Any business management tool that is functioning should incorporate the localization aspects based on the region in which the business is functioning. This capability will make the solution be used globally where the region-specific elements can be brought into the solution for complete business management. The Odoo platform supports the aspects of Localization, and it's one of its top features, which makes the Odoo platform different from other business management solutions available in the market. Odo supports any level of localization right from the aspects of the business Accounting operation, Report generation, Following the Norms and Regulations imposed by the authorities, the elements of Taxation, and many more all from the same platform, ensuring that the business will have complete control over the operations.

In Odoo, you will have specific modules which can be installed based on the Localization need which will help the business to define the operation of the aspects the needs of the region. Among the Localization aspects, Accounting and Finance management plays the crucial role on which the business should be more specific and considerate on its functioning. This is because the Taxes, the criteria, and the price divisions will be different in each country and continent. Therefore, in the case of a local and multinational business, the companies should be species with great tools to run the accounting management operation. In the case of Odoo, while installing the Localization aspects of each country and region, there will be a separate module available that will let you define the accounting aspects of the respective business based on the part of the operation.

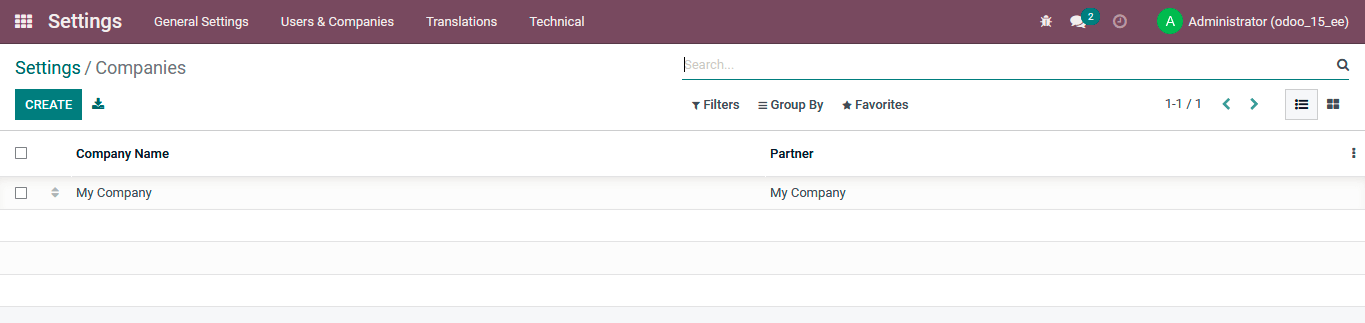

Initially, you need to create a new company or define the company functioning in the Netherlands. You can create a new company in your Odoo platform based in the Netherlands. For this, you need to move to the General Settings menu of the Odoo posts and select the Companies option available, which will depict you with the lists of companies in operation with the respective Odoo platform.

