Odoo ERP system is made up of efficient modules to manage all business-related activities by reducing excessive use of time and effort of employees. This ERP solution contains Human Resource Management modules that help an organization to ease the process of managing employees and related activities. The payroll module is one of the modules that work by integrating its functions with other HR management modules in Odoo to manage all payroll procedures in a company. This module integrates the employee contract, timesheets, attendance reports, time-off, and accounting to generate payslips for each employee within the company. Generally, processing payroll is a time-devouring and multifaceted process that requires careful attention for accuracy in payslips.

By configuring contracts to the employee profile Odoo helps you to generate payslips for that particular employee according to the salary package and salary rule defined in employee’s contracts. A company should configure an active contract with a well-defined salary package and parameters that determine the remuneration for each employee then only the generation of payslip is possible. Odoo guides a company to build every individual employee’s total compensation into payroll. In Odoo you can make reports of each of these payslips to document the salary details for future reference.

Accurate reporting of payroll is very essential to get a total picture of the payroll done in a company and calculate the expenses. The payroll reporting should be accurate and prices at each level of calculation. The Odoo ensures smooth functioning of payroll and correct reporting of payslips. Good reporting and documentation of payroll not only ensure the accuracy in payment but also assures that the employees are paid on time. Maintaining proper records over each employee’s payroll will be helpful to avoid issues with payment calculation and regulation. The automated reporting features in Odoo 14 are a blessing for companies to reduce the hassles in payroll reporting.

In this blog, we will be looking at the reporting features available in the Payroll module in Odoo and how they help to create good reports.

The payroll reports will help you make more informed decisions based on the monthly and yearly analysis. The data regarding the payslip generated on a monthly, hourly, or quarterly basis can be recorded and configured into spreadsheets in the Payroll module.

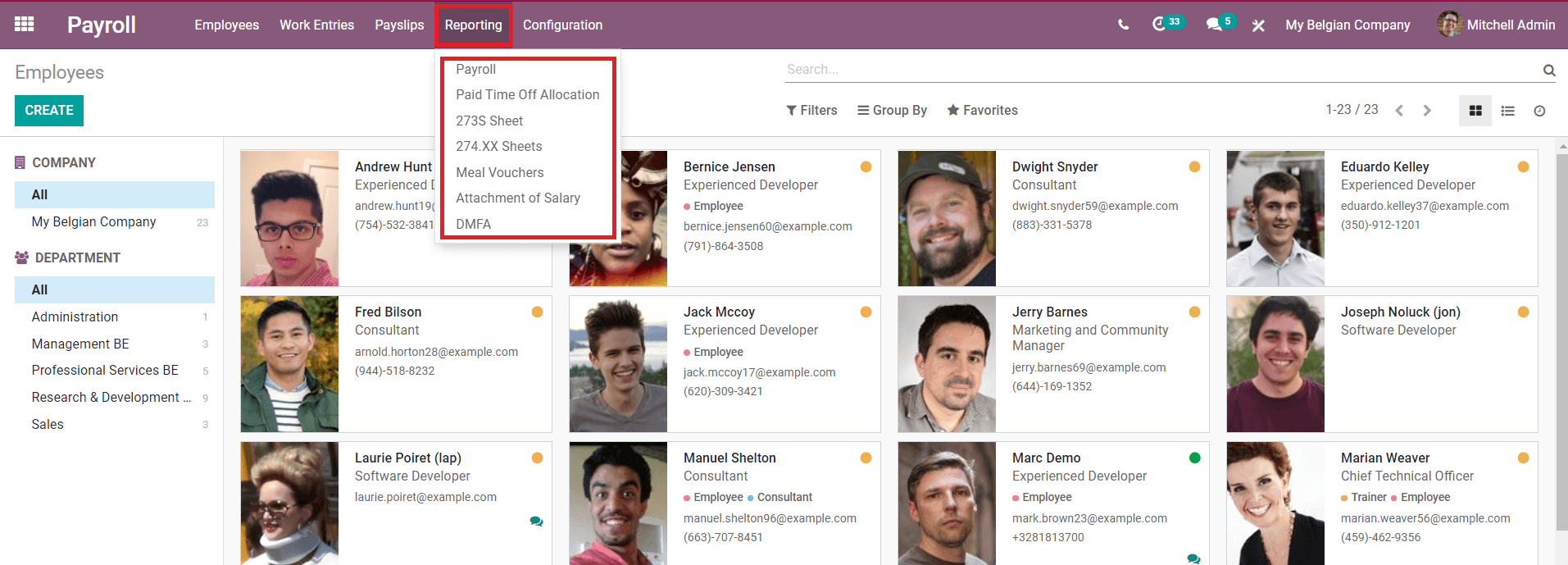

On the main dashboard of the Payroll module, you can see the ‘Reporting’ field which includes several options to facilitate the advanced functioning of payrolls.

This includes Payroll reporting, Paid Time Off Allocation, 273S Sheet, 274 XX Sheets, Meal Vouchers, Attachment of Salary, and DMFA. The reporting of Payroll will be available in both the Community and Enterprise editions of the Odoo but the other features given in the screenshot will be only found in the Enterprise edition of Odoo. Let’s take a look into each of these in detail.

