Discounts are certain aspects which would attract a wide range of customers to the business. In common there are various kinds of discounts and among them, the main ones are the ones which are initially described to the customer through advertisements and other promotions. The other one would be the discount which is not advertised but rather provider to the customer based on their payment terms. The latter one is more of an informal one and could be only provided to the loyal customer or based on the modes of payment terminologies that a customer pays his or her bill.

The discounts are a better way to ensure that customers come back to your installations as you care about them and are also willing to sacrifice the profit as a service to them. The discount operations which have been mentioned in the latter part of the last paragraph are unorthodox and in most cases, the decision depends upon the salesperson, cashier, manager, or business owner. Without a proper channel of management, this unorthodox and undrafted way of offering discounts will create accounting-related problems for the company in the long run.

The operations can be trackable to the manager therefore, there is an ultimate requirement of effective management tools to run the accounting operations of the company which will ultimately provide you with tools to manage the discount operations of the company. The Odoo accounting module will provide you with all the dedicated tools for the effective management of the discount operations of the company. Moreover, Odoo is a complete management tool for the business operations of the companies with dedicated modules for each operation such as for the accounting and financial operations. These dedicated modules will provide you with dedicated as well as advanced tools of operation which will be useful in the functioning of the company on all levels of functioning.

This blog will provide insight on how to set up discounts in Odoo

You can run the discount operations as per your need with the Odoo platform or with any other business management software however is the reconciliation feature of the Odoo platform which makes the operation run smoothly and in a systematic manner. Moreover, the reconciliation option of the Odoo platform ensures that the described accounting data and information is directly in synchronization with your bank and the accounting details which will be helpful during the accounting as well as tax-based operations of the company.

