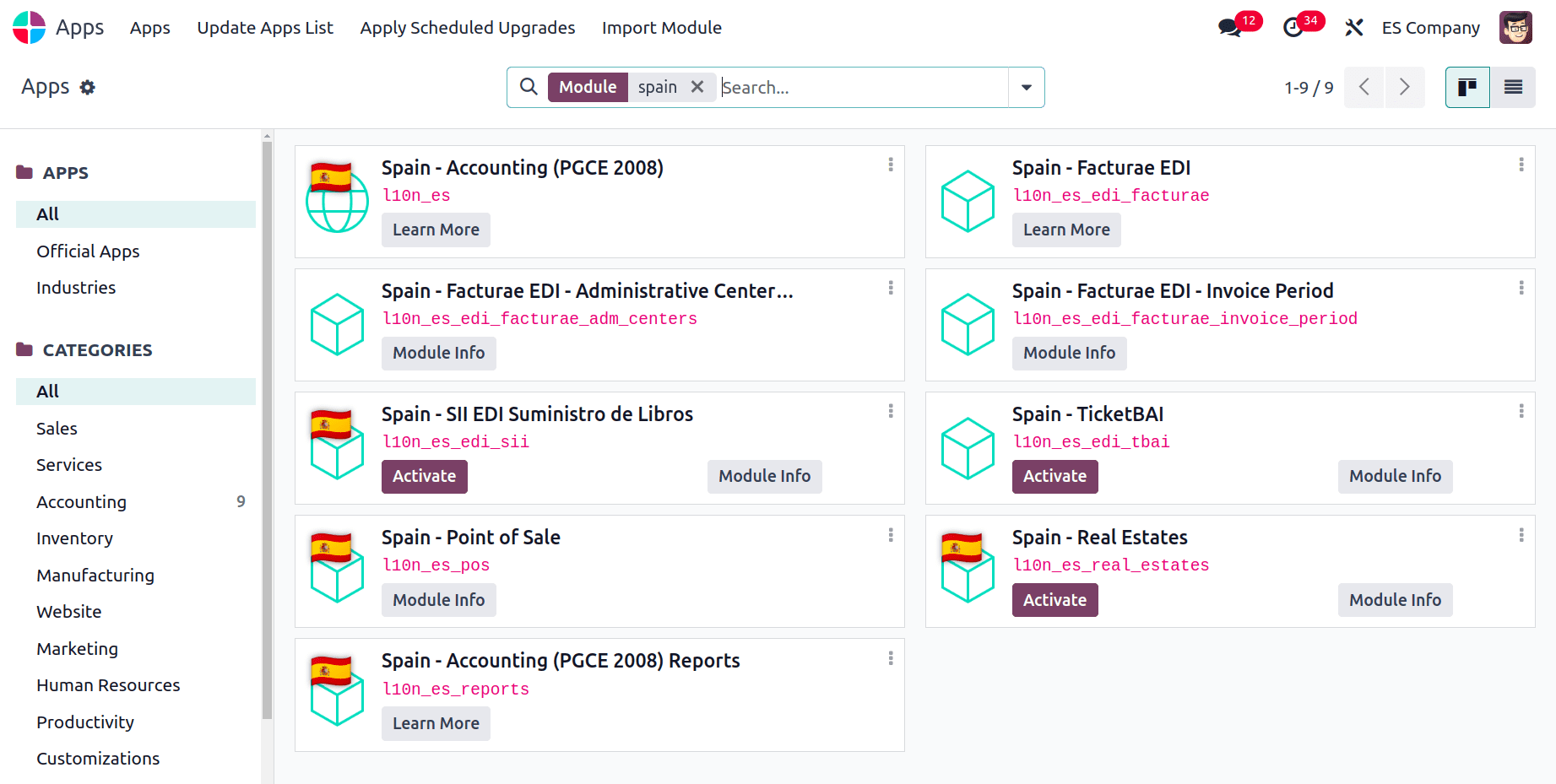

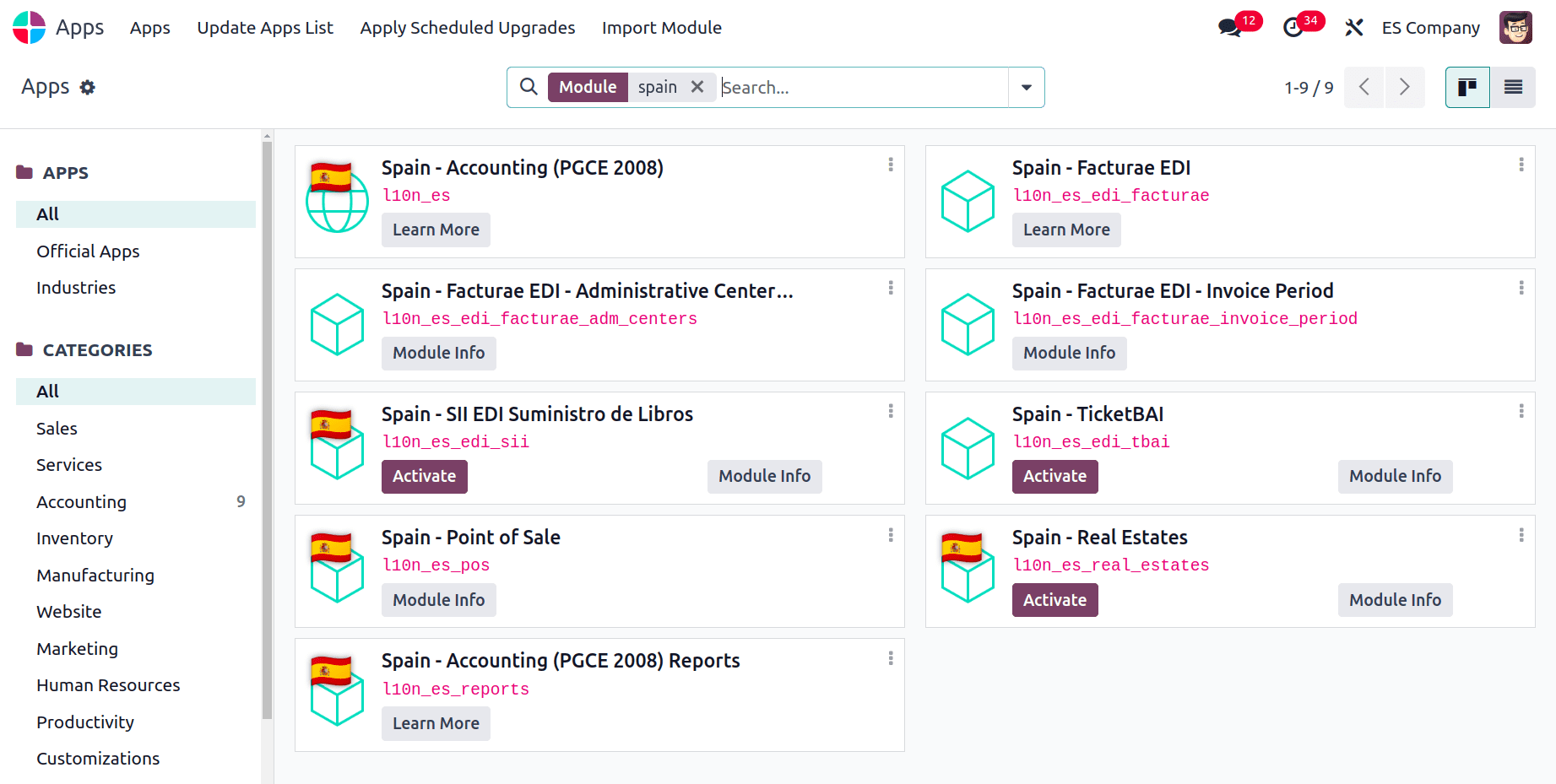

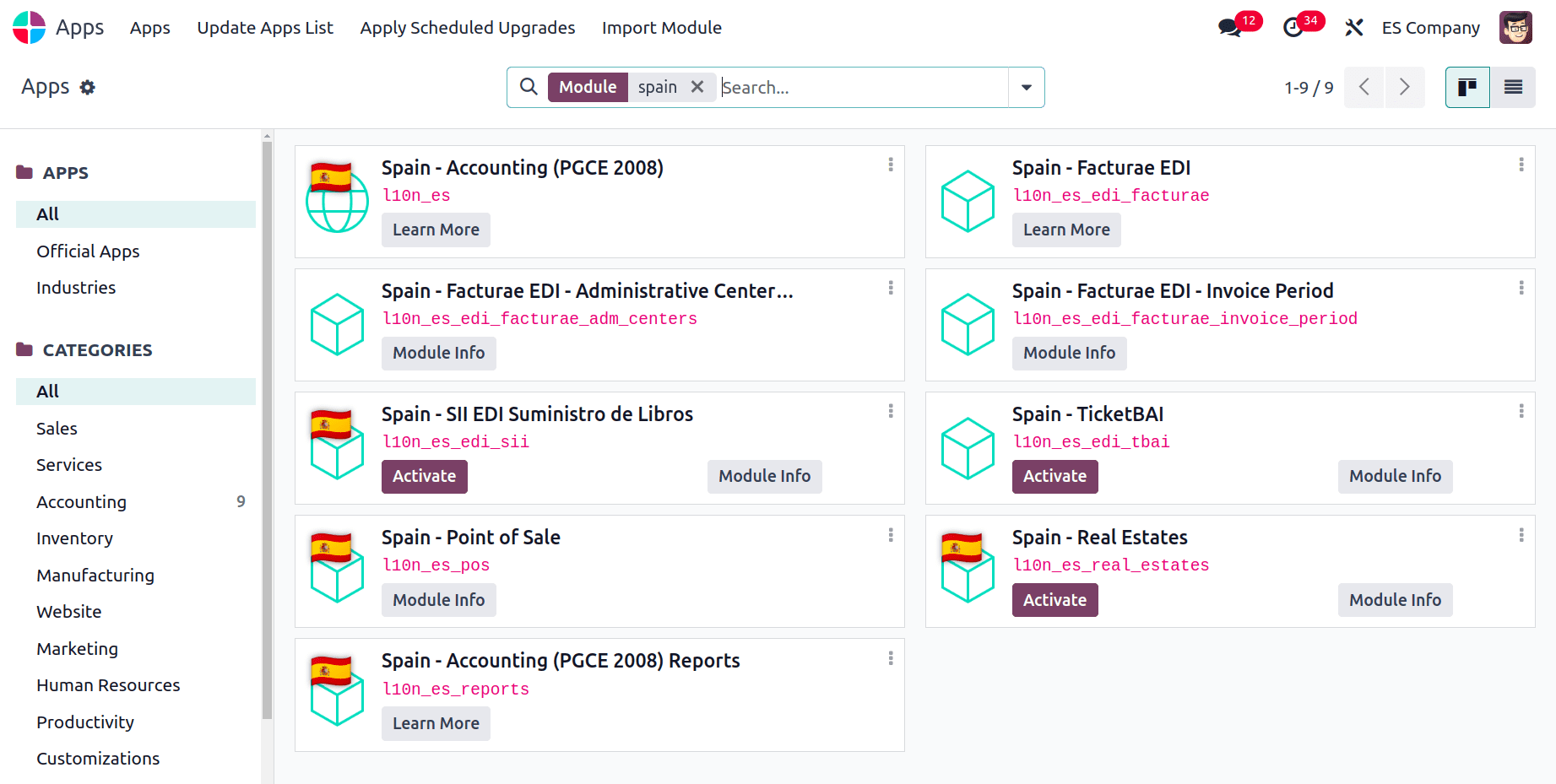

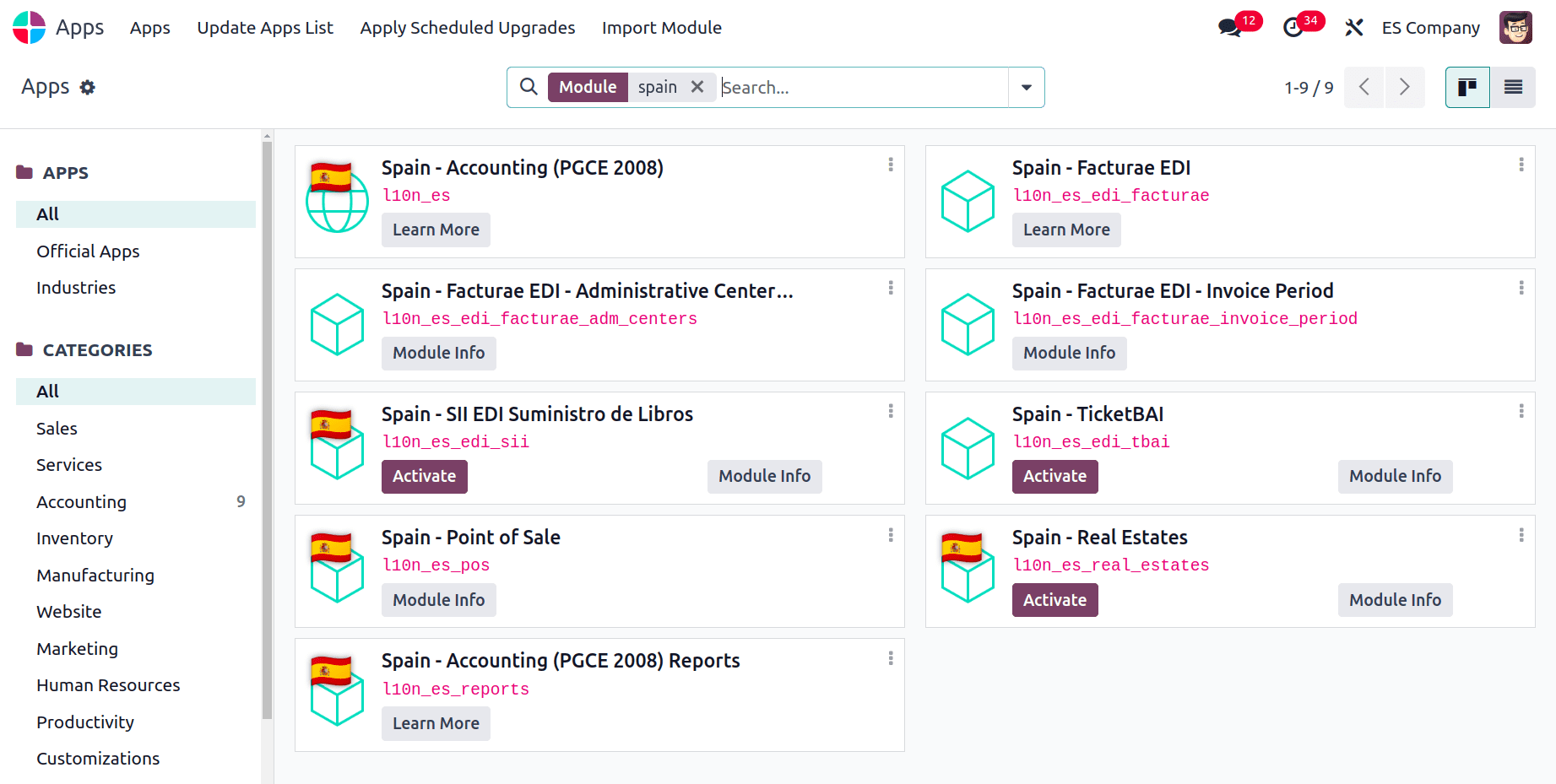

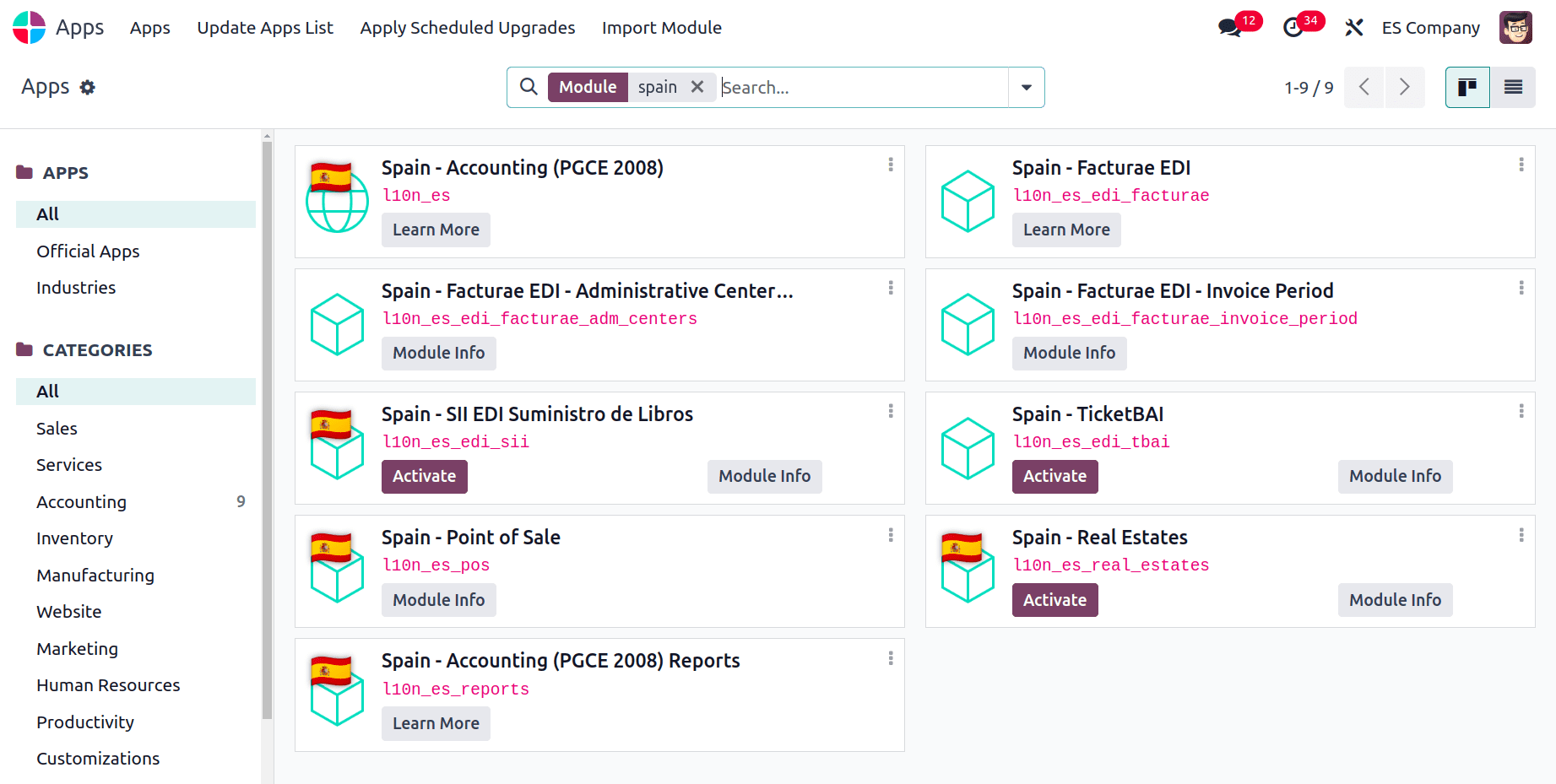

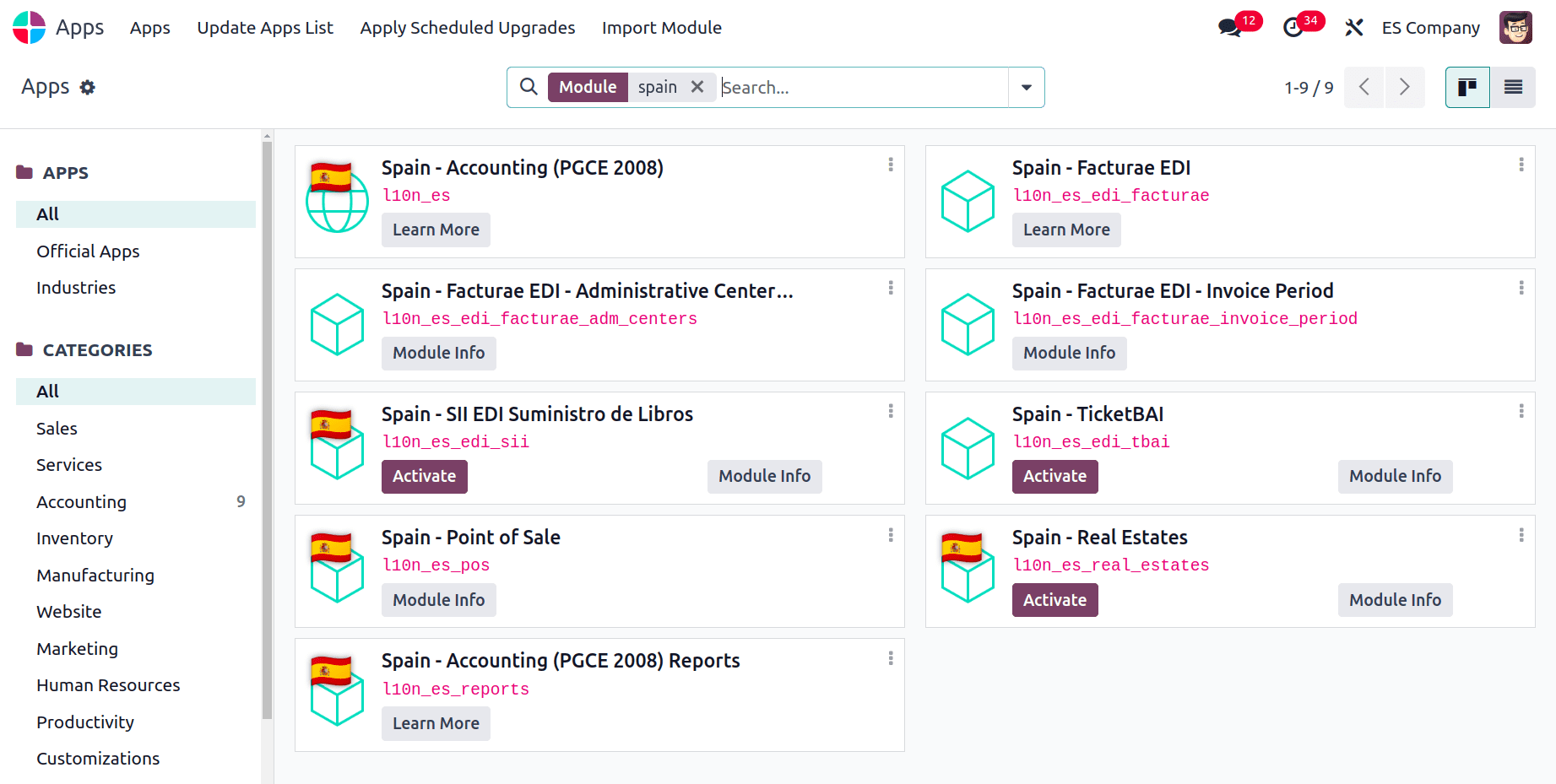

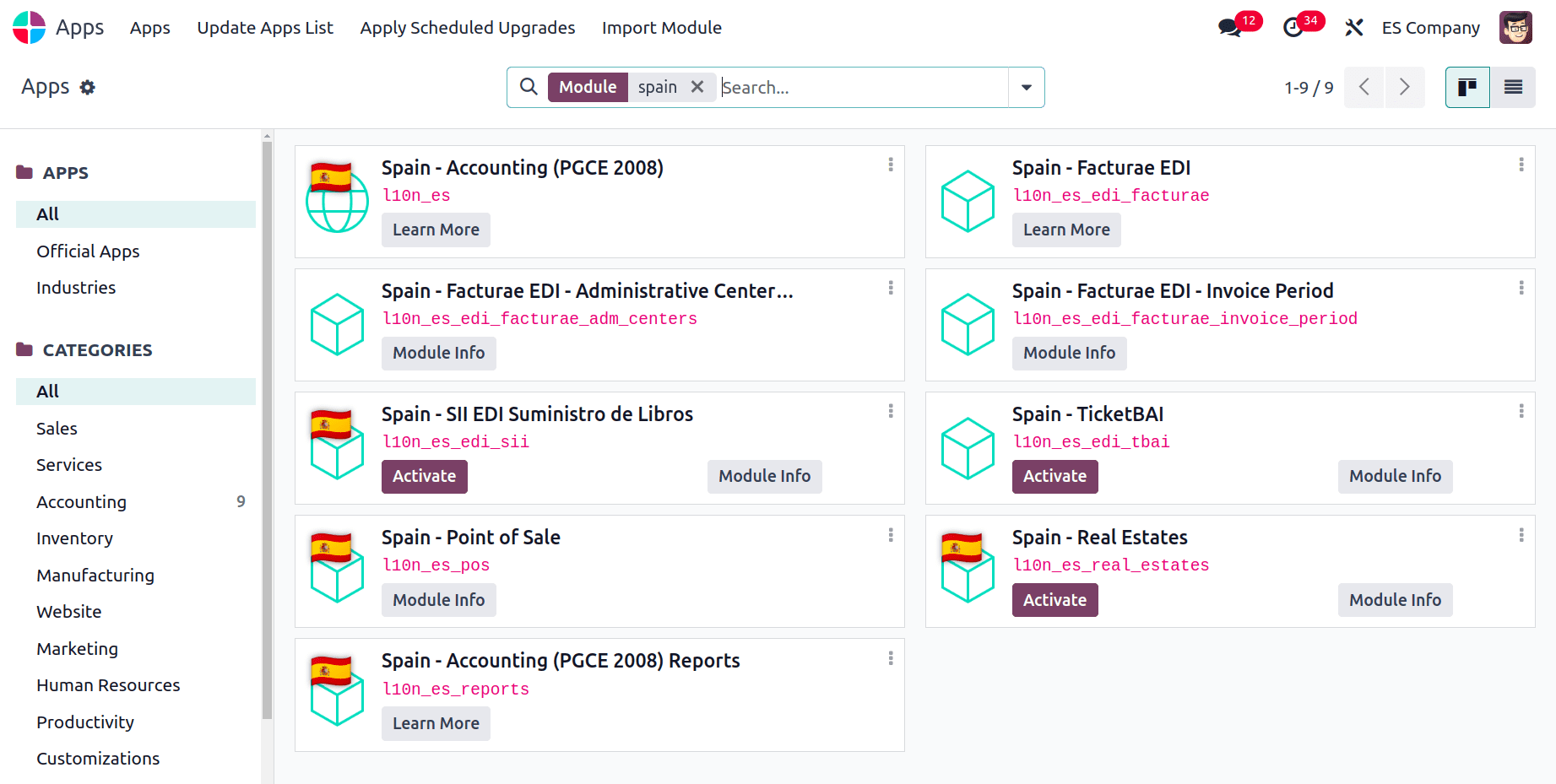

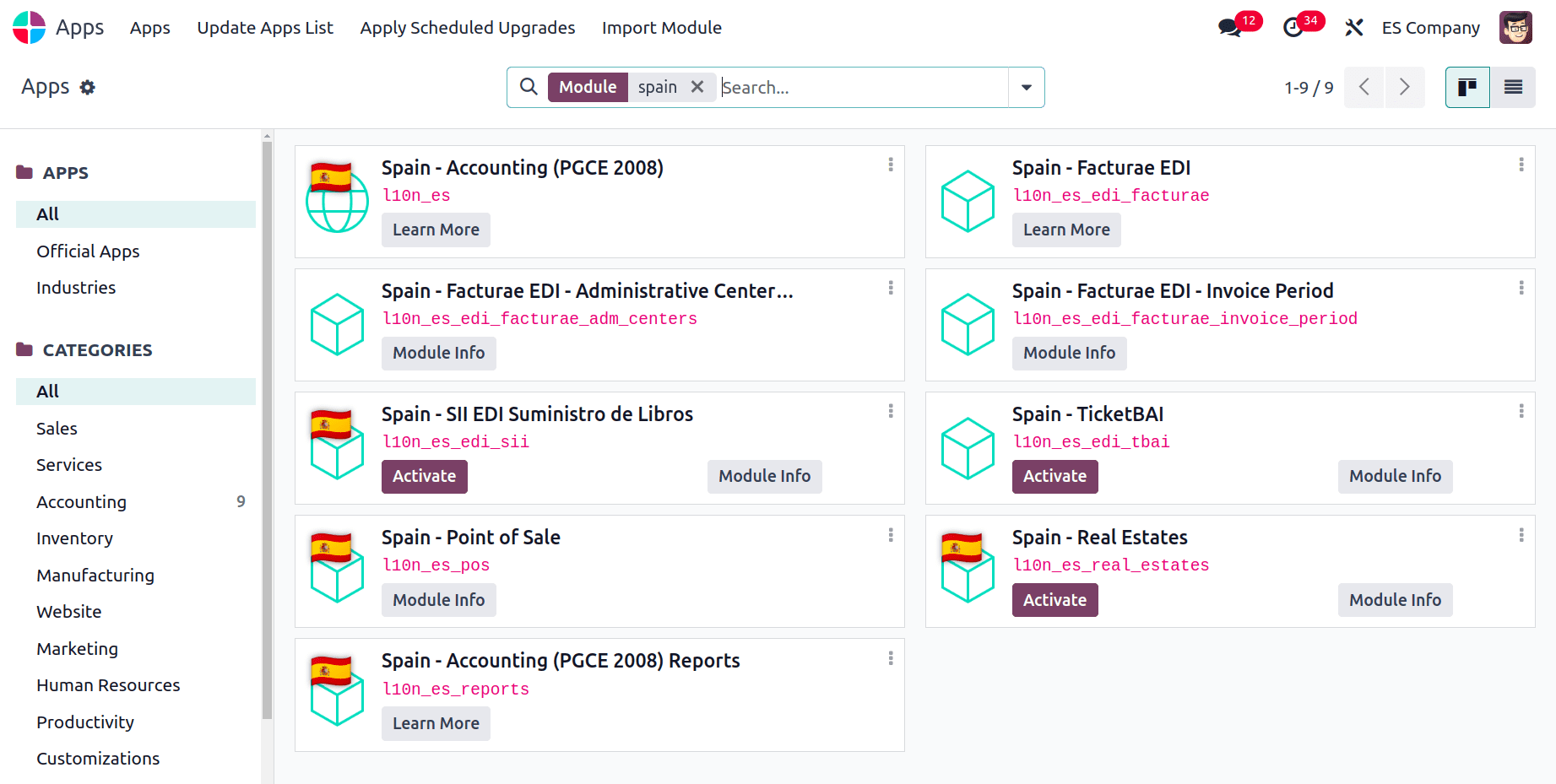

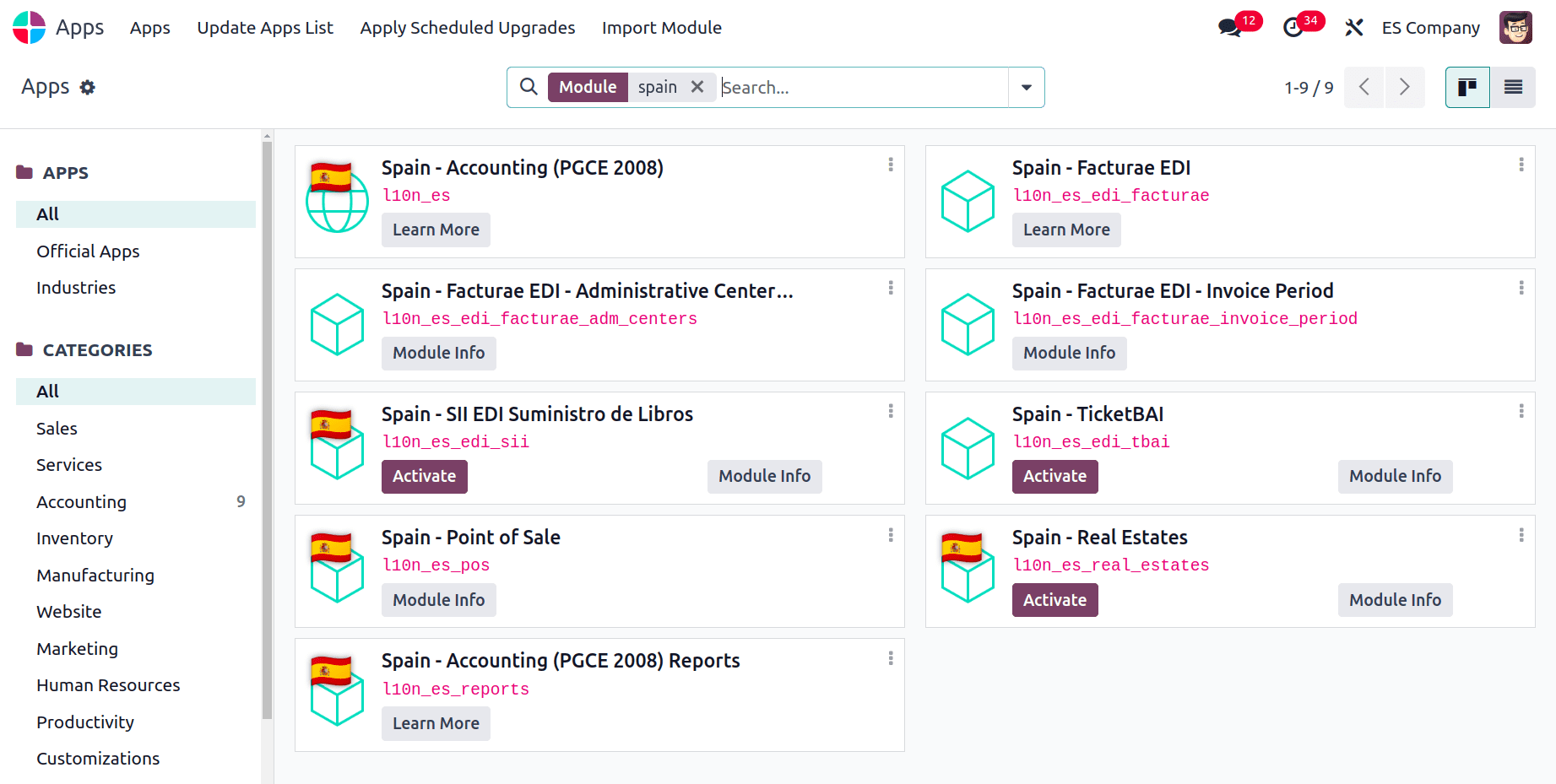

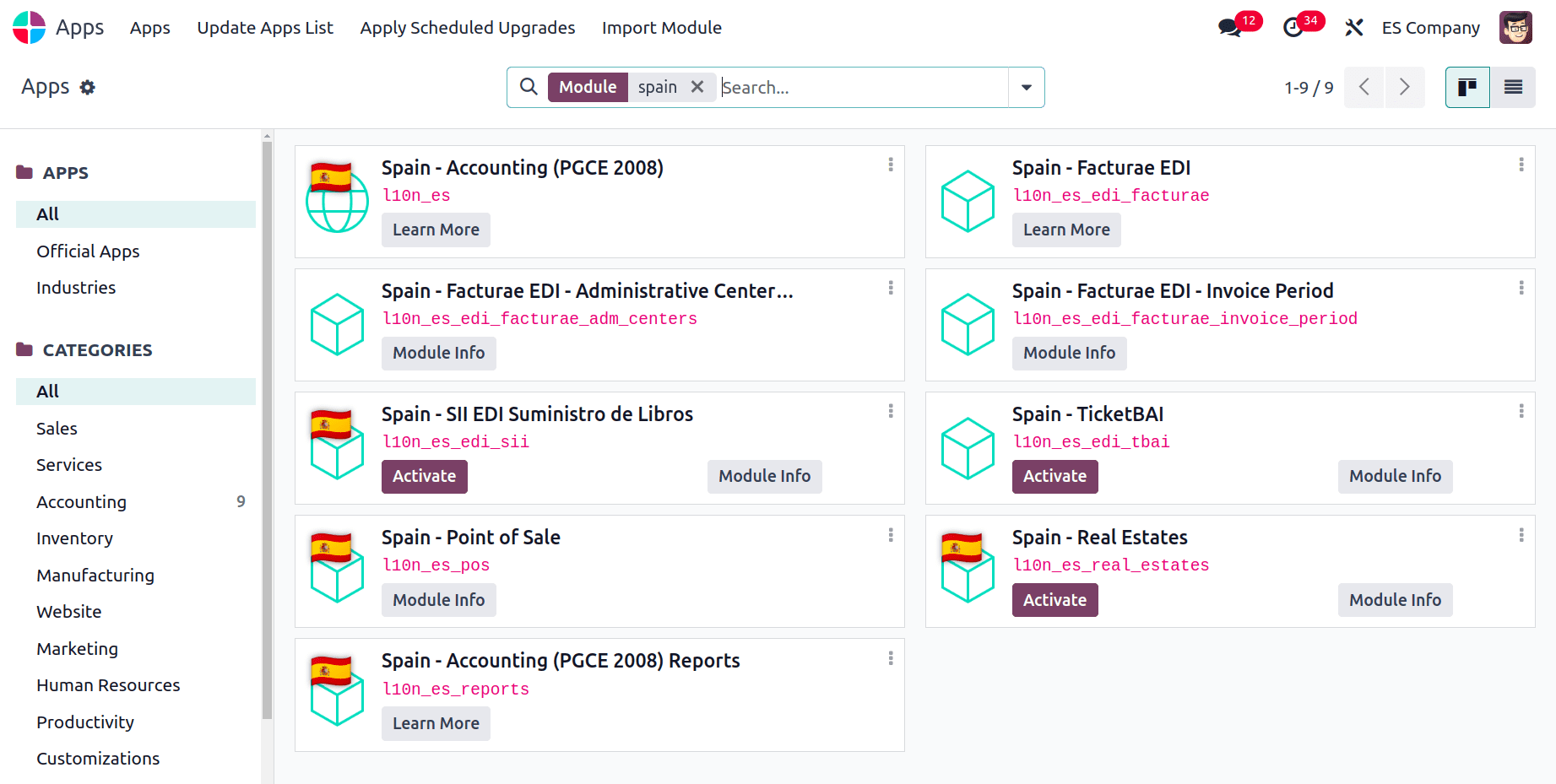

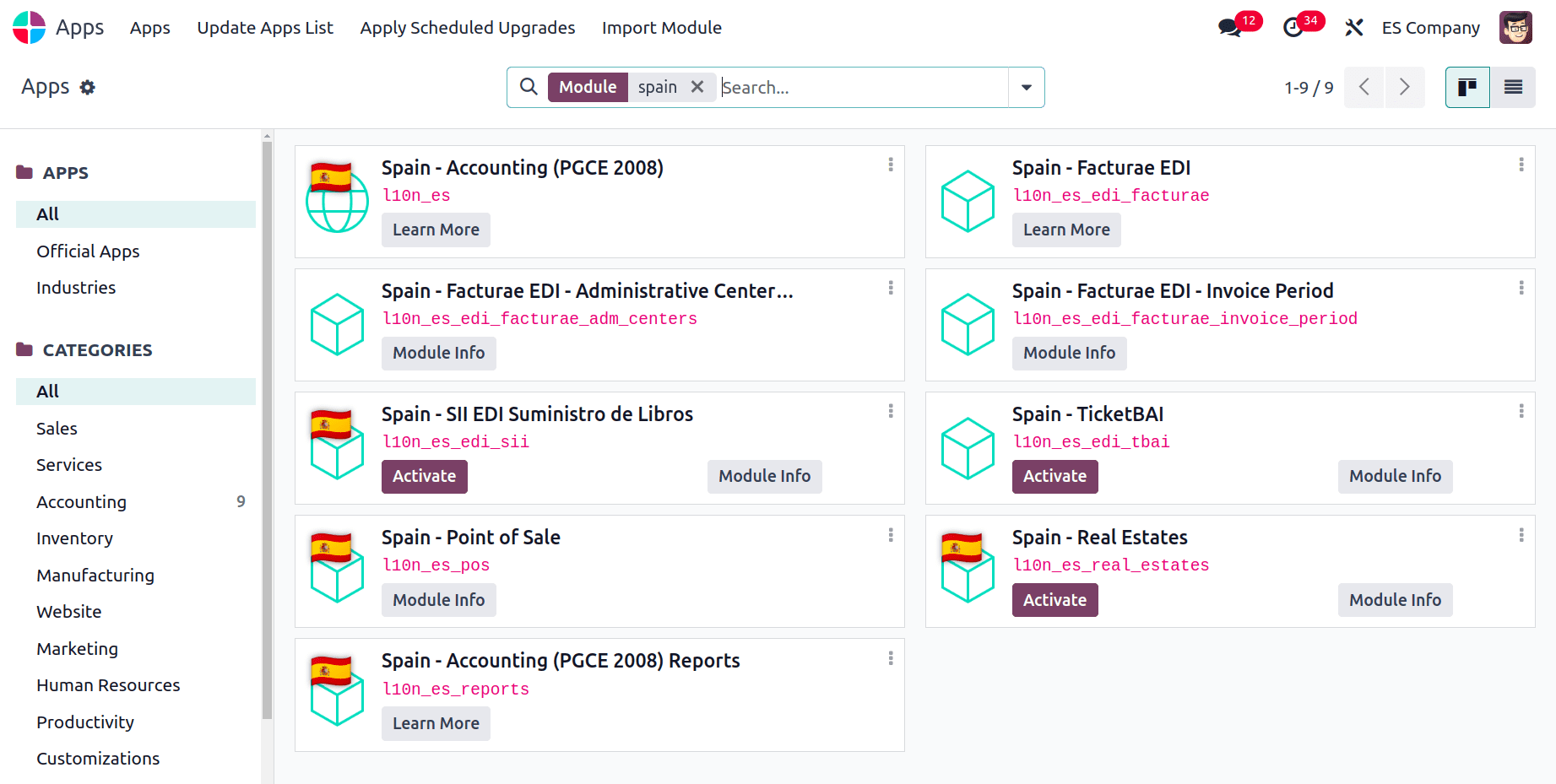

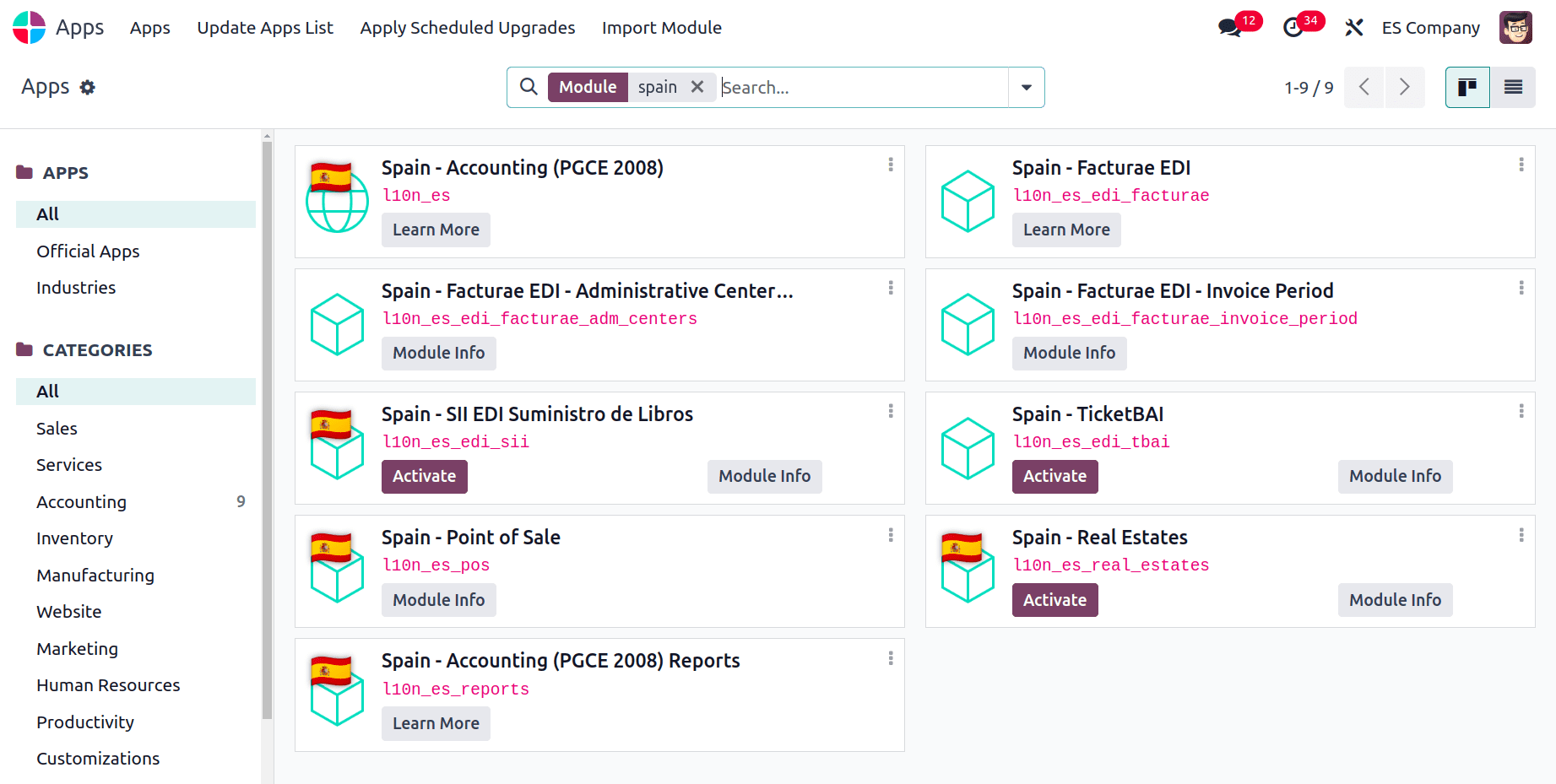

To get Spain's accounting localization in Odoo, you'll need to install some special modules first. These modules can be found in the "Apps" section of Odoo. Navigate to Apps and install the modules required.

There are three different Spanish localizations, and each has a pre-configured PGCE chart of accounts:

