The latest version of the Odoo 16 ERP system includes many advanced features to assist you in handling business seamlessly. You can find dedicated modules in Odoo that will support you in performing multiple business operations. With the help of the Accounting module, Odoo can easily streamline the most difficult accounting operations. Managing bank accounts is one of the crucial tasks in financial management. Using Odoo Accounting, you can manage and monitor your business bank accounts effortlessly. The system allows you to configure multiple bank accounts and use them at the same time. Once you configure your bank accounts in the database, you can handle your bank statements, cash transactions, and many more financial operations within the Accounting module itself.

This blog will give you an idea of how to manage bank accounts in Odoo and how to transfer cash between the accounts using the Accounting module.

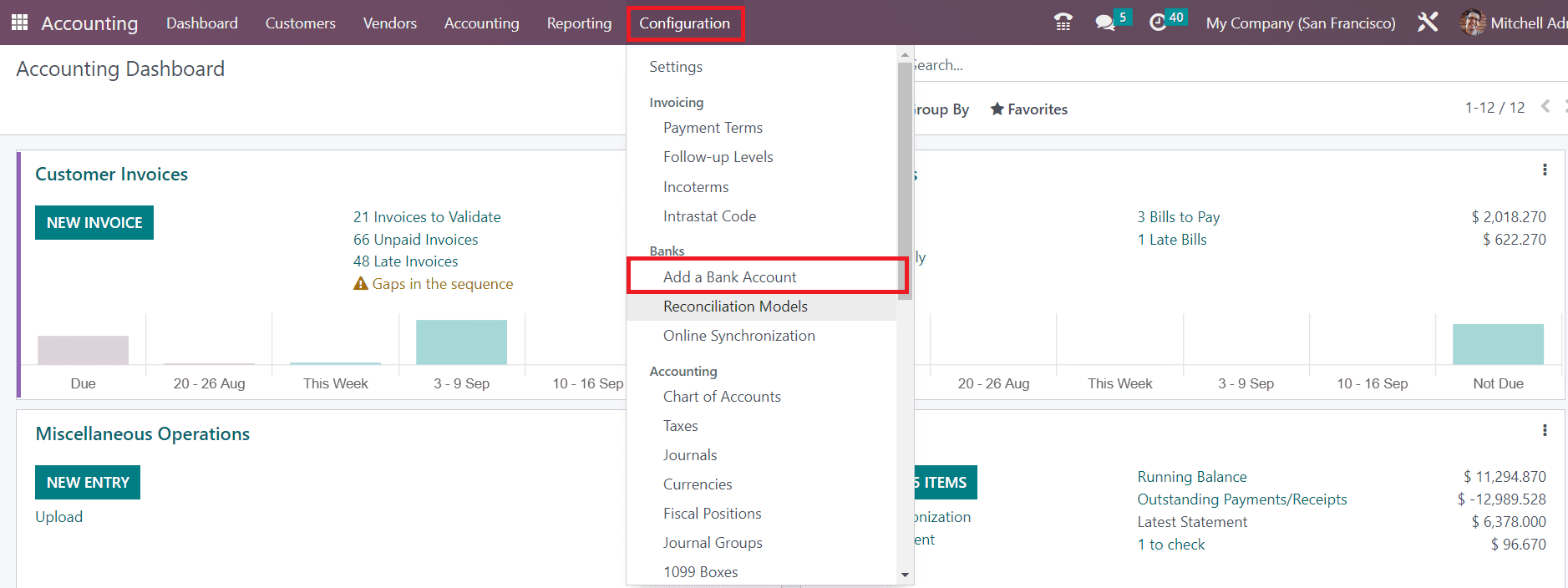

The Accounting module is equipped with enhanced features and tools that can simplify complexities in managing banking operations. Configuring new bank accounts in Odoo is an easy task now. To add a new account, you can go to the Configuration menu of the Accounting module.

As shown in the image above, you can find the option Add a Bank Account in the Configuration menu. You can click on this option to configure a new account to Odoo. as soon as you click on this option, a pop-up will appear on your screen.

