Reconciliation is the process of pairing bank account data with cash transactions. Finding out the mistakes in journal entries and securing your accounts is beneficial. Reconciliation of records is vital once the bank accounts are accurately imported into a company. Reconciliation models are helpful in speeding up the process of reconciliation. It is time-consuming to manually review the account statement and bank records. A company can handle cash discounts with the use of reconciliation models. By installing ERP software, users can manage reconciliation models as per company needs.

This blog assists you in configuring reconciliation models in the Odoo 16 Accounting.

We can manage the journal items, customers, payments, invoices, tax reports, currencies, and more in Odoo 16. You can compare the bank data and payment documents through Odoo ERP. The reconciliation becomes a simple procedure within your company once installing Odoo ERP software.

To Define a Reconciliation Model in the Odoo 16 Accounting

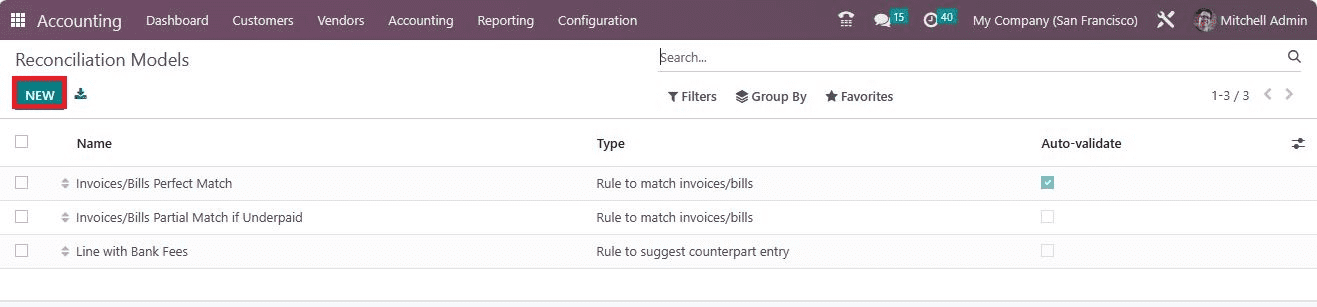

You can acquire the reconciliation model menu from the Configuration tab. The user can get the pre-configured reconciliation model data on the open screen. It shows details such as Name, Type, and more. Reconciliation models are classified into three: write-off button, matching recent invoices/bills, and suggesting counterpart entry. Let’s see details about each reconciliation model here. Click the CREATE button in the Reconciliation Models window to produce a new one, as pointed out in the screenshot below.

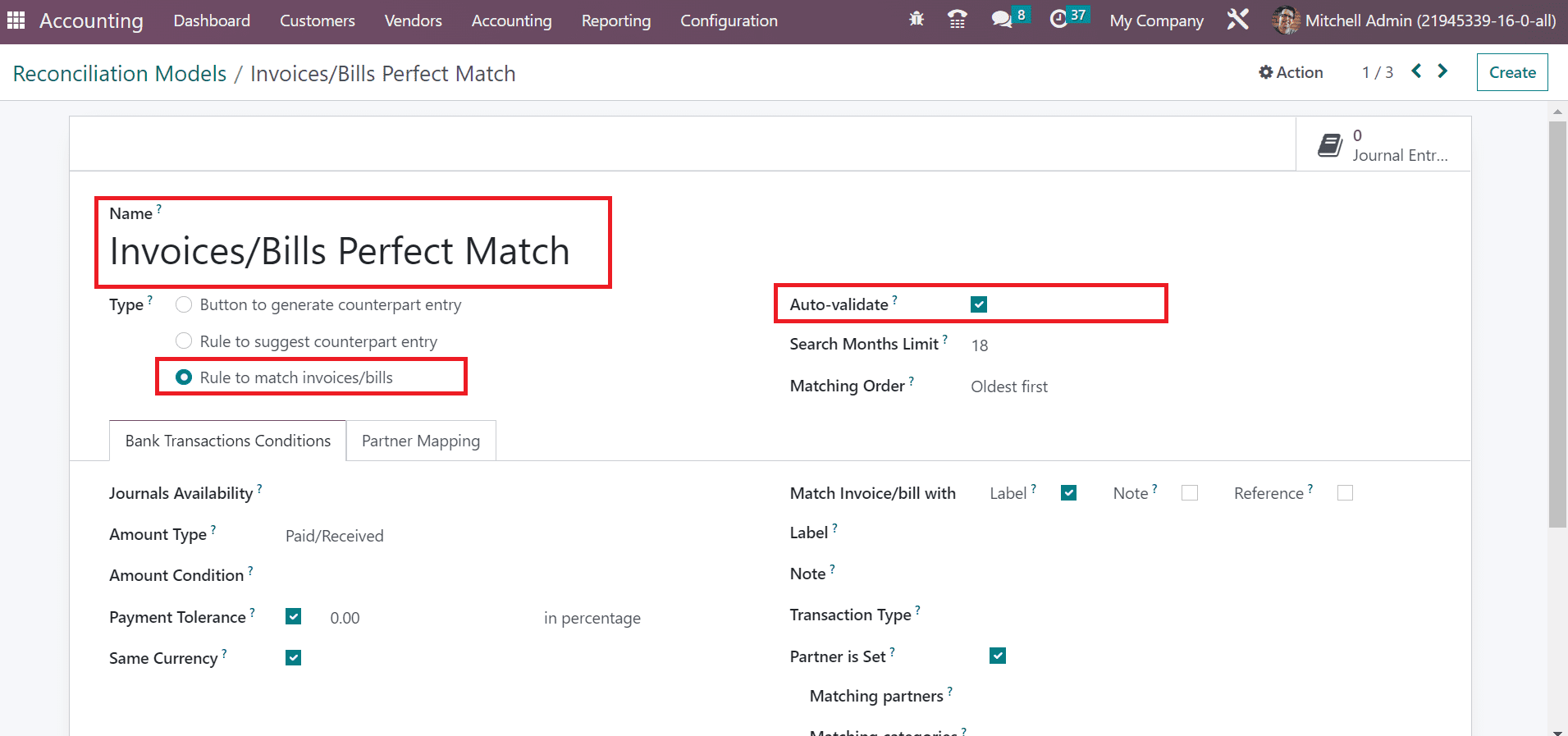

In the Open page, enter Name as Invoices/Bills Perfect Match and set the Type as Rule to Match invoices/bills. It is possible to choose the right vendor bill, and the customer invoice matches payment automatically with this type. Later, enable the Auto-Validate option to run reconciliation as per your rule, as figured in the screenshot below.

