Accounting in Odoo is sufficient for any organization to meet all their needs related to accounting. As you know for any organization, accounting is one of the most important processes in order to run the company without any financial losses. Odoo accounting is connected with all the other apps such as sales, purchase, inventory, and more.

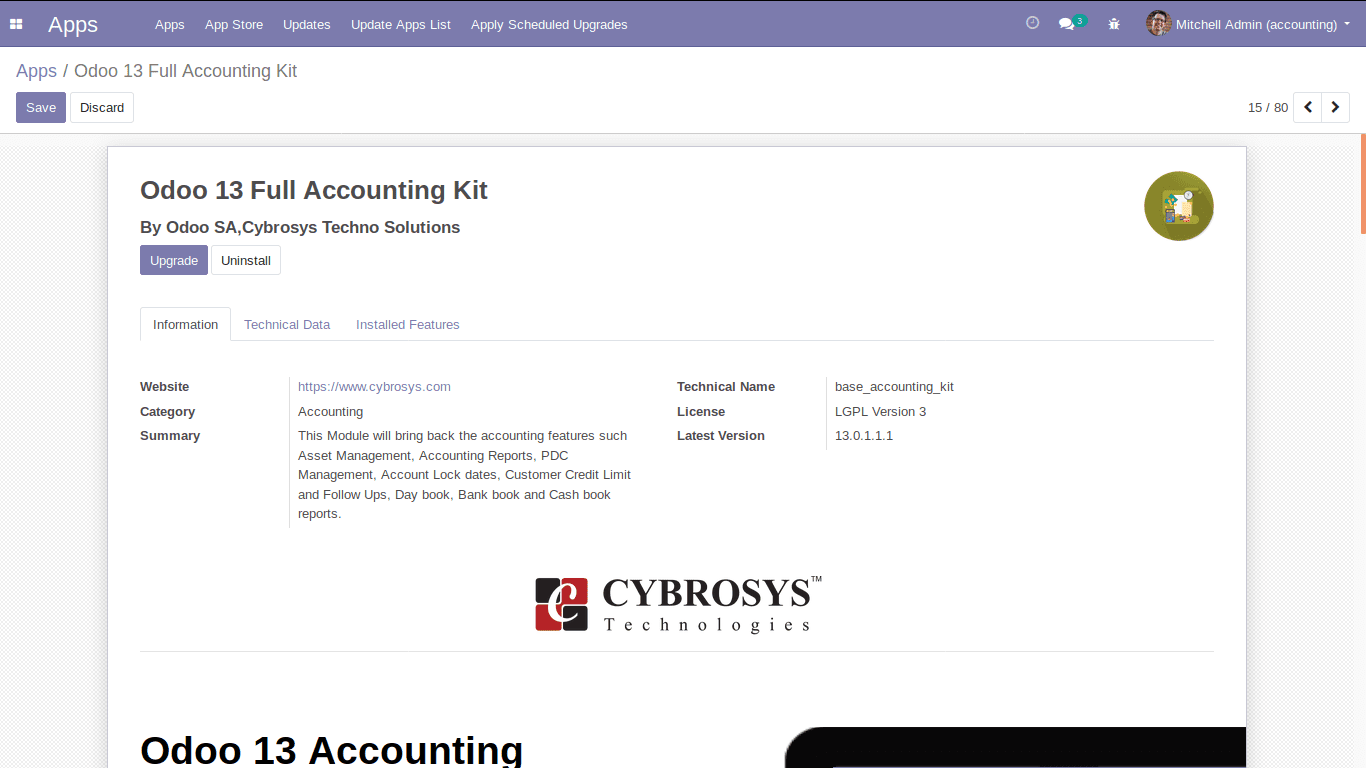

In community edition, we have only limited features available under Odoo accounting. Here comes the use of the module Odoo13 Full Accounting Kit by Cybrosys Technologies which is built under the V13 platform. This module will bring back the accounting features such as Asset management, Accounting Reports, PDC Management, Account Lock dates, Customer Credit Limit, and Follow-Ups, Daybook, Bankbook, and Cashbook reports.

You can download the module directly from Odoo Apps. via following this link Odoo 13 Full Accounting Kit

So let's see what are the features of the Odoo 13 Full Accounting Kit. As the name indicates it enables you to use the full accounting features in the community edition.

So What You Get with Odoo 13 Full Accounting Kit?

Recurring Entries

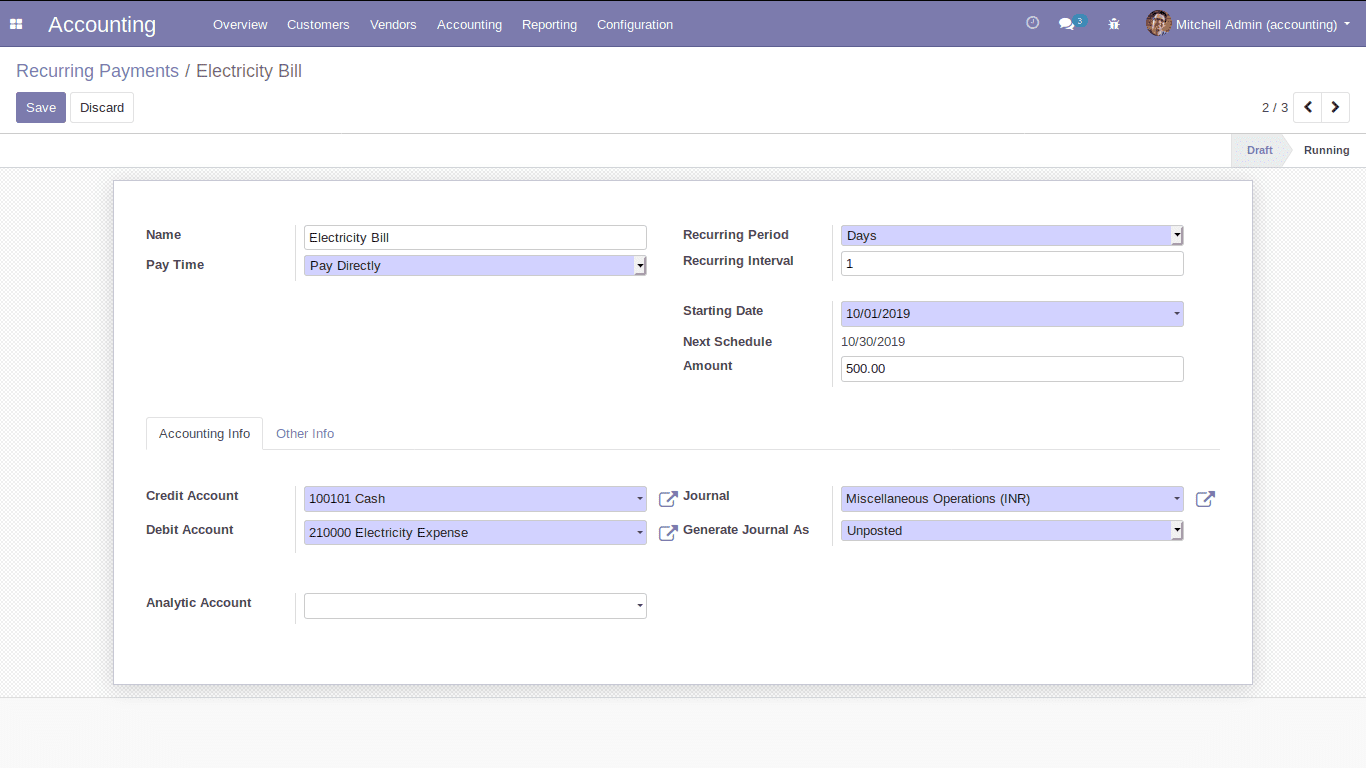

Recurring Entries is one of the most important features in this module. It allows you to generate entries for a specific bill such as electricity bill or rent which repeats periodically. So one can set the recurring template for that bill and the period for that template for which it repeats. So it will be posted or will be created as a draft automatically according to the recurring interval and recurring period. So at first, you have to create the recurring template

For that go to, Accounting -> Configuration -> Recurring Template

Enter the details in the following template:

Name: Name of the recurring payment

Pay Time: Specify whether it should be paid directly or Pay later. In case of pay later you have to select the corresponding partner.

Recurring Period: Select the recurring period whether it is days or weeks or months or years. The next schedule is calculated based on this period.

Recurring Interval: Specify the recurring interval that after how many recurring periods it should be repeated.

Starting Date: Specify the start date for the recurring payment.

Next Schedule: Next schedule is calculated based on the recurring period and recurring interval that you have specified.

Amount: Specify the amount for the recurring payment.

Generate Journal As: Here you can specify whether the journal should be posted or unposted. In case of posted, journal entries are posted automatically. And in the case of unposted, it will be in the draft stage.

After creating the recurring template you can see the template is in a draft state. Change the state to Running by clicking on the “running”. Now it is in a running state. So you can generate the entries as follows.