* Spain - SMEs (2008);

* Spain - Complete (2008);

* Spain - Non-profit entities (2008).

Next, it's important to make sure your company information is set up correctly in Odoo. This way, Odoo can use the Spain accounting rules accurately. You can check your existing company information or create a new company profile if needed. To do this, go to "Settings" in Odoo, then navigate to "Users and Companies" and select "Companies."

This will show you a list of companies you have set up in Odoo. You can then choose a company and check its details, or create a brand new company with the correct country information for Spain's accounting features.

Finally, you can confirm that Singapore is selected as the fiscal localization option within the Accounting module's settings.

Charts of Accounts

Odoo provides a ready-to-use Spanish chart of accounts and tax configurations that adhere to local reporting standards. This foundational setup enables accurate financial tracking and seamless tax compliance. It provides ready-made tools like charts of accounts and tax setups that match Spanish reporting standards. This helps businesses track finances accurately and comply with tax requirements.

Taxes

Upon the installation of the Spanish - Accounting (PGCE 2008) (l10n_es) module, default Spain-specific taxes are automatically generated. The platform includes templates for generating essential legal reports such as Modelo 303 (VAT returns), Modelo 349 (Intrastat declarations), and others mandated by Spanish authorities. These reports are crucial for compliance and are generated directly from the system based on the transactions recorded.

