A sales tax define as a tax consumption regarding value-added taxes, excise taxes, and tariffs. National-wide federal sales tax is applied in the US by the Federal Government, and some states have avoided these taxes. Most taxes increase revenue, and temporary tax upraises specific projects in the United States. Corporate tax rates levied on earnings differ from individuals' personal taxes. Firms need help managing sales tax depending on their states. One of the right solutions to configure sales tax rates is running an ERP software in your business. You can calculate sales tax in your Country by using the Odoo 16 Accounting module.

This blog points out the District of Columbia(US) sales tax management in the Odoo 16 Accounting.

The setting of financial accounts, default taxes, chart of accounts, define fiscal positions, and more controlled easily within Odoo 16 Accounting application. Users can review the tax reports of a company each year by installing ERP software in their business. Let's view the process of District of Columbia(US) Sales Tax management in Odoo 16.

Outline of District of Columbia(USA) Sales Tax

A sales tax rate of 6% has existed in the District of Columbia, also known as Washington, DC, since 1949. Unlike other states, the state does not permit the municipal government to assemble sales tax local options. Consequently, the sales tax rate across the District of Columbia remains the same. The sales tax mainly applied to the state's clothes, hotels, parking fees, vehicle rentals, etc. Some tax exceptions are available for prescription drugs, groceries, and more.

Before registering a sales tax in Washington, DC, you must take care of some essential information. These include social security numbers, business addresses, legal forms, and formal entities. Service related to product manufacturing is taxable in the District of Columbia.

To Set Up a District of Columbia(USA) Company Information in Odoo 16

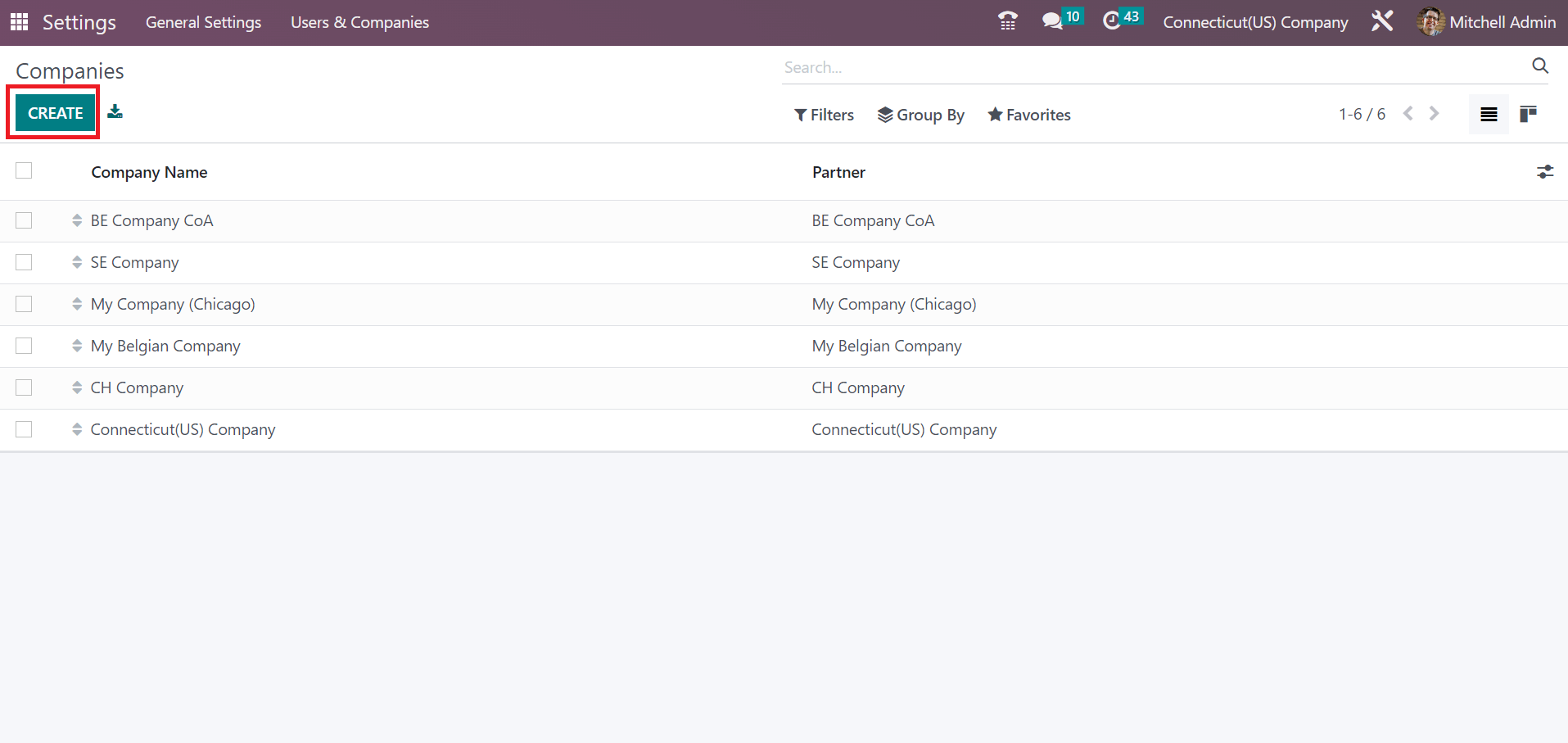

For configuring any taxes, we must set the company information related to the state within Odoo 16. You can obtain the Companies menu within the Settings window and quickly develop a new one. In the Companies window, the user can identify data related to each company, including Partner and Company Name. Select the CREATE button to generate Connecticut (US) based company information in Odoo 16, as demonstrated in the screenshot below.

