Odoo 15 Accounting module is the best tool to manage your company’s financial aspects. Data management is easier with the module as it is integrated with other major modules of the system. With its sophisticated features and tools you can save time as well as bring systematic management in your business. Double entry bookkeeping can be effortlessly executed as the module has an automated nature. The entries are automatically made during each transaction into the journals according to the data acquired from other modules. The entries are updated automatically as new actions take place. Revenues and expenses of the company can be monitored and managed from within the module. The accounts and its procedures related to the vendors and customers are managed in a systematic method through the Odoo 15 Accounting module.

In this blog let us check out how the Odoo 15 Accounting module helps in managing the business accounts of your company using its efficient tools.

Miscellaneous

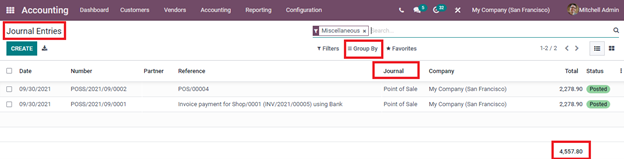

By selecting the Accounting tab from the Odoo 15 Accounting module you can view the Journal Entries option situated under the Miscellaneous menu. The journal entries recorded at the time of transactions are visible at this option. The list of journal entries along with the Date, Number, Partner, Reference, name of the Journal, Company name, Total amount and status of the entry is displayed. The journal entries can be grouped on the basis of their Partner, Journal, Status, Date and Company using the Group By option. The total amount of all the journal entries are denoted at the bottom

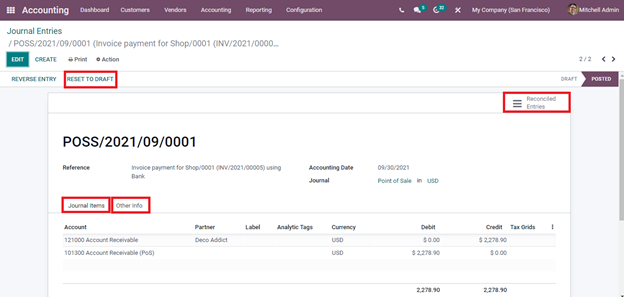

To view more details of the journal, you can simply click on the journal entry from the list. These details include the Journal Items and Other Info. Under the Journal Items menu you can view the Account name, name of the Partner, Label, Analytic Tags, Currency used, Debit amount and Tax Grids. At the Other Info menu the details such as whether the entry should be Post Automatically or not, whether the entry should be Checked again or not due to insufficient data while entering and the Fiscal Position is mentioned. To change the status of the journal entry to DRAFT from POSTED you can click on the RESET TO DRAFT button. To view the reconciled entries select the Reconciled Entries option.

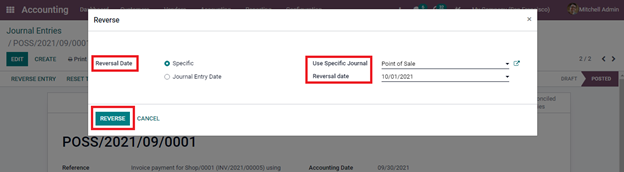

You can

reverse the journal entry by selecting the REVERSE ENTRY button. The Reverse window will appear on the screen.

From there you can select the Reversal Date as Specific or Journal Entry Date.

Then enter the Use Specific Journal and Reversal Date. Aftering entering the

details click on the REVERSE button to reverse the entry

Journals

In the Odoo 15 Accounting module you can view the journals related to Sales, Purchases, Miscellaneous and Bank and Cash. Let us look at each of them.

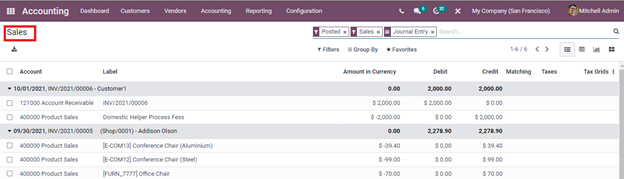

- Sales

By selecting the Sales option from the Accounting tab, you can view the list of journal entries made while Sales operation. The details of the Account, Label, Amount, Debit, Credit, Matching, Taxes and Tax Grids are listed.

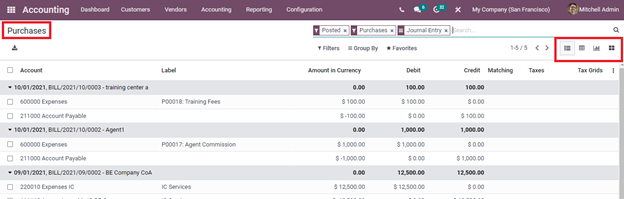

- Purchases

The journal entries related to the Purchase purposes can be viewed by selecting the Purchases option from the Accounting tab. Similar to the Sales journal the details of Account, Label, Amount in Currency, Debit, Credit, Matching, Taxes, and Tax Grids is displayed. You can view the entries in List, Pivot, Graph, and in Kanban view.

