Changes in exchange rates that impact open invoices or outstanding balances in foreign currencies are taken into account in Odoo 18 using unrealized currency gains and losses. They assist companies in accurately representing the value of their payables and receivables on a certain reporting date in their financial statements. By indicating the possible effect of exchange rate fluctuations on financial performance, these unrealized adjustments guarantee adherence to accounting standards. During period closings, Odoo automatically determines these gains or losses using the current currency rates. This tool facilitates more informed financial decision-making by improving visibility into currency risk.

Businesses may manage transactions in many currencies while keeping accurate financial records in the company's base currency with the Odoo 18's multi-currency capability. In order to ensure accurate conversions, currency rates can be manually defined or updated automatically through integrations with web exchange rate providers. Global operations, precise reporting, and adherence to foreign accounting standards are all supported by this competence.

Let's now examine how Odoo 18's Unrealised Currency Gain/Loss report functions. Let's imagine for the purposes of this that there is an Indian client. A month after the invoice date, the user created an invoice and set the customer's payment date. Therefore, within a month, there can be some adjustments to the currency exchange rate. These Unrealised Gain/Loss reports were used in Odoo 18 to manage these modifications.

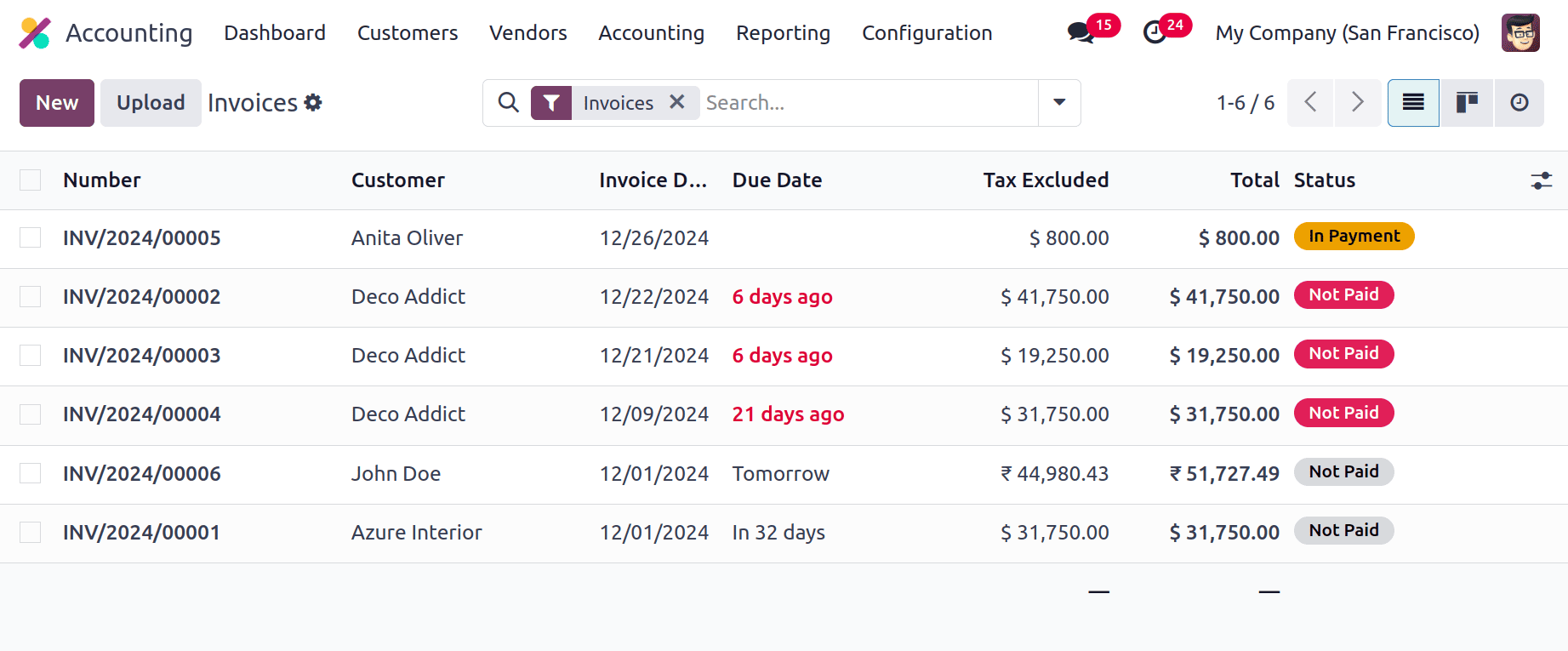

Create a new Invoice. For that choose the Invoice from the Customer menu. All the invoices are listed with details like Invoice Number, Customer, Invoice Date, Due Date, Tax Included, Total, and Status. To add a new invoice click on the New button.

