Purchase return is the process of returning a product after purchasing it from the vendor. The product is returned for several reasons such as damages in the product, on account of less space in the warehouse and so forth.

This returning of products, however, affects the accounts and stock in a specific manner.

In this blog, am explaining how does the purchase return affects the accounts and stock.

Odoo handles the return of products in an easy manner. Return of products affects the accounts based on the mode of accounting i.e.Continental and Anglo-Saxon.

Effect of Purchase Return on Accounts (in Anglo-Saxon)

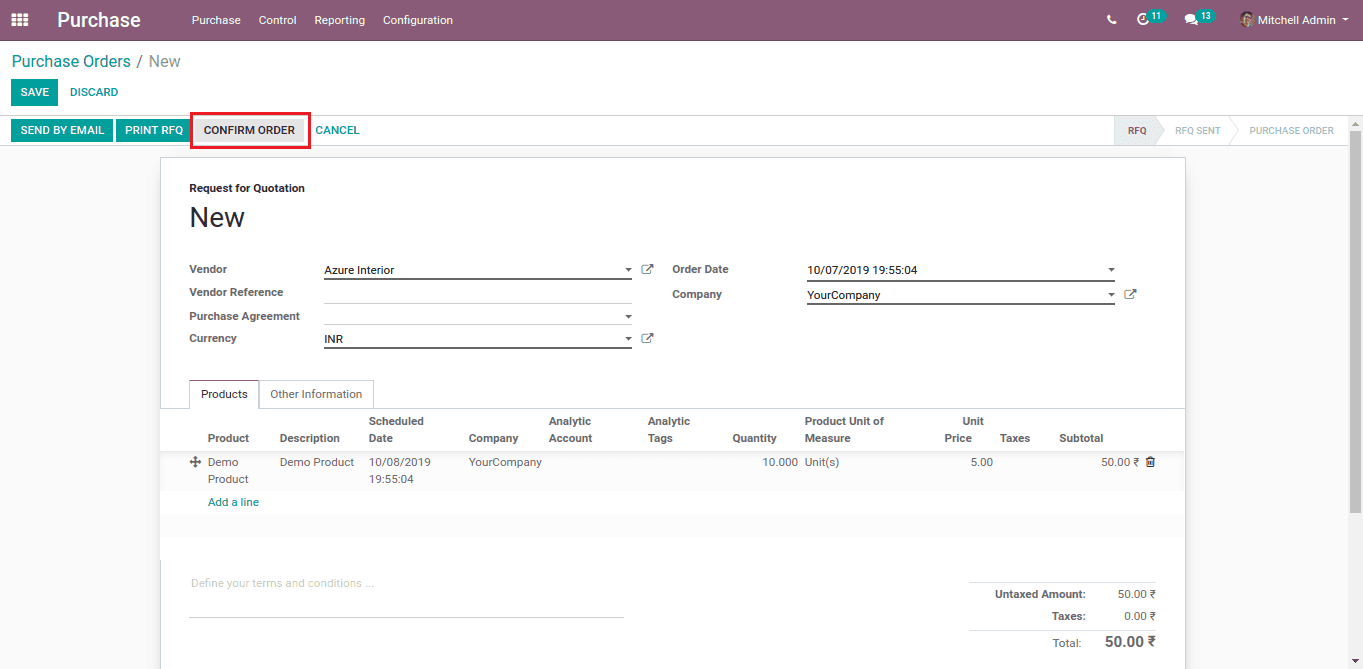

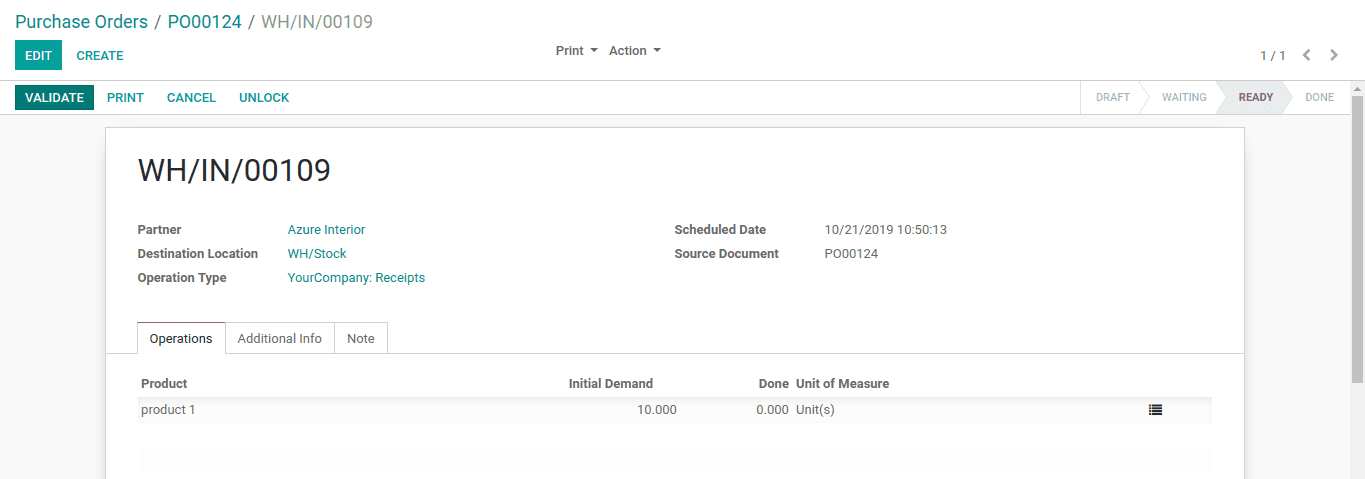

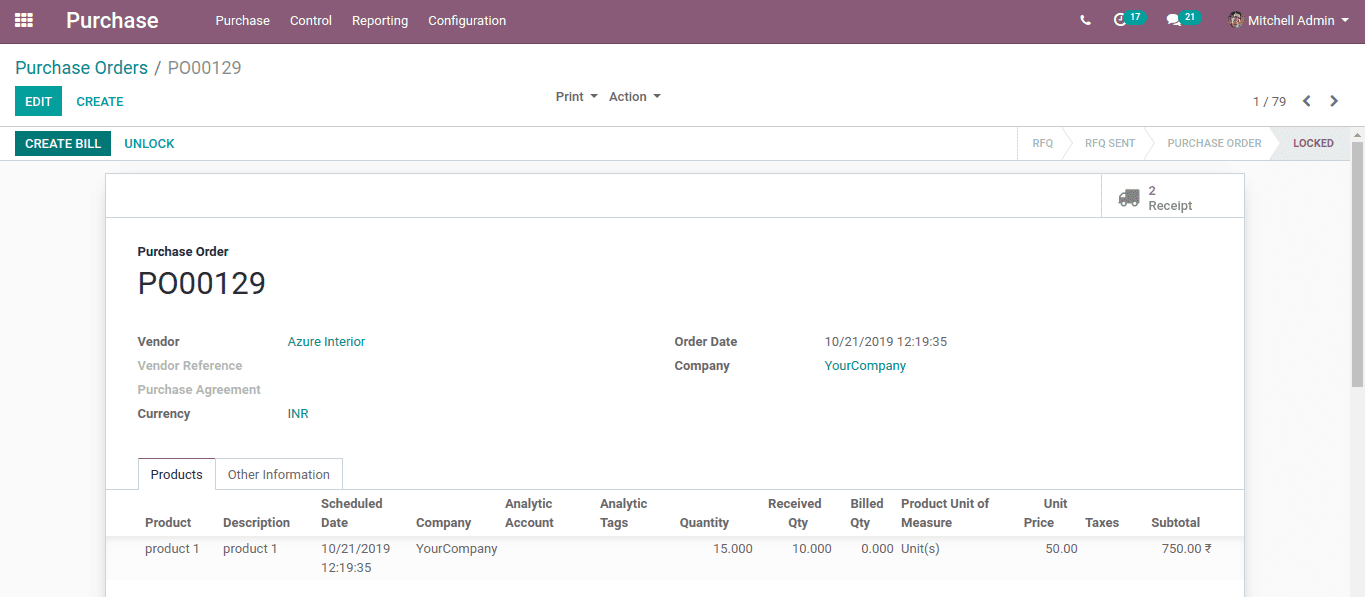

First of all, CREATE and CONFIRM a purchase order.

In this order, we purchased 10 products.

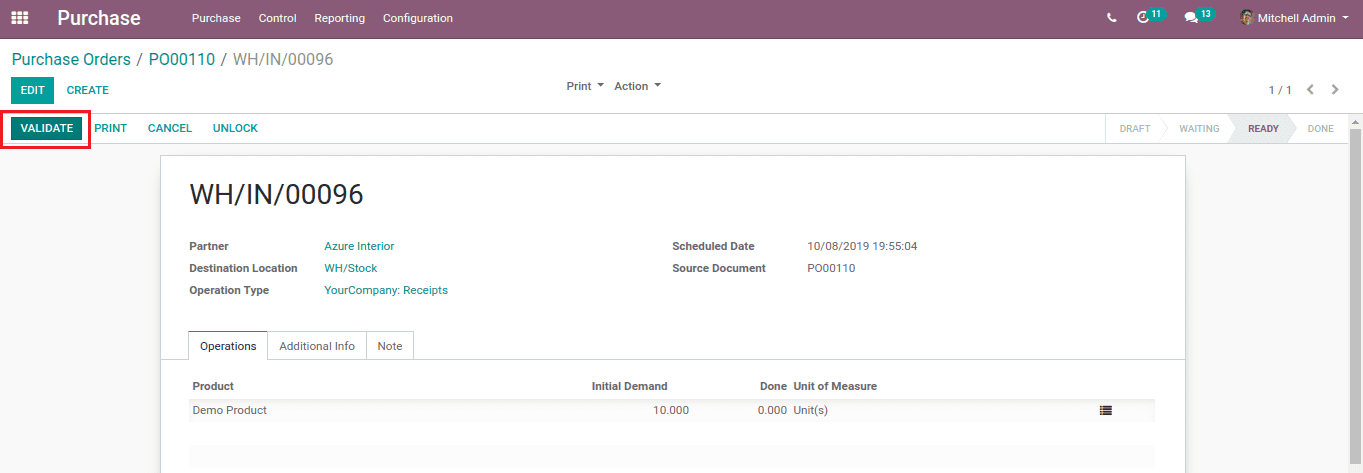

Then validate the delivery.

