Accounting reports are essential for providing insights into a business's financial performance, stability, and decision-making. Key reports include the Income Statement (Profit and Loss Statement), Balance Sheet, Cash Flow Statement, Budget vs. Actual Reports, Aging of Accounts Receivable/Payable, Financial Ratios Analysis, Audit Reports, Management Reports (Custom Reports), and Tax Reports.

* Income Statement: For the purpose of making well-informed decisions, the income statement summarizes revenues, costs, and losses.

* Balance Sheet: A balance sheet gives a quick overview of the financial situation of a business.

* Cash Flow Statement: The inflow of funds and the withdrawals of cash are shown in the cash flow statement.

* Budget vs. Actual Reports: Evaluate financial planning effectiveness.

* Aging Reports: Categorizes receivables and payables based on transaction time.

* Financial Ratios Analysis: Provides a deeper understanding of financial performance.

* External Audit Reports: Improve the dependability and trustworthiness of financial data via external audit reports.

* Customized Management Reports: Aids internal decision-making.

* Tax Reports: Ensures compliance with tax regulations.

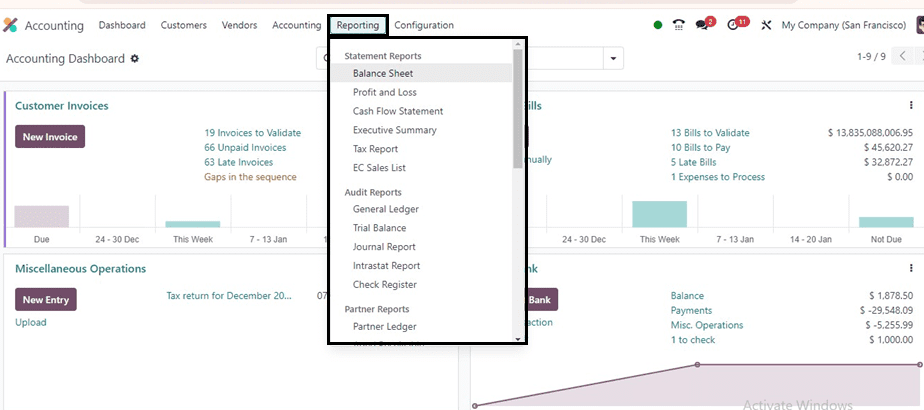

Users may now build accounting reports that are specifically matched to their needs with Odoo, thanks to a new feature that allows customization. Users may generate reports that are tailored to their needs using the Accounting Reports option, which is found in the Configuration menu of the Accounting module. In addition, by choosing the appropriate option from the list supplied, pre-existing reports can be set.

This blog will provide an exclusive overview of various reporting options available in the ‘Reporting’ menu of the Odoo 17 Accounting Module.

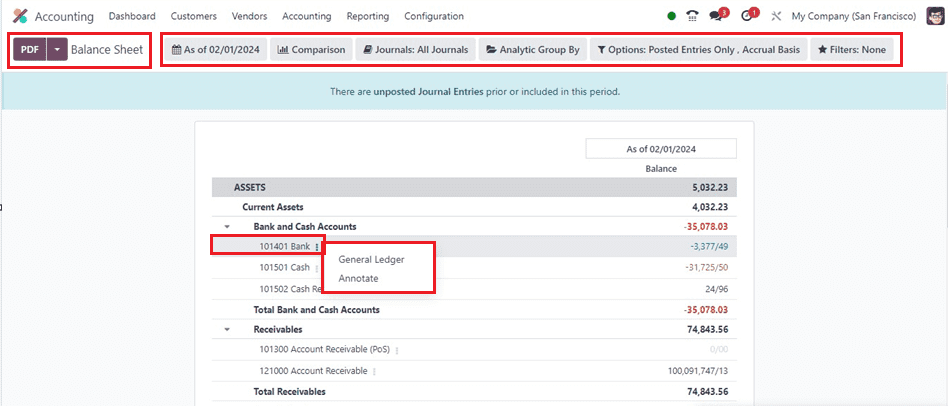

Balance Sheet Reporting

The Balance Sheet report provides a single point of view for an organization's asset, liability, and equity details. Users can create customized reports using additional features from Odoo. The balance sheet can be accessed by selecting a specific date from the calendar icon on the screen. To generate a Balance Sheet report in Odoo, navigate to the Accounting module. Access the Reporting Menu, typically labeled "Reports," and select the "Balance Sheet" option.

To customize the report based on your specific needs, you can set filters, such as various date ranges and other relevant criteria, such as Comparison, Journals, Analytic Groups, and many more. You can choose a journal entry from the balance sheet and click on the "General Ledger" and ‘Annotate" buttons to generate a detailed report, which should be displayed on your screen. You can also export the report in different formats (PDF, Excel, etc.) directly from this screen. This process ensures a comprehensive and accurate financial report.

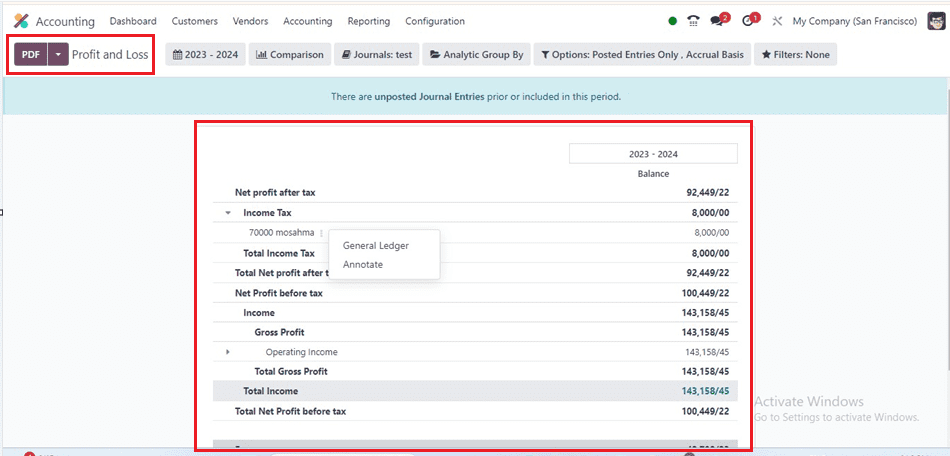

Profit and Loss Reporting

An organization's revenue, costs, profit, and loss during a certain time period are summarised in income statements, which are essential financial reports. Unlike the balance sheet, the closing balance of the selected period is not carried over to the following accounting period in the ‘Profit and Loss’ reporting platform.