: Customers > Invoices > New

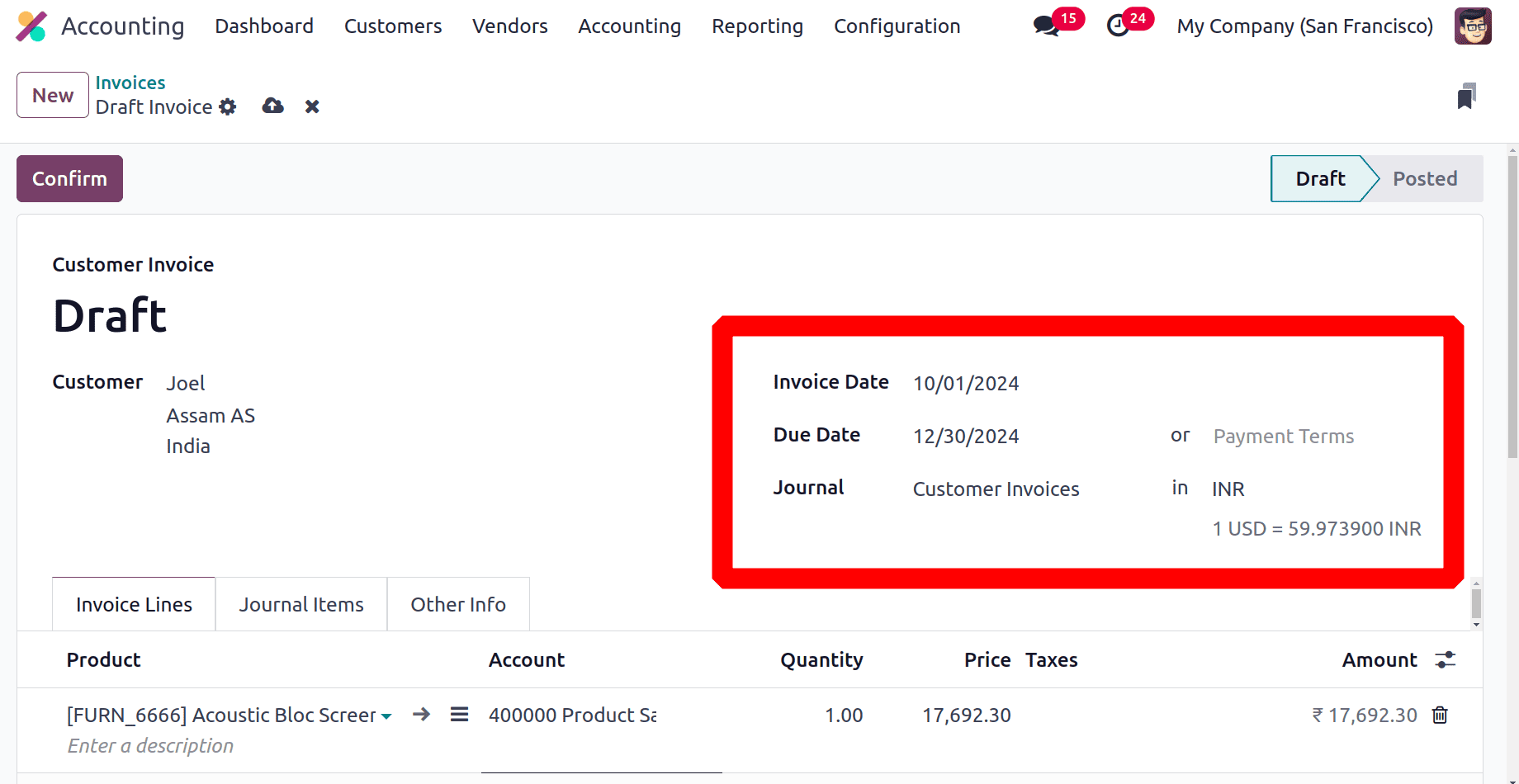

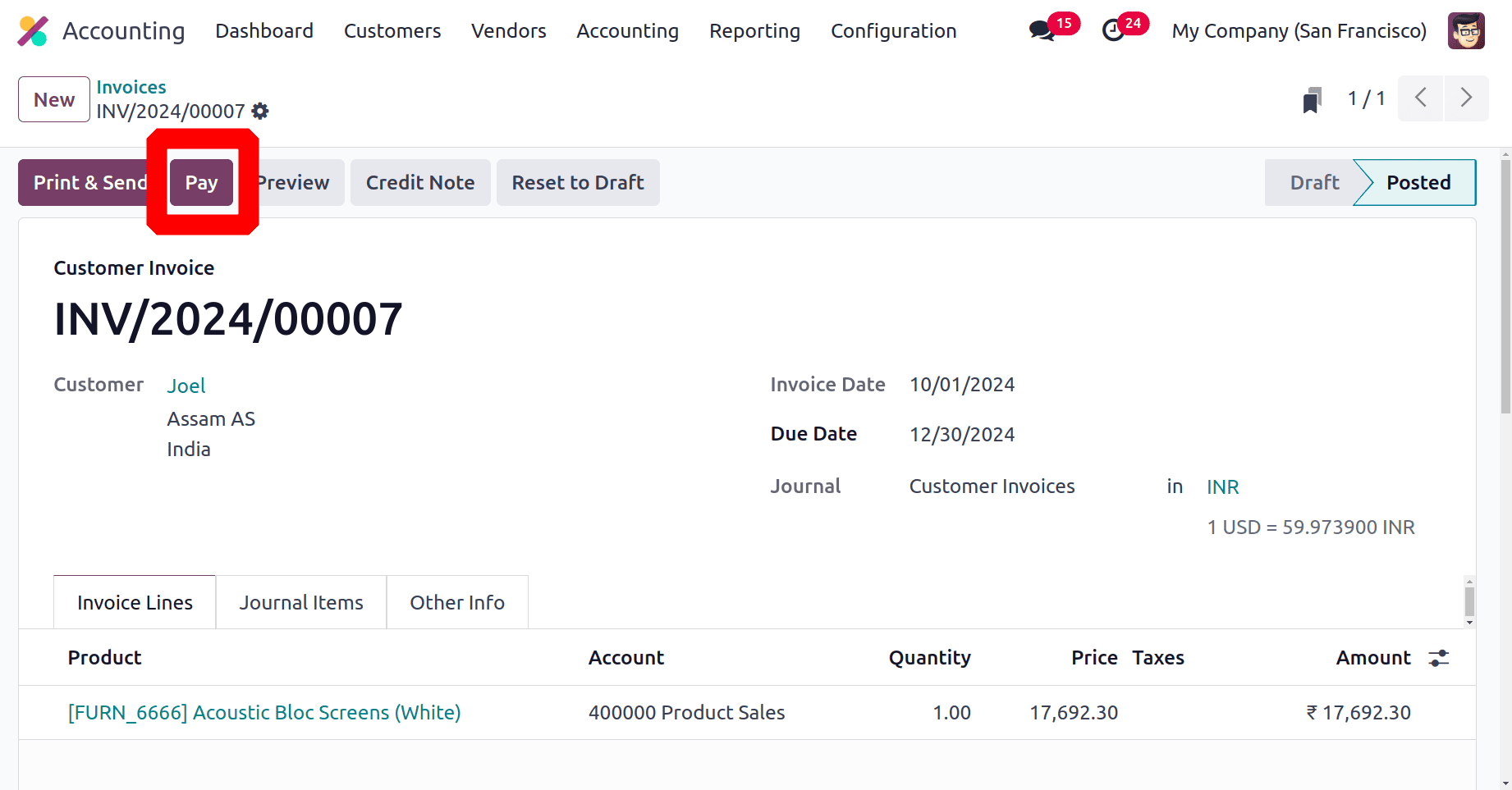

Add the customer, here the customer is an Indian customer. The invoicing currency is INR. Invoicing Date is set as October 1st and the payment due date is 3 months, which is December 31st.

