A down payment is a common factor used in various business organizations allowing the customers to pay a percentage of amount while ordering and paying the balance at the time of delivery. The down payment functionality comes as an add-on feature in every business organization allowing them to attract customers and business opportunities. The down payment facility can be seen in all modern applications of business from the online business platforms to regular shops. The down payments can be done for a fixed amount or a fixed percentage as per the choice of the company. The Odoo 13 platform has the feature to establish down payment in both ways of a fixed amount and fixed percentage as it varies across business organizations.

In this blog you will learn about:

Down Payments in Odoo 13

In the Odoo platform down payment is created as a separate product and is activated upon the request of the user. The down payment option for a sale can be enabled while invoking the check out an order which is available in the invoicing menu of the sales. The down payments in Odoo can be clearly explained with the help of an example of a sale.

How to Setup Down Payments in Odoo 13

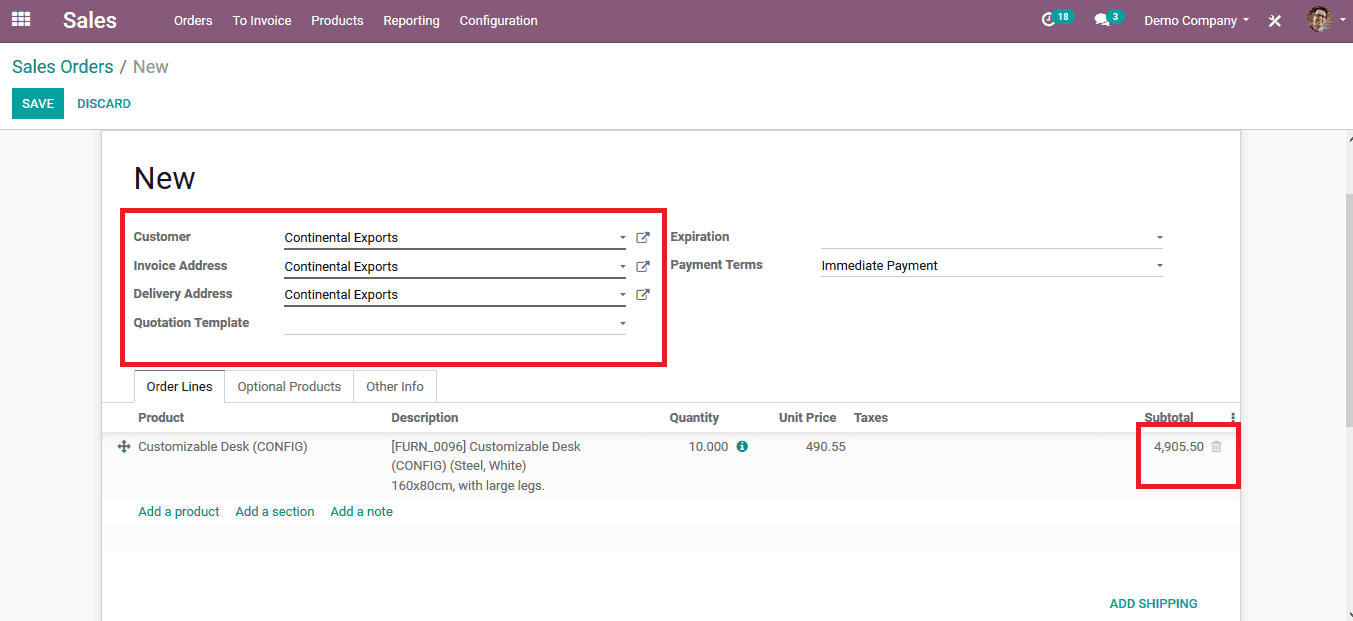

Step 1: Initially to enable down payment create a sales order from the sales module and fill in all the details. Choose the available products and avail the number of units needed. Check for the total amount down below the products.