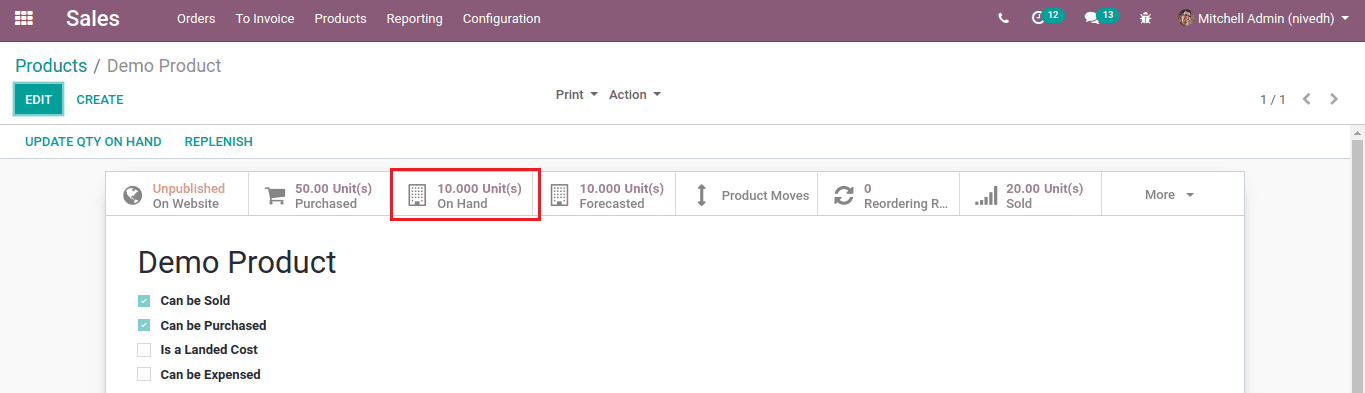

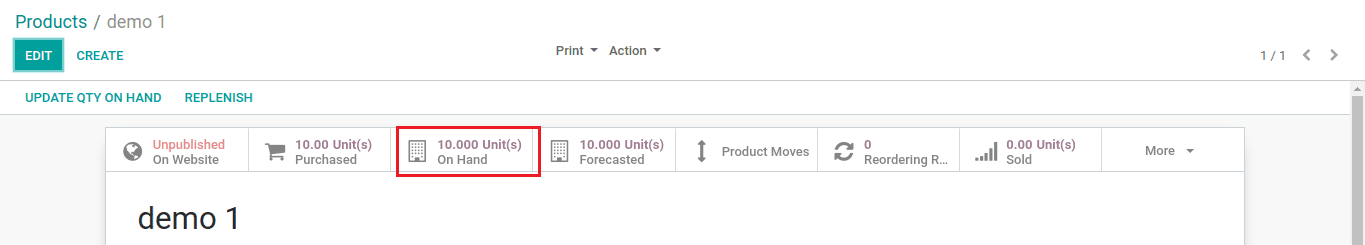

Upon validating delivery, the stock in hand will be changed(here the stock becomes 10 units). Initially, the stock in hand was 0, now it has changed to 10 units.

