To properly manage its accounting activities, a business might need to handle several accounts. Businesses often begin with a default chart of accounts to expedite the process. Every account that the business uses to carry out different accounting tasks will be included in a chart of accounts. A default chart of accounts can help a business get its accounting process underway. It will include the most widely utilized accounts that are appropriate for meeting the majority of the company's needs. You can later grow your chart of accounts and add more accounts to the operations.

You can make a basic chart of accounts for business operations using the sophisticated Odoo 17 Accounting management software. To manage different components such as profit, loss, and balance sheet, you can add appropriate accounts to this chart. You can add additional accounts to the list with Odoo based on your needs. You can make and utilize your chart of accounts based on needs in addition to the default one. The comprehensive Accounting module of the open-source Odoo software makes these tasks simple to complete.

The setting of default accounts in Odoo 17 Accounting for various accounting functions is covered in this blog.

It is crucial to configure the relevant database accounts to set up default accounts in Odoo Accounting. The Chart of Accounts option in the Configuration menu of the module allows you to add and manage accounts.

Chart of Accounts

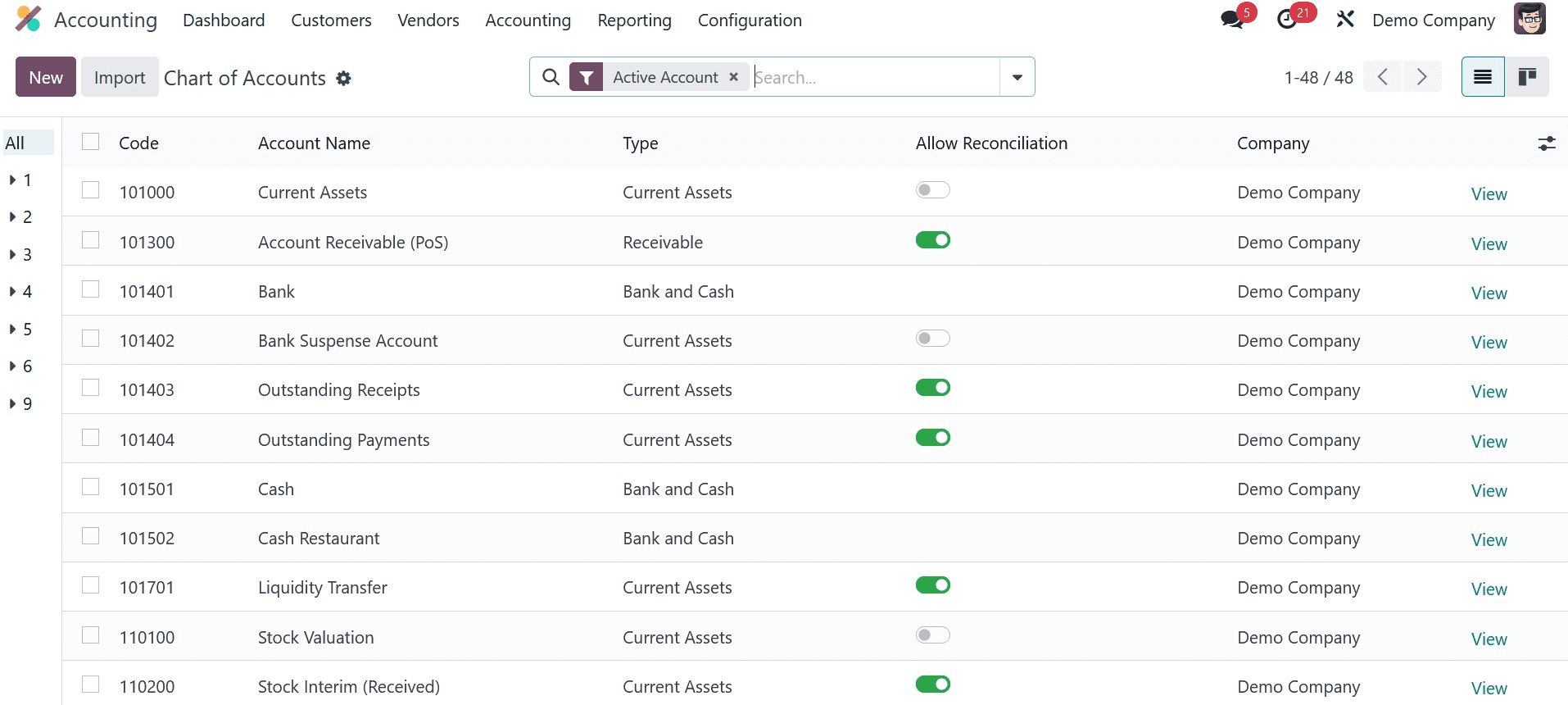

From the Configuration menu, you may choose the designated option to display the available list of Chart of Accounts. The window will display a list of all the accounts that are utilized in an organization's general ledger to record different financial transactions. In essence, the accounts listed in the list will record every financial transaction made by a business. Odoo gives you the ability to manage your current accounts and establish new ones right from this platform, depending on your needs.

The Code, Account Name, Type, Allow Reconciliation, Account Currency, and Company details are displayed in the list preview. The account type specified in the Type box establishes the guidelines for closing a fiscal year and creating opening entries, as well as producing legal reports tailored to a given nation. To enable accounts to match journal entries with invoices and payments, turn on the Allow Reconciliation box.

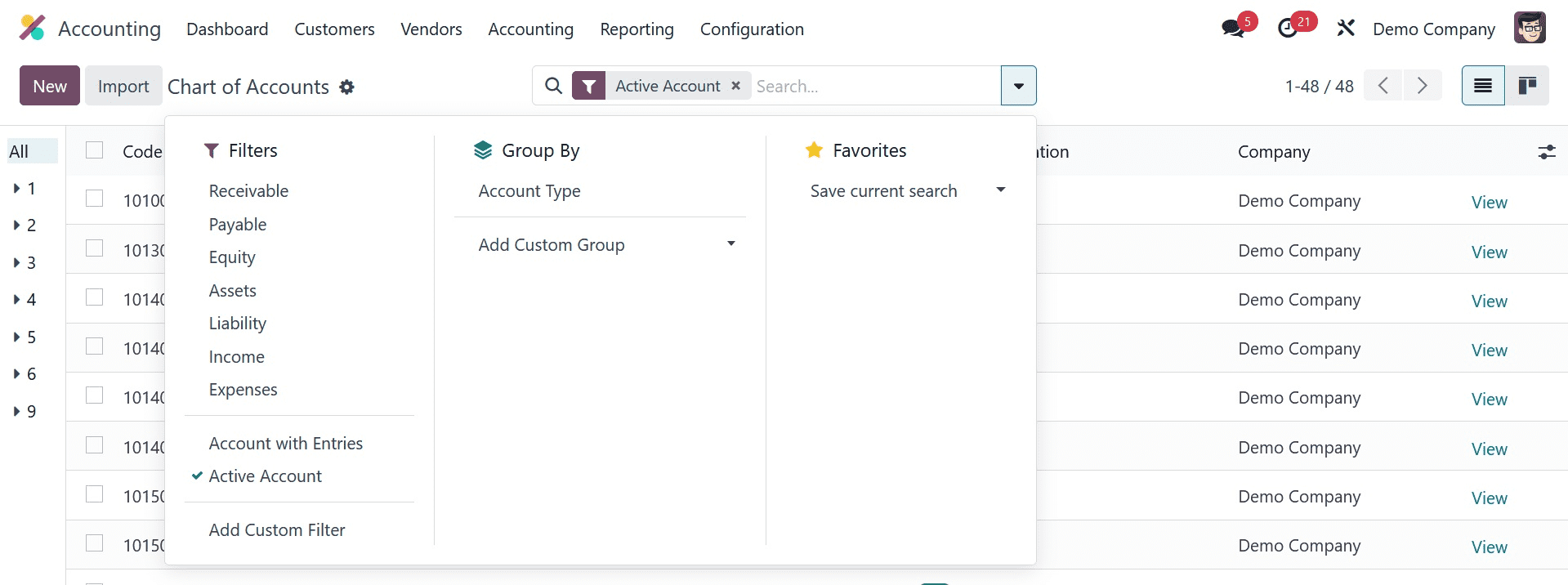

The default Chart of Accounts criteria are Receivable, Payable, Equity, Assets, Liability, Income, Expenses, Accounts with Entries, and Active Accounts. You can group the accounts according to Account Type. Use the Add Custom Filter and Add Custom Group choices, respectively, to create more personalized filters and grouping possibilities.

