Accounting localization in Odoo 17

In Odoo, accounting localization is the process of modifying the program to comply with the unique tax laws, accounting standards, and regulations of a certain country. For setting the localization, Odoo provides the Fiscal localization packages. These are country-specific modules that are installed on your database with pre-configured taxes, fiscal positions, charts of accounts, and legal statements. Odoo 17 accounting feature for localization lowers the possibility that your accounting data may contain errors and guarantees that your accounting records match with local laws. Additionally, it saves you time and effort while setting up your Odoo accounting system. In this blog, we can discuss the accounting localization in the case of Ireland in Odoo 17.

Localization for Ireland in Odoo 17

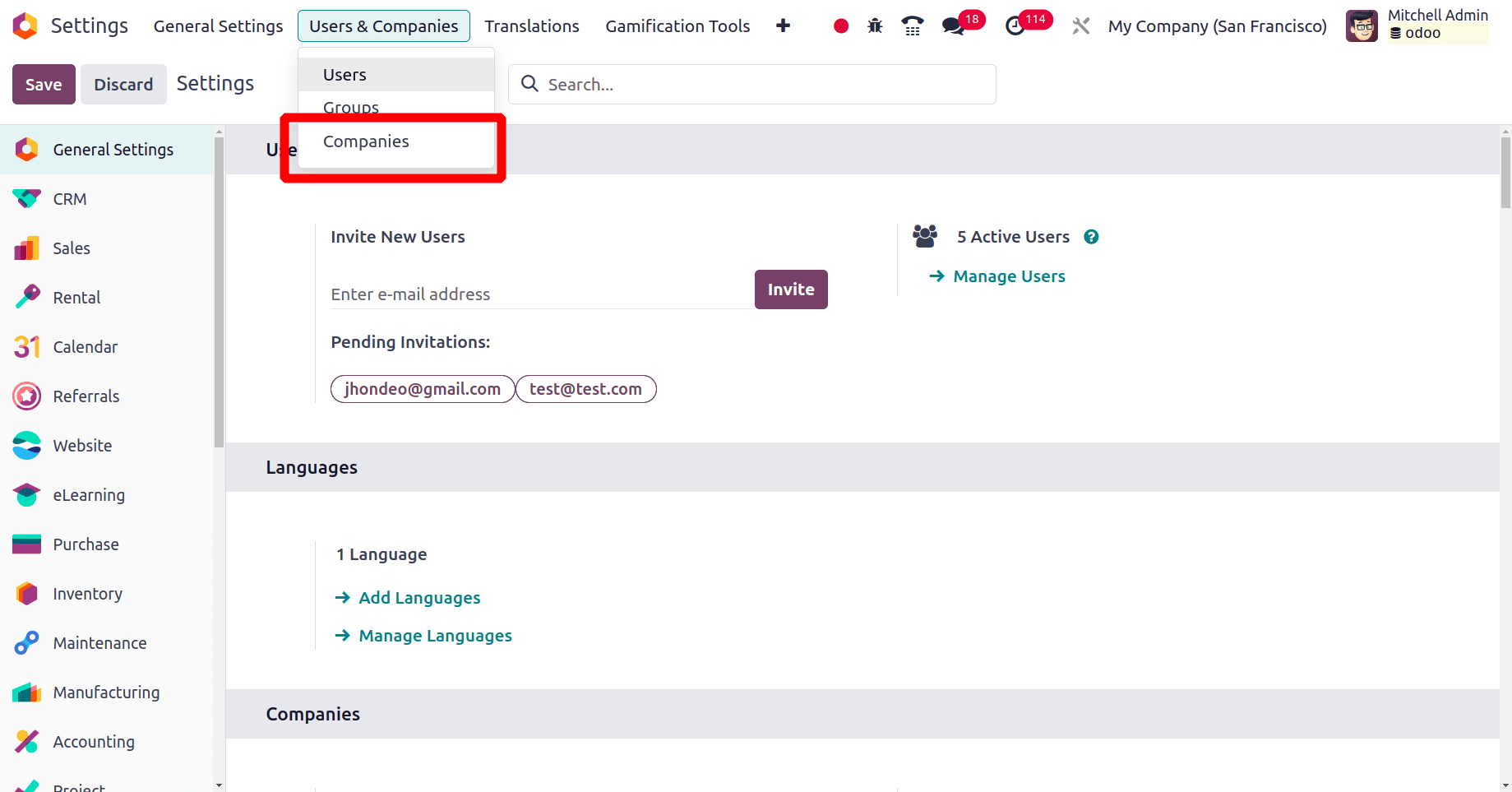

We want to create a new company in Ireland and also need to set up a localization package for that company in Ireland. So the first task is to create a new Ireland-based company. We can create a new company from Odoo using the General settings of Odoo. When we click the General settings, we can see the Users & Companies menu.