Payroll Reporting

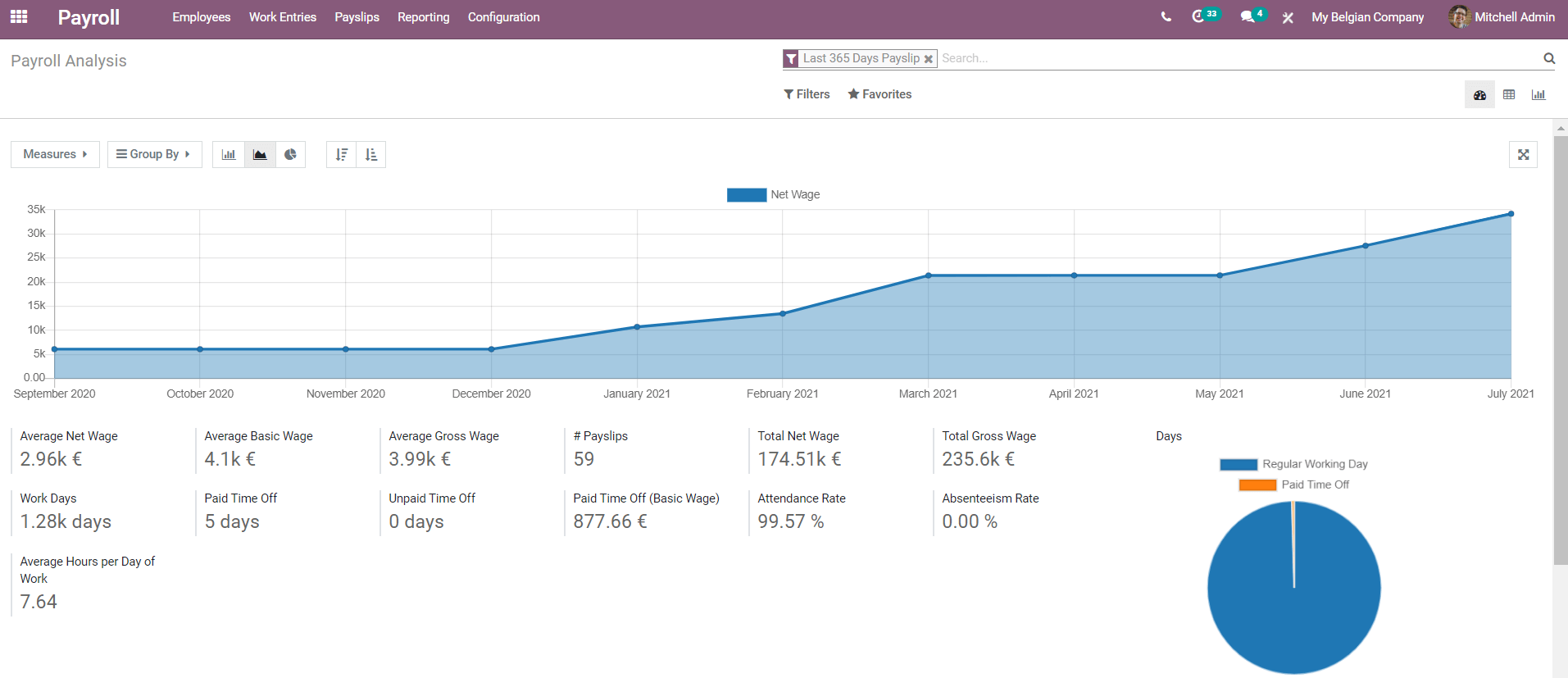

Odoo will record all payments carried out through the Payroll module so that at the end of the month or economic year the company can easily generate reports. The main dashboard of the payroll reports includes both graphical and tabular representations of the data regarding payroll.

You can select suitable filters for your report to make it easier for analysis. The filters will help you to generate reports on the payment of each employee, department, working days and hours, paid time off, and many more options that will sort the data according to your requirement. As you can see in the image, the dashboard will show the Average Net Wage, Average Basic Wage, Average Gross Wage, Payslips, Total Net Wage, Total Gross Wage, Work Days, Paid Time Off, Unpaid Time Off, Paid Time Off (Basic Wage), Attendance Rate, Absenteeism Rate, and Average Hours per Day of Work of the employees in your company.

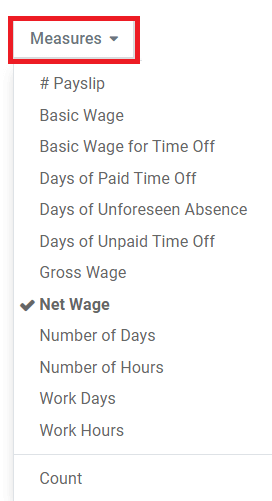

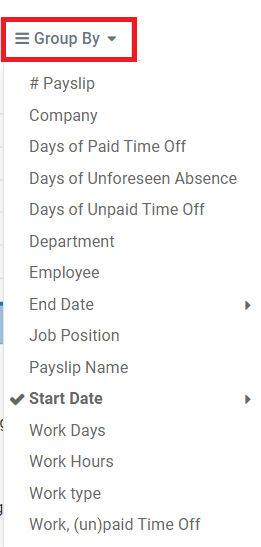

Odoo allows changing the measuring points of the graph using the ‘Measures’ given in reporting.