Additionally, by installing the Spain - Accounting (PGCE 2008) (l10n_es_reports) module, tax reports tailored to Spanish regulations become accessible. These taxes directly influence Spain-specific tax reports (Modelo), which can be accessed via Accounting --> Reporting --> Statements Reports: Tax Report.

The list of accessible Spanish-specific statement reports is as follows:

* Balance Sheet;

* Profit & Loss;

* EC Sales List;

* Tax Report (Modelo 111);

* Tax Report (Modelo 115);

* Tax Report (Modelo 303);

* Tax Report (Modelo 347);

* Tax Report (Modelo 349);

* Tax Report (Modelo 390).

When on a report, click the book icon and choose the Spain-specific edition (ES) to view tax reports particular to Spain.

Invoice

Odoo supports electronic invoicing in compliance with Spanish regulations (Facturae). This feature ensures that invoices generated within Odoo meet the required format and standards set by the Spanish tax authorities.

TicketBAI

The three provincial councils of Álava, Biscay, and Gipuzkoa, as well as the Basque government, employ the Ticket BAI or TBAI e-invoicing system.

For all three Basque Country regions, Odoo supports the TicketBAI (TBAI) electronic invoicing format. Set your company's Country and Tax ID in the Companies section of Settings ? General Settings to activate TicketBAI. Next, install the Spain -TicketBAI (l10n_es_edi_TBAI) module. Next, navigate to Accounting ? Configuration ? Settings. In the Tax Agency for TBAI section, pick a region.

Select a region, then click Manage certificates (SII/TicketBAI).