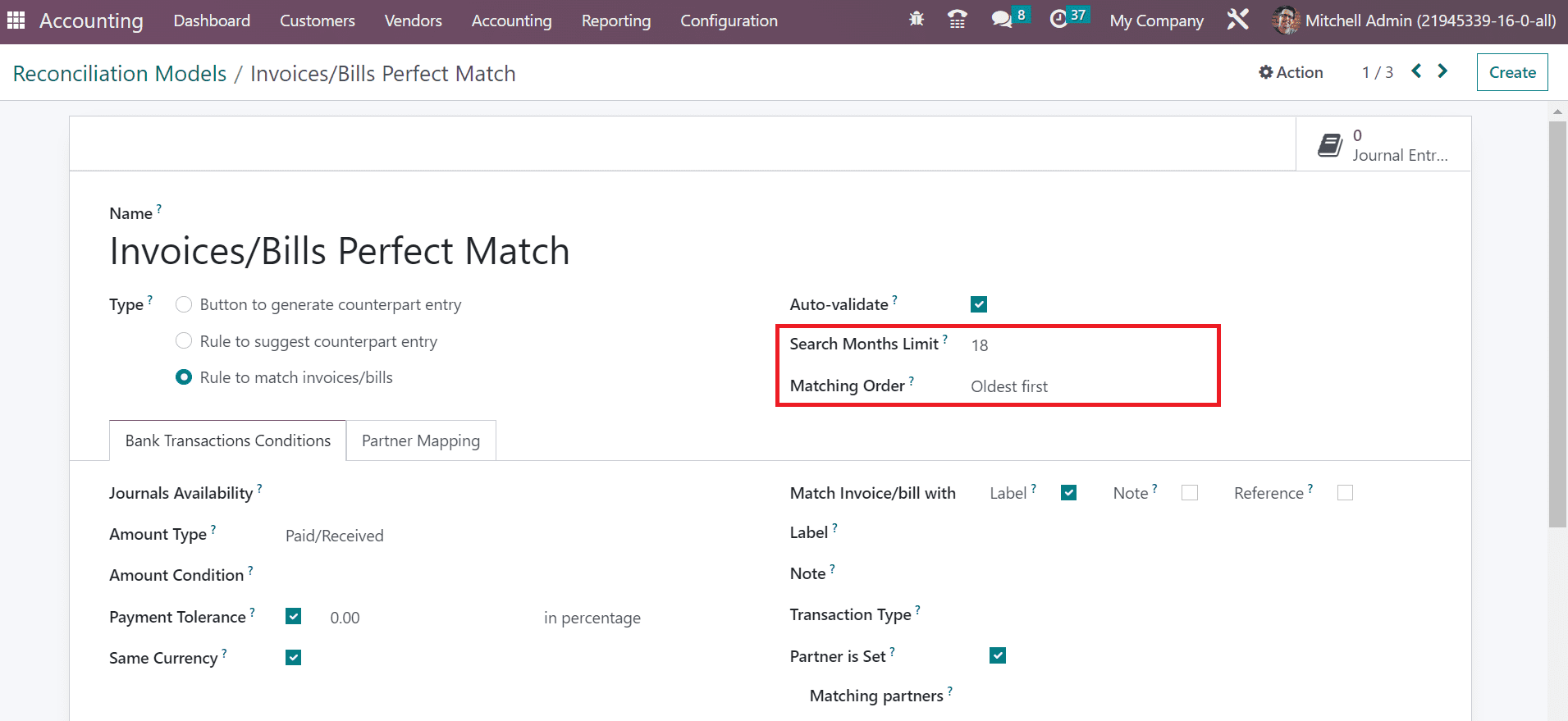

Add the past month count for entries related to your model in the Search Months Limit field. We can match the order in two ways: Newest first and Oldest first. You can select the Oldest first option inside the Matching Order field, as mentioned in the screenshot below.

