When it comes to currency rounding, the smallest coin with the lowest denomination is larger than the minimum account unit. Transactions can occasionally become challenging because of the small amount. Businesses use cash rounding when coins are not available to transact at the correct price. You can manage daily cash rounding in numerous transactions with the help of ERP software. It improves the accuracy and speed of the cash rounding processes. Users can manage commercial organizations with the Odoo 17 Accounting module's cash rounding capability.

With Odoo 17 Accounting, you can set up accounting periods, check taxes, and add a bank account. After receiving payment in cash, sellers can round off expenses with the help of cash rounding. We may use the Odoo 17 Accounting module to quickly manage cash rounding for different nations. For instance, after receiving payment in cash, certain businesses in a particular nation round up the invoice amount to five cents. Let's now examine how to set up cash rounding in a US business using Odoo ERP.

To Turn on Cash Rounding in the Accounting Settings of Odoo 17:

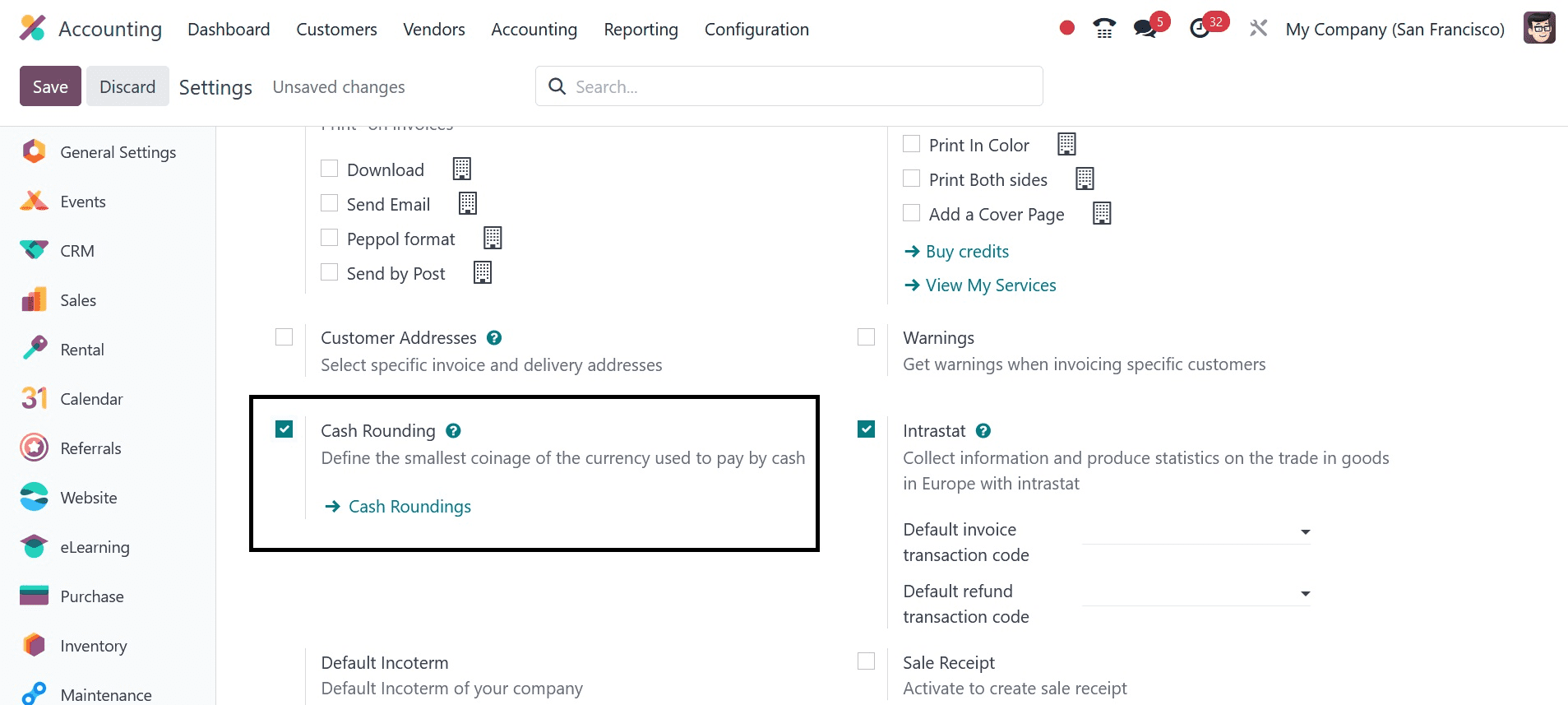

Using the Odoo database, cash rounding helps users round a company's total bill amount. This feature needs to be enabled from the Accounting module's options panel. The Configuration tab provides users with access to the Settings menu, where they may view the Customer Invoices section. As shown in the screenshot below, enable the Cash Rounding option to take into account the smallest currency coin when making a cash payment.

To enable cash rounding in Odoo 17 Accounting, click the SAVE icon. We may then produce a cash rounding for a certain scenario.

Two rounding options are supported by Odoo: adding a rounding line and changing the tax amount. In this scenario, you must define cash roundings for specific account records. A rounding line applied to an invoice is known as the add-a-rounding line technique. Another is to adjust the tax amount on rounding that is applied to the section on taxes. Let's now examine each strategy's specifics.

