Managing finances in Argentina comes with its own set of regulations and complexities. Odoo 17 Argentinian localization module streamlines the process, ensuring simplification of the accounting tasks. It is important to have the proper accounting localization set up according to the country they function in. This blog post delves into the module's functionalities and highlights the importance of testing them in Odoo 17's designated environments.

Argentinian Accounting with Odoo 17

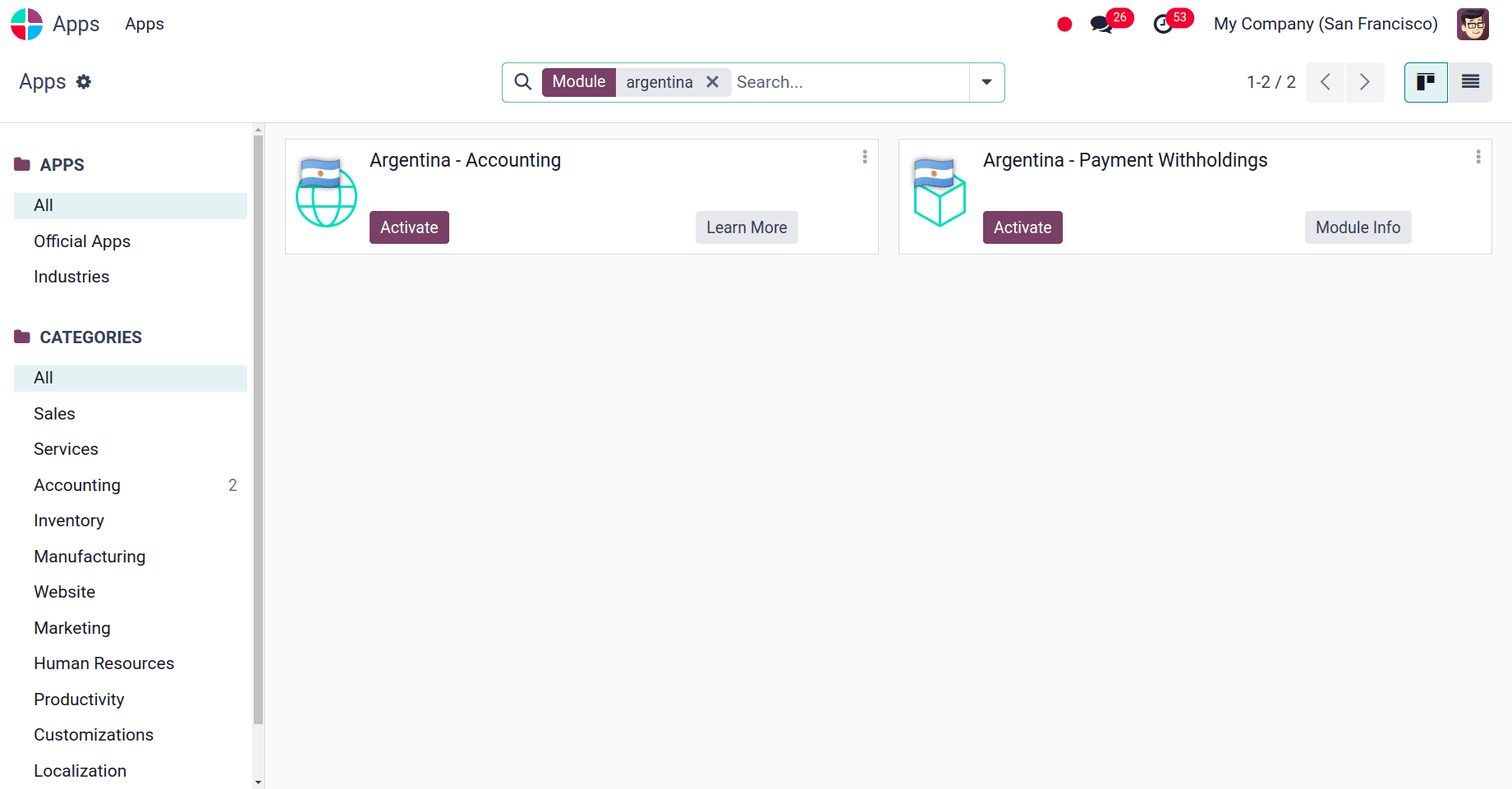

With Odoo 17's Argentinian localization module, the local tax regulations and accounting practices can be performed effortlessly. For setting up the accounting localisation for Argentina, the first step is to install the Argentina localization. For that, we can go to Apps and install the modules that are required to set up the accounting localization for Argentina.

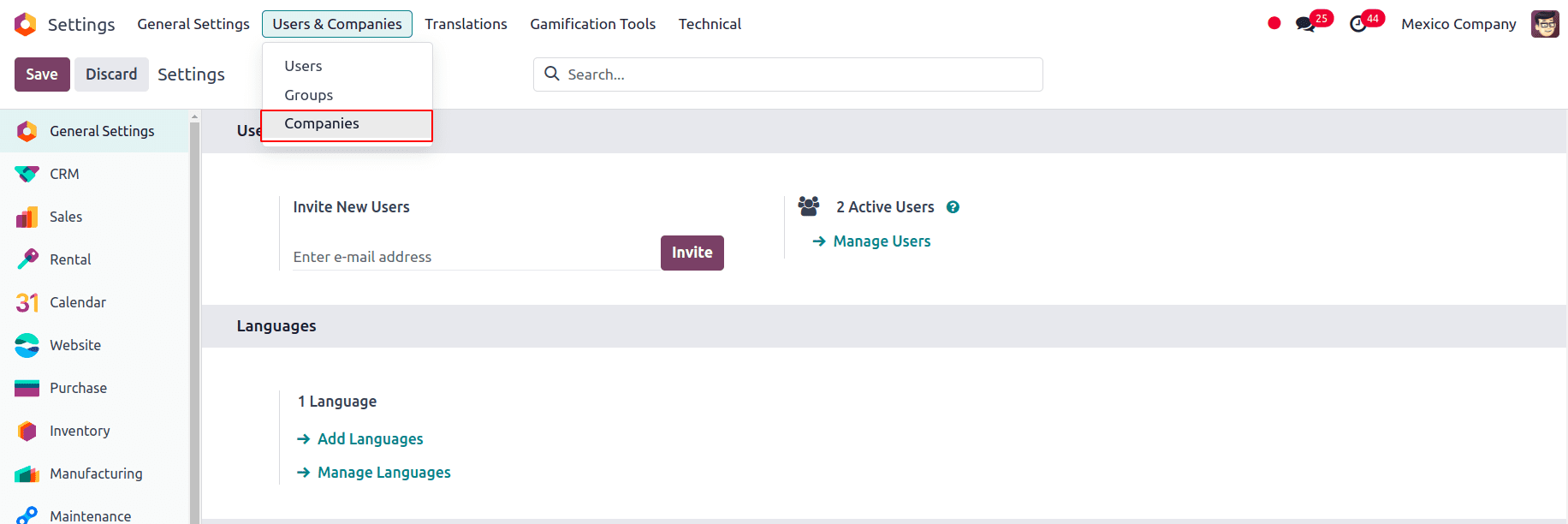

After installing the modules required for Argentina localization, we can make sure the company is configured correctly or we can create a company with the proper configurations. For that navigate to Settings --> Users and Companies --> Companies.