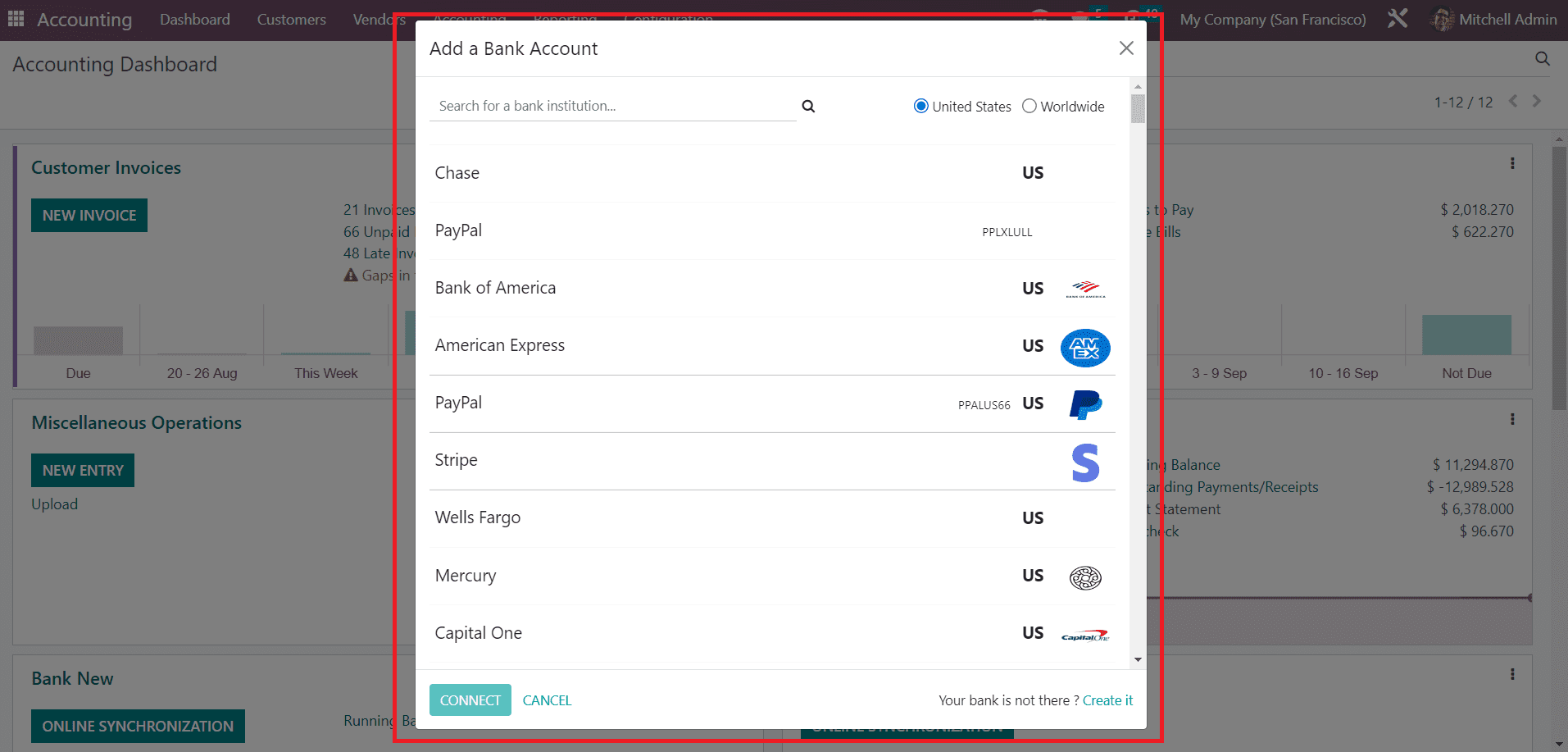

You can scroll down to see the available bank accounts or you can use the search bar to locate your bank. You can find the filters United States and Worldwide here, which help you to filter the accounts. Once you find your bank, you can click on the label and select the Connect button. This will open another pop-up to add the details of your account in the selected bank.

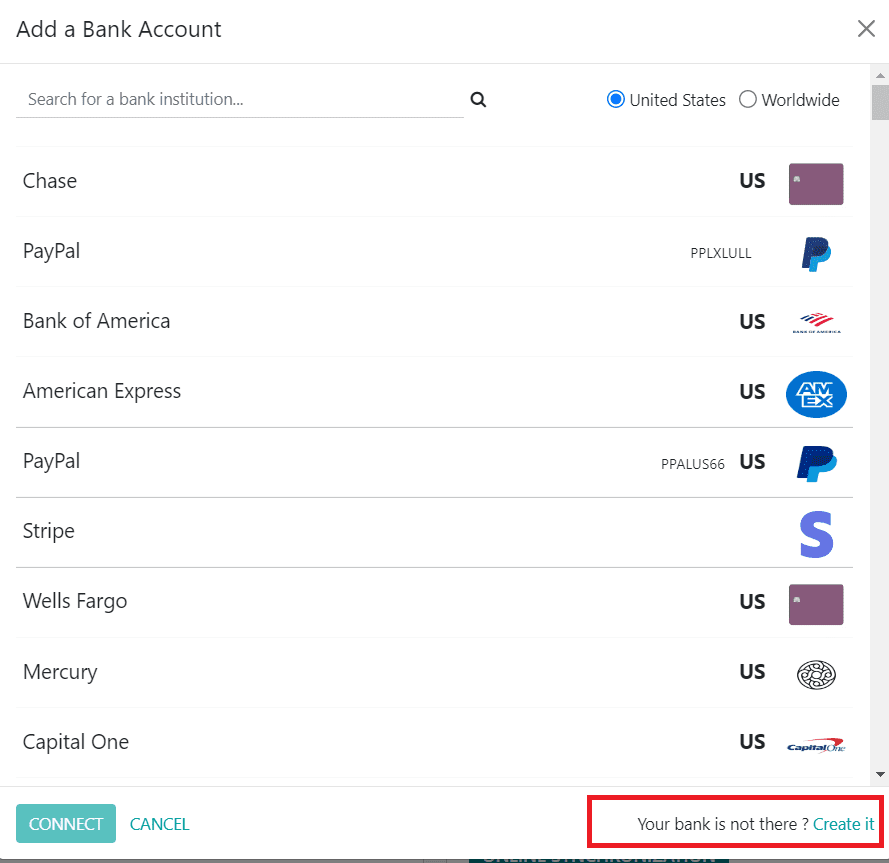

In case, your bank name is not available in the list, you can add it using the Create It button.

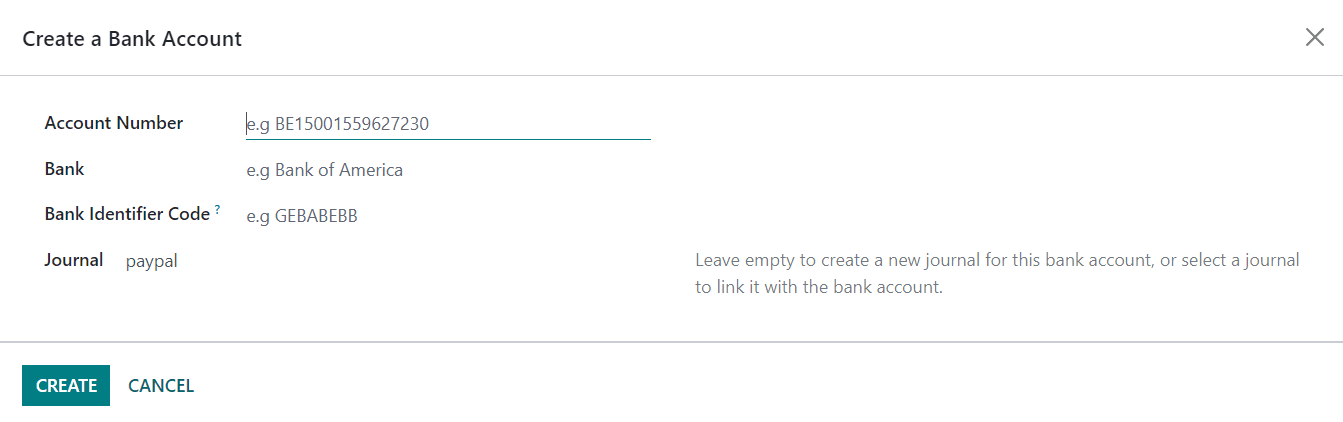

As soon as you click on this button, you will get a new pop-up that can be used to create your bank details.

You can mention your Account Number, Bank, Bank Identifier Code, and Journal in the given space. You can leave the Journal field empty to create a new journal, particularly for this account. Once you mention details, use the Create button. By doing so, you can configure your bank account in the Odoo Accounting module.

Let’s check how to perform an internal transfer in Odoo to move cash from one bank account to another within the same company.

