What is accounting localization in Odoo 17

Accounting localization in Odoo is the process of modifying the accounting module to conform to the unique tax laws, accounting standards, and legal reporting obligations of a given nation. Odoo 17 offers Country-specific modules named "Fiscal Localization Packages". Accounting localization ensures that the tax regulations, reporting requirements, and chart of accounts unique to your country are followed by your Odoo system. This lowers the possibility of mistakes and fines while submitting taxes. Localization automates Numerous accounting duties based on regional customs. This comprises features such as:

* pre-programmed tax calculations

* creation of reports and invoices that comply

* Integration (if applicable) with regional e-invoicing systems

Accounting localization helps your accounting team save time and resources by automating tasks and following local norms. Rather than focusing on compliance assurance and manual data entry, they can concentrate on more strategic duties. In this blog, we are going to discuss the localization features of a company from Greece.

Localization for Greece in Odoo 17

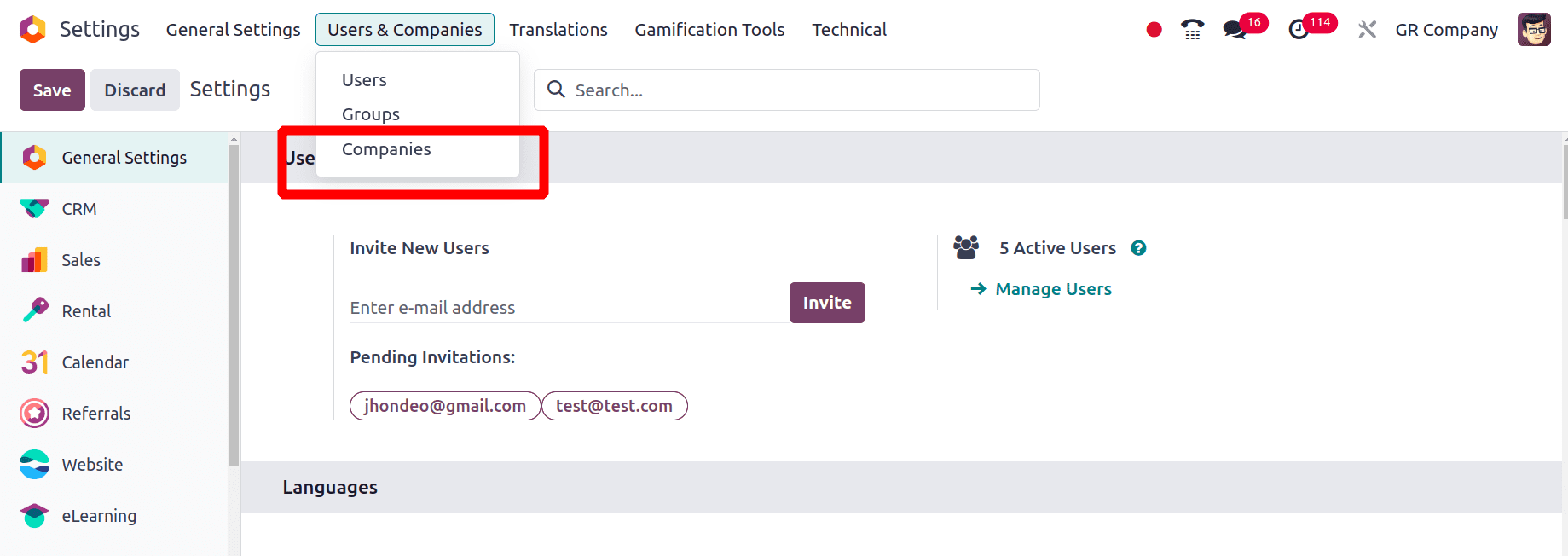

First, we need to create a company from Greece to set up the localization for Greece in Odoo. To do this, move to the General settings of Odoo and click the Users & Companies menu, then the Companies sub-menu.

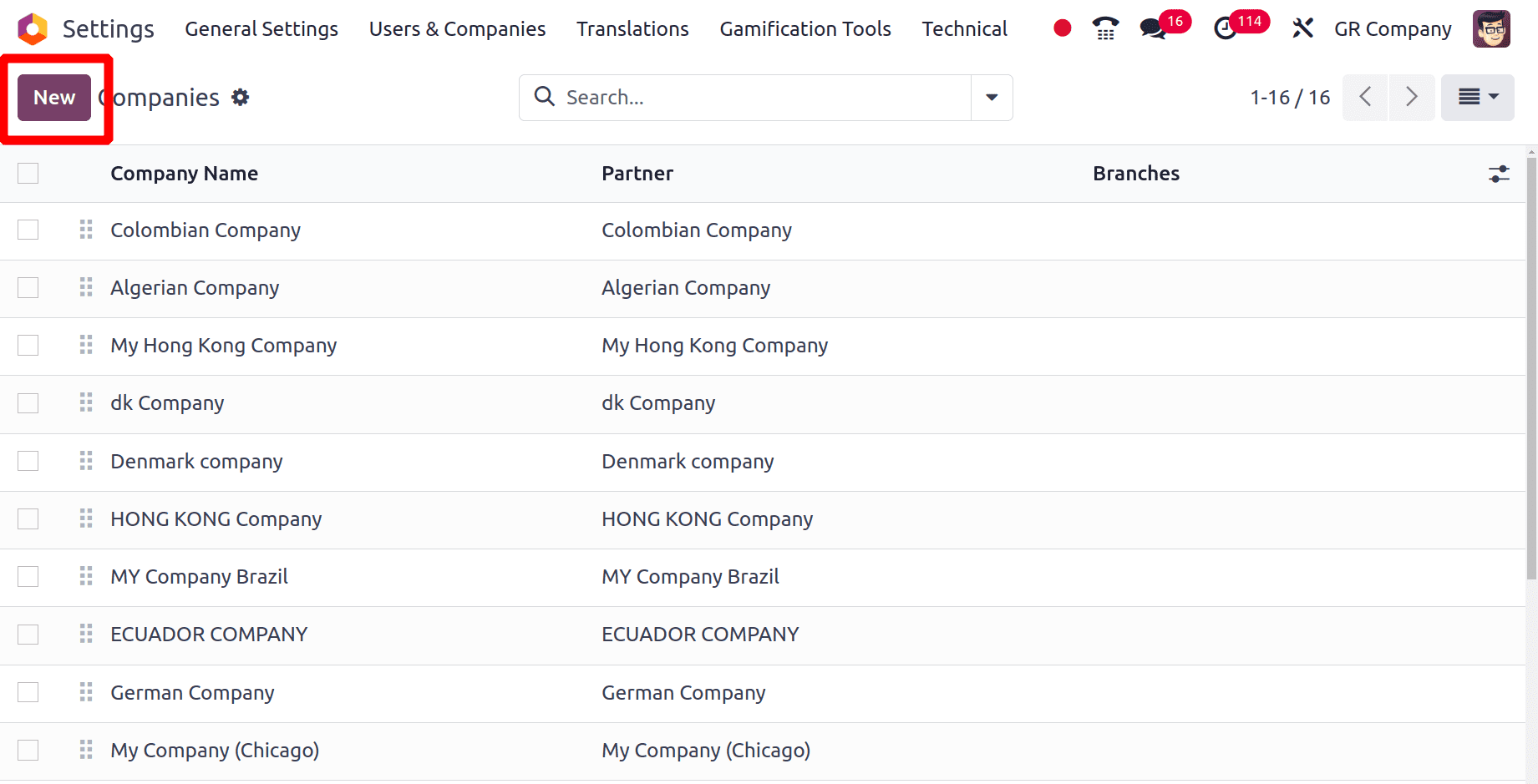

When we click the companies sub-menu, all the companies that are already created can be shown, and to create a new company, click the New Button.