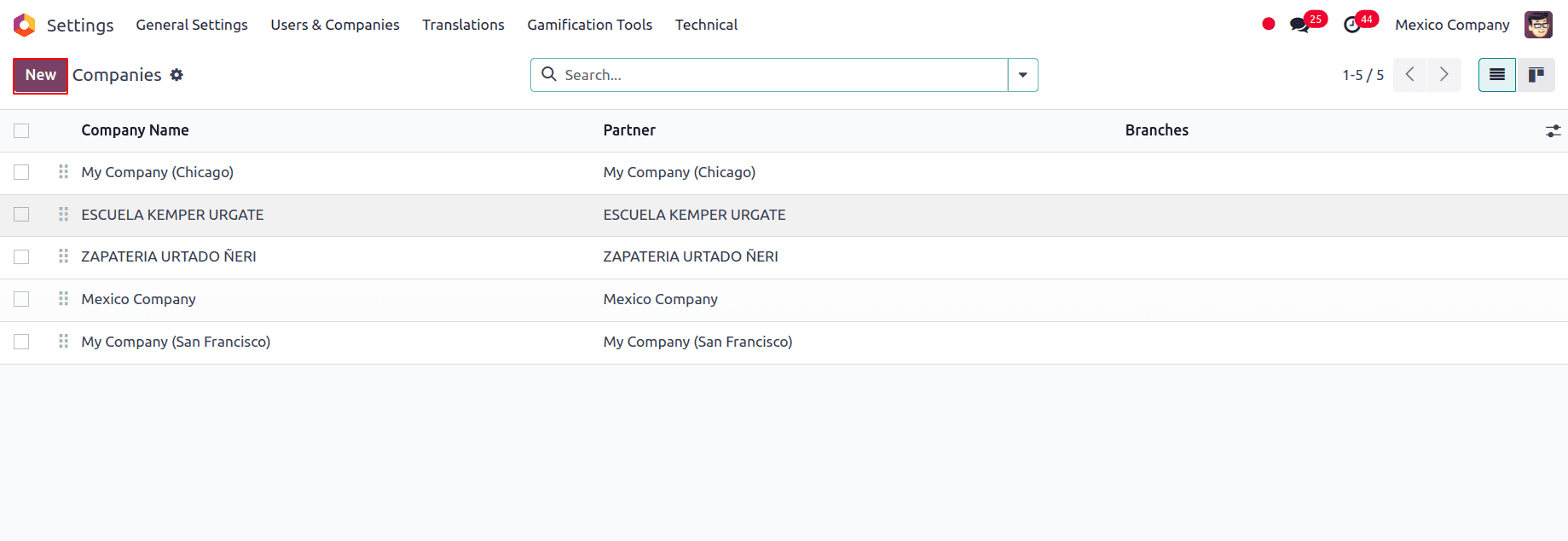

A page appears where we can view the list of all the companies. We can click on the New button at the top left corner to create a new company.

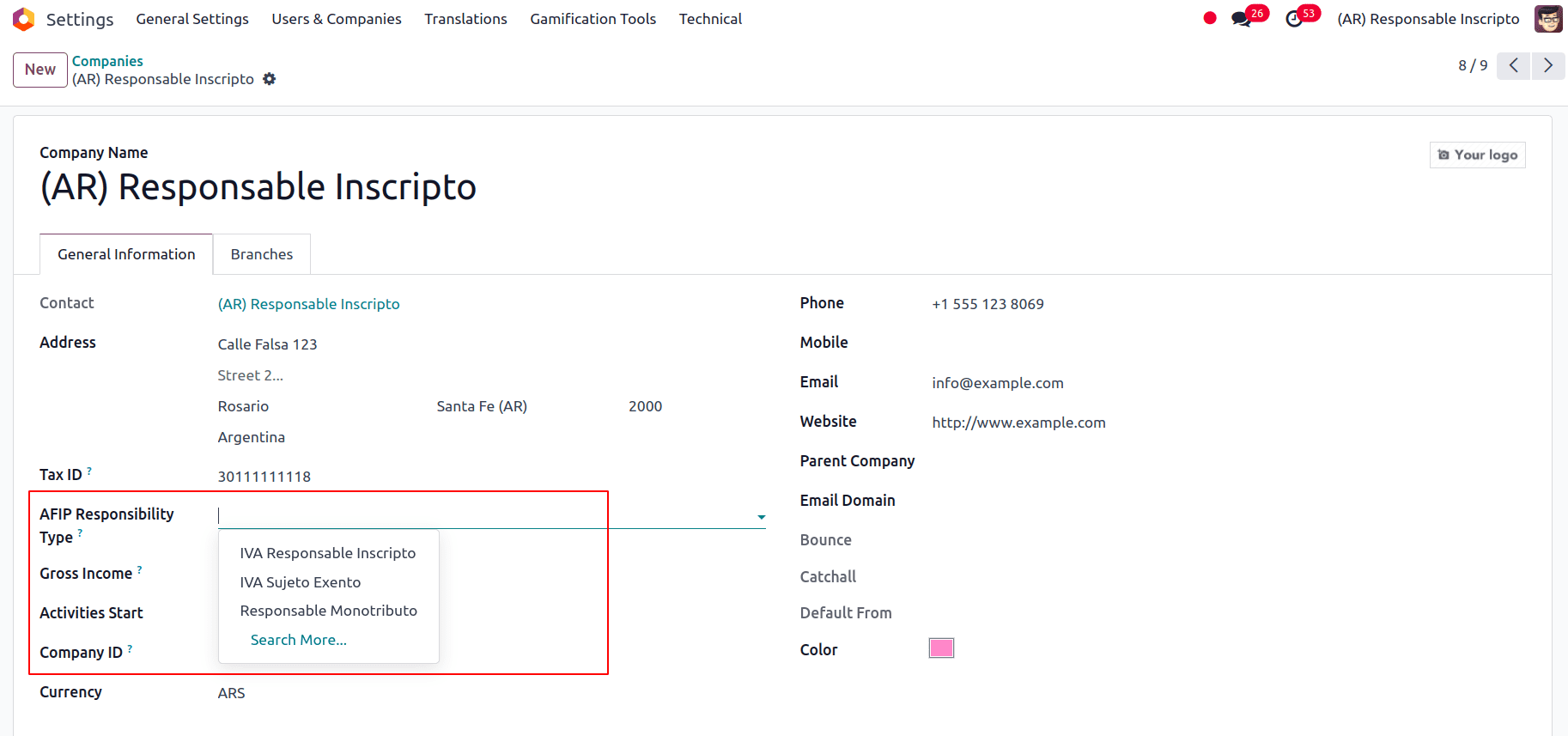

Or we can select the company for which we want to check the configuration. Since the organization operates within the Argentina region, the user must define the AFIP Responsibility Type. The AFIP Responsibility Type assigns the responsibility that a person or a legal entity will have, establishing the company's obligation and the surety of operating. Here, the IVA Responsable Inscripto, IVA Sujeto Exento, or Responsale Monotributo can be selected as the AFIP Responsibility Type.

