We are all sure to run mad and confused with all the expense approvals that we have to manage every day. The requests, categorization, and approval is no easy task. We have to process pay and audit the spending we make in the business. Expense management tracks the company expenses and the maintenance of these expenses. The expenses usually include the client expenses, employee expenses, wages, leases and so on.

The management of these expenses includes both the policies employed for governing the spending and also the technologies and systems used to manage the approvals and accounting. Managing the cost of operations can be important in accounting. It involves a strict categorization of the expenses made to achieve the most out of the transactions and income of the company. Expenses can be tabulated to be reimbursed, re-invoiced, filed for tax returns, and so.

Cutting down on expenses can really reflect in the profit of the company. But knowing where to cut down the expense is also equally relevant. Knowing which expense to avoid, where to hold back, and when to invest in what maximizes profit. Maintaining the real-time data of the expenses made by employees and the company will simplify the accounting works.

The accountant record expenses based on a cash or accrual basis. Cash basis records expenses at the time of payment. Whereas the accrual method records expenses when the transaction is made. The payment could be on a later date, but the recording is done since the company has to make the payment in the future.

While managing the expense we must keep in mind expenses that we make on behalf of our clients, these expenses will be reimbursed by the client. As an enterprise, we will deal with 2 types of reimbursement. Reimbursement from our side, and reimbursement of our money. The first deals with the expenses from our employees made on behalf of the company. We will be obliged to pay the employee after validating the reimbursement claims. This might include the travel, accommodation, and other expenses made by the employee for the benefit of the company. For example, an employee paying for a client dinner has to be reimbursed, as the expense is made on behalf of the company.

Now the other is when the company makes an expense on behalf of the client. This would include expenses made on clients' behalf while working to deliver their projects. Depending on the nature of the project, we might have to take it out of our pockets to meet the demands of the project. We can provide receipts and expense reports to the client and demand a reimbursement. Keeping track of the expenses made is to be done with much caution so as not to miss out and create unnecessary expenses for the company.

Now, keeping track of expenses, categorizing, and filing for validation are all hectic paperwork, which is better off digitized. Odoo offers a dedicated expense management module to keep track of all the expenses. Odoo Expenses is dedicated to managing the expenses of the employees. The expenses made are drafted by employees, validated by managers, and reported by accountants. Breaking down the expense management, lets the company process them easily. We can even upload the receipts of payment to the reports, avoiding the loss of expense receipts.

