The National Directorate of Taxes and Customs (DIAN) classifies businesses into various groups based on their revenue, the company’s nature, and other factors. Hence tax bound differs on each type of company. Some pre-configured taxes like IVA, Rte IVA, Rte ICA, Rte Fuente, and chart of accounts, specific to localization, are introduced for the company to operate their business in Colombia.

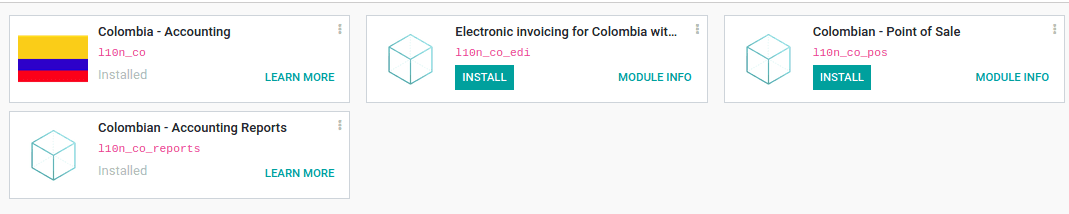

Install the Colombia accounting package in the Odoo database.

Colombian localization provides the electronic invoicing option from Odoo V12 itself.

The Colombian localization package includes the following modules:

Colombia-Accounting (l10n_co): All the basic features for handling the accounting module including a chart of account, default taxes, identification document types, etc.

Electronic invoicing for Colombia with Carvajal (l10n_co_edi): generates extra field Type of Invoice Value and Colombian EDI codes. Also supports electronic invoicing

Colombian Accounting Reports (l10n_co_reports): generates accounting reports for Colombia

Colombian-Point of Sale (l10n_co_pos): Colombian Point of Sale

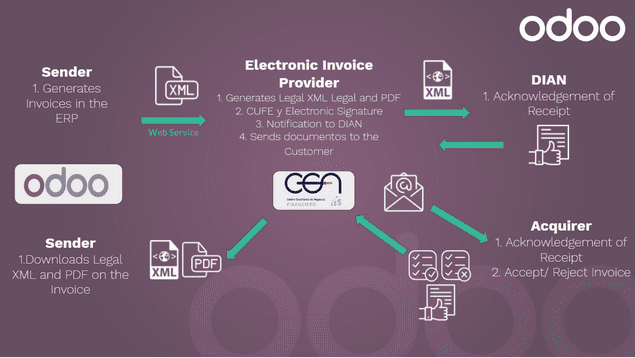

Workflow

credit: odoo.com

Configuration

After installing the colombian localisation modules, colombian accounting, and electronic invoicing from odoo apps, we will move to the configuring credentials for electronic invoicing.

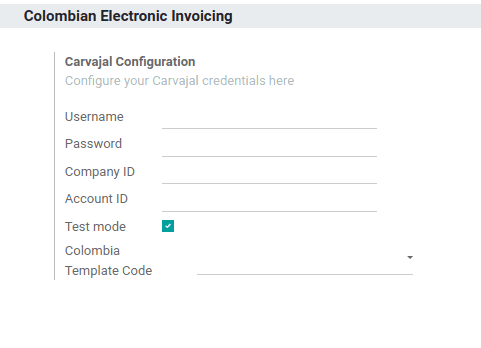

Configure credentials for Carvajal T&S web service

One has to configure the Carvajal credentials from Accounting > Configuration > Settings > Colombian Electronic Invoicing.

Add the credentials to the required fields. The test mode can be enabled so that one can connect with a Carvajal T&S testing environment. This helps users to verify the full workflow and integration with the CEN Financial portal.

The test mode can be disabled once the configuration for odoo and Carvajal are set and ready for production.

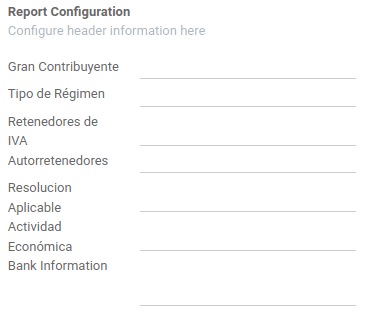

Configure your report data

To configure the electronic invoice header information, one can define the tax and bank information at report configuration.

Go to Accounting module > Configuration > Settings > Colombian Electronic Invoicing.