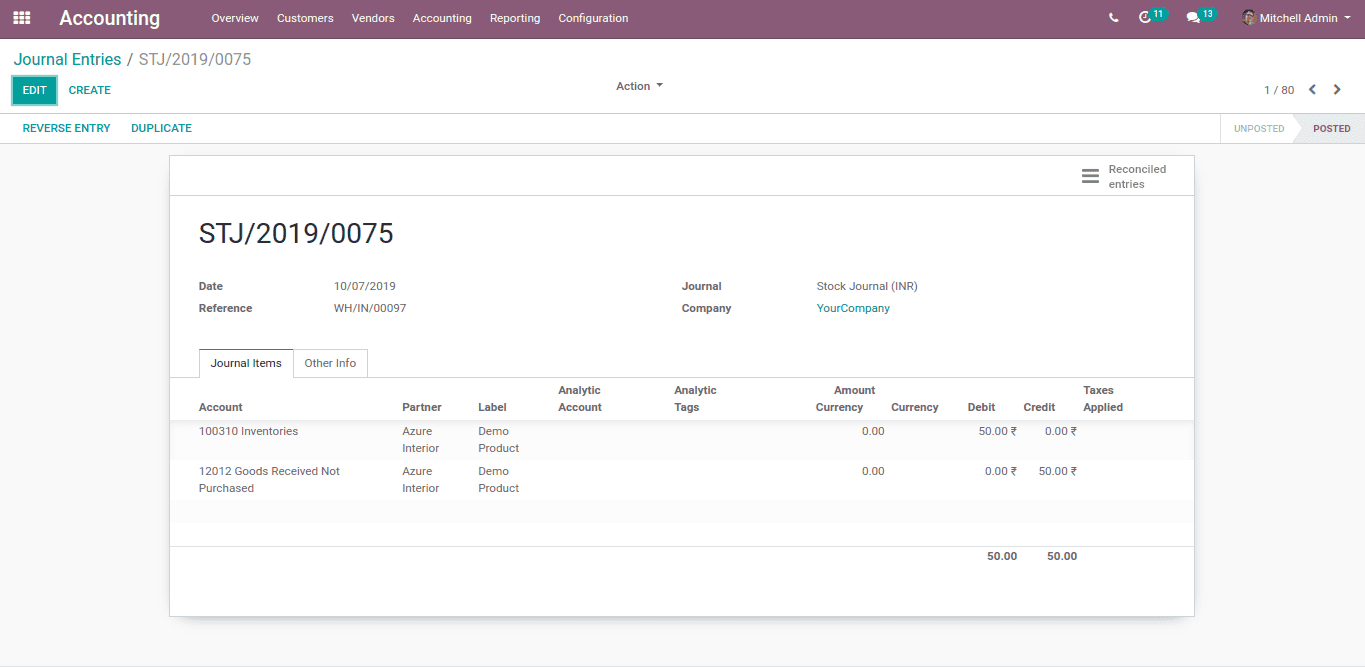

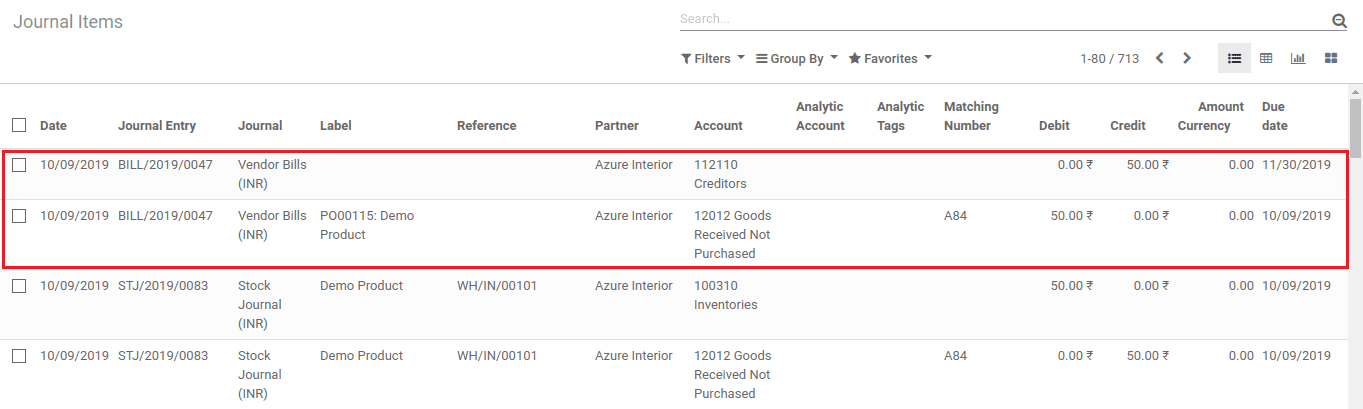

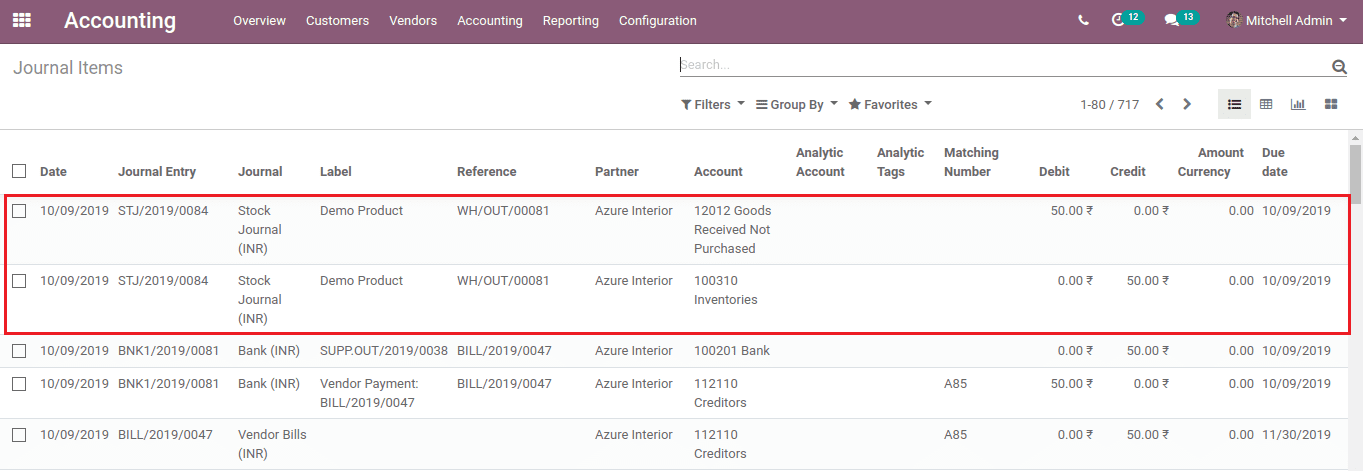

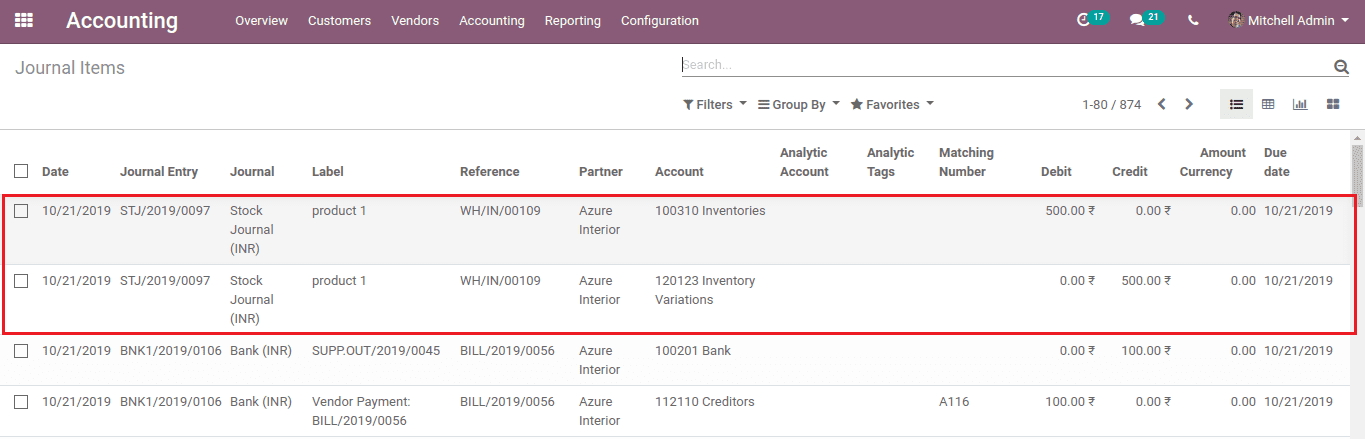

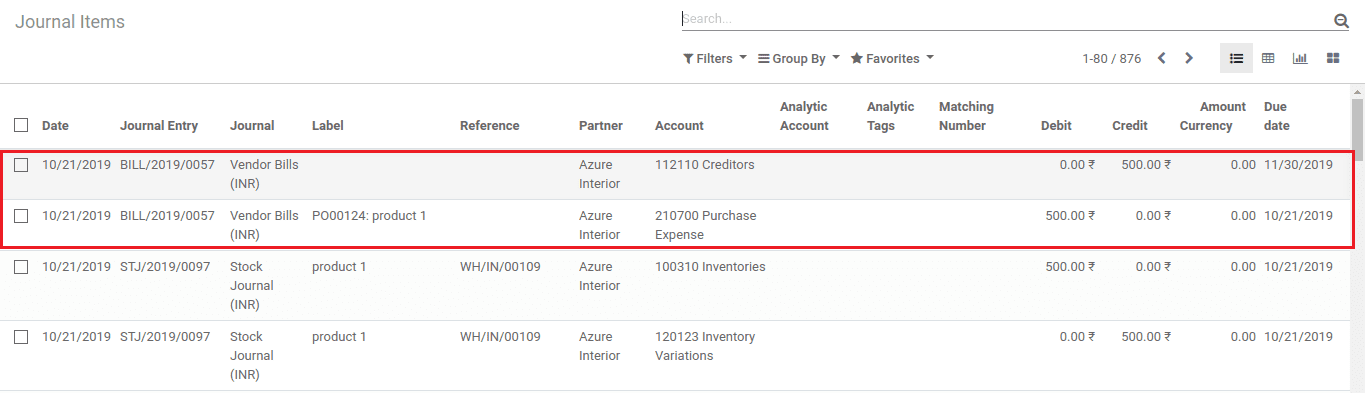

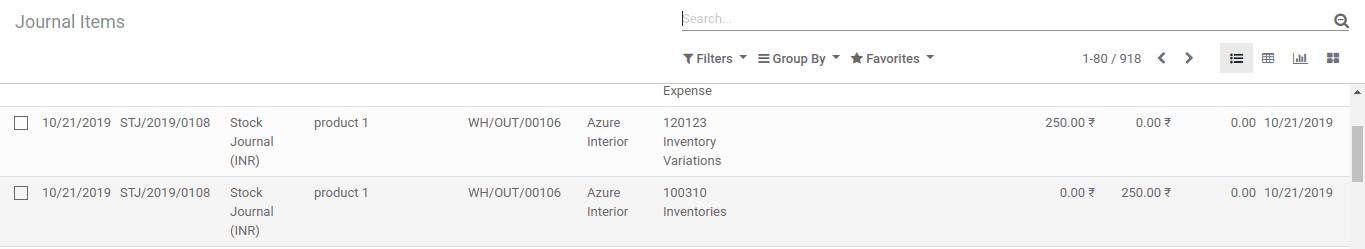

Upon validating the delivery, 2 journal entries will be created.

We can see the entries under the accounting module via going to Accounting -> Journal entries.

Stock Input Account (Goods received not purchased) is credited and Stock Valuation Account(Inventories) is debited. These two amounts are based on the cost of a unit product.

Upon validating the bill, two more entries will be created, ie account payable (Creditors) is credited and Stock Input Account (Goods received not purchased) is debited.

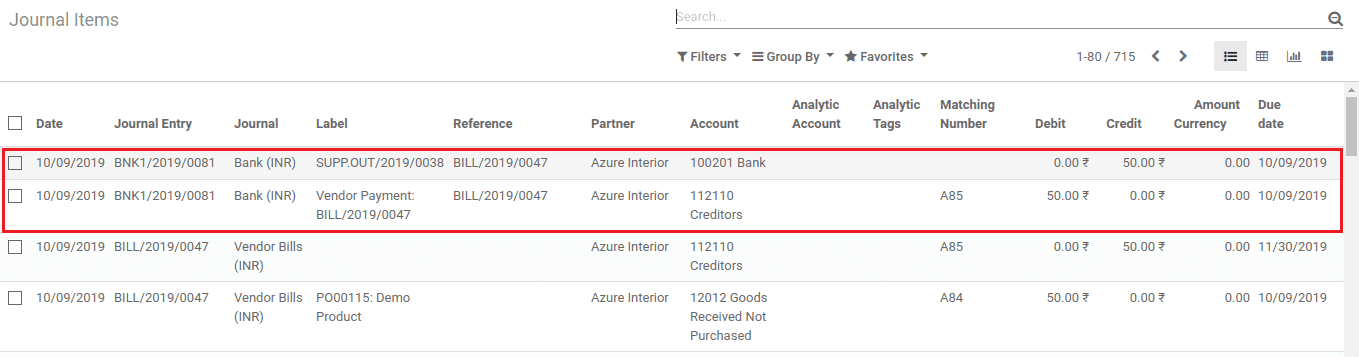

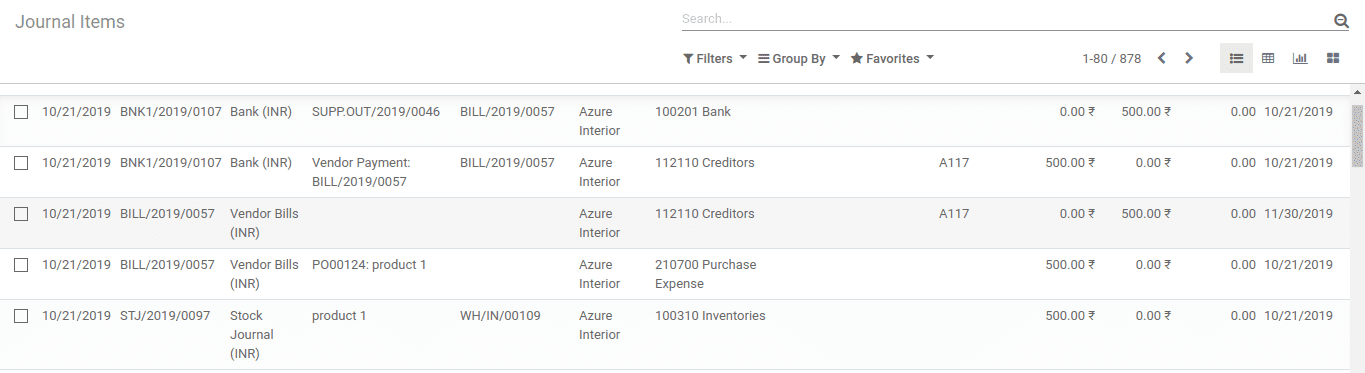

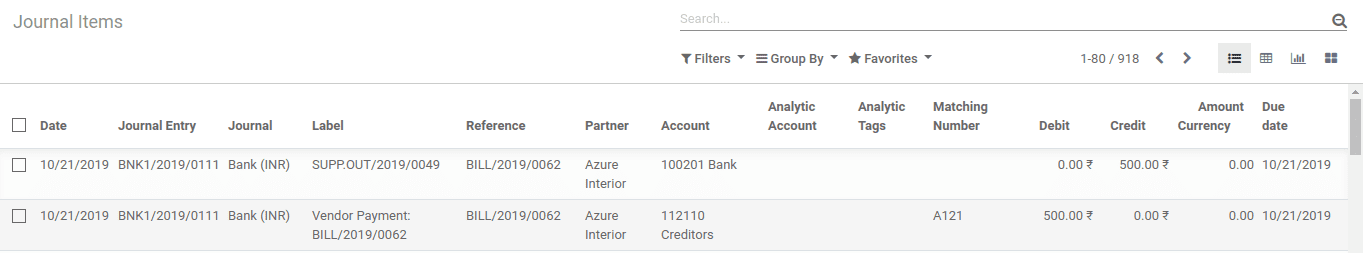

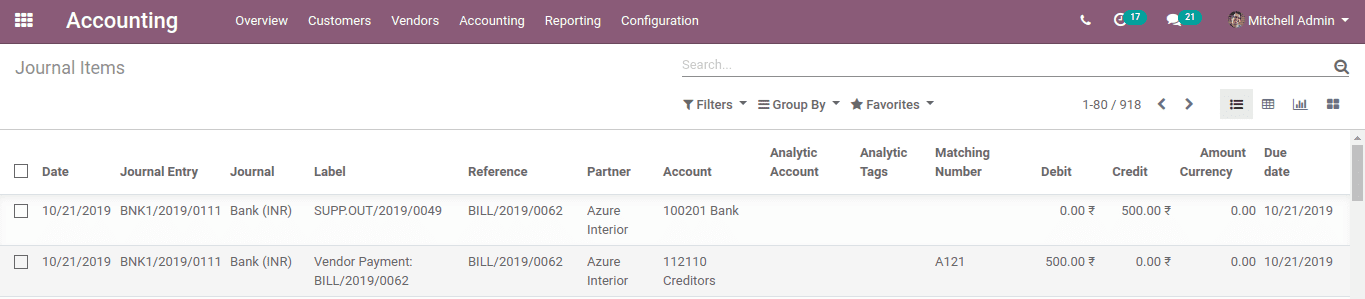

After registering the payment, the journal entries will be like below:

account payable(Creditors) is debited and the bank account is credited.