Draft an Expense to Report

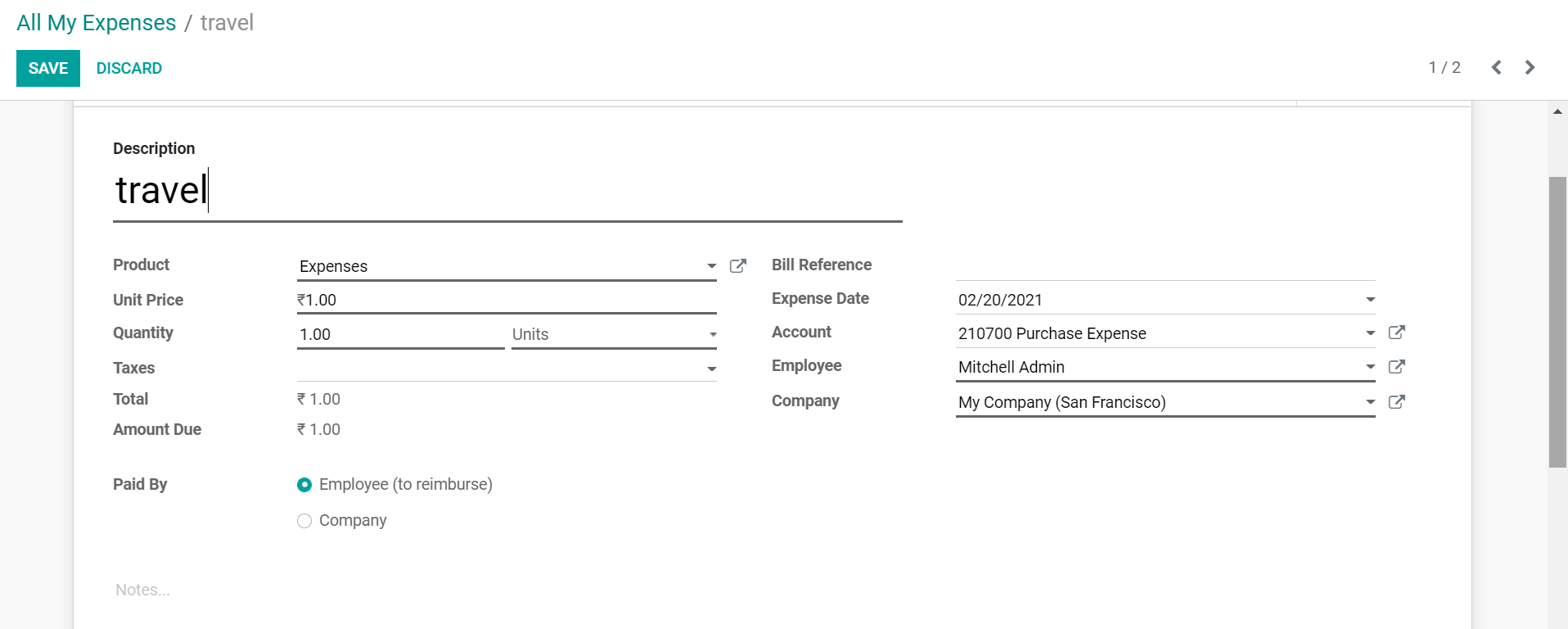

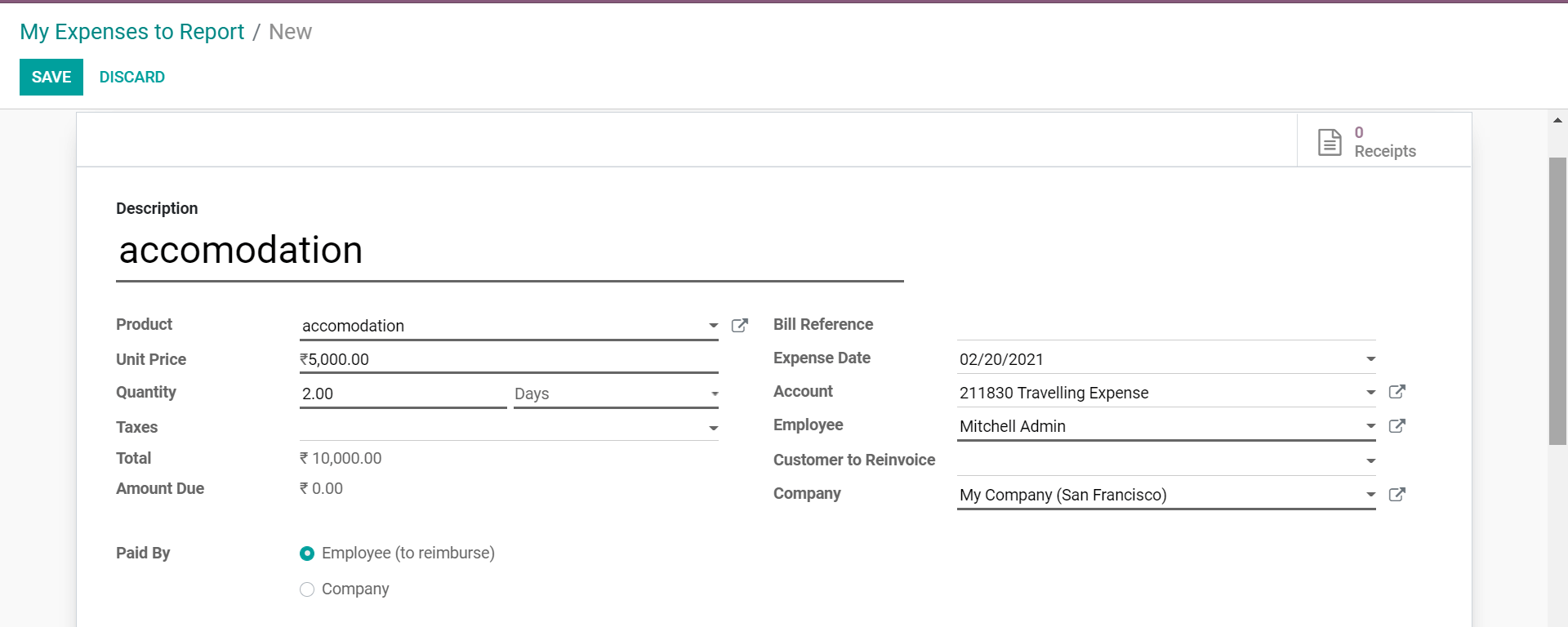

The employees can draft expenses made and add notes or receipts as necessary. The expense details can be entered and we can also opt between employee and company for paid by.