Configure data required in the XML

1. Partner

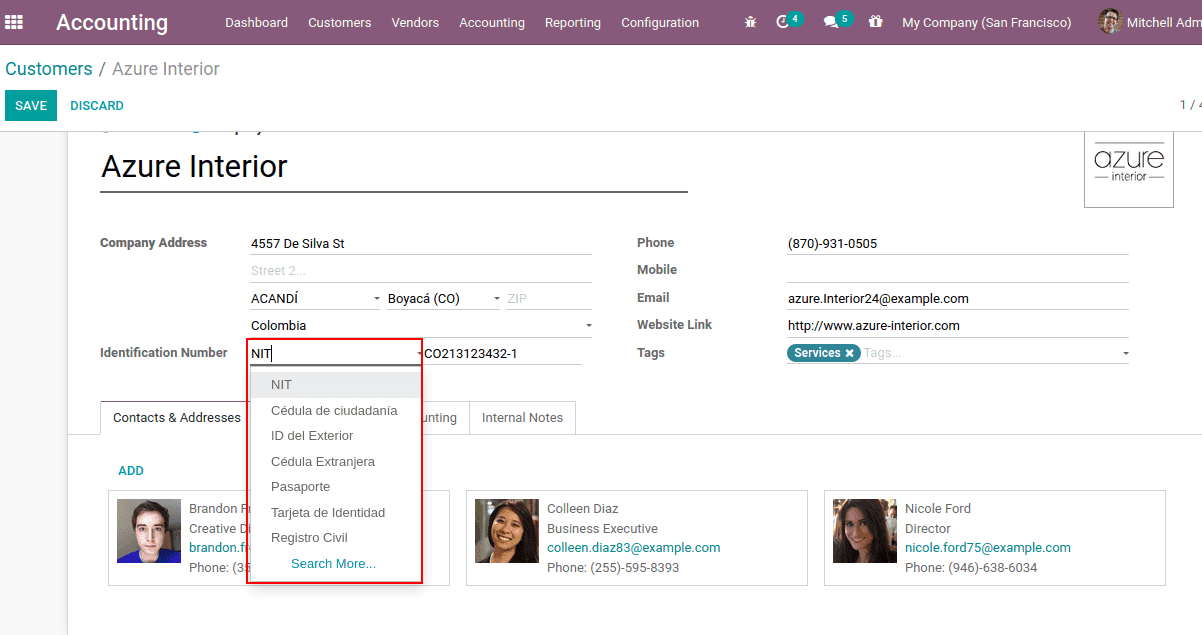

Identification: In the partner form, Colombian localization introduces fields to add the document identification number. All the partners have the field to add identification type and number.

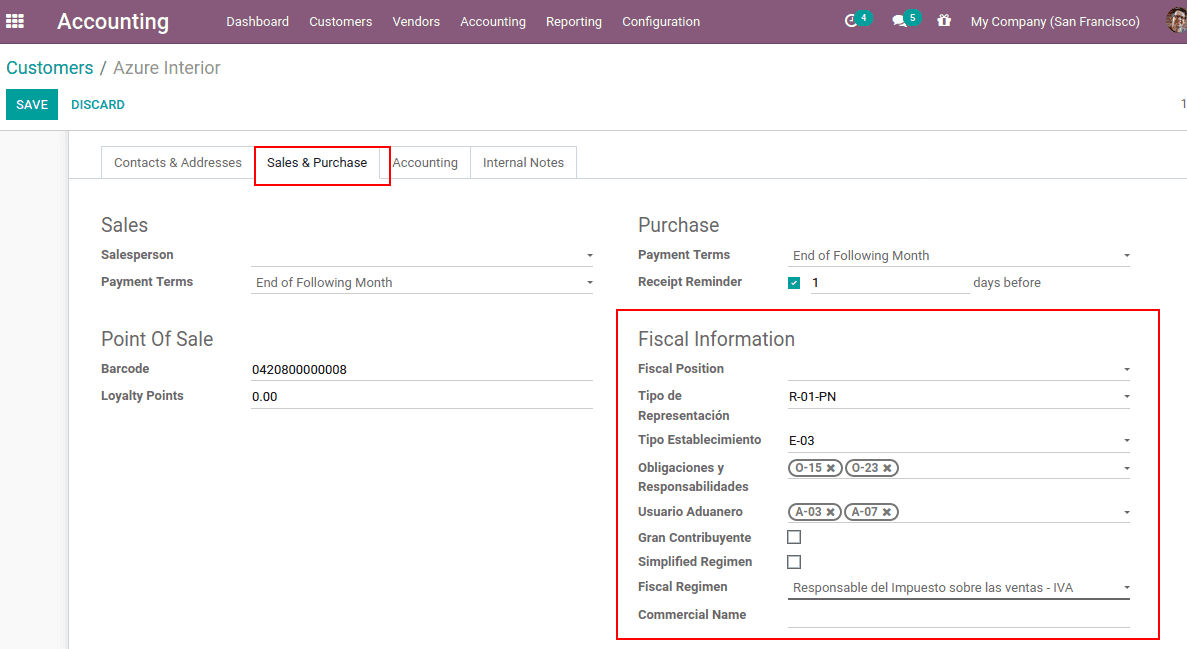

Fiscal structure: The responsibility codes of the partner is the information provided by DIAN that will be included in the electronic invoicing.

Under the sales & purchase tab of the partner form, one can add the fiscal information.

The fiscal information includes two boolean fields to add the fiscal regimen of the partner.

