What is Odoo Accounting localization?

Odoo accounting localization refers to the adaptation of Odoo's accounting features to comply with the specific tax, accounting, and legal requirements of a particular country. Being adaptable, an ERP system's features can be adjusted to match the particular requirements of various regions.

Advantages and features of Odoo Accounting localization

Ensures adherence to local tax, accounting, and legal regulations, minimizing risks and penalties. Provides pre-configured tax structures, reporting formats, and account charts to streamline accounting procedures. Reduces errors in tax calculations, financial reporting, and data entry. Facilitates seamless operations in multiple countries with varying accounting standards, which reduces the need for specific development and configuration, saving time and resources.

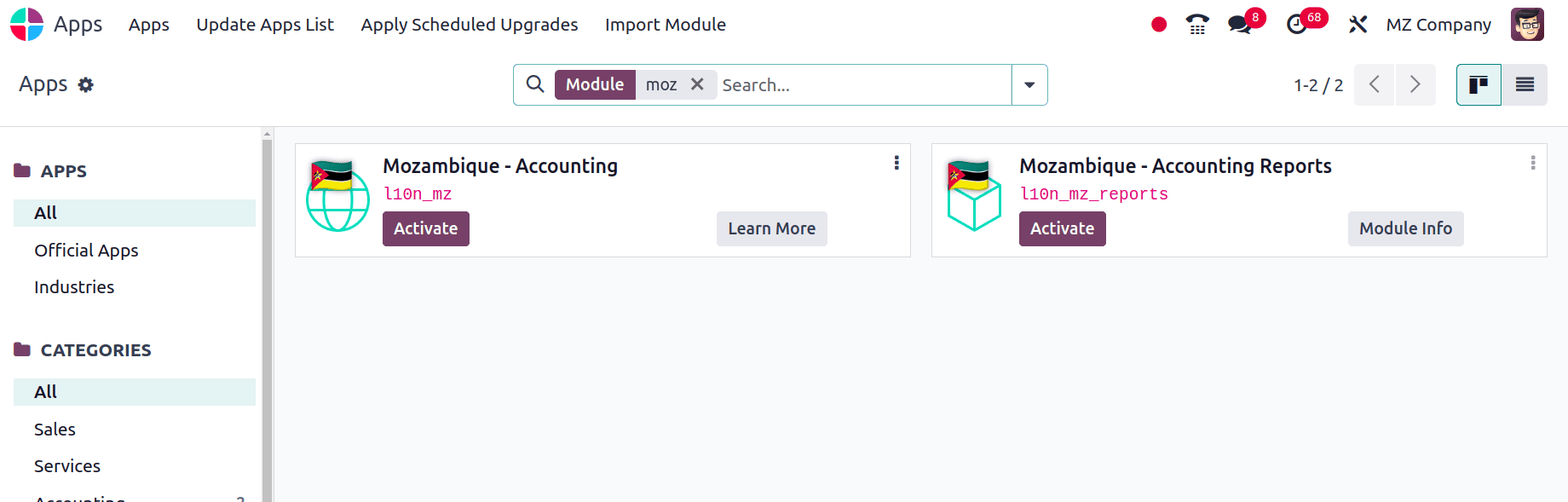

To set up the localization for the country Mozambique, we need to activate the modules mentioned below. So move to the Odoo Apps and activate these modules.