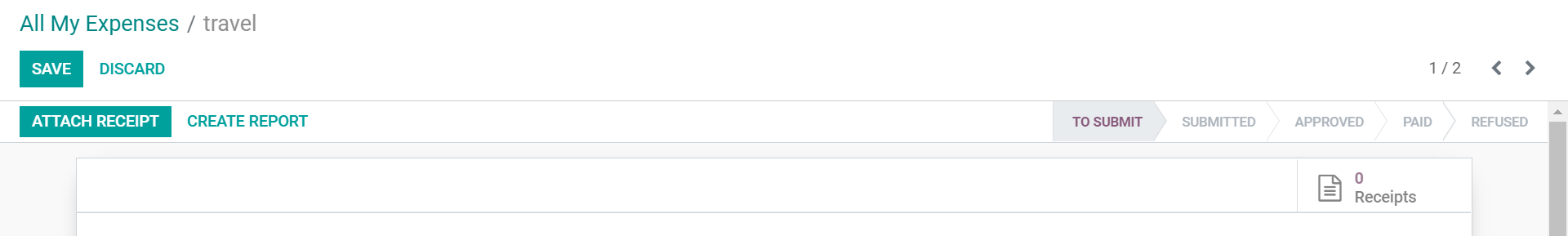

Payments made by employees will be marked for reimbursement from the company. We can attach the receipts once the expense is created and view them in the receipts tab.

The draft when complete can be submitted by clicking on creates the report. The report will be submitted to the manager and they can approve or refuse the report.

We can alternatively create the expense report by submitting the receipts to an authorized mail id. The mail id can be configured in settings.

