What is Accounting localization in Odoo?

Every nation has its own set of reporting obligations, tax laws, and accounting standards. As a worldwide ERP solution, Odoo 17 offers localization tools that let companies tailor their accounting configurations to the regulations and customs of the nation in which they conduct business. That is, the process of modifying the accounting features of the Odoo 17 ERP system to meet the unique legal and financial needs of a given nation or region is known as accounting localization in Odoo 17.

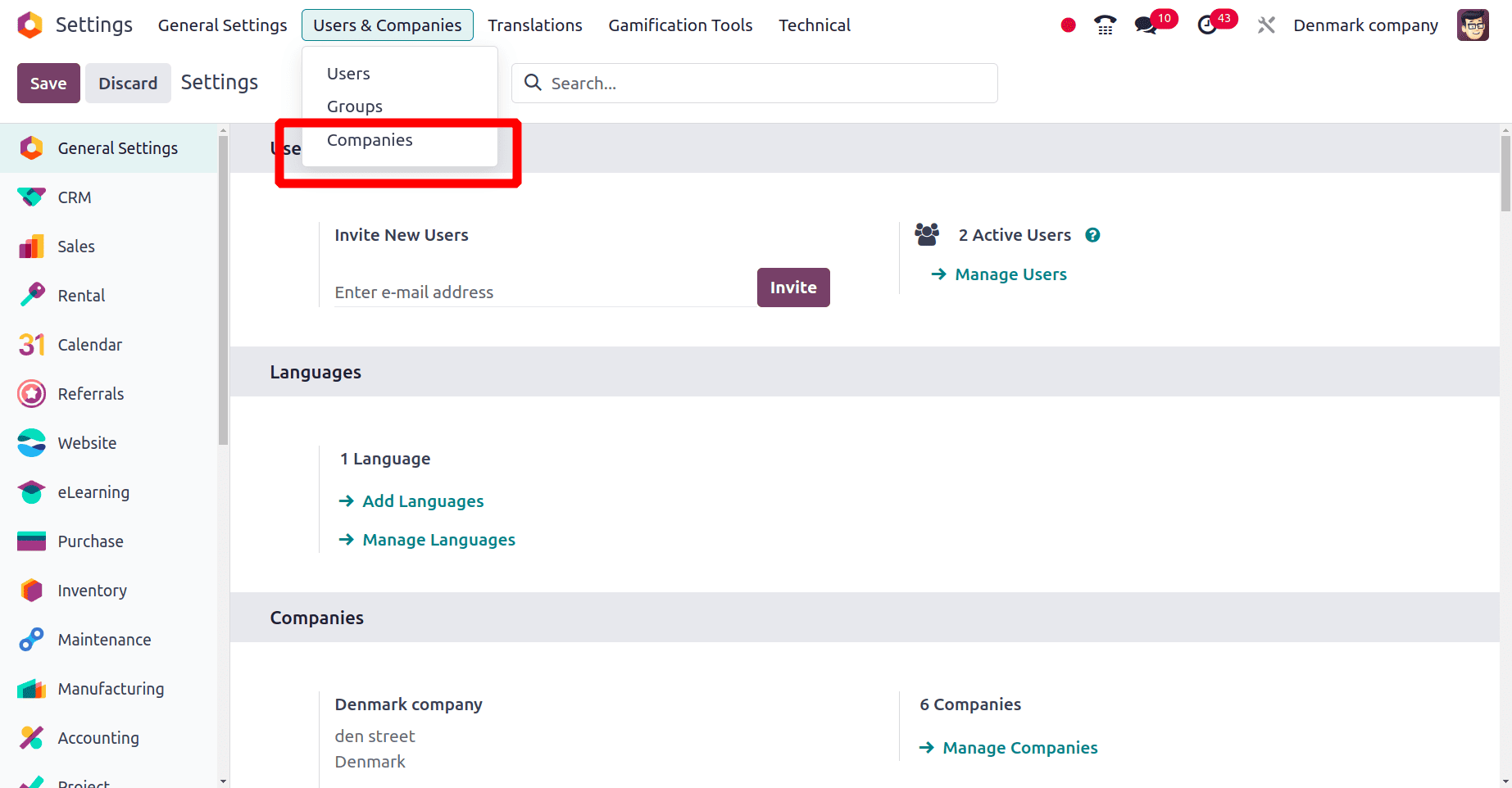

Odoo 17 offers an Ecuadorian localization module to streamline accounting processes for businesses operating in Ecuador. So before configuring the country-specific localization, we need to create a new company. To create a new company, move to the General Settings of Odoo 17. There we can find a Users & Companies menu. Click Users and Companies, and then the Companies sub-menu.

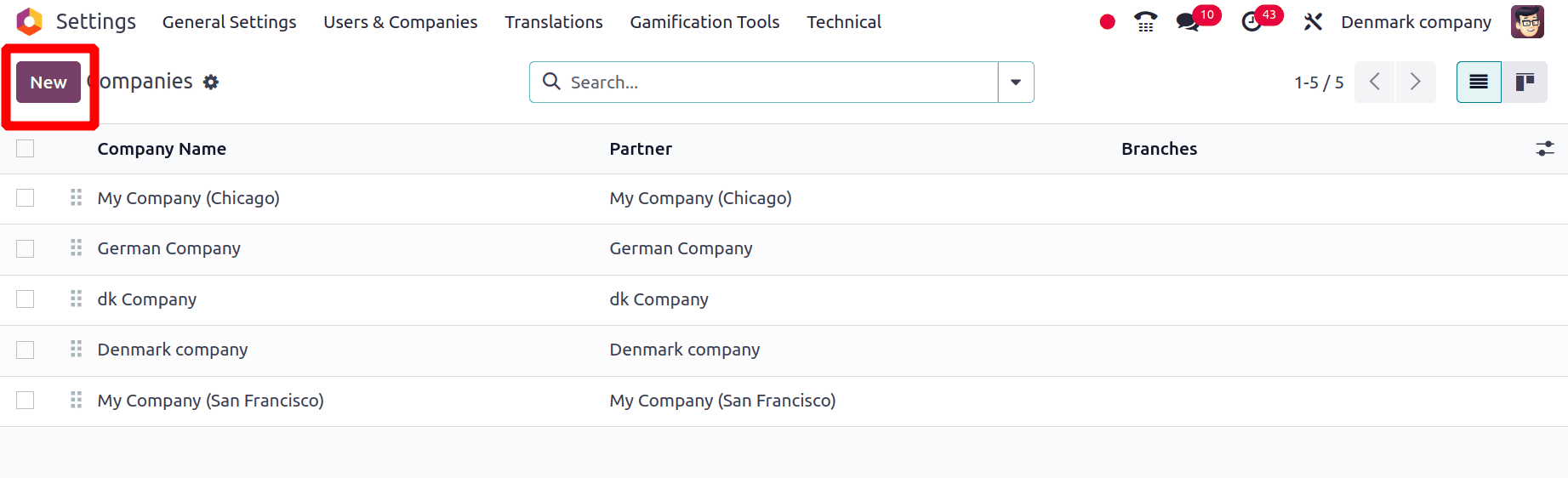

On clicking the companies sub-menu, you will get a list of companies that are already created. We are also able to create new companies from this page. For that, click the ‘New’ button.

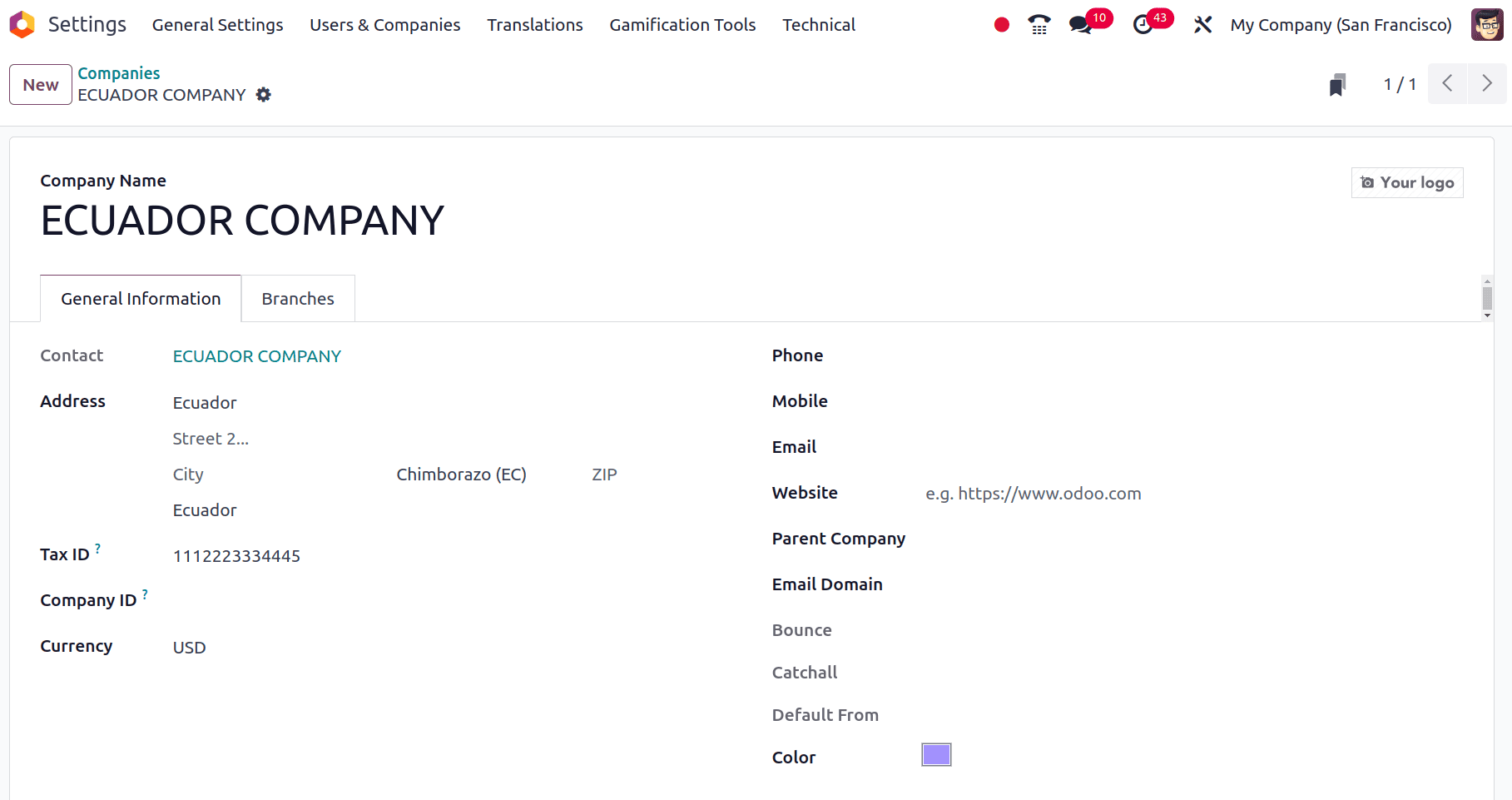

On clicking the New button, you will get a form to fill in the details of the company. In that form, you can provide the name of the company, the address of the company, and the country to which the country belongs to. We know that the currency in Ecuador is the United States Dollar (USD). So when we provide the country for the company, Odoo 17 automatically sets the currency for the company as the United States Dollar. After the company details have been provided, save the company.