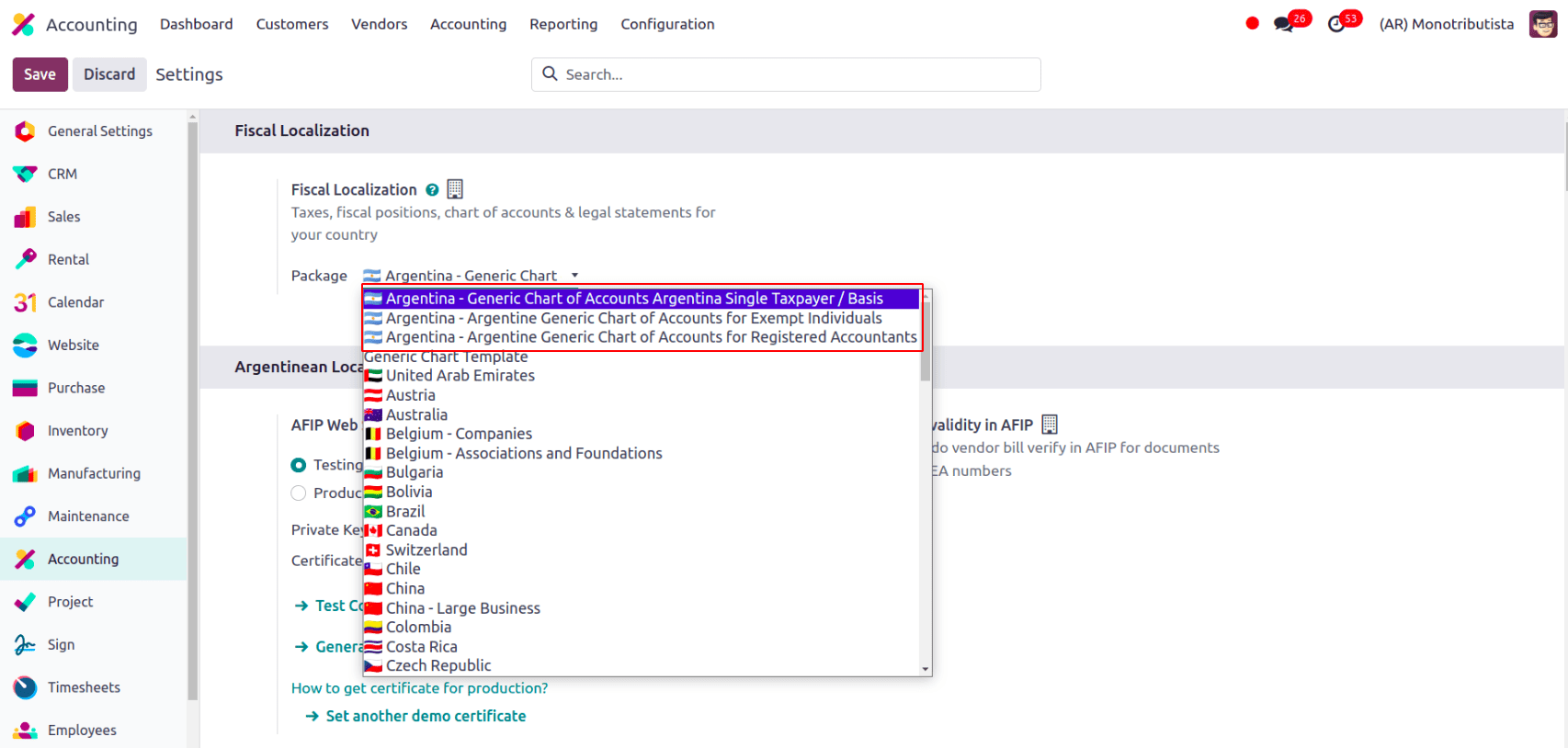

Now go to the configuration settings of the company, and we have three packages for Fiscal Localization for Taxes, fiscal positions, chart of accounts & legal statements for your country. To access that, go to Accounting --> Configuration --> Settings. Under Fiscal Localization we can choose the package according to the country.

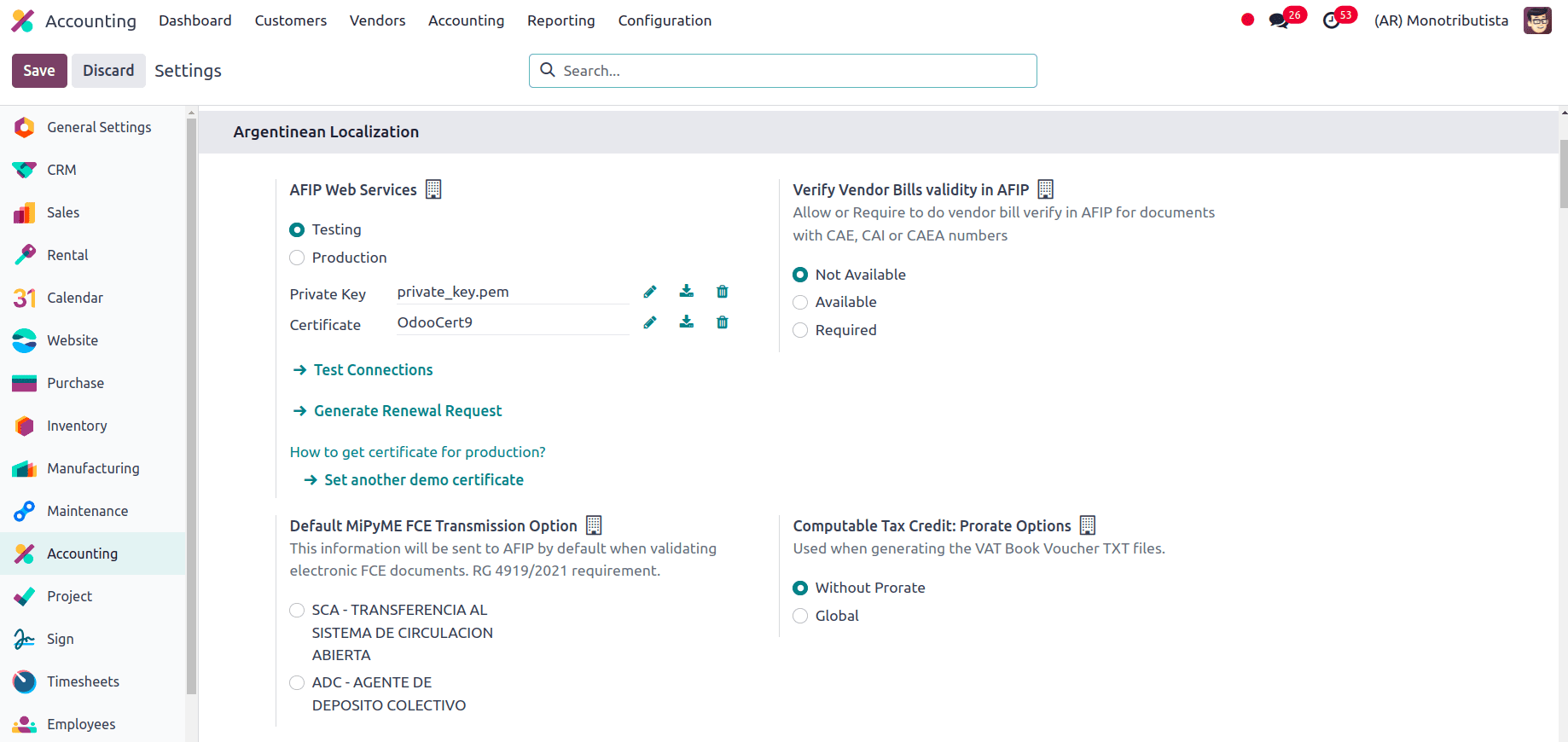

After selecting the package, we can save the settings and scroll down to view the Argentinean localization.

