Numerous nations employ the value-added tax identification number as a means of identification. A unique identification number is provided to each enterprise that has registered for VAT. Due to some circumstances, including the transportation of goods or services subject to VAT and the entry of commodities into the EU, the majority of entrepreneurs register for VAT. Every EU country has a unique VAT number assigned to it. Using Odoo ERP in a system resulted in a swift improvement in business workflow. The Odoo 17 Accounting module facilitates fast maintenance of the VAT numbers. The European VIES service in Odoo 17 was supported, which allowed for this verification.

Value-Added Tax Benefits

Every state's goods sales include VAT charges based on the relevant gross margin. Value-added taxes are paid on a particular movement from maker to merchant. Various nations have VAT laws, including India and Union Territories. There are two parts to the value-added tax calculation: output and input VAT. The following is the formula used to determine the VAT:

OUTPUT TAX - INPUT TAX equals VAT.

Using VAT eliminates the possibility of error and is mostly used in the acquisition and sale of commodities. Value-added taxes guarantee efficiency through a standardized tax payment procedure.

How to Configure an Odoo 17 Tax ID for a US Company

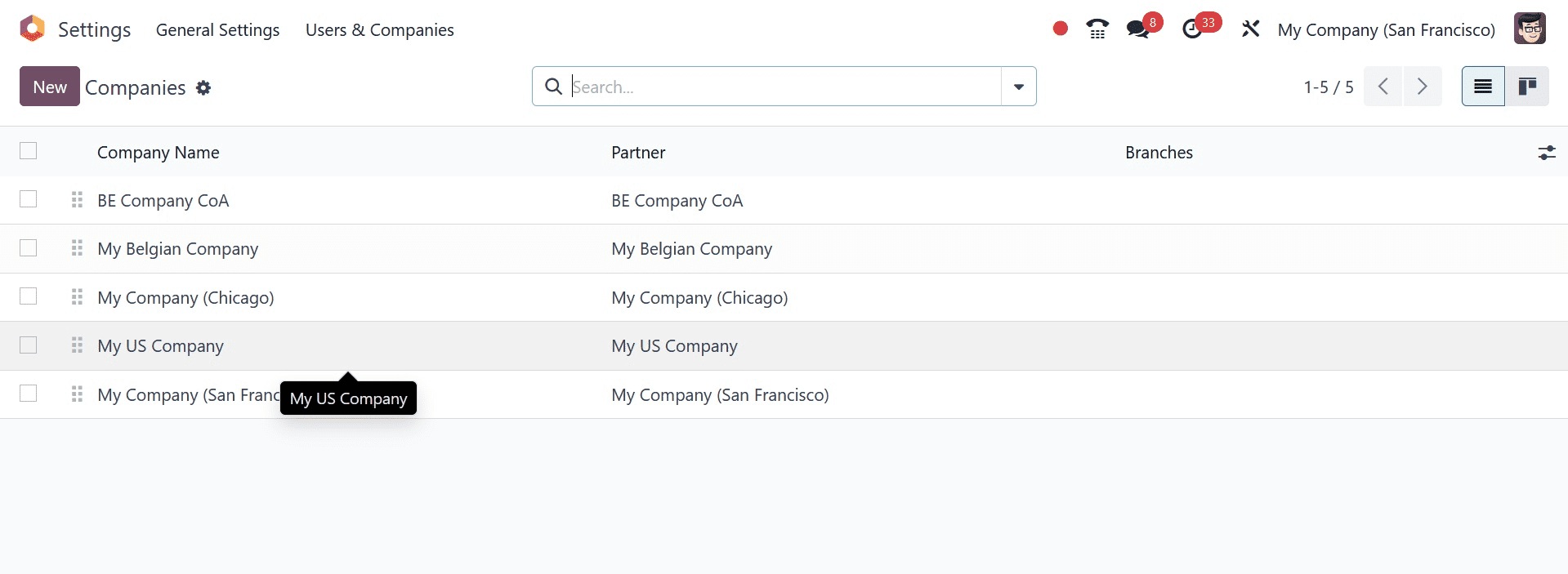

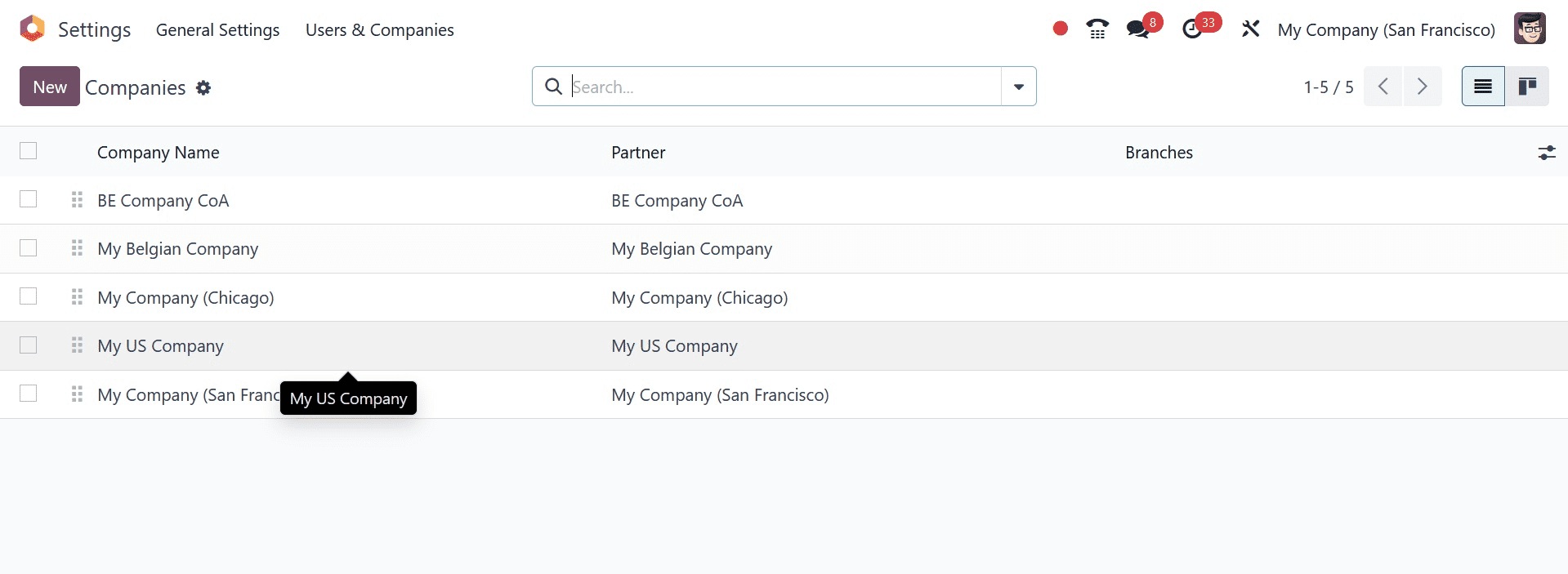

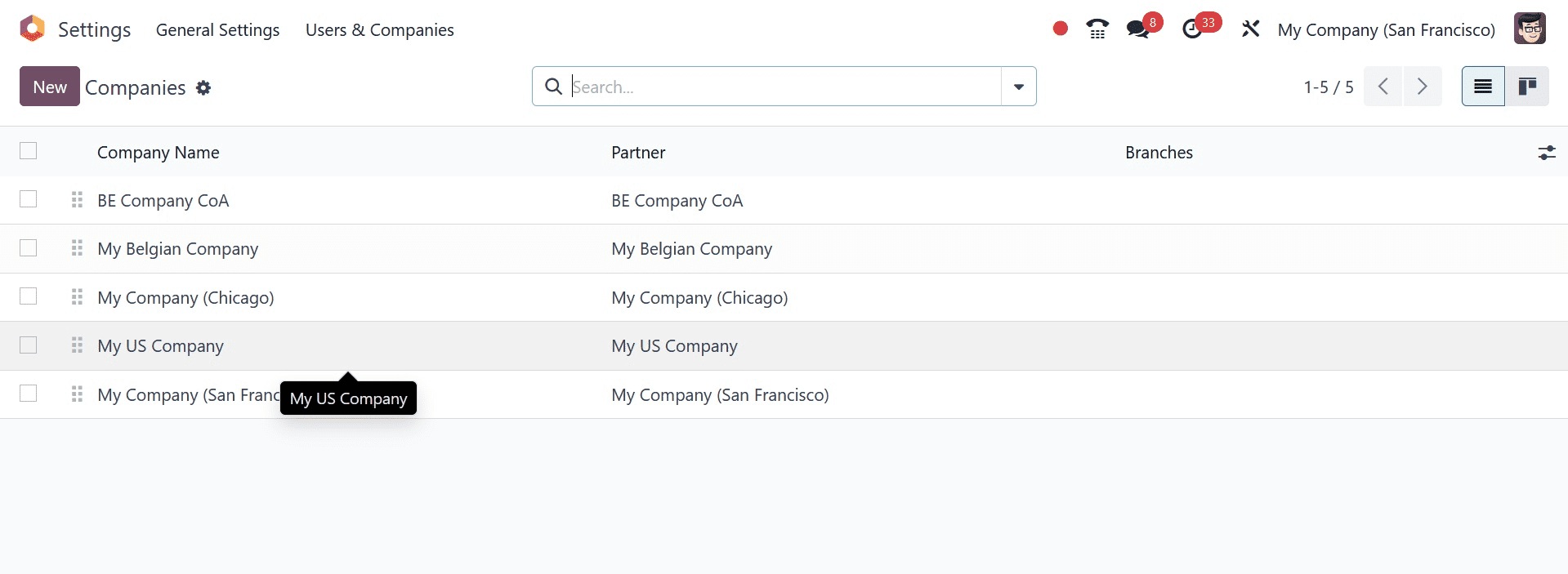

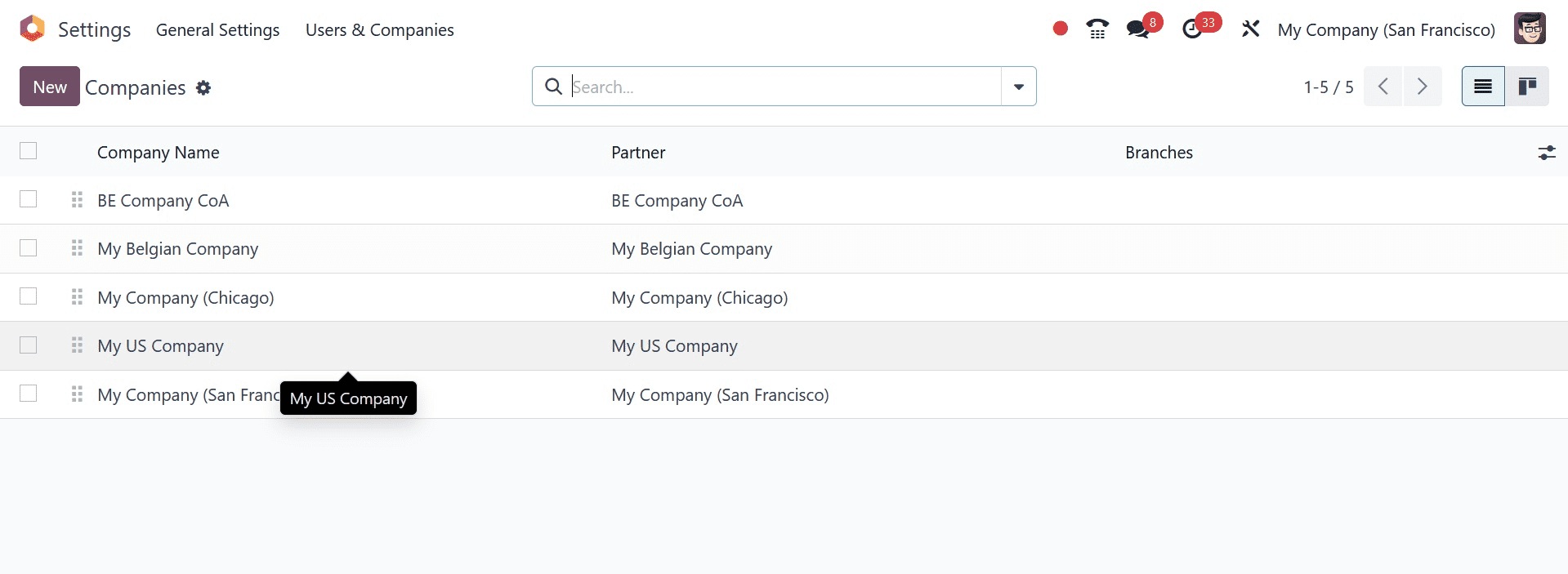

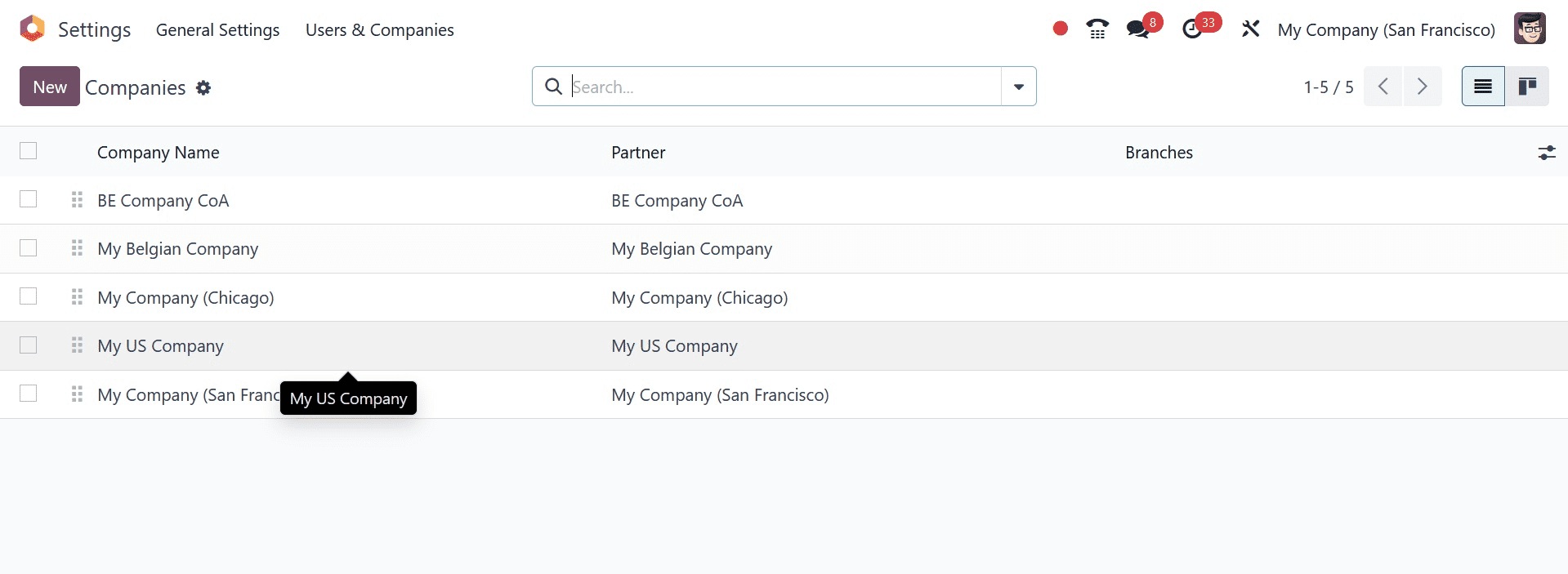

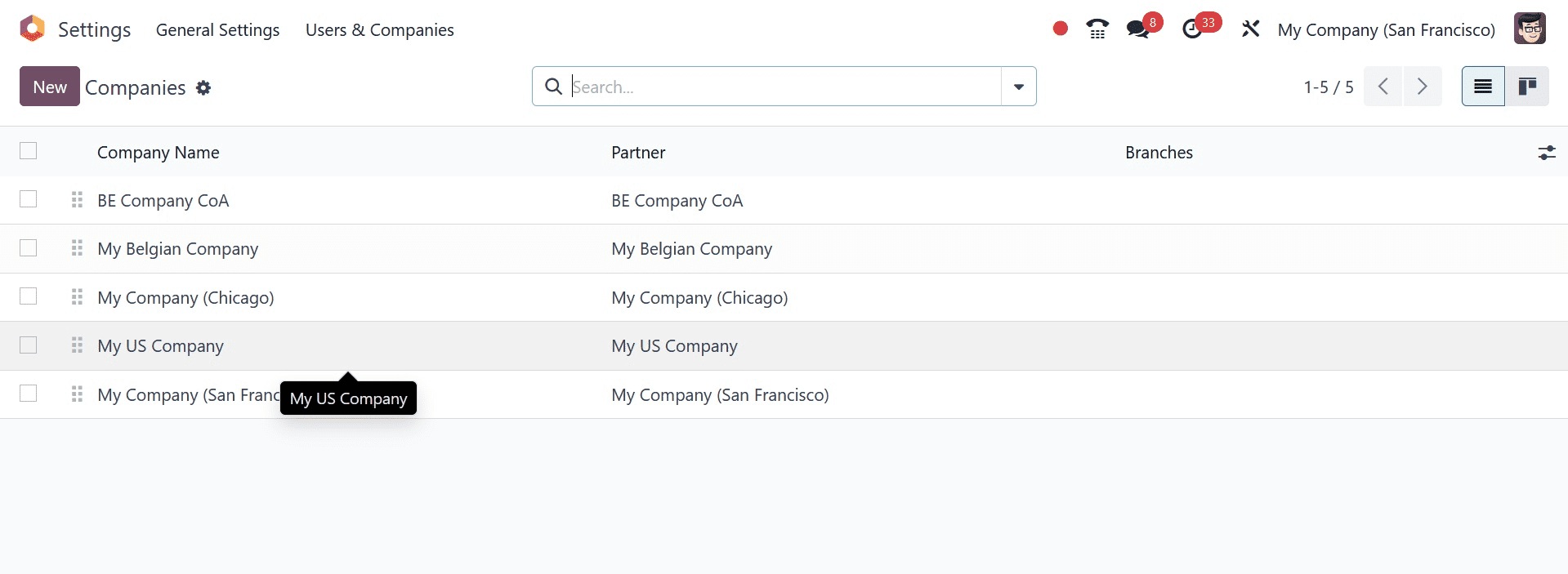

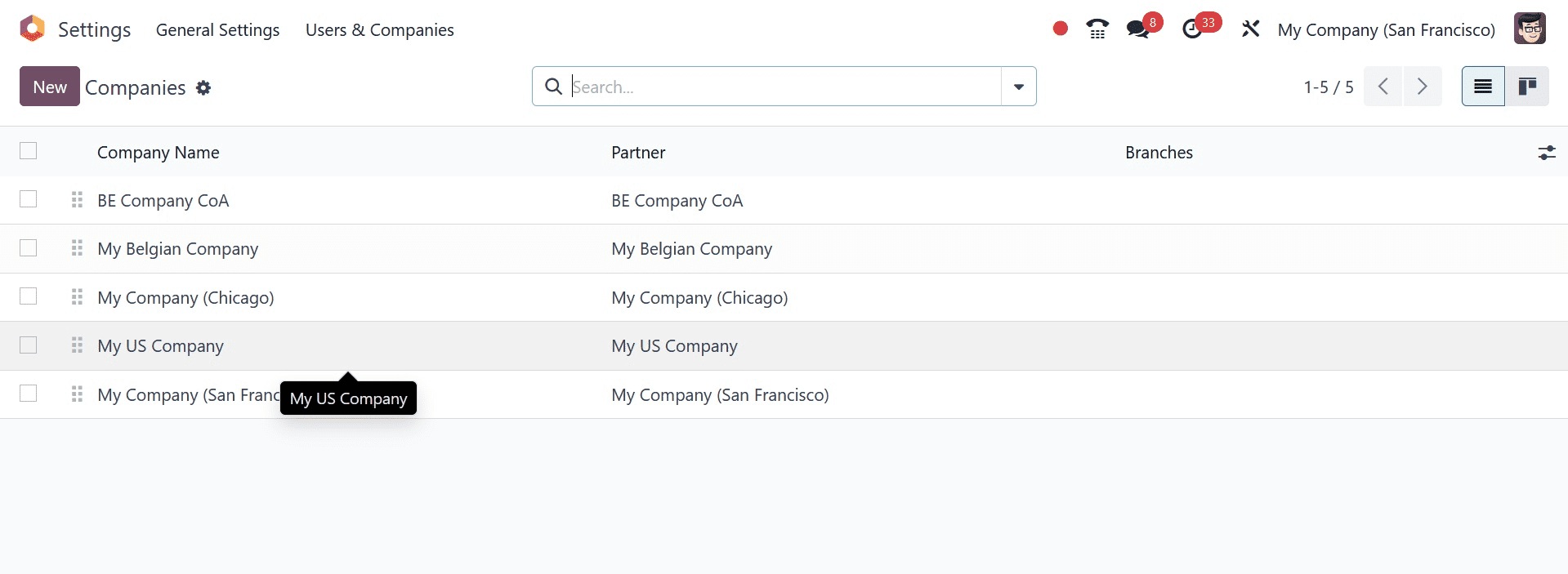

