Any firm or organization's accounting module must include taxation and tax reporting. The following main ideas emphasize their importance: Adherence to Lawful Mandates: Governments enact tax rules and regulations to guarantee revenue collection and uphold a just and equitable tax system. Companies must abide by these laws, and a basic prerequisite is correct tax filing. Penalties, fines, and legal repercussions may follow noncompliance.

An organization's profitability and financial status are greatly impacted by taxes. Making decisions and planning finances. With the aid of appropriate tax planning, businesses can lower their tax obligations, take advantage of any tax incentives, and make prudent financial decisions. By analyzing tax data, businesses can find trends, assess tax burdens, and develop strategies to lower tax expenses.

Calculating Tax Liability: Tax reporting provides a complete picture of a business's financial activity, including income, expenses, credits, and deductions. Companies examine their taxable income and use accurate tax reporting to determine the correct amount of taxes to pay. It discourages underreporting and tax evasion and guarantees the transparency of financial statements.

Communication with External Stakeholders: Lenders, investors, auditors, and other external stakeholders are among the parties with whom it is frequently necessary to share tax reports. These reports give financial statements more transparency and legitimacy while proving that a business complies with tax laws. Maintaining stakeholder confidence and ensuring regulatory compliance are two benefits of accurate tax reporting.

Audit and Due Diligence: In audit and due diligence scenarios, tax reports are crucial for evaluating a business's fiscal soundness and tax compliance. Accurate and well-documented tax reports that display financial activity, deductions, and credits can be used by auditors, investors, or prospective buyers to assess a company's tax status and potential risks.

Future Tax Planning: When preparing for the future, tax returns from previous years are helpful resources to consult. By examining past tax data, businesses can identify areas for potential tax savings, prepare for expected tax payments, and make informed decisions to enhance their tax status going forward.

All things considered, taxes and tax reporting are crucial parts of the accounting module since they aid in decision-making, permit tax planning for the future, guarantee legal compliance, ease financial planning, and establish tax responsibility. Businesses must keep up-to-date and accurate tax records to comply with tax regulations and support effective financial management.

Odoo 17 accounting also provides advanced reporting features for handling and analyzing taxes. Businesses can produce tax reports that provide a comprehensive account of tax transactions, tax liabilities, and tax payments. These reports help businesses track their compliance with tax rules, calculate their tax liabilities, and make informed financial decisions. Businesses may identify trends, comprehend their tax situation, and assess the impact of taxes on their financial performance with the help of Odoo 17's reporting features.

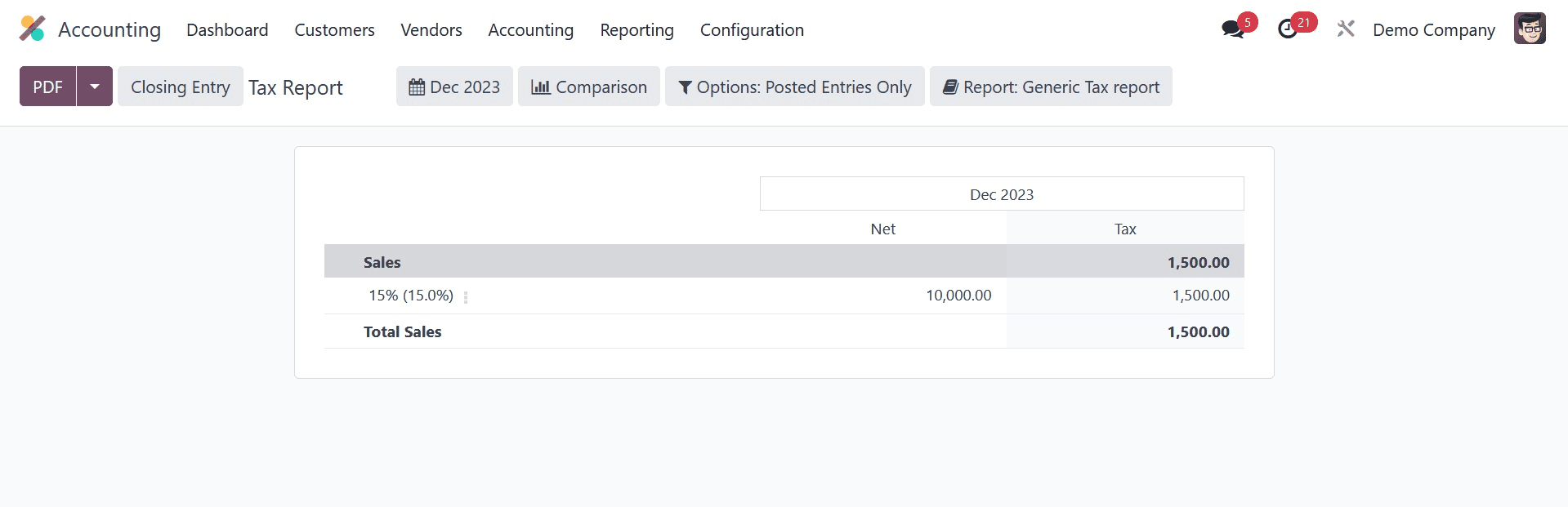

The tax report page will appear as indicated in the screenshot below when you choose the tax report option from the reporting menu.

Comprehensive reports on sales and purchase taxes can be generated using the Tax Reports platform, which can be accessed through the Reports menu. Using the Closing Entry option, you can file the return tax for the selected period.

