Accounting is a vital part of business management. Having an effective accounting section is of utmost importance if the company has to balance out the investment and expenses with the gains. This demands a large chunk of the employee hours and yet stands the chance of human error. An optimized software solution would simplify the accounting struggles and save the company time. Accounting is about the complete financial data of the company and its reporting.

Odoo accounting is one of the best among the competitors with its user-friendly interface and easy integration.

The accounting module of Odoo places itself in the cream of the crop. Looking at the features that make this possible, Odoo accounting has

- Minimal data entry time

- Effortless setup and configuration

- Numerous third-party payment integrations

- Automated follow-up methods

- Comprehensive customer statements

- Instantaneous cash flow statements

- Efficient tax management

- Combined and coherent reporting

For any investment accounting tabulations are inevitable. Without a proper accounting system, it is nearly impossible for any organization to function successfully. An efficient accounting system can do a big part in improving the financial status of the company. This can be done with the help of proper reports and analyses. The reporting feature of Odoo comes to good use in the accounting module more than any other module.

Reporting in Accounting

Reporting makes sure that all details are looked at and studied with care. It acts as the go-to guide for the activities of the previous year or period. Additionally, it will be the prediction guide for the cash flow and the revenue. Accounting reports allow us to access where exactly we stand in terms of finance. What makes reporting in Odoo 14 Accounting a good feature is its attention to detail and flexibility.