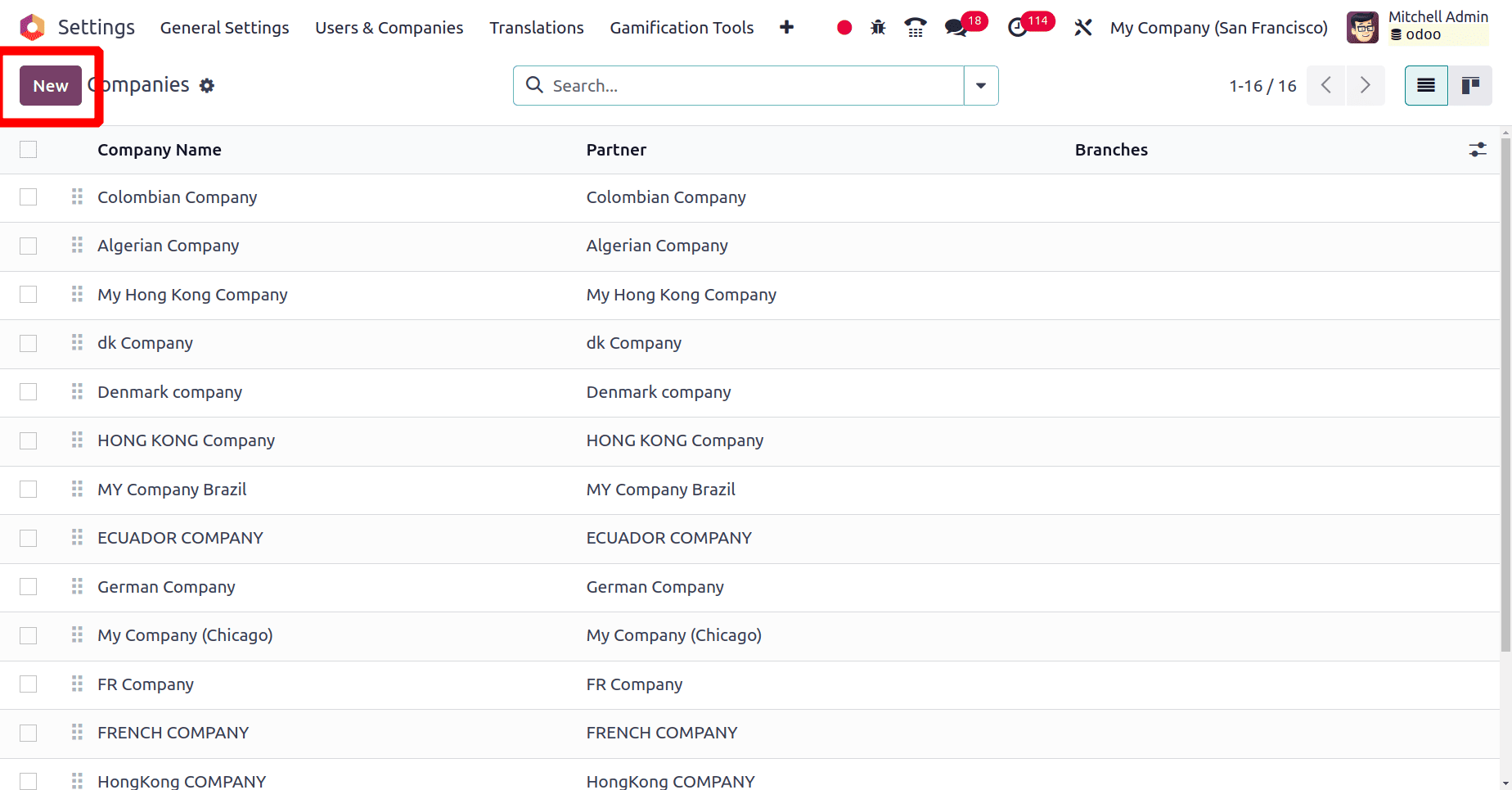

Under the Users & Companies, choose the Companies sub-menu. Then we will get a list of companies that are already created, and from that page, we can click the New button to create the new company.

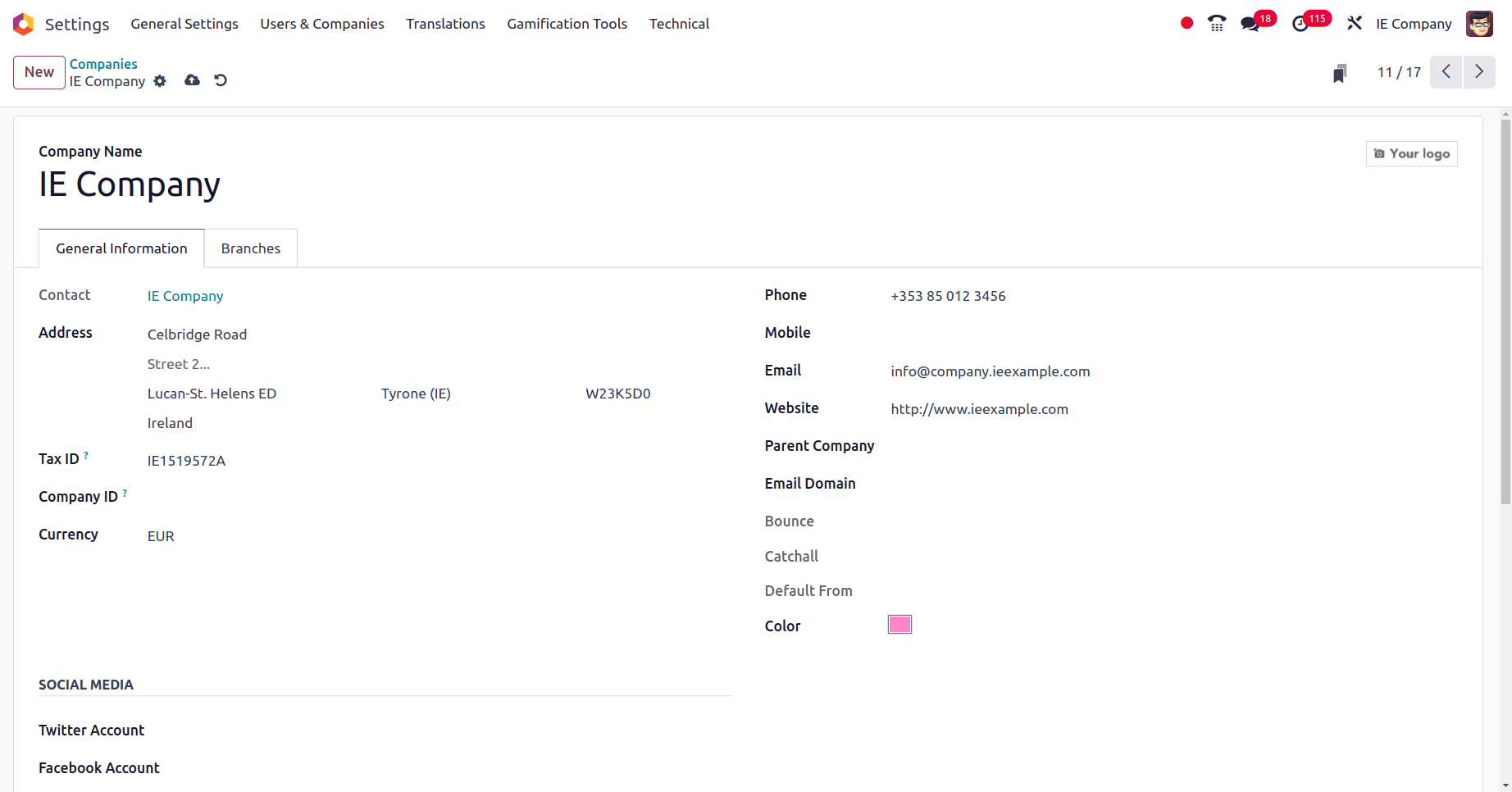

Then Odoo will provide a form to fill out the details of the company that we are going to create. Provide the name and other essential details about the company in that form.