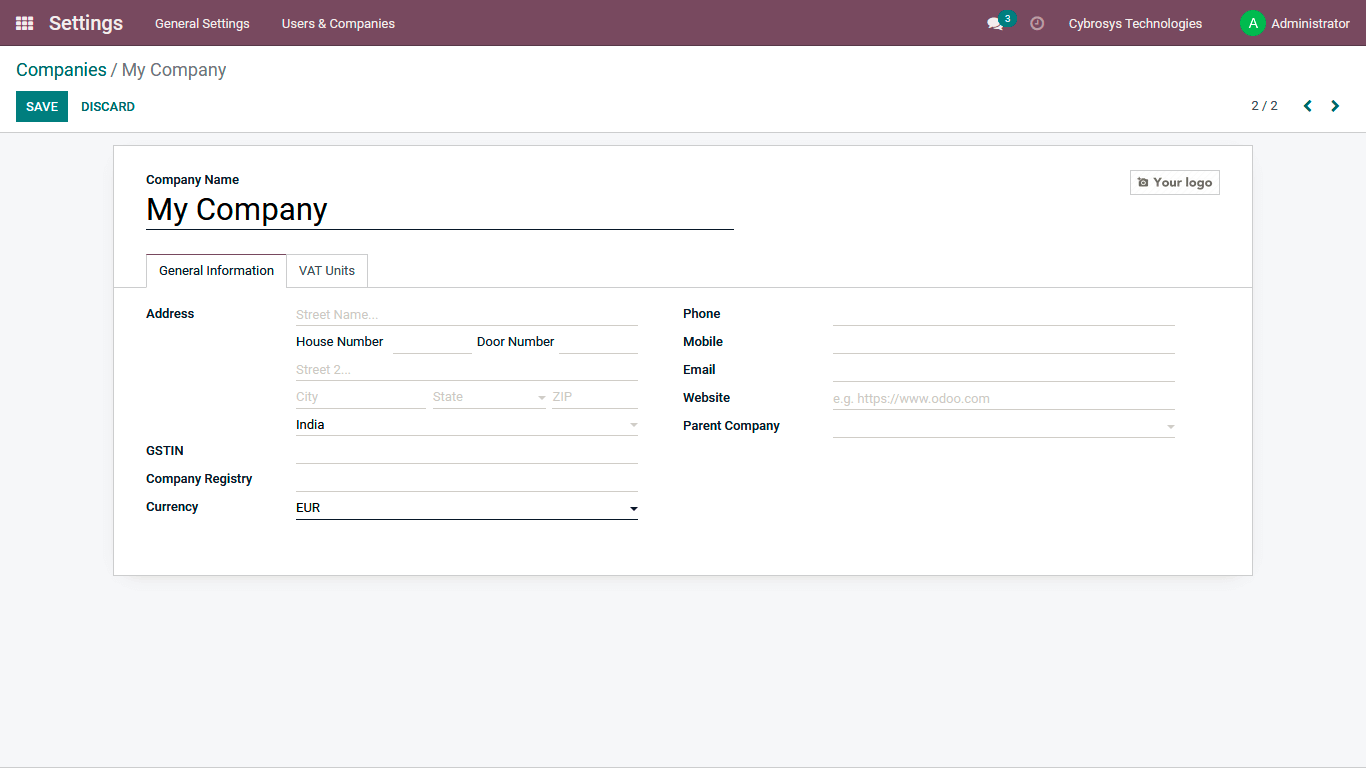

You can create a new Company by selecting the Create option, which will depict you with the Creation window just as depicted in the following screenshot. Here you need to provide the Name of the Company initially, and you can assign the log if needed. Further under the General Information, you will need to give the company's Contact Address. As we define a company in the Netherlands, the country should be provided. As the Country is being changed, you will view that various operations have been changed, which should be defined based on the country Netherlands for the business operations. You will need to provide the GST number and the KVK number, an eight-digit number for the business registration in the Dutch Commercial Register. Further, the Company Registry should be specified along with the currency, auto-defined as EUR.

Additionally, the Social Media details and the company's Contact details should also be provided in the respective spaces defined.

The Vat Units menu also defines the Vat Tax Units for the business. You will be able to determine multiple VAT Units in the platform, ensuring that all the aspects of the VAT Taxation for the company will be covered.

Further, under the CBS tab which will be available once the Netherlands Localization is been defined, the Register number for the business should be defined. The company should provide a CbC report to the Dutch tax authorities. Additionally, they should also keep the local file and the master files in the administration. Moreover, companies with annual revenue of EURO 750 million and more are required to submit this report. The CBC Report defines the aggregate summary of the total revenue, profit and loss on income tax, tax paid, number of employees, and many more financial aspects of the company.

Defining the Netherlands Localization in Odoo.

