For companies that operate globally, Odoo 18's multi-currency management is essential since it allows for precise handling of transactions, accounting, and reporting in many currencies. It guarantees smooth currency conversions and real-time exchange rate changes, lowering errors and improving financial transparency.

Users can send and receive purchase orders, quotations, and sales invoices in a variety of currencies with Odoo's multi-currency feature. By turning this function on, you can perform reports on foreign exchange activities and conduct transactions and bank account transactions in other currencies. Businesses may create bank accounts in other currencies, issue and receive invoices, record transactions in different currencies, and provide reports on foreign exchange activity thanks to Odoo's multicurrency technology.

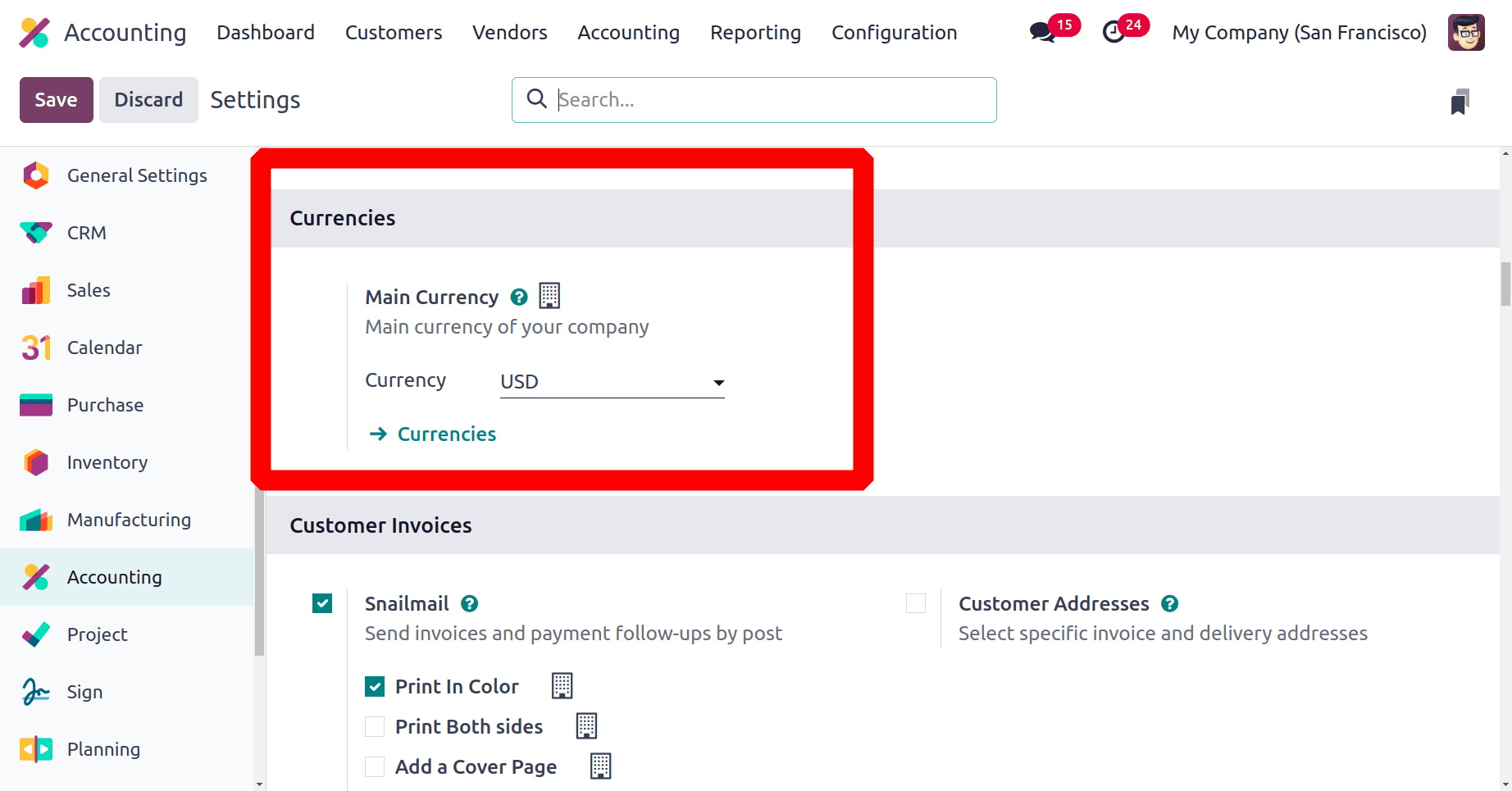

The primary currency's default meanings consider the business's country. Navigate to the "Currencies" tab of the "Settings" window from the "Configuration" menu to set up the currencies for your Odoo 18 accounting module. Next, set the currency as indicated below in the "Main Currency" section.

