Accounting localization in Odoo, or any other ERP system, is the process of modifying the program's accounting features to conform to the unique legal and regulatory specifications of a certain nation or area. Here we are setting up the accounting localization for Germany.

To set up the country-specific localization, first of all, we would need a German company to set the localization. So we can create a new company by moving to the general settings in Odoo.

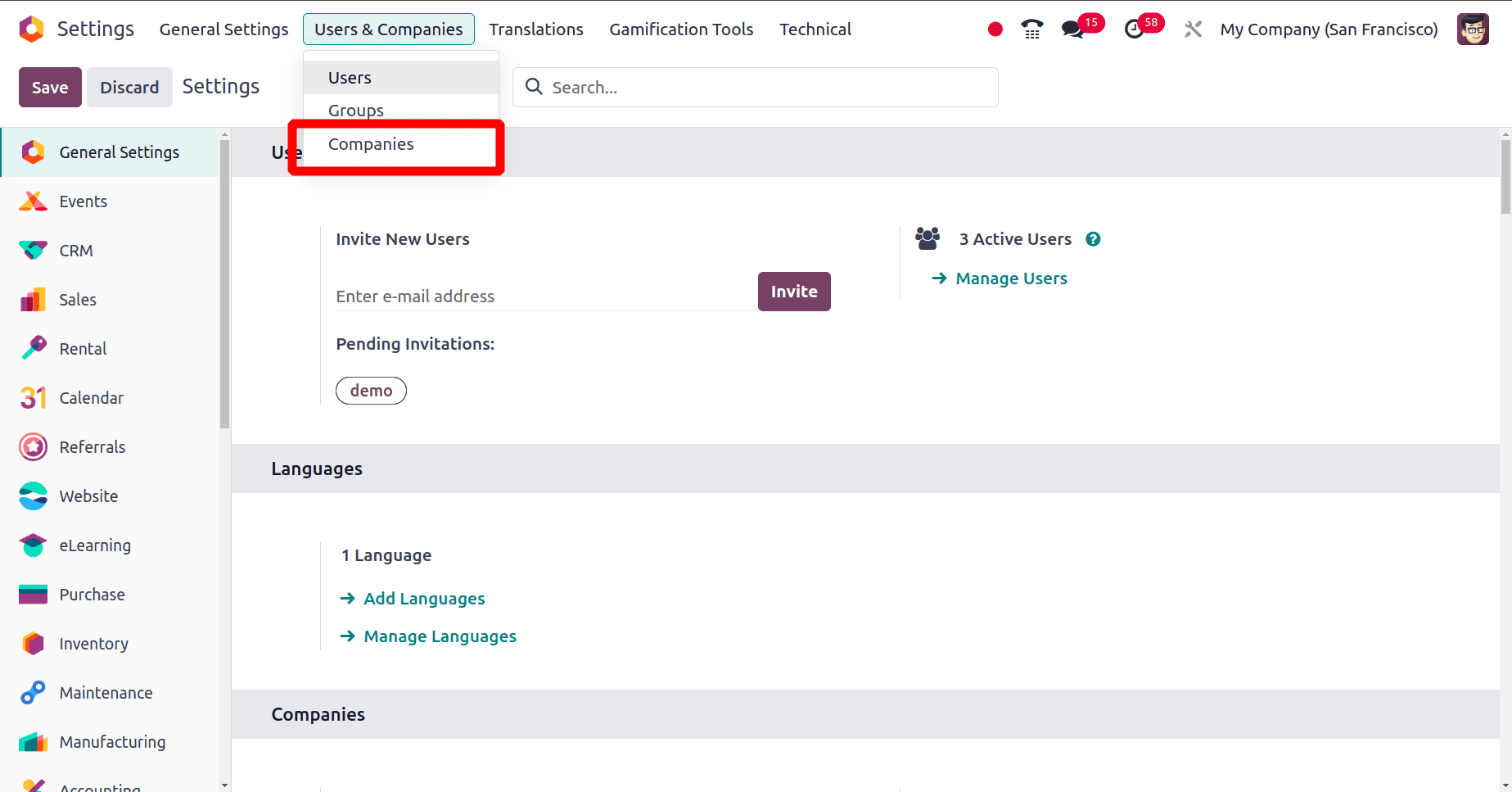

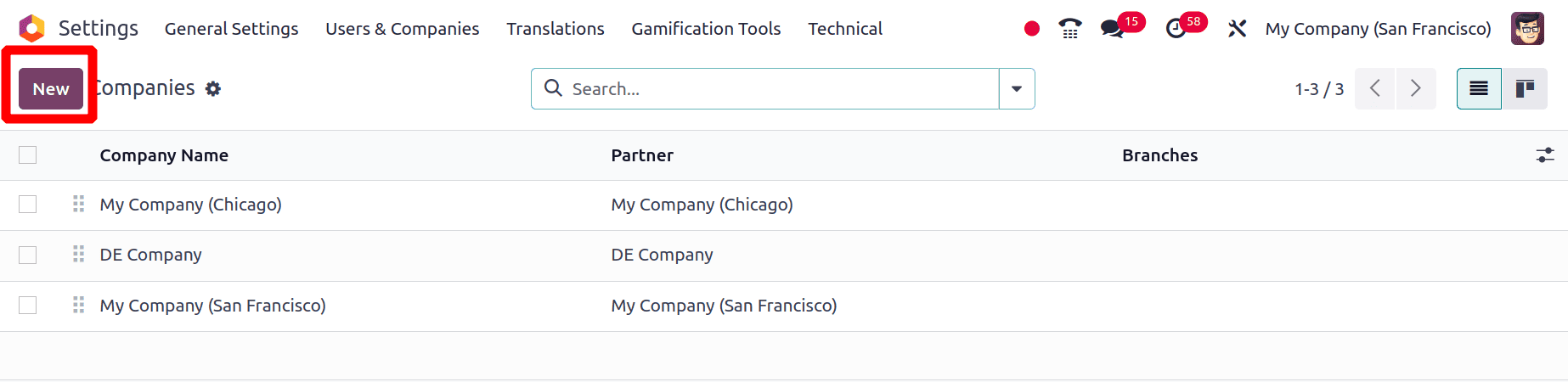

Then go with the Users & Companies menu. Under this menu, there is a sub-menu, Companies. Click on the ‘Companies’ submenu and we will be directed to a new page. There will be a list of companies on that page and click the New button on the page to create a new company.