Using the supplied icon, you can also obtain the tax report in PDF format. Any organization's accounting practices need to incorporate efficient tax management. Precise tax adjustments are necessary to maintain compliance with tax laws and ensure accurate financial records. Odoo 17 accounting provides strong features and capabilities for effectively modifying taxes. In this blog post, we will walk through the whole process for modifying taxes in Odoo 17 accounting. The first step in adjusting taxes in Odoo 17 is to configure the tax settings.

Navigate to the accounting settings in Odoo and choose the "Taxes" option. You can specify the tax laws, rates, and tax codes here, based on your company's tax needs. You can create several tax rules and rates in Odoo 17 to support different tax jurisdictions or tax kinds. Calculate taxes based on the applicable tax rates, exemptions, and tax categories, as well as your local tax legislation.

After the tax settings are configured, taxes are assigned to products and services. In Odoo 17, every product or service has the potential to be linked to a specific tax code or tax law.

This ensures that taxes are computed and applied automatically when generating invoices or recording transactions involving certain items or services. In Odoo 17, while creating or editing a product or service, you have the option to select from a dropdown menu the applicable tax codes or tax rules. This organization ensures that the correct taxes are applied when invoicing or documenting transactions.

Odoo 17 is also quite adaptable in handling complex tax scenarios. It lets you define tax rules based on a range of variables, such as the location of your clients, the types of products you offer, or unique situations. This enables businesses to adhere to specific tax exclusions, distinct tax rates, or other unique tax requirements.

Because of the established tax settings and product links, Odoo 17 automatically computes and applies taxes when generating invoices or recording transactions. The tax amounts are computed based on the chosen tax regulations and rates, accounting for the good or service being invoiced or transacted. Automation reduces the chance of human error and ensures accurate and consistent tax calculations throughout the accounting process.

However, there may come a moment when tax adjustments are necessary. These adjustments may be required to correct errors, request exemptions, or address special tax situations. Odoo 17 provides possibilities for tax changes for specific invoices or transactions. When reading an invoice or transaction in Odoo 17, you can access the tax lines and make the necessary modifications to the tax amounts, tax codes, or manual tax adjustments. It's important to exercise caution and ensure that any tax adjustments are well-justified and documented.

When there are frequent tax revisions or complex computations involved, Odoo 16 gives you the flexibility to create custom tax rules or formulas. These rules or formulae can be adjusted to deal with specific tax scenarios such as multi-tiered taxes, compound taxes, or tax computations based on certain conditions. The ability to create custom tax rules or formulae in the Odoo 17 accounting system enables firms to effectively manage complex tax requirements.

Maintaining accurate financial records requires routinely reconciling tax accounts. In Odoo 17 accounting, tax accounts are used to track tax amounts in addition to other financial activities. The company's tax liabilities and payments are displayed in these tax accounts.

Tax accounting is capable of being reconciled in Odoo 17. This feature allows you to connect tax payments or refunds to the corresponding tax responsibilities. Reconciling tax accounts ensures that the tax liabilities are accurately reflected in the financial records and assists in identifying any errors or inconsistencies in tax transactions.

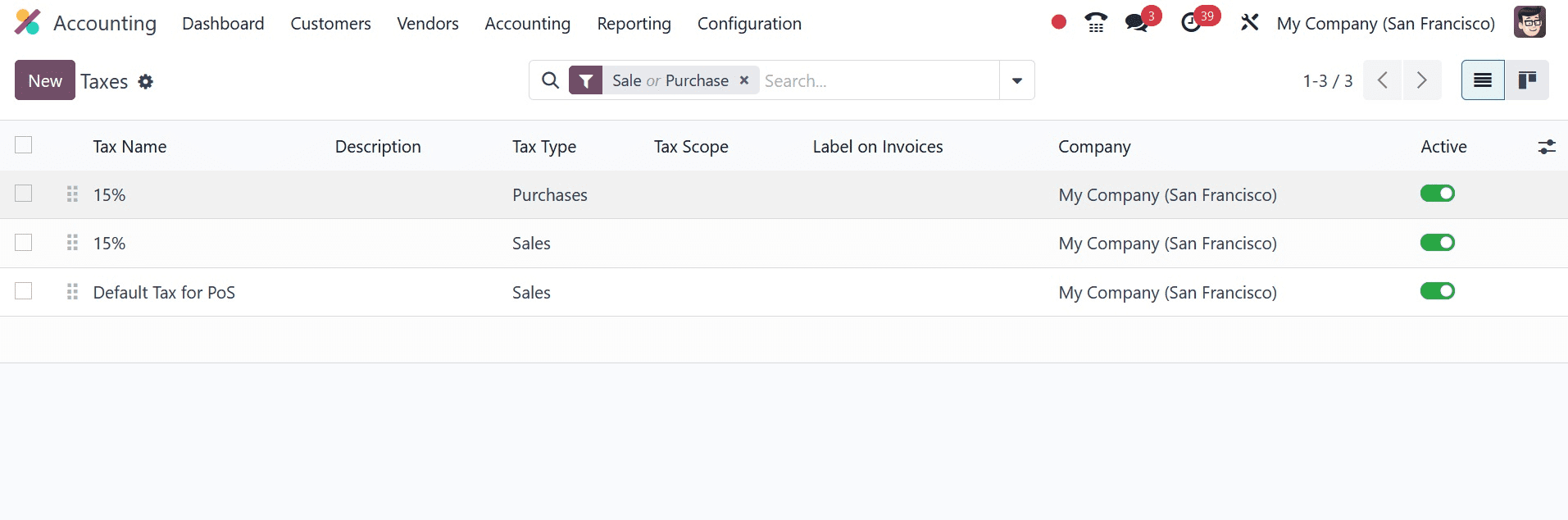

Tax calculation is one of the challenging accounting management duties that requires accuracy in its implementation. Even a small arithmetic error puts your business in danger. Since the release of the Odoo Accounting module, tax computation has gotten significantly simpler. Through the module's Configuration menu, you may get to the Taxes platform, where you can manage sales and purchase taxes.