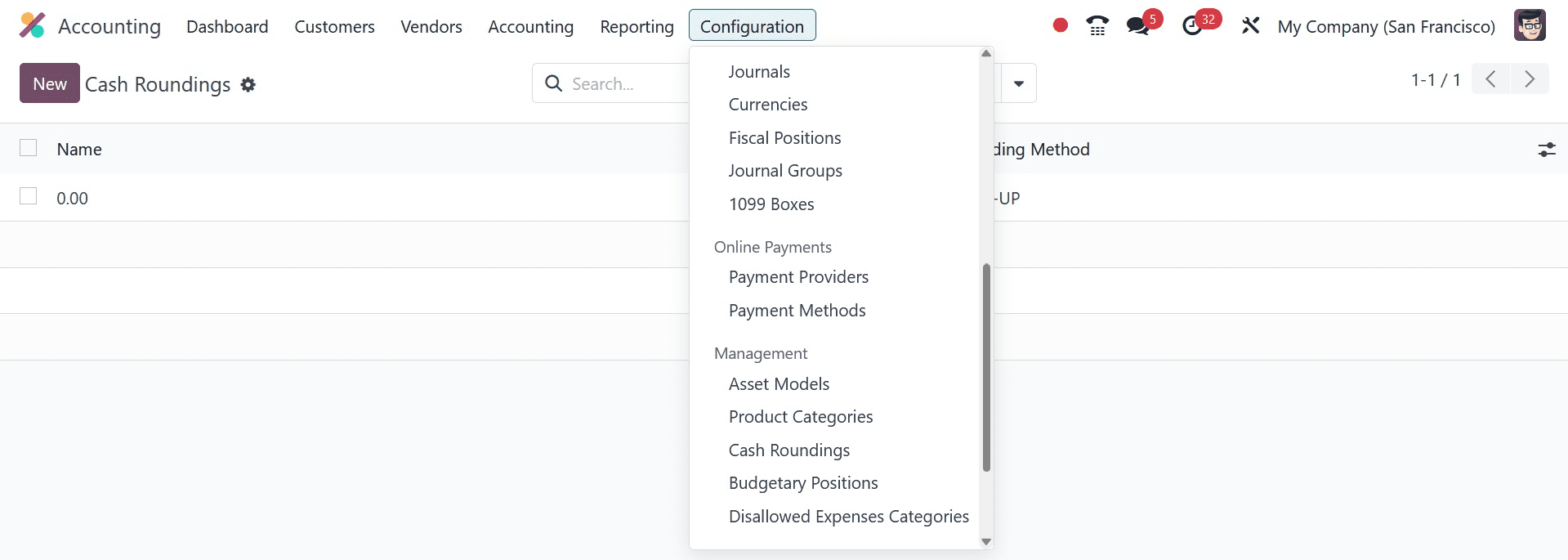

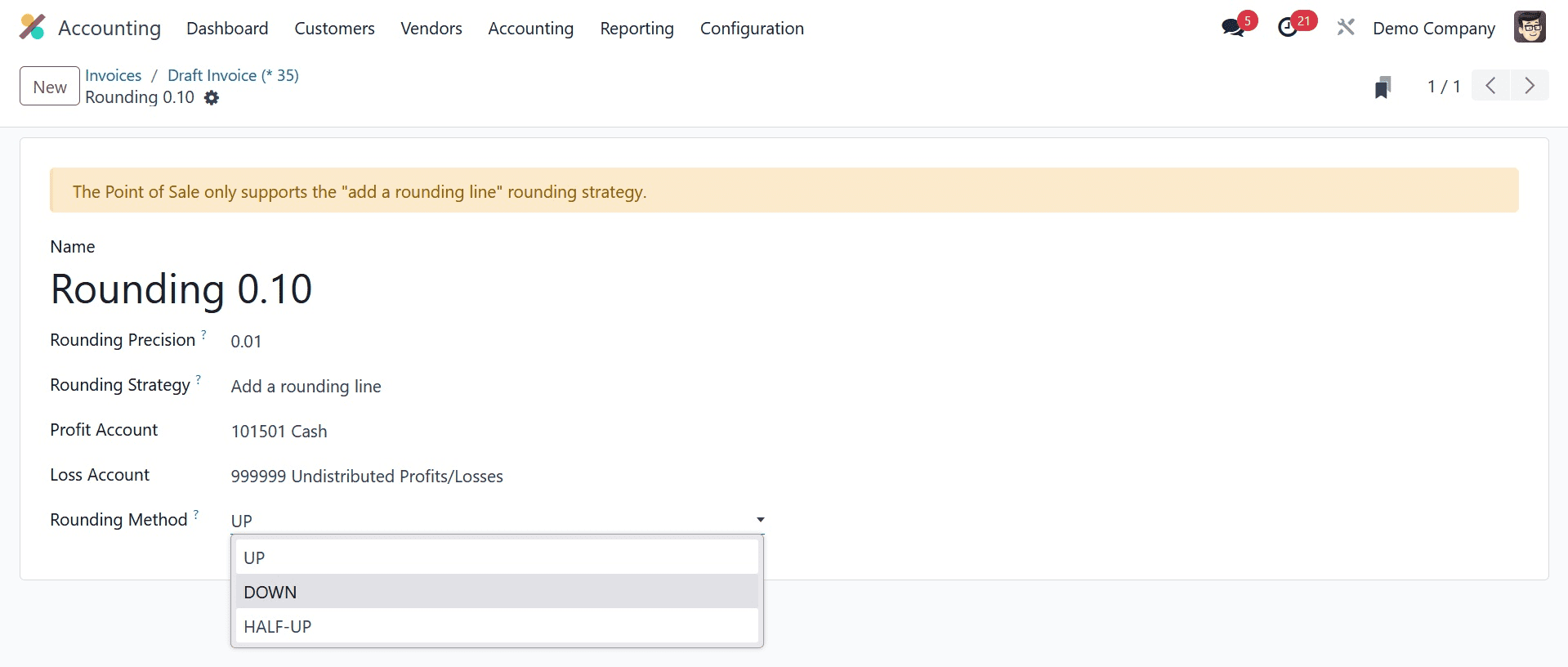

Before employing the add-a-rounding line technique, we must create a cash rounding. As shown in the screenshot below, pick the NEW button after choosing the Cash Roundings menu on the Configuration tab.