In the invoice line added 1 quantity of Acoustic Bloc Screen with unit price as $295.00, which means 17,692.30 INR. Confirm the invoice first.

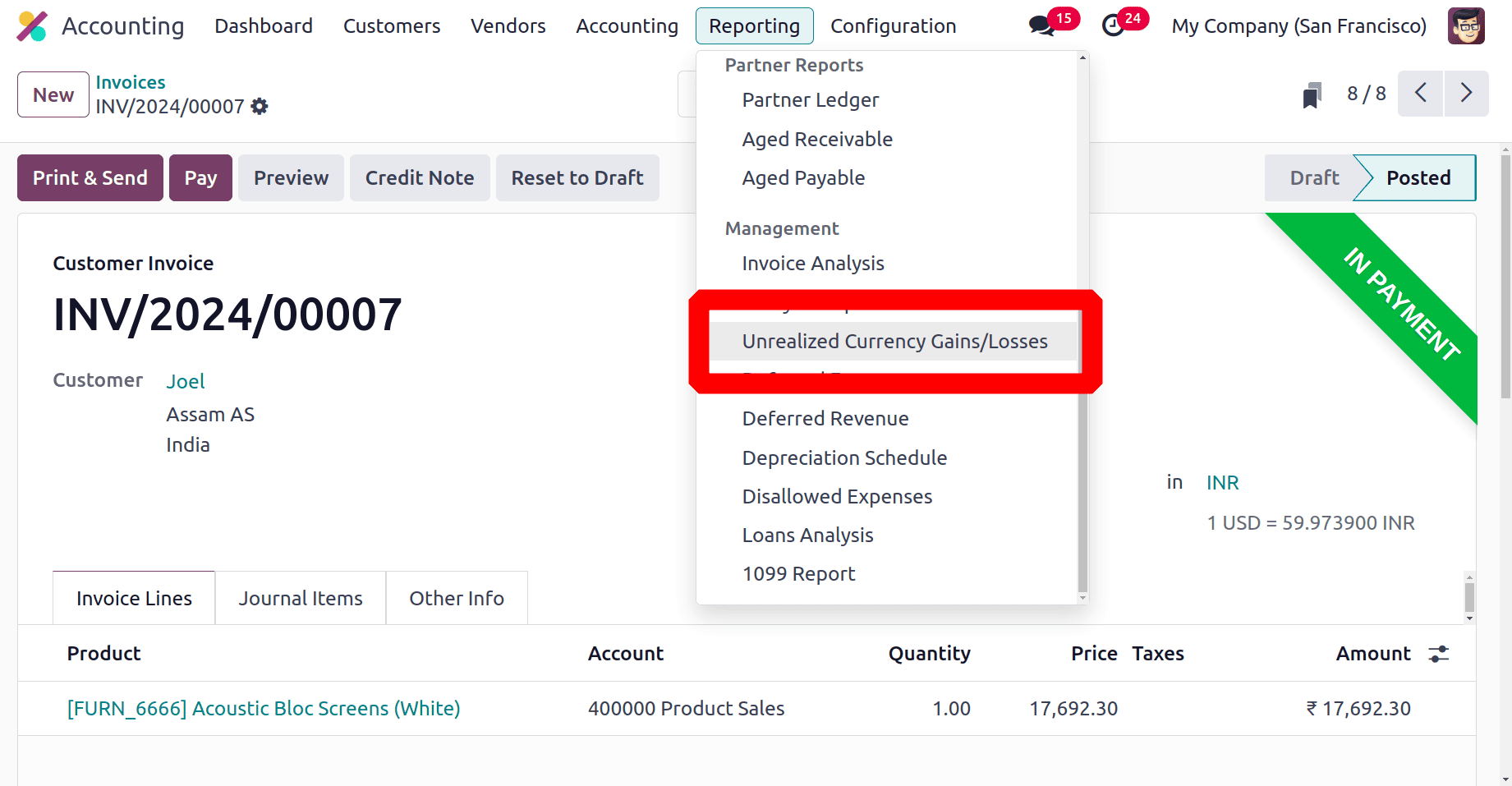

So let's check the Unrealised currency Gain/Loss report. The report is from the Reporting menu. And which is added under the Management report.

