Various businesses localize their accounting systems based on the nation in which they operate. Odoo 17 facilitates localization across multiple nations. For accurate interactions with taxes and other legal matters, we should configure the company's accounting to the proper localization. Thus, we will talk about Odoo 17's Accounting Localization for Singapore in this blog. Accounting localization in Singapore provides all the accounting components required by a company operating in Singapore. The tax and account charts are automatically created when we install a country's localization.

Odoo, offers powerful accounting localization features tailored to meet specific regional standards and compliance needs. Whether navigating tax regulations, financial reporting standards, or currency complexities, Odoo's accounting localization module provides businesses with the tools to streamline operations and ensure adherence to local financial practices.

Effective accounting localization in Odoo goes beyond mere compliance, it empowers organizations to optimize financial processes, enhance transparency, and mitigate risks associated with regulatory non-compliance. By integrating seamlessly with other Odoo modules, such as invoicing, inventory, and sales, the accounting localization feature fosters comprehensive business management solutions that are adaptable and scalable.

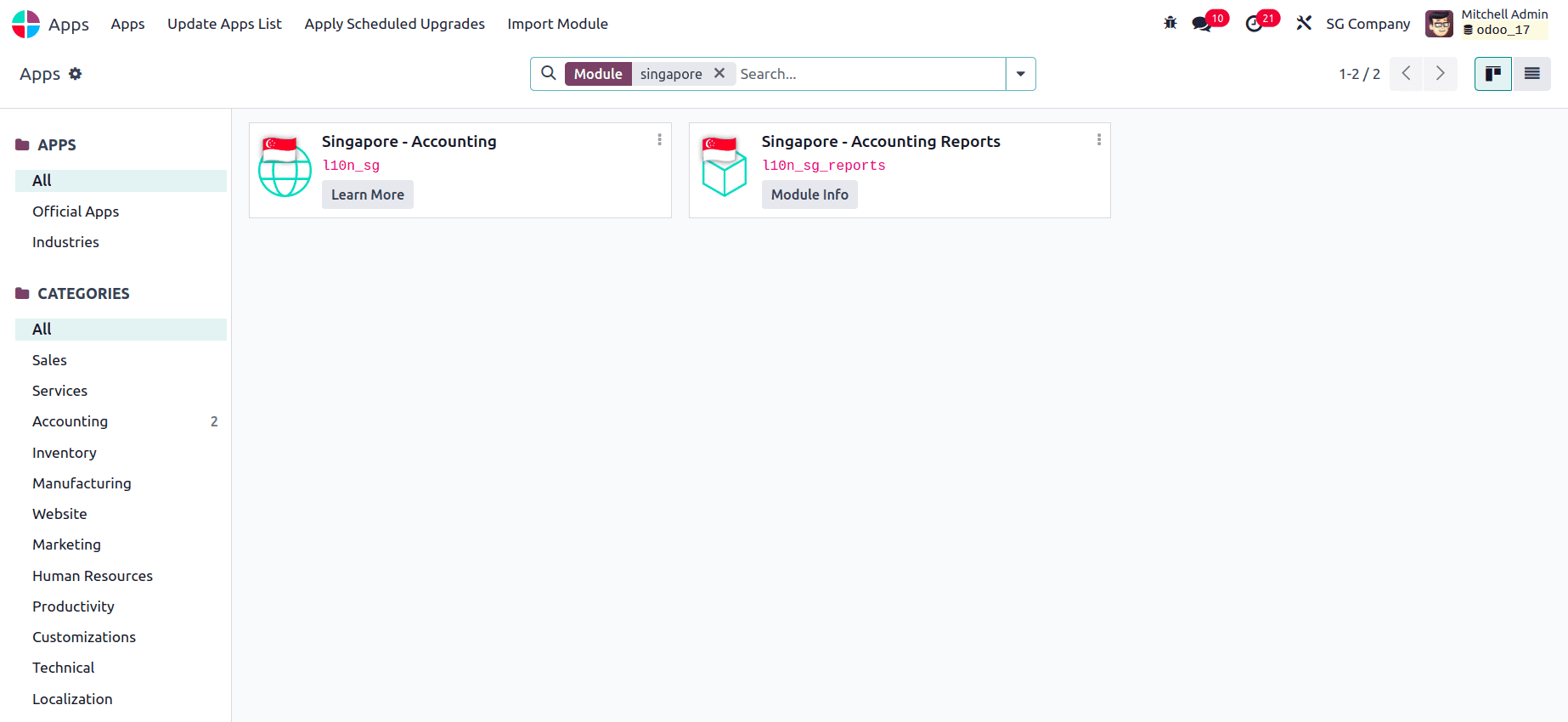

First, we can go to Apps and install the modules required for Installing the Singapore accounting localization in Odoo.

