A complex set of local and federal state sales tax obligations applies to a foreign business selling goods into the US. Most US states are free to charge sales tax on companies with a nexus in their territory. Sales tax liability is effortless for single conditions in retailers. Configuration of taxes is the most demanding task for most companies. Installing ERP software makes it easy to calculate sales tax per state in a country. Odoo 16 Accounting module lets users compute sales tax rates according to their states.

This blog specifies the steps for configuring Georgia Sales Tax in 2022 within Odoo 16 Accounting module.

Accounting application in Odoo 16 is easy to manage vendor bills, digitization, fiscal periods, currencies, bank & cash, and more. Additionally, you can set fiscal positions, default accounts, and reporting in Odoo 16 Accounting. Let's view the process of computing the Georgia(US) Sales tax for 2022 in Odoo 16 Accounting.

Analysis of Georgia Sales Tax 2022

In some cities, a state sales tax of 4% exists in Georgia. The highest sales tax is 9% in towns like Midland, Columbus, Fortson, and more. Moreover, countries and cities can impose additional tariffs on the state. Most tangible products are taxable in Georgia. However, we can see exceptions for groceries, machinery, medicines, chemicals, etc. If a non-taxable item is brought to the state use tax is applicable. Fewer services are not taxable in the state for business owners.

For registering a sales tax permit in Georgia, we must take care of some essential details. It includes entity type, business activity info, state IDs, business address, and more. Georgia Tax Centre helps you to register the details of your business. So it is easy to register your firm details with the Georgia government.