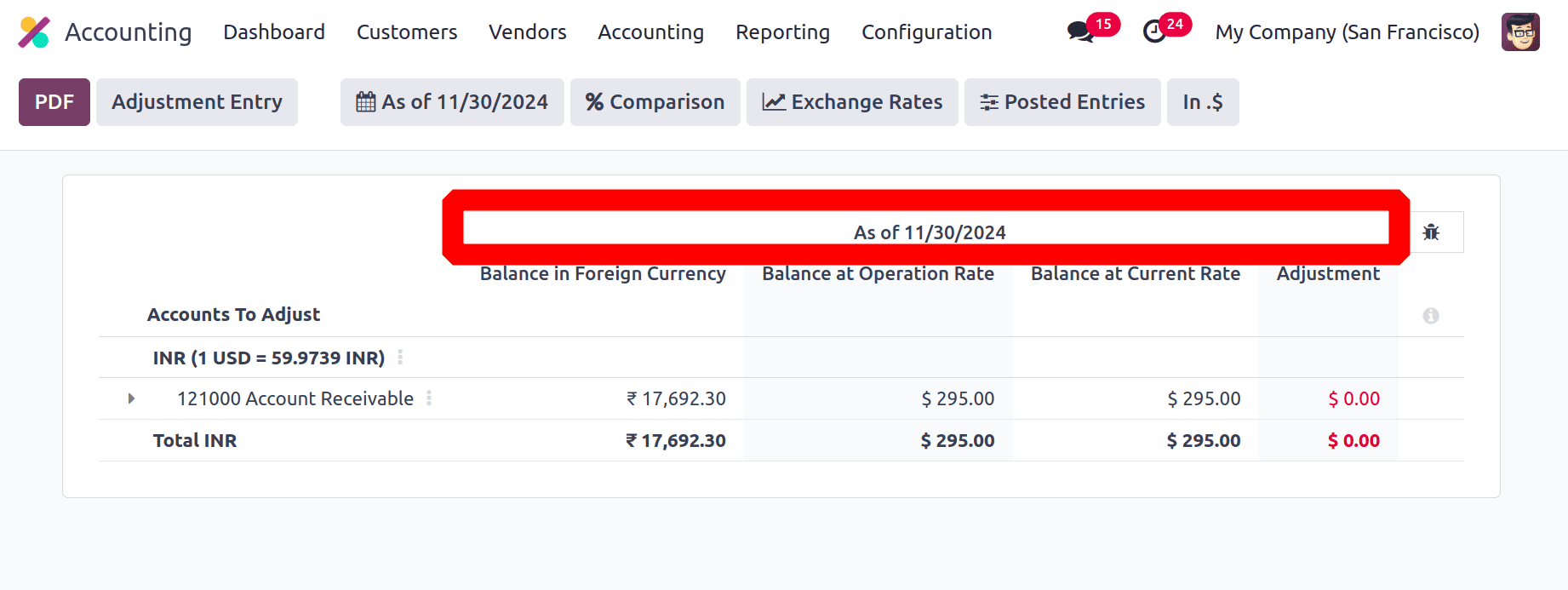

The Unrealised Currency Gain/Loss report shows the transaction details with the multi currencies. Here the Balance in Foreign Currency shows the transaction amount of the invoice. Then the Balance at the Operation Rate shows the transaction amount in company currency.