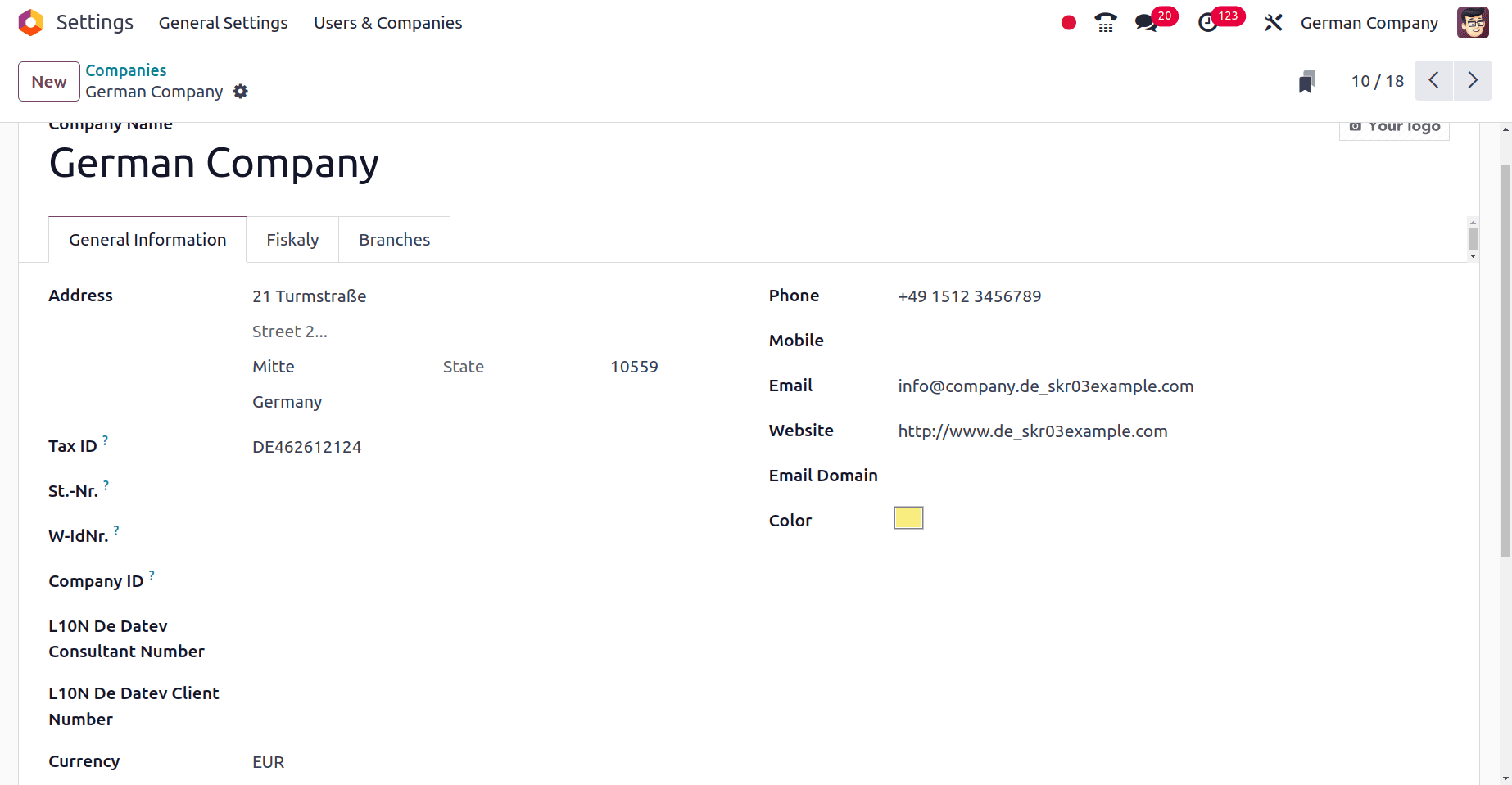

There we can create a new company that provides the Company name and country for the company. Now we are going to create a country which is located in Germany, so provide country for the company as Germany. In the form for creating the company, we can provide the address of the company and also provide all the details of the company and save these details.

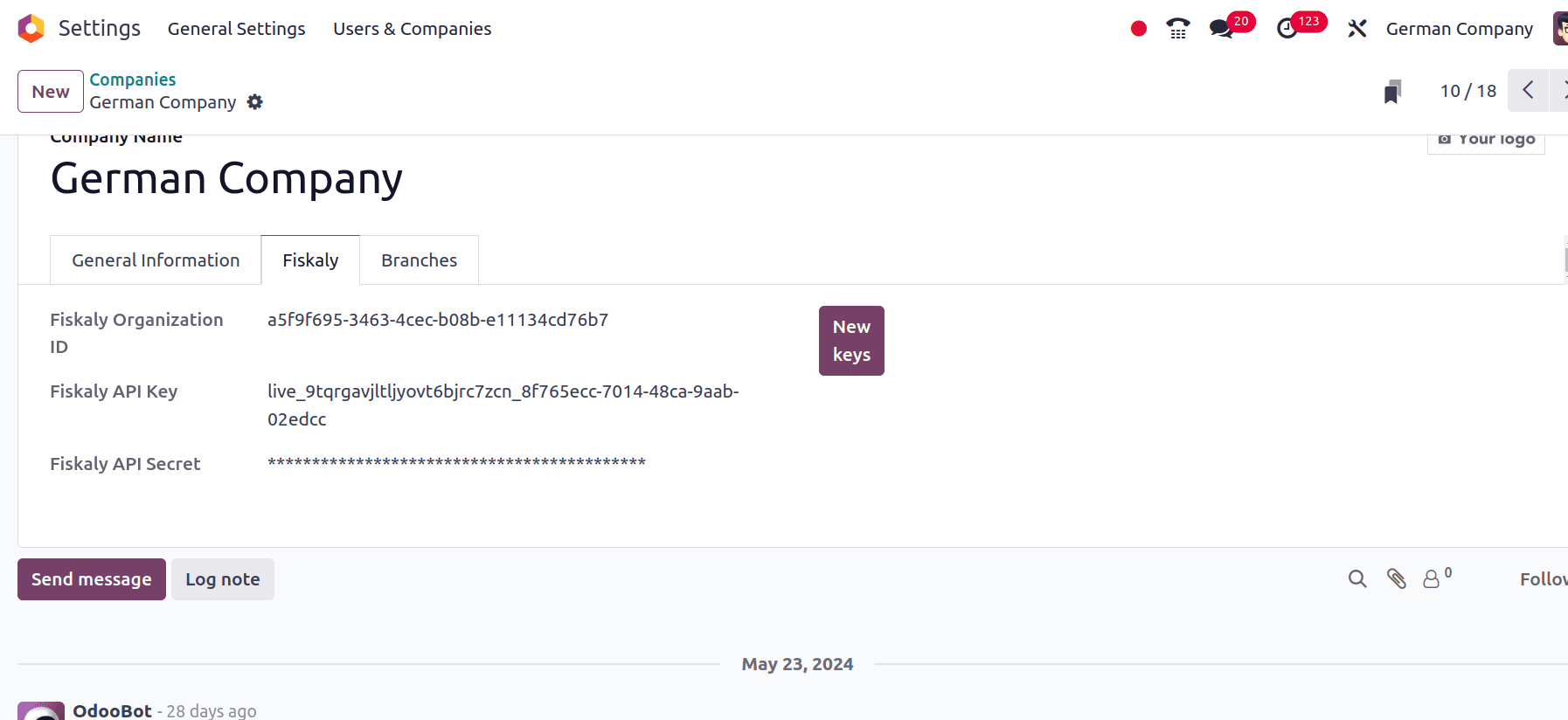

Here ‘St.-Nr.’ is the Steuer-Nummer that translates tax numbers in English. Steuer-Nummer is the specific field name for storing the tax number in Germany. And ‘W-IdNr.’ stands for Wirtschaftssteuer-Identifikationsnummer, which translates to German Tax Identification Number. It functions as a unique identification number assigned by the German tax authorities to businesses operating in the country. When we look at the Fisklay tab of the company, we can configure the Display information of the company here.

* Fisklay Organization ID: it represents the ID of our company on the fiskaly side.

* Fisklay API Key: it is used to connect your Odoo system with the Fiskaly service for electronic receipt compliance.

* Fisklay API Secret: it acts as a credential for your Fiskaly account. It allows authorized applications to access and potentially modify your tax data