Users will get a quick overview of their company’s Net profit after tax, Gross Profit, Total Income, Total Gross Profit, Expenses, and other journal entries from this dashboard. These reporting details can also be expanded and modified using the various filter options provided at the top of the reporting window. You can access the general ledger by using the menu provided near each journal entry.

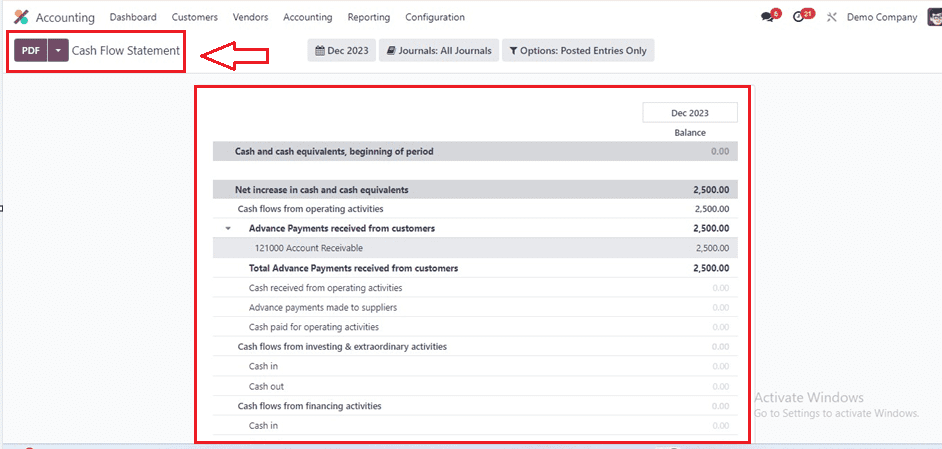

Cash-Flow Statement

Categorized into operations, investment, and financial activities, the Cash Flow Statement offers a thorough financial summary of cash inflows and outflows. It is a crucial part of Odoo's financial management system, enabling companies to track and examine cash flow inside the company. Proper cash flow reporting helps businesses make informed decisions about liquidity, budgeting, and financial planning, ensuring a smooth financial landscape.

The reporting page depicts a quick overview of the cash and cash equivalents beginning of the period, the Net increase in each and every equivalents, the Total advance payments received from customers, and many valuable aspects of the accounting cash flow system. You can filter or sort out the required information using various filters provided by the Odoo.

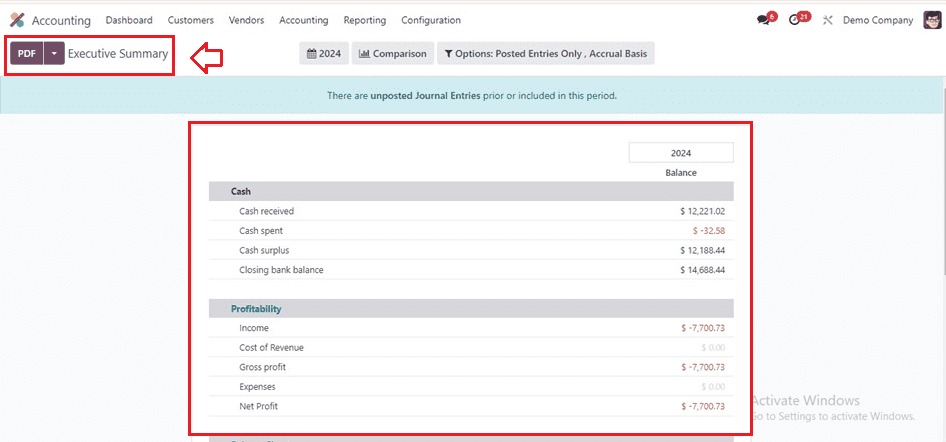

Executive Summary

An Executive Summary platform, available through the Reports menu, compiles balance sheet, profitability, and cash flow reports for a certain time frame.

Furthermore, indicators like Return on Investment, Net Profit Margin, and Gross Profit Margin are explained on the Performance page. In the Position tab, users can analyze the Average Debtor's Day, Average Creditor's Days, Short-Term Cash Forecast, and the ratio of Current Assets to Liabilities.

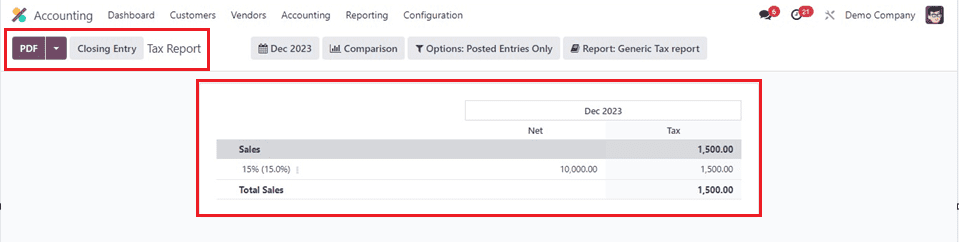

Tax Report

The Tax Reports platform, accessible through the Reports menu, can produce comprehensive reports on sales and purchase taxes. The return tax for the chosen period can be reported by using the ‘Closing Entry’ button, as shown in the screenshot below.

Similar to all the other reporting windows, you can print the Tax Reporting information in PDF and XLSX format and customize them using the different filter choices at the top of the reporting page.