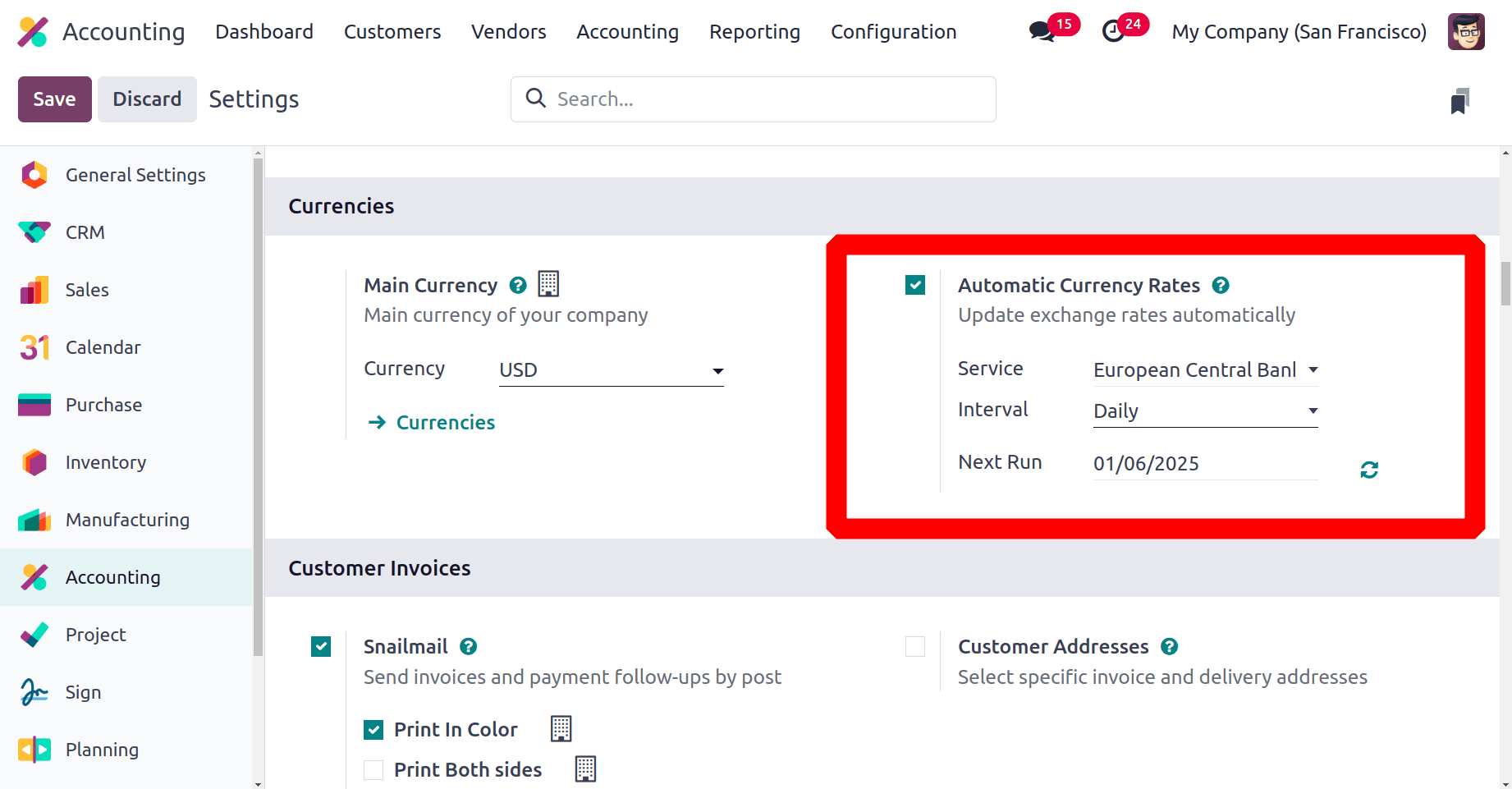

So the users can update the currency rates automatically. For that, choose the Settings from the Configuration menu. Under Currencies, there is an option named Automatic Currency Rates. Choose the interval and update the currency rate.

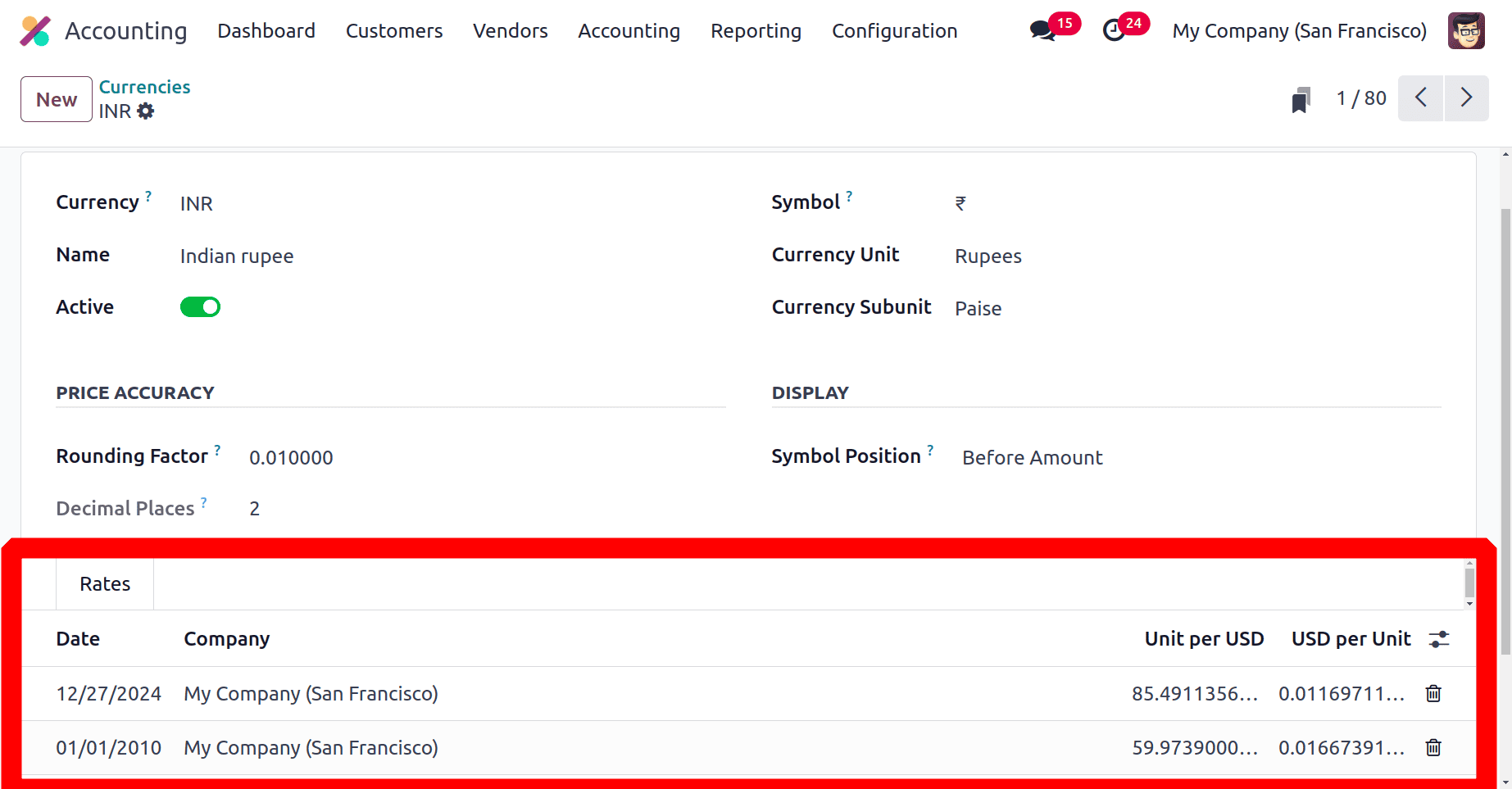

To view the updated rate, click on the Currencies from the Configuration. A list of currencies will be displayed, and from the list chosen the necessary one. The updated rate is shown in the Rates tab. The current rate Unit per USD is updated as 85.491135601342.

