Accounting is the most vital and important part of any business. Its management can make a direct impact on the profit of the company and at the same time reduce losses. Managing the accounts of a company is not an easy process when done manually. The risks of error will have an influence on the overall performance of the business.

The best open source ERP, Odoo ERP is the very best choice when it comes to managing to accounting. With its advanced features and user-friendly tools, accounting can be managed effectively and efficiently.

This blog will discuss the main features that Odoo 15 Accounting module has to offer.

Dynamic Accounting Management

Odoo 15 Accounting module offers you dynamic and clear accounting management. By opening the module itself, the dashboard is completely equipped with advanced accounting operations. An informational overview of the accounting operations is displayed on the dashboard. The dashboard guides you through the accounting procedures and provides you with filtering as well as grouping options. You can directly start defining the fiscal years and tax returns periodicity and configure it. After configuring the accounting periods you can set up the chart of accounts and record initial balances. Following the review of the chart of accounts, you can set the default taxes for the purchase and sales transactions. After reviewing the taxes, you can move on to connect your financial accounts. Within seconds you can add a bank account to the database. The well-structured dashboard gives you direct access to the accounting operations.

Integration with other modules

The Odoo 15 Accounting module is operated with other main modules as well as supporting modules of the software. This integration allows you to add up the features of management in the accounting module. It also helps in indulging the entire operations of the company.

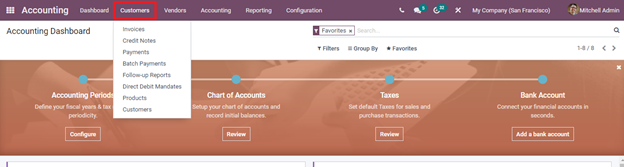

Customer Accounting Management

At the Customer tab, you can easily manage the Invoices, Credit Notes, Payments, Batch Payments, Follow Up Reports, Direct Debit Mandates, Products, and Customers. The customer list can be updated and also you can add new customers to the list. The follow-up reports related to the invoicing can be executed easily.

Invoices

In the Odoo 15 Accounting module to start the invoicing operations, you can set up the company’s data for documents header or footer. After setting up the data you can customize the look you need for the invoices. Then you can start creating invoices on the platform.

The existing invoices can be viewed and updated from the Invoices window. The invoice lines and journal entries can be managed and viewed from the invoice profiles. You can add credit notes or debit notes to the invoices from within the invoice window. From the invoice profile, you can generate the payment link and send it to the customer directly. The invoices can be sent by email or post as per the requirement. The payment can be registered within a few clicks. By entering the details of the journal, amount, bank account, and other necessary details you can create a payment from the invoice window.

Vendor Account Management

The functional operations related to the vendor’s accounting management can be easily done through the Odoo 15 Accounting module. Based on the quantity of the products ordered and delivered, vendor bills can be generated. In case of an exchange of products, you can use the refund options to request the amount back. You can make payments and track their statuses from the Accounting module. Even the employee expenses that have occurred can be approved and paid based on the expense report from within the module. The vendor list can be updated and managed along with creating vendor bills.

Dynamic Financial Statements

At the Accounting tab of the module, you can view various financial statements of the company listed. Journal and ledger entries of the company can be viewed and checked. Journals of the sales, purchases, bank, cash, and other miscellaneous items can be viewed separately with simple clicks. General ledger and partner ledgers can be reviewed and analyzed from within the Accounting module. The automatic transfers can be managed and you can create new automatic transfer entries in the system from the module. Multiple budgets can be created and assigned to different responsibilities of the company. These budgets can be tracked and checked periodically. The assets of the company can be managed with the Odoo Accounting module. A periodical depreciation amount can be assigned and the value will be changed periodically. You can manage deferred revenues and deferred expenses from the Odoo 15 Accounting module. The accounting entries can be reconciled easily with a few steps.

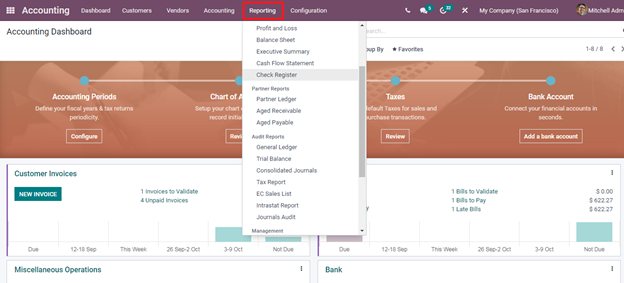

Reporting

Almost all the Odoo modules allow you to have the analytical reports of their operations. At Odoo 15 Accounting module you can view the Profit and Loss statement of the company. You can compare the statement with the profit and loss statement of other periods and analyze the stage of the company. In the same way, the Balance sheet of the company accounts can be viewed within simple clicks. Executive summary and Cash Flow Statements can be easily generated using the Odoo Accounting module. The Check Register of the company can be viewed and analyzed. You can select the period of which the register should be displayed and analysis can be done on them. The Audit reports such as General Ledger, Trial Balance, Consolidated Journals, Tax Report, EC Sales List, Intrastat Report, and Journals Audit. Other major reports that can be generated and analyzed with Odoo 15 Accounting module are Invoice Analysis, Analytic Report, Unrealized Currency Gains or Losses, Depreciation Schedule, Disallowed Expenses, Budgets Analysis, Product margins, and 1099 Report.

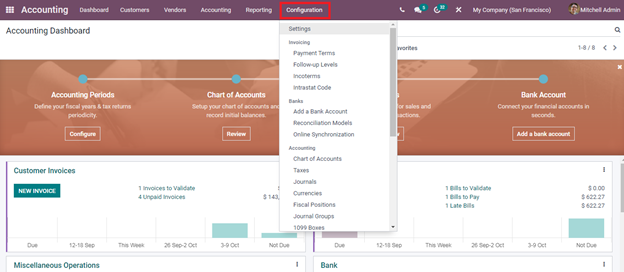

Configuration

Apart from the general settings which allow you to configure the default taxes, the round-up method, customer invoices, vendor bills and so on, you can also configure the Payment Terms, Follow Up Levels, Incoterms and Intrastat Code. From the Configuration tab, you can add bank accounts to the system and also configure Reconciliation Models. The Online Synchronisation of the bank accounts can be done from the Odoo 15 Accounting module. The configuration can also be done on the Chart of Accounts, Taxes, Journals, Currencies, Fiscal Positions, Journal Groups, 1099 Boxes, on Payment Acquirers, Asset Models, Deferred Revenue Models, Product Categories, Deferred Expense Models, Budgetary Positions, Disallowed Expenses Categories, Analytic Items, Analytic Accounts, Analytic Account Groups and Analytic Defaults Rules.

Odoo 15 Accounting module

is the complete solution for digitizing your accounting operations. With its

sophisticated and advanced tools, the accounting management of your company can be

a piece of cake.