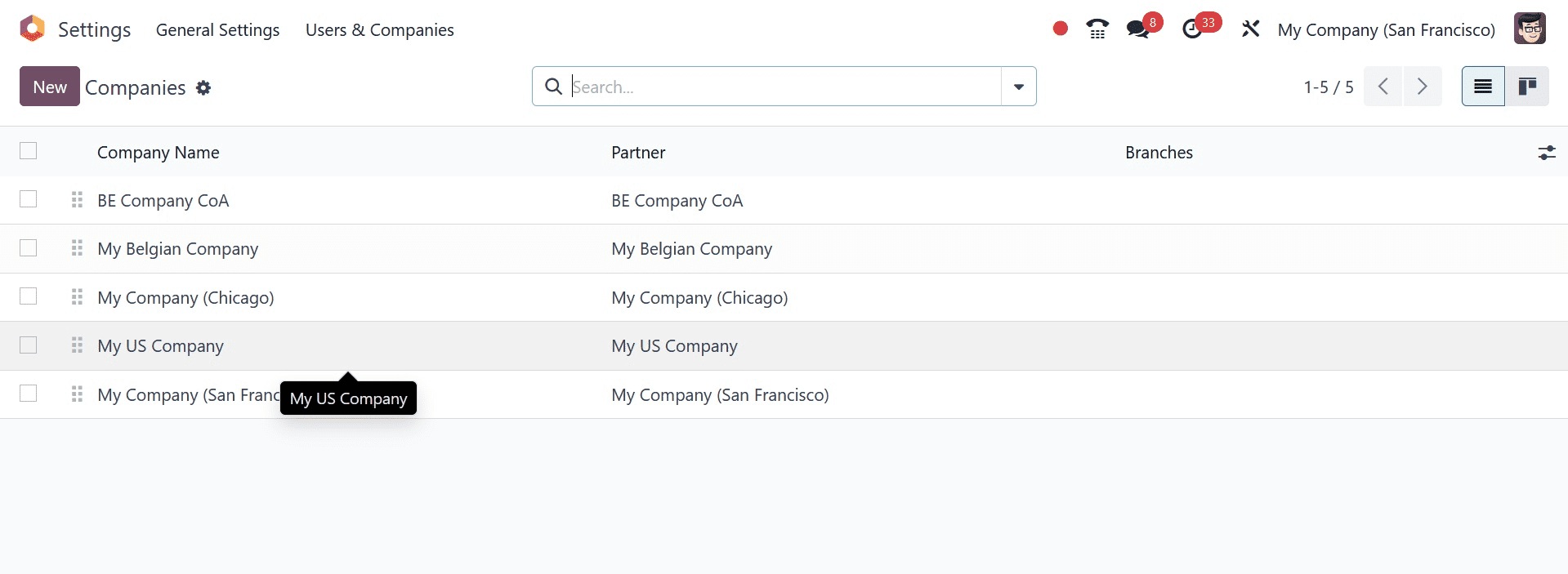

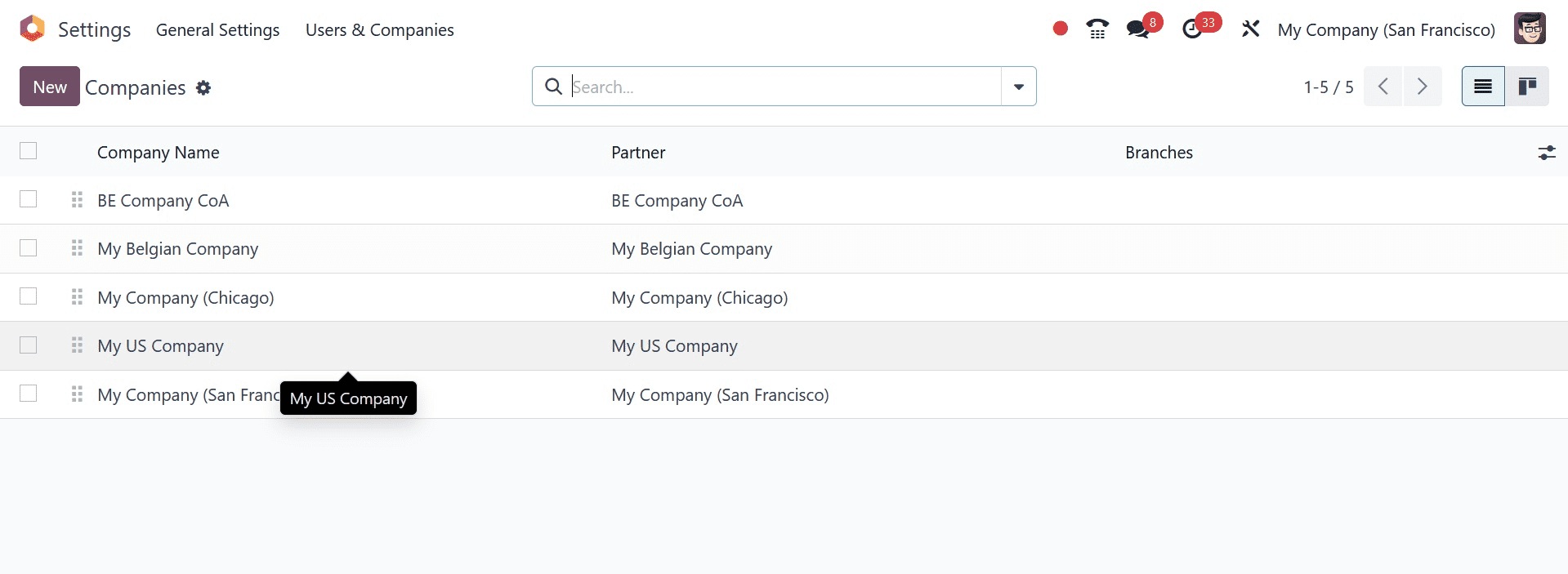

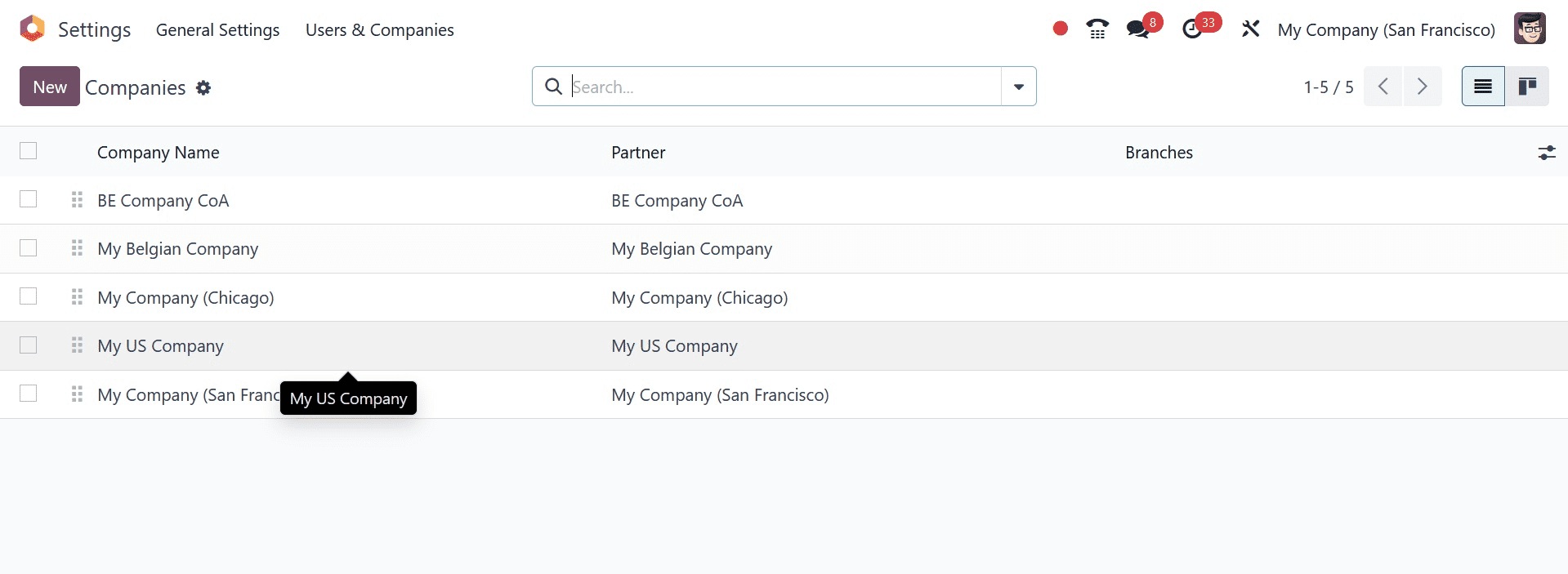

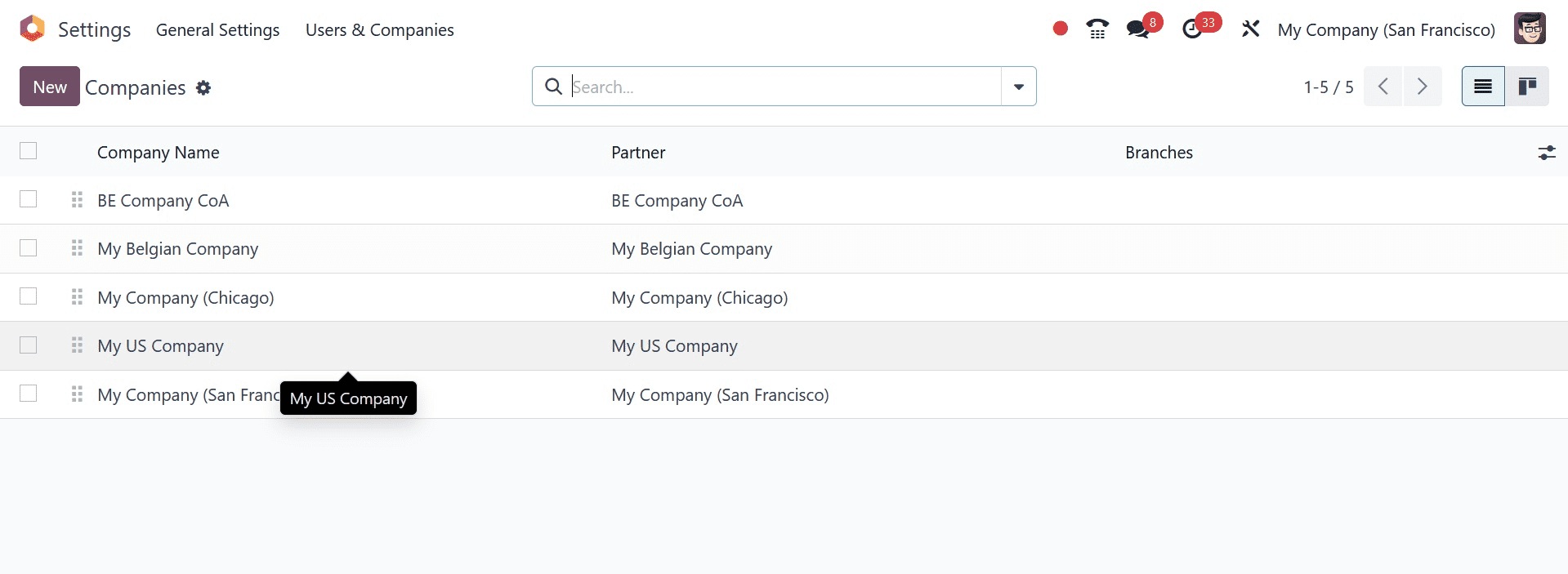

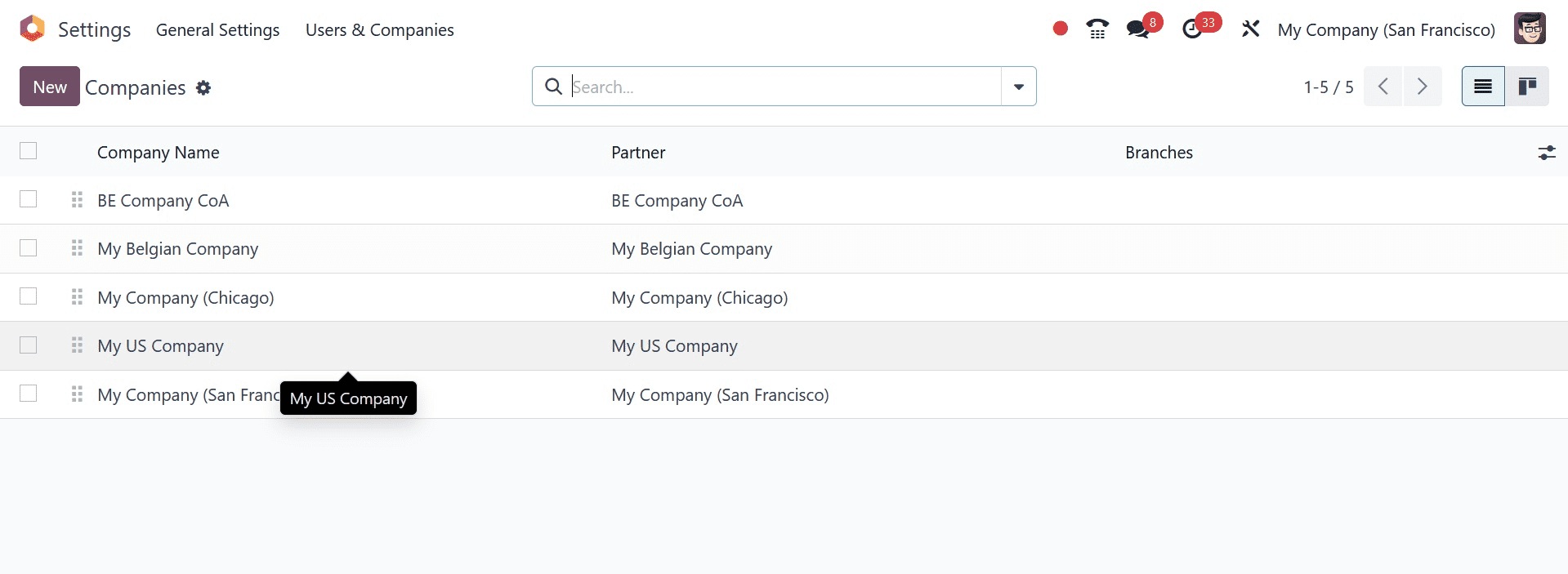

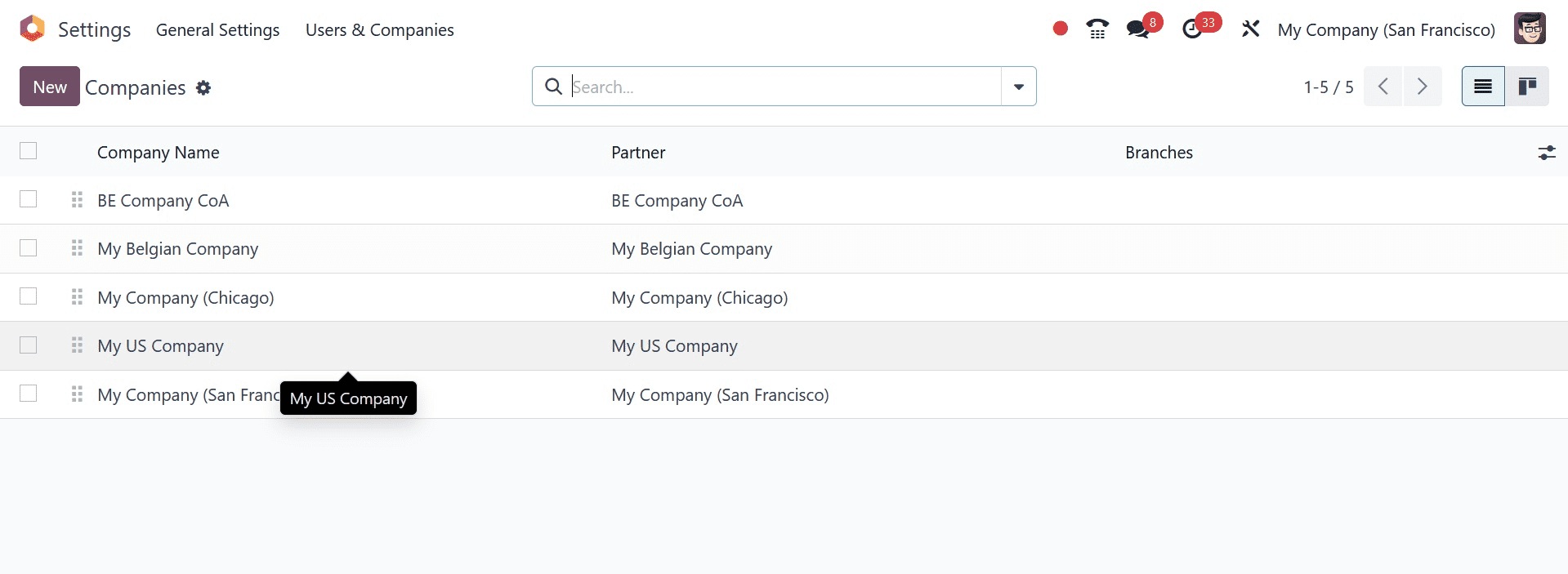

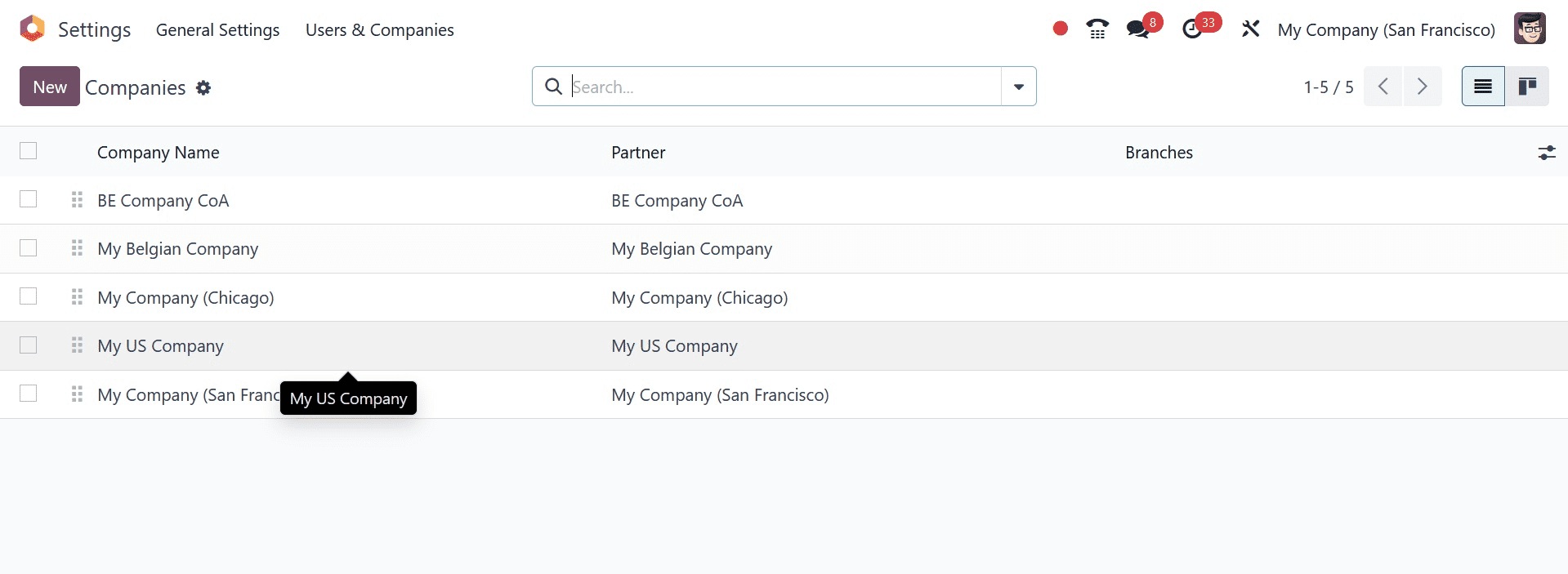

A company's Tax ID can be configured in the Odoo 17 Settings. Under the Users & Companies tab, select the Companies menu. Users can view the list of all companies in a separate window, along with details like Partner or Company Name. From the Companies window, select your US company, as seen in the screenshot below.

The company name and further general information, like contact details, address, email, etc., are displayed on the new page. Each taxpayer is granted a Tax Identification Number (Tax