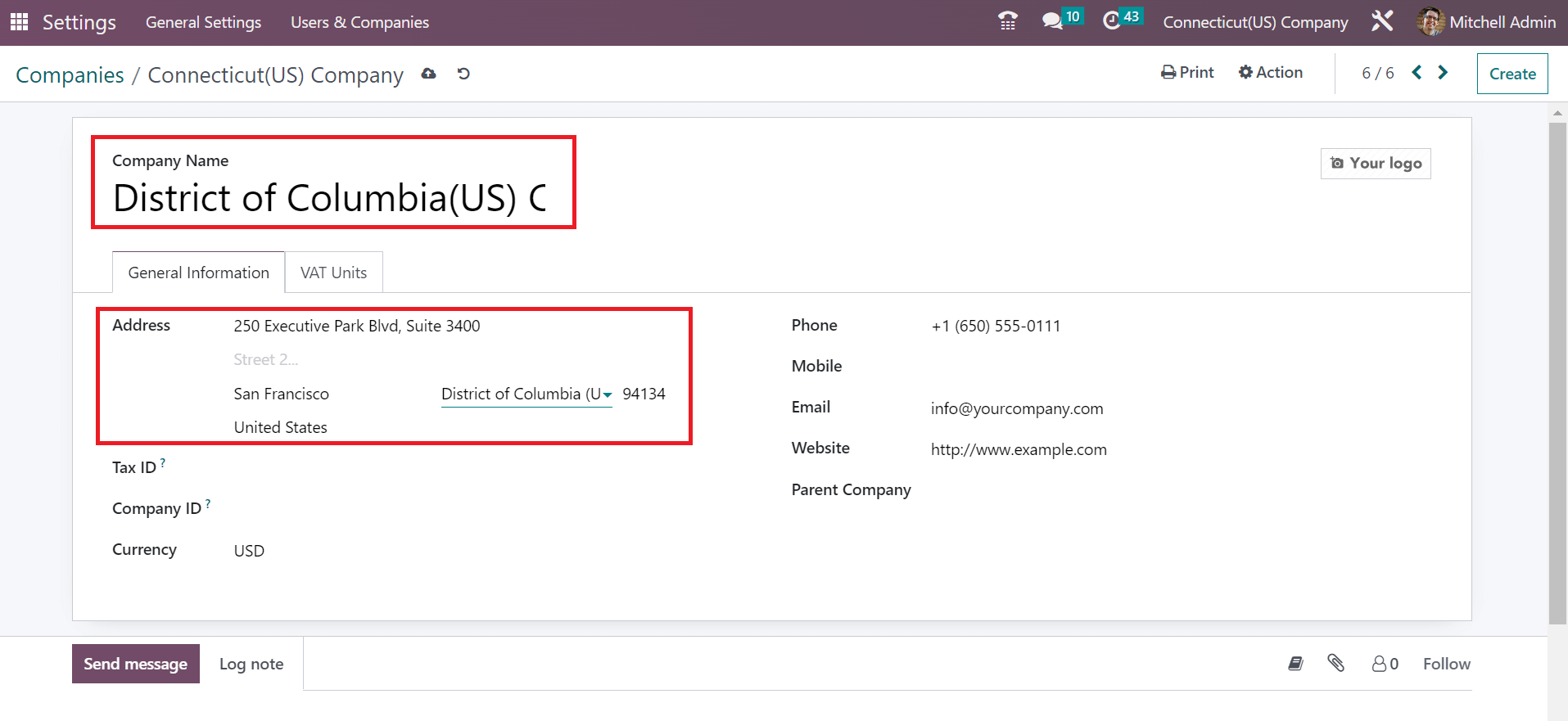

Add the Company Name as District of Columbia(US) Company in the Companies window. After, you can mention details of a company in the Address field under the General Information tab, as marked in the screenshot below.

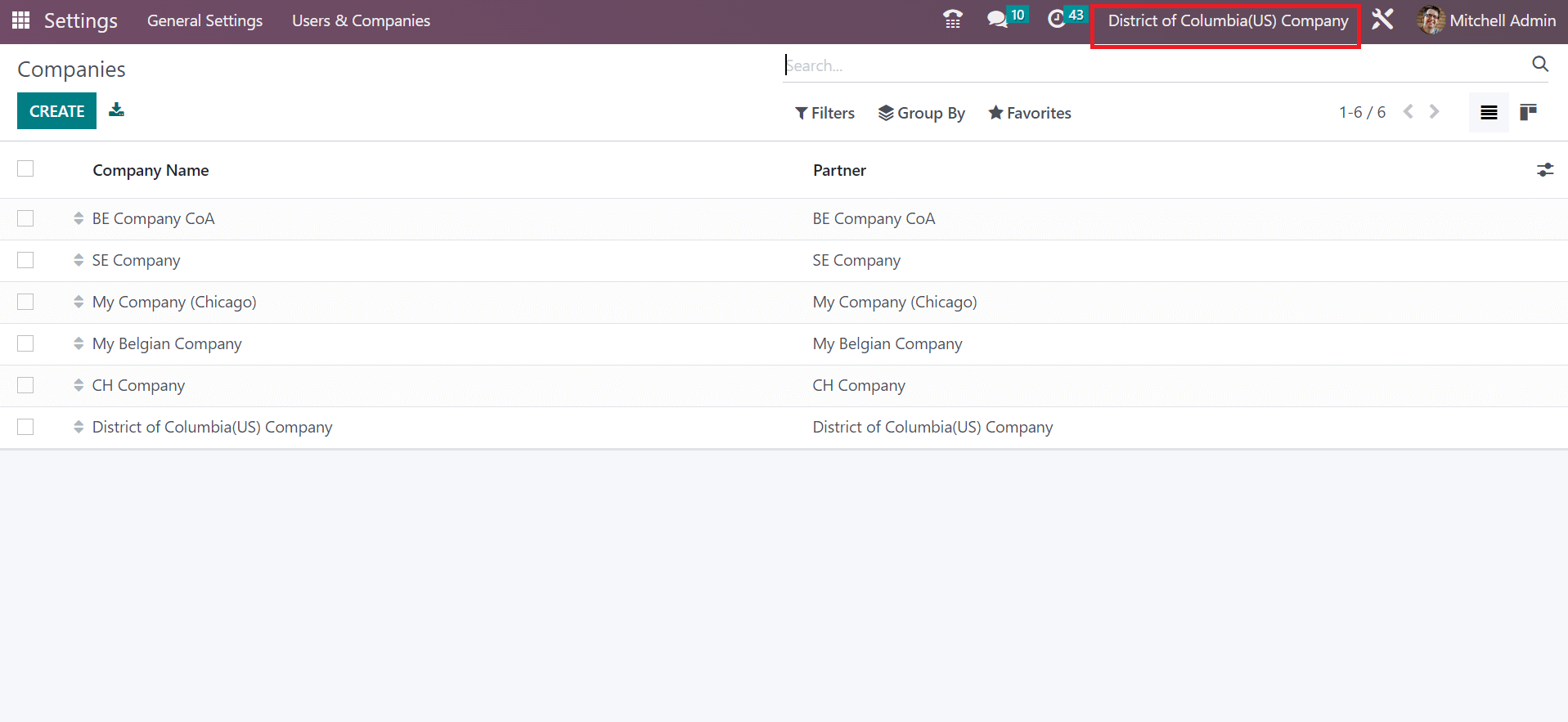

Here, you can apply the street address and city for your company. Additionally, enter the District of Columbia(US) in the state field and choose the CountryCountry as the United States, as shown in the above screenshot. Users can also add a logo concerning the company at the right end of the window. All applied information of the District of Columbia(US) Company is manually saved in Odoo 16. The created company data is viewable at the right end of the top bar of Odoo ERP, as specified in the screenshot below.