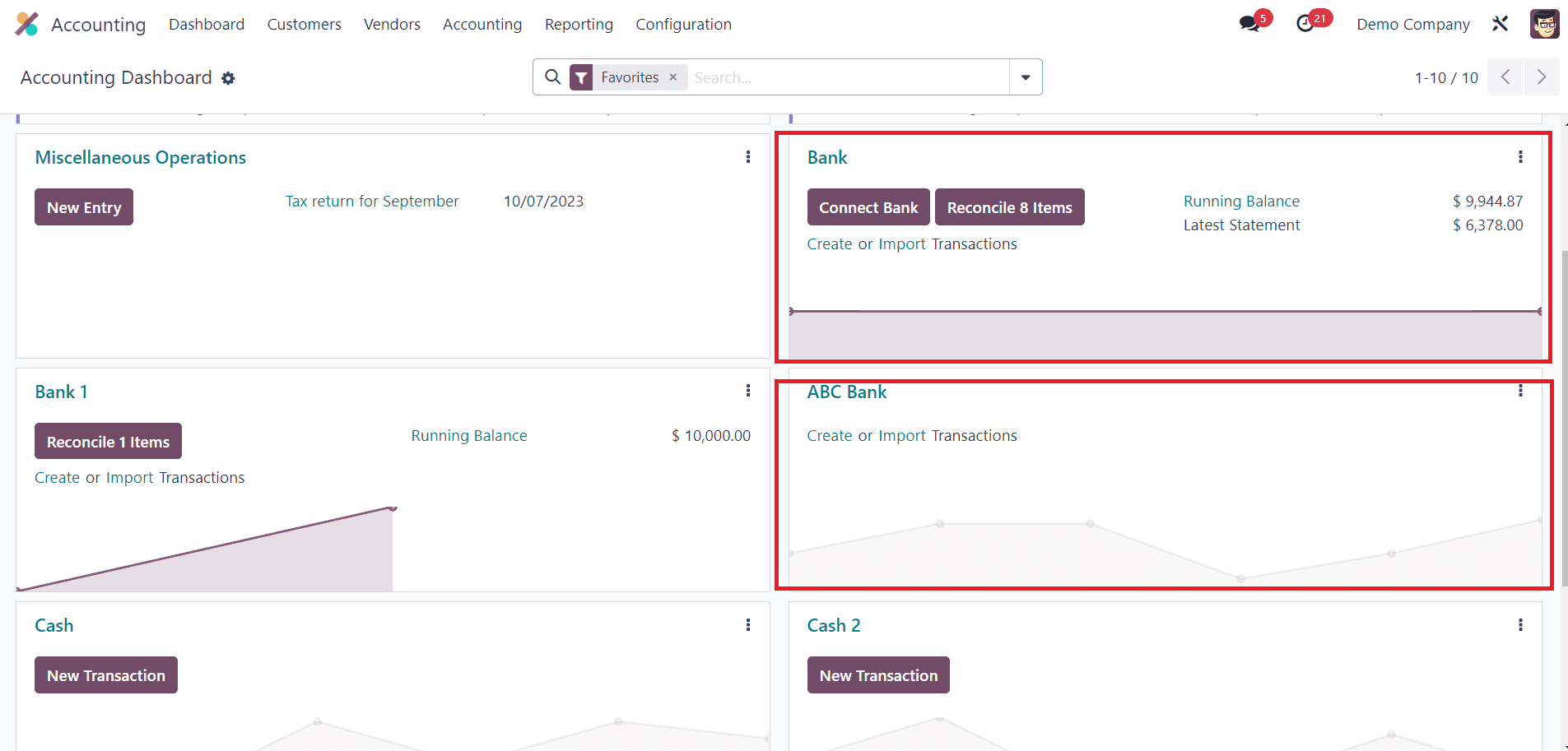

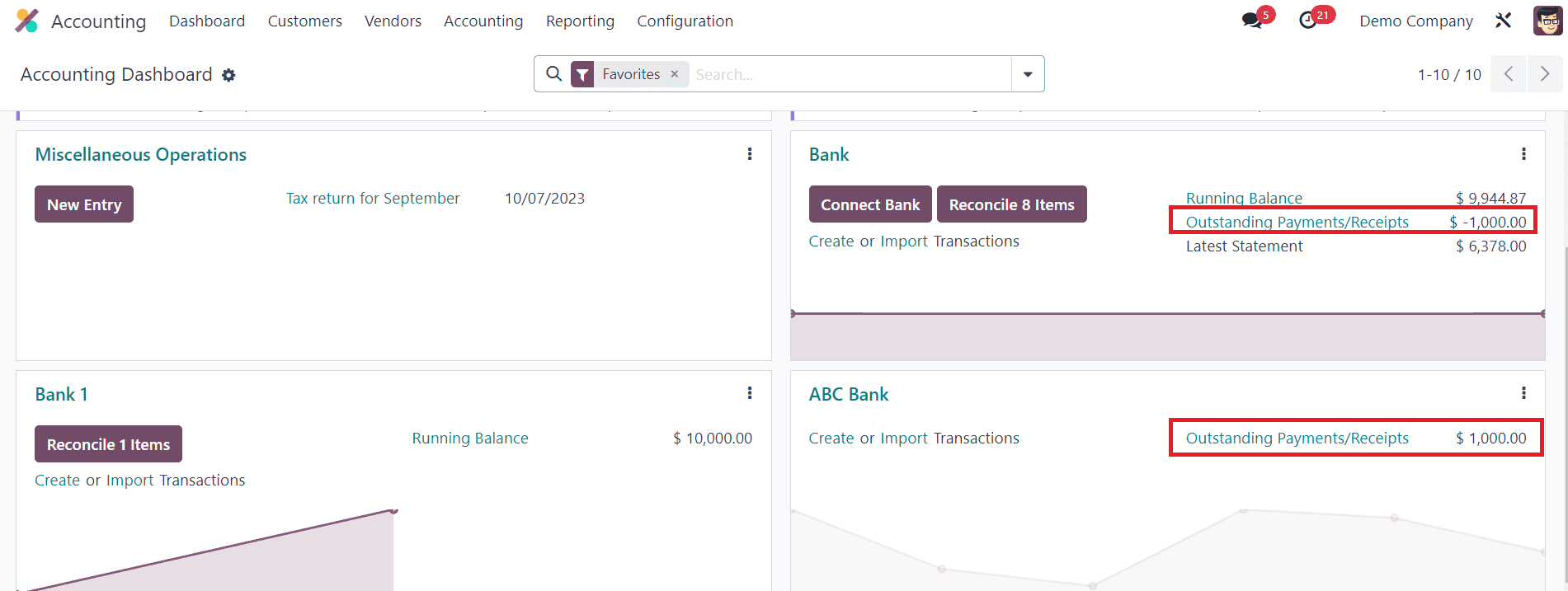

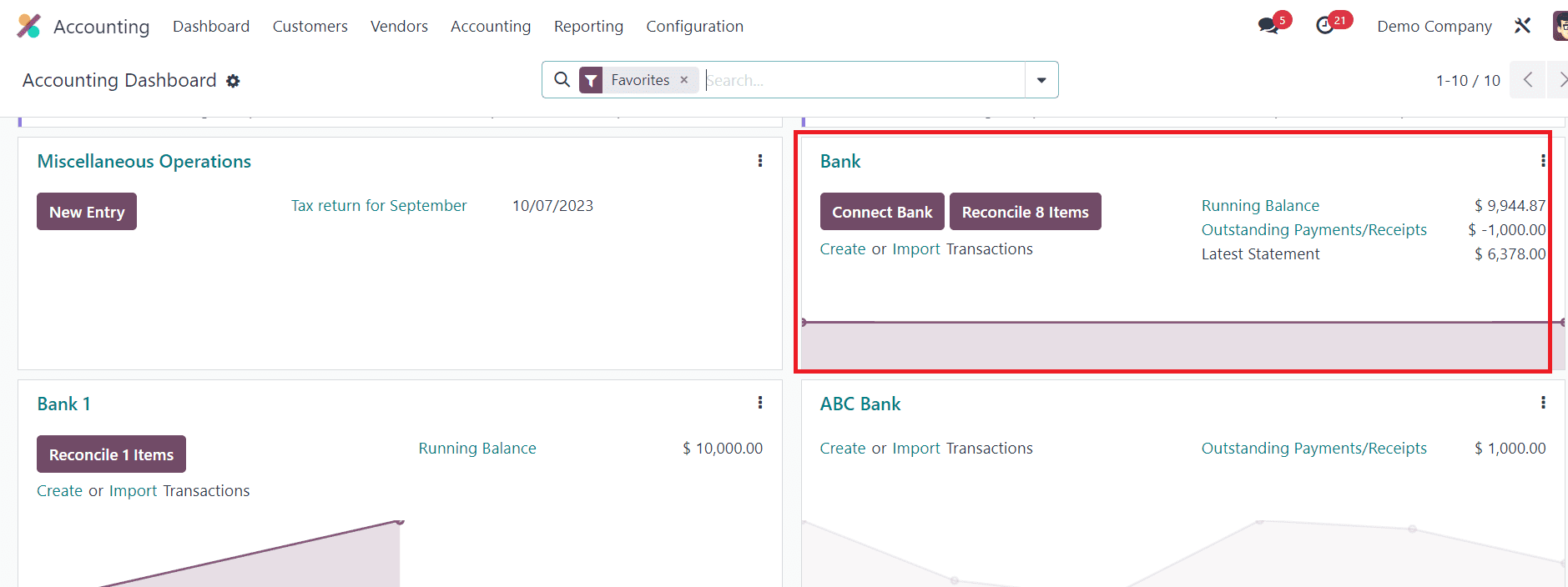

