The accounting module of Odoo is made to adapt to a variety of financial settings. Managing accounting localization effectively necessitates a thorough awareness of both the capabilities of the program and the unique regulatory requirements of other areas. This blog seeks to clarify Odoo's approach to accounting localization issues by providing an overview of its capabilities and how they assist companies in navigating the nuances of regional accounting requirements.

Upon entering new markets, organizations must adjust to local accounting norms as a crucial element of their operational success. Through its accounting module, Odoo offers businesses operating in Morocco a strong foundation to handle these localization needs.

Specific rules and regulations in Morocco's financial environment can be difficult for businesses that are not familiar with the local norms. The Moroccan localization of Odoo's accounting is intended to simplify adherence to these rules for smooth operations.

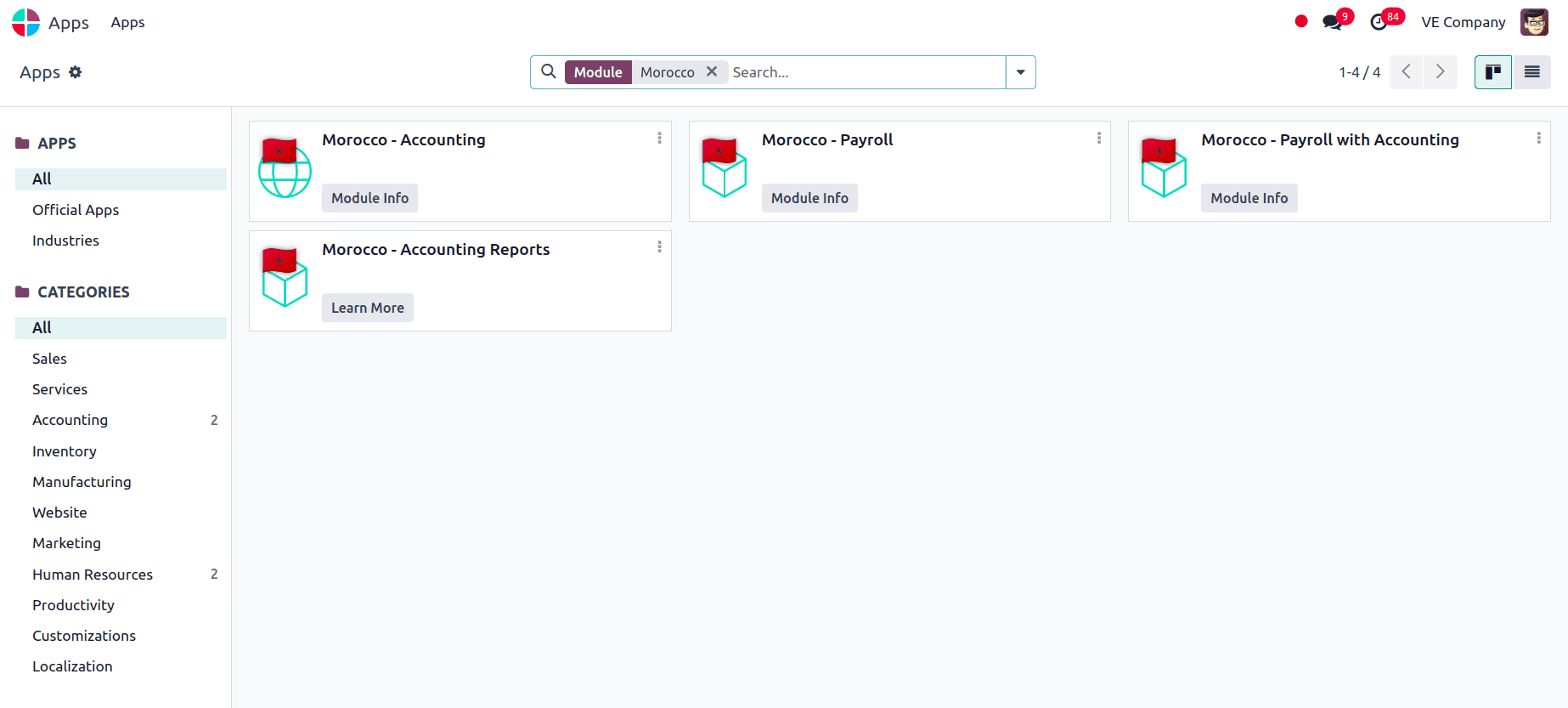

The first step in setting up the localization is the installation of the required modules so that we can go to Apps and search. Install the required modules.