To Formulate Georgia(US) Company Data in Odoo 16

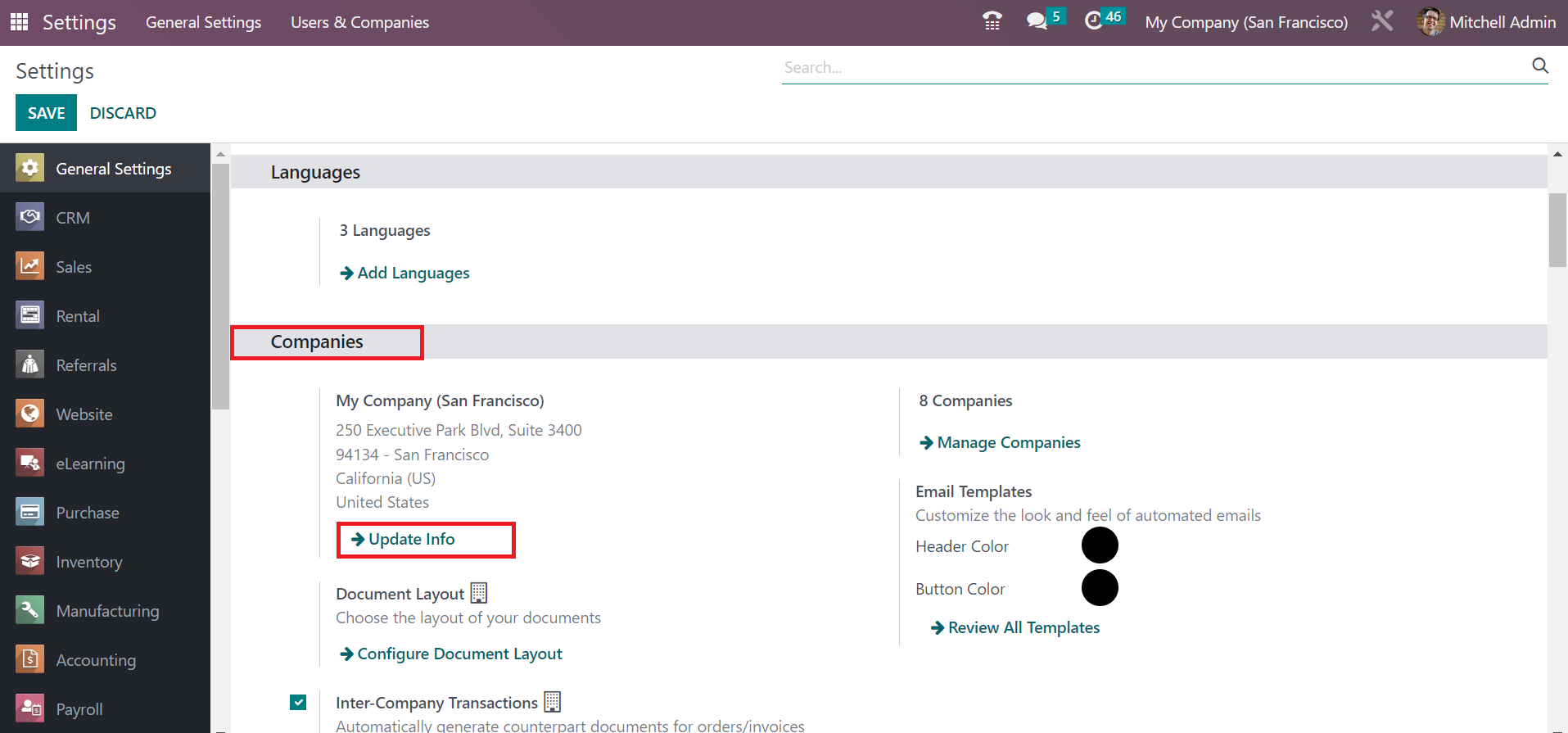

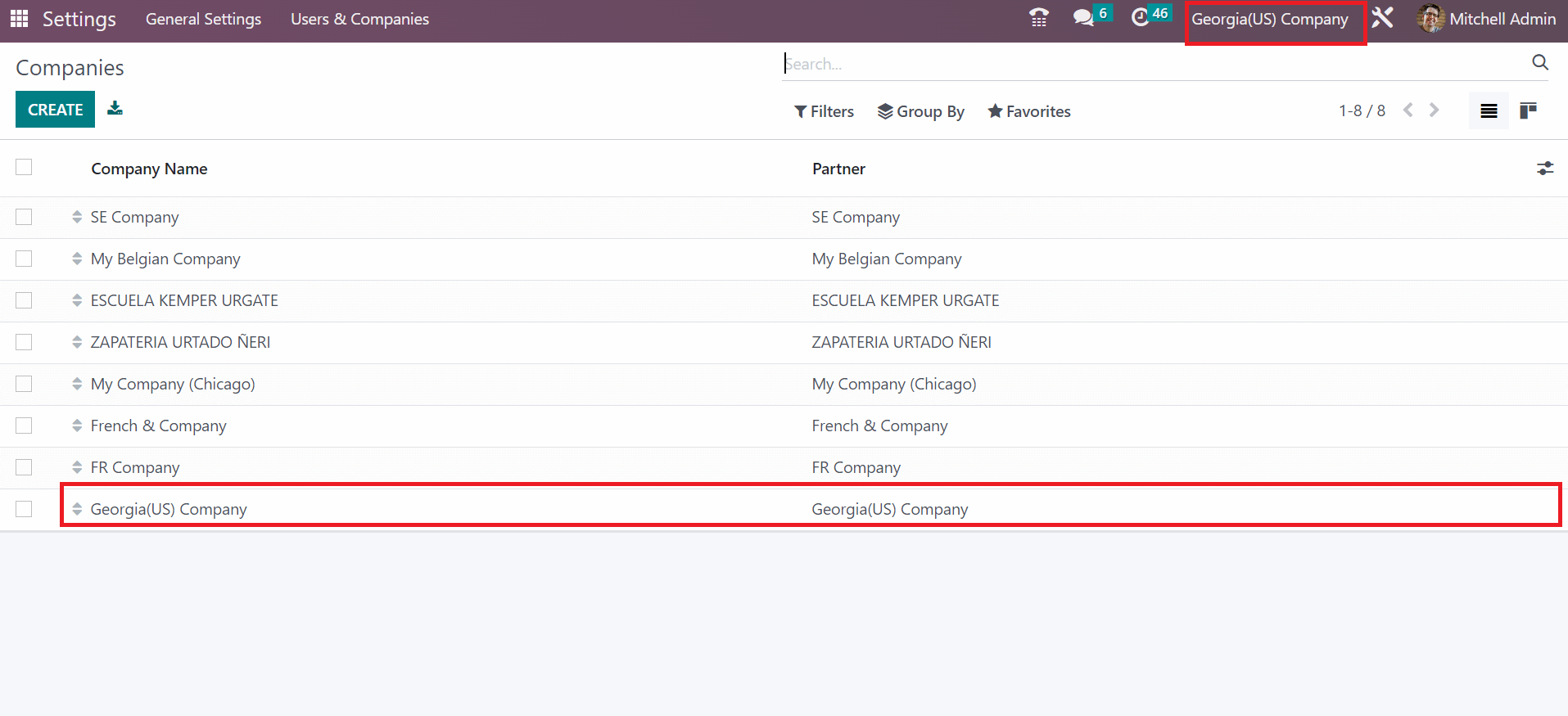

Users can update the Georgia company information within Odoo 16. For that, move to Odoo 16 Settings window and click the Update Info option below the Companies section, as marked in the screenshot below.

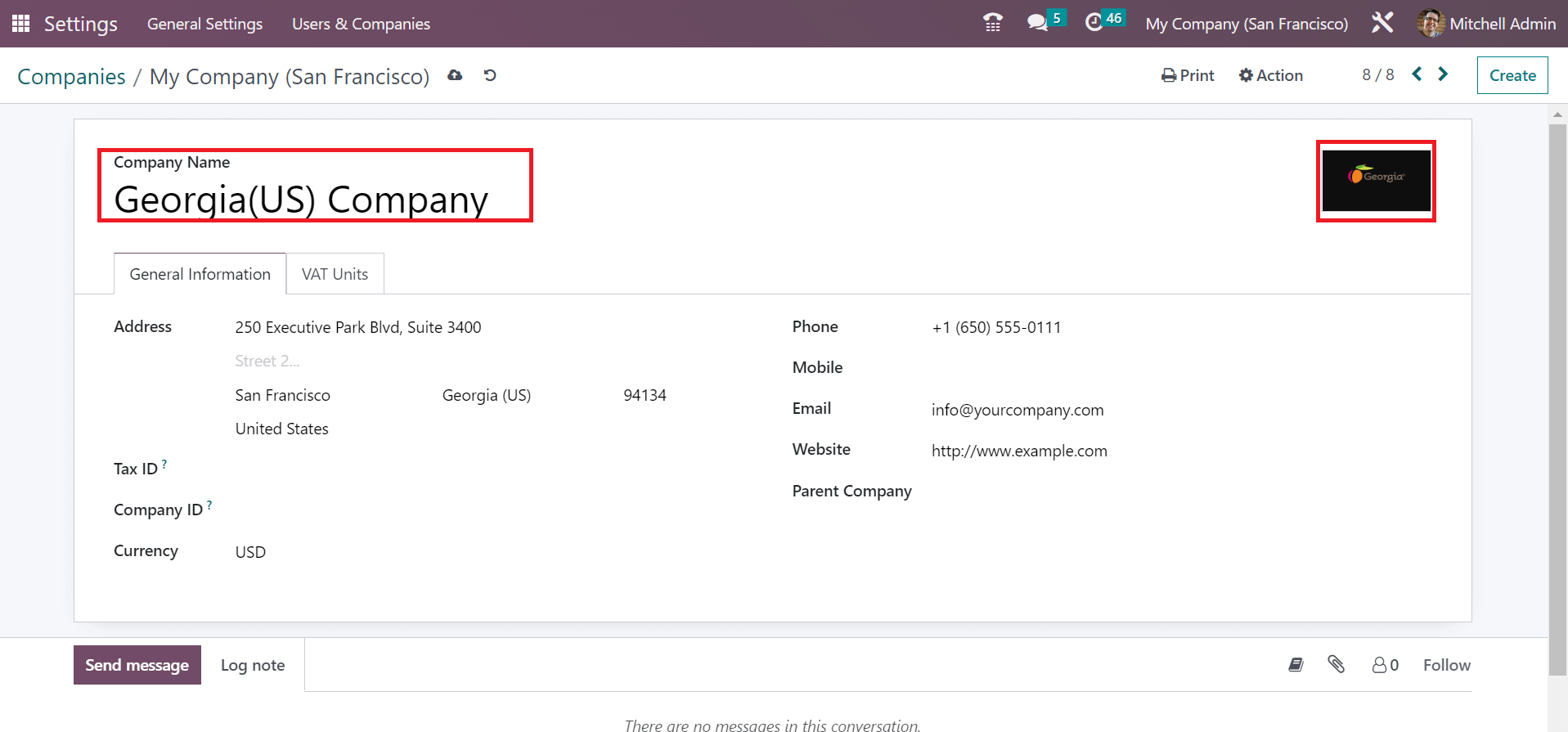

On the open page, set the Company Name as Georgia(US) Company. You can upload the company logo by clicking on the Edit icon at the right end. Later, the company logo was updated easily in the Companies window, as depicted in the screenshot below.