One can arrange the easily accessible tax list based on Sales, Purchases, Services, Goods, Active, and Inactive. You can classify them based on the firm, tax type, and tax scope. The user can completely customize the Group By and Filters options. Now click the Create button to set up a new tax.

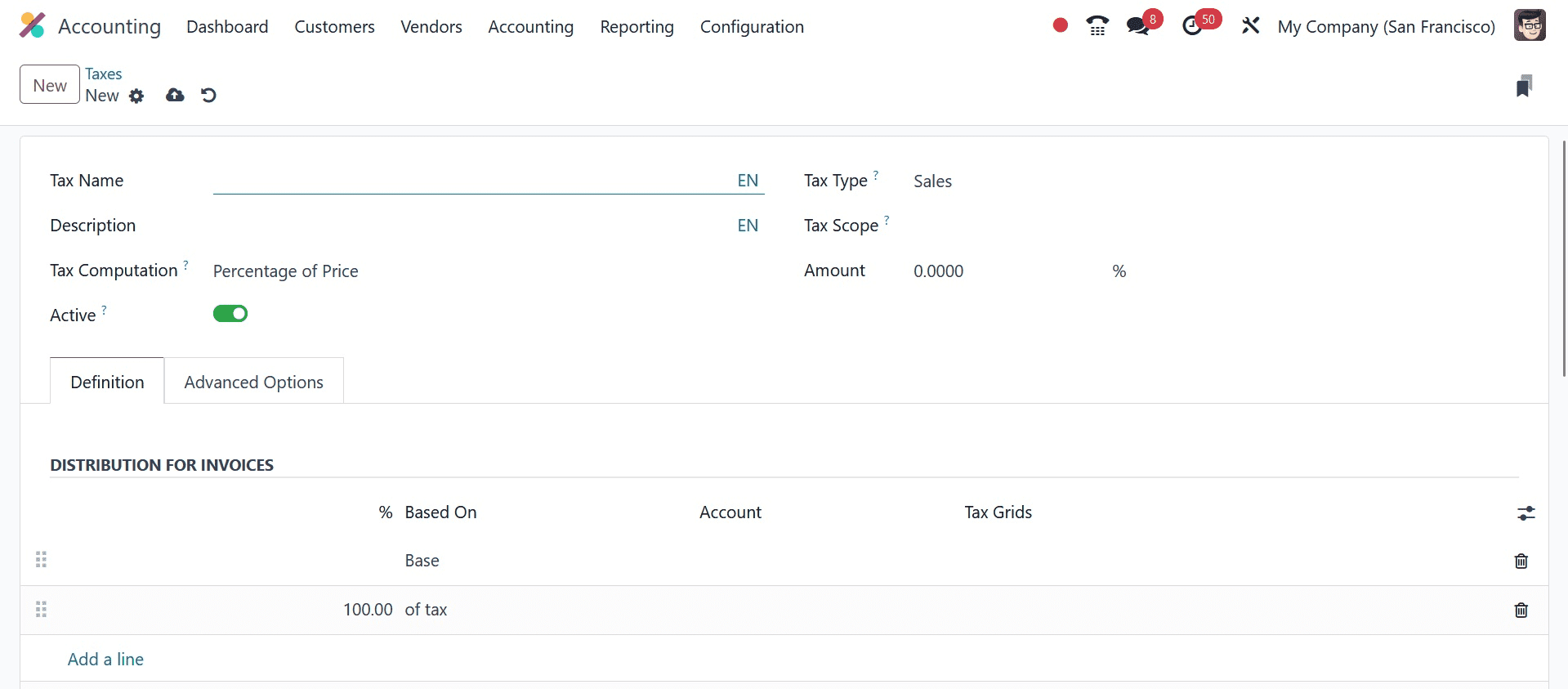

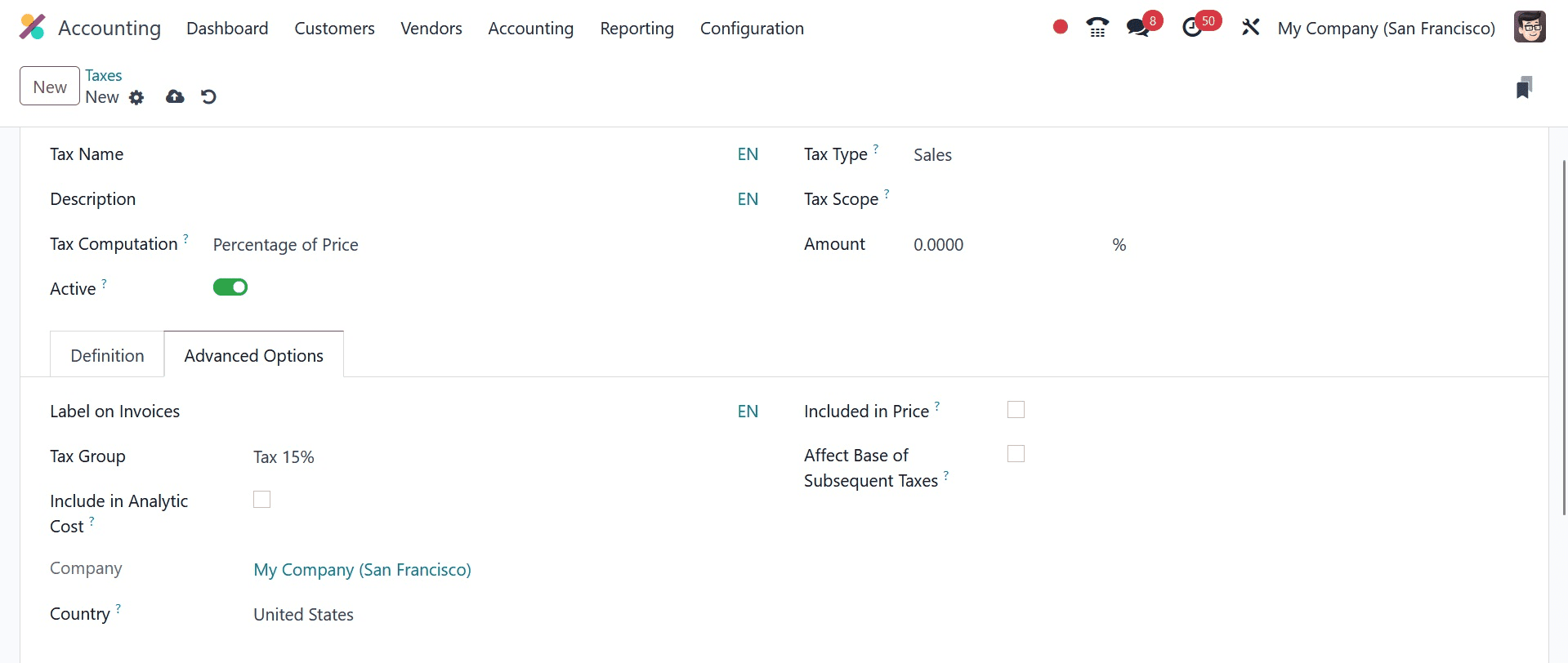

Give the new tax a name in the Tax Name field. There is a choice between the purchases and sales tax types. It selects the regions in which the tax is selectable. When the value is "none," the tax can be levied to a group but not to an individual. You can restrict