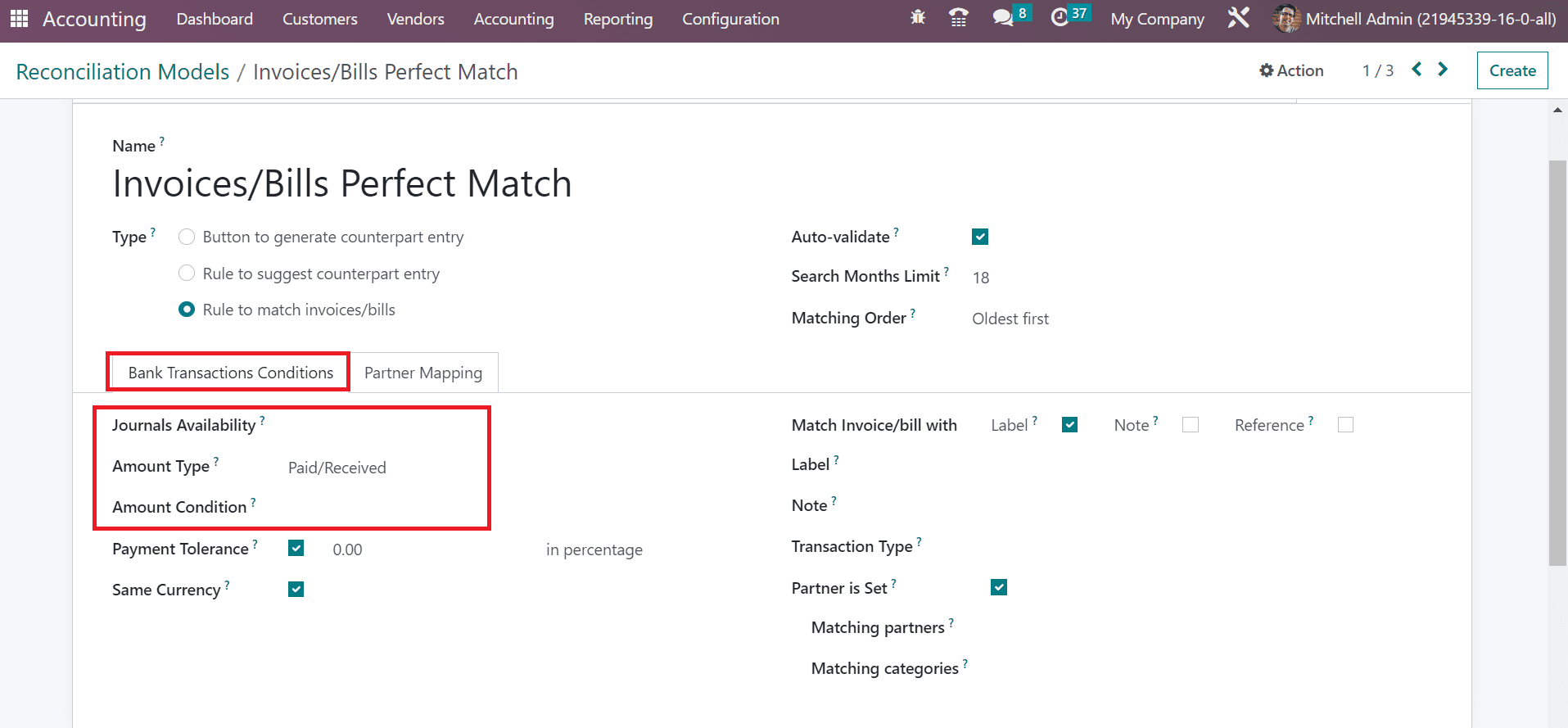

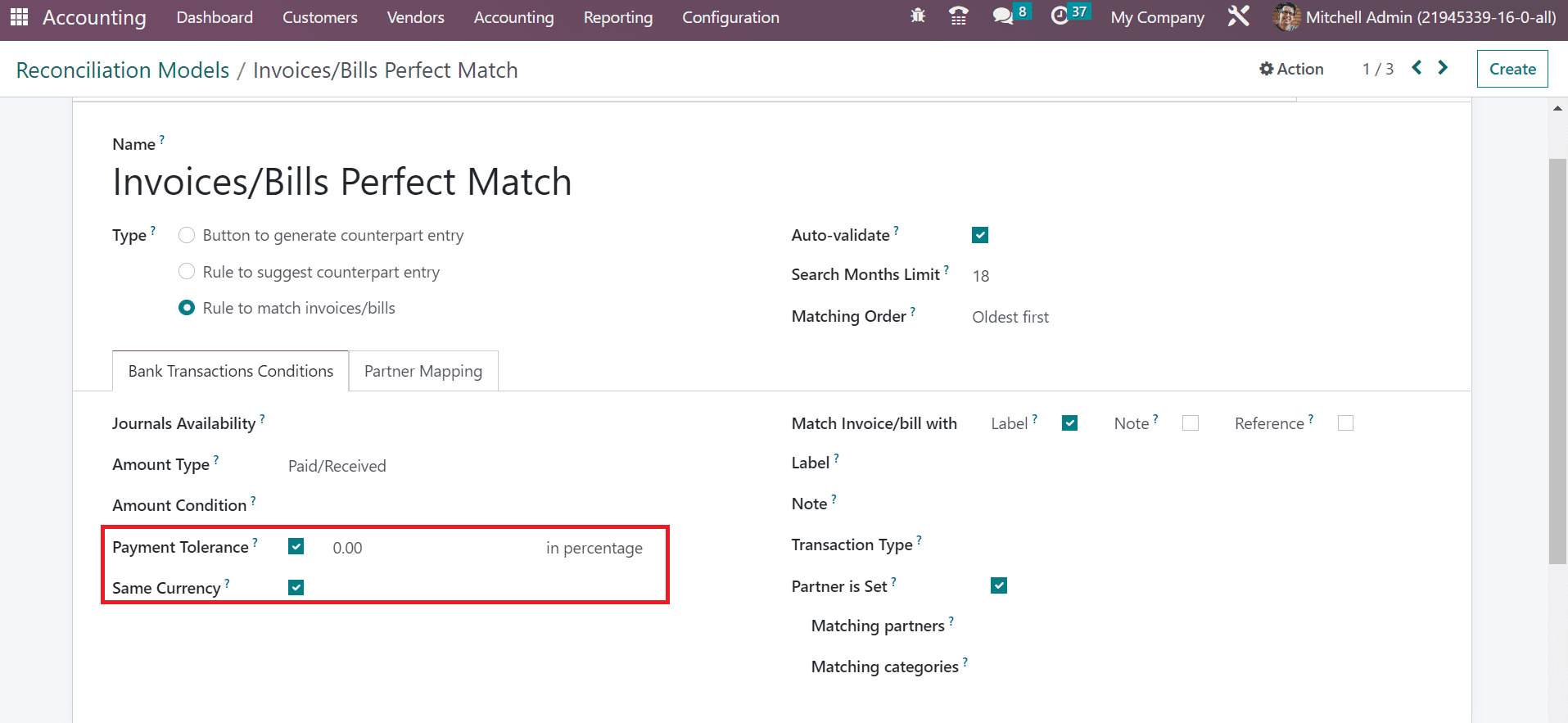

Users can apply further conditions for the reconciliation model below the Bank Transactions Conditions tab. You can pick a journal for the reconciliation model within the Journals Availability field. Moreover, setting the Amount Type as Paid/Received ensures both receiving and paying an amount. You can specify any condition for the amount in the Amount Condition option.

We get the exact amount between the invoice and bill by choosing zero in Payment Tolerance. Also, the transaction is available to the user in a similar currency on a statement line once the Same Currency field.

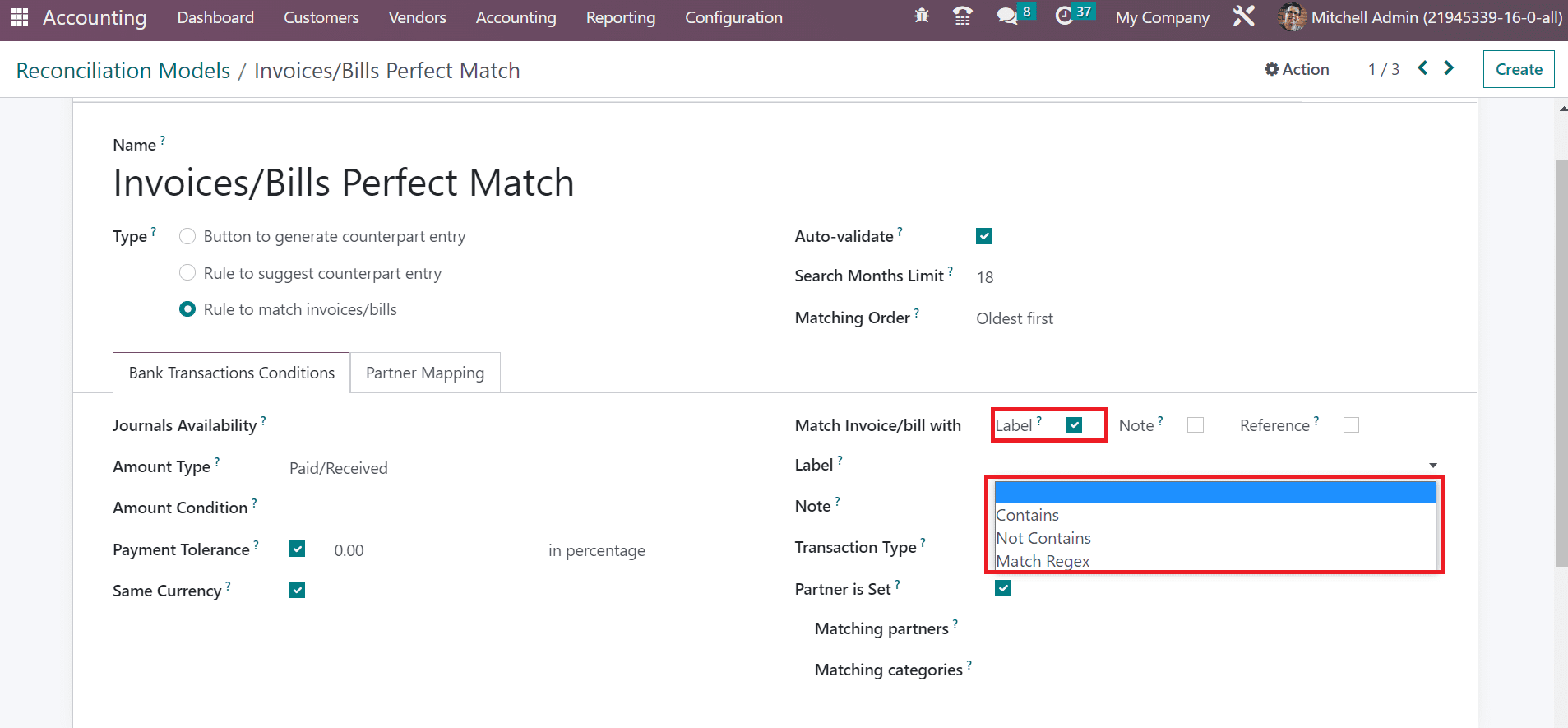

We can match the bill/invoice based on Label, Note, and Reference. By choosing the Label option, we can find invoice references once searching in the statement label. A Label field opens before you after activating the Label option in Match Invoice/bill field. A reconciliation model only applies when the label consists of Match Regex, Contains, and Not Contains, as defined in the screenshot below.

