The transportation of goods from one member state to various recipients, including another member state or consumers, is known as intra-community distance sales. It is commonly taxed in a member state where transfers are ending, and micro business sales are taxable on transport beginning in member states. Intra-community distance sales cover orders of physical goods, telesales, mail orders, and more. The goods sales to private customers in other member states instead of direct meeting with the seller is defined as EU distance sales. Most organizations apply Value Added Taxes(VAT) on distance sales paid to a member state for delivering the services/goods. By imparting ERP software, management of intra-community distance selling for European Unions has become an easy process. Odoo 16 Accounting assists users in specifying the EU Intra Community distance sales and mentioning specific VAT on a country.

These blog assists users in activating EU Intra-Community Distance Selling with the Odoo 16 Accounting module.

EU Intra Community Distance Sales

Distance selling with European Union mainly concerns eCommerce sales with private EU buyers. An intra-community distance sales manager quickly through Union One-Stop Shop (OSS) is a virtual portal that helps the business register for OSS. Uniting an online OSS portal for each EU Member state is possible. An organization can generate new taxes and fiscal positions per the company’s country when using an EU Intra Community Distance Selling. We can view some factors that depend on EU Intra Community Distance Sales below.

Dispatched or Transported Goods

Dispatching goods on behalf of the supplier takes place in intra-community distance sales in various ways. Firstly, a supplier can subcontract the goods transportation to a third party who assists in delivery. On the other hand, suppliers can accept partial or total responsibility for goods delivery provided by a third party. The transport fees by a customer are collected by a provider and set aside for another party. Hence, goods delivery is not possible without the permission of a supplier.

Several Customers

Goods supply is limited to specific customers when using the Intra community distance selling. Particular customer includes non-taxable customers and legal persons covering international bodies, NATO, etc. Apart from these, taxable persons related to second-hand margin schemes, flat rate schemes of farmers, and more are also part of the customer lists.

Internet Sales

Online goods purchased by customers also apply in distance selling for value-added tax needs. Various VAT rules are claimed for electronically supplied services through the internet. All of these come under the community distance sales to manage taxes and fiscal positions.

How to Configure EU Intra-Community Distance Selling in the Odoo 16?