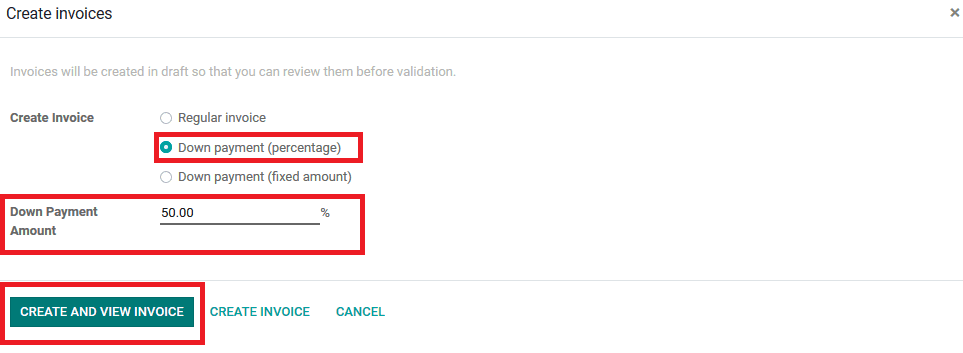

Step 2: save the sales order after filling in all the details and opt for the option to create an invoice. Upon choosing to create the invoice a pop-up window opens up as shown below in the image.

Step 3: Choose the option for invoicing as per the user needs.

Regular invoicing generates a normal invoice as of the general operation. In case of down payments, the user can avail two options. One with a fixed amount and another with a fixed percentage. Both are used in various business organizations as per their terms and conditions.

Upon selecting the required option click on create and save the invoice.

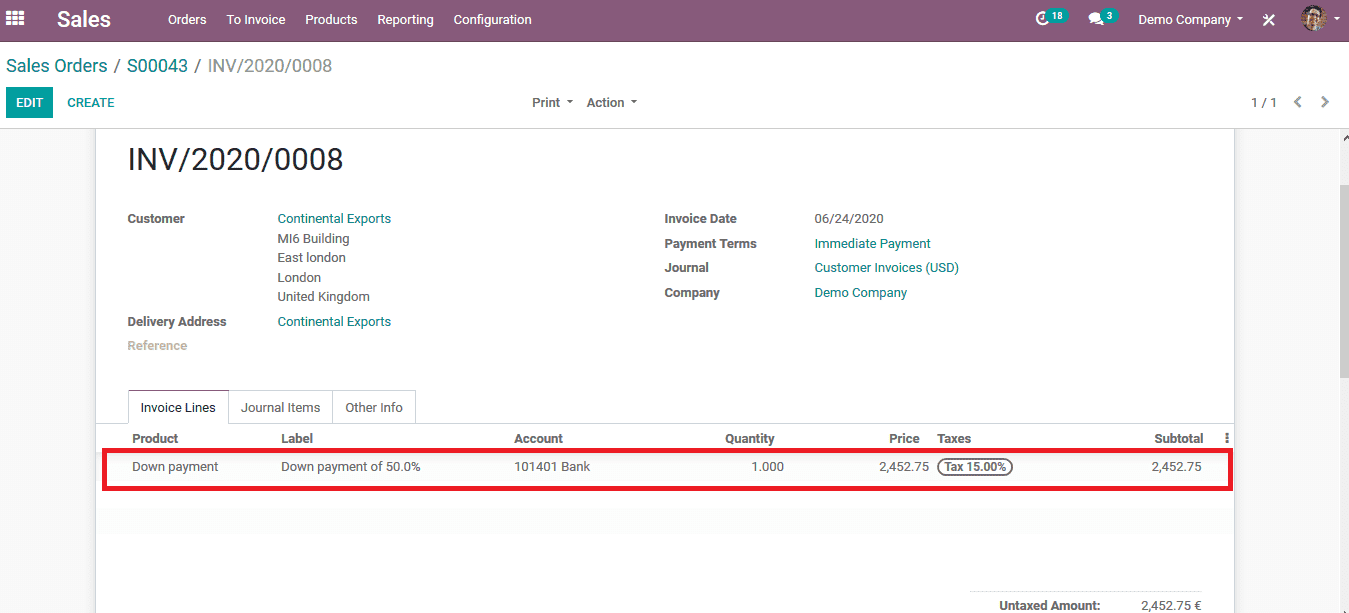

In the invoice, the user can view the details of the down payment along with the amount to pay in the initial stage of ordering.

Since certain companies have the rule to establish the initial down payment before delivery this can be availed as by validating the payment made by the customer upon checking the journal entries.

