If one asks what is the hardest part of a business, well! I would answer it is creating products or services that customers repeatedly purchase. If a business succeeds in developing such service or product for the customer, it is certain that their path is smooth and less challenging. However, this doesn’t mean you have done everything that is needed for your business. The next thing, you have to accomplish is, determining the mode of payment for the services/products.

With respect to the product or service, the businesses can initiate various arrangements like recurring payments for the customers.

Well everybody knows what is recurring payments. They are nothing else, but the repeated payments made to a business at a predetermined payment schedule. The payment schedule can be daily, weekly, monthly or yearly basis. The common examples of recurring payments are our electricity bills, phone bills, EMIs, etc. One of the prime advantages of recurring payment methods is that there is no physical presence demanded by the customer in order to make the payment. Via sharing the payment data with the business payment processor, the customer can easily make the payments.

Recurring payments thus saves the time of both seller and customer, meanwhile optimizing the checkout experiences. Predicting the business cash flow is simple with recurring payments, also it significantly improves customer retention within the business.

Though recurring payment glitters with many benefits such as customer convenience, flexibility, retention and so on, it is quite a difficult task to undertake. Until you have a good platform to manage the recurring billing of your business, you are subjected to follow plenty of steps, making it a highly complex procedure.

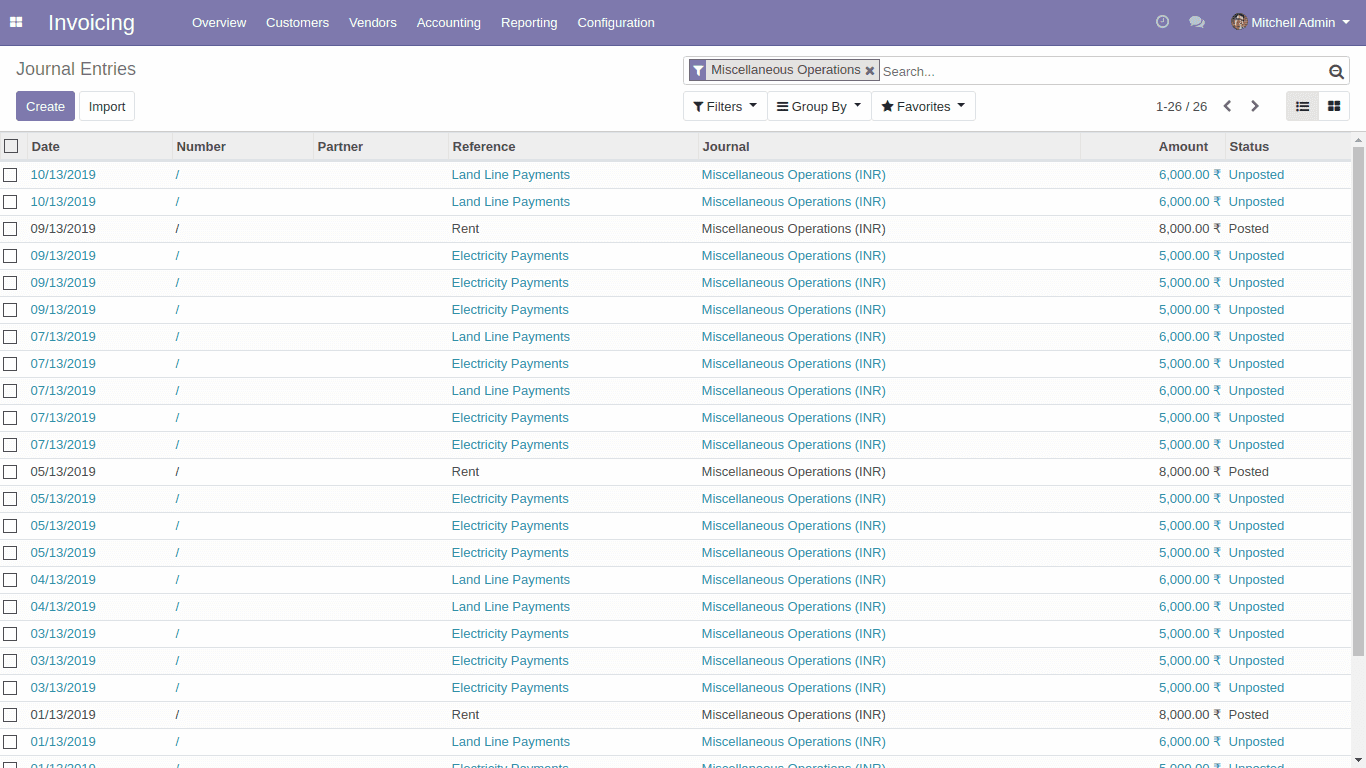

For instance, the journal entries are to be posted every time a payment is made with the business. This is indeed a time-consuming task.