: Configuration > Settings > Main Currency

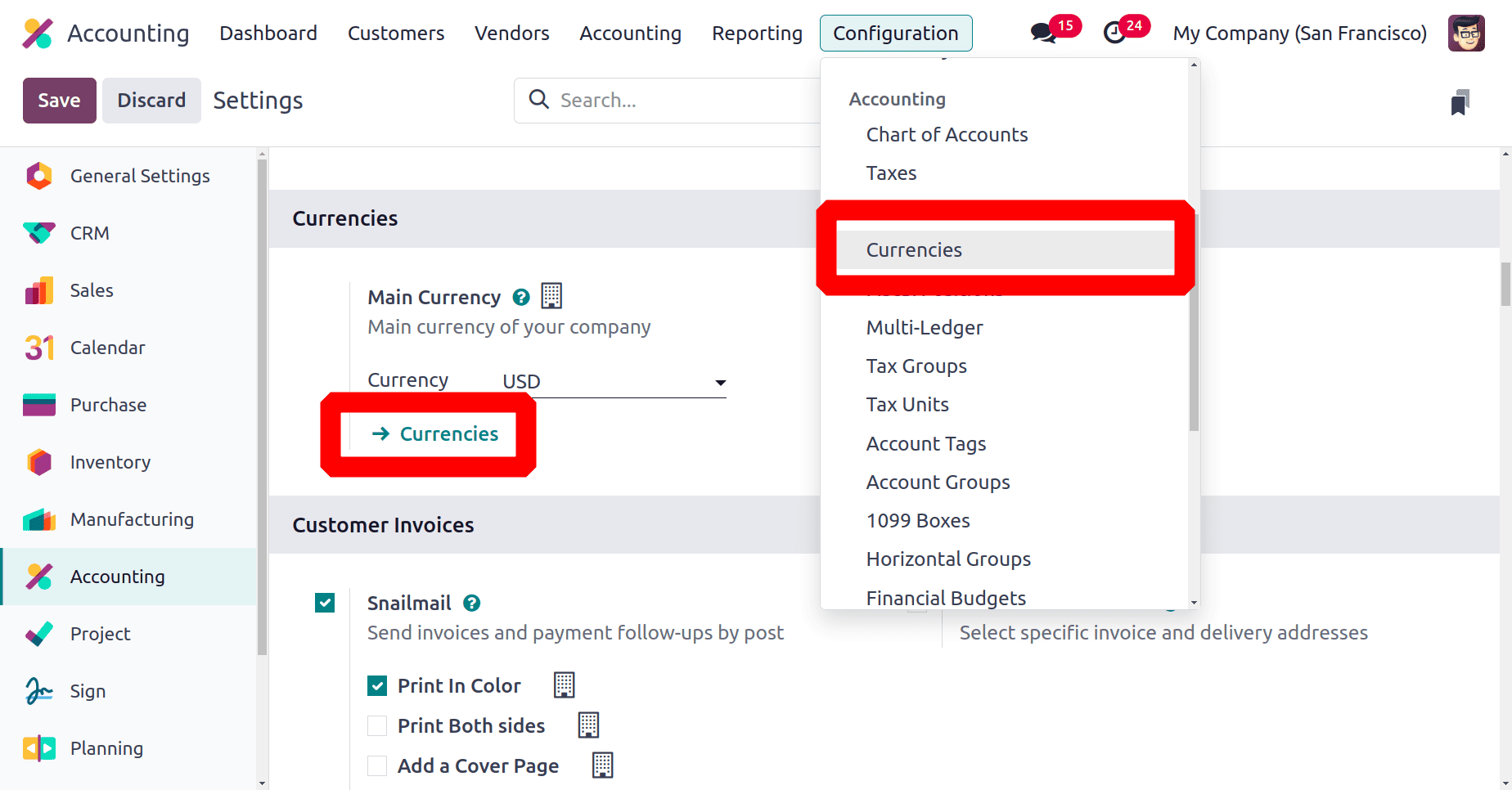

So as shown in the image above, the company currency is set as USD. It's possible to manage other currencies in Odoo 18. Currencies will be either clicking on the Currencies link on the settings or the "Currencies" window from the "Configuration" menu, which can be used to create and manage different currencies.

: Configuration > Currencies

In this case, users decided to use the US dollar as their primary currency for accounting purposes. We are capable of managing other currencies for your company. While clicking on the Currencies, a list of currencies will appear with the details like Currency, Symbol, Currency Name, Last Updated date, Unit per company currency, and Active.