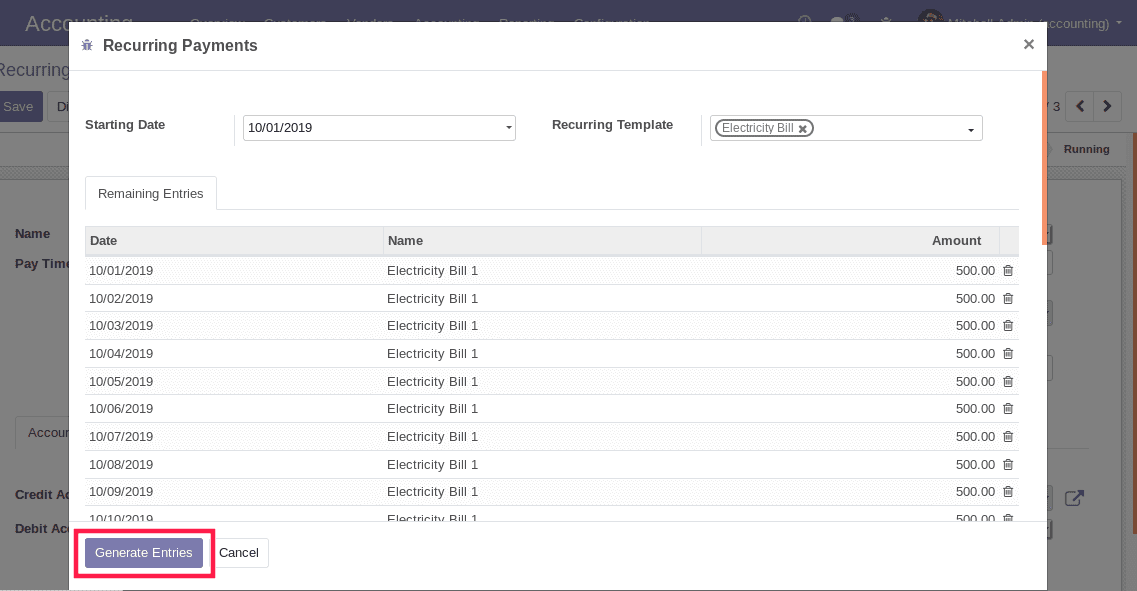

Accounting -> Customers -> Recurring Entries

You can select the start date and recurring templates. It will list out all the entries from the starting date for that selected template and you can generate the entries by clicking on the button.

Generate entries as shown below. The journal entries will be generated after that.

Customer Follow-Ups:

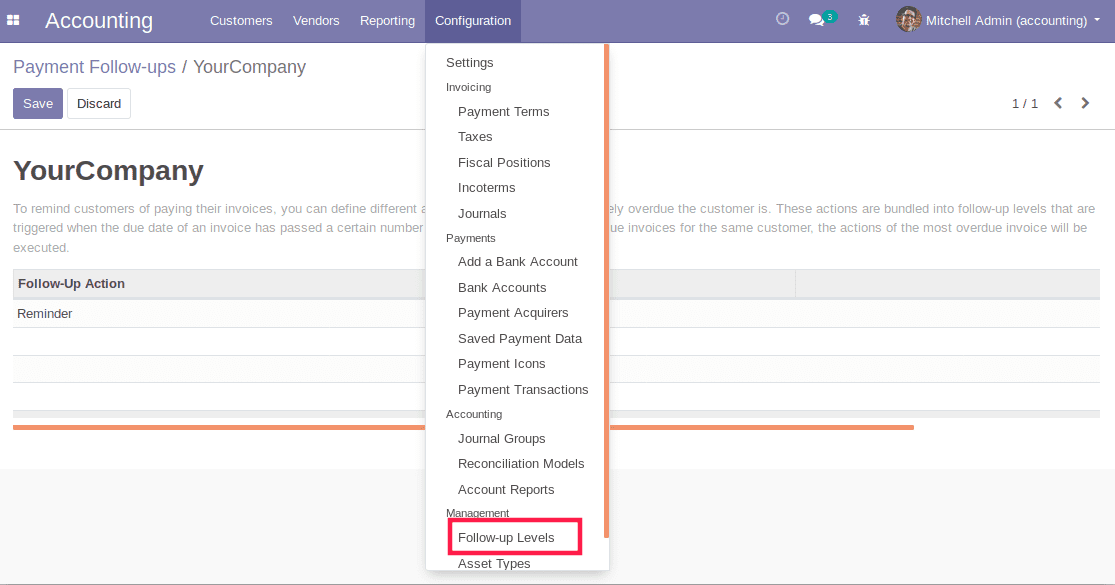

As you know in business it is essential to collect the payments that are overdue and send appropriate reminders according to the due date. Odoo enables you to set the follow-up levels for the company and you can see the follow-up reports of each customer whose payments are overdue. You can set the follow-up levels as follows.

Accounting -> Configuration ->Follow Up Levels

Here you can define the different actions depending on how severely overdue the customer is. These actions are bundled into the follow-up levels that are triggered when the due date of a customer invoice has passed a certain number of days.

Based on the follow-up level you can see the follow-up reports as shown below

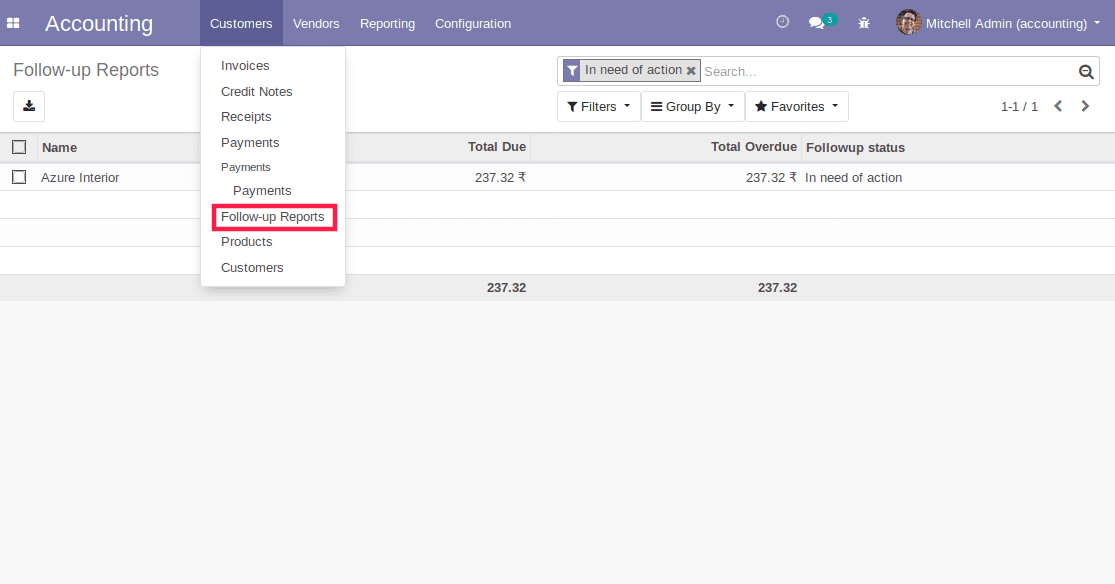

Accounting -> Customers -> Follow-up Reports

Accounting

In the menu accounting, you can see the following items.

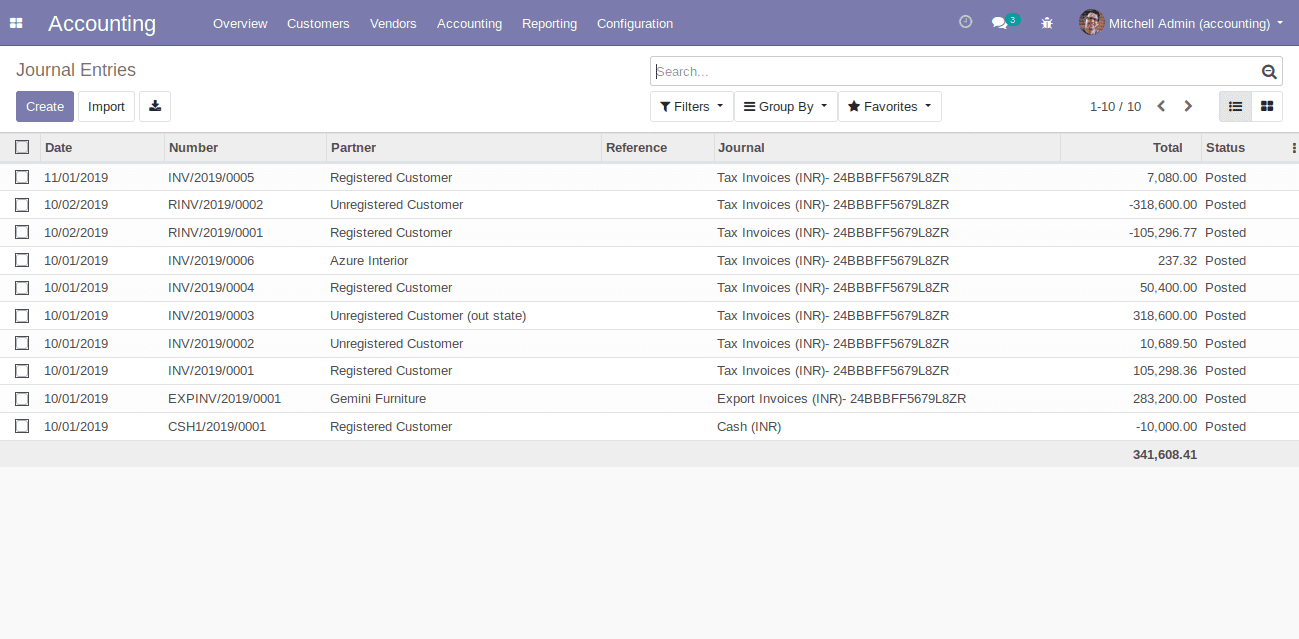

Journal Entries:

Journal entries display all the journal entries for the transactions inside your organization as shown below. While opening a journal entry, you can see the journal items of that journal. The debit and the credit amount will be displayed and also the corresponding journal and the date of the journal entry. Also, you can see whether the journal entry is posted or not simply from the tree view.