2. Taxes

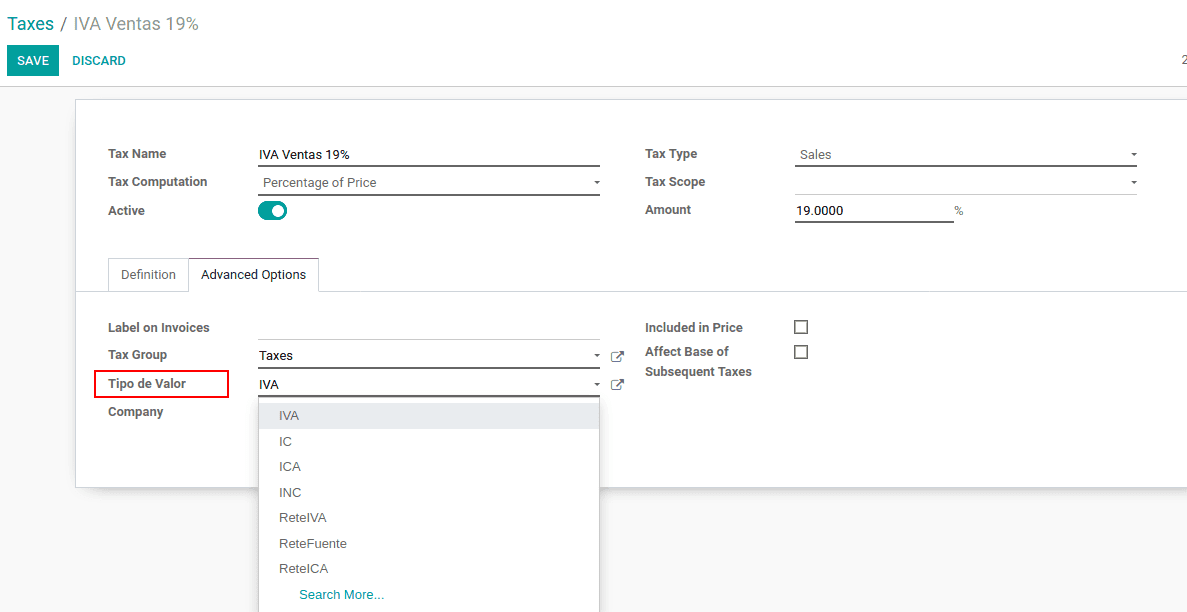

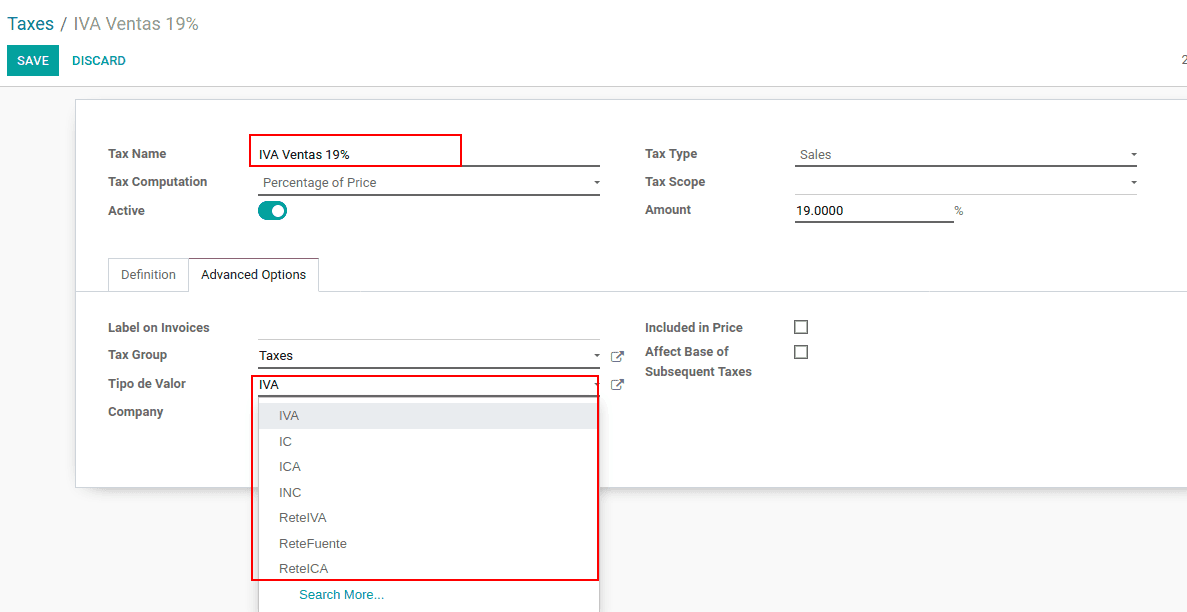

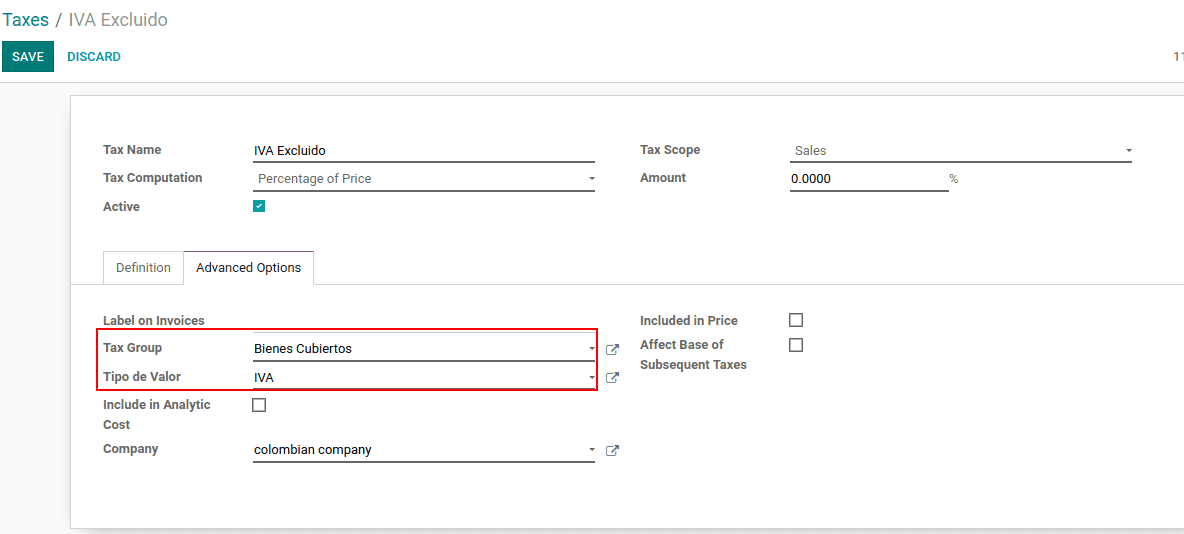

In most the cases of selling products, the tax should be imposed on the transaction. So it is important to add value type for the tax. This can be configured in the tax configuration. Go to Accounting > Configuration > Taxes, in the ‘Advanced Options’ tab of the tax one can add the value type.