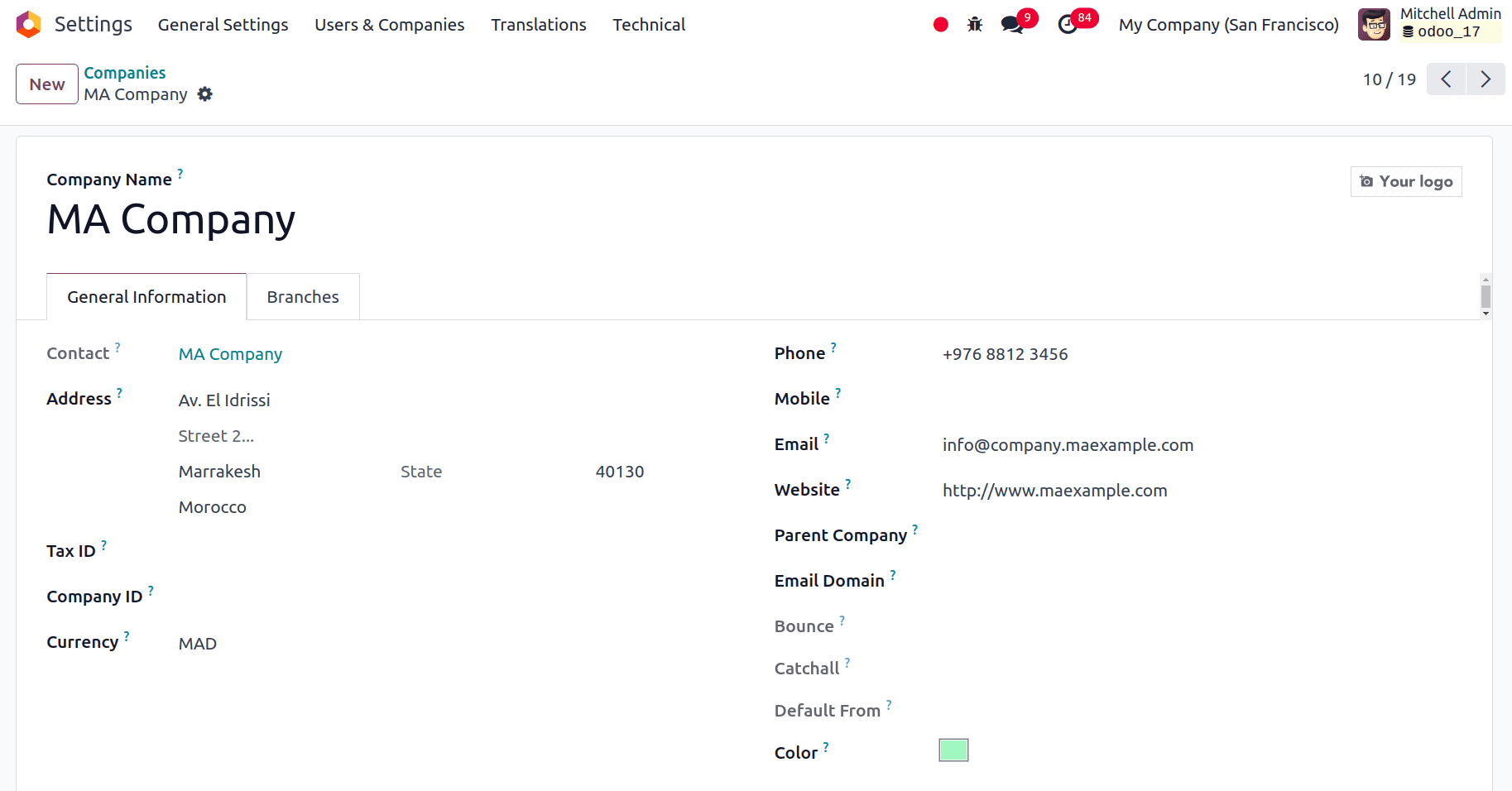

Now we can go to Settings > Users and Companies > Companies and select the company for which we want to check the configurations from the list of the companies.

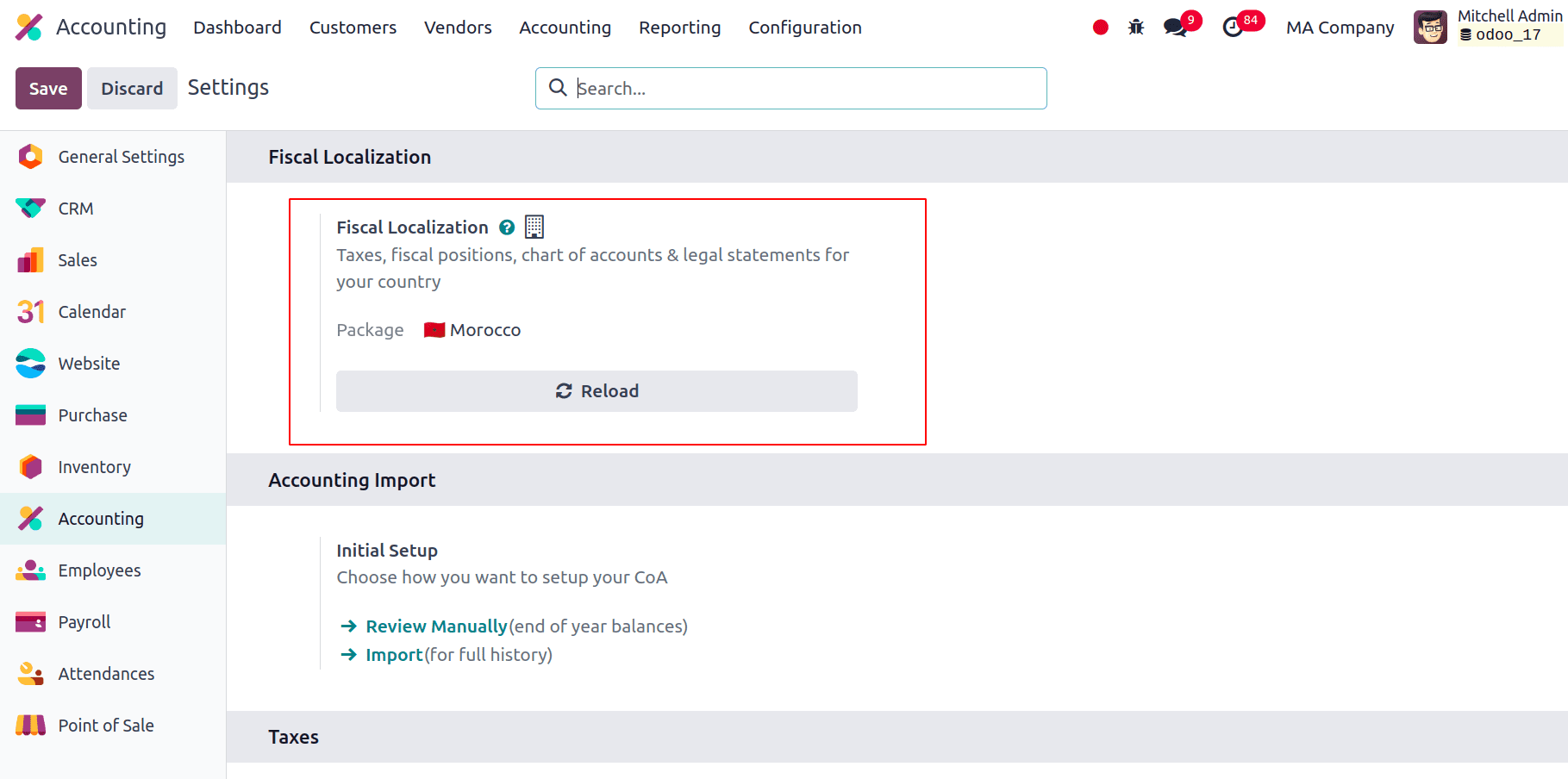

Now, we can look at the Fiscal Localization set for this localization. For that, navigate to Accounting > Configuration > Settings and check the fiscal localization it will be set to Morocco.