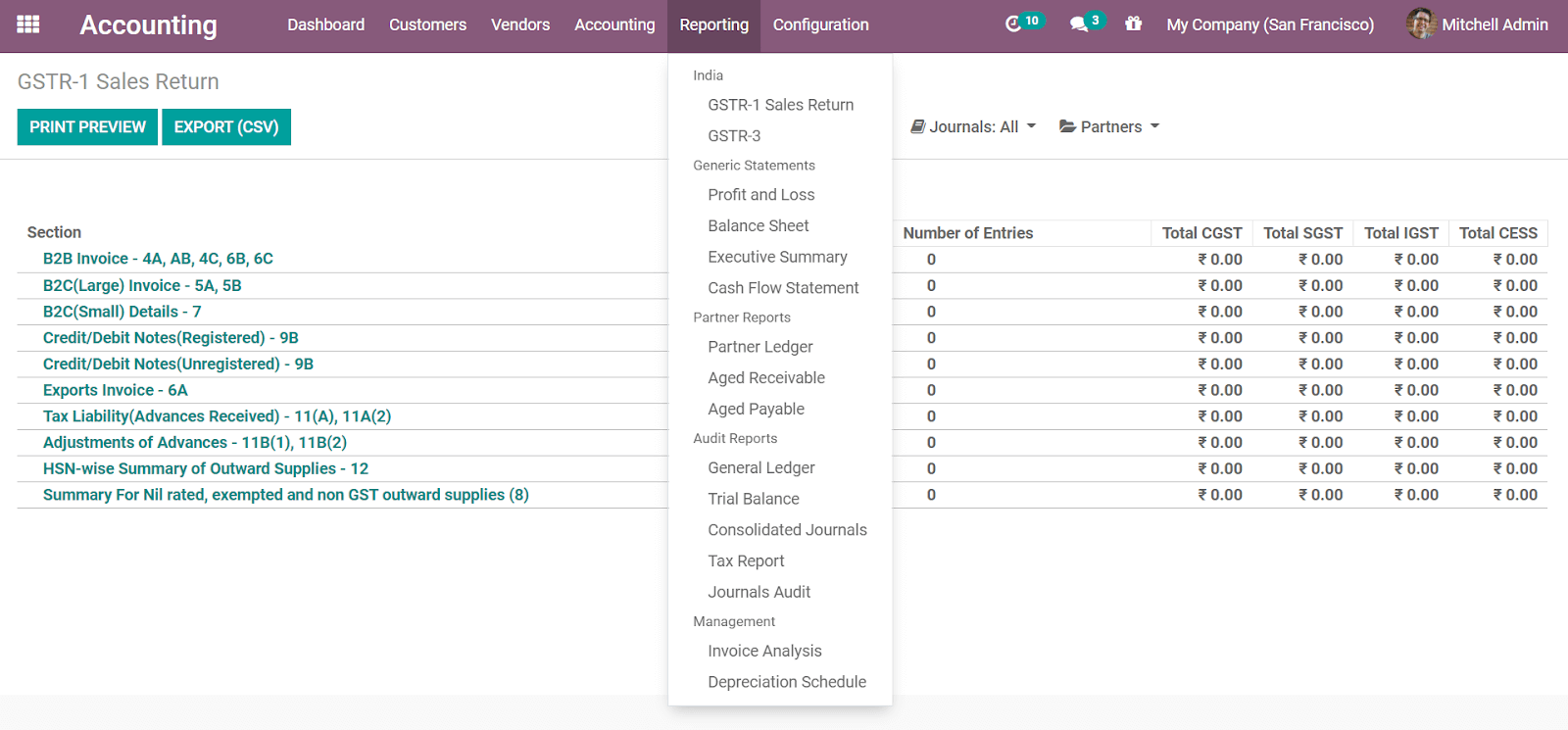

The reporting will depend on the fiscal localization chosen. We have currently chosen the Indian Chart of Accounts. This allows the localized reporting for India depending on the corresponding standards. The fiscal localization can be changed in Configuration > Settings > Fiscal Localization.

We can install the package for our country from the packages available and this would customize the fiscal position and tax accordingly. The same would reflect in reporting too.

Reporting Categories

The sections under the reporting are categorized as

a) Generic statements

b) Partner Reports

c) Audit Reports

d) Management

In the case of the Indian Chart of Accounts, we can view the reports for filing GSTR. We can export the reports as CSV, easing the filing processes. Similarly, Odoo is frequently updating to include localized changes in the fiscal policies, enabling us to keep our accounting data in sync with the changes.

Generic Statements

In generic statements, we will be able to generate encompassing reports like the profit and loss, balance sheet, and likewise.

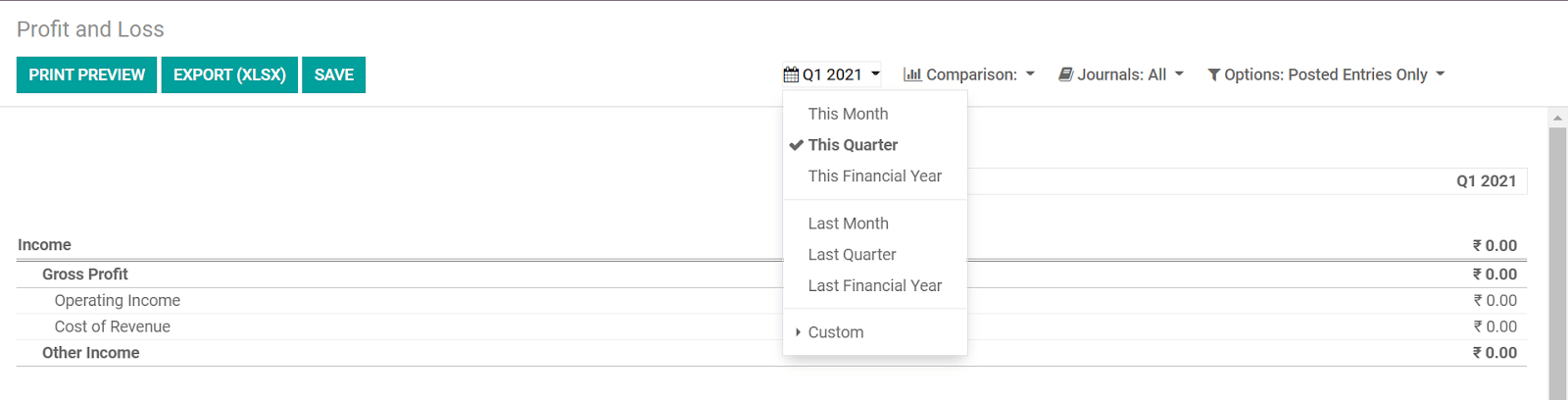

- Profit and loss statement: This would be the report of the income and expense, calculating the net profit of the company. It can be viewed for the financial year, quarter, or month. By modifying the calendar, we can view this for different periods.