You can use these measures for creating reports as per your need and there are similar ‘Group By’ options available to make the sorting procedure easier.

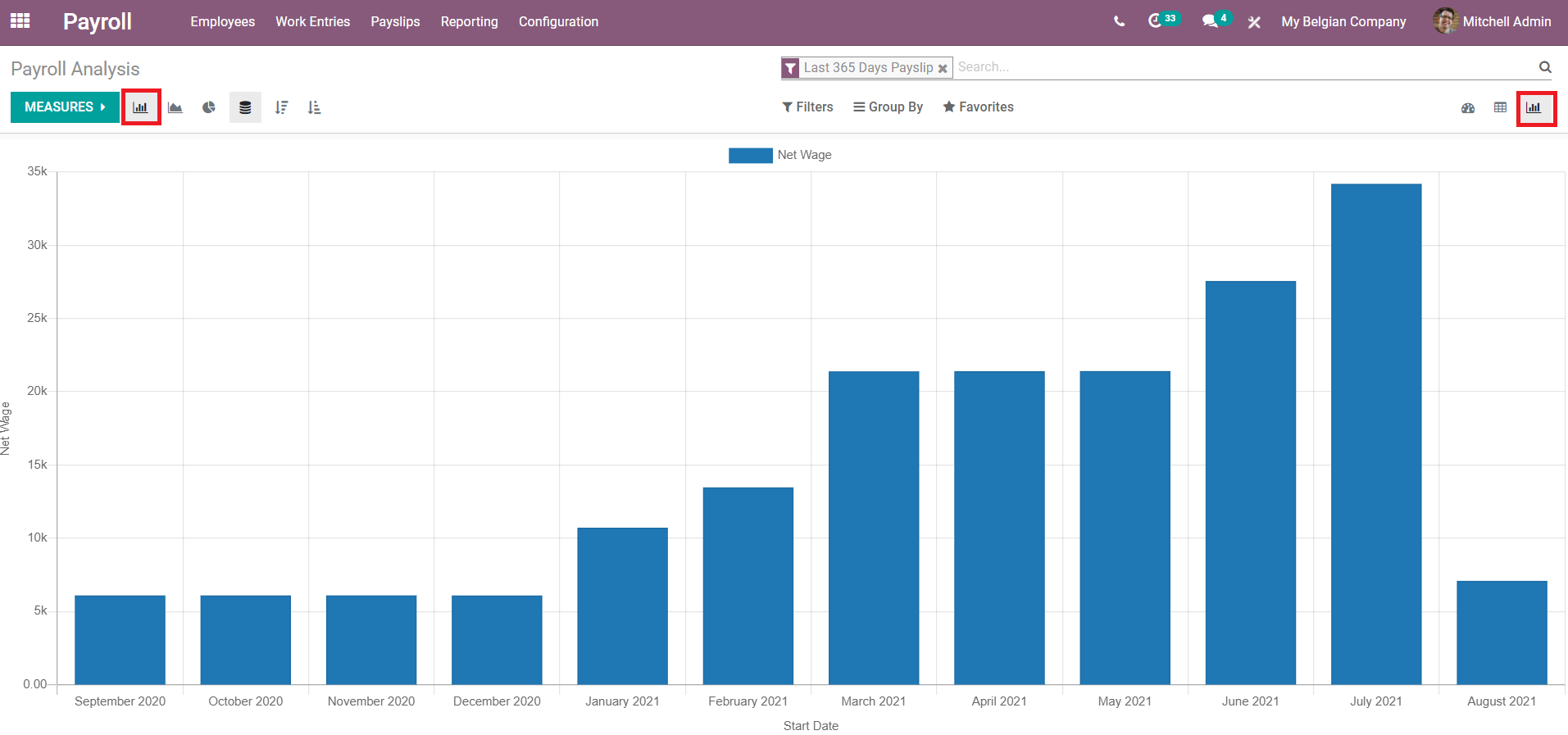

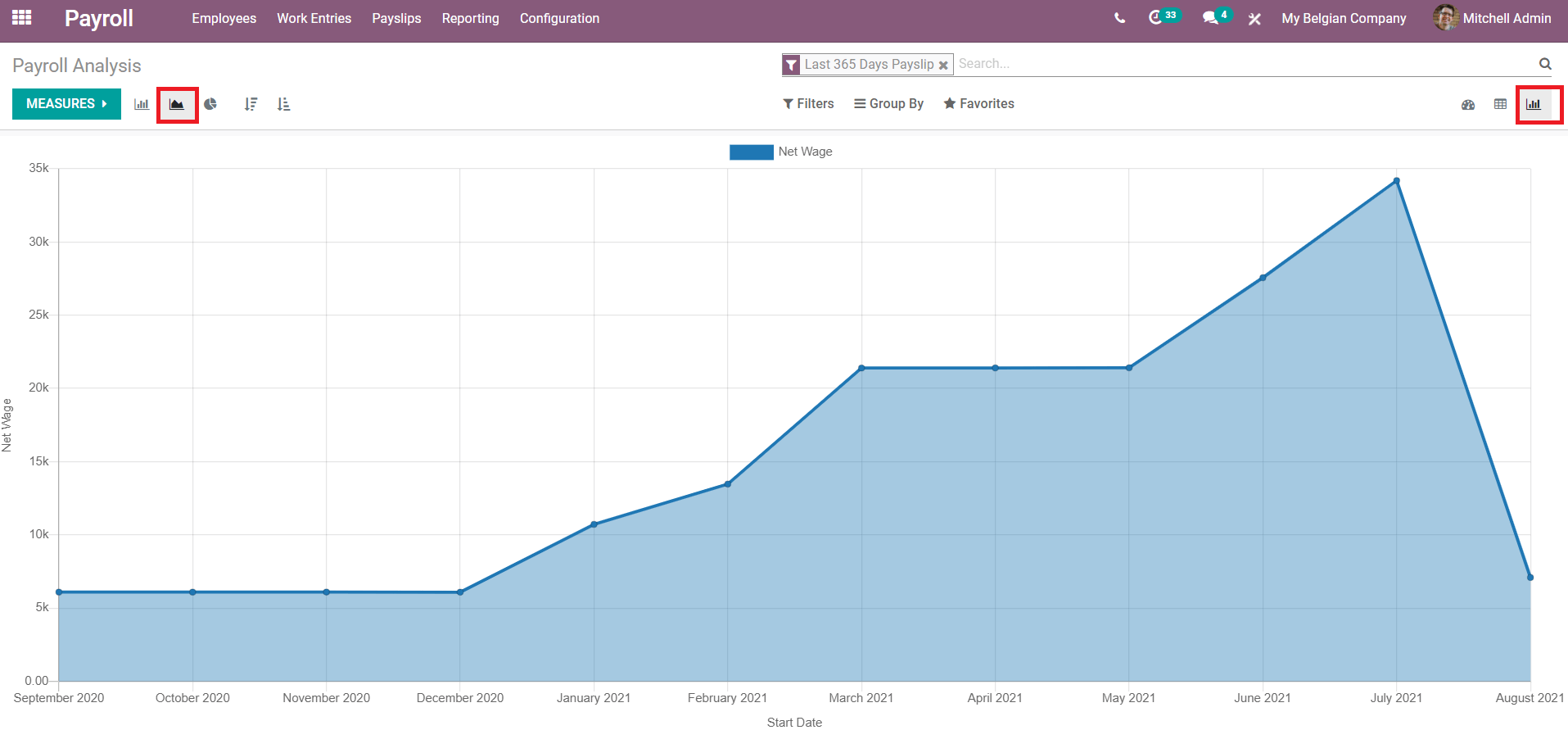