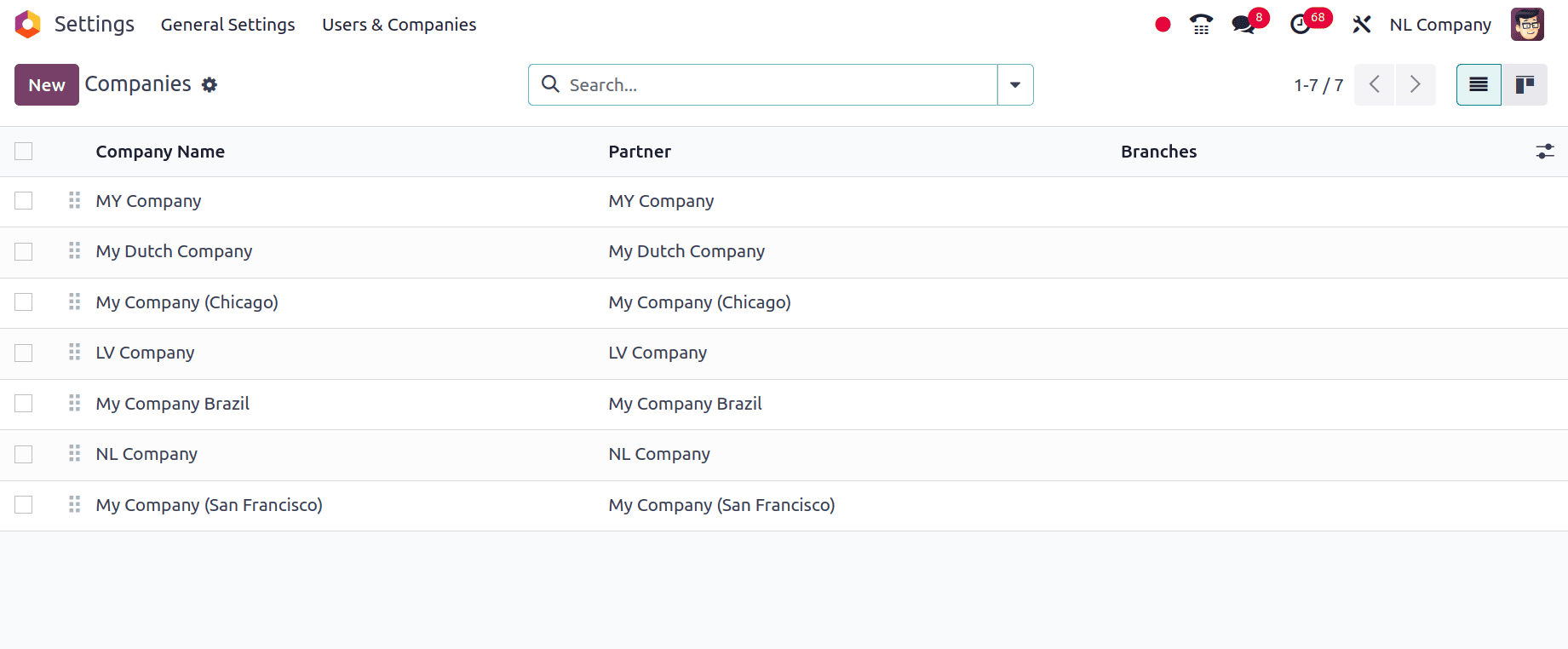

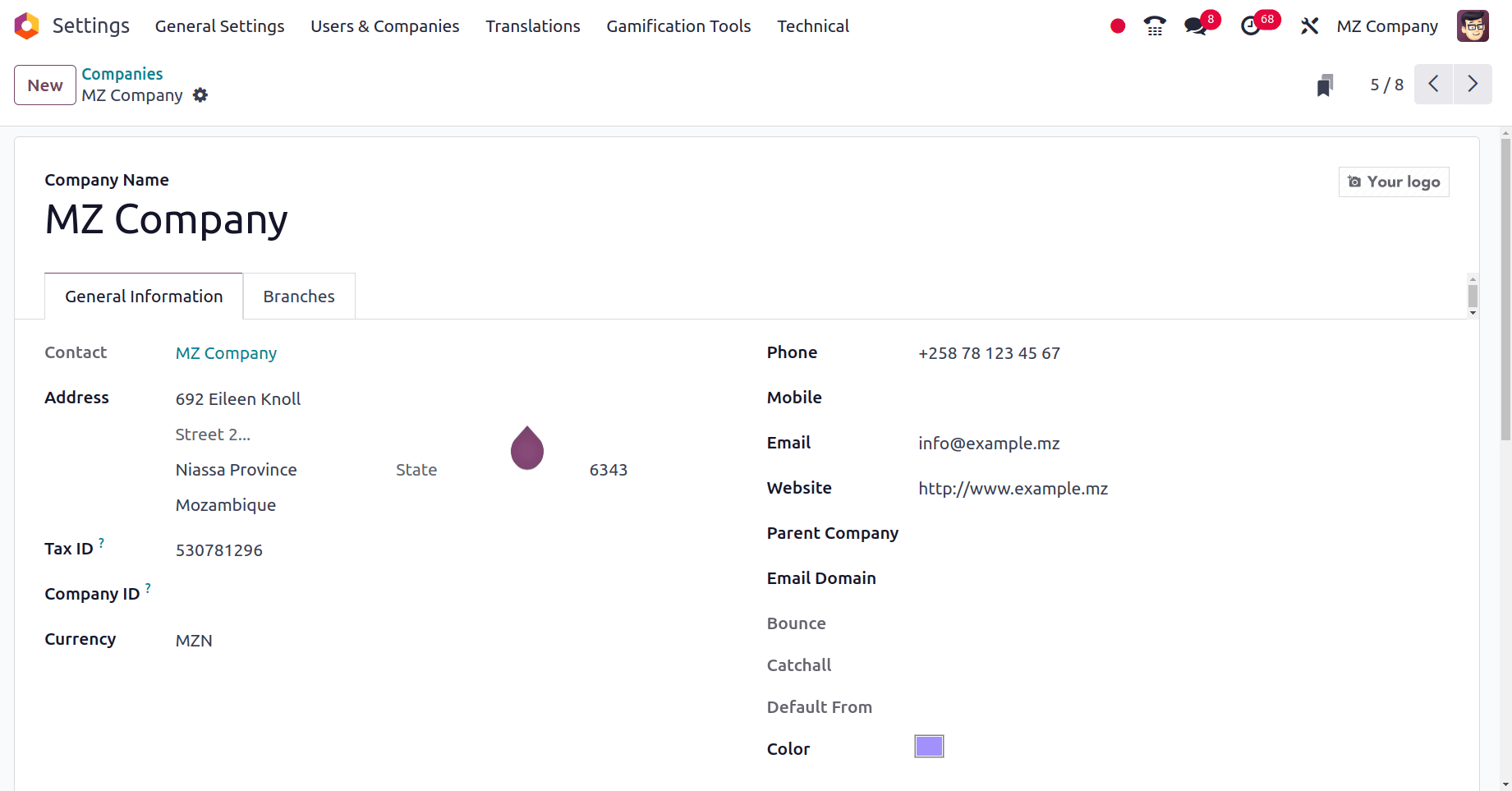

After the modules are installed properly, move to the General settings of Odoo to create a new company in the country, Mozambique.

A list of companies that have already been established will be provided there. Click the new button on this page to start a new company. Next, Odoo will give a form for the new businesses to fill out with information about themselves, like their name, address, and the nation they are located in.