Here we have two environments for AFIP Web Services Testing and production environments.

Testing is offered so that businesses can examine their databases before preparing to enter the production setting. The digital certificates from one instance are not valid in the other as these two environments are separated from one another.

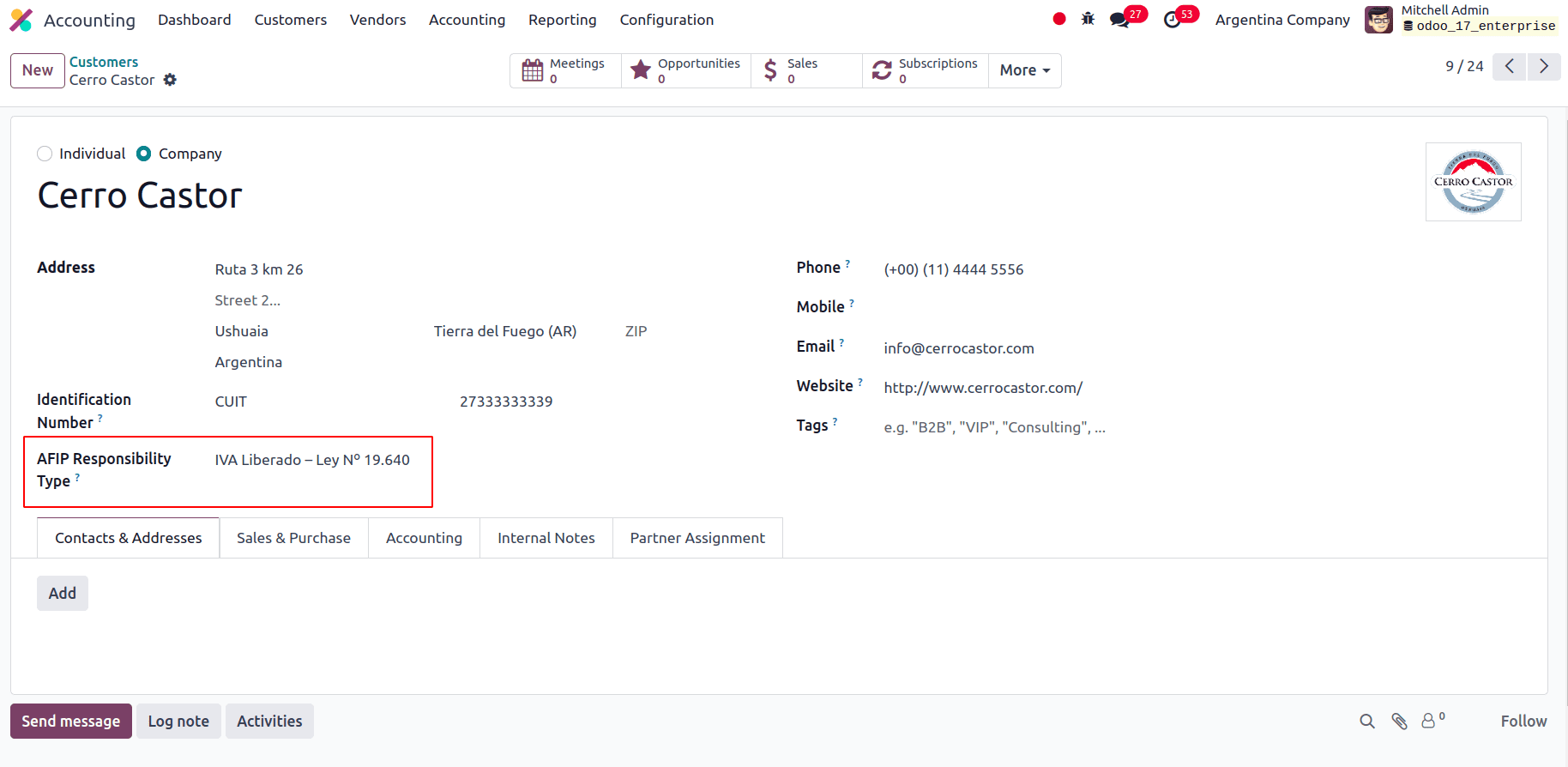

In the partner form, we have to set the AFIP Responsibility Type to identify the type of responsibility that a person or a legal entity could have and that impacts on the type of operations and requirements they need.