Returning of the purchased product

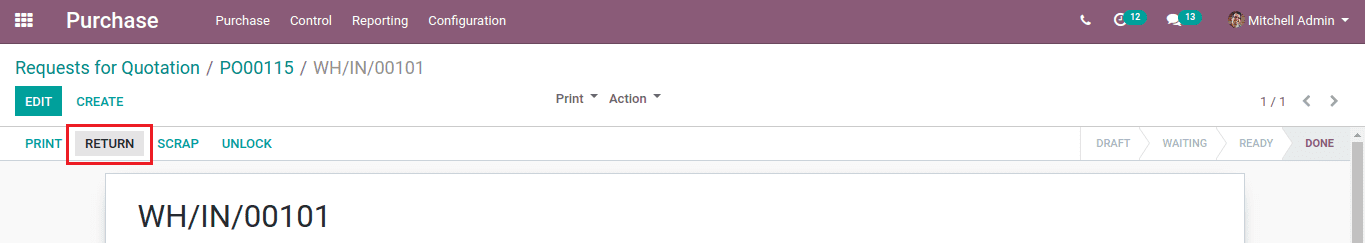

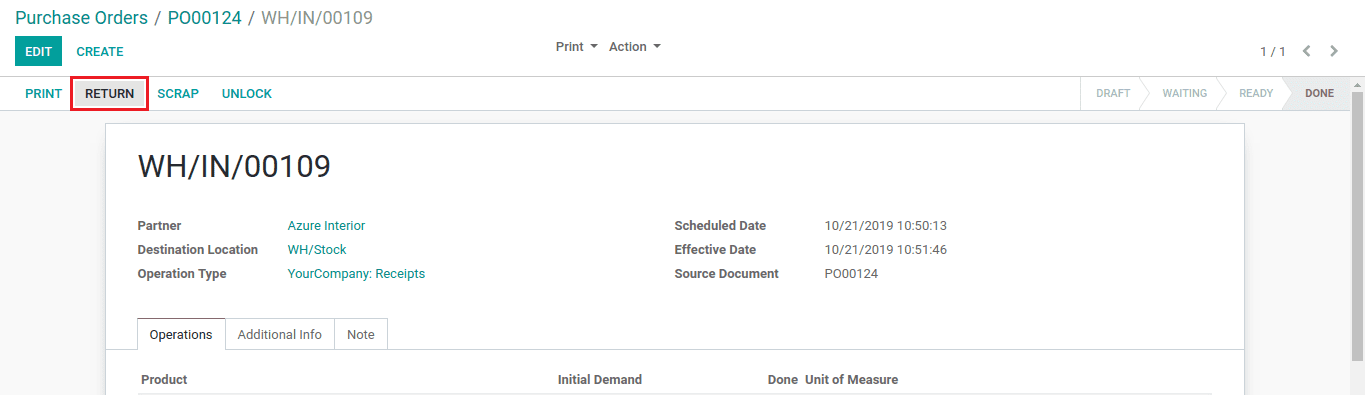

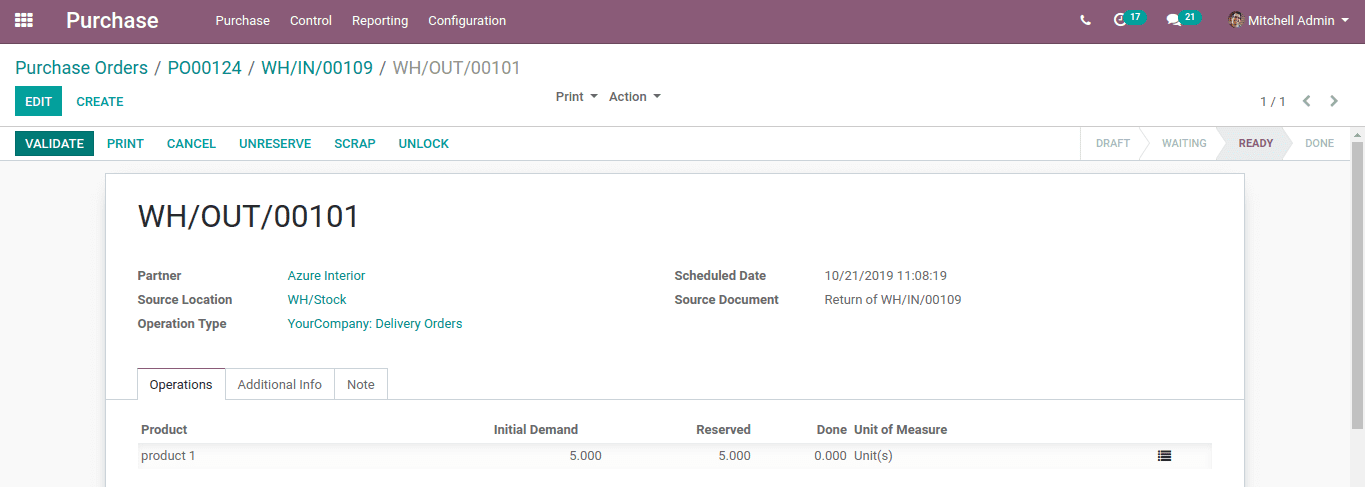

To return the purchased product, click on the RETURN option present in the delivery receipt.

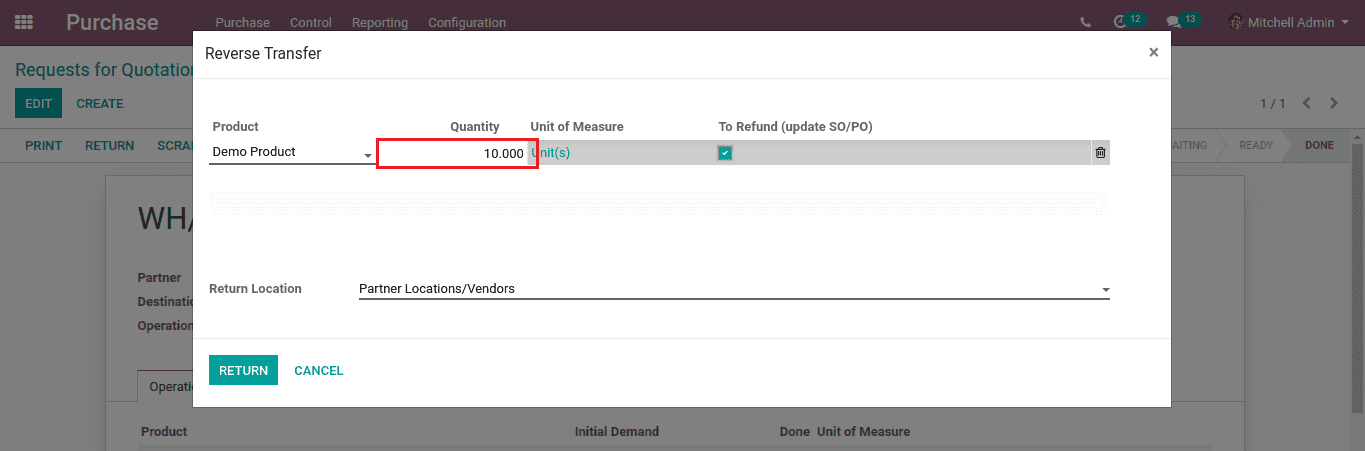

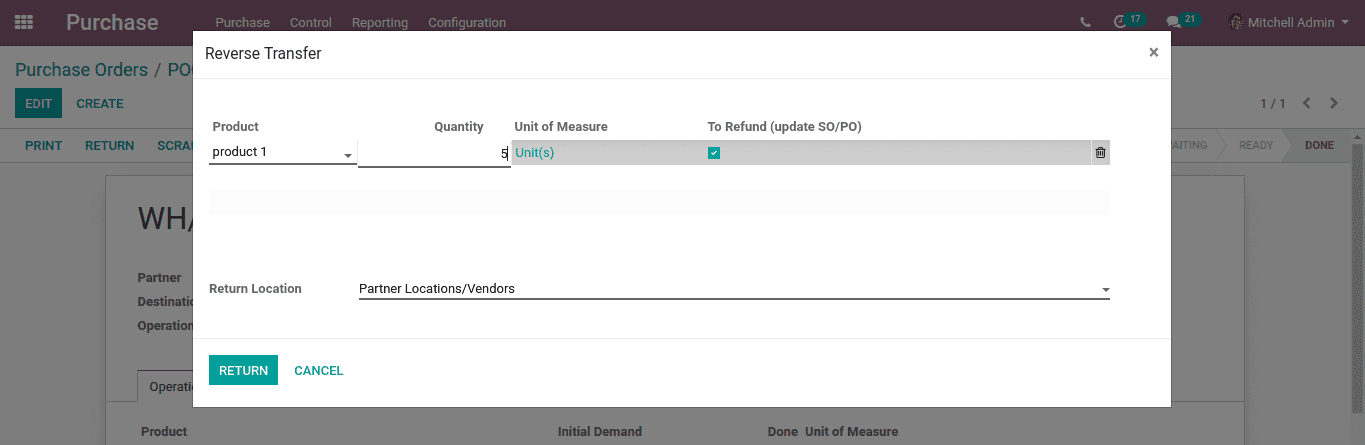

Next, enter the quantity of products that are to be returned to the vendor.