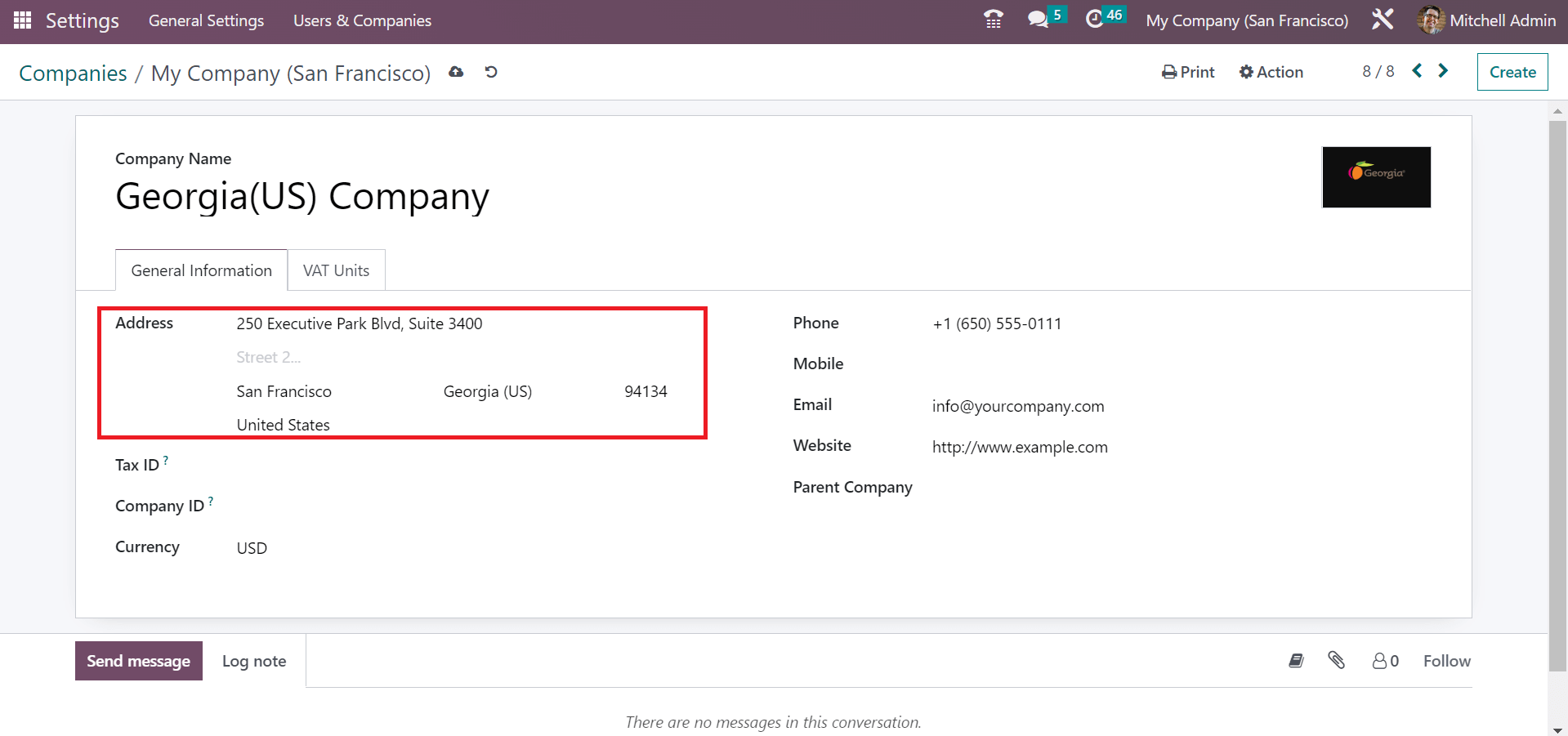

Next, you can mention the Company's details inside the General Information tab. Inside the Address field, add street info, city, and Georgia in the State option and enter United States in the Country as marked in the screenshot below.

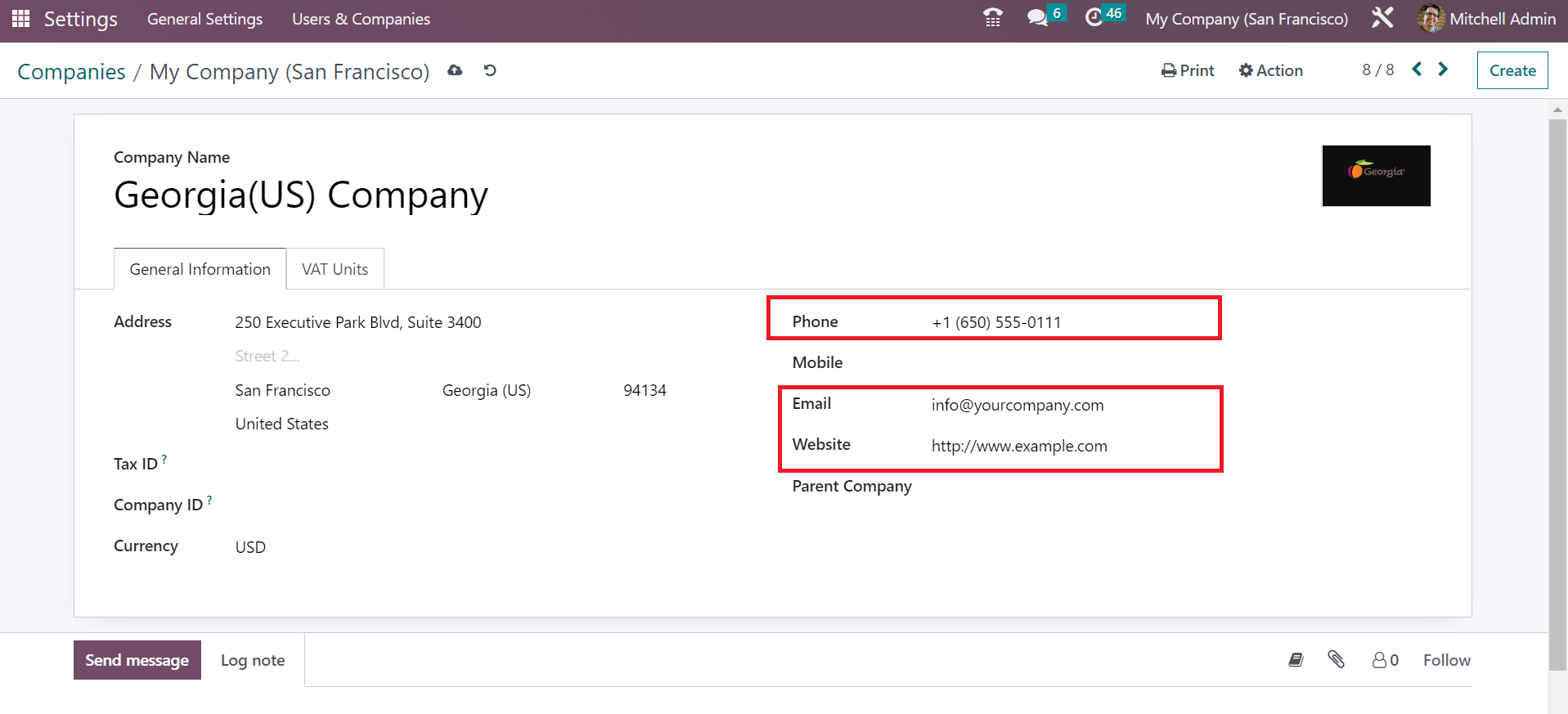

Specify the email address of the Company in the Email field. Also, enter the company website URL in the Website field and the Phone number as defined in the screenshot below.

All the entered data of a company is saved manually in Odoo 16. After saving the date, created company information is visible in the main Companies window. You can also access Georgia(US) Company title at the top end, as specified in the screenshot below.