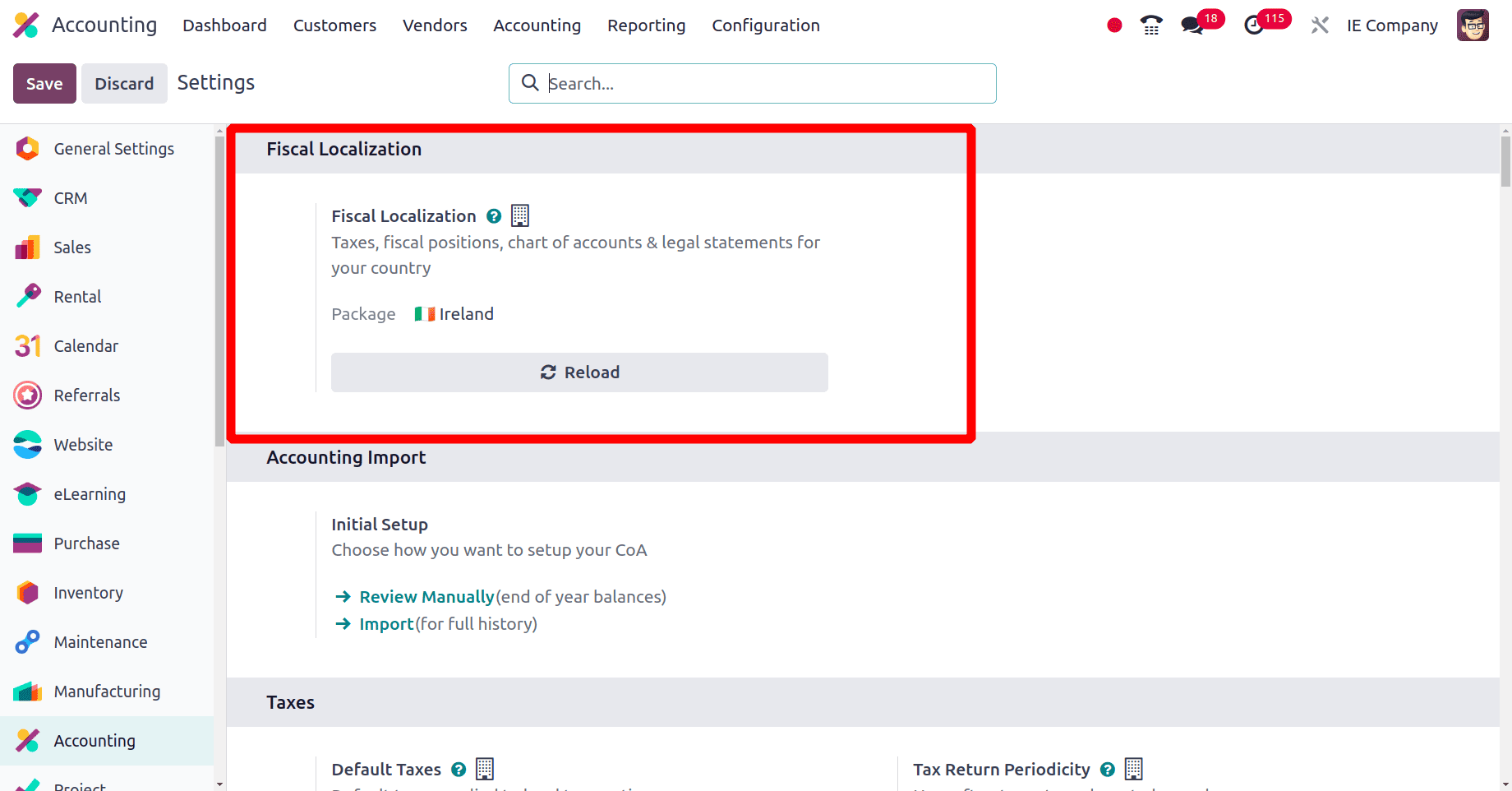

Fill out the Name of the company, Address, Tax ID, and also the country. We know that the currency used in Ireland is the Euro (EUR) and, here, when the country is set as Ireland, Odoo automatically adds the currency in the form of this company as Euro. Then after all the credentials are added successfully, click the save icon to save the details. The next step is to set the localization package for this company. Move to the Configuration > Settings of Accounting application.

Under the Fiscal localization section, we have the option to set the localization package for the company. We have created an Ireland-based company, so set the package as Ireland. This is the major step while configuring the country-specific localization.

Changes found during the configuration of the Irish localization

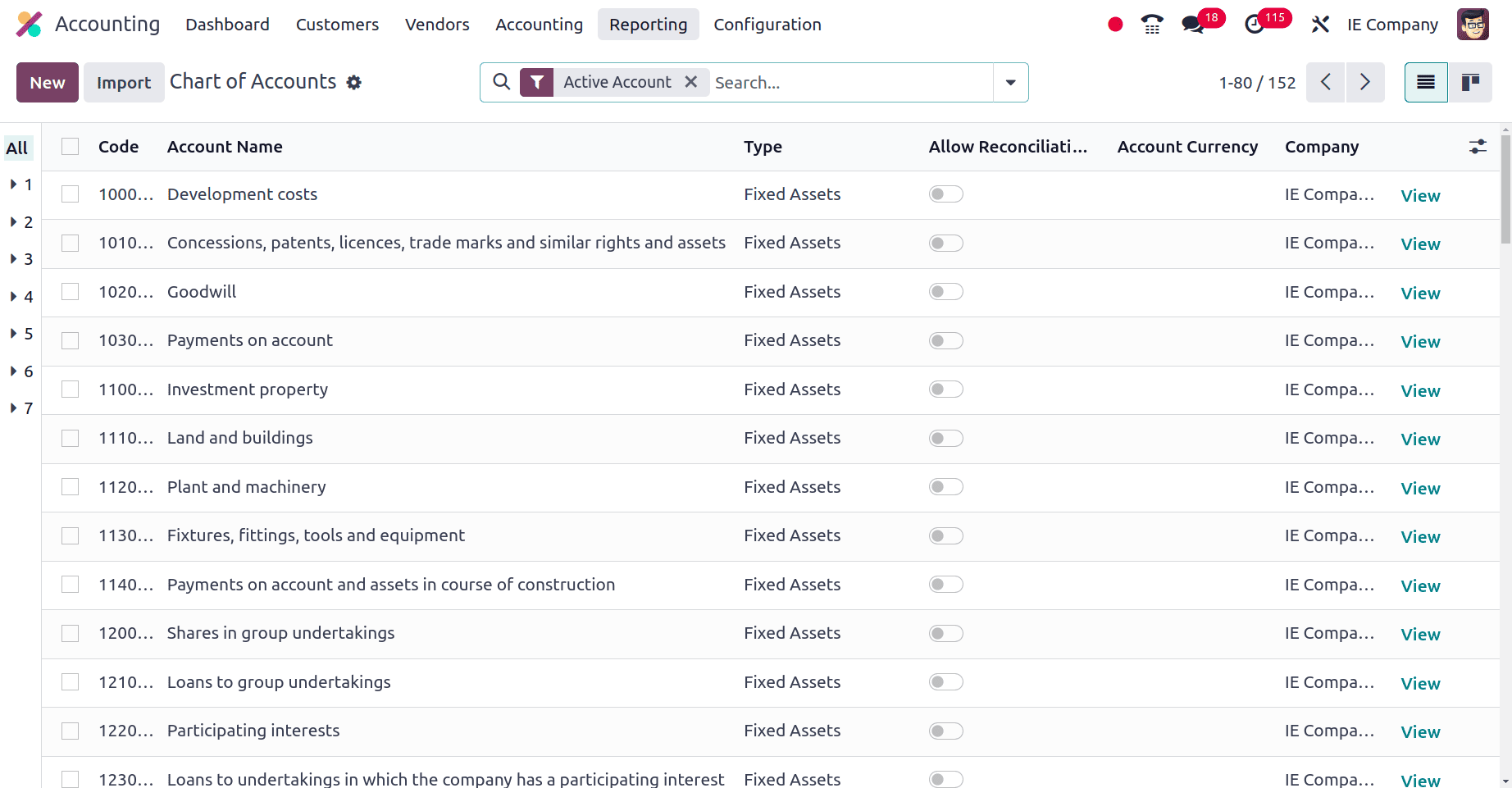

Once the localization package is added, all prerequisites for the company including CoA, taxes, journals, and Fiscal positions were installed in the database. The most important part of Odoo's accounting module is the chart of accounts. It gives you a clear view of the financial health of your business by giving you a systematic method to record your financial activities.

Each country has its own specific charts of accounts, that is the code and the name of the accounts may vary from country to country. The chart of accounts used by the companies from Ireland is shown in the screenshot above.