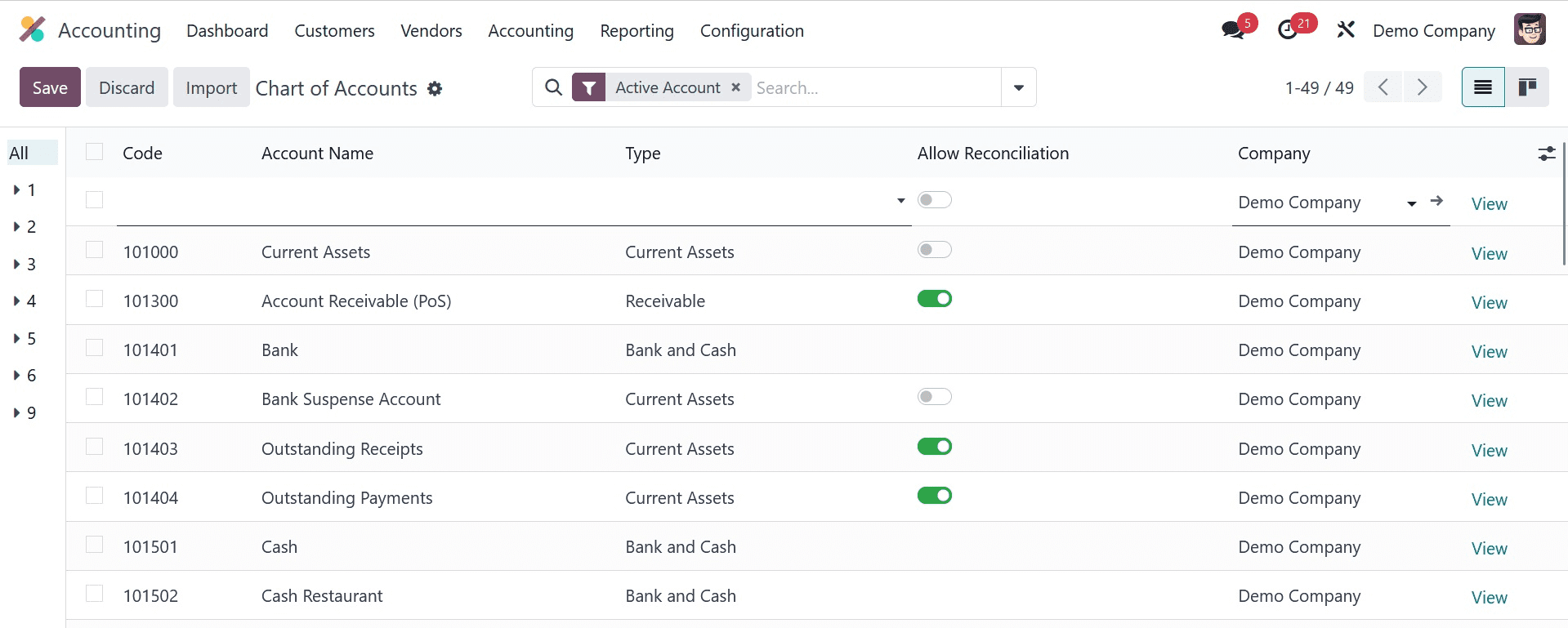

You can add a new account to the list of available accounts by using the New button. As soon as you click the New button to enter the account details, a new line will appear. In the designated spaces, you can enter the Code, Account Name, Type, Account Currency, and Company. The account details can be edited by using the Setup button.