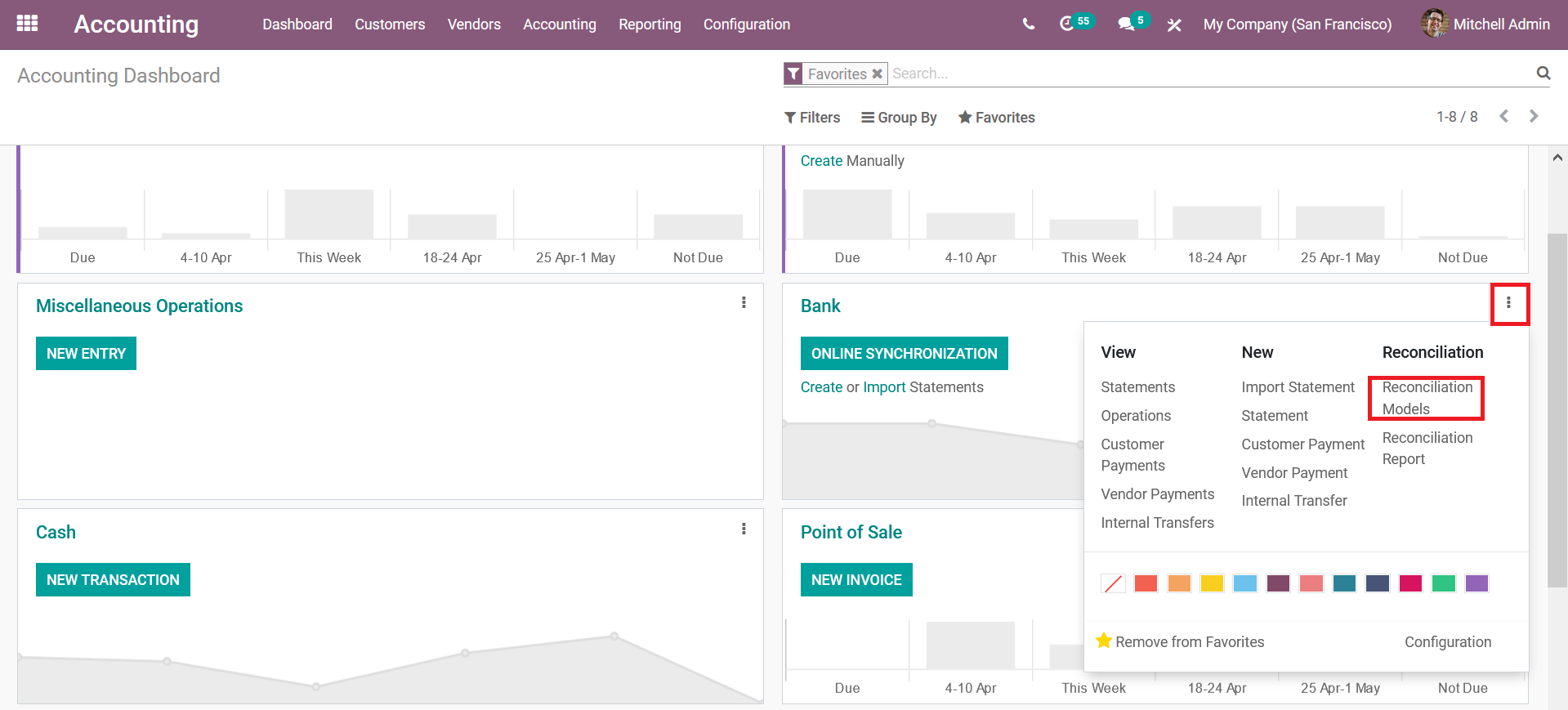

Let us now understand how the discount operations can be managed based on the payment provided by the customers with the help of an example as described below. Initially, we have to describe certain reconciliation models to run the discount management operation of the company. This can be done for the accounting module and by selecting the options available in the bank tab under the overview dashboard. Upon selecting the menu you will be depicted with a reconciliation option where there will be a reconciliation model option available as shown in the following image.

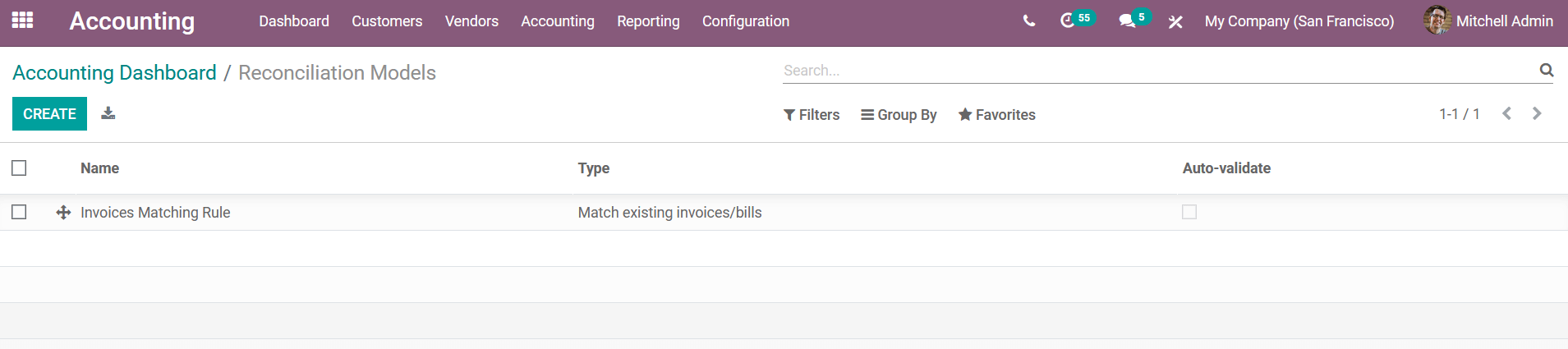

Upon selecting the reconciliation models option you will be depicted with the menu where all the reconciliation modules are being described.