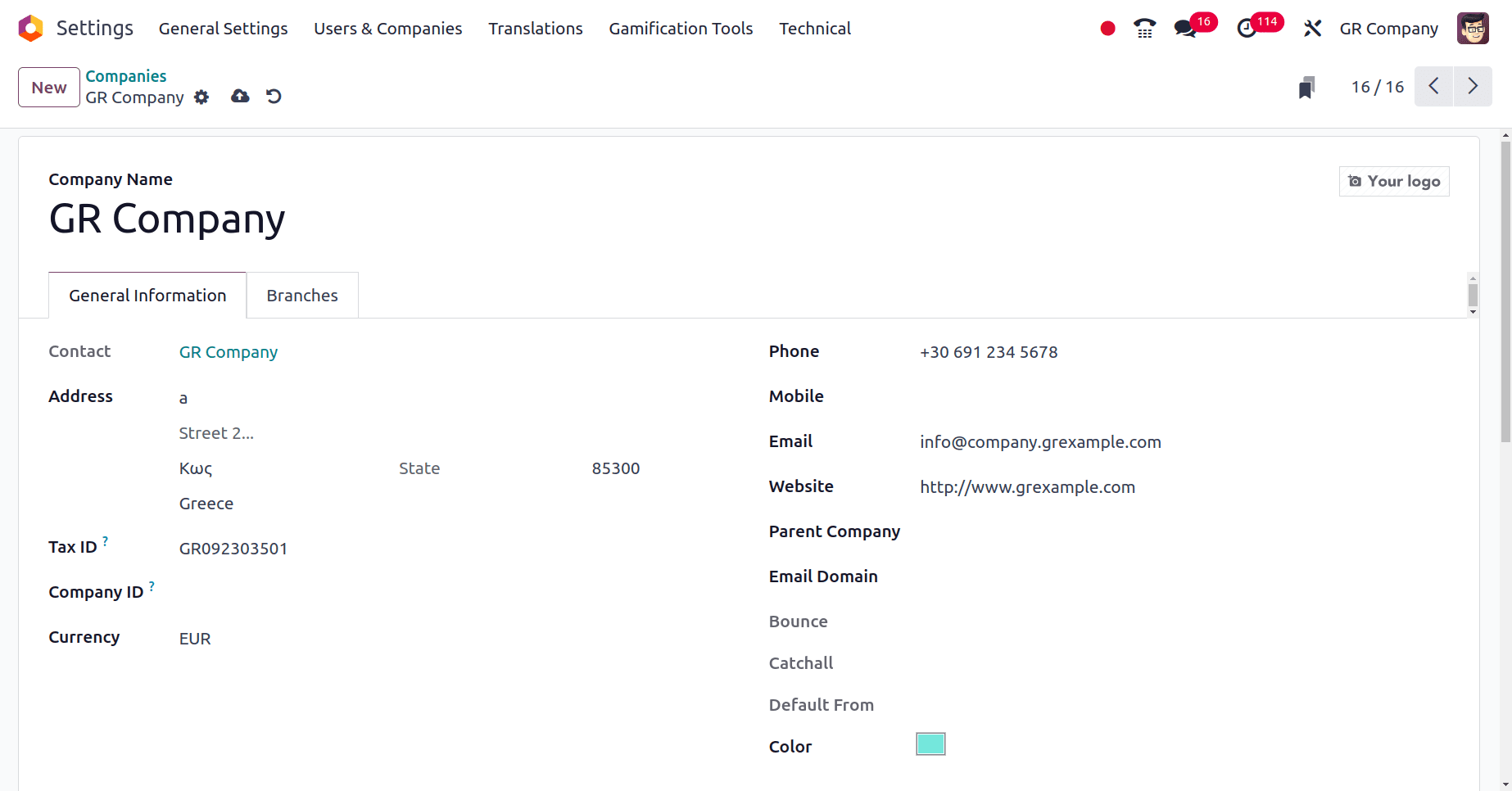

When we click the New button, we will get a form to fill out the details of the company that we are going to create.