Validate the return.

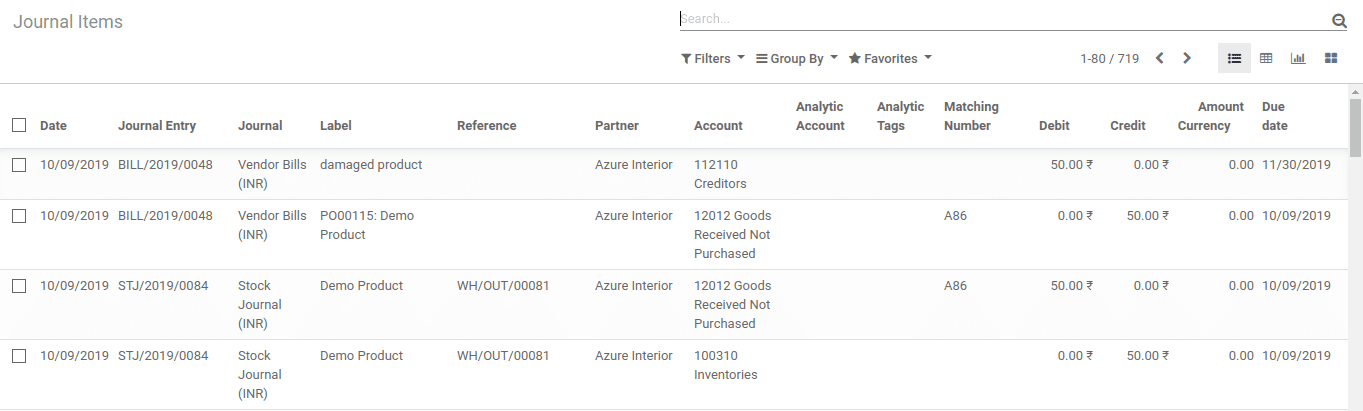

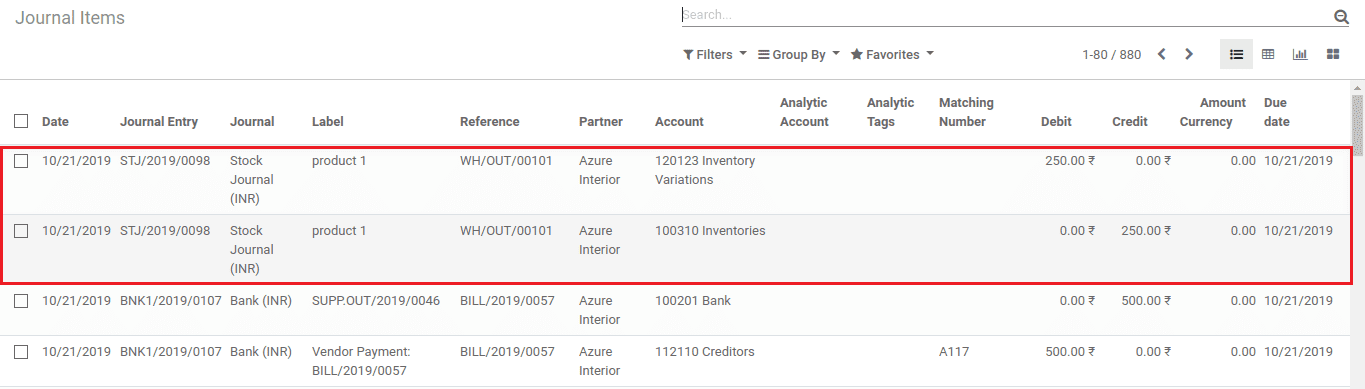

After validating the RETURN, the journal entries are created.

ie, the stock valuation account (Inventories) is debited and the stock input account (goods received not purchased)is credited. The amount is based on the cost of the product.

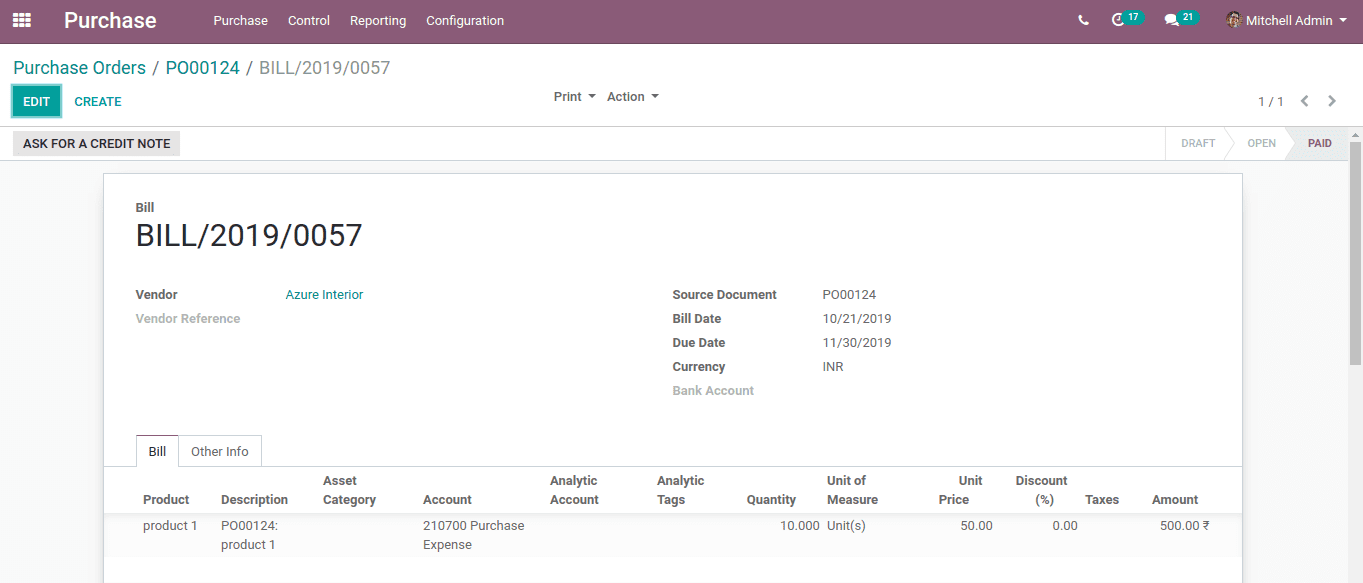

Applying Credit Note

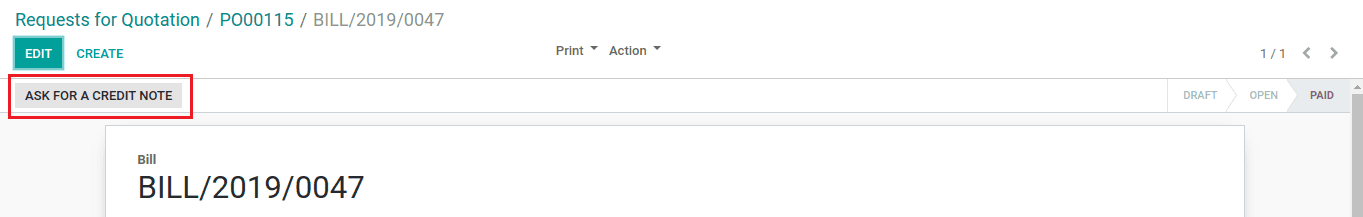

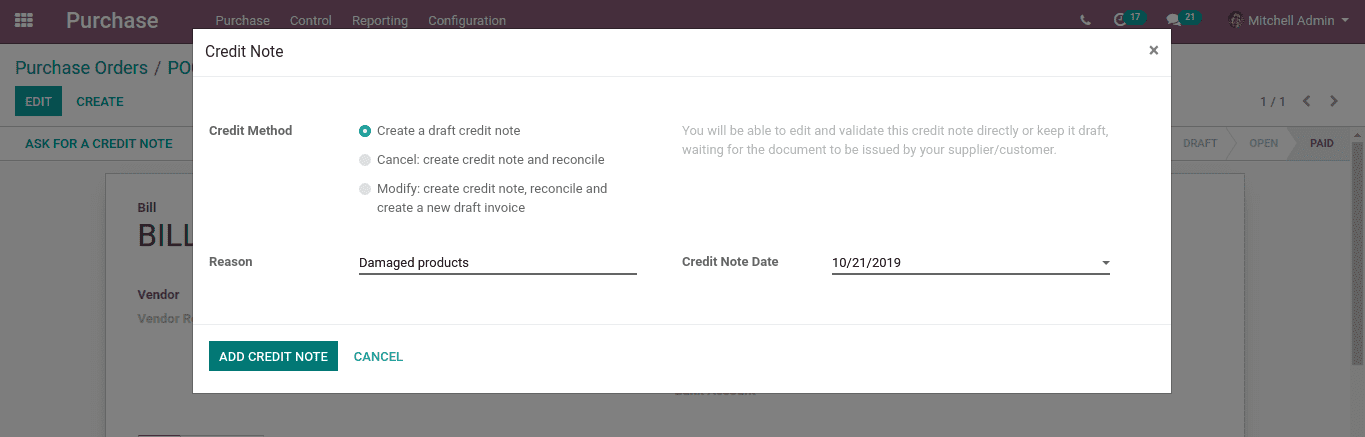

In order to get a refund, we have to ask the supplier for a credit note.