ID or VAT) as a permanent account number. As shown in the screenshot below, users can apply the US company's Tax ID below the General Information tab.

The processes for setting up a value-added tax number in Odoo 17 Accounting are now visible.

How to Set Up and Check VAT Numbers in Accounting with Odoo 17?

The VAT Information Exchange System is the instrument that the European Commission offers. It helps you verify the legitimacy of VAT numbers that businesses in the EU have registered. In Odoo 17 Accounting, the Verify VAT Number tool facilitates the saving of a contact. The user can view the Taxes section by selecting the Settings option in the Configuration tab. As shown in the screenshot below, activate the Verify VAT Numbers section and click the SAVE icon.

After activating the Verify VAT Numbers functionality, users can use the European VIES service to validate the VAT numbers. Let's now examine the Odoo 17 Accounting module's VAT number validation.

How to Verify a VAT Number in Accounting for Odoo 17

In Odoo 17, we may control the value-added tax number while generating new client information. To do so, choose the Customers menu. From there, a user can view the list of all partners that have been created. We have independent access to each customer's details in the Kanban view. It contains details like name, email address, country, income, and other information, as seen in the screenshot below. In the Customers pane, click the NEW symbol as seen in the screenshot below to create new customer data.

In Odoo 17, we may control the value-added tax number while generating new client information. To do so, choose the Customers menu. From there, a user can view the list of all partners that have been created. We have independent access to each customer's details in the Kanban view. It contains details like name, email address, country, income, and other information, as seen in the screenshot below. In the Customers pane, click the NEW symbol as seen in the screenshot below to create new customer data.

Next, as shown in the screenshot below, enter the company's address, including the Street name, City, Country, ZIP code, State, and more.

Users can enter the firm phone number in the Phone area and apply for the value-added tax number in the Tax ID field.

Upon entering the required data, the information will be automatically stored within the system. If not, you can utilize the Save manually