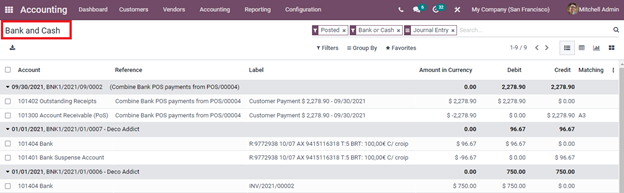

- Bank and Cash

Similar to the Sales and Purchase options, you can view the journal entries related to the Banks and Cash.

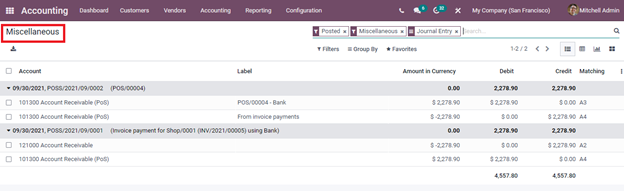

- Miscellaneous

To view the journal entries related to the Miscellaneous operations of the company select the Miscellaneous option from the Accounting tab.

Ledgers

The accounts related to the inventory, accounts receivable, accounts payable, investments, deposits, and many more can be found in the ledgers. In short, it is the record used to store the bookkeeping entries for the purpose of balance sheet and income statement. In Odoo 15 Accounting module you can view both General Ledger and Partner Ledger.

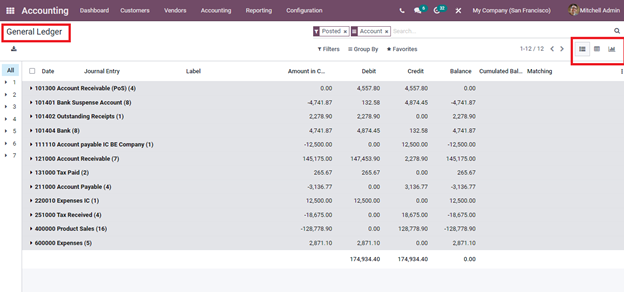

- General Ledger

By selecting the General Ledger option from the Accounting tab, you can view the ledger of the company with details such as Date, Journal Entry, Label, Amount in Currency, Debit amount, Credit amount, Balance, Cumulated Balance, and Matching. You can view more details such as Company, Journal, Account, Partner, Reference, Due Date, Analytic Account, Analytic Tags, Original Currency, Taxes, Tax Grids, and Product in General Ledger. The ledger can be viewed in List, Pivot, and in Graph view. Analyzing the ledgers will help you to make further decisions and to check the amount spent on different operations.

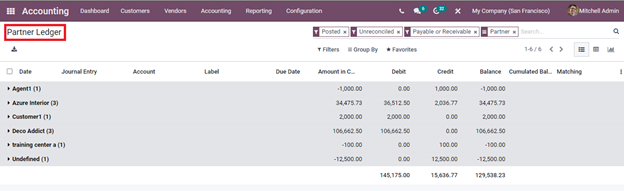

- Partner Ledger

To view the ledger related to the partners of the company select Partner Ledger from the Accounting tab. The ledger consists of information such as Date, Journal Entry, Account, Label, Due Date, Amount in Currency, Debit amount, Credit amount, Balance, Cumulated Balance, and Matching.

Management

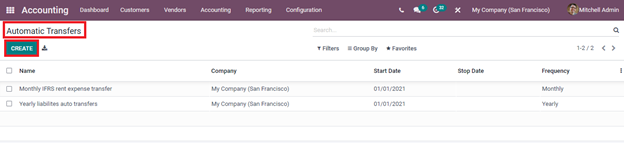

- Automatic Transfers

In the Odoo 15 Accounting module, you can create and manage automatic transfers. By selecting the Automatic Transfers option from the Accounting tab you can view the existing configured automatic transfers. The details of the transfer such as the Name of the automatic transfer, name of the Company, Start Date, Stop Date, and Frequency are displayed in the list. By clicking on the CREATE button you can create a new Automatic Transfer.

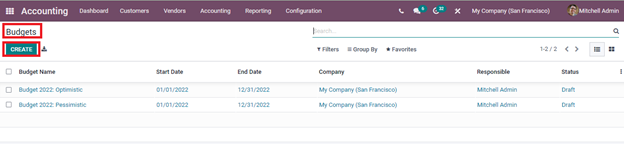

- Budgets

Management of budgets plays an important role in shaping the financial stability of the company. In the Odoo 15 Accounting module, you can create more than one budget. From the Accounting tab, select the Budgets option to view the list of budgets along with the details such as Budget Name, Start Date, End Date name of the Company, name of the Responsible, and Status of the budget. By selecting the specific budget from the list you can view the details of the Planned Amount, Practical Amount, Theoretical amount, and other details of the budget lines. New budgets can be created by selecting the CREATE button.