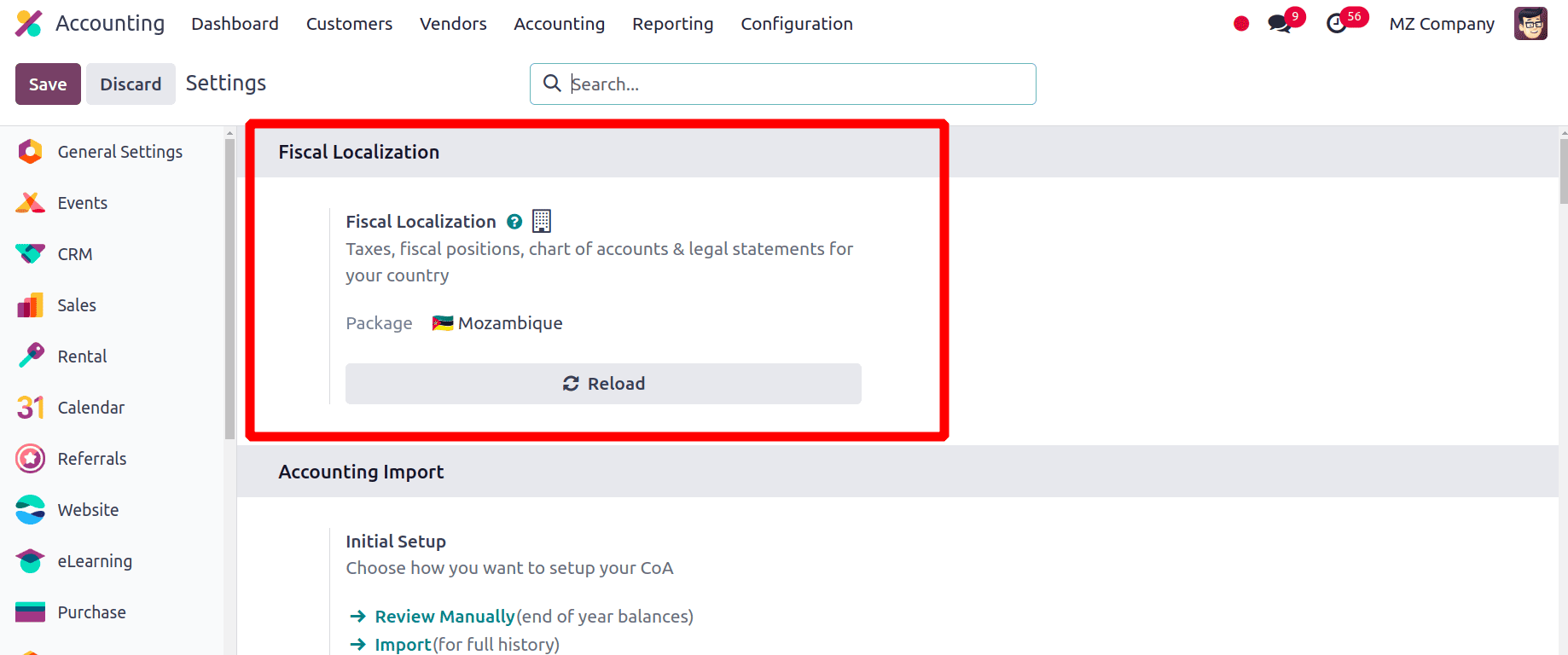

The next phase is to set up the localization package for this company. Go to the Odoo 17 Accounting application to configure the localization package for this company. In the Configuration > Settings section, you will see a fiscal localization section. There, we can provide the fiscal localization package for this company. Here, we have created a company from Mozambique, so we set the package for the company, which is also in Mozambique.

When we set these packages for the company, Odoo automatically configures the taxes, fiscal positions, currency, chart of accounts, and journals for the company successfully.

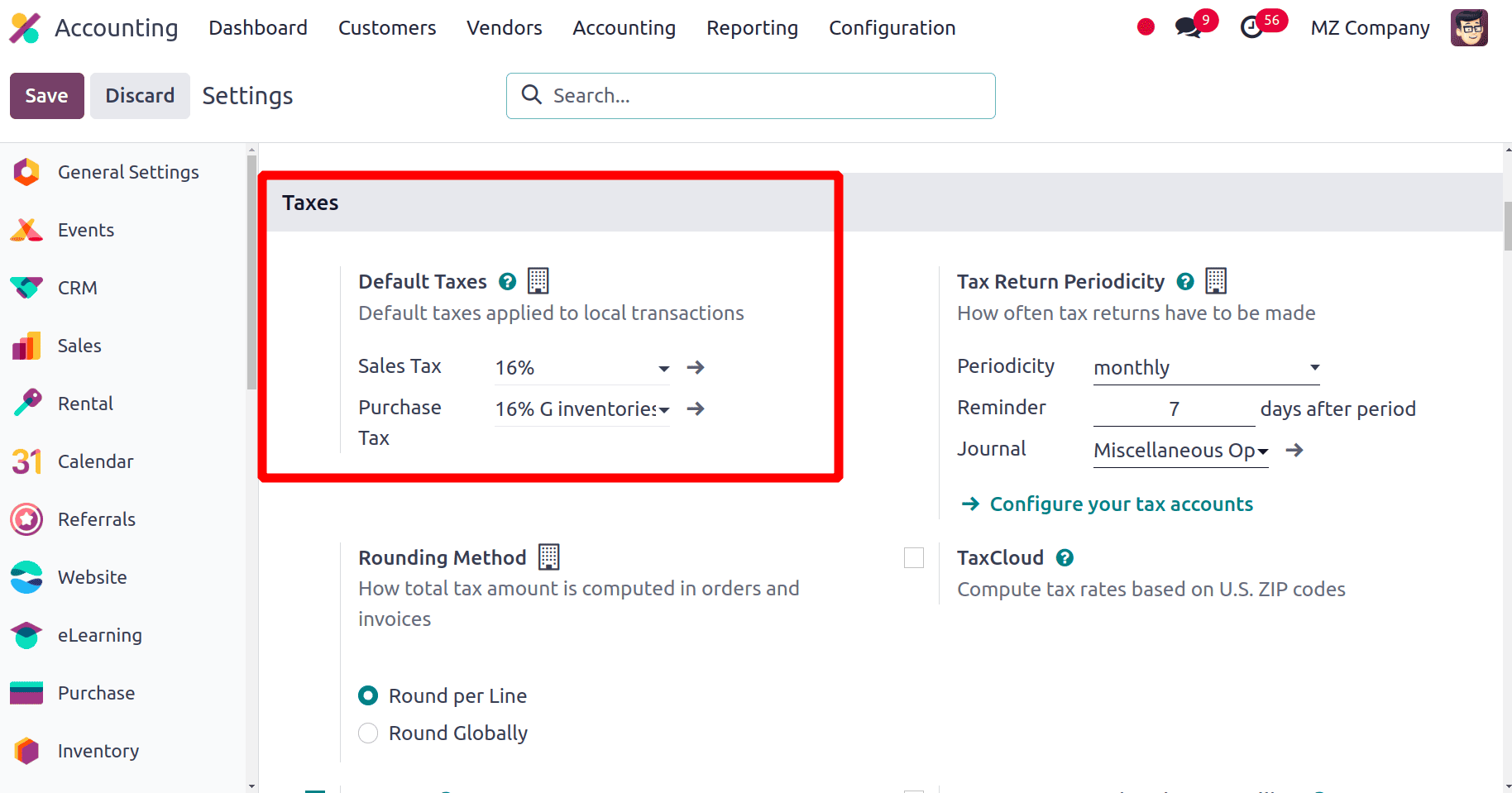

In the configuration Settings, there is a taxes section, and Odoo automatically sets the Default Taxes for the companies from Mozambique when the packages are configured properly. For the company, Odoo sets up the Default Purchase and Sales taxes.

* Default Sales Tax: Default sales tax in Odoo is the tax that is automatically applied to a product or service when it's added to a sales order or invoice unless a specific tax is manually selected.

* Default Purchase Tax: Refers to the tax that is automatically applied to purchased products or services when creating purchase orders or invoices unless a specific tax is manually selected. It's a pre-configured tax that simplifies the purchasing process by eliminating the need to manually select a tax for each item.