How to Create Sales Tax for the District of Columbia(USA) in the Odoo 16?

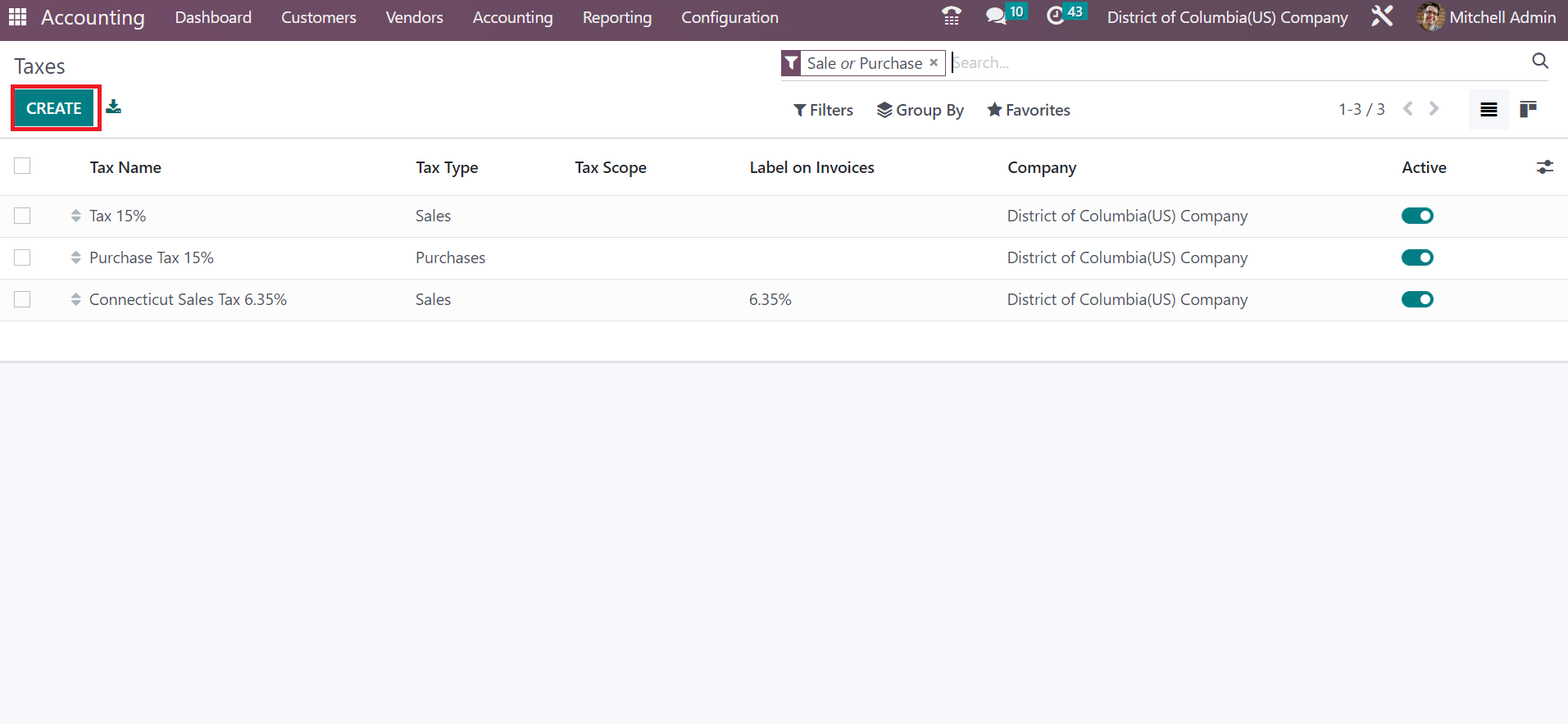

Tax configuration is made easy using the Odoo 16 Accounting application. Users can generate a sales/purchase tax by choosing the Taxes menu in Configuration. In the Taxes window, you can acquire each tax information such as Tax Type, Company, Name, and more. Click the CREATE button to produce a sales tax for your new state, as defined in the screenshot below.

