An inventory valuation of a company helps to know a monetary value for items in their inventory. To ensure reliable financial records on inventory reports, careful calculation of them is important.

The main aim of inventory valuation is to find the revenue. After deducting the expense of product sold from sales, gross profit is determined. Purchases plus opening stock minus closing stock are the cost of products delivered. The accurate value of the inventory measures the current assets, cash flow, shareholders' or owners' equity reported on the balance sheet.

Let us see the inventory valuation methods used in Odoo.

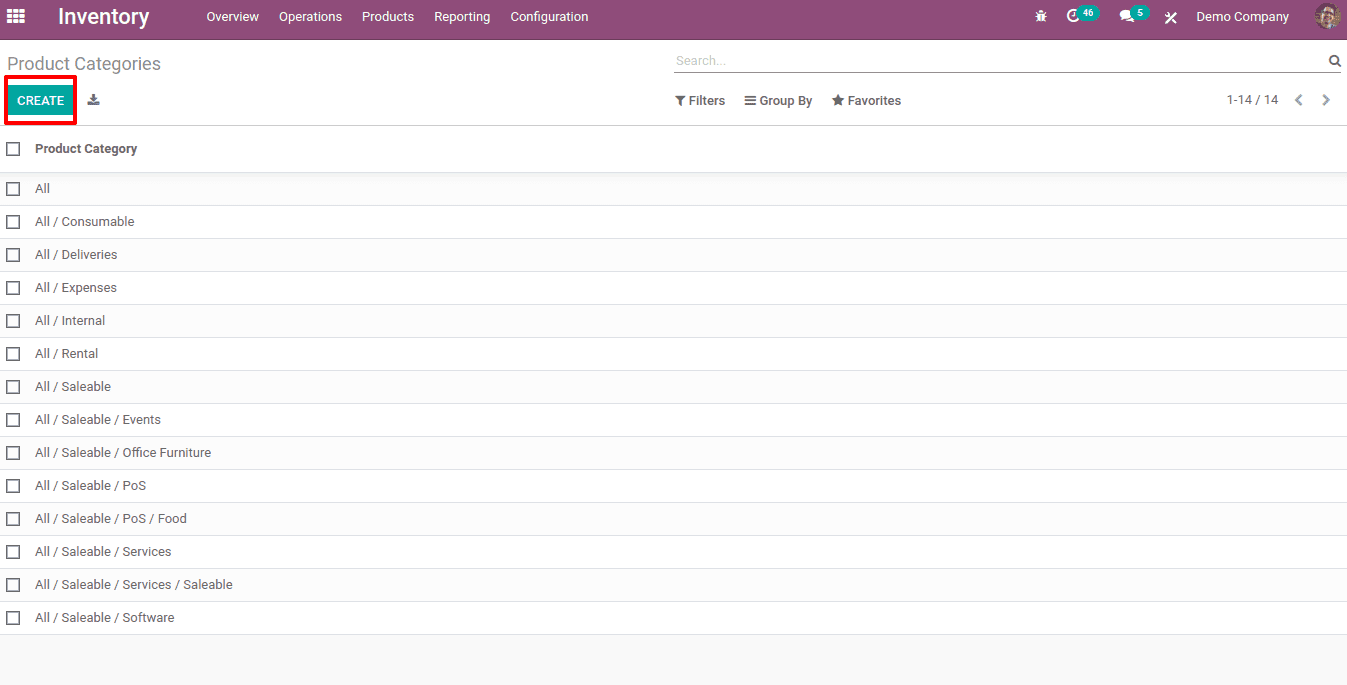

The inventory valuation method is defined inside the product category. So firstly let us have a look at the product category. The product category can be assigned to products to identify what category the product belongs to. The product category can be created from the Inventory > Configuration > Product categories.

One can see all the existing categories and create new categories by clicking on the CREATE button. The Product category form is like below.