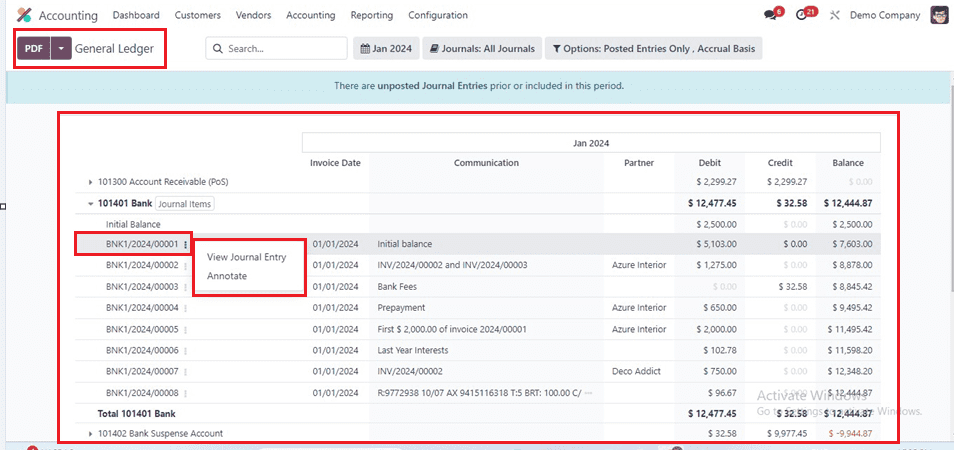

General Ledger

Every financial transaction made by your company over the course of a fiscal year is documented in the General Ledger reports, which show all transactions from every account in your system for a given period of time. Account names, Date, Communication, Partner, Currency, Debit, Credit, and Balance are all included.

The report will provide a summary of transactions and account balances and can be exported to PDF or Excel formats for further analysis or printing. To generate a general ledger report in the Accounting module, navigate to the Reporting section and select the desired fiscal year and period.

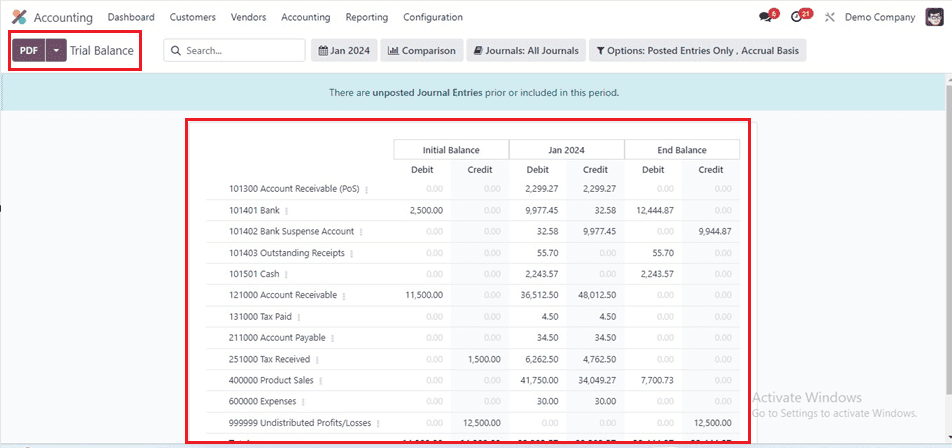

Trial Balance

A trial balance is an accounting report that displays the results of all entries posted through various journals, typically generated at the end of the financial year and is used for auditing operations. It offers credit and debit information from the journal entry's beginning balance, chosen month or year, and ending balance.

To generate a trial balance report in the Accounting module, navigate to the Reporting section and select the desired fiscal year and period from the filter section provided at the top of the page. The report will provide a summary of all account balances. Customize the report by selecting specific accounts or adjusting the layout. The report may be exported to Excel or PDF formats for further investigation or printing.

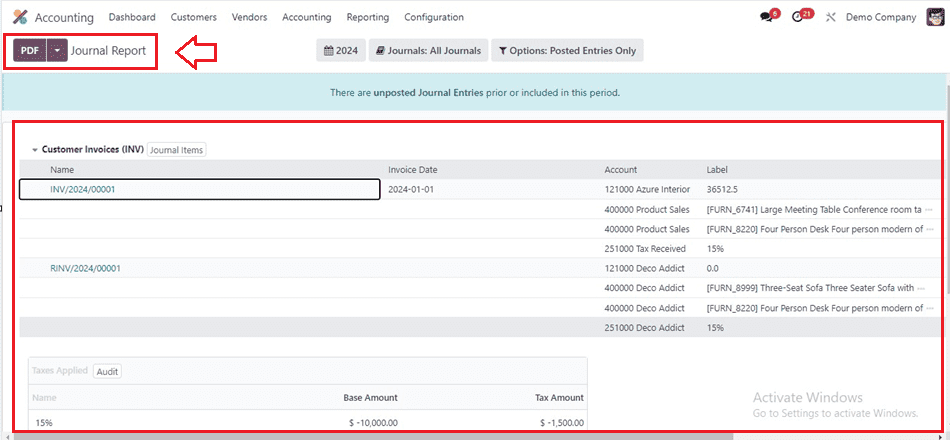

Journal Report

You may create accounting reports for different journals in your Accounting module using the Journal Reports platform. These reports provide information on the Name, Account, Label, Debit, and Credit of the related journal entries.

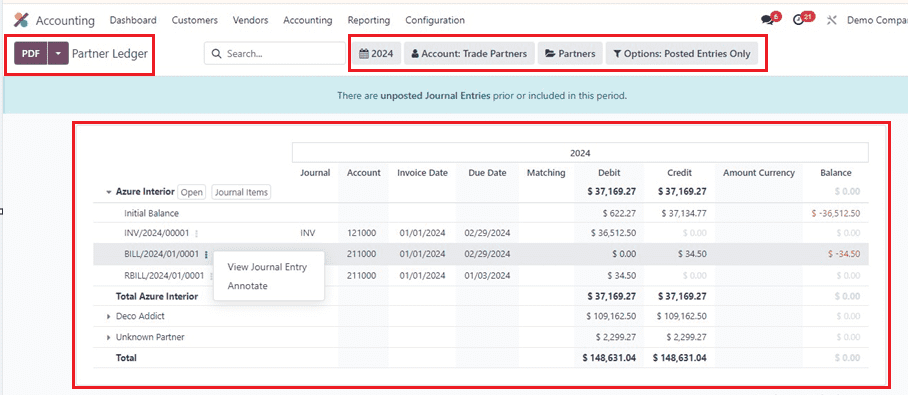

Partner Ledger

The reporting platform for Partner Ledger shows the journal entries for partners' accounts receivable and payable, together with their amounts, currencies, balances, matching numbers, references, and due dates. The Reconcile button on the report can be utilized by users to reconcile these accounts.