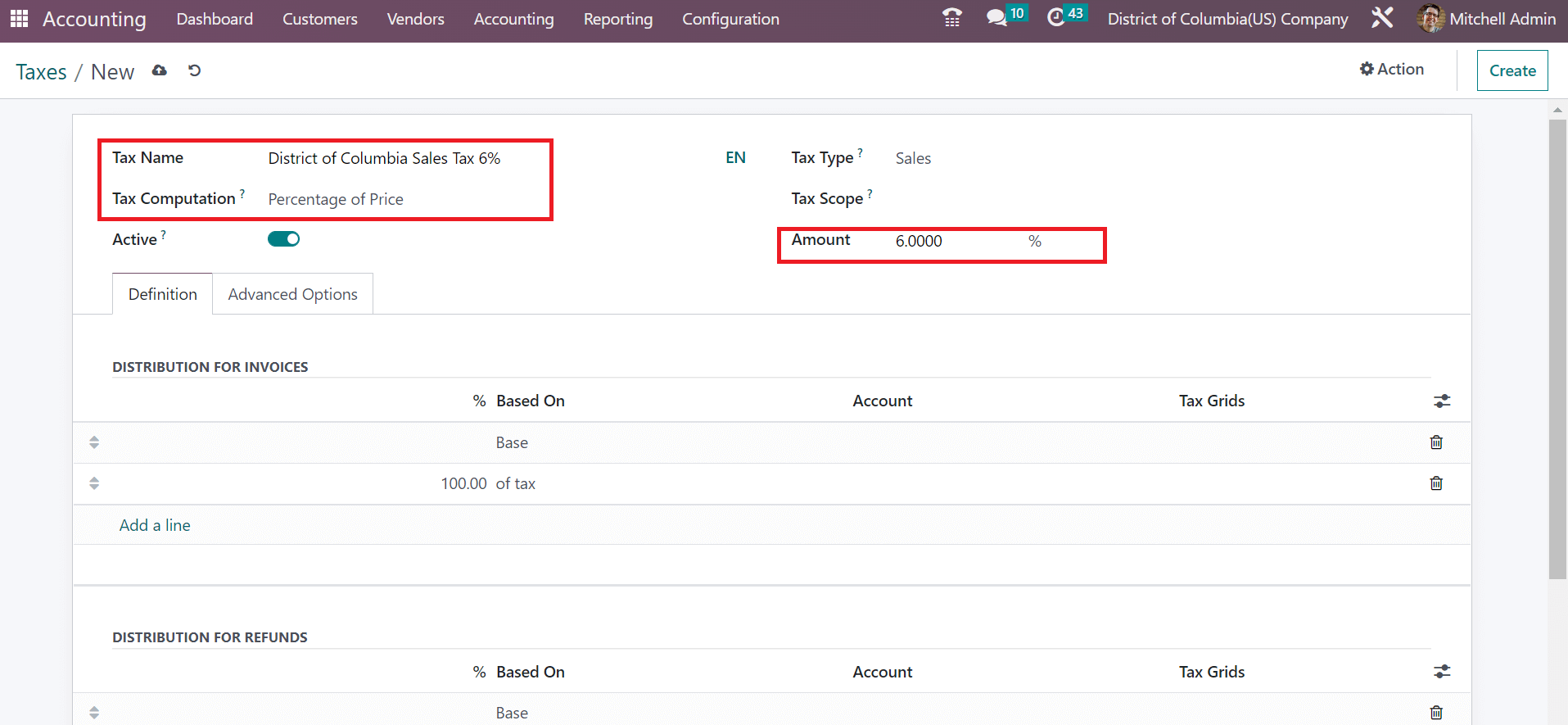

Mention your Tax Name as District of Columbia Sales Tax 6%, and you can choose the step to compute tax in the Tax Computation field. We pick up the Percentage of the Price option method to configure the District of Columbia sales tax as described in the screenshot below.

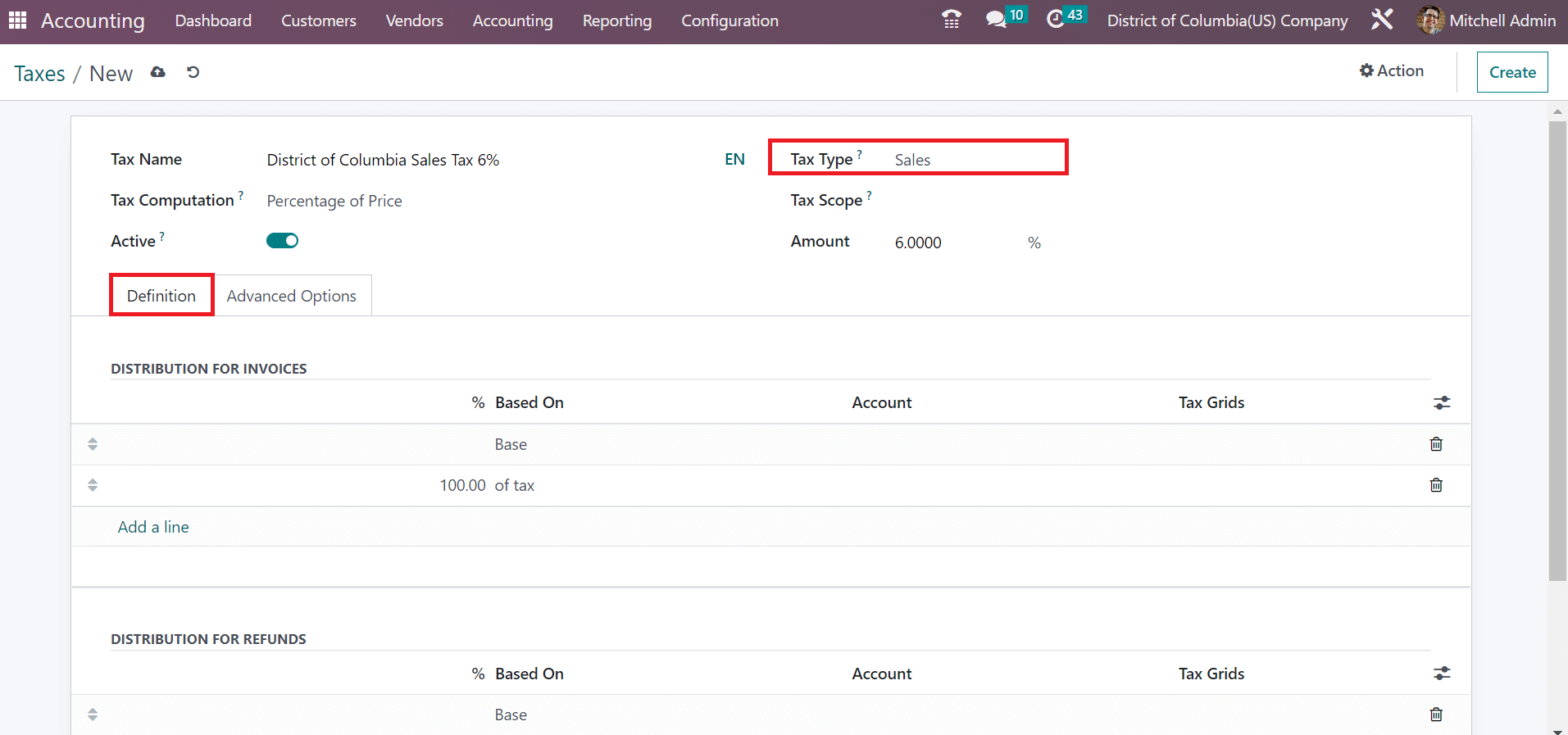

Users can add a default tax percentage to their computation method in the Amount field, as marked in the above screenshot. It is possible to alter the applied tax in the Amount option at any time. Furthermore, set a type of tax for your District of Columbia Sales Tax in the Tax Type field. We selected the Sales option in Tax Type for the Configuration of Sales tax in the District of Columbia state, as presented in the screenshot below.