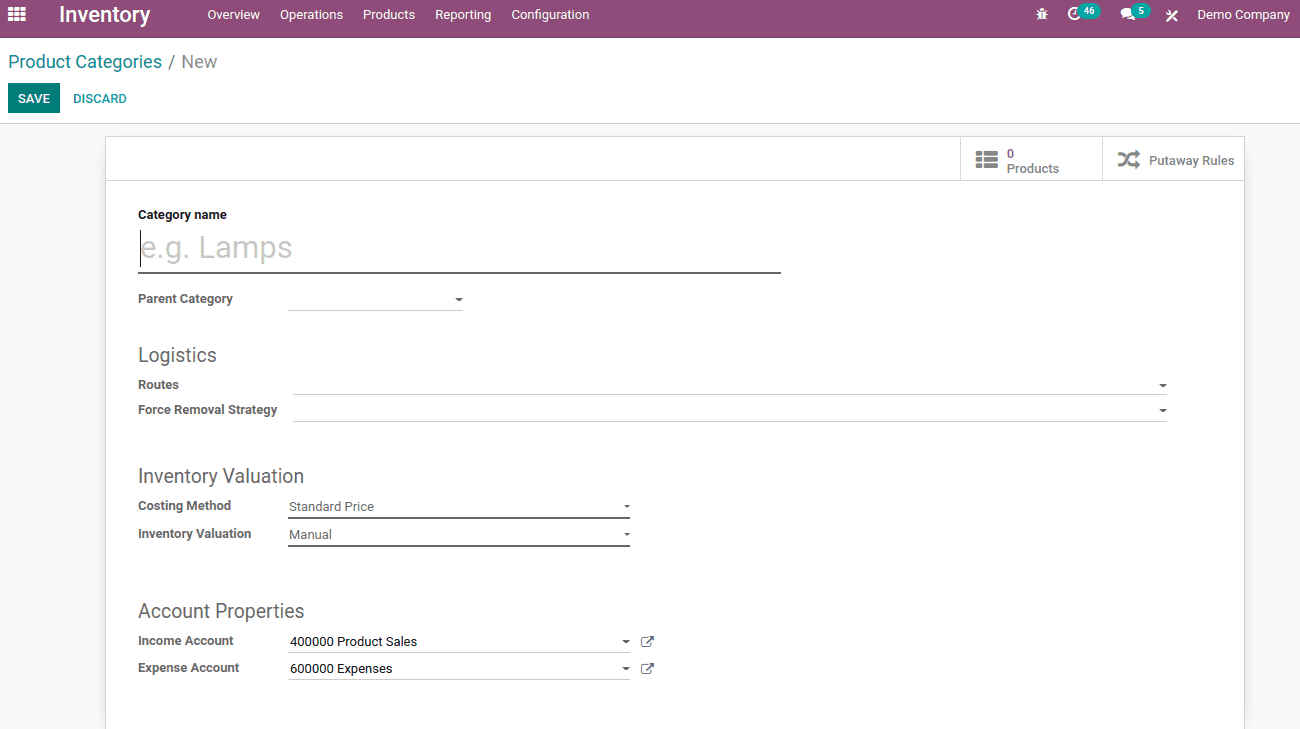

Category Name: Defines the name of the product category.

Parent Category: Sometimes, a category is the child of another category. So in such a case one can mention the parent category of the created category on the required field. If the category is not a child category, one can leave the parent category filed as blank. Not necessary to fill up the field.

Routes: Defines the path through which the product moves to the destination.

Force Removal Strategy: This defines how the product should leave the inventory regardless of the source location. It can be Last In First Out (LIFO) or First In First Out (FIFO) or First Expiry First Out (FEFO).

Costing Method: Defines how products are valued. There are 3 types of costing methods.

1. Standard Price: The products are valued at their cost price mentioned. It won't change until manually done by the user

2. Average Cost (AVGCO): The product cost is valued at its average cost

3. First In First Out (FIFO): The product cost is valued based on the cost of the first product entered and out from the inventory.

Inventory Valuation: Decides whether the inventory changes need to be recorded or not. There are two types of inventory valuation.

1. Manual: If the inventory valuation is manual the accounting entries will not be recorded automatically once the product enters or leaves the inventory.

2. Automated: If the inventory valuation is automated the accounting entries will be recorded automatically once the product enters or leaves the inventory.