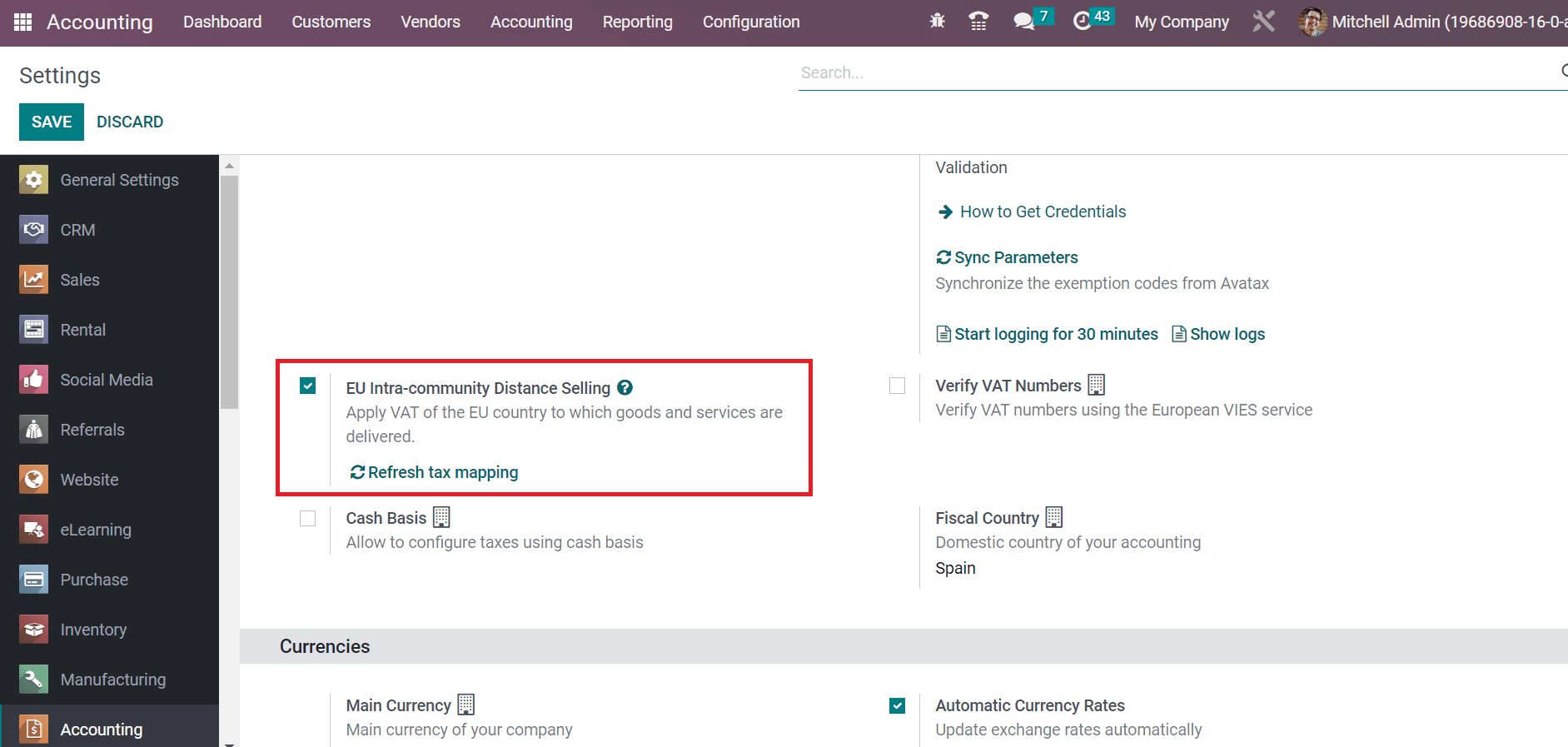

Physical goods purchased over the internet, phone, sales, mail order sales, and goods transportation intervenes indirectly by suppliers are included in an intra-community distance selling. Supplied goods after assembly and new means of transport are excluded from the intra-community sales. You can acquire the EU distance selling feature within the Odoo 16 ERP software and manage taxes in your firm in different countries. Select the Settings menu inside Configuration, and the user can view the Taxes section. Enable the EU Intra-community Distance Selling feature from the Settings window of Odoo Accounting, as described in the screenshot below.