Expense types

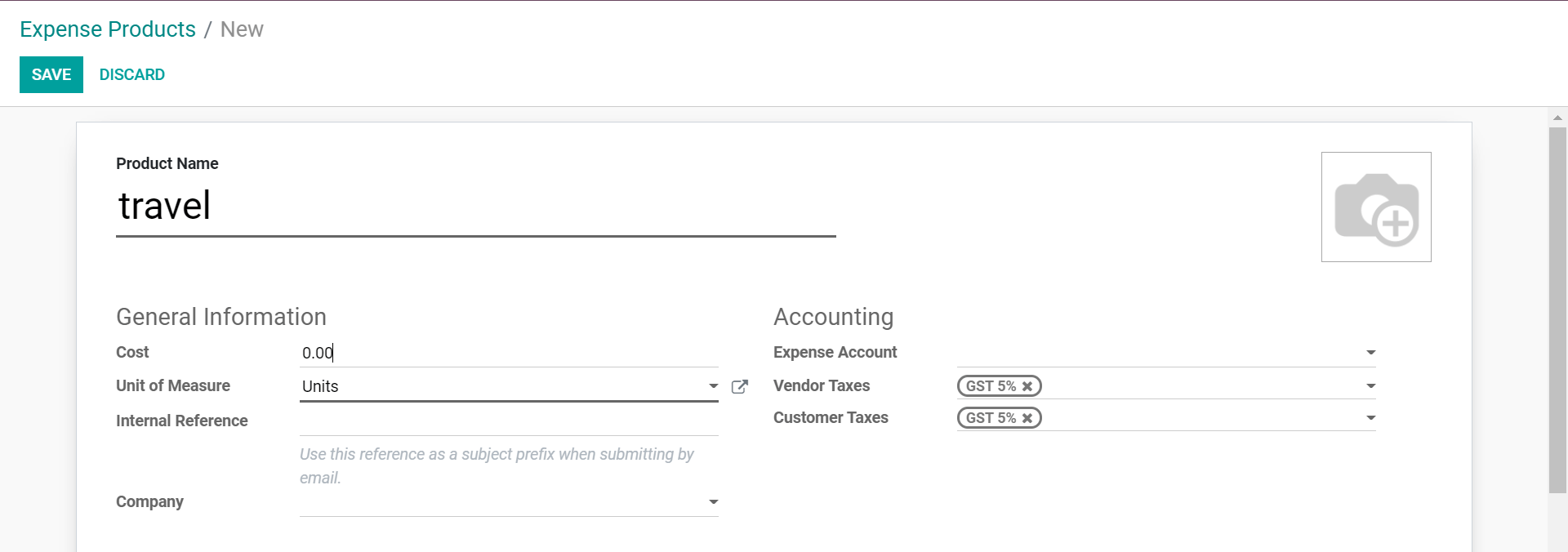

We can configure the expense types in the module. This helps manage the expenses better. The expense types are referred to in Odoo as expensive products. From configuration, go to expensive products. We can create new expense types here.

We can either add a fixed price or keep the cost to zero. If cost is set to zero, the employees can record the real cost of the expense. If fixed, the reimbursement price per unit will be fixed.

For the expense type created with a fixed price per unit, the unit price will be automatically filled in the corresponding fields.

Reinvoicing to customers

The expenses made on behalf of the clients can be reinvoiced to the clients. This would allow us to unnecessary expenses that we have to bear for the client projects. Depending on the nature of the client agreement, we can invoice the expense to them after creating the expense in the expenses module.

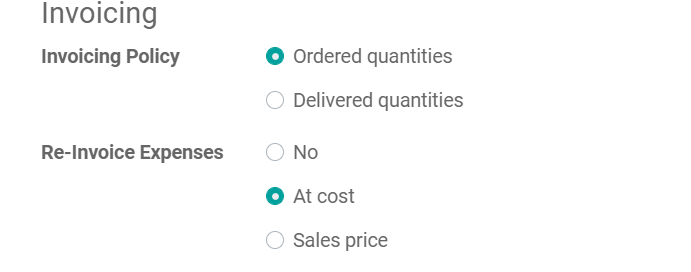

We can choose an invoicing method for the expense types when creating. It can be based on ordered quantities, delivered quantity, at cost, or at the sales price on the sales order.

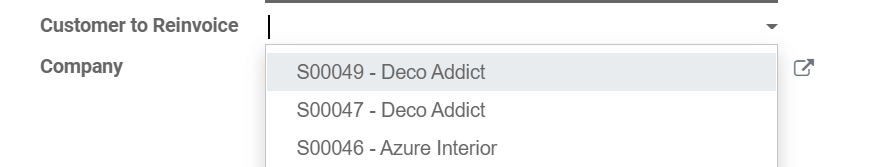

After the configuration, create a new record. We can choose the customer sales order in the field 'customer to re-invoice. Choose the sales order on which the expense is made. This would automatically add the expense to the corresponding order.

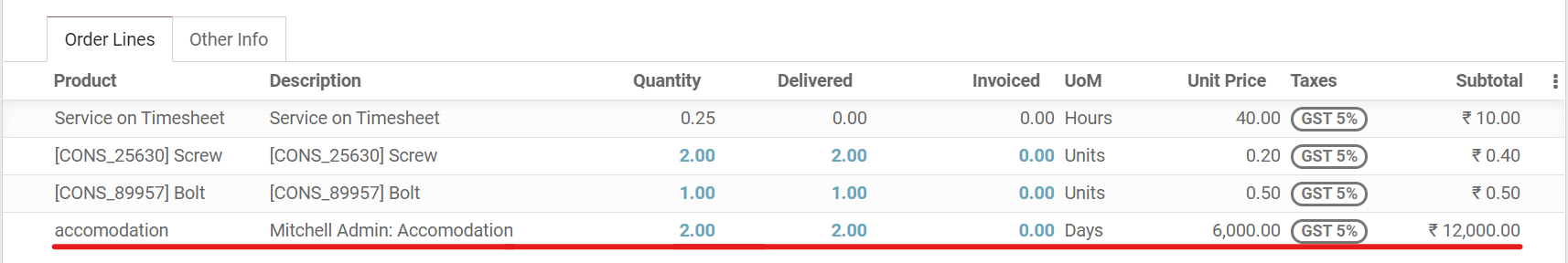

The entry once submitted will be added to the sales order.