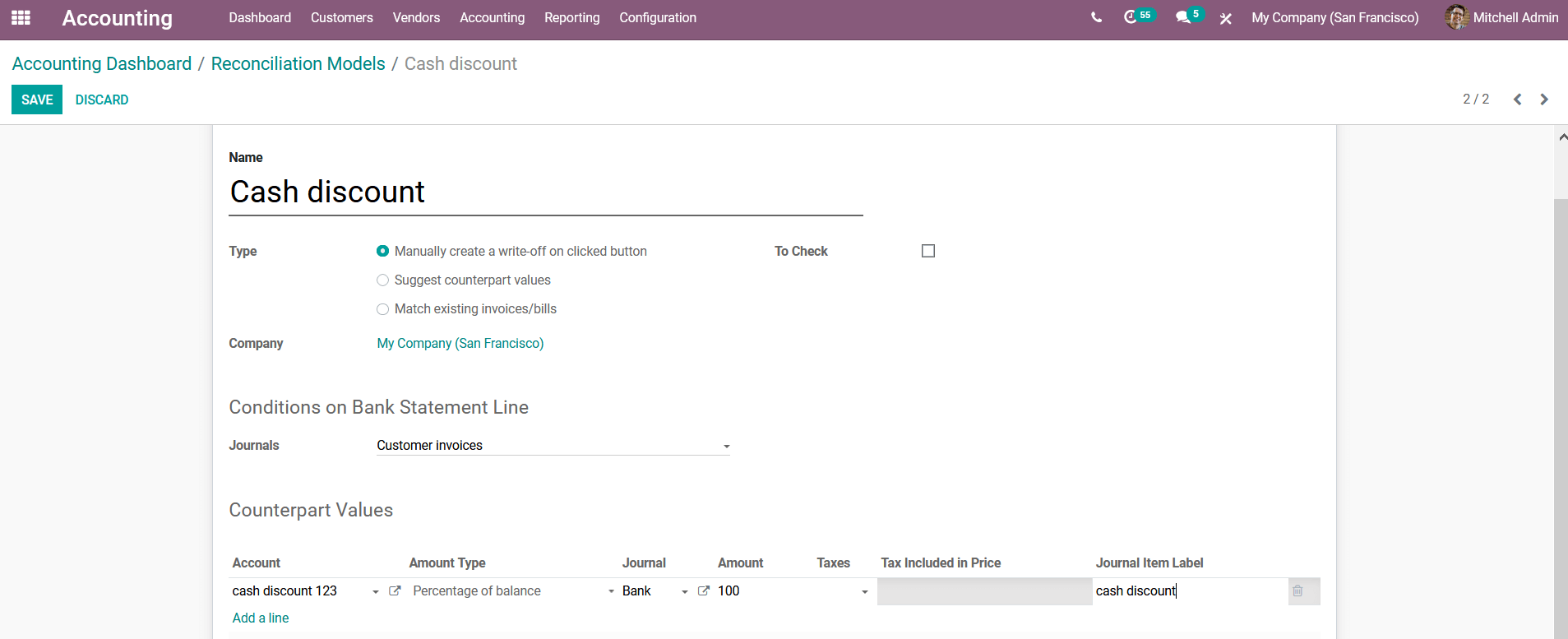

In the reconciliation models creation table, you can provide the name of the model, assign the type of the model. Furthermore, the type can be configured as Manually create a write-off on the clicked button, Suggest counterpart values, and match existing invoices or bills. In addition, you can always enable or disable the to check operations for the reconciliation model to be in operation.

In addition, under the conditions on the Bank statement line, the respective journal in operation can be described. Additionally, the counterpart values ??of operation under the model can be described by selecting the add a line option available. Here you have to assign the account, account type, journal, amount, taxes involved, tax included price, and the journal item label.