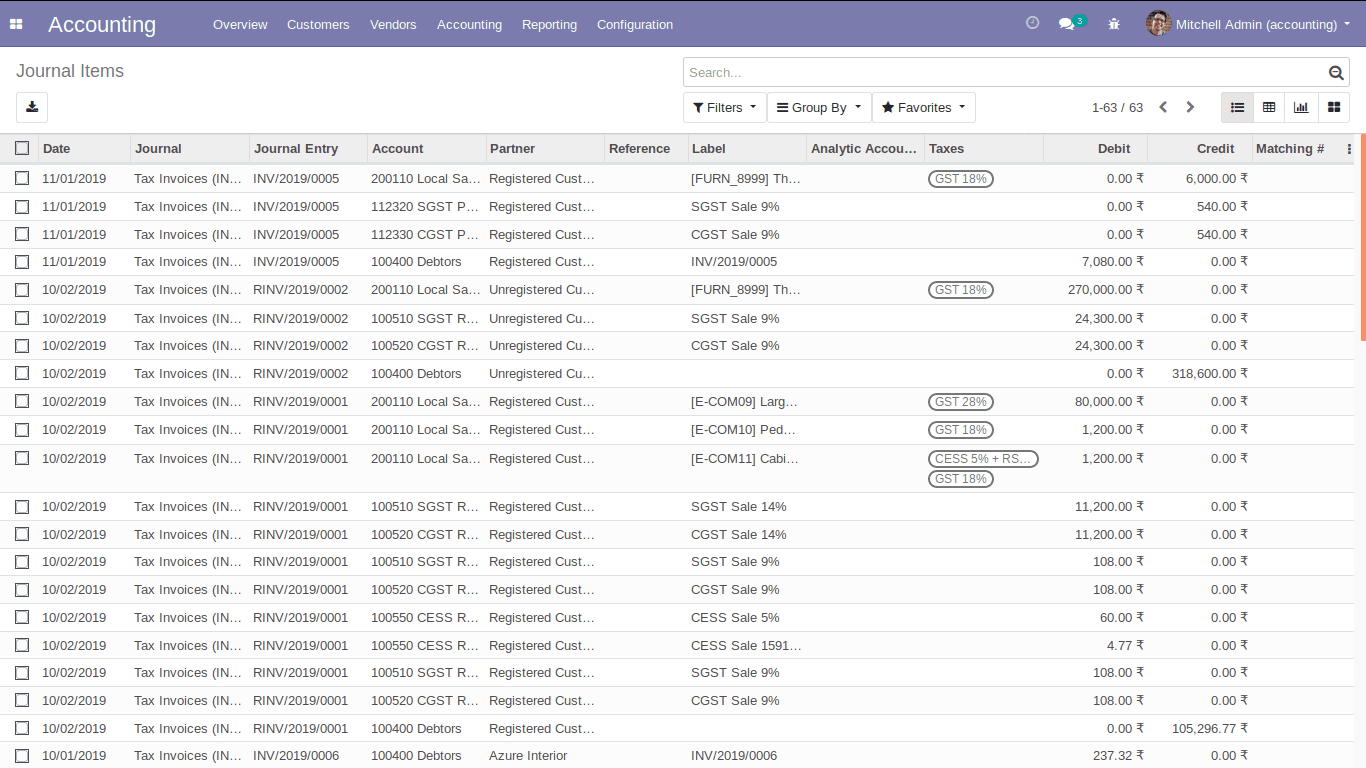

Journal Items:

In journal items, you can see all the journal items separately as the debit and credit aspect of each transaction as shown below.

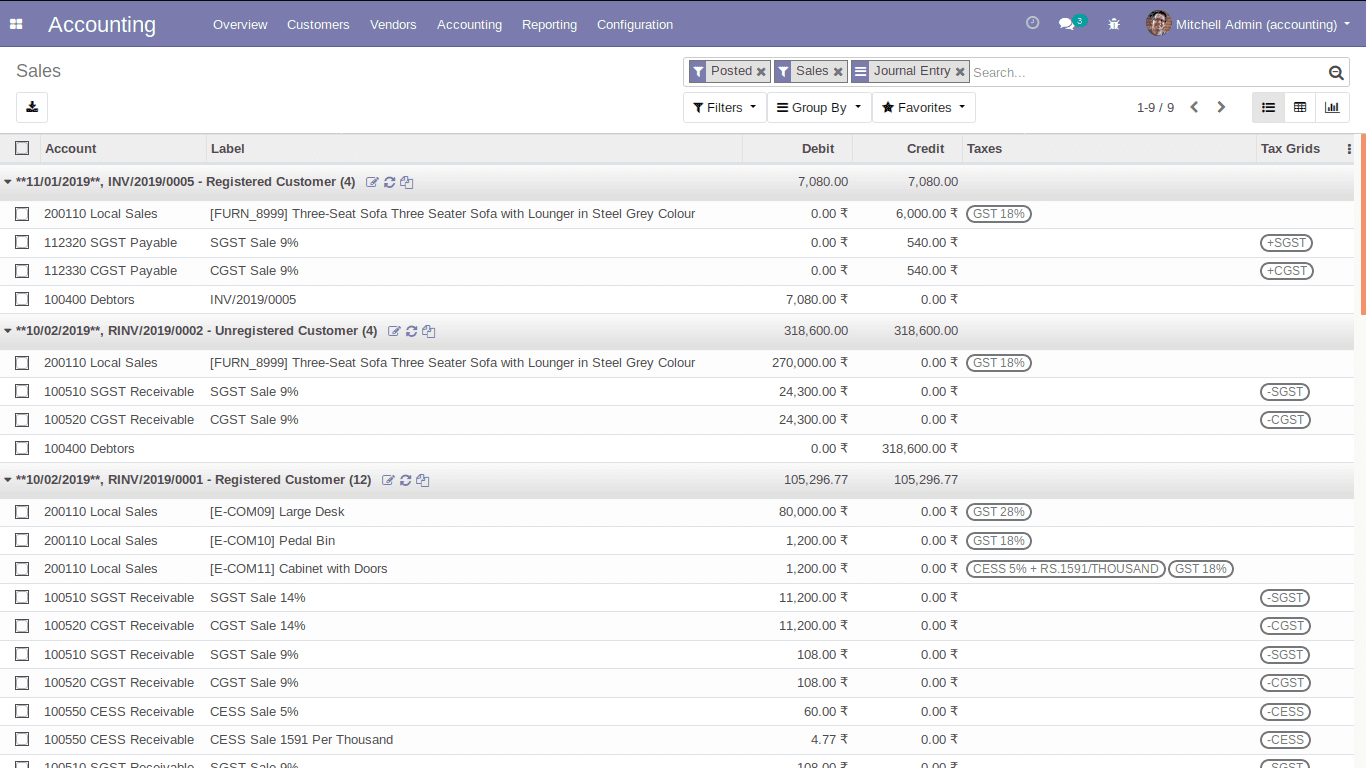

Sales:

Accounting -> Journals -> Sales

Here you can see every journal entry of your sales as shown below. And the respective partner, invoice number, the products in each invoice, debit and credit amount can be viewed.

Purchase:

Same as in the case of sales, as discussed above, you can see the details of all the purchases in your organization.

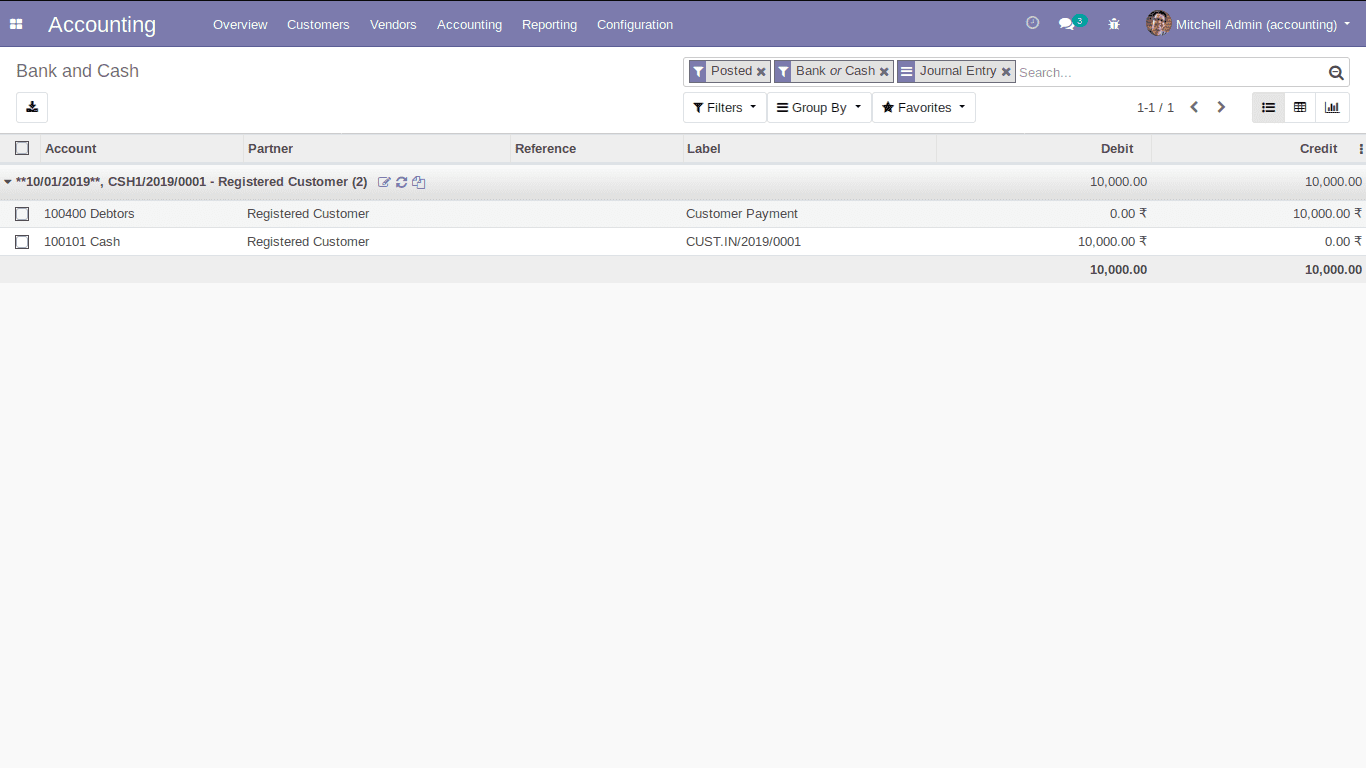

Bank and Cash:

Bank and cash display all the journal entries related to your bank and cash journal as shown below.