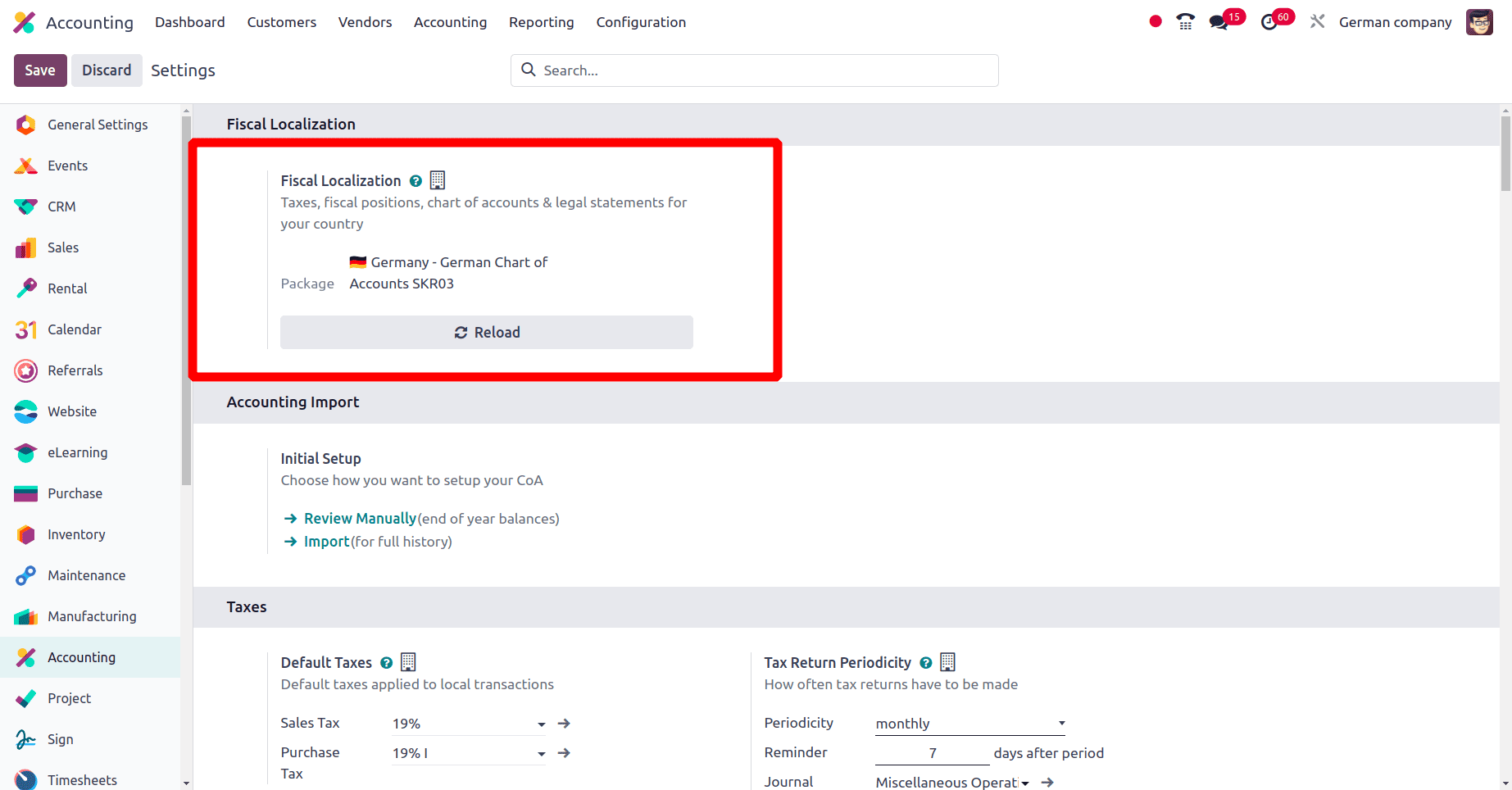

Next, we want to set the localization for Germany, for that move to the accounting application of Odoo and go to the configuration settings. Under the fiscal position section, we can provide the package for Germany.

Germany mainly has two localizations, a chart of accounts SKR04 and SKRO3. Odoo supports both of these and we can choose either one of these then and save that.

Changes occurred when German localization was configured

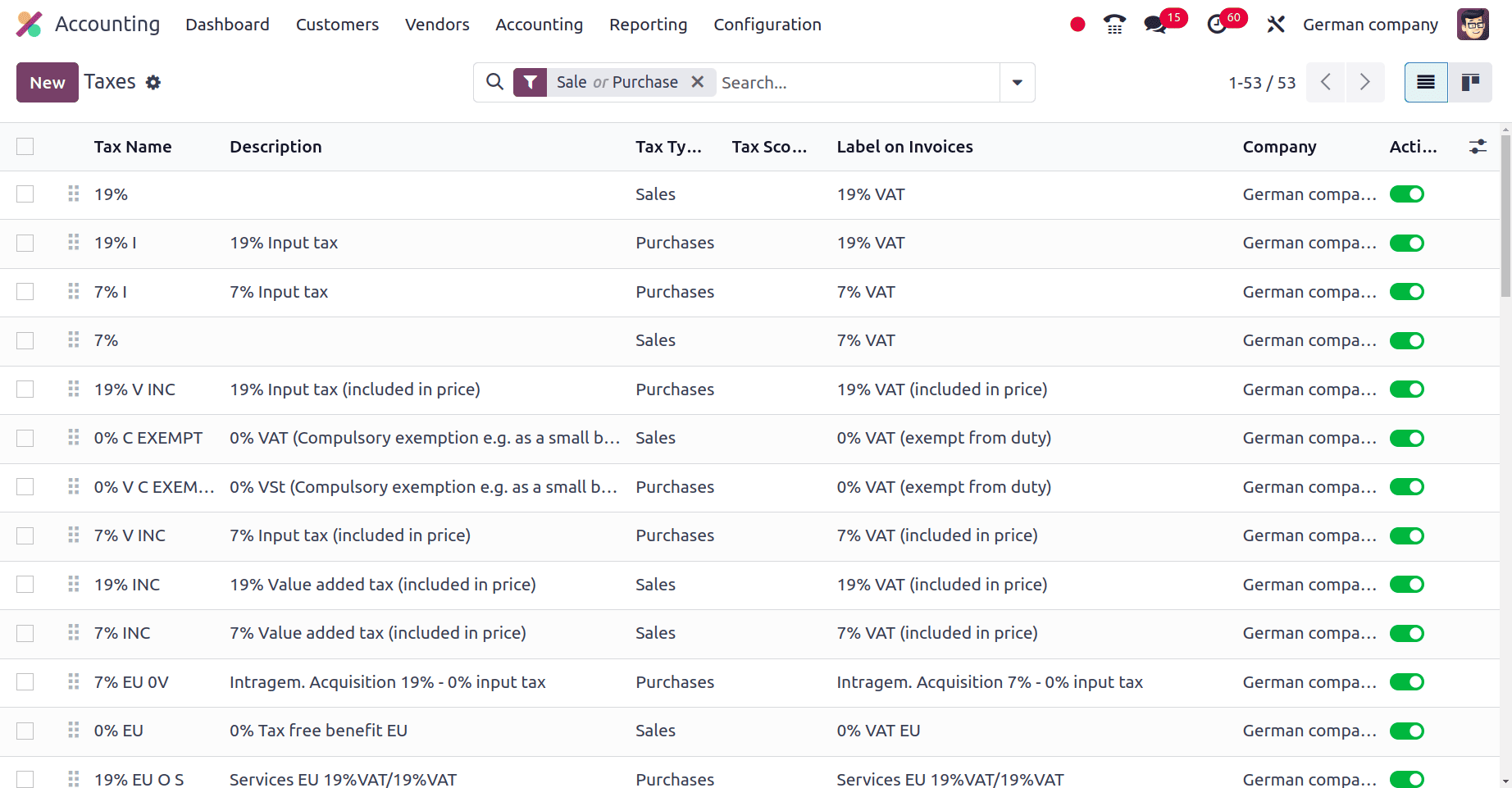

If the localization for Germany has been configured, we can check what changes occur in the accounting of odoo. First, we can move to the Taxes configured for the German company. So in the Taxes submenu under the Configuration menu, all the taxes that a German company can use are listed there. From the list of taxes, the company can use the respective taxes.

The default tax used in Germany, the VAT used in German companies, and we know that there are different taxes used for different purposes in different countries. So the company can use these taxes in the list during a financial transaction for different purposes.