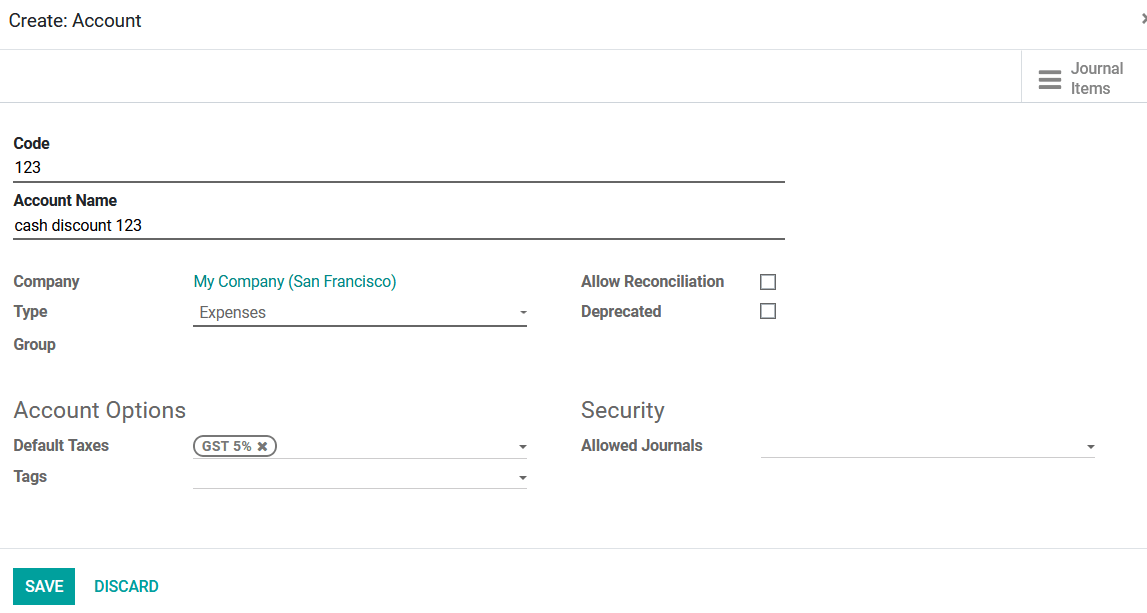

Moreover, you can create an account for the operations directly from the menu itself by providing the name and opting to create the account. In the account creation window, you have to provide the code, account name, and type of account. Furthermore, under the accounts options, you can describe the default taxes and the tags allocated. In addition under the security tab, the allowed journals can be described. Finally, save the accounts menu and continue with the reconciliation model creation.

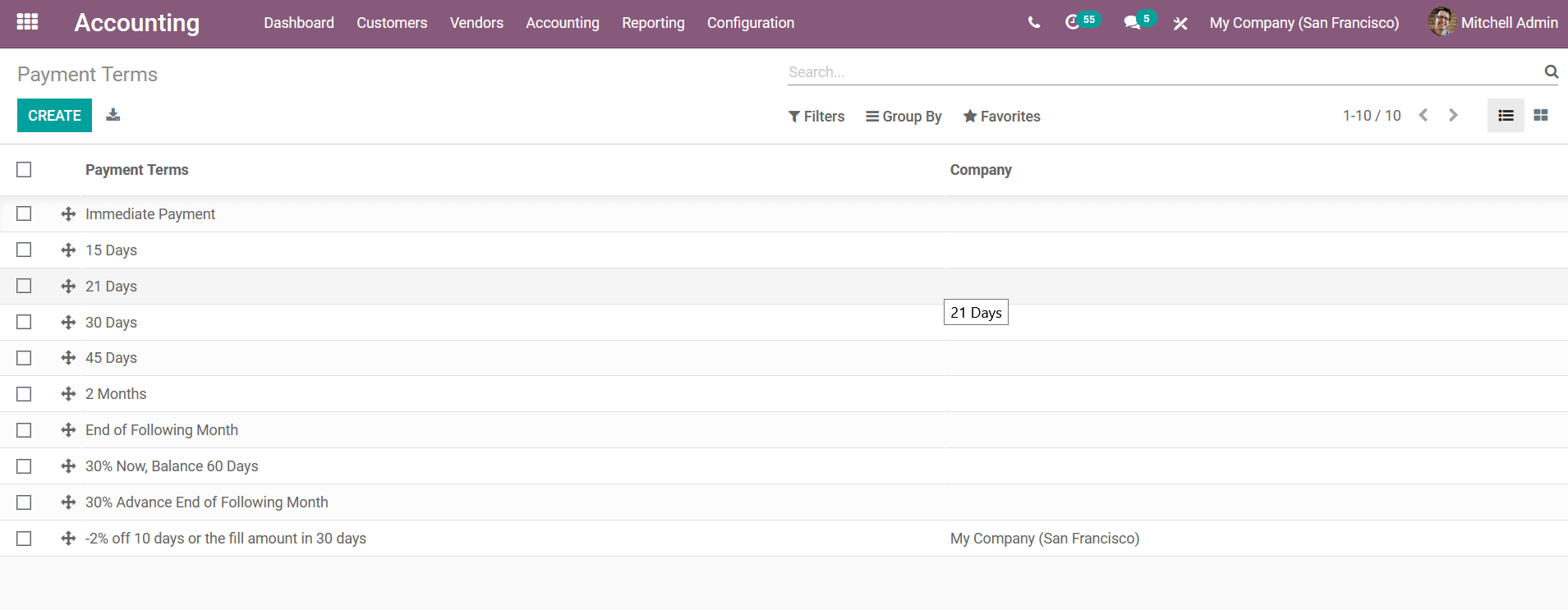

As the reconciliation models are being described, let's now move on to describe the payment terms in the Odoo platform where the discount operations can be configured. From the configuration, the tab selects the Payment terms option available which will direct you to the payment terms menu as depicted in the following image.