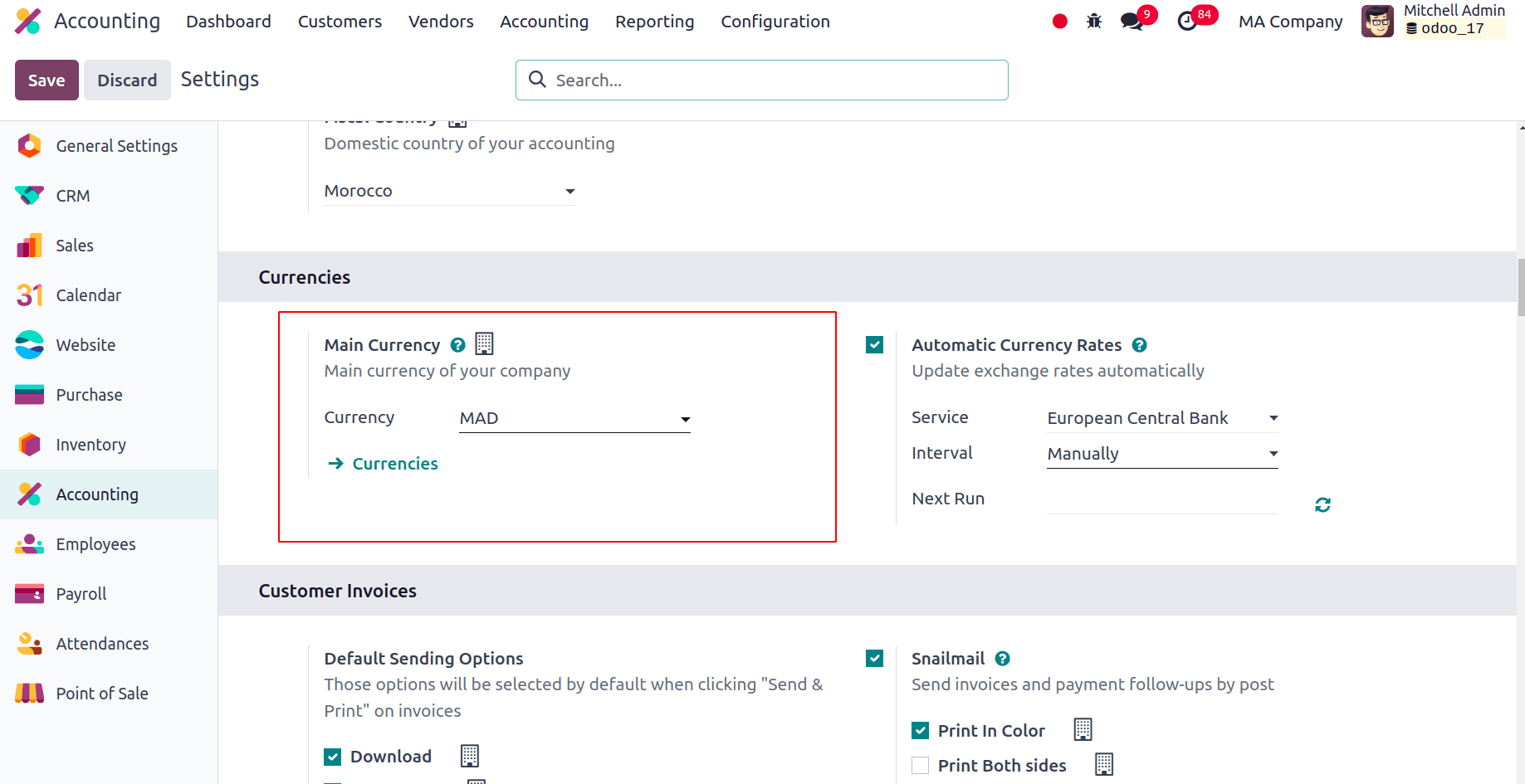

The Main Currency with which all the transactions of the company take place is configured in the configuration settings. Here we can see that it will be pre-defined as the official currency of the country since we have installed the localization modules. It will be set to Moroccan dirham (MAD).