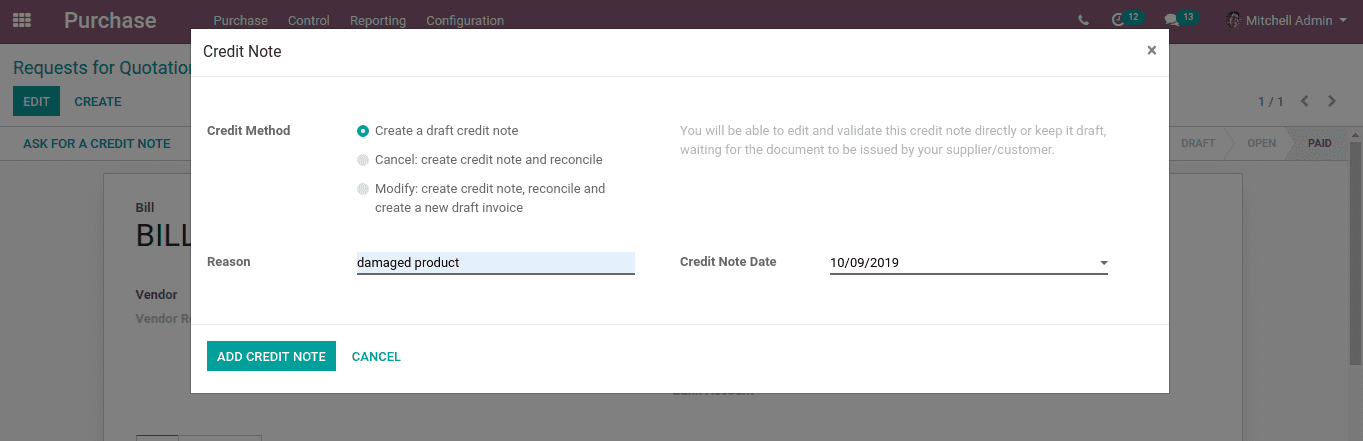

Select the credit method and specify the reason for the return.

Journal entries after creating the credit note:

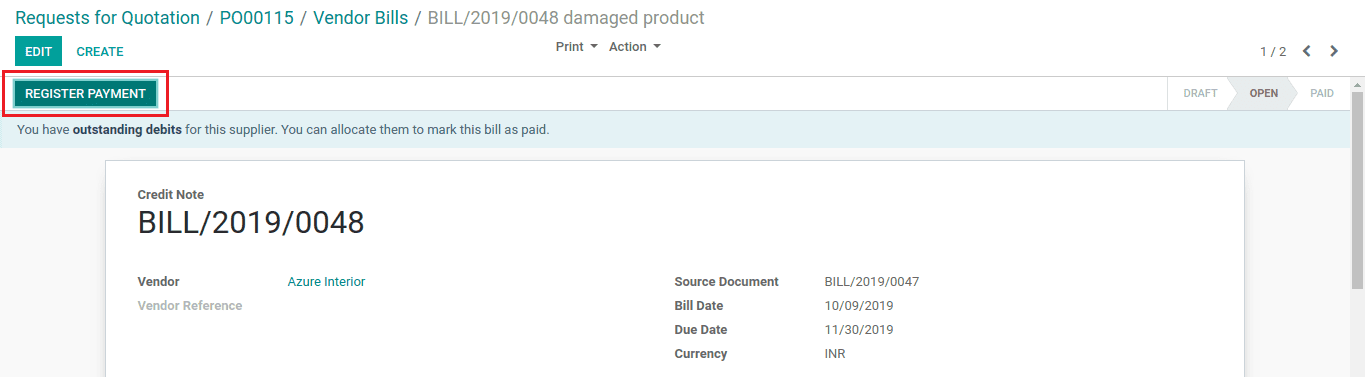

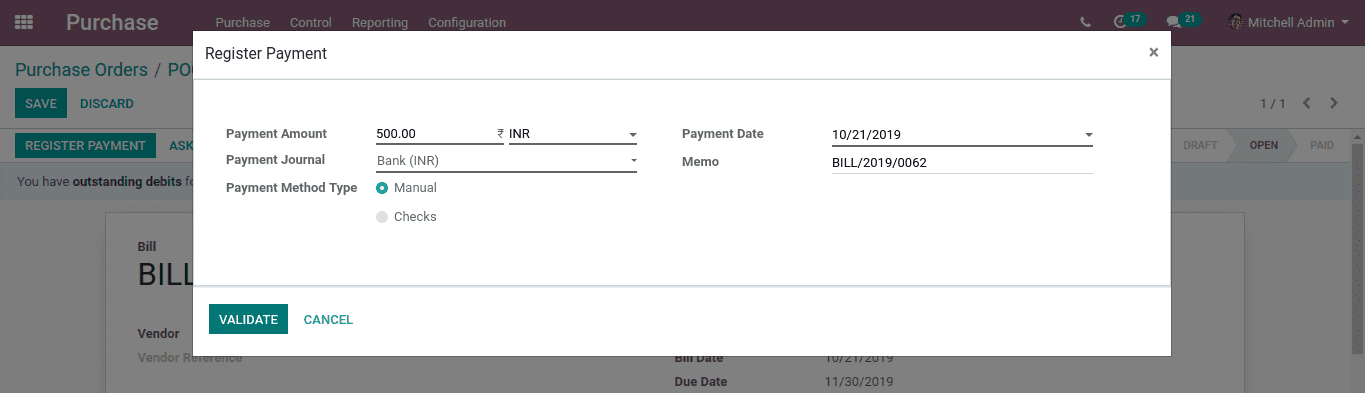

Register the refund payment by clicking the REGISTER PAYMENT.

Then validate the payment by clicking the VALIDATE option.

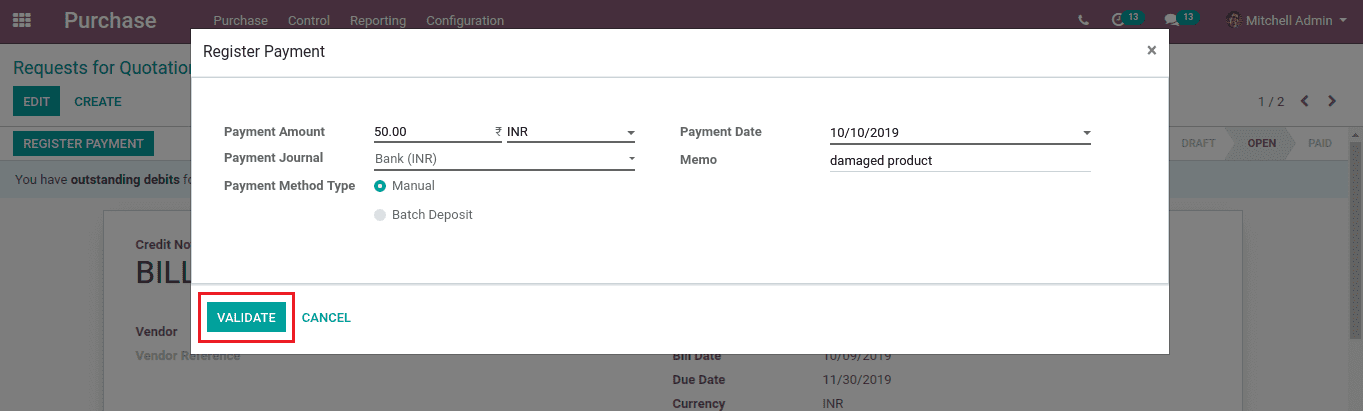

Journal entries created after validating the payment, ie after you have registered the refund payment:

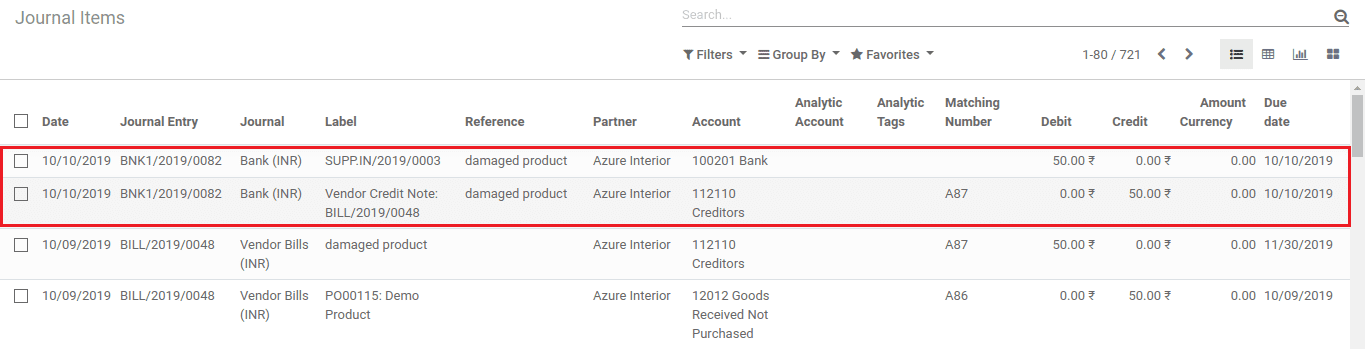

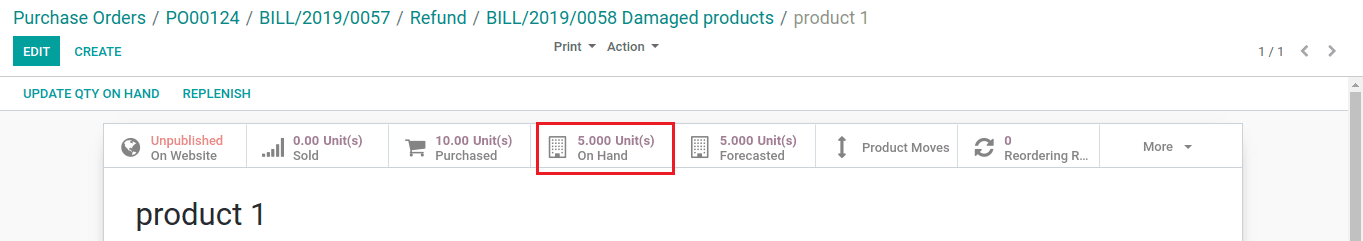

The inventory post returning of the 10 units of product, leave the quantity on hand to 0.

In Continental Accounting

Let's see what happens while purchasing and returning a product in the continental model of accounting.