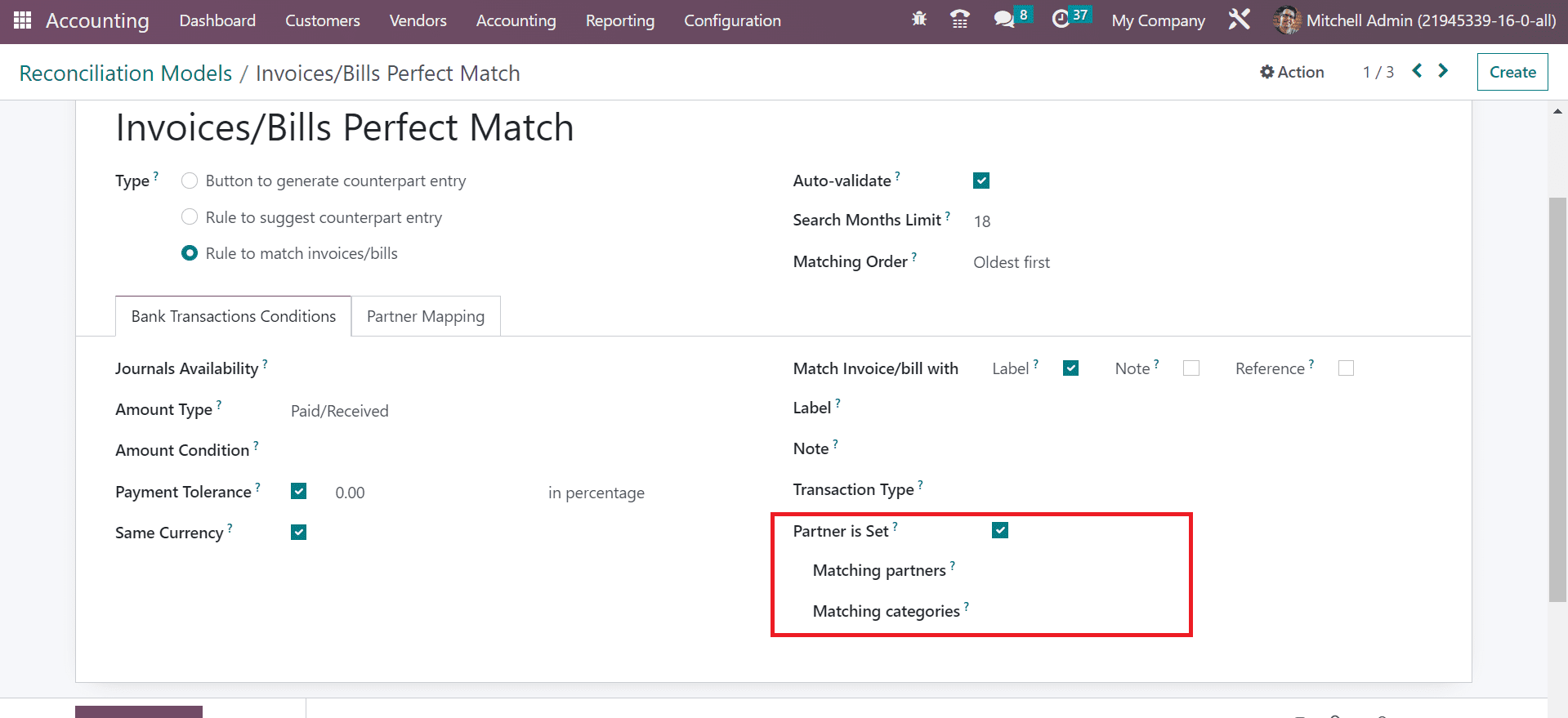

Users can set a customer for the reconciliation model by enabling the Partner is Set field. It is possible to select the customers within the Matching Partners field. The reconciliation model will only be applied to choose vendor categories.