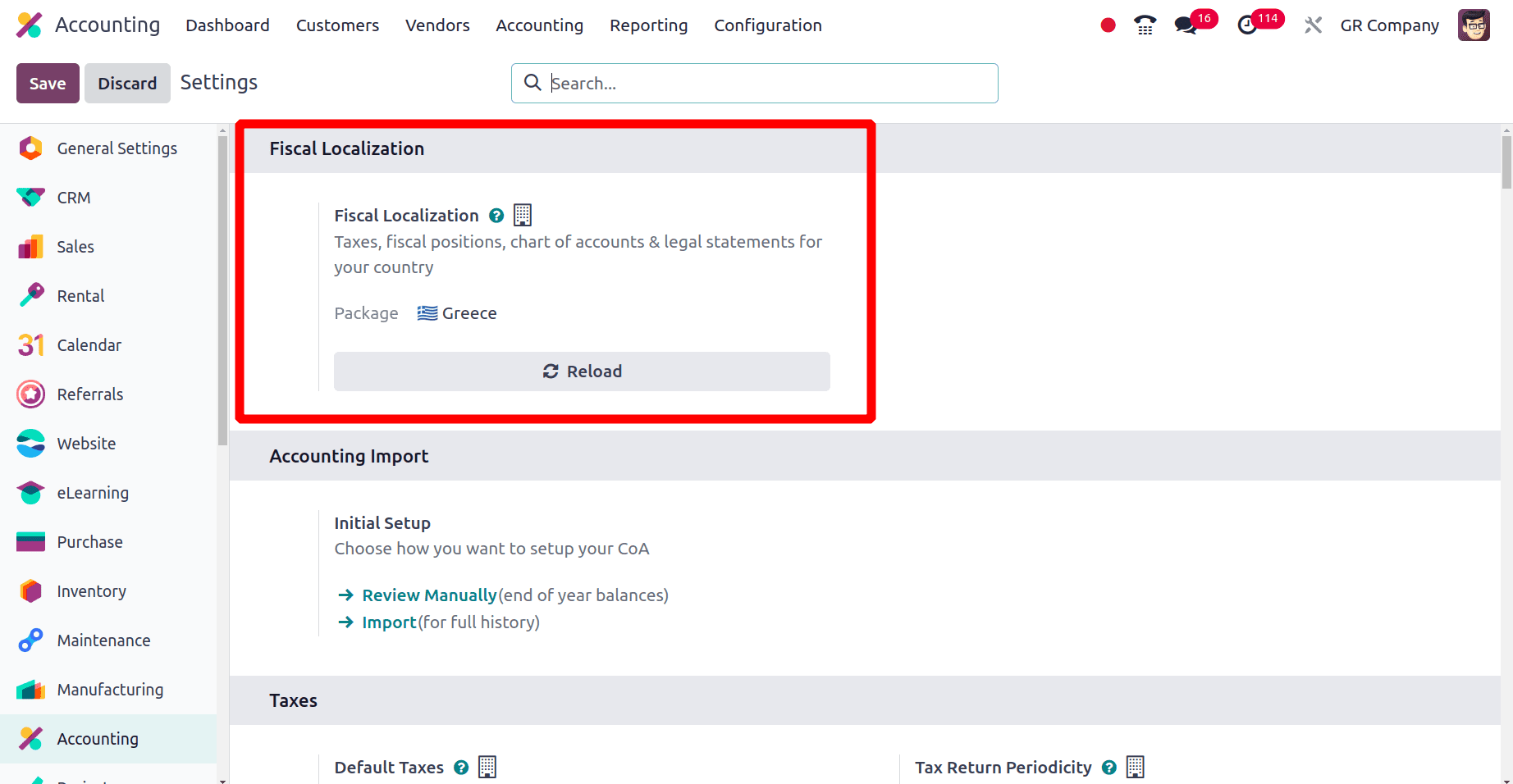

When all the details of the company are configured properly, click the save icon to save the company details. Here, when the country for the company is set as Greece, Odoo automatically updates the currency for the company as Euro as the official currency used in the country is Euro (EUR). The next step is to set up the localization package for this company. Move to the accounting application in Odoo 17 and choose Configuration > Settings. Under the Fiscal Localization section, we have the option to set the localization package. Choose the package as Greece and save.

Modifications discovered during Greece localization configuration

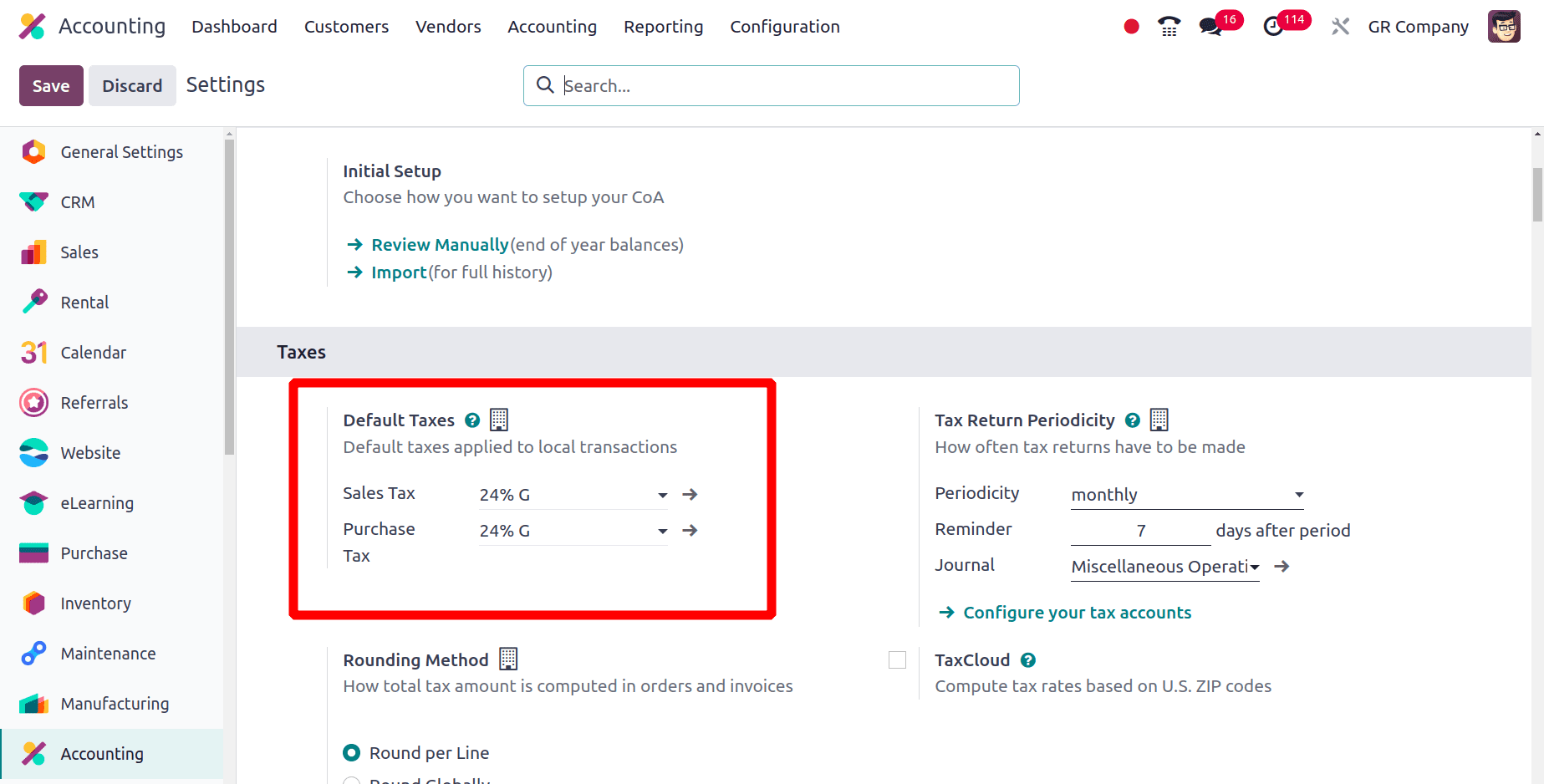

When the localization for the company is set as Greece, there will be a lot of changes. First, in the configuration settings, under the Taxes section, there is a field to update the default tax. Pre-established tax rates, known as default taxes are applied automatically on invoices and bills. There will be Default Sales Tax and Default Purchase Tax.

* Default Sales Tax: The predetermined tax rate that is automatically applied to invoices you make for your clients is known as the default sales tax in Odoo.

* Default purchase Tax: The predetermined tax rate that is automatically applied to the bill you make for your clients is known as the default purchase tax in Odoo.

From the above screenshot, we can say that the default sales tax and the default purchase tax used by the companies in Greece is ‘24% G’ so this 24% G will be the tax which is configured automatically to all the sale orders and the purchase orders.