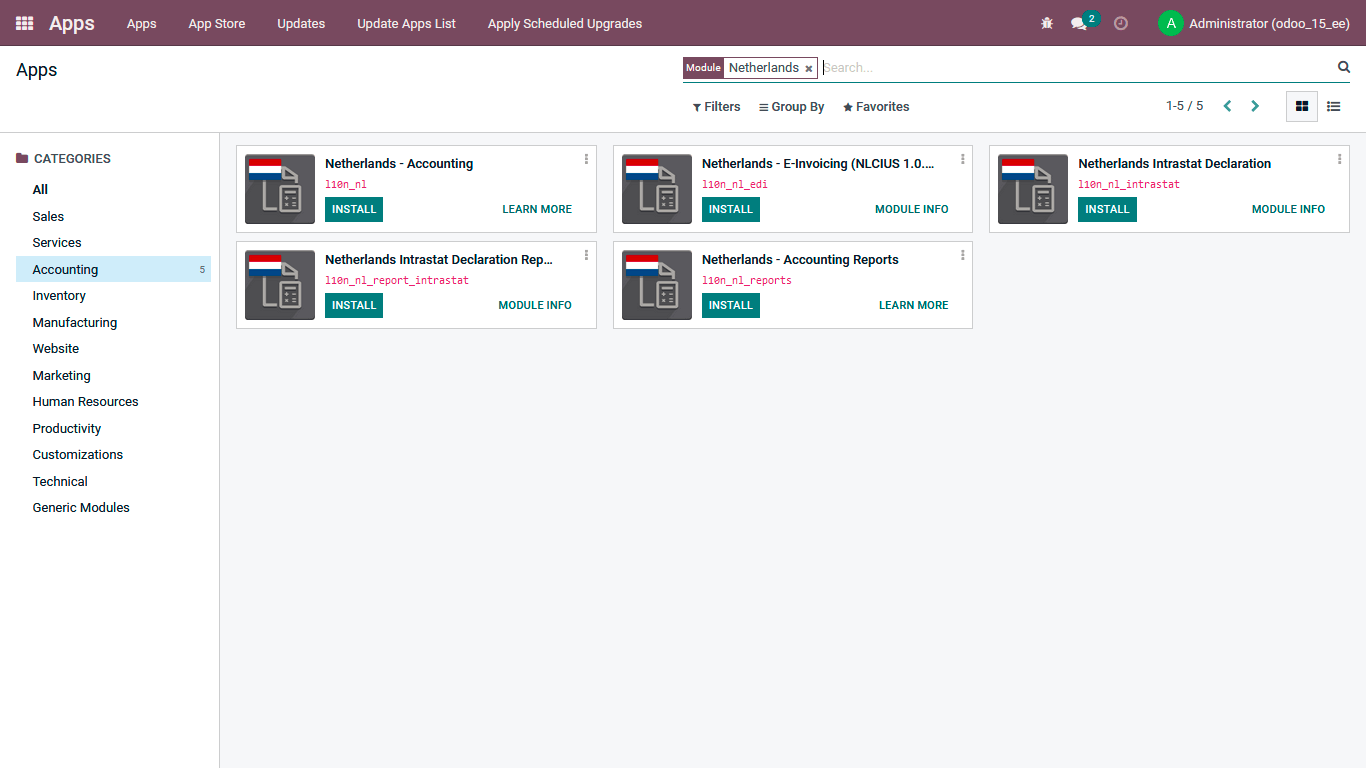

Business in the Netherlands can be effectively run in Odoo based on the operational aspects of business requirements and the Fiscal Localization of conditions needed for the company to function in this region. To configure the running of a business in the Netherlands with Odoo, you will need to define the operations and configure the Fiscal Localization for the Netherlands. This can be done by installing the Dutch Localization modules available in the Application module. In the Applications module, search for “Netherlands” by removing the Apps filter, which will depict you with all the supporting applications of Odoo, which will help the business run effectively in the Netherlands. These applications will act as the Localization aspects for the company, which need to be further configured.