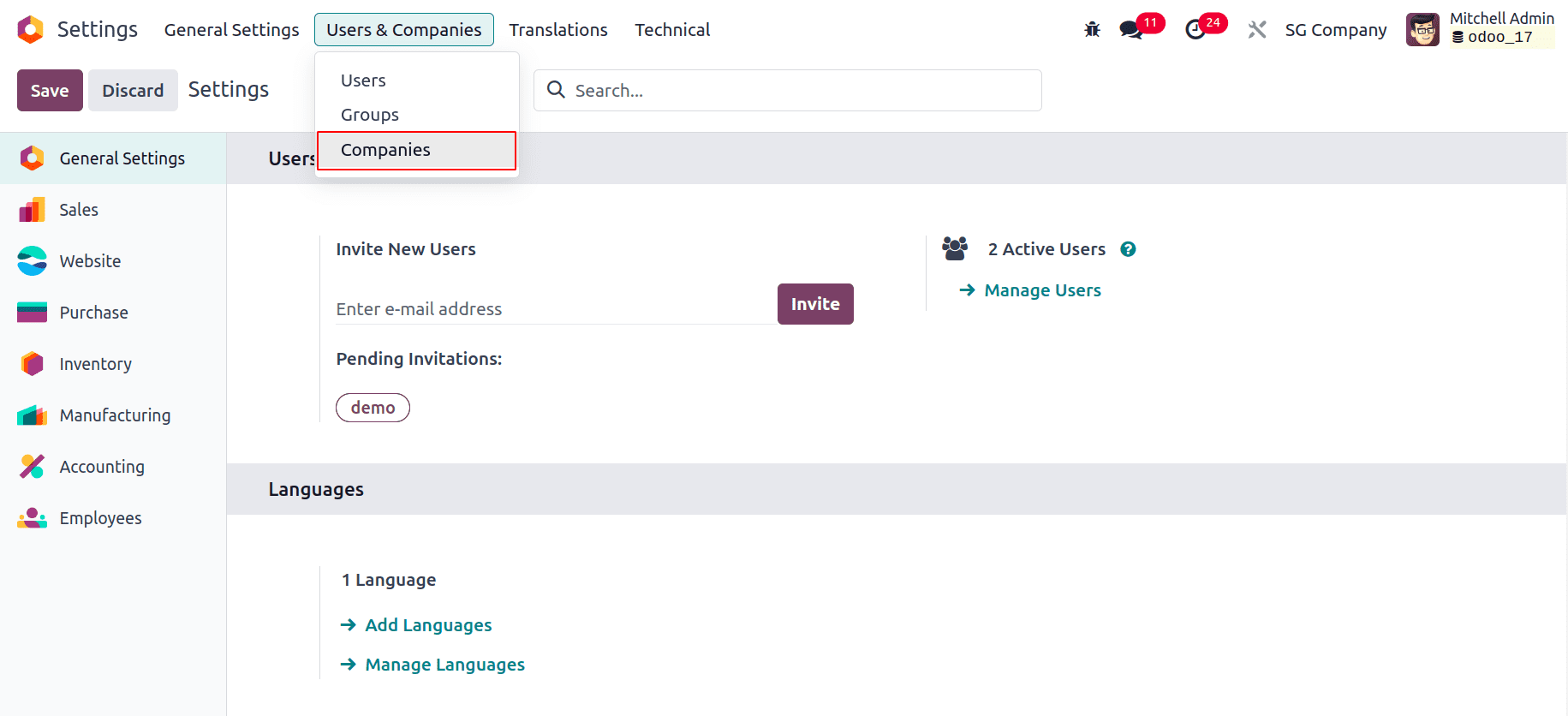

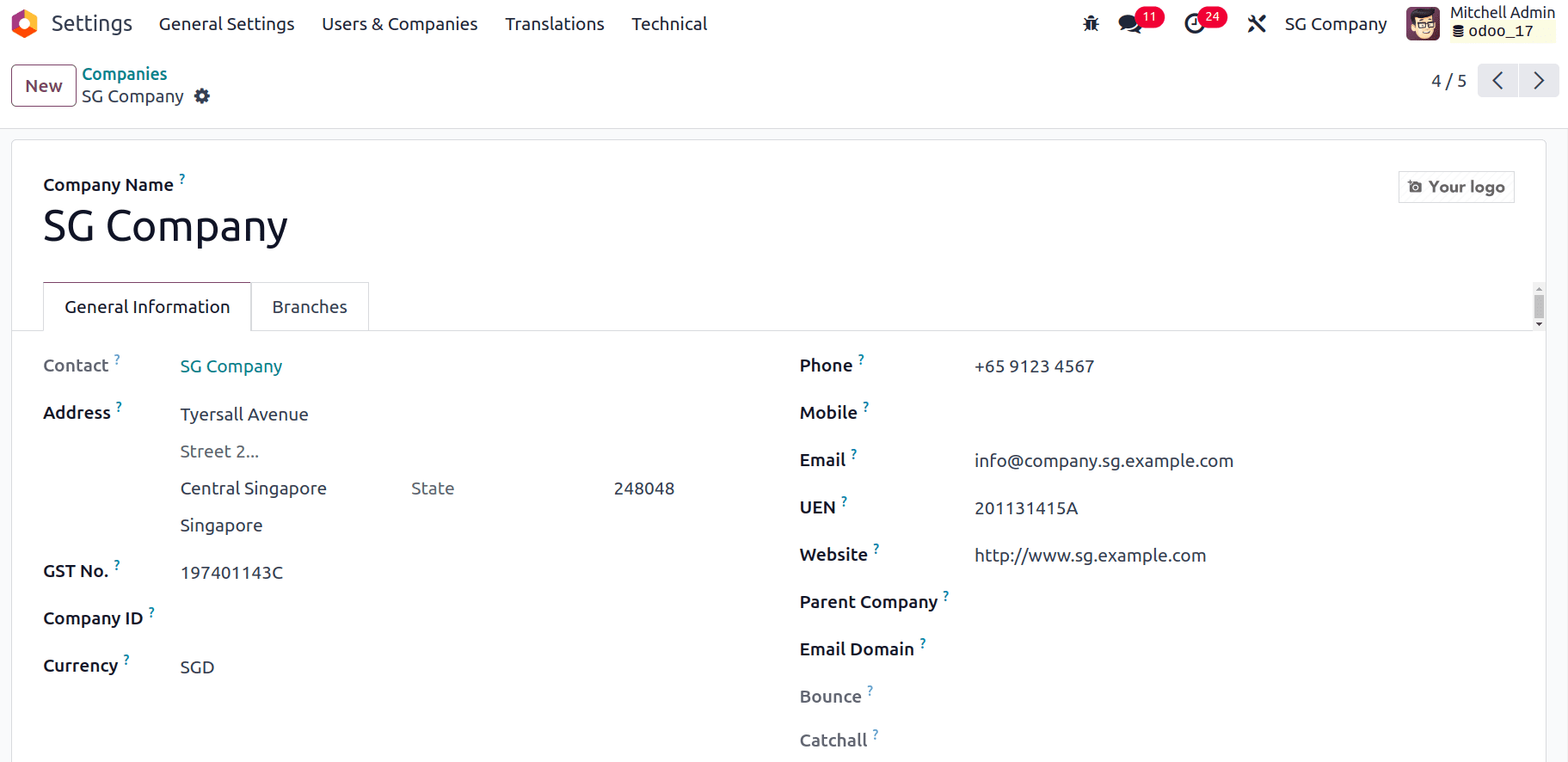

Now, to ensure accurate data and functionality within Odoo, it's crucial to verify the existing company configuration or create a new company profile if necessary. This configuration establishes essential details about your business. Navigate to the Settings menu within Odoo. From there, locate the "Users and Companies" section and select "Companies".

This will display a list of all companies currently configured in your Odoo instance, and from there we can select the company and check whether it is configured correctly or not. We can also create a new company and configure it correctly with accurate country details for that particular country’s accounting localization if necessary.

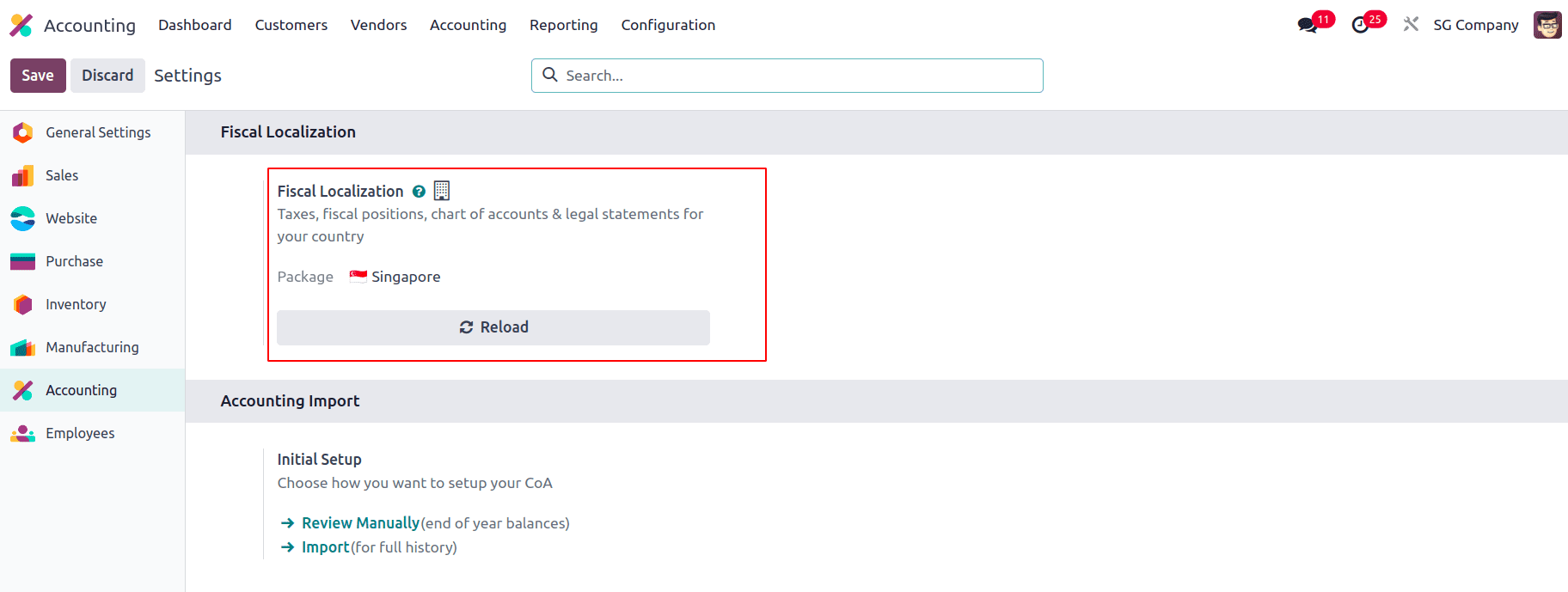

In the Configuration > Settings of the Accounting module, we can see that the fiscal localization will be set to Singapore.