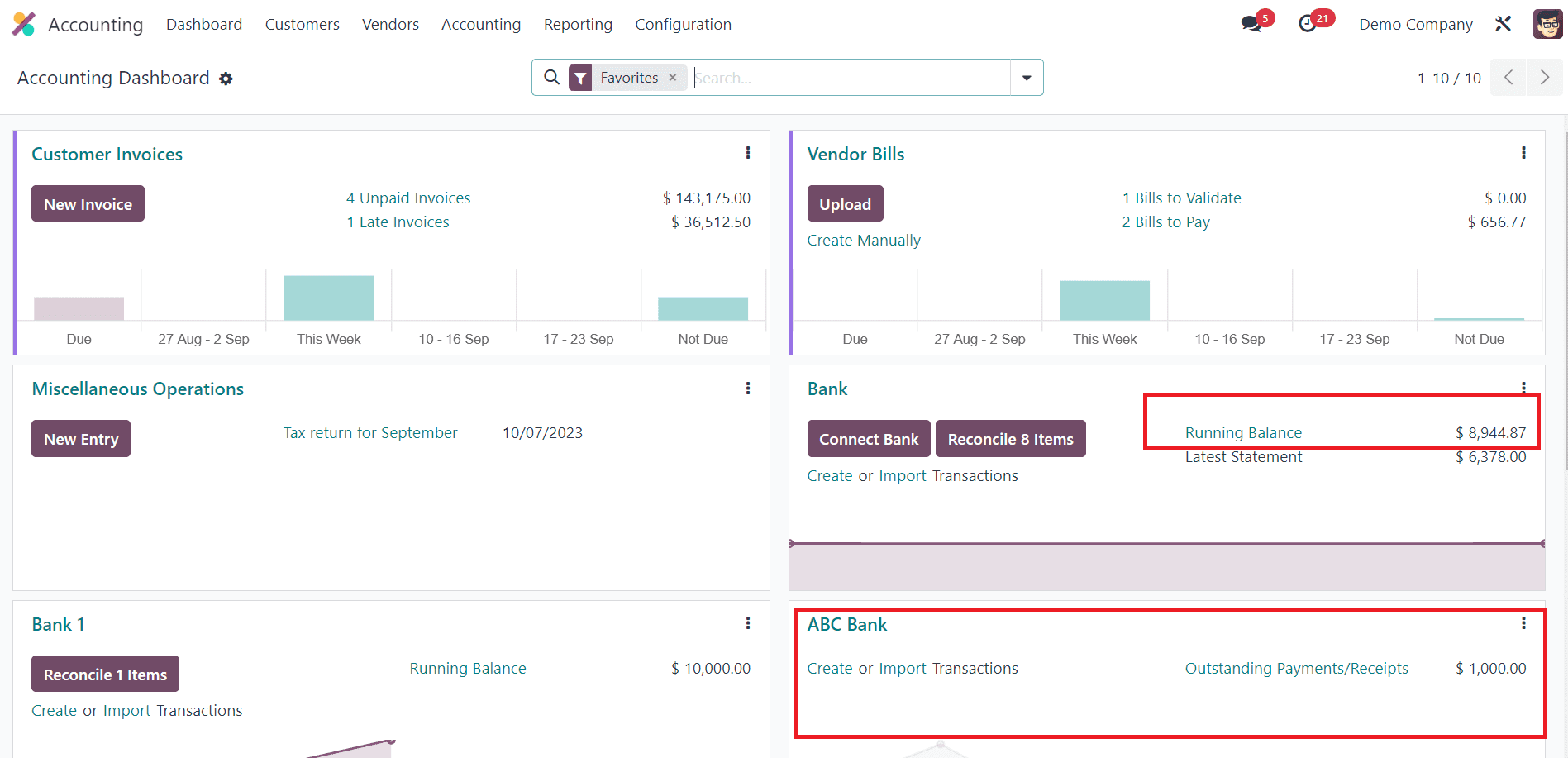

You can find the bank accounts configured in your database on your Accounting Dashboard.