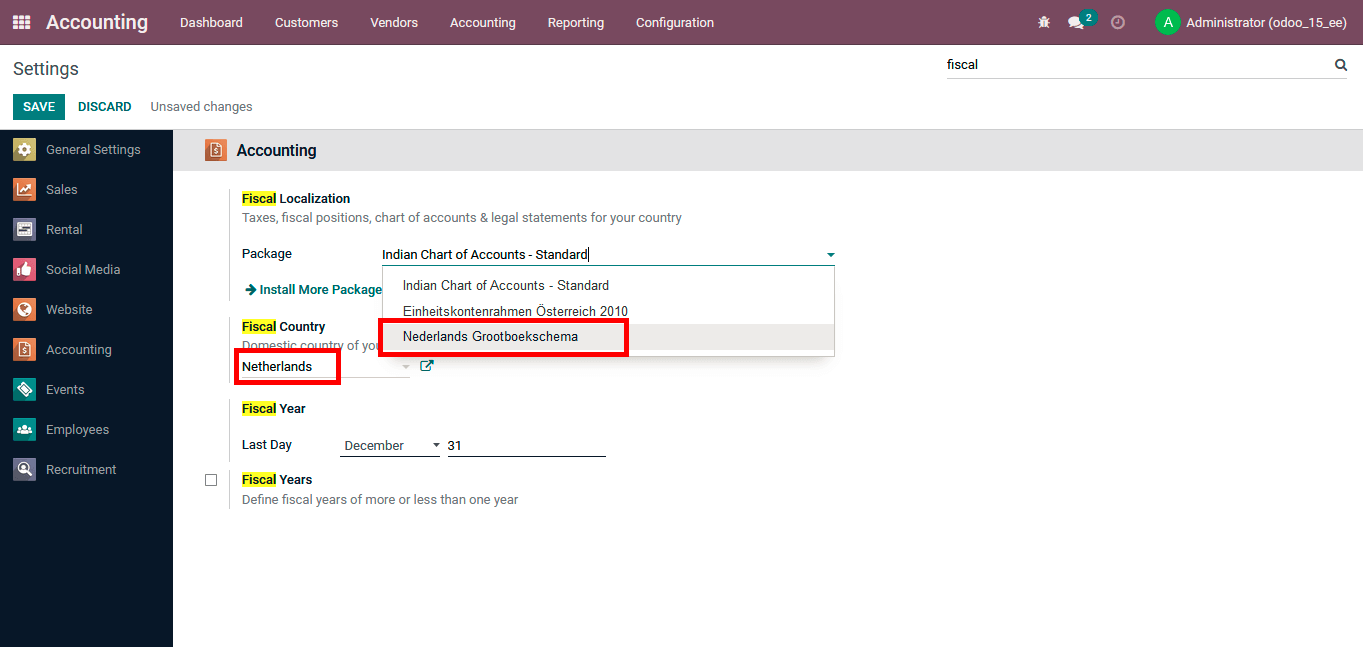

Once the Modules of the Netherland Localization has been implemented, you will need to enable it to be operated in Odoo. For that, you have to move to the Accounting module of the platform and search for Fiscal Localization options in the search bar of the Settings menu of the accounting module. Under the Fiscal Localization options, you will be depicted with the Packages option, defined as ‘Netherlands Grootboekschema’, which will determine the Accounting module based on the Netherlands Localization. Next, you will have to set the Fiscal Country as the Netherlands from the drop-down lists of countries available in the menu.

Once the configuration aspects of the Company and Localization have been completed, you will be able to view the changes in various menu items that have been defined. In the next section, we will be discussing the changes in the menu due to the Netherlands Localization being configured.

Changes in the menu of Odoo Accounting due to Netherlands Localization

If all the Localization modules regarding the Netherlands have been enabled in the Odoo platform and a company has been defined, then the menus of operation will be aligned based on the region.

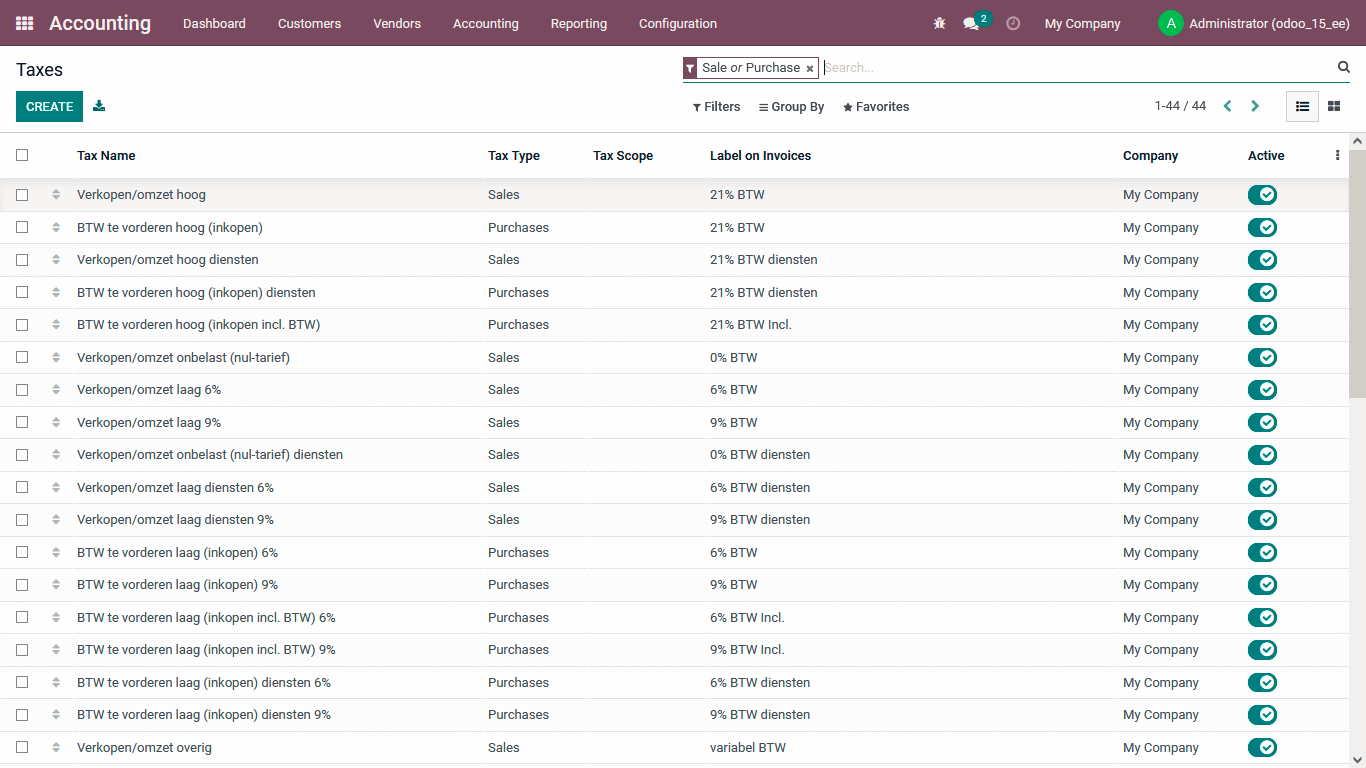

In the Taxes menu, the default Taxes of operation in the Netherlands will be defined, which will ensure that the business can select the respective taxes which can be selected at the time of a financial transaction to be embedded with.