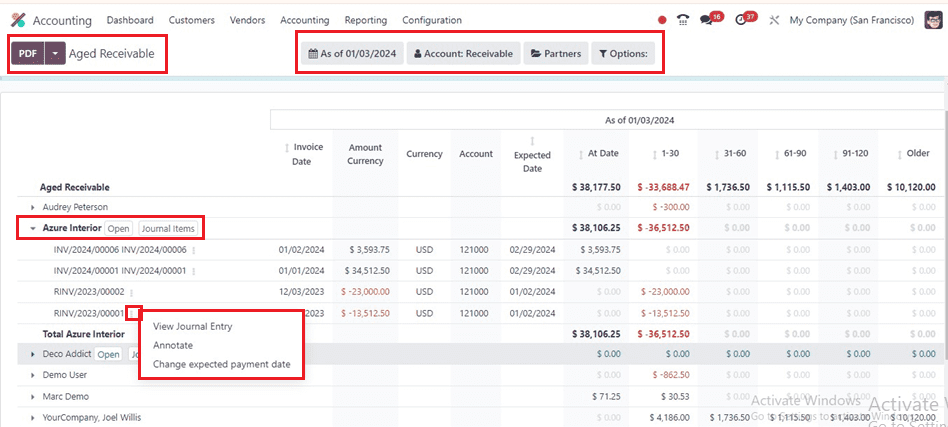

Aged Receivable

Within the Reporting menu, the ‘Aged Receivable’ platform facilitates the generation of reports detailing partner receivable balances as of a specified date. The screenshot below displays all of the information in the report, including the Due Date, Amount, Currency, Account, Expected Date, Receivable Amount at Date, Older, and Total.

These reports specifically highlight invoices awaiting payment. Should a customer neglect to settle the invoice within the stipulated payment terms, the outstanding payment is categorized as Aged Receivables.

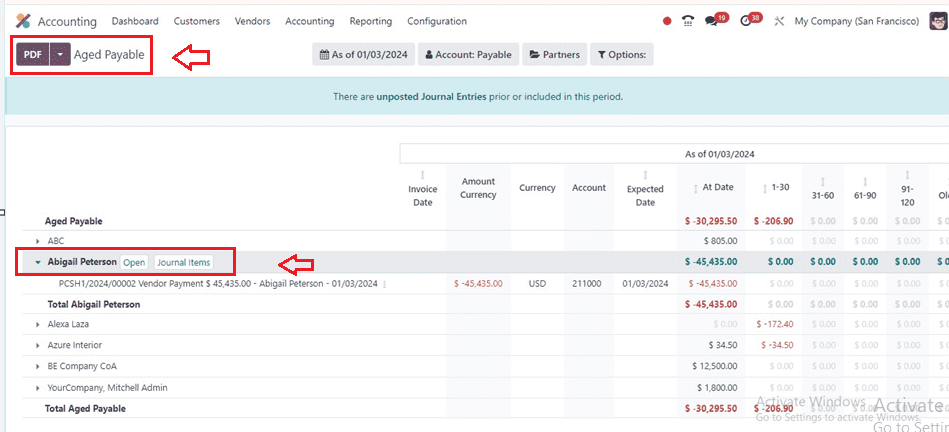

Aged Payables

Delayed payment reports, which result from an organization's inability to pay bills by the deadline, are shown on the Aged Payable platform. If a company doesn’t meet the payment conditions, it will be included in the Odoo Accounting Aged Payable report.h

These reporting details can be altered into another perspective using the various filter options such as Date Range, Account, Partners, and other filter options placed at the top of the page. Then, it is also possible to download and print the PDF and Excel document formats of the reporting window using the relevant buttons.

Clicking on the small menu provided next to the customer name inside the Aged Payable section of the reporting can be used to access the customer configuration form and the detailed journal items reports with the ‘Open’ and ‘Journal Items’ buttons, respectively.

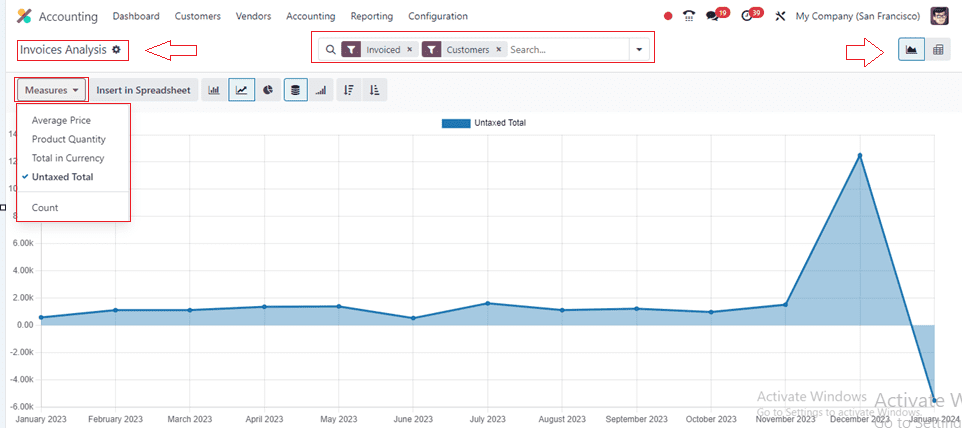

Invoice Analysis

Viewing firm invoice reports for a particular accounting period is possible by selecting the Invoice Analysis option from the Management section of the Reports menu. A graphical or pivot table format may be used to construct the report, which includes measures like Average Price, Product Quantity, Total in Currency, Untaxed Total, and Count, as shown below.

The monthly untaxed total invoice amount for your company will be displayed on the X-axis of the graphical depiction, while the Y-axis will display the untaxed total amount rate ranges.

You can change the graphical representation into various other visual formats such as Stacked view, Pie chart, Bar chart, Cumulative, Ascending, Descending, and many more using the designated icons provided at the top of the page. At last, group, filter, and mark your favorite report data using the advanced search bar.