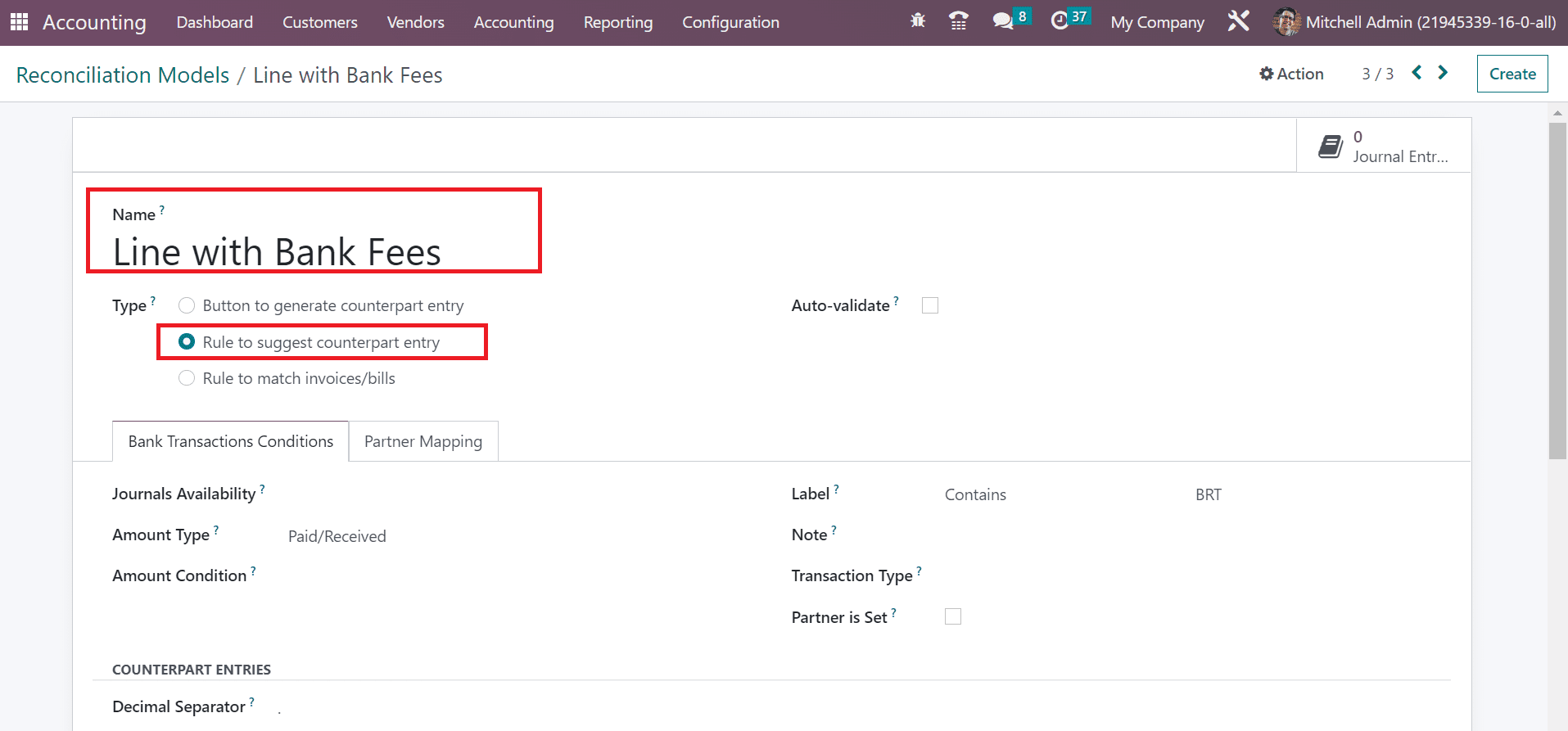

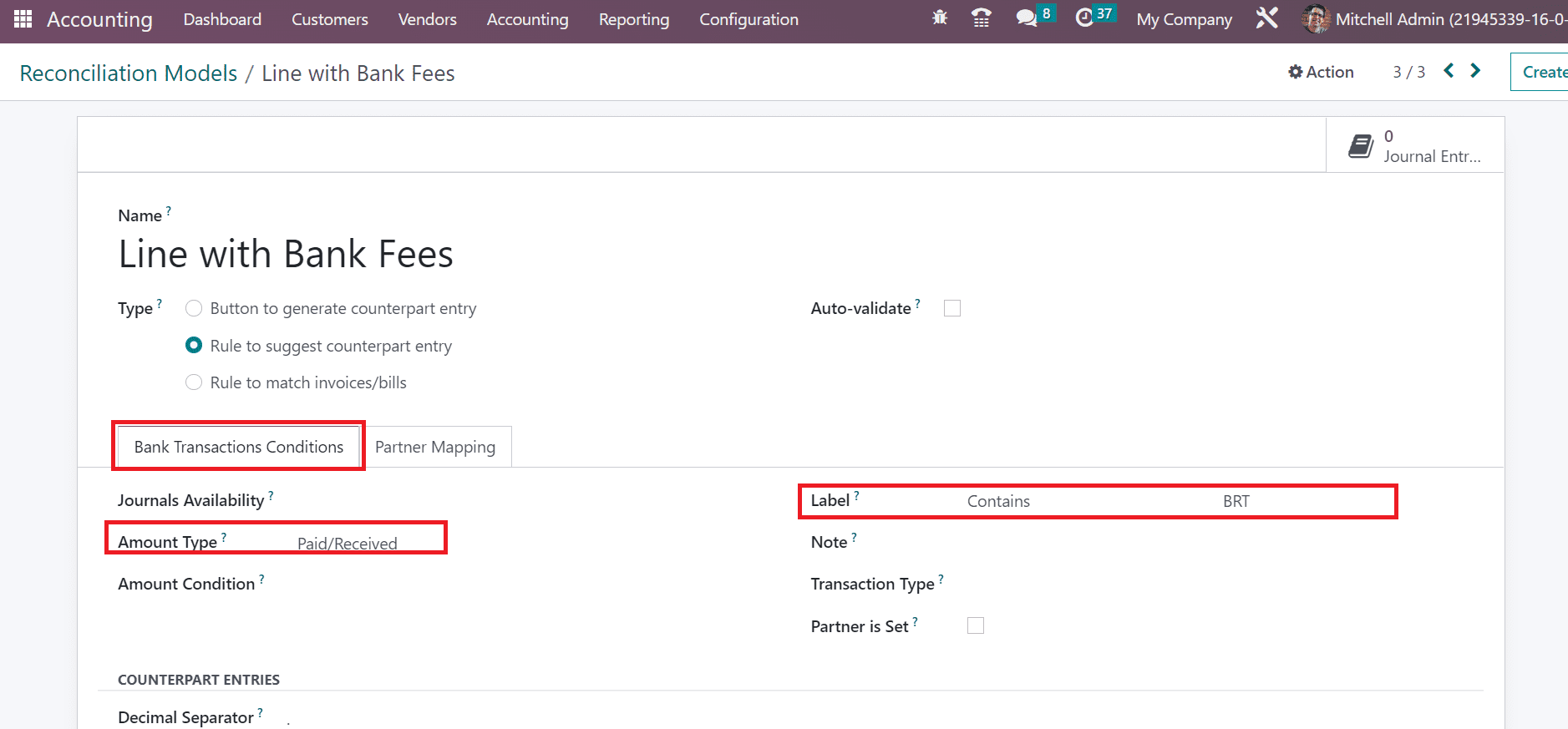

If all these conditions are adequately met, Odoo will automatically validate the matching and transaction. It is easy to update the payment entered. Next, we can define another reconciliation model classification Rule to Suggest counterpart entry. For that purpose, add a Line with Bank Fees as the Name in the Reconciliation Models window. We can suggest counterpart values need to be validated immediately once selecting the Rule to offer a counterpart entry option in the Type field as specified in the screenshot below.

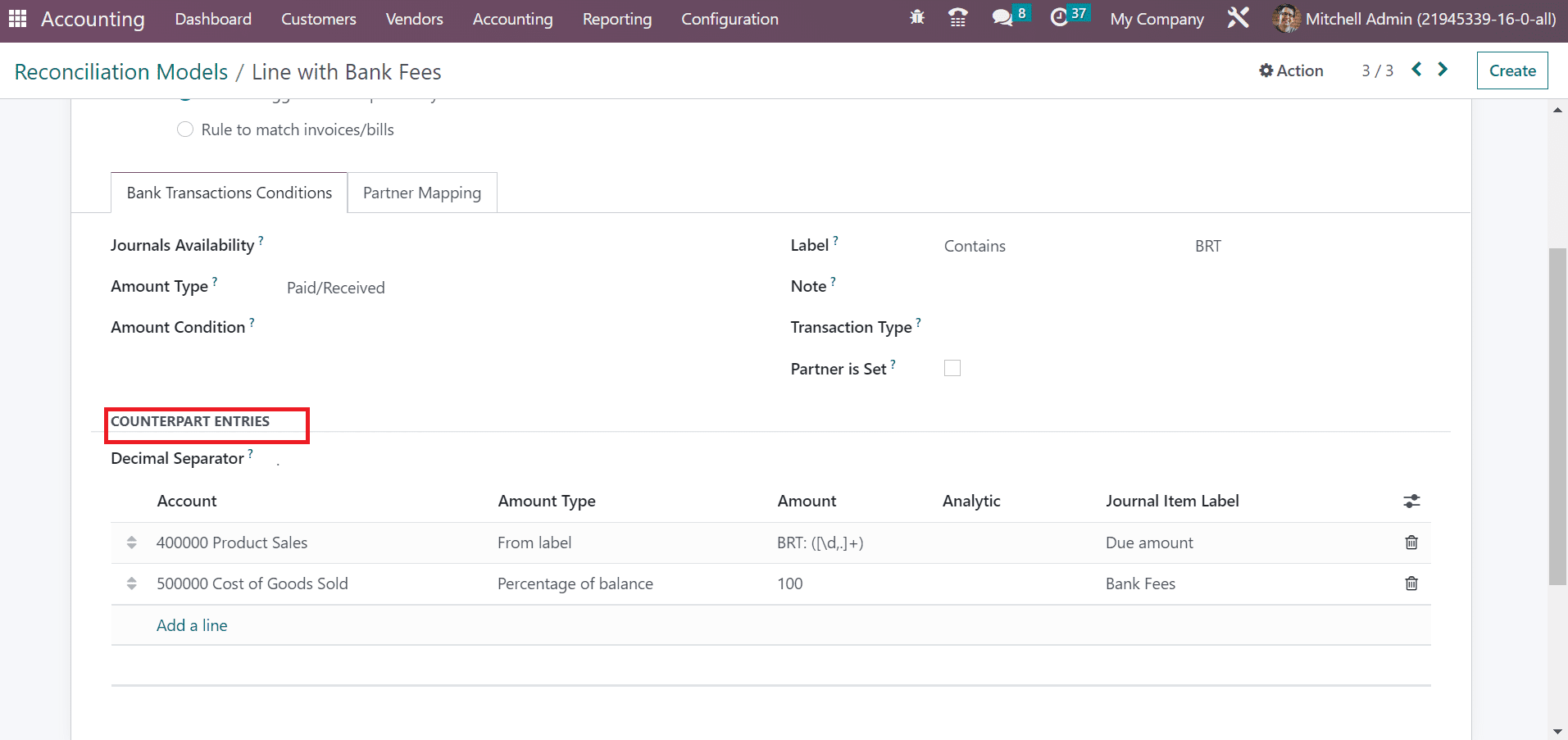

Inside the Bank Transactions Conditions tab, you can manage the necessary conditions for the reconciliation model. Choose Paid/Received option inside the Amount Type field. We can set the Label as Contains BRT. Based on your chosen label, a reconciliation model will be applied.

Users can access the financial expense accounts as per the label under the COUNTERPART ENTRIES section. You can obtain information such as Account, Amount, Journal Item Label, and more.