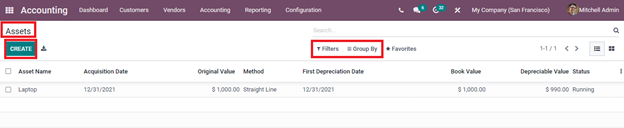

- Assets

Assets help in gaining profit as well as keep the business running. Odoo 15 Accounting module assists you in determining the financial status of your business by keeping an accurate record of the assets. By selecting the Assets option from the Accounting tab you can view the list of assets the company possesses. The details such as the Asset Name, Acquisition Date, Original Value of the asset, First Depreciation Date, Book Value, Depreciable Value of the asset, and Status. By applying Filters such as Current and Closed you can view the assets with current and closed status. Also with the Group By option, you can view the assets based on the Date and Asset Model. New assets can be added to the record by selecting the CREATE button and by entering the necessary details.

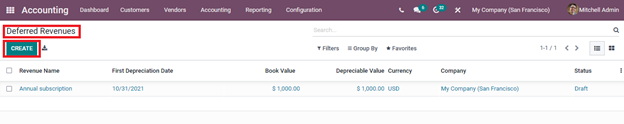

- Deferred Revenues

You can manage the unearned revenue or deferred revenue from the Odoo 15 Accounting module. These are the revenue that the company receives in advance for its products and services. The balance sheet records the deferred revenue as a liability. By selecting the Deferred Revenue option from the Accounting tab you can view the details related to the deferred revenue of the company. These details include the Revenue Name, First Depreciation Date, Book Value, Depreciable Value, Currency, name of the Company, and Status of the revenue. You can create and add new deferred revenue entries to the record by clicking on the CREATE button.

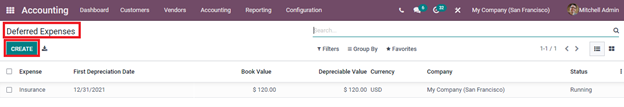

- Deferred Expenses

Just like managing the deferred revenue, you can also manage deferred expenses in Odoo 15 Accounting module. You can also compute the expenses from the Deferred Expenses. You can view the details such as the name of the Expense, First Depreciation Date, Book Value, Depreciable Value, Currency, name of the Company, and Status of the expense. To create a new deferred expense entry click on the CREATE button.

Actions

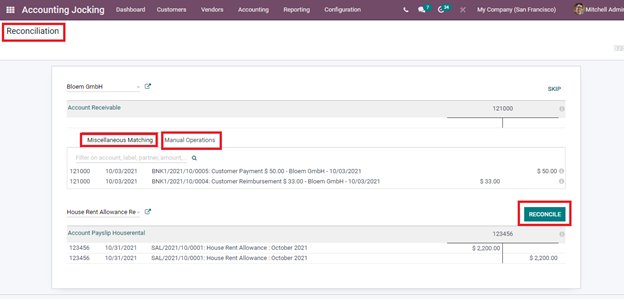

- Reconciliation

By selecting the Reconciliation option from the Accounting tab, you can view the details of reconciliation taking place. This allows you to compare the bank statements against the company’s accounting. By doing this process you can make sure that both the accounts match each other. At the Reconciliation window, you can view the name of the Partner along with the Amount Receivable. Under Miscellaneous Matching, you can match with entries that are not from receivable or payable accounts. You can also filter on account, label, partner, and amount. Under Manual Operations, you can add Account, Taxes, Journal, Label, Amount, and Write Off Date. If you are not sure about the details, enable the To Check option which will allow and remind you to recheck the details. To reconcile the statement click on the RECONCILE button.

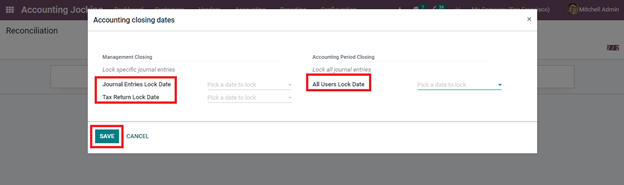

- Lock Dates

With the Odoo 15 Accounting module, you can lock specific journal entries or all journal entries according to their dates. By entering the dates at the space provided you can lock Journal Entries, Tax Returns and All Users. The changes will be saved after clicking the SAVE button.

Managing

accounts is easier with the Odoo 15 Accounting module. You can manage the

accounts, journals, and ledgers from the module. Budgets can be prepared and

monitored for the efficiency of the business.