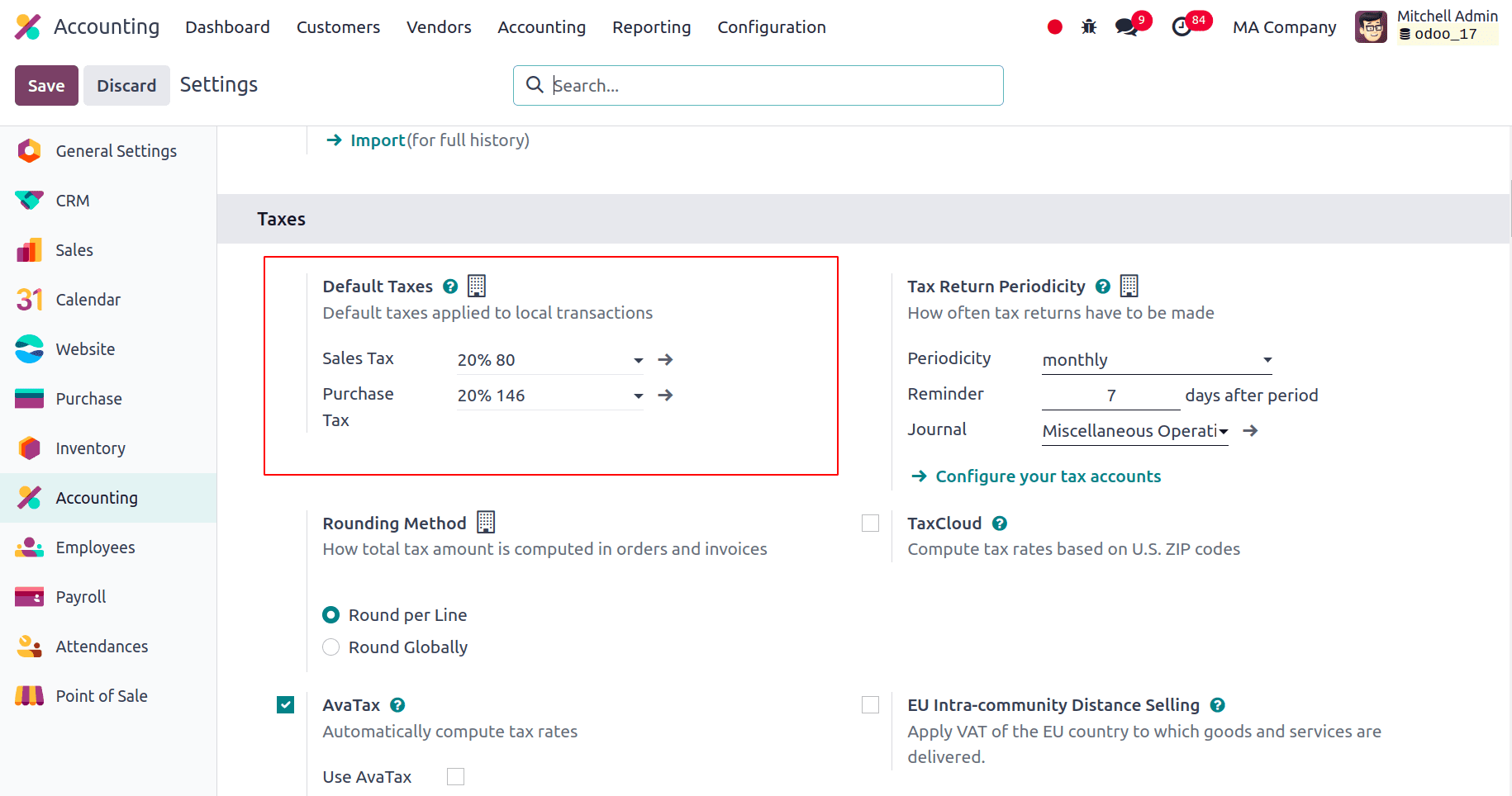

We can also set the Default Taxes that need to be used by default for the transactions that take place in the company. Default taxes are essential for effectively automating and controlling the taxation process.

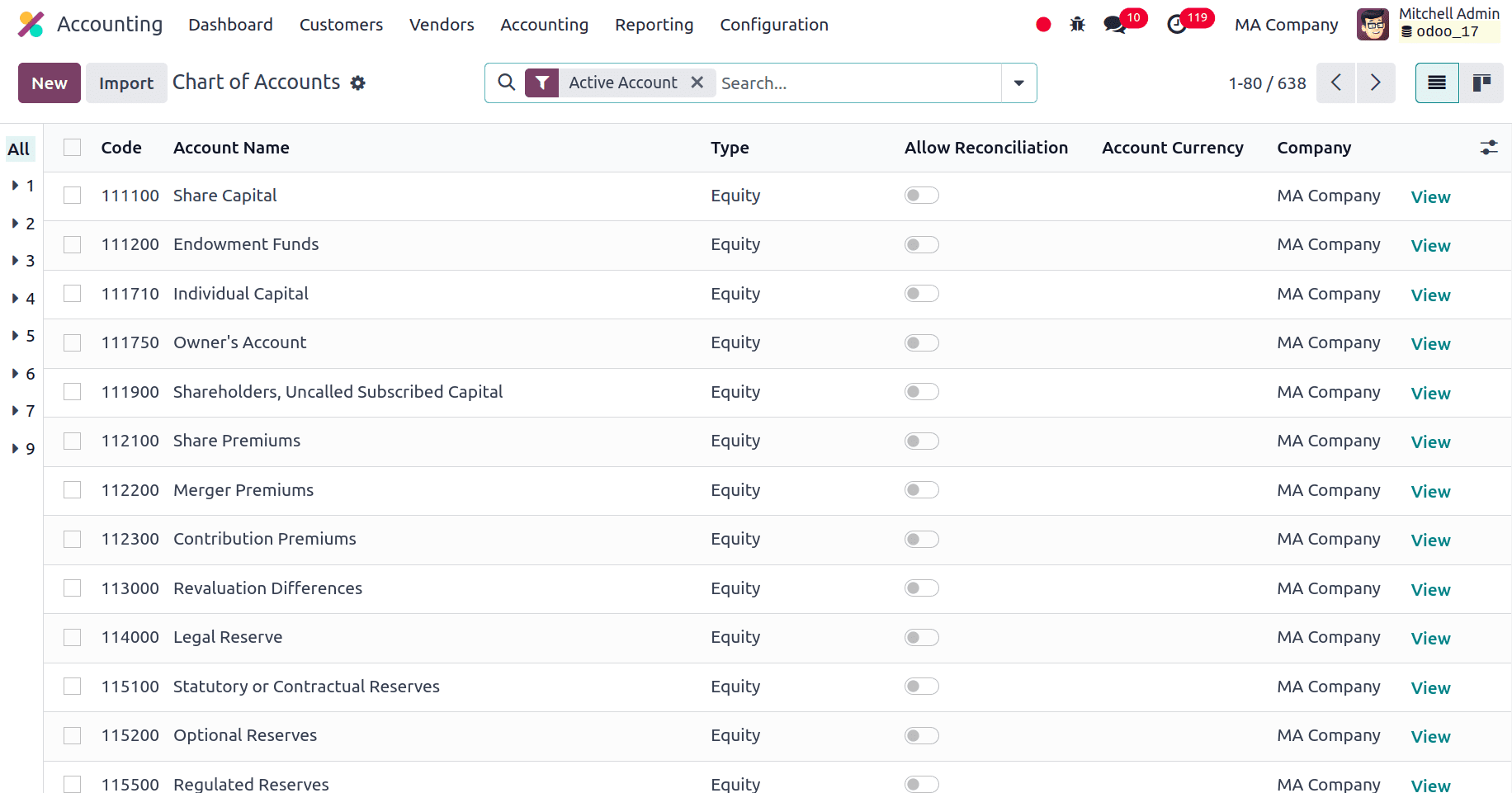

Chart of Accounts

A firm can record transactions and manage financial data by using the chart of accounts in Odoo 17, which is a systematic listing of all financial accounts. It is set up to classify and arrange accounts into primary groups, including Revenue, Expenses, Equity, Liabilities, and Assets. Since every financial transaction is correctly documented in its corresponding account, this hierarchical structure makes accurate financial reporting and analysis easier to accomplish. Chart of accounts is flexible and precise in financial administration, as it can be tailored to meet individual corporate needs. The accounts are set up in a way that complies with Moroccan financial reporting regulations. Contains accounts for Moroccan taxes such as Income Tax (IT) and Value Added Tax (VAT). Adheres to the Moroccan chart of accounts hierarchy, allowing financial transactions to be properly categorized. Enables the addition of unique accounts to meet certain business requirements while upholding legal requirements.