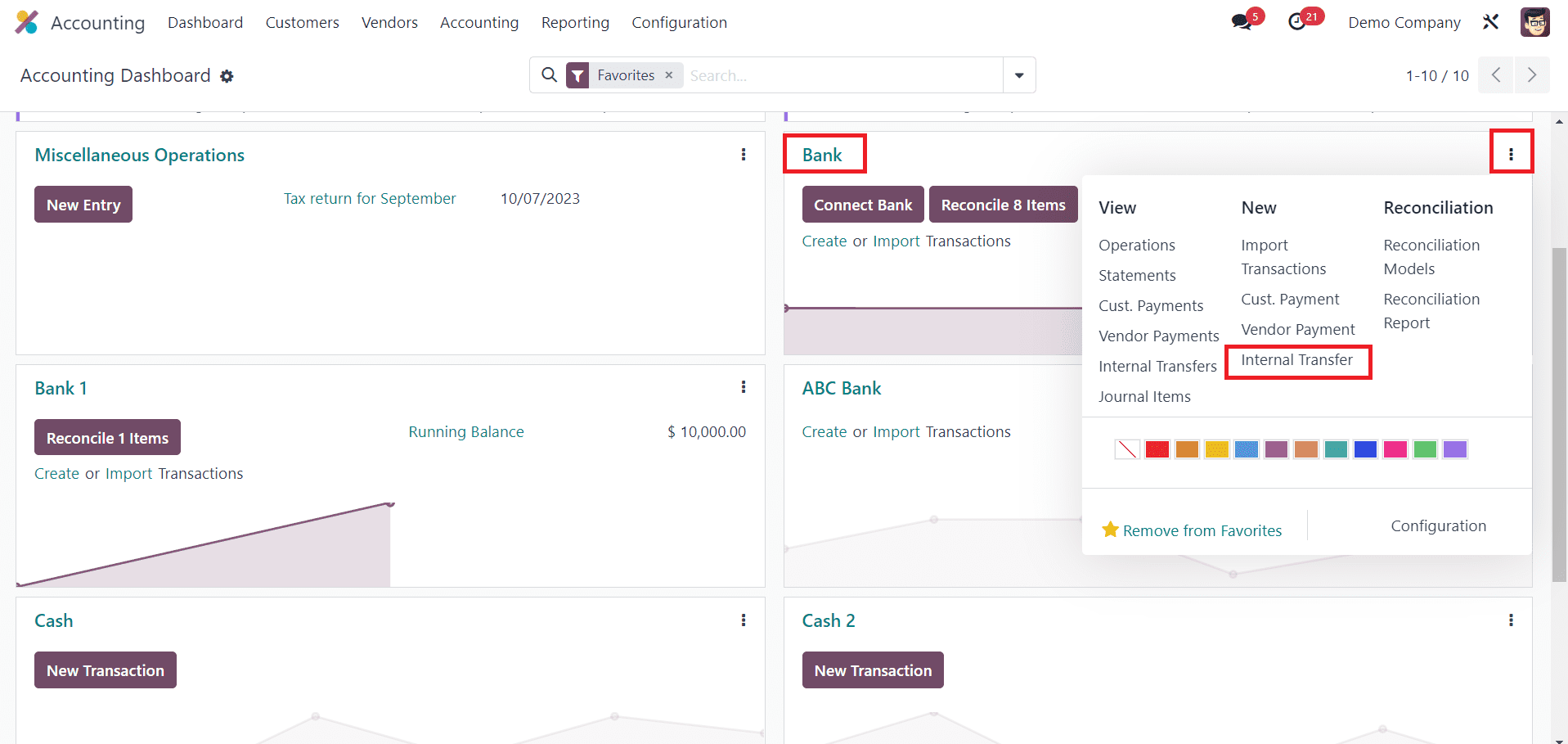

Here, we are going to transfer cash from the Bank to ABC Bank. As you can see in the image, the running balance of the Bank account is $9944.87. We are going to transfer $1000 from the Bank account to the ABC Bank account. In Odoo, this can be performed by internal transfer method. When you click on the three dots available in the top right corner of the journal, you can find the option Internal Transfer, as shown in the image below.

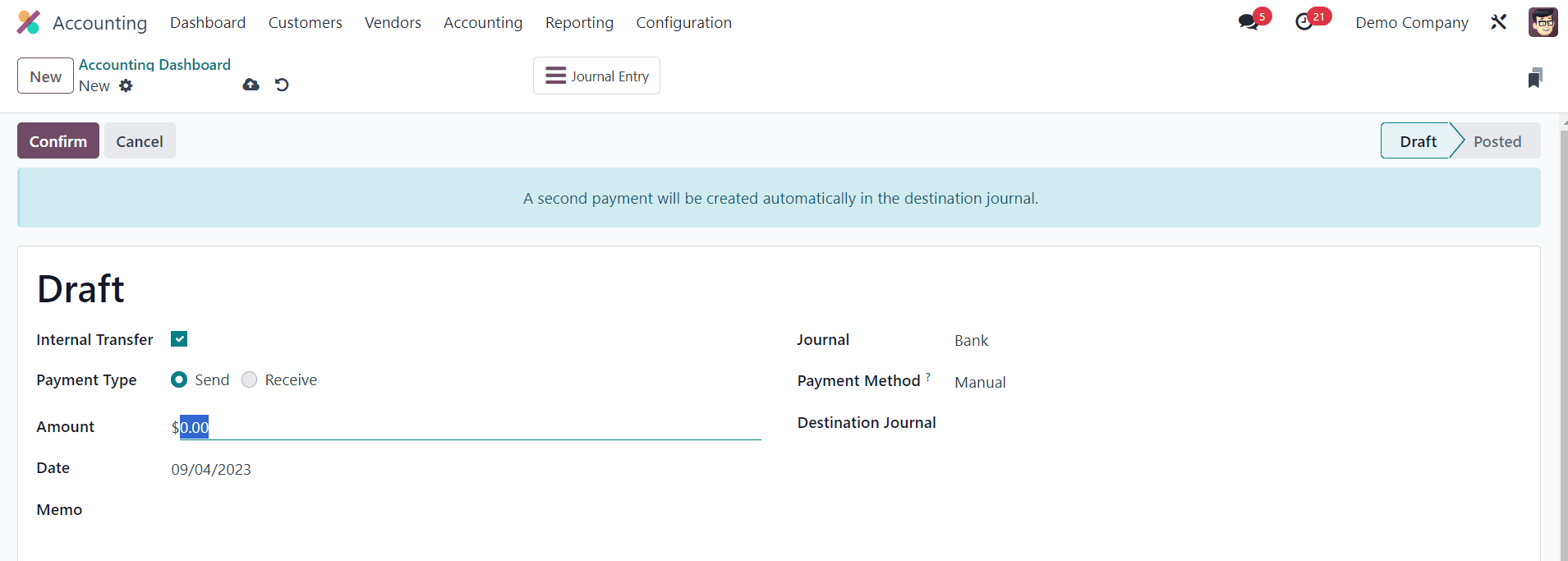

When you click on this option, you will get a new window to mention the details of the internal transfer.