Georgia(US) Sales Tax creation in Odoo 16 Accounting

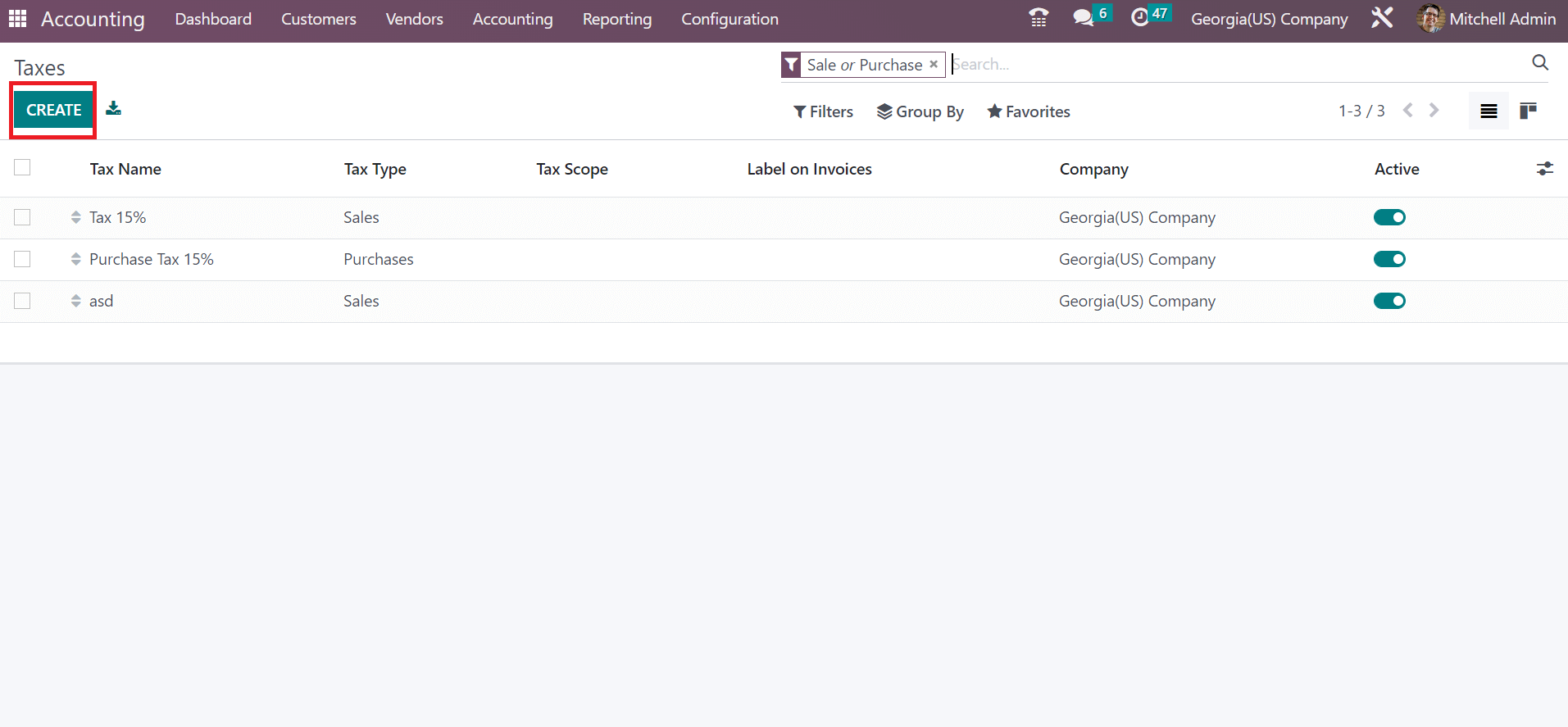

Tax configuration for a specific state based on your Company is made easy through Odoo 16 Accounting. You can obtain the taxes menu inside the Configuration tab, and all taxes history is visible to the user. For developing a new tax, select the CREATE button in the Taxes screen as mentioned in the screenshot below.

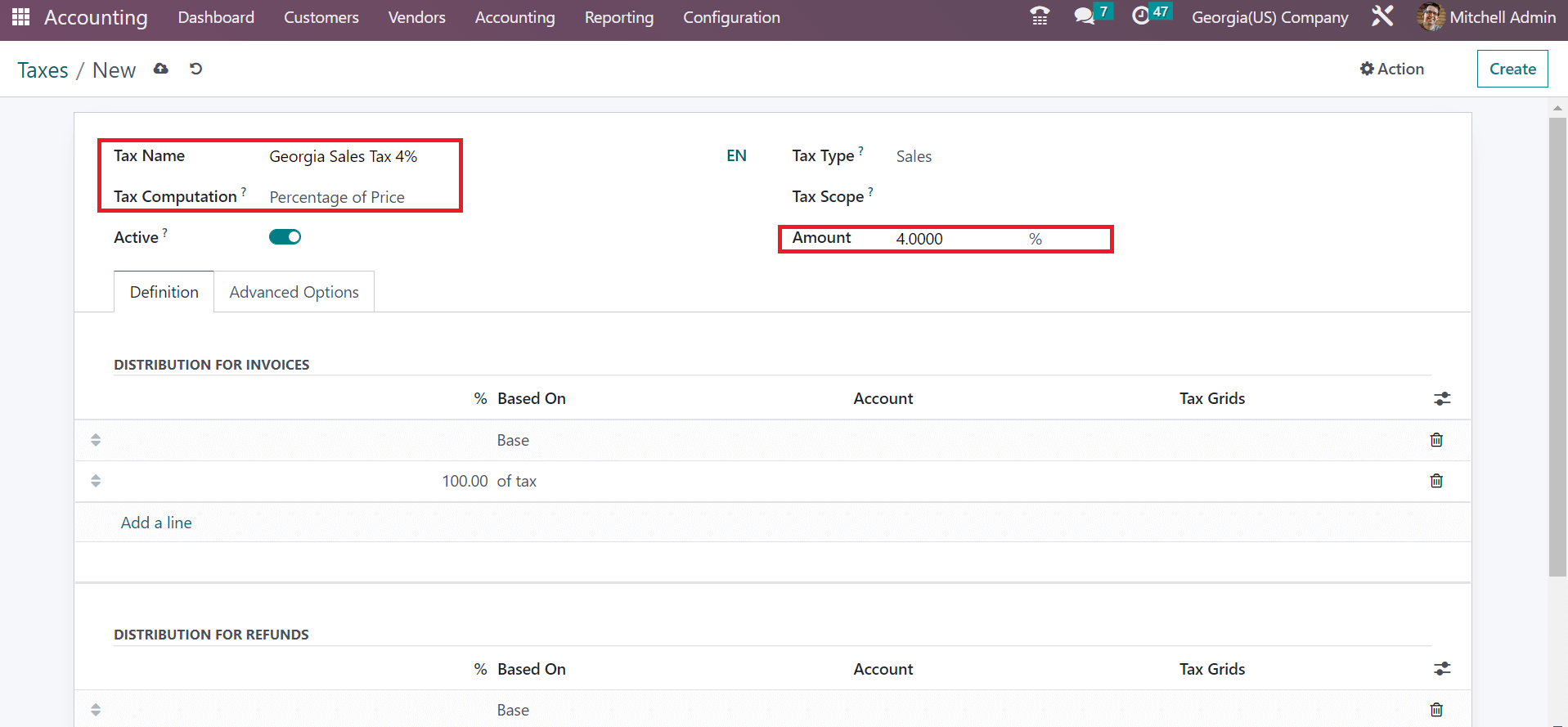

Add the Tax Name as Georgia Sales Tax 4% and apply your tax computation method. Choose a percentage of the Price in the Tax Computation field to calculate your tax. After selecting your computation method, enter the amount as a percentage in the Amount field. The tax rate for sales in Georgia is 4%. So, we applied 4% within the Amount option, as illustrated in the screenshot below.