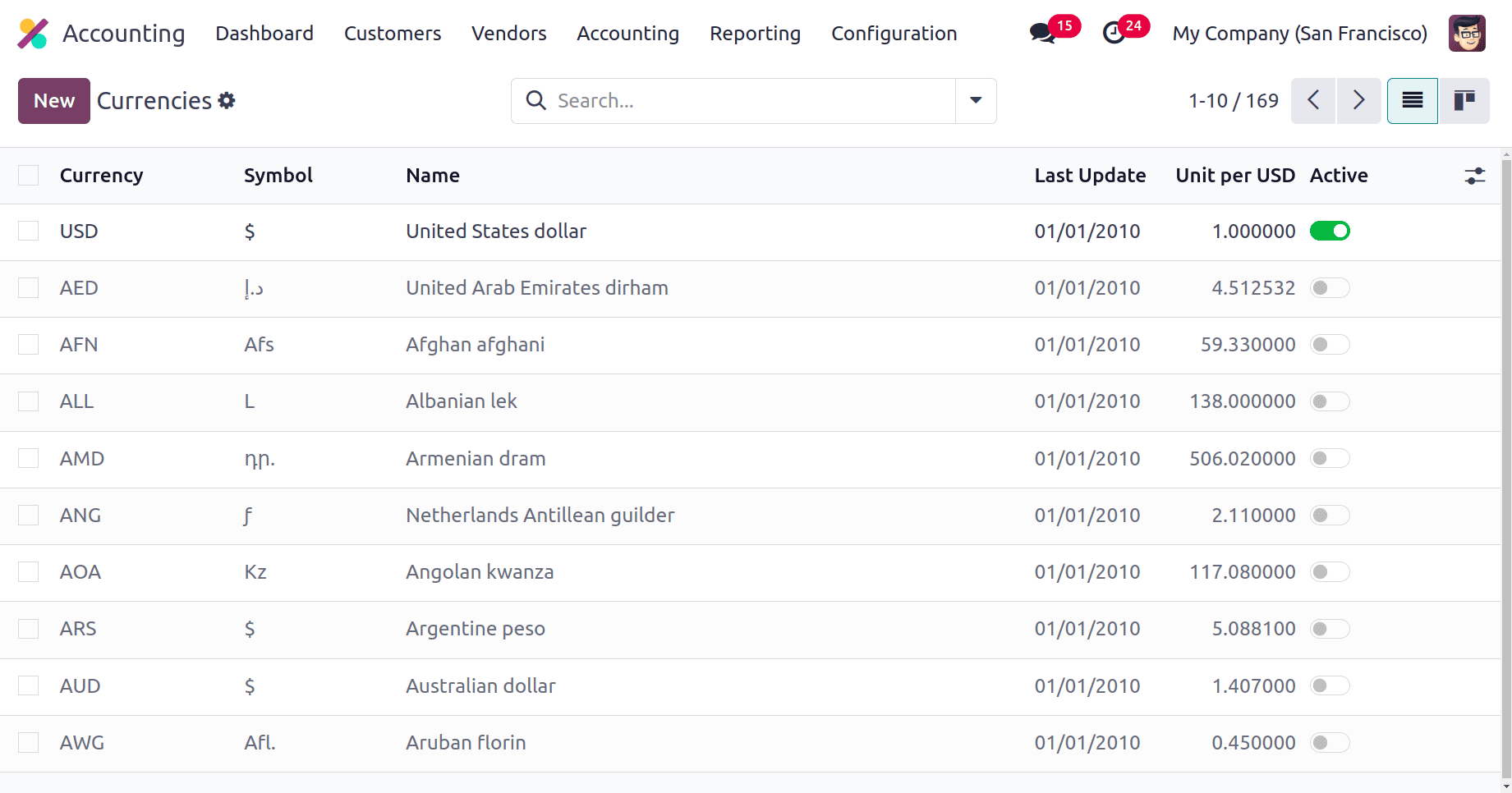

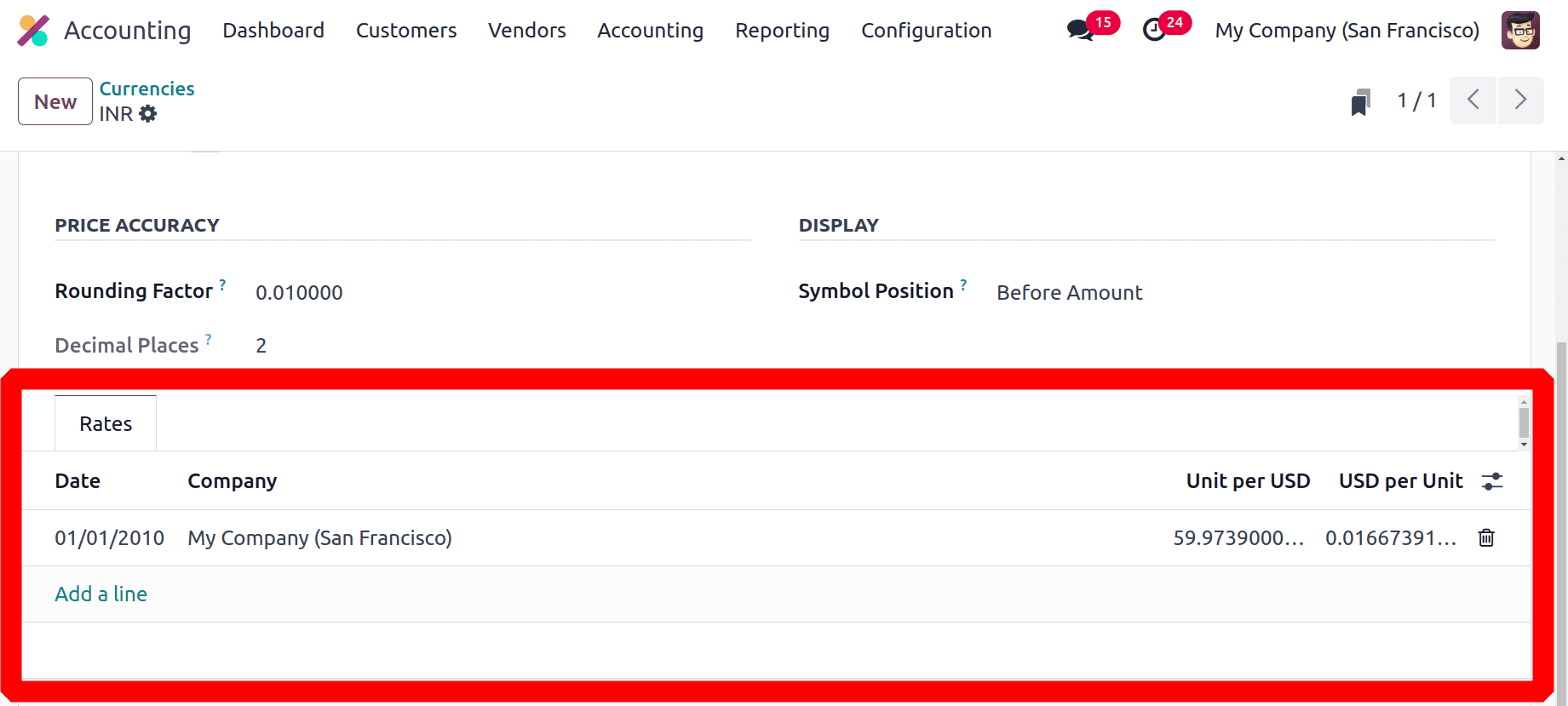

Click on the necessary one to view the settings. Here the chosen currency is INR, which is Indian Rupee. The Symbol is shown there. Additionally, a Currency Unit is Rupee and the Currency Subunit is Paise. In the PRICE ACCURACY section, the Rounding Factor and the Decimal Places are given. Symbol Position is set as ‘Before Amount’.

The Rates tab shows the exchange rate of the INR currency with the company currency USD. exchange udated date shown first. Then the Unit per USD, which is Company Rate : the currency of rate 1 to the rate of the currency. USD per unit is Inverse Company Rate: the rate of the currency to the currency of rate 1. Users can manually add the exchange rate by using the Add a line.