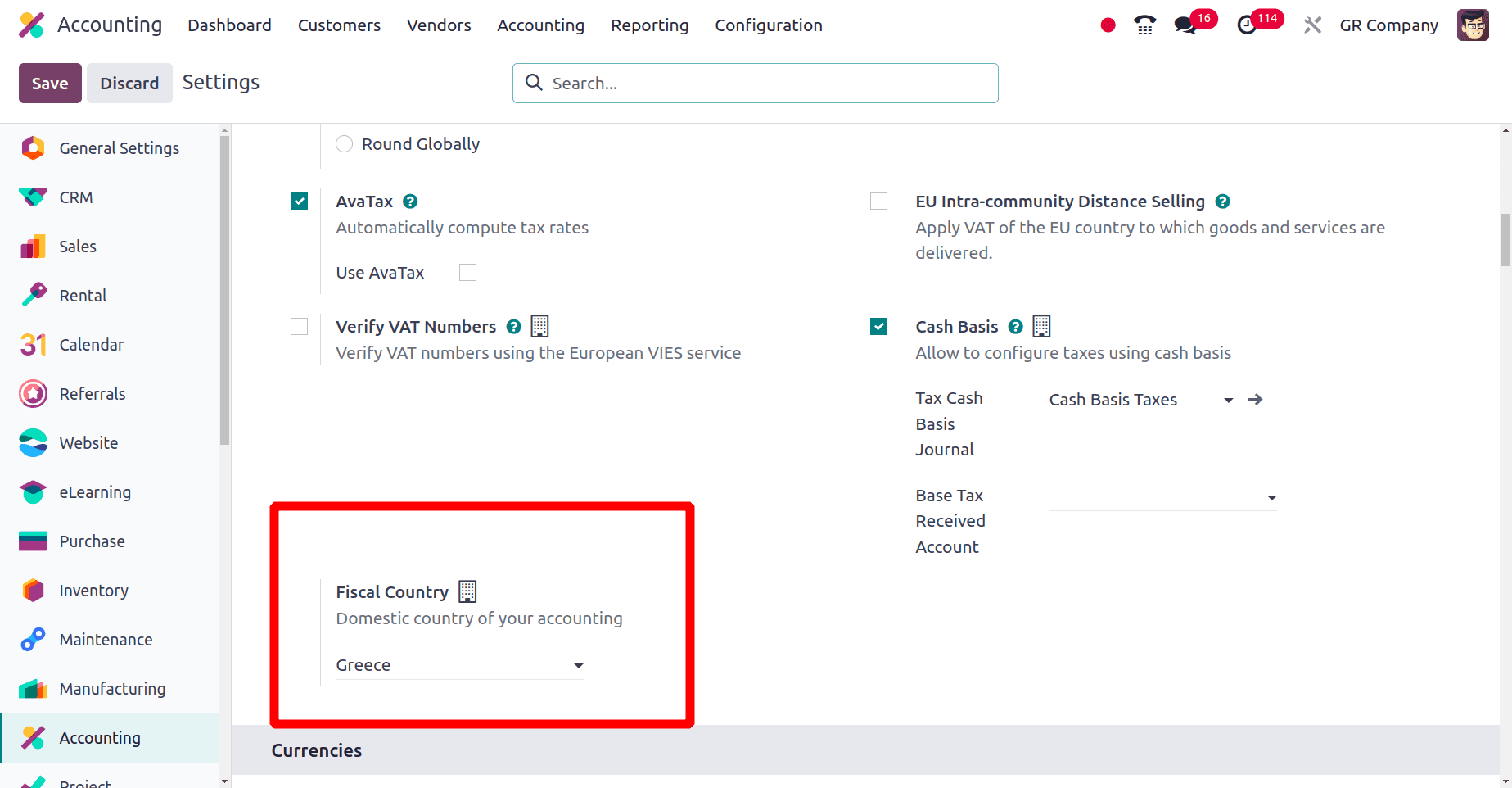

In this taxes section itself, we have the option to set up the Fiscal country for this company. But here, Odoo automatically sets the Fiscal country as Greece when the localization package is set as Greece.

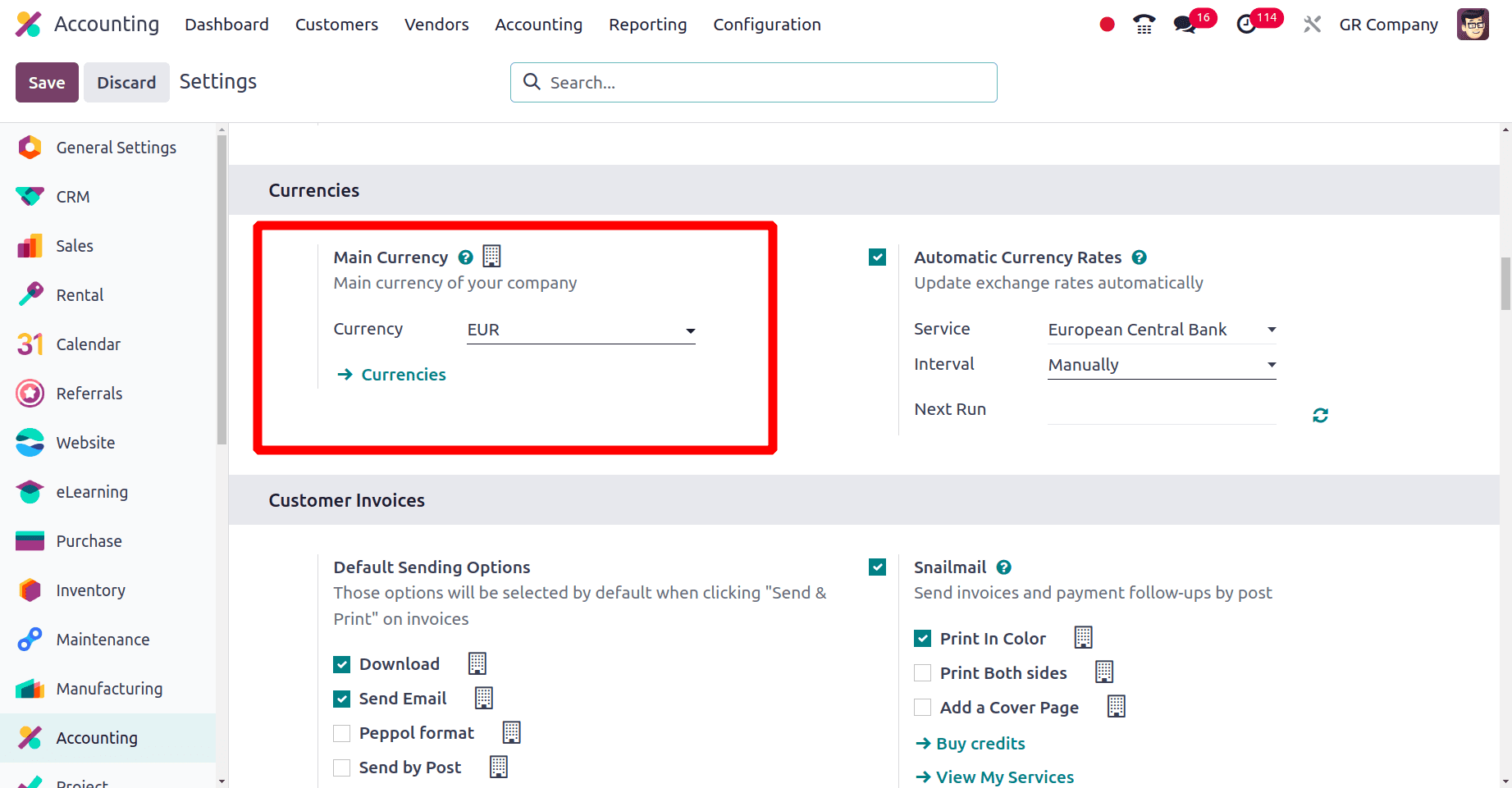

Under the currencies section, we have the option to set the main currency for the company, and also we can activate other currencies. But when we set a main currency for the company, this currency will be used for every transaction in the company.

We know that the main currency used in Greece is the Euro (EUR) and here, when we configure the localization package for the country, Odoo spontaneously sets the main currency for the company as Euro (EUR).