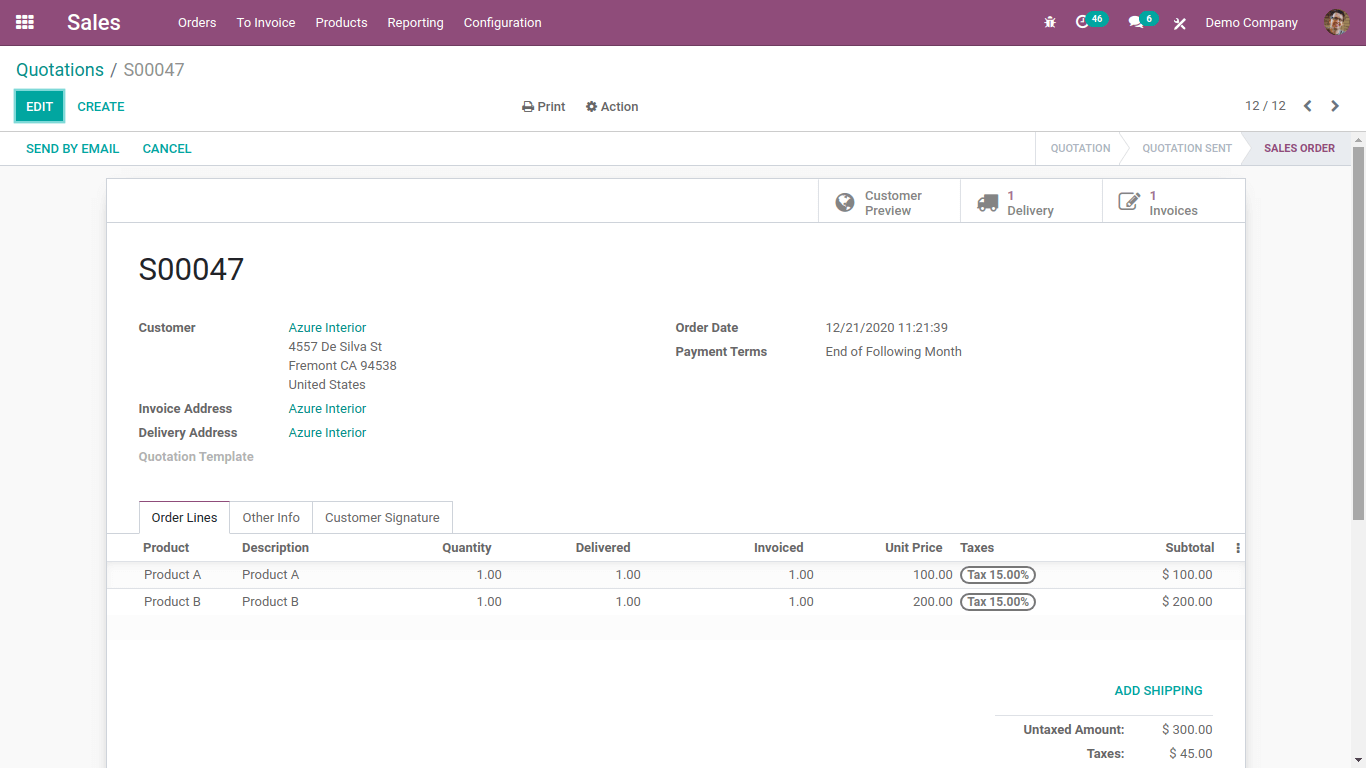

Create two categories, one with inventory valuation ‘Manual’ and others with ‘Automated’. Assign these categories to products and create a sales order.

Here Product A belongs to Category A, whose inventory valuation is ‘Manual’, and Product B belongs to Category B, whose inventory valuation is ‘Automated’.