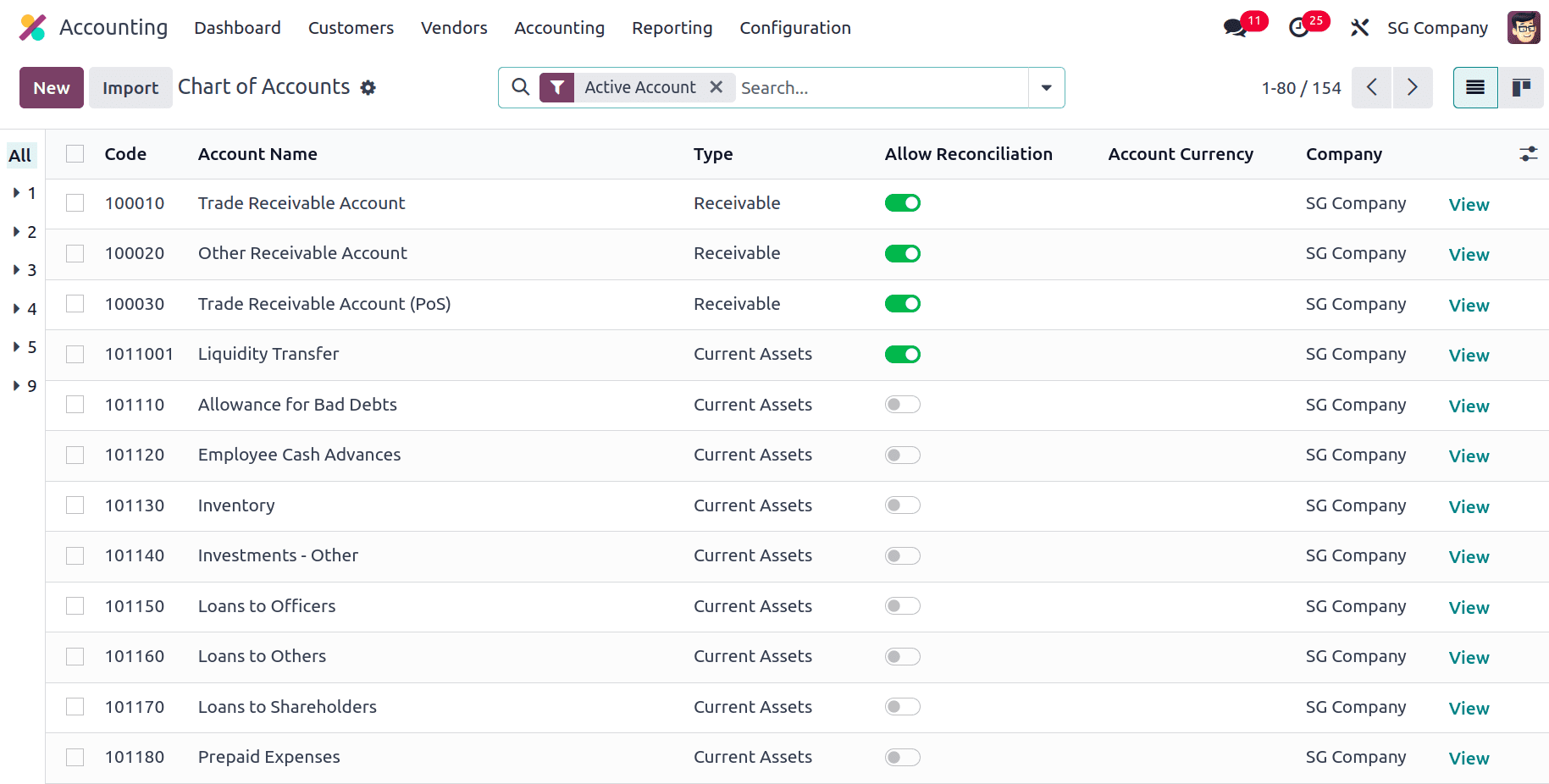

Charts of Accounts

Every financial transaction in Odoo, from sales invoices to expense payments, is recorded in a specific account within the chart of accounts. This ensures all your financial activities are meticulously tracked and categorized. When we install the Singapore localization, the Chart of Accounts required for recording that country’s financial transactions are installed. There are different Chart of Accounts that are included for Singapore localization, like Trade Receivable Account which plays a crucial role in managing your sales transactions and ensuring accurate financial reporting under Singaporean accounting standards, Allowance for Bad Debts plays a critical role in managing the potential risk of uncollectible customer receivables and ensuring accurate financial reporting, Employee Cash Advance account serves a specific purpose in managing short-term loans provided to employees and ensuring proper accounting treatment under Singaporean regulations, and there are several other Chart of Accounts that are added specifically for this localization.

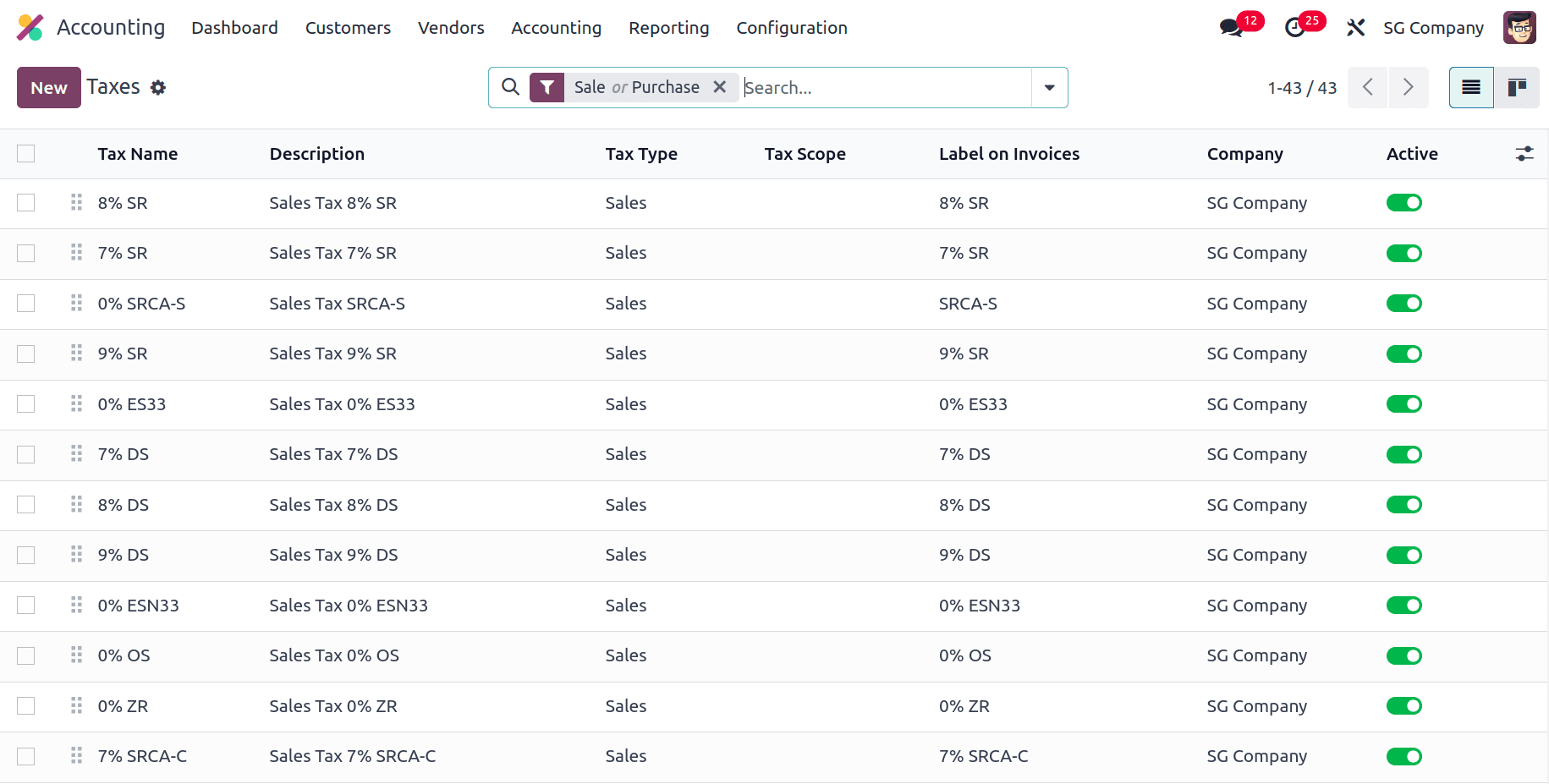

Taxes

Odoo streamlines tax management for businesses by automating calculations based on vendor location and product type, eliminating manual errors and ensuring compliance. You can create various sales and purchase taxes with their specific rates and conditions within the Taxes in Odoo. This automation saves you time, reduces errors, and ensures accurate tax application for every transaction, ultimately simplifying tax management and financial reporting. When we install the Singapore accounting localization, the taxes corresponding to it will be pre-installed in the Accounting module.