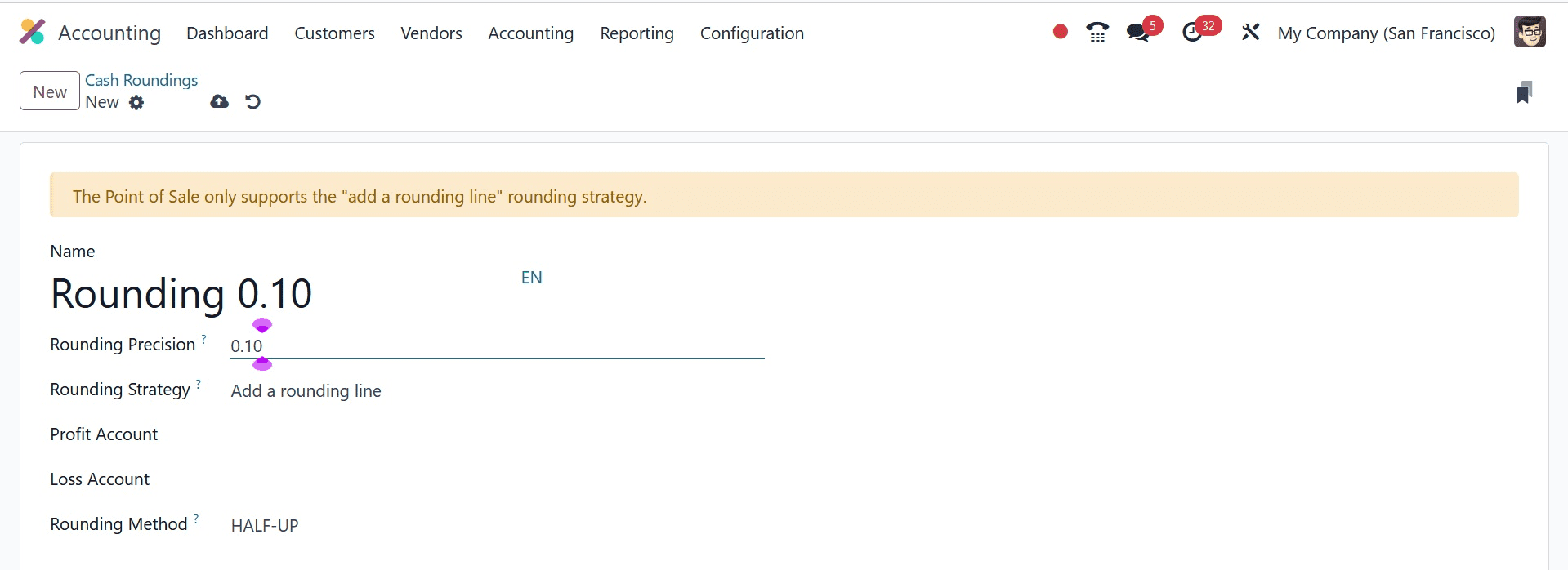

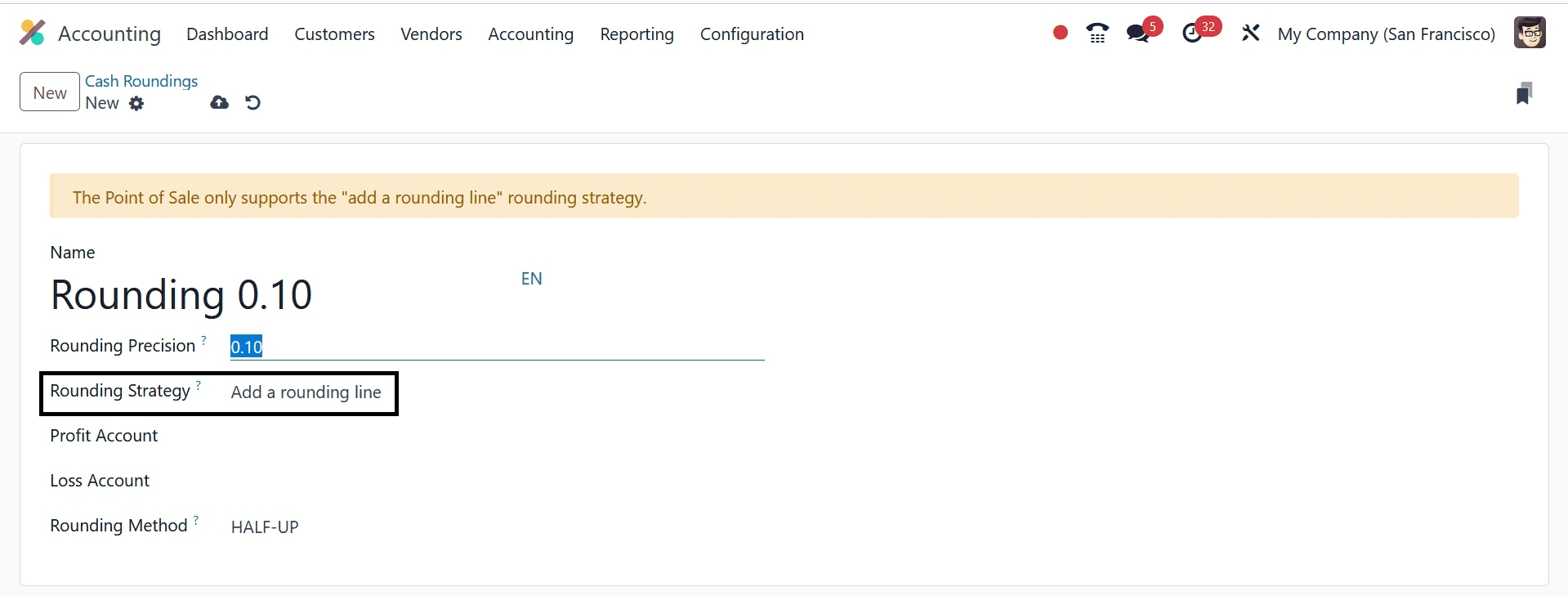

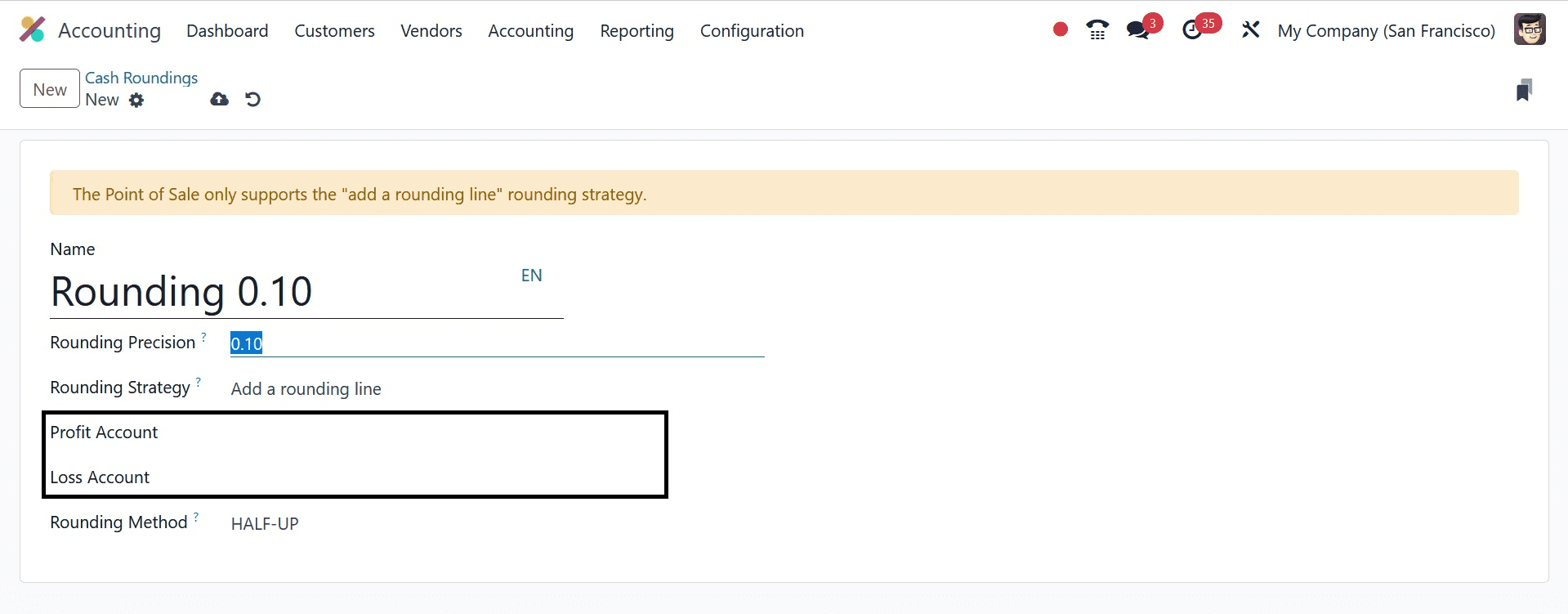

In the new window, type Rounding 0.10 as the rounding name in the Name area. Rounding Precision, as seen in the screenshot below, is the non-zero value of the smallest coin.

A numerical value includes the digits to the right and left of any decimal points and indicates a precision number. There are two methods we can use round cash: Adding a rounding line and changing the tax amount. Next, as indicated in the screenshot below, you may add a rounding line option to help you round the invoice amounts. You can then set any of these techniques inside the Rounding Strategy field.

For a company's cash roundings, we can select a profit and loss account. The screenshot below shows that the values that are set for these accounts are unique to the firm.

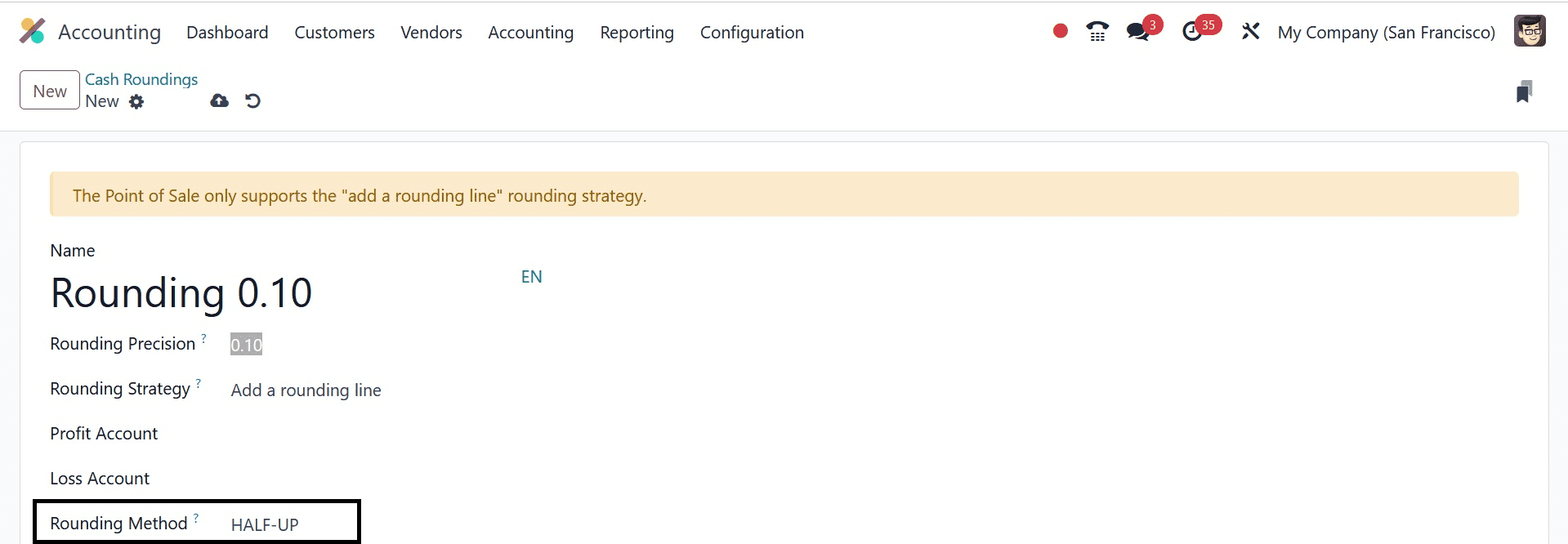