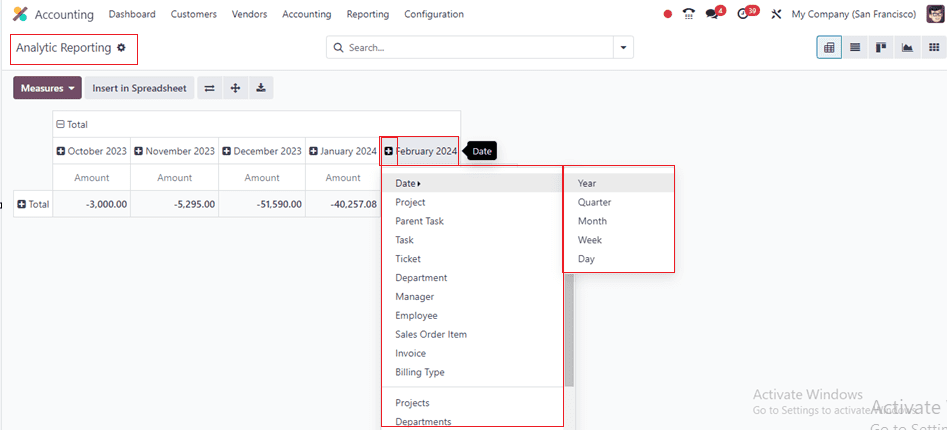

Analytic Reporting

Odoo's accounting module offers an ‘Analytical Reporting’ window in its ‘Reporting’ menu, which uses analytical accounts to track and analyze financial transactions based on specific criteria like departments, projects, or business units. This allows businesses to gain insights into their operations' performance. Key features include creating and defining analytical accounts for various business dimensions, allocating costs to specific accounts, providing pre-built reports for analyzing financial data, and supporting budgeting and forecasting functionalities. These tools help businesses plan and monitor their financial performance against predefined targets, enhancing their overall financial performance.

A full picture of your company's month-based accounting amount data is available through this pivot analytical reporting window. You can insert new data spreadsheets, expand the report view, flip the pivotal axis, and download the reports using the relevant buttons provided near the ‘Measures’ button. Clicking on the ‘+’ button will help you to generate the report data based on various filters such as Date, Project, Parent Task, Task, Ticket, Department Manager, Employee, and many other aspects, and the ’-’ button can be used to delete these filters as illustrated in the above screenshot.

You can also change the pivotal reporting style into other graphical formats using the various icons.

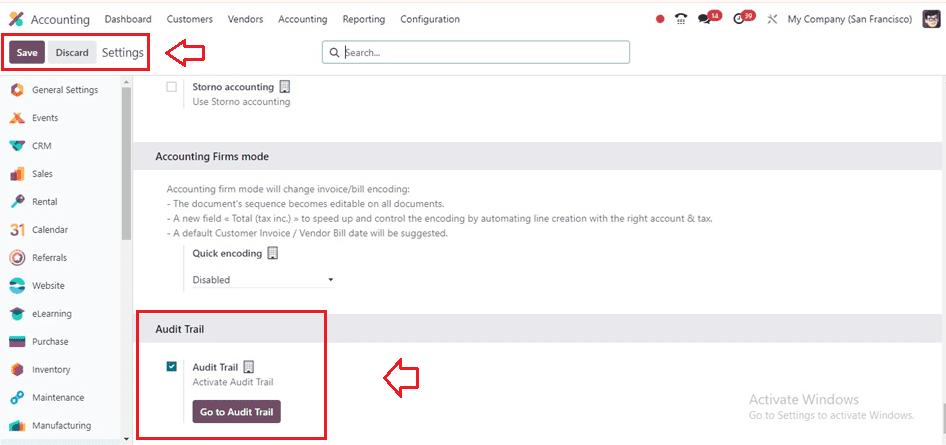

Audit Trail

Accounting features such as audit trail reporting are essential for monitoring adjustments and actions pertaining to financial transactions, entries, and configurations. Maintaining accountability, transparency, and adherence to financial standards are contingent upon it.

To access the detailed dashboard or reporting of your company’s audit trials, you must activate the ‘Audit Trail’ option from the ‘Settings’ window of the ‘Configuration’ menu, as shown below.

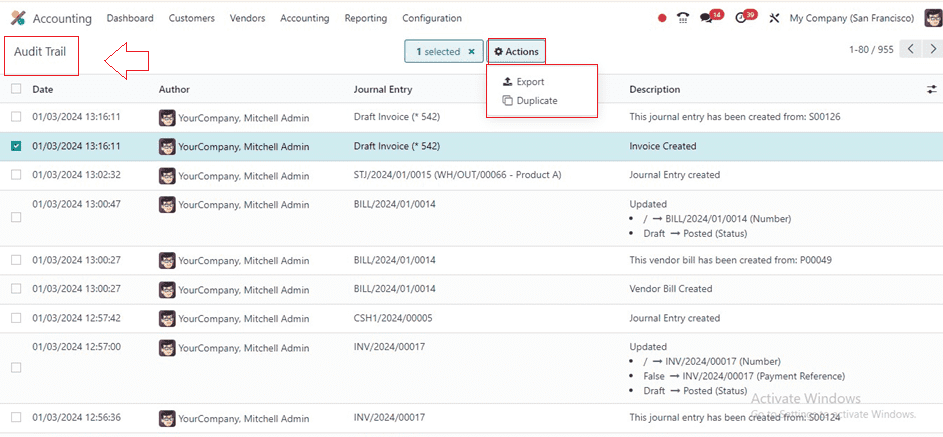

After saving the settings, you can click on the ‘Go to Audit Trail’ button to get audit trail reporting in Odoo's accounting module or go to the ‘Reporting’ menu and access the ‘Audit Trails’ window.

This dashboard gives a detailed overview of the audit trail reports data available inside your Accounting database with their Date, Author, Journal Entry, and Description as shown below.

To examine the detailed form view of any audit trail entry, click on the particular column from this window.

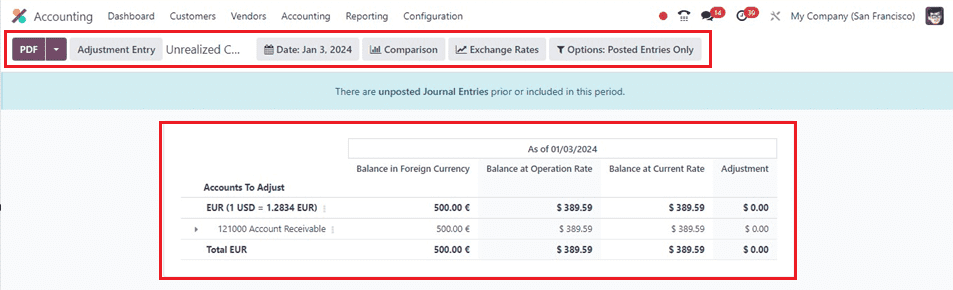

Unrealized Currency Gains/Losses

On your balance sheet, the Unrealized Currency Gains/Losses platform offers a report that may be used to reevaluate open accounts. The report, which is organized based on currency, contains information on the Balance in Foreign Currency as well as the Balance at Operation and Current Rates and Adjustments. The Adjustment Entry button can be used to make adjustments.