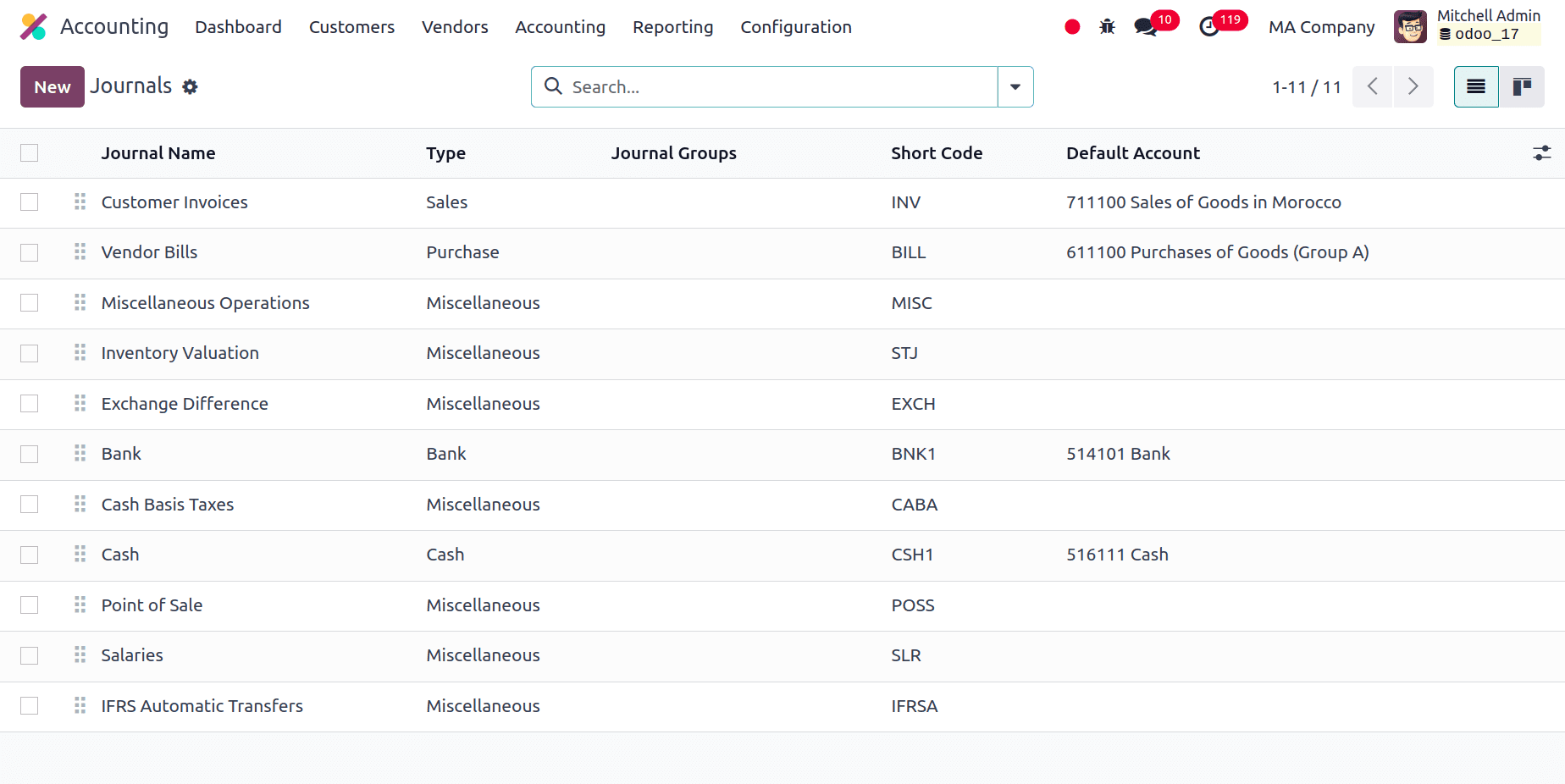

Journals

Journals are an essential element of Odoo's financial transaction recording and management system. Under each transaction category (e.g., sales, purchases, bank operations), they serve as comprehensive records of all accounting entries. In Odoo, every journal records particulars about transactions and makes sure that entries are consistently pushed to the right account. This provides an organized and transparent picture of a business's financial activity and aids in the maintenance of accurate financial records and effective bookkeeping. Also provides common journal templates for general entries, cash, bank, sales, and purchases. Using transaction data, tax calculations and records (such as TVA) are automatically generated. Verifies that, in accordance with the Moroccan chart of accounts, journal entries are posted to the appropriate accounts. Enables the creation of unique journal entries to meet certain business requirements.

