An accounting tool should be a comprehensive support system to manage all accounting-related tasks. The key tasks of an accounting wing are to record and manage all transactions including inbound and outbound transactions. The revenue, as well as expenses, has to be recorded and calculated to make sure that the business is enjoying the profit.

Odoo Accounting, a complete ERP solution for accounting-related worries, ensures support to manage Profit and Loss the best way. It gives you the ease of managing profit and loss sheets so that the accounting team can have quick glance at the most important figures for any period of time. The tool also offers you support for generating reports and compare profit and loss statements for different periods.

It is the profit and loss that helps a business to plan and manage all accounting activities and prepare a budget for the next period. We can otherwise say that profit and loss statements are the most significant reports generated by an accounting wing.

We can define the profit and loss statement of a company as the income statement of the company compiled with the expense statement. Usually, profit and loss statements are generated for a period of one year or one financial year. But with Odoo Accounting we cannot just manage the profit and loss statements. We can use this tool to customize profit and loss statements. We can give inputs like the profit and loss period for managing the operations.

The investors and the managers will need this statement to get an understanding of the performance of the company in the market and know whether it is a profitable company or not.

In this blog, we can understand more about Profit and Loss statements in Odoo Accounting. We can also check how to make use of Odoo to handle profit and loss statements.

Odoo Accounting module has many menus and we can find Profit and Loss under the Reporting menu.