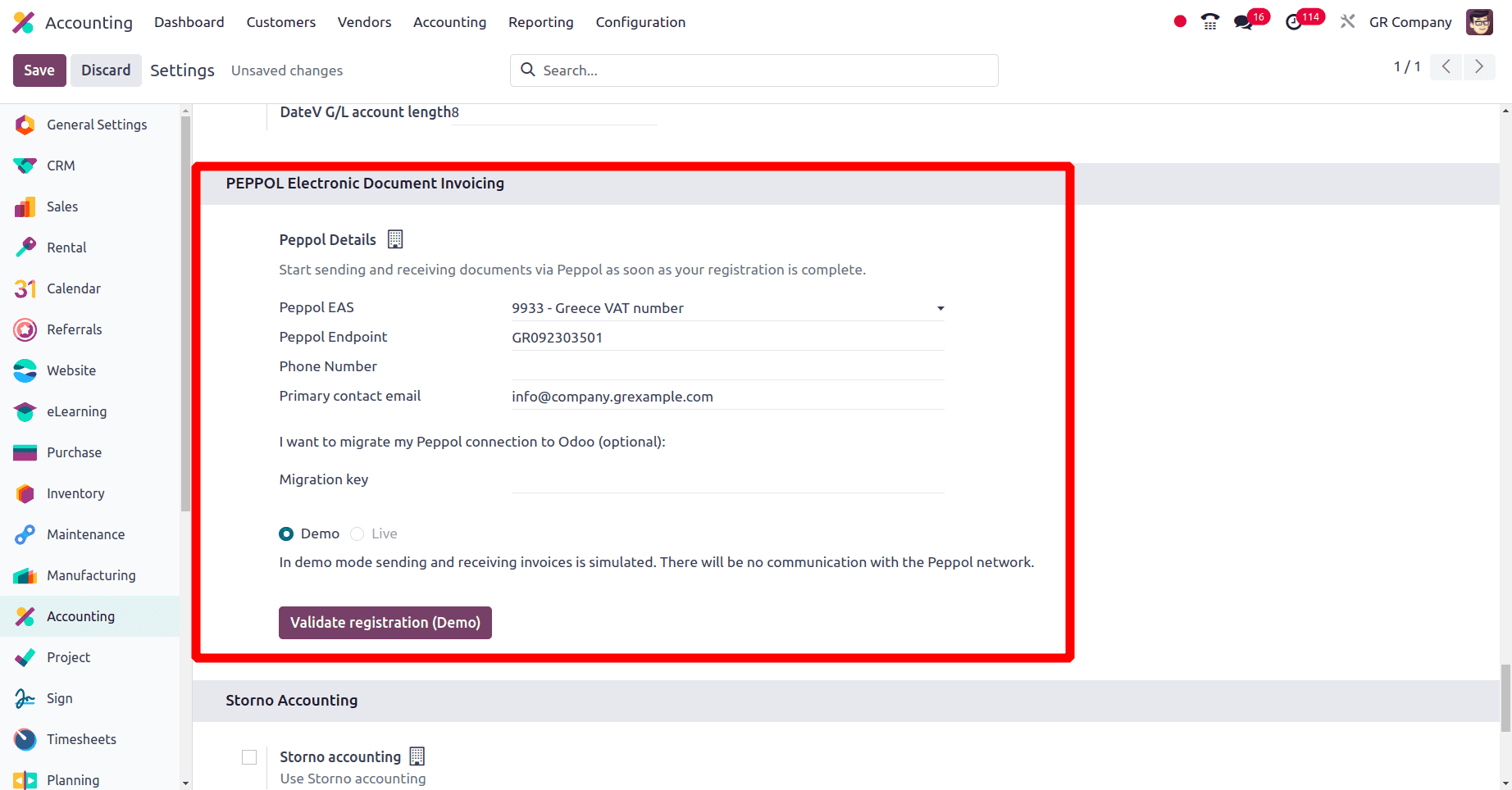

In the Configuration > Settings an Extra section, ‘PEPPOL Electronic Document Invoicing’ is added. Under this section, Peppol details like Peppol EAS, Peppol Endpoint, Phone Number, Primary contact email, etc.

* Peppol EAS: The Peppol Electronic Address Scheme serves as the participants' electronic "address book" at Peppol. Every member of the network is uniquely identified by their Peppol EAS identifier.

* Poppol Endpoint: Peppol is an international network that makes safe electronic invoicing possible for companies. Every member of the Peppol network is identified by a unique endpoint. Invoices can be found and sent electronically by other Peppol participants using this endpoint, which functions as an address.

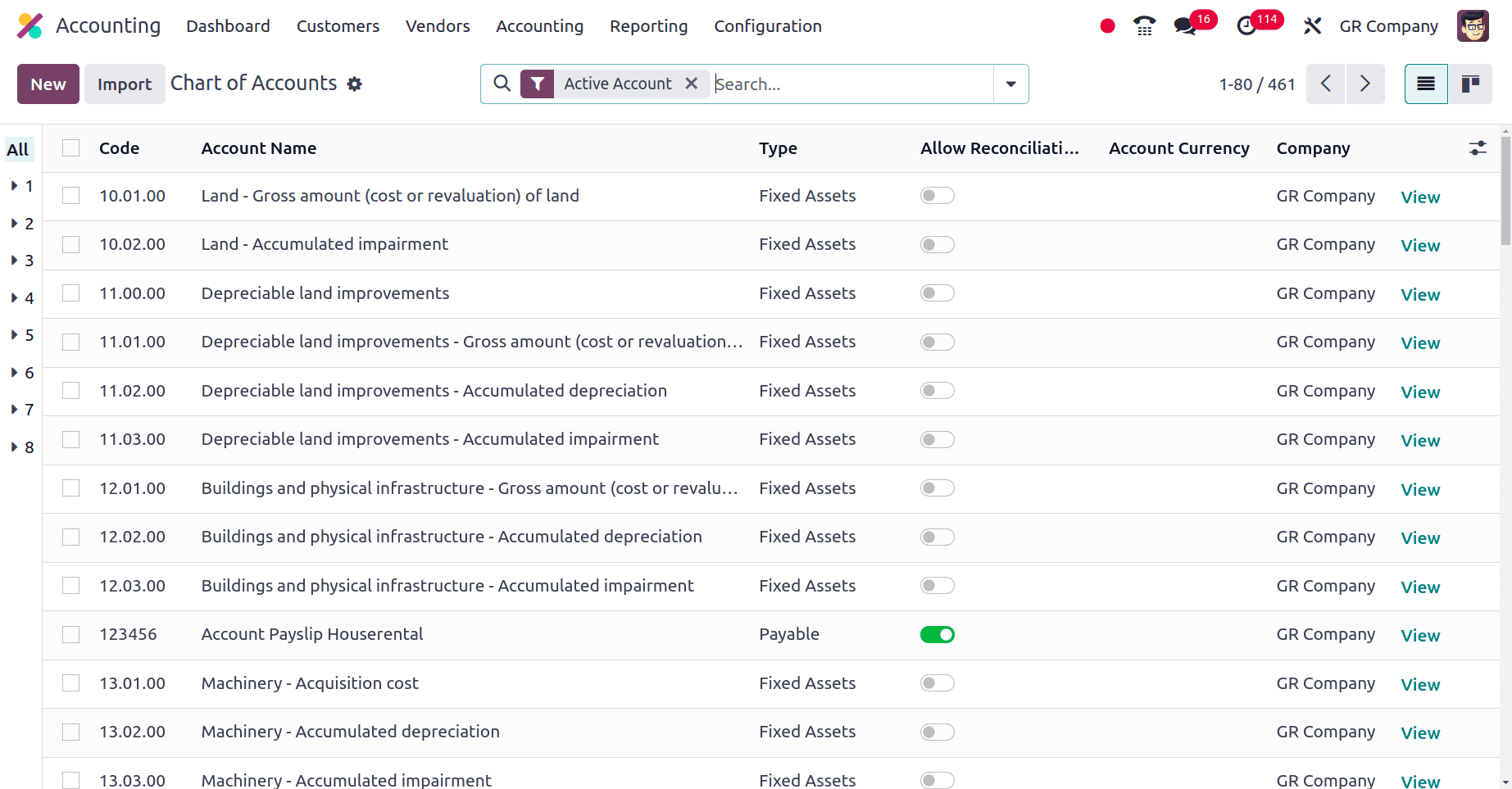

Charts of accounts used by the companies from Greece may also vary. The basis of your whole accounting system is the chart of accounts (COA). It arranges all of the financial accounts you utilize to monitor the finances of your company. All of your company's financial transactions are categorized in the chart of accounts. It offers an organized method for keeping track of income, expenses, assets, liabilities, and equity.