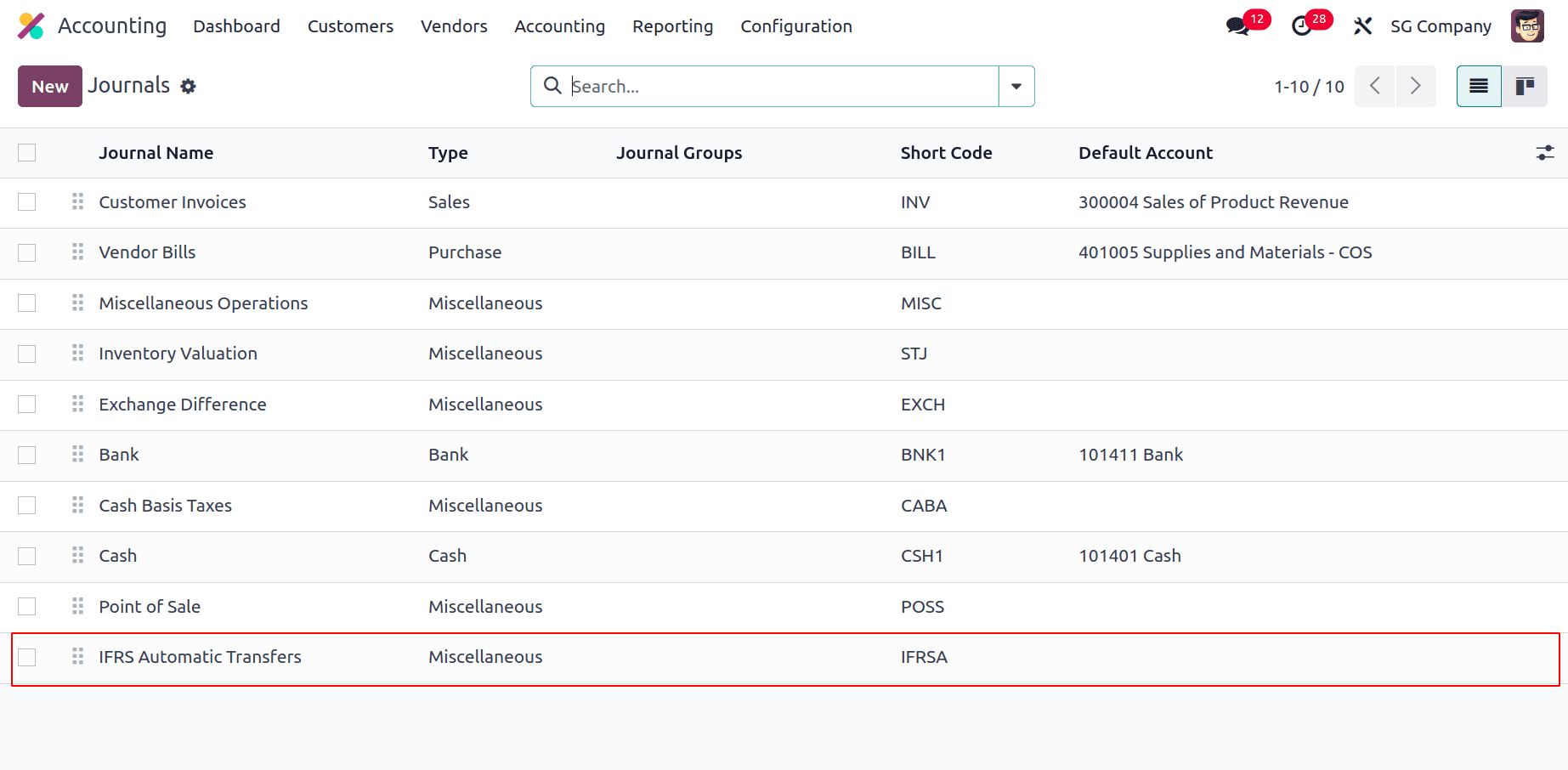

Journals

Journals are used to record all financial transactions and act as a foundation for your accounting system thus providing an organized record of all your financial activities. Journals in Singapore localization mainly have all of the basic journals along with the IFRS Automatic Transfers. Automatic transfers for transactions connected to IFRS must provide compliant journal entries in order to guarantee correct accounting in accordance with IFRS.This may involve using specific accounts mandated by the relevant IFRS standard.

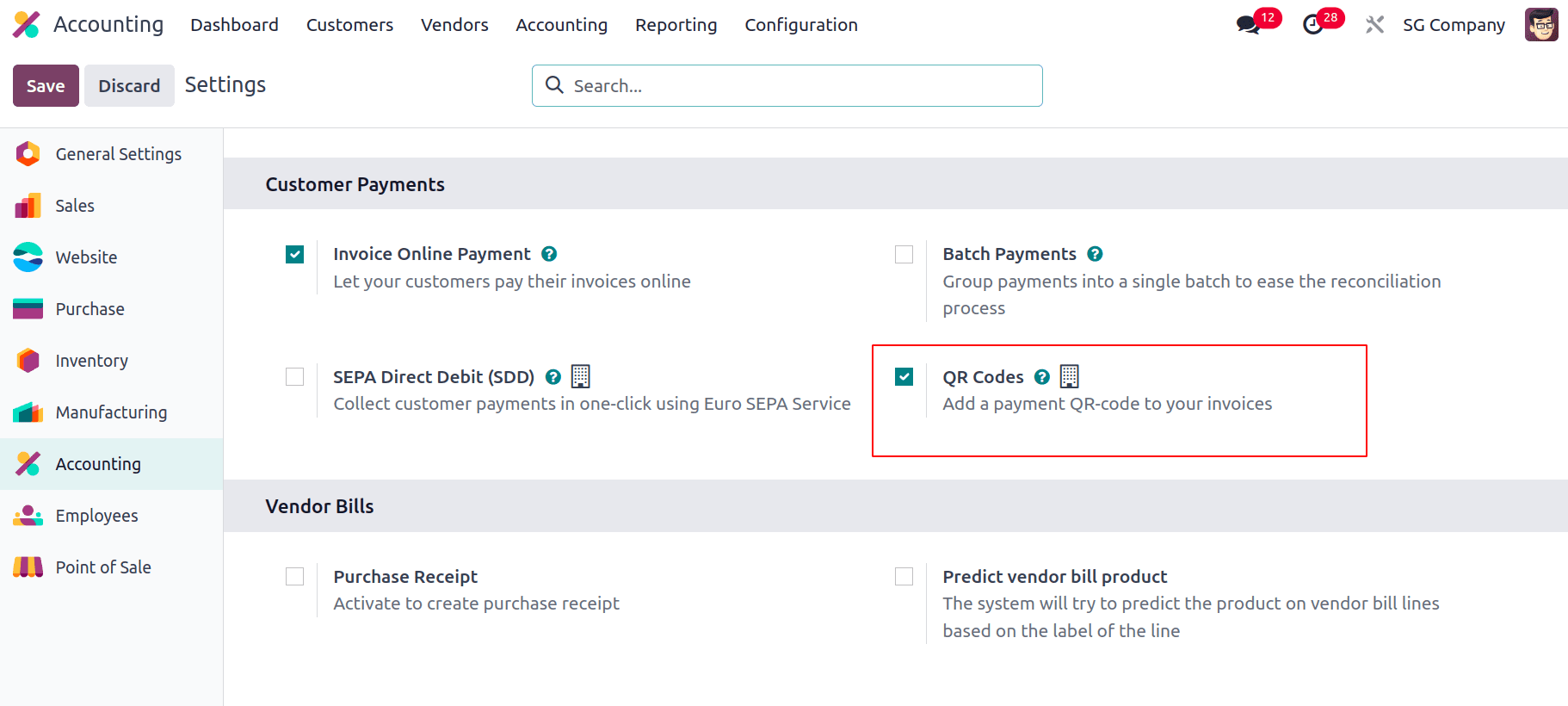

Invoices

With Singapore localization, we can add Pay Now QR codes to invoices. PayNow is a payment service platform that enables users to use online and mobile banking to instantly send domestic payments in Singapore dollars to people and businesses. For that, we have to activate the QR codes feature first. For that, navigate to Accounting > Configuration > Settings, and under Customer Payments, enable the option QR codes.