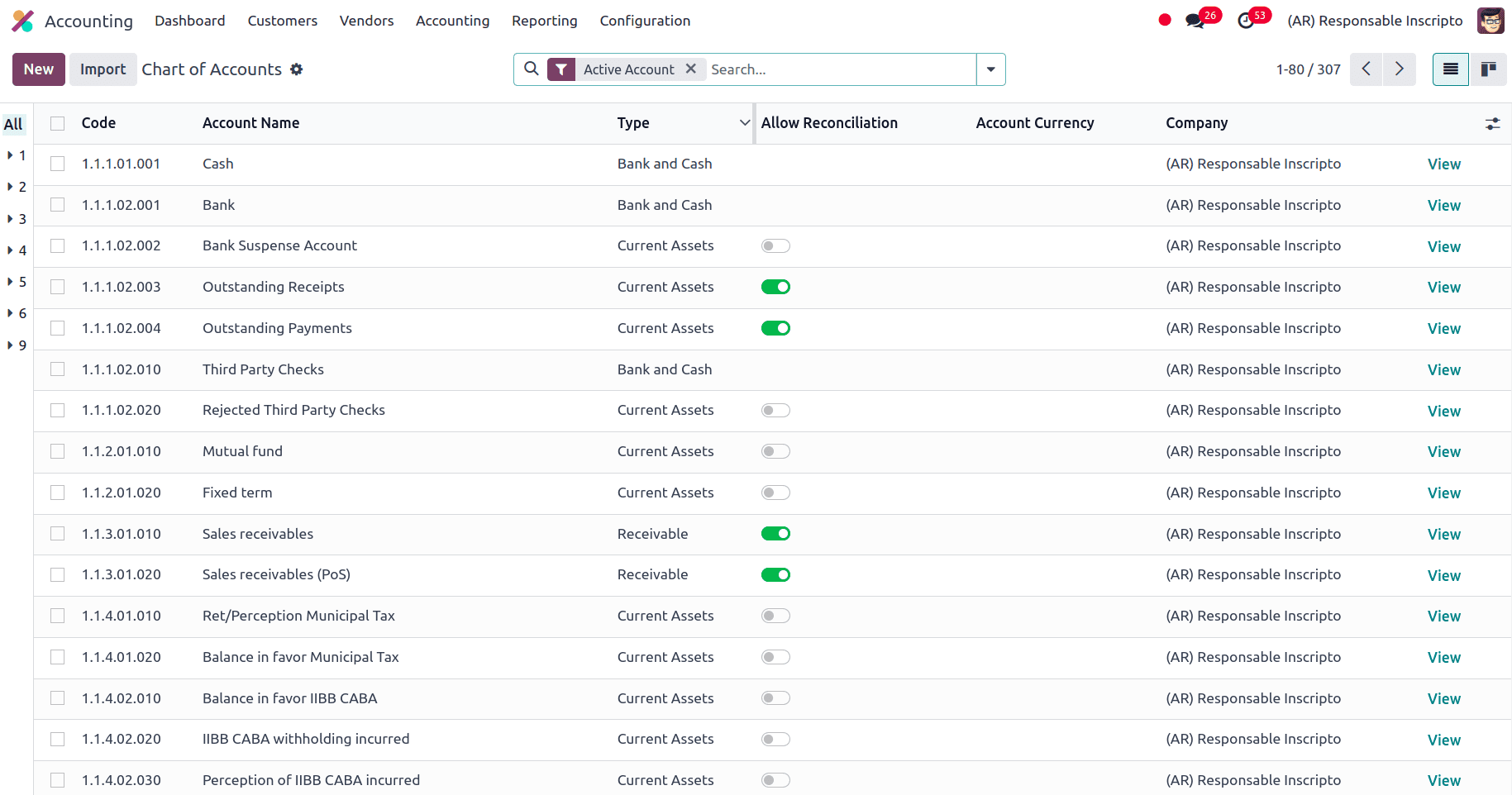

Now we can go to Chart of Accounts, and for that, navigate to Accounting --> Configuration --> Chart of Accounts. We can see several new Chart of Accounts have been added for this specific accounting localization. Odoo 17 adapts to the Argentinian chart of accounts, ensuring your financial statements and reports comply with local standards.

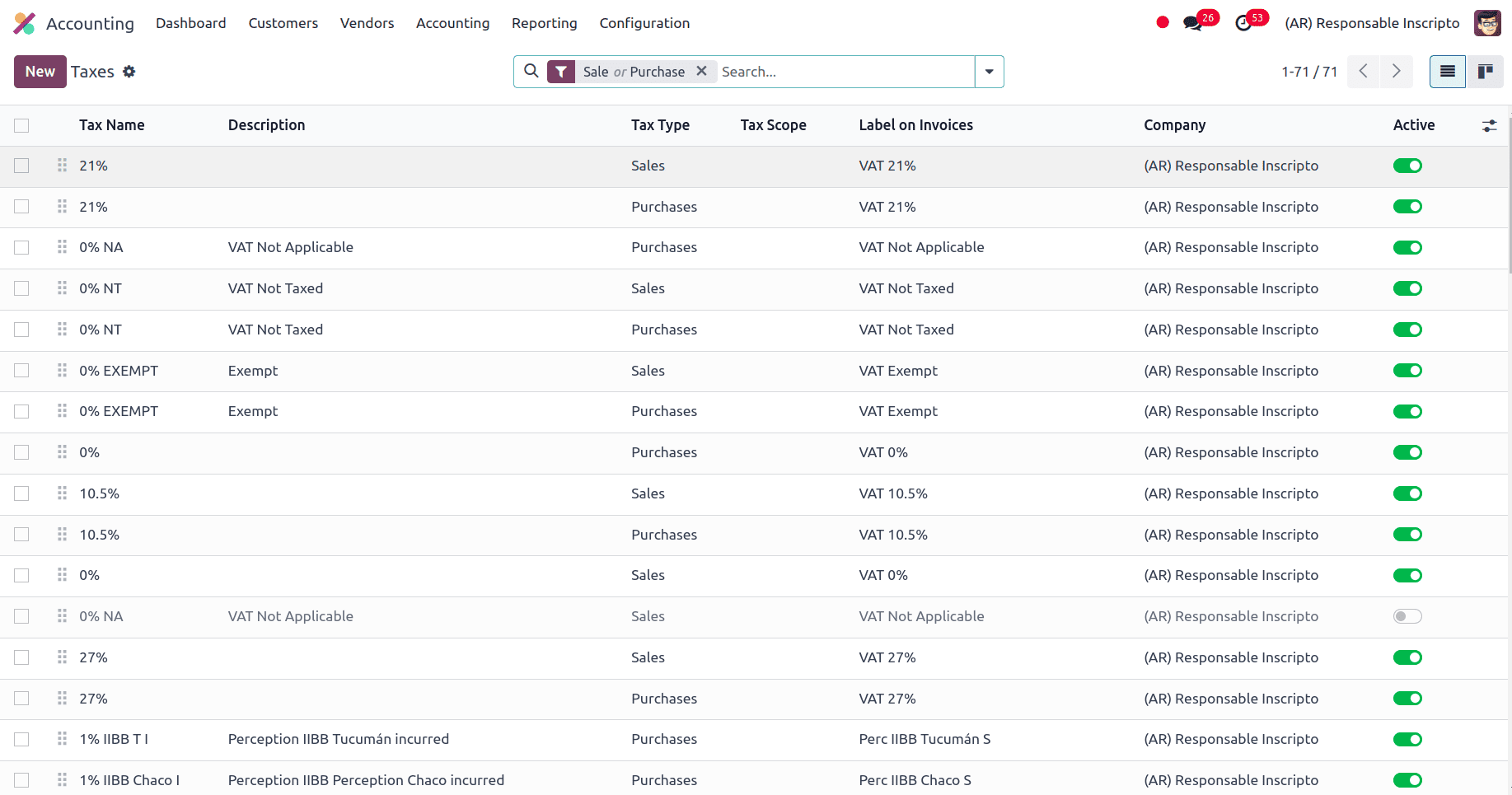

This localization module pre-configures various Argentine Taxes, including IVA (Impuesto al Valor Agregado) and Ingresos Brutos. This removes the need for manual tax calculations and ensures accurate tax reporting. Argentina has different tax types such as VAT which can have diverse percentages, and Perception which is the advance payment of a tax that will be applied on invoices. Retention is the advance payment of a tax that will be applied to payments.