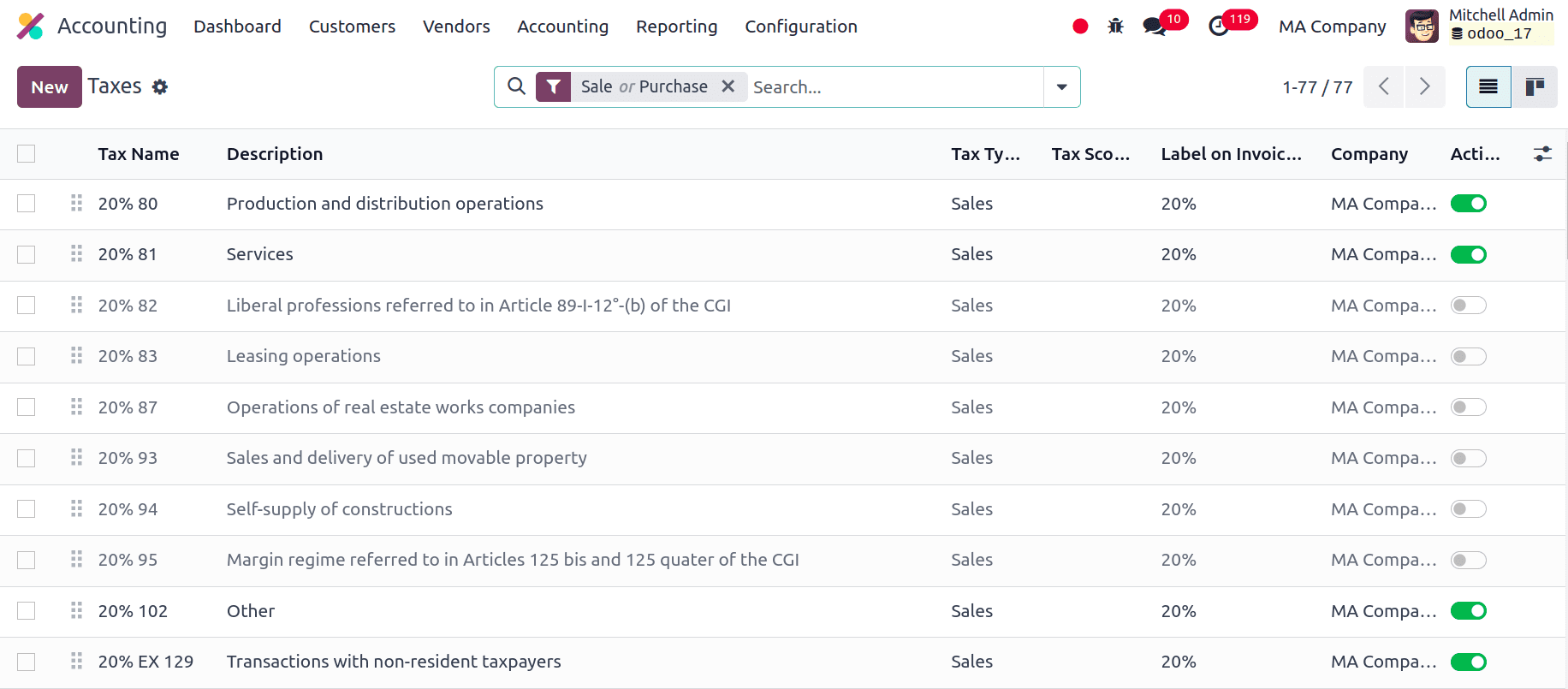

Taxes

Taxes are used in Odoo 17 to control and enforce different tax rates and regulations on financial activities. Businesses can specify tax kinds, rates, and jurisdictions using the tax configuration, which guarantees that sales and purchase transactions are correctly taxed in accordance with regional laws. Odoo streamlines compliance and aids in the maintenance of accurate financial records for businesses by automating tax computations and reporting. Strong functionality for tax management is included in the Moroccan localization of Odoo. It manages a variety of Moroccan taxes, including VAT. We can prepare tax returns in compliance with Moroccan tax laws. Managing tax certifications and registrations is important and we can easily incorporate tax data into financial accounts.

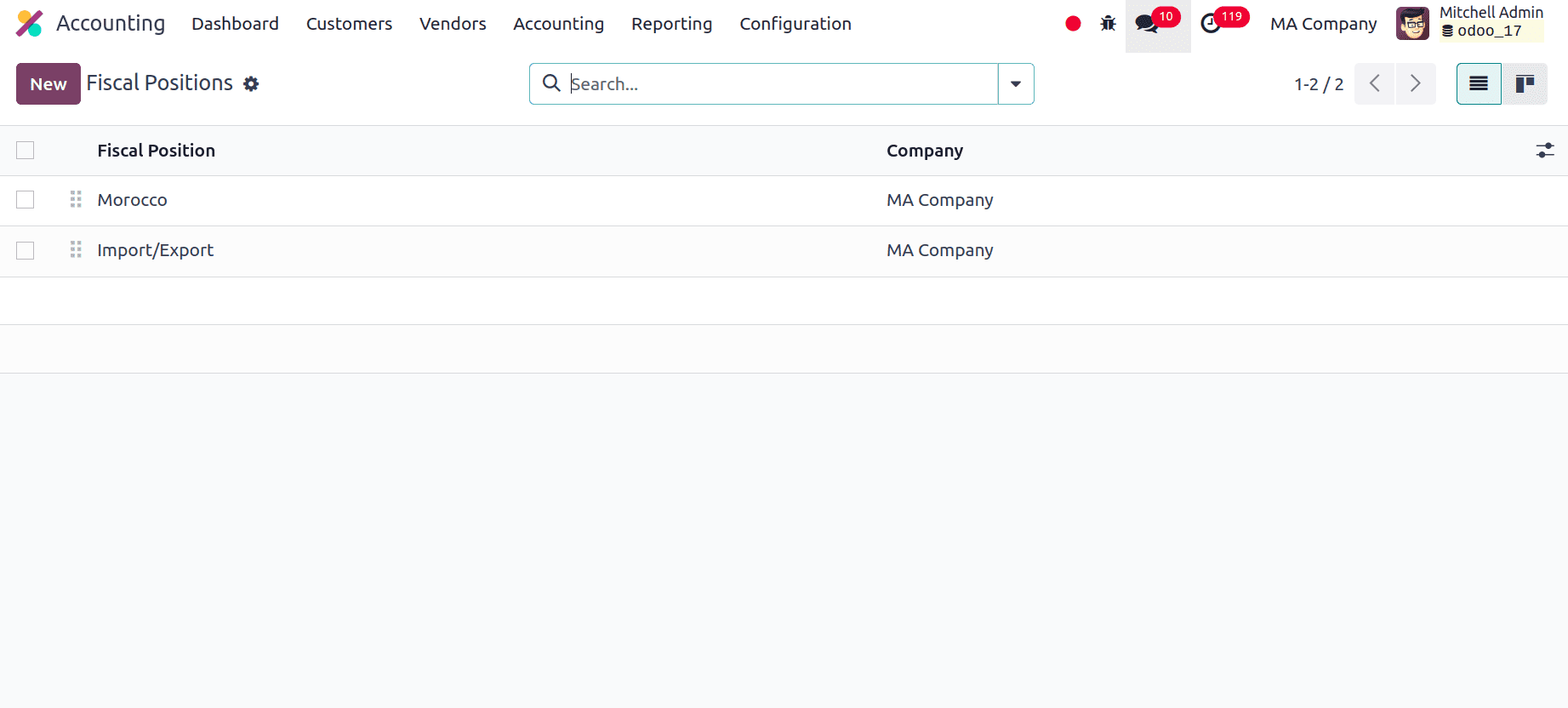

Fiscal Position

In Odoo, fiscal position is an important concept, especially when working with numerous nations or regions that have different tax laws. Regarding Moroccan localization, it guarantees accurate accounting and taxation in accordance with Moroccan regulations. Fiscal positions assist in implementing the appropriate tax laws and rates with local requirements for Moroccan localization. Here there are two fiscal positions that are pre-defined with the installation of the Moroccan localization module.