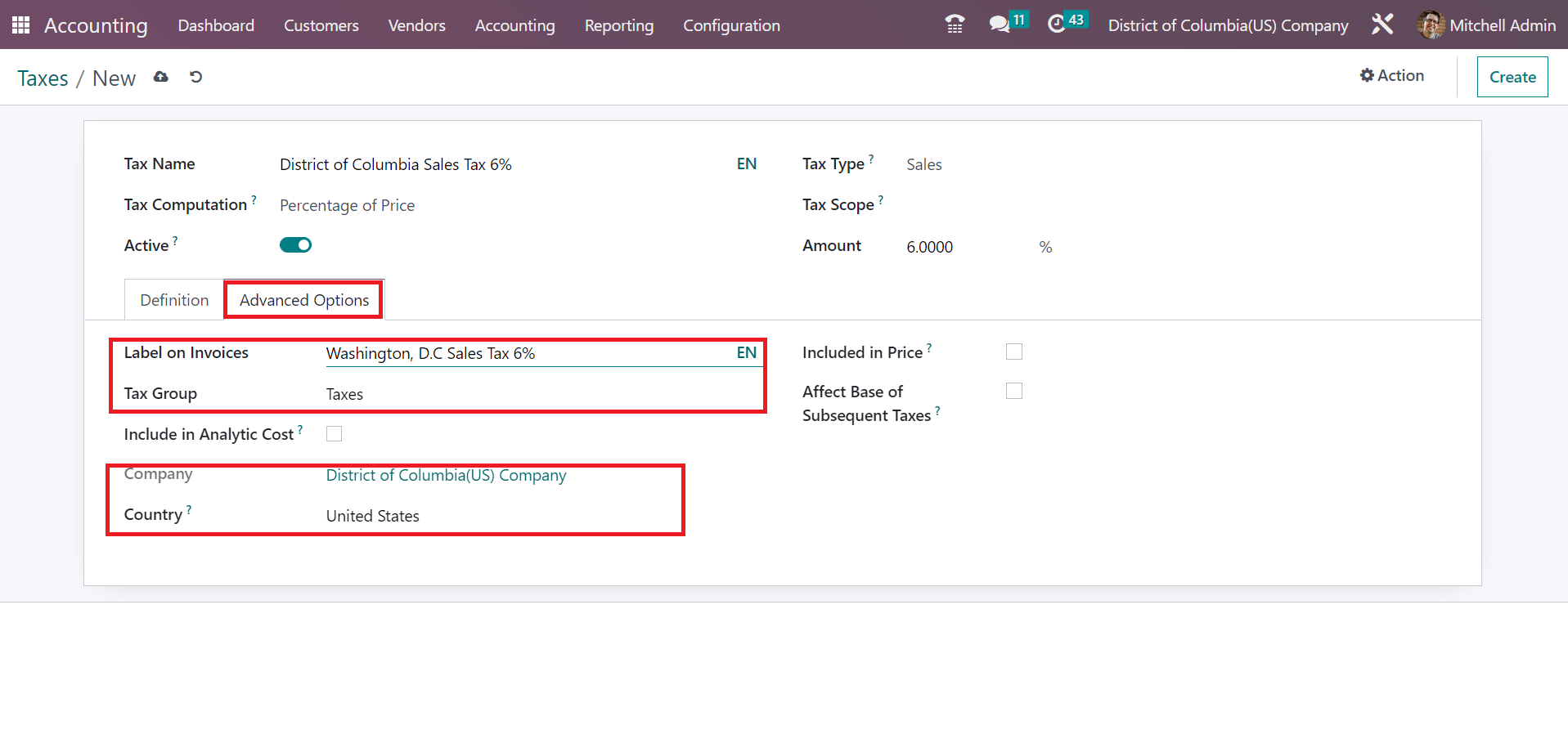

We can access advanced options for tax computation within the Definition tab. Users can perform tax configuration according to the distribution of invoices and taxes. Inside the Advanced Options tab, mention the label visible on invoices within the Label on Invoices field. Moreover, as portrayed in the screenshot below, you can select a tax group that is specified on your tax in the Tax Group field.

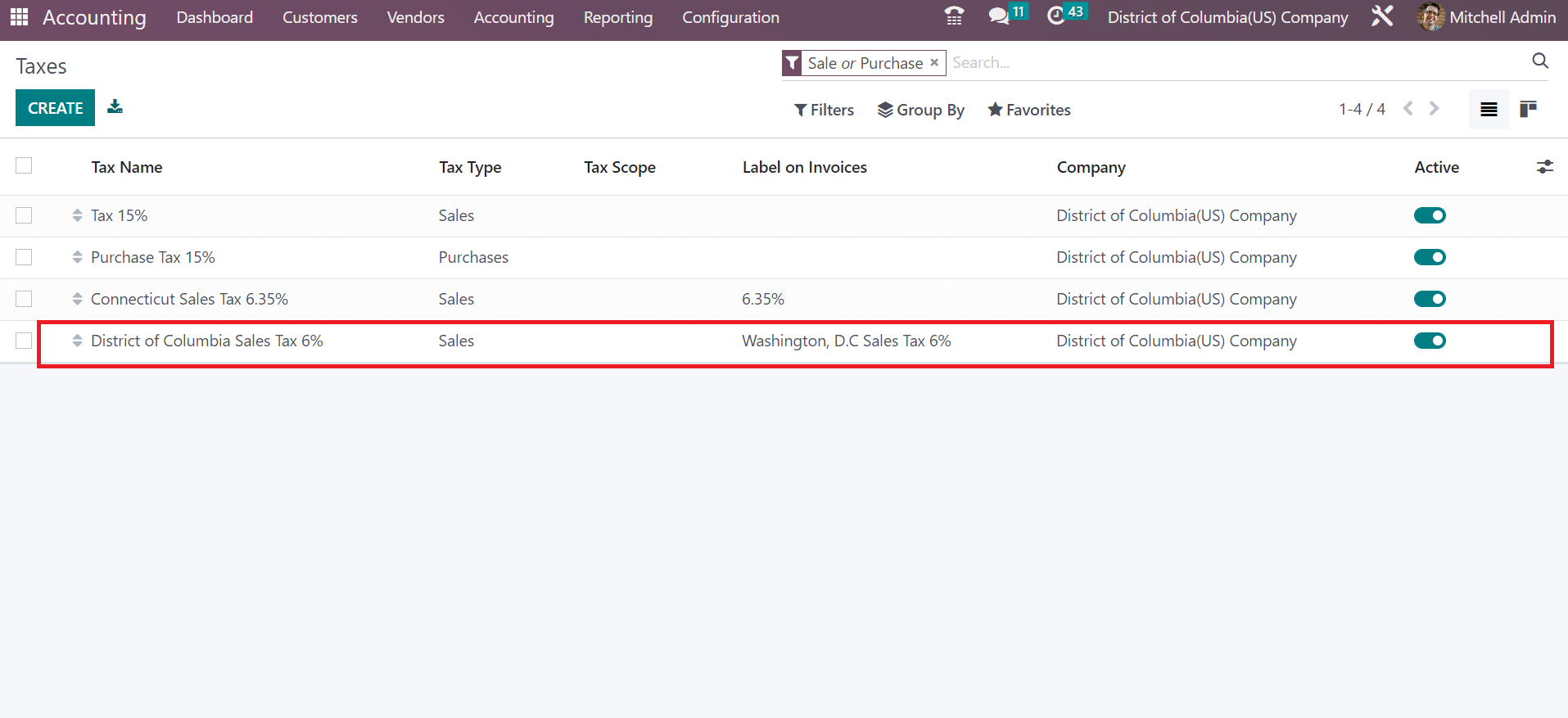

Details of Company and Country are automatically applied at the end of the Advanced Options tab. Every detail concerning the sales tax is saved in the Odoo 16 Accounting module. Your created tax District of Columbia Sales Tax 6%, is visible in the main Taxes window.