We can also compare this with the previous year. This would help analyze the growth of the company. Moreover, we can select the journals from the drop-down menu.

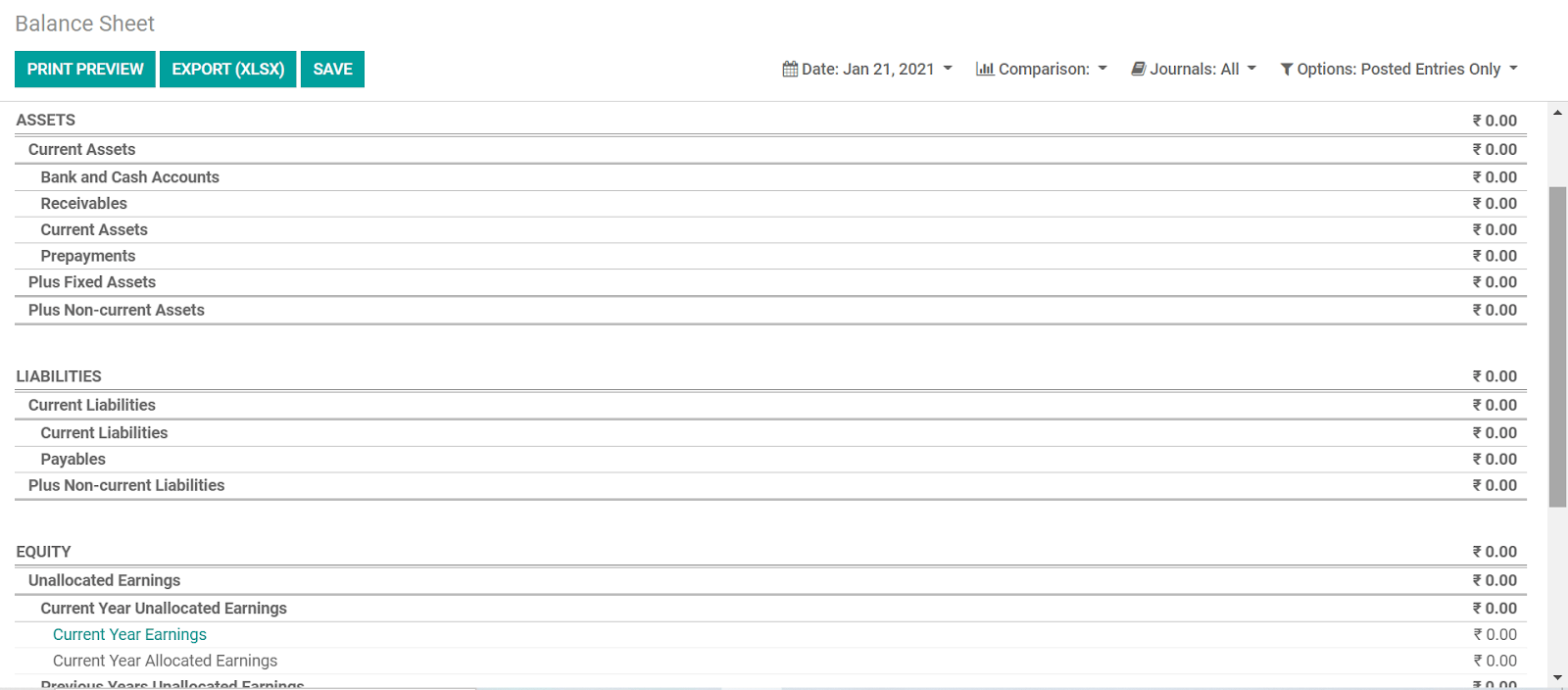

- Balance sheet: The balance sheet is the financial record of a company, listing all its assets, liabilities, and equity. The balance sheet can also be displayed according to the chosen period or date. We can customize the end date in the date drop-down menu. The report can be exported as XLSX.