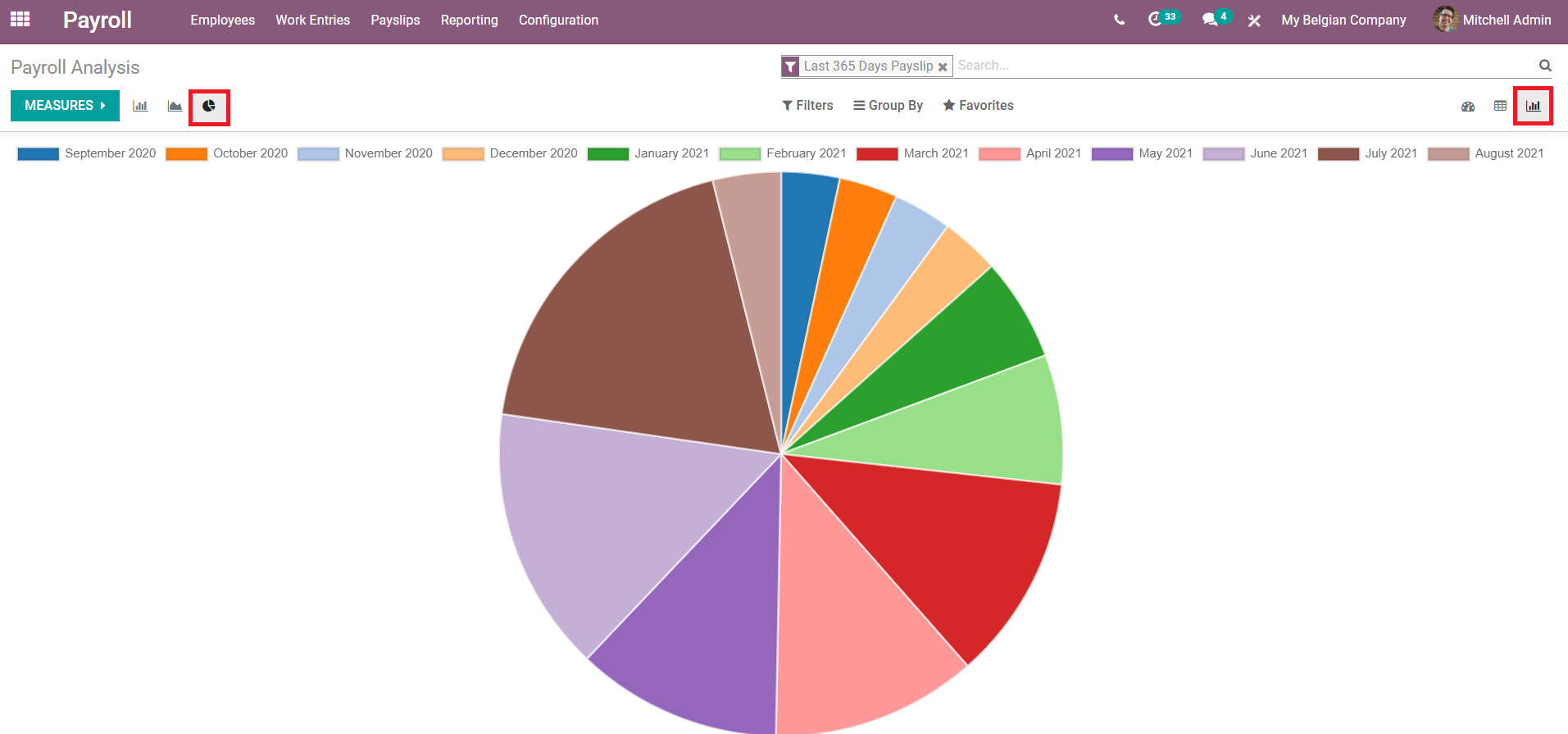

As we can see in many other modules, the payroll reporting also can change into different graphical and pivot table views. The graphical views mainly include Pie charts, Bar charts, and Line charts. As said earlier you