the application of taxes to a certain class of items by selecting the relevant option in the Tax Scope box. To hide the tax, change its Active property to false without deleting it.

To indicate how taxes will be computed, use the Group of Taxes, Fixed, Percentage of Price, Percentage of Price Tax Included, and Python Code options in the Tax Computation field.

The tax in the case of the Group of Taxes is essentially a collection of sub-taxes, and the total tax is determined by using the sub-taxes.

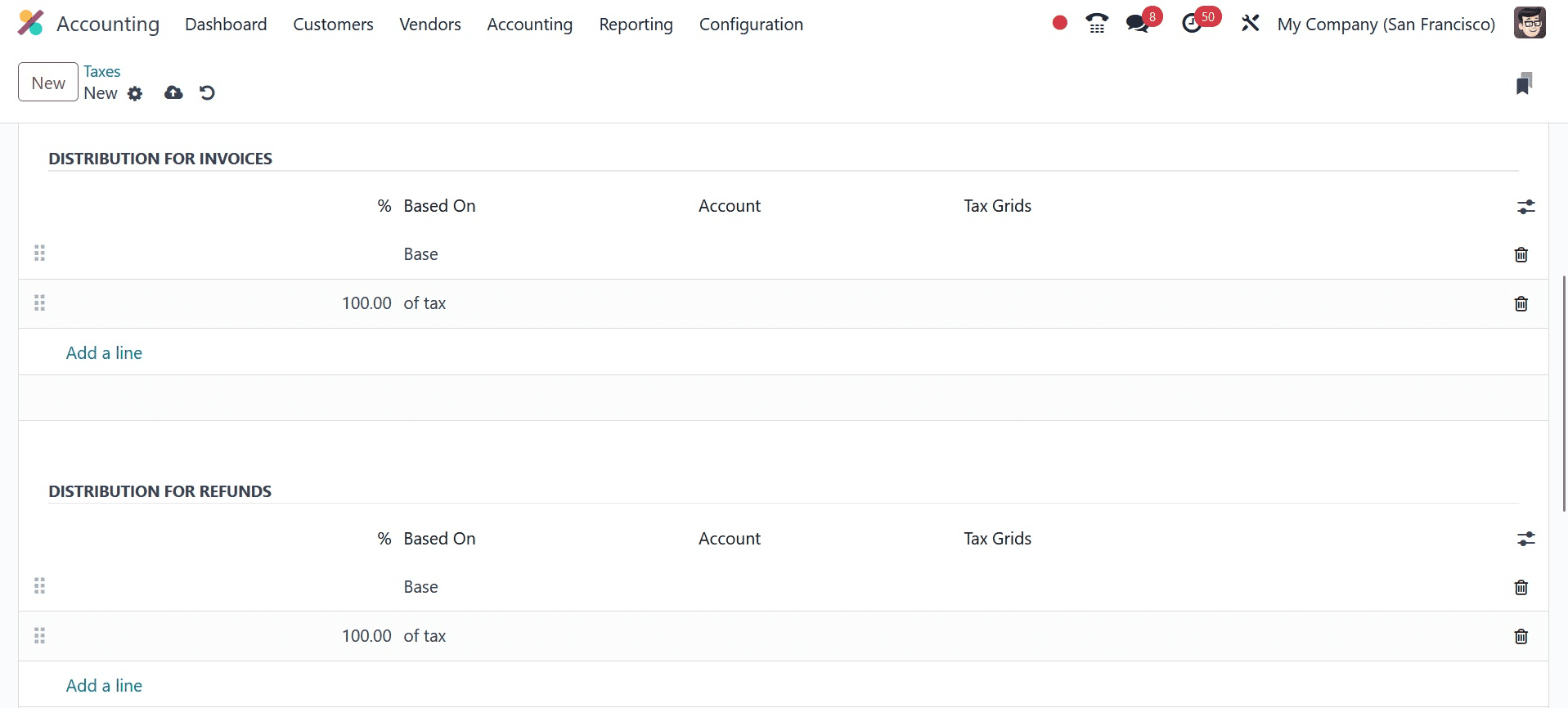

You can add the sub-taxes under the Definition tab one at a time by using the Add a Line button.