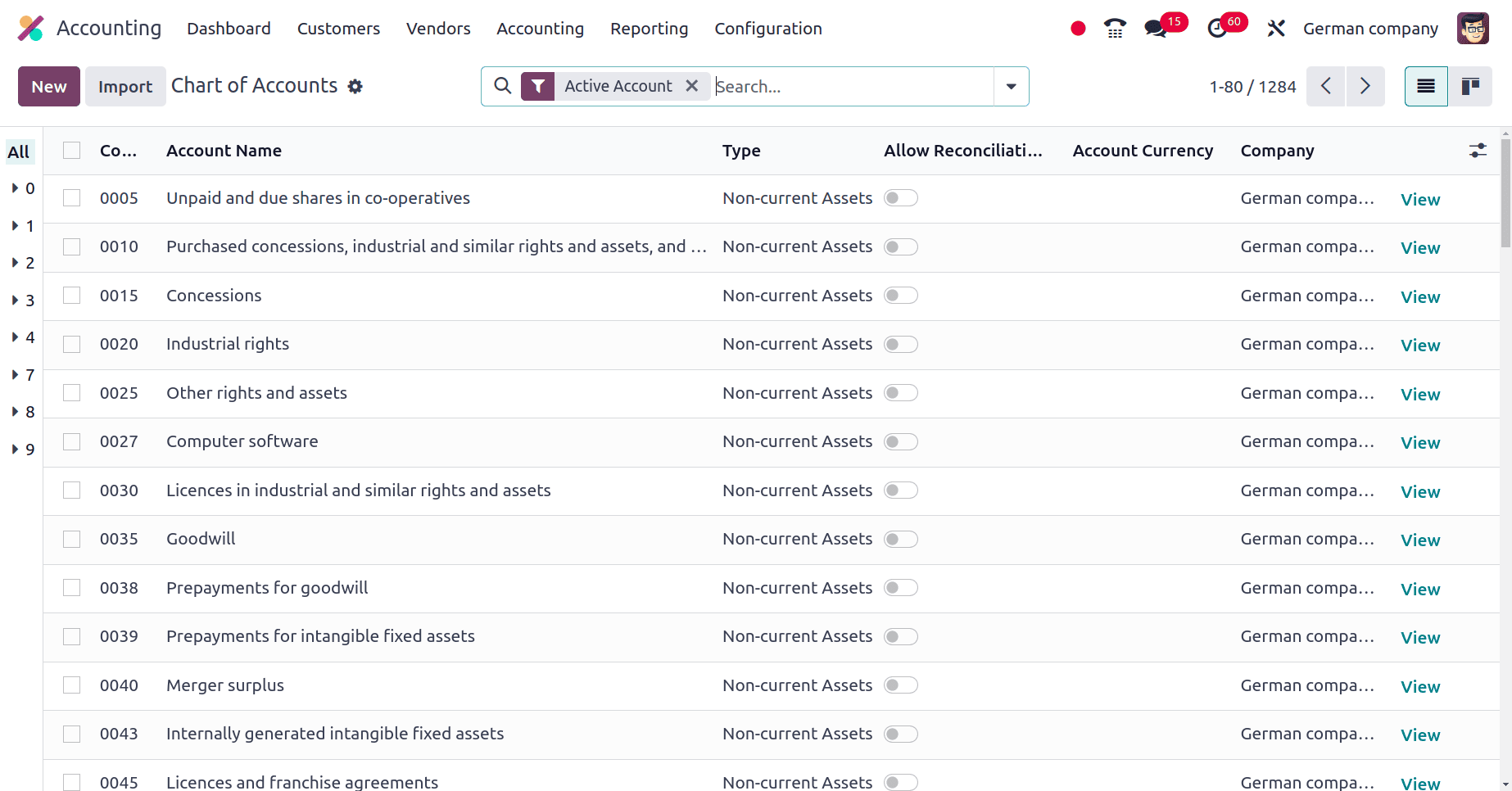

Then we can move to the Chart of Accounts for the German companies, for that click the Chart of Accounts sub-menu under the Configuration menu. There will be a list of Chart of Accounts.

Here when we look at the Account Names the names of the accounts are entirely different. Moreover, the different accounts used by the businesses in Germany can be intended here.

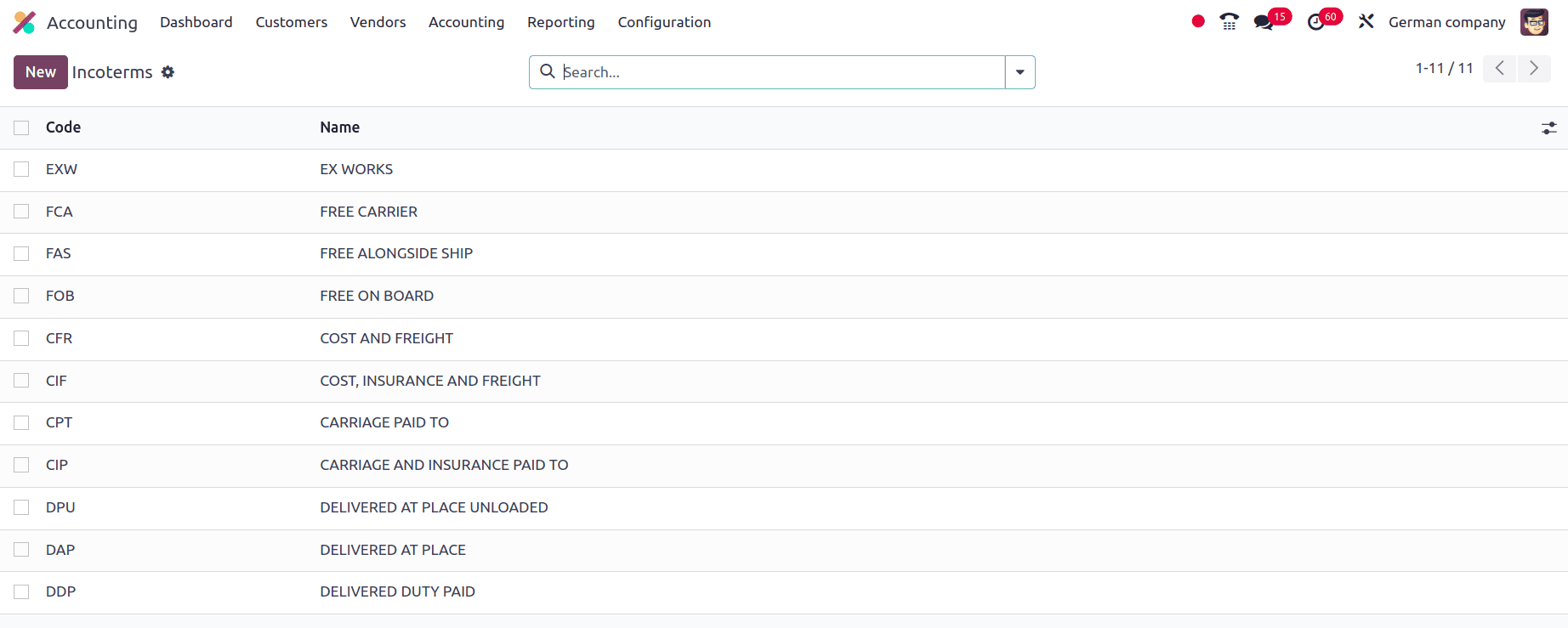

Now we can go with the Incoterm for German companies. Click on the Incoterm sub-menu under the Configuration menu. There will be different Incoterm used for different operations by different companies in Germany.

The definition of Incoterms will be useful as it will lead to effective management of the financial operations, which will be very helpful for the company's financial operations.

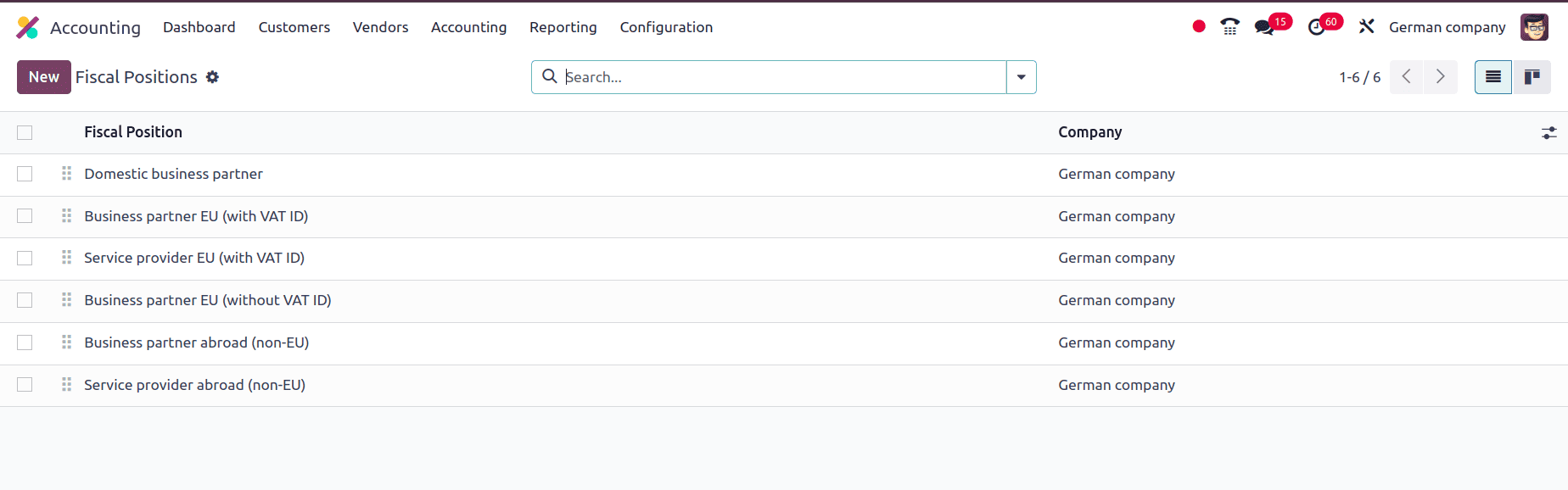

The next one is the Fiscal position, we can go to the fiscal position sub-menu by clicking on the configuration menu. A feature to simplify managing transactions with various tax laws or account formats is Fiscal positions. Financial positions guarantee automatic compliance for companies that operate in several locations with different tax laws.