In Odoo, there are three different cash rounding techniques available. First, using the rounding precision, the round value for plus infinity is determined using the UP method. The other is DOWN, which is the minimum value rounded to the accuracy of the rounding. Lastly, a value greater than or equal to 0.5 is considered HALF-UP. About the particular cash rounding shown in the screenshot below, we have the Rounding Method set to UP.

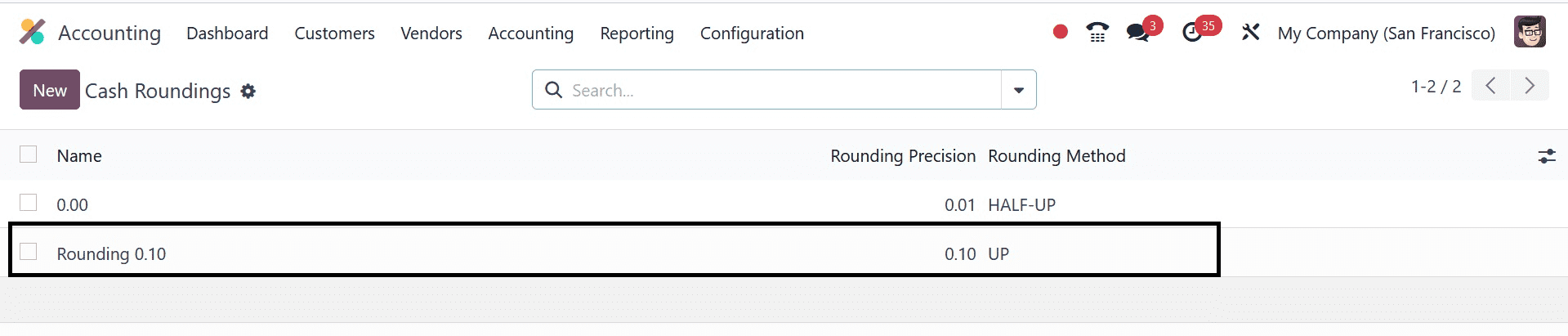

The Cash Roundings window, which indicates the details like Name, Rounding Method, or Rounding Precision, allows you to view the constructed rounding once the data has been saved.

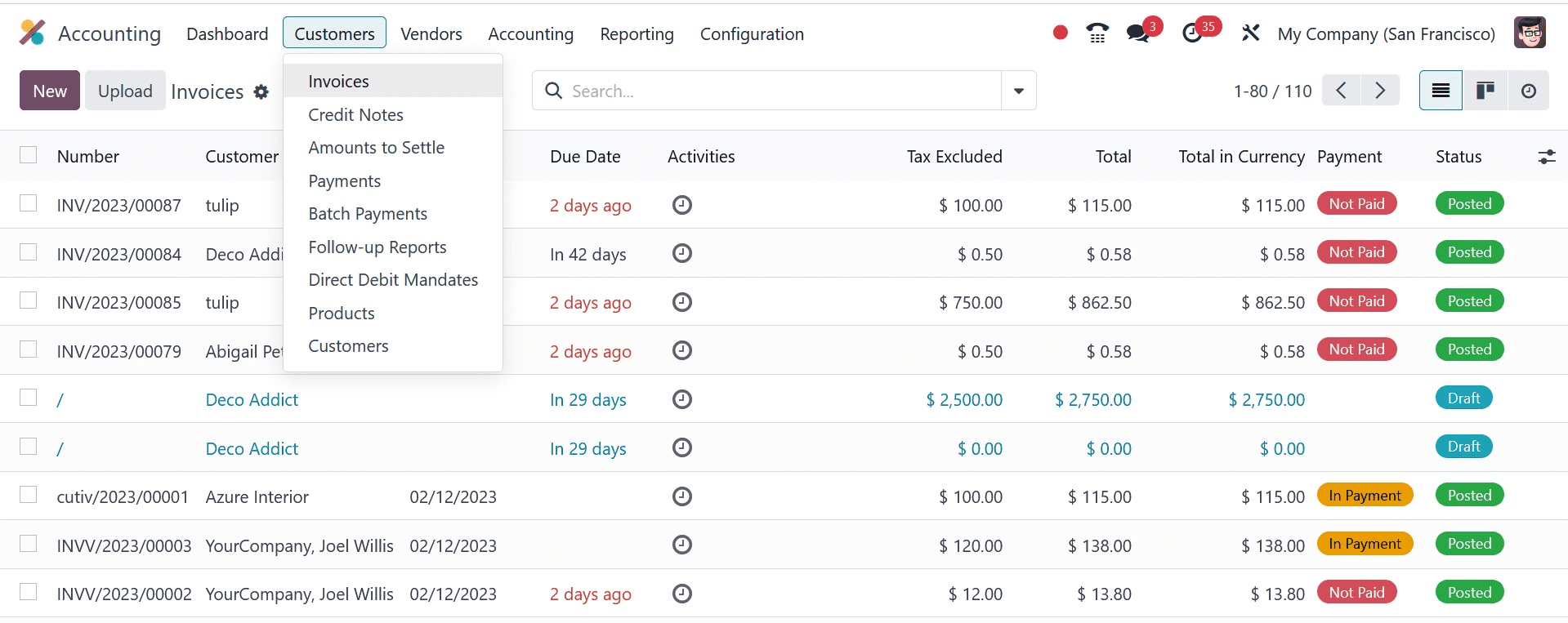

Let's create a client invoice in Odoo 17 for the Add a rounding line strategy. Click on the Customers tab, then select the Invoices option. All of your company's invoices are available here, as shown in the screenshot below.