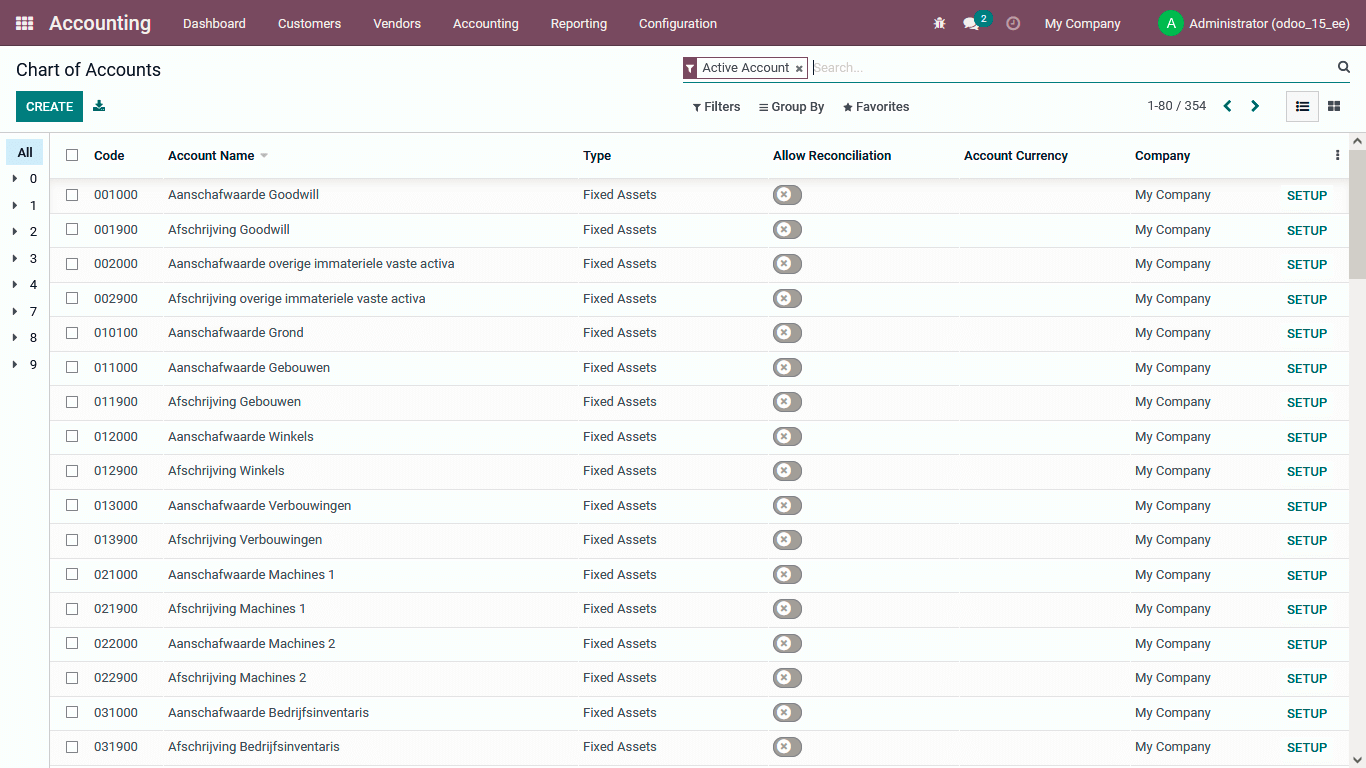

Under the Chart of Accounts section, the definite Chart of Accounts of operation can be defined. Moreover, the distinctive Account used by businesses in the Netherlands can be determined here.