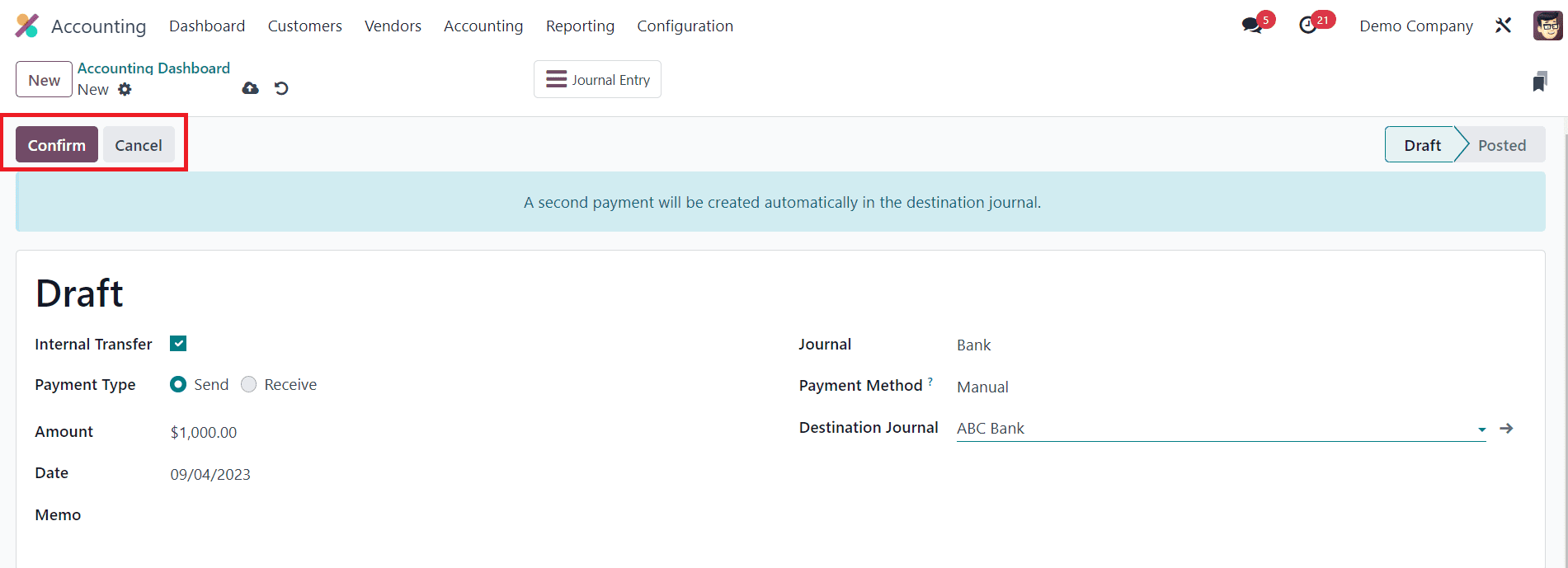

Here, the internal transfer will be automatically selected, and the payment type can be set as Send. Now, mention the amount of $1000 in the Amount field. The date of the transfer will be available in the corresponding field. You can mention a Memo in the given space. The Destination Journal will be the target account where you can mention your ABC Bank account.

After adding details, you can click on the Confirm button.

When you check your Accounting Dashboard, you can see that the Outstanding Payments are showing minus $1000 on the source account. By bank reconciliation, you can clear the outstanding payments. For this, you can create a bank statement manually and complete the bank reconciliation process.