can change the measures for different views according to your purpose of reporting.

Bar Chart:

Line Chart:

Pie Chart:

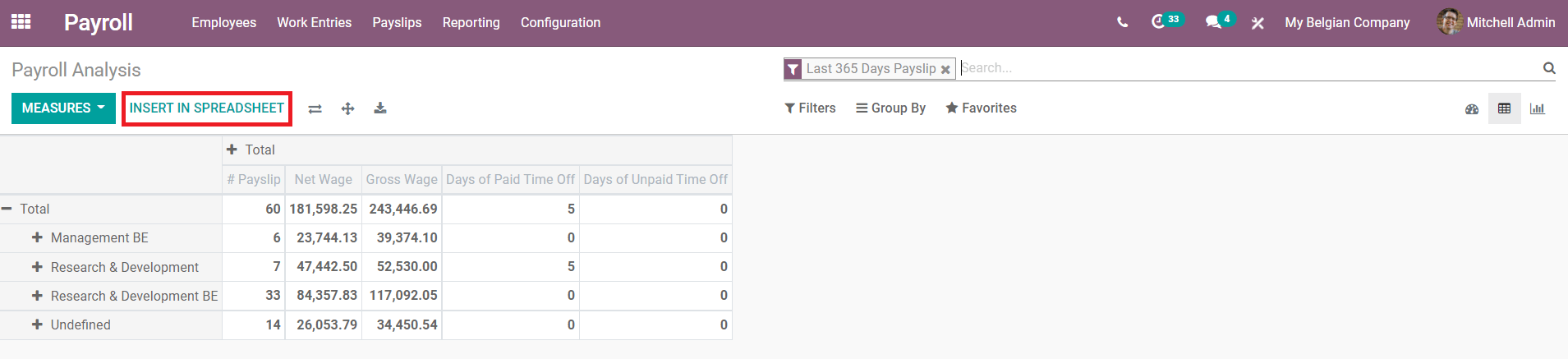

In the pivot view, you can insert the data into a spreadsheet for further analysis.