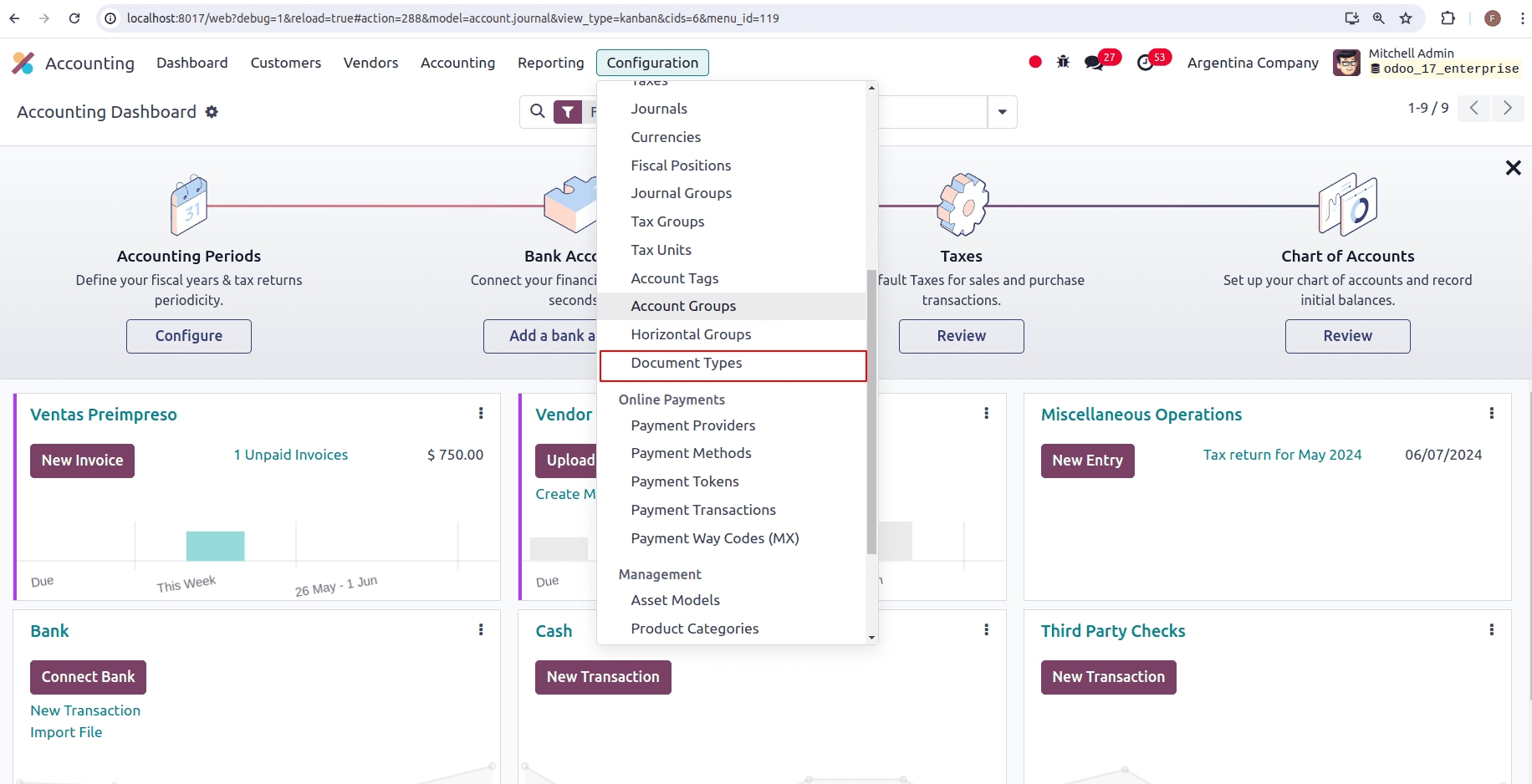

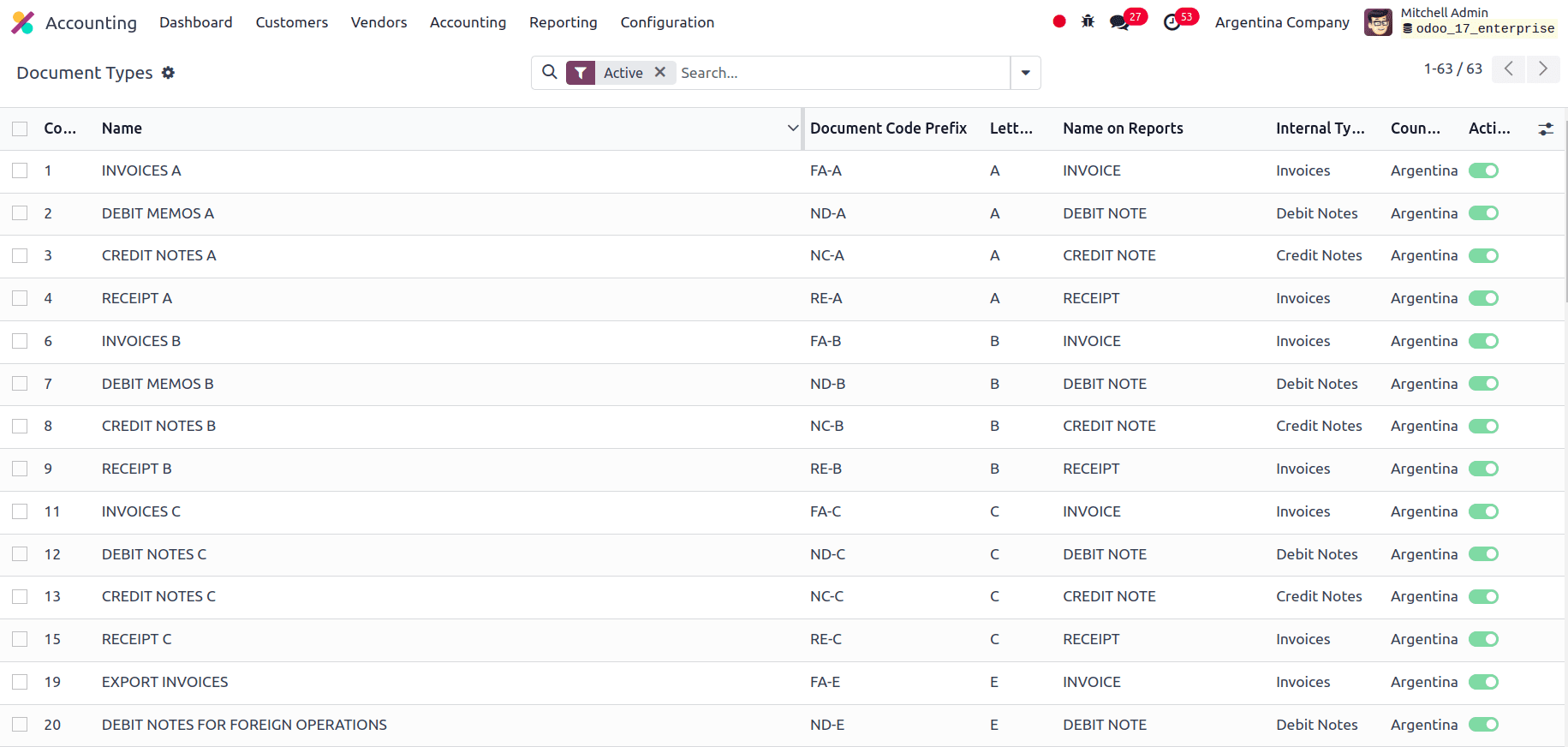

In Argentina Localization, when defining Customers, the Accounting Documents can be assigned using the document types that are defined in the menu. To view that, we can navigate to Accounting --> Configuration --> Document Types. A crucial piece of data that must be prominently shown in printed reports, invoices, and journal entries that detail account transfers is the document type.

Here, we can view all the document types available.

Automated Electronic Invoicing (CAE) is a mandatory feature in Argentina. The module automates the generation of the invoices, complete with the necessary Código de Autorización Electrónico (CAE) provided by the AFIP (Administración Federal de Ingresos Públicos). This eliminates manual processes and ensures compliance.