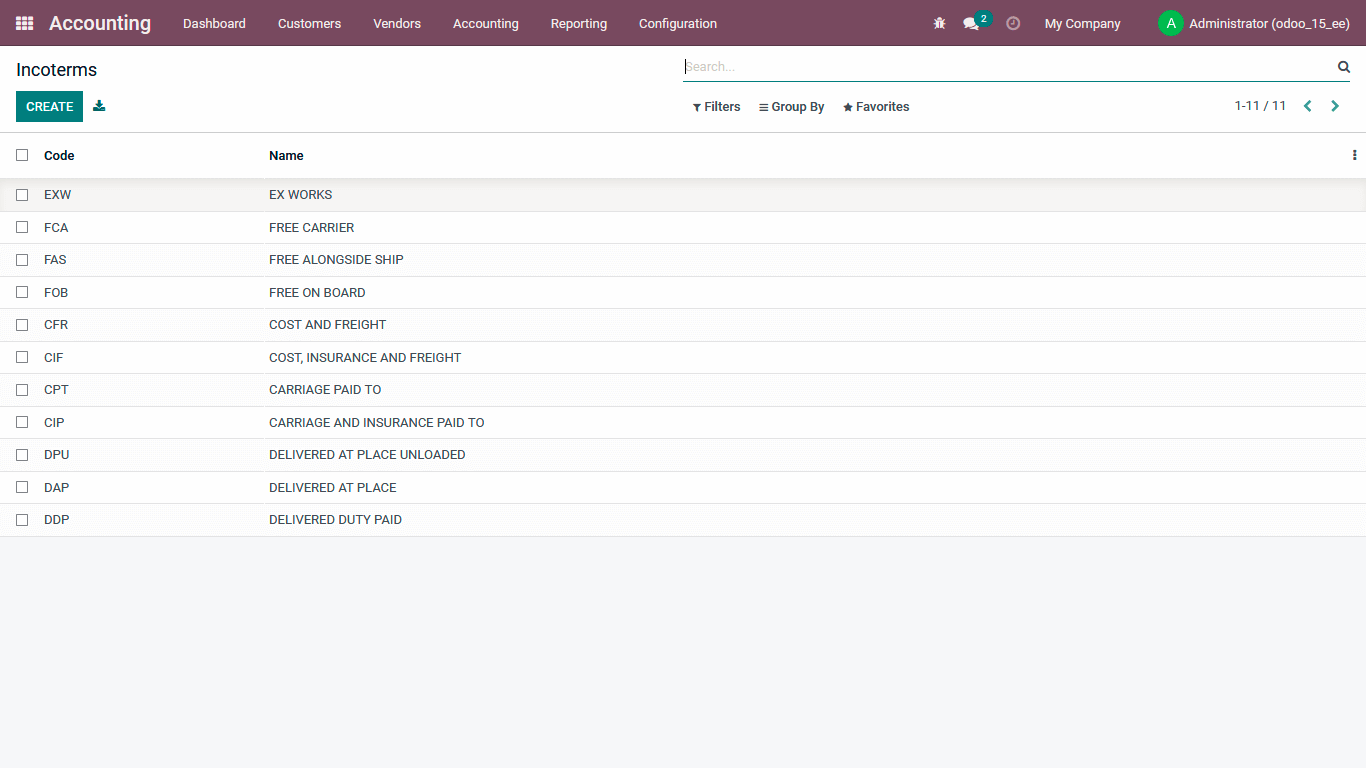

Under the Incoterms menu, you will be able to define the distinctive Incoterms used by the business of operations in the Netherlands. This will be extremely helpful for the fInancial operation of the company as the definition of Incoterms will be beneficial as it will lead to effective management of the financial operations.