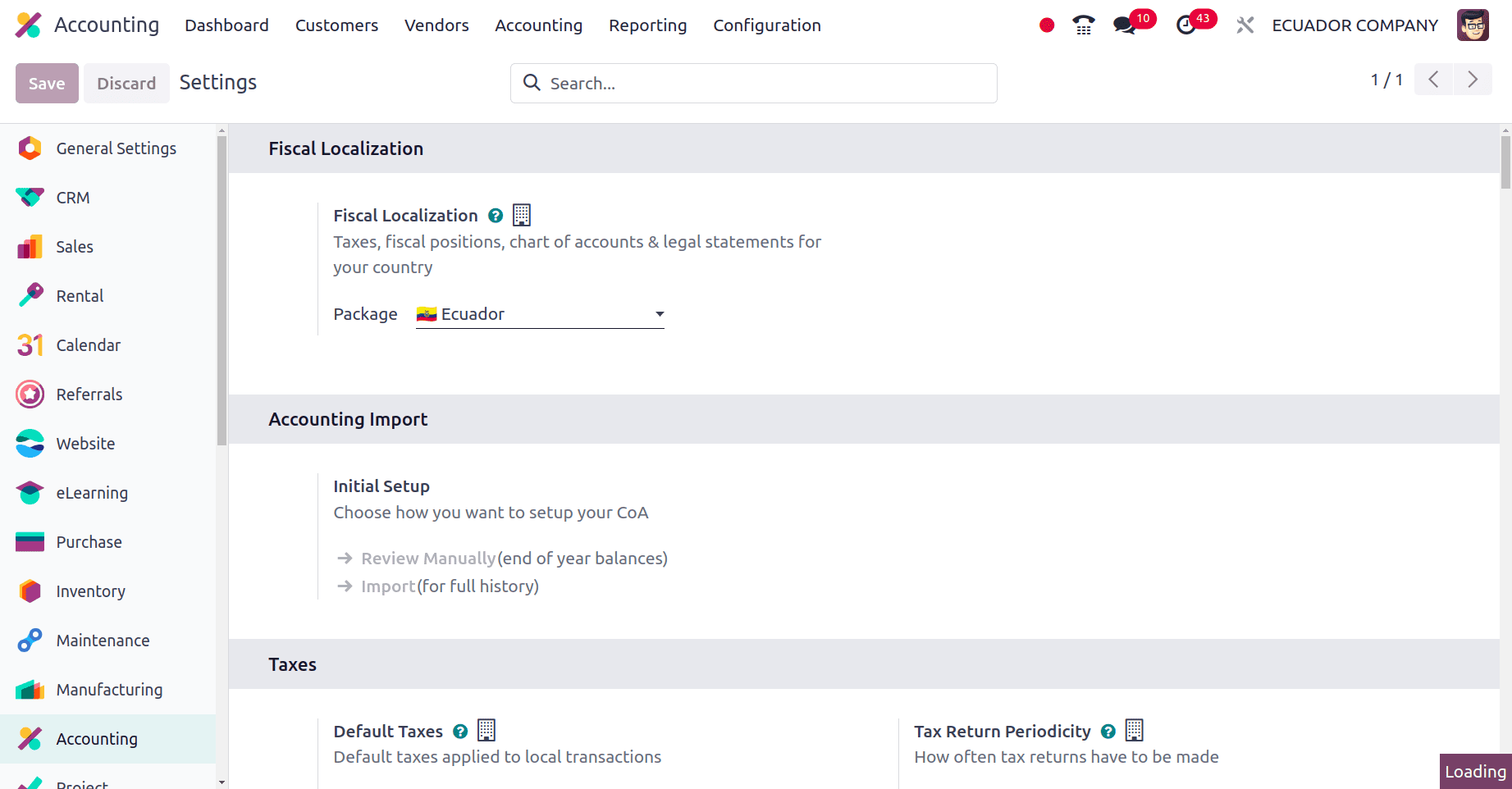

The next step is to set the localization package for this newly created company. To set the localization package, move to the Accounting module of Odoo 17. In the configuration settings set the package for the country as Ecuador. This is the specific package for the companies from Ecuador.

Changes formed when Ecuador localization was configured.

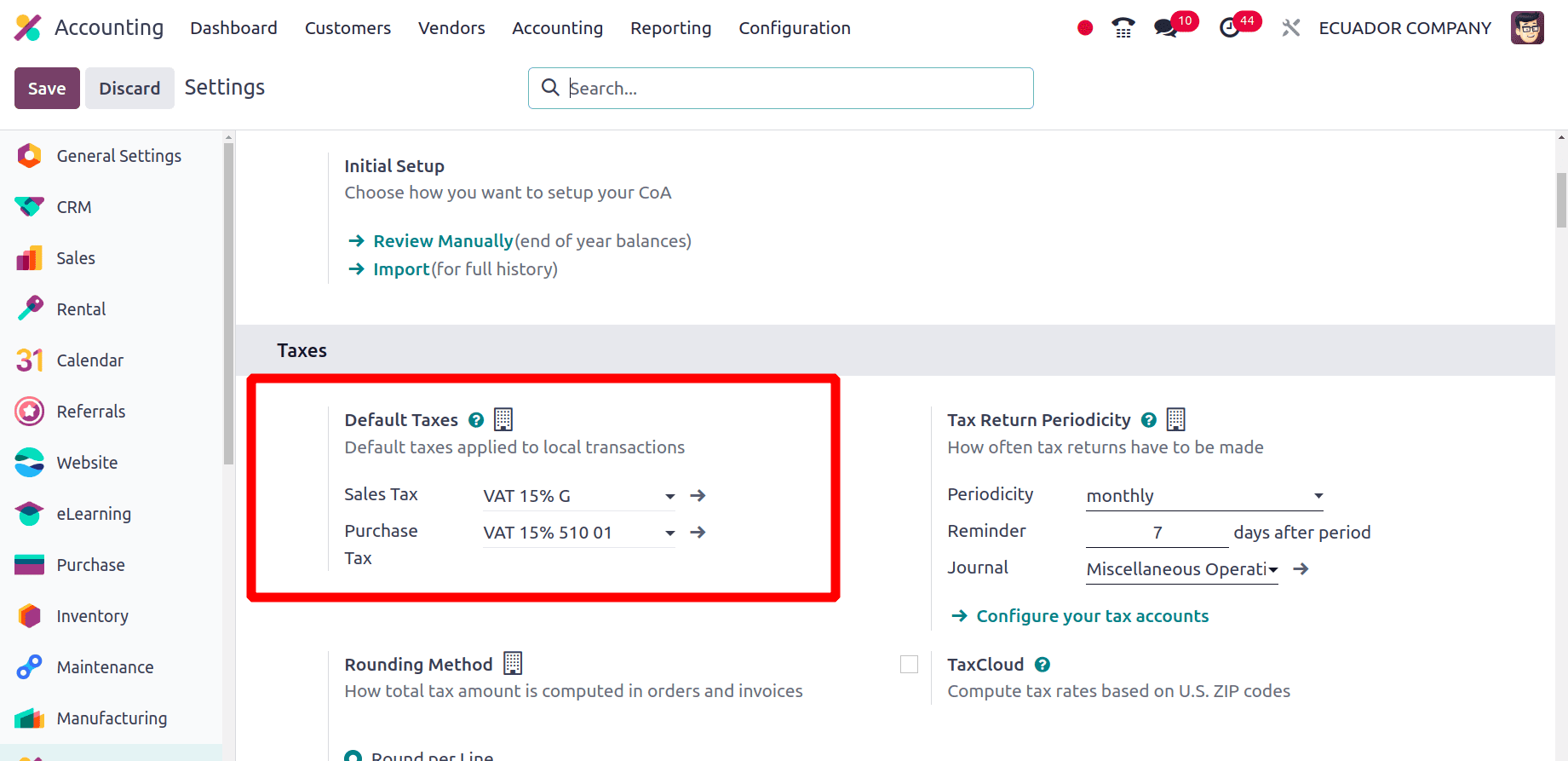

First, in the Configuration > Settings itself, under the Taxes section, there is a Default Taxes field. We can set the default tax for the company manually, or Odoo 17 can configure the tax automatically. Here, when the package is saved, Odoo will automatically set the default tax for the company.