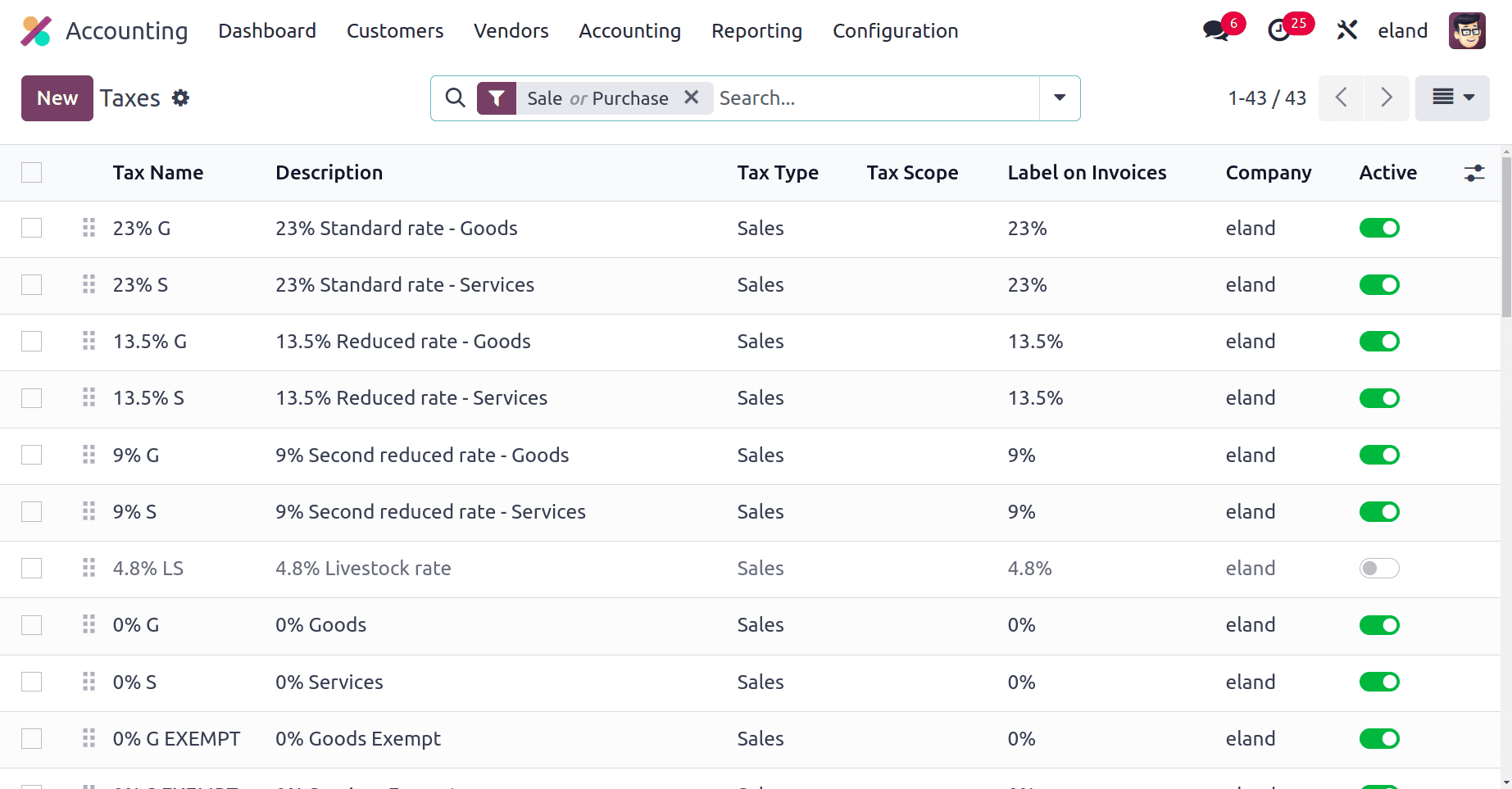

Each country uses its specific default taxes in the transactions. Default taxes are the predetermined tax rates when generating invoices, sales orders, and other financial documents.

There will be Default sales tax and Default Purchase taxes. The default sales taxes are applied to the products during sales only if those products don't have any custom taxes and the Default purchase taxes are applied during the purchase of products that do not have any custom taxes.