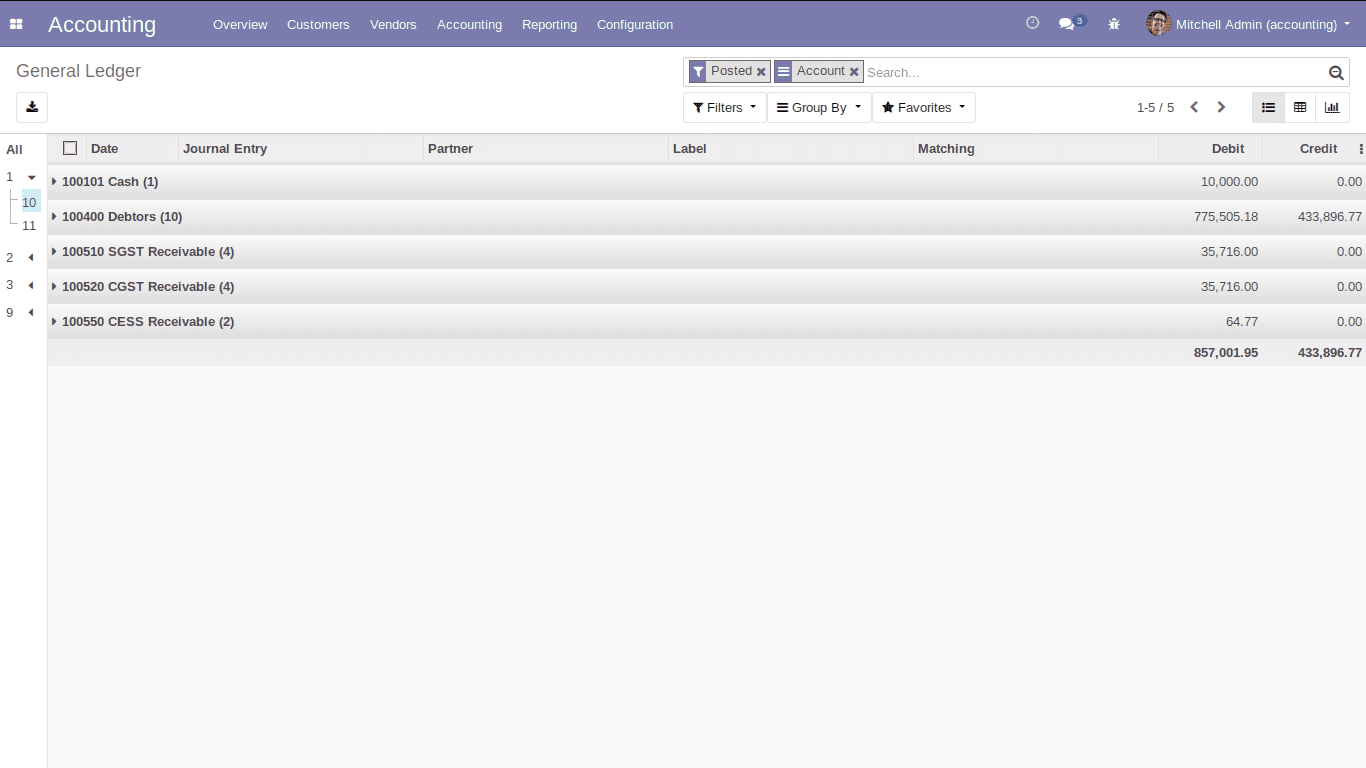

General Ledger:

The general ledger displays all the transactions in your organization from all the accounts as shown below.

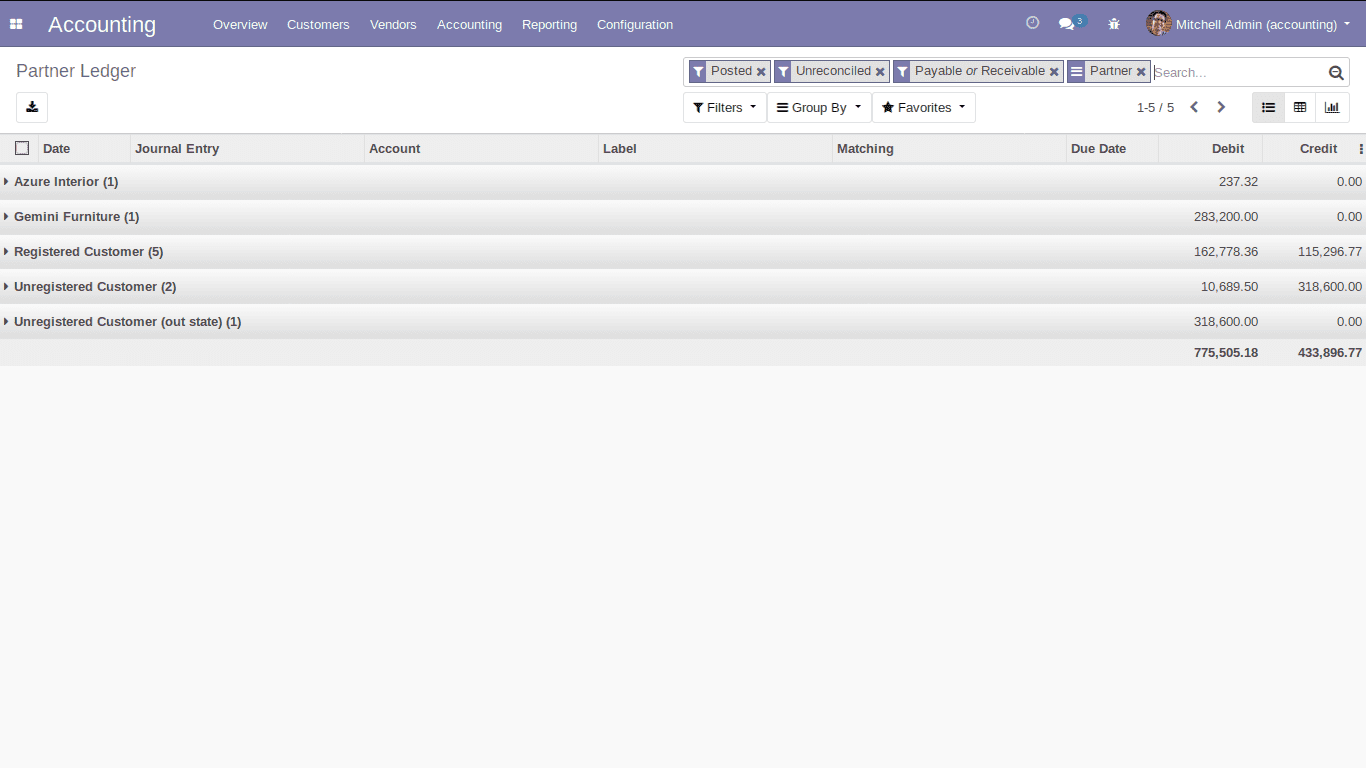

Partner Ledger:

The details of current open balances with any customer or vendor will be shown in the partner ledger.

Assets:

Accounting -> Accounting -> Assets

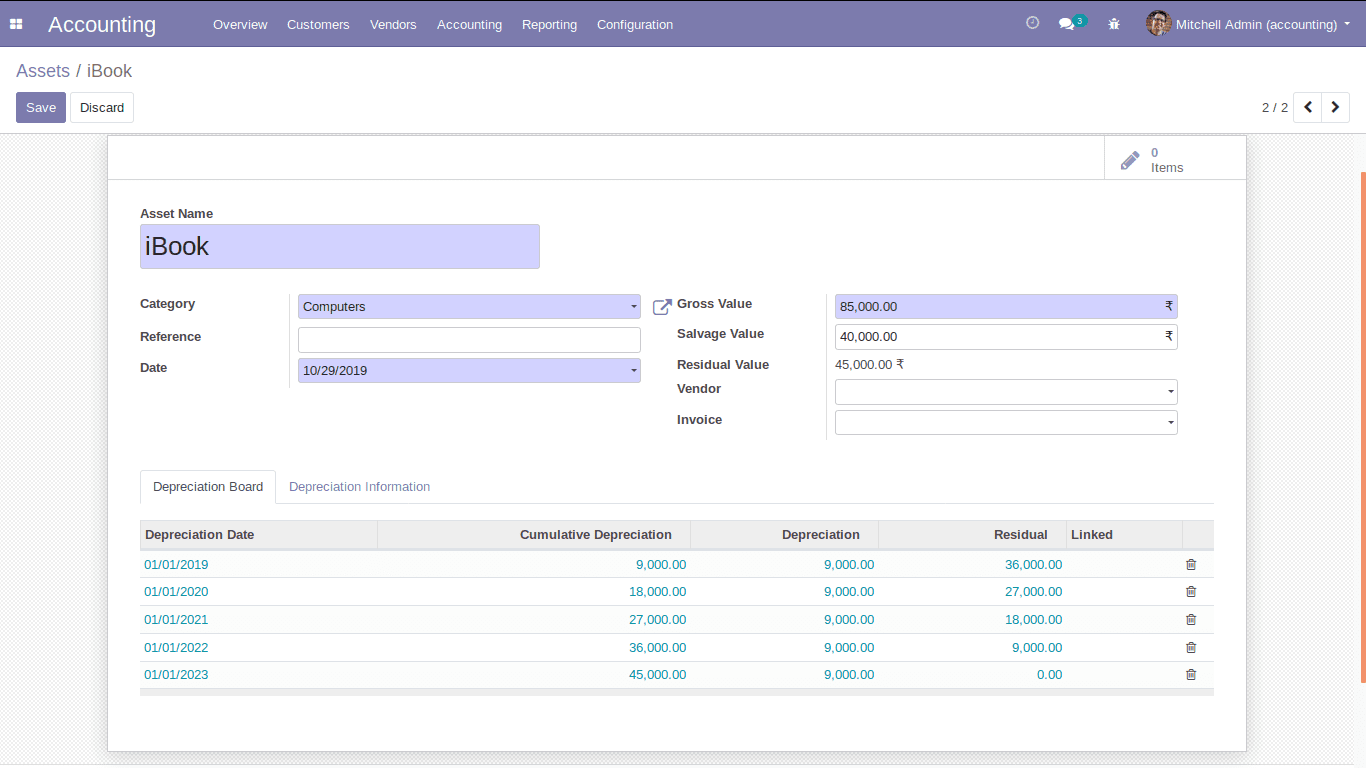

Using this module you can manage the assets owned by your company or by an individual and keep track of the depreciation that occurred on those assets.