The Retention tax types (ICA, IVA, Fuente) that Colombian localization provides are available in the dropdown option. This specification is used to show the taxes accurately in the PDF invoice.

3. Journals

The journal related to the invoice is updated once the DIAN assigns an official sequence and prefix for the electronic invoice resolution. Activate the developer mode and go to the journal from the accounting configuration menu. The sequence number gets updated in the journals. Then configure the prefix anr the next number of the sequence number and should synchronize with the CEN Financiero.

CEN Financiero is the website of the CEN (Electronic Business Center) which enables companies to exchange financial information between business partners in an adaptable and online way for efficient resource management, assisting the management on multiple areas like accounting, billing, investments, other financial deliveries.

4. Users

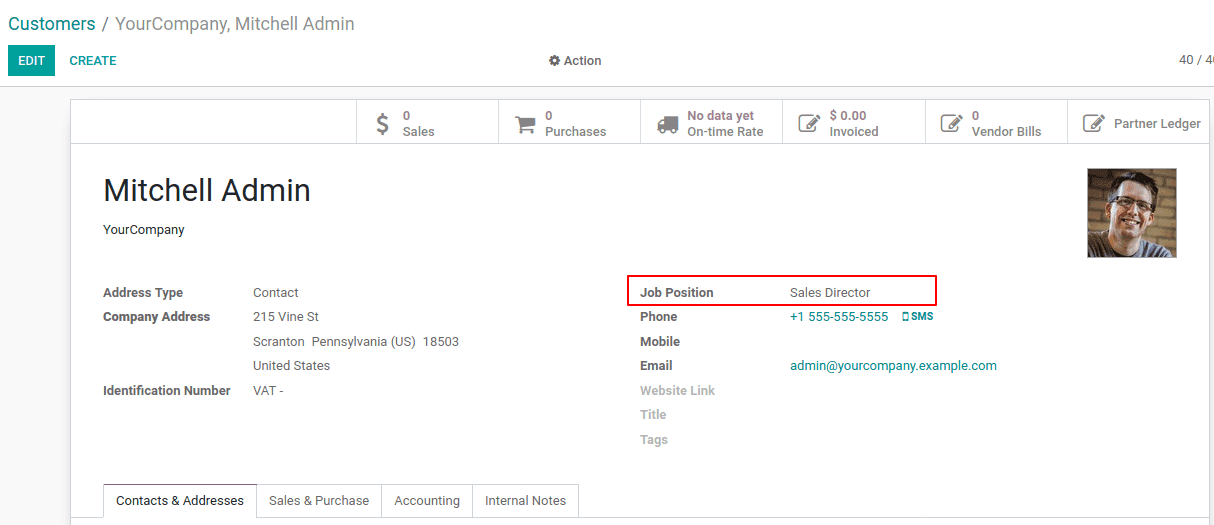

The invoice PDF template of Odoo will include the job position of the partner by default. Thus the job position should be added in the partner form.

Usage and testing

Invoice

To test the workflow of an electronic invoice is only possible if all the master data and credentials are configured correctly. The National Directorate of Taxes and Customs (DIAN) in Colombia creates new legal criteria for e-invoicing. The resolution determines which businesses are expected to invoice electronically, sets a timeline for the systematic use of e-invoicing, and describes the invoicing type to become electronic.

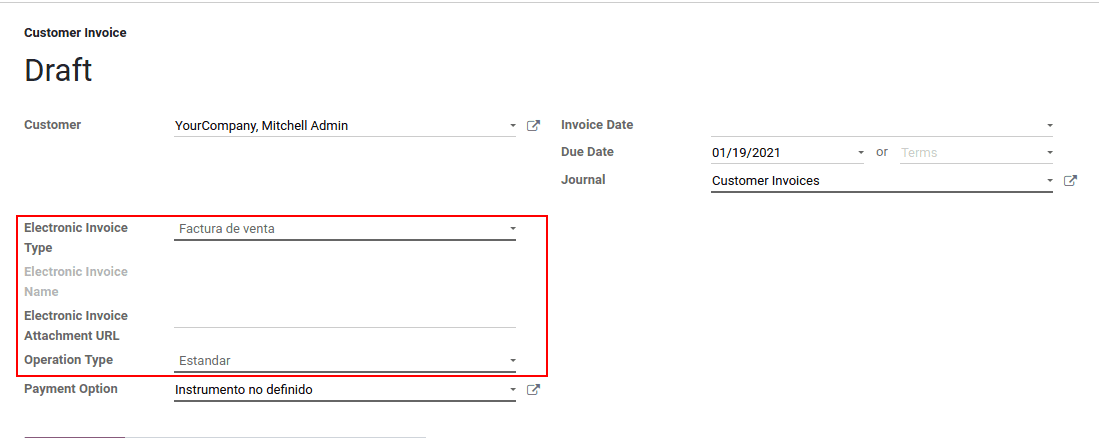

One can create the invoice as created in default Odoo. There are some additional fields while creating the invoice.

Electronic Invoice Type includes:

Factura Electronica (Electronic bill): The regular document type used for invoices, credit/debit notes etc.