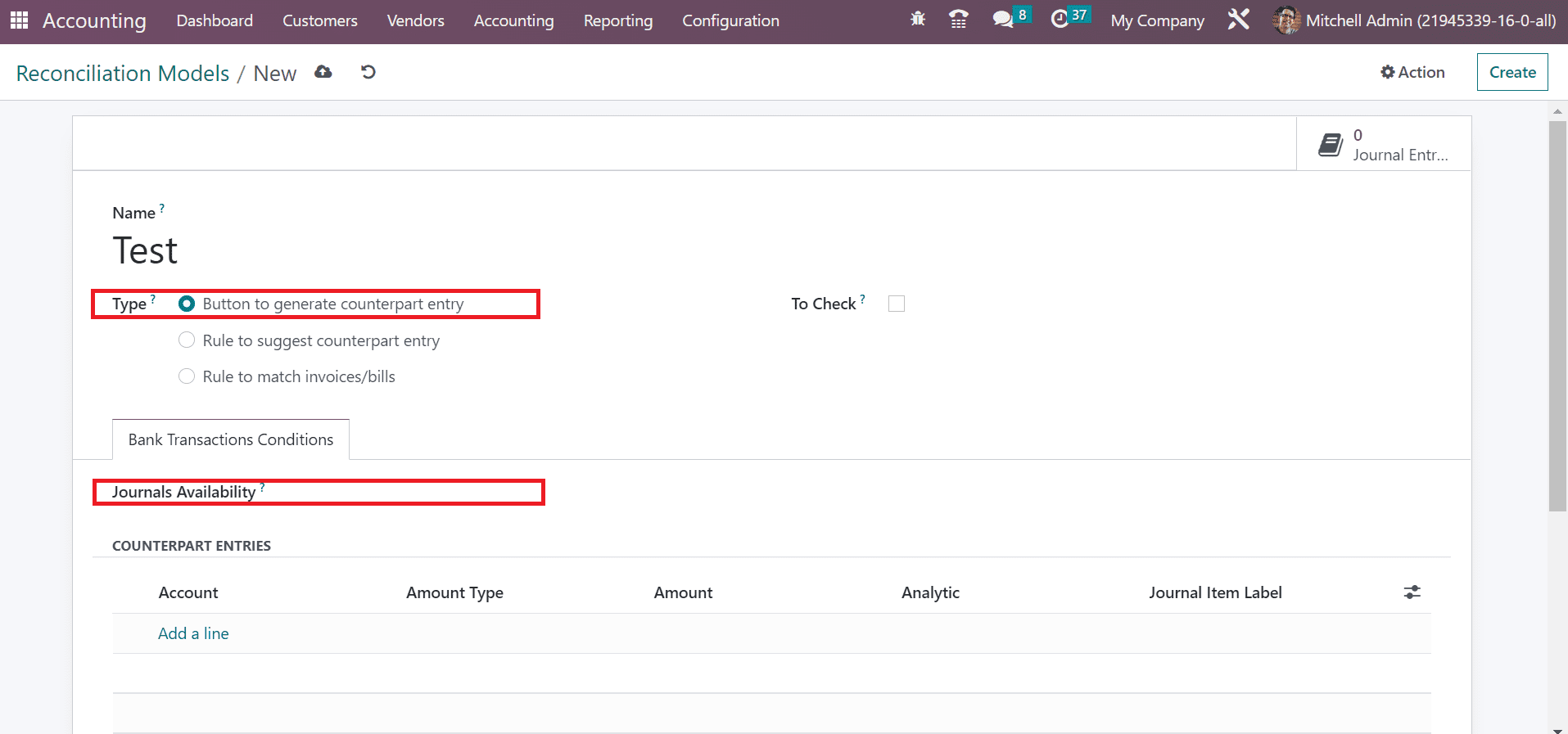

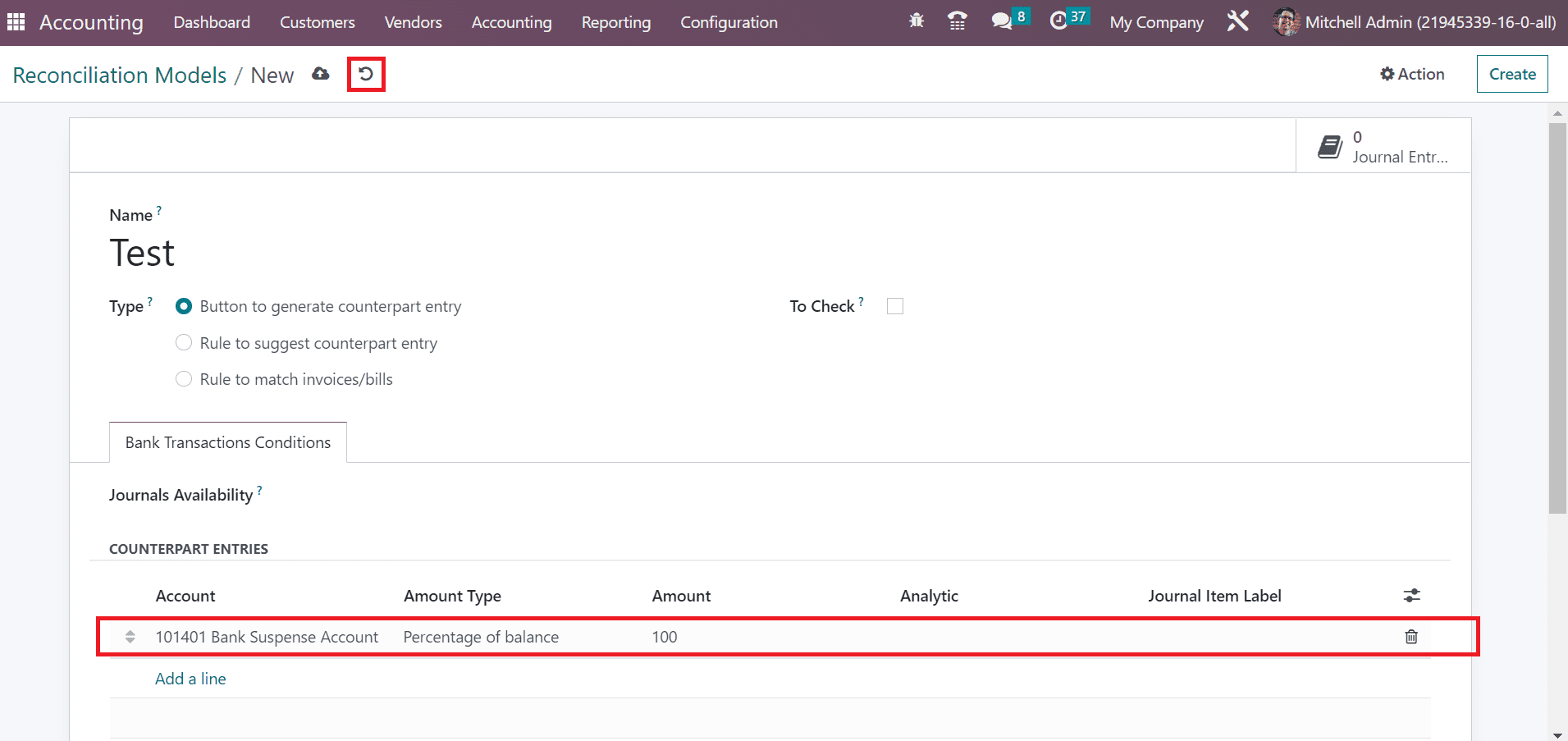

Finally, we can view the last reconciliation model classification button to generate a counterpart entry. In the New Reconciliation model, select Button to generate a counterpart entry option, as noted in the screenshot below.