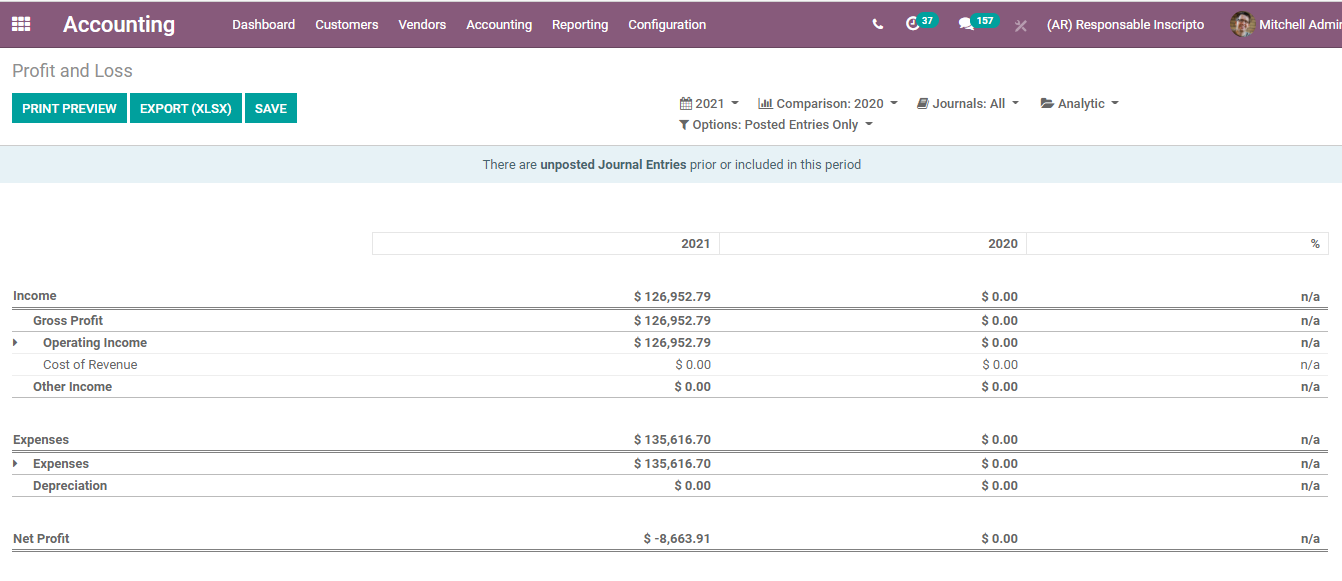

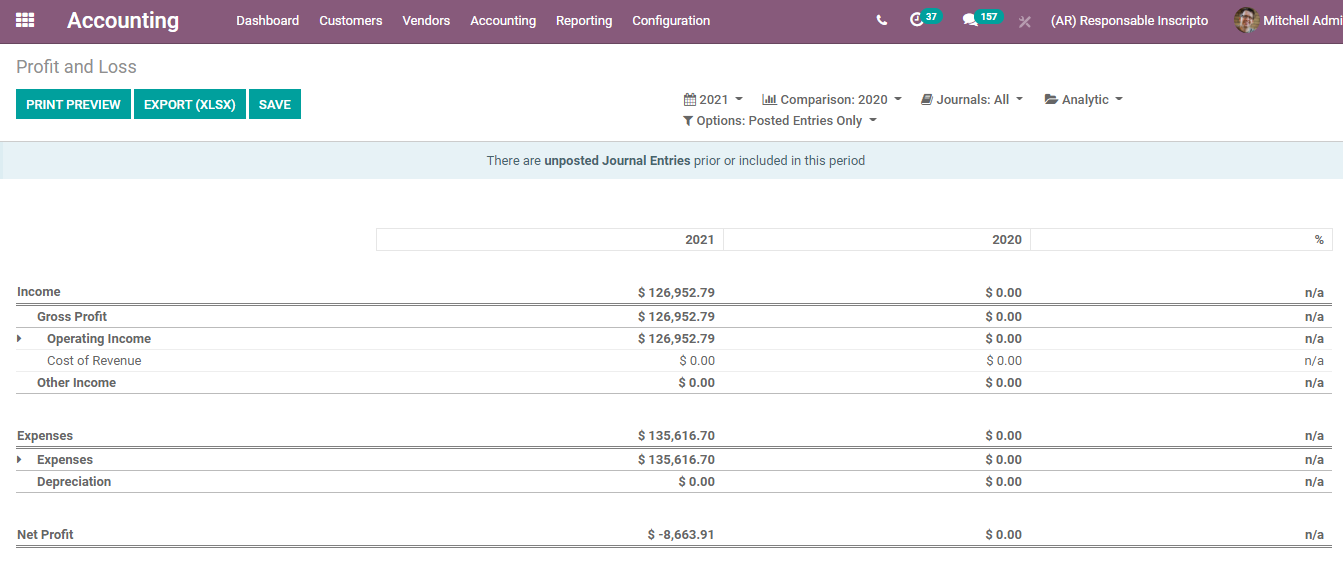

When we open it we can find the Profit and Loss sheet

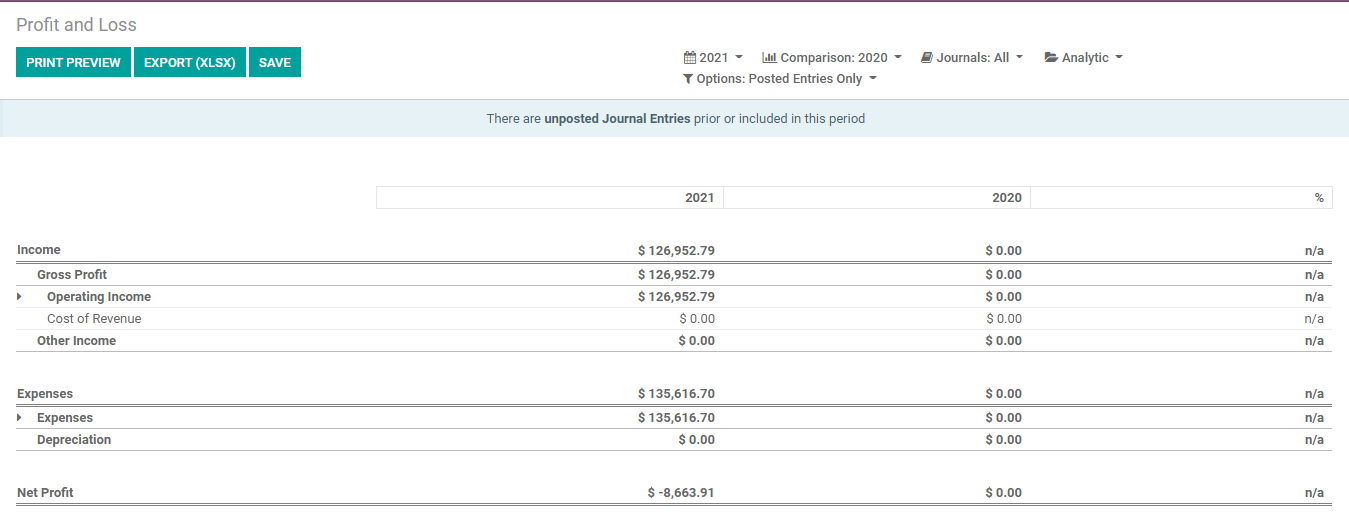

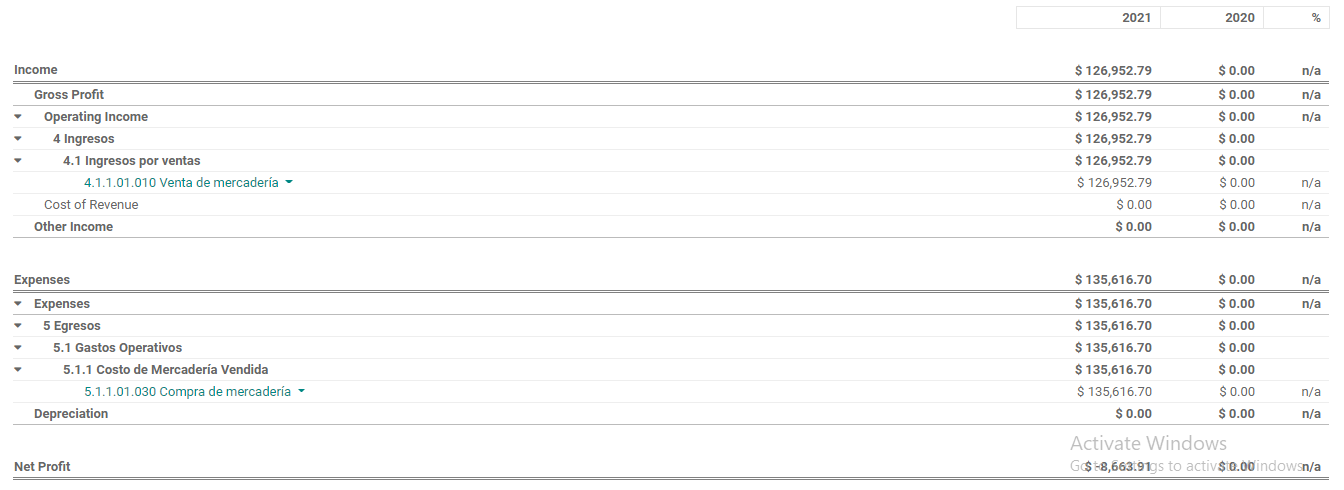

This is the Profit and Loss statement.

Here, we can find different rows and columns.

On the top, we can find Income. Below the Income, we can find gross profit. We can also view Operating Income and the cost of revenue. Other income can also be viewed there.

Income: Income is the money that we make on selling services or goods to a customer. We also have to subtract the cost from this.

Gross Profit: For a company, the gross profit is the amount that we get after subtracting the costs we incurred following the manufacturing and selling of the product or the cost incurred on providing service from the revenue.

Operating Income: Operating income means the amount of profit that we have gained from a business operation. This is calculated by deducting the operating expense. Operating expense is the wage or depreciation.

Cost of Operation: Cost of Revenue can be defined as the total of different costs that we have incurred following the production, marketing, and distribution of products or services to the end-users.

Then we have another segment named Expenses.

Expenses: IT is the amount we spent as labor charge, material cost, or other charges for making a product or offering a service.