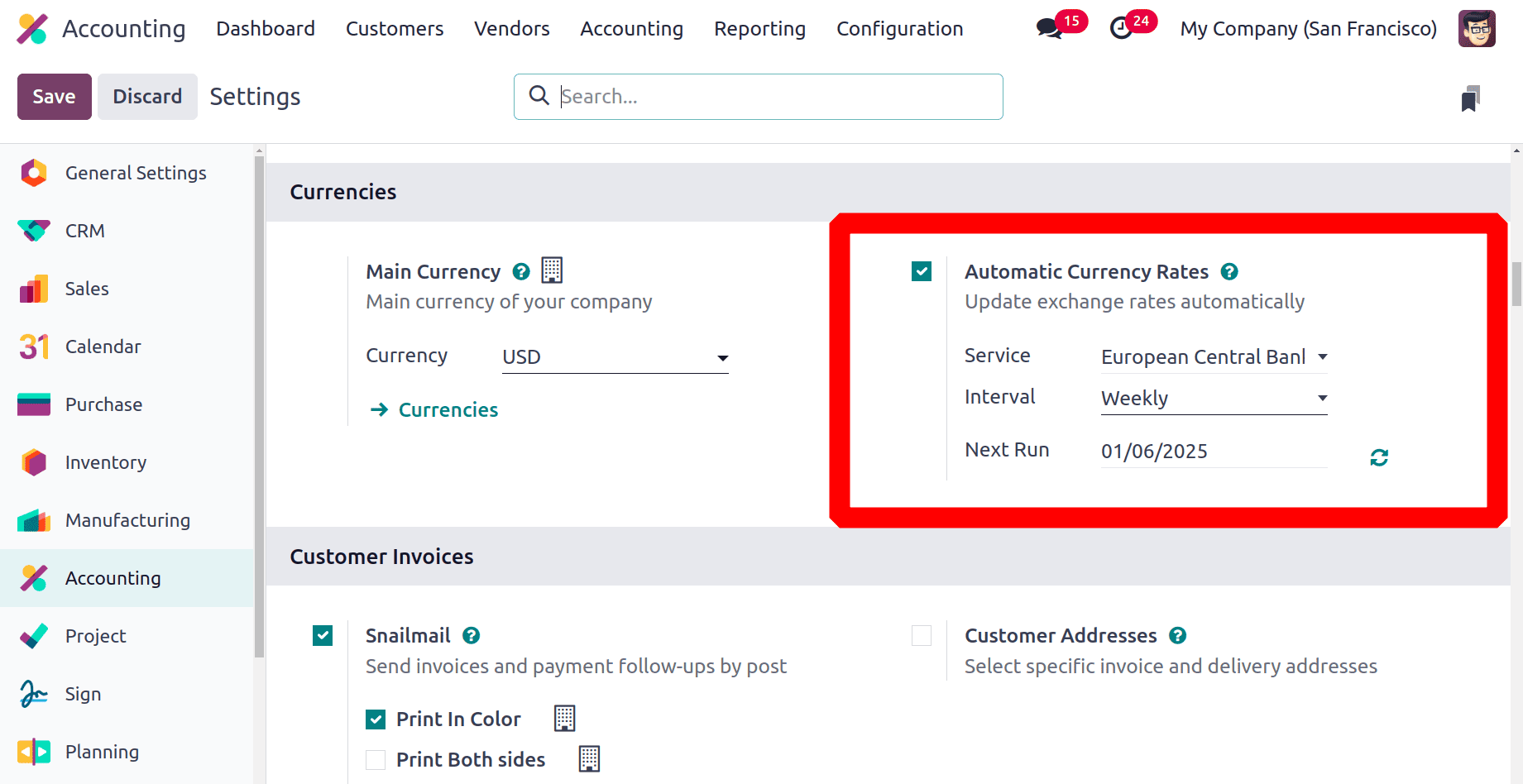

Additionally, the "Automatic Currency Rates" feature allows a user to adjust exchange rates automatically. Turn on the Automatic Currency Rates field in the Currencies section, as seen in the image below.

You may also select which online service to use to obtain the most recent currency rates by clicking in the "Service" section. Odoo can adjust the exchange rates often. You can accomplish this by choosing Daily, Weekly, or Monthly as the interval in the "Interval" column rather than Manual. Odoo 18 displays the subsequent synchronization run between the database and provider once you select the preferred interval in the "Next Run" column. To save the currency date for a specific day, click the refresh button after applying the necessary data, making sure to wait until the next synchronization. Let's now examine how to manage several currencies within the Odoo 18 Accounting Module.

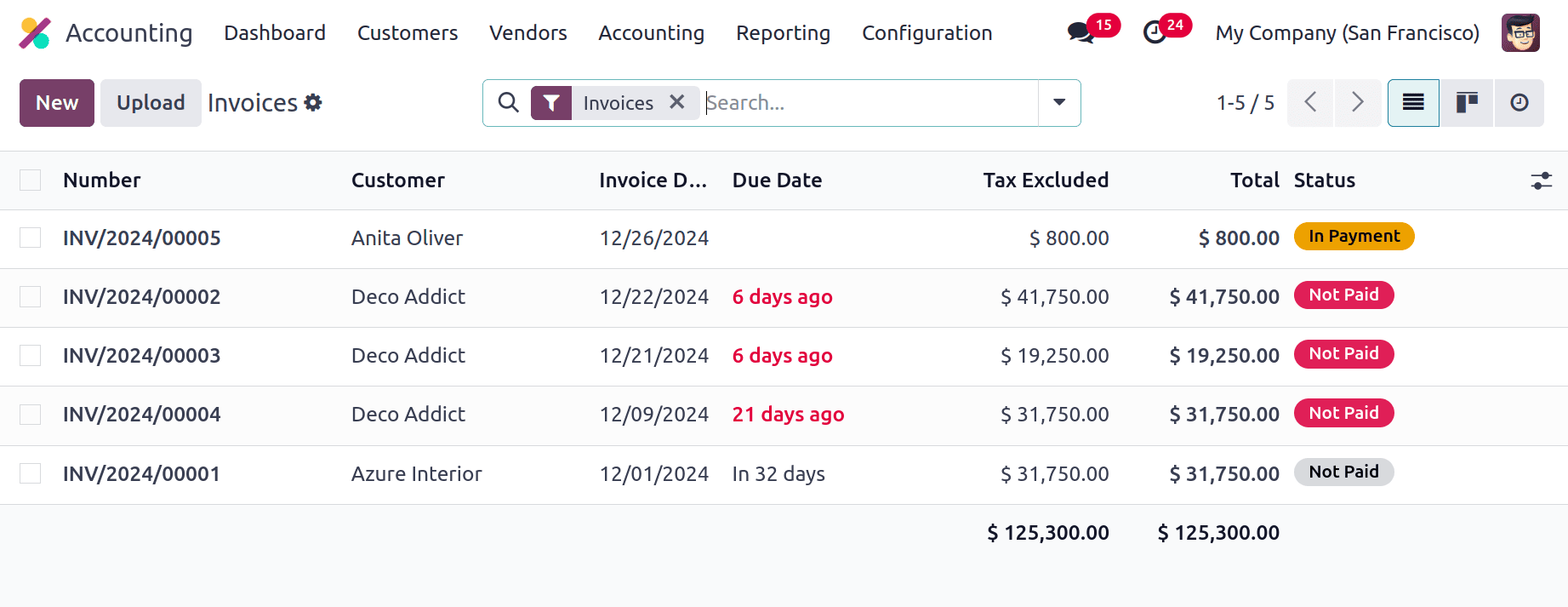

So then let's check how Multicurrency is used in Odoo 18. Go to the "Invoice" option under the "Customers" page in Odoo 18 to create a new invoice in order to verify the use of multicurrencies. The Invoice pane displays all generated invoices together with details about the Customer, Invoice date, number, amount, status, and due date, as can be seen in the screenshot.