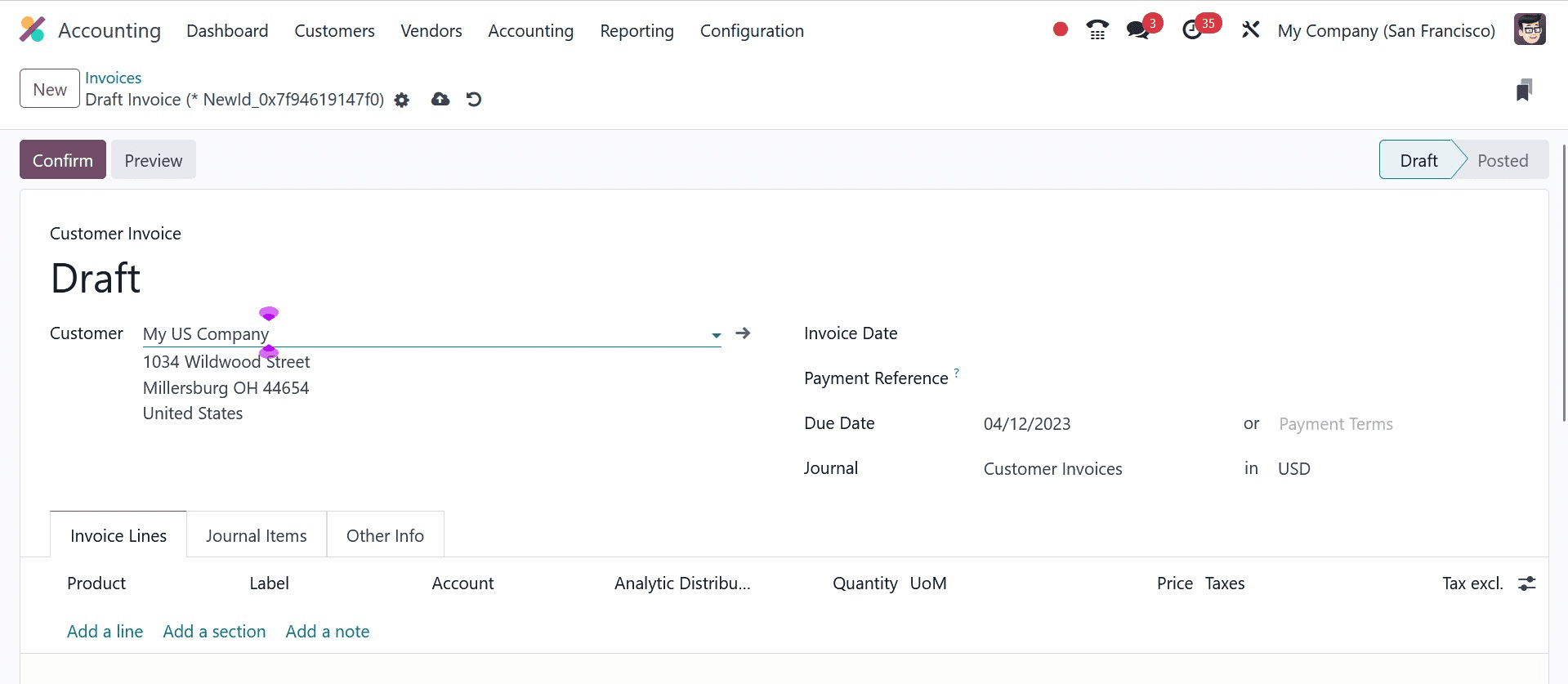

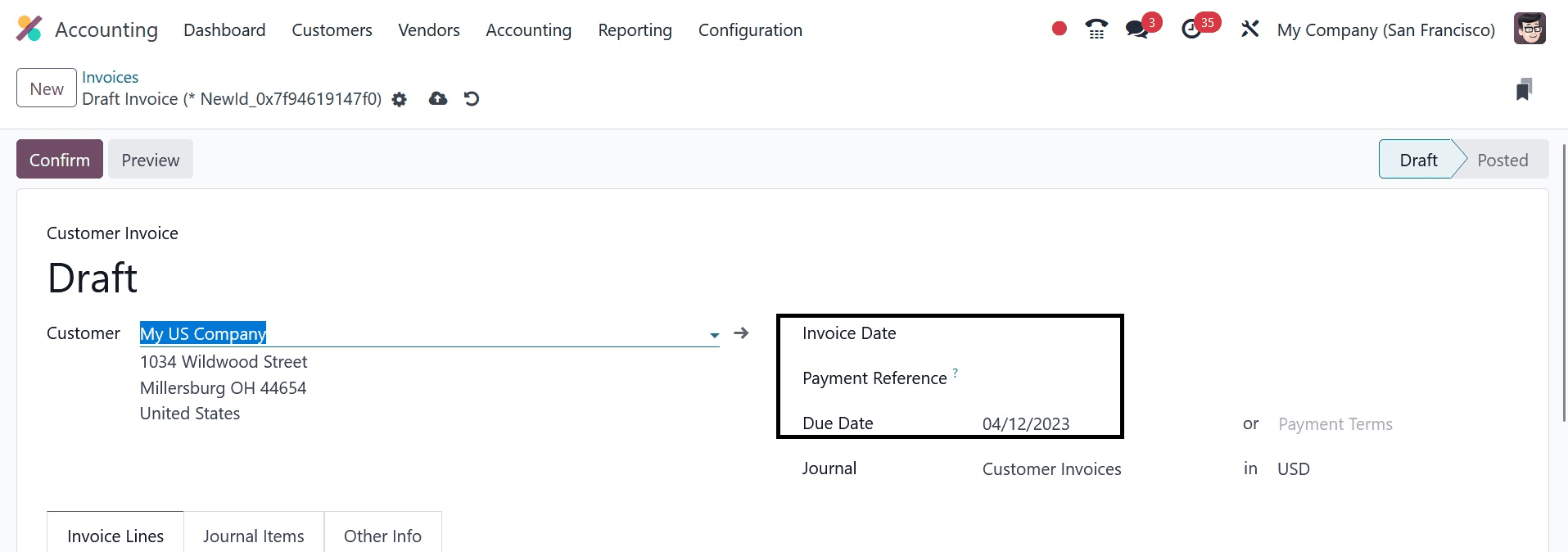

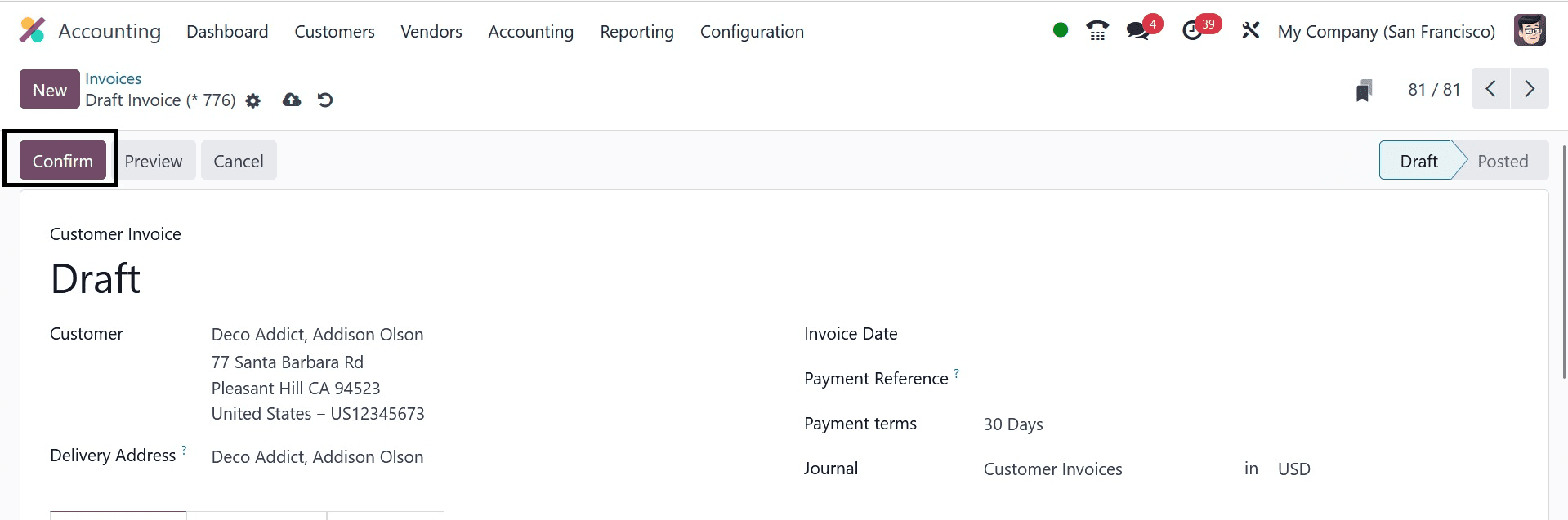

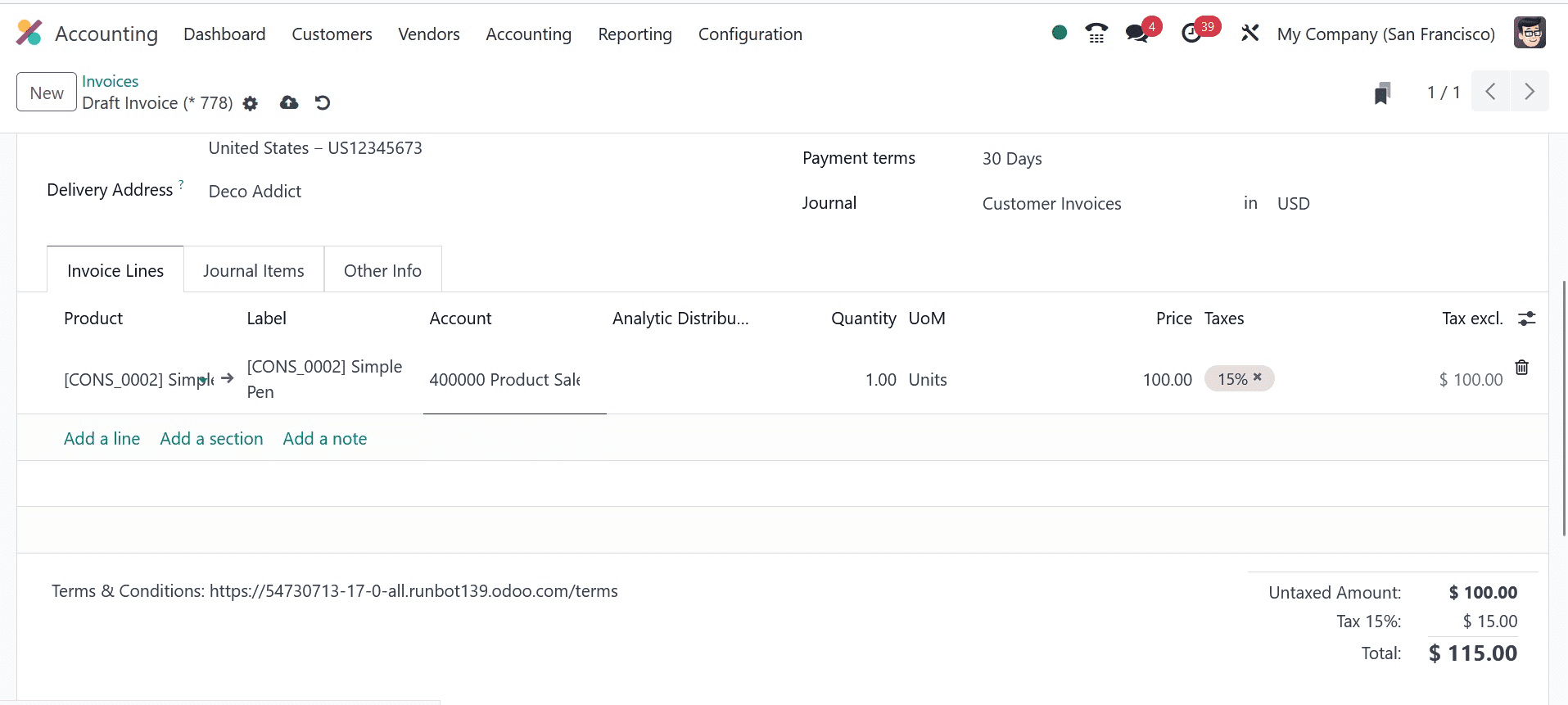

Each invoice's details, including the customer, tax excluded, total, status, invoice date, and more, are displayed in the invoices pane. As seen in the above screenshot, by clicking the NEW button, you may apply a new invoice for a customer. When you enter your customer as a US company in the new Invoices box, the address of your most recent customer will appear automatically in the Delivery Address field, as shown in the screenshot below.

Choose your anticipated bill date in the Due Date section and your official record date of the transaction later on.