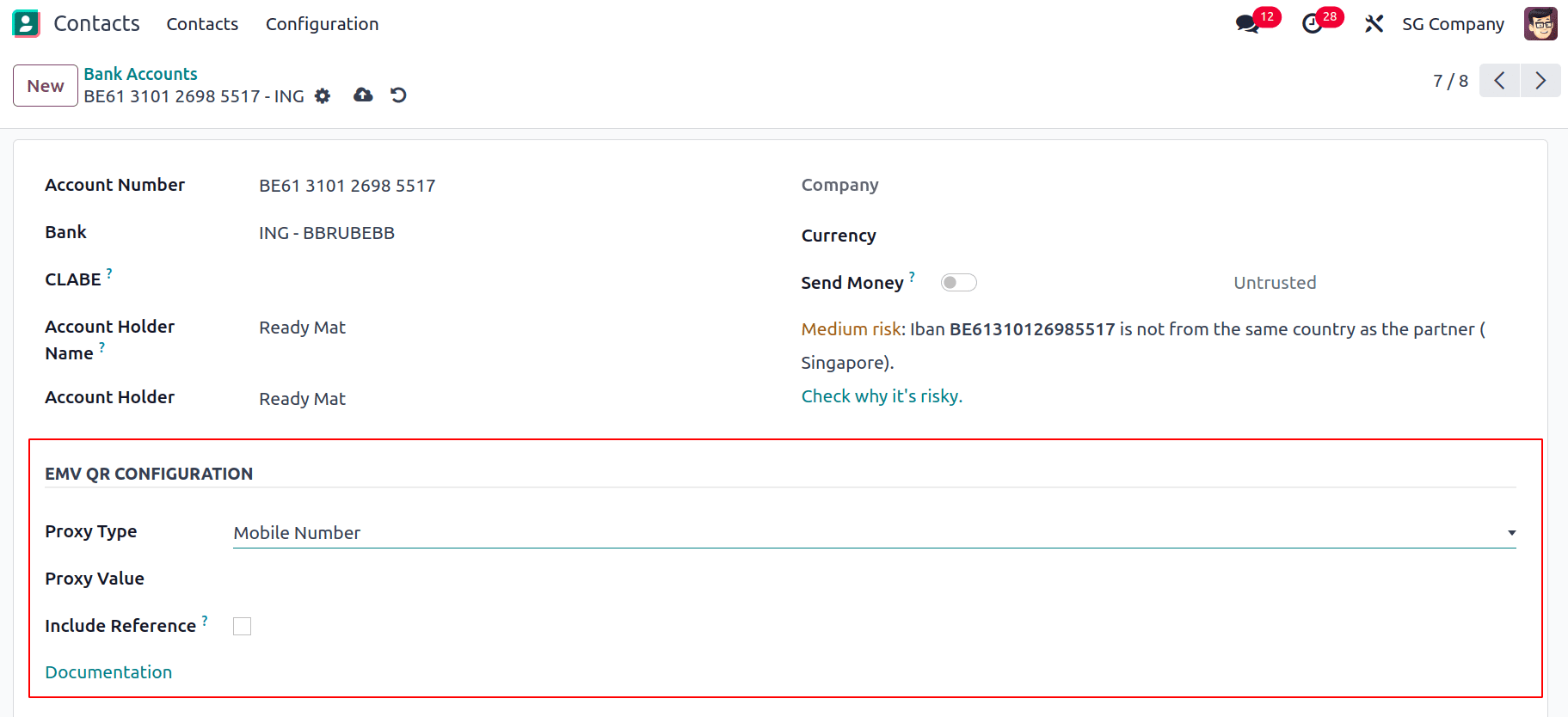

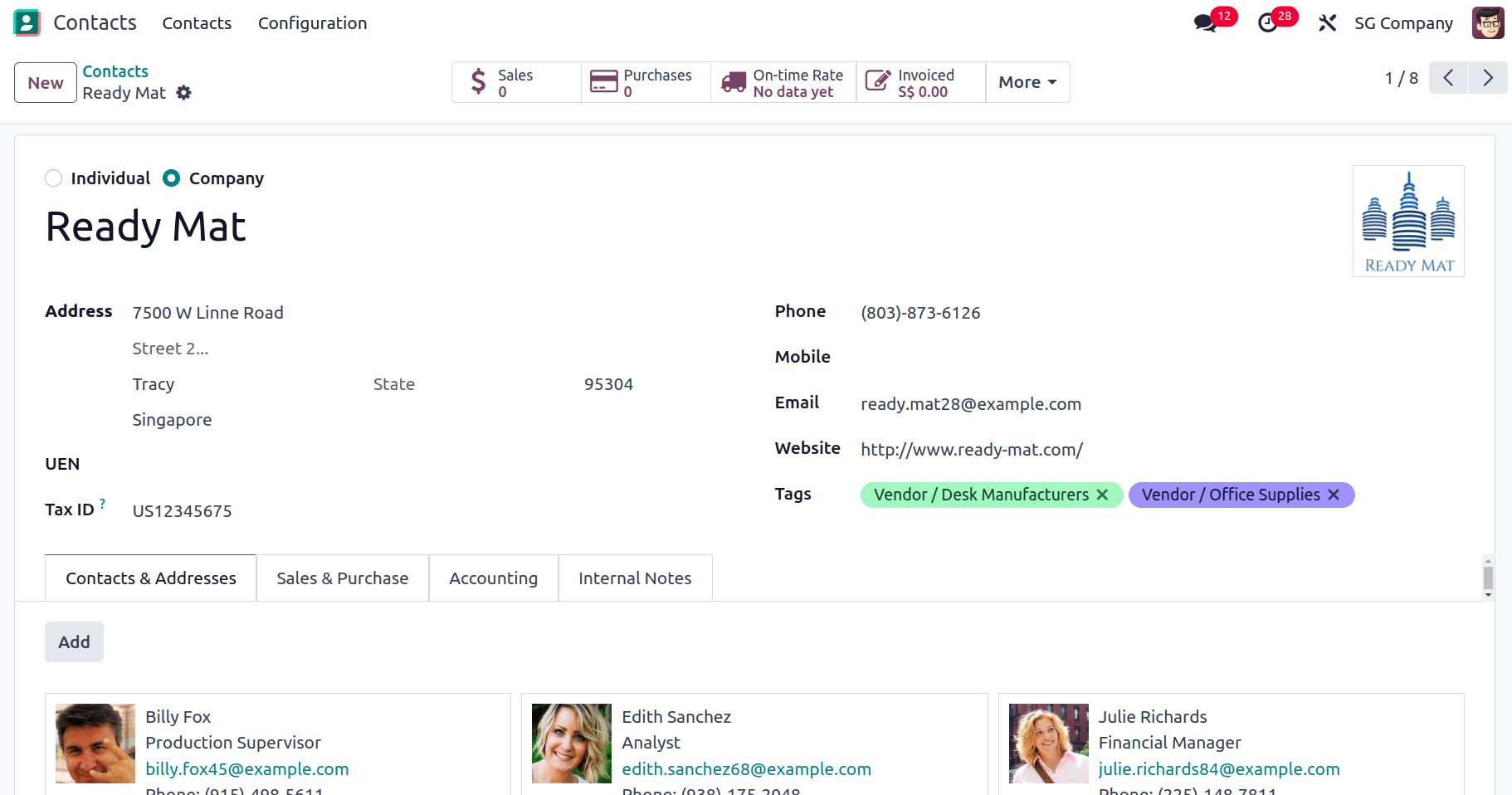

By enabling the option we will be able to add QR codes to the invoices so that the customers can make the payment online and through mobile banking. We have to make certain account configuration to make use of the QR codes feature. For that, navigate to Contacts > Configuration > Bank Accounts. Choose the bank account for which we want to enable PayNow and set the Proxy Type and enter the Proxy Value to that account.

The Include Reference check box can be checked to include the invoice number in the QR code. For configuring the Proxy Type and Proxy Value for the bank account the account holder’s Country must be set to Singapore on their contact form.

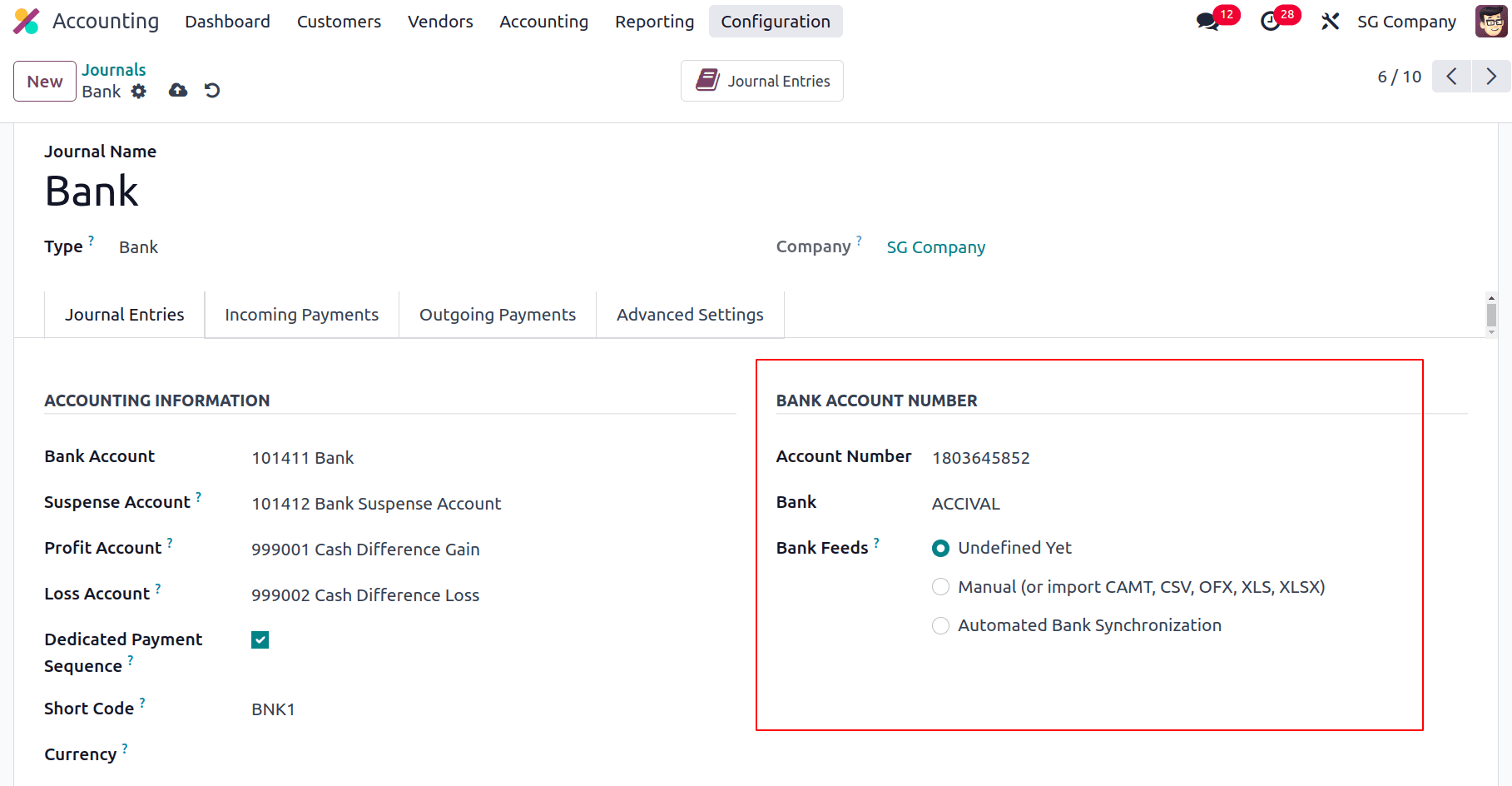

Then we have to add the account number and bank in the Bank Journal. For that navigate to Accounting > Configuration > Journals and select Bank Journal, there we have the option to add these details.