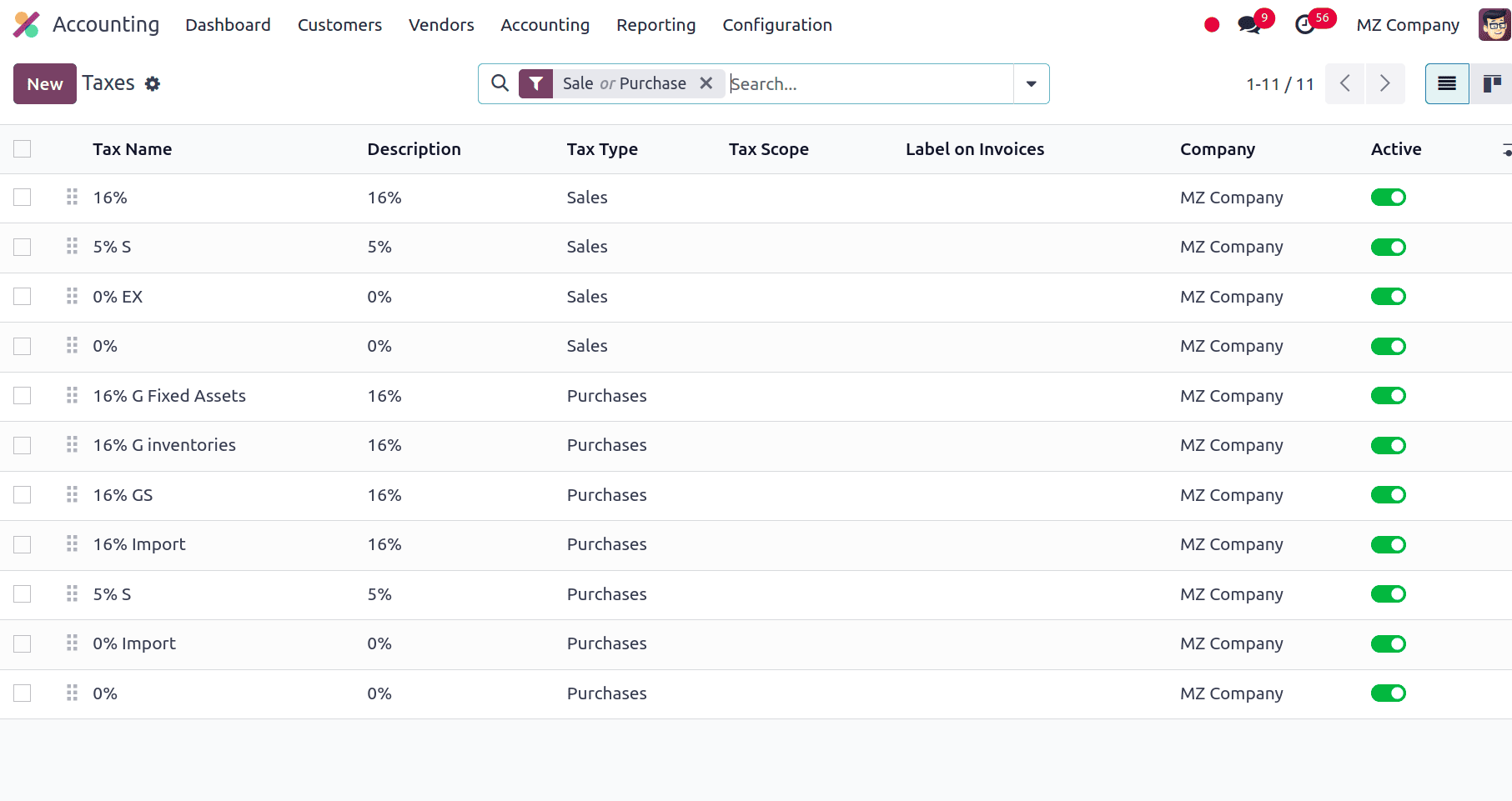

Under the configuration, we have the Taxes for the company that odoo configured when the localization package is set for the company. On this page, we can create new taxes if needed.