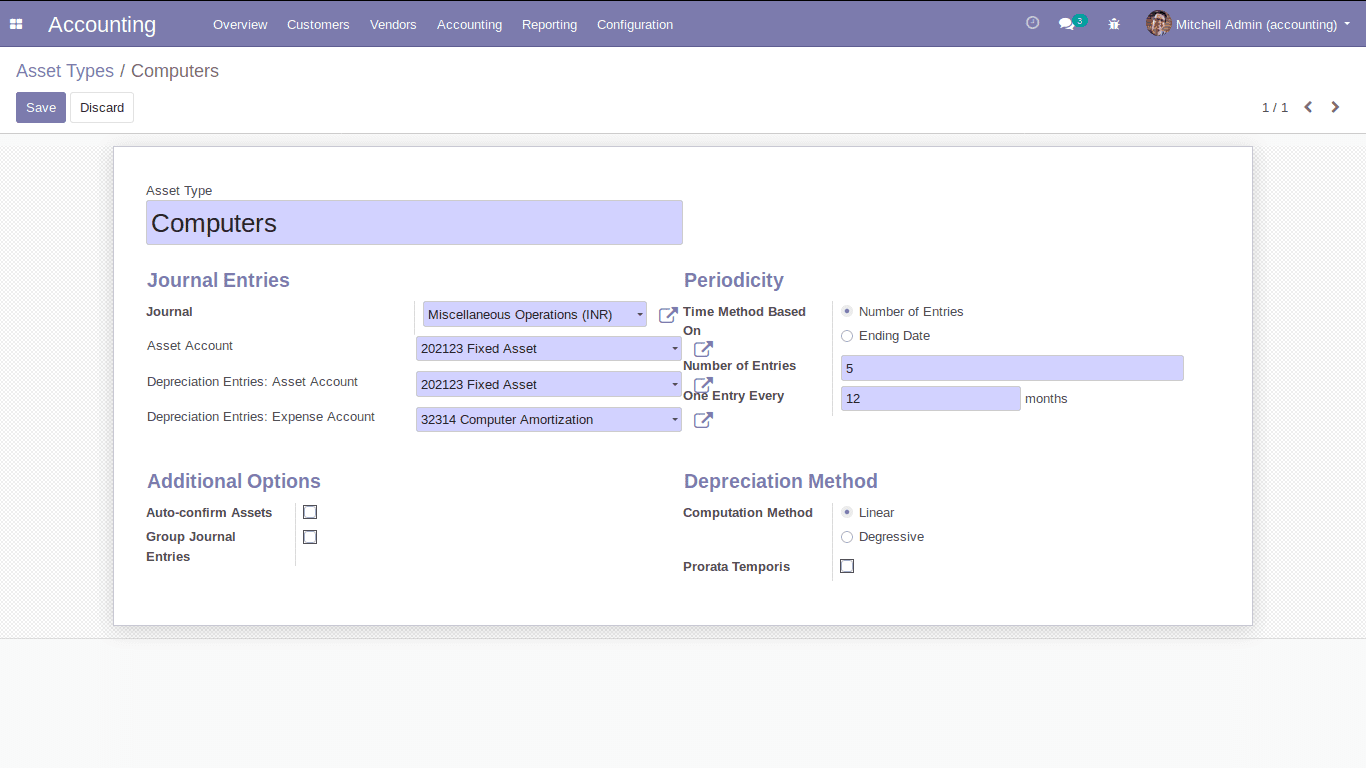

Before creating an asset you have to create the asset type, for that go to Odoo Accounting -> Configuration -> Asset Types and create an asset type as follows.

Now you can create the asset by clicking on the create button in assets.

You can compute the depreciation based on different types of asset types. Also, you can sell or dispose of the assets.

Generate Asset Entries:

The option generates asset entries that allow you to generate the asset entries until the date that you have given. It will automatically generate the entries for the assets.

Lock Dates:

You can set lock dates for non-advisers. So that after setting the lock dates the non-advisers cannot make any changes in the accounts of your organization and it comes in use in case of auditing time.

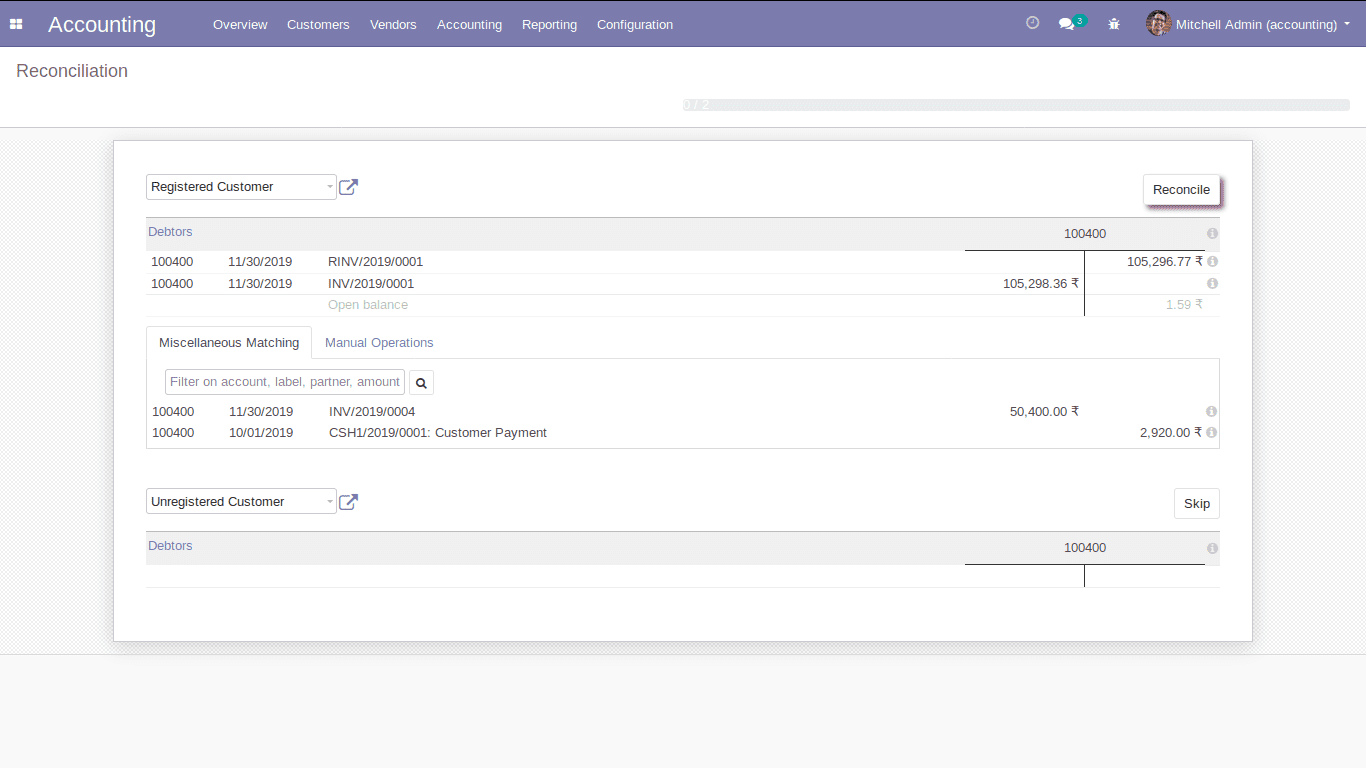

Reconciliation:

This is the invoice-payment reconciliation. Reconciliation allows you to match the payment with the corresponding invoices.

Reporting:

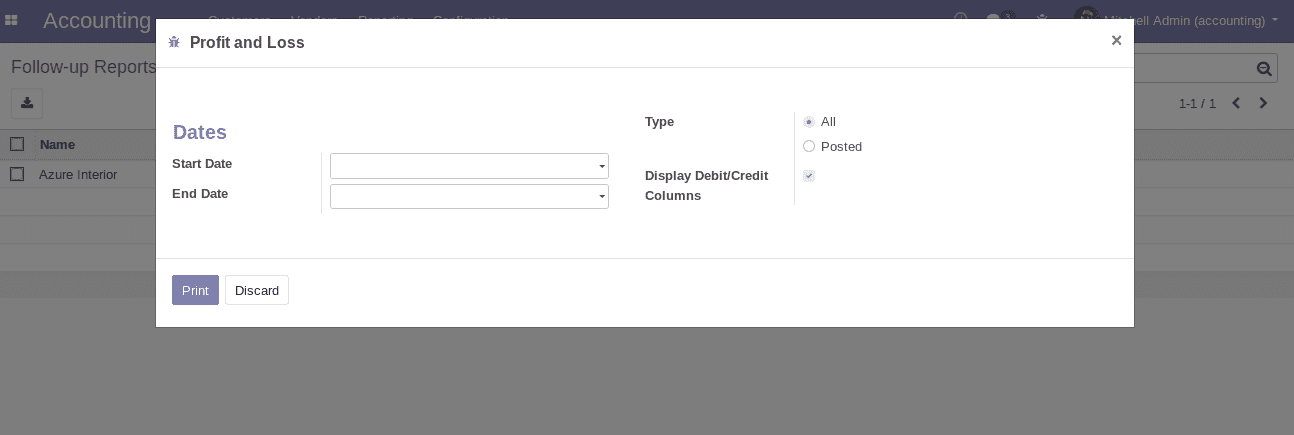

1. Profit and Loss

The profit and loss report in Odoo accounting shows your organization’s net income by deducting expenses from revenue for the reporting period.

Here you can select the reporting period by specifying the start date and end date for the report. Also, you can choose the type of whether the report shows only the posted entries or all the entries.