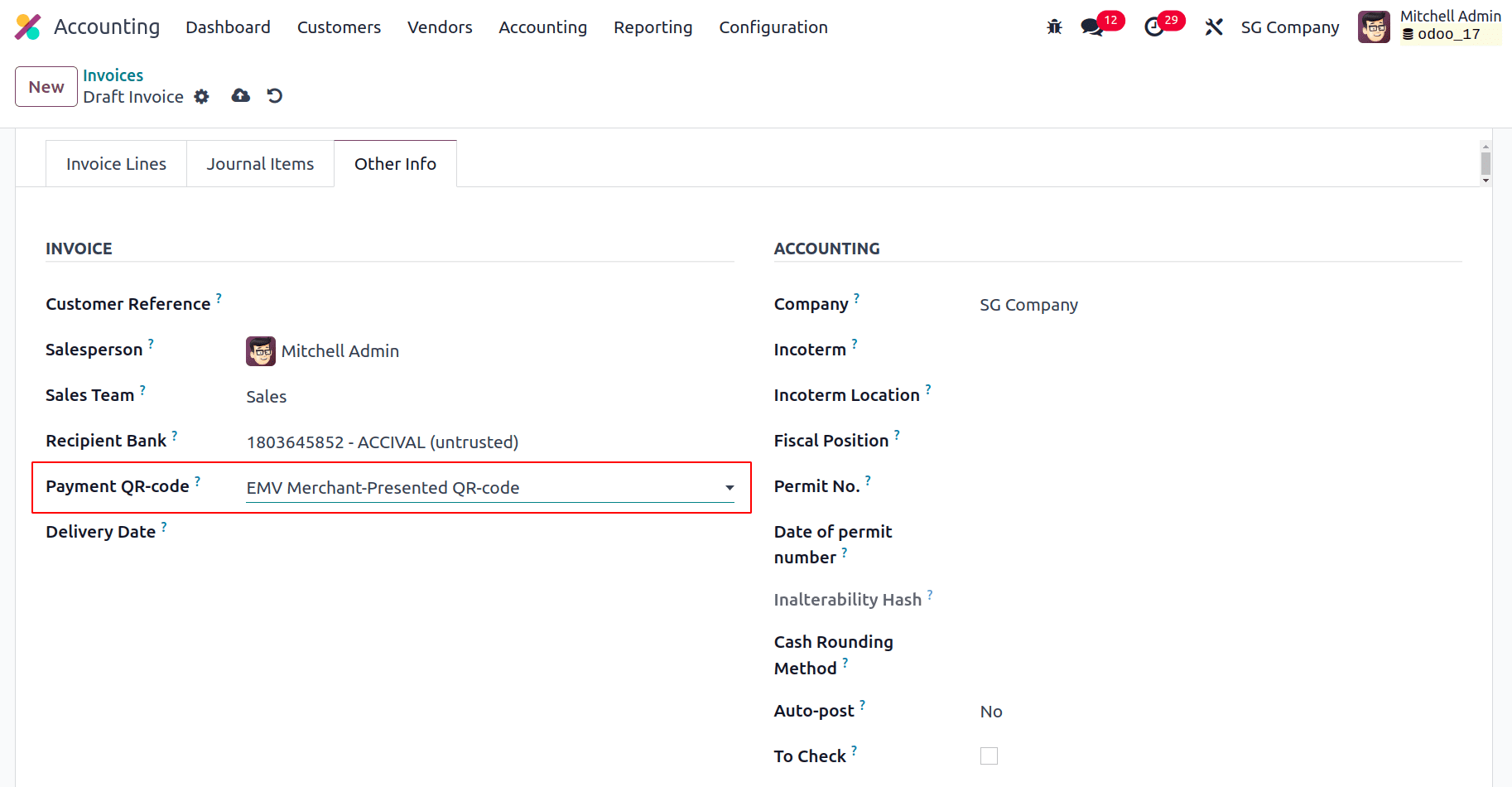

Then we can add the Payment QR code in the other info tab of the invoice.