Customer Invoice for District of Columbia(USA) Company

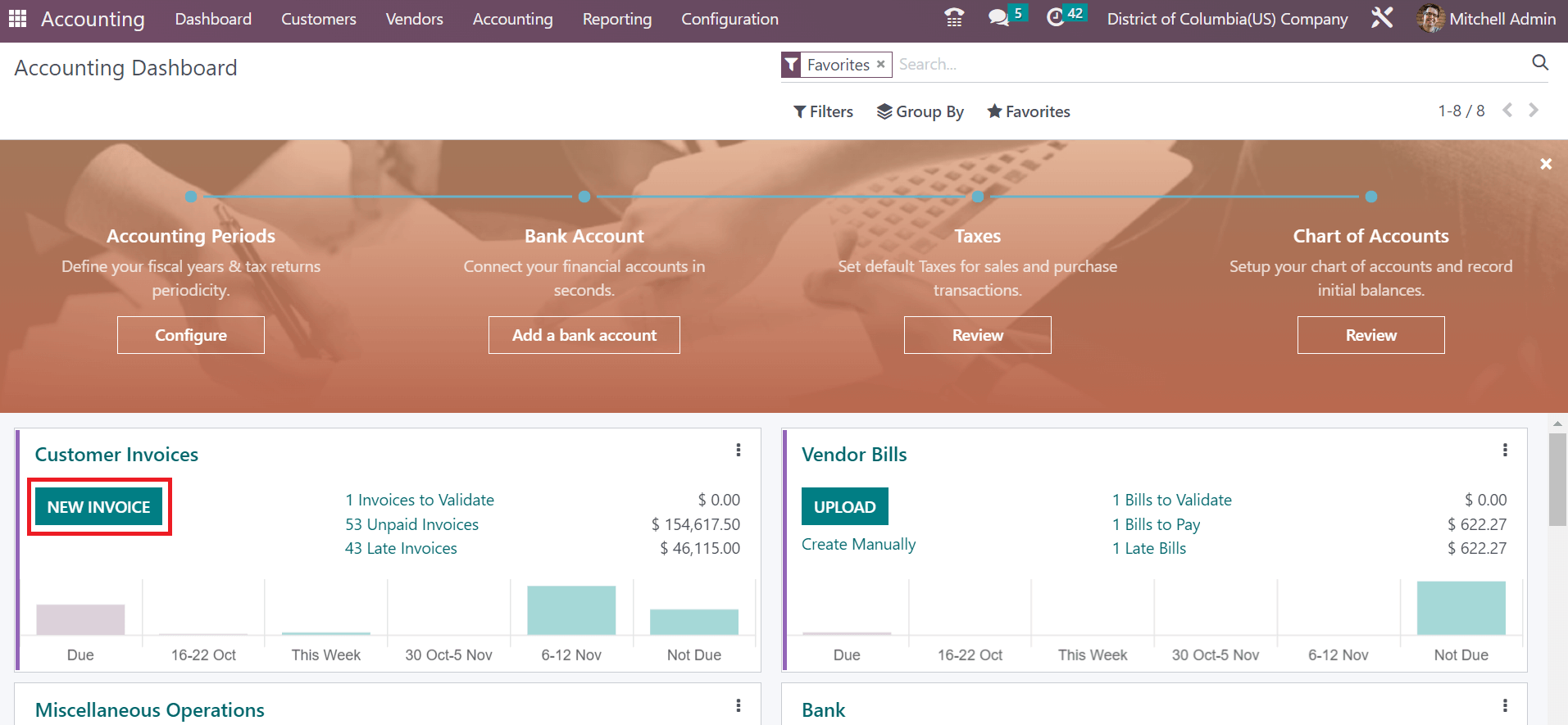

Invoice for a customer as per a particular state generate easily within the Odoo 16 Accounting module. We can define a customer invoice by moving into the Accounting dashboard of Odoo 16. Select the NEW INVOICE icon inside the Customer Invoices journal, as indicated in the screenshot below.