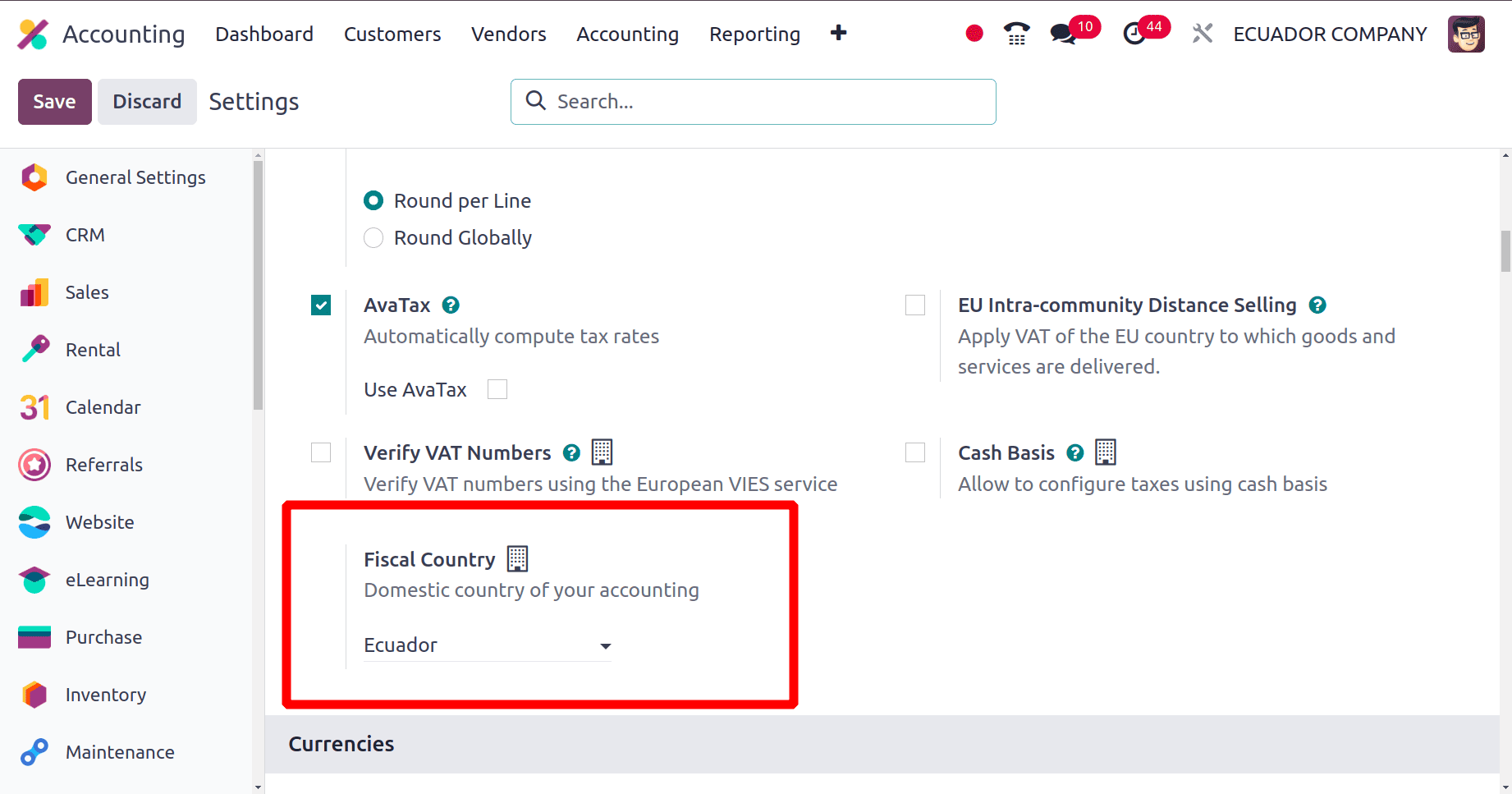

All the companies from Ecuador use ‘VAT 15% G’ as the Default Sales Tax and ‘VAT 15% 510 01’ as the Default Purchase Tax. Under the taxes section itself, there is a Fiscal Country field. We can manually give the name of the fiscal country. But here, when we set the localization package for this company as Ecuador, Odoo 17 automatically sets the Fiscal country as Ecuador.

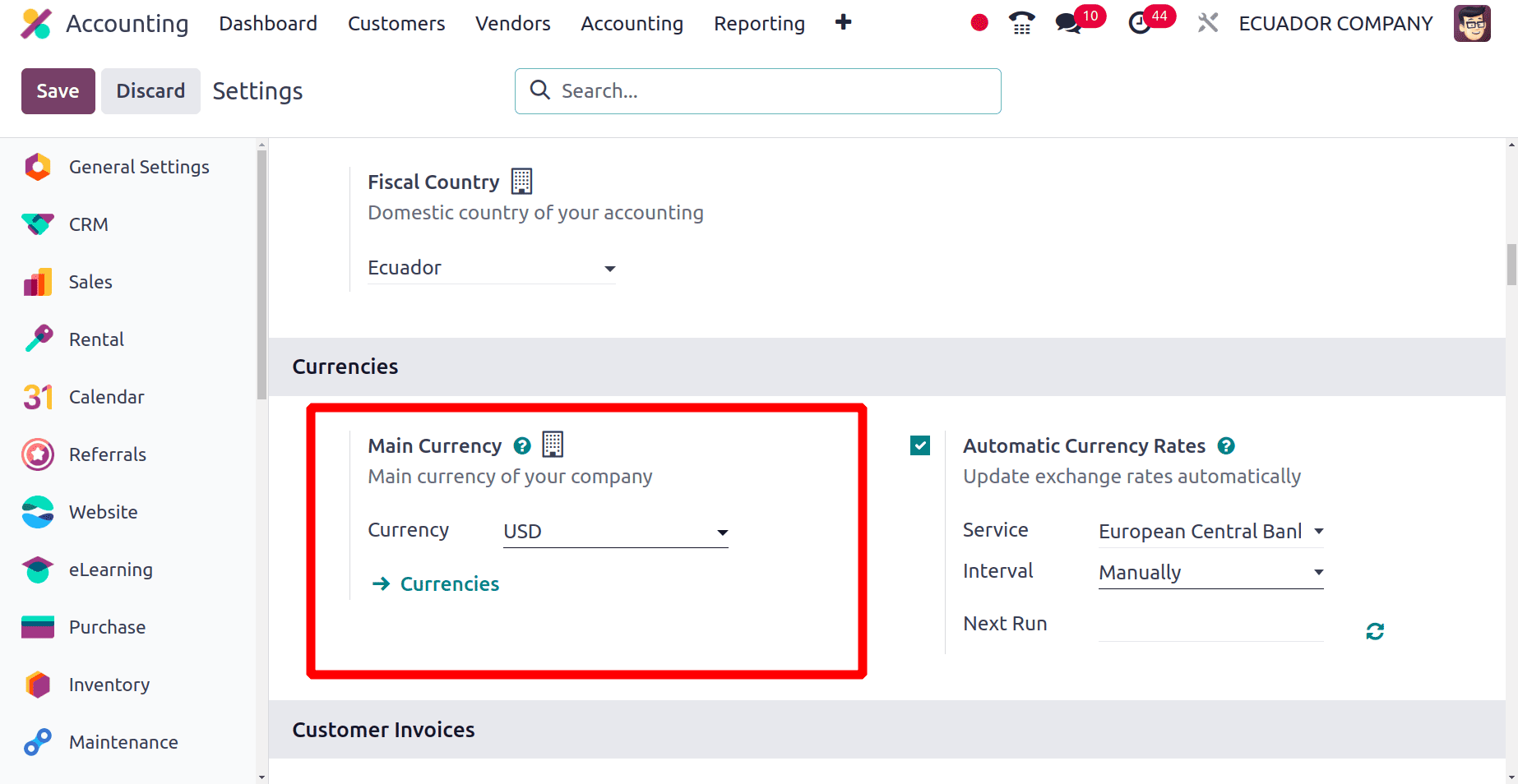

We know that the currency used in Ecuador is the United States Dollar (USD). Here, Odoo automatically configures the main currency for the company as the United States Dollar (USD), when we configure a localization package for the company Ecuador.

Now, for this company, USD will be the main currency, and we can also activate other currencies by clicking the ‘Currency’ under the Main Currency.

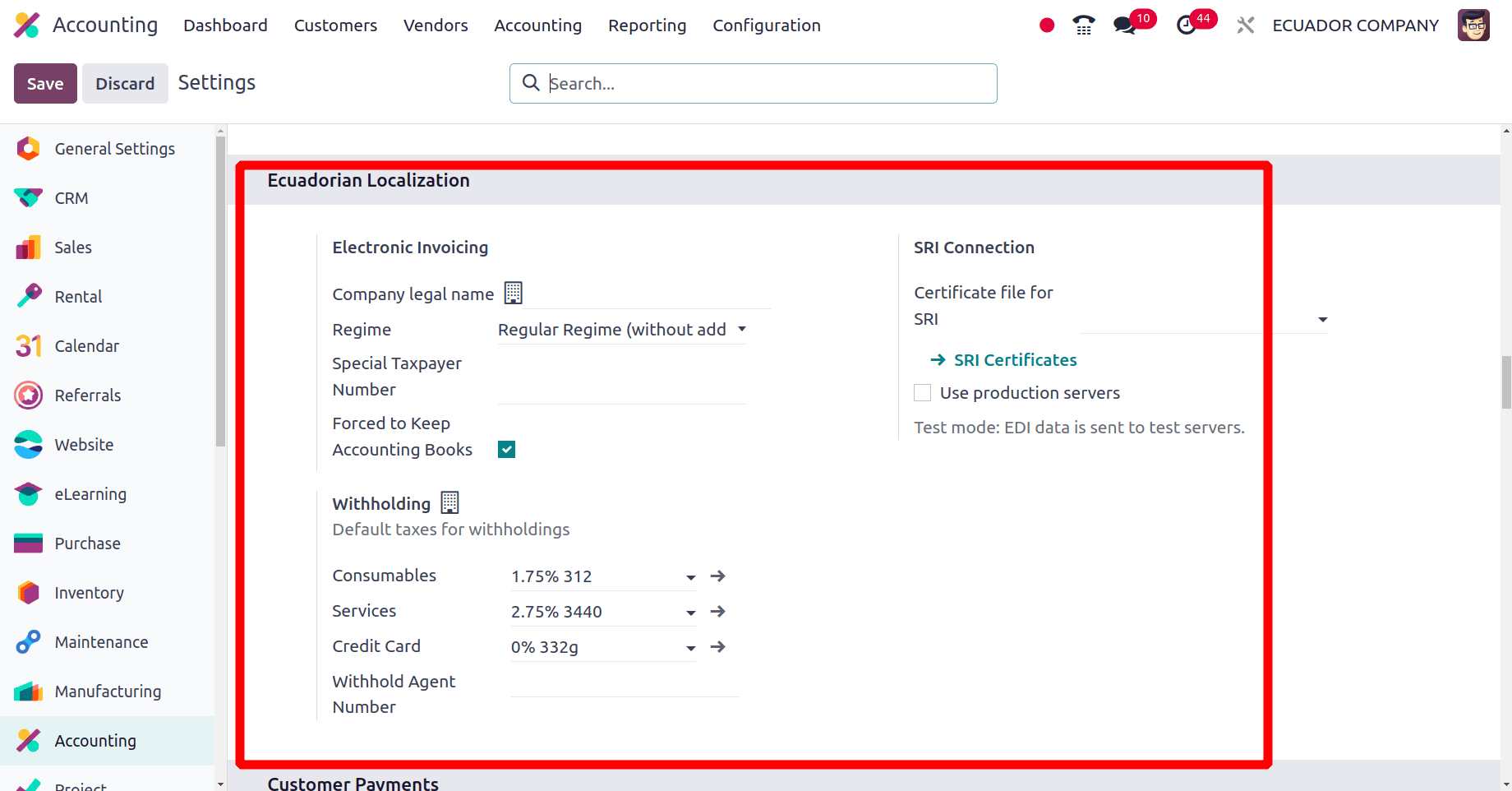

Under the configuration tab, the ‘Ecuadorian Localization’ section was added. Under this section, we can give the details needed to provide the electronic invoice service. Electronic invoice is a requirement that many businesses must meet. It includes sending and receiving bills in a digital version that complies with official rules. As an accounting program, Odoo 17 can assist you in handling electronic bills in Ecuador.