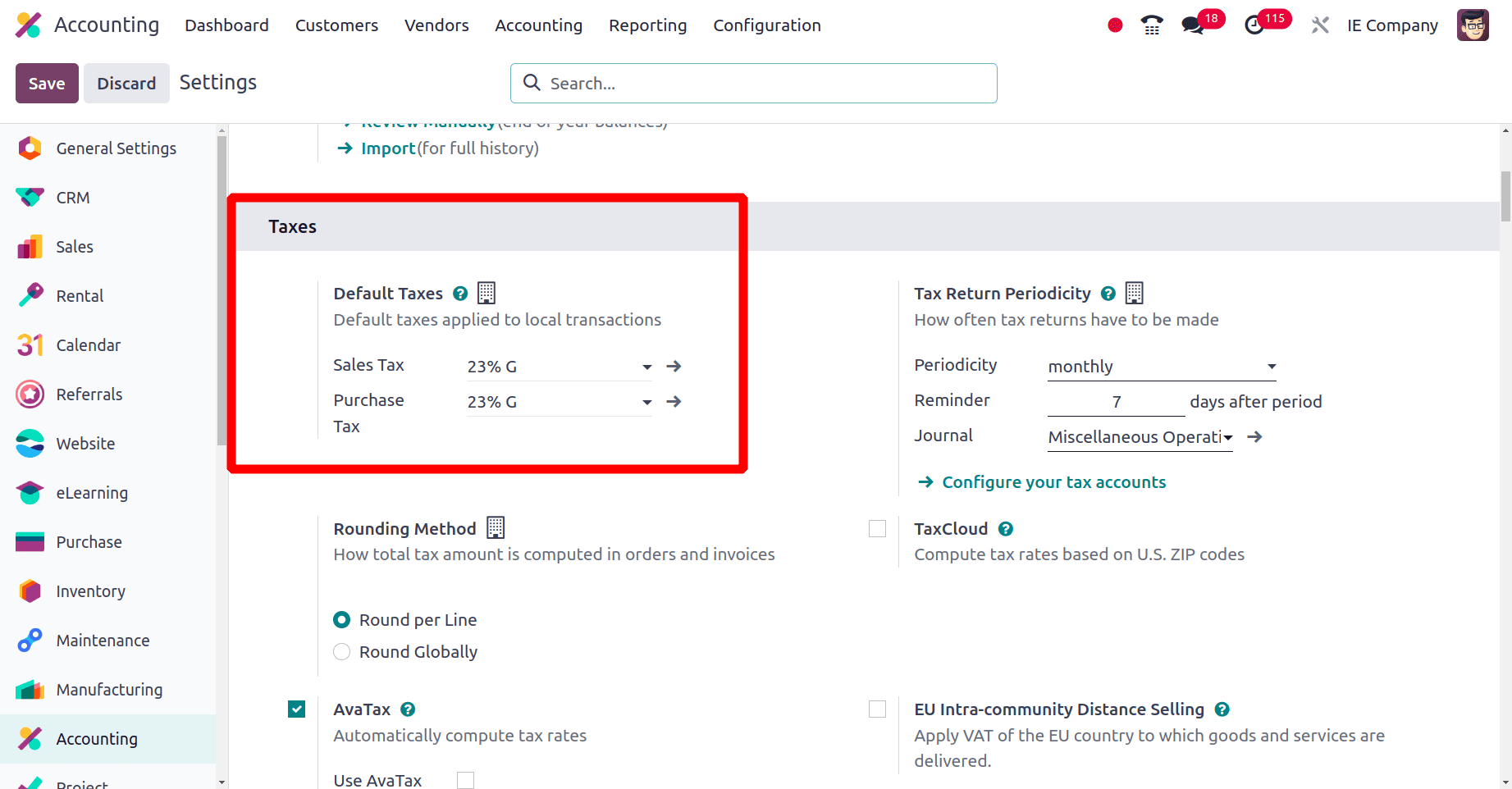

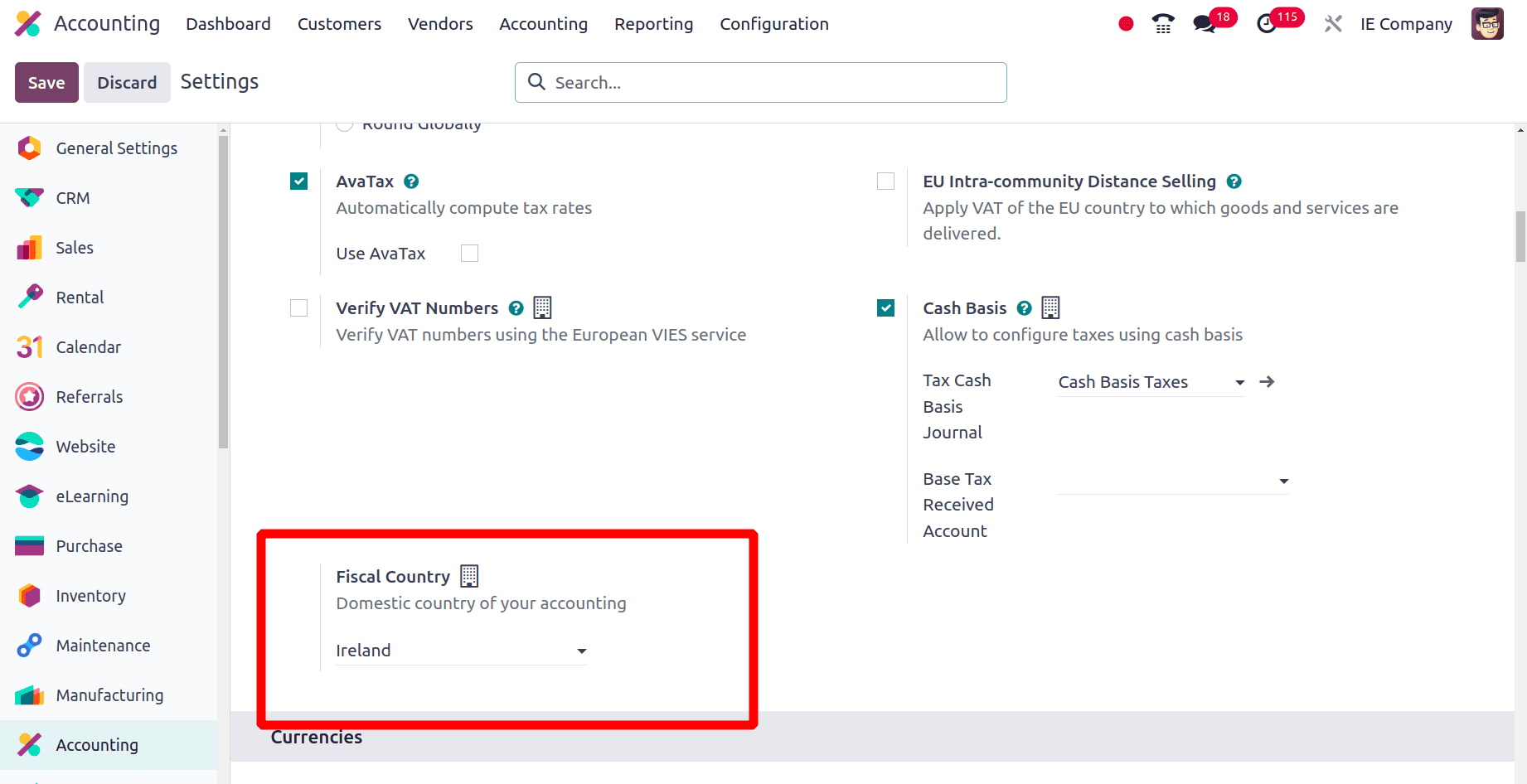

In the above screenshot, we can notice that the default sales taxes and the default purchase taxes are added by Odoo automatically when the localization package is set as Ireland. When we move down, there is a field to set the Fiscal country of the company.

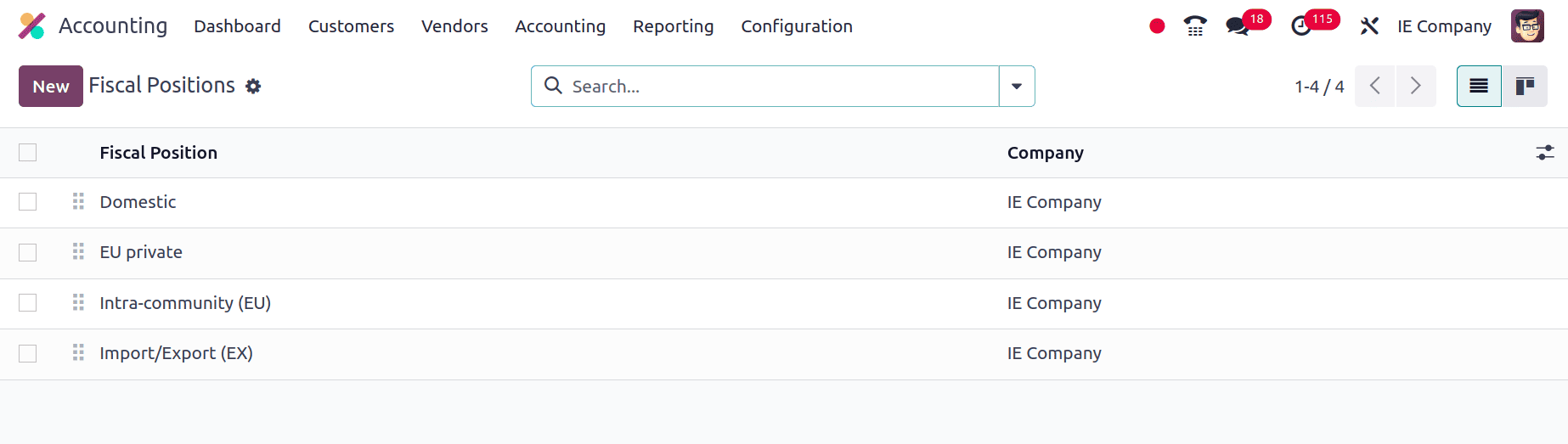

Businesses that are required to handle complicated tax situations or international transactions might benefit greatly from the use of fiscal positions in Odoo. They improve tax compliance, enhance precision, and reduce the effort required to handle your money.

The Fiscal positions used by the companies in Ireland for accounts mapping and tax mapping are shown in the above screenshot.

When we set the fiscal localization package as Ireland, Odoo automatically set the Fiscal country as Ireland.