The name and code of the charts of accounts used by the businesses from each country may vary. The accounts used by the companies from Greece are shown in the above screenshot.

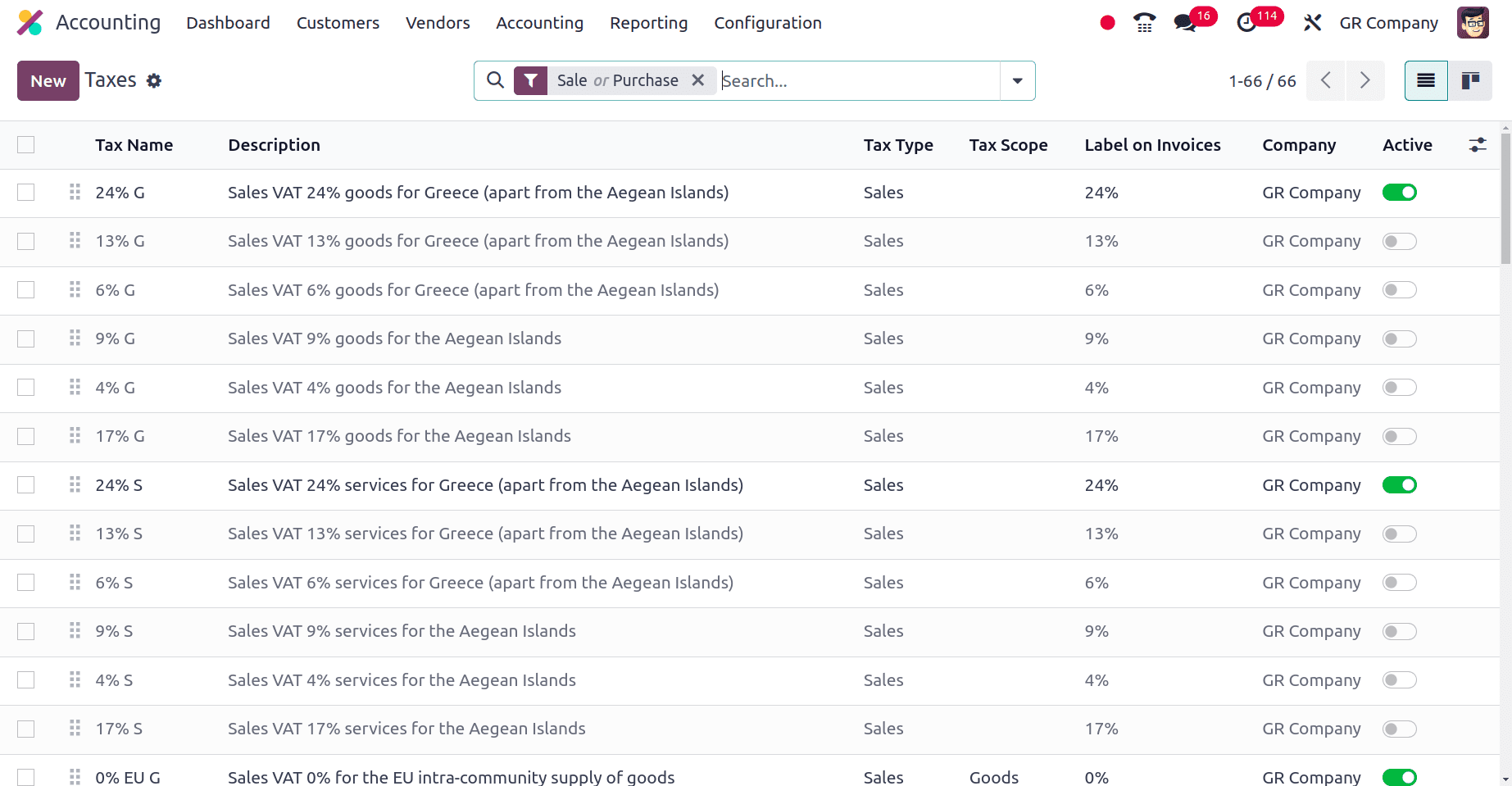

Click the taxes sub-menu under the configuration, and there will be a number of sales taxes and purchase taxes that the companies from Greece can use.

The taxes that a company from Greece can use are shown in the above screenshot. We can also create new taxes for this company by clicking the New button.