* Company legal name: This is used to represent the company in the electronic invoice.

* Regime: Tax regimes control things like tax rates, allowable expenses, and filing requirements for proper accounting. Odoo must be configured with the right regime.

* Special Taxpayer Number: Unique Taxpayer Registry (RUC) is the common way that taxpayers are identified. It's not always reserved for "special" taxpayers.

* Forced to Keep Accounting Books: When we enable this field, companies keep complete and accurate financial records as required by law.

* Withholding Consumable: refers to the practice of keeping some of the money that is paid for specific consumables that are bought from a supplier withheld. On behalf of the buyer, the withheld sum is subsequently sent to the Ecuadorian government.

* Withholding Service: refers to the method of keeping some of the money you give a vendor or supplier before giving them the whole amount. On behalf of the supplier, the withheld money is subsequently sent to the Ecuadorian government; this is usually done instead of income taxes or other required payments.

* Withholding Credit Card: Refers to a particular tax withholding method used for purchases made with SRI-issued credit or debit cards.

* Withhold Agent Number: Refers to the Internal Revenue Service of Ecuador's (SRI) resolution number, which identifies a business as a withholding agent.

* Certificate file for SRI: It is a digital certificate used by the Internal Revenue Service (SRI) of Ecuador for electronic invoicing. When transmitting electronic invoices, this certificate is essential to guarantee a safe and dependable connection between your Odoo system and the SRI.

* Production servers: Real-time server environment where you can access and save your actual accounting data for day-to-day operations. It is the server that manages reporting and real-time financial transactions for your Odoo application and database.

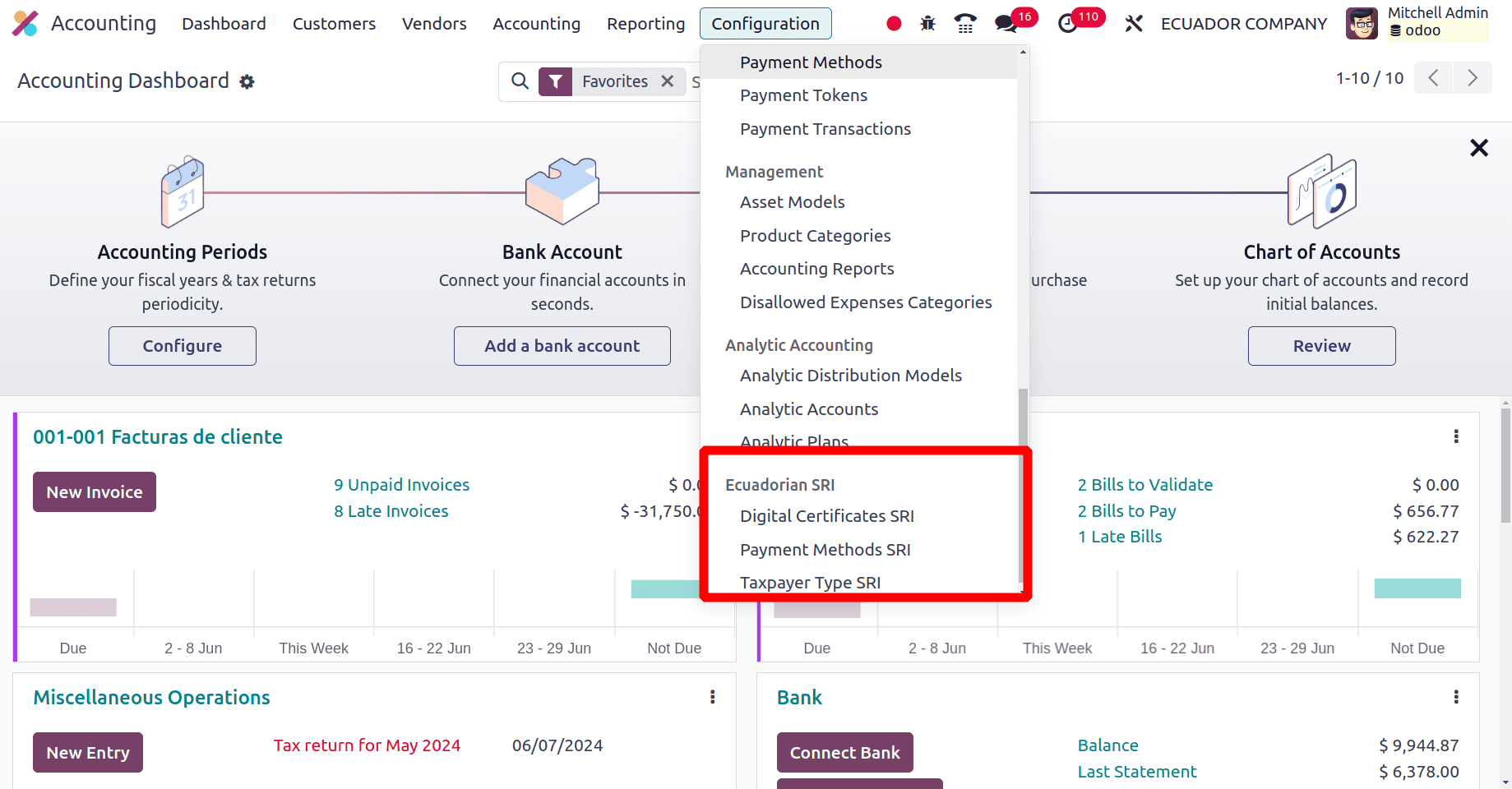

Under the Configuration menu, an extra section ‘Ecuadorian SRI’ is added, and under this section, there are three sub-menus, Digital certificate SRI, Payment Method SRI, and Taxpayer Type SRI

Digital Certificate SRI: This refers to a digital certificate that has been granted by an Ecuadorian-accredited authority. This certificate serves as your electronic signature, ensuring the validity and consistency of electronic documents that you submit to the Ecuadorian Internal Revenue Service, or Servicio de Rentas Internas (SRI).

Click the new button, and we can create digital certificates that the company provides.

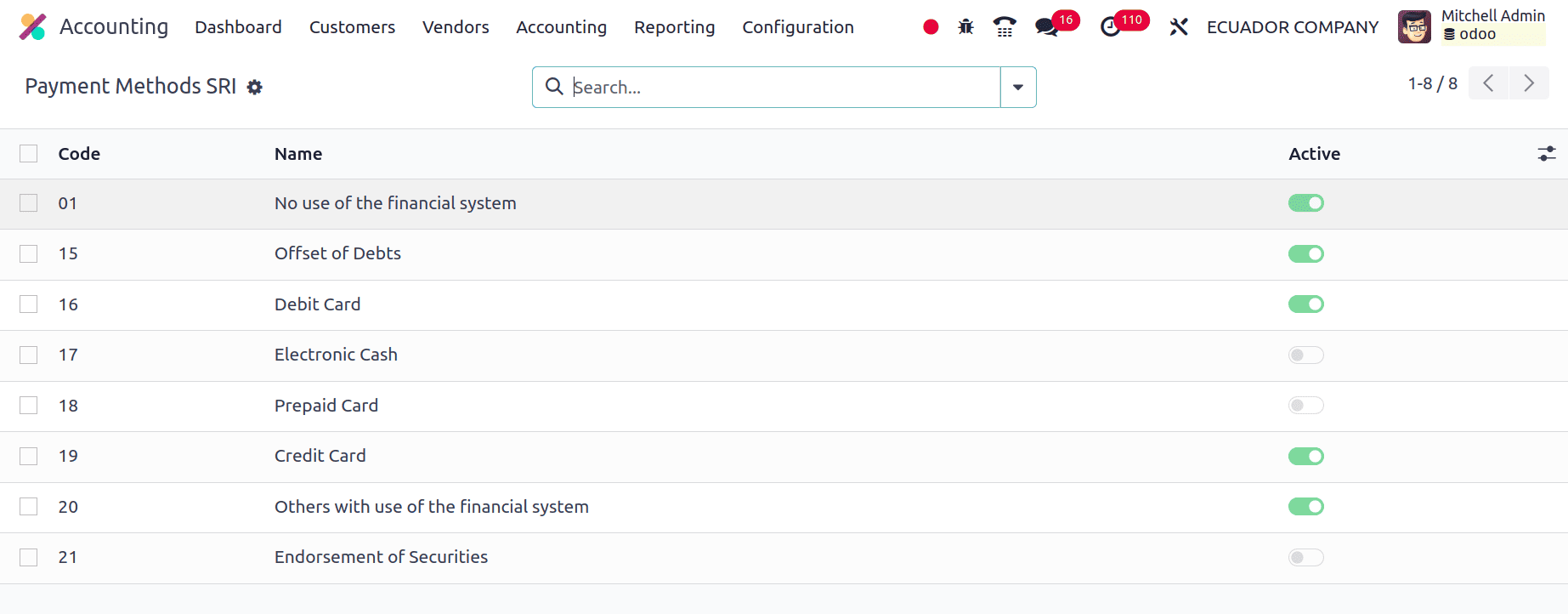

Payment methods SRI: The actual payment processing is unrelated to the "Payment Method SRI" in Odoo for Ecuador. It serves as a link between the electronic invoicing system required by the SRI, the Ecuadorian tax office, and the payment options you have selected in Odoo. Click the Payment Methods SRI sub-menu to open, and there we can see that the payment methods SRI for the companies from Ecuador

The payment methods SRI used by the businesses in Ecuador are shown in the above screenshot. And the next is the Taxpayer Type SRI.