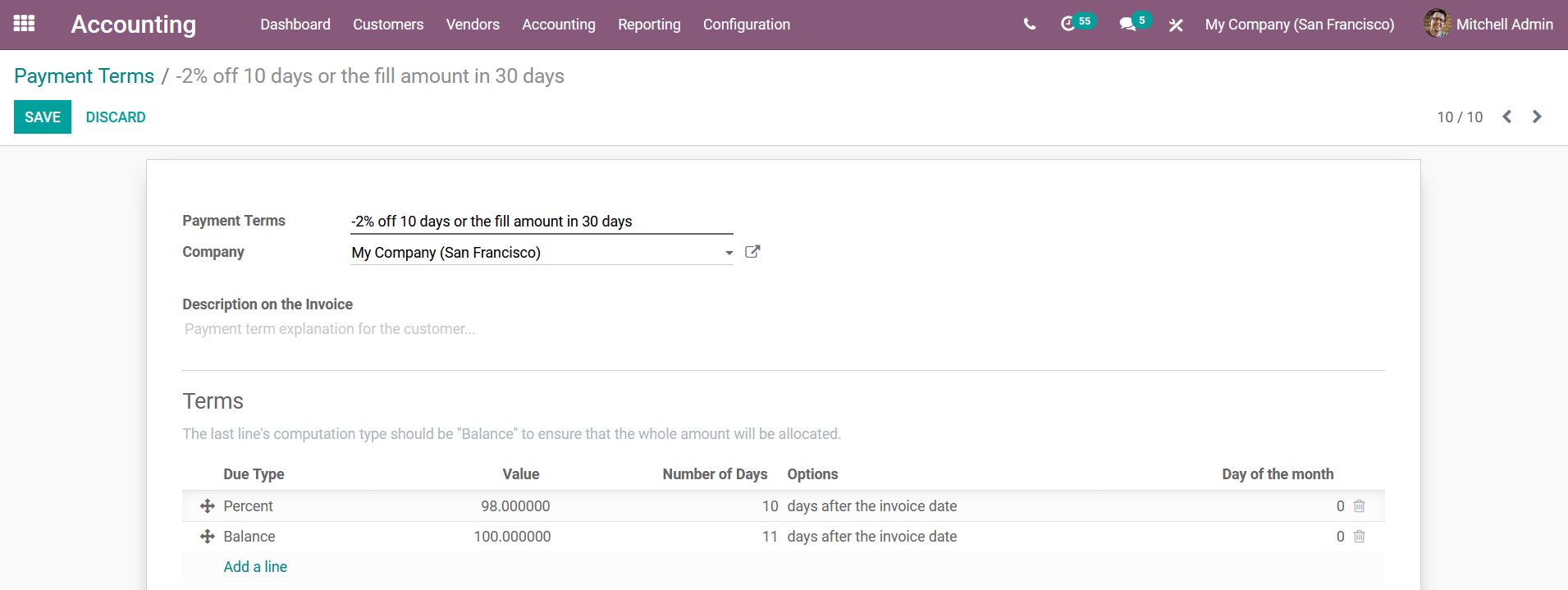

To create a new payment term select the create option and you will be depicted with the menu to create the payment term as depicted in the following image. Here initially describes the payment terms, the company in which it functions in and the description of the invoice that should be described the payment terms.