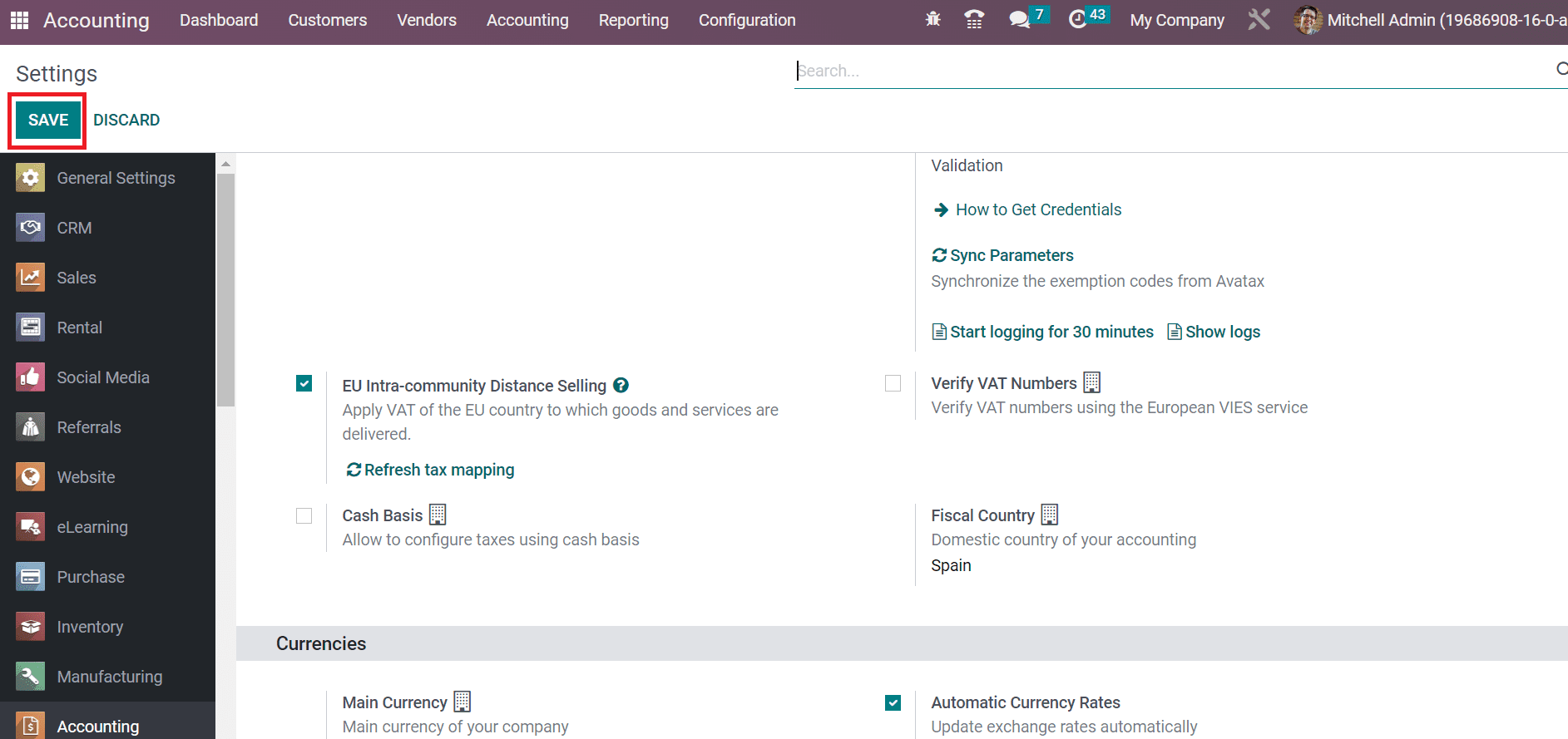

By enabling the EU Intra-community Distance Selling feature, users can mention value-added taxes concerning the EU country for delivering services and commodities. Click the SAVE icon after activating the specific part, as marked in the screenshot below.

All necessary taxes required for each EU member state are automatically created as per the company’s country once the EU Intra-community distance selling feature is activated. Now, let’s check out the fiscal positions of your company’s countries after enabling the EU distance selling quality.