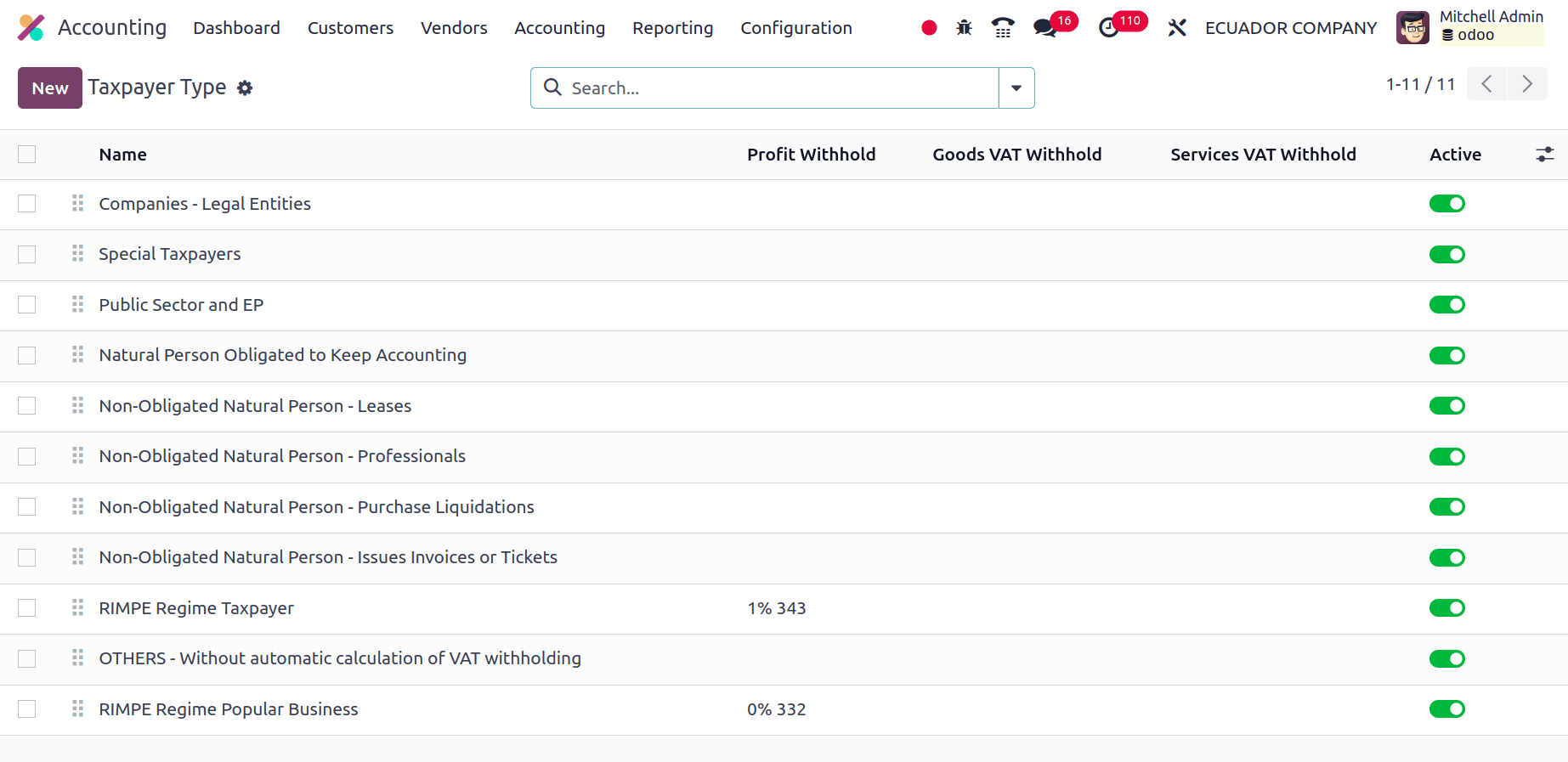

Taxpayer type SRI: It is an important feature that sets up electronic invoicing and tax calculations based on the Ecuadorian tax status of your company. You can choose the right taxpayer category in this box based on the SRI business registration that your company is registered under.

The above screenshot shows the default Taxpayer type used by the companies from Ecuador. We can also create a new Taxpayer type by clicking the New button.

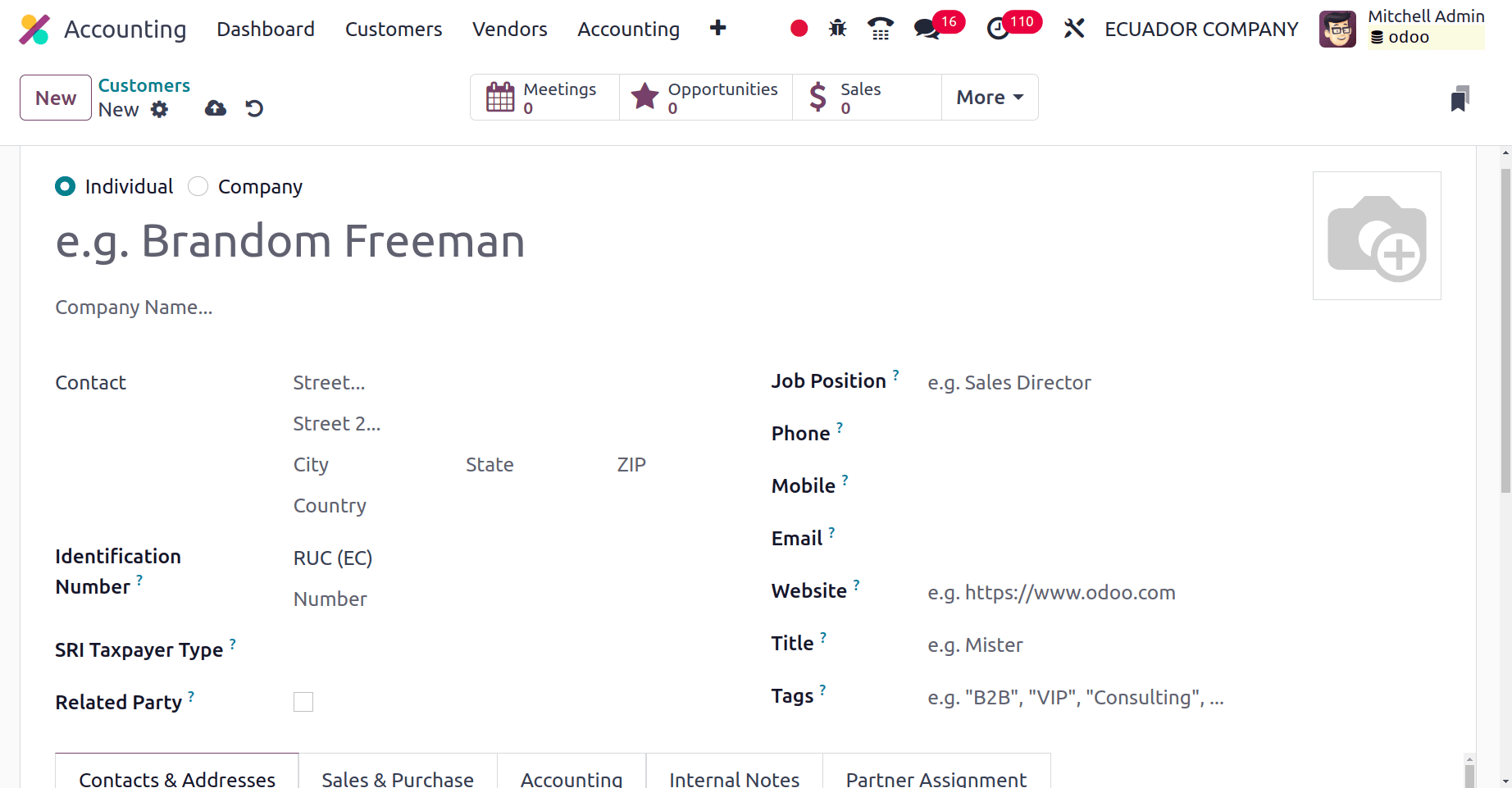

When we look at the partner form of the Ecuadorian companies, SRI Taxpayer Type and Related party are two extra fields included.

In the SRI Tax Payer type section, we can choose the Taxpayer Type from a dropdown list which is used to specify the taxpayer category for business partners in this company.

Related parties are other companies or persons that participate directly or indirectly in the Management, Administration, control, or capital of your company. Enable this related party option if the partner is a related party.

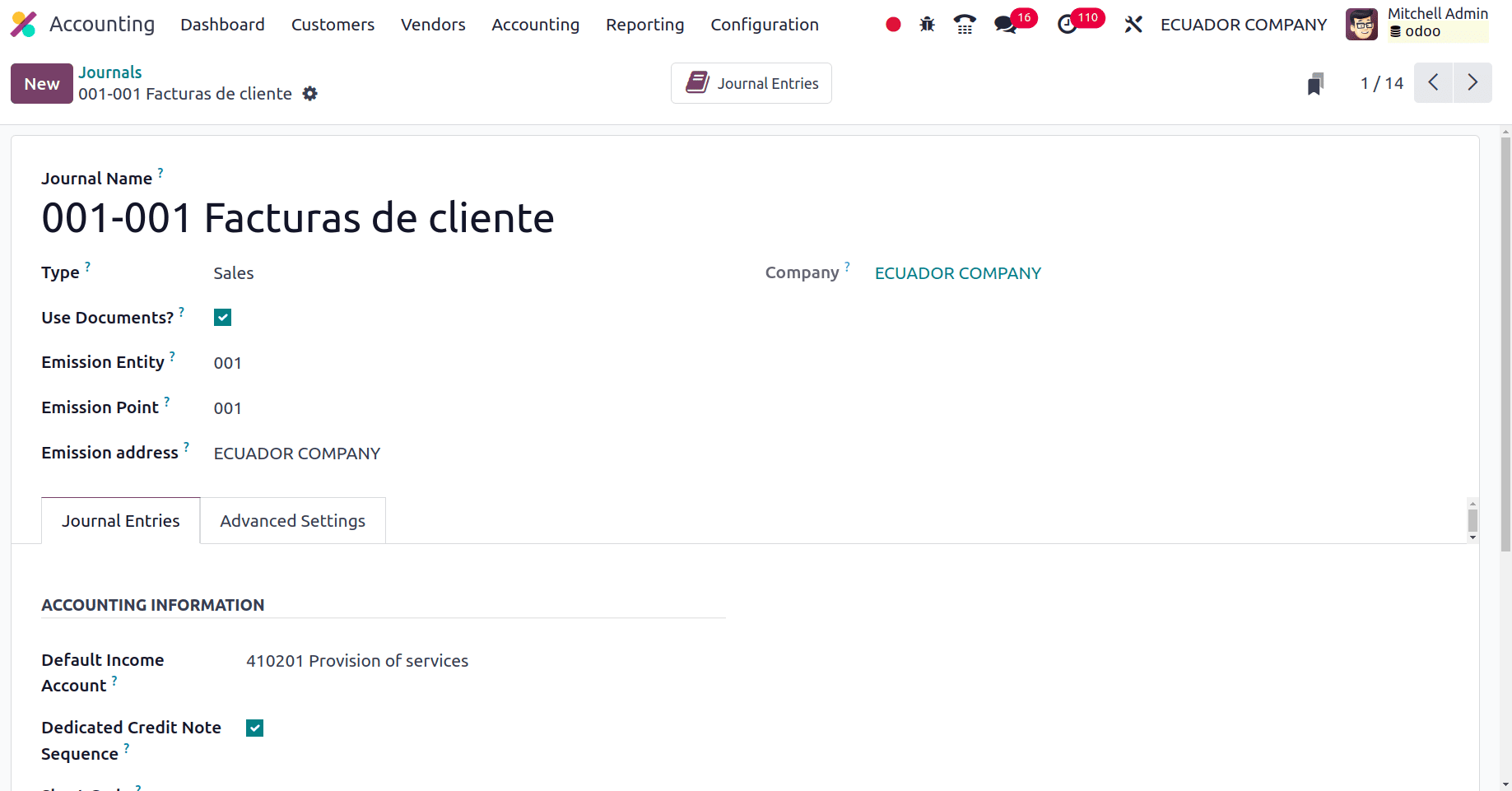

On clicking in the Configuration menu, choose the Journals sub-menu and then select the sales journal from a list of journals.