To solve this problem, Cybrosys Technologies have crafted an odoo app-Recurring Payments to automatically record every transaction happening.

The Odoo v12 app envisions in minimizing the efforts in handling repeated customer payments in business.

Key Highlights

1. Create multiple recurring methods(templates) to handle multiple payments.

2. Customize recurring periods (daily, weekly, monthly or yearly) with time intervals.

With the Recurring payments app, one can establish a seamless payment recording process by generating automatic journal entries dependent on set conditions. Also using it, one can create multiple types of recurring methods(templates) for handling multiple payment types.

Here is the workflow of the recurring payment module.

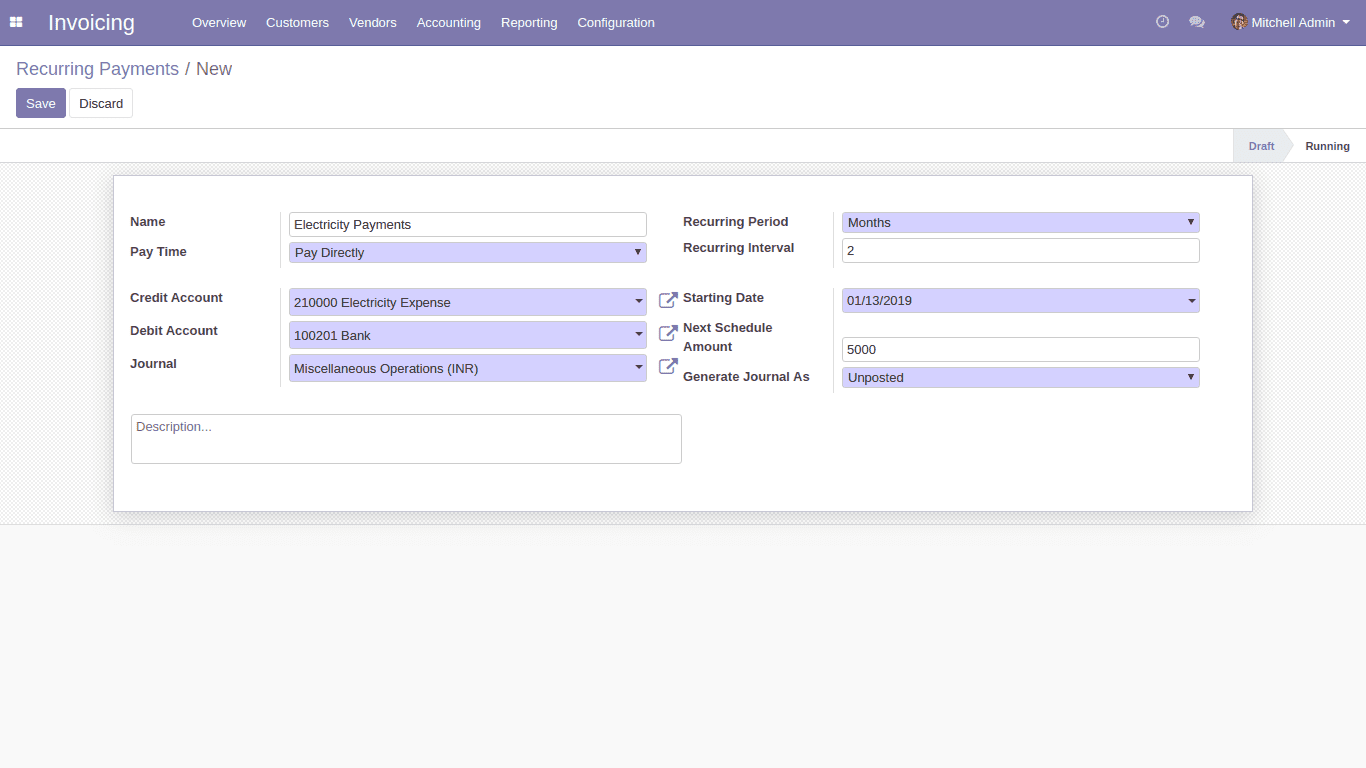

To start with, go to Invoicing -> Configuration -> Payments -> Recurring Templates

Here we can add the templates for each payment. Under the module, two payment options are made available. Also one can choose the credit account, debit account and journal.