Display Debit/Credit columns: This option allows you to get more details about the way your balances are computed. Because it is space-consuming, we do not allow it to be used while doing a comparison.

After specifying the necessary details you can print the report by clicking on the Print button.

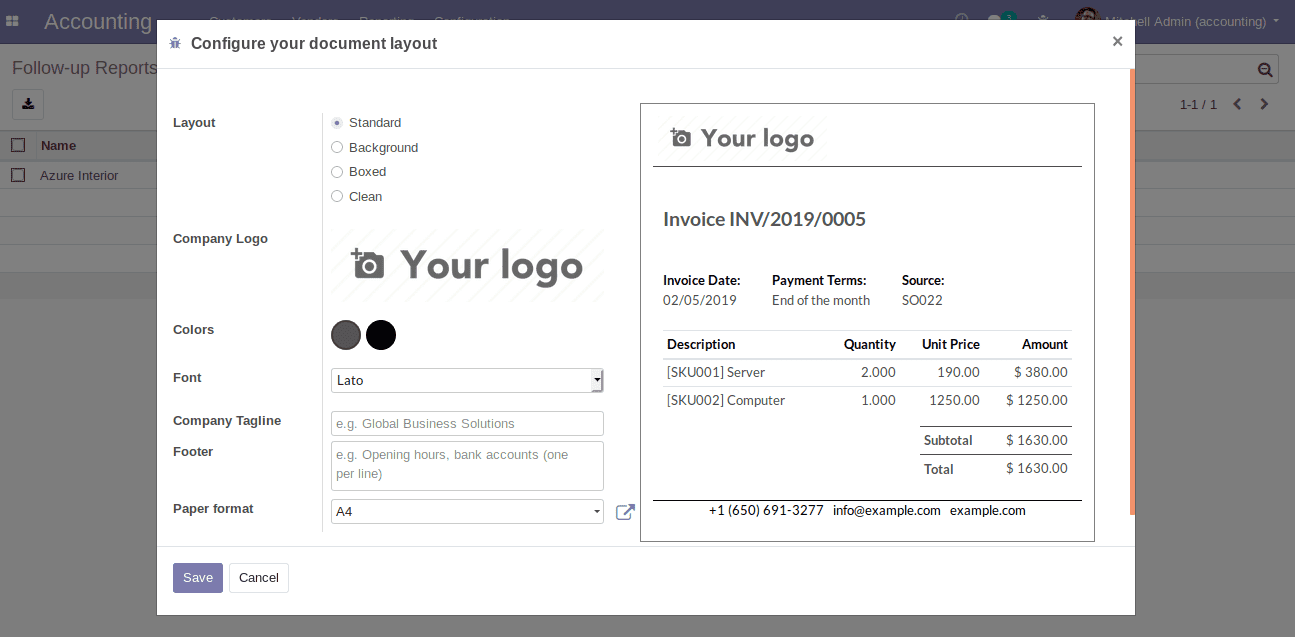

So now you can configure your document layout as shown below.

You can add your company logo, choose the layout type whether it is Standard, Background, Boxed or Clean. And you can see a sample of your report on the right side itself which enables the user to choose the layout much more easily. Also, one can specify the company tagline, footer and can choose the page format also. After configuring the layout you can print the report.

As explained above you can see the report as shown below and can easily get the details about the income and expenses of your company.

2. Balance Sheet

The balance sheet report gives you a snapshot of a company’s assets, liabilities, and equity. Equity is calculated by deducting the liability from the asset.

3. Cash Flow Statement

The cash flow statement in Odoo accounting shows how changes in balance sheet accounts and income affect cash and cash equivalents. Simply it is the flow of cash in cash out of the company.

4. Bank Book

Bank Book Report allows you to print the report of your bank transactions. Here you can specify whether the report should include the initial balance.

Include Initial Balances: If you selected a date, this field allows you to add a row to display the amount of debit/credit/balance that precedes the filter that you have set.

Also, you can select the bank accounts and journals and can specify whether the report should be sorted according to the Date or Journal and Partner.

5. Cash Book

Similar to the case of the bank book report, you can easily access the cash transactions of your organization for the reporting period by selecting the Cash Book in the report.

6. Day Book

The Day Book Report allows you to print all the transactions of your organization each day in the reporting period.

7. Partner Ledger

The partner ledger shows all the transactions of your partners currently with open balances and both the credit and debit details of respective partners for the journals you have selected.

8. Aged Partner Balance

Here you can select the partner’s account whether it is receivable or payable or both receivable and payable. In the case of receivable, the report shows sales invoices that were awaiting payment during a selected month and several months prior. And in case of payable, the report displays the information on individual bills, credit notes, and overpayments owed by you and how long these have gone unpaid. If you are choosing both receivable and payable it will display both the aged receivables and aged payable reports in a single report.

9. General Ledger

In the general ledger, you can see all the transactions from all the accounts for the period you have chosen. You can see all the journals and transactions in all the accounts under each journal of your organization.

10. Trial Balance

Trial balance report is used to ensure whether the total debt amount and credit amount of your organization are in a balanced state that is equal. If the total of the debit side is equal to the total credit side then the balance is said to agree. Otherwise, it implies that some errors have occurred while preparing the accounts.

11. Tax Report

The tax report displays the consolidated tax report on the sales and purchase during the reporting period. It also displays both the tax amount and the base amount being taxed grouped by sales and purchase.

12. Journal Audit

Journals audit displays all the transactions of your organization according to accounting journals. You can select the journals to be displayed in the report and based on that report are displayed.

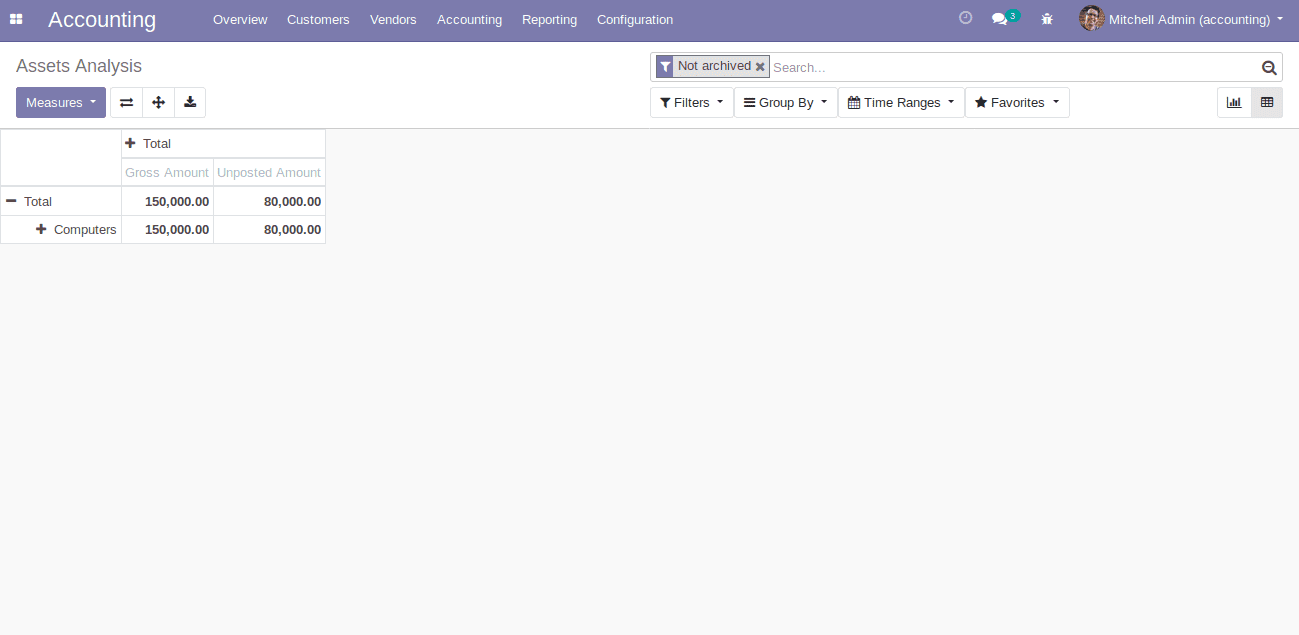

13. Asset

The asset report shows an analysis of the asset. You can see pivot analysis and the graph view of the asset as shown.