In the sales journal, we can find that Use Documents, Emission Entity, Emission Point, and Emission Address are the extra fields that are specially included for the Companies from Ecuador. Emission Entity is the field that is used to specify the Electronic invoice issuing entity, which usually refers to your company. There is another option, which is to activate and deactivate - Use Documents option. If the Use Document option is activated, this journal will be used for legal invoicing, and if not activated, this will be used to register accounting entries not related to invoicing legal documents. Emission point refers to a certain place or department inside your company that has been given permission to send an electronic invoice, and the Emission point number is given by SRI. The next is the Emission Address which is the address of the organisation that is issuing the electronic invoice.

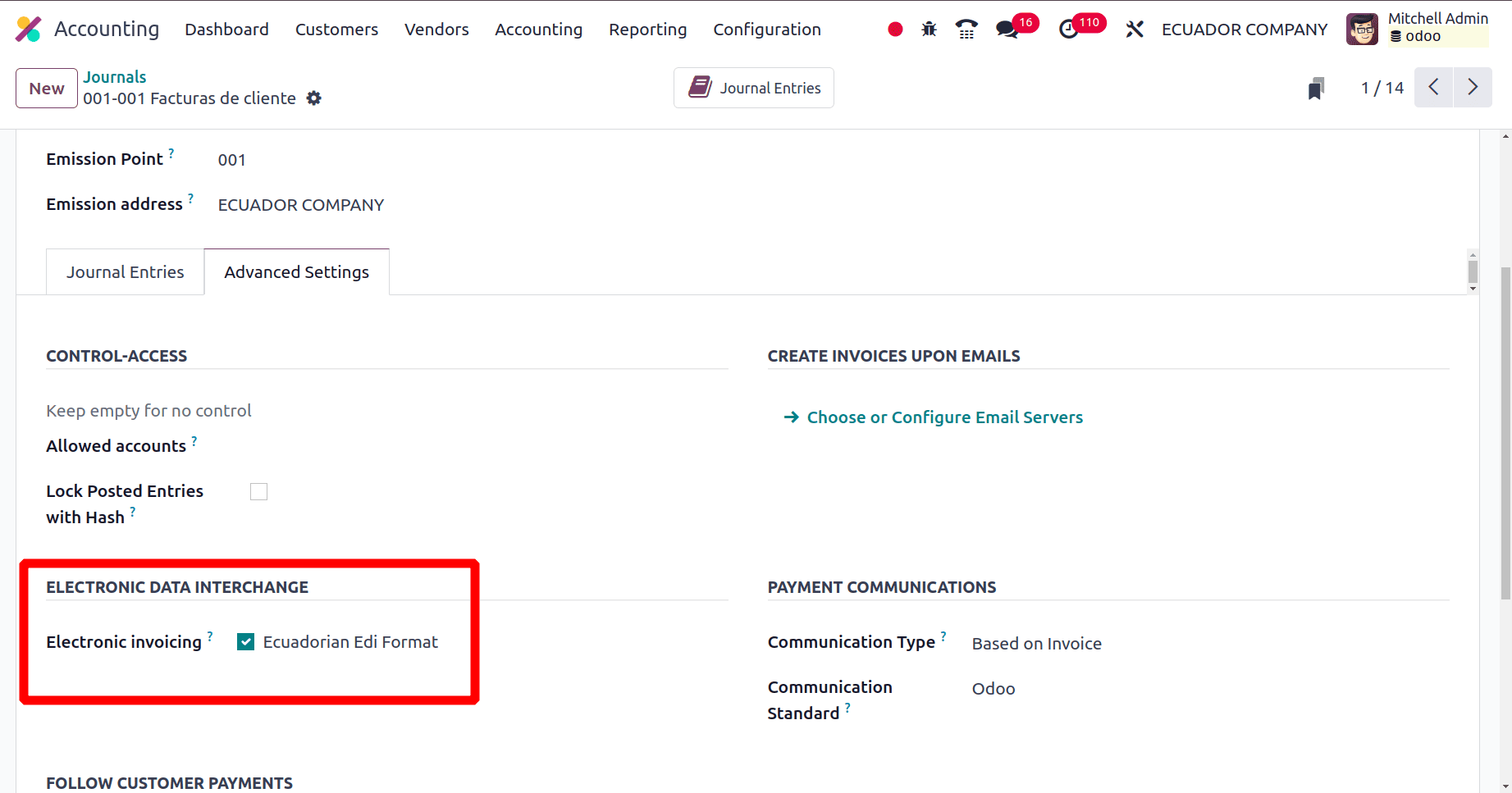

Under the Advanced Settings tab of the sales journal, electronic data interchange is an extra section, and under this section, we have the option to activate the Electronic invoicing. Once this Electronic invoicing option is activated, XML or EDI invoices will be send.

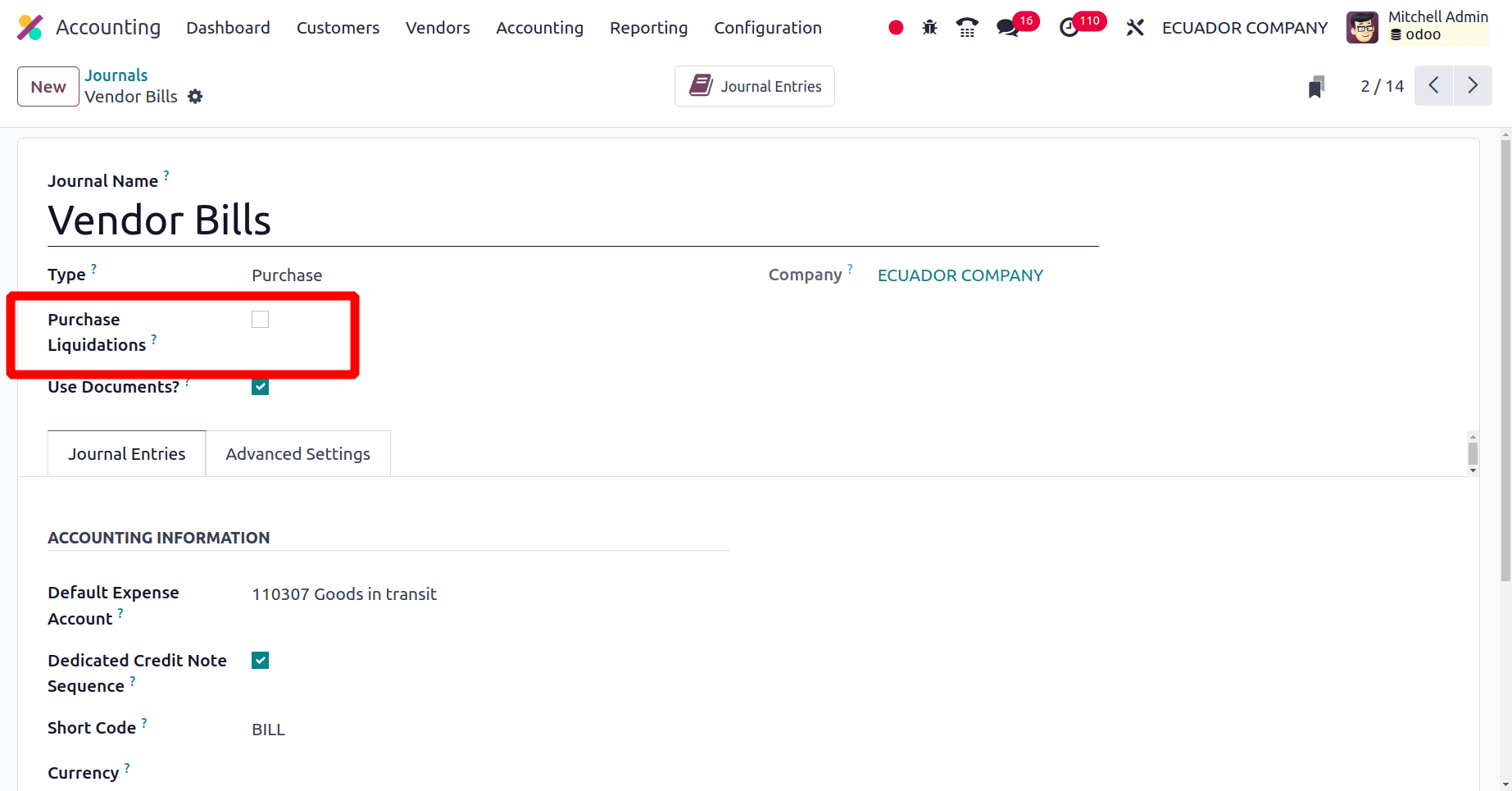

When we move to the purchase journal, there we can find an option to activate the purchase liquidation.

Purchase liquidation refers to a particular document that you use to pay for goods or services from a non-resident provider who doesn't normally send out invoices on a regular basis. Enable this Purchase Liquidation option if the selected journal is dedicated to purchase liquidation.