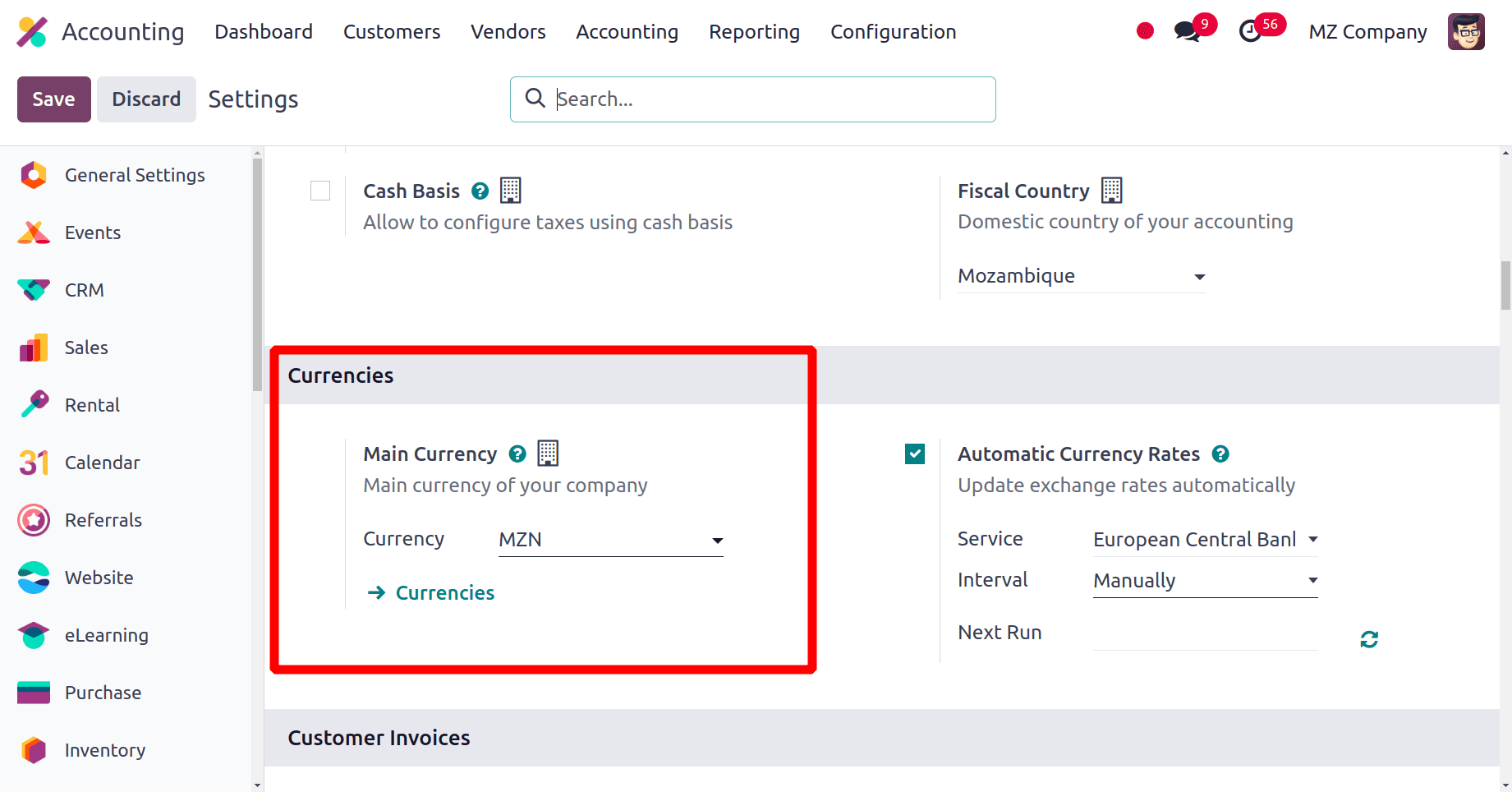

Next the currency of the company, and we know that the currency used in Mozambique is Mozambican Metical. Thus, Odoo automatically selects Mozambican Metical (MZN) as the company's primary currency.

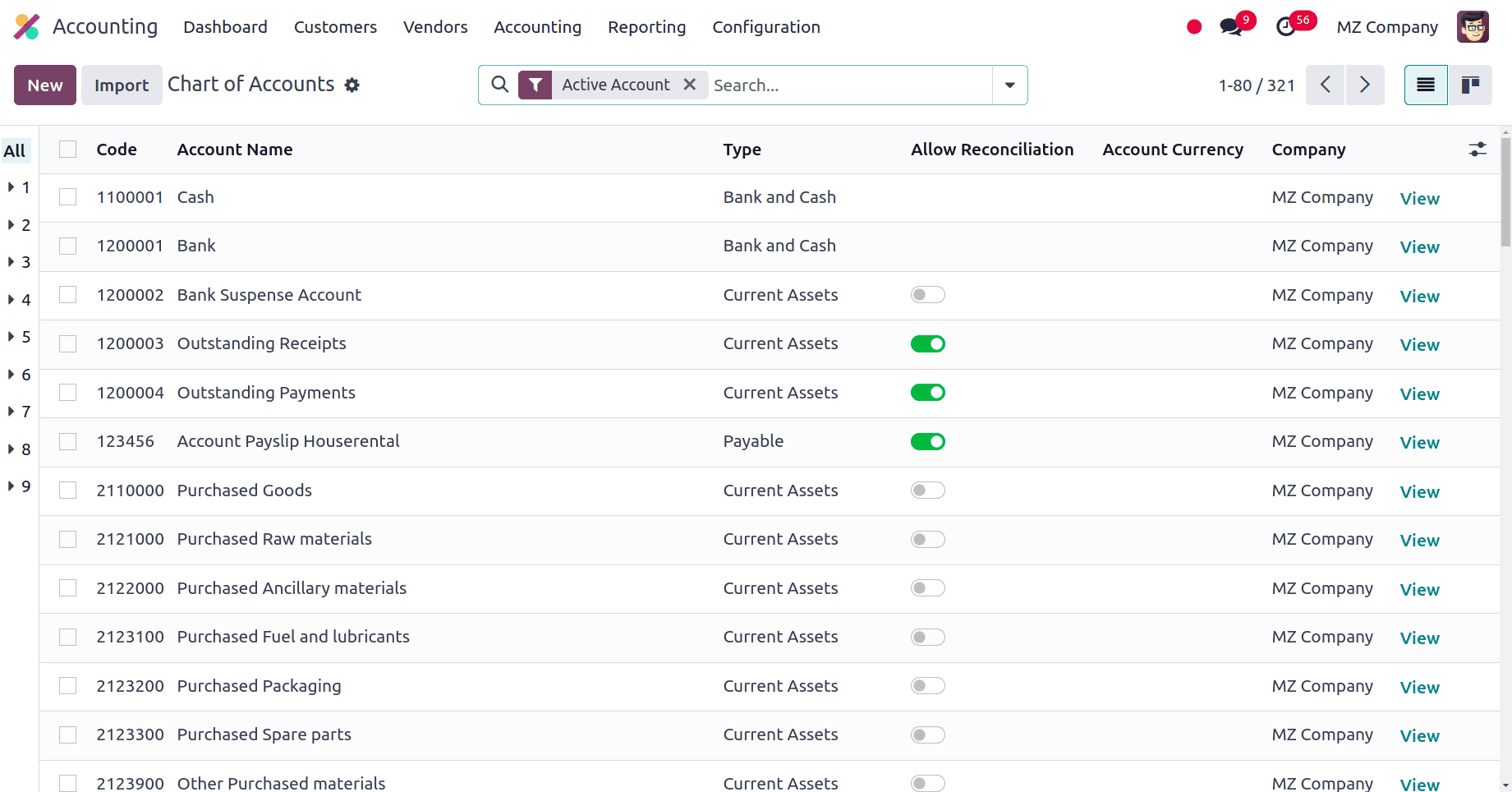

Odoo established the company's chart of accounts, In a general ledger, a chart of accounts (COA) is simply a list of all the accounts that are used to record financial transactions. In Odoo, it's a crucial component of the accounting module, providing a structured framework for tracking your company's financial activities. The chart of accounts used in several nations may never be the same.