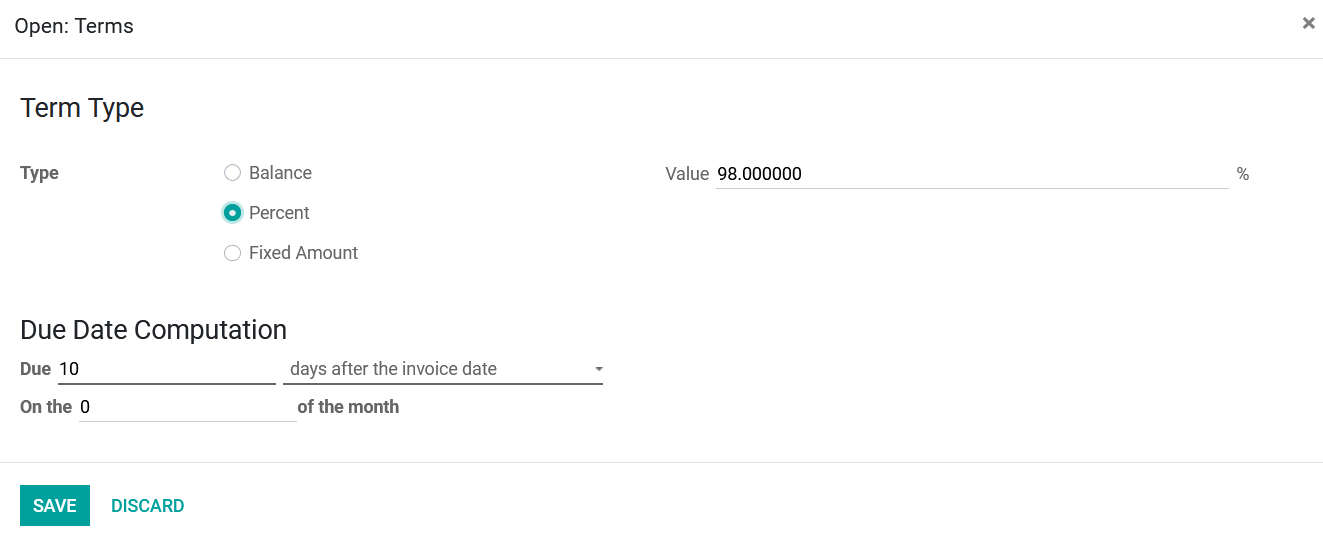

Furthermore, the terms can be added by seeing the add a line option available which will depict you with the pops up window as described in the following screenshot. Here the terms type can be either chosen as balance, percent, or a fixed amount. In addition, if the percentage of the fixed amount is chosen the value should be described. For example, here we are providing a 2 percent discount to the customer if he or she pays within ten days of the invoice date. So the value is set as 98 percent and the due date for the payment is set as 10 days after the invoice date.

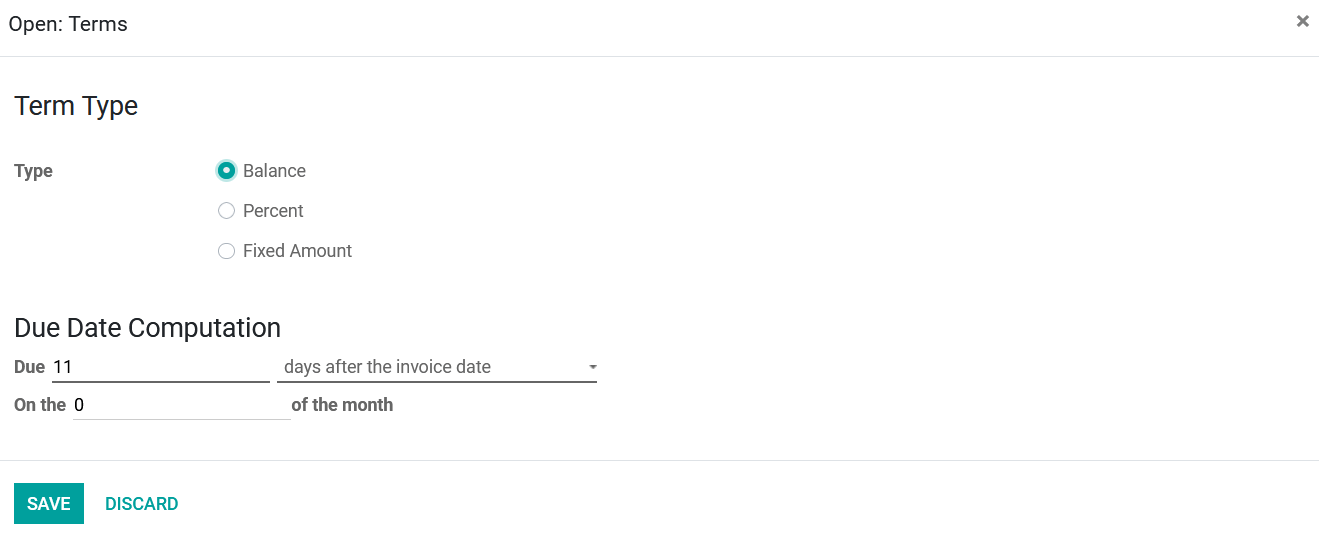

Now if the customer does not pay within the ten days you are not willing to provide any discount therefore, another payment term should also be described. Here the payment type should be set as a balance and the due date will be 11 days after the invoice date where the customer pays the full amount of the invoice.

With this method, you will be able to describe any form of discount operations in an orthodox and conventional way which will not only be beneficial in the initial stages but also in the long run operations of the company as well.