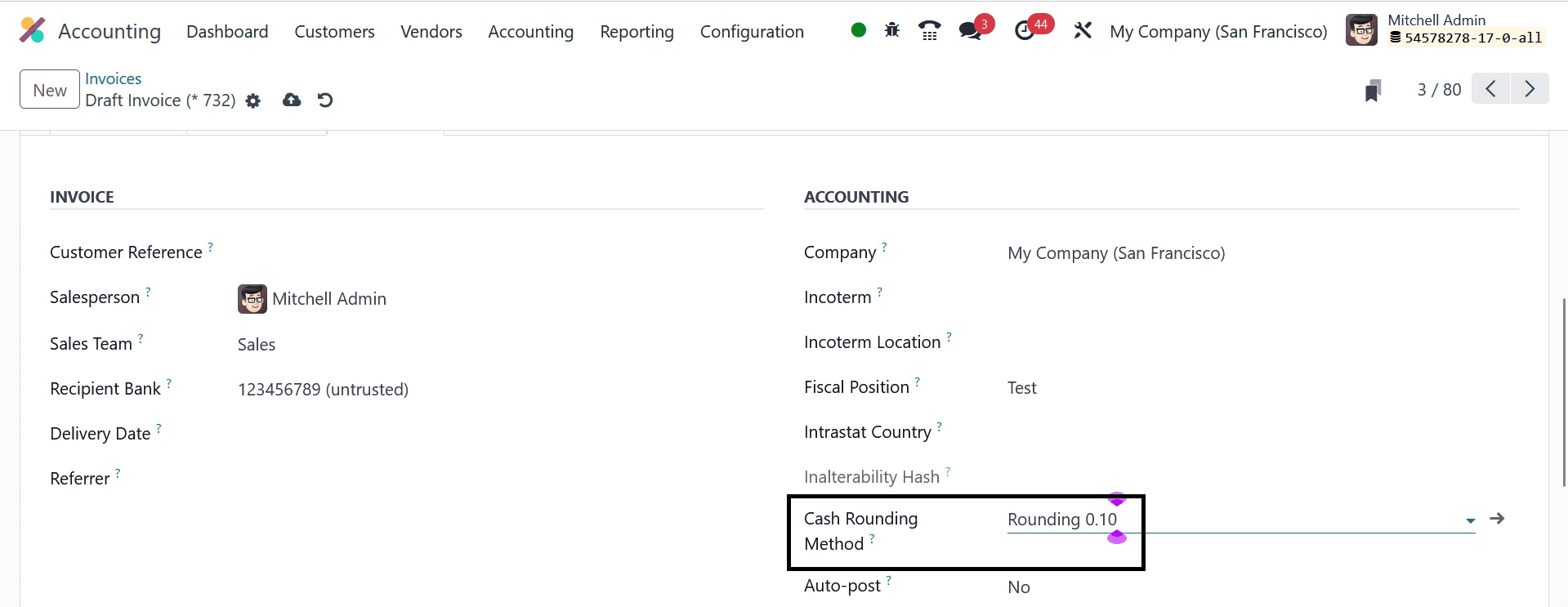

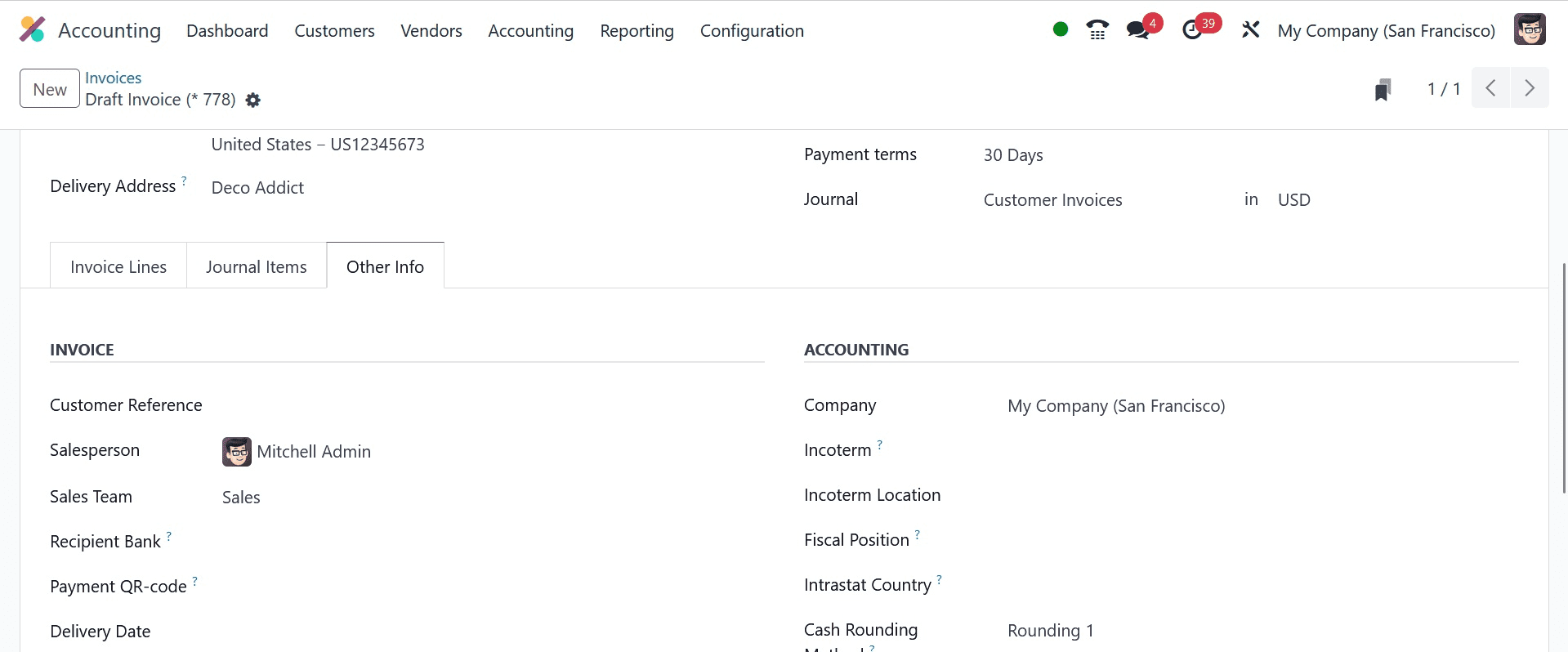

The cash rounding technique is then available for selection beneath the Other Info tab. In the Accounting section, select the Rounding 0.10 option in the Cash Rounding Method field, as seen in the screenshot below.