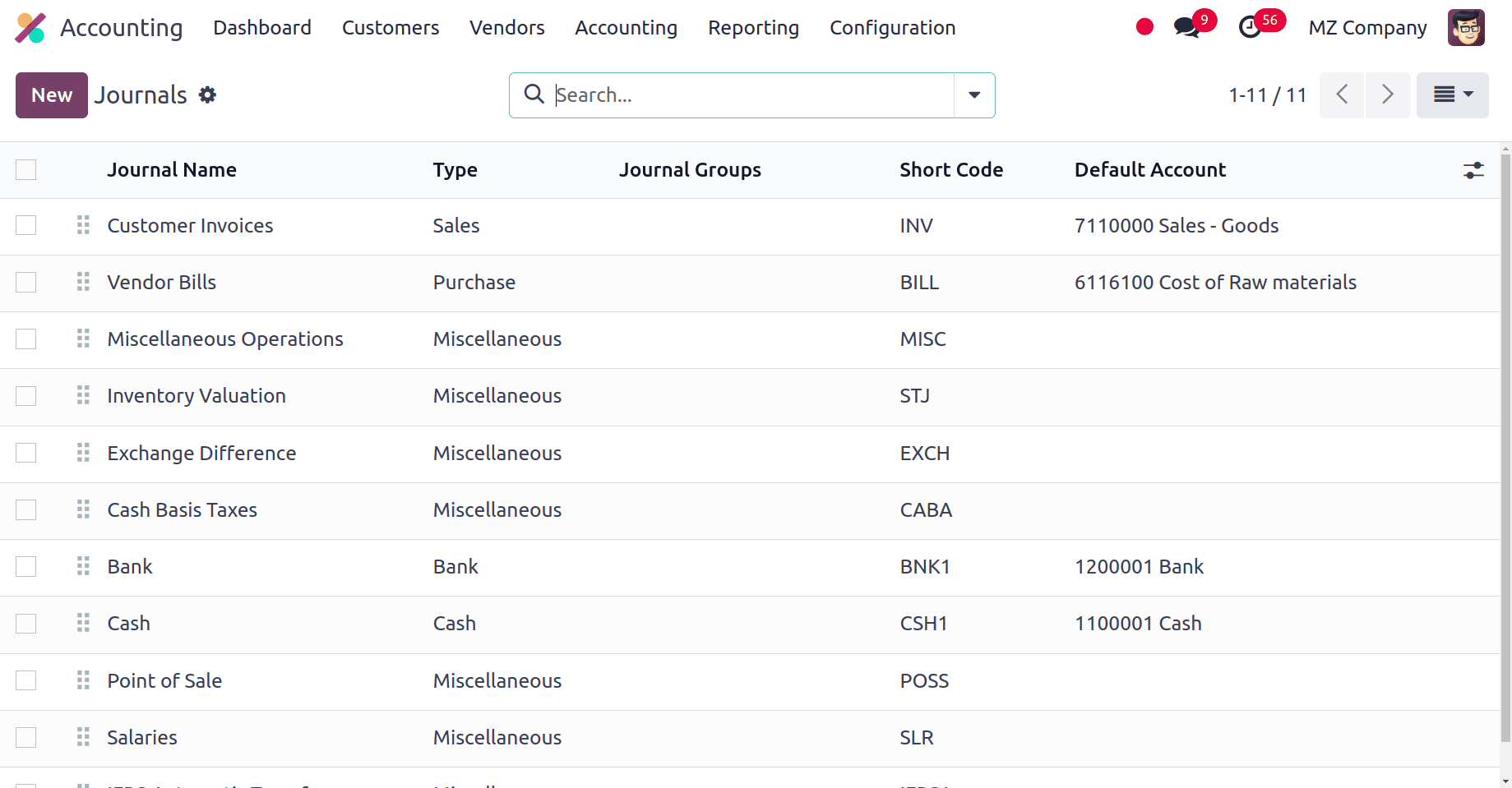

Next are the journals of the company. Journals in Odoo are the backbone of your accounting system. They have a number of benefits. Every financial transaction is fully documented in journals, complete with dates, accounts impacted, amounts, and descriptions. A clear audit trail is maintained, which is essential for financial transparency and compliance.

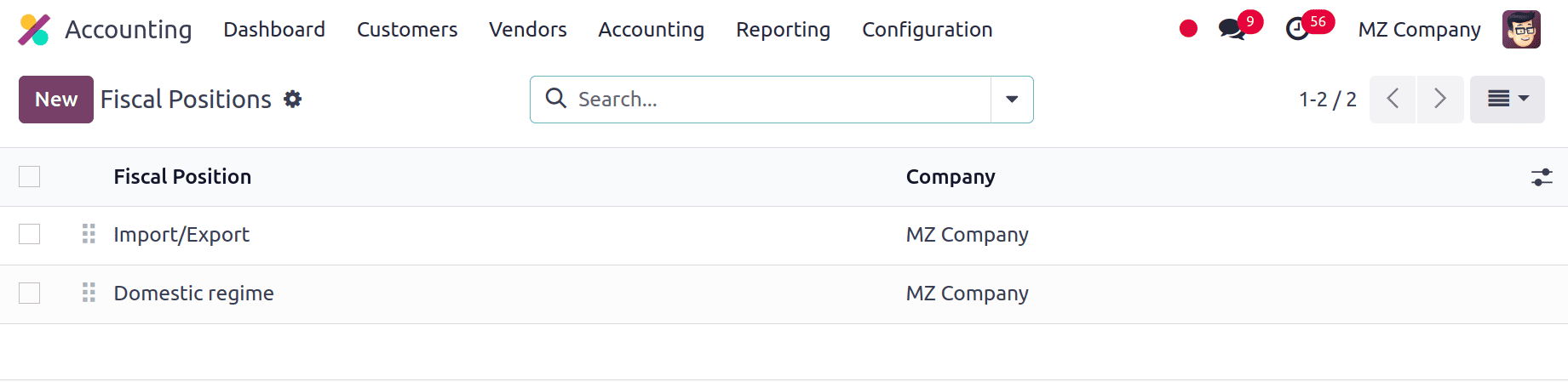

Under the configuration, we have the company's fiscal positions. In Odoo, a fiscal position is a configuration that specifies the taxes that apply to certain kinds of transactions. It establishes the tax computation, which includes the computation of output taxes and input tax recovery. The fiscal position sub-menu can be found in the accounting application's Configuration > Fiscal Positions. There is a list of preconfigured fiscal positions for Dutch corporations when we click on the sub-menu for fiscal positions.

When selecting one fiscal position, we will get a form view with all the details of that specific fiscal position. The tax mappings and the account mappings of those fiscal positions are listed there.