The manager can approve the request to add the expense to the invoiced amount. The accountant can post the journal entry. We can view the sales order from the sales module. We can then create an invoice from the sales order and send it to the customer. Once the payment has been registered, we can register the payment on the expense report from the expense module.

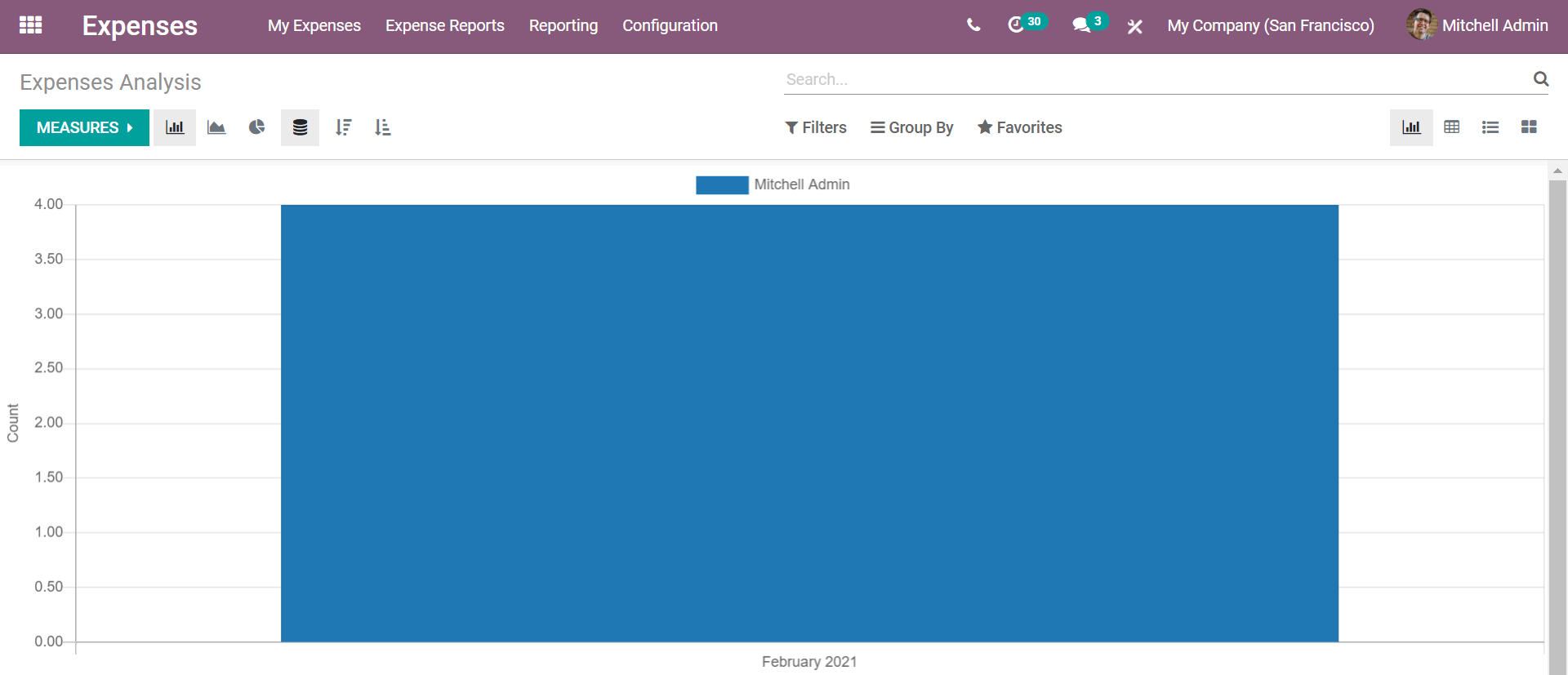

Reporting

We can view expense analysis from the reporting menu. For managers, they can view and manage the expense across the team with a team overview. This would let the manager know that the target and budget are maintained.

You can also read about employee reimbursement and other features of expense management from our blog.