The relevant filter area at the top of the page allows you to modify or customize the report data using different filter rules.

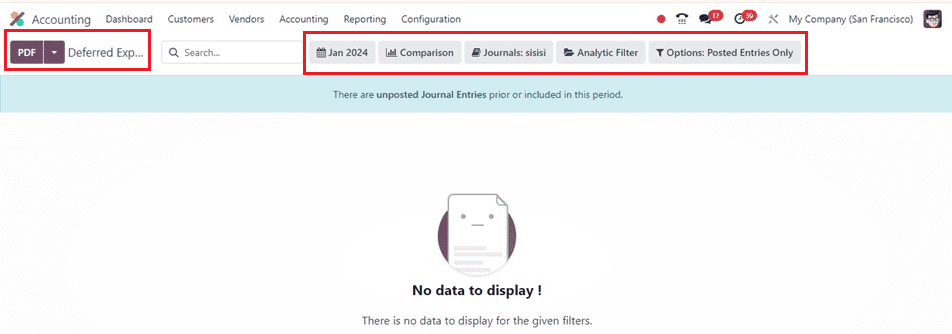

Deferred Expense

The money paid in advance for products or services that are never completed or delivered is known as deferred revenue. Since it is still received rather than earned, it cannot be recorded in an income account. In the Accounting module, it may be recorded as a liability, though. The general ledger, income statement (profit and loss), and custom reports that enable the examination of the amortization of delayed expenditures over certain periods are among the reports available in Odoo's accounting module for monitoring and analyzing deferred expenses.

The ‘Deferred Expenses’ reporting window shows the detailed reporting of all the deferred expenses of your company accounts.

You may receive a customized analysis of the delayed expense reports for your company needs by using the filter choices based on Dates, Fiscal Periods, Comparisons, Journals, Analytic Accounts, and other parameters.

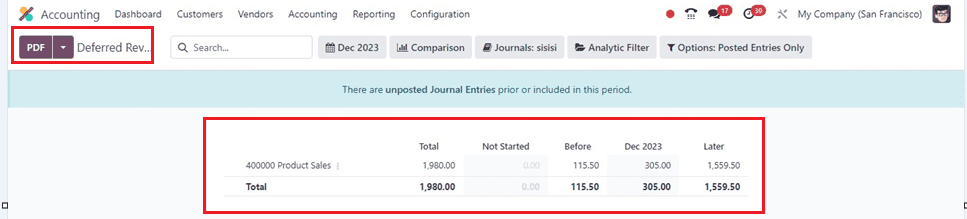

Deferred Revenue

Deferred revenue in Odoo refers to income received by a company in advance of earning it, creating a liability on the balance sheet. This occurs when a business receives payment for goods or services it hasn't yet delivered, creating a future obligation. Odoo's ‘Deferred Revenues’ reporting of the ‘Reporting’ menu offers various reports to track and analyze deferred revenue, including Income Statements (Profit and Loss), General Ledger, and custom reports that allow monitoring of deferred revenue recognition over specific periods.

This reporting window shows the journal entry of deferred revenues generated inside your accounting system with their Total Amount, Not Started, Before, etc. Use the different filter options if you would like to modify these report parameters.

Depreciation Schedule

The Depreciation Schedule platform displays the schedule established to spread the cost of significant assets across a specified number of accounting periods. An overview of the report's contents, including the acquisition date, initial depreciation, method, duration/rate, depreciation dates, and book value, is displayed in the image below.

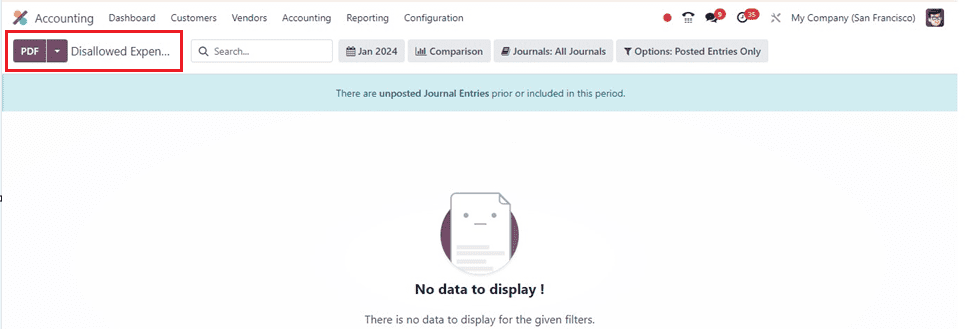

Disallowed Expenses

Disallowed expenses are costs that a business or individual cannot deduct or recognize for tax purposes, typically excluded from taxable income calculation due to specific tax regulations or internal company policies. These expenses can be partial or complete, and their reasons can vary. Odoo Accounting Module also provides a comprehensive reporting of all the disallowed expenses inside the ‘Disallowed Expenses’ window of the ‘Reporting’ menu.

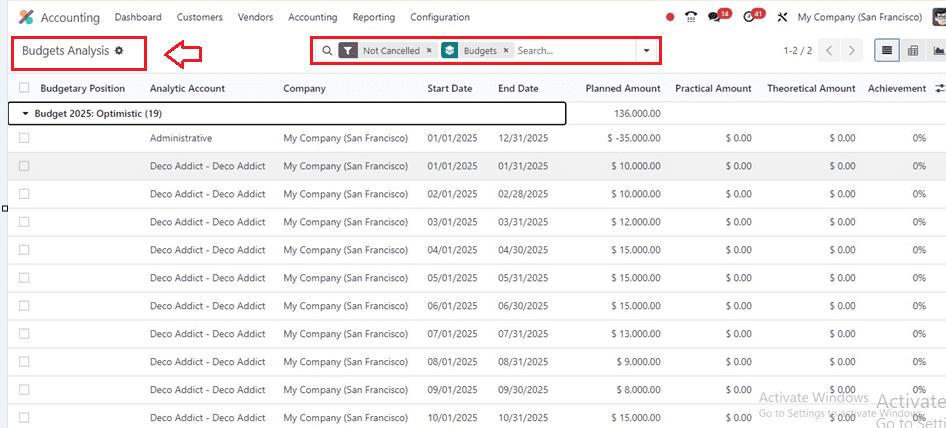

Budget Analysis

Budget analysis is a crucial process that evaluates an organization's financial performance by comparing actual income and expenses to budgeted figures. It involves analyzing variances between actual and budgeted figures, evaluating performance, forecasting, and adjustments, providing decision-making support, and contributing to continuous improvement. In Odoo, you can get an exclusive budget analysis report from the ‘Budget Analysis’ window of the ‘Reporting’ menu, as shown below.