First, we are going to create a bank statement for the first Bank account

0000000000000000000000000000

000000000000000000000000000000000000000000000000

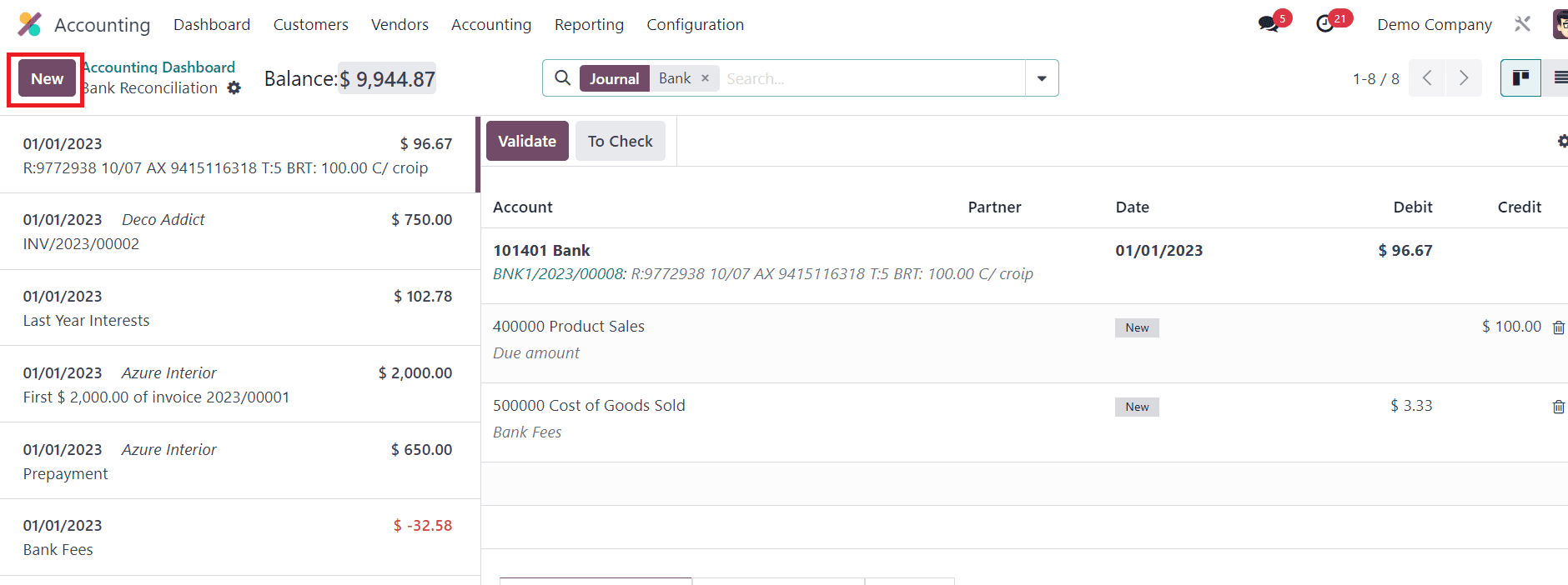

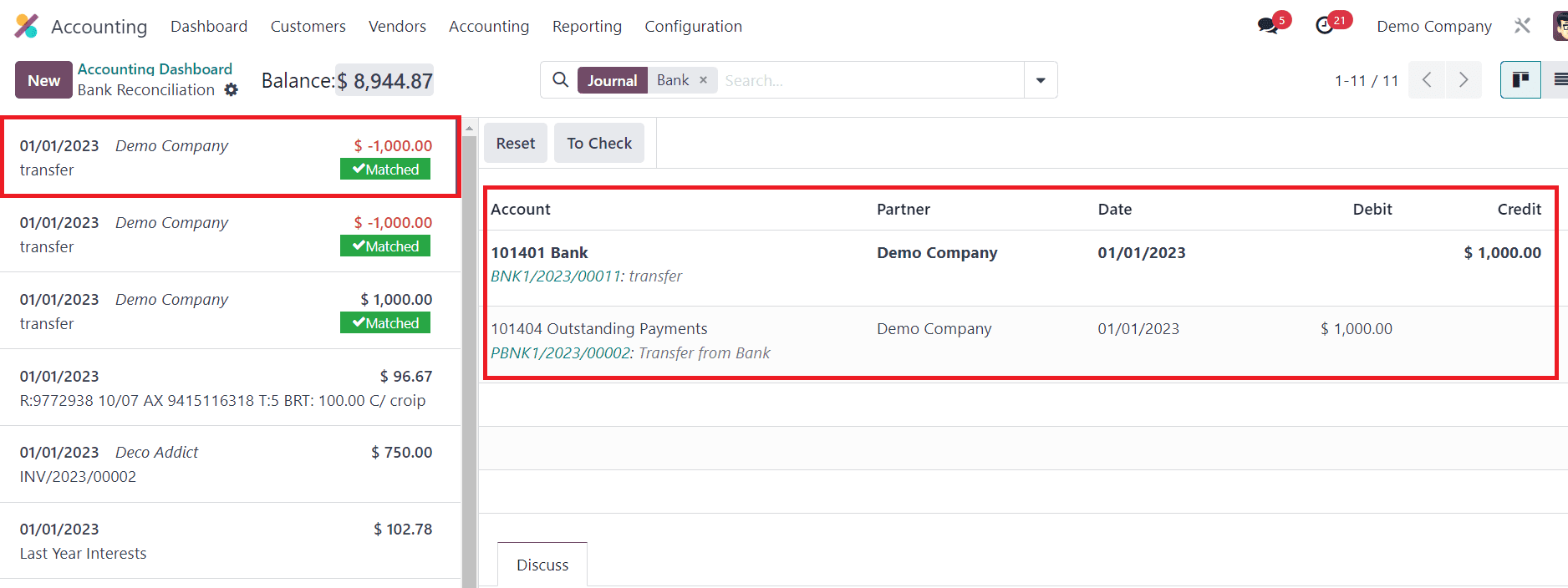

When you click on the bank journal, Odoo will lead you to the reconciliation window of the respective bank.

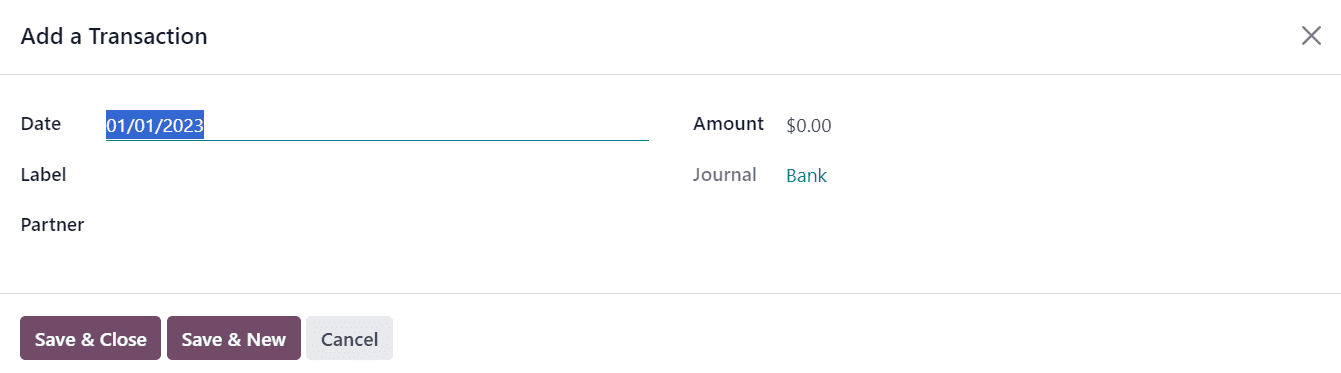

From here, you can use the New button to create a new bank statement.

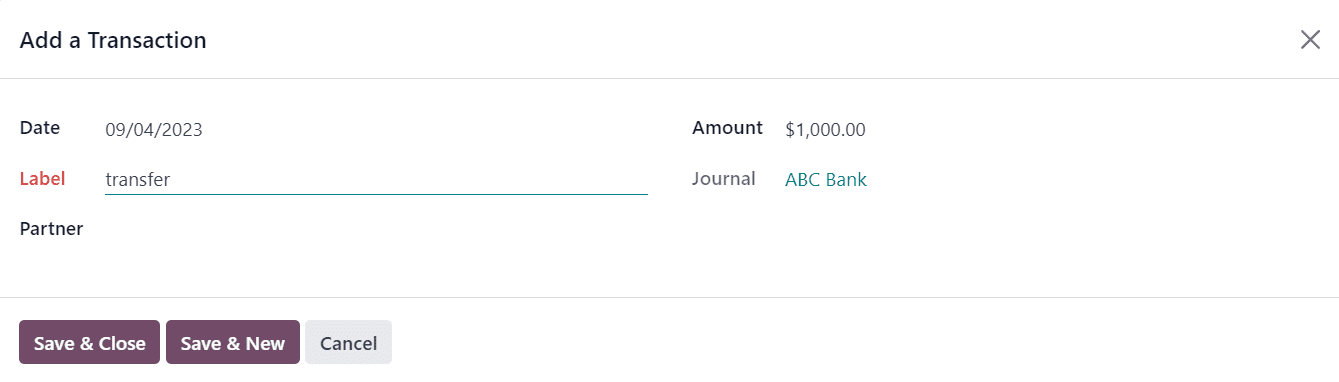

In the pop-up window, you can add the Date, Label, Partner, Amount, Foreign Currency, and Journal. Then, click on the Save & Close button.