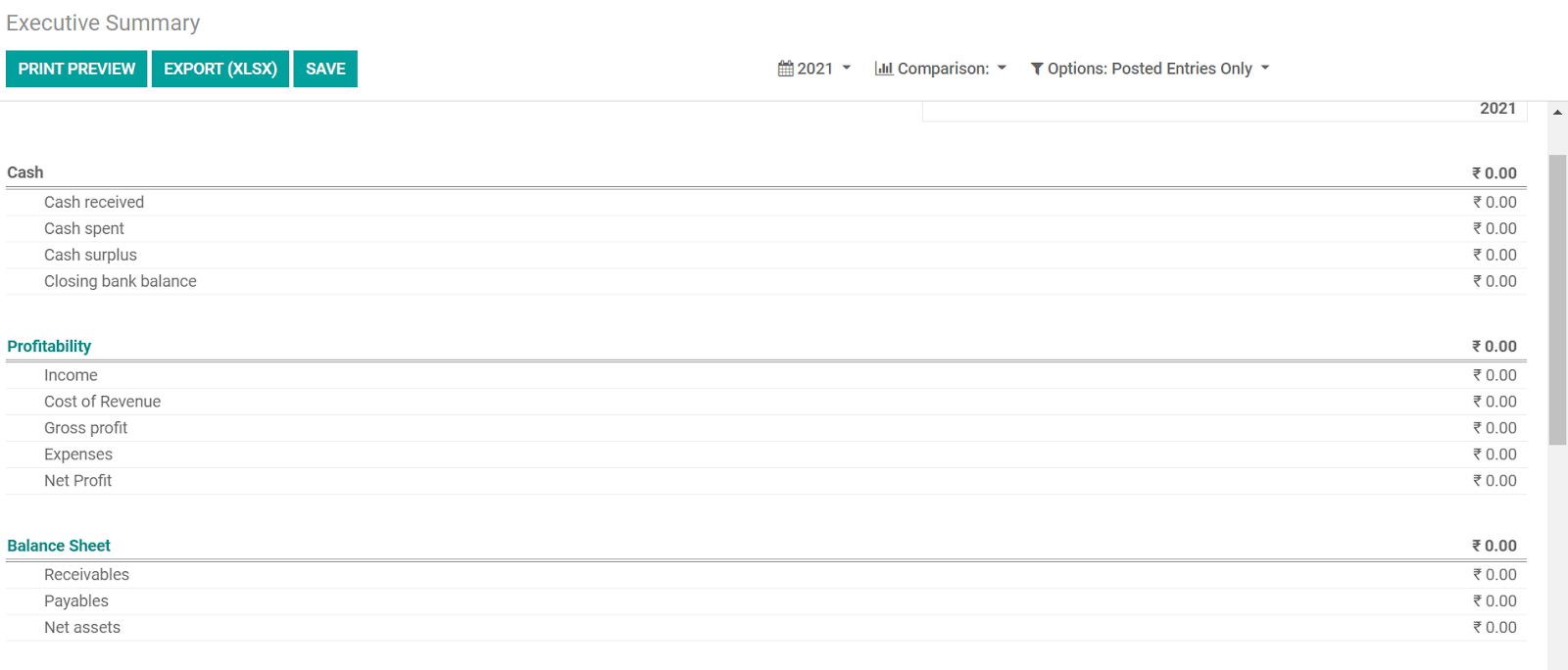

- Executive Summary: It tabulates the cash, profitability, balance sheet, performance and position. The cash table would report the received, spent, and surplus, along with the closing bank balance. The profitability is tabulated with information about the income, cost of revenue, gross profit, expenses, and net profit. The balance sheet would have payables, receivables, and net assets. Performance tabulates

- The gross profit margin-the gross profit divided by the operating income.