So the invoice has not yet been paid. Let's pay the invoice first. For that, choose the created invoice again. Then click on the Pay button to complete the payment.

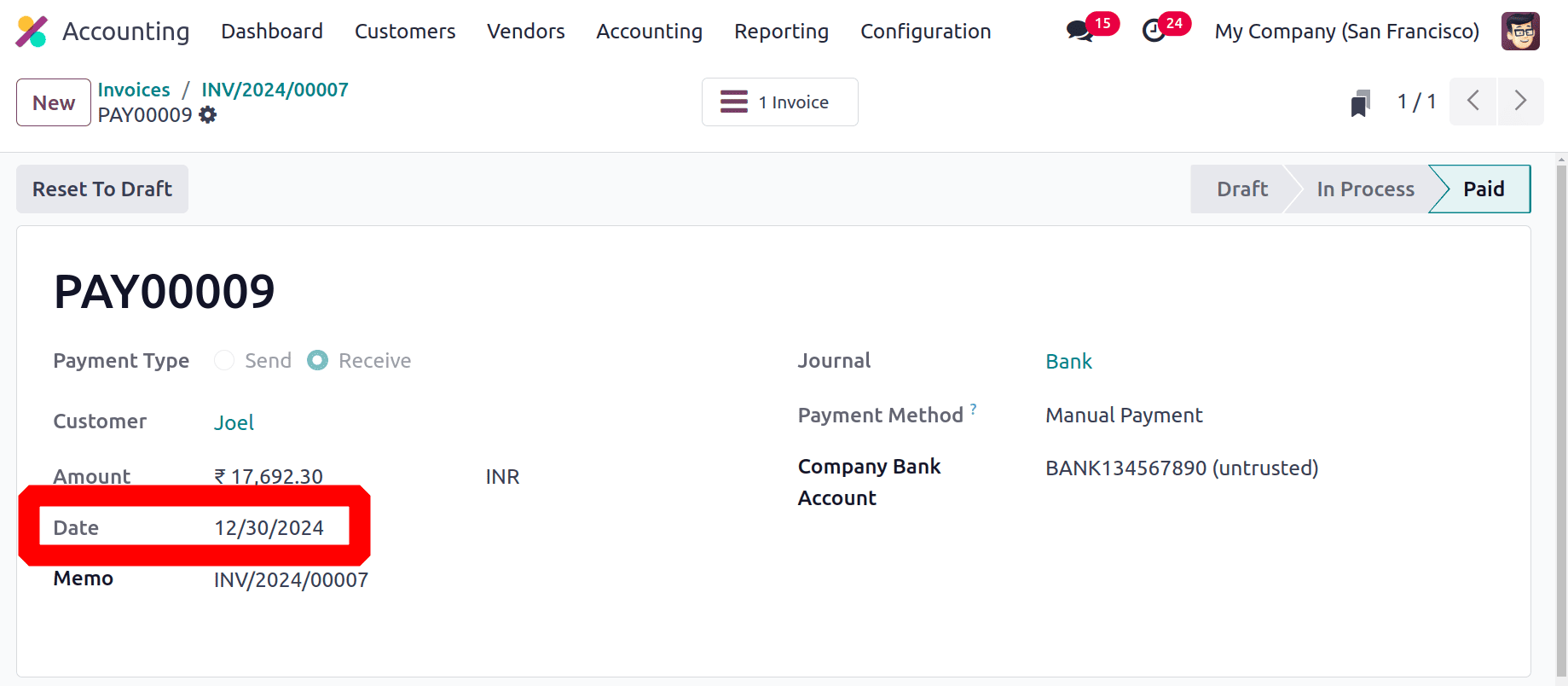

The payment date will be shown inside the payment. The payment date is shown as 12/30/2024.

Here the invoice is created on 10/01/2024. On that date, the currency rate was 59.973900000000 units per USD. But the payment date is 12/30/2024, and the payment date exchange rate is increased to 85.491135601342 units per USD.