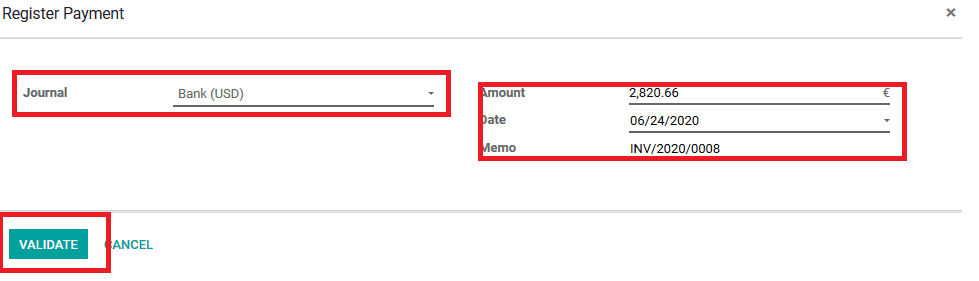

If the customer has credited the invoice amount to the company's bank account the user can check it and validate the payment by comparing it to the details in the invoice which has been generated.

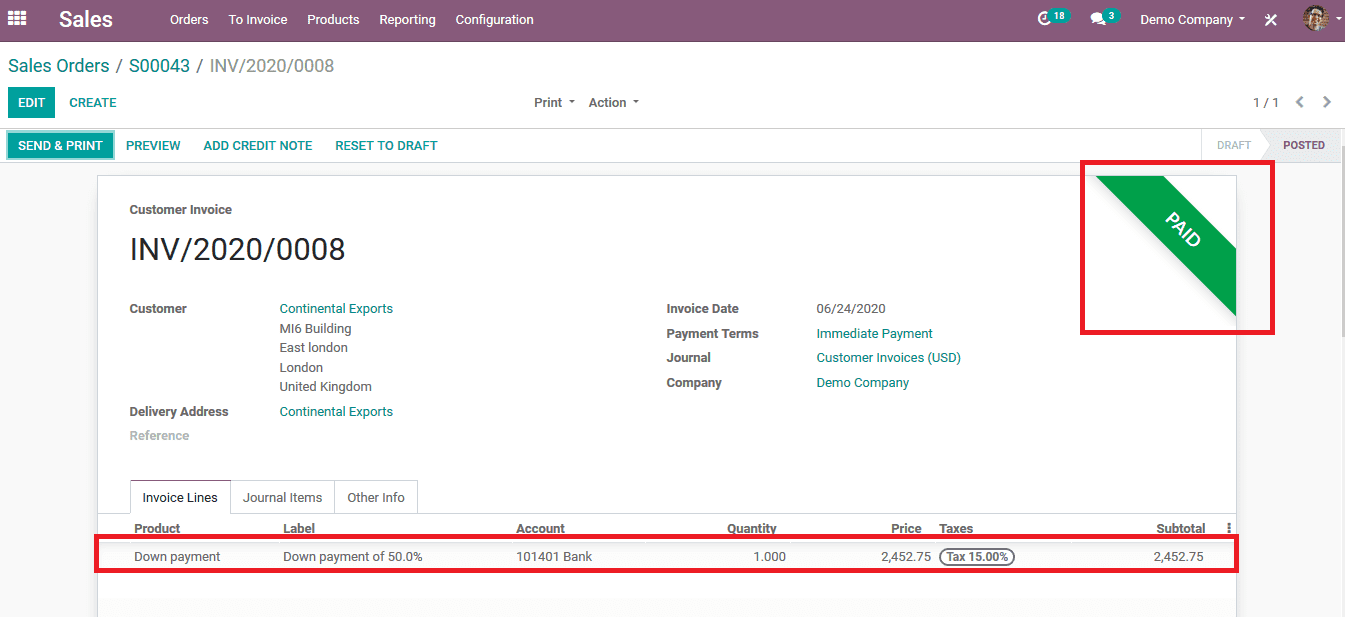

After validating the payment he user can view the invoice where it depicts the successful payment to the invoice with a paid mark on the invoice.

As the company's rule is to deduct the balance payment after the delivery only the user has to wait for the confirmation of the delivery and the number of initial units delivered in case of delivery based on the number of units.