Factura de Importación (Import invoice): For importation transactions, this type is used

Factura de contingencia (Contingency bill): This type is used rarely. It is used in cases when the user is not able to the ERP and it becomes necessary to generate an invoice manually. So when the invoice is being added to the ERP this invoice type can be used.

So once the invoice is created and posted, an XML file is generated and automatically sent to Carvajal. The details including the file can be viewed in the chatter. Then the electronic invoice status updated to ‘In progress’ and in the ‘other info’ tab a new field updated as the same name of the XML file.

Reception of legal XML and PDF

Once the xml file is received by the electronic invoice vendor it verifies the information in it. Now from ‘Actions’ click on ‘Check Carvajal status’. If all the data in the invoice are valid, the invoice status changes to ‘Validated’.

For now, the legal XML document and PDF document can be generated with a QR code and a unique code (CUFE). In the chatter, the zip file of these xml and pdf documents can be shown and if needed it can be downloaded. Then the invoice status changes to ‘Accepted’.

The functional workflow of the Credit/Debit note is the same as that of the invoice.

Annex 1.7 in colombain localisation (Updation)

The Colombian Tax Administration (DIAN) published a new resolution 00042/2020 in May 2020. It intends to set new requirements for compliance with Colombia's requirement for electronic invoicing, and to integrate, in a single clause with numerous regulations in the area of electronic invoicing.

A significant feature of this latest resolution is that it also contains Technical Annex 1.7-2020, which is necessary for the enforcement of the mandate. The DIAN has also added several recent revisions to the previous version 1.7 of the Technical Annex, with a view to incorporate some of the changes contained in Technical Annex 1.8 which can not be given due to legal challenges.

New resolution 00042 brings changes in

- Billing systems

- Technology providers

- The registration of the electronic sales invoice as a security

- The technical annex of the electronic sales invoice is issued and

- Other provisions regarding billing systems are issued

Annex 1.7: Main Changes

- Changes in the definition of Partner.

- Inform covered goods for the 3 days without VAT.

- Tax description update.

- The concept is added for Excluded VAT.

- Inform the effective date of delivery of the goods.

- Adjustments in the Graphic representation (PDF).

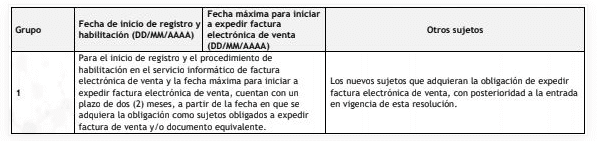

Calendar

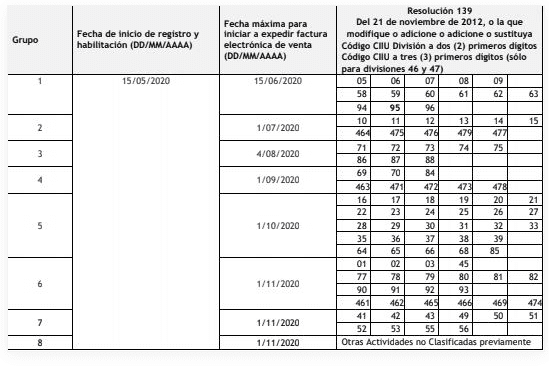

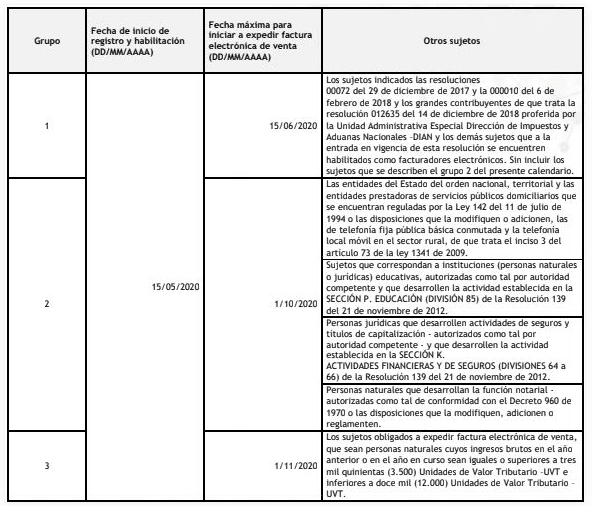

There are several deadlines for production release under the conditions of Annex 1.7, which depend on the following factors:

1. Implementation schedule according to the main economic activity in the RUT:

2. Implementation of calendar for other obligated subjects:

3. Permanent implementation schedule

Requirements in Odoo

In order to encourage the implementation of standard Odoo V12 and v13 databases, it would only be necessary for admins to update those modules and to create master data relevant to new procedures.

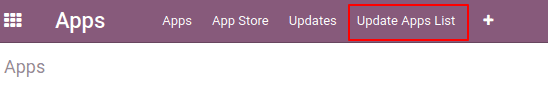

Activate the developer mode and go to Apps, then click on ‘Update Apps list’.