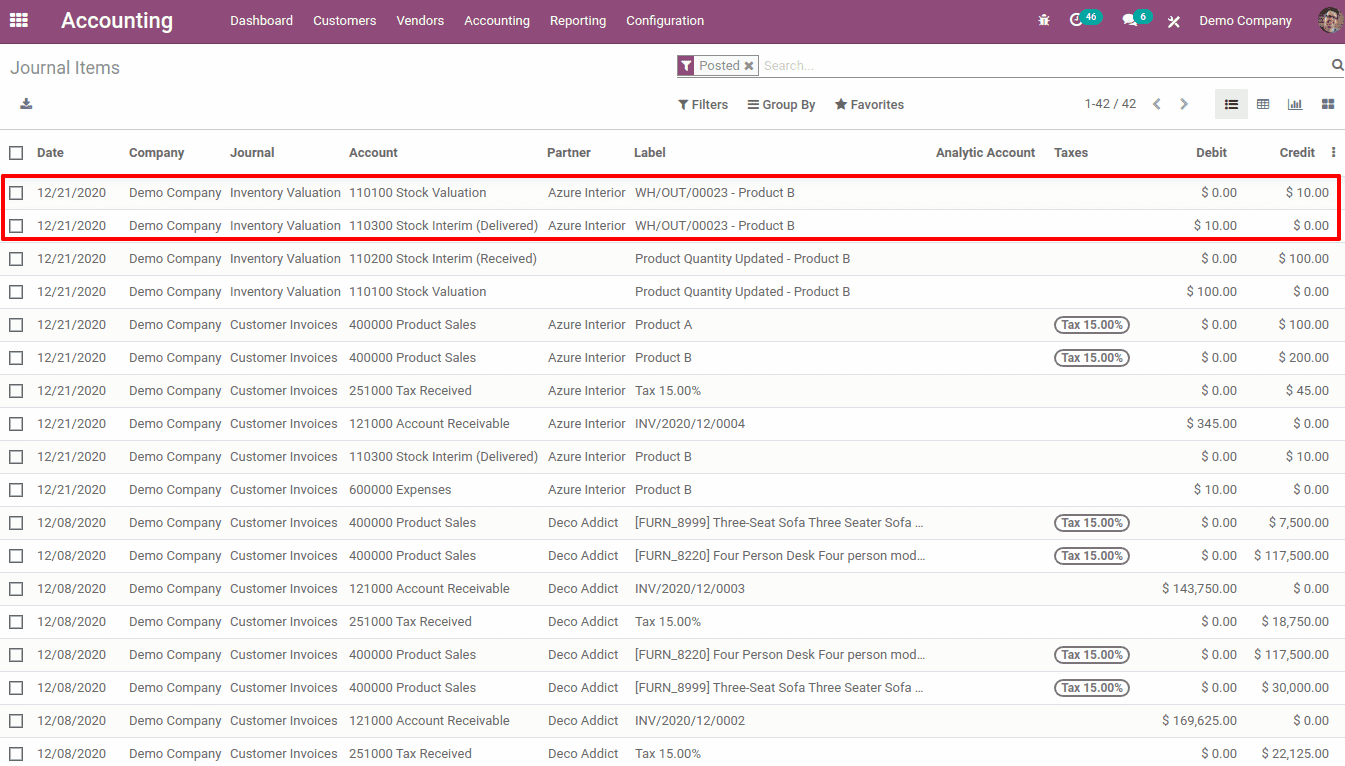

So even when the products are delivered, the accounting entry of the product having inventory valuation ‘automated’ only gets recorded ( here for product B ).

Cost Variation based on Inventory Valuation

Standard costing: For the standard costing method the cost of the product won't change due to a sale or purchase. One has to manually change the cost of the product if needed.

Average cost: For the average costing method the cost of the product is taken as the average cost. Purchasing the product, whose costing method is chosen as automated, the product cost will automatically change.