: Customers > Invoice > New

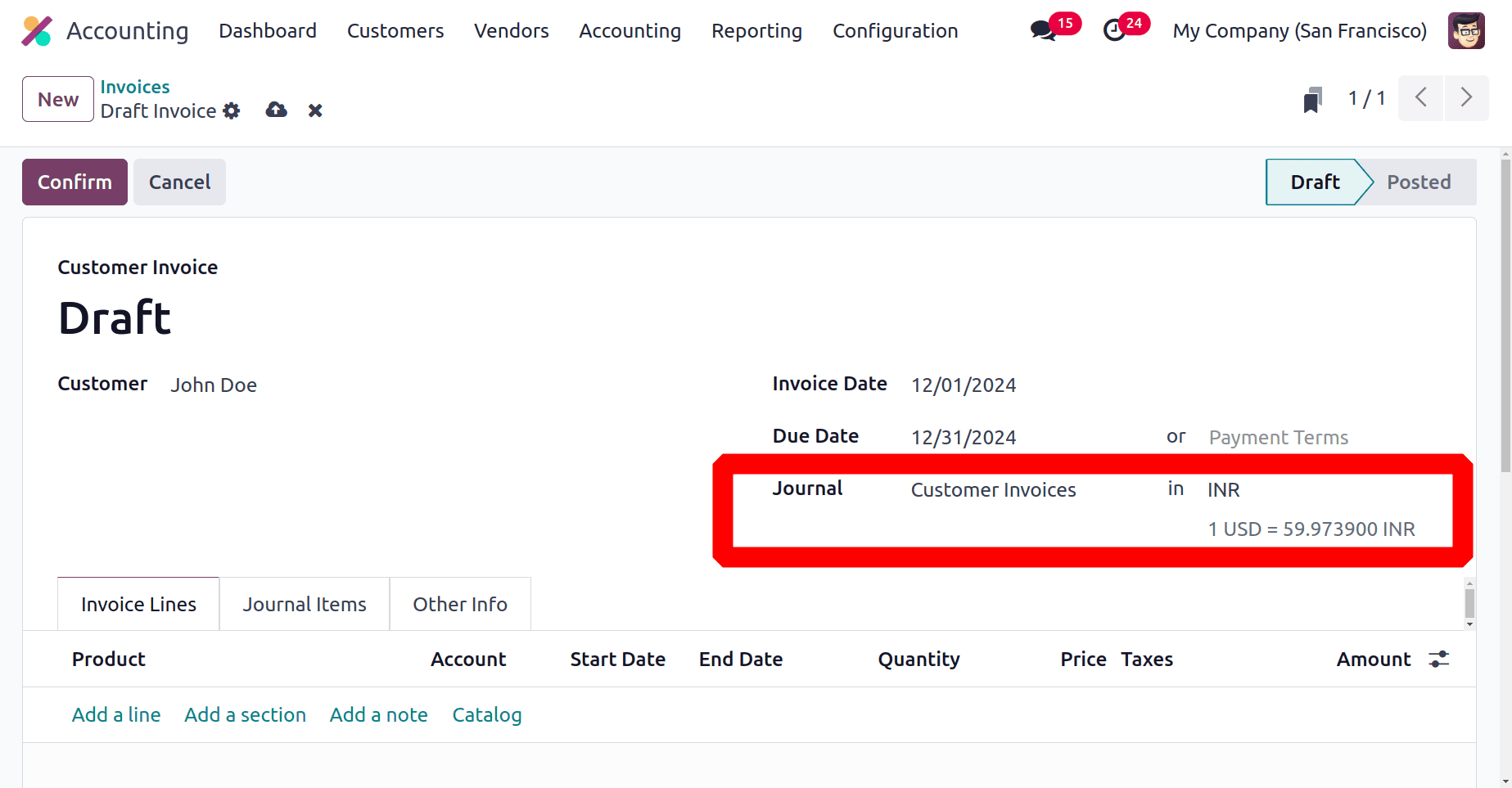

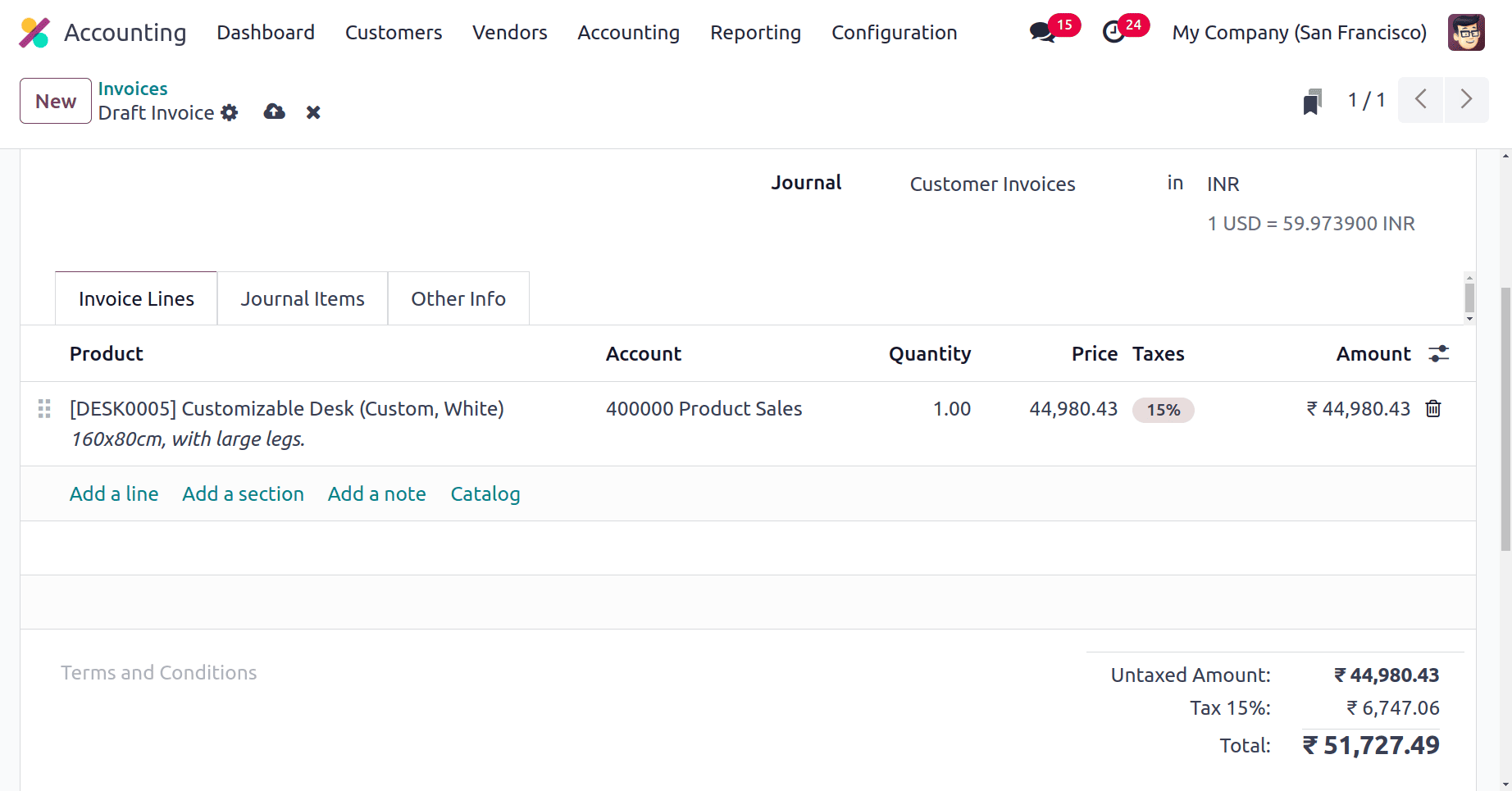

Next, create a new Customer Invoice by opening the window that appears after choosing the "New" option. By choosing their partner in the "Customer" area. Next, enter the invoice date in the "Invoice Date" section. Add the closure date in the "Due Date" field and lastly, choose their journal for the Invoice in the "Journal" area. Choose the currency, here the currency is set to INR.

Users can enter the product for the customer invoice together with its Label, Account, Quantity, UoM, Price, Taxes, and tax-exclusive amount under the "Invoice Lines" Tab section. For example, users