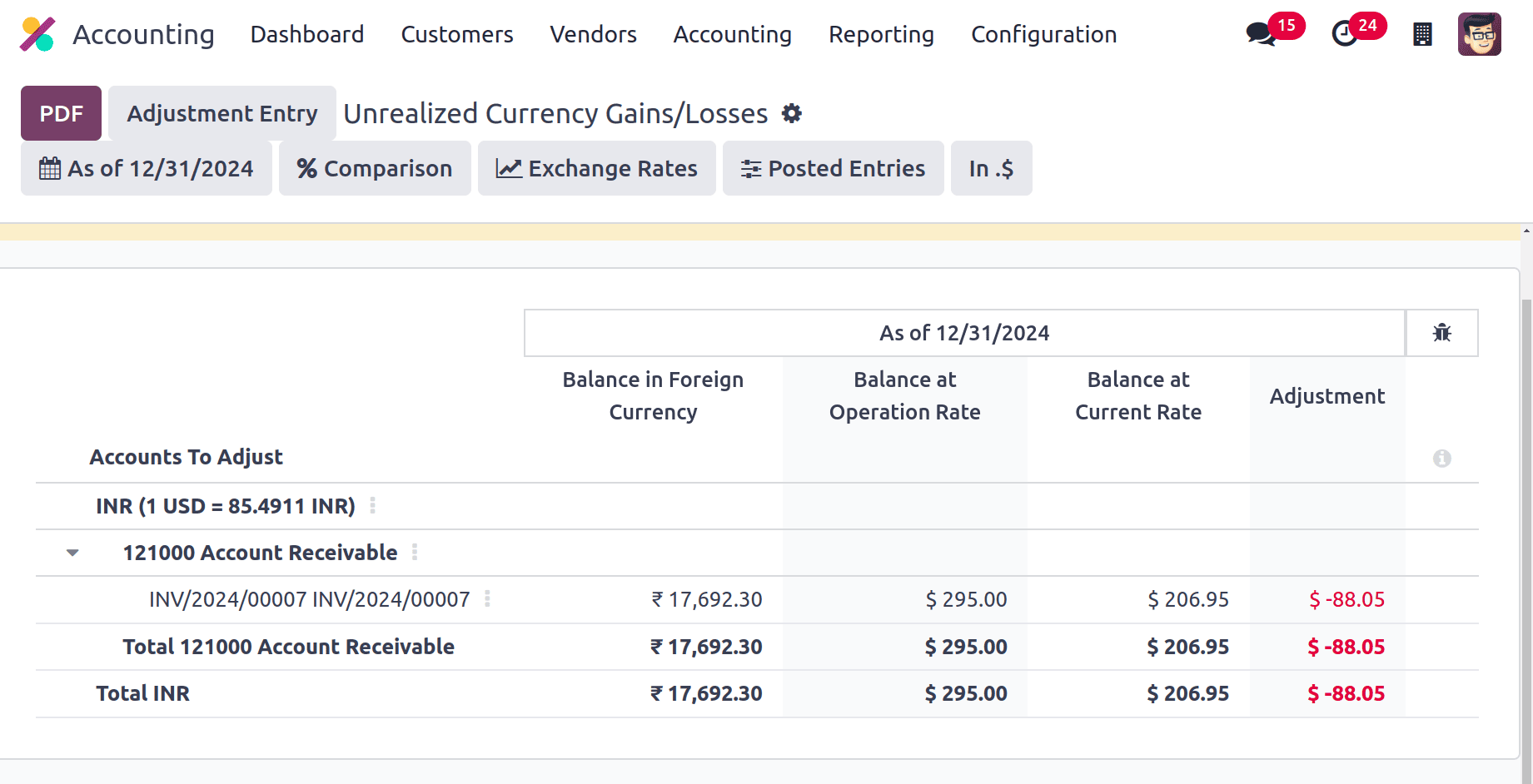

So let's check the Unrealised Currency Gain/Loss report again. There are some updates. Check them. The screenshot below shows the report after the update of the currency rate.

As said before, the Balance in Foreign Currency shows the transaction amount of the invoice and the Balance at the Operation Rate shows the transaction amount in company currency. The actual sales price of the product Acoustic Bloc Screen is $295.

After updating the exchange rate, the new rate is 85.491135601342 units per USD. So to get the Balance at the Current Rate is calculated = (Balance in Foreign Currency / Current rate) and the Adjustment is the difference between the Balance at the Operation Rate and Balance at Current Rate.

Balance at Current Rate = 17692.30 / 85.491135601342 = 206.95

Adjustment = 206.95 - 295.00 = ( - 88.05)