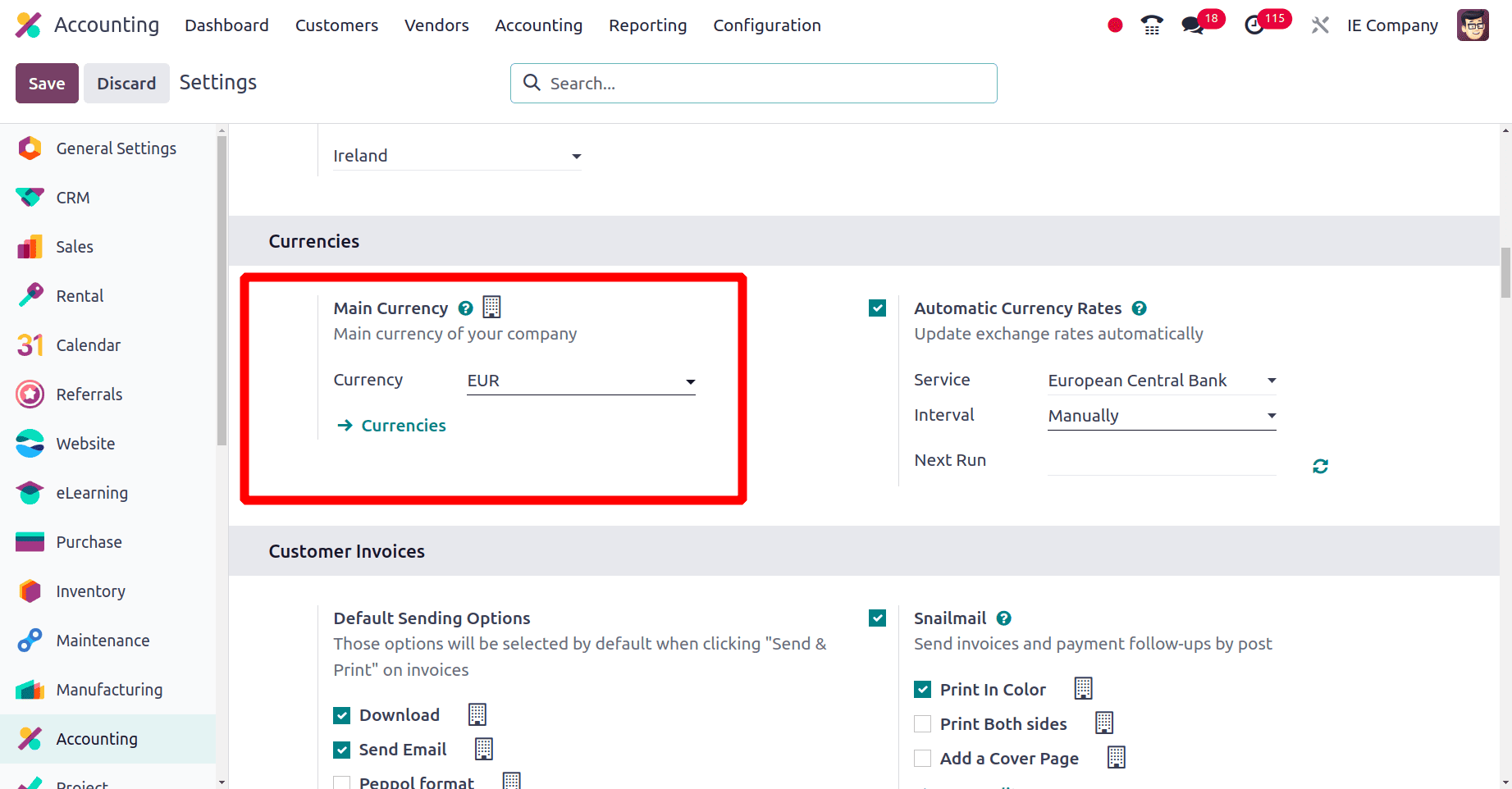

The next is the main currency used by the country. It is possible to set the main currency used by the companies in Odoo. Here, the official currency used in Ireland is the Euro (EUR).

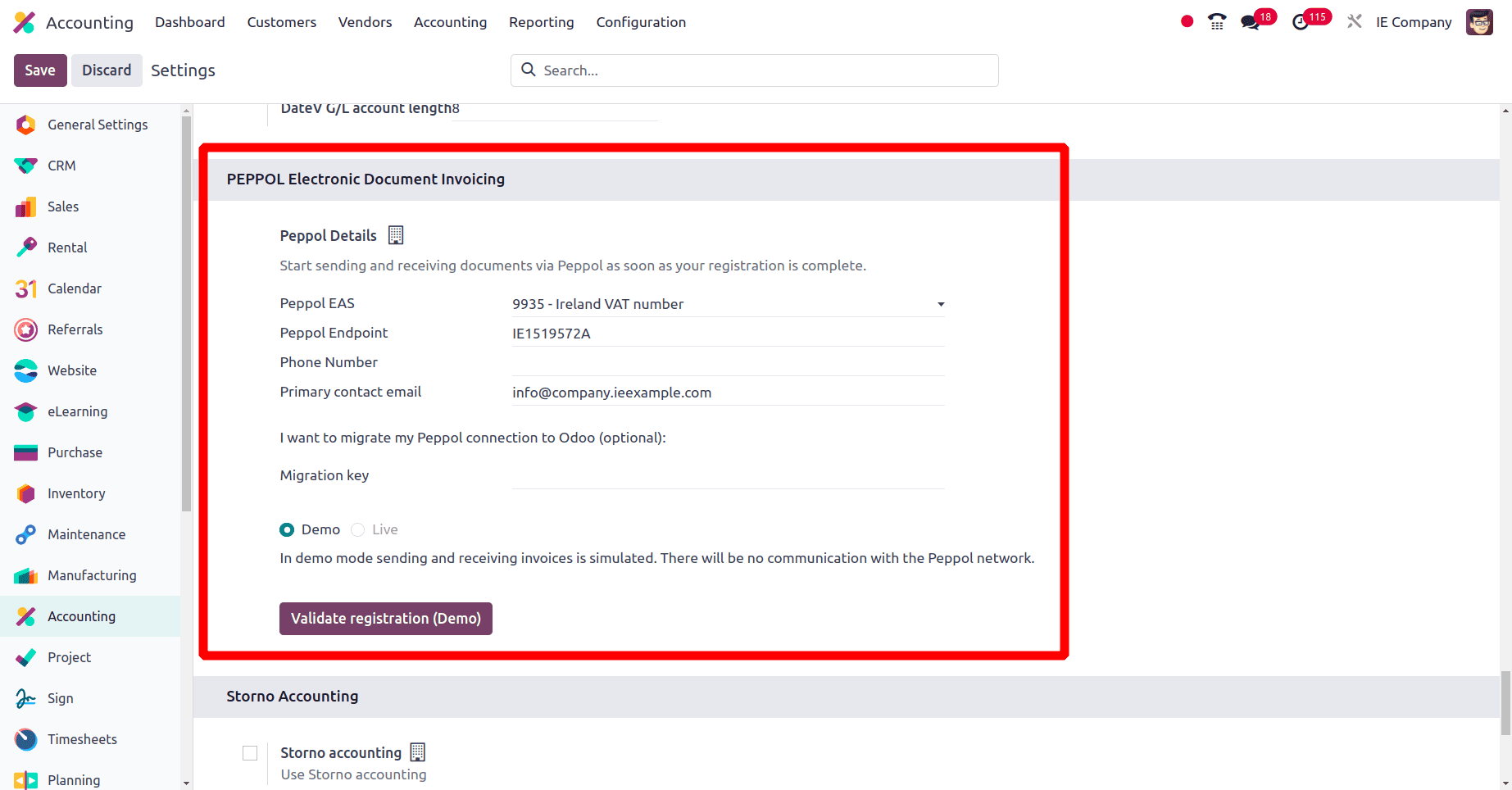

Under the Currencies, for the Field Main Currency Odoo, set the main currency as the Euro. In Configuration > Settings, an extra section PEPPOL Electronic Document Invoicing section is added.