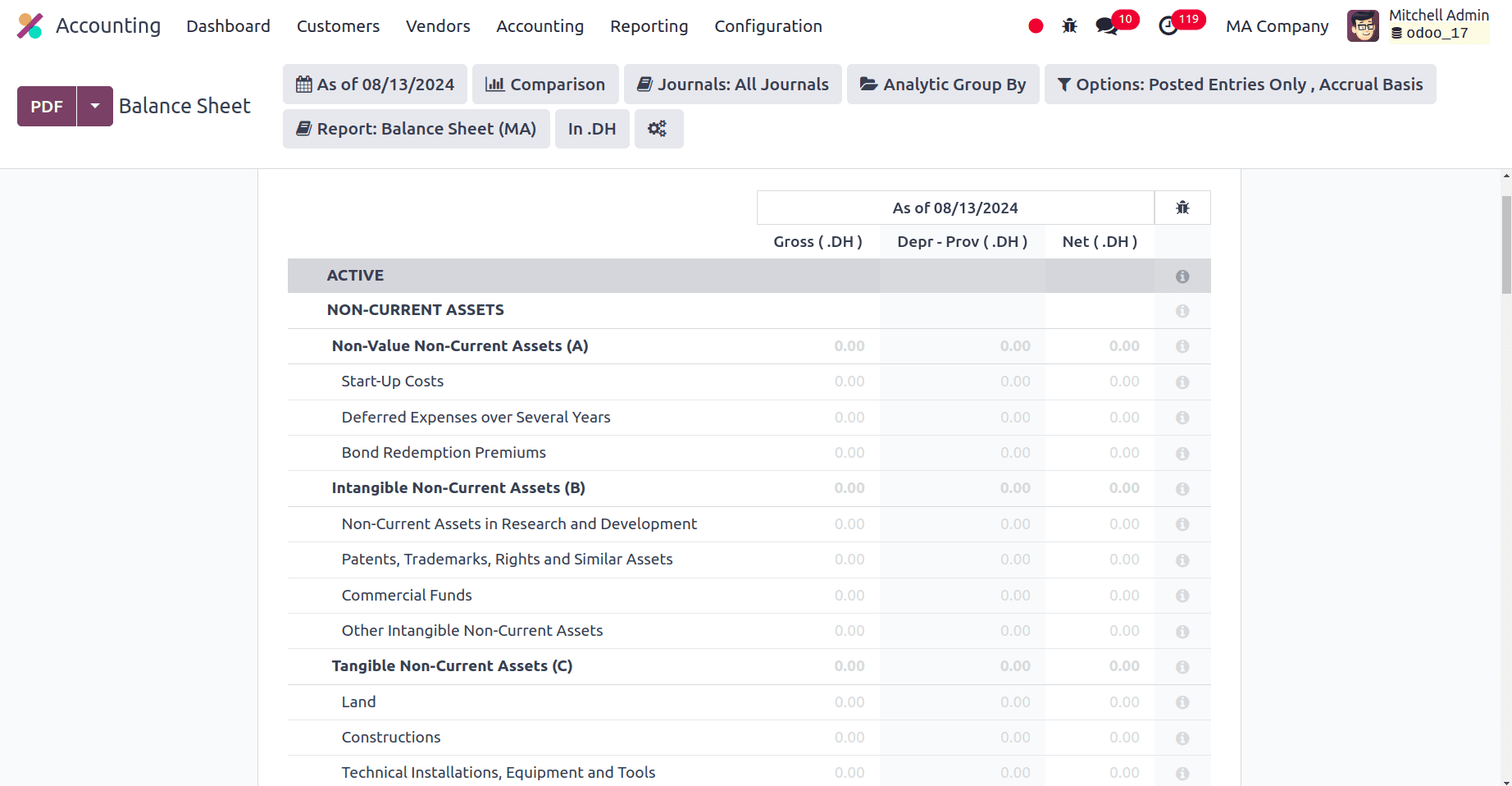

Balance Sheet

The balance sheet in Odoo displays the financial status of a company as of a specific date. It summarizes the company's equity, liabilities, and assets to provide information on the financial health of the business. By creating the balance sheet automatically from recorded accounts and transactions, Odoo's automated procedure for creating balance sheets enables accurate and up-to-date financial reporting and analysis.

The balance sheet's format and contents comply with the regional laws of Morocco. The Moroccan Dirham is used to display balances (MAD). To ensure correct account classification, the chart of accounts is set up to support Moroccan accounting practices. includes accounts for tax-related provisions from Morocco, like deferred taxes. Provides options for Arabic translation of report content and account names as needed.