From the fiscal position menu, we can define the fiscal position for the accounting operation. It is also able to edit the defined fiscal position based on our needs. When tax and account mapping are automated, it takes less time and effort than selecting each transaction by hand. This enables accounting personnel to concentrate on more strategic duties.

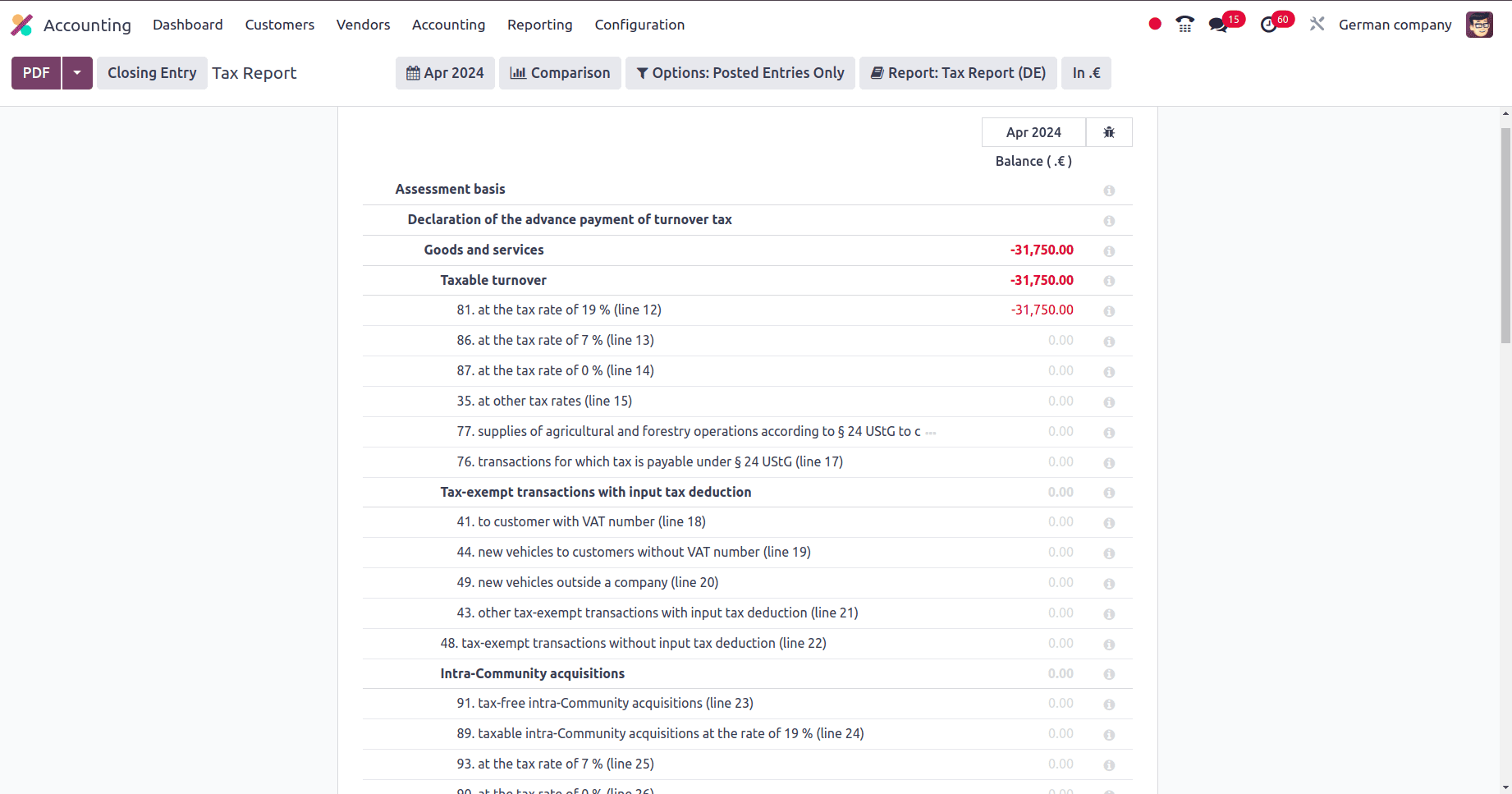

The next is the Tax Report of a German localized company. The Tax report of the German localized company will be shown under the Tax Report sub-menu which is under the Reporting menu. Click on the Tax Report and there we can see all the tax reports of that fiscal year.

* Taxable turnover: Refers to the entire amount of money received from the sale of goods and services after any value-added tax (VAT) that the buyer has previously paid is subtracted.

* Tax-exempt transaction with input tax deduction: In which the customer is not charged with the VAT at the Point of sale. But the tax amount will be included in the product amount itself.

* Intra-community acquisition: This refers to the exchange of commodities for commercial reasons between businesses that are registered within the European Union (EU).

* Supplementary information on turnover: more information that gives an enhanced understanding of a business's income data.

* Deductible input tax amount: This is the Value Added Tax (VAT) that a company has paid on purchases and deducts from the VAT it receives from sales.