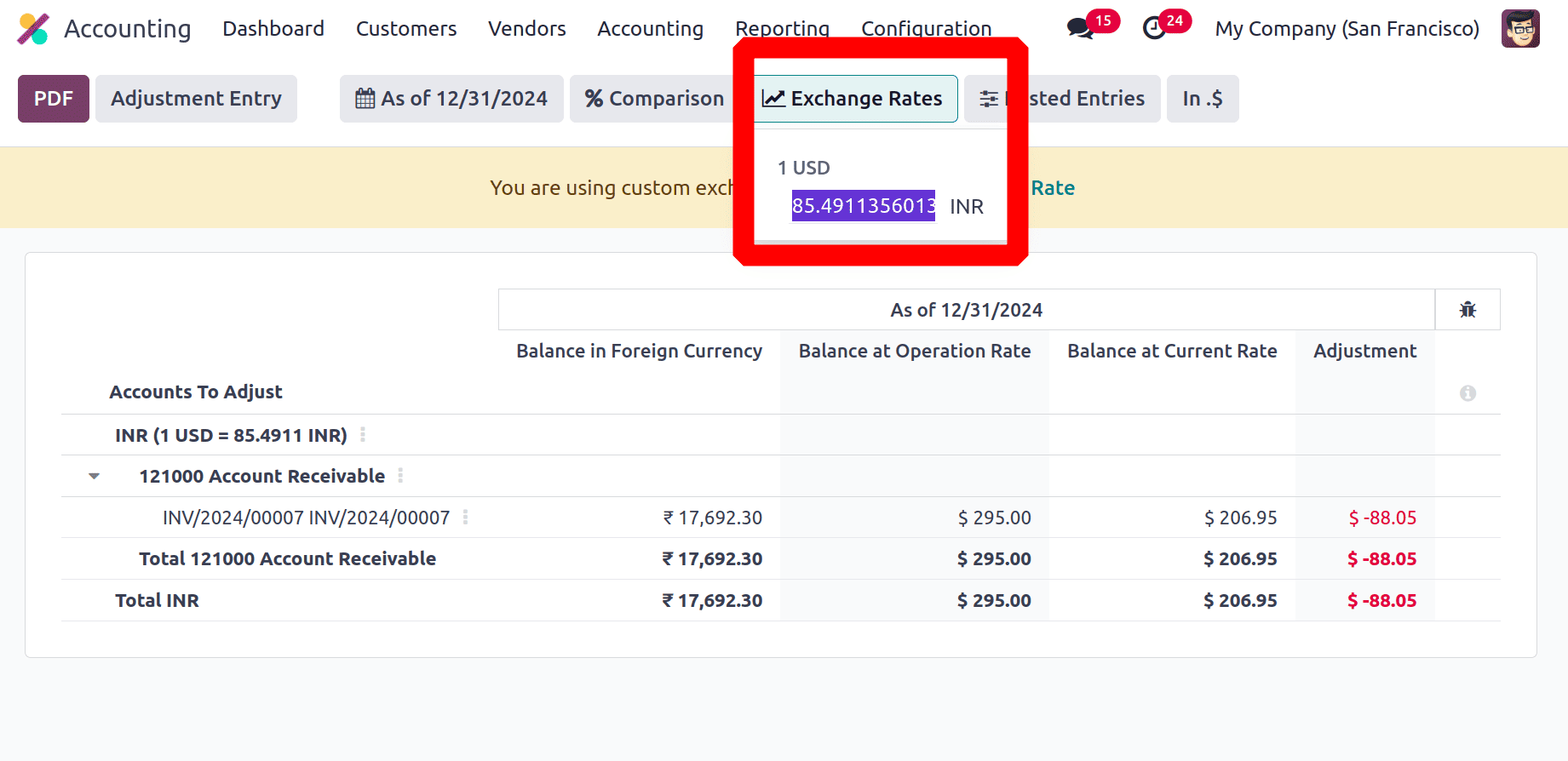

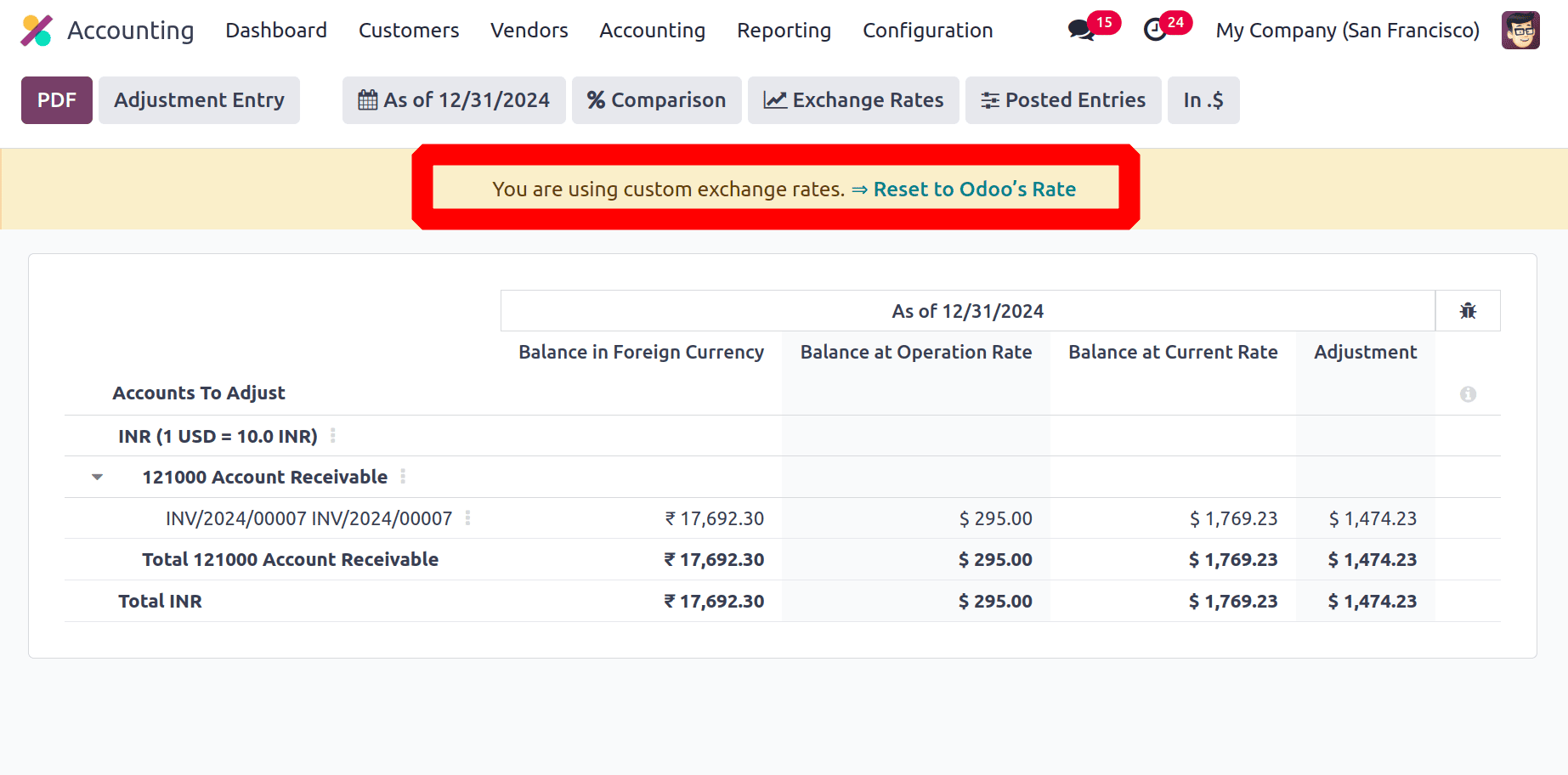

Users can add manual exchange rates. There are Exchange rates shown on the top of the screen as marked on the screenshot below.

So as per the manual updation of the exchange rate, all the above-mentioned values will change automatically.

One useful tool for precisely estimating the financial impact of changing currency rates on ongoing transactions is Odoo 18's Unrealised Currency Gain/Loss report. By taking into account the possible gains or losses resulting from currency fluctuations at a certain reporting date, it guarantees adherence to Odoo 18 accounting rules. This report improves financial transparency and gives companies the knowledge they need to successfully manage currency risk.

To read more about How to Manage Unrealized Loss or Gain in Odoo 17 Accounting, refer to our blog How to Manage Unrealized Loss or Gain in Odoo 17 Accounting.