- Net profit margin- the net profit divided by the income and

- Return of investments- the net profit divided by assets.

Position includes the average debtor and creditor days, short-term cash forecast, and current assets to liabilities.

This is exported as Ms. Excel Workbook.

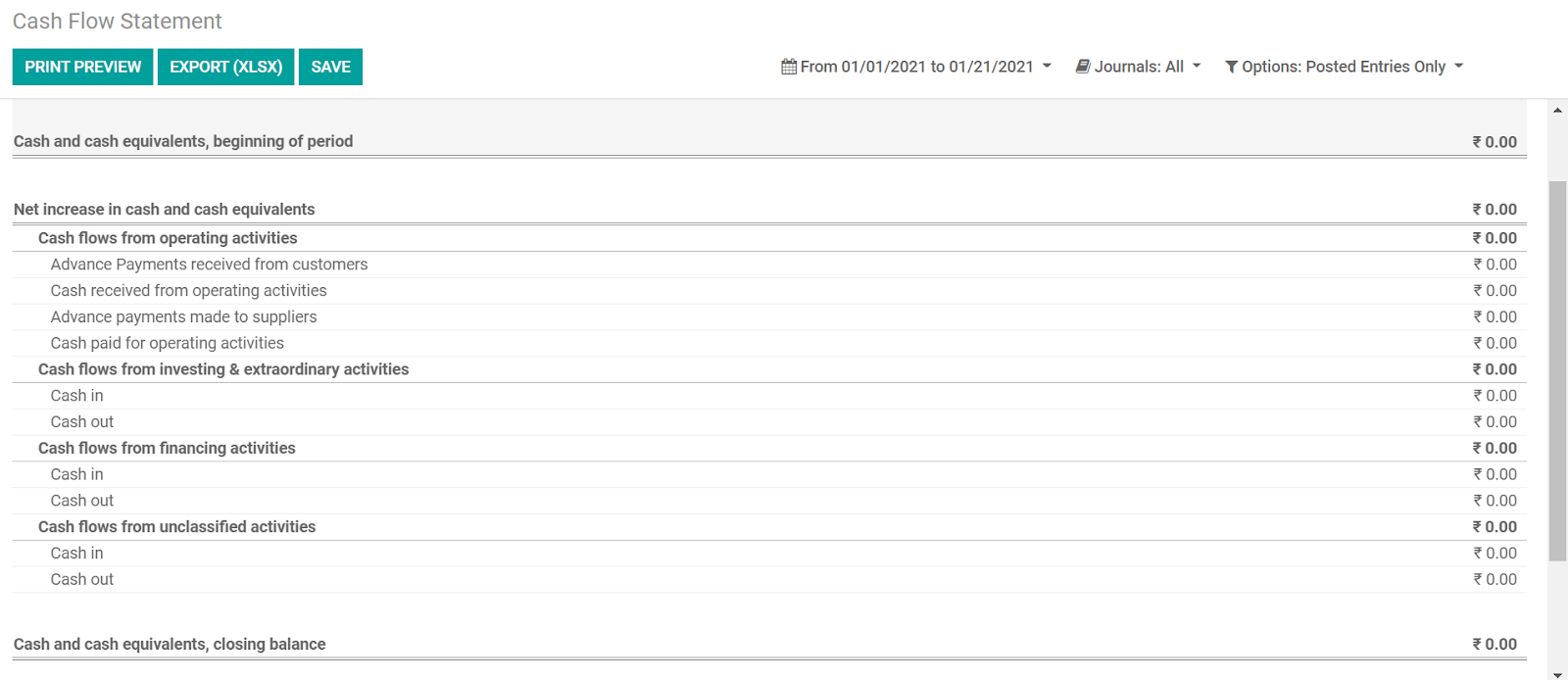

- Cash flow statement: It shows the cash inflows and outflows during the given period of time. We can custom set this period from the drop-down menu. The cash and cash equivalents at the beginning and end of the period are reported along with the net increase.

This too can be exported as a MS Excel file.