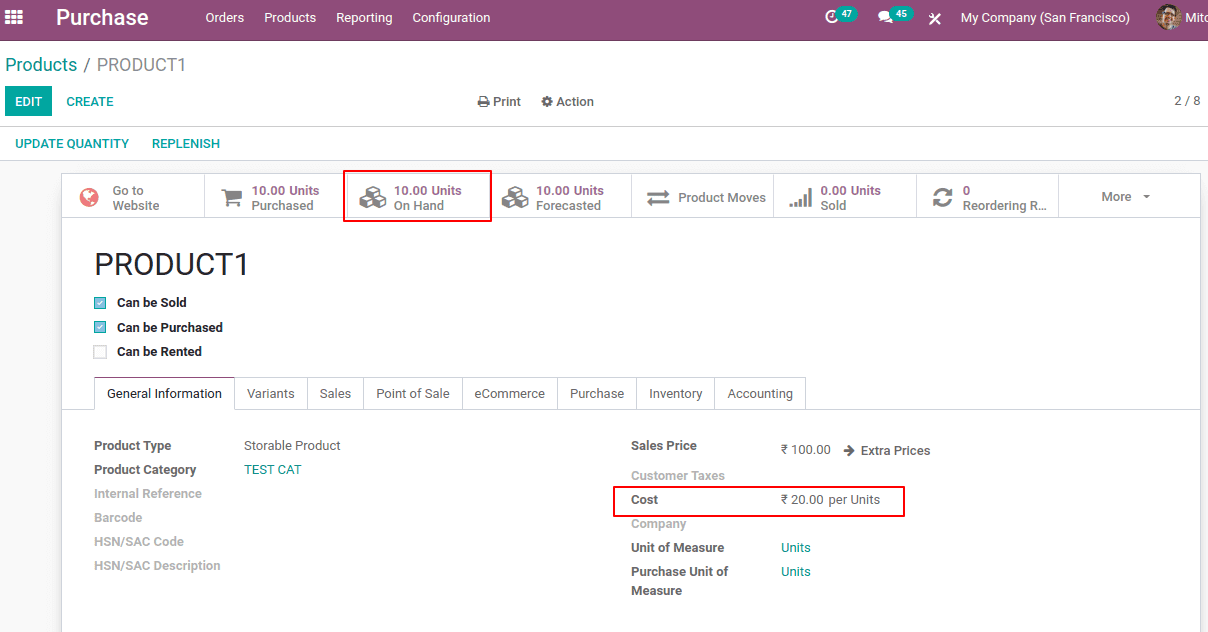

Consider a product with costing method average cost, for which 10 products are purchased for 20 rupees. Then purchase the same product 10 units again with 50 rupees. Let us see the cost change.

Initially, 10 units of product were purchased for 20 rupees. So the cost will be (10*20)/10=20.

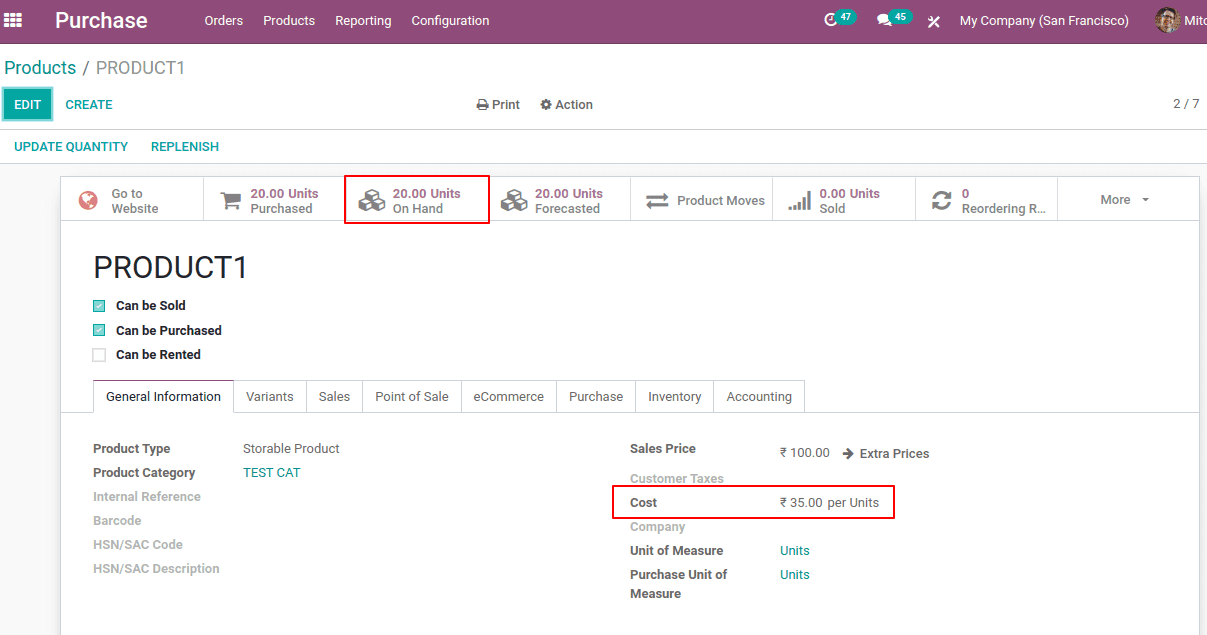

Again, 10 units of products were purchased for 50 rupees. So the cost will be the average cost of two purchases.