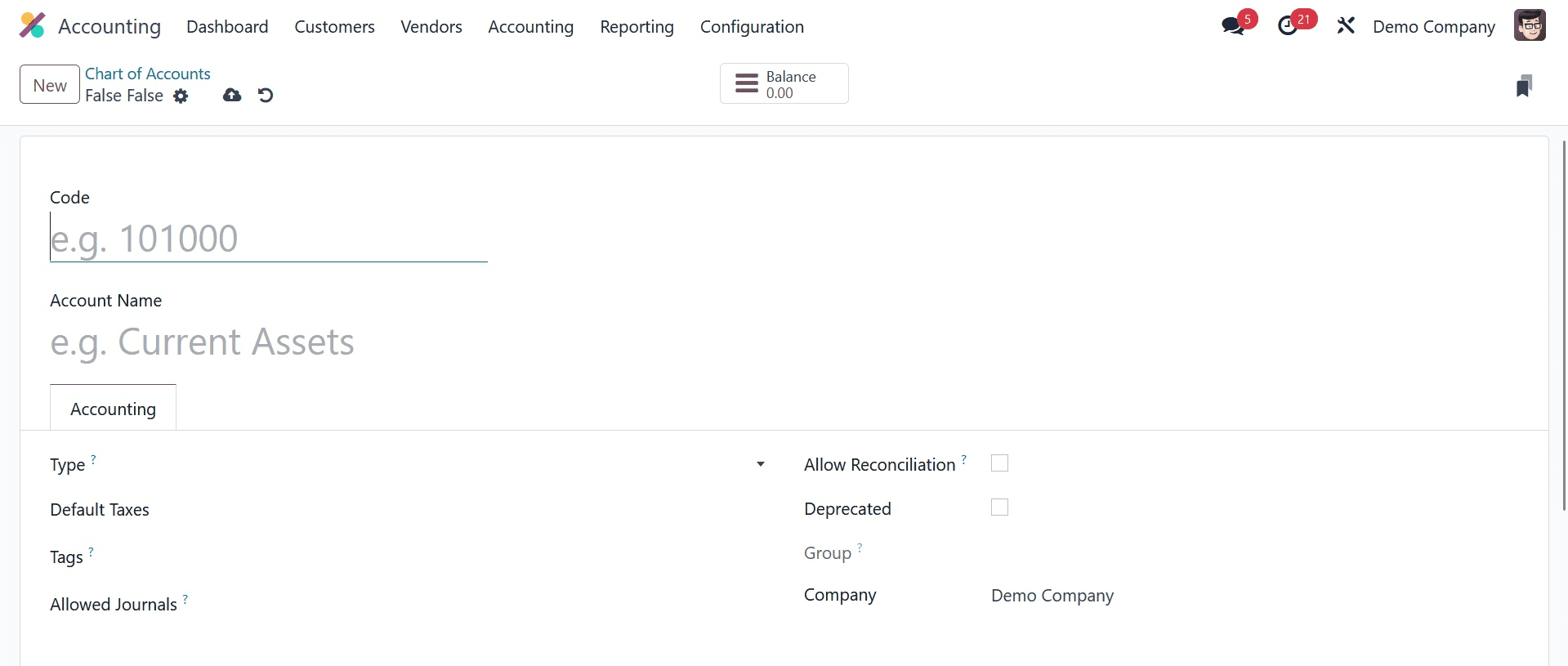

The account's debit and credit balances are displayed via the Balance smart button. To assist you in creating personalized reports, you have the option to put Tags in the provided box. The Allowed Journals section allows you to select the journal in which you wish to utilize this account. You can leave the field blank if you wish to use it in every diary. In the Chart of Accounts, new accounts are created in this manner.