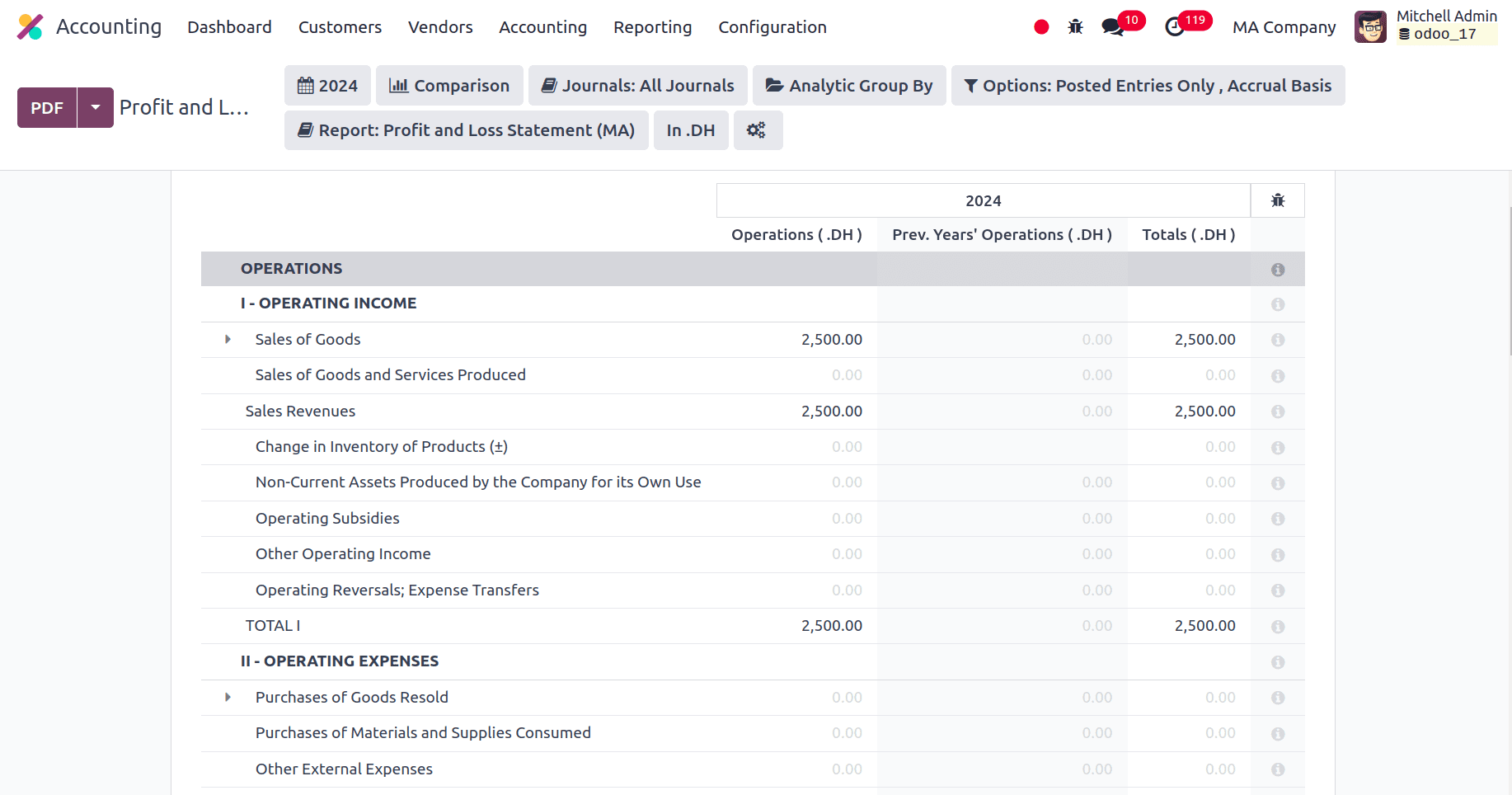

Profit and Loss Report

The income statement, sometimes referred to as the profit and loss report in Odoo, offers a thorough summary of a business's financial performance over a given time frame. It provides an overview of earnings and operational effectiveness by combining sales, costs, and net income. Based on transaction data and accounting entries, this report is prepared to assist firms in assessing their financial results and making well-informed decisions.

In the report we can see that the content and structure of the report comply with local laws. Integrating with Moroccan tax regulations to ensure precise tax calculations. Moroccan Dirham is used to display all amounts (MAD). The report can be tailored by users to highlight particular revenue and spending categories.

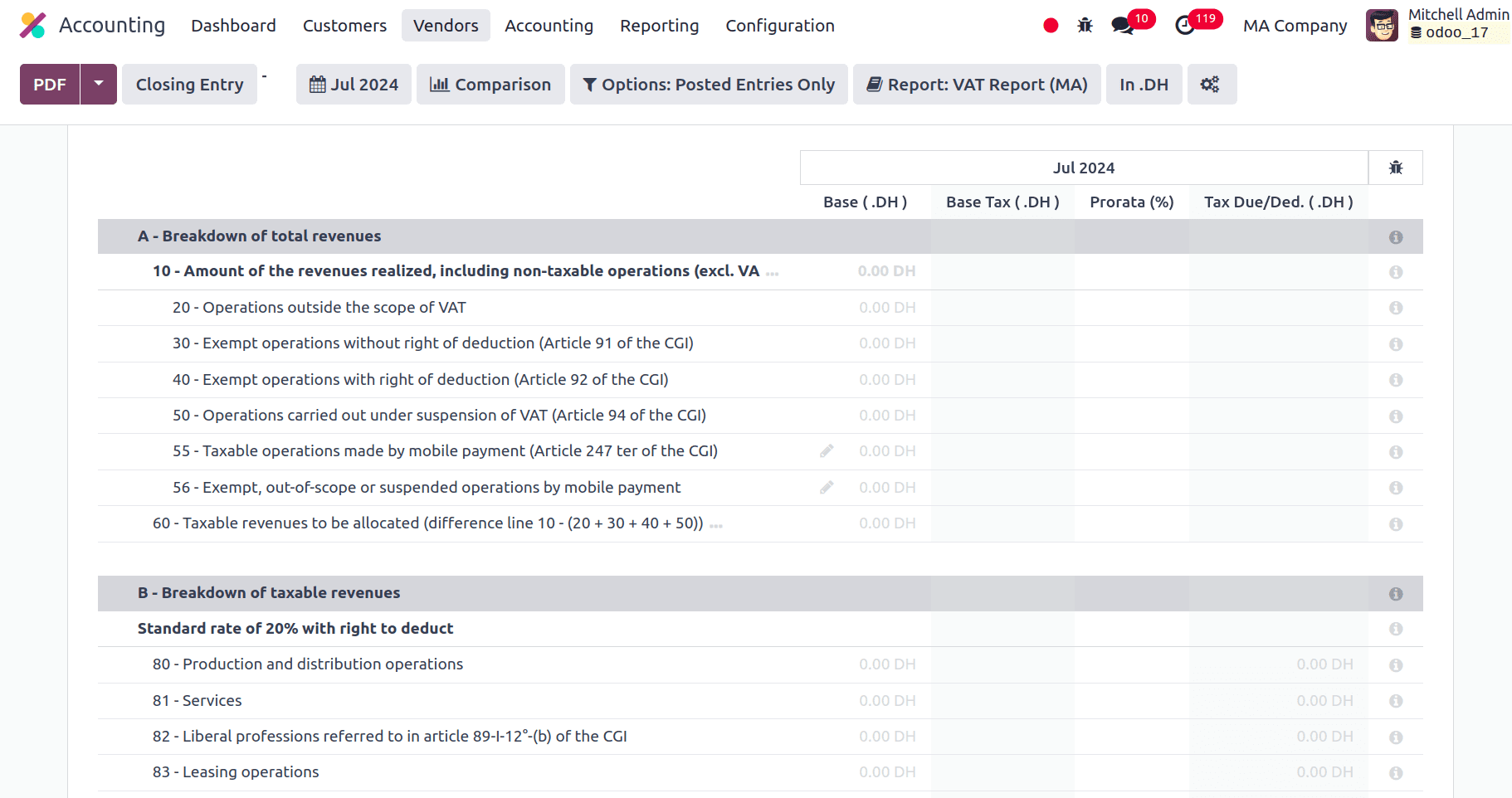

Tax Report

The tax report in Odoo combines and displays comprehensive data regarding taxes gathered and paid during a certain time frame. It facilitates correct tax reporting and compliance by offering a comprehensive view of tax liabilities, including VAT, sales tax, and other applicable taxes. In order to ensure compliance with regulatory requirements and streamline the process of filing tax returns, the report is prepared based on transactional data and tax configurations.

So we can say that Odoo's accounting localisation for Morocco provides a solid option for companies doing business there. Odoo reduces the complexity of complicated accounting procedures and guarantees compliance with Moroccan laws by offering a pre-configured chart of accounts, tax templates, and compliant financial reports. Businesses may retain accurate financial records while concentrating on their core competencies with the automated calculations and optimized workflows. Moroccan firms can now make well-informed decisions based on trustworthy financial data thanks to Odoo's localization, which eventually promotes overall business success and growth.

To read more about An Overview of Accounting Localization for Thailand in Odoo 17, refer to our blog An Overview of Accounting Localization for Thailand in Odoo 17.