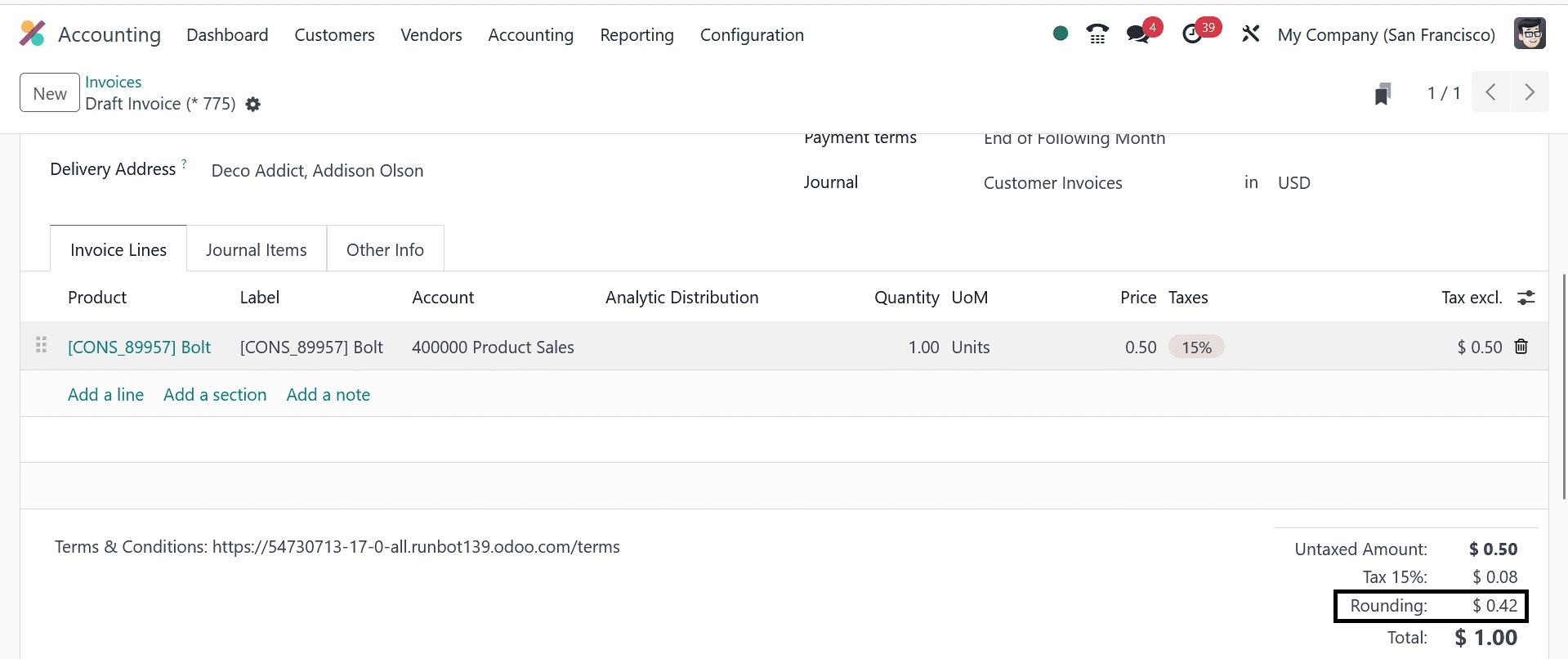

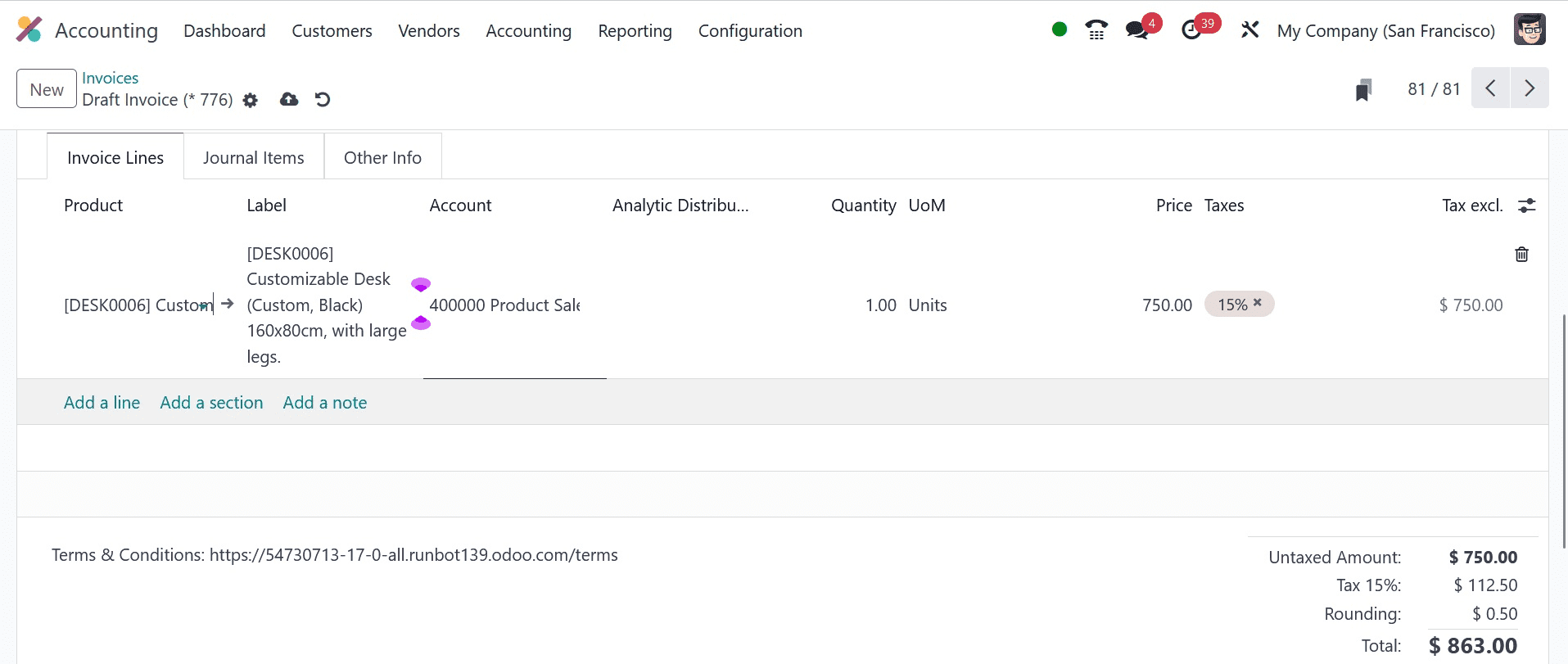

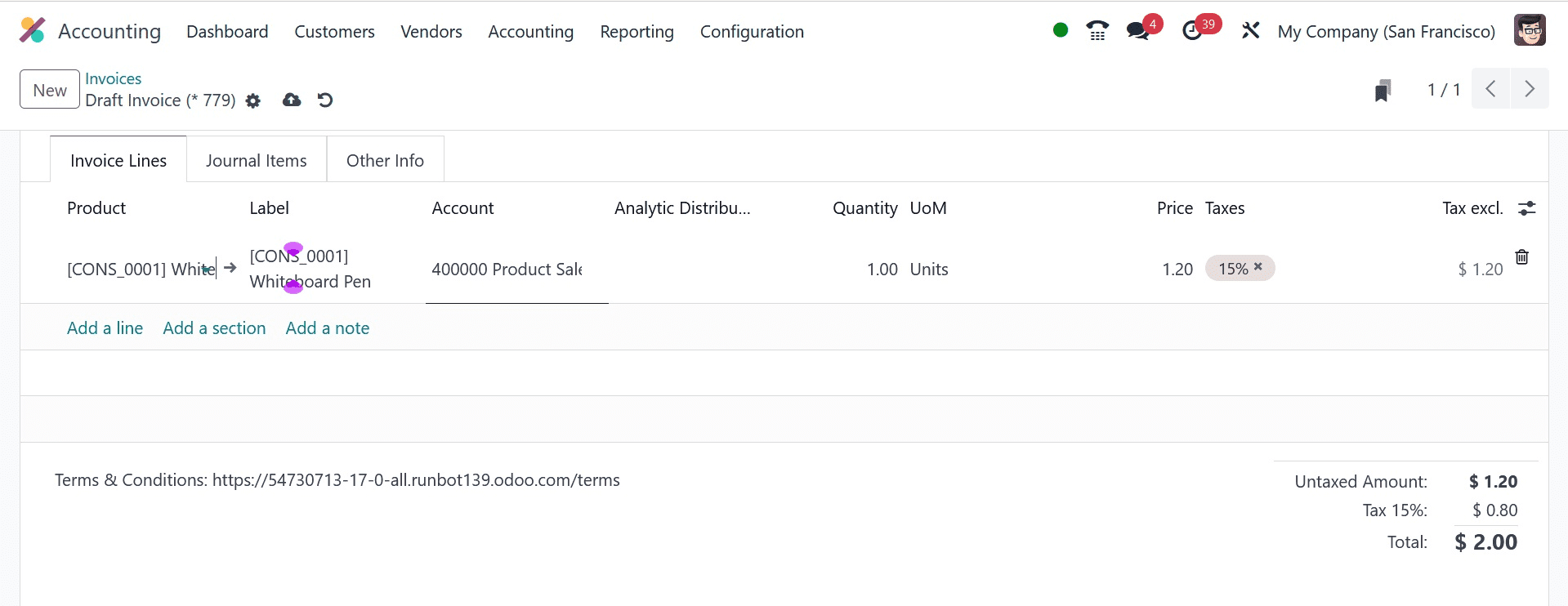

Under the Invoice Lines tab, users may additionally add products for client invoicing. You may easily add new commodity information to the invoice by clicking the Add a Line button located inside the Invoice Lines tab.

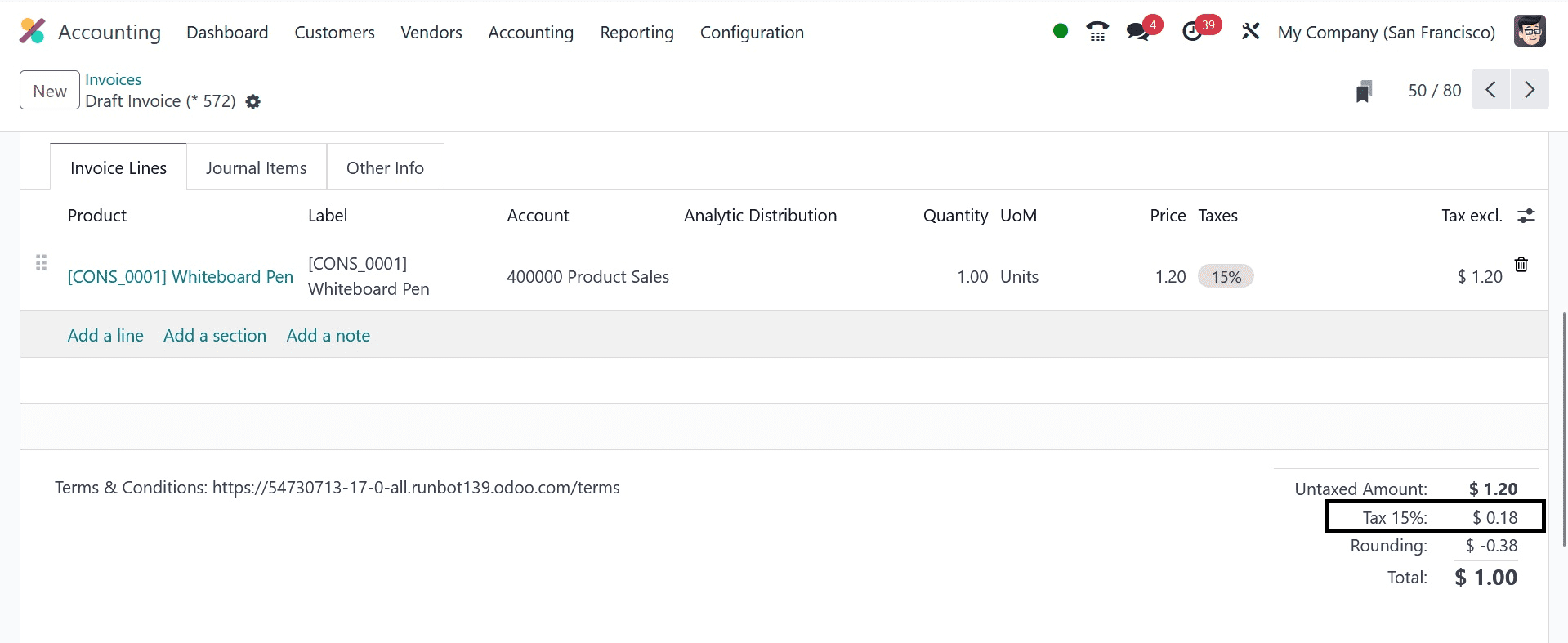

The screenshot above illustrates how the untaxed sum was rounded up to the resultant one. We can set the Rounding Method to DOWN to notice the difference in amount. In the Cash Rounding Method window, set the Rounding Method to Down.

When you view the total amount beneath the Invoice Lines tab after saving the method, you will notice a negative infinity on the rounding added for the product.

Here, using the DOWN technique resulted in a total price that rounded from top to bottom. Once you've selected your preferred rounding technique, you can store the invoice for a client. For a specific US customer company, we choose the UP rounding technique, and we confirm it by clicking the CONFIRM symbol in the Invoices pane.

As a result, using the cash rounding method to validate invoices and round up invoice amounts is simple. A company can benefit from controlling the quantity of decimal currency units.