icon, which is displayed in the preceding screenshot. Users who enter an invalid Tax ID may receive an error notice. Once the right VAT number has been applied for, customer information is readily saved. As seen in the screenshot below, the created customer data is viewable in the main Customers panel.

For this reason, using the Odoo 17 Accounting module to confirm a customer's Tax ID is simple.

Tax Report in Odoo 17 Accounting for Users

We can examine a company's tax returns for a given period in the Odoo Accounting module. Navigate to the Reporting tab, select the Tax Report option, and use the date Filter to select the appropriate date, as seen in the screenshot below.

Once the user has filtered the date, they can see an overview of the tax reports. Subsequently, click the CLOSING ENTRY button in the Tax Report tab, as seen in the following screenshot.

A user can view a tax return draft entry, and by clicking the POST icon in the Draft Entry window, they can publish the input.

The stage was changed from DRAFT to POSTED once the entry was posted. After clicking the Tax Report smart button on a Tax Report window, you can view the tax report.

We can view the overall tax amount for your sorted month on the new page. Additionally, by selecting the PDF button in the new window, you can download the tax report.

Users can access the general tax report, as shown in the screenshot below.

The Odoo 17 Accounting module makes VAT number management simple by utilizing the European VIES service. Setting up and configuring a Tax ID number for your business using the Odoo 17 Accounting program is simple.