The complete overview of different budgets may be viewed based on the following criteria: company, start and end dates, planned amount, practical amount, theoretical amount, achievement, and analytical account and budgetary position. Other graphical perspectives, such as Pivotal, are also available for this reporting. If you need to change the report settings, the advanced search box offers a number of additional filters and sorting choices. Organizations may improve their budgeting procedures and reach their financial objectives by being aware of the financial effects of choices.

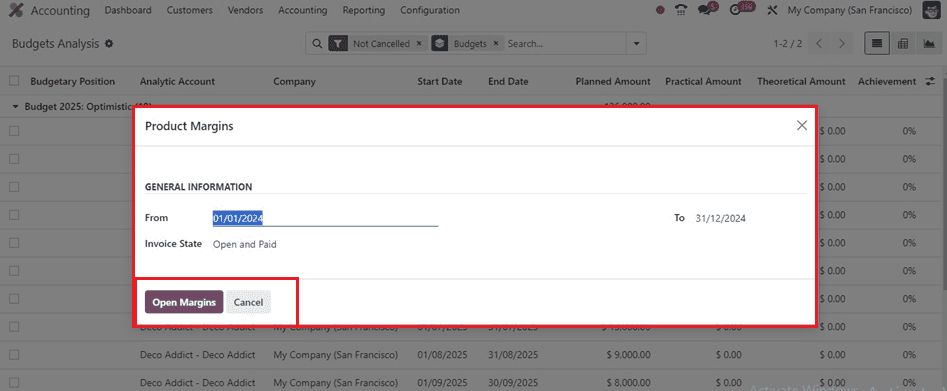

Product Margins

Click the Product Margins option from the Reporting menu to compute product margins. A pop-up will appear with the ‘From’ and ‘To’ dates. The ‘Invoice State’ can be set as ‘Paid,’ ‘Open and Paid,’ or ‘Draft, Open and Paid’ as shown below.

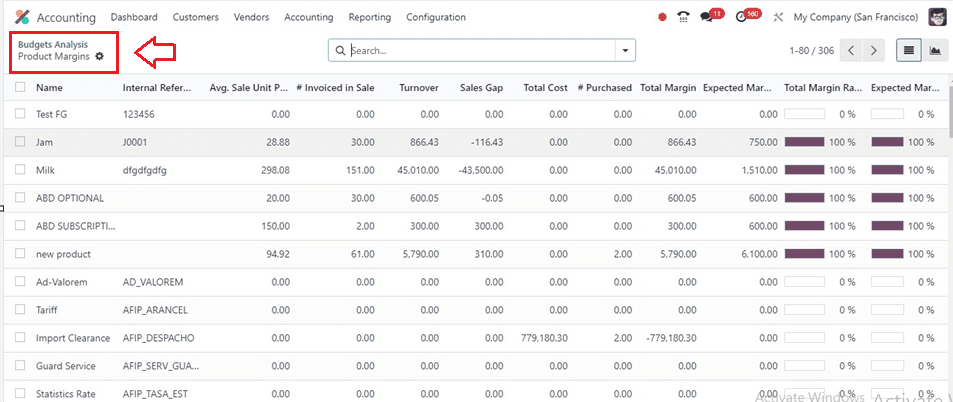

After providing the required information, save the details and access the reporting details by using the ‘Open Margins’ button.

This Product Margins Report includes the product name, Internal Reference, Average Sale Unit Price, Invoice in Sale, Turnover, Sale Gap, Total Cost, Purchased, Total Margin, Expected Margin, Total Margin Rate, and Expected Margin Rate. This report helps understand product sales progress and improves financial analysis by tracking performance reports over time.

By selecting the 'Pivot' symbol located in the top right corner of the page, users may also view this reporting window in a pivotal view.