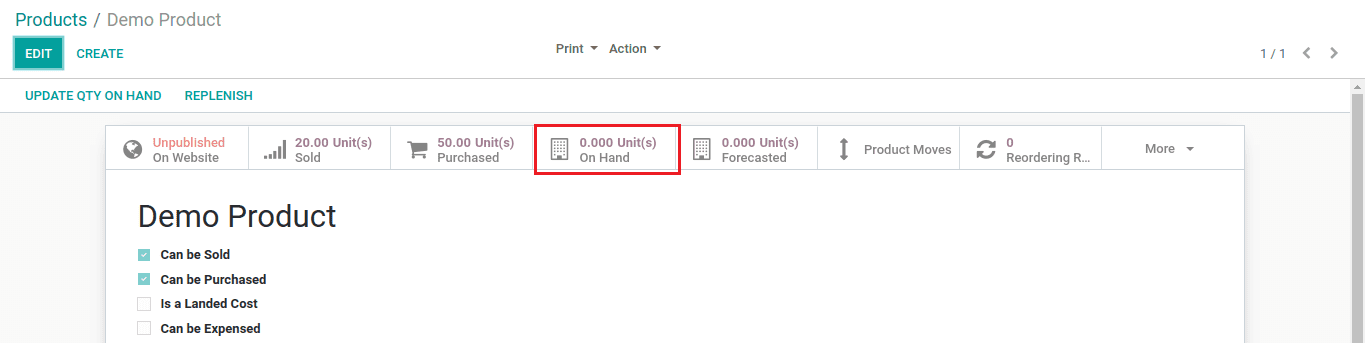

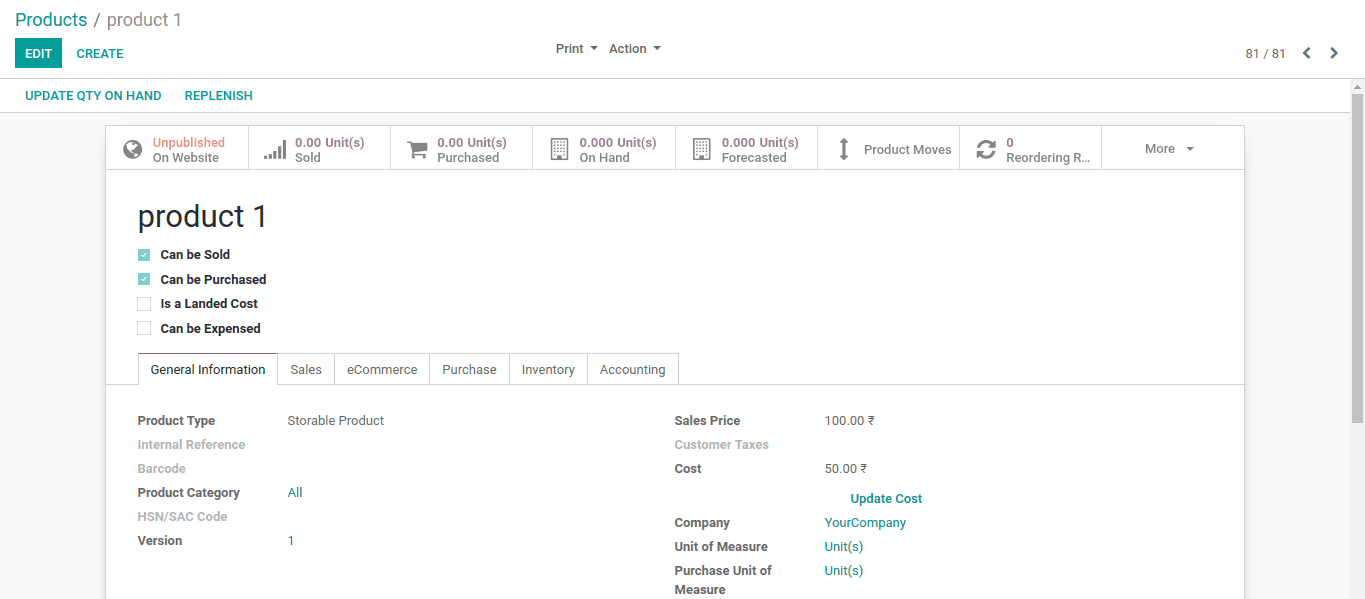

Here the number of products on hand is 0.

Create a purchase order (here 10 products are purchased). Validate the transfer.

Validate the purchase and the following journal entries will be created.

Stock input account (Inventory variations account) is credited and stock valuation account (Inventories account) is debited based on the cost of the product.

Now the quantity on hand changes to 10 units.

After validating the bill, the following journal entries will be created. Expense account (Purchase expense account) will be debited, account payable (creditors) will be credited.

Then proceed to register the payment. While registering the payment, account payable (Creditors) is debited and the bank account is credited.

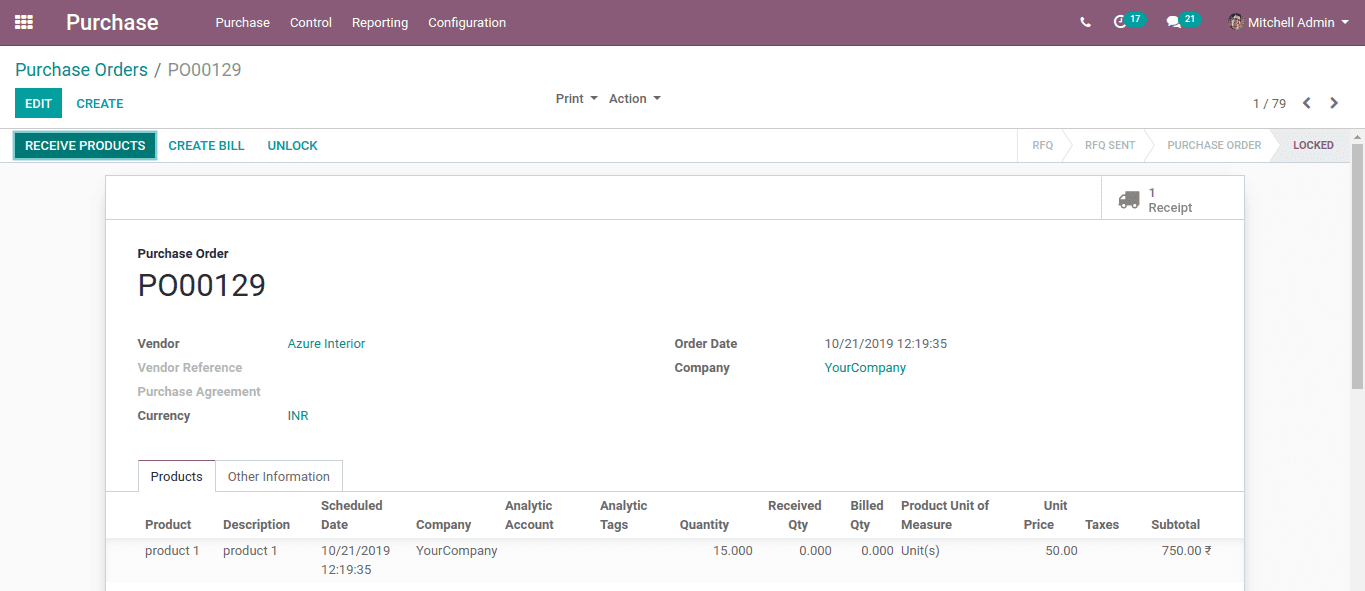

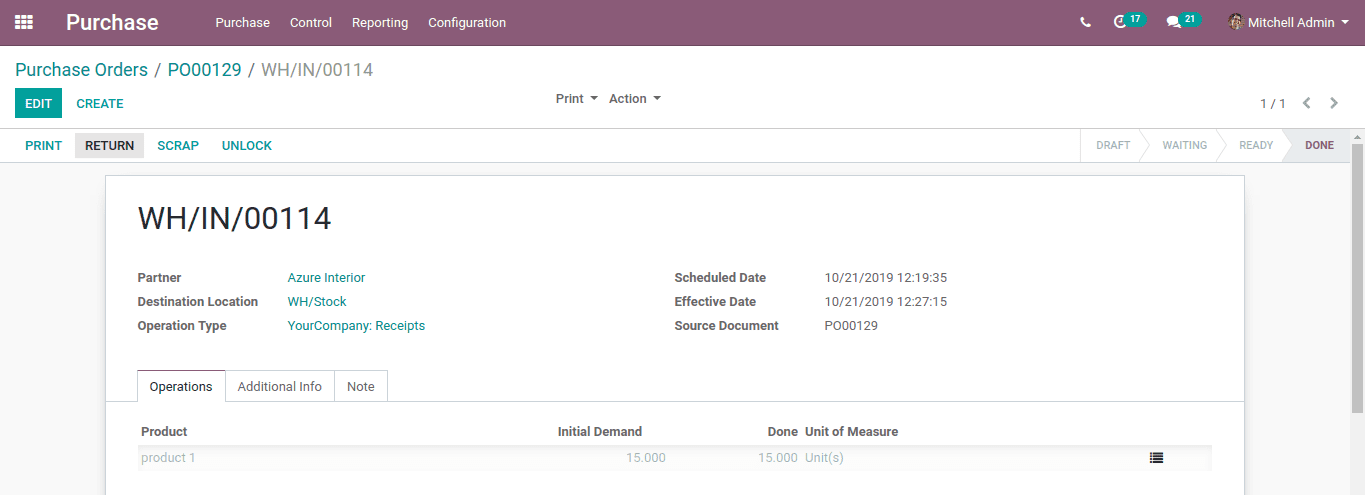

Then we can initialize the return process, for that click on the RETURN button, specify the number of products that are going to be returned.

Here, I am returning 5 products. The refund option will update the received quantity in the purchase order.

Validate the transfer.