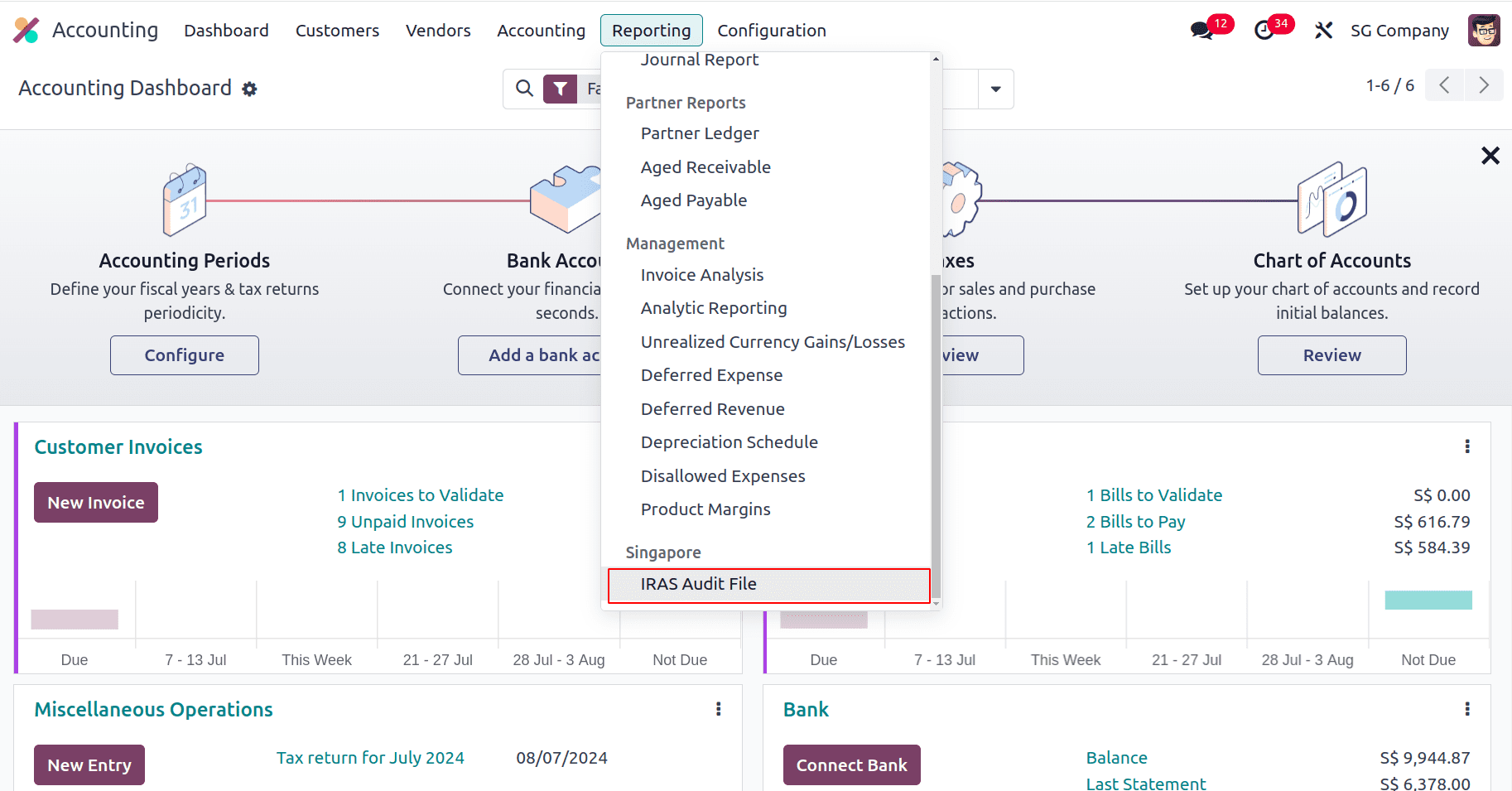

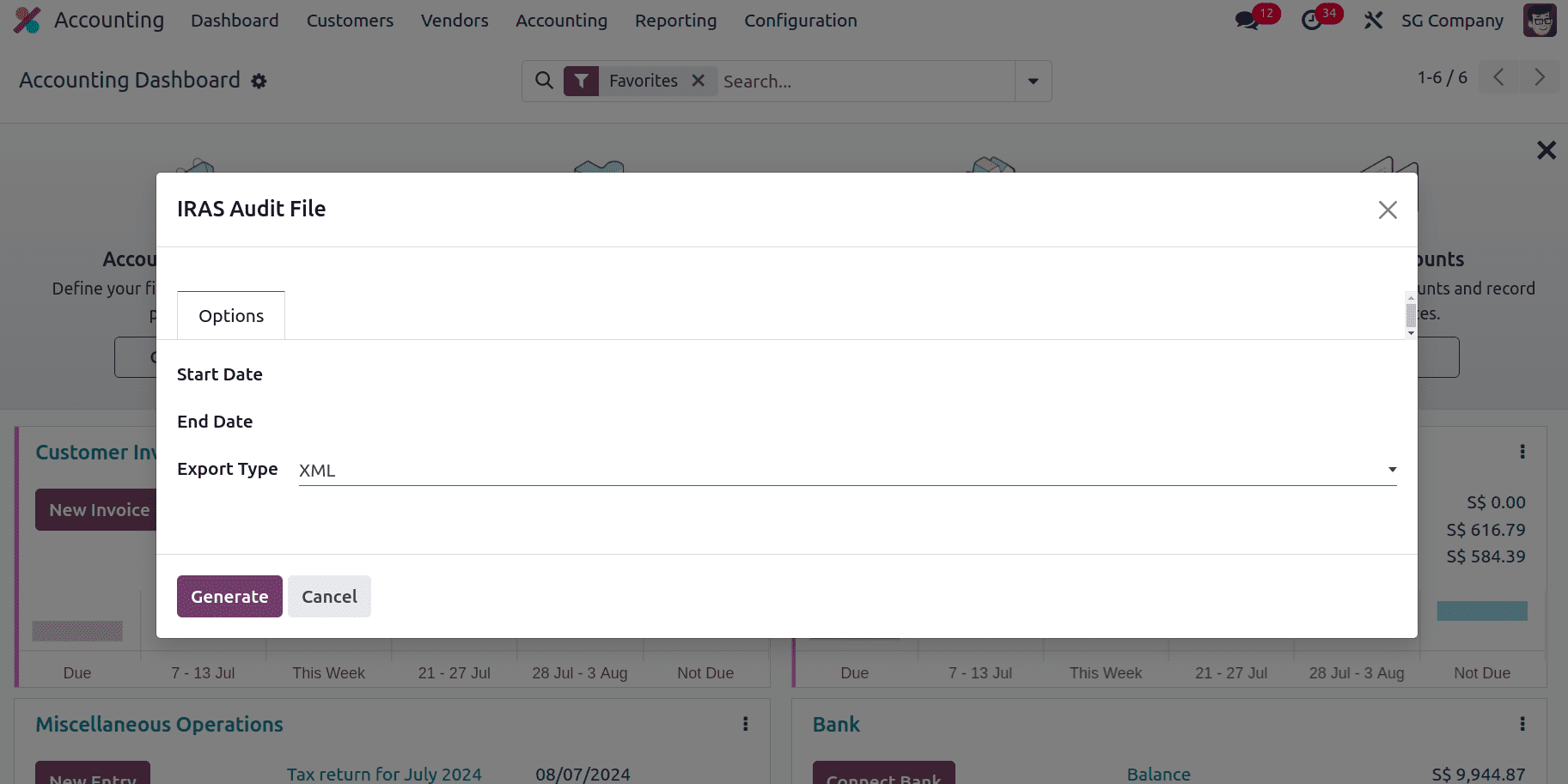

IRAS Audit File

In the Reporting, we have IRAS Audit File, The IRAS Audit File (IAF) is a structured file format used by businesses in Singapore to provide detailed financial data during audits conducted by the Inland Revenue Authority of Singapore (IRAS). This file format is specifically designed to facilitate the audit process by ensuring that auditors have access to comprehensive and accurate financial information in a standardized manner.

We have to give the Start Date and End Date and the export type can also be mentioned.

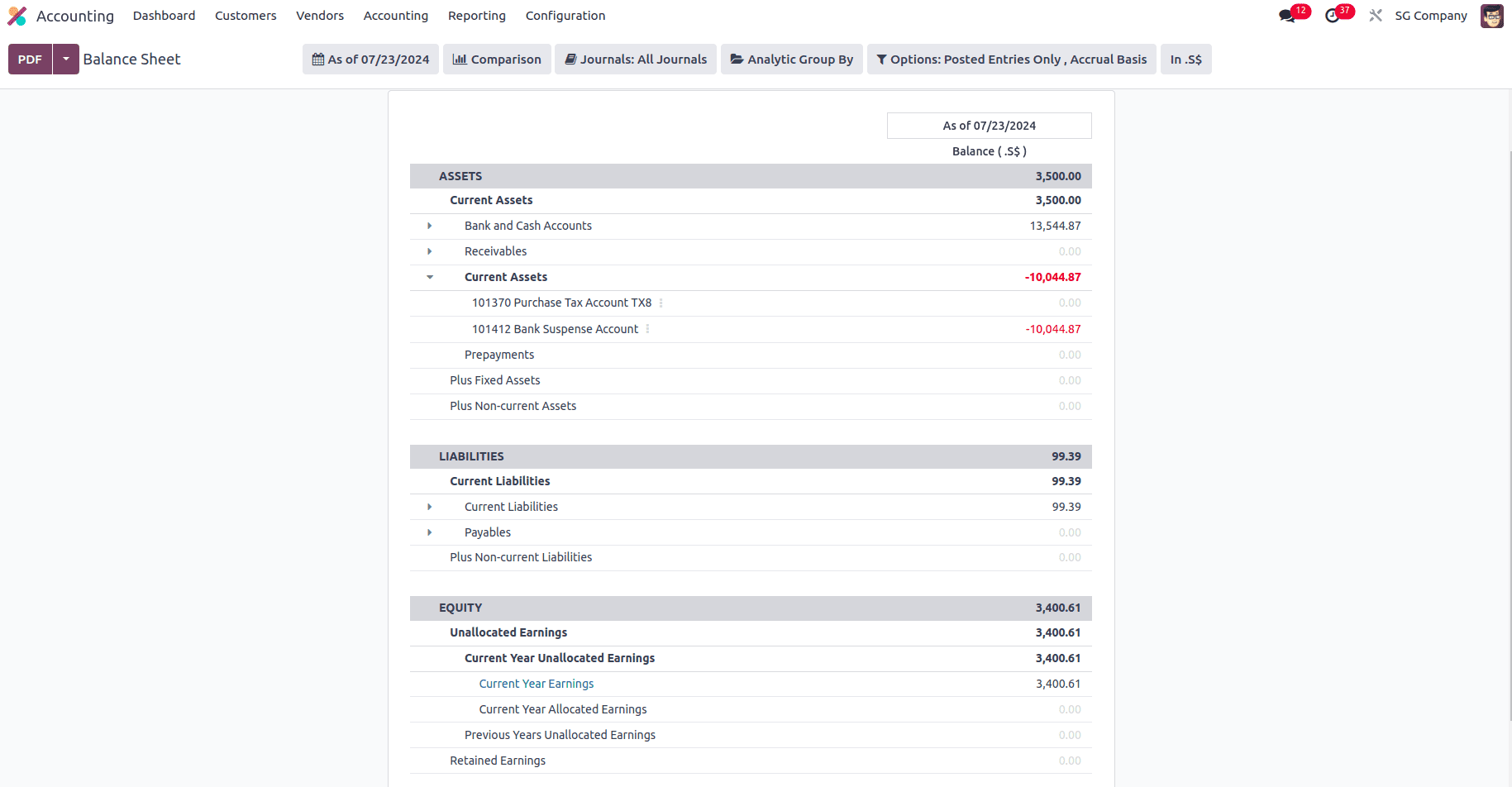

Balance Sheet

A balance sheet in Odoo accounting summarizes a company's assets, liabilities, and equity at a specific point in time. With the installation of Singapore Accounting localization, the balance sheet shows the Assets, Liabilities and Equity of the company at that time. Assets are the resources that a company possesses that are valuable commercially and are expected to yield benefits in the future. A fundamental idea in financial accounting, assets are often classified based on their type and function within the business. In the assets, we can view the bank and cash accounts, receivables, current assets etc with their values. Financial obligations or debts owed by a business to third parties are referred to as Liabilities. Liabilities are items on the balance sheet that reflect the sums owed by the company to lenders, suppliers, creditors, and other entities. In the Liabilities Current Liabilities and Payables can be viewed with their values. The portion of a company's assets that remains after deducting its liabilities is known as Equity. In the equity, we will be able to view the Unallocated Earnings, Current year unallocated earnings etc. It is an important section of the balance sheet that provides details about the entity's performance and financial status in addition to displaying the ownership position of the shareholders.