Partner Reports

Following general statements, we have the partner reports. This includes partner ledger, aged payable, and aged receivable.

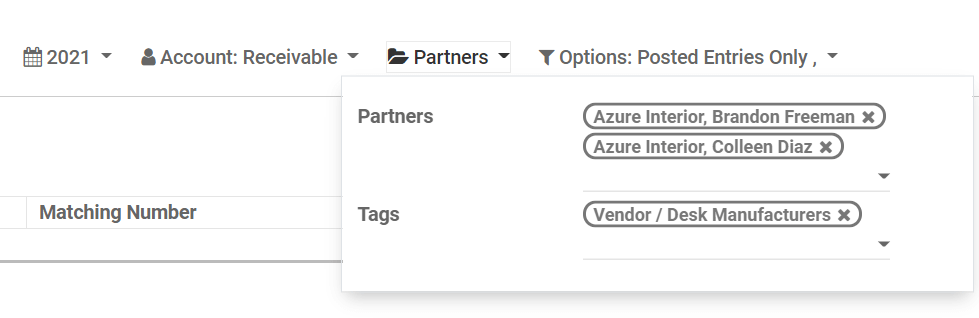

- Partner ledger: The ledger functions as a registry of the partnership and ownership of the company. This helps keep track of the records about the various partners. We can add the partners and the tags from the drop-down menu on the top-right.

- Aged receivables: The aged receivables display the accounts receivable, outstanding even after a certain period of time. This can also be displayed according to the selected partner.

- Aged payable: This displays the balance we owe to the partners, based on the days delayed since the invoice.

Audit Reports

The audit report is generated under the following categories,

- General ledger: It is the central repository kept by the accountants for all accounting data.

- Trial balance: This would display the ending balance of all the transactional accounts in the general ledger.

- Consolidated journals: It reviews the journal entries across the journals to create a consolidated report.