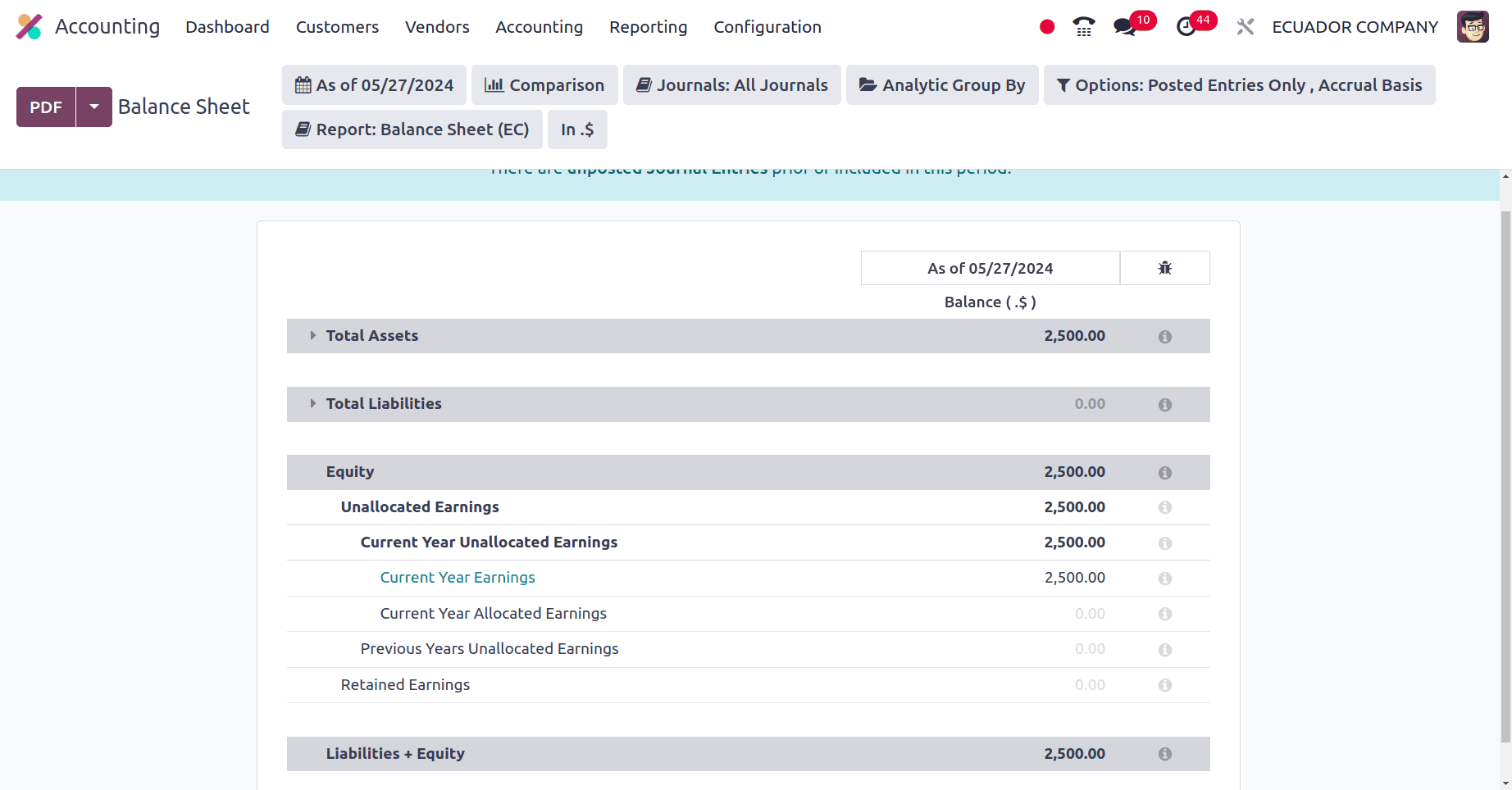

The balance sheet of a company in Odoo 17 is a type of financial report that shows the state of a business's finances as of a particular date. It describes three vital elements.

* Assets: The economic resources that a company possesses and that have the potential to be transformed into cash at a later time are represented as assets on the Odoo 17 balance sheet. These assets are categorized by Odoo 17 according to their predicted holding period and convertibility.

* Liability: Liabilities in an Odoo 17 balance sheet indicate the money a business owes other people. They serve as the company's primary sources of funding, but they also carry a debt that needs to be paid back eventually.

* Equity: The total amount of the owner's investment in Odoo is shown as equity on the balance sheet. It displays the company's net worth, which is determined as,

Equity = Asset - Liability

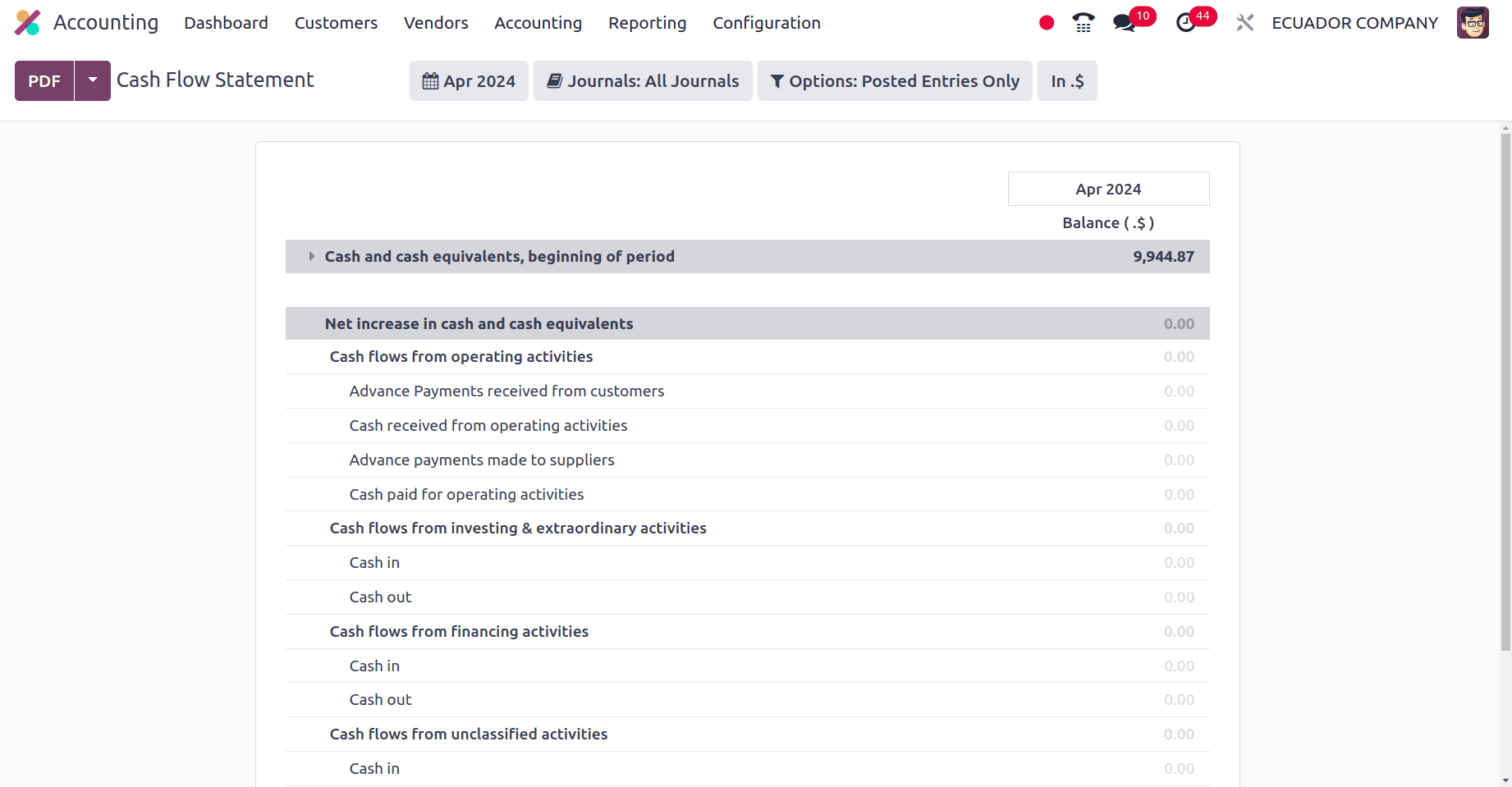

A financial report that lists the inflows and outflows of cash for a business over a given time period is called a cash flow statement in Odoo 17. It assists you in gaining insight into how effectively your business provides and manages cash to pay its bills.

The Cash Flow statement of the companies in Ecuador includes cash and cash equivalents, the beginning of the period, Net increase in Cash and cash equivalents, Cash flow from operating activities, cash flow from investing and extraordinary activities, Cash Flow from unclassified activities, etc.

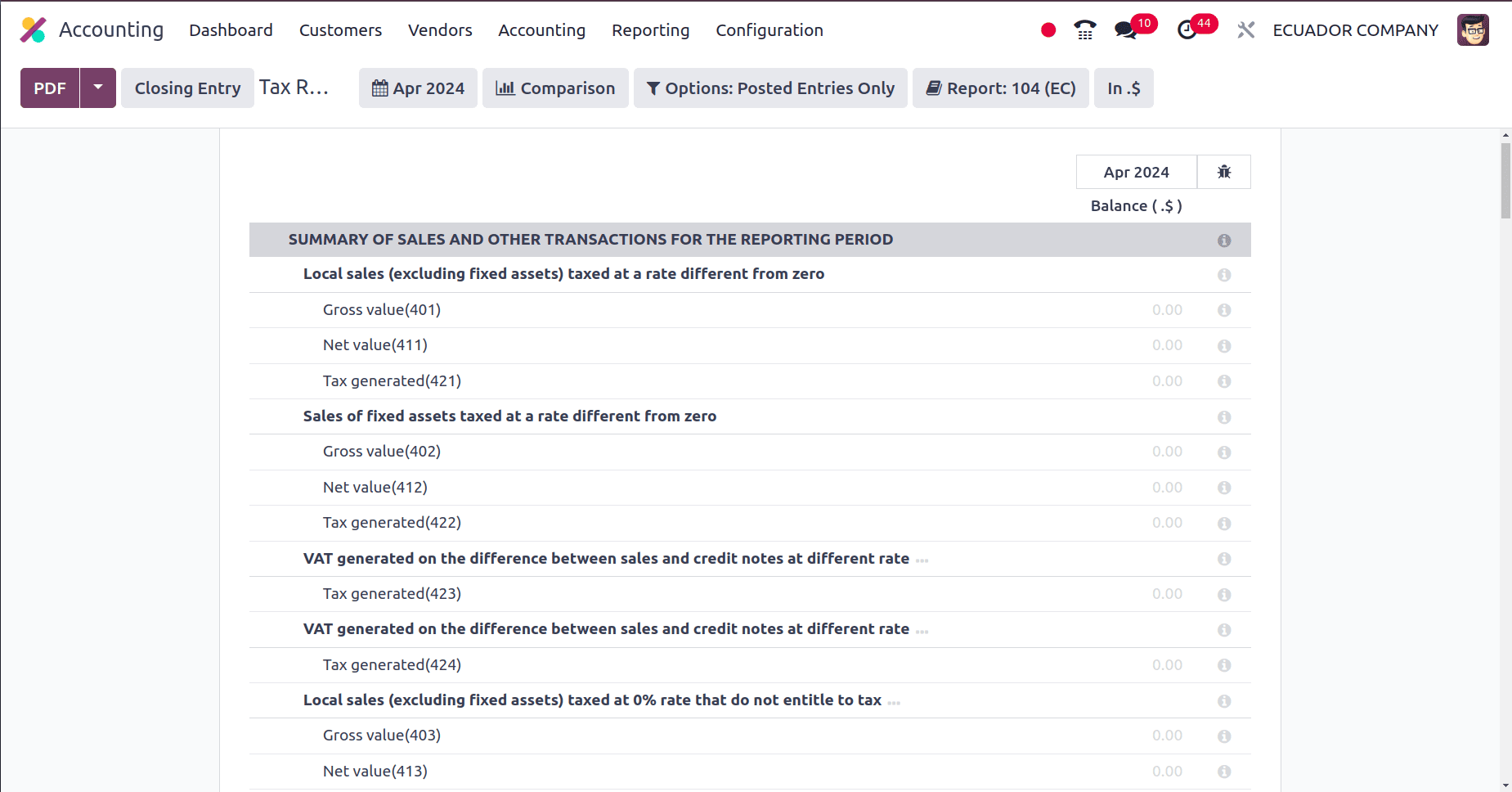

The Odoo 17 tax reports are to compile data about taxes for a given time frame (such as a month, quarter, or year). After that, tax returns are sent using this information to the appropriate authorities.