Under the Advanced Options menu, you may find information about the Company and the Country.

The tax amount is fixed when Tax Computation is set to Fixed, irrespective of the cost. The tax amount can be set as a particular percentage of the actual price by selecting the Percentage of Price tax computation option. The tax amount will be determined as a percentage of the actual price when using the Percentage of Price Tax Included technique. The tax can also be computed using Python code with the help of the Python Code option. The settings for each of these procedures are the same.

To establish the distribution for invoices and refunds separately under the Definition tab, use the Add a Line button to select the base on which the factor will be applied, the account on which to post the tax amount, and the tax grids.

By selecting the Label on Invoice option from the Advanced Options menu, you can include them in invoices. Select the most suitable Tax Group from the list of alternatives. By turning on the Cash Basis function, you can set up taxes on a cash basis. You can activate this option, which will add an entry for those taxes to a specific account during reconciliation if the taxes must be calculated on a cash basis.

You can provide information about the Base Tax Received Account and Tax Cash Basis Journal in the relevant areas.

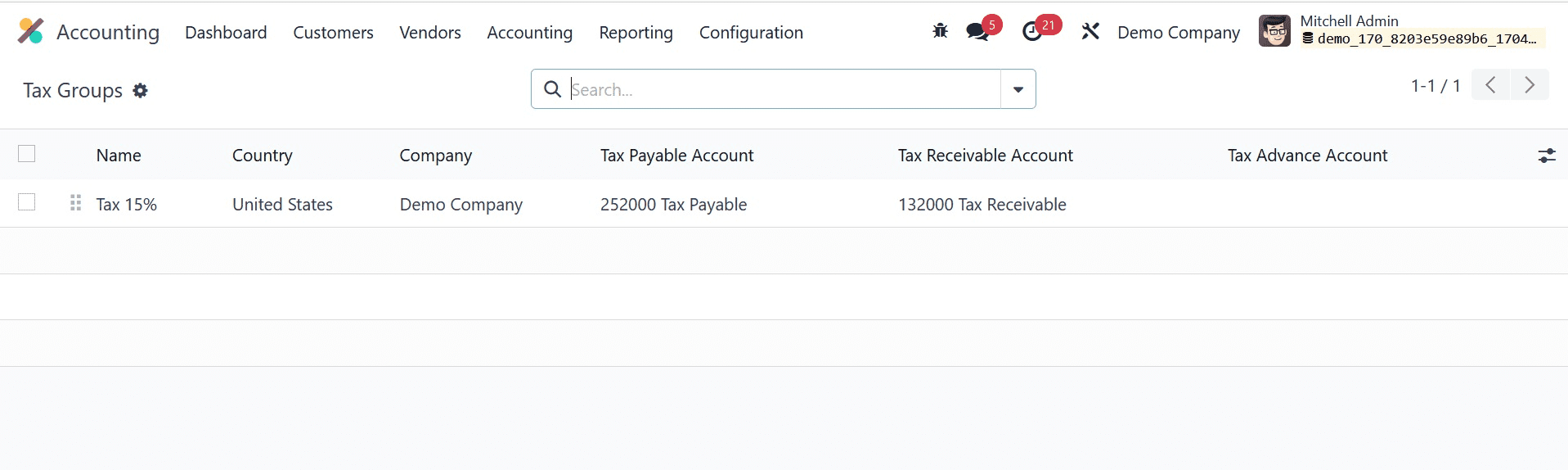

Depending on how your company runs, you may use these taxes on products, services, suppliers, companies, and accounts. You may view the list of Tax Groups that Odoo presently supports via the Configuration option in the Accounting module, as seen below.

The list view provides information on Name, Country, Tax Payable Account, Tax Received Account, and Tax Advance Account.