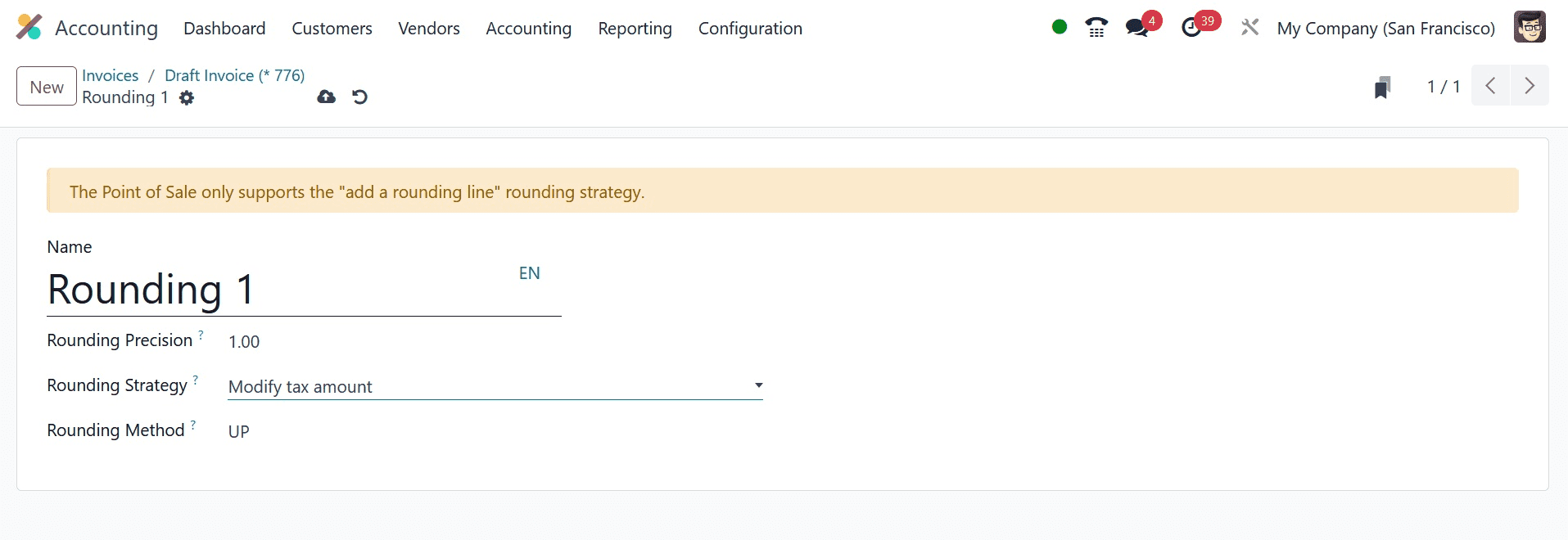

Modify Tax Amount

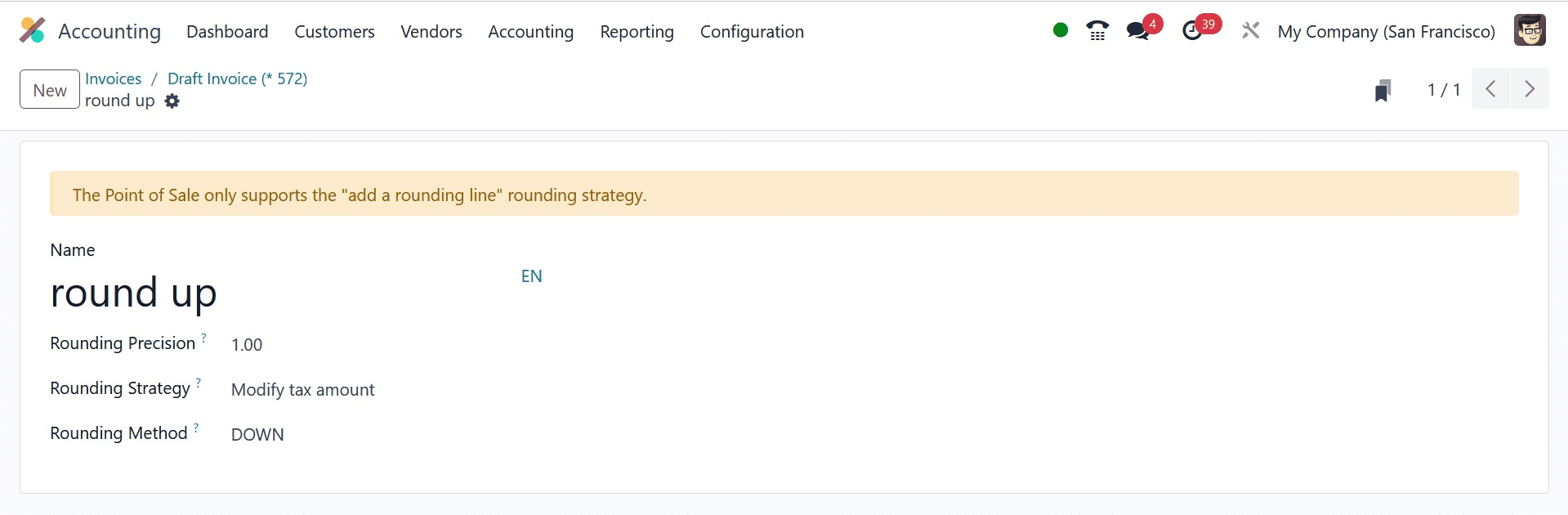

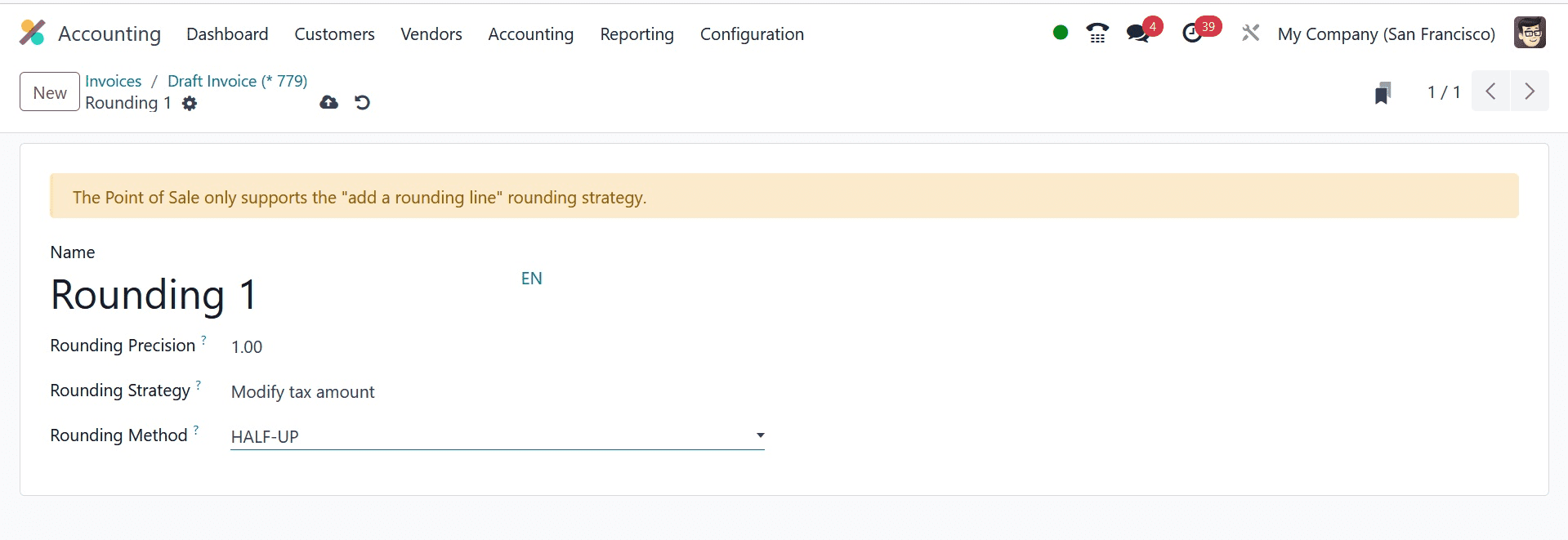

Modify Tax Amount rounding performed to a tax section is regarded as a cash rounding technique. From the Cash Roundings panel, users must generate a cash rounding using the Modify Tax Amount technique. Select the Modify Tax Amount rounding strategy and the UP rounding method.

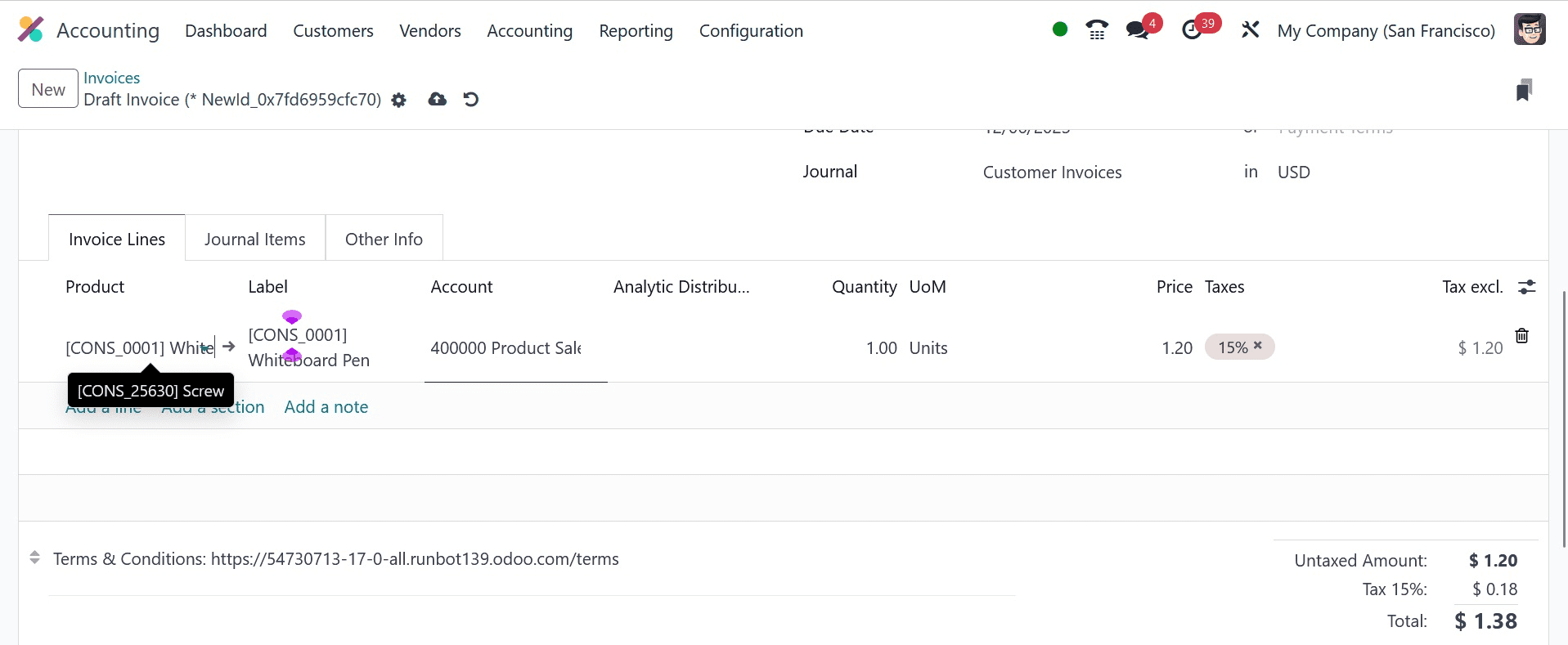

To access the Modify Tax amount rounding method for cash rounding in your organization, use the SAVE symbol. From the Customers page, we can now process a customer invoice with a tax. You can choose a product and view its tax before applying the rounding technique.

Subsequently, select your preferred way of rounding cash below the Other Info column.

After that, you may see cash rounding by selecting the Invoice Lines tab. The user may observe that by selecting the cash rounding technique, the tax amount.

We can now observe a difference by switching the rounding method to the DOWN method. To achieve that, select DOWN as your Rounding Method and press the SAVE icon.

The screenshot below illustrates how the tax percentage becomes reduced when you check the Invoice Lines tab.

After that, we can round up your precise cash using the HALF-UP procedure. Select the HALF-UP option located in the Cash Rounding Method page's Rounding Method box.

Upon examining the Invoice Lines tab, you will notice that the tax rate has been rounded up.

In this case, the tax amount on the invoice is rounded up to the maximum tax amount according to your selected rounding technique.

The Odoo 17 Accounting module helps you set up cash rounding in your company for several uses. For the cash rounding outcome, managing cash rounding techniques like UP, DOWN, and HALF-UP is simple.