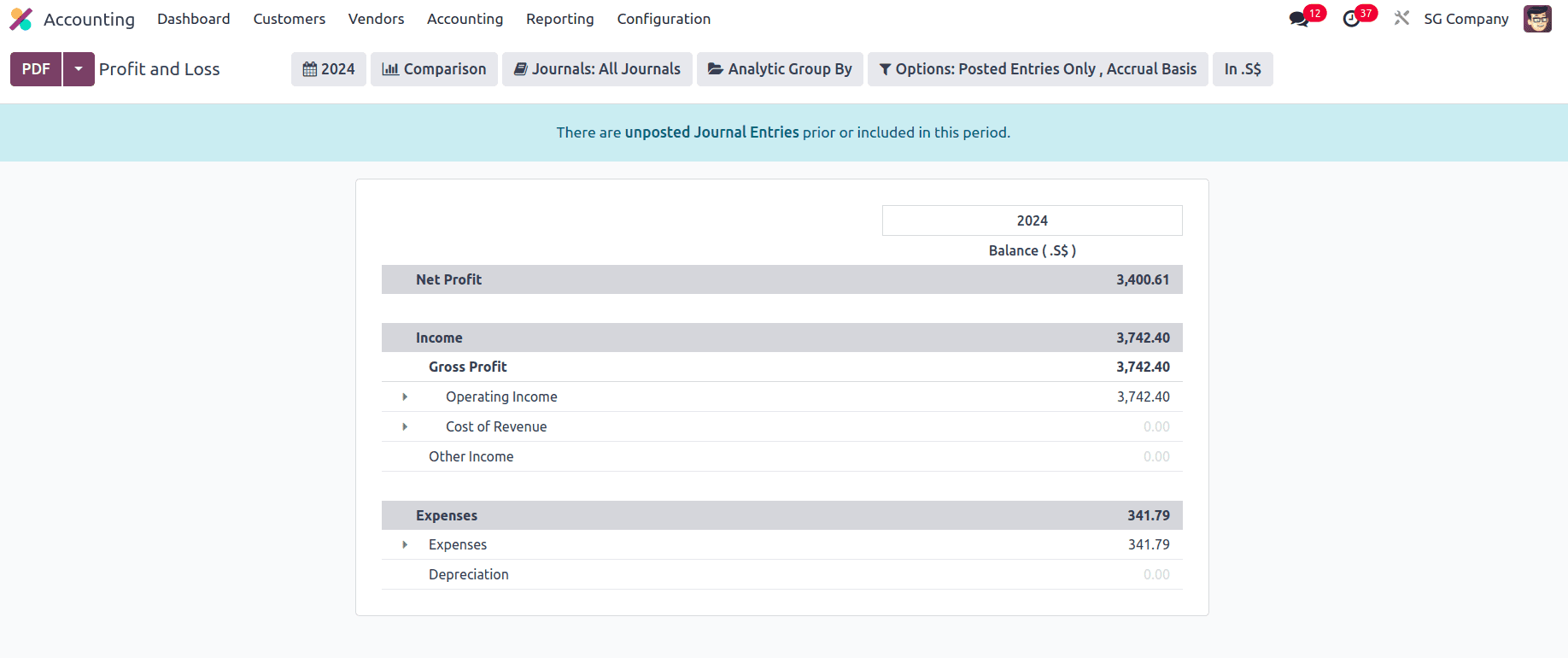

Profit and Loss

The Profit and Loss report in Odoo accounting shows a summary of revenues, expenses, and net profit (or loss) for a specific period. We can view the Net Profit, Income and Expenses of the company in the profit and loss report. Under the income we will be able to view the Gross Profit along with the Operating Income, Cost of Revenue and Other Income. And under the Expenses section, we will see the Expenses and Depreciation.

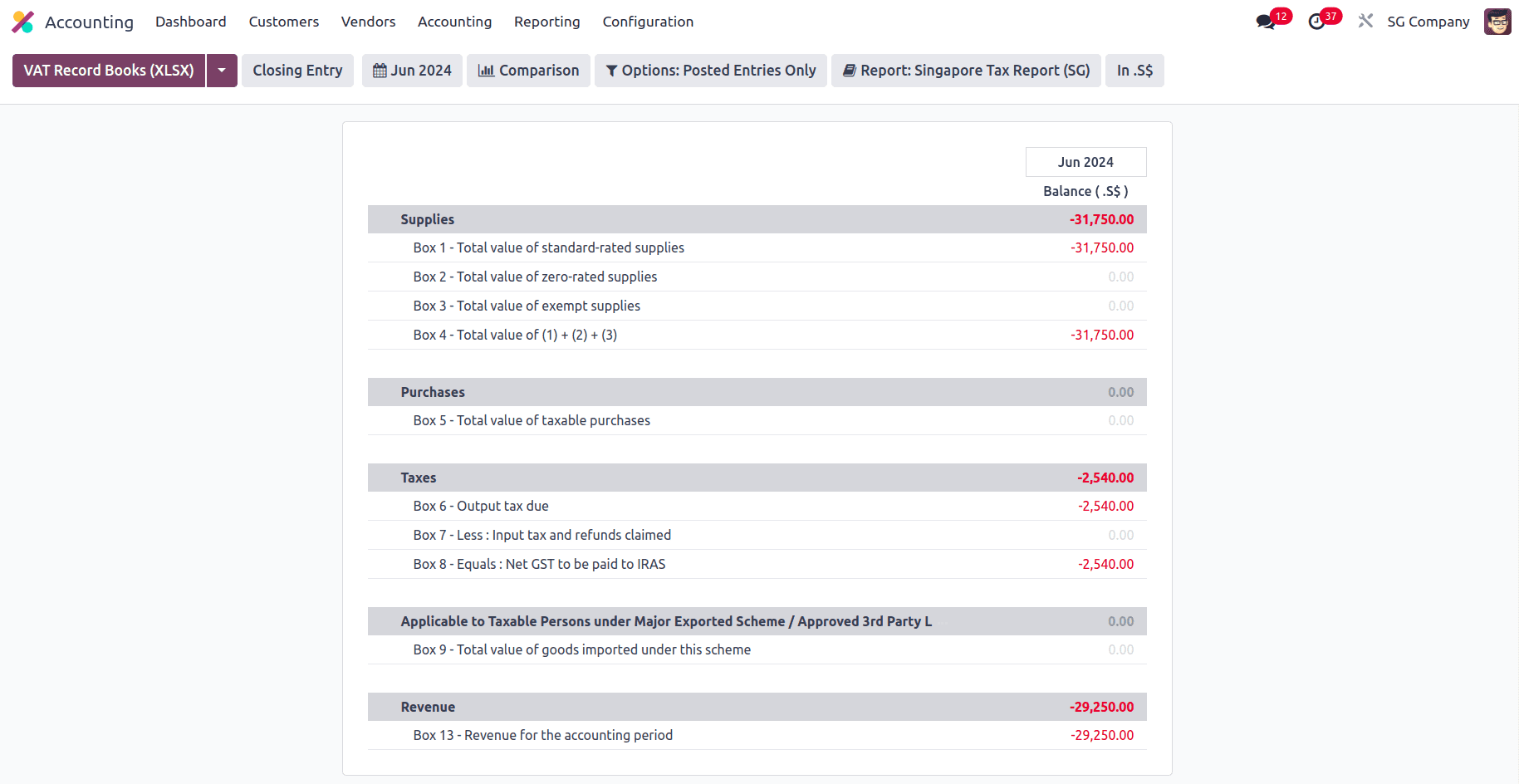

Tax Report

In Odoo accounting with Singapore localization, the tax report plays a vital role by summarizing key financial data essential for compliance with Singaporean tax laws. It helps businesses accurately calculate GST collected on sales, GST paid on purchases, and other tax liabilities. This report helps businesses follow Singapore's tax rules and also gives useful information for planning finances, making budgets, and decisions. Additionally, it serves as a reliable record for audits, promoting transparency and accuracy in financial reporting while safeguarding businesses from potential penalties associated with incorrect tax filings.

In this blog, we have seen the Singapore accounting localization in Odoo 17. Adopting Singapore accounting localization practices, such as utilizing the IRAS Audit File (IAF), is pivotal for businesses operating in the region. These practices not only streamline financial reporting processes but also enhance compliance with local regulatory requirements. By adopting these standards, businesses can effectively navigate audits, minimize administrative complexities, and foster a more transparent financial environment. Ultimately, integrating Singapore accounting localization not only ensures regulatory adherence but also lays a robust foundation for sustainable growth and operational efficiency in the competitive Singaporean market.

To read more about An Overview of Accounting Localization for Estonia in Odoo 17, refer to our blog An Overview of Accounting Localization for Estonia in Odoo 17.