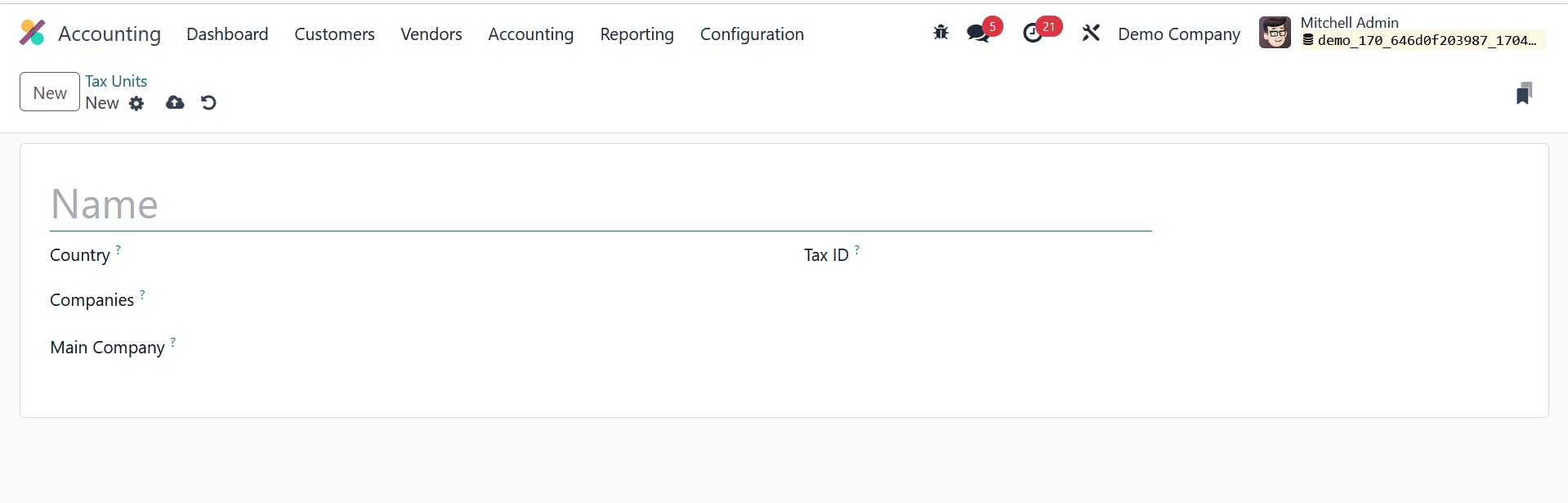

The Tax Report Declaration in the Accounting module is grouped using the Tax Unit option in the Configuration menu. The new Tax Units configuration window will show up, as seen below.

After giving the taxing unit a title, you can designate the nation in which this taxing unit is utilized to compile the tax report declaration for your business. The Companies and Main Company (the organization in charge of filing and paying taxes) can be included in the relevant spaces. The identifier to be used when filing a report for this unit can be changed and added to the Tax ID field.

Tax Defaults

The default taxes in Odoo will be selected for you automatically if no other taxes are specifically mentioned in financial operations. These tariffs will be applied automatically during the configuration of new goods. Later on, the product form will allow you to change it. This will also be utilized in the local translation if no other taxes are available.