The Tax report of the companies in Ecuador includes Local sales (excluding fixed assets) taxed at a rate different from zero, Sales of fixed assets taxed at a rate different from zero, VAT generated on the difference between sales and credit notes at different rates, Sales of fixed assets taxed at 0% rate that do not entitled to tax credits, Exports of goods, etc.

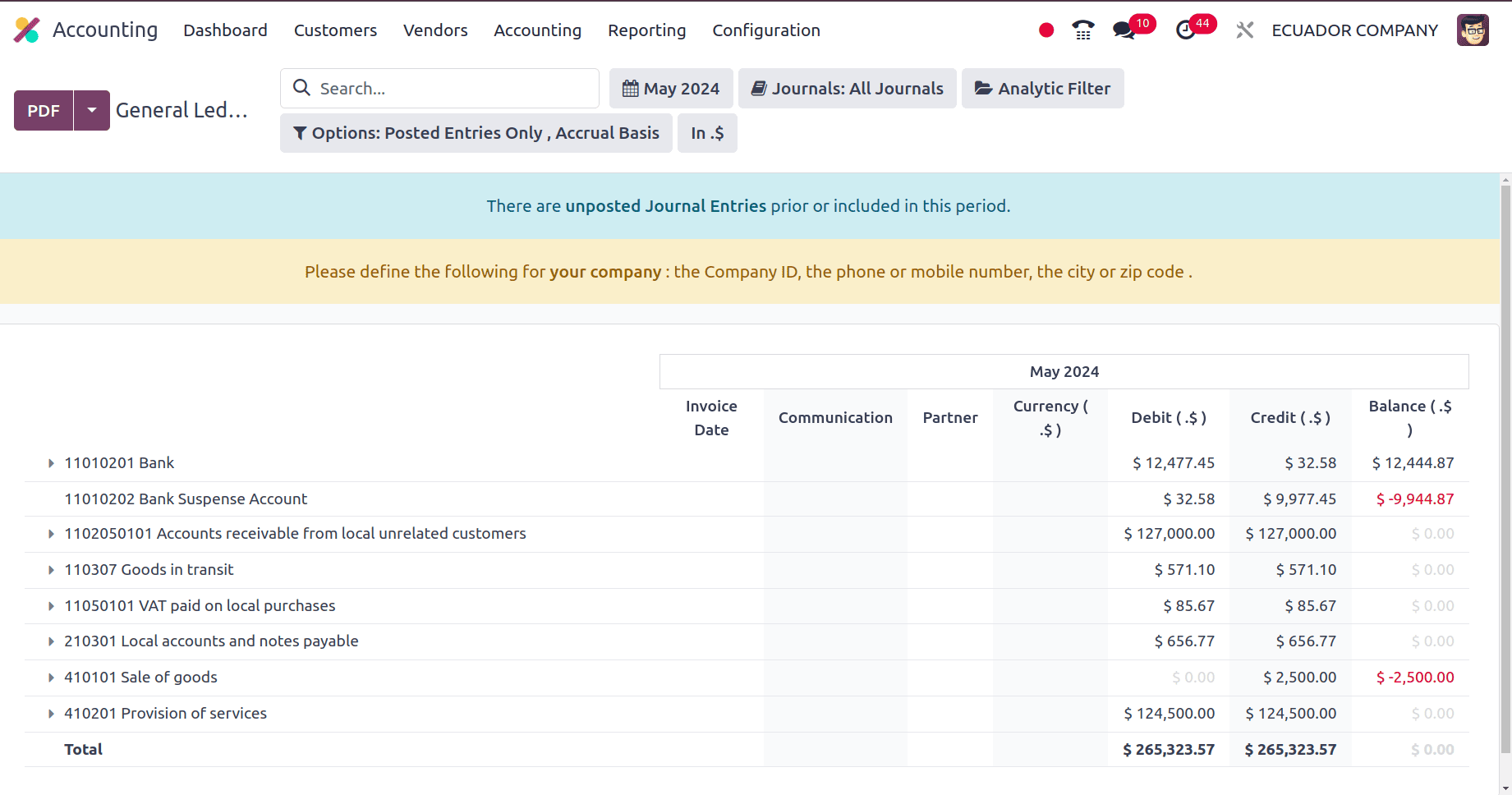

One of the main features of the accounting module in Odoo17 is the general ledger, which serves as a single repository for all financial transactions for your business. It offers a thorough analysis of every account in your chart of accounts.

You can make sure your chart of accounts is in line with the particular accounts required by regional tax laws and accounting standards by using a general ledger tailored to a particular nation. This lowers the possibility of mistakes or noncompliance with financial reporting regulations.

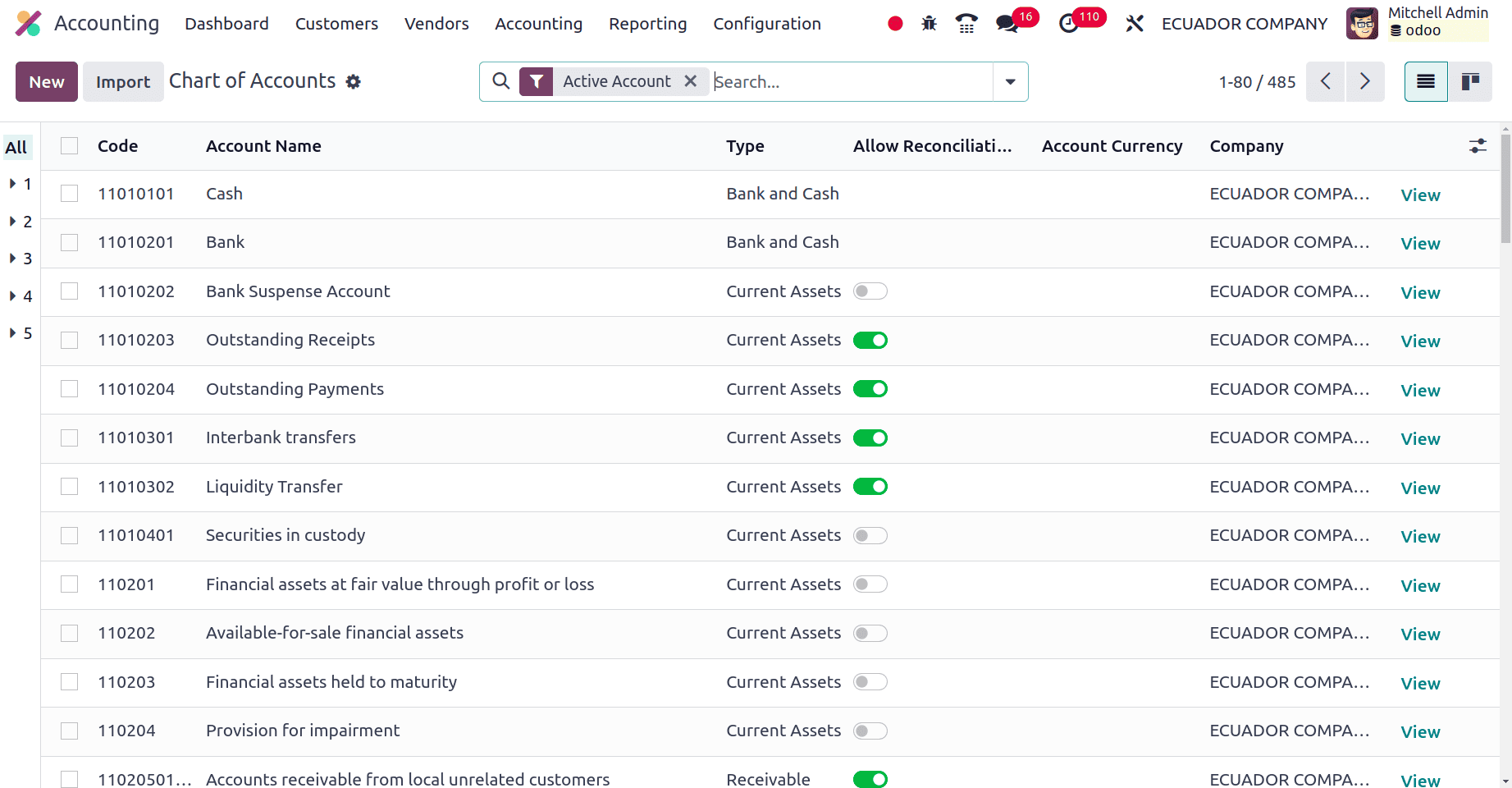

The basis of your accounting system in Odoo is the chart of accounts. It serves as an exhaustive inventory of every account you utilize to keep track of your financial activity. The chart of accounts of the companies in Ecuador shows the normal accounts used by businesses in Ecuador.

So, in general, we can say that the accounting localization for each country in Odoo 17 ensures compliance with state and federal tax laws, which is a significant advantage. Modules specific to a certain nation arrive pre-configured to match the required accounts in your chart of accounts with regional norms. By doing this, you can avoid potential fines and penalties by lowering the possibility of errors or non-compliance during financial reporting. And provide tools to automate tax computations according to the tax laws and rates in your nation. By doing away with the necessity for human computations, it reduces errors and streamlines the accounting procedure.

To read more about An Overview of Accounting Localization for Argentina in Odoo 17, refer to our blog An Overview of Accounting Localization for Argentina in Odoo 17.