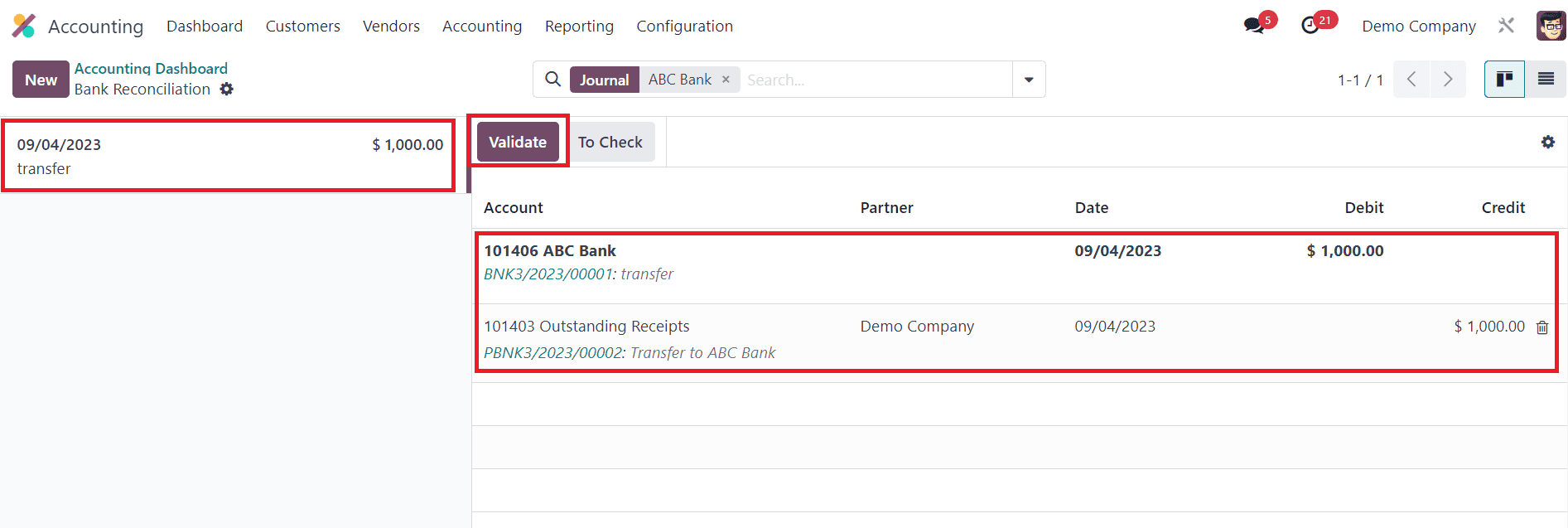

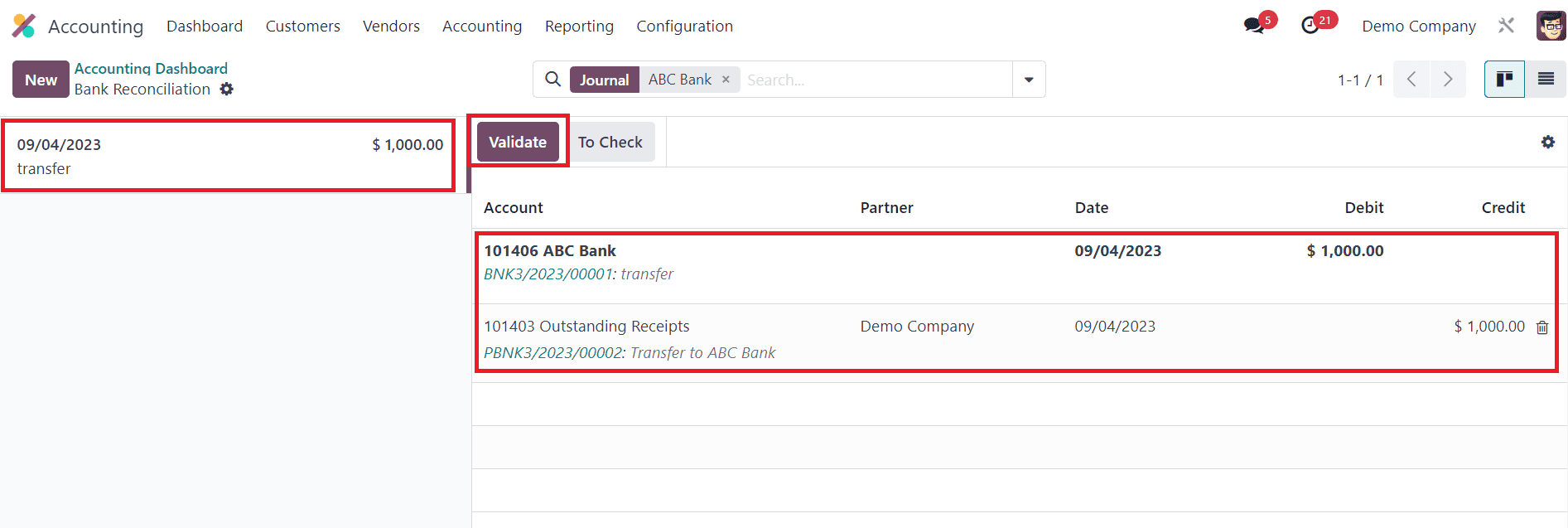

After selecting a suitable counterpart, you can click on the Validate button to complete the reconciliation. As the reconciliation is completed, you can check the Accounting Dashboard.

Here, the outstanding payment of the first Bank is cleared. The running balance of the account is now reduced to $8944.87 which indicates that an amount of $1000 has been transferred to the ABC Bank account. You can reconcile the transferred amount with the bank statement of ABC Bank just like we did earlier to clear the Outstanding Payment.

For this, you can click on the Create transaction button and create a statement manually, and reconcile with the corresponding counterpart.

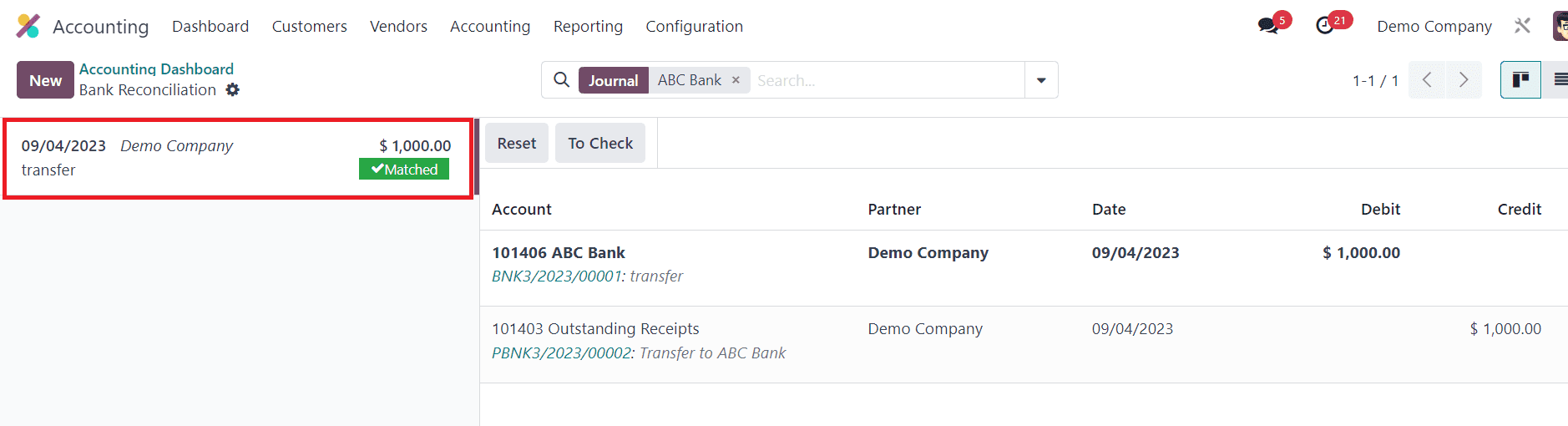

Click the Validate button to complete the reconciliation.

Now, the reconciliation is completed. When you check the Accounting Dashboard, you can see that the running balance of the ABC account is $1000.

This is how we manage bank accounts in Odoo 16 and transfer cash between accounts in the Accounting module.