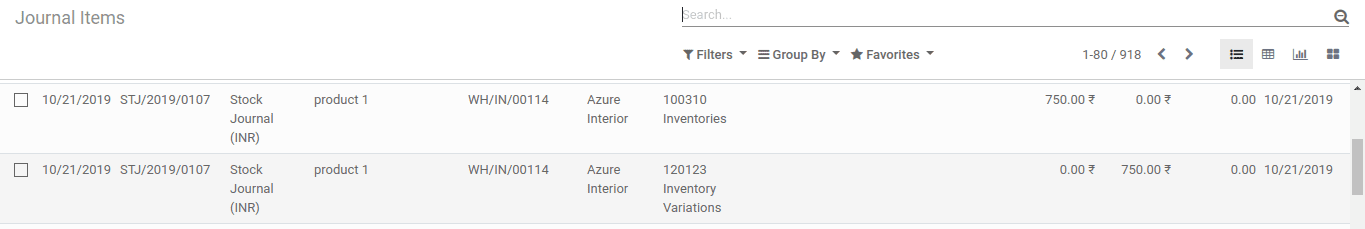

By validating the transfer, the following journal entries are created.

Stock valuation account is credited with the cost and on the number of products returned (here 5 product is returned), and the stock input account is debited.

Ask for a credit note.

Specify the reason for the credit-note and credit method.

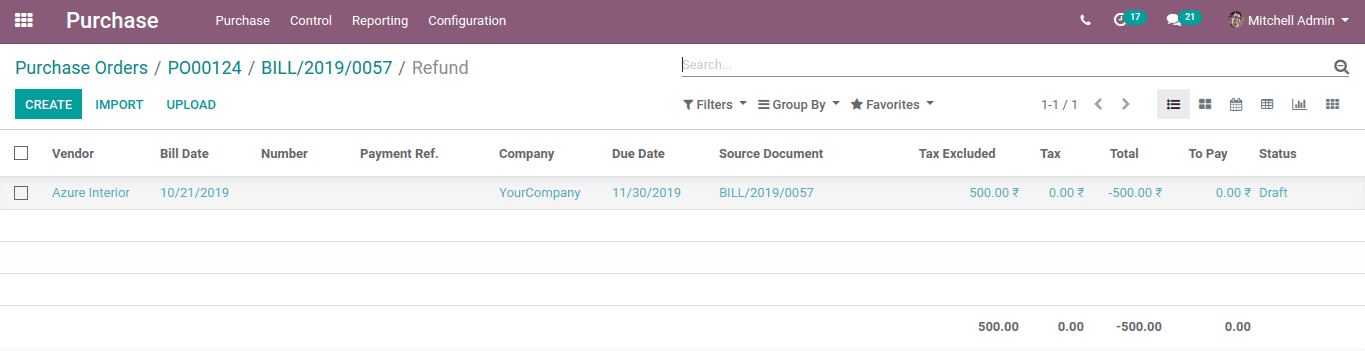

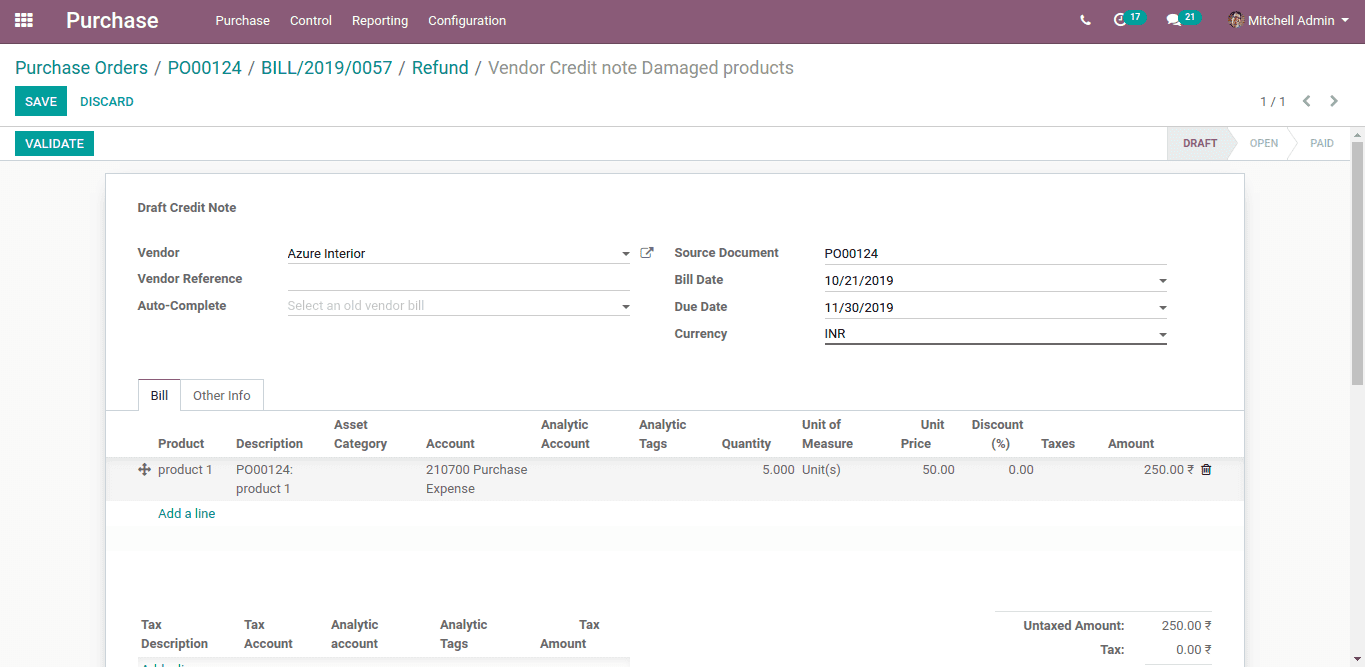

As a result, a return invoice will be created as a DRAFT.

Edit the draft invoice to specify the number of products that are returning.

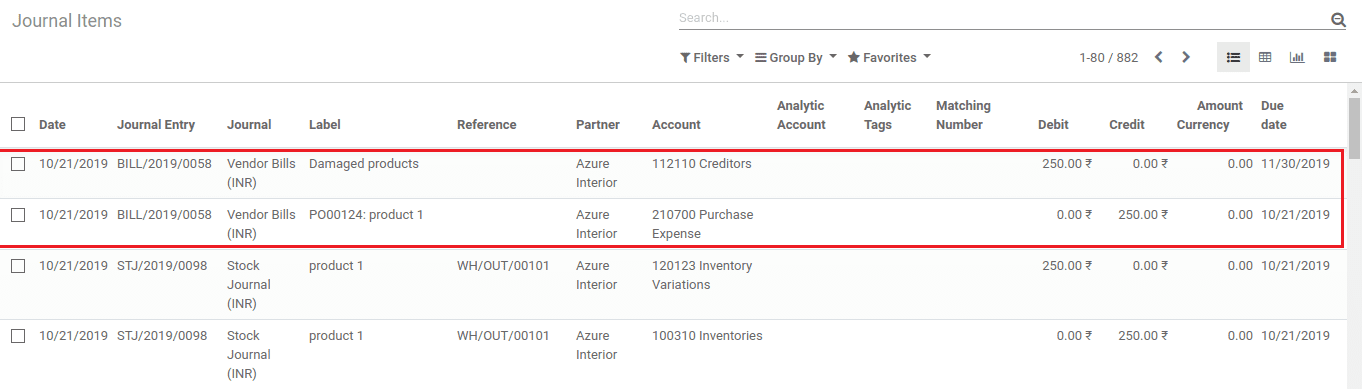

The following journal entries are created as a result of validating the vendor credit note. Expense account (purchase expense) is credited and the account payable (creditors) is debited with the amount that must be refunded by the vendor.

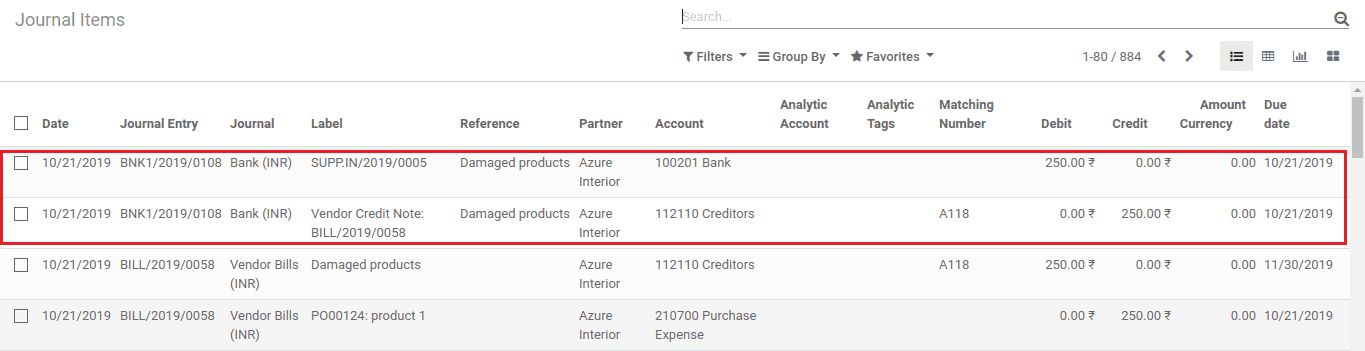

Upon registering the payment by the vendor, the following journal entries are created. The account payable is credited and the bank account is debited.

The stock will become 5 after returning 5 from the received 10 product.

Returning the product before registering the vendor bill payment

Create a purchase order and validate the receipt of the product.

Journal entries created as a result of validating the receipt are as follows,

the stock input account (Inventory variations account ) is credited and the stock valuation account is debited with the cost of the received product.

Initialize the return process.

Journal entries are as follows:

The stock input account that was earlier credited will be debited and the stock valuation account will be credited.

Create a vendor bill, here the received quantity becomes updated value.

When the bill is validated, the following journal entries are created. The Expense account (Purchase expense account) is debited with the cost that have to be paid to the vendor excluding the cost of the product that is returned. Account payable (creditors account) is credited.

Register and validate the payment.

Journal entries created are as follows,

The account payable(creditors) is debited and the bank account is credited with the amount to be paid to the vendor.

The above mentioned are the different ways in which the account will g affected during stock movement, purchase return, registering payment by the vendor in both continental and Anglo-Saxon model of accounting.