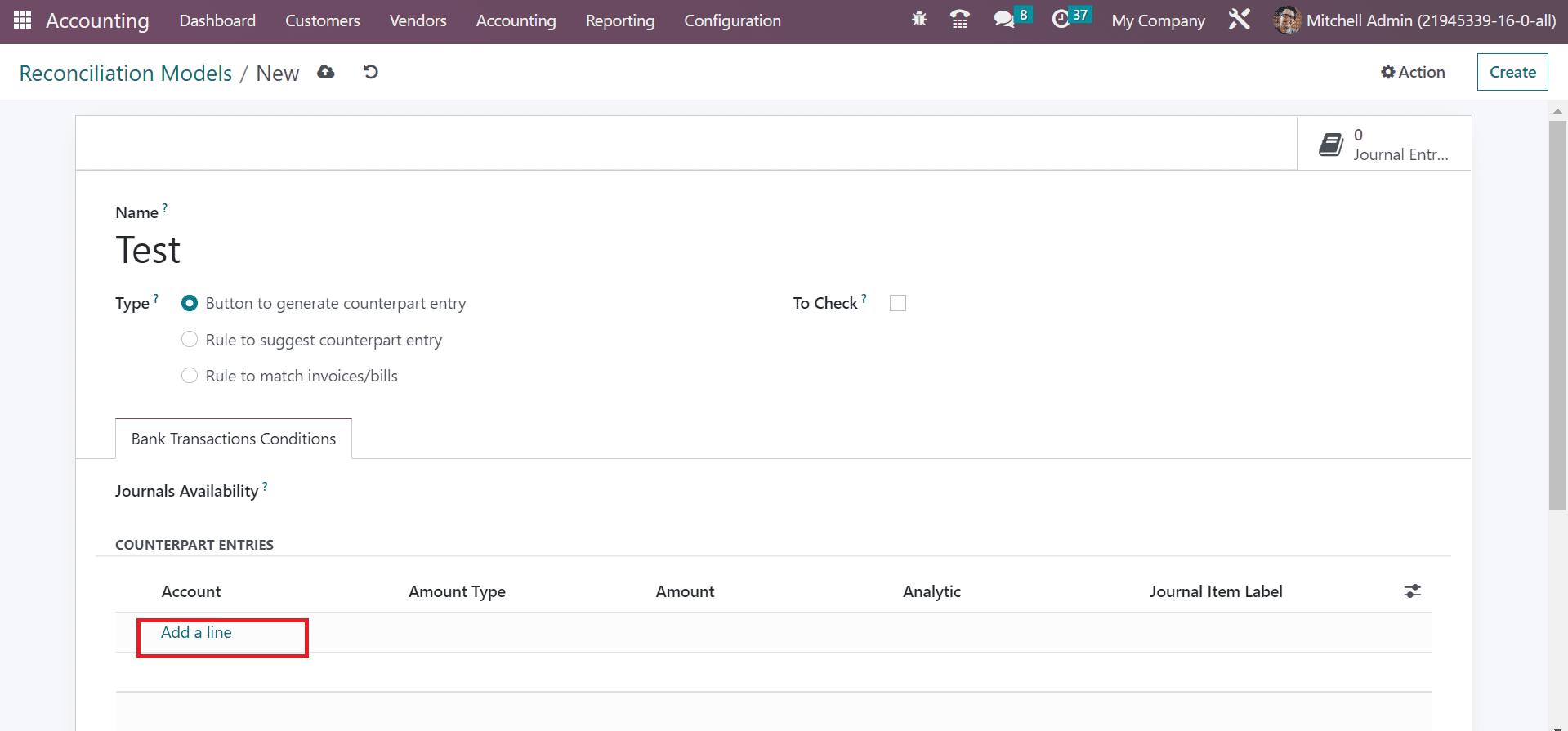

The two available journals for the reconciliation model are bank and cash. If you want any journal, select it from the Journals Availability option, as depicted in the above screenshot. To apply for a new entry, you can select the Add a line option below the COUNTERPART ENTRIES section.

In the open space, we can add Account, Amount, Amount Type, and more, as displayed in the screenshot below.

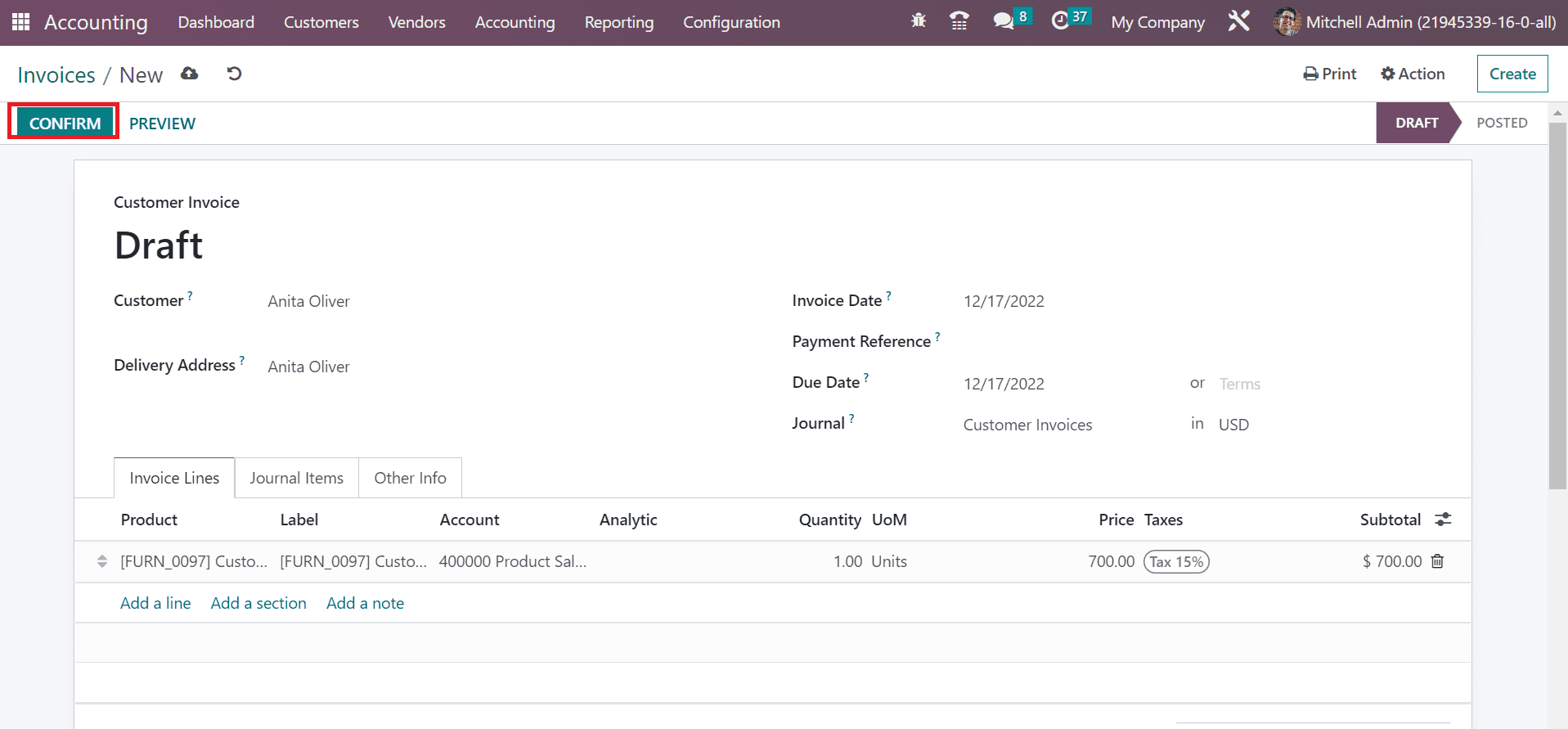

Select the save option manually after mentioning essential data regarding the Reconciliation Models. This reconciliation model will be ready to use after managing button-generated counterpart entries. We can develop a customer invoice to test it. Users can access the Invoices menu from the Accounting Dashboard of the Customer Journal. Choose your Customer, Invoice Date, Due Date, and more in the new window. After adding essential data, press the CONFIRM icon in the Invoices window, as marked in the screenshot below.

Later, you can design a bank statement and proceed with further procedures.