In the case of the recurring period, we can choose days, weeks, months or years.

Choose the recurring interval, starting date, amount and type of journal entry.

Save the template and move it to running state.

Note: Templates which are in 'Running' status only generate the recurring entries.

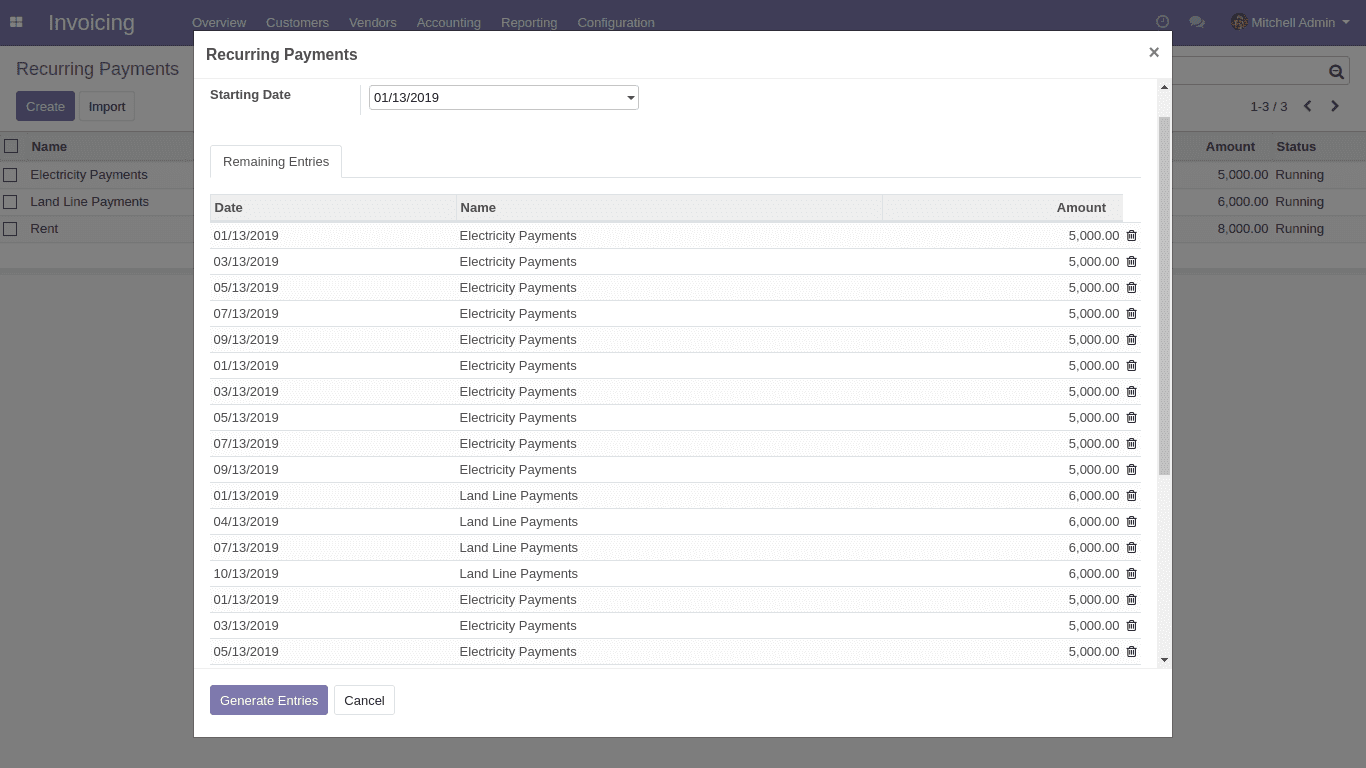

Next, go to Invoicing -> Customers -> Payments -> Recurring Entries

OR

Invoicing -> Vendors -> Payments -> Recurring Entries

Choose the starting date of recurring payments. You can see all the remaining payments. Press the button ‘Generate Entries’ to create corresponding journal entries.

To sum up, here are the features of the recurring module once again:

Generate multiple recurring methods(templates) for handling multiple payments.

Customize recurring periods (daily, weekly, monthly or yearly) with time intervals.

Displays remaining payments, preventing the generation of its journal entries.

Prevent any payment method(template) from generating journal entries.

Can edit the remaining payment's date, name and amount before generating journal entries.

To know more, go to Recurring Payments in Accounts