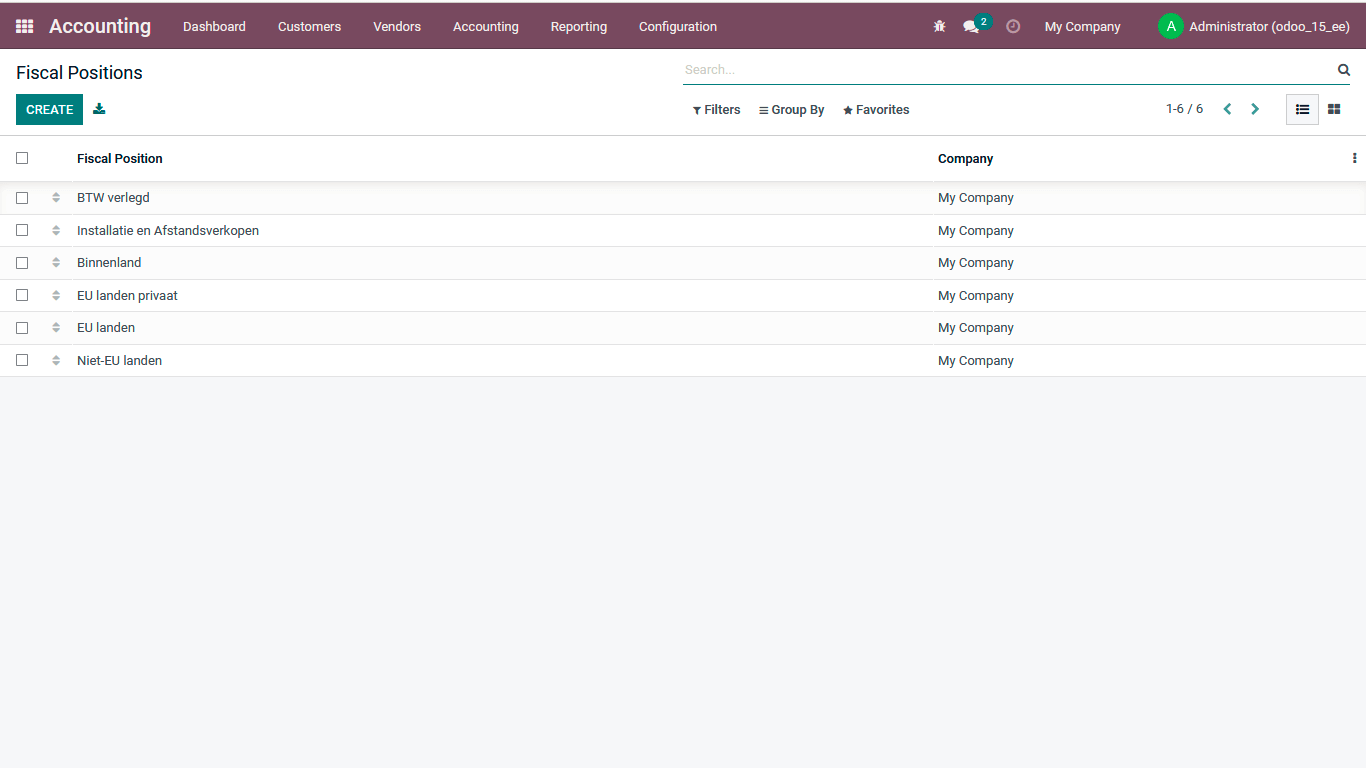

With the Help of the Fiscal Position menu, you will be able to define the Fiscal positions for the accounting operation. Moreover, the definitions of the custom-made fiscal positions can be changed and added any time the business operations needs. There is also the capability to edit the defined Fiscal positions based on the need. Regarding the operation of the business in the Netherlands, the definitions of Custom fiscal positions will be beneficial for the finance management operation.

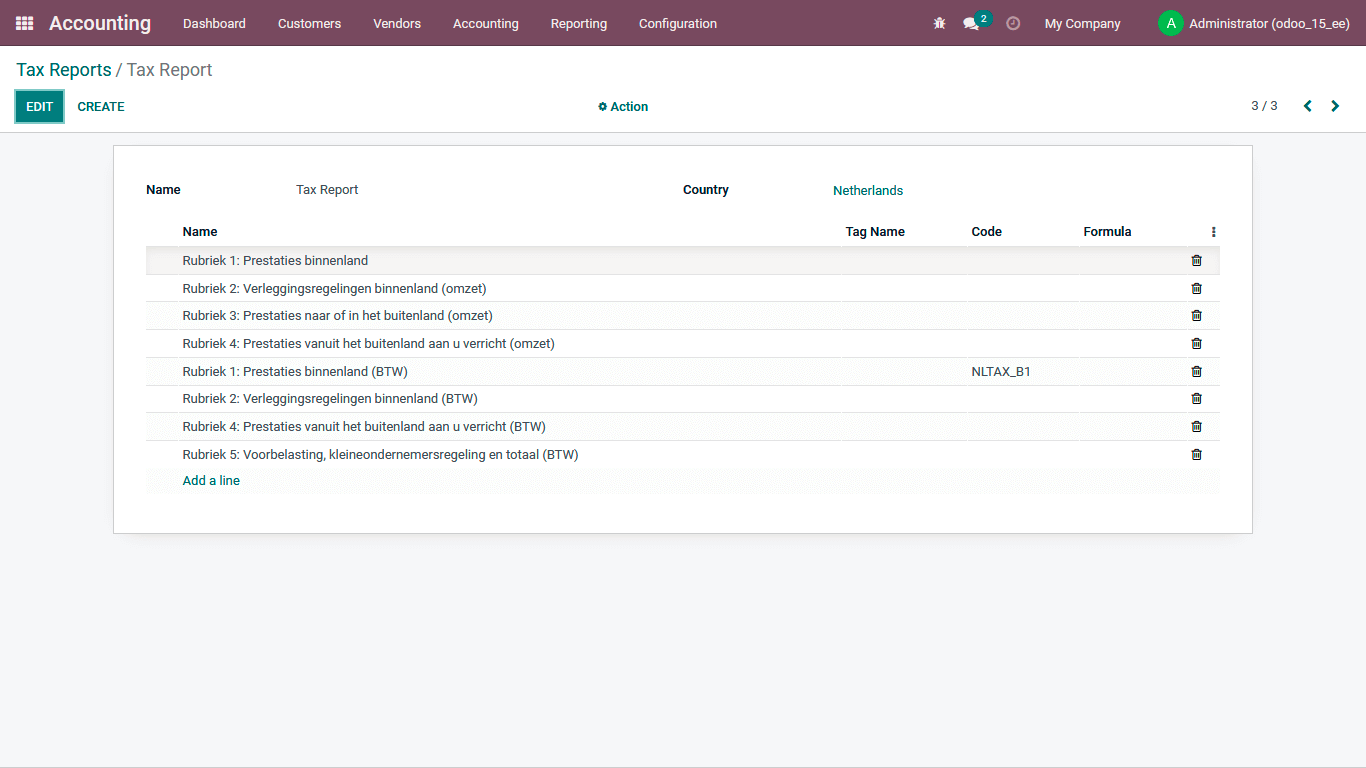

The dedicated Tax Report regarding the operation of the business will be defined under the Tax Reports menu, which is available in the Accounting module. At the same time, the configuration is done for Netherlands localization. In addition, custom Tax Reports are based on the business operations and management needs.