Configuration

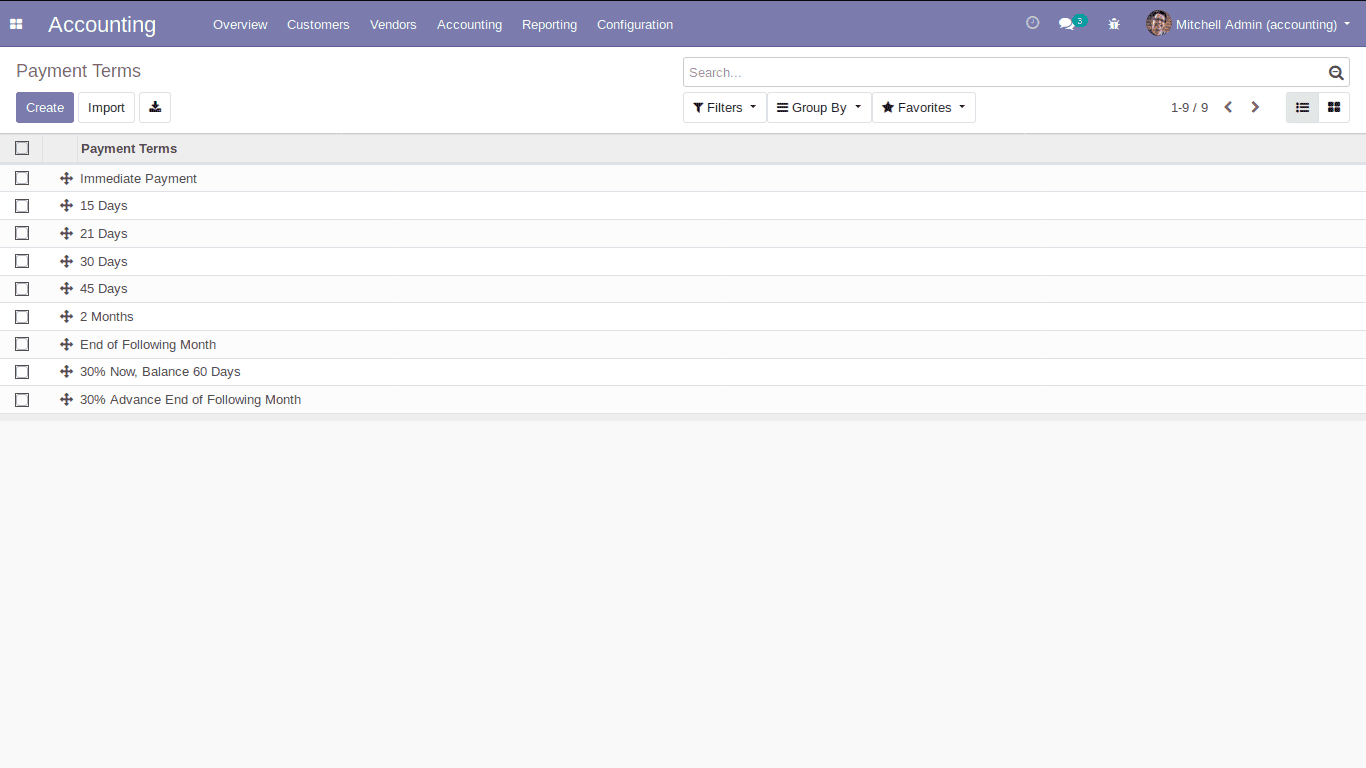

Payment Terms:

Accounting -> Configuration -> Payment Terms

Here you can configure the payment terms. Due dates for invoices are calculated based on the payment terms that we have set for the customers.

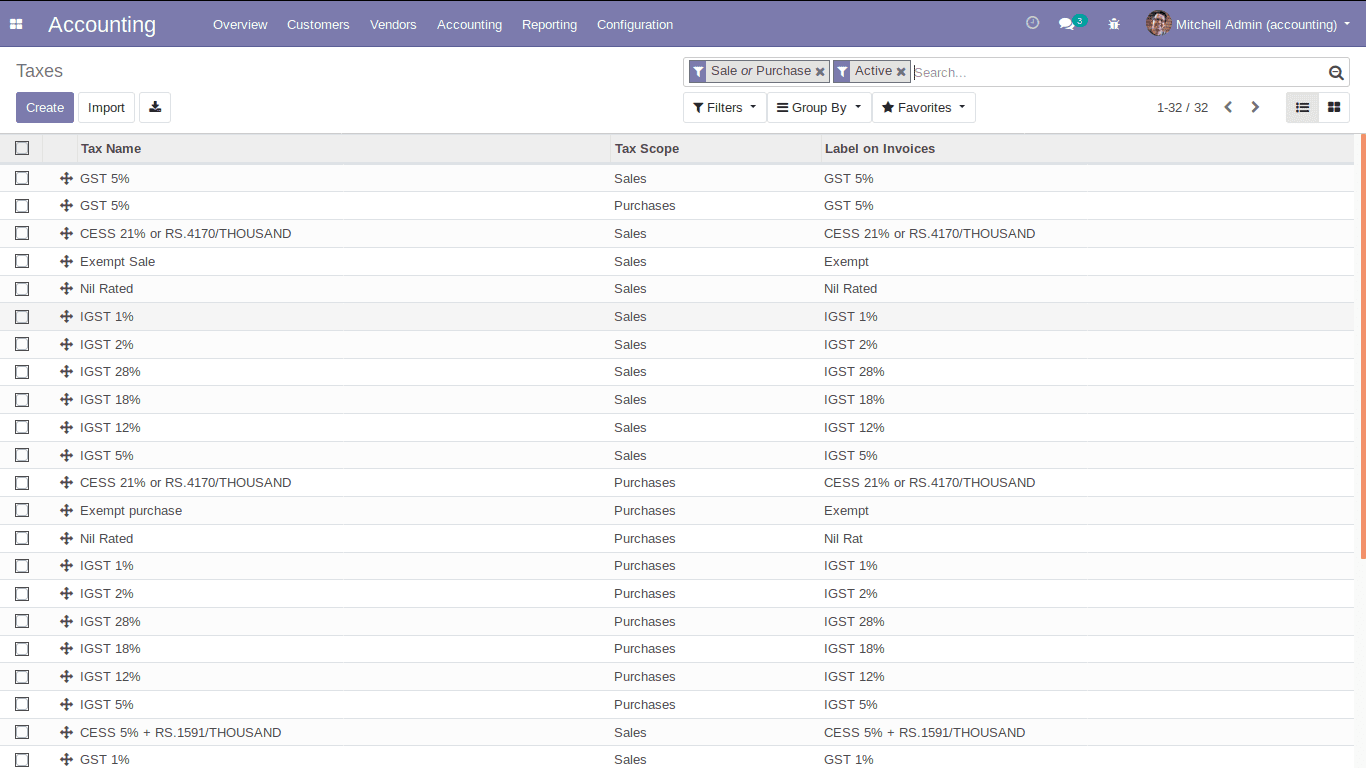

Taxes:

Here you can see the different taxes created for different scope and you can also create new taxes based on your needs and also can group the taxes.

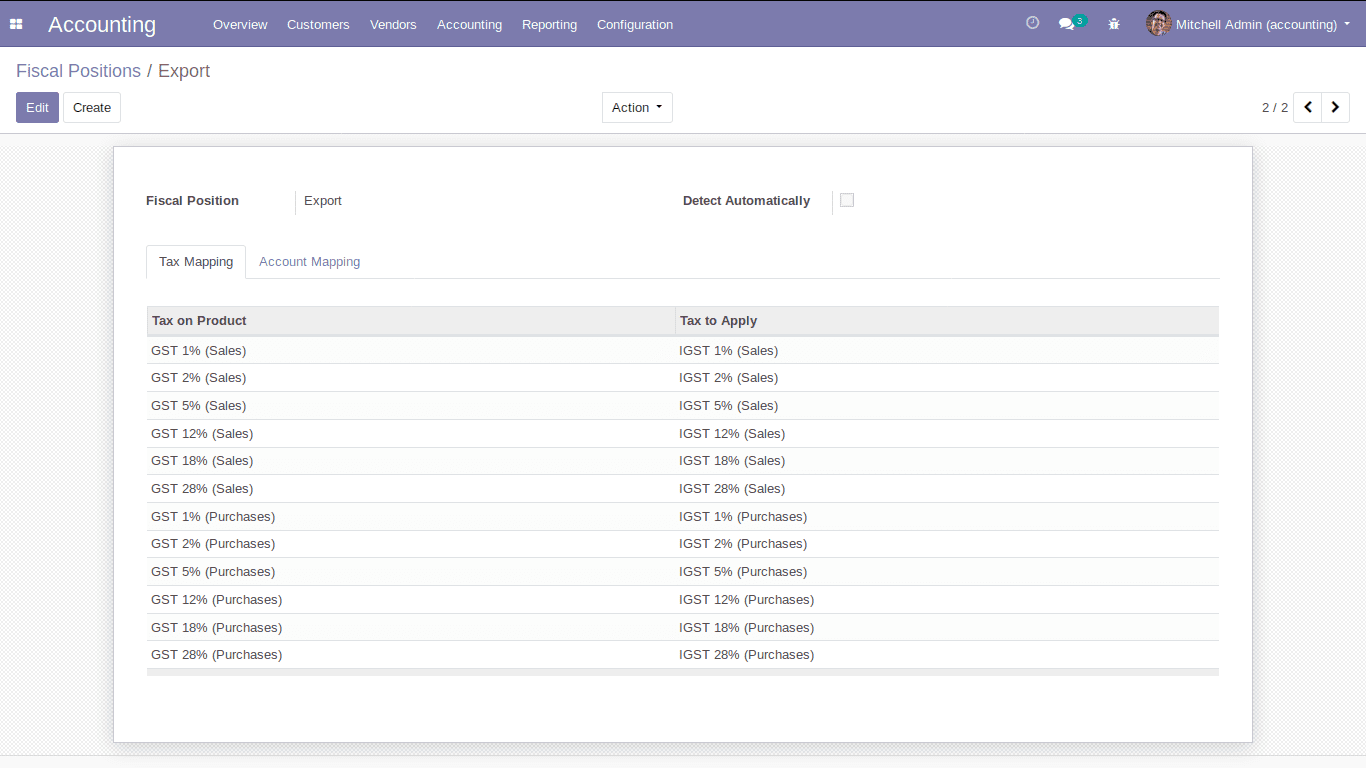

Fiscal Positions:

Fiscal position in odoo helps the business organization who are dealing with outstation clients. It enables you to map taxes and accounts specific to that country.

Tax Mapping: It is the process of mapping a particular tax into another.

Account Mapping: By using account mapping, one can change or set relative accounts based on different countries or customers.

Incoterms:

Incoterms stands for International Commercial terms. Basically, Incoterms are trade terms published by the International Chamber of Commerce(ICC), and that is commonly used in both international and domestic trade contracts. These are intended to convey the expenses and risks related to the transportation and delivery of products.