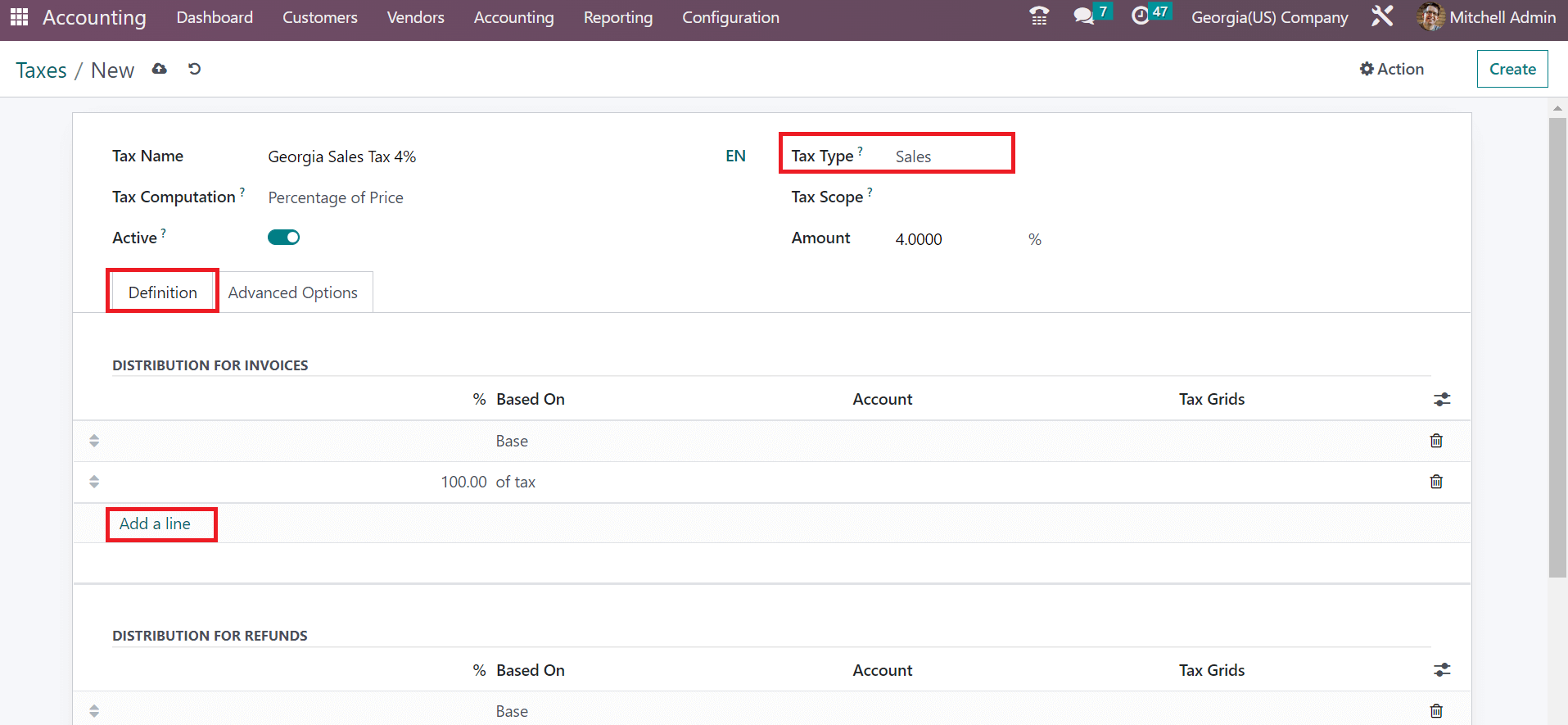

Users can choose the kind of tax in the Tax Type option. It is classified as Sales and Purchases. In the Tax type field, select the Sales option for your Georgia Sales Tax 4%. Additionally, users can distribute taxes for invoices and refunds after clciking on the Add a line option under the Definition tab.

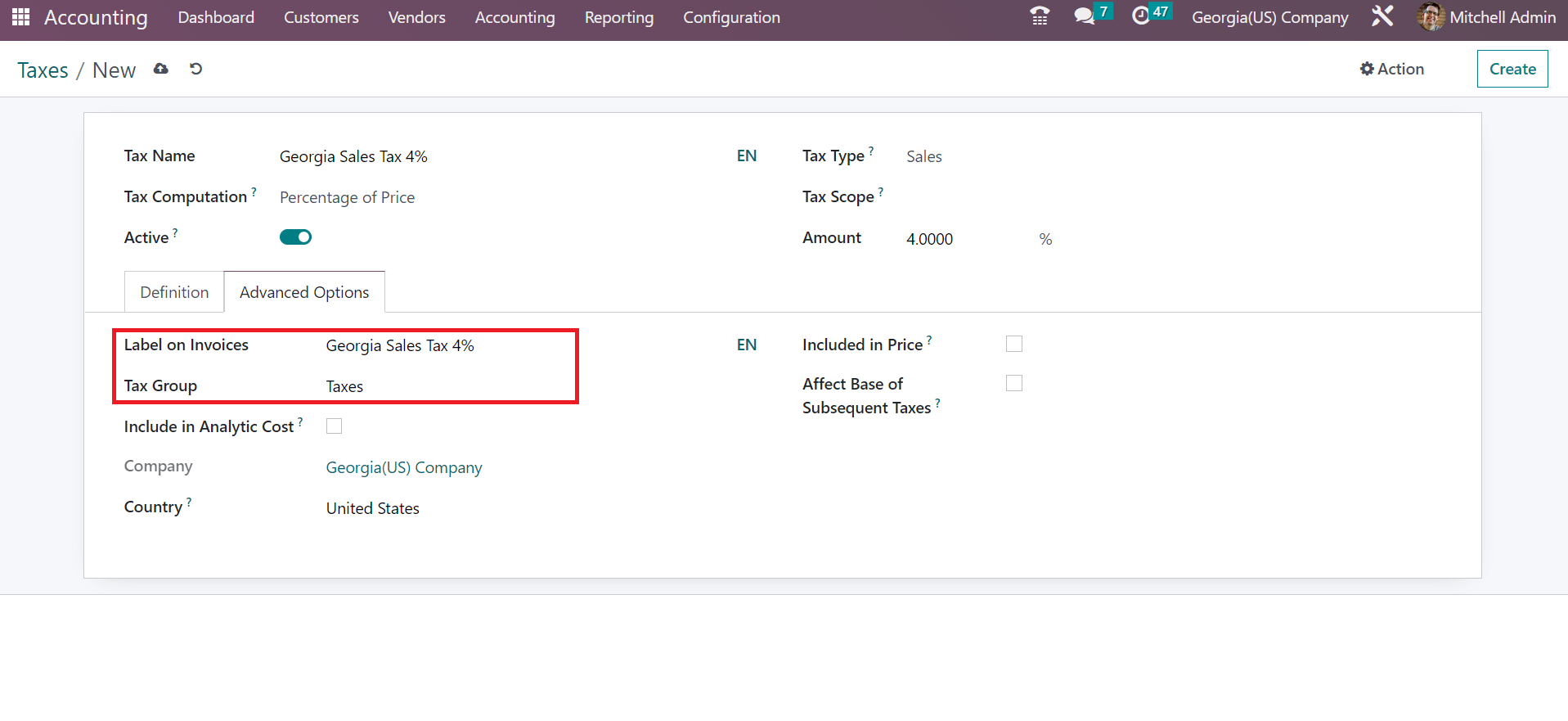

Inside the Advanced Options tab, we can add the label viewable on an invoice in the Label on Invoices field. We added Georgia sales tax of 4% as a label on the invoice. Moreover, it is possible to pick a group for your tax in the Tax Group field, as specified in the screenshot below.