introducing a $750 Customizable Desk (Custom, White) to the lineup. However, since INR is the selected currency in this case, the product price is displayed as 44,980.43 INR. The tax amount is also shown in Indian rupees as shown in the image below.

The additional accounting details are displayed on the "Other Info" tab. After completing the form fields, save your information and click the "Confirm" button to validate the Invoice order.

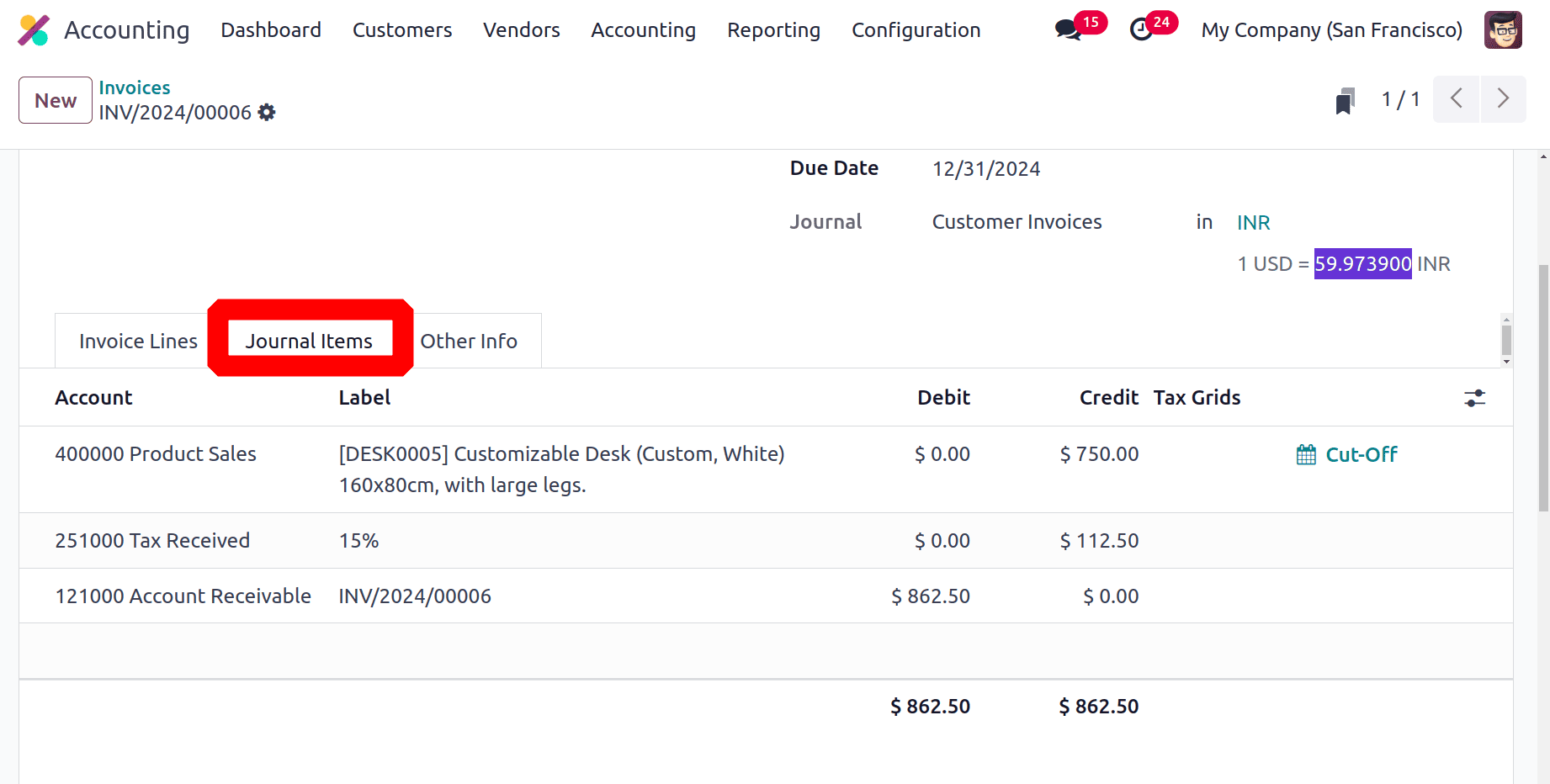

After posting the entry, check the Journal items. The accounting journal entries with their corresponding Account, Label, Debit, Credits, and Tax Grids are displayed in detail on the "Journal Items" tab.