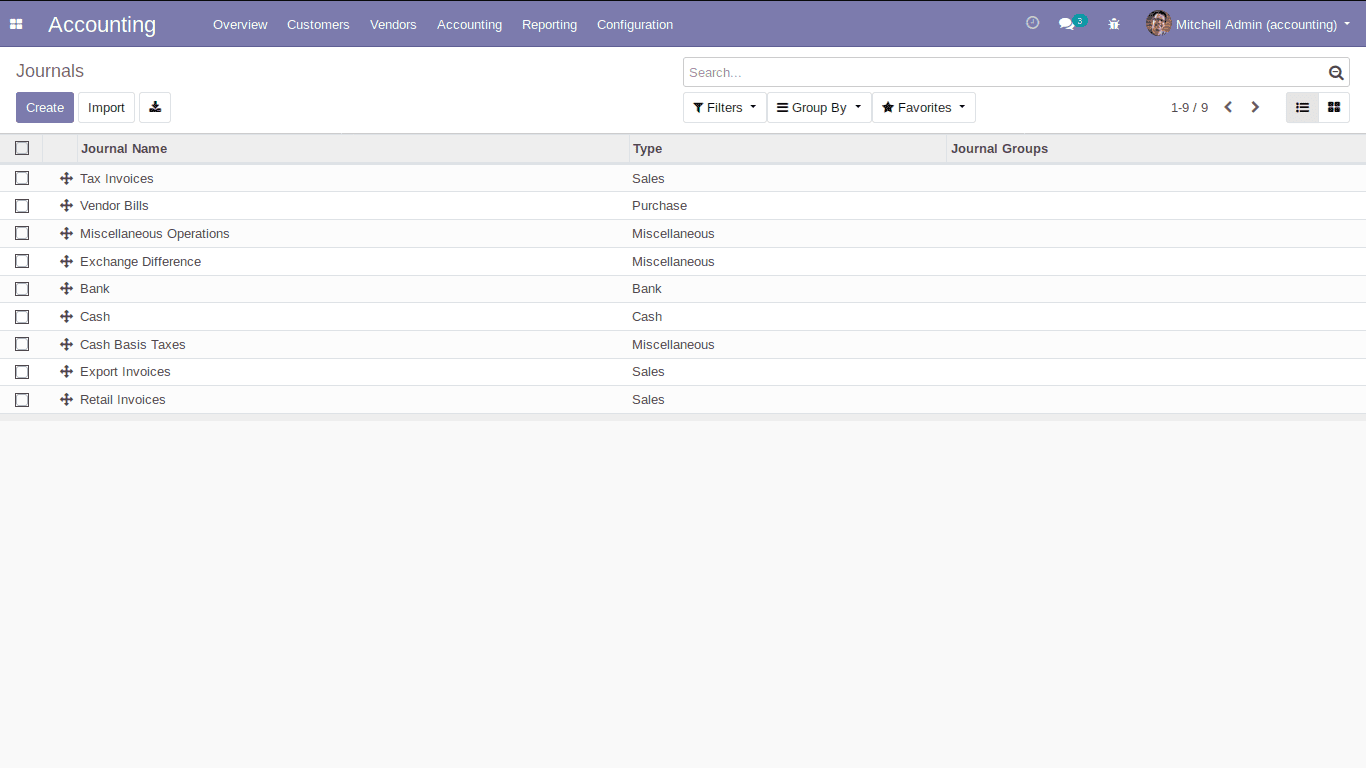

Journals:

You can create various journals here and specify the type whether it is sale, purchase, cash, or general

Bank Accounts:

It lists all the created bank accounts. Also, you can create a new bank account using Accounting -> Configuration -> Add a Bank Account.

Payment Acquirers:

Transactions in your organization can be made easier using the built-in payment acquirers.

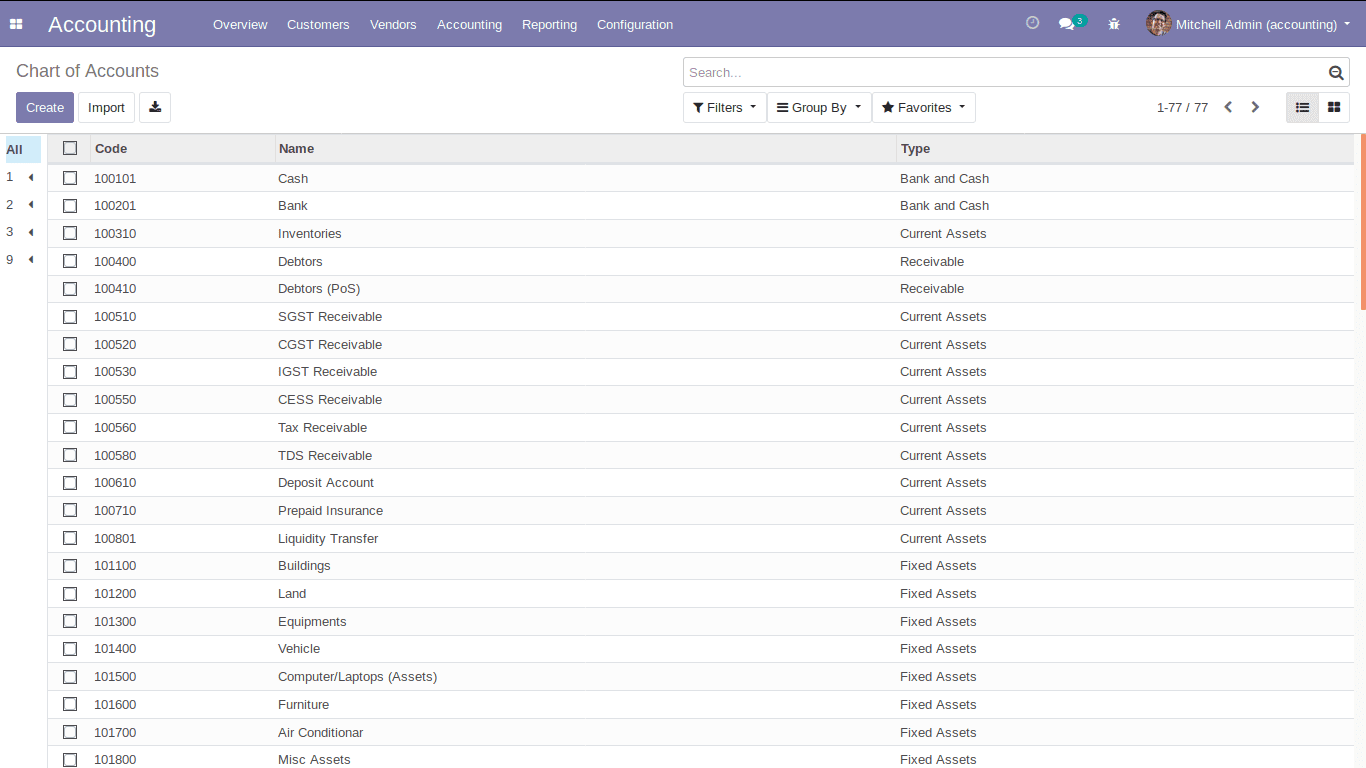

Chart of Accounts:

Chart of accounts displays all the accounts used in your organization. You can also create a new account as per your needs.

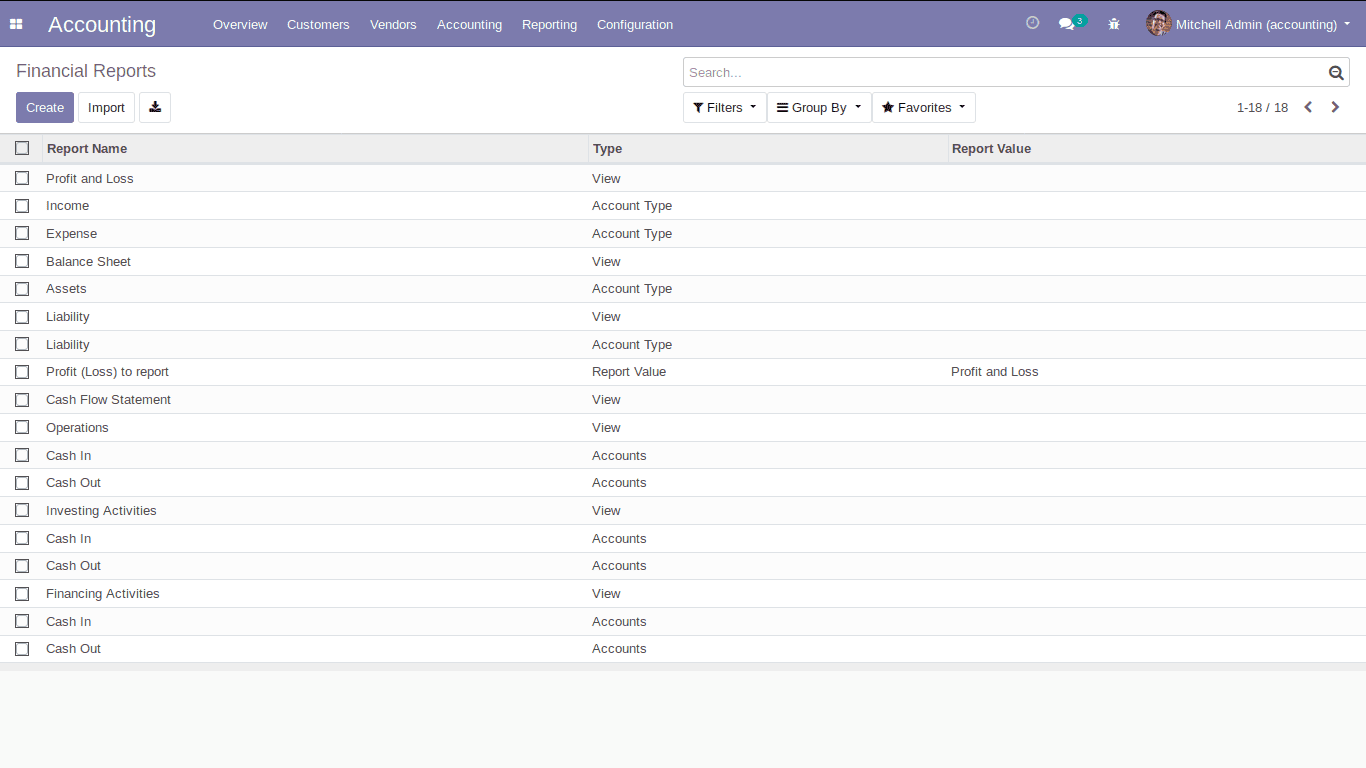

Account Reports:

Here you can specify the financial reports of your company as shown.