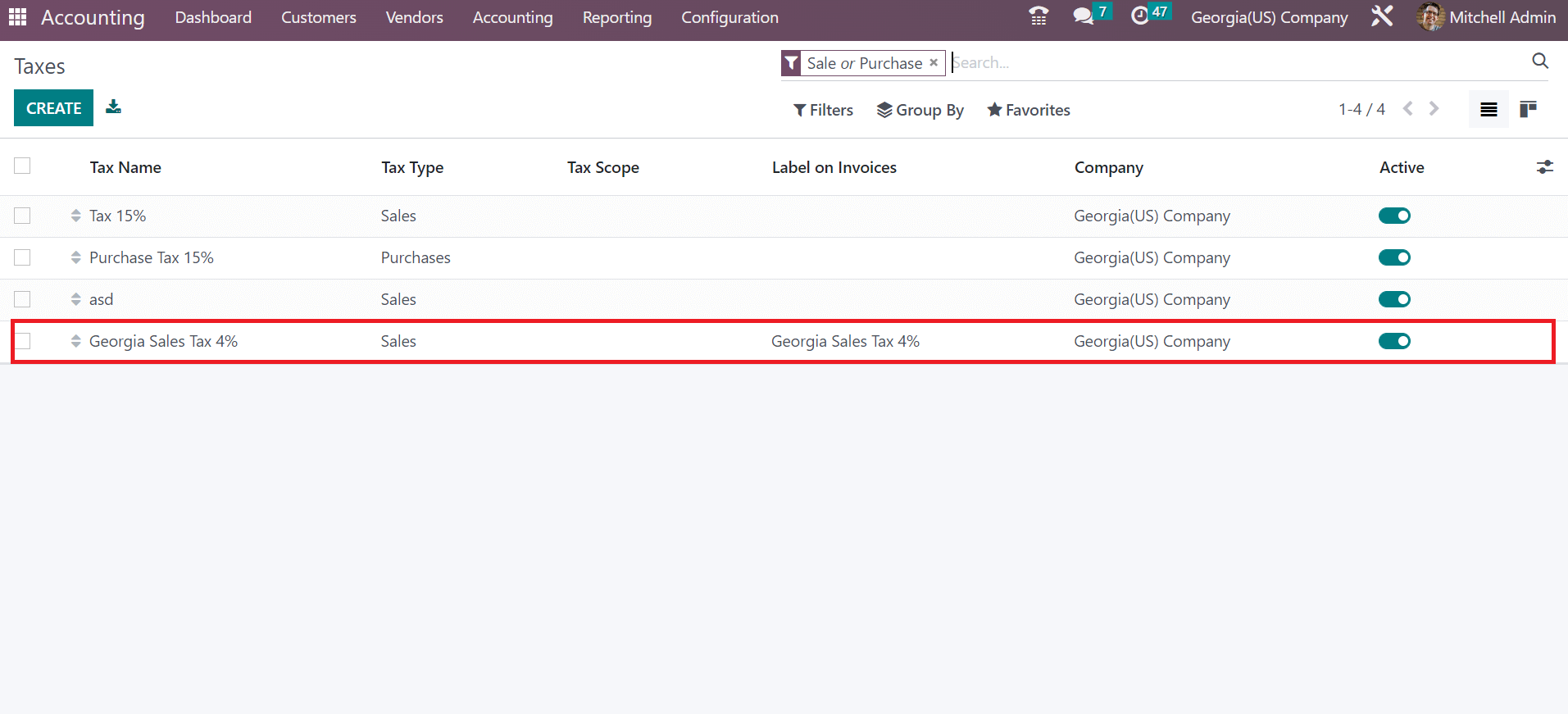

Data related to your Company and Country are automatically visible to the user below the Advanced options section. After applying the tax data, details are saved automatically in Odoo 16. Your created sales tax is accessible from the Taxes window, as noted in the screenshot below.

How to Specify Georgia(US) Sales Tax in a Customer Invoice?

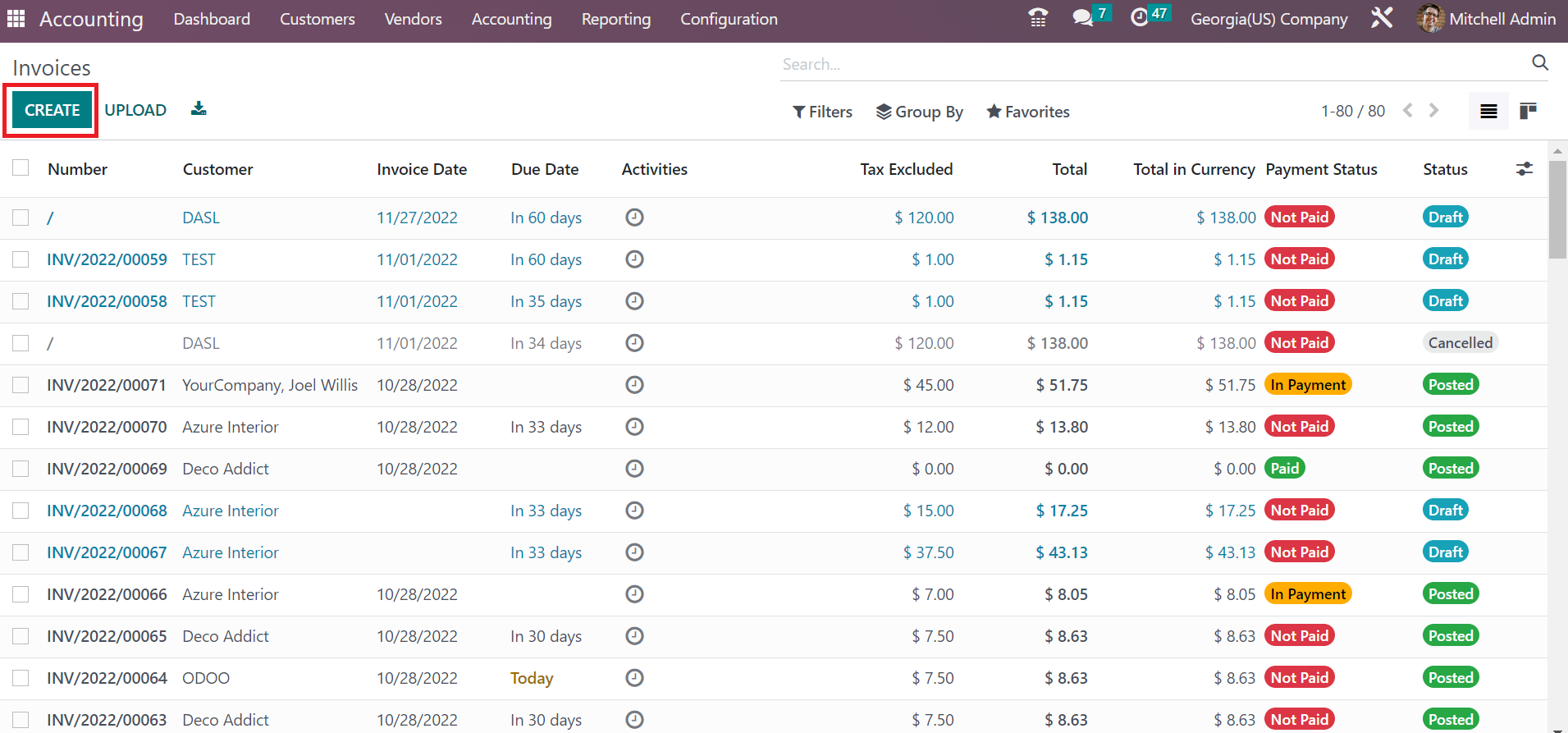

We can apply created sales tax of Georgia to a customer invoice using Odoo 16 Accounting. Users can either generate an invoice from the Customers tab or select the Customer Invoice journal from Odoo 16 Accounting dashboard. By choosing the Invoices menu under the Customers tab, a list of all invoices is obtainable to a user. You can view each invoice's details separately, including Payment Status, Invoice Date, Number, etc. Click the CREATE icon to produce a new customer invoice, as denoted in the screenshot below.