1099 Report

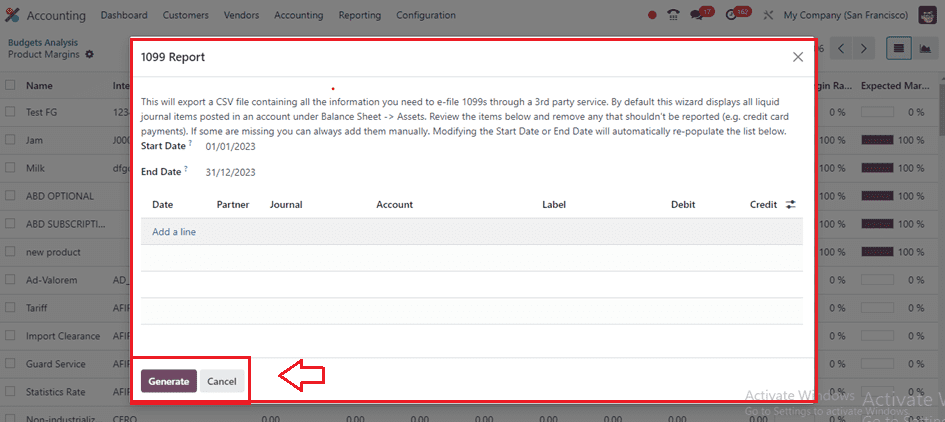

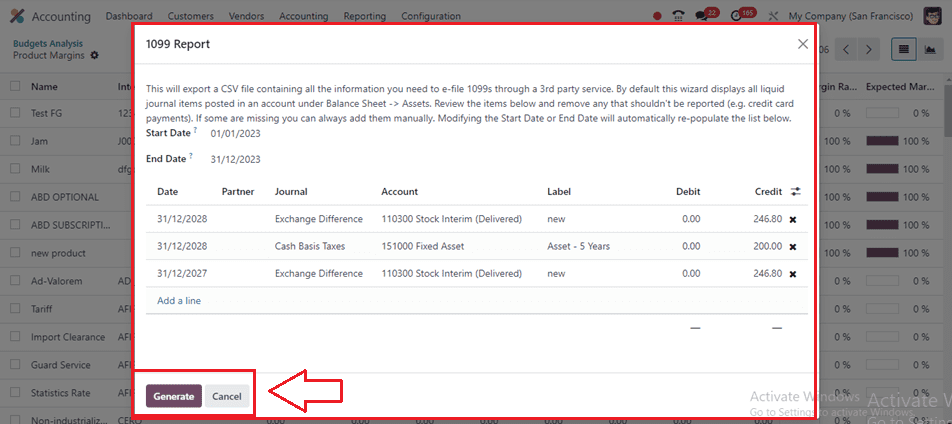

In order to record different forms of income, such as wages, salaries, and tips, to the Internal Revenue Service (IRS) for tax purposes, a 1099 form is utilized in the US. Common types include reporting payments made to non-employees, interest income earned from investments, dividends, securities sales, retirement accounts, pensions, annuities, and government payments. In Odoo, you can access the details of your company’s various income details from the ‘1099 Reporting’ page of the ‘Reporting’ menu. Clicking on this option will open a wizard where you can export the file of the income file you need to add to the 1099 reporting through a third-party service.

Provide a Start Date and End Date, and choose the income journal entries from the Date column by pressing the ‘Add a line’ button. Then, click on the ‘Generate’ button to generate the report.

The report that has been prepared will be downloaded to your device's storage, where you may view and store the CSV file for additional examination.

Belgium Localization Reports

Odoo's accounting module supports localization for various countries, including Belgium. To configure your instance, ensure it is set up with Belgium localization. Configure your Chart of Accounts according to Belgian accounting standards, which often comes with pre-configured charts for different countries. Generate VAT declarations as required by Belgian tax regulations, using features to generate VAT reports.

Inside the ‘Belgium’ section of the ‘Reporting’ menu, we can see various Belgium-localized accounting reports such as Partner VAT Listing, Create 325 Form and Open 325 Form.

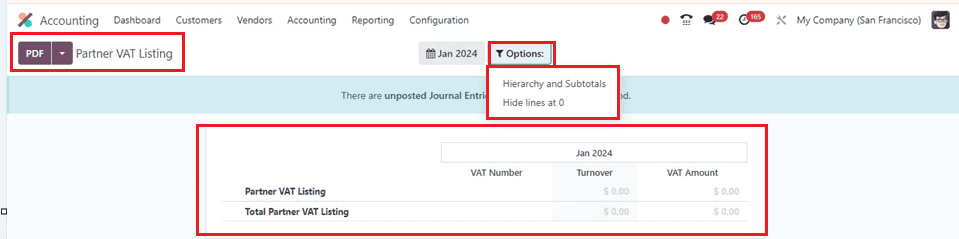

Partner VAT Listing

Odoo's Accounting module allows for the creation and analysis of a Partner VAT Listing report inside the ‘Reporting’ window, which provides detailed information about your business partners and their VAT (Value Added Tax) data, as shown below.

The report data can be printed using the PDF button and modified using the various filter options available at the top of the page.

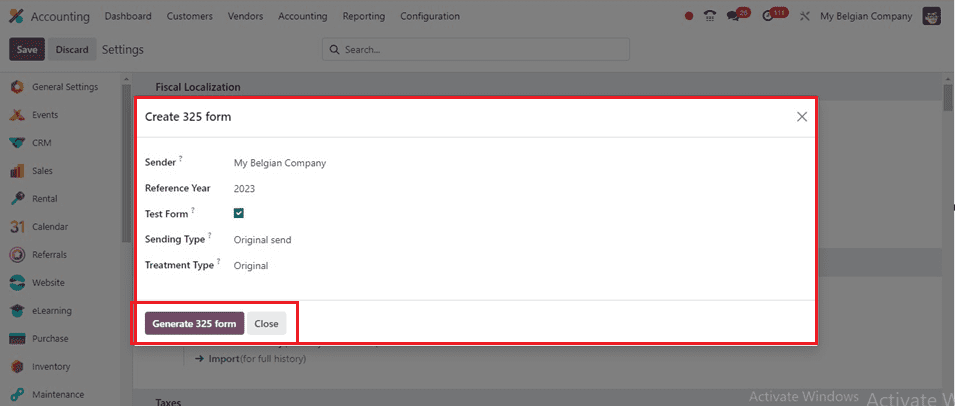

Create 325 Form

In Belgium, companies are required to file various tax returns and reports, including VAT declarations, corporate income tax returns, and social security contributions, for the most accurate information on specific forms, such as Form 325. Initially, your Odoo account must be a business account with a Belgian address. The 'Create 325 Form' option in the 'Reporting' menu may then be used to build a new form. As seen below, selecting this option will cause a little pop-up window to appear.

Inside the form, mention the Sender, Reference Year, Test Form, Sending Type, and Treatment Type as per your company requirements, and click on the ‘Generate 325 form’ button to create a new form.

Open 325 Form

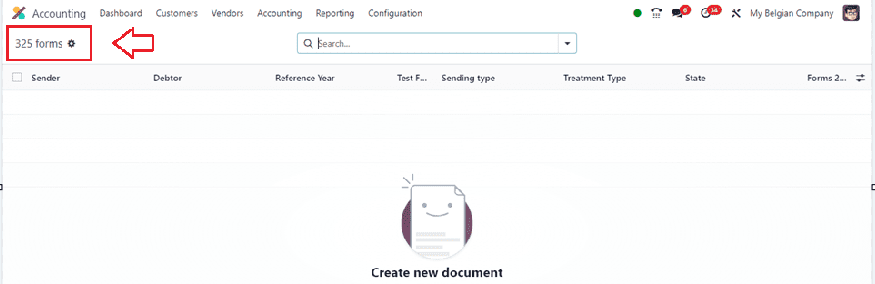

To generate a 325 form, navigate to the ‘Reporting’ menu and choose Belgium: ‘Open 325 form’ option. A new page will appear where you can see the list of Sender, Debtor, Reference Year, Test Form, Sending Type, Treatment Type, State, and Form, as shown below.

These are the major reporting sections available in the Odoo 17 Accounting Module. Reports are crucial for real-time financial management within a company. This section outlines the reporting features provided by the Odoo Accounting module in relation to various financial operations.