In Argentina, accounting transactions, such as vendor bills and invoices, are categorized by document categories specified by the national fiscal authorities in a few Latin American nations. The national fiscal authority in Argentina that defines these transactions is the AFIP.

Every type of document may have a distinct sequence assigned to it in each journal. The country in which the document is appropriate is included in the document type as part of the localization process (this information is generated automatically upon installation of the localization module).

Each transaction's document type will be decided by:

* The invoice-related journal item (if the journal retains documentation);

* Certain conditions were applicable depending on the issuer and recipient types (e.g., the buyer's and vendor's fiscal regimes).

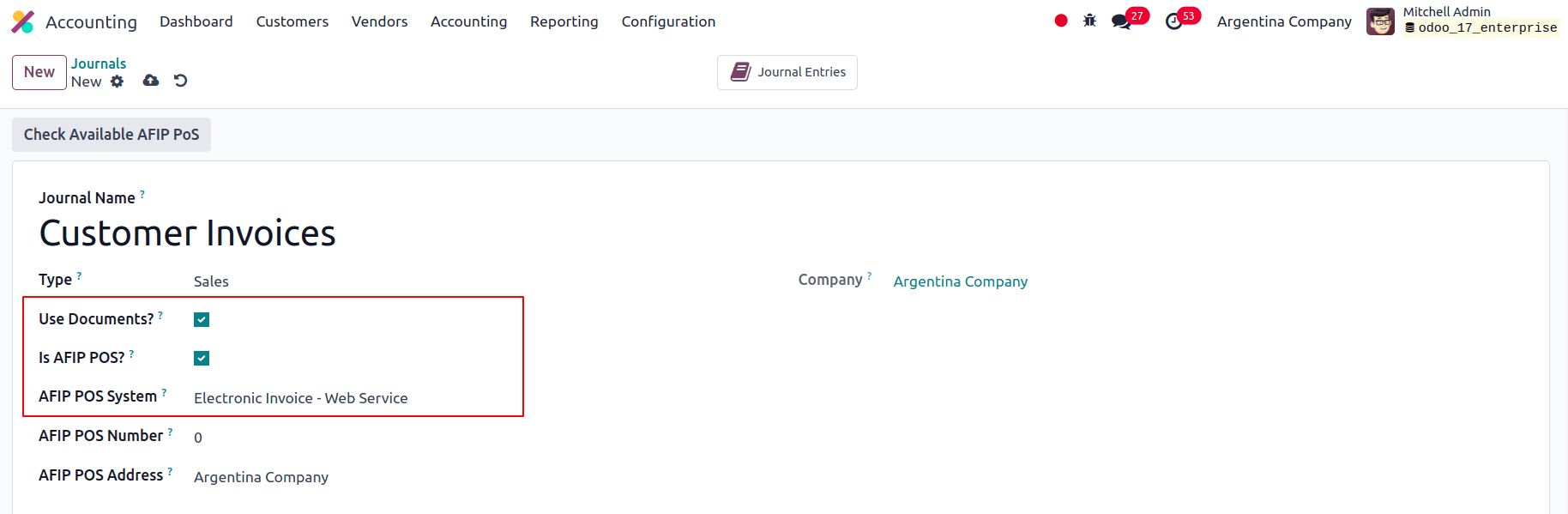

Depending on its internal kind and usage, the journal may take a different approach in the Argentina localization. Navigate to Accounting --> Configuration --> Journals to set up your journals. The Use Documents option, which opens a list of Document Types that can be connected to invoices and vendor bills, can be enabled for sales and purchase journals. The use case for the sales and buy journals will be mostly restricted to tracking account movements associated with internal control procedures if the Use Documents option is not enabled. This is because they will not be able to produce fiscal invoices.

‘Is AFIP POS?’ checkbox can specify if this journal will be used to send electronic invoices, and in the AFIP POS System we can specify which type of system will be used to create electronic invoicing. And we can also specify the AFIP POS Number is the number set up in the AFIP to identify this AFIP POS's associated operations, and AFIP POS Address is the field related to the business address that is registered for the point-of-sale system, which is typically the same address as the business. For instance, the AFIP will mandate that a business have one AFIP point of sale (POS) per fiscal location if it has many storefronts. The invoicing report will print this address.