Average cost will be [(10*20) + (10*50)] / (10+10) = 35

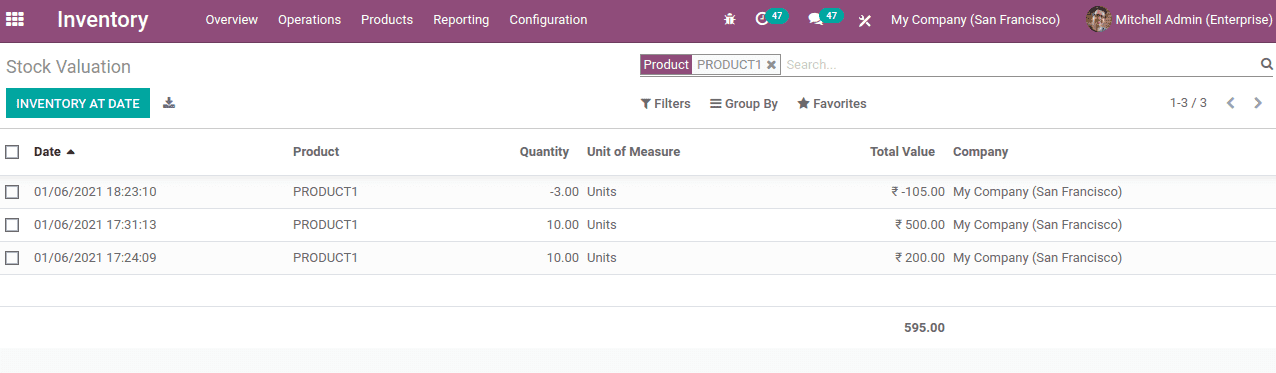

The inventory valuation will record the product value that was bought and sold.

The negative value represents the value of the products that are sold.