Peppol details are the details you must set up in order to exchange invoices with your trading partners electronically via the Peppol network. Peppol, which stands for Pan-European Public Procurement Online, is a global e-invoicing platform that is used throughout Europe. Under this section, we have to set Peppol details such as Peppol EAS, Peppol Endpoint, Phone Number, Primary contact email, etc.

* Peppol EAS: The Peppol EAS is known as the Peppol Electronic Address Scheme. it is an electronic document identification and routing system, for purchase orders and invoices between businesses

* Peppol Endpoint: A unique identity within the Peppol network for exchanging e-invoices is referred to as a Peppol Endpoint in Odoo. It's comparable to an email address but made especially for safe online billing.

After the details are configured properly, validate registration to complete the registration process. Once the registration process has been completed, Odoo begins to send and receive documents via Peppol.

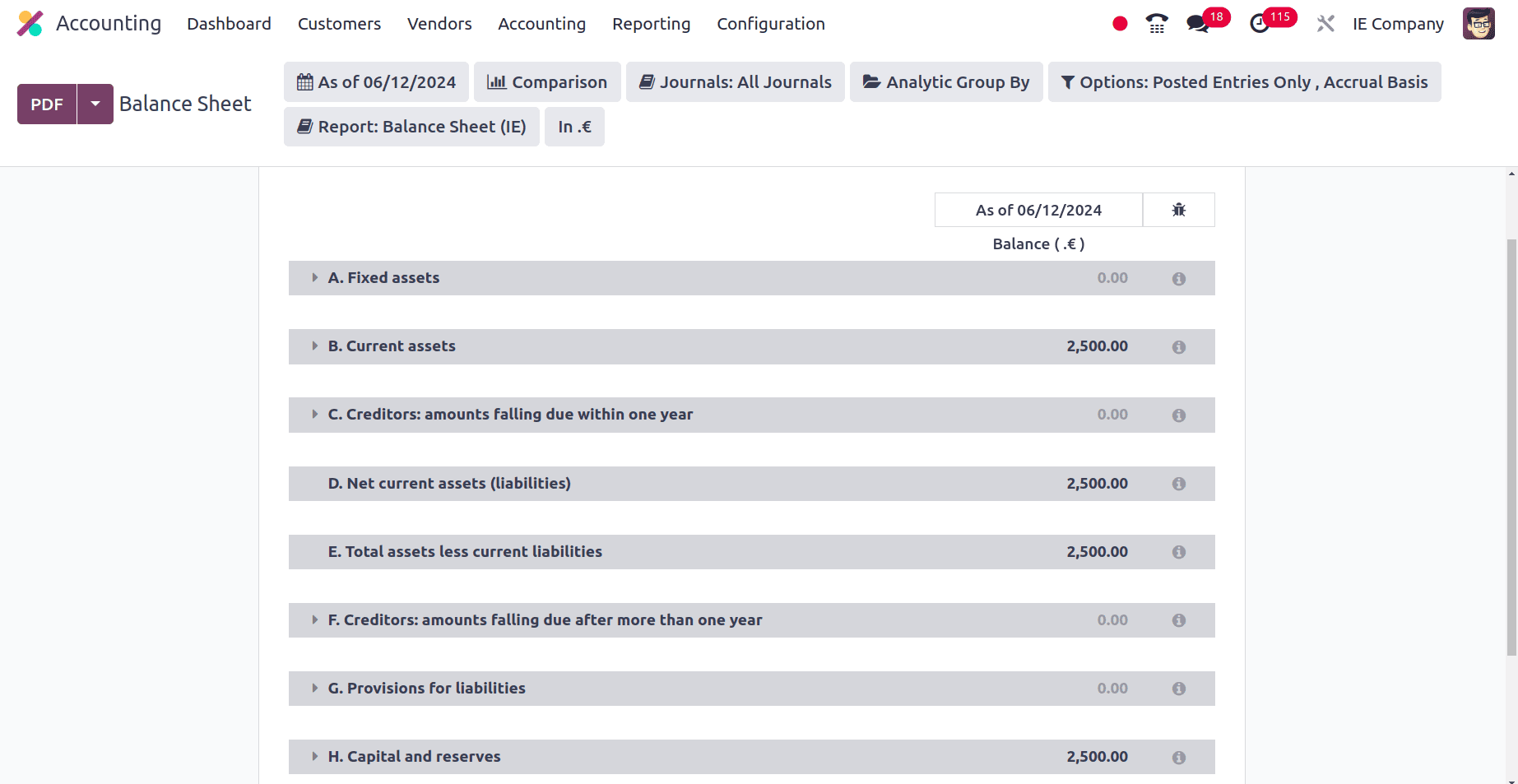

The next is the Balance Sheet of the businesses in Ireland. A company's financial status at a certain date is summarised in the Odoo balance sheet report, which divides financial information into three primary sections, Assets, Liabilities, and Equity.

Depending on how you have configured your chart of accounts, every section of the Odoo balance sheet may further categorize accounts. To examine the company's financial situation at various times, you can alter the balance sheet report's date range. You may learn a lot about the company's solvency, liquidity, and financial health by analyzing the balance sheet's content in Odoo.