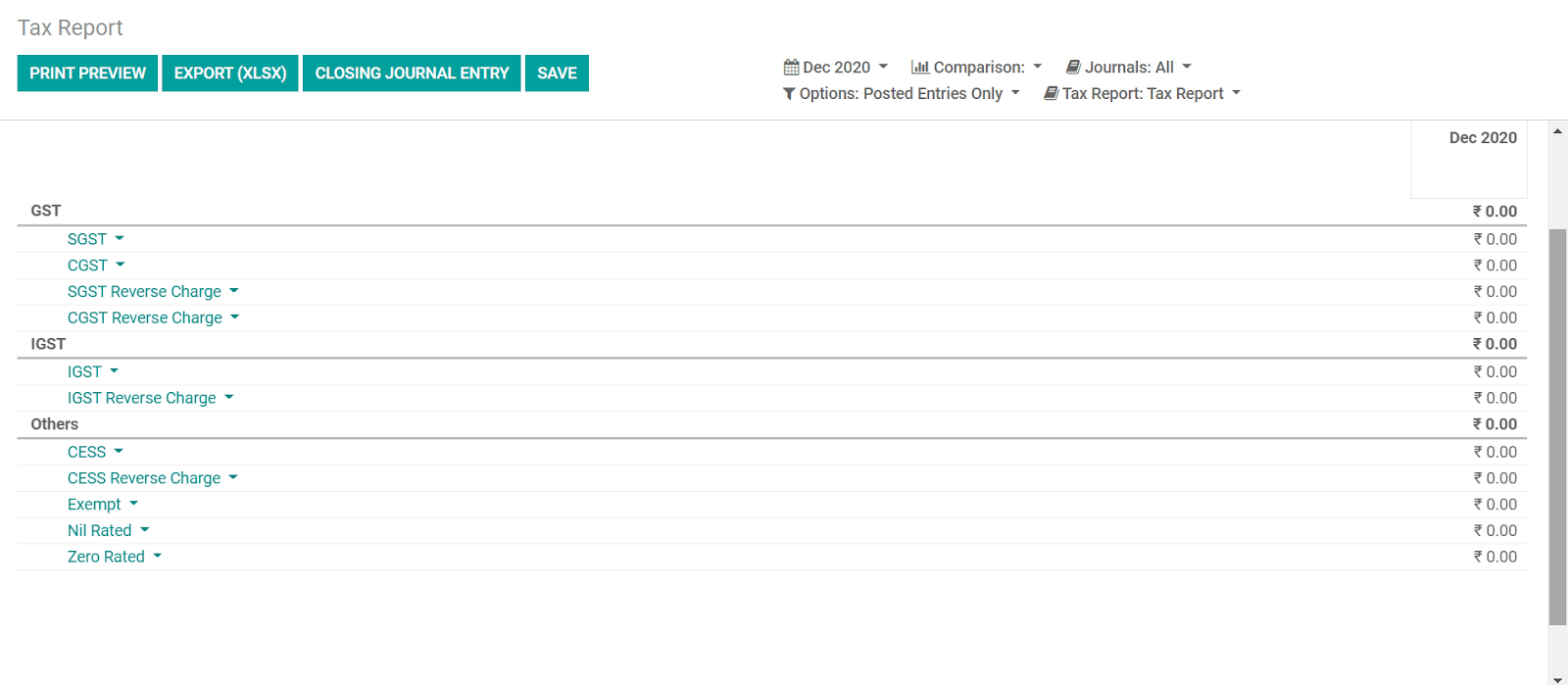

- Tax reports: It has all the tax reports according to the taxes in the chosen country of our company.