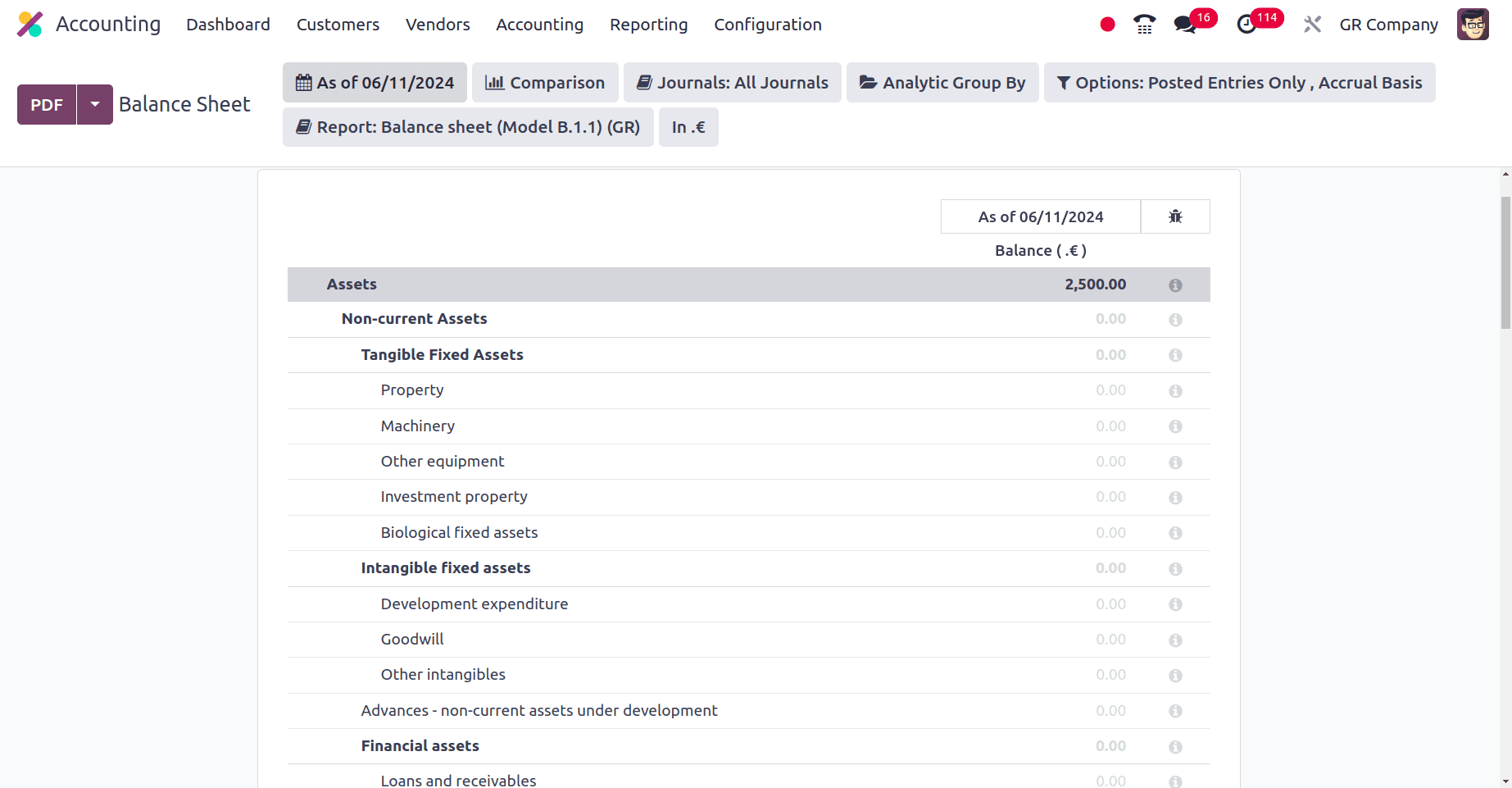

Under the Reporting menu, there is the Balance Sheet of the company for a specific period or day.

The balance sheet of the companies from Greece includes Tangible Fixed Assets, Intangible Fixed Assets, Financial Assets, Inventories, Financial Assets and Prepayments, Capital Paid up, Provisions, Long term liabilities, etc.

A snapshot of your company's financial situation as of a particular date is provided by the balance sheet. It isn't an income statement-style log of all the transactions over a period of time.

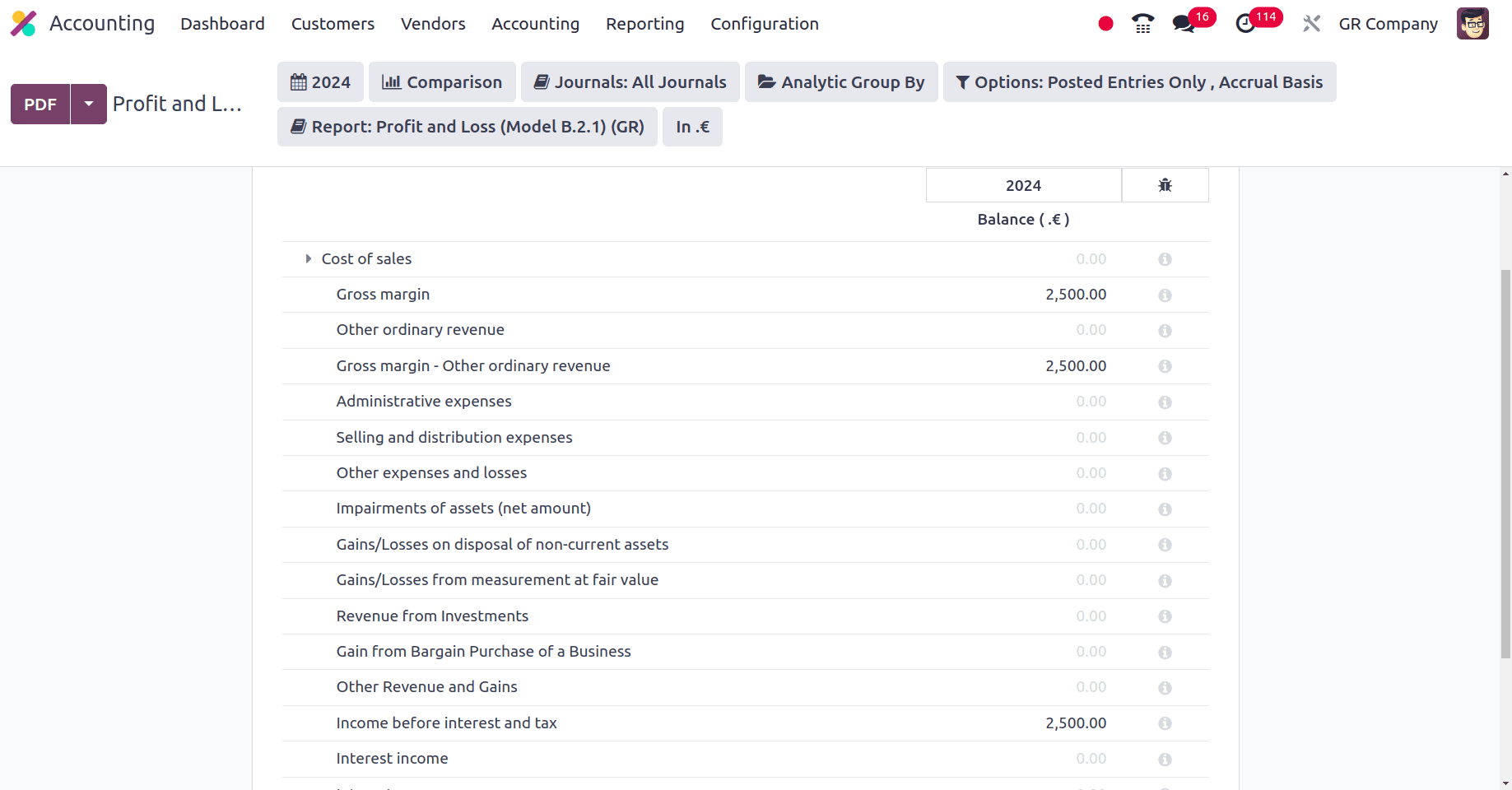

The balance sheet of this company includes Gross margin, Other ordinary revenue, administrative expenses, Impairment of assets, Revenue from investment, etc.