Update Modules

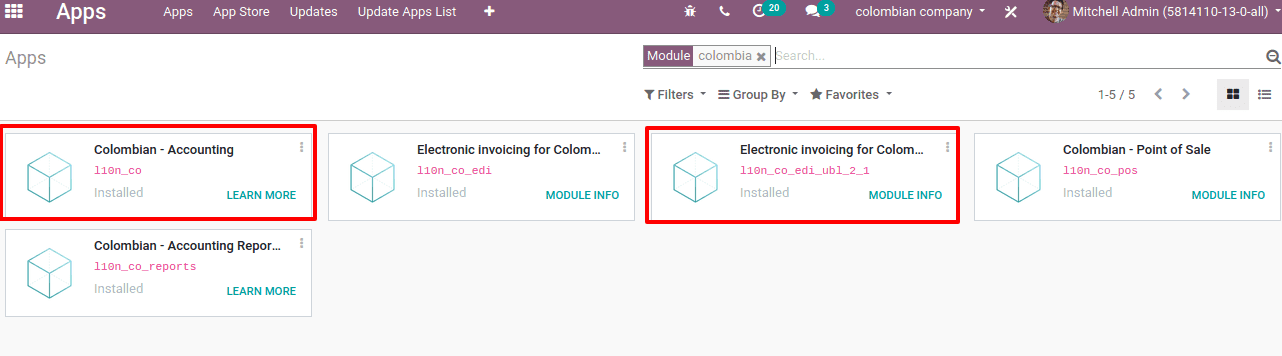

Now search for Colombia in the apps which will show all the related modules of Colombian accounting package. Update two modules ‘Colombian - Accounting’ and ‘Electronic invoicing for Colombia with Carvajal UBL 2.1’.

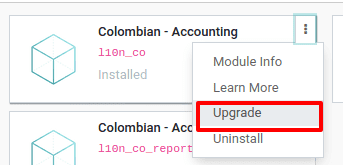

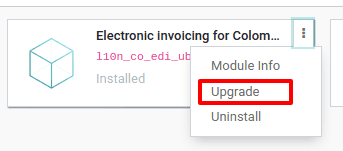

For each module, at the right top corner there will be 3 points. Click on it and upgrade.

Upgrading Colombian- Accounting (l10n_co),

Upgrading module, Electronic Invoicing for Colombia with Carvajal UBL 2.1 (l10n_co_edi_2_1)

Master Data

In order to properly operate in the existing databases, i.e, in V12 and V13 as of June 2020, one must create necessary master data.

1. Partner Data

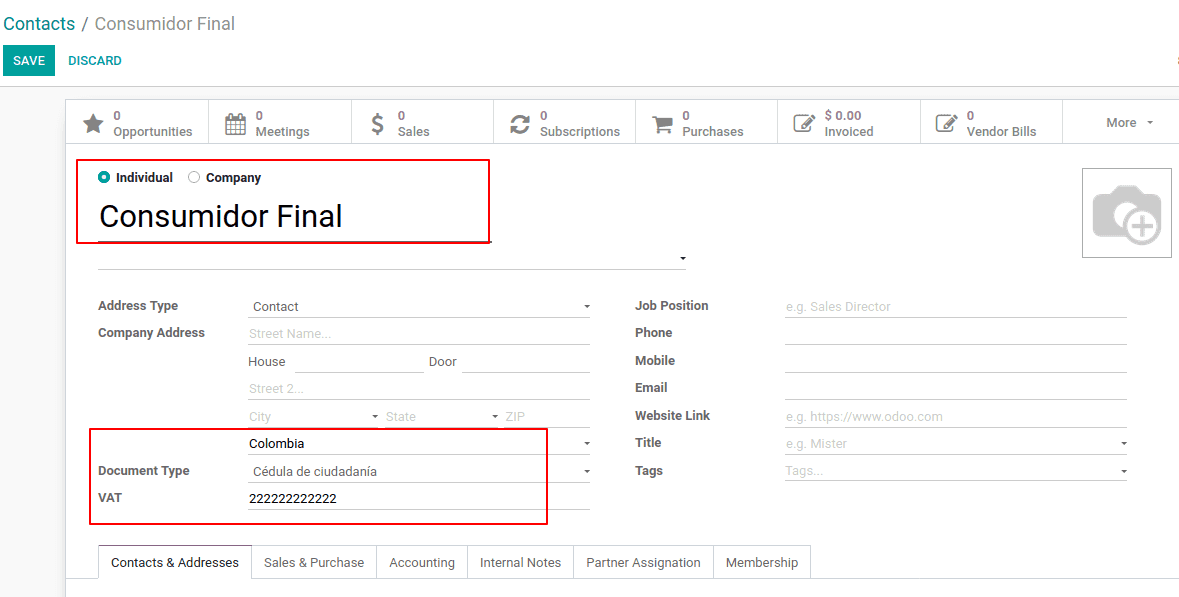

One has to create a partner contact with all the characteristics defined by the DIAN. So, while creating an invoice/bill for the partner all the information like tax and demographic information of the client are available. The partner details should include the following:

- Contact Type: Individual

- Name: Final Consumer

- Type of document: Citizenship Certificate

- Identification Number: 222222222222

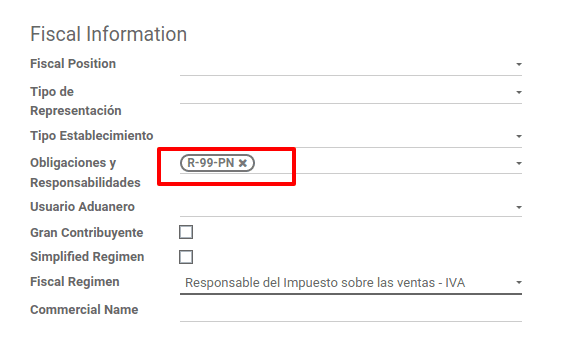

In the fiscal information section of the ‘Sales & Purchase’ tab, add obligations and responsibilities as R-99-PN.