Taxes and Fiscal Positions in each EU Member State in Odoo 16 Accounting

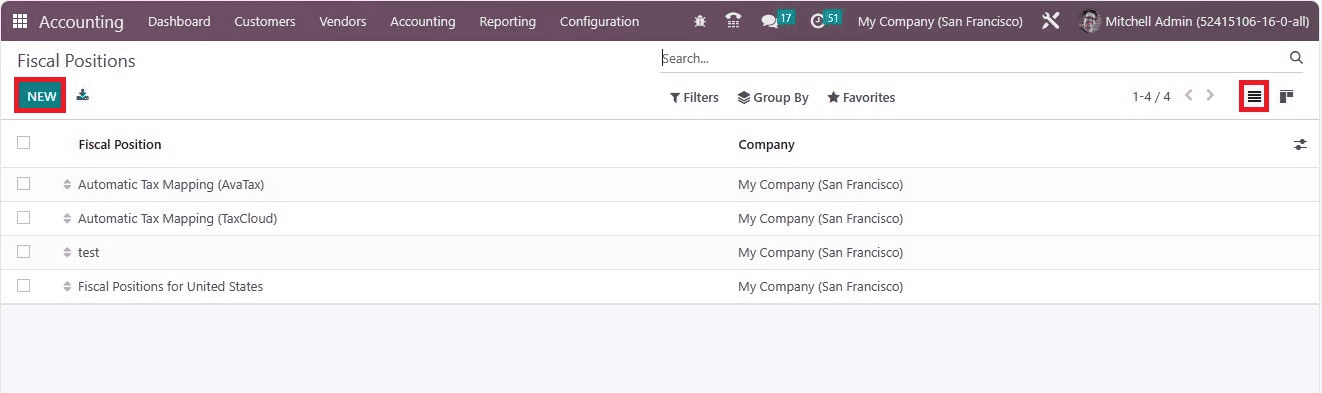

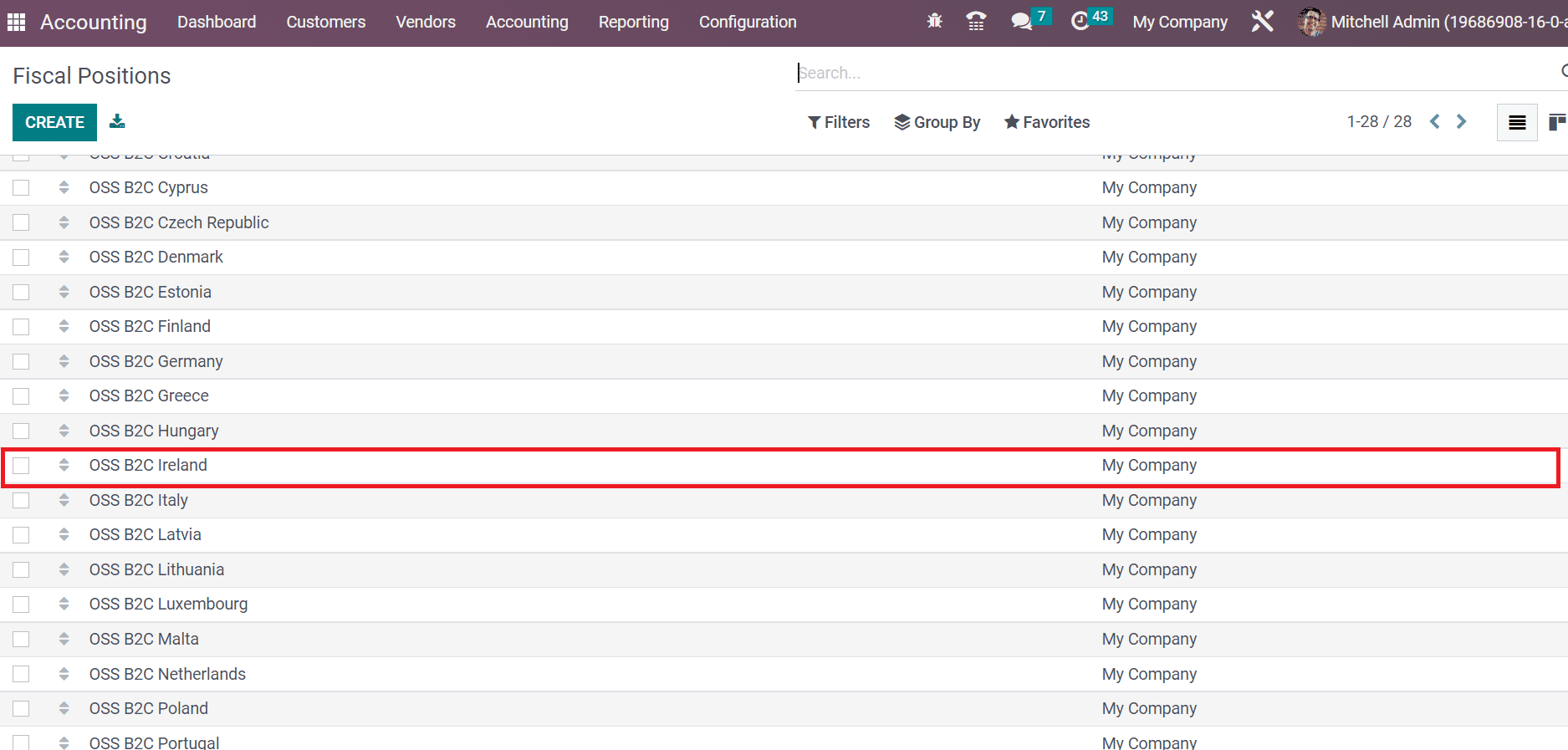

The partnership of the European Union between 27 European countries is defined as Member states or EU Countries. Most of the European continent is covered by them, and certain EU countries consist of Austria, Italy, Romania, Poland, etc. Most member states are regularly individualistic concerning fiscal policy. The difference between current expenditure and revenue is represented through a fiscal balance. Choose the Fiscal Positions menu in the Configuration tab, and a record of all fiscal positions concerning EU Member states is accessible to the user. In the List view, you can obtain details such as Company and Fiscal Position, as portrayed in the screenshot below.

Click the CREATE button to generate a new fiscal position regarding your country. We can enable the VAT for a specific country by selecting the particular Fiscal position. For example, select the fiscal position of Ireland if you want to set Value added taxes(VAT) for Ireland. We choose the Fiscal Position for Ireland as specified in the screenshot below.