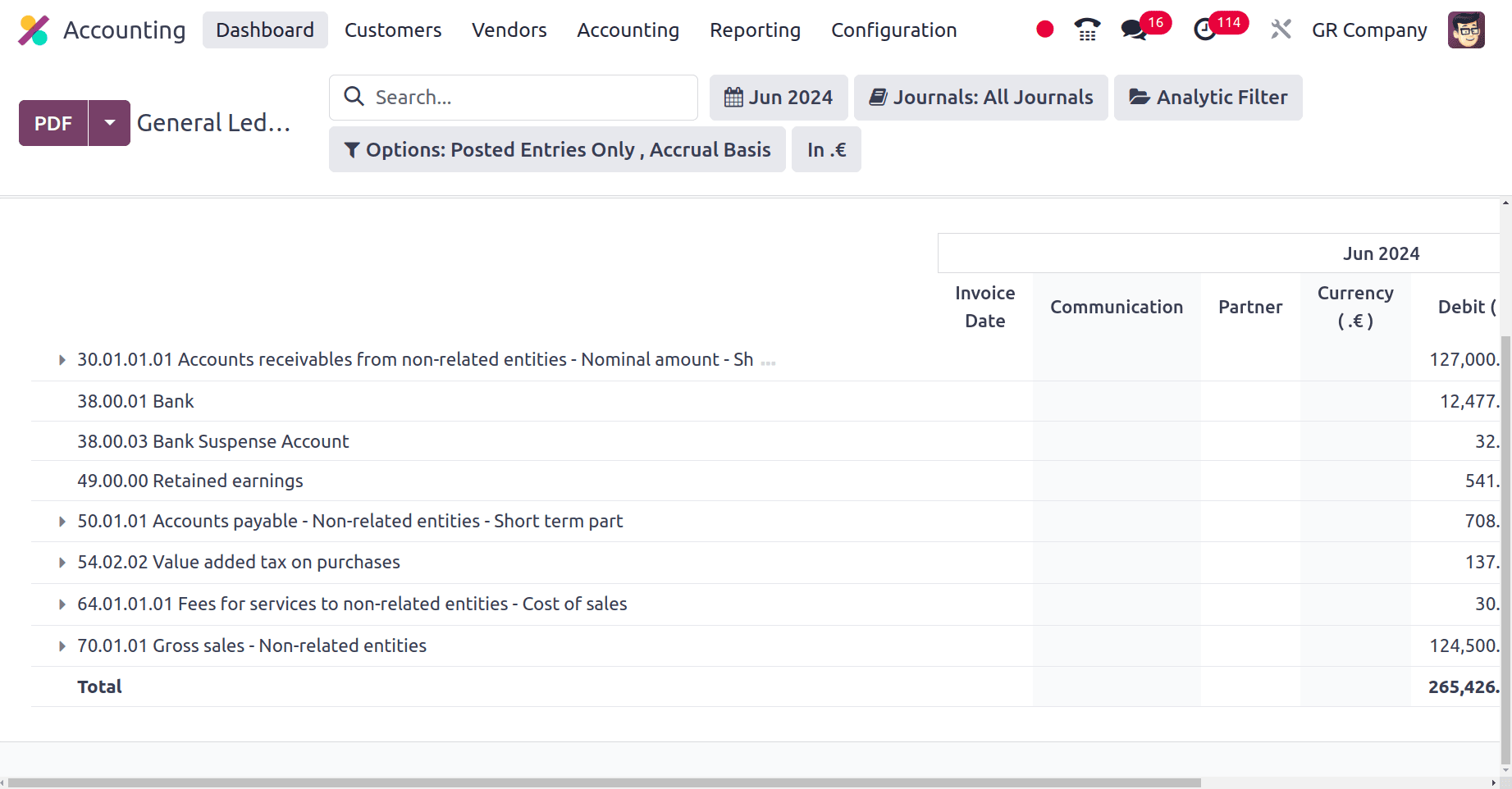

The General ledger in Odoo 17 serves as a thorough log of each financial transaction that takes place in your company. Every debit and credit entry for every account in your chart of accounts is monitored by the general ledger. Recall that the two sides of every financial transaction are represented by debits and credits.

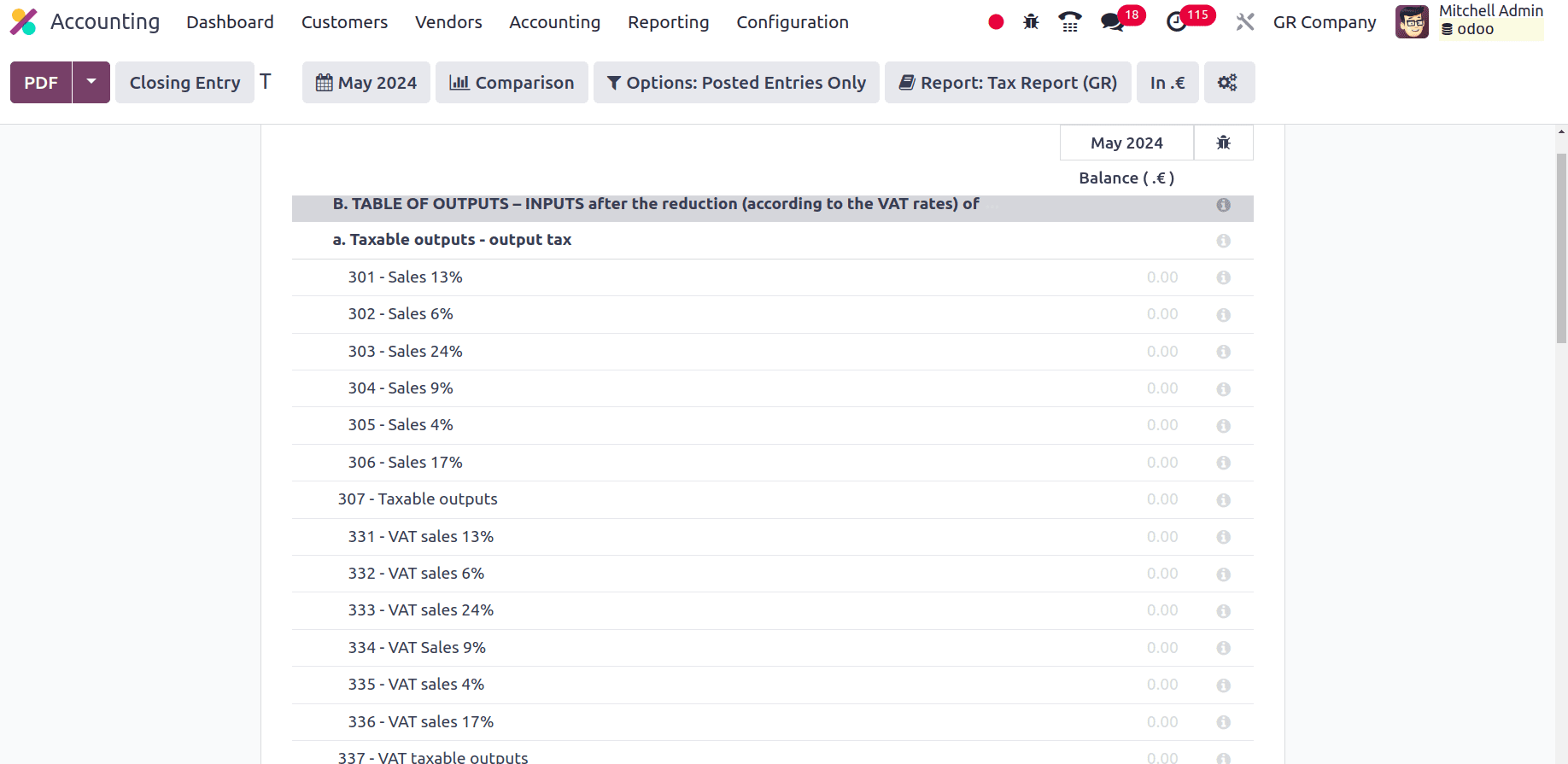

In the Tax report of the companies from Greece, Taxable output-output Tax, taxable Input-input tax, Amount added to the input tax total, Deductible amount from the total input tax, Table of tax settlement to be paid, deducted, or refunded, etc are added.

Taxable outputs is the entire quantity of goods or services your company has supplied to clients during a given tax period, less any amount of VAT that has already been paid.

International company operations are more frequent than ever in today's networked corporate environment. However, overseeing funds in several locations might be challenging. By utilizing the localization capabilities of Odoo 17, you've acquired an effective tool for streamlining your international accounting. From making sure local laws are followed to automating chores and increasing productivity.

To read more about An Overview of Accounting Localization for Chile in Odoo 17, refer to our blog An Overview of Accounting Localization for Chile in Odoo 17.