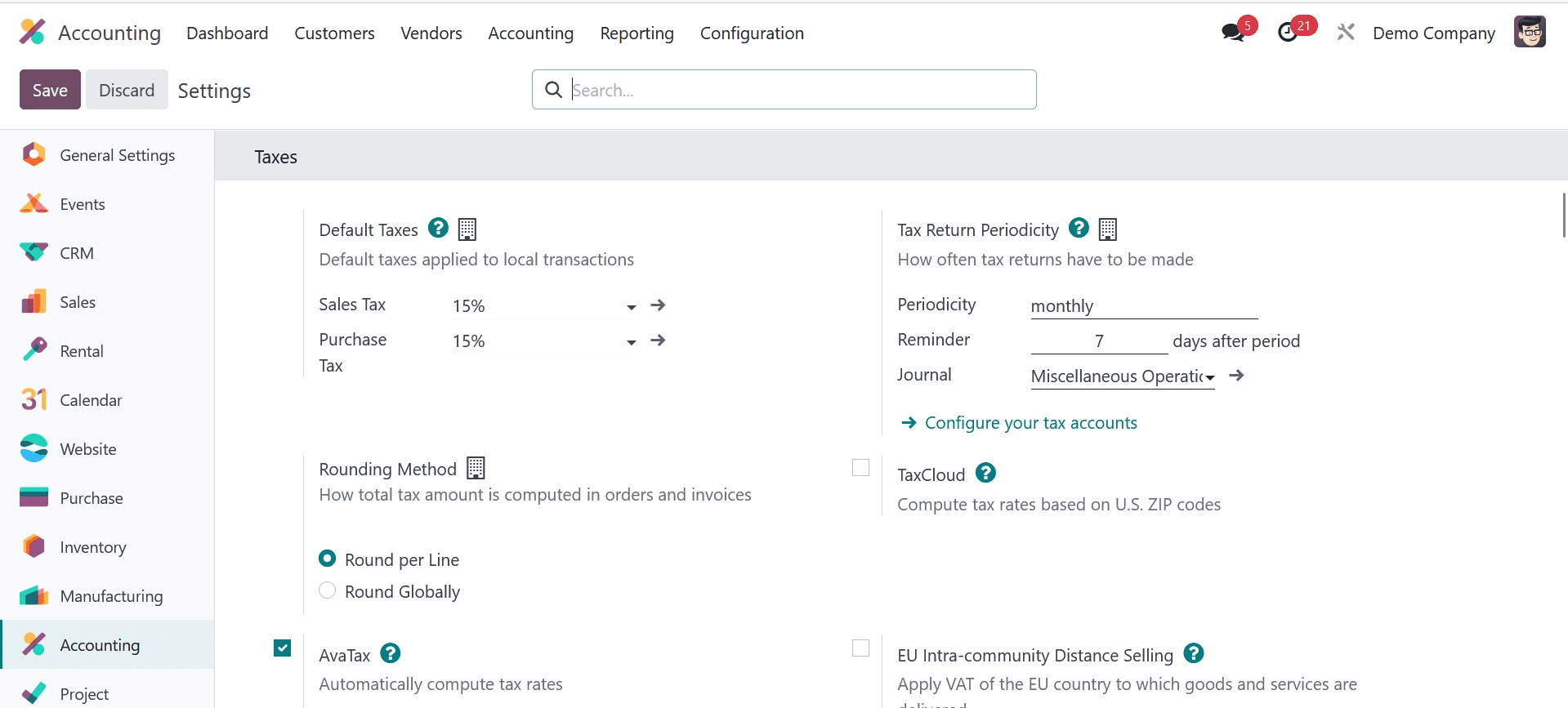

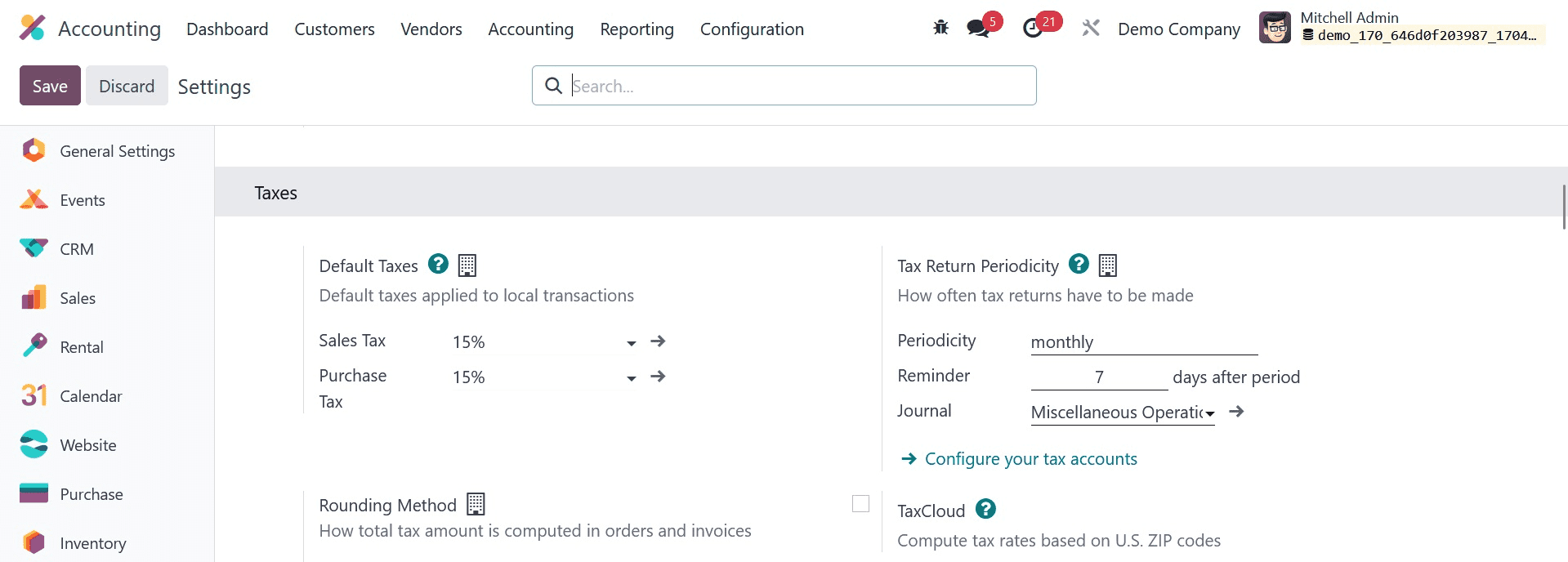

As seen in the above figure, you can change the Default Taxes for sales and purchases within the Settings menu of the Accounting module. By utilizing the internal link found in the default taxes area, you can modify the sales and purchase taxes. The Tax Return Periodicity parameter specifies the frequency at which tax returns must be filed. To enter tax returns in the relevant fields, utilize Periodicity, Reminders, and Journals.