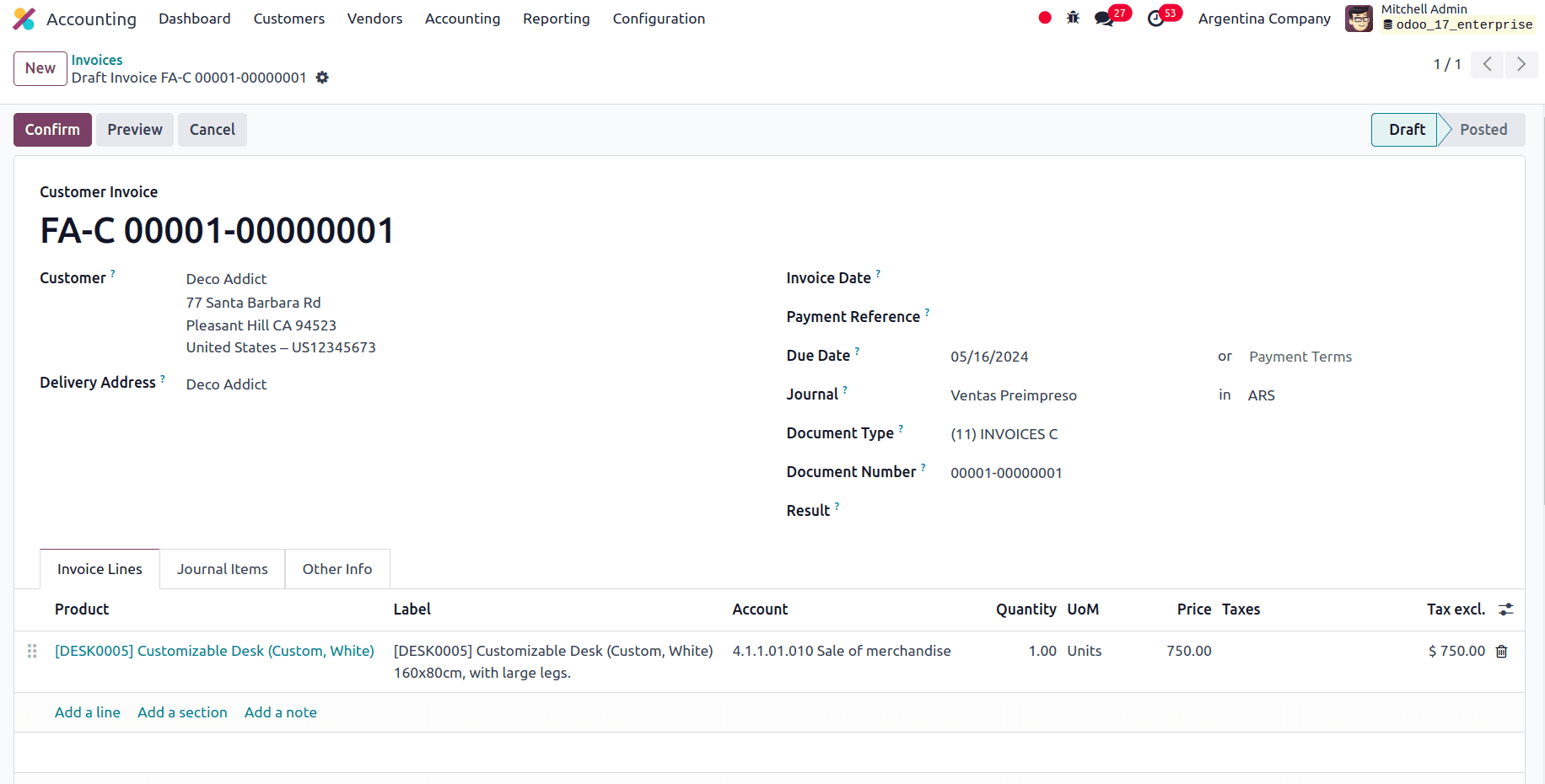

After properly configuring the partner and journal, we can now create an invoice, and go to Accounting-->Customers-->Invoice. When we add the customer, the Document Type field is filled automatically according to the AFIP Responsibility Type of the partner.

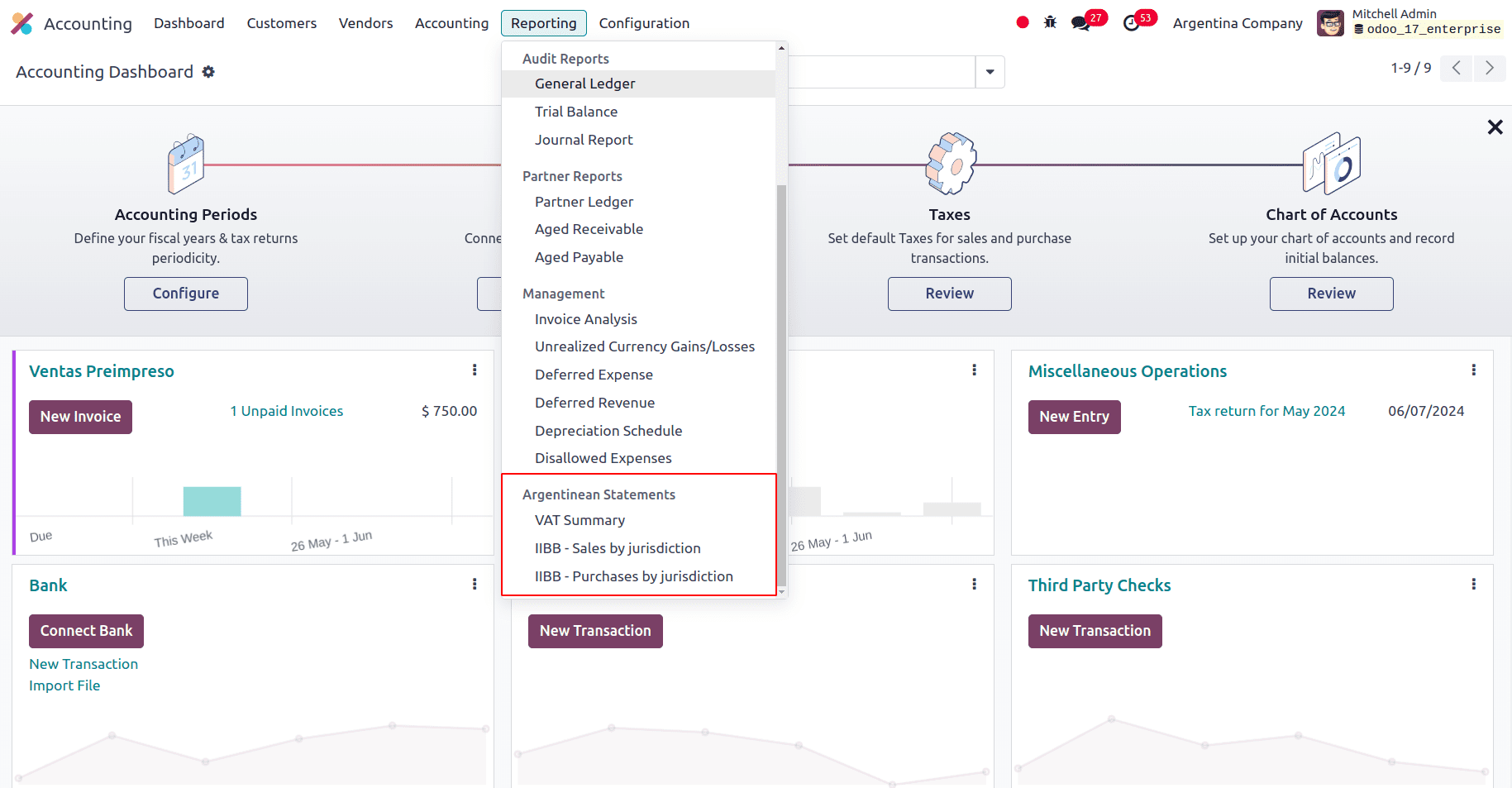

In the Argentinian Reporting, we have three new options VAT Summary, IIBB- Sales by Jurisdiction, IIBB- Purchases by Jurisdiction.

VAT Summary:

* This report summarizes the Value Added Tax (VAT) activity for a specific period. It details the VAT you've collected on sales (Débito Fiscal) and the VAT that we paid on purchases (Crédito Fiscal).

* When we install the Argentinian localization module, it automatically calculates VAT based on configured tax rates for our sales and purchases. It then generates the Libro IVA Digital report, categorizing the VAT according to debit and credit accounts. This report complies with AFIP's format and data requirements.

IIBB Sales by Jurisdiction (Ingresos Brutos - Ventas por Jurisdicción):

* This report details the sales activity subject to Ingresos Brutos (IIBB), a provincial tax on gross income. It categorizes sales based on the jurisdiction (province) where your customers are located. Different provinces might have varying IIBB rates.

* Odoo can potentially be configured to capture the customer's jurisdiction during the sales process. This information can then be used to generate the IIBB Sales by Jurisdiction report, which summarizes the sales for each relevant jurisdiction.

IIBB Purchases by Jurisdiction (Egresos Brutos - Compras por Jurisdicción):

* Similar to the sales report, this report details the purchases subject to IIBB, categorized by the jurisdiction of the suppliers. This helps to claim any IIBB credits that might be entitled to based on the purchases.

* Odoo can potentially be configured to capture the supplier's jurisdiction during the purchase process. This information can then be used to generate the IIBB Purchases by Jurisdiction report, summarizing your purchases for each relevant jurisdiction.

Thus, we can say that Odoo 17's Argentinian localization module can be a valuable tool for generating essential tax reports like the VAT Summary, IIBB Sales by Jurisdiction, and IIBB Purchases by Jurisdiction. However, it's crucial to ensure proper configuration and potentially explore customization options or additional modules to achieve complete functionality for jurisdictional IIBB reporting.

To read more about An Overview of Fiscal Localization in Odoo 17 Accounting, refer to our blog An Overview of Fiscal Localization in Odoo 17 Accounting.