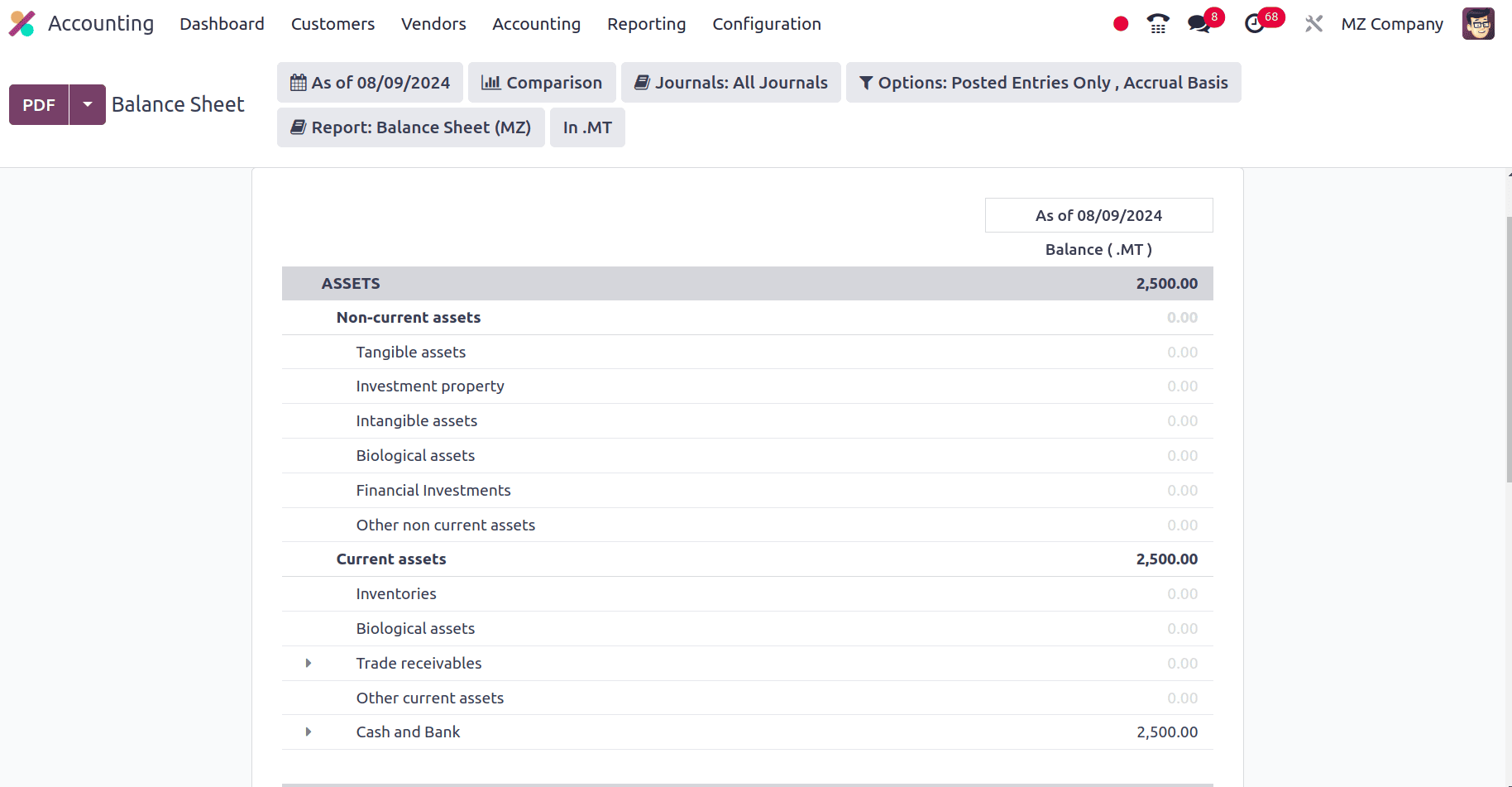

The company's balance sheet, cash flow statement, profit and loss report, tax report, and other reports are available when we navigate to the reporting menu.

The balance sheet of the companies from Mozambique is divided into two sections: assets and the Liability and Equity section.

Tangible Assets, investment property, intangible assets, biological assets, current assets, inventories, etc, are included in the Assets section. Share capital, Reverse, Retained earnings, supplementary capital share premiums, etc, are included in the Assets and Liability section.