Depreciation: We can term depreciation as the method of calculating the cost of an asset based on its life expectancy.

We can find Expenses and Depreciation etc.

At the bottom of the page, we can also find Net Profit. The net profit is calculated based on the income and the expense.

We can get a print preview of the page using the Print Preview button. It can also help to export the file or save the file.

We can complete many other operations also using the profit and loss features of Odoo Accounting

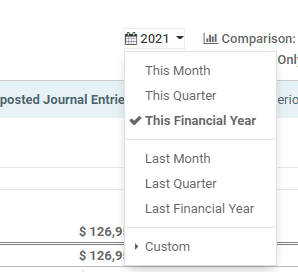

The calendar tab helps us to access the Profit and Loss report for different periods. With Odoo Accounting we can generate profit and loss report for a month, a quarter, a year, etc

Besides, we can also generate a custom period for preparing the profit and loss statement.

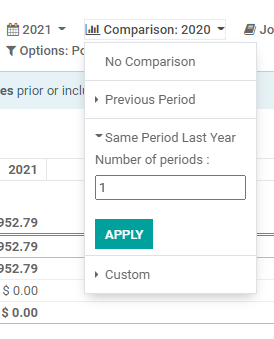

We have another option Comparison

The comparison feature can help us compare the selected profit and loss statement with the profit and loss statement of another period.

Suppose you have generated the profit and loss statement for April 2021. When you choose the compare option we can compare it with this month, last month, or a custom period. The comparison will help us easily grasp if the business is experiencing growth or not.