Default Accounts

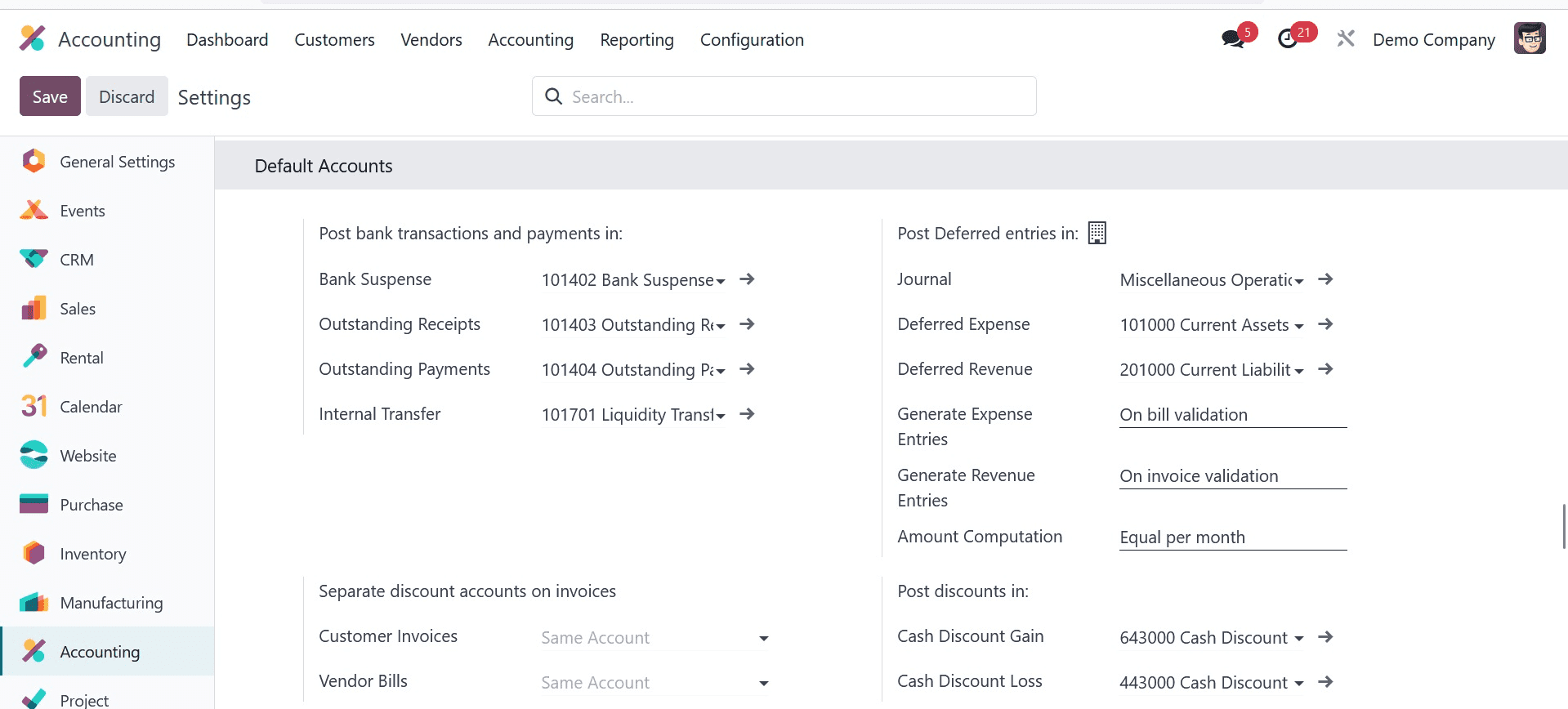

You can now designate default accounts for specific operations after setting up the necessary accounts to handle the majority of your accounting procedures. To do this, select the Accounting module's Settings menu. Default Accounts is a dedicated tab that lists default accounts for various accounting functions.

The Journal, Gain Account, and Loss Account columns allow you to specify the default accounts that are used to submit exchange difference entries. You can add default accounts used with specific functionality in additional spaces. They are listed below.

Bank Suspense Accounts: Located in the general ledger, the suspense account serves as a temporary holding place for transactions in situations where it's unclear which account should be used to record a certain transaction.

Outstanding Accounts: When you manually record a payment, the outstanding receipts and payment accounts will be used rather than the actual bank account. In these situations, you must reconcile the payment with the relevant bank statement as well as the invoice or bill.

Internal Transfer Accounts: The company's internal transfer account will be used to track internal financial transfers.

Cash Discount Gain/Loss Accounts: The default cash discount accounts will be used to record the gain and loss resulting from the cash discounts.

Once the default accounts for the designated functions have been mentioned, you may click the Save button to apply the new adjustments. In the most recent Odoo 17 Accounting module, you can establish default accounts in this manner to streamline your accounting processes.