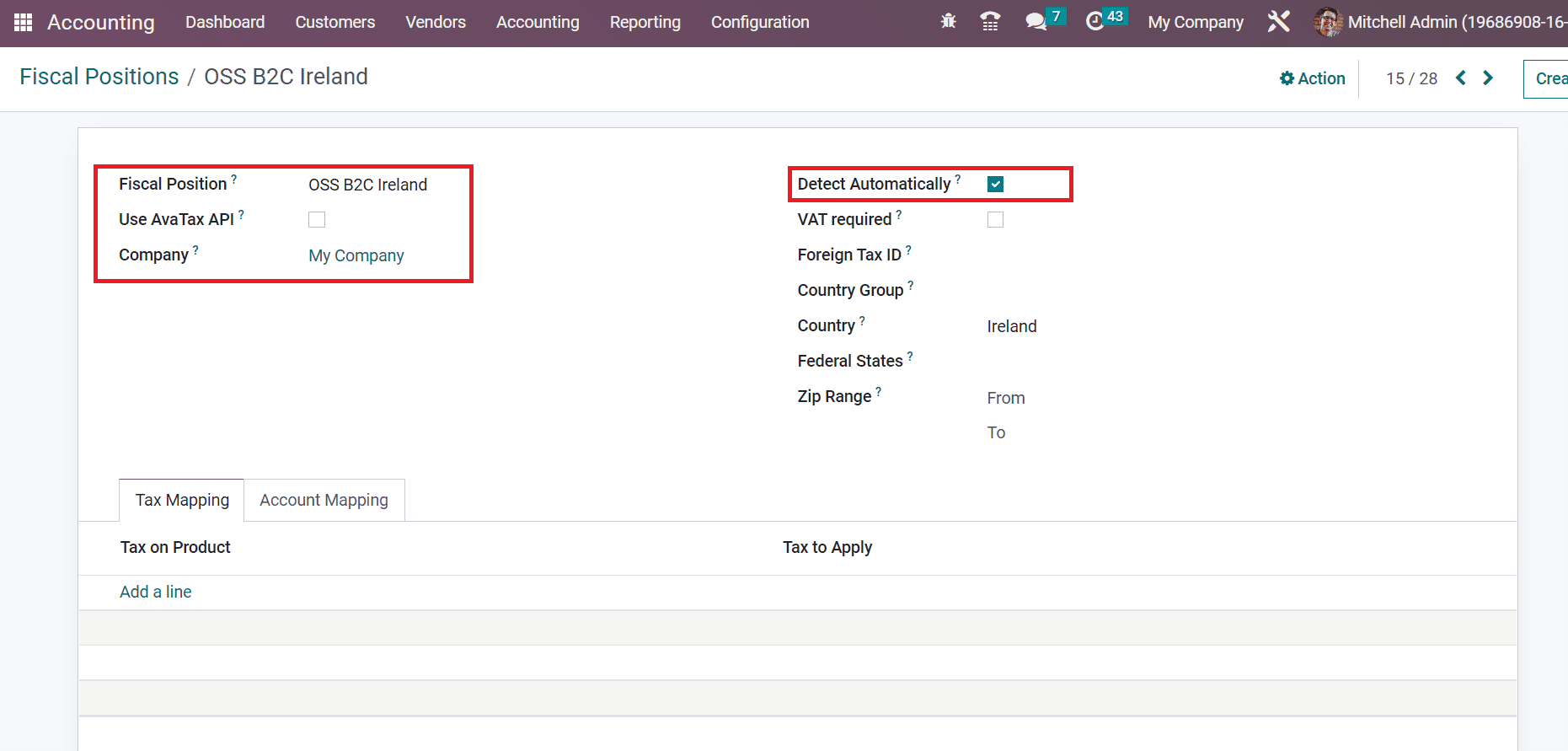

In the new window, we can see the Fiscal Position as OSS B2C Ireland and the Company name. Applying for the fiscal position automatically, enable the Detect Automatically option as indicated in the screenshot below.