When we click on the period we will get a window

Select the number of periods to be selected and then Apply.

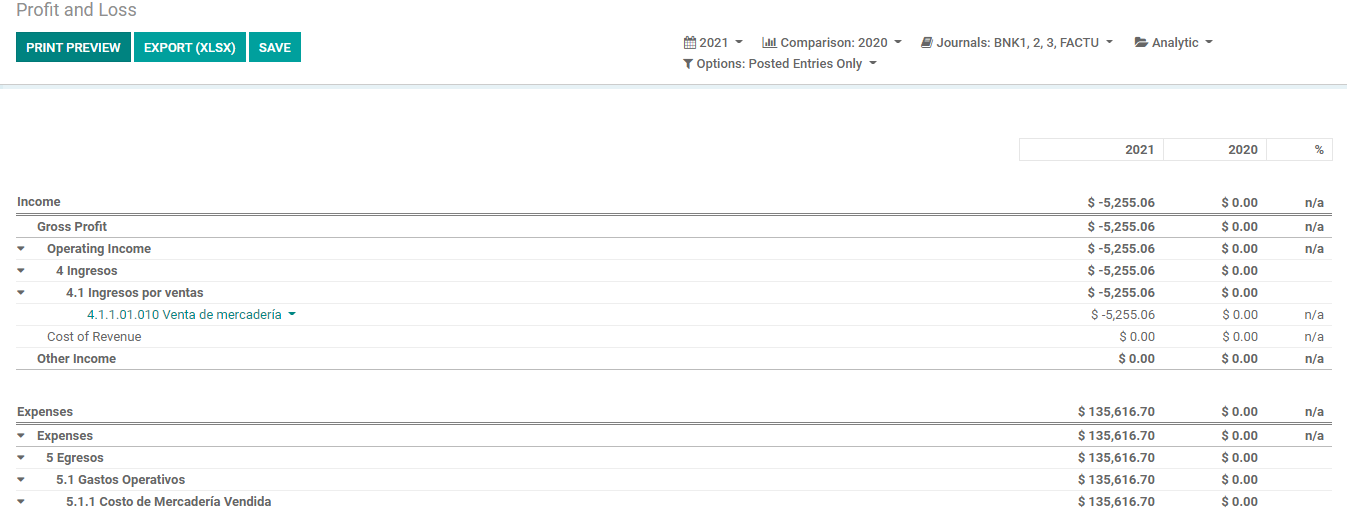

On applying we get a comparison of the profit and loss of the given periods.

Here we can find the Profit and loss statement for the years 2021 and 2020.

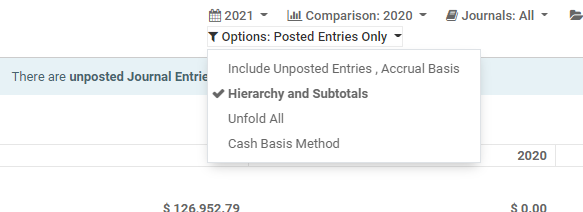

We also have a filter option to choose different facts

This will enable us to include unposted entries, accrual basis, hierarchy, and subtotal, cash basis methods. Profit and loss statements based on these facts can be found.

The above-given profit and loss statement is based on hierarchy and subtotals

The below given is prepared by including unposted entries.

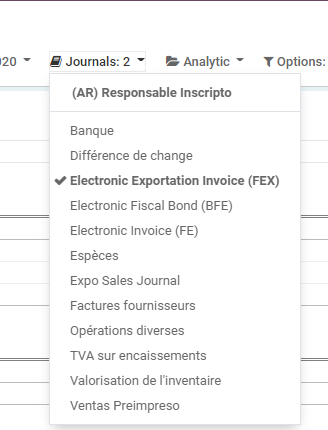

Profit and Loss based on different journals

Selecting journals we can choose the journal from where we have to choose the data for calculating profit and loss.

Analytic

We have an analytic tag and this will help us to add analytic account and analytic tag details and find the profit and loss for the particular analytic account.

This way Odoo Accounting helps us to generate Profit and Loss Statements in an accurate way. This statement can be used by the managers to assess and evaluate how the company is performing. The investors can get an idea of the growth rate of the company. The accounting wing can compare the statistical figures and make use of the scenario while preparing the budget. The financial plans of a company can also be prepared with the help of an efficiently generated profit and loss statement.

Mail to odoo@cybrosys.com or dial +918606827707 for more details.