2. VAT Excluded for covered goods

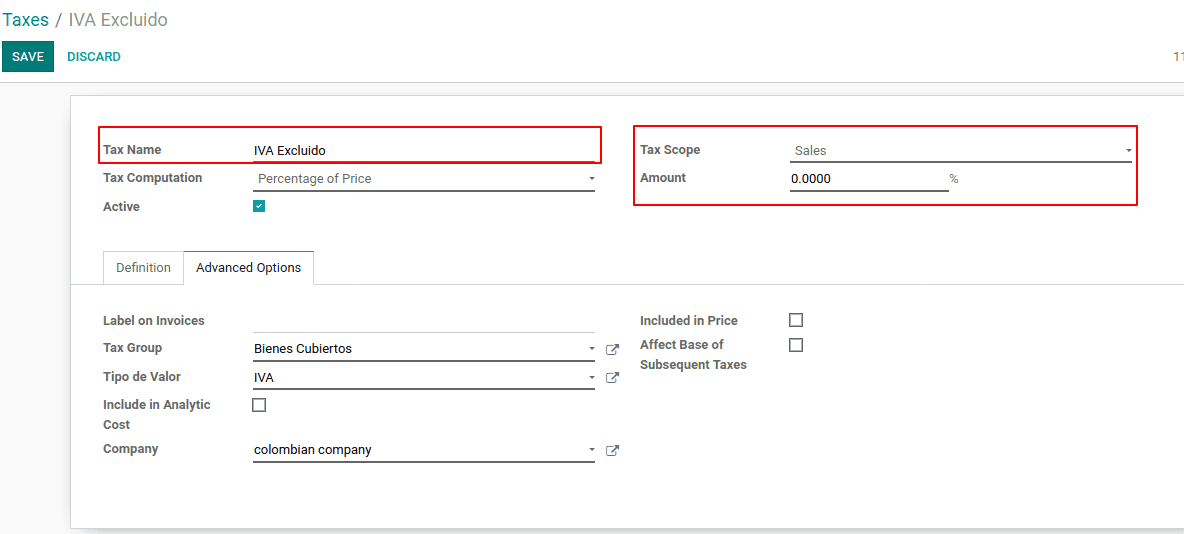

To report the transactions made through Covered Goods for the three days without VAT, it is necessary to create a new Tax to which a specific tax group must be associated. The new tax will be used by Odoo to add the required section in the electronic invoice XML. Taxes can be created from Accounting > Configuration > Taxes.

For tax excluded VAT, the amount can be given a 0%. Under the ‘advanced options’ tab, the tax group can be added as ‘Bienes Cubiertos’(covered goods) and value type as IVA.

3. Departments description update

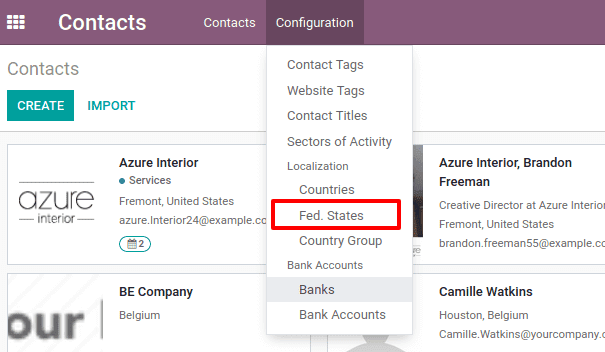

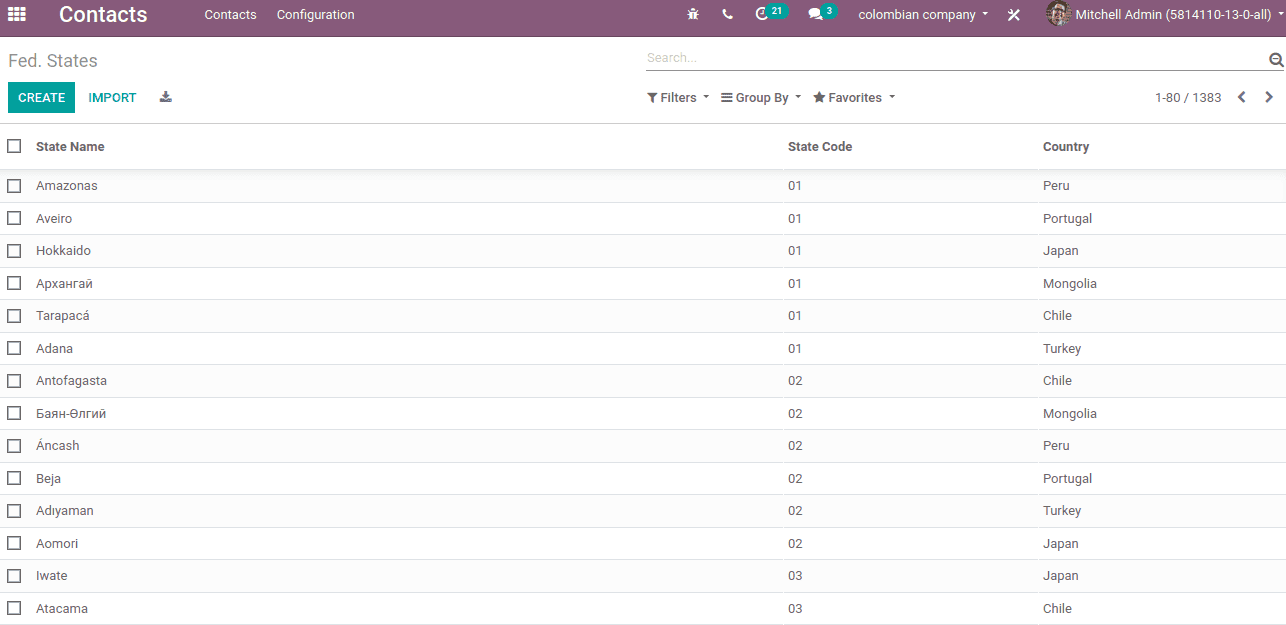

It is essential to modify the listing of certain departments for which we will have access to the Contacts Module from Configuration menu > Fed. States

Later, one can add by Country to clearly identify the states of Colombia.