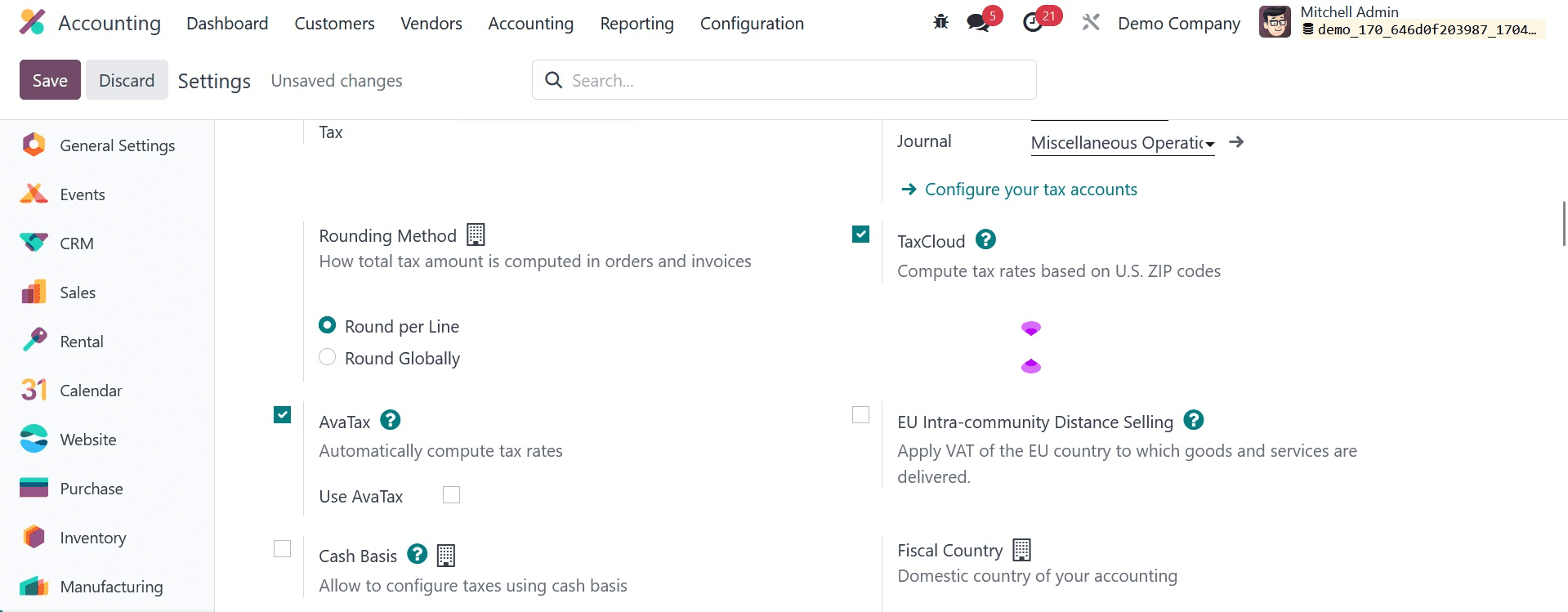

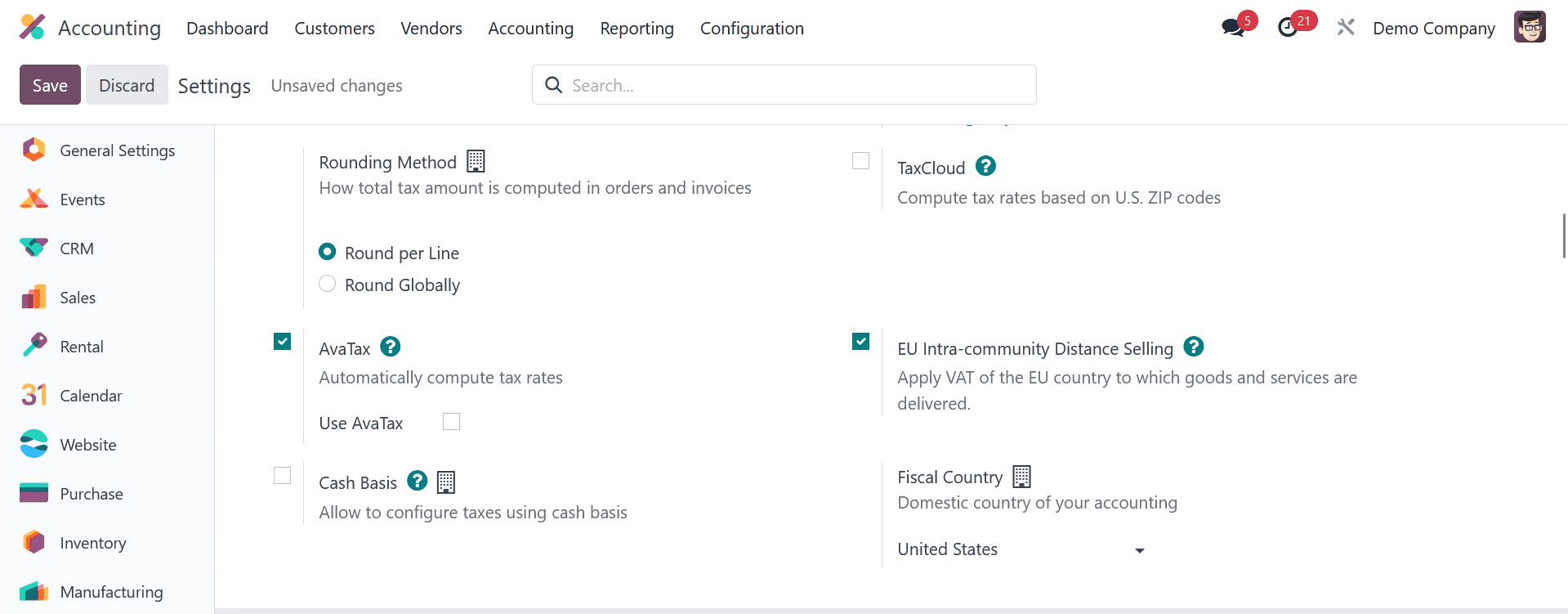

Use the Rounding Method section to indicate how orders and invoices calculate the total tax amount. Here, you can choose between rounding worldwide or rounding per line. Rounding each line independently is advised if tax is included in your pricing. The line subtotals are added to determine the total with taxes. In the Cash Discount Tax Reduction area, you can define the conditions that will apply when a cash discount is given. It can be configured to Never, On early payment, or Always (upon invoice). With this new feature, the Odoo 17 Accounting module is now capable.

Tax Cloud

If you activate the TaxCloud feature from the Accounting module's Settings menu, Odoo can compute the tax rates depending on U.S. Zip codes. In the designated fields, you can input the API ID, API KEY, and Default Category.

The default category will be used if no tax cloud is selected for any products or product categories. You can define many tax cloud categories using the Configuration menu of the module. The Management tab of the Configuration menu contains the TaxCloud Categories. This is where you can establish a new category by providing the TIC Description and TIC Code.

The tax computation service Avatax automatically determines the tax rates. In the relevant fields, make mention of the Environment, API ID, API KEY, and Company Code. Use UPC, Commit Transactions, and Address Validation should all be enabled if needed. Once you have provided enough information, you can configure products and product categories to have Avatax categories. It is useful to have the option to automatically compute taxes on orders and invoices.

VAT has to be applied when selling goods and services to customers in another European Union country, depending on the delivery address. To enable this feature, navigate to the Settings menu in the Accounting module and turn on the EU Intra-community Distance Selling option, as shown below. This guideline is relevant no matter where you are.

Odoo will automatically determine the proper tax and fiscal positions required for each EU member state based on your country. And this is how we manage taxes in Odoo 17 Accounting.