Invoice Analysis in Odoo 16 Accounting

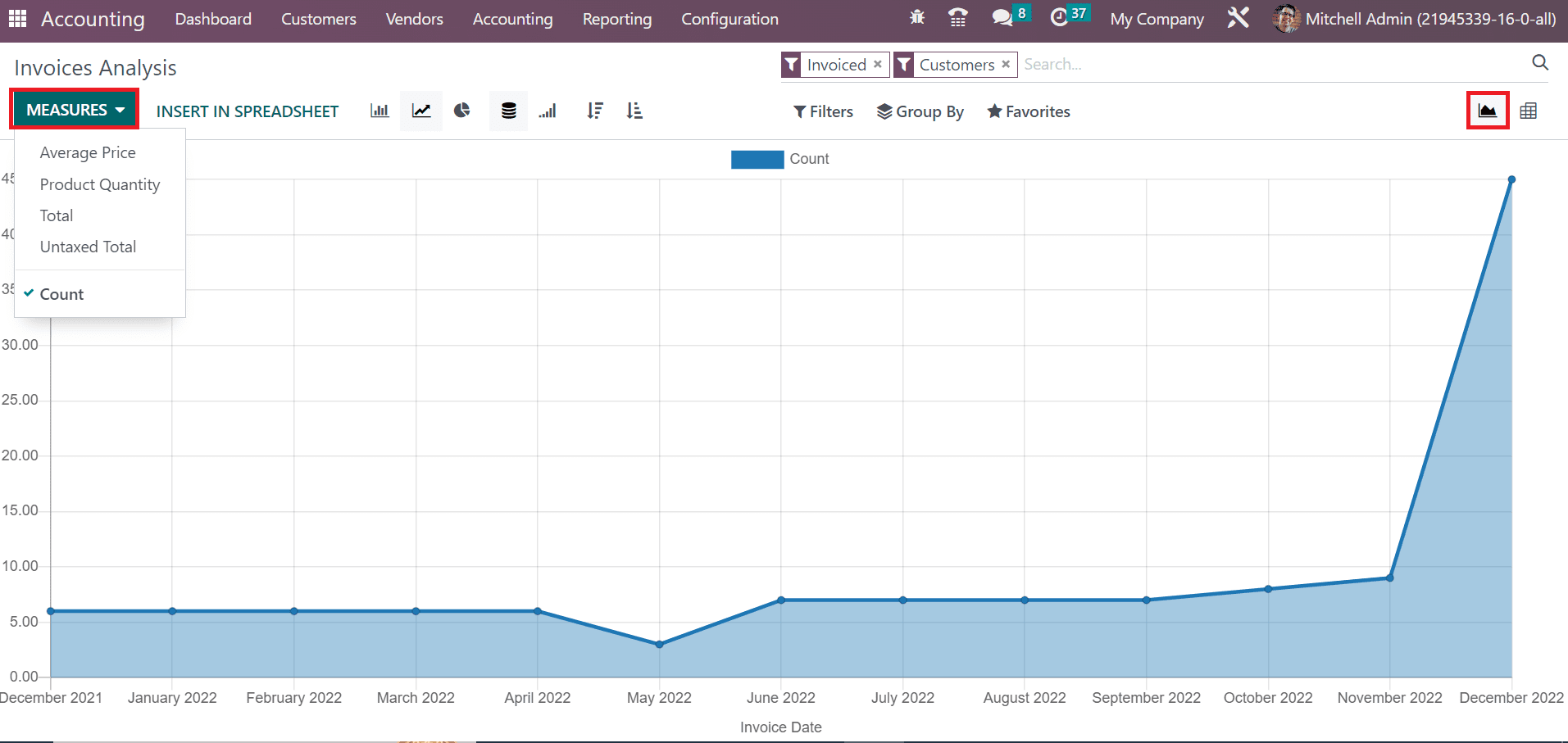

Odoo 16 Accounting module is beneficial for evaluating invoices in a company. In the Graph view, the user can see data concerning the Invoice Date on X-axis and Count on Y-axis. We can apply various values to the graph once choosing the MEASURES icon, as portrayed in the screenshot below.

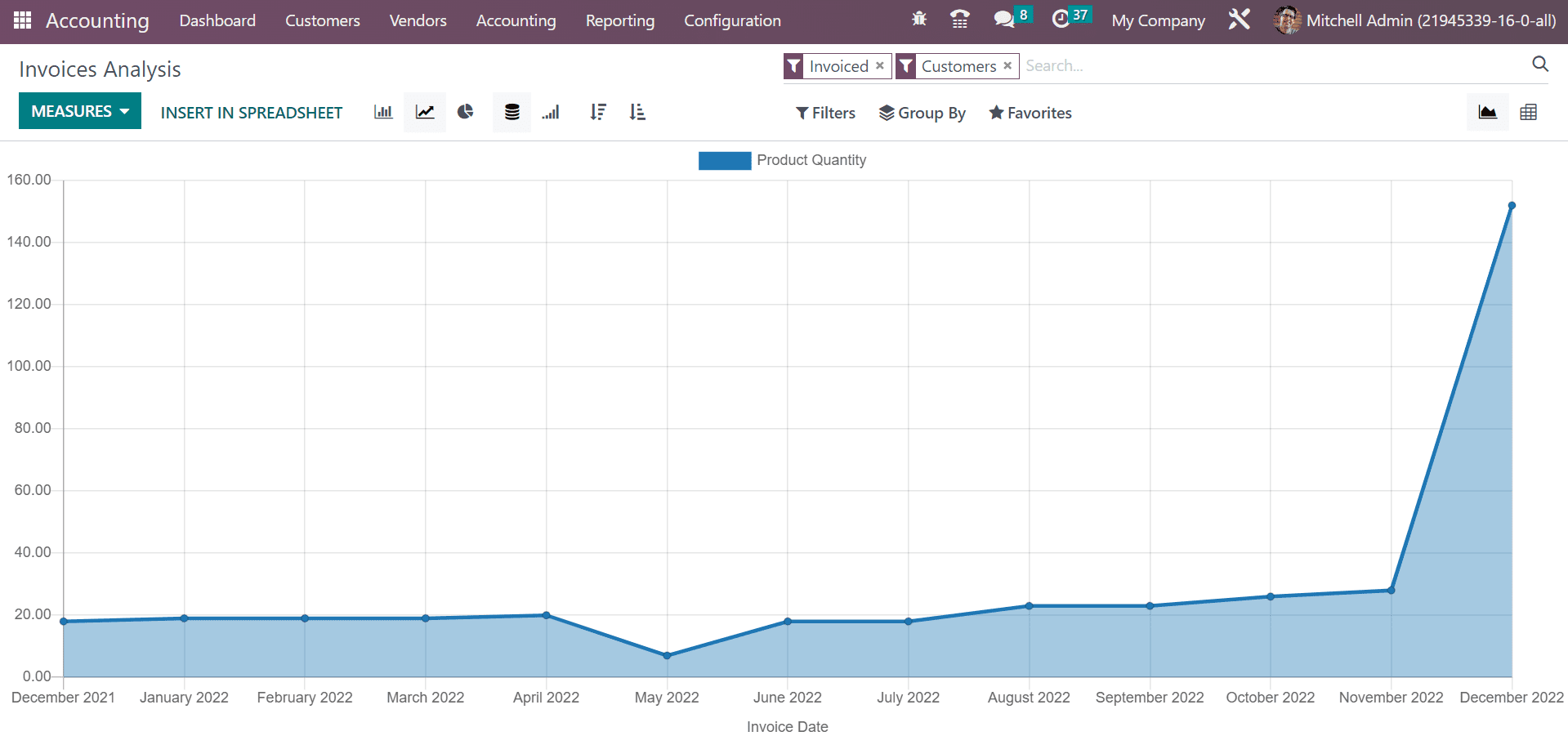

For example, you can select the Product Quantity option in the MEASURES button if you want to analyze the invoice based on the number of commodities. Respective results are viewable on the graph once selecting the Product Quantity option.

So, evaluating invoices in a firm becomes a more straightforward process using the Odoo 16 Accounting.

The reconciliation process becomes simpler once setting the reconciliation models. Invoice maangemnt and statement efficiency enrich quickly through these models. Accurate workflow is accessible to each company with an effective reconciliation model management.