One can use filter and group by option to sort the fed.states based in-country, state name, or state code.

4. Postal Code Verification

The postal code of the addresses for Colombian contacts corresponds to the official tables defined by the DIAN, so it must be verified in Annex 1.7 to ensure that this field is duly filled in according to those defined in

Codigos_Postales_Nacionales.csv Operational Considerations

Once the partner record has been created, it must be used on-demand, generally it will be used in point of sale billing transactions.

The validation process of the Invoice will be carried out in a conventional way in Odoo and the invoice will be generated in the same way. Upon detecting that the identification number corresponds to the Final consumer, the XML that is sent to Carvajal will be generated with the corresponding considerations and sections.

VAT Excluded - Covered Goods

On May 21, 2020, Decree 682 was published, which establishes a special exception in sales tax. The main objective of this decree is to reactivate the economy in Colombia due to the low sales generated due to COVID.

Dates

Days of exemption from sales tax - VAT for covered goods (3 days WITHOUT VAT).

Day One: June 19, 2020

Second day: July 3, 2020

Third day: July 19, 2020

Due to the fact that these transactions will be generated in an exceptional way and that there is a combination of several factors and conditions, the producers must be updated manually in Odoo, temporarily assigned the sales tax exempt VAT - Goods covered in each company as appropriate.

Some of the main conditions that companies must verify according to the rules includes,

- Type of products and maximum price

- Payment methods ( Payment must be made by electronic means, for example, credit/debit cards or online payment mechanisms )

- Limit of units ( Each customer can purchase only 3 units maximum of each product )

Measurements in Odoo

1. Data preparation

- Create the Tax for Covered Assets

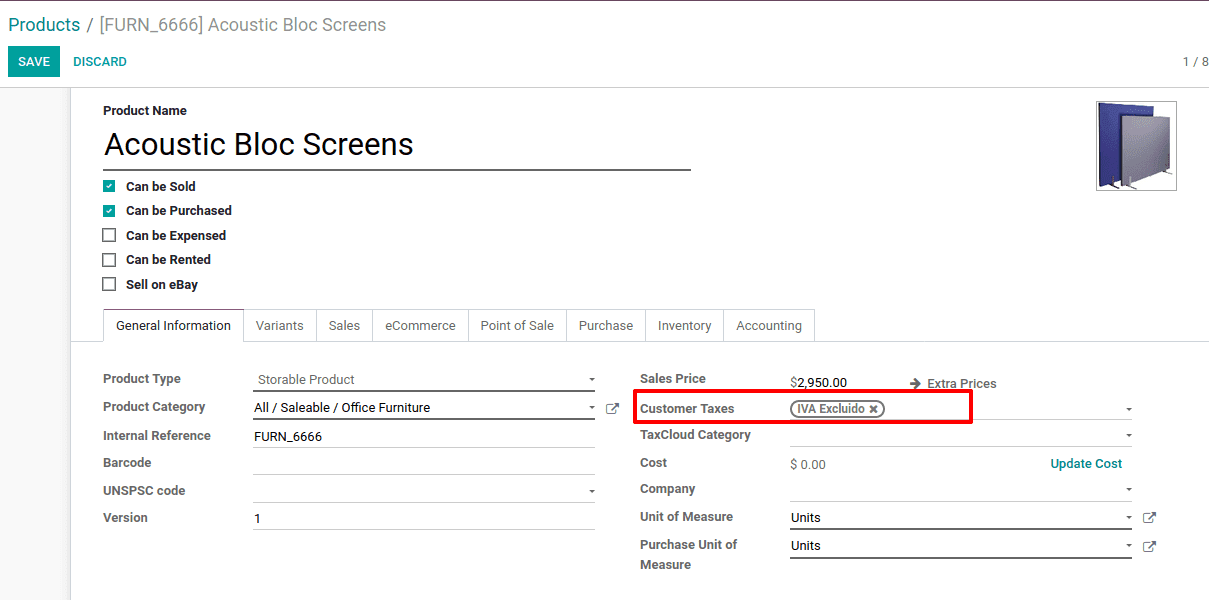

- Identify the products and transactions on which VAT exclusion is applied according to the new rule(Decree 682). In the case of a large number of items, it is suggested that the tax be temporarily changed in Odoo.

- Export a list of products that will be affected, including the VAT field for sale, which will be temporarily replaced by VAT for covered goods.

- At the end of the operations of the day before the established dates of the day without VAT, the temporary update to VAT of Covered Goods must be made

2. During the day WITHOUT VAT

- By default, the products previously considered with VAT of covered goods will be generated with this parameter both in sales orders and invoices created during the same day

- Sales orders generated with this tax must be invoices on the same day

- In case any of the conditions is not fulfilled (example the payment is made in cash) the tax must be updated manually at the time of invoicing.

3. After the day WITHOUT VAT

- The products that were updated must be reconfigured to their original VAT

- If any invoice sales order is detected in which VAT of Covered Goods is included, a manual update corresponding to conventional VAT must be performed.