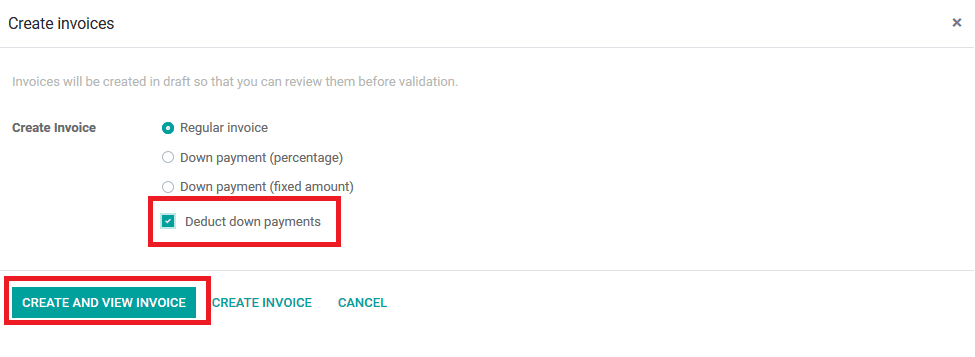

Step 4: When the customer validates the delivery the user can create the invoice for the remaining down payment. The user can do this by selecting the sales order and creating an invoice as done earlier. Since a down payment has already been made there would be a new option available to the user while generating an invoice.

To generate an invoice for the remaining amount the user can select the regular invoice and avail the deduct down payment option.

The user can also avail downpayment by percentage or fixed amount again in case of a three installment payment for the sale. Upon selecting the required option from the invoicing menu select the create and view invoice icon.

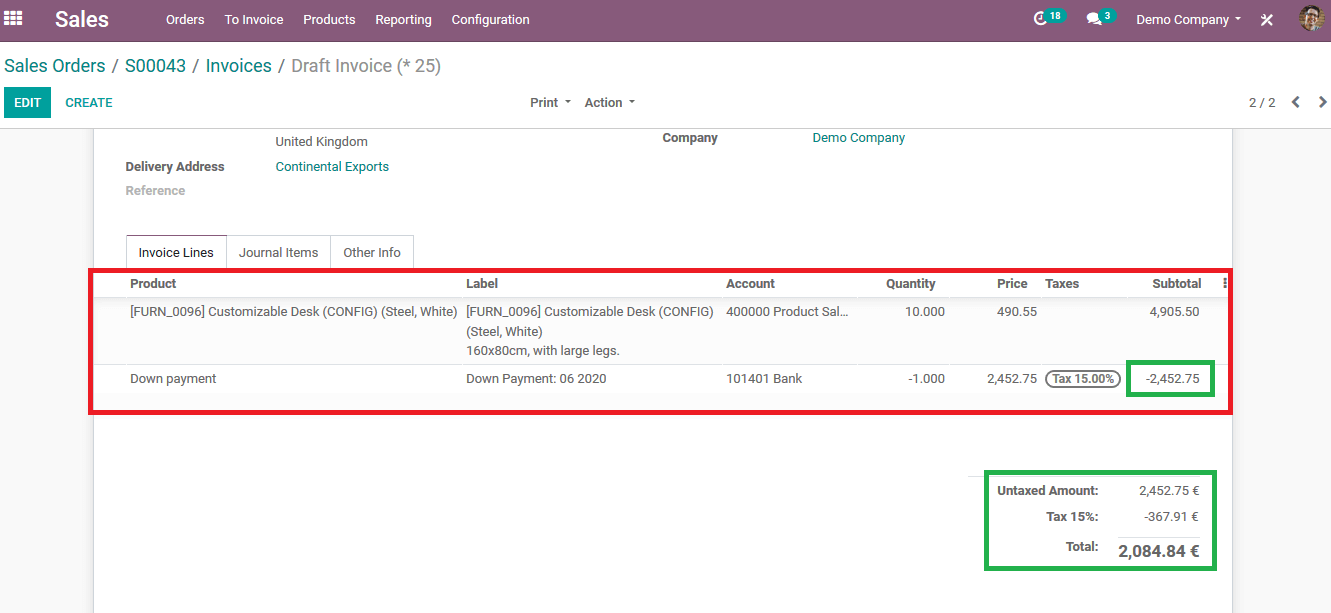

The user can view the new invoice where the down payment has been deducted from the total amount. The deduction is indicated across the downpayment in the products with a negative sign along with the amount.

The final amount of the invoice is the one that shows the down payment amount is deducted from the total amount.

The user can avail of the down payment option by the fixer amount in a similar manner to that of the fixed percentage. In the case of percentage or the amount, the user can set the fixed target according to their company policy. In certain institutions, they may charge a token amount of small value while purchasing a car, bike, or a product of high value. The use of a down payment tool from odoo can come as an ideal option for those institutions. The down payment option on an invoice can be used many times by the user considering their company policy and terms of operation.

Also Read: How to Add a Payment Method in Odoo 13