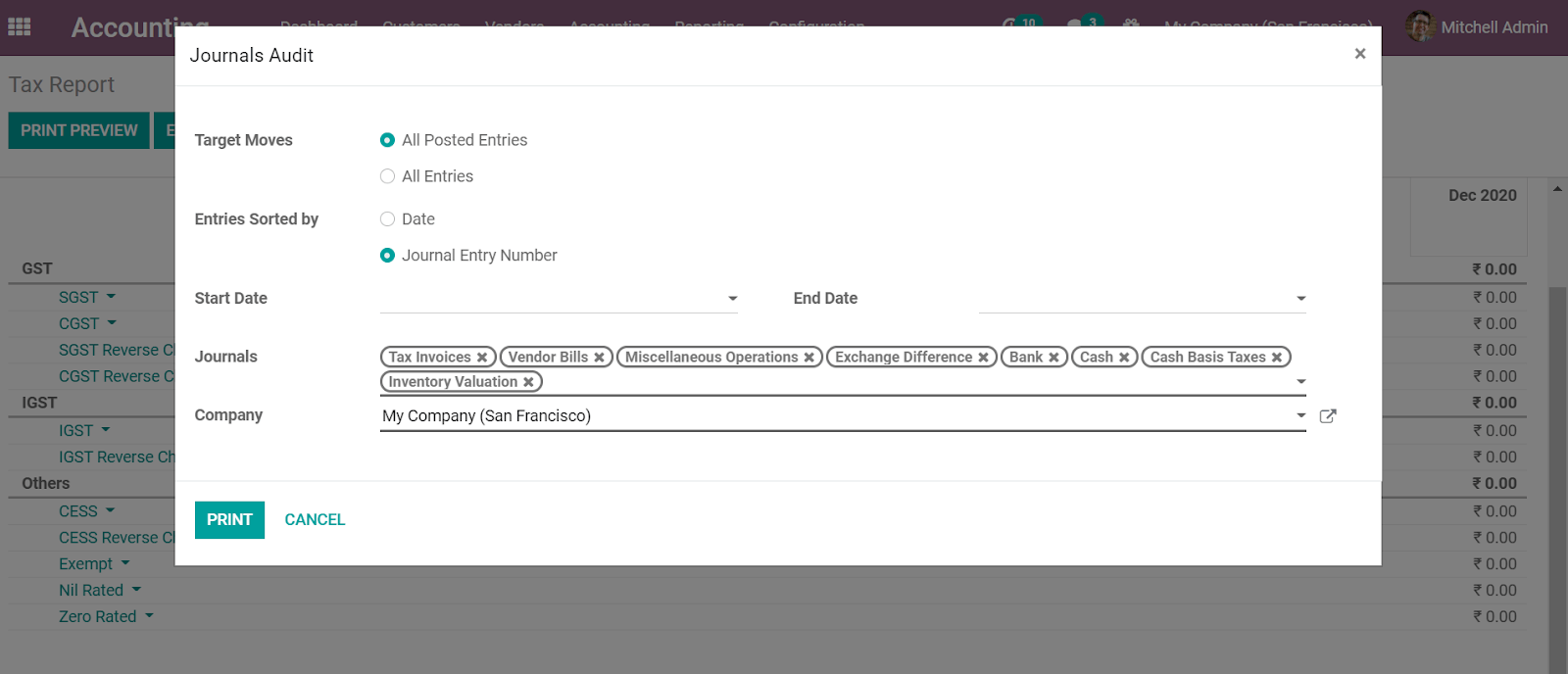

- Journals audit: The journal audit would display a pop-up window to sort and filter the journal entries and print them.

Management

The last part of Accounting reporting is the management reports. This is further categorized as invoice analysis and the depreciation schedule.

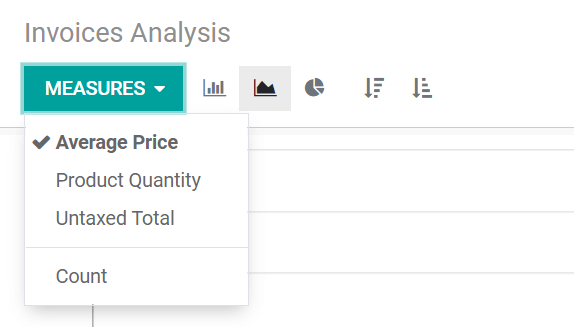

- Invoice analysis: It analyses the amount invoiced and displays the overview. It can be filtered and grouped according to our choice. We can also select the measure of our choice.

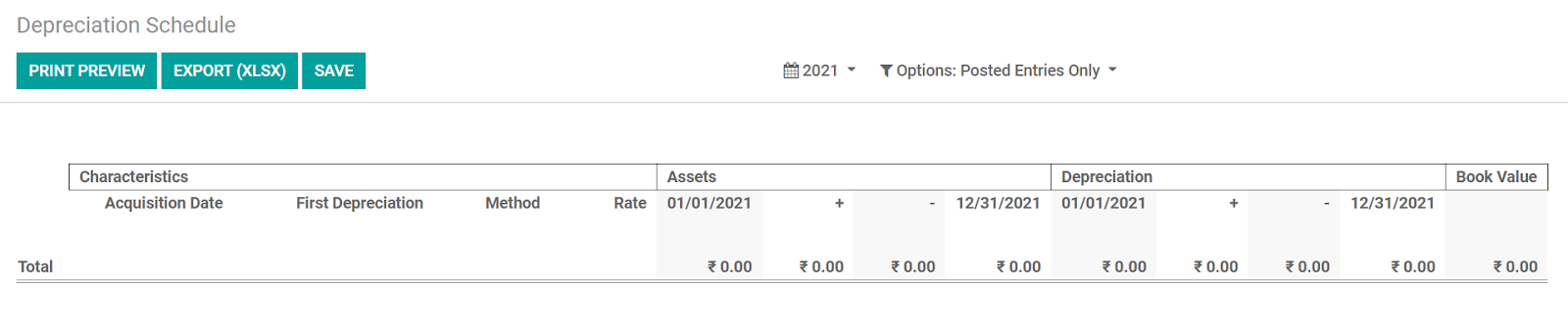

- Depreciation Schedule: Depending on the accounting method chosen the depreciation in the value of the assets is calculated and charted in the depreciation schedule.

This is an overview blog dedicated to Reporting in Odoo 14 Accounting module. You can read more about Odoo accounting in our

blog or contact us for

Odoo Accounting services.