Next, click New, upload the certificate, and input the password that the tax agency supplied. Next, click New.

A TicketBAI banner shows at the top of an invoice once it has been created and confirmed.

Odoo automatically sends bills via TicketBAI once a day. On the other hand, if you want to send the invoice right away, click Process now. The XML file is located in the conversation and the field Electronic Invoice changes to Sent once the invoice is sent. You may view the traceability of other created documents associated with the invoice under the EDI Documents tab (for example, this is where it will show up if the invoice needs to be delivered over the SII).

FACe

The electronic invoicing platform that the Spanish public administrations use is called FACe.

Install the Spain - Facturae EDI (l10n_es_edi_facturae) module and other Facturae EDI-related modules before configuring the FACe system.

In order to activate FACe, navigate to Settings ? General Settings, select Update Info under the Companies section, and then adjust your company's Country and Tax ID. After that, click Add a line, upload the tax agency's certificate, and input the password to add the Facturae signature certificate.

Click Send & Print once the invoice has been produced and verified.

Click Send & Print once again after making sure that Generate Facturae edi file is enabled.

Upon sending the invoice, the resulting XML file becomes accessible within the conversation.

The invoice needs to have particular information about the administrative centers in order for FACe to operate with them. Make a new contact and add it to the partner firm to add administrative centers. After choosing FACe Centre as the type and giving that contact one or more roles, save the change. Typically, three roles are needed, which are:

* Organismo gestor: Receiver/receptor;

* Traitor Unit: Payer (Pagador);

* Fiscal (Fiscal) is the office contable.

In this blog, We have seen the Accounting localisation for Spain. Odoo's fiscal localization for Spain stands out as a comprehensive solution for businesses looking to streamline their financial operations and comply with local tax regulations. By leveraging Odoo's integrated approach, companies can focus more on growth and less on navigating complex fiscal requirements.

To read more about An Overview of Accounting Localization for Greece in Odoo 17, refer to our blog An Overview of Accounting Localization for Greece in Odoo 17.