This will have an effect on both the Income Account and the Receivables Account. When we look at the characteristics of these accounts, we find that the Income Account is called "Income," and the Account Receivable is called "Asset." In this case, the asset is declining while the revenue is increasing. Consequently, the Account Receivable is credited and the Income Account is debited.

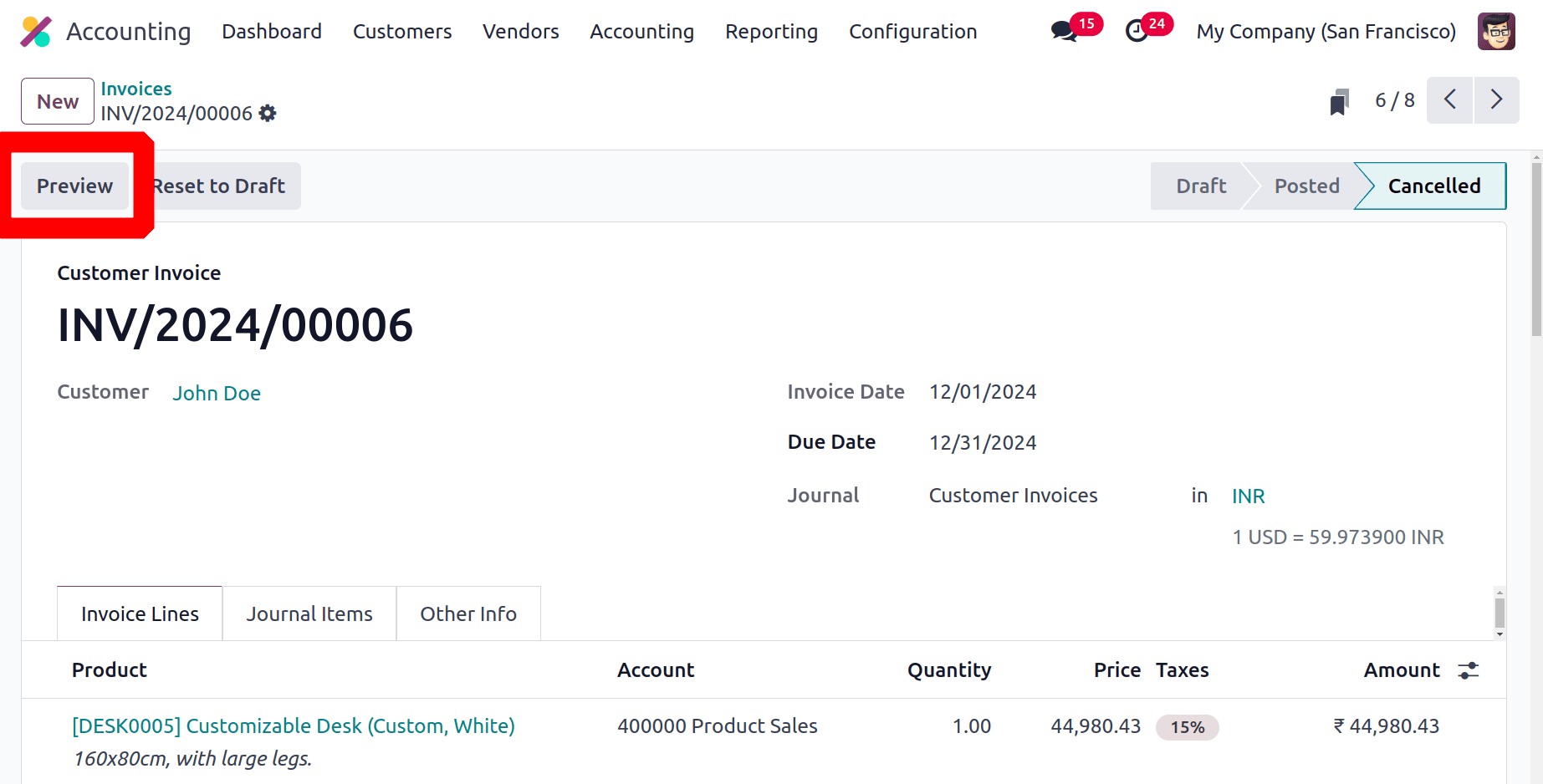

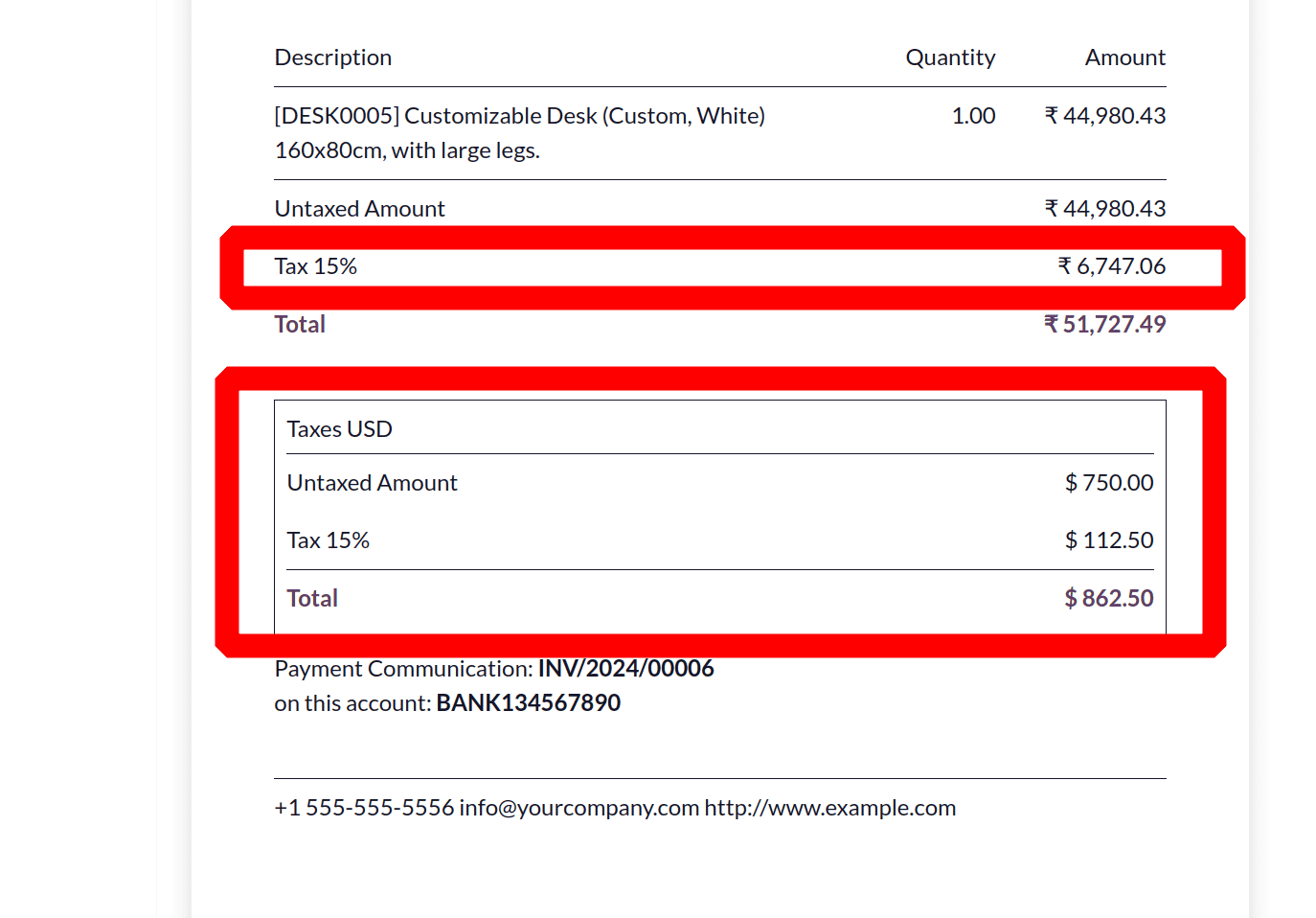

There is a Preview button on the Invoice, which helps the user to view the customer portal view. There the customers can view the Tax in both company currency and Customer currency as shown in the image below.

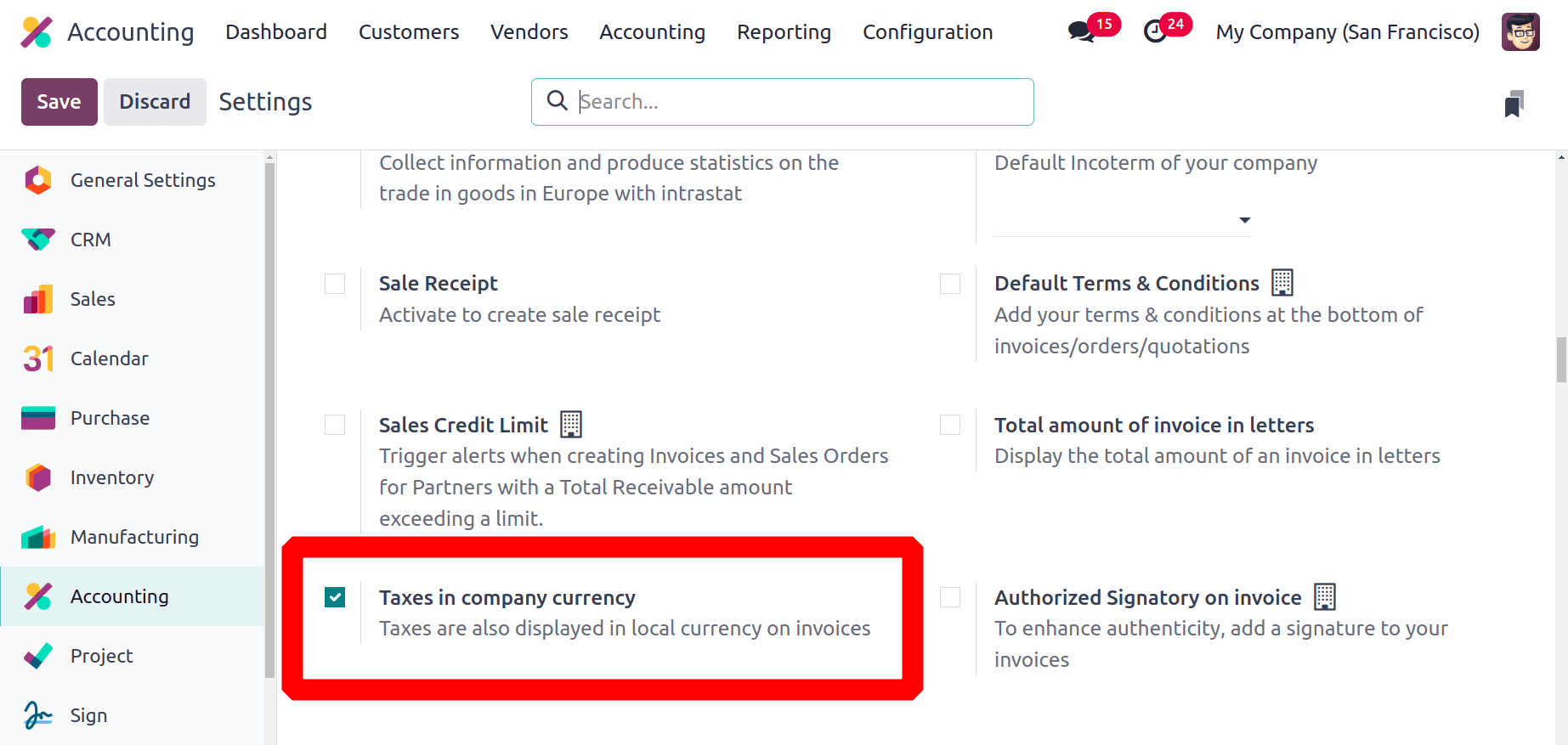

To get the option the customer needs to enable one more feature named Taxes in company currency from the Settings.

Users of the Odoo 18 Accounting software can effortlessly conduct transactions in the currencies of their choice. When a payment is made, the Bills window's stage changes from DRAFT to POSTED. Users can review the journal information for invoice bills if they choose the paid amount and click the investigate option.

By authorizing journal entries for particular accounts, Odoo gives users access to journal items for invoice bills. It facilitates accounting transactions in ERP software by supporting several currencies and automatically calculating exchange rates for invoices or vendor bills.

To read more about How to Manage Multi-currency in Odoo 17 Accounting, refer to our blog How to Manage Multi-currency in Odoo 17 Accounting.