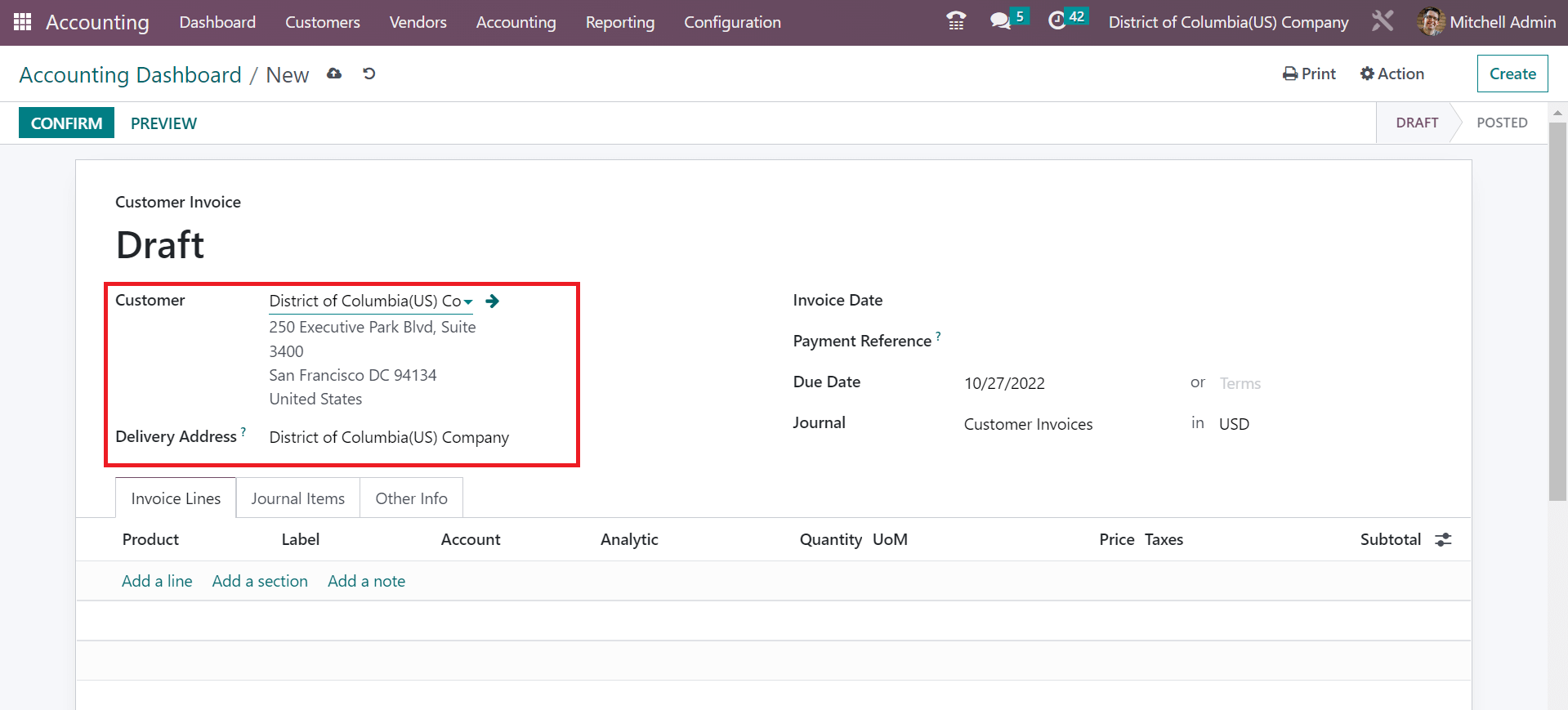

Choose District of Columbia(US) Company in the Customer field on the open screen. Later, the user can see the address concerning your partner in the Address field, as illustrated in the screenshot below.

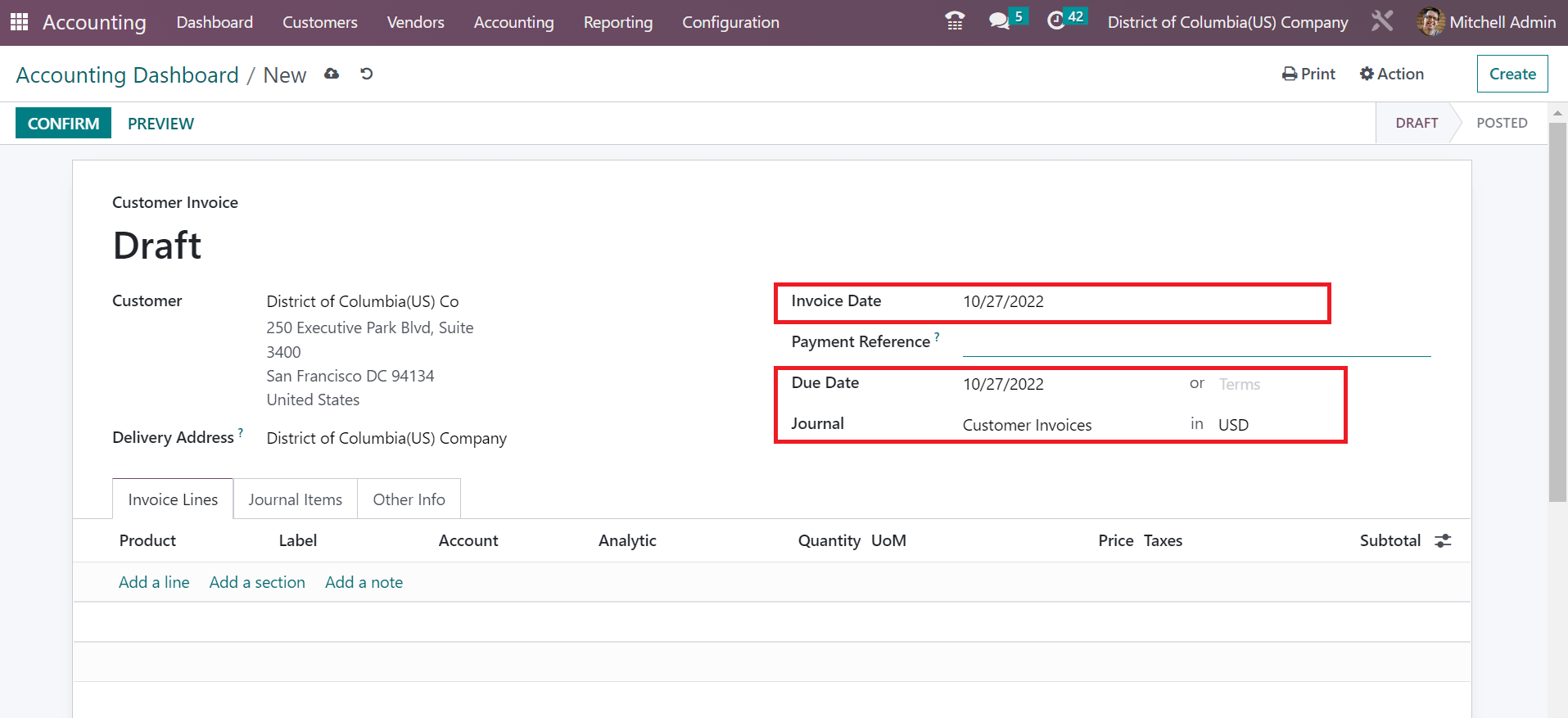

Apply the end date for the invoice in the Due Date field and the beginning date within the Invoice Date field. Furthermore, ensure to enter the Journal for your customer invoice with currency data as specified in the screenshot below.