Paid Time Off Allocation

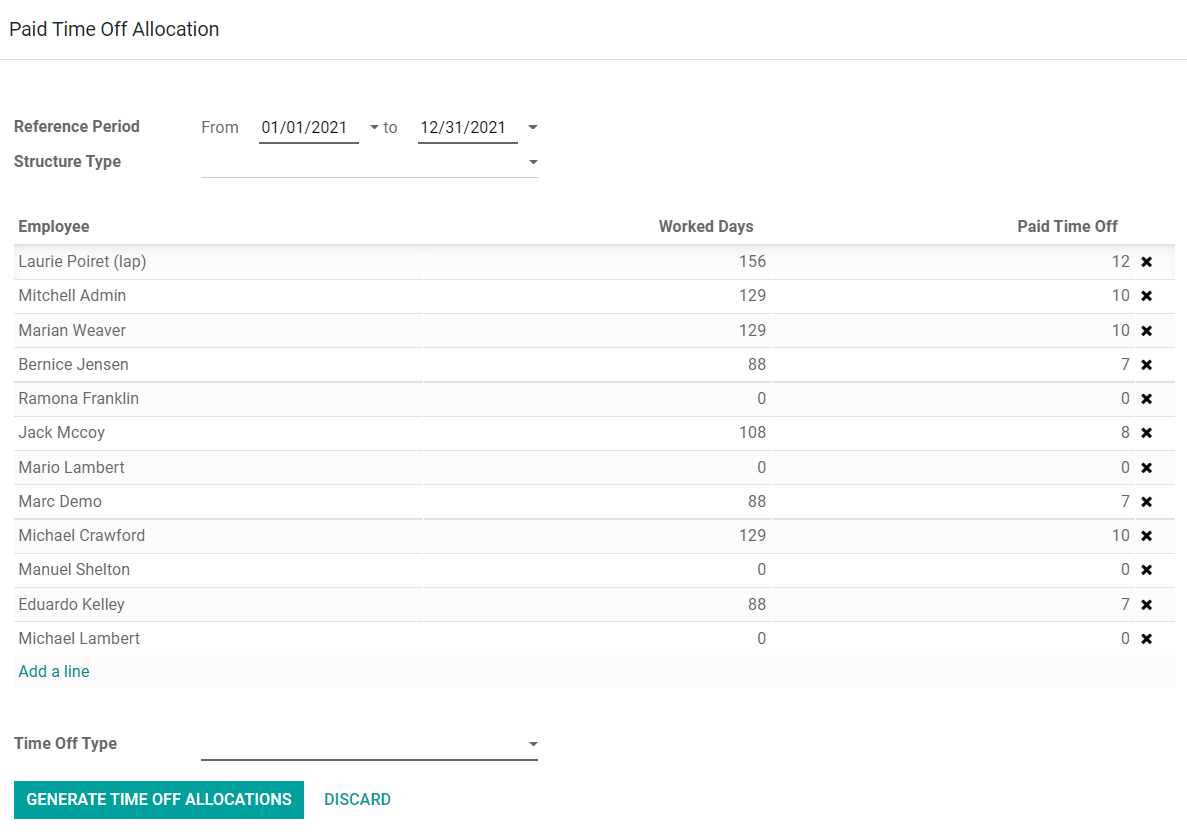

You can generate a form of paid time off of workers and employees in your company using the ‘Paid Time Off Allocation’ menu in the reporting. While you click the menu, a pop-up window will appear where you can add employee names, their working days, and the number of days of paid time off as shown below.

In the Reference Period, you can add the time period in which you are going to select for paid time off. Select the structure type and add the employee in the respective fields. Use the ‘Generate Time Off Allocations’ to generate a request for paid time off. This will direct you to a window where the respective officer can approve or reject the paid time off allocation.

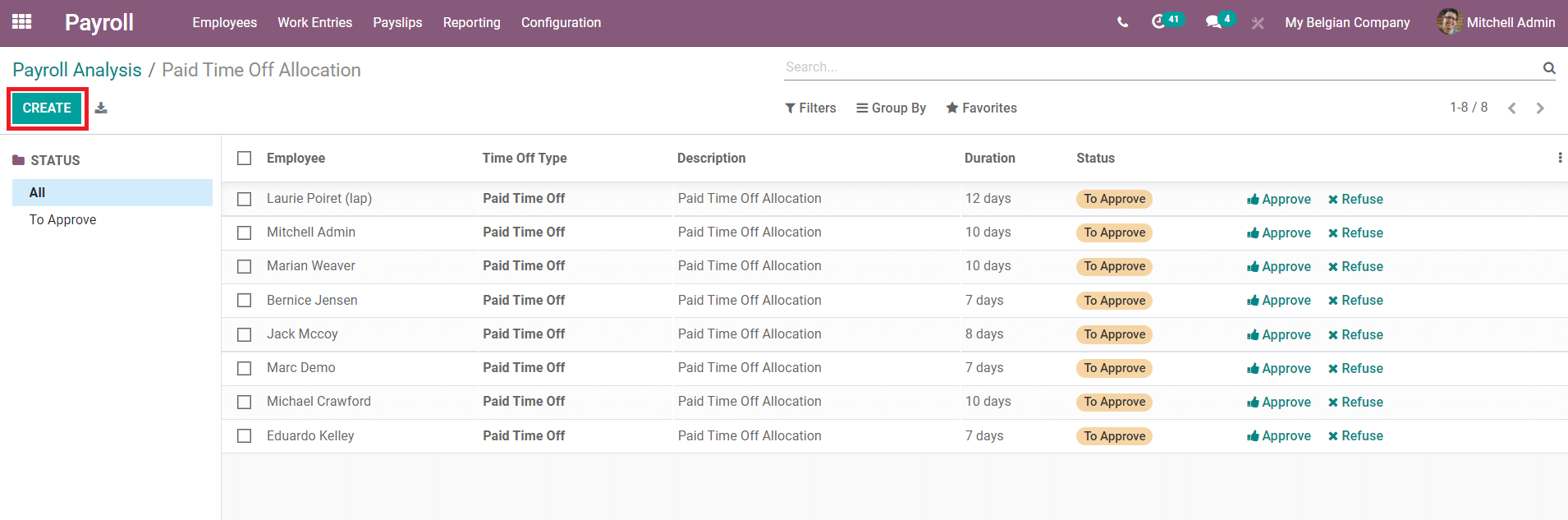

As you can see in the screenshot, the window will show Employee name, Time Off Type, Description, Duration, and Status of the allocation. You can approve or refuse the request from the same window or you can select an employee to get a detailed view.