FIFO

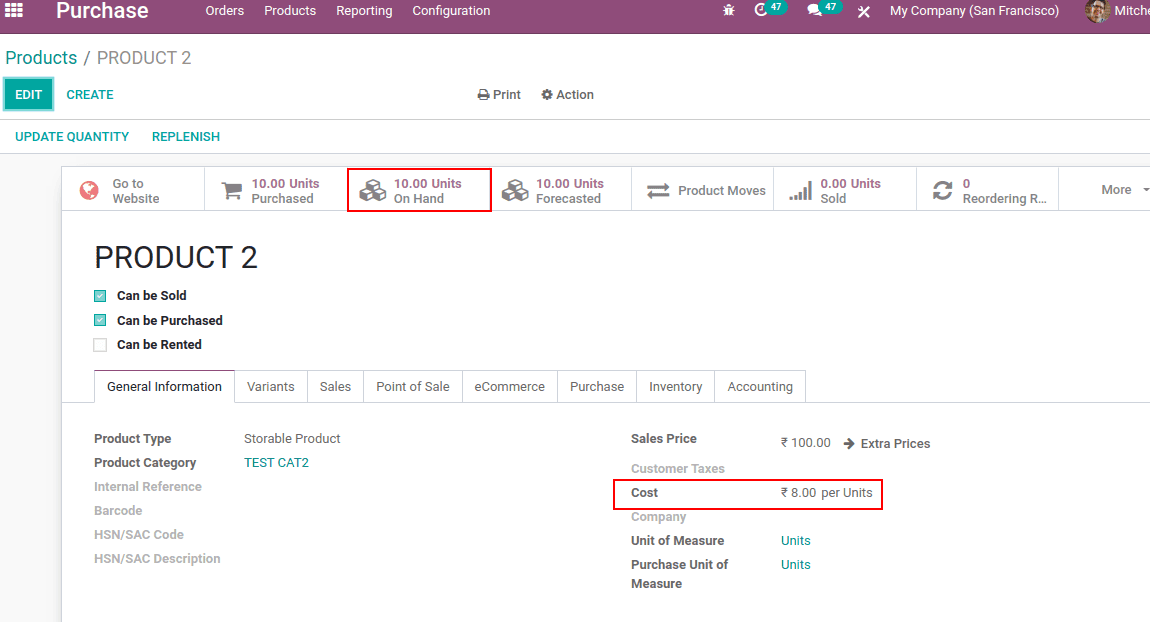

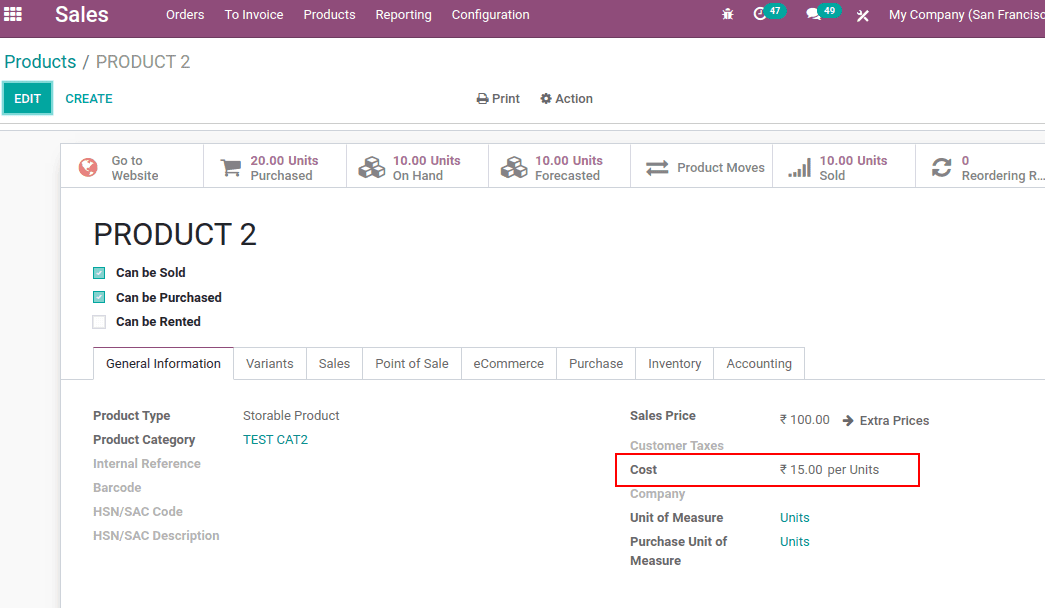

In this costing method, the cost of the product is updated on the basis of the removal strategy first in first out. Consider a product with a removal strategy as FIFO. Now let us see how the purchase and selling of the products change the product cost.

Initially, a product of 10 units purchased for 8 rupees. Thus the product cost was updated to 8 rupees.

Again 10 products were purchased for 15 rupees. Here for the second purchase, the cost of the product does not change.

Now sell 10 products. So the products will be removed from the first purchased set. Now check the product cost.

The product cost now changed to 15, i.e. is the cost of the secondly purchased set.

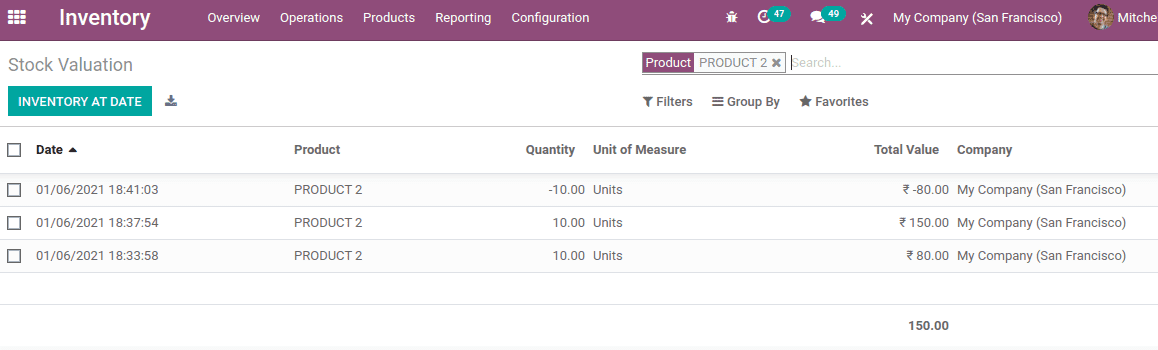

Now let us check the inventory valuation for the FIFO costing method.

Here negative quantity refers to the sale and positive quantity refers to the purchase.

Account Properties

1. Price difference account

This account is mainly used in anglo-Saxon accounting. It records the difference in amount between the purchase order and invoice

2. Income account

The income generated by the product category for different products that belong to the category are recorded in this income account specified

3. Expense Account

The expense generated by the product category for different products that belong to the category are recorded in this expense account specified

Account Stock properties

1. Stock valuation account

This account is used to record the current stock value of the inventory

2. Stock input account

When the product is moving to the warehouse on a purchase operation, this account gets affected.

3. Stock output account

When the product is moving out from the warehouse on a sale operation, this account gets affected.

4. Stock journal

The stock journal records all the stock moves

Watch Video