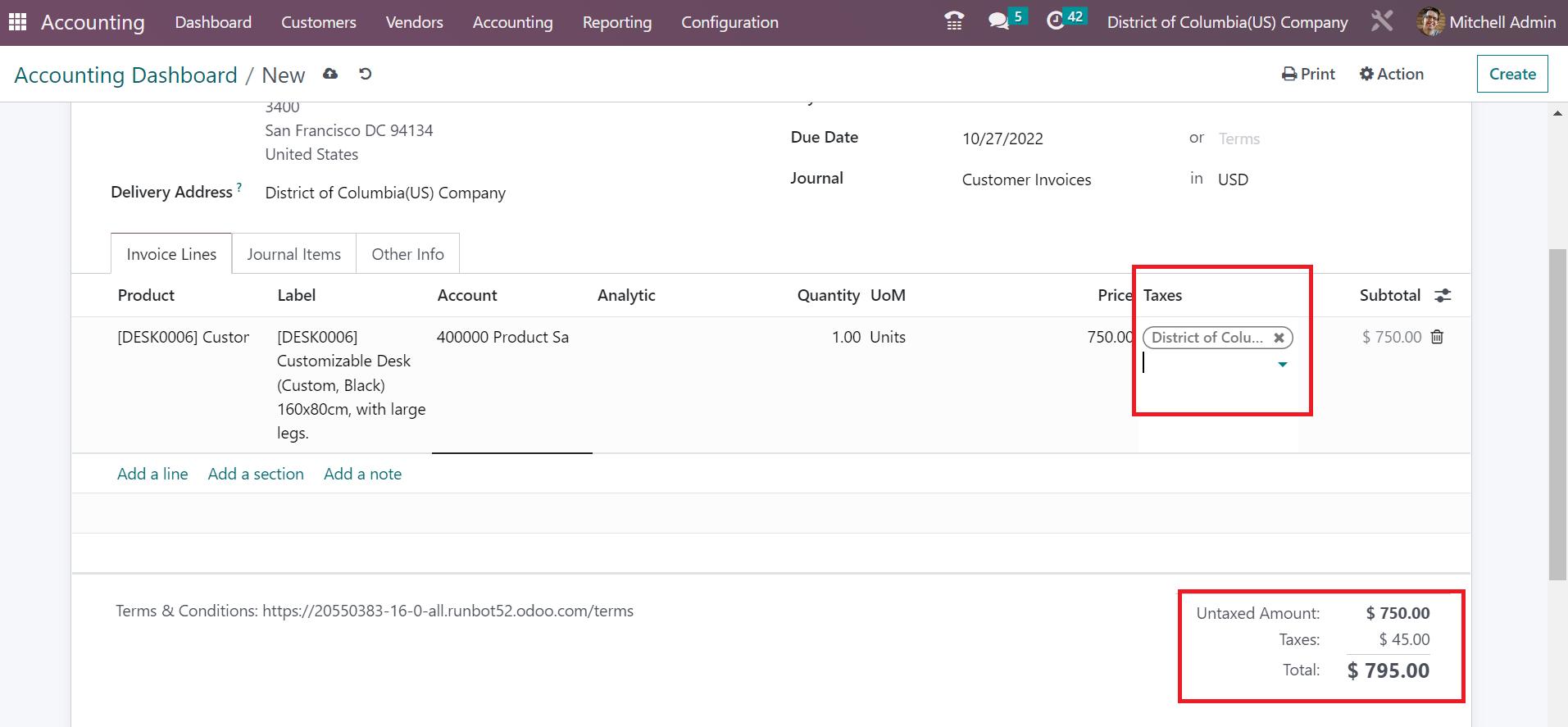

To add a new product for the customer, click the Add a line option under the Invoice Lines tab. In the open space, pick your product and choose the District of Columbia(US) below the Taxes section. Moreover, you can see the Total amount of your product at the right end, along with taxes, as described in the screenshot below.

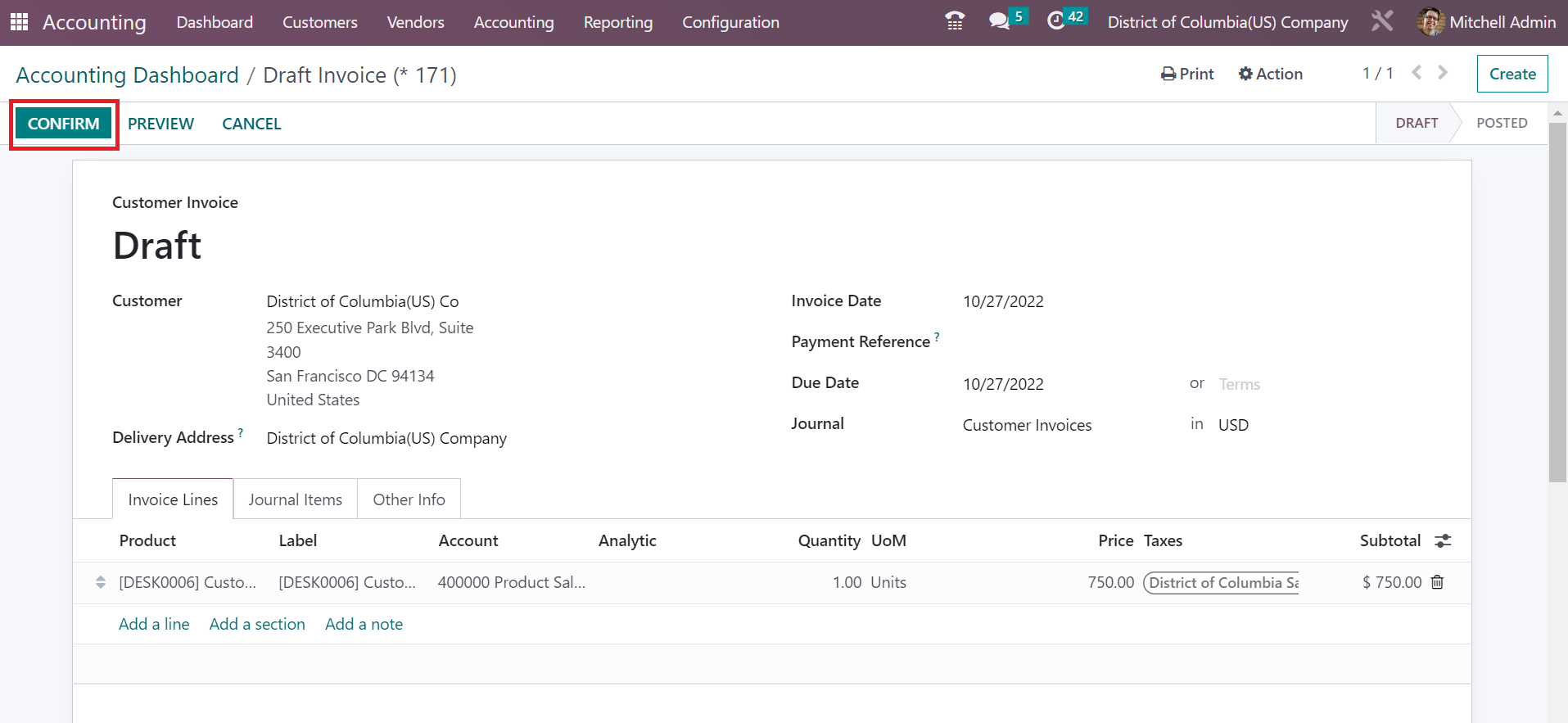

The details of a customer invoice are saved automatically within the Customer Invoice window. Press the CONFIRM icon within the Draft Invoice window to process forward, as displayed in the screenshot below.

Hence, we can quickly process an invoice for customers in Odoo 16 Accounting.

Sales tax configuration for the District of Columbia(US) is managed easily with the assistance of Odoo ERP software. Business productivity and development depend on tax management. Users can enhance the workflow and apply customer invoices and taxes in the Odoo 16.