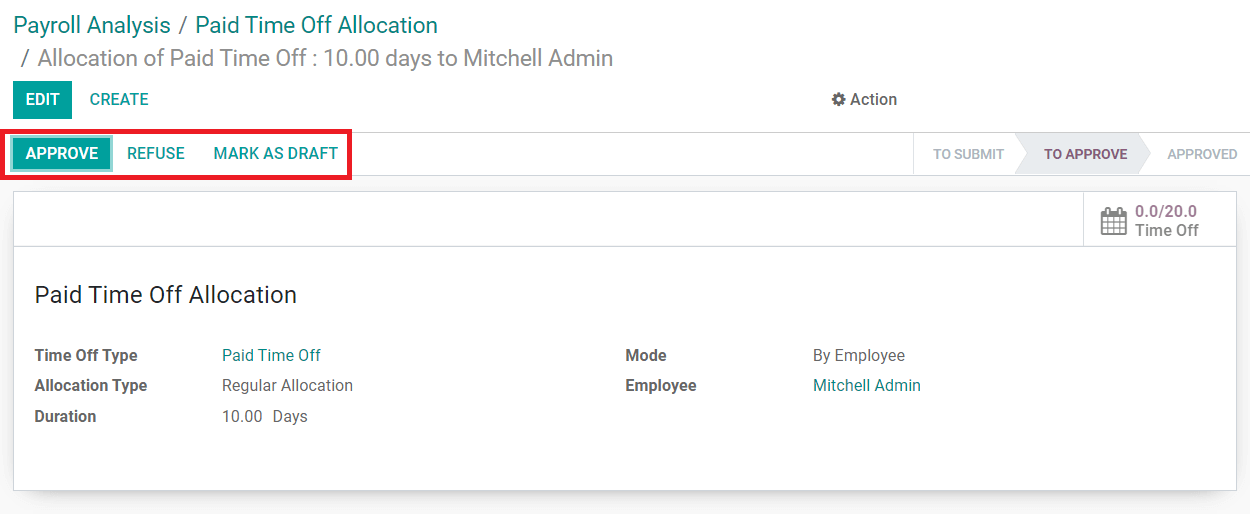

You can Approve, Refuse, or Mark As Draft the request using the respecting button as shown in the screenshot.