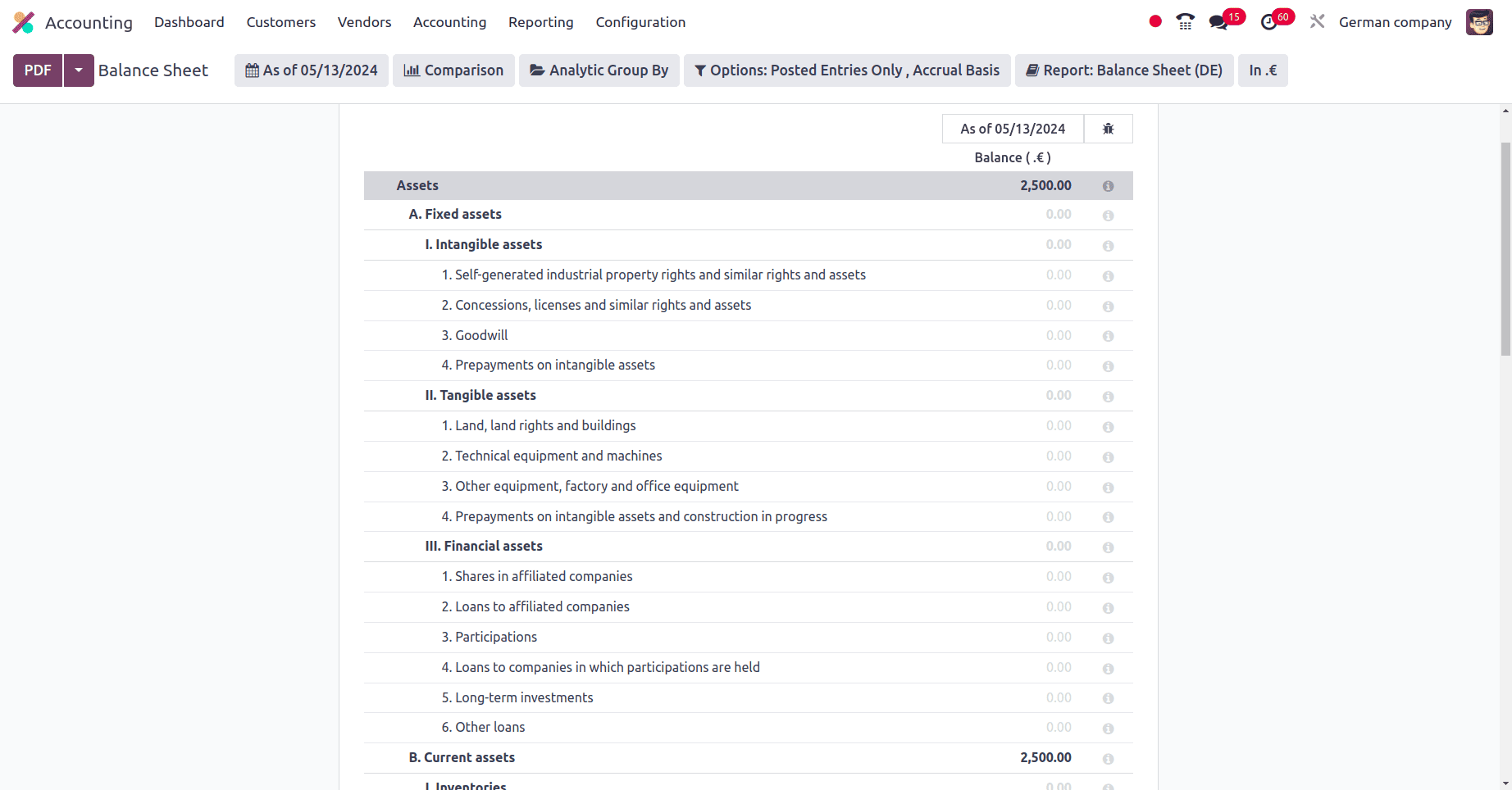

In Balance sheets, there will be Assets, Equity, and Liabilities. There are different assets, Intangible assets, Tangible assets, Financial assets, Inventories, Receivables and other assets, securities, etc. and the different types of Equity and Liabilities are Subscribed capital, Revenue reserves, legal services, etc.

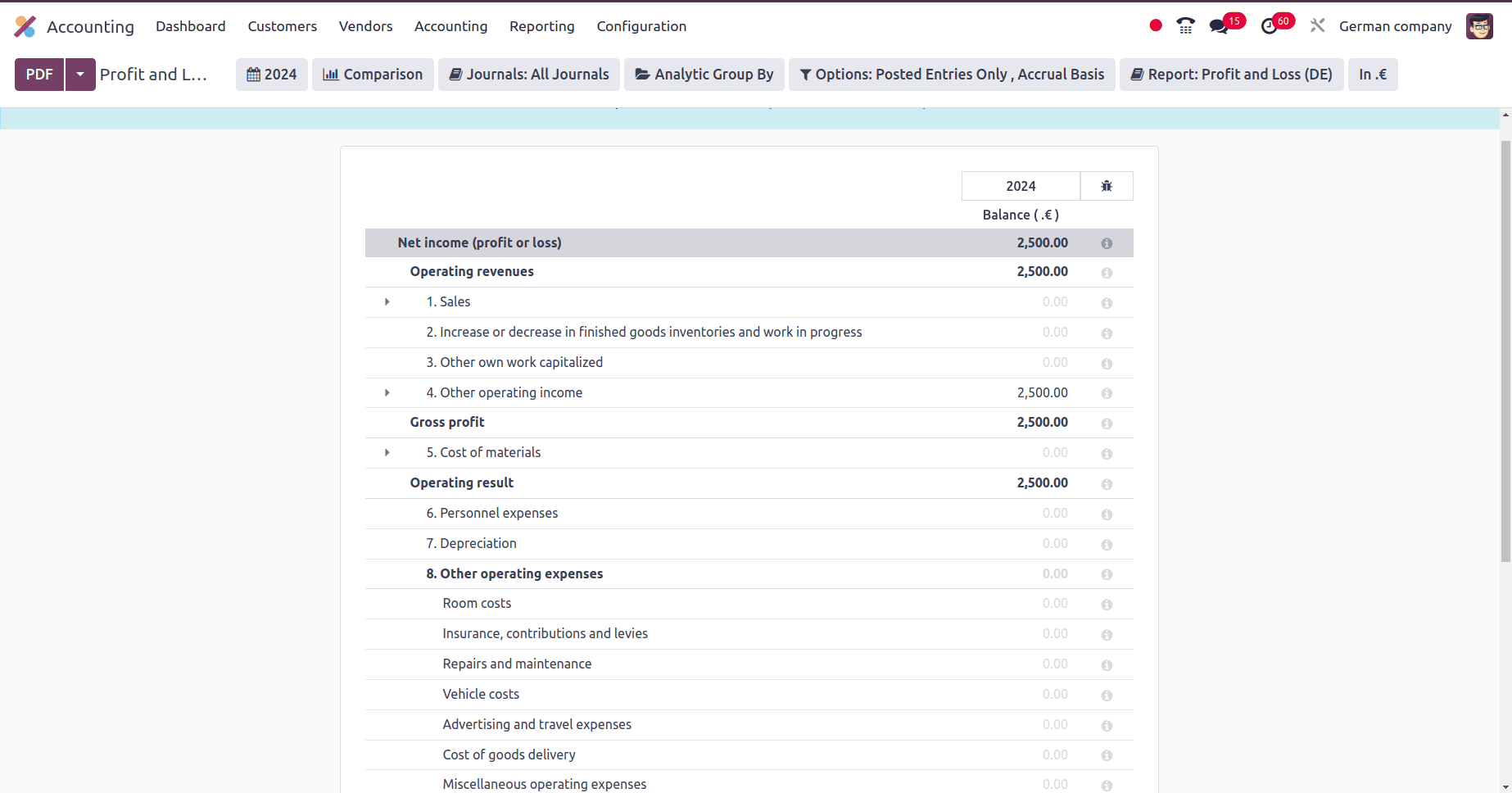

Then we can look at the Profit and Loss of the German company. There will be operating revenue, gross profit, operating results Financial results, and earnings after taxes, etc are the major accounts used to show the profit and loss of the German companies.

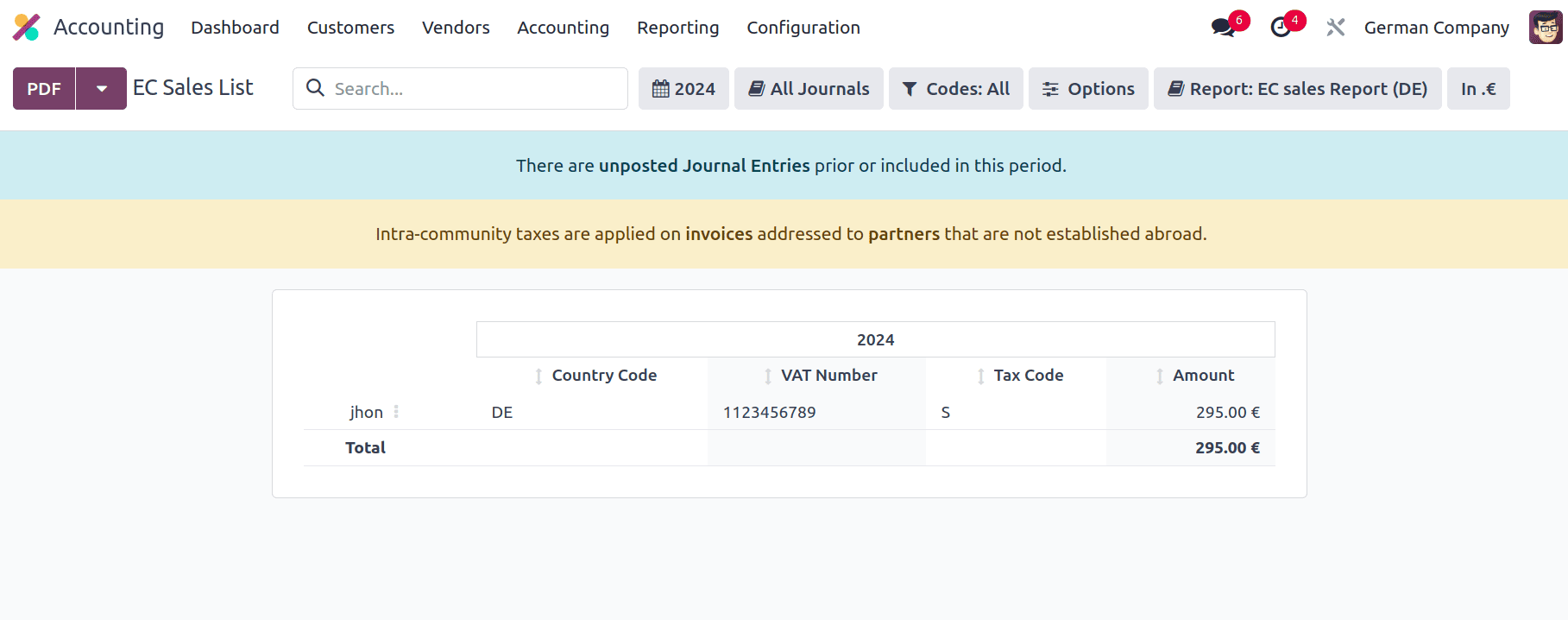

EC Sales List stands for European Commission Sales List. These reports include a summary of sales made to other EU countries' VAT-registered enterprises for products or services. They are essential for EU VAT compliance.