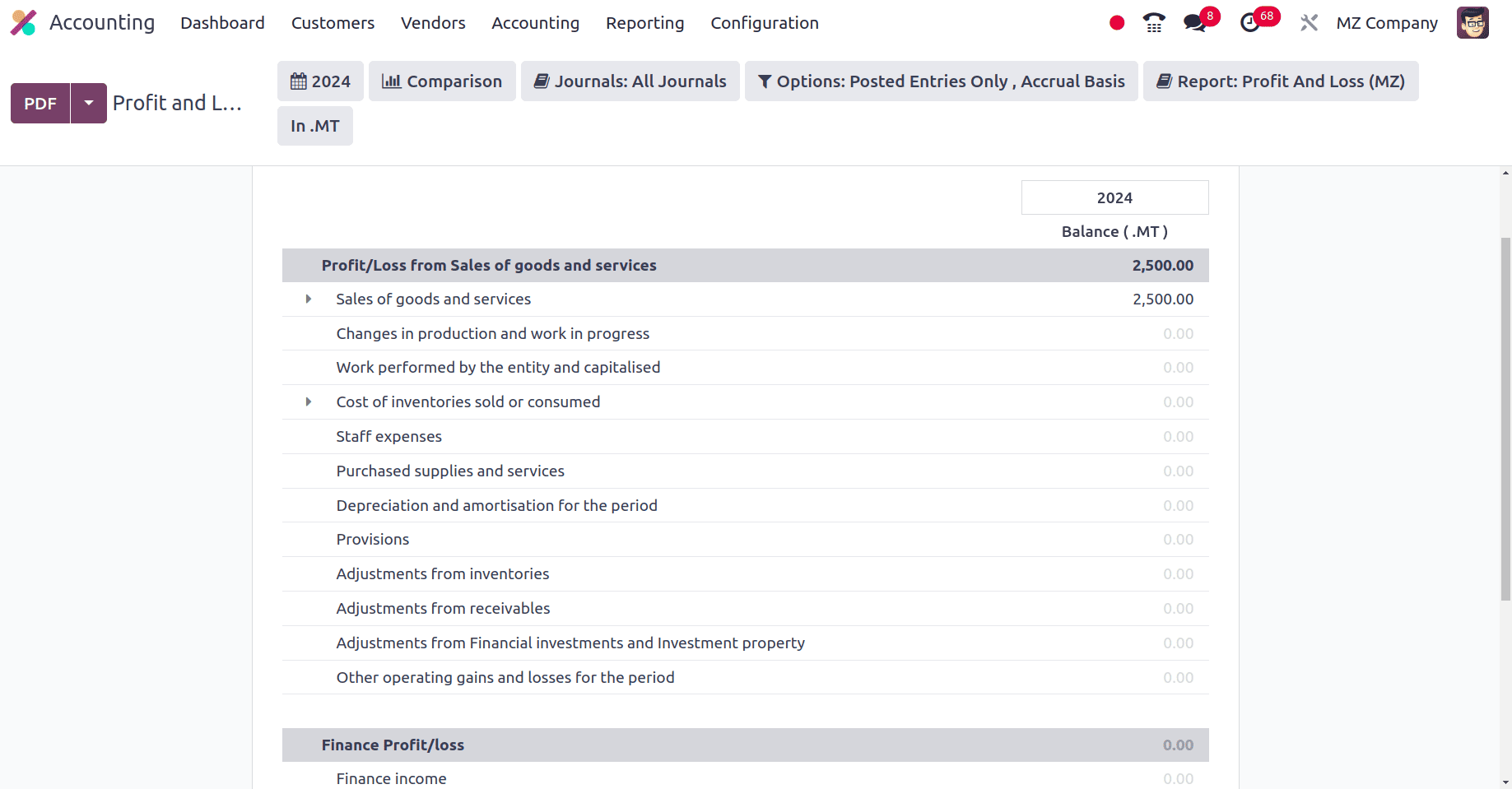

Next, we can move to the odoo profit and loss report. Under the reporting menu of the accounting application, odoo provides the company's profit and loss report.

The Profit and Loss report defines the profit and loss for each section. In Odoo, the Profit and Loss (P&L) report is an effective instrument for financial analysis and judgment. It offers up-to-date information on the financial performance of your company. Profit and loss from sales of goods and services, financial profit and loss, etc are in the profit and loss report.

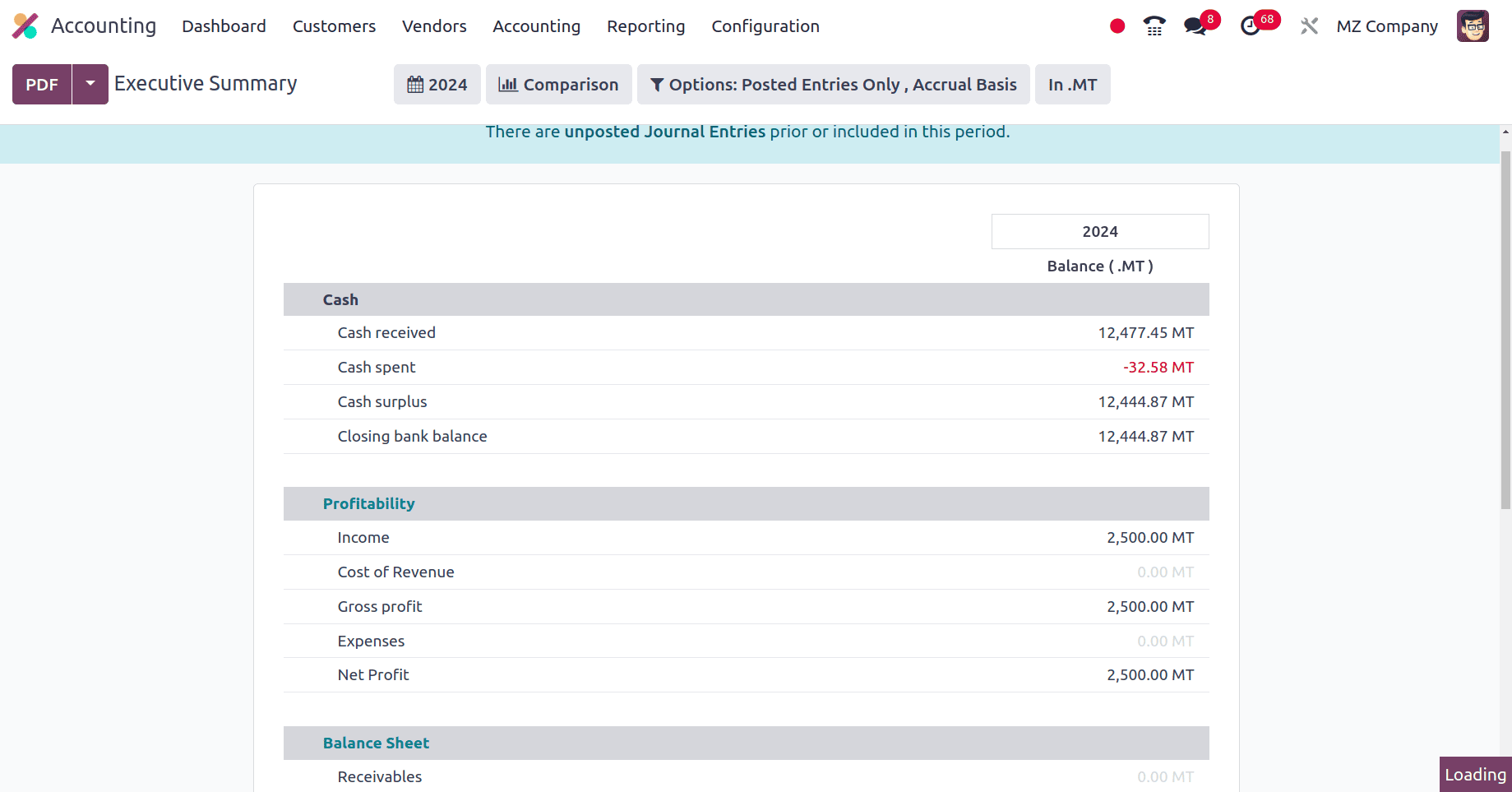

The Odoo Executive Summary report offers a brief overview of your business's financial situation. It's designed to offer key performance indicators at a glance, enabling you to quickly assess your business's performance.

Odoo is a viable platform for organizations in Mozambique looking for effective and compliant accounting solutions because of its versatility and strong feature set. Businesses can improve decision-making, expedite financial operations, and lower errors by properly designing the system to match Mozambique's tax regulations, accounting standards, and currency.

To read more about An Overview of Accounting Localization for Slovakia in Odoo 17, refer to our blog An Overview of Accounting Localization for Slovakia in Odoo 17.