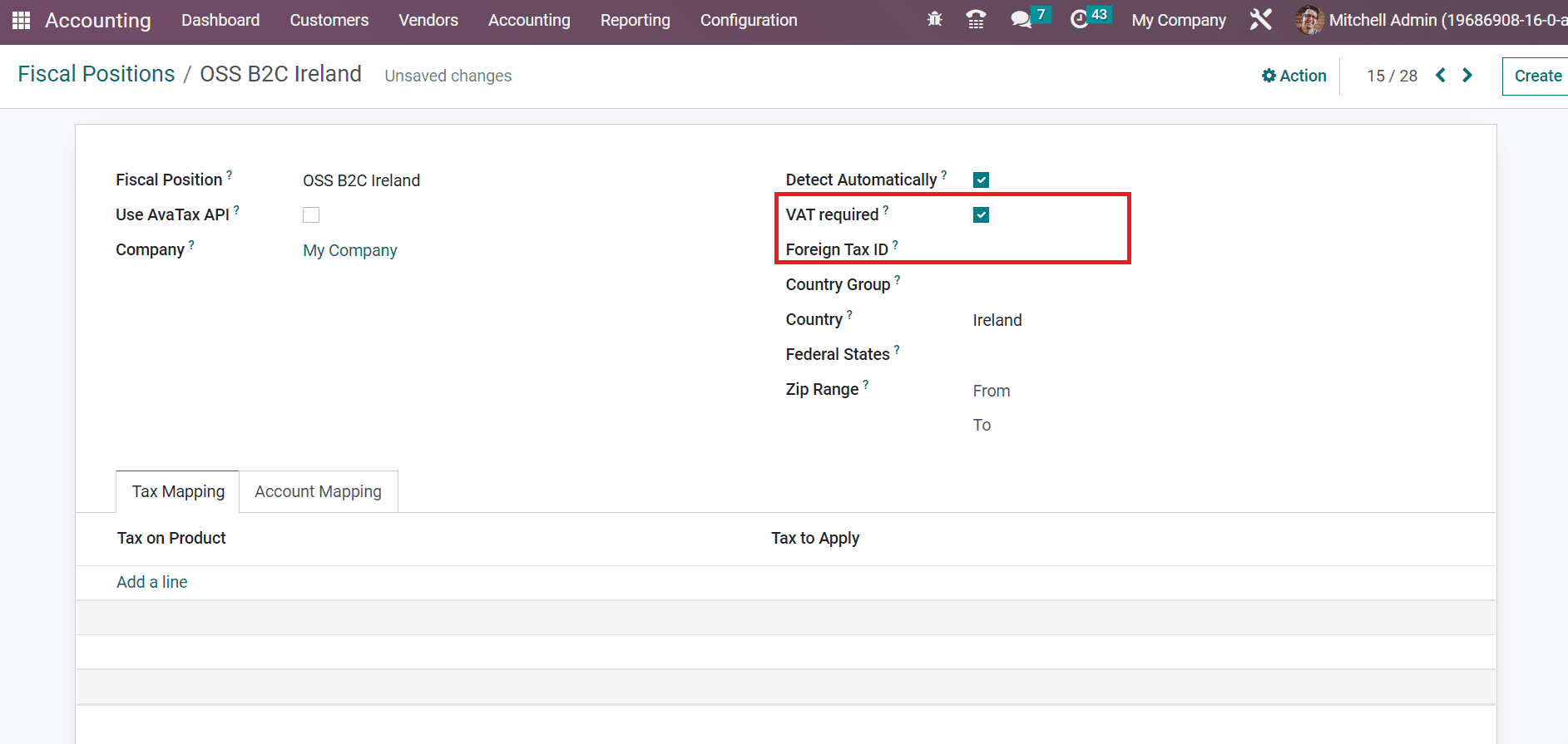

Users can enable the VAT required field if the partner has a VAT number. As per the mapped region fiscal position, you can enter your company tax id in the Foreign Tax ID option, as illustrated in the screenshot below.

The fiscal position of a specific country name is viewable in the Country field. Save the details after applying the necessary information about the fiscal position

Hence, it is eays to apply value-added taxes in a fiscal position according to the specific country part of your company.