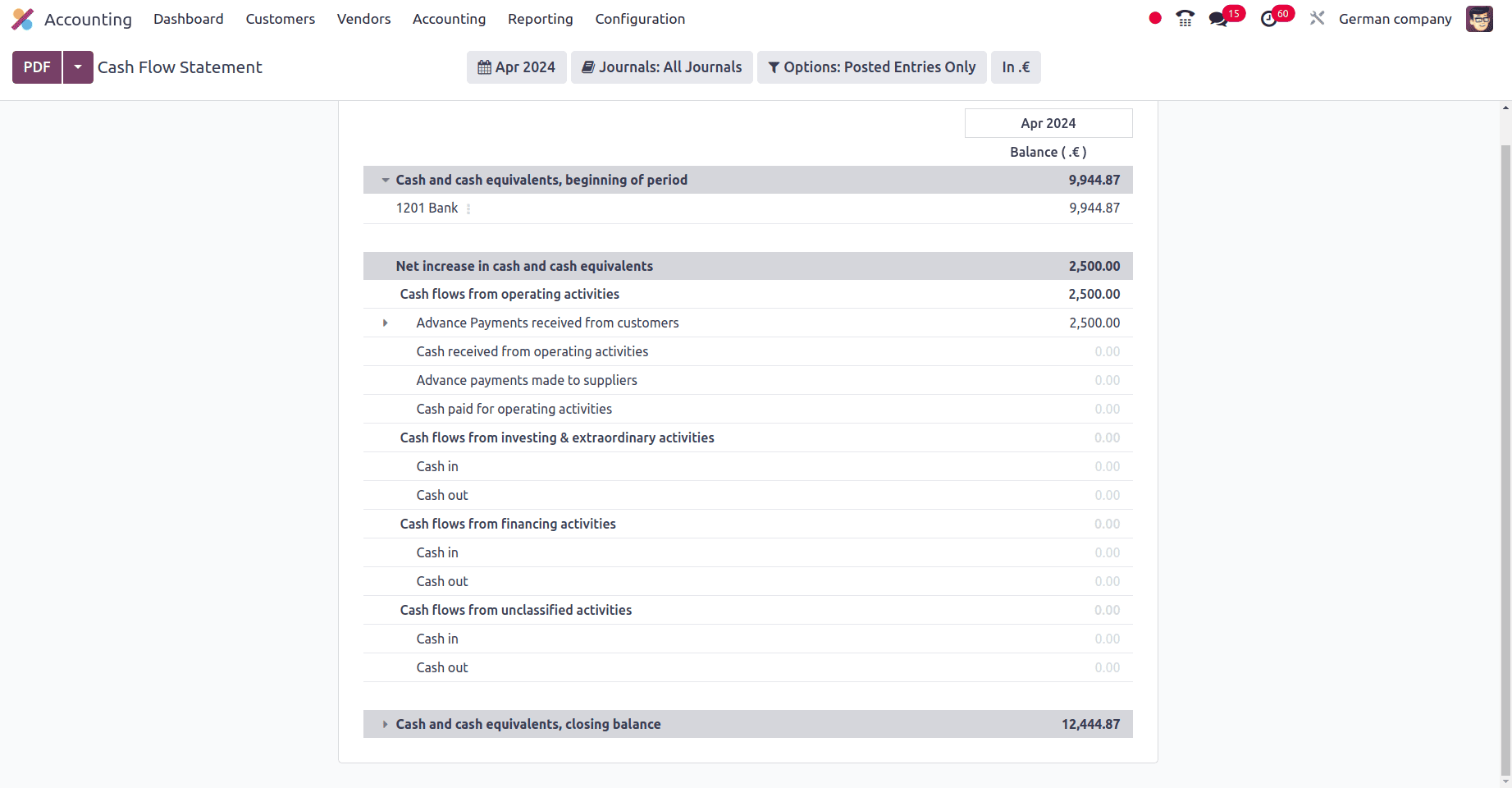

The next is the Cash Flow Statement, and here the Cash Flow Statement, Cash and Cash equivalents, the beginning of the period, Net increase in the cash and cash equivalents, Cash and Cash equivalents, and closing balance all were shown there.