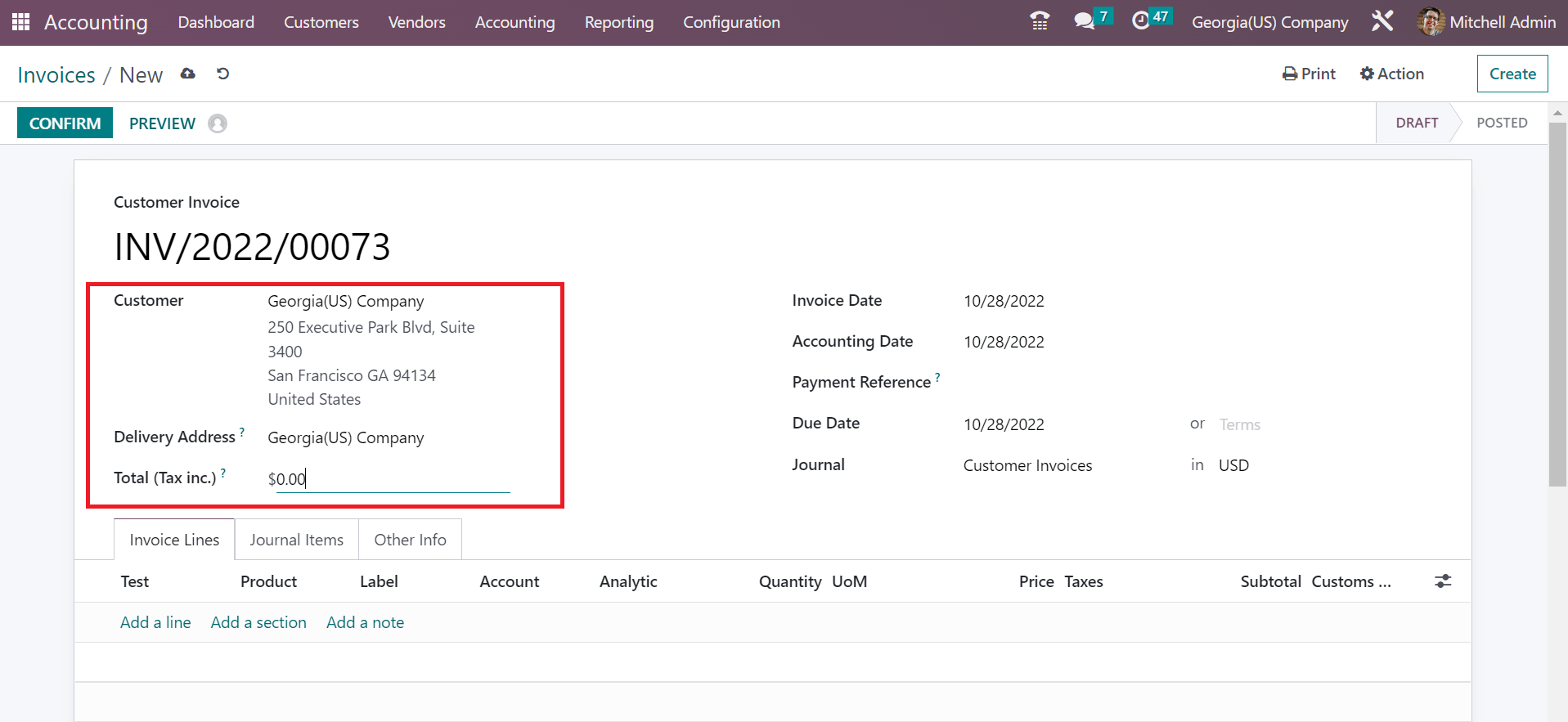

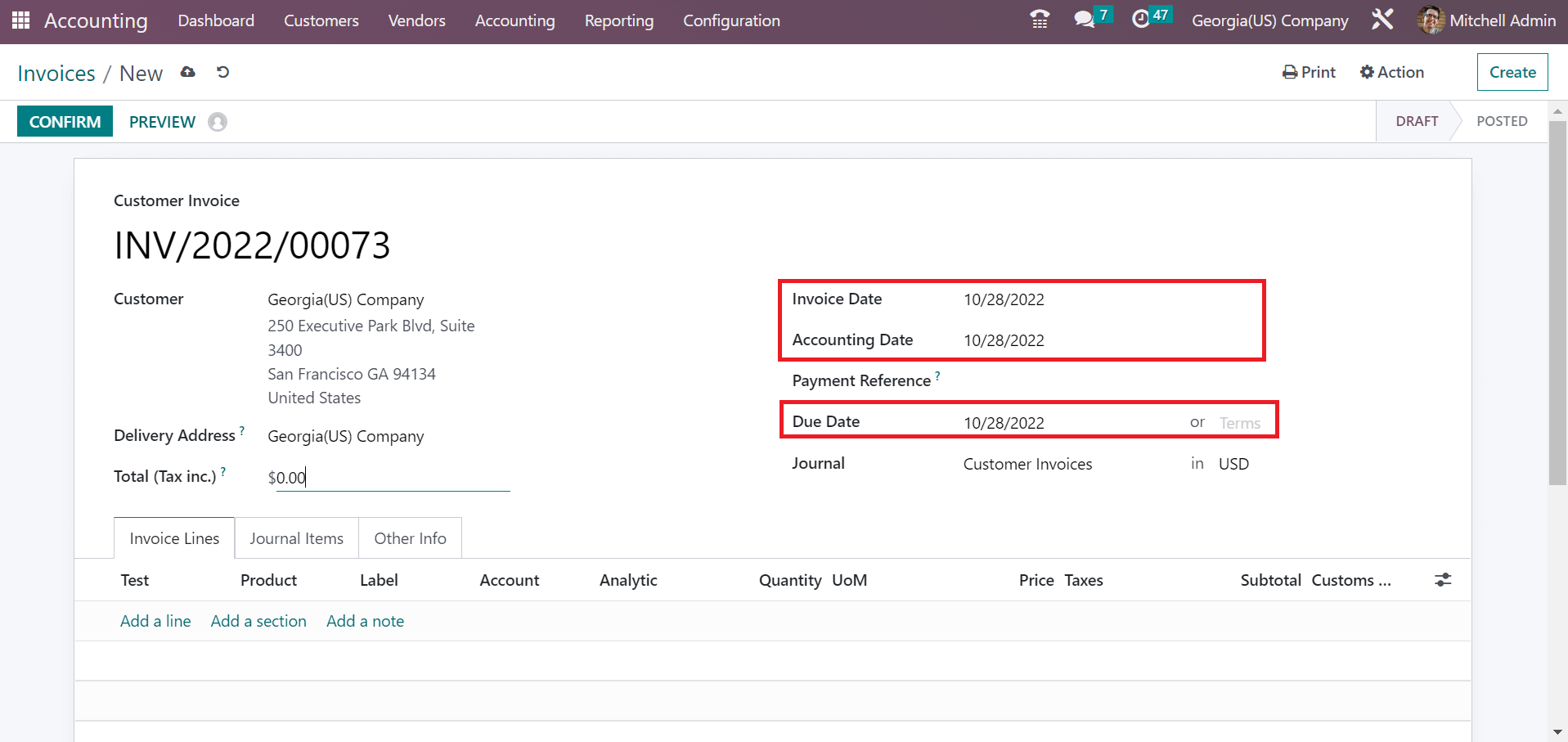

In the open window, pick the Customer as Georgia(US) Company. After choosing the customer, the address related to the customer invoice is viewable in the Delivery Address option. Users can encode the total invoice amount in the Total(Tax inc.) field, as mentioned in the screenshot below.

Users can set the start date of the invoice in an Invoice Date field. Later, mention your Accounting Date and Due Date, which means the expiry date of your customer invoice.