Refresh Tax Mapping

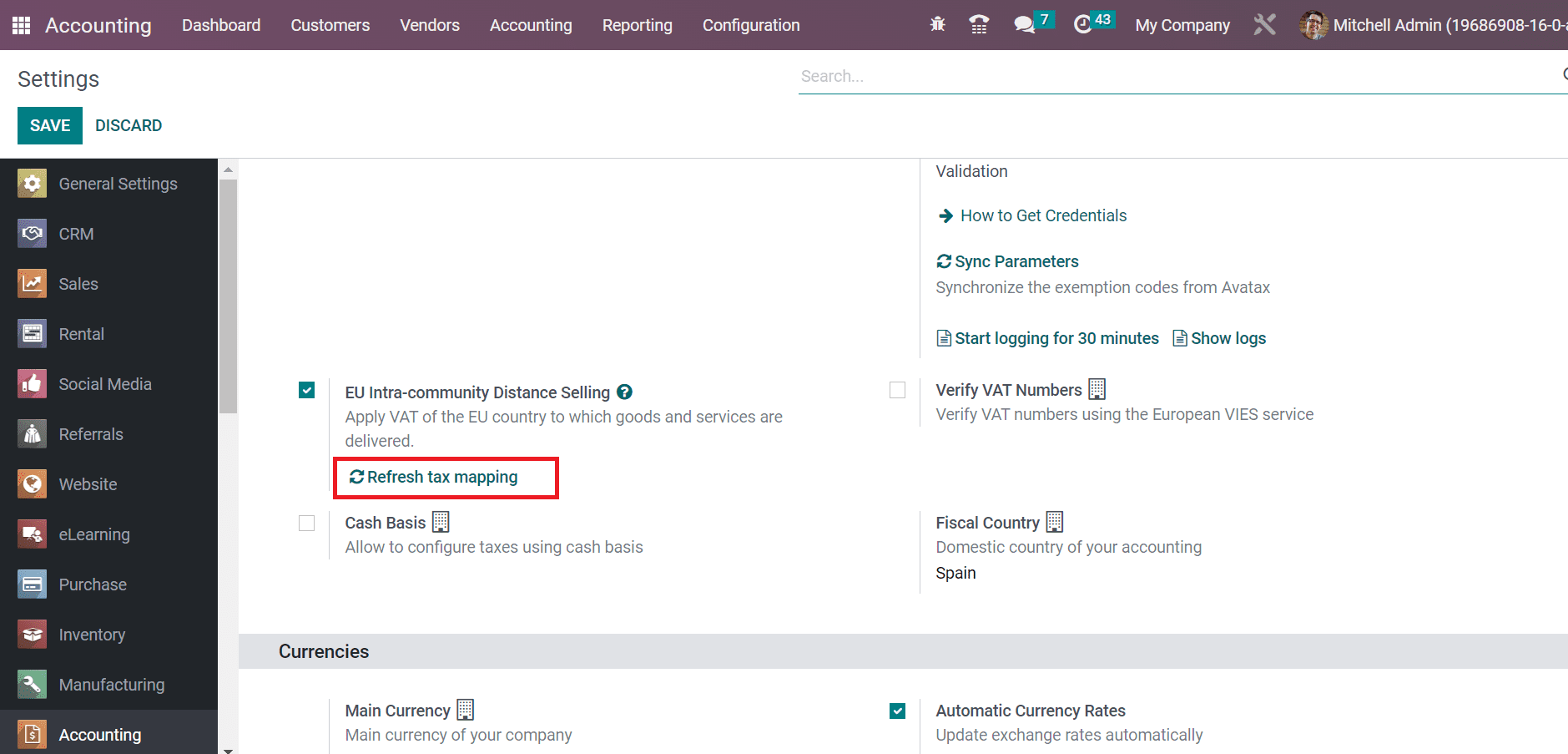

The fiscal positions are updated automatically whenever we modify or add taxes in Odoo 16 Accounting. To activate the updates, go to the Settings window of the Odoo 16 Accounting module. Choose the Refresh tax mapping button inside the EU Intra-community Distance Selling field below the Taxes section, as mentioned in the screenshot below.

Users can now manage the tax mapping under a specific fiscal position of a country within the Odoo 16.

We can manage the EU distance selling sales for a specific country by applying value-added taxes using the Odoo 16 Accounting module. Fiscal positions as per the Distance Selling Sales are generated automatically using the Odoo ERP software.

To read more about managing intra-community trade using Intrastat in Odoo 16, refer to our blog How to Manage Intra-Community Trade Using Intrastat in Odoo 16