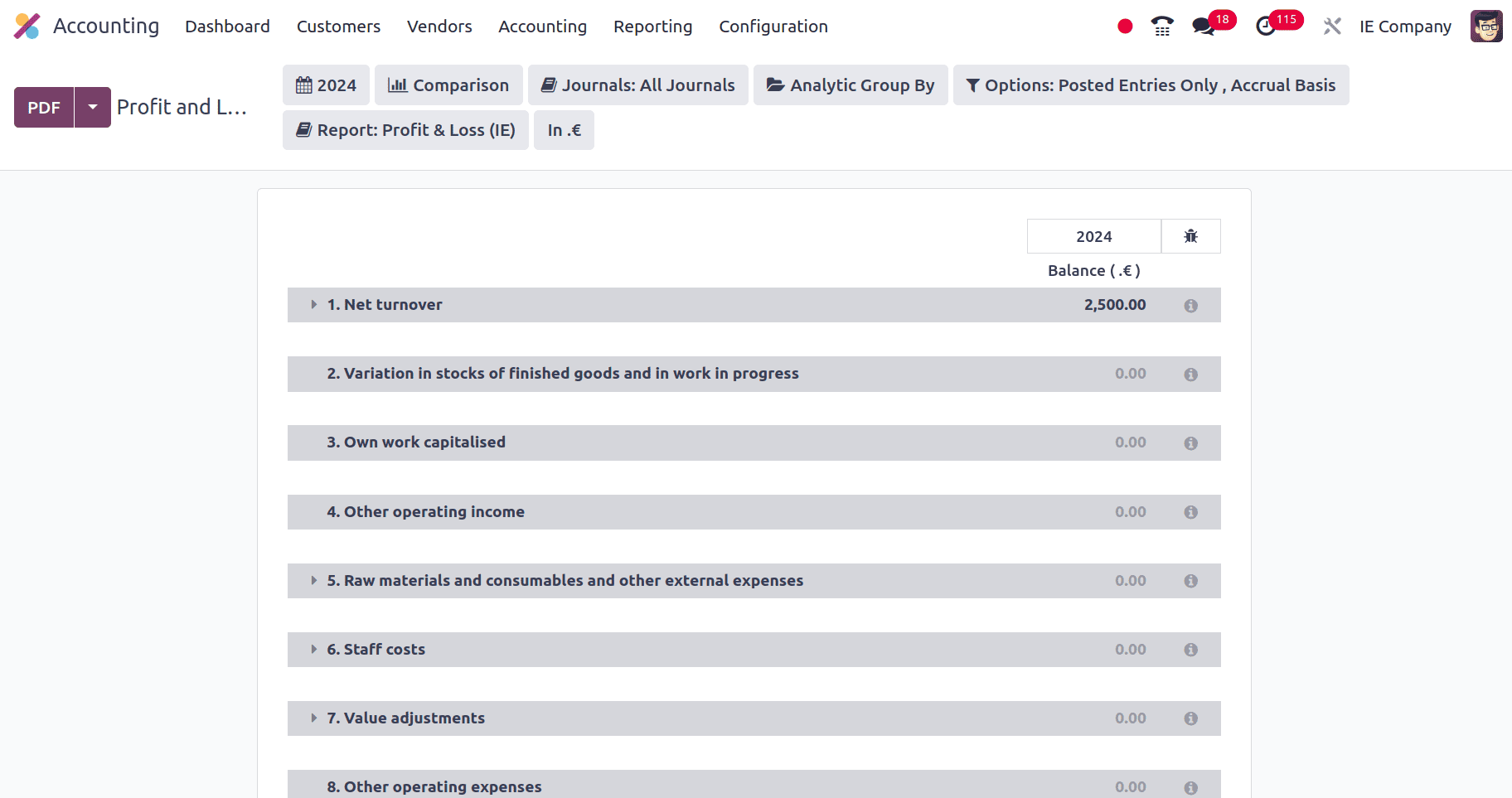

An important financial statement that provides an overview of a company's performance over a certain time period is the profit and loss report found in Odoo. In essence, it displays the amount of money the business has made (income) and spent (expenses) throughout that period of time.

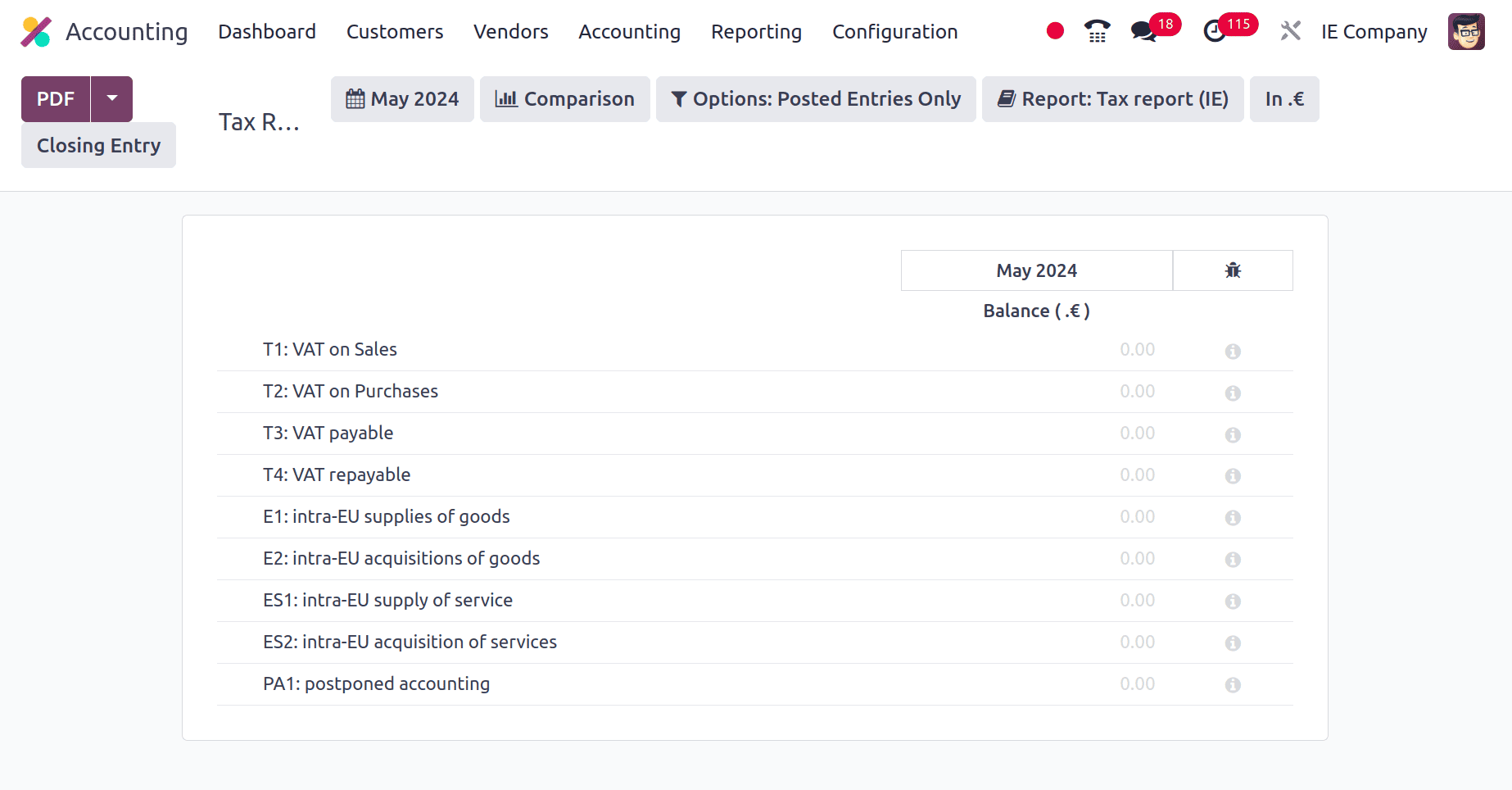

A tax report in Odoo is a document that provides an overview of your business's tax-related activities during a given time frame. It assists you in comprehending your tax responsibilities and guarantees that you adhere to tax laws.

The Tax Reports of the companies in Ireland include VAT on Sales, VAT on Purchases, VAT Payable, VAT Repayable, Intra-EU supplies of goods, etc.

* VAT on Sales: This refers to the way you manage Value Added Tax (VAT) that is applied to sales transactions for customers who are based in Ireland.

* This refers to the way you manage Value Added Tax (VAT) that is applied to purchase transactions from vendors who are based in Ireland.

* VAT Payable: The amount of Value Added Tax that your company owes the Revenue Commissioners for a given time period is referred to as VAT payable. This usually appears as a liability account in the tax report.

* Intra-EU supplies of goods: The sale and transfer of products between two companies that are registered for VAT (Value Added Tax) inside the European Union is referred to as an intra-EU supply of goods.

So here we have discussed the noticeable Changes found during the configuration of the Irish localization. We can conclude that the Irish localization of Odoo 17 guarantees compliance with complex Irish tax laws. Also allows us to create financial reports that are easily understood by Irish financial institutions and stakeholders and that follow local requirements. Overall, Odoo 17's accounting localization for Ireland provides a complete answer for companies doing business in the area. It guarantees adherence, streamlines procedures, enhances precision and facilitates more informed financial decision-making.

To read more about An Overview of Accounting Localization for Denmark in Odoo 17, refer to our blog An Overview of Accounting Localization for Denmark in Odoo 17.