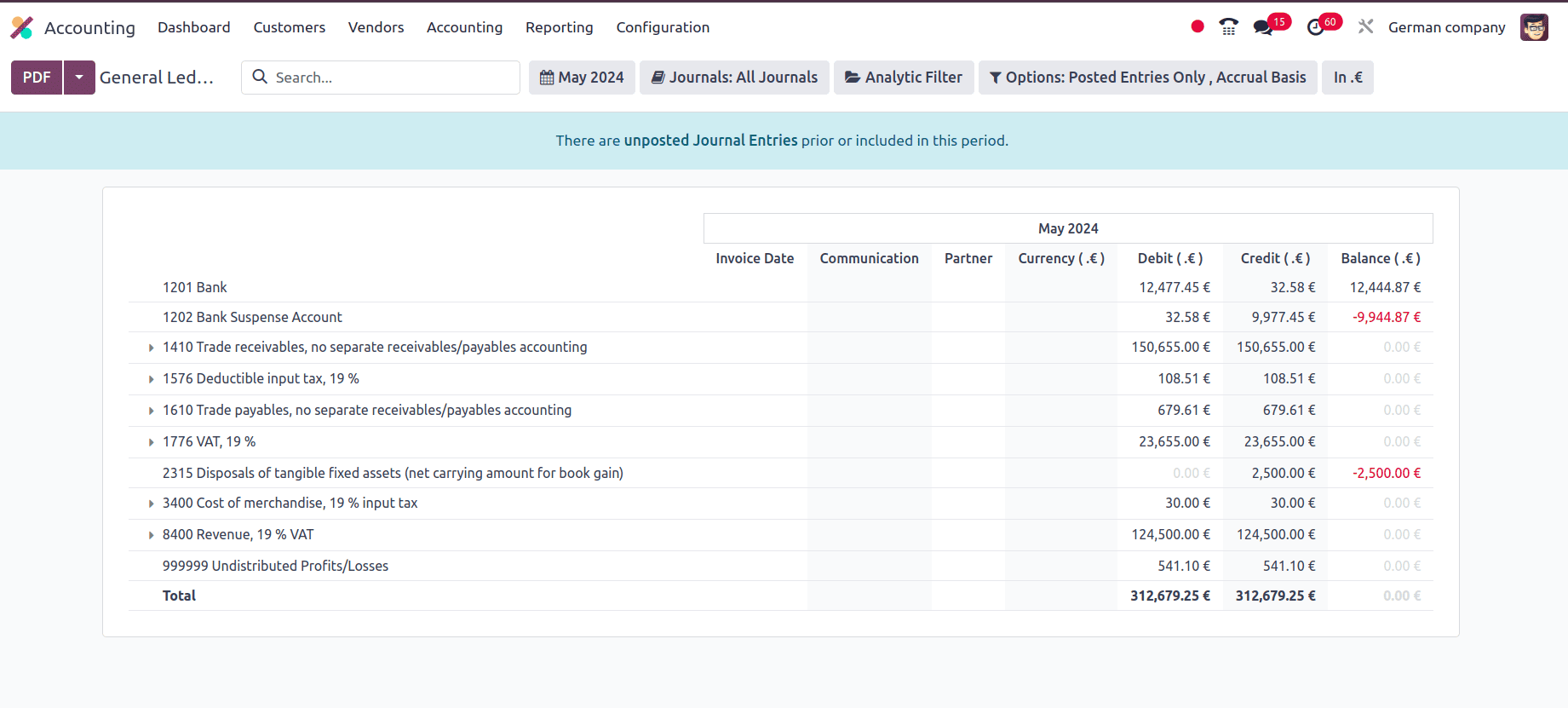

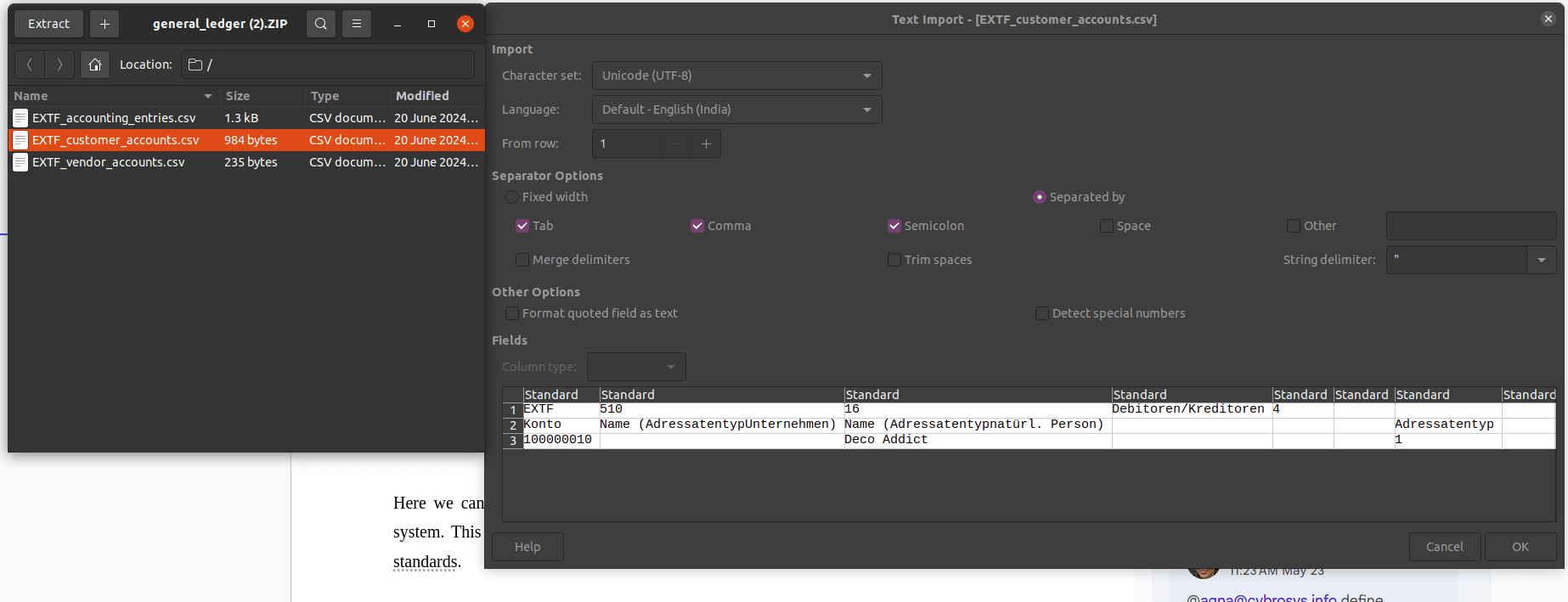

A General ledger is the foundation of the complete financial recording system in accounting which keeps track of every financial transaction made by a business during an accounting period. In the general ledgers, we can see all the ledger postings done under German-based companies.

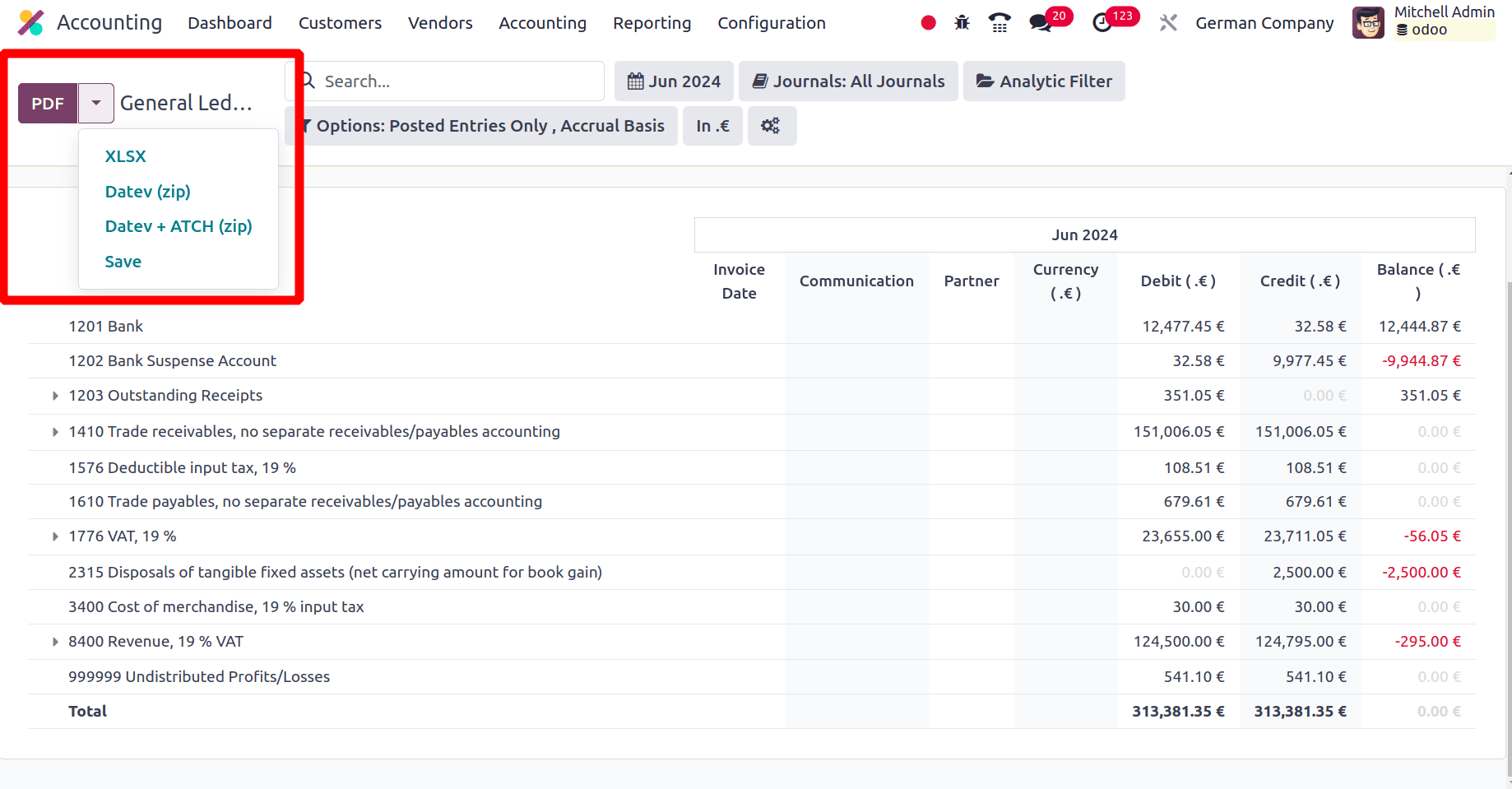

A well-known German accounting software program is referred to as Datev. In Odoo 17 it is possible to export your accounting entries from Odoo to Datev. It is a popular software package created especially for the German accounting industry. In accordance with German tax laws, it provides features for accounting, tax filing, and financial reporting.

When we choose the General Ledger sub-menu under the Reporting menu of the accounting application, near the PDF button there is a drop-down list that lists out different exporting formats.

Here we can choose the Datev format and thus the data will be exported successfully to our system. This data typically includes journal entries categorized according to German accounting standards.

Like this, we will get the accounting data in Datev format in our system. This feature in Odoo 17 helps to Streamline collaboration with tax advisors or auditors who use Datev. It is less time-consuming and effortless than entering data into Datev manually. It also reduces the errors which occur due to the manual data entry.

There are different varieties of features that Odoo German localization brings out. All the facilities and functionalities that are necessary to execute and perform a business in Germany. In this blog, we have discussed localization for a German company so that the company can smoothly perform its accounting functions smoothly.

To read more about An Overview of Accounting Localization for Poland in Odoo 17, refer to our blog An Overview of Accounting Localization for Poland in Odoo 17.