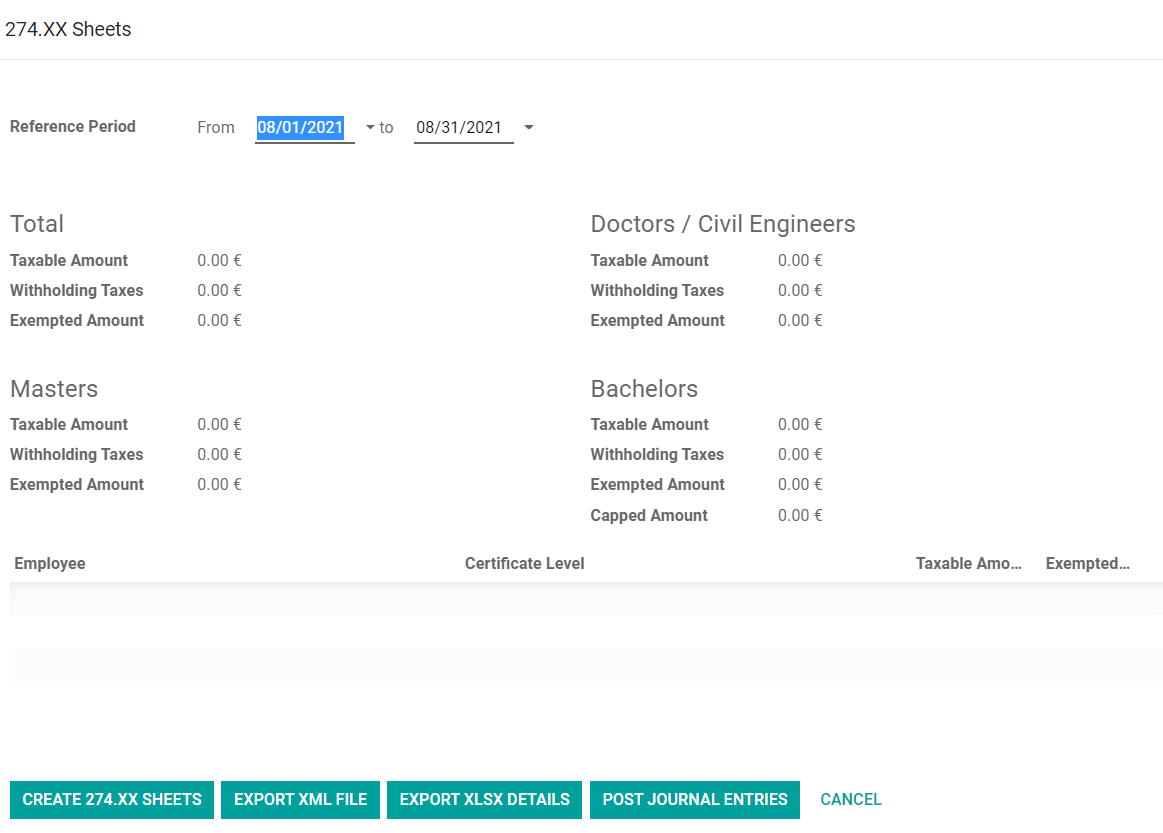

273S Sheet and 274.XX Sheets

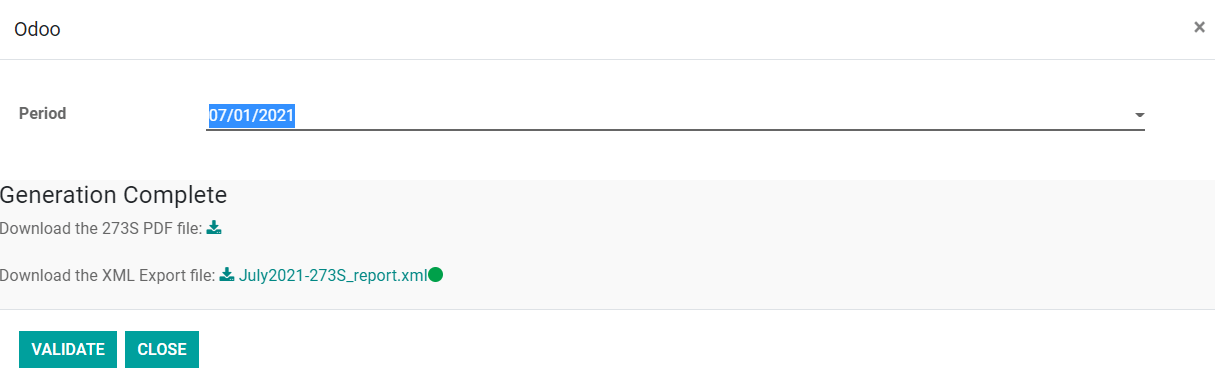

It is easy to transfer the data of a particular time period into an XML file or PDF file. In the reporting menu, you will get options to export data for analysis.

273S Sheet:

274.XX Sheet:

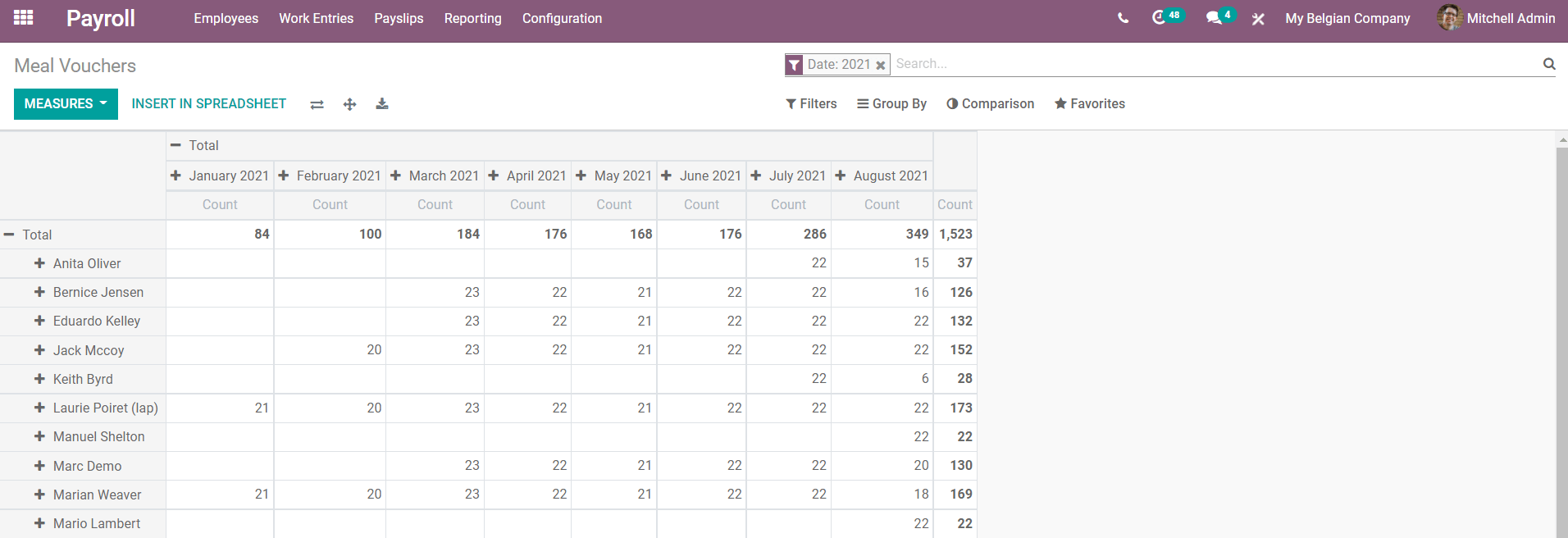

Meal Vouchers

This field in the reporting will record the number of meal vouchers granted for all employees separately on a monthly and yearly basis.

You can also insert these data into a spreadsheet.

These are the general reporting features available in the Payroll module that help a company to generate useful reports for the analysis of payrolls done throughout the year.