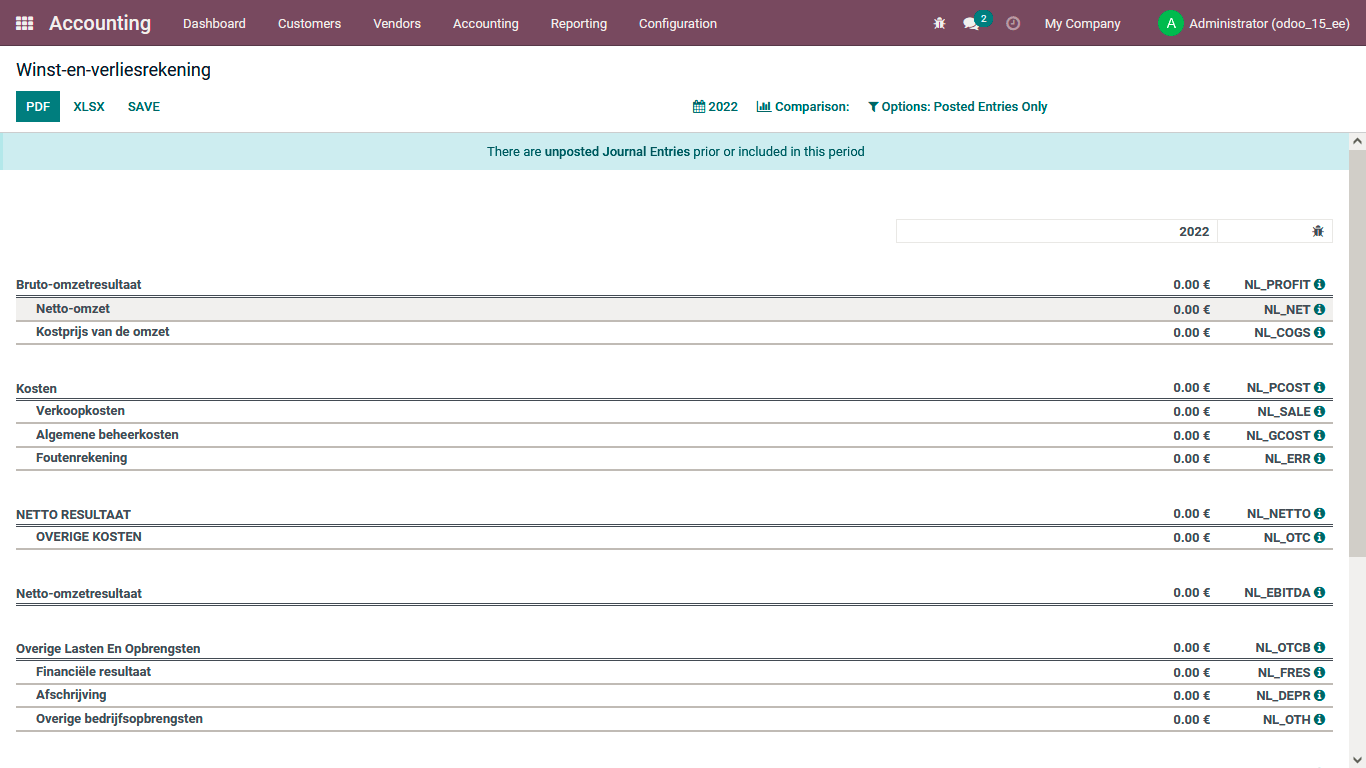

Winst-en-verliesrekening is a distinctive reporting menu available in Odoo upon the platform's configuration for the Netherlands localization. This is an Income Statement report on the aspects of the company income for a dedicated period of time. There are Filteration and Comparison options available, which will help provide the proper insight into the financial aspects of the company's functioning.

These are certain of the highlight features that the Odoo localization based on the Netherlands will bring into the platform. Moreover, it has all the tools and functionalities to run and manage a business in the Netherlands.

Cybrosys Technologies, the prominent Odoo Gold partner, offers assistance and support to businesses in defining the localization aspects in the Odoo platform. You can contact us through info@cybrosys.com