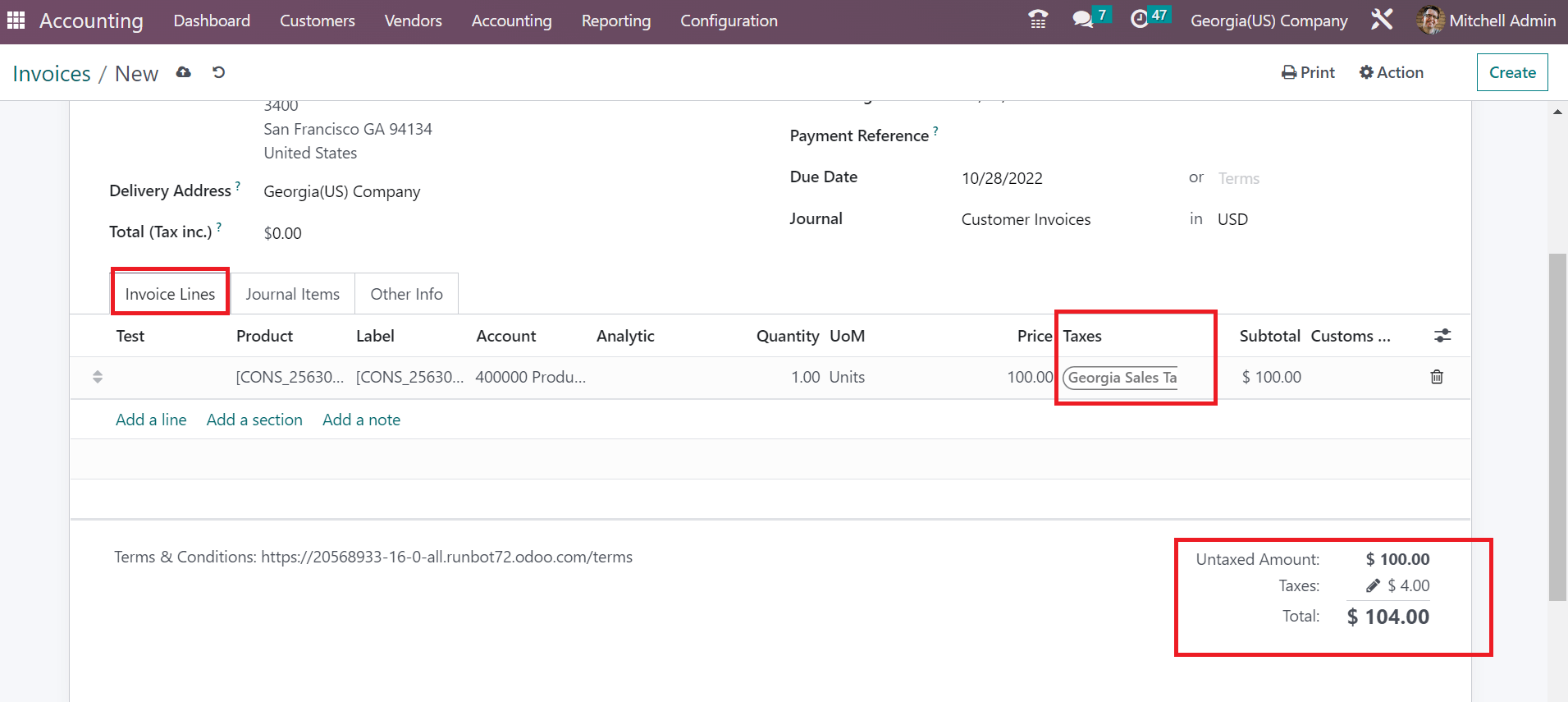

By choosing the Add a line button under the Invoice Lines tab, it is easy to apply commodity details for customers. Once selected your product, the user can pick Georgia Sales Tax 4% under the Taxes section. After choosing the tax, you can obtain the product cost combined with a 4% tax rate, as represented in the screenshot below.

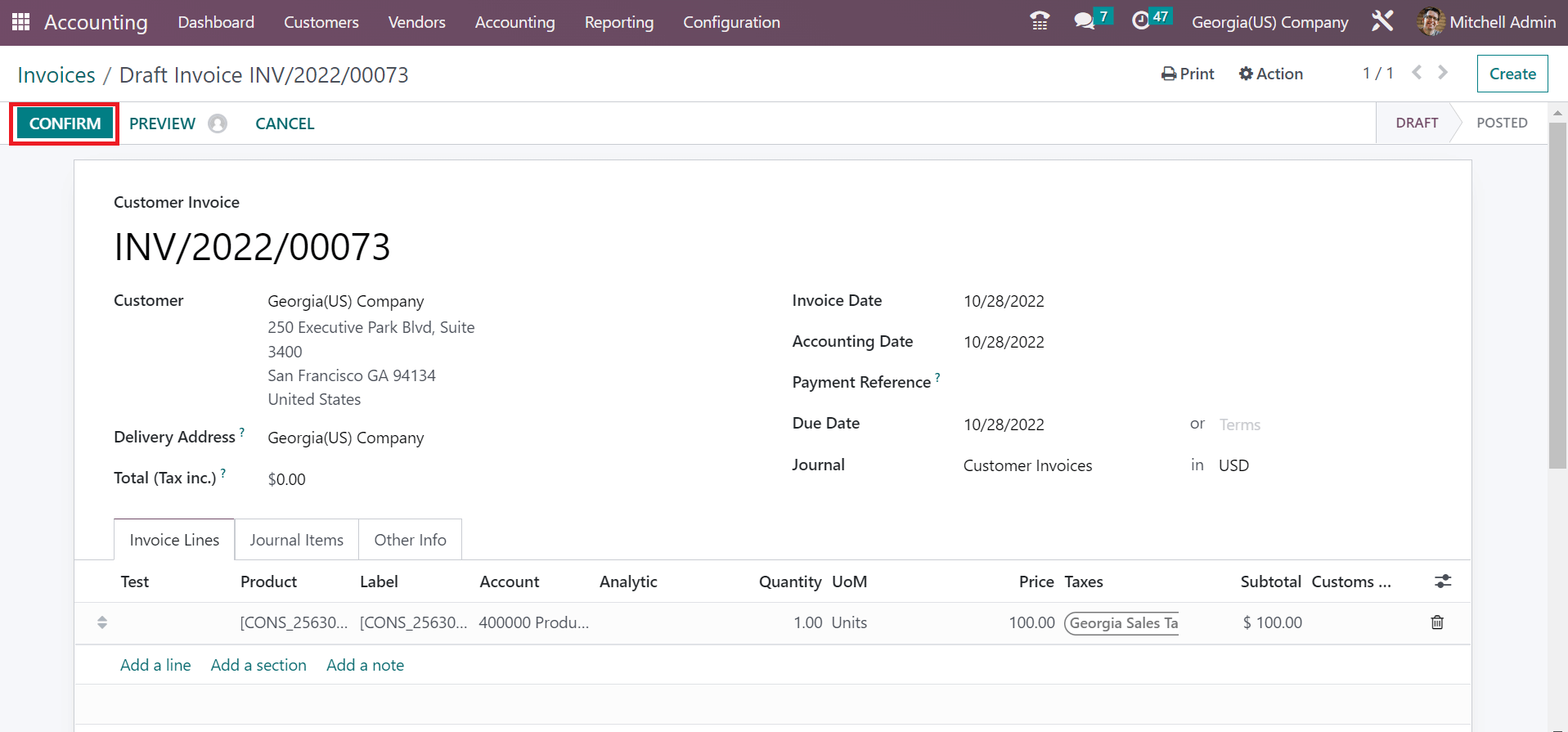

All your entered details are saved in Odoo 16 automatically. We can validate the invoice by pressing the CONFIRM button in the Invoices window.

So, we can efficiently generate customer invoices according to the special tax rate of a country.

A company can achieve business growth through effective tax management. Odoo ERP software is an effective solution to compute tax rates and manage your company accounts easily. Accounting localization assists in improvising business processes and workflow quickly. Refer to the following link to know about Arkansas(US) sales tax Computation